Abstract

The travel and tourism industry has numerous components that contribute to the economy and create new jobs since it is a service sector that incorporates other service networks. Furthermore, it acts as a catalyst in sustaining investment attractiveness and economic indicators such as closing the current account deficit. The Travel and Tourism Competition Index utilized in this research has four dimensions and fourteen indicators. In this research, the Entropy-based VIKOR approach, which is a Multi-Criteria Decision-Making method, Spearman Correlation analysis, and K-means clustering analysis were employed to propose a methodological novelty in this field. The study analyzed the competitiveness of significant European and Eurasian nations based on key indicators. According to country evaluations, Spain, France, Germany, the United Kingdom, Italy, and Switzerland differ from other countries in a positive sense and with a significant difference. Eastern European and Balkan nations are often at the bottom of the table. As a consequence of this study, it is expected that the results of future studies using other methodologies or methods will be compared with this study. At the same time, it is aimed to explain the relevant indicators and their dimensions.

1. Introduction

Tourism has been one of the fastest-growing industries since the end of World War II. The United Nations World Tourism Organization reported that about 25 million international trips were taken all over the world in the 1950s, and that number has grown over time. In the 1990s, there were more than 500 million international trips [1,2]. In 2011, there were more than 1 billion. In the years before the pandemic, the average growth rate of the world tourism industry was about 4%. This steady growth continued in the years that followed. UNWTO data show that international tourism grew by 3.8% in 2019, bringing the total number of international travelers to almost 1.5 billion and the amount of money made from international tourism to $1.5 trillion [3,4]. The World Travel and Tourism Council (WTTC) has reported that the tourism industry contributes $8.9 trillion to the world economy as a whole. According to the WTTC, 10% of the world’s jobs are in the tourism industry, which employs 330 million people [5,6].

Important aspects of sustainable tourism development that are determined through analysis of the scientific literature are the following: the construction of new business environments which would include job opportunities in the tourism industry; the protection of the natural ecosystem; the prevention of climate change; the minimization of waste and pollution and the promotion of green and environmentally responsible consumption behavior. These factors are felt in a variety of other societal, economic and environmental contexts, including local employment and unemployment rates, the business environment, availability of services and infrastructure in popular tourist areas, affordability and sustainable environment [7,8,9]. Currently, in the tourism industry, it is crucial to create the infrastructure that guarantees eco-friendly tourism or sustainable tourism to sort waste, conserve natural resources and address other ethical concerns [10,11,12].

Competitiveness is seen as one of the key economic characteristics of sustainability relevant to the tourism sector, although it is often overlooked when discussing sustainable tourism because of its apparent connection to the promotion of green and social tourism. Based on a review of the literature on sustainable tourism, the most pressing issue is how to simultaneously improve economic, social and environmental sustainability, or how to build a successful tourism sector by taking a comprehensive approach to the social and environmental challenges that accompany tourism development [9,13,14].

Figure 1 shows the interconnectedness of key factors in sustainable tourism development. This figure not only highlights key findings, but also suggests dimensions to be considered in future studies of barriers and opportunities to sustainable tourism [9].

Figure 1.

Fundamental aspects of sustainable tourism development [9].

The tourism industry has a wide variety of benefits to the economy. A significant portion of GDP in nations where tourism is encouraged and flourishing comes from tourist spending. Revenue gained from tourism not only contributes directly to expansion but also helps reduce the country’s trade imbalance with other countries. The tourist industry has numerous elements that boost economic output and generate new jobs since it is a service sector that incorporates other service networks. Furthermore, it acts as a catalyst in sustaining investment attractiveness [15,16].

Countries such as Turkey, France, Spain, Italy, and Greece, where tourism makes up a significant part of the economy, benefit greatly from these elements. In order to mitigate the negative effects of tourism-diminishing variables, these economies need to be more flexible and responsive to unforeseen shifts and situations [17,18,19].

In Spain, tourism is the third largest contributor to the national economic life after the industry and business/banking sectors, contributing about 10–11% of the Spanish GDP. Since the 1960s and 1970s, the country has been a popular destination for summer vacations, with large numbers of tourists, especially from Ireland, the UK, France, Germany, Italy, the Benelux and the USA.

Tourism is one of the most important sectors in the economy of France, which is the most visited country in the world. French Minister of State for Tourism Jean-Baptiste Lemoyne announced that the aid to the tourism sector during the COVID-19 pandemic period amounted to 28 billion euros. According to OECD’s 2018 data, the share of the tourism sector and sector-related expenditures in gross domestic product reaches 7%. While the sector employs 1.4 million people directly, this number reaches 2 million people with indirect employment.

After exports, tourism is the second greatest contributor to a country’s surplus in foreign currency. Moreover, it is connected to forty-one distinct sectors, each of which consists of a variety of business lines of varying sizes. It is among the three fundamental service industries that have shaped the world in the 21st century, together with telecommunications and information technologies [20,21]. Transportation, commerce, construction, lodging, healthcare, finance, and the food and beverage industries are just a few of the many that benefit from the supporting impact of tourism. Additionally, rises in tourist income also help to lessen economic disparities between nations and regions [22,23].

Foreign currency earnings from tourism have a multiplier impact on a country’s balance of payments. There are, however, many factors beyond the control of the tourism industry that have an impact on it. The stability of the tourism sector is adversely impacted by many external factors, all of which lower foreign exchange revenue and worsen the equilibrium of payments, including financial and political problems, pandemics that affect the life and property protection of tourists, natural disasters, military conflict, and terrorist attacks [24,25,26].

After the coronavirus began in December 2019, there was a gradual halt to all international travel. Travel restrictions were already in place in the nations hit hardest by the pandemic, and almost all international flights were canceled [27,28]. The UN World Tourism Organization (UNWTO) stated that the harm done by COVID-19 to the tourism industry was eight times more than that done by the worldwide economic crisis in 2009 [29]. During this time span, the industry lost $730 billion in revenue from tourists from across the world. The tourist sector felt the effects of the detrimental impact of the coronavirus on employment. According to a study undertaken by The World Travel & Tourism Council (WTTC), it is projected that between 98 and 197.5 million tourism employees lost their employment worldwide as a result of the epidemic [30,31]. Additionally, according to this study, the tourism industry worldwide has been deprived of almost $5.5 trillion in revenue. However, the study reveals that the recovery has begun in the industry as of 2022, though it is not happening at the same speed everywhere or in all market types [32,33].

This study aims to provide an overview of the performance of the travel and tourism industry across 43 nations in Europe and Eurasia using data from the Travel & Tourism Development Report. Therefore, the purpose of this article is to evaluate the tourism sector-based policies implemented in European countries during the COVID-19 pandemic and to compare 43 countries in Europe and Eurasia in terms of 14 indicators determined regarding sustainable travel and tourism competitiveness. In order to accomplish this, the following research tasks were implemented: (1) a review of the literature on the effects of the COVID-19 pandemic on the travel and tourism industry; (2) a presentation of the tourism sector-oriented policies implemented by European countries during 2019–2021; and (3) an evaluation of countries using multi-criteria decision-making methods with respect to determined indicators and clustering the identified nations. This approach produces results that allow the evaluation of countries one by one in terms of many important topics and indicators concerning sustainable tourism, which became the focal point during the pandemic period, as well as a ranking table that allows them to be evaluated on a larger scale. The goal of developing these clusters is to facilitate the identification and presentation of groups of countries that have similar tourism sector infrastructures in terms of tourism development that are both sustainable and competitive.

This article consists of six sections. Section 1 is an introduction, detailing the rationale behind this study, its primary objective, and the specific goals of the research to be conducted. Section 2 is a literature review of research into how the COVID-19 pandemic has affected the travel and tourism sector. Section 3 details the sources and techniques employed in the research. In Section 4, the results are presented. Section 5 includes discussions about the tourism sector. The article ends with a conclusion that is a presentation of the results and the limitations of the results obtained. The Section 6 also provides recommendations for future research.

2. Literature Review

2.1. Review of the Literature on the Influence of COVID-19

Pandemic on Tourism

The airline sector is one of the sectors that has been most affected by the pandemic. While many airline companies continued to report losses during this period, some went bankrupt. Air travel is not expected to reach pre-COVID-19 levels globally until 2024, although a faster recovery is possible in Asia. During this period, two-thirds of the world’s aircraft fleet was parked, while 18 airlines filed for bankruptcy within a few months [34,35].

The cruise industry has been among the travel segments most affected by the pandemic process. The cruise industry, which reached a global size of 42 billion dollars in the pre-pandemic period, closed with a loss of up to 100% during the pandemic period [36,37].

A study by the Professional Congress Management Association, which is among the institutions that determine the strategies for congresses and events on a global scale, clearly revealed the extent of the damage caused by the COVID-19 process to the MICE industry. The highlights of this research were [38,39,40]:

- 26 million people working in the congress, meeting, and event sector on a global scale were negatively affected by the pandemic process in professional terms;

- 87% of event planners announced that they canceled the events they were going to organize;

- 66% of the events were postponed to a later date;

- 61% were undecided whether to cancel or postpone events due to uncertainty;

- 70% moved their face-to-face activities to virtual platforms;

- 63% of them stated that they are seeking to develop their competencies in order to be successful in online platforms;

- 43% faced issues such as layoffs, salary cuts, and other measures.

Hotels were one of the other areas where the effect of the pandemic was felt intensely. During this period, the hotel industry suffered a revenue decline four times greater than the sum of the two previous crises. Many hotels have experienced significant reductions in their workforce and many have had to close temporarily or permanently. Hotel revenue per room may not recover until 2024 [41,42].

Tour operators and travel agencies are among the most critical stakeholders of the tourism industry, along with the aviation and accommodation sectors. In general, the tourism sector has been the sector most affected by the COVID-19 process, while tour operators and travel agencies have been the most adversely affected by this period due to the obligations they have undertaken. The fact that mass and group travel movements have come to a standstill during the COVID-19 period has dealt the heaviest blow to travel agencies. A study by McKinsey, conducted in April 2020 with the participation of approximately 1200 tour operators worldwide, revealed that the loss in reservations was 85% compared to 2019 [43]. Travel agencies, which are the locomotive of the sector, need support in order to survive in difficult times in terms of tourism, such as pandemics and crises. In this context, governments in countries such as Germany, France, Spain, and Russia have announced special support packages for travel agencies [44].

Consumers whose holidays have been canceled have applied to tour operators or travel agencies for the refund of their payments. Therefore, travel agencies were left with a serious financial crisis. In Europe, which is an important source market for tourism, while tour operators applied for government support to cope with the crisis, campaigns and coupon applications that encouraged consumers to postpone their travels to later dates came to the fore. In some European countries, the support given to the tourism sector, especially tour operators, are as follows [43,45,46,47]:

Germany: A 10-year loan support was provided by the Development Bank, 100% of which was state-guaranteed, for travel agencies in Germany. While the upper limit of the loan provided for companies with fewer than 50 employees was 500 thousand euros, and 800 thousand euros for companies with more than 50 employees.

In terms of grant support, the German government has announced a 50 billion euro grant support package for all small businesses and self-employed workers. Travel agencies were also able to benefit from this grant package. In this context:

- -

- Travel agencies with up to five employees were provided with 9 thousand euros for 3 months;

- -

- Travel agencies with up to 10 employees were provided with a grant of 15 thousand euros for 3 months.

In the beginning of July 2020, the Ministry of Economy and Energy of the Federal Republic of Germany announced that it had prepared a 25 billion euro support package for the tourism sector.

TUI, which is the biggest tour operator in the European travel market, which is also in a difficult situation in Germany, has been provided with financial support and a credit of nearly 3 billion euros by the German government in two parties.

In addition, against the travel cancelation demand of consumers, travel agencies and tour operators have been offered a government-guaranteed holiday voucher to be used in the next period instead of a refund. Although this proposal was accepted by the German government, the European Union declared that it should be returned to consumers who want a refund.

Italy: Within the scope of the measures announced by the government, employment package support was created for the payment of 80% of the salaries of all sector employees. In addition, the self-employed and seasonal workers were paid 600 euros. In addition, the total size of the employment support package, which also covers the tourism sector, was 25.6 billion euros. Among the support provided to the tourism sector was the granting of 500 euro holiday checks to low-income families to be used for domestic travels in order to revive domestic tourism. In addition, tax reductions for hotels and 2 billion euros of assistance to businesses that make arrangements in accordance with the social distance rule were also among the support provided. Along with this, a 500 million euro fund was created for the damage suffered by the aviation industry and Alitalia.

France: While France promised unlimited budget support for companies and employees, a 2 billion euro solidarity fund was established for travel and tourism companies in the first place. While the government created a package of 45 billion euros for businesses that were closed due to the coronavirus, 8.5 billion euros of this package were allocated to the short-time working allowance. Within the scope of short-time working allowance, 70% of their gross salary was paid to employees. Employees earning minimum wage or less were paid their full salaries. The French government has created a guarantee system of up to 300 billion euros covering banks to protect the financial system.

France announced a “Tourism Support Package” of 18 billion euros on 15 May 2020. In addition to the aforementioned support, the French government has also established a tourism commission consisting of public and private sector representatives and Atout France officials.

Austria: The Ministry of Agriculture, Regions and Tourism in Austria announced the first support package for the tourism sector on 6 March 2020 due to the COVID-19 outbreak. This package mostly includes credit support through the Austrian Hotel and Tourism Bank. Accordingly, it has been announced that a support budget of approximately 1.6 billion euros has been allocated. The Austrian government has also created a 2 billion euro support fund for all commercial enterprises to overcome the COVID-19 crisis.

Spain: The Spanish government announced a 200 billion euro package against the economic effects of the coronavirus on 17 March 2020. While 117 billion euros of this package are allocated to the public, 83 billion euros are reserved for companies and workers affected by the crisis. The size of the support package for the tourism sector, announced on 18 June, was 4.2 billion euros. While 2.5 billion euros of this support package consist of loans to be provided to the sector, 850 million euros were given to encourage competition with digitalization and sustainability, and 756 million euros were given to the Spanish Airports Operators (AENA) as an incentive.

Portugal: In the first period of the pandemic, the Portuguese government implemented employment support that cover 70% of the insurance burden of employers, while covering 2/3 of the salaries of employees. While a 600 million euro loan package was created specifically for the tourism sector for restaurant businesses, a 200 million euro loan package was provided for travel agencies and event organization companies. The size of the credit channel opened to hotels was 900 million euros. Under the umbrella of Turismo de Portugal, a loan package of 60 million euros was announced for small-scale businesses in distress.

Russia: The Russian government decided to support domestic tourism through a program called “Cash Refund”. Within the framework of the decision taken, a cash refund of 5 thousand rubles was given to the citizens who purchased tours worth more than 25 thousand rubles in the country.

2.2. Literature Review about Studies on Similar Methods and Subjects

In terms of topic and methodology, the following studies are similar to this one in the scientific literature. Firstly, in order to compare and contrast the travel and tourism industries of different countries, Aydoğan and Özmen [48] presented a hybrid MCDM approach combining Rough SWARA with the TODIM method. There were 13 European nations evaluated and ranked by Fedajev, Popovic [49] based on nine assessment criteria related to their tourist performance. For the purpose of evaluation, the EDAS technique was used. The primary objective of this article was to assess where the Republic of Serbia is as a tourist hotspot right now. By constructing tourism competitiveness (TC) synthetic indicators using data from the Travel and Tourism Competitiveness Index, Rodríguez-Díaz and Pulido-Fernández [50] sought to examine the impact of the weights (TTCI). Statistical approaches were used to assess the weights in the research. The researchers then used these values to apply to the TTCI and four synthetic TC indices created using multi-criteria methods, yielding a variety of significant outcomes. Using Data Envelopment Analysis (DEA) and the TOPSIS approach, Gómez-Vega, Martín [51] examined the T&TC of 136 global tourism locations. They conclude that both of the offered techniques are reliable for estimating the T&TC of global tourist hotspots. Using the Tourist Competitiveness indicators from the World Economic Forum’s (WEF) Trade and Competitiveness (T&TC) Index, Liu, Ko [52] planned to establish a country-based tourism competitiveness assessment model including the Kruskal–Wallis test and fuzzy AHP methodologies. Cultural distinctiveness and ecological/environmental considerations were selected as the two most important features by the group. By using a DEMATEL and Fuzzy TOPSIS-based hybrid MCDM method, Bire, Conterius [53] sought to investigate a conceptual criterion framework for gauging the competitiveness of tourist destinations. It was shown that natural attractions, accessibility and port infrastructure, lodging options, and a destination’s reputation are the most crucial factors. Subjective rankings of travelers were utilized by Hašková and Horák [54] to determine the level of travel and tourism competitiveness of a country using the fuzzy technique. According to the findings, China has a very high level of competition in the travel and tourist industry compared to the other nations analyzed. The Czech Republic, Pakistan, Russia, and Turkey are nations that are conditionally competitive in the travel and tourist industry. Tourist sites in Central and Southern/Mediterranean Europe were compared using the MCDM technique of Preference Selection Index (PSI) by Stanujkic, Stanujkic [55]. Stecyk, Sidorkiewicz [56] tried to use Delphi, AHP, and PROMETHE II in order to evaluate the attractiveness of tourist in 21 regions in the West Pomeranian Voivodeship.

3. Material and Methods

The data utilized in this study is based on the Travel and Tourism Development Index (TTDI), which is compiled with the help of the World Economic Forum (WEF). The Index, which is comprised of a professional advisory board and collaborators, is a valuable and adaptable instrument for assessing the state of T&T’s growth, administration, and lengthy objectives, as well as comparing them to those of other nations.

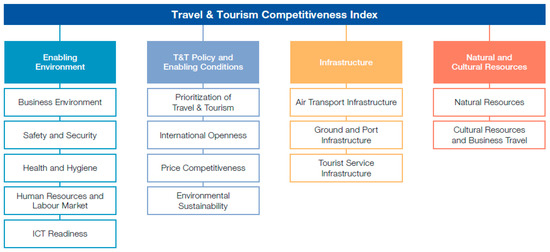

Bloom Consulting, International Air Transport Association (IATA), JLL Hotels & Hospitality Group, Pacific Asia Travel Association (PATA), University of Surrey, World Travel and Tourism Council (WTTC), World Tourism Organization (UNWTO), AirDNA, Euromonitor International, GlobalPetrolPrices.com, International Civil Aviation Organization (ICAO), STR, TripAdvisor, UNWTO, and WTTC are only a few of the organizations that provide data for the index. The dimensions of the index used in this research and the relevant indicators are presented in Figure 2.

Figure 2.

The Travel and Tourism Competitiveness Index framework [57].

After assessing the World Economic Forum’s (WEF) Travel and Tourism Index [57], four aspects and fourteen criteria were decided to evaluate the chosen nations. Additionally, the paper attempted to provide a hybrid MCDM approach as a contribution to this topic, while also demonstrating the present state of these nations. Dimensions assessed in the study are enabling environment, travel and tourism policy and enabling conditions, infrastructure, and travel and tourism demand drivers. Metrics that were employed in the application of the research include highly essential issues related to the travel and tourism industry, such as safety and security, health and hygiene, human resources and labor market, travel and tourism ICT readiness, government prioritization of travel and tourism, international openness and travel facilitation, price competitiveness in the travel and tourism industry, environmental sustainability, air transport infrastructure, ground and port infrastructure, tourist service infrastructure, natural resources, and cultural resources of countries.

Table 1 displays the dimensions, their corresponding indications, and their implications.

Table 1.

Dimensions and definitions of indicators in the index used in the study [57].

The decision matrix consisting of raw values for the VIKOR is presented in the Table 2.

Table 2.

VIKOR Decision Matrix with raw data.

3.1. Proposed Multi-Criteria Decision-Making Methods

This section provides information on the data and methodologies of study. The Entropy approach, which is one of the objective-weighting MCDM methods, was used in the research to calculate the relative importance of each of the indicators.

The VIKOR approach was used to rank 43 nations in Europe and Asia based on four categories and fourteen different indicators of the travel and tourism industry. Cluster analysis, a kind of data mining categorization, is also used to classify nations that are similar to one another.

Entropy Method and Objective Weights

The idea of Entropy developed by Shannon and Weaver [58,59] is used to estimate the relative contrast intensities of the decision-making criteria. This method has been implemented in several fields, including spectrum analysis [60], language modeling [61], and economics [62]. The following are the weight calculation phases of the Entropy method [63,64,65,66]:

1st Step: Obtaining the Decision Matrix.

2nd Step: Computing the Normalized Decision Matrix.

These indicators are normalized according to their utility or cost features so that the indicator values with different units can be evaluated together:

; ; ;

Pij defines normalized values while “a” defines utility values;

3rd Step: Determining the Entropy Measure.

; ; ;

4th Step: Determining the (dj) Uncertainty Value.

5th Step: Determination of wj weights expressing the relative importance of j.

The total value of these weights is equal to 1.

3.2. Cluster Analysis

The challenge of cluster analysis or clustering is to classify items into meaningful categories. Clustering items in this challenge requires a higher degree of similarity between them and components in other clusters. It is a common method of statistical data analysis and one of the major challenges of data mining. It is also utilized in data compression, computer graphics, bioinformatics, machine learning, and pattern recognition. The processes of cluster analysis used in the study are presented below [67]:

- (1)

- Determine the K center positions (c1, …, cK);

- (2)

- Distribute all xi to closest cluster center cK;

- (3)

- All cluster centers are recalculated to be the average of all xi’s nearest to it;

- (4)

- Compute

- (5)

- When the value of D converges, (c1, …, cK) is returned; otherwise, continue from Step 2.

3.3. VIKOR (Multi-Criteria Optimization and Compromise Solution)

Opricović [68] created the VIKOR approach, whose goal is to achieve a compromise order and a consensus solution within the constraints of predetermined weights. When used here, “consensus” means agreement among decision-makers over the course of action to take. The VIKOR procedure includes the following phases [69]:

Step 1. A positive ideal solution fi* and a negative ideal solution fi− are first calculated. Specifically, I1 represents a beneficial outcome, whereas I2 represents a cost.

Step 2. Calculate the Sj and Rj of the scheme. Wi represents the weight of index i.

Step 3. Calculate Q of each scheme.

The quantity of v in the Qj formula indicates the relative significance of most of the parameters, in this case, the largest group benefits, whereas the value of 1-v indicates the significance of the minimal regret of the opponents or the weight. The options may be ranked by arranging the values of S, R, and Q in ascending order. Three rankings are determined by this kind of assessment. There are two requirements that need to be satisfied before the result can be considered reliable.

The best option must be significantly better than the second-best option (C1)—(Acceptable advantage):

The first-best option, A1, has the lowest Q value; hence, it is the best option. The second-best option, A2, has a higher Q value. Let us now examine the justifiable benefit in this scenario:

As Q(A2) > Q(A1) > DQ

DQ = 1/(m − 1); m is the number of alternatives

To guarantee the stability of the discovered compromise solution, we need to meet Condition 2 (C2)—(Acceptable stability), which states that the A1 option with the greatest Q value must have also received the highest value from at least one of the S and R values;

Step 4. Only once all these requirements are satisfied can the option with the lowest Q value be called the optimal choice.

4. Results

Table 3 shows the weights of the WEF [57] travel and tourism indicators obtained using the Entropy method.

Table 3.

The indicator weights obtained from Entropy analysis.

Applying the Entropy method for determining criteria weights, the weights of all criteria for each dimension of sustainable tourism and competitiveness (enabling environment; travel and tourism policy and enabling conditions; infrastructure; travel and tourism demand drivers) are obtained in Table 3. The top five significant criteria of impact are depicted in Table 2, including C14. Cultural resources and business travel, C2. Safety and security pillar, C3. Health and hygiene, C8. Price competitiveness in the travel and tourism industry pillar, and C12. Tourist service infrastructure pillar. Table 4 presents the weighted normalized matrix used in the VIKOR analysis.

Table 4.

Weighted normalized matrix of VIKOR analysis.

Differentiating factors between index leaders and laggards include (but are not limited to) the availability of safety and security, price competitiveness, quality transport and tourist service infrastructure; the degree of international openness; the distribution and promotion of natural, cultural, and non-leisure assets and activities; and favorable factors such as (increasingly important) ICT readiness and health and hygiene. Nonetheless, leaders in the travel and tourism industry can play a pivotal role in enticing investment that helps the economy as a whole by focusing on things like infrastructure and health and hygiene, which are crucial to the growth of travel and tourism.

This is especially true for emerging markets that have natural and cultural resources that can be used to attract foreign investment. Transport, safety and security, health and hygiene, cultural resources and nature, price competitiveness in the travel and tourism industry, and transportation infrastructure must be developed with attention. This can assist in distributing tourism and its benefits to a greater number of communities, making them more desirable destinations and increasing their capacity to accommodate more tourists. Within urban centers, improved road and public transport infrastructure and access to efficient, accessible, safe, and cost-effective transport alternatives can minimize the likelihood of overcrowding and lead to a higher quality of life for inhabitants and a better experience for visitors.

Table 5 displays the ranks derived according to each Qi value obtained from the VIKOR analysis. In the VIKOR study, country rankings were determined by ascendingly ordering the Qi values generated for each country. Additionally, WEF Travel & Tourism Competitiveness Index scores of the relevant countries are presented in Table 5.

Table 5.

WEF Travel & Tourism Competitiveness Index Values and VIKOR analysis Qi scores.

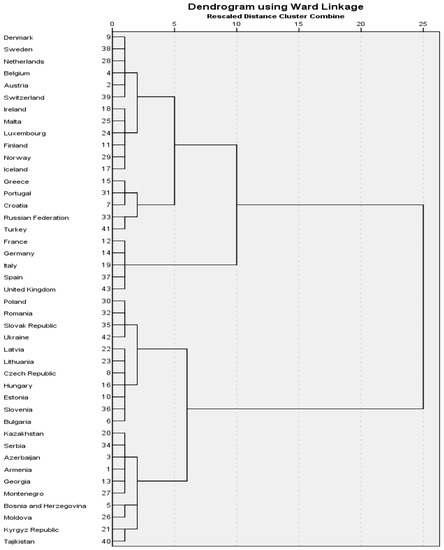

Figure 3 illustrates the dendrogram derived using the K means cluster method.

Figure 3.

Dendrogram obtained from K means cluster analysis.

After analyzing the dendrogram using cluster analysis, it was determined to cluster the nations into four categories using k-means clusters analysis. According to the Euclidean distances between the final cluster centers included in the cluster analysis, clusters 1 and 4 are most different, cluster 2 is approximately equally similar to clusters 1 and 4, and cluster 3 is approximately equally similar to clusters 2 and 4. In this way, we are able to compare nations that are similar in terms of assessment criteria. When the nations in the clusters generated by the K-means clustering technique are analyzed, those with close scores in the rankings generated by the Entropy-weighted VIKOR methods and the WEF T&T Index are found to be clustered together. Consequently, it has been seen that the clustering analysis findings are quite consistent with both MCDM and index rankings. In the cluster analysis, the five countries in the first cluster, consisting of France, Germany, Italy, Spain, and the United Kingdom, are also the countries in the top five in the WEF Index. In the VIKOR analysis ranking, Switzerland is in the top five instead of the United Kingdom.

The resulting cluster center distances are shown in Table 6. After analyzing the dendrogram, the countries were divided into four groups by the K-means clusters assessment.

Table 6.

Distances between final cluster centers.

This table shows the Euclidean distances between the final cluster centers. Greater distances between clusters correspond to greater dissimilarities. Clusters 1 and 4 are most different. Cluster 2 is approximately equally similar to clusters 1 and 4. Cluster 3 is approximately equally similar to clusters 2 and 4.

Table 7 presents the cluster membership, WEF Index values, and VIKOR Qi scores.

Table 7.

Cluster membership, WEF Index values, and VIKOR Qi scores.

Table 7 can help us understand which economies have the appropriate infrastructure and flexible policies for travel and tourism, and which may need to prioritize more investment in travel and tourism enablers. Low- and middle-income, upper-middle-income, and Eurasian economies have low scores in terms of travel and tourism, indicating a potential constraining factor for their economic recovery. On the one hand, these economies are the ones that can gain the most by investing in the drivers of travel and tourism development, as they are more dependent on the industry for economic development. Such investment will help their economic recovery by enabling stronger tourism growth as well as supporting their overall economies to be more robust and resilient.

The economies in the second and third clusters have higher WEF TTDI and VIKOR Qi scores, which means they are more developed and in the best position for industry recovery. From a resilience point of view, high-income economies are in the best position because they have good conditions for travel and tourism operations but are less dependent on it for their overall economic performance. However, that does not mean that T&T does not play an important role in their overall economic development, especially locally and for certain parts of the workforce and small and medium-sized enterprises (SMEs). At the same time, economies in Eastern Europe seem to be highly vulnerable to the impact of the pandemic, as are the economies below them in the ranking. In general, for the most developed travel and tourism countries, such as those higher in the top rankings, sector performance and resilience may be less about making major improvements in aspects of travel and tourism development, such as infrastructure, and more about continuously calibrating their travel and tourism strategies to adapt to changing demand dynamics, local needs, and overall travel and tourism trends. Additionally, more than half of the nations in the WEF Index with above-average scores in environmental sustainability are located in Europe and Eurasia, making these regions the global leaders in environmentally sustainable economies.

In addition, the Spearman Correlation analysis was used to assess the consistency of the results of analysis. Table 8 presents the Spearman Correlation analysis results. The WEF and VIKOR rankings have perfectly positive correlation.

Table 8.

Spearman Correlation analysis results.

In the cluster analysis, the five countries in the first cluster consisting of France, Germany, Italy, Spain and the United Kingdom are also the countries in the top 5 in the WEF Index. In the VIKOR analysis ranking, Switzerland is in the top five instead of the United Kingdom.

When WEF and VIKOR values and rankings based on scores are compared with the second cluster of cluster analysis, the countries included in WEF and Cluster Analysis are completely overlapping, whereas in cluster analysis and VIKOR analysis, the results are consistent except for Switzerland, the United Kingdom, and the Czech Republic. According to the general evaluation of the results, Austria, Belgium, Croatia, Denmark, Finland, Greece, Iceland, Ireland, Luxembourg, Malta, the Netherlands, Norway, Portugal, Sweden and Switzerland, which closely follow the countries in the top five, are countries in the same classification in terms of travel and tourism sector indicators. Bulgaria, Czech Republic, Estonia, Georgia, Hungary, Latvia, Lithuania, Montenegro, Poland, Romania, Russian Federation, Slovak Republic, Slovenia, and Turkey are countries in the same cluster in terms of travel and tourism sector performance. Armenia, Azerbaijan, Bosnia and Herzegovina, Kazakhstan, Kyrgyz Republic, Moldova, Serbia, Tajikistan, and Ukraine are the countries with the lowest score and the worst ranking in terms of travel and tourism sector indicators among the countries evaluated in the analysis and WEF ranking. Serbia, Moldova, Tajikistan, Kyrgyz Republic, and Bosnia and Herzegovina have been identified as the five countries with the lowest scores among the countries included in the analysis.

5. Discussion

The coronavirus outbreak has led to significant shifts in travel trends around the world. During and after the pandemic, there were many issues that came to the fore in travel habits, such as the expectations in hygiene standards, and they continue to come to the fore. The pandemic process has brought different types of tourism to the fore by affecting consumer habits and preferences. This difficult period, the effect of which still continues in some regions, highlights different types of tourism. The tendency of people to stay away from crowded places has increased the interest in eco-tourism, that is, nature tourism. The percentage of those who prefer closer areas with their own vehicles, areas where they will be alone with nature, and small and boutique hotels in terms of accommodation has increased. In this period, accommodation units such as boutique hotels, home tourism, villa rentals, yacht tours with small groups, and caravans have also attracted great attention rather than large hotels.

During the pandemic period, travels have also decreased, while stays have become longer. This shows that the interest in different cultures will always continue despite various difficulties. Alternative tourism types such as nature and adventure became more prominent in this period. There is also a serious change in business tourism. In this period, online meeting techniques attract great attention. Business meetings, panels, and seminars have shifted to online applications. Therefore, the importance of digital technologies was better understood in this period. Tour operators further developed their digital infrastructure in this period.

Many new tourism trends emerged during and after the pandemic [70,71]; discounted holidays, short trips, virtual travel, luxury getaways, safe destinations, reservation flexibility, and the increase in demand for winter holidays.

It is predicted that the digitalization process, which has been on the rise until today, will gain even more momentum after the pandemic period experience. According to the report prepared in cooperation with Skift Research and McKinsey & Company, digitalization in the tourism sector will become even more important during and after the pandemic. Regarding digital channels, 75% of first-time users say they will continue to use them when things return to “normal”. Therefore, investing in digital can be considered as the first phase in which travel businesses plan to grow again following COVID-19 [72,73].

The travel and tourism industry has numerous components that contribute to the economy and create new jobs since it is a service sector that incorporates other service networks. Furthermore, it acts as a catalyst role in sustaining investment attractiveness and economic indicators such as closing the current account deficit. This situation is also detailed in the implications in terms of the indicators section. If a nation receives a poor score on the travel and tourism index criteria, the stability and viability of its economy, the welfare of its population, the quality of life, economic fairness, sustainable growth, and job opportunities are at risk.

When an evaluation is made in terms of Turkey, it is seen that the comparisons in the reports and policies related to the travel and tourism sector in Turkey are made especially with Spain, Italy, Greece, Croatia, and Portugal. However, considering the analysis made in the study and WEF Index rankings, these countries are well ahead of Turkey in terms of the travel and tourism indicator values included in the study. It is seen that the promotions and events highlighting Turkey’s airport, ports investments, and cultural heritage in recent years will contribute to the closure of these differences.

After France, Spain is the second-most visited country in the world. After that comes the US and China. Spain’s cultural and natural attractions play a significant role in the country’s tourism success, but the government’s emphasis on the industry, as well as the country’s well-developed transportation, hotel, and service infrastructures, also play important roles. These are the most weighted key indicators that the research considers essential to having a competitive advantage over other countries in tourism. The tourist sector plays a crucial role in Spain’s economy and labor market (2.3 million jobs). About half of the tourism industry’s internal expenses (tourists spend around 90 billion euros) are covered by overseas visitors thanks to the strong state policies backing businesses, public–private partnerships, and a clear orientation towards a sustainable and quality tourism model.

The recent outbreak of war in Ukraine, as well as the sanctions and visa restrictions imposed on Russia as a response, have placed additional strain on the recovery. The world’s airlines have been forced to reroute their operations, increasing travel times and expenses. Due to diminished demand from Russia and Ukraine, many travel and tourism economies in Europe, Eurasia, and beyond may also be severely affected. Together, these two economies account for approximately 3% of foreign tourism expenditures, with Russia being a major source of tourists for locations such as Azerbaijan, Georgia, and Turkey.

Rising travel demand; available labor amount, capacity, and other shortages; global supply-chain disruptions; and increases in fuel prices and inflation caused by factors like the war in Ukraine will likely increase costs and service prices throughout the entire T&T supply chain and ecosystem. This is not yet fully reflected in the WEF TTDI’s Price Competitiveness pillar. In mid-May 2022, the price of jet fuel was more than twice what it had been a year earlier; if this trend continues, airlines will undoubtedly increase their yields and ticket prices. According to a recent study by the UNWTO, the performance of the travel and tourism industry may be negatively impacted by conflict-related uncertainties, rising energy and food prices, and general inflation. Additionally, the rising cost of financing can have a negative multiplier effect on demand from consumers and investment in travel and tourism, as economies like the United States raise interest rates to fight inflation.

6. Conclusions

The COVID-19 process has probably caused long-lasting changes in the organizational system of the industry as well as the expectations of consumers. People are pickier than they used to be when it comes to vacation spots, and this is particularly true when it comes to issues of safety and cleanliness. Fast solutions by governments during problems like COVID-19, and the response to a new concern like monkeypox, could potentially be deciding factors for visitors. As a result, both the government and enterprises in T&T have had to reevaluate their investment horizons, strategies for weathering swings in demand, and approaches to meet shifting consumer expectations.

According to the data announced by the World Travel and Tourism Council (WTTC), the total contribution of the tourism sector to the world economy is 8.9 trillion dollars. According to the WTTC assessment, the tourism sector accounts for 10% of the world’s employment and provides employment to 330 million people. It is seen that many countries cannot receive the necessary contribution economically from such an important sector. It is essential for the countries that are in last place in travel and tourism revenue to create action plans to find ways to rise to higher ranks in the sector and increase their income by taking advantage of the geographical and cultural riches of their respective country.

In terms of indicators, it is expected that the evaluations stated in the implications section will be taken into account by the policymakers, and the investments that the sector deserves will be made. In conclusion, with the increase of these and similar studies, it is expected that the awareness of the problems of the travel and tourism sector, which is an important dimension of sustainable economic development in the world, will increase in every country, and more effective policies will be created. In many countries, especially in cities with seasonal tourism potential or natural and cultural richness, a sustainable travel and tourism sector policy and investments are needed to ensure sustainable quality of life.

Indicators of the travel and tourism index are in contradiction with one another. Thus, it is recommended that MCDM methodologies may be employed in these issues. The novelty of the research is that it illustrates the present condition of 43 nations in terms of the Travel & Tourism Development Index indicators and provides an integrated decision support system comprised of multi-criteria decision-making approaches for evaluating the tourism industry.

The purpose of the research is to assess the state of the travel and tourism industry and European and Eurasian nations in terms of pertinent indicators, to compare them with one another, and to use innovative methodologies in this area. As indicated in the literature review, although some research on this topic use MCDM approaches, the Entropy-based VIKOR method has not been applied. This is a novel suggestion made by the research. In the research on related topics, descriptive statistical approaches have often been used to assess nations.

Due to the fact that many MCDM techniques, such as the ANP and the AHP, rely on individual judgment, various studies for the same indicators might provide quite different outcomes. If even the criteria weights are chosen using subjective judgements, the same procedures will provide different outcomes for the same indicator values. MCDM methods were implemented in this study, with objectively weighted criteria and requiring no subjective assessment, and with just the parameter data being processed and evaluated. These evaluations have been conducted in a setting that was free of any subjectivity. In terms of its scope, methodology, and number of included nations, it is evident that the application of this research introduces an original study to the literature.

The article assesses 43 European and Eurasian nations based on four aspects and fourteen indicators connected to the travel and tourism industry. In addition to demonstrating the present situation of these nations, the article intends to contribute to this subject by providing a hybrid MCDM approach. Comparing the consistency of the study’s findings with those of the index using the Spearman Correlation test reveals an extremely high correlation with a value of 0.997.

Indicators employed in the application of research include highly essential topics such as business environment-related concerns, safety and security, health and hygiene, human resources and labor market, travel and tourism ICT readiness, government prioritization of travel and tourism, international openness and travel facilitation, price competitiveness in the travel and tourism industry, environmental sustainability, air transport infrastructure, ground and port infrastructure, tourist service infrastructure, natural resources, and cultural resources of countries.

High-income European countries are at the top of the rankings and have rich cultural and non-recreational assets and quality transport and tourism infrastructure that make them available to large numbers of visitors. On the other hand, those ranked lower in the VIKOR and WEF rankings have below-average values in terms of city center accessibility, being able to host large tourist masses and transportation infrastructure.

In terms of the WEF Index, Europe is still ahead of the curve and among the best-positioned regions for future growth. EU countries are also at the forefront of this region according to the results of analysis. According to the WEF report data, out of the 43 regional economies assessed in the study, 32 are performing better than the world average, and 18 of these have seen increases in their index scores since 2019. Northern Europe, Southern Europe, and Western Europe are the most economically developed regions in Europe, and they also have the greatest concentration of advantages in these other categories. The countries with the best score in the analysis results are the EU member countries and the UK in these regions. When evaluated in terms of these 10 countries at the top of the rankings, their high international openness and quality infrastructure, including the greatest ground and tourism service facilities, contribute to their standing as worldwide economic and cultural hubs with some of the highest marks for cultural and non-leisure resources. There are a number of factors that make doing business in these countries less difficult, including first-rate information and communication technology and healthcare infrastructure, as well as advantageous business climate, security, human resource and labor market conditions, and social and economic climates. Additionally, membership in the European Union and the Schengen Area is the basis of the region’s international openness of the leading countries in the rankings (26 European countries that have abolished passport control, etc., at their mutual borders).

Compared to their western neighbors, countries in Eurasia, the Balkans, and Eastern Europe offer more competitive prices, while those in the south of Europe, which rely more heavily on tourism, stand out for their investment in tourism infrastructure and natural resources.

As a suggestion for future research, several approaches for resolving this issue may be implemented, and the results may be compared to those of this article. In addition, it is suggested that this research may be repeated in subsequent years in order to assess the success of travel and tourism sectors of these nations.

Author Contributions

G.O.: conceptualization: data curation, methodology; investigation; validation; writing—original draft; writing—review and editing; supervision proofreading. A.D.: conceptualization; methodology; validation; writing—review and editing; proofreading. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data sources presented in this study are available in the manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Gamlen, A. Migration and Mobility after the 2020 Pandemic: The End of an Age; IOM’s Migration Research High Level Advisers: Washington, DC, USA, 2020; pp. 2–14. [Google Scholar]

- Tsai, M.-C. Developing a sustainability strategy for Taiwan’s tourism industry after the COVID-19 pandemic. PLoS ONE 2021, 16, e0248319. [Google Scholar] [CrossRef] [PubMed]

- Marinković, G.; Stevanović, S. Performance changes of the tourism sector in the crises. In 5th International Thematic Monograph: Modern Management Tools and Economy of Tourism Sector in Present Era; Association of Economists and Managers of the Balkans; Faculty of Tourism and Hospitality, Belgrade: Belgrade, Serbia, 2021. [Google Scholar]

- Teczke, M.; Kaliyeva, T.; Sembiyeva, L.; Zhagyparova, A.; Zholamanova, M.; Zhussupova, A. Silk Roads Routes. Sustainable Tourism after COVID-19. J. Environ. Manag. Tour. 2022, 13, 1192–1206. [Google Scholar]

- Iwamoto, H. The unexplored potential of foreign workers in Japan’s travel and tourism industries. In Open Borders, Open Society? Immigration and Social Integration in Japan; Verlag Barbara Budrich: Leverkusen, Germany, 2022; p. 145. [Google Scholar]

- Hambira, L.W.; Stone, L.S.; Pagiwa, V. Botswana nature-based tourism and COVID-19: Transformational implications for the future. Dev. South. Afr. 2022, 39, 51–67. [Google Scholar] [CrossRef]

- Hall, C.M. Constructing sustainable tourism development: The 2030 agenda and the managerial ecology of sustainable tourism. J. Sustain. Tour. 2019, 27, 1044–1060. [Google Scholar] [CrossRef]

- Almuhrzi, H.M.; Al-Azri, H.I. Conference report: Second UNWTO/UNESCO world conference on tourism and culture: Fostering sustainable development. Int. J. Cult. Tour. Hosp. Res. 2019. [Google Scholar] [CrossRef]

- Streimikiene, D.; Svagzdiene, B.; Jasinskas, E.; Simanavicius, A. Sustainable tourism development and competitiveness: The systematic literature review. Sustain. Dev. 2021, 29, 259–271. [Google Scholar] [CrossRef]

- Andereck, L.K.; Nyaupane, G.P. Exploring the nature of tourism and quality of life perceptions among residents. J. Travel Res. 2011, 50, 248–260. [Google Scholar] [CrossRef]

- Luekveerawattana, R. Key factors affecting of tourists’ decisions to stay at environmental friendly hotels. Pol. J. Manag. Stud. 2018, 17, 148–157. [Google Scholar] [CrossRef]

- Murava, I.; Korobeinykova, Y. The analysis of the waste problem in tourist destinations on the example of Carpathian region in Ukraine. J. Ecol. Eng. 2016, 17, 43–51. [Google Scholar] [CrossRef]

- Font, X.; Torres-Delgado, A.; Crabolu, G.; Palomo Martinez, J.; Kantenbacher, J.; Miller, G. The impact of sustainable tourism indicators on destination competitiveness: The European Tourism Indicator System. J. Sustain. Tour. 2021, 1–23. [Google Scholar] [CrossRef]

- Rodríguez-López, N.; Diéguez-Castrillón, M.I.; Gueimonde-Canto, A. Sustainability and tourism competitiveness in protected areas: State of art and future lines of research. Sustainability 2019, 11, 6296. [Google Scholar] [CrossRef]

- Henseler, M.; Maisonnave, H.; Maskaeva, A. Economic impacts of COVID-19 on the tourism sector in Tanzania. Ann. Tour. Res. Empir. Insights 2022, 3, 100042. [Google Scholar] [CrossRef]

- Onifade, S.T.; Gyamfi, B.A.; Bekun, F.V.; Altuntaş, M. Significance of air transport to tourism-induced growth hypothesis in E7 economies: Exploring the implications for environmental quality. Tour. Int. Interdiscip. J. 2022, 70, 339–353. [Google Scholar] [CrossRef]

- Jäggi, C.J. Economic Importance of Tourism, in Tourism before, during and after Corona; Springer: Berlin/Heidelberg, Germany, 2022; pp. 27–46. [Google Scholar]

- Yıldırım, S.; Yıldırım, D.Ç.; Aydın, K.; Erdoğan, F. Regime-dependent effect of tourism on carbon emissions in the Mediterranean countries. Environ. Sci. Pollut. Res. 2021, 28, 54766–54780. [Google Scholar] [CrossRef] [PubMed]

- Doğanalp, N.; Arslan, A. Comparative efficiency analysis of tourism industry in the Southern Mediterranean region. In Contemporary Issues in Social Science; Emerald Publishing Limited: Bingley, UK, 2021; pp. 49–66. [Google Scholar]

- Senanayake, U.J. Threats and opportunities of the COVID 19 on tourism industry in Sri Lanka and South Asian region. Int. J. Hosp. Tour. Manag. 2021, 5, 15. [Google Scholar]

- Ranasinghe, R.; Sugandhika, M. The contribution of tourism income for the economic growth of Sri Lanka. J. Manag. Tour. Res. 2018, 1, 67–84. [Google Scholar]

- Adinugraha, H.H.; Nasution, I.F.A.; Faisal, F.; Daulay, M.; Harahap, I.; Wildan, T.; Takhin, M.; Riyadi, A. Halal Tourism in Indonesia: An Indonesian Council of Ulama National Sharia Board Fatwa Perspective. J. Asian Financ. Econ. Bus. 2021, 8, 665–673. [Google Scholar]

- Behere, D. Global Tourism and Its Impact on Business. ZENITH Int. J. Bus. Econ. Manag. Res. 2018, 8, 73–85. [Google Scholar]

- Kataya, A. The Impact of COVID-19 Pandemic on International and Lebanese Tourism Indicators. Econ. Appl. Inform. 2021, 2, 5–13. [Google Scholar] [CrossRef]

- Ertaş, M.; Sel, Z.G.; Kırlar-Can, B.; Tütüncü, Ö. Effects of crisis on crisis management practices: A case from Turkish tourism enterprises. J. Sustain. Tour. 2021, 29, 1490–1507. [Google Scholar] [CrossRef]

- Jawabreh, O. Management of tourism crisis in the Middle East. In Public Sector Crisis Management; IntechOpen: London, UK, 2020. [Google Scholar]

- Kumar, S.; Nafi, S.M. Impact of COVID-19 Pandemic on Tourism: Perceptions from Bangladesh. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3632798 (accessed on 15 February 2022).

- Fernandes, N. Economic Effects of Coronavirus Outbreak (COVID-19) on the world Economy; University of Navarra, IESE Business School; European Corporate Governance Institute (ECGI): Barcelona, Spain, 2020. [Google Scholar]

- Payne, E.J.; Gil-Alana, L.A.; Mervar, A. Persistence in Croatian tourism: The impact of COVID-19. Tour. Econ. 2022, 28, 1676–1682. [Google Scholar] [CrossRef]

- de Silva, O.D.; Aulicino, M.P. Obstacles and adaptations of mega-events in São Paulo in the face of the COVID-19 Pandemic. In Handbook of Research on the Impacts and Implications of COVID-19 on the Tourism Industry; IGI Global: Hershey, PA, USA, 2021; pp. 728–746. [Google Scholar]

- Moreno-Luna, L.; Robina-Ramírez, R.; Sánchez MS, O.; Castro-Serrano, J. Tourism and sustainability in times of COVID-19: The case of Spain. Int. J. Environ. Res. Public Health 2021, 18, 1859. [Google Scholar] [CrossRef] [PubMed]

- Sucheran, R. Global impacts and trends of the COVID-19 pandemic on the cruise sector: A focus on South Africa. Afr. J. Hosp. Tour. Leis. 2021, 10, 22–39. [Google Scholar] [CrossRef]

- Zhong, L.; Sun, S.; Law, R.; Li, X.; Yang, L. Perception, reaction, and future development of the influence of COVID-19 on the hospitality and tourism industry in China. Int. J. Environ. Res. Public Health 2022, 19, 991. [Google Scholar] [CrossRef]

- Dube, K.; Nhamo, G.; Chikodzi, D. COVID-19 pandemic and prospects for recovery of the global aviation industry. J. Air Transp. Manag. 2021, 92, 102022. [Google Scholar] [CrossRef]

- Napoli, J.; Goetz, P.A.R.; Drogoul, F.; Basile, M.; Depasse, S.; Cavallo, J.; Chaufrein, M.; Silvie, T.; Brilland, J. Agility in the Air Transport and Tourism Sectors: A Worldwide Vision. J. Tour. Sports Manag. 2022, 5, 15–41. [Google Scholar]

- Peručić, D.; Greblički, M. Key Factors Driving the Demand for Cruising and Challenges Facing the Cruise Industry in the Future. Tour. Int. Interdiscip. J. 2022, 70, 87–100. [Google Scholar] [CrossRef]

- Antonellini, L. Impact of COVID-19 on the Cruise Industry. J. Tour. Res. 2022, 27, 1–10. [Google Scholar]

- Kapia, A. Crisis Management in MICE Industry: The Case of Thessaloniki. Master’s Thesis, School of Humanities, Social Sciences and Economics, Hospitality & Tourism Management, International Hellenic University, Nea Moudania, Greece, 2021. [Google Scholar]

- Rouhi Khorasani, P. Event Industry during COVID-19 Pandemic in Sweden; Impact, Recovery and Future Trends. Ph.D. Thesis, School of Natural Sciences, Technology and Environmental Studies, Tourism Studies, Södertörn University, Huddinge, Sweden, 2021. [Google Scholar]

- Alwi, K.M.; Patwary, A.K.; Ramly, N.I. Impact of COVID-19 Towards Tourism Industry: An Evidence from Malaysia. PalArch’s J. Archaeol. Egypt Egyptol. 2020, 17, 354–382. [Google Scholar]

- Herédia-Colaço, V.; Rodrigues, H. Hosting in turbulent times: Hoteliers’ perceptions and strategies to recover from the COVID-19 pandemic. Int. J. Hosp. Manag. 2021, 94, 102835. [Google Scholar] [CrossRef]

- Smart, K.; Ma, E.; Qu, H.; Ding, L. COVID-19 impacts, coping strategies, and management reflection: A lodging industry case. Int. J. Hosp. Manag. 2021, 94, 102859. [Google Scholar] [CrossRef] [PubMed]

- Gössling, S.; Scott, D.; Hall, C.M. Pandemics, tourism and global change: A rapid assessment of COVID-19. J. Sustain. Tour. 2020, 29, 1–20. [Google Scholar] [CrossRef]

- Abbass, K.; Begum, H.; Alam, A.F.; Awang, A.H.; Abdelsalam, M.K.; Egdair IM, M.; Wahid, R. Fresh insight through a Keynesian theory approach to investigate the economic impact of the COVID-19 pandemic in Pakistan. Sustainability 2022, 14, 1054. [Google Scholar] [CrossRef]

- Desson, Z.; Lambertz, L.; Peters, J.W.; Falkenbach, M.; Kauer, L. Europe’s COVID-19 outliers: German, Austrian and Swiss policy responses during the early stages of the 2020 pandemic. Health Policy Technol. 2020, 9, 405–418. [Google Scholar] [CrossRef] [PubMed]

- Clark, E.A.; Lepinteur, A. Pandemic policy and life satisfaction in Europe. Rev. Income Wealth 2022, 68, 393–408. [Google Scholar] [CrossRef] [PubMed]

- Clark, E.A.; d’Ambrosio, C.; Lepinteur, A. The fall in income inequality during COVID-19 in four European countries. J. Econ. Inequal. 2021, 19, 489–507. [Google Scholar] [CrossRef]

- Aydoğan, K.E.; Özmen, M. Travel and tourism competitiveness of economies around the world using rough SWARA and TODIM Method. In Strategic Innovative Marketing and Tourism; Springer: Berlin/Heidelberg, Germany, 2020; pp. 765–774. [Google Scholar]

- Fedajev, A.; Popovic, G.; Stanujkic, D. MCDM framework for evaluation of the tourism destination competitiveness. In Proceedings of the 5th International Scientific Conference Innovation as an Initiator of the Development–MEFkon, Belgrade, Serbia, 6 December 2019. [Google Scholar]

- Rodríguez-Díaz, B.; Pulido-Fernández, J.I. Analysis of the Worth of the Weights in a new Travel and Tourism Competitiveness Index. J. Travel Res. 2021, 60, 267–280. [Google Scholar] [CrossRef]

- Gómez-Vega, M.; Martín, J.C.; Picazo-Tadeo, A.J. Ranking world tourism competitiveness: A comparison of two composite indicators. In Tourism and Regional Science; Springer: Berlin/Heidelberg, Germany, 2021; pp. 15–35. [Google Scholar]

- Liu, Y.L.; Ko, P.F.; Chiang, J.T. Developing an Evaluation Model for Monitoring Country-based Tourism Competitiveness. SAGE Open 2021, 11, 21582440211047559. [Google Scholar] [CrossRef]

- Bire, B.R.; Conterius, A.L.F.; Nasar, A. Drivers of Regional Destination Competitiveness: A DEMATEL-Fuzzy TOPSIS Approach. Indones. J. Geogr. 2021, 53, 144–152. [Google Scholar] [CrossRef]

- Hašková, S.; Horák, J. Fuzzy logic and artificial intelligence tools in the context of tourism analysis. In Modern Management Tools and Economy of Tourism Sector in Present Era; 2020; p. 601. Available online: https://www.udekom.org.rs›tmt.2020.601.pdf (accessed on 10 April 2022).

- Stanujkic, M.; Stanujkic, D.; Karabasevic, D.; Sava, C.; Popovic, G. Comparison of Tourism Potentials Using Preference Selection Index Method. QUAESTUS Multidiscip. Res. J. 2020, 177–187. [Google Scholar]

- Stecyk, A.; Sidorkiewicz, M.; Orfin-Tomaszewska, K. Model of regional tourism competitiveness: Fuzzy multiple-criteria approach (FDM-FAHP-PROMETHE II framework). Eur. Res. Stud. J. 2021, 24, 638–662. [Google Scholar] [CrossRef]

- Uppink, L.; Soshkin, M. Travel & Tourism Development Index 2021 Rebuilding for a Sustainable and Resilient Future; World Economic Forum: Geneva, Switzerland, 2022. [Google Scholar]

- Shannon, E.C.; Weaver, W. A Mathematical Model of Communication; University of Illinois Press: Urbana, IL, USA, 1949; p. 11. [Google Scholar]

- Zeleny, M. Multiple Criteria Decision Making Kyoto 1975; Springer: Berlin/Heidelberg, Germany, 2012; Volume 123. [Google Scholar]

- Burg, J.P. Maximum entropy spectral analysis. Astron. Astrophys. Suppl. 1974, 15, 383. [Google Scholar]

- Rosenfeld, R. Adaptive Statistical Language Modeling. Ph.D. Thesis, Carnegie Mellon University, Pittsburgh, PA, USA, 1994. [Google Scholar]

- Golan, A.; Judge, G.; Miller, D. The maximum entropy approach to estimation and inference. In Applying Maximum Entropy to Econometric Problems; Emerald Group Publishing Limited: Bingley, UK, 1997; pp. 3–24. [Google Scholar]

- Lihong, M.; Yanping, Z.; Zhiwei, Z. Improved VIKOR algorithm based on AHP and Shannon entropy in the selection of thermal power enterprise’s coal suppliers. In Proceedings of the 2008 International Conference on Information Management, Innovation Management and Industrial Engineering, Taipei, Taiwan, 19–21 December 2008. [Google Scholar]

- Wang, T.C.; Lee, D.H. Developing a fuzzy TOPSIS approach based on subjective weights and objective weights. Expert Syst. Appl. 2009, 36, 8980–8985. [Google Scholar] [CrossRef]

- Shemshadi, A.; Shirazi, H.; Toreihi, M.; Tarokh, M.J. A fuzzy VIKOR method for supplier selection based on entropy measure for objective weighting. Expert Syst. Appl. 2011, 38, 12160–12167. [Google Scholar] [CrossRef]

- Apan, M.; Öztel, A.; İslamoğlu, M. Teknoloji Sektörünün Entropi Ağırlıklı Uzlaşık Programlama (CP) ile Finansal Performans Analizi: BİST’de Bir Uygulama. In Proceedings of the 19th Finance Symposium, Hitit University Çorum, Çorum, Turkey, 21–24 October 2015; Available online: https://www.researchgate.net/publication/283299704 (accessed on 7 December 2017).

- Azadnia, H.A.; Ghadimi, P.; Molani-Aghdam, M. A hybrid model of data mining and MCDM methods for estimating customer lifetime value. In Proceedings of the 41st International Conference on Computers and Industrial Engineering (CIE41), Los Angeles, CA, USA, 23–26 October 2011. [Google Scholar]

- Opricović, S. Vikor method. In Multicriteria Optimization of Civil Engineering Systems; University of Belgrade-Faculty of Civil Engineering: Belgrade, Serbia, 1998; pp. 142–175. [Google Scholar]

- Ozkaya, G.; Timor, M.; Erdin, C. Science, Technology and Innovation Policy Indicators and Comparisons of Countries through a Hybrid Model of Data Mining and MCDM Methods. Sustainability 2021, 13, 694. [Google Scholar] [CrossRef]

- Morrison, A.M. Tourism Marketing: In the Age of the Consumer; Routledge: Oxfordshire, UK, 2022. [Google Scholar]

- Ianioglo, A.; Rissanen, M. Global trends and tourism development in peripheral areas. Scand. J. Hosp. Tour. 2020, 20, 520–539. [Google Scholar] [CrossRef]

- Scully, E.; Douma, F.; Krishnan, V.; Seeley, J.; Neher, K.; Obeid, M. Rebooting Customer Experience to Bring Back the Magic of Travel; Mckinsey and Company: New York, NY, USA, 2021. [Google Scholar]

- Constantin, M.; Saxon, S.; Yu, J. Reimagining the $9 trillion tourism economy—what will it take. In Travel, Logistics and Transport Infrastructure Practice; Mckinsey and Company: New York, NY, USA, 2020. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).