Abstract

Alleviating household economic fragility and poverty is a global challenge in achieving a nation’s well-being. This study aims to examine the impact of social capital and Indonesian household economic welfare, as well as understand the mediating role of entrepreneurial, digital, and financial literacy. To address this objective, a structural equation modeling partial least square was adopted to acquire comprehend findings. The survey data were gathered from households in East Java of Indonesia using a simple random sampling approach. The findings from this study highlight that social capital significantly influences several literacies of households in Indonesia, including digital literacy, financial literacy, and entrepreneurial literacy. However, this study failed to confirm the nexus between social capital and household economic welfare. In addition, financial literacy, digital literacy, and entrepreneurial literacy all play an important role in mediating the connection between social capital and the economic welfare of households.

1. Introduction

Enhancing household economic welfare is a central issue in the Indonesian government. The main goal of economic development is almost identical in various countries, which aims to alleviate poverty and enhance household welfare [1,2]. Living in poverty leads to a shortage of money, food and basic needs, inappropriate education, and entrepreneurship [3]. The government has responded to this issue by promoting entrepreneurship. An active scholar believes that entrepreneurship can promote wider job opportunities that absorb unemployment [4]. In addition, entrepreneurship also enables a household to obtain a better income, which leads to well-being [5]. Therefore, entrepreneurship literacy is essential for individuals and households as an attempt to enhance economic welfare.

In addition to entrepreneurship, financial literacy plays a pivotal role in enlarging household economic welfare [6]. A preliminary study remarked that saving and financial planning become essential for enhancing resilience to revenue and can increase the household well-being in the long run [7]. Financial literacy is useful for understanding, analyzing, and making financial decisions, thus increasing entrepreneurs’ confidence in innovating and leading to household economic well-being [8]. Another scholar mentioned that financial literacy is defined as an individual’s awareness, knowledge, and skills in making financial decisions to achieve financial welfare [9]. This indicates that financial programming is beneficial for achieving economic well-being [10].

To enhance household economic welfare, digital literacy is also essential for individuals in this current era [11]. Digital literacy is required to respond to the rapid development of information and communication technology (ICT) [12]. ICT facilitates the preparation, transmission, and manipulation of information to make it easier and cheaper [13]. In addition, ICT has a special place as a source of information because of its ability to provide it at a more affordable cost [14]. For example, a housewife digital literacy can provide business online, which will greatly help the family economy. An antecedent study remarked that being digitally literate can improve the welfare of the people in general and the Indonesian population in particular [15].

Since the role of household economic welfare is critical for the economic development of a nation, its study is also on the rise. Most existing studies have linked household economic welfare with microcredit and economic growth [16,17]. A recent study concerned the relationship between business empowerment programs and household economic welfare among Indonesians [18]. In China, a study mentioned that business entities can lead to family economic welfare among farmers [19]. Despite the heightening interest in how to increase household economic well-being, existing scholars have overlooked the role of entrepreneurship and financial literacy.

We therefore set out how financial literacy and entrepreneurship literacy can lead to household economic welfare. Research to date has primarily been concerned with financial literacy and consumption behavior [20,21] and saving and investment behavior [22,23], while other studies have proposed entrepreneurship literacy as the predictor for entrepreneurial intention and activities [24]. This study also involves social capital as a predictor for household economic behavior. The fundamental rationale is that social interaction occurs because of mutual assistance between individuals, communities, and groups to achieve common goals. A preliminary study noted a correlation between social capital and community welfare [18].

This study proposes some essential contributions. This research makes insights into the literature on household economic behavior by examining the influence of entrepreneurship literacy, financial literacy, digital literacy, and household economic behavior, which has been overlooked in the prior literature. As mentioned previously, several previous studies solely examined the effect of social capital on household welfare by introducing the financial literacy factor [16,17,18], whereas this study attempted to investigate how the role of the three essential literacies can be a factor that mediates or strengthens the effect of social capital on improving household economic welfare.

Second, it adds the insight of social capital as a predictor for Indonesian household economic welfare. The unique reason for studying in Indonesia is that Indonesia is well-known as a highly social value for helping each other in many economic and other activities. Additionally, the focus study in Indonesia is reasonable as it moves to the developing countries, but poverty and household welfare are the primary concern in the nation. Third, through an empirical examination of the nexus between social capital, entrepreneurship literacy, and financial literacy, this research can identify and inform a better policy in alleviating household economic fragility in the future.

This paper is presented as follows. Section 1 focuses on the research background and is followed by comprehensive literature in Section 2. Section 3 describes the sample, study design, and data analysis. The main findings are provided in Section 4 and discussions are presented in Section 5. Section 6 proposes the study’s conclusion, limitations, and suggestions for further studies.

2. Literature Review

2.1. Underpinning Theory

Social capital studies in this study adopted a framework developed by some prior studies that discussed social capital in two approaches: cultural and social [25,26,27]. An earlier scholar pointed out that social capital is a process of internalizing to enhance the value of individual and social class analysis units [28]. Additionally, it is noted that networking, solidarity, access to resources, and social capital can promote social and economic welfare among society [26]. Grootaert and Bastelaer provided an explanation of how social capital can be measured in the context of community development [29]. At the micro-level, the social capital aspect encompasses the cognitive element, including values, norms, and beliefs, and the structural aspect encloses the network and existence of local institutions, whereas the macro level encompasses governance as a cognitive and institutional aspect of the state and legal regulation as a structural dimension. Some recent works remarked that four aspects of social capital have been confirmed as valid and credible at the community level, including family and friend relationships, participation in the local community, trust and security, and environmental relations [30,31].

The growing literature mentions that social capital plays an essential role as a source (information, ideas, support) for individuals to acquire resources based on their relationships with others [27,32]. This suggests that those who occupy key or strategic positions in social networks, especially important positions in groups, tend to have a greater social capital than regular group members [29,32]. Several studies remark on the role of social capital as a driver in entrepreneurial development, especially as an essential part of social relationships, managerial, and formal and informal networks in facilitating, maintaining, and developing entrepreneurship to start new businesses [31,33]. Entrepreneurs are generally linked with the stigma of poor financial and management knowledge, as well as the limitations of their access to external finance [34,35]. In addition, limited financial skills negatively impact opportunities for small entrepreneurs to survive, grow, and innovate. Preliminary research remarked that limited skills in financial management correlate with entrepreneurs’ access to finance and have a negative impact on a company’s ability to access loans and equity, which can lead to bankruptcy [36].

2.2. Social Capital and Household Economic Welfare

Social capital is increasingly important and unique for household economic welfare. Social capital is associated with characteristics of social life, including reciprocity, norms, and trust, which are translated into mutual benefit [26]. This involvement allows individuals and communities to build trust and provides an essential network for promoting a new business, as well as better economic well-being. An antecedent study noted that a suitable social environment increases the likelihood of individuals moving forward in search of new and more excellent entrepreneurial opportunities [27]. Another study revealed that the economic, social, and network variables mentioned were most important in developing new ventures [37]. Indeed, a prior work added that social capital aims to increase community involvement, provide joint ventures, and increase household income and welfare [38].

It is mentioned that welfare deals with life quality satisfaction, which aims to measure the position of members of society in building life balance, which includes material welfare, social welfare, emotional welfare, and security [39]. Economic welfare also assumes that individuals are the best judges of their welfare; that is, everyone will prefer greater welfare. To determine economic welfare, concepts such as resource rent, producer surplus, consumer surplus, infra-marginal rent, socio-economic rent, and profit are involved in this study. Using general economic theory, most economists argue that economic welfare should include all relevant rents and surpluses, and consensus on this definition has long existed [40]. Some studies have succeeded in looking at the relationship between household welfare and social capital separately in Nigeria [41,42]. An empirical study stated the positive effect of social capital on household welfare and provided recommendations on what policies are needed to improve the living standards of Nigerians [43]. Thus, the hypothesis is presented below.

H1.

Social capital influences household economic welfare.

2.3. Entrepreneurial Literacy

Entrepreneurship knowledge aims to prepare people for responsible and energetic individuals with the attitudes, skills, and knowledge to achieve their goals. The key to entrepreneurial success is that the competence possessed from the results of entrepreneurship education can be seen in the composition of entrepreneurial attitudes, entrepreneurial skills, and knowledge of entrepreneurship [44]. In 2014, Bustamante considered that entrepreneurial illiteracy might reflect a lack of ability to seize opportunities and incorporate them into new ventures that must be managed, or a lack of a proactive attitude towards change and autonomous solutions [45]. Therefore, when implementing an entrepreneurship program, one must distinguish between developing entrepreneurial attitudes, skills, and abilities in one of the previous three domains.

To promote entrepreneurial literacy, social capital takes a pivotal role. Social capital is a resource that can be viewed as an investment to acquire new resources [46]. The dimensions of social capital are quite broad and complex. Social capital is different from other popular terms, namely human capital. In human capital, everything refers to the individual dimension, namely the power and expertise that an individual possesses [47]. Social capital emphasizes the potential of groups and patterns of relationships between individuals within a group and between groups by paying attention to social networks, norms, values, and beliefs between people born from group members and becoming group norms [48].

Entrepreneurial literacy in institutions of higher learning is still oriented on the number of graduates who looks for a job instead of creating jobs [49]. Students find it difficult to start entrepreneurship because they need to be taught and are stimulated to try independently [50]. To increase the number of entrepreneurs, it should be started with a growing interest in the field of entrepreneurship [49]. Various efforts have been made to cultivate entrepreneurial literacy, especially by changing the mindset of students who are still student-oriented as job seekers rather than job creators [51]. Becoming entrepreneurs, students will only partially depend on income as private employees or civil servants. They will be more economically independent, which will directly improve the economic well-being of their households. Entrepreneurs will not only be the backbone in supporting the household economy but all economies around the world, which, in turn, has a significant impact on economic growth and job creation and poverty reduction, and contributes to the gross domestic product (GDP) expansion of developed and developing countries [35]. Therefore, the hypotheses are provided below.

H2.

Social capital promotes entrepreneurial literacy.

H3.

Entrepreneurial literacy can lead to household economic welfare.

H4.

Entrepreneurial literacy can mediate the relationship between social capital and household economic welfare.

2.4. Financial Literacy

Financial literacy is defined as an individual’s awareness, knowledge, and skills in making financial decisions to achieve financial welfare [9]. Financial literacy has two dimensions: comprehension and consumption [52,53]. The first dimension of financial literacy indicates personal financial knowledge, whereas the second dimension indicates the application of knowledge in managing personal finance. Financial education is a process used to increase the understanding of financial products and services among individuals [54]. Financial literacy is the ability of individuals to use the knowledge and abilities that they acquire. This knowledge and these abilities are allocated to manage resources effectively to provide financial welfare.

Lusardi and Mitchell added that financial literacy is the ability to make financial decisions [8]. A simple example is an ability to understand and bind debt, applying basic knowledge of compound interest in financial decisions. Financial literacy can also be defined as an individual’s ability to manage financial instruments [55]. These instruments constantly change over time, and new instruments emerge [52]. Individuals with financial literacy can evaluate and assess these financial instruments using accurate information and then direct it to efficient decision-makers in money use and management, which is expected to promote economic welfare [54]. Therefore, the hypotheses are provided as follows.

H5.

Financial literacy influences household economic welfare.

H6.

Social capital can impact financial literacy.

H7.

Financial literacy can mediate the relationship between financial literacy and household economic welfare.

2.5. Digital Literacy

Putnam places social capital as a social network and reciprocal norms related to their relationship [26]. Social networks provide the basis for social cohesion because they allow people to cooperate, benefiting each other and not only people that they know directly. This is necessary for entrepreneurship to market the products it sells. Social capital at the individual and collective levels will affect people’s ability to use information technology to improve their lives, especially their knowledge, to contribute to entrepreneurial literacy [27].

Tohani stated that using social capital to improve entrepreneurship education can be carried out by subjects with different levels of quality [56]. The utilization of the resulting benefits for the target group, among others, increased business networks, knowledge, skills, legality, and funding. Therefore, social capital, as one of the determinants of success in implementing entrepreneurship education, needs to be utilized in a sustainable and accountable manner [57]. A combination of individual creativity and collaboration with the community, knowledge of international business and finance, and the ability to set goals in business is needed to build entrepreneurial literacy to manage and prioritize tasks in order to set and evaluate goals effectively [58].

Digital literacy has become an important tool for the economic and social development of people’s lives. However, achieving digital literacy is challenging due to socioeconomic factors such as low literacy levels, poverty, inadequate local content, a lack of infrastructure, and social inequality. A new pathway to getting out of poverty, specifically through the advancement of the Internet subscription, has been mentioned [12]. To encourage higher penetration, the government should consider a few drivers of Internet appropriation, such as an omnipresent Internet framework, open mindfulness of the benefits of the Internet, expanded digital literacy, neighborhood substance creation, and the reasonableness of administrations as users [59].

According to human capital theory, when taking care of others equally, people will have different incomes due to different amounts of investment in human resources [60]. For example, in some jobs, employees with better digital literacy will perform their jobs better and be more productive than others. Thus, they will earn a higher income. Their ability to utilize the Internet effectively reflects their sacrifice in investing in human capital related to the use of the Internet. It is argued that ICTs enable improvements in processes, product innovation, and trade, which facilitates a faster diffusion and distribution of knowledge [61]. To obtain benefits from social capital, everyone must maintain and expand social networks. Both can be performed by being part of a social group and actively participating in various activities. The more social the network formed, the greater the opportunity for a person to access and utilize the existing social capital in the community network [62]. Given the phenomenon of digital social media over the last decade, most of them refer to Internet-based services such as Facebook, Instagram, and Twitter, which are popular platforms used by the public. This could be interesting when examining the relationships of sub-variables related to social networks that are included in the concept of comprehensive digital literacy and its relation to digital literacy. Thus, the hypotheses are provided below.

H8.

Social capital influences digital literacy.

H9.

Digital literacy can lead to household economic welfare.

H10.

Digital literacy can mediate the relationship between social capital and household economic behavior.

3. Materials and Methods

3.1. Research Design and Data Collection

This study was concerned with the impact of social capital and household economic welfare, as well as examining the role of entrepreneurial literacy, digital literacy, and financial literacy. To propose this objective, a structural equation modeling partial least square was adopted to acquire comprehending findings. The survey data were gathered from households in East Java of Indonesia using probability sampling with a simple random sampling strategy. The rationale behind the study in East Java of Indonesia considered the highest entrepreneur growth and the lack of welfare standards among households. In addition, East Java Province is one of the biggest Province in Indonesia as a whole, currently has 38 districts, has an area within population of 40.16 million, recorded in 2021, and a working population of 21.93 million. In 2021, East Java had more than 4.6 million small and medium enterprises, 21,717 cooperative units, 4181 million impoverished people, and a per capita income of IDR 429,133 [63].

The simple random sampling method was then used to select 400 respondents from several areas in East Java, including Malang, Pasuruan, Surabaya, Kediri, and Gresik, categorized as big cities with the largest number of industries and entrepreneurs. Next, we distributed questionnaires using Google Forms through WhatsApp, and 361 respondents (90.25%) filled it in completely, and thus could be used for the following process. The respondents of this study were voluntary and anonymous to ensure the ethical clearance. In detail, the demographic characteristics of respondents selected for the study are presented in Table 1.

Table 1.

Demographic characteristics of participants.

The final sampled households selected were male (48.47%) and female (51.53%). Other demographic respondents in this study were dominated by university graduates (54.57%) with bachelor’s degrees and 11.93 for master’s or doctoral holders. As informed in Table 1, the households in this study have an average income between IDR 5 million and IDR 10 million, and a small percentage of respondents receive approximately IDR 2 million to IDR 5 million per month. Additionally, the majority of households have been involved in a particular community for between 6 to 10 years, and most of the participants work as entrepreneurs (74.25%). Another piece of information for the respondents’ characteristics is that most of them have sufficient working experience in the range of 6 to 10 years.

3.2. Measurement and Data Analysis

The structured questionnaire was involved based on a 7-point Likert-type scale of responses. The validity, reliability, and hypothesis estimations were calculated by undergoing the SmartPLS version 3.0. The item constructs to measure structural social capital dimensions were adopted from Chua [64]. Entrepreneurial literacy was measured by two European Commission [44] characteristics, namely attitudes and knowledge. Data on digital literacy were gathered using a Spiers-and-Bartlett-developed instrument (2012). These instruments can be divided into three categories: (a) information access, (b) content creation, and (c) digital content communication. Financial literacy data were collected using three questions modified by some researchers [52,53] who were tasked with evaluating literacy based on various characteristics. In this study, financial literacy was defined as financial knowledge, financial behavior, and financial attitudes.

4. Results

4.1. Statistical Model

To calculate the validity and reliability of the research, we adopted criteria from Hair et al. [64] using convergent validity, composite reliability (CR), average variance extracted (AVE), and Cronbach’s alpha. As illustrated in Table 2, the model reaches the convergent validity when the loading factor (λ) is higher than 0.70. The statistical calculation indicates that SC, EL, FL, DL, and EW have a value of λ ranging between 0.708 and 0.855, indicating that convergent validity is reached. In addition to convergent validity, this study also followed the discriminant validity evaluation of each variable. Table 3 informs the discriminant validity evaluation, in which, the cross-loading value of the SC, EL, FL, DL, and HEW variables is greater than 0.70, meeting the convergent validity.

Table 2.

Convergent validity.

Table 3.

Discriminant validity using the Fornell–Larcker model.

To measure discriminant validity, we also engaged the test using the heterotrait–monotrait (HTMT) ratio. Based on the statistical calculation, the result of each variable has a ratio value of <0.90, implying that they meet discriminant validity criteria (see Table 4).

Table 4.

Discriminant validity using HTMT.

This study tested the collinearity using the variance inflation factor (VIF), in which, the value of VIF should less than 5.00. Table 5 illustrates that the VIFs of variable SC, EL, FL, DL, and HEW were less than 5.00, which means that collinearity does not exist in the model [65]. Furthermore, the construct can be used for the next analysis.

Table 5.

Variance inflation factor (VIF).

The R-squared (R2) estimation indicates the total amount of changes in the dependent variables performed by the model. The R2 values of 0.53, 0.43, 0.59, and 0.49 imply that approximately 53%, 43%, 59%, and 49% of the changes in the dependent variables of digital literacy, entrepreneurial literacy, financial literacy, and household economic welfare are explained by the respective independent variables. Furthermore, the F-squared (f2) test aims to comprehend the size of the influence of latent predictor variables (exogenous latent variables) on the structural model. The statistical calculation shows that SC has an effect on DL with broad levels (f2 value = 1.139), EL (f2 value = 0.771), and EL (f2 value = 1.482). Similarly, SC, EL, DL, and FL affect HEW with a broad level (f2 value = 0.581). The next stage is the Q-squared (Q2) evaluation to know the observed values generated by the model, as well as the parameter estimates. The value of Q2 > 0 (zero) shows that the model has predictive relevance and vice versa. It is known that the Q2 value of SC, EL, DL, FL, and HEW variables is greater than 0, so it can be concluded that the model has predictive relevance. The last estimation is to check the model fit using the goodness of fit (GoF) with the criteria of α > 0.70, CR > 0.70, and AVE > 0.50. As shown in Table 6, the value of α, CR, and AVE satisfied the goodness of fit criteria.

Table 6.

Goodness of fit (GoF).

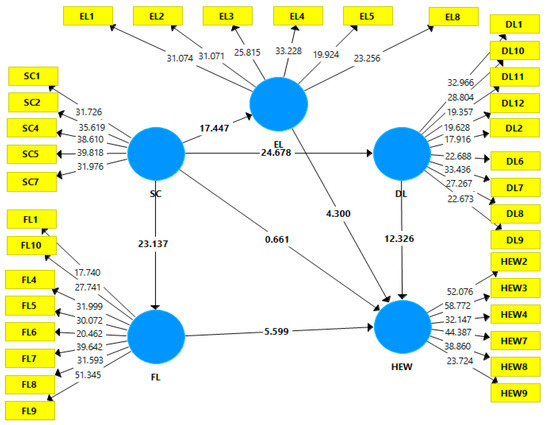

The calculation from the structural relationships of these variables indicating the effects of the direct pathway and the structural model is depicted in Table 7 and Figure 1.This hypothesis was tested based on research data processing by utilizing SEM-PLS analysis using the bootstrap resampling method. Furthermore, hypothesis testing was carried out using the t-test (t-count must be 1.65), where the p-value (probability) must be smaller (<) than 0.050. If the results of data processing meet the required value, then the proposed research hypothesis can be accepted. Table 7 shows that the six hypotheses in this study were accepted because they had a t-value of 4.211–26.103 > 1.65 and a p-value of 0.000 < 0.050. Surprisingly, one hypothesis (H1) was rejected because the t-value < 1.65 and p > 0.050 (p-value = 0.263).

Table 7.

Hypothesis testing.

Figure 1.

The structural equation modeling calculation.

4.2. Hypothesis Testing on Mediation

The bootstrapping analysis showed that the three indirect effects, β = 0.551, β = 0.190, and β = 0.348, were significant, with t-values of 9.292, 4.018, and 5.094. The indirect effects 95% boot CI bias corrected: [LL = 0.647, UL = 0.463], [LL = 0.267, UL = 0.114], and [LL = 0.242, UL = 0.473] did not straddle a 0 in between, implicating that there is a mediation effect [66]. Therefore, it can be confirmed that the mediation effects are statistically significant. Therefore, H4 was supported, in which DL mediated the relationship between SC and HEW. H7 was supported, whereby EL mediated the relationship between SC and HEW. In addition, H10 was supported, in which FL mediated the relationship between SC and HEW. The detail of the mediation analysis estimation is presented in Table 8.

Table 8.

Results of the structural model (mediating effect).

5. Discussion

Ten assumptions were tested in this study using structural equation modeling. It is worth noting that this analysis verifies nine of the ten hypotheses proposed and denies one. In further detail, the first hypothesis indicates that social capital has a detrimental effect on household economic welfare. Therefore, the findings indicate that none of the social capital indices substantially affected a household’s economic welfare in East Java, Indonesia. According to the results of hypothesis testing, social capital has no significant effect on a household’s economic welfare in East Java, Indonesia. This finding contradicts some papers, which all find a statistically significant positive relationship between social capital and household welfare [43,67]. However, it supports several prior findings that social capital does not always have a significant positive effect on a household’s welfare [68,69]. The rationale behind this finding is that social capital enables communities to collaborate and create a network to accomplish goals, and it is insufficient for improving a household’s economic welfare. It requires a combination of knowledge and the ability to use social capital to achieve the goal of enhancing a household’s economic welfare.

The second hypothesis mentioned a positive impact between social capital and entrepreneurial literacy, which confirmed the finding of some studies [31,70]. The main reason is that social capital fosters community and the development of informal learning. This community serves as a platform for learning, sharing information, and implementing practices that can improve knowledge, skills, and entrepreneurial abilities. In addition, social capital can be a place for optimizing the potential resulting from long-term personal relationships with other people, becoming one of the capitals that can be used to advance their entrepreneurial literacy. A prior study stated that understanding the micro-level entrepreneurial process in subsistence marketplaces requires understanding social capital [71]. The subsequent conversion of entrepreneurial behaviors into developing a community exchange system can be performed [72]. An informal learning community is where learners work together to understand practical knowledge and skills. Communities of interest are informally formed groups based on shared beliefs, values, and concerns instead of locality or social patterns [73]. Informal learning centers offer opportunities for the community to learn outside of the formal education system, particularly for adults and rural residents, and can also serve as a gathering place. Furthermore, the learning community improves their knowledge and skills, setting a positive example for young children, adolescents, and early adults by demonstrating that everyone, regardless of age or educational background, has the opportunity to learn [74].

Third, the current finding is consistent with previous research, which found a positive relationship between entrepreneurial literacy and households’ economic welfare and confirms some previous studies [74,75,76]. The basic explanation of this finding is that entrepreneurial literacy, as a critical factor in entrepreneurial activity, has a fundamental role that can shape the mentality and character of entrepreneurs. For instance, women with a high level of entrepreneurial literacy will be able to adopt appropriate business practices, such as record keeping, work plan development, and participation in value-added processes, which will increase their business potential and economic welfare [75]. In addition, people with entrepreneurial literacy in rural areas will have entrepreneurial awareness and skills that encourage them to add value to each of their agricultural or plantation products in order to increase their income. The rural literacy community program, which aims to establish a learning community to improve literacy and reduce poverty, has demonstrated its ability to enhance the welfare of rural communities [74].

Fourth, this study found that entrepreneurial literacy mediates social capital and household economic welfare, and this finding broadly supports the work of other studies [77,78]. These findings suggest that social capital in a community where knowledge about entrepreneurship is transferred will be a more assertive driving factor in improving household welfare. This indicates that households will become more prepared to make business decisions as they share entrepreneurship knowledge and experiences. Therefore, social capital combined with good entrepreneurial literacy will build a support system in a healthy business environment, reducing risk and increasing profits.

Fifth, the study indicated that financial literacy influences household economic welfare and confirmed some preliminary papers [79,80]. This demonstrates that an individual’s knowledge of financial products currently in use or being developed has an impact on how the individual achieves his or her welfare. Fundamentally, financial products are designed to make people’s lives easier. As a result, having a good understanding of financial products as part of financial literacy will be very beneficial in maximizing their use to achieve prosperity. In addition, poverty will be linked to a lack of financial literacy and, when an economic crisis occurs, illiteracy in financial matters will only exacerbate and prolong the crisis [81]. The global economy’s vigorous effort to improve the financial well-being of its citizens has contributed to the growing importance of financial literacy because it equips individuals to make quality financial decisions to improve their financial well-being. Educating households on the advantages of competent savings product management can positively impact their household welfare [79].

This sixth hypothesis in this study sought to determine the impact of social capital and financial literacy, which supports several studies [53,76,82]. The underlying rationale for supporting this result is that social capital is an essential factor in financial development, which leads to the creation of more human capital. In addition, social capital is a dimension built on values, culture, perceptions, institutions, and mechanisms in positive activities to empower communities. Social capital is important in increasing various resources, including community knowledge and skills as drivers of financial literacy. For example, a study observed that social capital available to participants comprises knowledge resources and identity resources brought to the interaction by the participants individually and collectively [83]. Social capital is the subset of these resources used to achieve the desired goal of any specific interaction that contributes to the common purpose. Furthermore, Cohen and Nelson argued that poor households participating in associational networks might improve their financial knowledge and skills, allowing them to make wise financial decisions and choices [82].

Seventh, this study found that financial literacy mediates social capital and household economic welfare, and this finding broadly supports the findings of previous studies [19,84,85]. Social capital is about solidarity, self-confidence, and facilitating business operations, and it is derived from social relationships involving family, friends, coworkers, and others [86]. Social capital is expected to be one of the options for increasing financial literacy in Indonesia, which can improve household economic welfare. Solidarity and high trust will catalyze the development of a financial sector cooperation system based on the principle of kinship. Cooperation is an example in Indonesia, and it is a financial system that grew from the seeds of solidarity and financial literacy. Cooperation is financial institutions whose primary goal is to help their members prosper by providing financial assistance and raw materials for production [74].

Eighth, the result of this study confirmed an indirect positive impact between social capital and digital literacy [1,87,88]. The finding is rational because social capital in online community life generates information that can boost interactivity, and specifically the process of developing knowledge exchange [87]. Since the pattern of social relations can increase knowledge from various sources, social relations in the digital community significantly increase digital literacy. This is important not only in identifying various problems encountered (and finding alternative solutions) but also in creating and capitalizing on opportunities through the use of information technology. Social media, for example, can generate information that not only spreads quickly and to a large number of people but can also create stimuli and invite direct open responses.

This study found that digital literacy can lead to household economic welfare. This finding broadly supports the work of other studies [15,89]. Considering its high level of efficiency, digitization can have an impact on productivity. It will also improve the quality of the work or product and reduce the time required to produce an output. In terms of marketing, digitalization or the Internet will allow business households to reach a larger market, potentially increasing the household income easily. Empirical shreds of evidence are provided that point out that the promotion of Internet infrastructure density has a positive impact on the monthly household income. This finding led to a further conclusion that the Internet does not only provide benefits to households in developed countries, as presented in earlier works, but also to those in developing countries such as Indonesia.

Lastly, the result of this study showed that digital literacy can mediate the relationship between social capital and household welfare, which is in agreement with some studies [75,90,91]. The primary rationale is that social capital predicts social support, status achievement, employment, unemployment, and academic achievement, and is a useful conceptual tool for assessing the social effects of the Internet [88]. The Internet’s social affordability, such as its convenience, social connectivity, and social cues, create different opportunities for interaction, such as social capital production, promotion, distribution, and mobilization. This social media viewpoint allows for the interaction of technology, interactions, transactions, and social structures. As a result, the Internet, through social media, provides (1) a variety of synchronous and asynchronous communication cooperation opportunities, (2) the ability to find and form new relationships, (3) the potential to expand the market by reuniting old ties, such as elementary school friends, and (4) the presence of the ability to manage the length and scope of different social interactions while carrying out other things at the same time (e.g., a form of social multitasking). Furthermore, various social media (e.g., social networking sites, instant messaging sites) enable people to collect social information, interact with others, and coordinate and manage their business at a lower cost, with an extensive social network, to increase income and improve a household’s economic welfare.

6. Conclusions

The purpose of this study was to look into the relationship between social capital, financial literacy, entrepreneurial literacy, digital literacy, and household welfare in East Java Province in Indonesia. The findings indicate the role of financial, digital, and entrepreneurial literacy in mediating the relationship between social capital and a household’s economic welfare. However, this study noted that social capital failed to explain the households’ economic welfare. Based on the discussions, this study proposes two significant implications. First, it demonstrates the importance of literacy (entrepreneurial, financial, and digital) in mediating the relationship between social capital and household welfare. In doing so, government and policy researchers can pay attention to improving these three literacies to raise household welfare.

Second, this study demonstrates that, in general, digital literacy has the potential to be used to alleviate poverty. In some cases, digitalization is not a well-integrated component of Indonesia’s national poverty-reduction strategy. More importantly, most of those who benefit from ICT development in the country have the resources and skills, leaving a large portion of the poor behind. With a large population and distinct characteristics of the poor, current government policies aimed at lowering the national poverty rate, and the potential of digitalization as a direct source of livelihood for the community, various approaches involving government intervention are required. In addition, social capital itself is not always enough to improve household welfare, but it will be more beneficial if it is accompanied by excellent entrepreneurial, financial, and digital literacy.

As with other studies, this study has some limitations. The first concerns the demographical matter, which solely involves households in East Java of Indonesia. Thus, further research can involve other regions in Indonesia. In addition, the response rates in this research counted fewer than 400 respondents, and further scholars can enhance this number with a particular sampling method to reach more robust and generalized results.

Author Contributions

Conceptualization, P.H.P. and S.S.; methodology, P.H.P.; software, M.H.; validation, S.S. and M.H.; formal analysis, P.H.P. and S.S.; investigation, P.H.P.; resources, S.S. and M.H.; data curation, S.S.; writing—original draft preparation, P.H.P.; writing—review and editing, S.S. and M.H.; visualization, P.H.P.; supervision, S.S. and M.H.; project administration, M.H.; funding acquisition, P.H.P., S.S. and M.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was granted by the Universiti Kebangsaan Malaysia under research grant number TAP: K022287 and the APC was funded by the Universiti Kebangsaan Malaysia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Nguyen, H.M.; Nguyen, T.A. Investigating the determinants of household welfare in the Central Highland, Vietnam. Cogent Econ. Financ. 2019, 7, 1684179. [Google Scholar] [CrossRef]

- Pham, A.T.Q.; Mukhopadhaya, P. Multidimensionl poverty and the role of social capital in poverty alleviation among ethnic groups in rural Vietnam: A multilevel analysis. Soc. Indic. Res. 2021, 159, 281–317. [Google Scholar] [CrossRef] [PubMed]

- Piwowar, A.; Dzikuć, M. Poverty and social exclusion: Is this a problem in rural areas in the Visegrad Group Countries? Eur. Res. Stud. J. 2000, 23, 45–54. [Google Scholar] [CrossRef]

- Sutter, C.; Bruton, G.D.; Chen, J. Entrepreneurship as a solution to extreme poverty: A review and future research directions. J. Bus. Ventur. 2019, 34, 197–214. [Google Scholar] [CrossRef]

- Shepherd, D.A.; Parida, V.; Wincent, J. Entrepreneurship and poverty alleviation: The importance of health and children’s education for slum entrepreneurs. Entrep. Theory Pract. 2021, 45, 350–385. [Google Scholar] [CrossRef]

- Haque, A.; Zulfiqar, M. Women’s economic empowerment through financial literacy, financial attitude and financial wellbeing. Int. J. Bus. Soc. Sci. 2016, 7, 78–88. [Google Scholar]

- Mahapatra, M.S.; Raveendran, J.; De, A. Building a model on influence of behavioural and cognitive factors on personal financial planning: A study among Indian households. Glob. Bus. Rev. 2019, 20, 996–1009. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory and evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef]

- Rodrigues, L.F.; Oliveira, A.; Rodrigues, H.; Costa, C.J. Assessing consumer literacy on financial complex products. J. Behav. Exp. Financ. 2019, 22, 93–104. [Google Scholar] [CrossRef]

- Bilan, Y.; Mishchuk, H.; Samoliuk, N.; Yurchyk, H. Impact of income distribution on social and economic well-being of the state. Sustainability 2020, 12, 429. [Google Scholar] [CrossRef]

- Jin, K.Y.; Reichert, F.; Cagasan, L.P., Jr.; de la Torre, J.; Law, N. Measuring digital literacy across three age cohorts: Exploring test dimensionality and performance differences. Comput. Educ. 2020, 157, 103968. [Google Scholar] [CrossRef]

- Gnambs, T. The development of gender differences in information and communication technology (ICT) literacy in middle adolescence. Comput. Hum. Behav. 2021, 114, 106533. [Google Scholar] [CrossRef]

- Anser, M.K.; Yousaf, Z.; Usman, M.; Yousaf, S. Towards strategic business performance of the hospitality sector: Nexus of ICT, E-marketing and organizational readiness. Sustainability 2020, 12, 1346. [Google Scholar] [CrossRef]

- Suhartanto, D.; Leo, G. Small business entrepreneur resistance of ICT adoption: A lesson from Indonesia. Int. J. Bus. Glob. 2018, 21, 5–18. [Google Scholar] [CrossRef]

- Alakrash, H.M.; Abdul Razak, N. Technology-based language learning: Investigation of digital technology and digital literacy. Sustainability 2021, 13, 12304. [Google Scholar] [CrossRef]

- Thanh, P.T.; Saito, K.; Duong, P.B. Impact of microcredit on rural household welfare and economic growth in Vietnam. J. Policy Model. 2019, 41, 120–139. [Google Scholar] [CrossRef]

- Mariyono, J. Micro-credit as catalyst for improving rural livelihoods through agribusiness sector in Indonesia. J. Entrep. Emerg. Econ. 2019, 11, 98–121. [Google Scholar] [CrossRef]

- Purwanti, P.; Susilo, E.; Indrayani, E. Business empowerment program and household economic welfare: Lesson from Indonesia. J. Asian Financ. Econ. Bus. 2020, 7, 313–320. [Google Scholar] [CrossRef]

- Cheng, L.; Zou, W.; Duan, K. The influence of new agricultural business entities on the economic welfare of farmer’s families. Agriculture 2021, 11, 880. [Google Scholar] [CrossRef]

- Zhang, Y.; Jia, Q.; Chen, C. Risk attitude, financial literacy and household consumption: Evidence from stock market crash in China. Econ. Model. 2021, 94, 995–1006. [Google Scholar] [CrossRef]

- Xue, R.; Gepp, A.; O’Neill, T.J.; Stern, S.; Vanstone, B.J. Financial well-being amongst elderly Australians: The role of consumption patterns and financial literacy. Account. Financ. 2020, 60, 4361–4386. [Google Scholar] [CrossRef]

- Zakaria, Z.; Nor, S.M.M.; Ismail, M.R. Financial literacy and risk tolerance towards saving and investment: A case study in Malaysia. Int. J. Econ. Financ. Issues 2017, 7, 21–34. [Google Scholar]

- Abebe, G.; Tekle, B.; Mano, Y. Changing saving and investment behaviour: The impact of financial literacy training and reminders on micro-businesses. J. Afr. Econ. 2018, 27, 587–611. [Google Scholar] [CrossRef]

- Karyaningsih, R.P.D.; Wibowo, A.; Saptono, A.; Narmaditya, B.S. Does entrepreneurial knowledge influence vocational students’ intention? Lessons from Indonesia. Entrep. Bus. Econ. Rev. 2020, 8, 138–155. [Google Scholar] [CrossRef]

- Coleman, J.S. Social capital in the creation of human capital. Am. J. Sociol. 1988, 94, 95–120. [Google Scholar] [CrossRef]

- Putnam, R. The prosperous community: Social capital and public life. Am. Prospect. 1993, 13, 35–42. [Google Scholar]

- Portes, A. Social capital: Its origins and applications in modern sociology. Annu. Rev. Sociol. 1998, 24, 1–24. [Google Scholar] [CrossRef]

- Siisiainen, M. Two concepts of social capital: Bourdieu vs. Putnam. Int. J. Contemp. Sociol. 2003, 40, 183–204. [Google Scholar]

- Grootaert, C.; Oh, G.T.; Swamy, A. Social capital, household welfare and poverty in Burkina Faso. J. Afr. Econ. 2002, 11, 4–38. [Google Scholar] [CrossRef]

- Onyx, J.; Bullen, P. Measuring social capital in five communities. J. Appl. Behav. Sci. 2000, 36, 23–42. [Google Scholar] [CrossRef]

- Roxas, R.; Azmat, A. Community social capital and entrepreneurship: Analyzing the links. Community Dev. 2014, 45, 134–149. [Google Scholar] [CrossRef]

- Burt, R.S. The network structure of social capital. Res. Organ. Behav. 2000, 22, 345–423. [Google Scholar] [CrossRef]

- Besser, T.L.; Miller, N.J. Community matters: Successful entrepreneurship in remote rural US locations. Int. J. Entrep. Innov. 2013, 14, 15–27. [Google Scholar] [CrossRef]

- Carbo-Valverde, S.; Rodriguez-Fernandez, F.; Udell, G.F. Trade credit, the financial crisis, and SME access to finance. J. Money Credit Bank. 2016, 48, 113–143. [Google Scholar] [CrossRef]

- Hussain, J.; Salia, S.; Karim, A. Is knowledge that powerful? Financial literacy and access to finance. J. Small Bus. Enterp. Dev. 2018, 25, 985–1003. [Google Scholar] [CrossRef]

- Fraser, S.; Bhaumik, S.K.; Wright, M. What do we know about entrepreneurial finance and its relationship with growth? Int. Small Bus. J. 2015, 33, 70–88. [Google Scholar] [CrossRef]

- Chen, F.W.; Fu, L.W.; Wang, K.; Tsai, S.B.; Su, C.H. The influence of entrepreneurship and social networks on economic growth—From a sustainable innovation perspective. Sustainability 2018, 10, 2510. [Google Scholar] [CrossRef]

- Nguyen, M.H.; Hunsaker, A.; Hargittai, E. Older adults’ online social engagement and social capital: The moderating role of Internet skills. Inf. Commun. Soc. 2022, 25, 942–958. [Google Scholar] [CrossRef]

- Garbarino, S.; Lanteri, P.; Durando, P.; Magnavita, N.; Sannita, W.G. Co-morbidity, mortality, quality of life and the healthcare/welfare/social costs of disordered sleep: A rapid review. Int. J. Environ. Res. Public Health 2016, 13, 831. [Google Scholar] [CrossRef]

- Boadway, R.W.; Bruce, N. Welfare Economics; Blackwell: New York, NY, USA, 1984. [Google Scholar]

- Omonona, B.T. Poverty and Its Correlates among Rural Farming Households in Kogi State, Nigeria. Unpublished Ph. D. Thesis, University of Ibadan, Ibadan, Nigeria, 2001. [Google Scholar]

- Okunmadewa, F. Poverty Reduction in Nigeria: A Four-Point Demand; The House: Ibadan, Nigeria, 2001. [Google Scholar]

- Yusuf, S.A. Social capital and household welfare in Kwara State, Nigeria. J. Hum. Ecol. 2008, 23, 219–229. [Google Scholar] [CrossRef]

- Gibcus, P.; De Kok, J.; Snijders, J.; Smit, L.; Van der Linden, B. Effects and Impact of Entrepreneurship Programmes in Higher Education; Directorate-General for Enterprise and Industry, European Commission: Brussels, Belgium, 2012. [Google Scholar]

- Bustamante, G.P. Developing Entrepreneurial literacy at university: A hands-on approach. Int. J. Multidiscip. Comp. Stud. 2014, 1, 57–75. [Google Scholar]

- Lindvert, M.; Patel, P.C.; Wincent, J. Struggling with social capital: Pakistani women micro entrepreneurs’ challenges in acquiring resources. Entrep. Reg. Dev. 2017, 29, 759–790. [Google Scholar] [CrossRef]

- Subramony, M.; Segers, J.; Chadwick, C.; Shyamsunder, A. Leadership development practice bundles and organizational performance: The mediating role of human capital and social capital. J. Bus. Res. 2018, 83, 120–129. [Google Scholar] [CrossRef]

- Kim, N.; Shim, C. Social capital, knowledge sharing and innovation of small-and medium-sized enterprises in a tourism cluster. Int. J. Contemp. Hosp. Manag. 2018, 30, 2417–2437. [Google Scholar] [CrossRef]

- Saptono, A.; Wibowo, A.; Narmaditya, B.S.; Karyaningsih, R.P.D.; Yanto, H. Does entrepreneurial education matter for Indonesian students’ entrepreneurial preparation: The mediating role of entrepreneurial mindset and knowledge. Cogent Educ. 2020, 7, 1836728. [Google Scholar] [CrossRef]

- Lee, L.; Wong, P.K. Attitude towards Entrepreneurship Education and New Venture Creation. J. Enterprising Cult. 2003, 18, 339–357. [Google Scholar] [CrossRef]

- Wardana, L.W.; Narmaditya, B.S.; Wibowo, A.; Mahendra, A.M.; Wibowo, N.A.; Harwida, G.; Rohman, A.N. The impact of entrepreneurship education and students’ entrepreneurial mindset: The mediating role of attitude and self-efficacy. Heliyon 2020, 6, e04922. [Google Scholar] [CrossRef]

- Potrich, A.C.G.; Vieira, K.M.; Kirch, G. Determinants of financial literacy: Analysis of the influence of socioeconomic and demographic variables. Rev. Contab. Finanças 2015, 26, 362–377. [Google Scholar] [CrossRef]

- Bongomin, G.O.C.; Ntayi, J.M.; Munene, J.C.; Nabeta, I.N. Social capital: Mediator of financial literacy and financial inclusion in rural Uganda. Rev. Int. Bus. Strategy 2016, 26, 291–312. [Google Scholar] [CrossRef]

- Munisamy, A.; Sahid, S.; Hussin, M. Socioeconomic sustainability for low-income households: The mediating role of financial well-being. Sustainability 2022, 14, 9752. [Google Scholar] [CrossRef]

- Servon, L.J.; Kaestner, R. Consumer financial literacy and the impact of online banking on the financial behavior of lower-income bank customers. J. Consum. Aff. 2008, 42, 271–305. [Google Scholar] [CrossRef]

- Tohani, E. Utilization of social capital on the rural community entrepreneurship education. J. Entrep. Educ. 2020, 23, 1–21. [Google Scholar]

- Kraus, S.; Palmer, C.; Kailer, N.; Kallinger, F.L.; Spitzer, J. Digital entrepreneurship: A research agenda on new business models for the twenty-first century. Int. J. Entrep. Behav. Res. 2018, 25, 353–375. [Google Scholar] [CrossRef]

- Rauch, K.L.; Slack, D. Entrepreneurial literacy and the second language curriculum. Hispania 2016, 99, 423–435. [Google Scholar] [CrossRef]

- Scholz, R.W.; Bartelsman, E.J.; Diefenbach, S.; Franke, L.; Grunwald, A.; Helbing, D.; Hill, R.; Hilty, L.; Höjer, M.; Klauser, S.; et al. Unintended side effects of the digital transition: European scientists’ messages from a proposition-based expert round table. Sustainability 2018, 10, 2001. [Google Scholar] [CrossRef]

- Schiemann, W.A.; Seibert, J.H.; Blankenship, M.H. Putting human capital analytics to work: Predicting and driving business success. Hum. Resour. Manag. 2018, 57, 795–807. [Google Scholar] [CrossRef]

- Welfens, P.J.J. ICT—Productivity and economic growth in Europe. In Digital Excellence; Welfens, P.J.J., Walther-Klaus, E., Eds.; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- BPS. Statistik Modal Sosial 2014; Badan Pusat Statistik: Jakarta, Indonesia, 2016. [Google Scholar]

- Statistic Indonesia. East Java Province in Figures 2022. 2022. Available online: https://jatim.bps.go.id/ (accessed on 10 July 2022).

- Chua, A. The influence of social interaction on knowledge creation. J. Intellect. Cap. 2002, 3, 375–392. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE Publications: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Penning, J.M. Child Welfare Across the States: Does Social Capital Matter. In Proceedings of the Eighth Annual State Politics and Policy Conference, Philadelphia, PA, USA, 30–31 May 2008; pp. 30–31. [Google Scholar]

- Maluccio, J.; Haddad, L.; May, J. Social capital and household welfare in South Africa, 1993–1998. J. Dev. Stud. 2000, 36, 54–81. [Google Scholar] [CrossRef]

- Antoni, G. Does satisfaction matter? A microeconomic empirical analysis of the effect of social relations on economic welfare. J. Socio-Econ. 2009, 38, 301–309. [Google Scholar] [CrossRef]

- Hidalgo, G.; Monticelli, J.M.; Vargas Bortolaso, I. Social capital as a driver of social entrepreneurship. J. Soc. Entrep. 2021, 13, 1–24. [Google Scholar] [CrossRef]

- Viswanathan, M.; Echambadi, R.; Venugopal, S.; Sridharan, S. Subsistence entrepreneurship, value creation, and community exchange systems: A social capital explanation. J. Macromark. 2014, 34, 213–226. [Google Scholar] [CrossRef]

- Viswanathan, M.; Sridharan, S.; Ritchie, R.; Venugopal, S.; Jung, K. Marketing interactions in subsistence marketplaces: A bottom-up approach to designing public policy. J. Public Policy Mark. 2012, 31, 159–177. [Google Scholar] [CrossRef]

- Dingyloudi, F.; Strijbos, J.W. Community representations in learning communities. Scand. J. Educ. Res. 2020, 64, 1052–1070. [Google Scholar] [CrossRef]

- Sutisna, A.; Dalimunthe, H.H.B.; Retnowati, E. Building entrepreneurial literacy among villagers in Indonesia. Rural Soc. 2021, 30, 45–58. [Google Scholar] [CrossRef]

- Kavuma, S.N.; Muhanguzi, F.K.; Bogere, G.; Cunningham, K. Entrepreneurial literacy as a pathway to economic empowerment of rural women in Uganda. In The Palgrave Handbook of Africa’s Economic Sectors; Palgrave Macmillan: Cham, Switzerland, 2022; pp. 197–216. [Google Scholar]

- Fatoki, O. The financial literacy of micro entrepreneurs in South Africa. J. Soc. Sci. 2014, 40, 151–158. [Google Scholar] [CrossRef]

- Thomas, A.; Gupta, V. Social capital theory, social exchange theory, social cognitive theory, financial literacy, and the role of knowledge sharing as a moderator in enhancing financial well-being: From bibliometric analysis to a conceptual framework model. Front. Psychol. 2021, 12, 664638. [Google Scholar] [CrossRef]

- Berraies, S.; Lajili, R.; Chtioui, R. Social capital, employees’ well-being and knowledge sharing: Does enterprise social networks use matter? Case of Tunisian knowledge-intensive firms. J. Intellect. Cap. 2020, 21, 1153–1183. [Google Scholar] [CrossRef]

- Deuflhard, F.; Georgarakos, D.; Inderst, R. Financial literacy and savings account returns. J. Eur. Econ. Assoc. 2019, 17, 131–164. [Google Scholar] [CrossRef]

- Garg, N.; Singh, S. Financial literacy among youth. Int. J. Soc. Econ. 2018, 45, 173–186. [Google Scholar] [CrossRef]

- Kovács, L.; Terták, E. Financial Literacy Theory and Evidence; Verlag Dashöfer: Bratislava, Slovakia, 2019. [Google Scholar]

- Cohen, M.; Nelson, C. Financial literacy: A step for clients towards financial inclusion. In Proceedings of the Global Microcredit Summit, Valladolid, Spain, 14–17 November 2011. [Google Scholar]

- Falk, I.; Kilpatrick, S. What is social capital? A study of interaction in a rural community. Sociol. Rural. 2000, 40, 87–110. [Google Scholar] [CrossRef]

- Wilmarth, M.J. Financial and economic well-being: A decade review from Journal of Family and Economic Issues. J. Fam. Econ. Issues 2021, 42, 124–130. [Google Scholar] [CrossRef]

- Khan, F.; Siddiqui, M.A.; Imtiaz, S. Role of financial literacy in achieving financial inclusion: A review, synthesis and research agenda. Cogent Bus. Manag. 2022, 9, 2034236. [Google Scholar] [CrossRef]

- Felicio, J.A.; Couto, E.; Caiado, J. Human capital, social capital and organizational performance. Manag. Decis. 2014, 52, 350–364. [Google Scholar] [CrossRef]

- Bucy, E.P.; Tao, C.C. The mediated moderation model of interactivity. Media Psychol. 2007, 9, 647–672. [Google Scholar] [CrossRef]

- Smith, C.; Smith, J.B.; Shaw, E. Embracing digital networks: Entrepreneurs’ social capital online. J. Bus. Ventur. 2017, 32, 18–34. [Google Scholar] [CrossRef]

- Mavlutova, I.; Fomins, A.; Spilbergs, A.; Atstaja, D.; Brizga, J. Opportunities to increase financial well-being by investing in environmental, social and governance with respect to improving financial literacy under COVID-19: The case of Latvia. Sustainability 2021, 14, 339. [Google Scholar] [CrossRef]

- Williams, J.R. The use of online social networking sites to nurture and cultivate bonding social capital: A systematic review of the literature from 1997 to 2018. New Media Soc. 2019, 21, 2710–2729. [Google Scholar] [CrossRef]

- Lin, N.; Erickson, B.H. Theory, measurement, and the research enterprise on social capital. In Social Capital: An International Research Program; Oxford University Press: New York, NY, USA, 2008; pp. 1–24. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).