Abstract

With economic globalization, sustainable development has become the preferred choice of enterprises facing fierce competition. Innovation is the primary driving force of development. As the driving force of sustainable development, green technology innovation (GTI) is crucial for enterprises. As a key influencing factor for green technological innovation, corporate social responsibility (CSR) behavior has received increasing attention. Based on stakeholder theory, stakeholders influence enterprises’ long-term strategic development goals. This study aims to examine the importance of CSR in advancing GTI and the involvement of stakeholders. Thus, this study selected Chinese A-share listed companies from 2011 to 2020 as research objects and used fixed-effects regression models. The results identify the positive effects of CSR on GTI. This study also divided the stakeholders into different groups and elucidated, from different stakeholder perspectives, the positive moderating effects of government environmental subsidies, investor attention, and executive environmental attention on the relationship between CSR and GTI. This study verifies the direct impact of CSR on GTI, enriches the theoretical foundations of stakeholder theory and resource-based theory, and provides practical suggestions for enterprises to improve their social and environmental performance and green development. It also reveals the cognitive roles of governments, investors, and executives in environmental protection and governance, which will help Chinese enterprises to better fulfil their social responsibility, improve their own green technological innovation, and achieve sustainable development.

1. Introduction

Corporate social responsibility (CSR) and green technology innovation (GTI) are important drivers of sustainable development and corporate value. As the most important and complex form of business organization, companies have a significant impact on society and the environment through their business activities. Economic globalization has created instability in the business environment, particularly given the increasing risks posed by climate change, and sustainability has emerged as a critical global issue. Countries attach great importance to corporate environmental governance practices, forcing companies to adopt green development strategies to improve their environmental performance to better cope with global climate issues [1]. As the largest developing country, China has committed to attaining a carbon peak by 2030 and carbon neutrality by 2060 under the Paris Agreement, demonstrating its significance and commitment to environmental protection. Meanwhile, China has proposed the “One Belt, One Road” strategy, which provides a huge business ecosystem for global players. To alleviate the huge pressure of carbon emissions, companies need to adopt a competitive strategy to fully mobilize internal and external resources to develop green performance [2] and improve their social value and innovation capacity [3].

In recent years, the Chinese government has committed to green development and has proposed and actively implemented a series of environmental governance policies [4]. Meanwhile, stakeholders are beginning to focus on corporate social performance and green development, recognizing the importance of the sustainable development of enterprises. Therefore, Chinese companies must improve their own green technological innovation capabilities for their long-term development [5]. The matter of how to improve corporate green technology innovation has gained academic attention. The European Commission regards CSR as a crucial tool for innovation, sustainability, and corporate competitiveness [6]. This shows that social responsibility can act as a driving force for green innovation. Many studies have attempted to verify the relationship between CSR and GTI, and the results of these studies present two main views. For general innovation, some scholars argue that CSR positively affects investments in research and development (R&D) and capabilities for innovation exploration [7]. In recent years, researchers have focused on the role of CSR in promoting innovation from the perspectives of corporate governance, dynamic capabilities, and the segmentation of social responsibility. The results of the study concluded that CSR is a key motivation for GTI [8,9,10]. However, other scholars have found either that socially responsible corporate behavior inhibits companies’ ability to innovate or that there are mixed effects [11]. First, from an internal corporate decision-making perspective, some researchers have argued that, when firms face social responsibility pressures, management may ignore or abandon innovation in pursuit of rapidly improved environmental performance. In this scenario, corporate decisions are influenced by the behavioral characteristics of management [12], and corporate social responsibility inhibits the companies’ green innovation capabilities. Second, some studies start with the dual externality of green technology innovation, considering the high-risk and high-cost characteristics of innovation, and argue that many resources are used by firms to maintain external relationships in order to balance economic benefits and social and environmental performance, which is not easily translated to the innovation level [13,14]. Therefore, the direct effect of CSR on green technology innovation capabilities needs to be further verified.

As the topic of eco-environmental protection becomes mainstream, the stakeholders of enterprises present increased social and environmental demands. Pressure from stakeholders creates a business environment where CSR is evaluated [15]. Active CSR calls for stakeholder accountability and transparent environmental disclosure practices. Stakeholders can influence the formulation and implementation of corporate decisions regarding green innovation, and their support for GTI is conducive to reducing environmental pollution [16]. The substantial body of extant literature on CSR and GTI combines related management theories and has gradually shifted its focus from having a direct influence to the exploration of moderating and mediating effects. Stakeholder theory is a major extension of CSR and GTI influence mechanism research, but most of the literature is based on single or overall stakeholders, and fewer comparative studies have been conducted for different stakeholder subgroups. Therefore, to elucidate the influence mechanism between CSR and corporate GTI, this study subdivides the corporate stakeholder groups into three specific clusters: government, investors, and corporate executives. At the same time, the existing literature is extended.

To elaborate on the above issue, this study selected Chinese A-share listed companies from 2011 to 2020 as a sample for fixed-effects regression. The results show that CSR makes a significant positive contribution to green technology innovation capabilities. Meanwhile, government environmental subsidies, investor attention, and the environmental commitments of the executive team play a positive moderating role. This study enriches the relevant theories by exploring different corporate stakeholder perspectives individually.

This study offers two main contributions: First, it enriches the relevant research by verifying the relationship between CSR and GTI. Although the relationship between CSR and innovation has been studied in the existing literature, the direct impact of social responsibility on GTI has rarely been explored, and academic opinions are divided. This gap is addressed in the study through empirical analysis, and the findings may help enterprises to achieve sustainable development. Second, considering stakeholder theory, this study explores the mechanism of the moderating influence on CSR and GTI through government environmental subsidies, investors’ attention, and executives’ environmental commitments. The findings thus provide a basis for promoting related theories.

This study is structured as follows: Section 1 is the introductory section, which summarizes the study’s background, purpose, and significance. Section 2 contains the theoretical background and hypothesis derivation. Section 3 presents the sample selection and data sources, variable definitions, and research model design. Section 4 reports the empirical findings and robustness tests. Section 5 provides a discussion of the results. Section 6 presents the conclusions, implications, and limitations of this study.

2. Theoretical Background and Hypothesis

2.1. Influence of CSR on Enterprises’ GTI Capabilities

Previous studies have defined CSR from different perspectives. The concept of CSR was first introduced in 1924 by Sheldon, who contended that corporate social responsibility included an ethical element [17]. Aguinis defines CSR from a multidimensional perspective as “context-specific organizational actions and policies that take into account stakeholder expectations and the triple bottom line of economic, social, and environmental performance” [18]. According to conventional business theory, corporate financial management aims to maximize shareholders’ interests. CSR bridges the gap between “interests” and “green innovation”. It requires enterprises to realize their interests and development while seeking benefits other than financial performance, and while balancing development issues with environmental and social concerns. Many scholars have identified a link between CSR and technological innovation, suggesting that CSR positively impacts innovation [7,19,20,21].

Stakeholder theory is a theoretical framework commonly used to assess CSR, and companies have specific ethical responsibilities towards their stakeholders [22]. At the same time, the development of the enterprise cannot be separated from the support of stakeholders. Therefore, stakeholder theory can explain the impact of CSR on green technological innovation from different perspectives. Companies face pressure from stakeholders, such as shareholders, employees, consumers, competitors, and the government; thus, they need to take a stand on environmental issues and invest in GTI to address social and environmental problems while sustaining their daily operations [23]. For example, employees are important internal stakeholders of companies, in that companies with high levels of social responsibility are attractive to their employees. Their employees, in turn, demonstrate dedication, which can stimulate innovation potential and facilitate the retention of technical talent and knowledge integration [24]. Furthermore, the environmental requirements of suppliers and customers, as external stakeholders of the company, drive companies to implement green development strategies. Companies must fulfill their social responsibility strategies and continuously develop green processes and products to meet the environmental needs of consumers and suppliers.

Analyzed from the perspective of resource theory, unique resources and capabilities are the source of lasting competitive advantages for enterprises. Therefore, the active fulfillment of social responsibility by enterprises can provide a source of motivation for the development of their green technology innovation level. First, active social responsibility practices can produce resources and information for green technology innovation while providing good feedback to stakeholders; this can form a solid internal and external network framework and thus promote green innovation. Companies that engage in social responsibility have good internal and external information flow systems and are able to boost their corporate image and reputation [25,26] and employee loyalty [27]; these companies are able to gain the trust and support of stakeholders and thus increase their productivity and level of innovation. Second, social responsibility shapes a culture of innovation and paves the way for the creation of new products, models, services, and processes through the use of resources from external stakeholders, thereby increasing productivity at the firm and in the supply chain [28].

In response, companies are increasingly focusing on environmental protection and ensuring sustainable development by actively fulfilling their social responsibilities and accelerating the development of green technologies that can reduce carbon emissions. On the basis of the aforementioned theories, the following hypothesis is proposed in this study:

Hypothesis 1 (H1).

CSR positively influences the ability of companies to innovate in green technologies.

2.2. The Regulating Role of Government Environmental Protection Subsidies

Knowledge spillovers and environmental governance bring risks, such as high costs and low expected benefits. Firms avoid the risks associated with environmental governance by limiting their socially responsible activities, thereby inhibiting GTI. This situation is exacerbated by a lack of financial support for development, which results from companies’ lack of motivation [29,30]. Some scholars argue that government subsidies have a negative impact on or an inverted U-shaped relationship with corporate environmental protection or innovation due to crowding-out effects and managerial short-sightedness [31]. However, other studies have found that government environmental subsidies catalyze enterprises’ fulfillment of social responsibility and green innovation. The influence mechanism of government as an external stakeholder of enterprises has two main aspects.

First, institutional theory suggests that external institutions influence the strategic decisions of firms. Regulatory elements constrain firms while bringing resources and benefits to them; this provides a theoretical basis for the mechanism whereby CSR influences green technology innovation from the perspective of pressure [32]. Based on institutional theory, government influence on CSR is mainly rooted in environmental regulations. Establishing a regulatory environment that encourages firms to engage in socially responsible activities is conducive to promoting market equity and developing a green economy [33]. Environmental subsidies, as an effective means of government intervention in environmental governance, signify that companies are fulfilling their social responsibilities and prompt them to take their social responsibilities seriously in their daily operations and to regulate their management and operations. Ren et al. contend that environmental protection subsidies are equivalent to environmental regulations [34], which in turn drive the environmental performance of firms [35].

Second, resource-based theory suggests that a firm’s core competitive advantage is derived from its unique scarce resources [36]. Subsidies can solve market imperfections and allocate resources efficiently. According to resource-based theory, government environmental subsidies are constrained by fiscal budgets. To maintain a sustainable competitive advantage, companies need to actively pay attention to government policy guidance on environmental management, take the initiative to assume social and environmental responsibilities, and obtain the maximum possible government environmental subsidies to promote GTI [37]. Firms that receive government environmental subsidies are inclined to undertake environmental transformations [38]. Environmental protection subsidies can convey the government’s emphasis on environmental protection to the world, encourage enterprises to increase their participation in social responsibility, and guide the overall market environment to attract green talent and undertake green innovation. Under the indirect effect of information transmission, the government granting environmental subsidies can help to provide external financial support to enterprises, prompting them to pay attention to the needs of stakeholders, pursue social and environmental performance beyond their economic benefits, and carry out GTI to protect the environment and achieve long-term sustainable development [39,40]. Therefore, this study proposes the following hypothesis:

Hypothesis 2 (H2).

Government environmental subsidies positively moderate the impact of CSR on GTI.

2.3. Moderating Effect of Investor Attention

Corporate stakeholders anticipate whether a company is adhering to social expectations, and companies aiming to achieve long-term sustainability must execute their strategies in line with their stakeholders’ general expectations. While previous researchers have mainly linked investor attention to the stock price or firm value, this study focuses on analyzing the impact of investor attention on the relationship between CSR and green technology innovation.

According to limited attention theory, individuals have a limited capacity to process information or perform tasks. Therefore, investors’ attention is a limited cognitive resource [41]. Limited by their attention spans and ability to process information, investors prefer to purchase stocks that attract their attention [42]. As the essential capital providers of enterprises, investors’ role in promoting enterprises’ environmental and social performance has thus attracted much attention from scholars [43,44,45]. Investors serve as a link between environmental protection and capital markets and must consider long-term sustainability. Investors who are in an ideal position can guide corporate capital allocation toward sustainable ends [46]. Martínez et al. suggest that investors who invest according to ethical criteria prefer to invest in companies with a high level of social responsibility. [47]. Dyck and Roth et al. found that the higher the attention of institutional investors, the higher the CSR performance [48], resulting in improved corporate sustainability.

From the perspective of institutional economics, social concerns pertain to informal institutions that can create pressure on firms. Heavy polluters or companies associated with negative environmental news alarm investors and influence those who are averse to environmental risks [49]. Participation in social responsibility and good disclosure levels significantly reduce information asymmetry and promote knowledge sharing and information communication between internal and external enterprises. Investor attention, as feedback, influences firms’ green innovation and encourages green behaviors. Xu et al. found that institutional investors promote the green innovation of firms by providing financial support and supervising corporate governance [50]. As representative forces in the market environment, investors have become increasingly concerned about environmental issues. Firms that commit to social responsibility and focus on green innovation can earn lucrative returns in the stock market, which motivates them to fulfill their social responsibility and innovate environmentally [50]. Therefore, when investors convey concerns about the environment, firms are able to fulfill their social responsibility and achieve green innovation through technology. As a result, investor concerns are the primary motivator of corporate GTI. Based on this analysis, this study proposes the following hypothesis:

Hypothesis 3 (H3).

Investor attention positively moderates the impact of CSR on GTI.

2.4. The Moderating Role of Environmental Attention in Top Management Teams

Top management personnel, as the decision makers in a company, play a leading role in daily management, strategy formulation, and change and innovation; they are the decisive force in determining the direction of corporate development. Most previous studies have focused on the relationship between corporate innovation and the demographic characteristics of the executive team, including gender composition and educational experience [51,52,53,54].

With the development of the attention-based perspective, decision makers’ attention has become an important influencing factor. From the perspective of the high-level ladder theory, executive team members make decisions and strategic choices on the basis of their values, and their output consequently affects organizational behavior [55,56]. According to corporate behavior theory, attention has a top-down influence. Ocasio (2011) found that senior management’s forward-looking attention perspective is conducive to overcoming structural inertia and that its social structure and environmental information processing abilities form a unique cognitive model and encourage discretion in environmental management [57]. Liu et al. found that companies’ environmental strategies depend on decision makers’ perception of the environment [58]. Some scholars have opposing views, however. The behavioral traits of the executive team are determinants of their decision-making behaviors, and managers’ environmental awareness does not necessarily translate into positive environmental behaviors [59]. Gao et al. proposed that, based on principal–agent theory, management may give up high-risk GTI projects in pursuit of stable personal status, because green innovation is characterized by high levels of risk and high costs [60].

This study agrees that managers play an active role in strategic corporate decision making. Managers who are concerned about environmental governance can guide companies to implement sustainability strategies [61,62]. Considering the motivations for environmental protection, Li et al. classified executive environmental awareness into the categories of opportunity- and responsibility-based environmental awareness [63]. Managers with high opportunistic environmental awareness are highly sensitive to environmental opportunities. To meet stakeholders’ moral expectations regarding whether a company fulfills its social responsibility, these managers tend to optimize resource allocation and direct the company to pay attention to the R&D of green products and technologies. Responsible and environmentally conscious managers have a strong sense of environmental responsibility, view public environmental issues as CSR, and take the initiative to guide companies toward green activities and assist them in not only developing an outstanding social reputation and green image but also in attracting investors who value environmental protection [63]. The potential risks associated with environmental governance alarm investors. To mitigate companies’ negative impact on the environment, executives take the initiative to lead companies in CSR activities and increase the number of strategic decisions aimed at environmental protection [64]. Implementing environmental laws and regulations draws the attention of the public, investors, and analysts to the ecological environment, and stakeholder pressure forces executives to increase their involvement in CSR activities and pay attention to green governance [65]. Executive environmental attention leads to the formalization of corporate beliefs and behavioral norms, as well as the implementation of environmental concepts in production activities, leading to long-term improvements in economic and social performance [66,67]. When executive team members direct their attentions to environmental protection, they determine the direction of corporate green behavior, improve the efficiency of socially responsible strategies, and allocate resources to technological innovation [68]. Based on this analysis, this study proposes the following hypothesis:

Hypothesis 4 (H4).

Executive teams’ environmental attention positively moderates the impact of CSR on GTI.

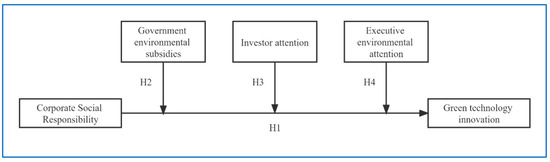

Figure 1 shows the model diagram used in this study.

Figure 1.

Study model.

3. Data and Research Methods

3.1. Sample Selection and Data Sources

In 2010, China’s Ministry of Environmental Protection issued the Guidelines for the Disclosure of the Environmental Information of Listed Companies (Draft for Public Comment), reflecting an increased emphasis on the mandatory disclosure of environmental information at the national level. However, given the impact of the COVID-19 outbreak on the economy, data availability and stability after 2020 are poor. Therefore, this study selected 1673 Chinese A-share listed companies from 2011 to 2020 as research objects. The data related to corporate GTI, government environmental protection subsidies, and investor concerns were obtained from the China Research Data Service (CNRDS) platform database. The social responsibility data were obtained from Hexun.com’s social responsibility ratings. As for the other data, they were obtained from the WIND database, the China Stock Market and Accounting Research database, and annual reports of listed companies. To exclude the interference of other factors and ensure the rationality and accuracy of the data, this study adopted the following treatment for the sample data: (1) ST (special treatment, which refers to listed companies with negative net profits for two consecutive fiscal years), *ST (special treatment*, which refers to listed companies with losses for three consecutive fiscal years and delisting warnings), PT (special transfer, which refers to listed companies that have stopped trading and are cleaning up their prices and waiting for delisting), and delisted companies were excluded. (2) Companies in the financial sector were excluded because the financial statement standards for companies in this sector are not consistent with those for other industries. (3) To eliminate the influence of outliers on the results, this study winsorized all continuous variables at the 1% and 99% levels. (4) To eliminate the influence of heteroskedasticity, this study logarithmicized some of the main continuous variables. (5) To explain the economic significance of the coefficients of the independent variables and covariance issues, this study considered the continuous variables involved in the interaction term of the moderating effect. Table 1 illustrates the sample processing.

Table 1.

Sample selection.

3.2. Definition of Variables

3.2.1. Dependent Variable

GTI follows the laws of ecological economics. It is the core component of green innovation, which involves a series of technological innovation activities, such as process innovation and green production, with limited consideration of resource conservation and the reduction of pollution and environmental damage based on the premise of pursuing ecological environmental protection and adhering to relevant legal policies [69]. It is also one of the ways in which the dual goals of environmental protection and economic performance improvement can be achieved.

In this study, we refer to the work of Zhang and Jin and use the total number of green patents granted by a firm in the current year as a proxy variable for the dependent variable, that is, GTI capability [70]. The total number of green patent authorizations is the sum of the number of patent authorizations for green invention and the number of green utility model patent authorizations of the enterprise in the current year. On the basis of these variables, we add 1 and take the natural logarithm. The data on the green patents granted by enterprises in the current year were obtained from the database of the CNRDS platform.

3.2.2. Independent Variable

CSR requires the pursuit of social benefits that go beyond corporate interests [71]. Scholars such as Javeed have pointed out the need to reasonably and appropriately measure the outcomes of CSR behaviors. The measurement of CSR involves many aspects, with human rights, stakeholder power, and community power being discussed in most studies and later expanded to a greater extent (e.g., the disclosure of CSR reports) [72]. This study selects CSR as an independent variable. Considering authority and independence, this study refers to the work of Wu and Jin and adopts the CSR scores released by third-party rating agencies and Xun.com as independent variables [73]. The higher the social responsibility score issued by Hexun.com, the better the CSR performance. This indicator contains five components: shareholder responsibility; employee responsibility; supplier, customer, and consumer responsibility; environmental responsibility; and social responsibility.

3.2.3. Regulating Variables

Government Environmental Protection Subsidies

Government environmental protection subsidies are the direct financial support provided by the government to encourage enterprises to develop environmental protection projects and to research and develop environmental protection products. They compensate for the investment cost of enterprise innovation and increase enterprises’ willingness to fulfill their social responsibilities. Government subsidies include a number of general items; therefore, this study specifically selects the subsidy items disclosed by enterprises that relate to environmental protection, including environmental protection fund subsidies, special subsidies for energy conservation, circular economy incentives, and pollution treatment subsidies. This study refers to the studies of Jiang et al. [37] and takes the natural logarithm of the total amount of annual government environmental subsidies [74,75]. The data on government environmental subsidies for enterprises were obtained from the CNRDS platform.

Investor Attention

Investor attentiveness measures investors’ attention to the stock market during a specific period and reflects their reactions to information, which is an important factor in investment decisions. In previous studies, different scholars have proposed various ways to measure investor attention. Some scholars have used the trading volume and turnover rate to measure investors’ attention to stocks [76,77]. The development of the internet has provided investors with new ways to obtain information. Pham and Cepni used the Google search volume index and Bloomberg Terminal News to measure investor attention [78]. Hao and Xiong suggested using the Baidu engine search volume to measure the Chinese market level of investor concern [42]. As search indexes can reflect investors’ desire to obtain information, the current study refers to the work of Hao et al. (2023), who used the online search index of listed companies to measure investor attention using a logarithmic approach [79]. The annual data on investor attention for enterprises were obtained from the CNRDS.

The Executive Team’s Environmental Focus

The executive team’s attention to the environment may lead them to introduce green ideas into the company’s daily management activities, and their views on society and the environment will affect their decision making [64]. According to the Whorf–Sapir hypothesis, the embedded words used by individuals while participating in social activities accurately reflect their inner thoughts and can be used as a concrete manifestation of their perceptions [80]. Duriau et al. suggested that textual analysis is largely effective in measuring managers’ perceptions and can be used in research design [81]. Therefore, the frequency with which environment-related terms appear in companies’ annual and social responsibility reports can be used to measure the level of environmental awareness of corporate executive teams [63]. To this end, the current study identified 75 environment-related keywords, such as low carbon, sustainability, green, reuse, recycling, environmental protection, environment, harmless, paperless, emission, destruction, and energy; these keywords were selected in conjunction with the relevant literature and policies and regulations. The frequency of related terms in corporate annual reports was counted to capture the environmental attention of corporate executives.

3.2.4. Control Variables

To mitigate the effects of other possible factors, this study referred to the studies of Wu and Zhang et al. and selected the following seven control variables from different aspects [70,73,82]: firm size (Size), gearing ratio (Lev), asset margin (Roa), investor shareholding ratio (Inst), cash flow ratio (Cashflow), dual position (Dual), and independent director ratio (Indep). Industry (industry) and year (year) were also controlled. Table 2 presents the definitions and measurements of these variables.

Table 2.

Definitions and measurements of variables.

3.3. Research Model

To examine the impact of CSR on GTI—that is, to test whether Hypothesis 1 is true—this study constructed the following panel econometric model (1):

In model (1), i and t denote an individual enterprise and the year, respectively; denotes the level of social responsibility taken on by enterprise i in year t; denotes the level of GTI of enterprise i in year t represents each control variable; α represents the constant term; represents the random disturbance term; and and represent the fixed effects on industry and year, respectively. If the coefficient in the model is positive and significant, then hypothesis 1 is supported.

To further verify the moderating effect of government environmental protection subsidies, investor attention, and the environmental attention of the executive team on the relationship between CSR and GTI capabilities, that is, to test whether hypotheses 2 to 4 are supported, this study added an interaction term between the moderating variables and CSR in models (2)–(4):

In models (2)–(4), the moderating variables are with interaction term , with interaction term , and with interaction term . If the coefficient of the interaction term in the model is positive and significant, then hypotheses 2 to 4 hold. The Hausman test yielded a p-value of 0.0000; therefore, this study used a fixed effect regression model.

4. Results of Empirical Analysis

4.1. Descriptive Statistics and Correlation Analysis

Table 3 shows that the mean of green patent authorizations is 0.25, with a minimum value of 0 and a maximum value of 4.86. These results imply that listed companies do not prioritize GTI. The maximum value of the CSR score is 90.87, the minimum value is −11.27, and the standard deviation is 15.09. These results indicate that different enterprises do not equally fulfill their social responsibilities and that the gap between them is large. The minimum value of government environmental protection subsidies is 5.8, the maximum value is 21.24, and the mean value is 13.27. These values indicate that environmental protection subsidies are mostly concentrated at the middle level. The mean value of investor concern is 12.76, while the standard deviation is 0.69. The minimum value for the environmental attention of the executive team is 0, the maximum value is 7.67, and the mean value is 4.41. These results reveal some differences between different individual companies. Furthermore, the standard deviation of some control variables is significant. For example, the standard deviation of enterprise size is 1.2, the minimum value of total asset margin is −0.4, and the maximum value is 0.24, indicating clear differences in the strength of the sample enterprises. Table 3 lists the detailed descriptive statistical results.

Table 3.

Descriptive statistics.

4.2. Correlation Analysis

The results of the correlation analyses are shown in Table 4. The table shows that the social responsibility scores of the sample companies are significantly and positively correlated with the number of green patents granted at the 1% level. Hence, Hypothesis 1 is supported to some extent. In addition, the correlation coefficients between the explanatory variables are less than 0.8, and the variance inflation factor values of all variables are less than 3, indicating that multicollinearity is not an issue.

Table 4.

Correlation analysis.

4.3. Analysis of Regression Results

According to the results of model (1) (column 2 in Table 5), the regression coefficient of the CSR score and green patent authorizations (GTI) is 0.005, indicating that companies can improve their GTI capabilities by fulfilling their social responsibility. Thus, Hypothesis 1 holds; that is, enterprises with a high level of GTI have excellent CSR.

Table 5.

Regression results.

Column 3 in Table 5 shows the regression test results for model (2). The regression coefficients between the CSR scores and the number of green patents granted by enterprises are significantly and positively correlated at the 1% level. Meanwhile, the interaction term between social responsibility and government environmental subsidies is significantly positive at the 1% level, indicating that government environmental subsidies positively moderate the positive impact of CSR on GTI capabilities. On the one hand, as a form of environmental regulation, government environmental subsidies improve the environmental performance of enterprises; on the other hand, government environmental subsidies provide direct financial resources for enterprises, reducing their costs and risks. Therefore, Hypothesis 2 is supported; that is, the greater the government environmental protection subsidy, the stronger the positive impact of social responsibility on GTI.

According to column 4 of Table 5, the regression coefficient between the CSR scores and the number of green patents granted by enterprises is 0.004, which is significantly and positively correlated at the 1% level. Meanwhile, the interaction term between social responsibility and investor attention is statistically significant at the 1% level, indicating that investor attention positively moderates the positive impact of CSR on GTI capabilities. On the one hand, investor attention serves as an informal system that has a supervisory effect on strategic corporate decisions. On the other hand, firms that cater to investors’ environmental preferences can reap more rewards. Therefore, Hypothesis 3 is supported; that is, the higher the degree of investor concern, the stronger the positive influence of the corporate fulfillment of social responsibility on GTI capabilities.

As shown in column 5 of Table 5, the regression coefficients between CSR scores and the number of green patents granted by companies are significantly and positively correlated at the 1% level. Meanwhile, the interaction term between social responsibility and the environmental focus of the executive team is significantly positive at the 1% level, indicating that the executive team’s environmental focus positively moderates the positive effect of CSR on GTI capabilities. The behavioral perceptions of executives determine the strategic direction of the company, and the environmental attentions of executives drive corporate decisions toward green development. Therefore, Hypothesis 4 is supported; that is, the greater the environmental commitment of executives, the stronger the positive effect of CSR fulfillment on GTI capabilities.

4.4. Robustness Tests

To test the robustness of the empirical results, this study refers to other studies and uses the following three approaches for validation:

4.4.1. Substitution of Independent Variables

Referring to Xue et al., this study selected three sub-scores in the CSR report of Hexun.com as alternative variables to the total CSR score: environmental responsibility (CSR_E); social responsibility (CSR_S); and supplier, customer, and consumer rights and interests responsibility (CSR_R) [21]. Table 6 displays the results, with columns 2–4 showing the regression results without control variables. When the independent variables are CSR_S, CSR_E, and CSR_R, the results are significantly positive at the 1% level. When the control variables are added, the regressions between CSR_S, CSR_E, and CSR_R and the number of green patents granted are significantly positive at the 1% level. These results indicate that enterprises that actively undertake social responsibility, environmental responsibility, and responsibility for the rights and interests of suppliers, customers, and consumers have robust GTI capabilities. There are two possible explanations for this relationship: first, companies that meet the social and environmental expectations and requirements of their stakeholders pay close attention to their green innovation and sustainable development and take the initiative to conduct R&D on GTI. Second, companies that satisfy this condition are likely to gain the attention of the public, government, and investors, and thus receive support for developing GTI capabilities. Thus, the robustness of the regression results is verified.

Table 6.

Substitution of independent variables.

4.4.2. Replacement Sample Interval

The COVID-19 pandemic in 2020 had a significant impact on the economies of countries worldwide. Specifically, epidemic prevention and control policies have caused significant disruptions to business operations and development; therefore, the study results may be biased. To illustrate the robustness of the empirical results, this study refers to the work of Gao and Jin [83]. For the sake of sample stability and rationality, the observations from 2020 are excluded; that is, the sample observation interval is adjusted from 2011 to 2020 to 2011 to 2019, and regression statistical analysis is performed [83]. Table 7 presents the regression results after replacing the sample interval. The results in Table 7 show that the regression coefficients between the CSR scores and the number of green patents granted in models (1) to (4) are all significantly and positively correlated at the 1% level. Meanwhile, all the interaction terms (CSR*ESA, CSR*IA, and CSR*EEA) are also statistically significant at the 1% level and pass the significance test. This test demonstrates the robustness of the empirical results.

Table 7.

Replacement of sample interval.

4.4.3. Two-Stage Least Squares (2SLS) Test

This study conducted fixed-effects regression to explore the mechanism of the influence between CSR and GTI. Issues such as omitted variables, reverse causality, and sample selection bias may have affected the findings. To address potential endogeneity issues and consider the possible temporal effects of social responsibility, this study drew on previous studies, used one-period lagged corporate social responsibility (LCSR) as an instrumental variable, and performed robustness tests using the two-stage least squares (2SLS) method [84,85,86]. Table 8 presents the results of the 2SLS test. In the first stage of the 2SLS test, the regression coefficient of LCSR on CSR is 0.211, indicating a positive correlation at the 1% significance level. In the second stage of the test, the regression coefficient of the fitted value of CSR on GTI is 0.009, which is significantly positive at the 1% significance level. In addition, the results of the Durbin–Wu–Hausman test showed that the Kleibergen–Paap rk Lagrange multiplier statistic is 26.505, indicating that the instrumental variables are identifiable. Meanwhile, the Cragg–Donald Wald F statistic and Kleibergen–Paap rk Wald F statistic are 73.220 and 36.209, respectively, thus passing the weak instrumental variable test.

Table 8.

Two-stage least squares regression results.

5. Discussion

The relationship between CSR and green innovation is controversial due to issues such as management myopia and externalities, but most scholars believe that CSR positively promotes GTI. The findings of this study further confirm the positive impact of corporate social responsibility on corporations’ green technology innovation capabilities, which is consistent with previous empirical studies [87,88,89]. At the same time, the study results support stakeholder theory. Therefore, CSR practices can be used to achieve sustainable development by enhancing corporate image [90], improving environmental performance [91], facilitating resource interaction between companies and stakeholders [92], and achieving talent–knowledge integration [93], which in turn improve green technology innovation.

In addition, this study explored the moderating mechanisms from the perspectives of different stakeholder groups and considering the three dimensions of government environmental subsidies, investor concerns, and executive environmental attention. The results of the regression analysis indicate that, despite the different mechanisms of action of different stakeholders, the pressure and drive of stakeholders to actively engage in socially responsible behavior is still beneficial to the advancement of their green technology innovation level. Therefore, the results of the study provide a more detailed extension of the stakeholder theory. Future research can define and classify CSR in more detail according to the different perspectives of stakeholders and analyze it from the perspective of motivation.

6. Conclusions and Implications

6.1. Conclusions

With increasing environmental awareness, China is actively encouraging companies to participate in activities linked to social responsibility. Stakeholders, such as the government and the public, are paying increasing attention to corporate social and environmental performance. In this context, this study selected for analysis data from Chinese A-share companies listed on the Shanghai and Shenzhen Exchanges from 2011 to 2020. We explored the direct impact of CSR on corporate GTI. Additionally, we offer an in-depth discussion of the moderating mechanisms of the relationship between CSR and GTI through elements such as government environmental subsidies, investor attention, and executives’ environmental attention. The conclusions of this study are as follows: (1) CSR has a positive impact on corporate GTI. (2) The greater the government’s environmental protection subsidies, the stronger the promotion effect of CSR on corporate GTI. (3) The higher the level of investor attention, the more obvious the promotion effect of CSR on corporate GTI. (4) The higher the environmental attention of executives, the greater the promotion effect of CSR on corporate GTI. The empirical results of this study are consistent with the results of previous studies and further validate the direct influence mechanism of CSR on green technology innovation. At the same time, this study subdivides the stakeholder groups and analyzes their moderating effects, providing a basis to extend and complement the relevant theories.

6.2. Implications

6.2.1. Theoretical Implications

Through the empirical analysis of Chinese A-share listed companies, this study has the following theoretical implications. This study extends the body of relevant literature. The correlation between corporate social responsibility and green innovation has been debated for a long time, and the discussion on corporate green innovation capability is still a major hot topic. This study focuses on the socio-environmental performance of firms, with a focus on improving corporate green technology innovation, and explores how active corporate social responsibility can improve green technology innovation, providing a theoretical basis for future research. This study clarifies the direct influence mechanism of corporate social responsibility on green technology innovation from the perspective of stakeholders and resource-based theory, and more studies can be conducted in the future to explore the relationship between the two. Despite the externalities of corporate green innovation, this study hypothesizes and verifies the driving role of social responsibility on green technology innovation. At the same time, this study, by subdividing according to different types of corporate stakeholders, reveals the moderating role of stakeholders, enriches stakeholder theory, and provides new directions for future research. From the results, it can be seen that government environmental subsidies play a supervisory and supportive role, that investor attention can motivate firms to fulfill their social responsibility and engage in green innovation, and that the environmental attention of executives determines the direction of firms’ green strategies.

6.2.2. Managerial Implications

On the basis of the analyses herein, this study provides the following insights of how companies can be supported at various levels in their social responsibility activities and in improving their GTI capabilities.

Government level. First, the government should increase the strength of environmental regulations, adjust the corresponding policies appropriately, and create a macro-market environment favorable to the green development of enterprises. Second, to alleviate financing constraints, the government should increase the depth and breadth of environmental protection subsidies and provide reasonable and effective financial support for CSR activities and green behavior.

Investor level. First, investors should observe the evolution of the environment and pay attention to the aspects of enterprises that go beyond financial performance. Investors should consider whether enterprises adequately fulfill their social responsibilities in their assessments of enterprises, as well as encourage enterprises to increase their participation in social responsibility activities and provide direct financial support for enterprises to promote the improvement of GTI on the basis of a reasonable assessment of macro- and micro-environmental risks. Second, from the perspective of enterprises, they should take advantage of the internet era to capture investors’ attention in a timely and accurate manner, guiding investors to focus on the sustainable development of enterprises and increasing investment support.

Executive level. First, corporate executives should astutely and accurately determine the social and environmental preferences of corporate stakeholders, improve their green cognition, adhere to green management concepts, guide the development of green innovation, and enhance their green image to gain the satisfaction and trust of stakeholders. Second, enterprise management personnel should consider the dual externalities of green innovation, avoid the risks associated with environmental pollution, and focus on the dual development of the short-term gains and long-term sustainable development performance of the enterprise.

6.3. Limitations and Future Prospects

This study has several limitations. First, it only explored listed companies as the research object and did not consider the applicability of non-listed companies, and it lacks comparative analysis. Therefore, other researchers can fill this gap, starting with SMEs. Second, this study selected variables from the perspectives of three corporate stakeholders, namely, governments, investors, and executives, to verify the moderating mechanism; however, it did not consider other stakeholders. Future research could supplement the relevant theoretical studies from the aforementioned perspectives. Third, this study used green patents to measure enterprises’ level of green technological innovation, which is a single measurement. Due to the limited data collection time, we did not explore other options. Future research can use other means of investigating variables of the green technology innovation of enterprises.

Author Contributions

Y.C., data collection and formal analysis; S.J., manuscript—initial draft preparation, review, and editing. All the authors contributed to the study’s conception and design. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Roh, T.; Noh, J.; Oh, Y.; Park, K.S. Structural relationships of a firm’s green strategies for environmental performance: The roles of green supply chain management and green marketing innovation. J. Clean. Prod. 2022, 356, 131877. [Google Scholar] [CrossRef]

- Roh, T.; Lee, K.; Yang, J.Y. How do intellectual property rights and government support drive a firm’s green innovation? The mediating role of open innovation. J. Clean. Prod. 2021, 317, 128422. [Google Scholar] [CrossRef]

- Lee, M.J.; Roh, T. Unpacking the sustainable performance in the business ecosystem: Coopetition strategy, open innovation, and digitalization capability. J. Clean. Prod. 2023, 412, 137433. [Google Scholar] [CrossRef]

- Pan, D.; Hong, W. Benefits and costs of campaign-style environmental implementation: Evidence from China’s central environmental protection inspection system. Environ. Sci. Pollut. Res. 2022, 29, 45230–45247. [Google Scholar] [CrossRef]

- Pu, X.; Zeng, M.; Zhang, W. Corporate sustainable development driven by high-quality innovation: Does fiscal decentralization really matter? Econ. Anal. Policy 2023, 78, 273–289. [Google Scholar] [CrossRef]

- Halkos, G.; Nomikos, S. Corporate social responsibility: Trends in global reporting initiative standards. Econ. Anal. Policy 2021, 69, 106–117. [Google Scholar] [CrossRef]

- Bai, Y.A. Corporate social responsibility and corporate innovation output: Empirical evidence based on Chinese listed companies. Manag. Decis. Econ. 2022, 43, 3534–3547. [Google Scholar] [CrossRef]

- Hao, J.; He, F. Corporate social responsibility (CSR) performance and green innovation: Evidence from China. Financ. Res. Lett. 2022, 48, 102889. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- García-Piqueres, G.; García-Ramos, R. Complementarity between CSR dimensions and innovation: Be-haviour, objective or both? Eur. Manag. J. 2022, 40, 475–489. [Google Scholar] [CrossRef]

- Yang, H.; Shi, X.; Wang, S. Moderating effect of chief executive officer narcissism in the relationship be-tween corporate social responsibility and green technology innovation. Front. Psychol. 2021, 12, 717491. [Google Scholar] [CrossRef]

- Li, C.; Wang, Z.; Wang, L. Factors affecting firms’ green technology innovation: An evolutionary game based on prospect theory. Environ. Monit. Assess. 2023, 195, 227. [Google Scholar] [CrossRef] [PubMed]

- Halkos, G.; Skouloudis, A. Corporate social responsibility and innovative capacity: Intersection in a mac-ro-level perspective. J. Clean. Prod. 2018, 182, 291–300. [Google Scholar] [CrossRef]

- Xie, Y.; Gao, S.; Jiang, X.; Fey, C.F. Social ties and indigenous innovation in China’s transition economy: The moderating effects of learning intent. Ind. Innov. 2015, 22, 79–101. [Google Scholar] [CrossRef]

- Seroka-Stolka, O.; Fijorek, K. Linking stakeholder pressure and corporate environmental competitiveness: The moderating effect of ISO 14001 adoption. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1663–1675. [Google Scholar] [CrossRef]

- Jayaraman, K.; Jayashree, S.; Dorasamy, M. The effects of green innovations in organizations: Influence of stakeholders. Sustainability 2023, 15, 1133. [Google Scholar] [CrossRef]

- Sheldon, O. The social responsibility of management. Philos. Manag. 1924, 70–99. [Google Scholar]

- Aguinis, H. Organizational responsibility: Doing good and doing well. In APA Handbook of Industrial and Organizational Psychology, Vol. 3. Maintaining, Expanding, and Contracting the Organization; Zedeck, S., Ed.; American Psychological Association: Washington, DC, USA, 2011; pp. 855–879. [Google Scholar] [CrossRef]

- Wang, Y.; Yang, Y.; Fu, C.; Fan, Z.; Zhou, X. Environmental regulation, environmental responsibility, and green technology innovation: Empirical research from China. PLoS ONE 2021, 16, e0257670. [Google Scholar] [CrossRef]

- Bahta, D.; Yun, J.; Islam, M.R.; Ashfaq, M. Corporate social responsibility, innovation capability and firm performance: Evidence from SME. Soc. Responsib. J. 2021, 17, 840–860. [Google Scholar] [CrossRef]

- Xue, Y.; Jiang, C.; Guo, Y.; Liu, J.; Wu, H.; Hao, Y. Corporate social responsibility and high-quality development: Do green innovation, environmental investment and corporate governance matter? Emerg. Mark. Financ. Trade 2022, 58, 3191–3214. [Google Scholar] [CrossRef]

- Farmaki, A. Corporate social responsibility in hotels: A stakeholder approach. Int. J. Contemp. Hosp. Manag. 2019, 31, 2297–2320. [Google Scholar] [CrossRef]

- Pekovic, S.; Vogt, S. The fit between corporate social responsibility and corporate governance: The impact on a firm’s financial performance. Rev. Manag. Sci. 2021, 15, 1095–1125. [Google Scholar] [CrossRef]

- Paruzel, A.; Klug, H.J.; Maier, G.W. The relationship between perceived corporate social responsibility and employee-related outcomes: A meta-analysis. Front. Psychol. 2021, 12, 607108. [Google Scholar] [CrossRef] [PubMed]

- Flores-Hernández, J.A.; Cambra-Fierro, J.J.; Vázquez-Carrasco, R. Sustainability, brand image, reputation and financial value: Manager perceptions in an emerging economy context. Sustain. Dev. 2020, 28, 935–945. [Google Scholar] [CrossRef]

- Chun, R. Corporate reputation: Meaning and measurement. Int. J. Manag. Rev. 2005, 7, 91–109. [Google Scholar] [CrossRef]

- Ramayah, T.; Falahat, M.; Soto-Acosta, P. Effects of corporate social responsibility on employee commitment and corporate reputation: Evidence from a transitional economy. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 2006–2015. [Google Scholar] [CrossRef]

- Padilla-Lozano, C.P.; Collazzo, P. Corporate social responsibility, green innovation and competitiveness–causality in manufacturing. Compet. Rev. Int. Bus. J. 2022, 32, 21–39. [Google Scholar] [CrossRef]

- Malen, J.; Marcus, A.A. Environmental externalities and weak appropriability: Influences on firm pollution reduction technology development. Bus. Soc. 2019, 58, 1599–1633. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M. Who is financing corporate green innovation? Int. Rev. Econ. Financ. 2022, 78, 321–337. [Google Scholar] [CrossRef]

- Wu, Z.; Fan, X.; Zhu, B.; Xia, J.; Zhang, L.; Wang, P. Do government subsidies improve innovation investment for new energy firms: A quasi-natural experiment of China’s listed companies. Technol. Forecast. Soc. Chang. 2022, 175, 121418. [Google Scholar] [CrossRef]

- Dong, Q.; Wu, Y.; Lin, H.; Sun, Z.; Liang, R. Fostering green innovation for corporate competitive advantages in big data era: The role of institutional benefits. Technol. Anal. Strateg. Manag. 2022, 34, 1–14. [Google Scholar] [CrossRef]

- Wenqi, D.; Khurshid, A.; Rauf, A.; Calin, A.C. Government subsidies’ influence on corporate social responsibility of private firms in a competitive environment. J. Innov. Knowl. 2022, 7, 100189. [Google Scholar] [CrossRef]

- Ren, S.; Sun, H.; Zhang, T. Do environmental subsidies spur environmental innovation? Empirical evidence from Chinese listed firms. Technol. Forecast. Soc. Chang. 2021, 173, 121123. [Google Scholar] [CrossRef]

- Zhang, W.; Luo, Q.; Liu, S. Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Anal. Policy 2022, 74, 105–121. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, Y. Do state subsidies increase corporate environmental spending? Int. Rev. Financ. Anal. 2020, 72, 101592. [Google Scholar] [CrossRef]

- Ding, L.; Xu, Y. Government subsidies and corporate environmental investments: A resource-based perspective. Kybernetes 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Zhong, Z.; Peng, B. Can environmental regulation promote green innovation in heavily polluting enterprises? Empirical evidence from a quasi-natural experiment in China. Sustain. Prod. Consum. 2022, 30, 815–828. [Google Scholar] [CrossRef]

- Qi, Y.; Chai, Y.; Jiang, Y. Threshold effect of government subsidy, corporate social responsibility and brand value using the data of China’s top 500 most valuable brands. PLoS ONE 2021, 16, e0251927. [Google Scholar] [CrossRef]

- Nekrasov, A.; Teoh, S.H.; Wu, S. Visuals and attention to earnings news on Twitter. Rev. Account. Stud. 2022, 27, 1233–1275. [Google Scholar] [CrossRef]

- Hao, J.; Xiong, X. Retail investor attention and firms’ idiosyncratic risk: Evidence from China. Int. Rev. Financ. Anal. 2021, 74, 101675. [Google Scholar] [CrossRef]

- Gilal, F.G.; Channa, N.A.; Gilal, N.G.; Gilal, R.G.; Gong, Z.; Zhang, N. Corporate social responsibility and brand passion among consumers: Theory and evidence. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2275–2285. [Google Scholar] [CrossRef]

- Biktimirov, E.N.; Afego, P.N. Do investors value environmental sustainability? Evidence from the FTSE Environmental Opportunities 100 index. Financ. Res. Lett. 2022, 44, 102112. [Google Scholar] [CrossRef]

- Kordsachia, O.; Focke, M.; Velte, P. Do sustainable institutional investors contribute to firms’ environmental performance? Empirical evidence from Europe. Rev. Manag. Sci. 2021, 16, 1409–1436. [Google Scholar] [CrossRef]

- Yoshino, N.; Taghizadeh-Hesary, F.; Otsuka, M. COVID-19 and optimal portfolio selection for investment in sustainable development goals. Financ. Res. Lett. 2021, 38, 101695. [Google Scholar] [CrossRef]

- Martínez, M.D.C.V.; Román, R.S.; Mart, P.A. Should risk-averse investors target the portfolios of socially responsible companies? Oecon. Copernic. 2022, 13, 439–474. [Google Scholar] [CrossRef]

- Dyck, A.; Lins, K.V.; Roth, L.; Wagner, H.F. Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 2019, 131, 693–714. [Google Scholar] [CrossRef]

- Kyaw, K.; Olugbode, M.; Petracci, B. Stakeholder engagement: Investors’ environmental risk aversion and corporate earnings. Bus. Strategy Environ. 2022, 31, 1220–1231. [Google Scholar] [CrossRef]

- Xu, J.; Zeng, S.; Qi, S.; Cui, J. Do institutional investors facilitate corporate environmental innovation? Energy Econ. 2023, 117, 106472. [Google Scholar] [CrossRef]

- Chen, W.; Zhu, Y.; Wang, C. Executives’ overseas background and corporate green innovation. Corp. Soc. Responsib. Environ. Manag. 2022, 30, 165–179. [Google Scholar] [CrossRef]

- Javed, M.; Wang, F.; Usman, M.; Gull, A.A.; Zaman, Q.U. Female CEOs and green innovation. J. Bus. Res. 2023, 157, 113515. [Google Scholar] [CrossRef]

- Ju, X.; Jiang, S.; Zhao, Q. Innovation effects of academic executives: Evidence from China. Res. Policy 2023, 52, 104711. [Google Scholar] [CrossRef]

- Wu, J.; Richard, O.C.; Triana, M.D.C.; Zhang, X. The performance impact of gender diversity in the top management team and board of directors: A multiteam systems approach. Hum. Resour. Manag. 2022, 61, 157–180. [Google Scholar] [CrossRef]

- Yi, Y.; Chen, Y.; He, X. CEO leadership, strategic decision comprehensiveness, and firm performance: The moderating role of TMT cognitive conflict. Manag. Organ. Rev. 2022, 18, 131–166. [Google Scholar] [CrossRef]

- Hambrick, D.C. Upper echelons theory: An update. Acad. Manag. Rev. 2007, 32, 334–343. [Google Scholar] [CrossRef]

- Ocasio, W. Attention to attention. Organ. Sci. 2011, 22, 1286–1296. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, J.; Liu, S. Executive Team Functional Background and Enterprise Green Technology Innovation. In Proceedings of the 2022 2nd International Conference on Business Administration and Data Science (BADS 2022), Kashgar, China, 28–30 October 2022; Atlantis Press: Paris, France, 2023; pp. 109–116. [Google Scholar] [CrossRef]

- Wang, L.; Zeng, T.; Li, C. Behavior decision of top management team and enterprise green technology innovation. J. Clean. Prod. 2022, 367, 133120. [Google Scholar] [CrossRef]

- Gao, K.; Wang, L.; Liu, T.; Zhao, H. Management executive power and corporate green innovation: Empirical evidence from China’s state-owned manufacturing sector. Technol. Soc. 2022, 70, 102043. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M.; Larsen, B.; Rosenbaum, P. CEO education and corporate environmental footprint. J. Environ. Econ. Manag. 2019, 94, 254–273. [Google Scholar] [CrossRef]

- Zhu, X.; Zuo, X.; Li, H. The dual effects of heterogeneous environmental regulation on the technological innovation of Chinese steel enterprises: Based on a high-dimensional fixed effects model. Ecol. Econ. 2021, 188, 107113. [Google Scholar] [CrossRef]

- Li, J.; Lian, G.; Xu, A. How do ESG affect the spillover of green innovation among peer firms? Mechanism discussion and performance study. J. Bus. Res. 2023, 158, 113648. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Samad, S.; Nilashi, M.; Almulihi, A.; Alrizq, M.; Alghamdi, A.; Mohd, S.; Azhar, S.N.F.S. Green supply chain management practices and impact on firm performance: The moderating effect of collaborative capability. Technol. Soc. 2021, 67, 101766. [Google Scholar] [CrossRef]

- Cao, C.; Tong, X.; Chen, Y.; Zhang, Y. How top management’s environmental awareness affect corporate green competitive advantage: Evidence from China. Kybernetes 2022, 51, 1250–1279. [Google Scholar] [CrossRef]

- Aftab, J.; Abid, N.; Sarwar, H.; Veneziani, M. Environmental ethics, green innovation, and sustainable performance: Exploring the role of environmental leadership and environmental strategy. J. Clean. Prod. 2022, 378, 134639. [Google Scholar] [CrossRef]

- Velte, P.; Stawinoga, M. Do chief sustainability officers and CSR committees influence CSR-related outcomes? A structured literature review based on empirical-quantitative research findings. J. Manag. Control 2020, 31, 333–377. [Google Scholar] [CrossRef]

- Wei, X.; Wu, H.; Yang, Z.; Han, C.; Xu, B. Simulation of Manufacturing Scenarios’ Ambidexterity Green Technological Innovation Driven by Inter-Firm Social Networks: Based on a Multi-Objective Model. Systems 2023, 11, 39. [Google Scholar] [CrossRef]

- Zhang, C.; Jin, S. What drives sustainable development of enterprises? Focusing on ESG management and green technology innovation. Sustainability 2022, 14, 11695. [Google Scholar] [CrossRef]

- Dmytriyev, S.D.; Freeman, R.E.; Hörisch, J. The relationship between stakeholder theory and corporate social responsibility: Differences, similarities, and implications for social issues in management. J. Manag. Stud. 2021, 58, 1441–1470. [Google Scholar] [CrossRef]

- Javeed, S.A.; Teh, B.H.; Ong, T.S.; Chong, L.L.; Abd Rahim, M.F.B.; Latief, R. How does green innovation strategy influence corporate financing? Corporate social responsibility and gender diversity play a moderating role. Int. J. Environ. Res. Public Health 2022, 19, 8724. [Google Scholar] [CrossRef]

- Fu, L.; Pan, L.; Zhao, J. Can Passive Investors Improve Corporate Social Responsibility? Evidence from Chinese Listed Firms. Emerg. Mark. Financ. Trade 2023, 59, 404–419. [Google Scholar] [CrossRef]

- Jiang, Z.; Xu, C.; Zhou, J. Government environmental protection subsidies, environmental tax collection, and green innovation: Evidence from listed enterprises in China. Environ. Sci. Pollut. Res. 2023, 30, 4627–4641. [Google Scholar] [CrossRef] [PubMed]

- Sun, X.; Tang, J.; Li, S. Promote green innovation in manufacturing enterprises in the aspect of government subsidies in China. Int. J. Environ. Res. Public Health 2022, 19, 7864. [Google Scholar] [CrossRef] [PubMed]

- Baker, M.; Wurgler, J. Investor sentiment in the stock market. J. Econ. Perspect. 2007, 21, 129–151. [Google Scholar] [CrossRef]

- Zhang, G.; Fang, C.; Zhang, W.; Wang, Q.; Hu, D. How does the implementation of the new Environmental Protection Law affect the stock price of heavily polluting enterprises? Evidence from China’s capital market. Emerg. Mark. Financ. Trade 2019, 55, 3513–3538. [Google Scholar] [CrossRef]

- Pham, L.; Cepni, O. Extreme directional spillovers between investor attention and green bond markets. Int. Rev. Econ. Financ. 2022, 80, 186–210. [Google Scholar] [CrossRef]

- Hao, J. Retail investor attention and corporate innovation in the big data era. Int. Rev. Financ. Anal. 2023, 86, 102486. [Google Scholar] [CrossRef]

- Sapir, E. Grading, a study in semantics. Philos. Sci. 1944, 11, 93–116. [Google Scholar] [CrossRef]

- Duriau, V.J.; Reger, R.K.; Pfarrer, M.D. A content analysis of the content analysis literature in organization studies: Research themes, data sources, and methodological refinements. Organ. Res. Methods 2007, 10, 5–34. [Google Scholar] [CrossRef]

- Zhang, C.; Jin, S. How does an environmental information disclosure of a buyer’s enterprise affect green technological innovations of sellers’ enterprise? Int. J. Environ. Res. Public Health 2022, 19, 14715. [Google Scholar] [CrossRef]

- Gao, Y.; Jin, S. Corporate nature, financial technology, and corporate innovation in China. Sustainability 2022, 14, 7162. [Google Scholar] [CrossRef]

- Zheng, Y.; Rashid, M.H.U.; Siddik, A.B.; Wei, W.; Hossain, S.Z. Corporate social responsibility disclosure and firm’s productivity: Evidence from the banking industry in Bangladesh. Sustainability 2022, 14, 6237. [Google Scholar] [CrossRef]

- Ang, R.; Shao, Z.; Liu, C.; Yang, C.; Zheng, Q. The relationship between CSR and financial performance and the moderating effect of ownership structure: Evidence from Chinese heavily polluting listed enterprises. Sustain. Prod. Consum. 2022, 30, 117–129. [Google Scholar] [CrossRef]

- Lin, Y.E.; Li, Y.W.; Cheng, T.Y.; Lam, K. Corporate social responsibility and investment efficiency: Does business strategy matter? Int. Rev. Financ. Anal. 2021, 73, 101585. [Google Scholar] [CrossRef]

- Sarwar, H.; Aftab, J.; Ishaq, M.I.; Atif, M. Achieving business competitiveness through corporate social responsibility and dynamic capabilities: An empirical evidence from emerging economy. J. Clean. Prod. 2023, 386, 135820. [Google Scholar] [CrossRef]

- Chkir, I.; Hassan, B.E.H.; Rjiba, H.; Saadi, S. Does corporate social responsibility influence corporate innovation? International evidence. Emerg. Mark. Rev. 2021, 46, 100746. [Google Scholar] [CrossRef]

- Mbanyele, W.; Huang, H.; Li, Y.; Muchenje, L.T.; Wang, F. Corporate social responsibility and green innovation: Evidence from mandatory CSR disclosure laws. Econ. Lett. 2022, 212, 110322. [Google Scholar] [CrossRef]

- Feng, Y.; Akram, R.; Hieu, V.M.; Tien, N.H. The impact of corporate social responsibility on the sustainable financial performance of Italian firms: Mediating role of firm reputation. Econ. Res.-Ekon. Istraž. 2021, 35, 4740–4758. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Chang. 2020, 160, 120262. [Google Scholar] [CrossRef]

- Flammer, C.; Kacperczyk, A. The impact of stakeholder orientation on innovation: Evidence from a natural experiment. Manag. Sci. 2016, 62, 1982–2001. [Google Scholar] [CrossRef]

- Pan, Z.; Liu, L.; Bai, S.; Ma, Q. Can the social trust promote corporate green innovation? Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 52157–52173. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).