Abstract

This paper investigates a dual-channel retailer’s inventory and pricing integrated decision-making problem over multiple periods. The quantity-sales mode is adopted in the online channel while the unit-sales mode is used offline. The customer demand of each sales channel is stochastic, and depends on visit costs, customer return costs, sales modes and pricing levels. To achieve the long-term profit maximization, the dual-channel retailer needs to optimize the pricing levels of both channels and the ordering quantity. For this problem, we first formulate a stochastic dynamic programming model, and then prove the joint concavity and the supermodularity of the objective function. With these properties, the optimality of the base-stock policy is proved, and the optimum price policy is characterized. Specifically, if the retailer’s optimum stock is neither too low nor too high, both sales channels need to be operated simultaneously, otherwise, only operating one channel is optimal. The online price is invariant with the retailer’s stock level while the offline price is decreasing in the retailer’s stock level. Finally, numerical results show that the quantity-sales mode, dual-channel sales model, and the multi-period dynamic decisions could benefit the dual-channel retailer. In addition, influences of cost parameters on the total profit are verified numerically.

1. Introduction

With E-commerce developing rapidly, a growing number of retailers operate the offline channel as well as the online channel [1,2]. Nearly 80% of American retailers and practically all large retailers adopt dual-channel sales models [3]. The main advantage of the online shopping is that one does not need to visit the retail store in person. It saves a great amount of time and energy for customers, especially for those far away from the retail store. Though online shopping brings much convenience for customers, buying offline still has some irreplaceable advantages. Customers visiting shops, for instance, can get more information of the product by feel and touch. This could avoid customers paying expensive return costs due to the uncertainty of the product valuation, before actually receiving the products. Therefore, customers are more likely to choose the online channel if they are far away from the offline store, or if the online return cost is low. Customers are generally willing to choose offline channels if they are close to the offline store, or face a high online return cost. As a result, channel visit costs and return costs are key factors impacting customers’ channel choice.

In addition to the costs referred to above, another crucial factor related to a customer’s channel choice is the sales mode in each channel. In practice, many products (e.g., the mineral water and facial tissue) are usually sold online in the quantity-sales mode. That is, several units of products are sold as a whole, and splitting is not allowed, which is different with the unit-sales mode. Table 1 presents sales modes and selling prices of some products in the online/offline channel. For instance, if a customer needs to buy facial tissues in Tmall supermarket, he/she must buy at least six units in the online channel or at least one unit offline. The quantity-sales mode can not only increase customer demand, but also avoid the case that the revenue from one unit is too low to offset the delivery fee. Hence, it is quite common in real life to use the quantity-sales mode online and the unit-sales mode offline. The difference in sales modes and prices in different channels leads to different customer utilities. Therefore, the effect of the sales mode also needs to be taken into consideration when the dual-channel retailer makes operational decisions.

Table 1.

Illustrations of the channel-based price differentiation.

Drawing on the above discussion, customers’ costs and the sales mode of the product influence their purchasing channel decisions, thus impacting sales of the dual-channel retailer. Furthermore, the sale influences the dual-channel retailer’s operational decisions, including the inventory level, pricing level and sales channel, and thus the total profit. At the same time, the dynamic inventory and price decisions are also two crucial and effective levers to manage the retailer’s profitability [4]. Accordingly, this paper will investigate the dual-channel retailer’s integrated inventory and price problem over multiple periods with the quantity-sales mode. We assume that customer valuation, offline visit costs and the market size are stochastic. To obtain the long-term profit optimization, the retailer needs to decide the total stock level and the pricing levels of both channels during each period, and the customer needs to choose the purchasing channel based on the customer valuation, visit costs, return cost, sales mode and pricing level of each channel. For this model, we concentrate on the main questions as below.

- What is the dual-channel retailer’s optimum inventory and pricing policy over multiple periods when the quantity-sales mode is adopted online? Specifically, when is it optimum to make the online and offline sales simultaneously? When is it optimum to make only the online or offline sales?

- Can the quantity-sales mode, the dual-channel sales model and the dynamic decisions really drive the retailer’s profit? How do the customer return cost and the inventory cost affect the dual-channel retailer’s profit?

To answer these two research problems, we first prove the concavity and supermodularity of the objective function. With the concavity, the optimality of the base-stock policy is established. Utilizing the supermodularity, we prove that if the replenishment level is low (resp. high), only operating the offline (resp. online) channel is optimum for the dual-channel retailer, otherwise operating both channels simultaneously is optimum. Moreover, the difference between the online price and the offline price of one unit product is decreasing in the replenishment level. Finally, by conducting numerical experiments, we conclude that the retailer’s profit is improved after the quantity-sales mode, dual-channel sales model and the multi-period dynamic decisions are considered. The retailer’s profit does not always decrease with the return cost. In addition, we also numerically verify influences of inventory costs on the total profit. Therefore, our research results would help the dual-channel retailer to obtain the long-term profit optimization by dynamically adjusting the price and stock decisions in a practical operation. Moreover, it would also enrich the research on the dual-channel supply chain with multiple periods and the research on the quantity-sales mode. In addition, the modeling process can provide ideas for solving similar dynamic programming problems.

2. Literature Review

Literature associated with our study is divided into three streams in Table 2 as below.

Table 2.

Three literature streams.

The first literature stream is related to the dual-channel retailer’s optimal decision problems. Radhi and Zhang [1] analyze the impact of cross-channel returns on the pricing decision. Liu et al. [5] consider the influence of return services on the retailer’s profit and pricing levels of both channels. Guo et al. [6] develop a dual-retailer’s coordinated pricing and service model with free riding. In these models, the deterministic demand only depends on the product price of each channel or the service level and is independent of the customer utility. Instead, we consider the utility-based demand model. That is, in addition to pricing decisions, customer demand of each channel is also related to the customer valuation, utility parameter and visit costs, which we have shown as key factors influencing the dual-channel retailer’s profit. Under the setting of the dual-channel retailer’s single-period pricing decision and the deterministic demand, some literature concentrates on the utility-based demand model. For example, Zhang et al. [7] develop the influence of the “purchase online and pick-up offline” (abbr. BOPS) mode and represent the channel price. They obtain the relationship between the optimal channel price and parameters including the customer valuation and the visit cost. Xu et al. [8] concentrate on the case of two competitive dual-channel retailers selling substitutable products. They compare two retailers’ prices when price matching is considered. One can refer to the literature [9,10,11] for more studies on the utility-based demand model and the dual channels. All the above literature referred to only focuses on the deterministic demand, and the effects of prices on the dual-channel sales. However, effects of the inventory decision are ignored. In contrast, we argue that the (s, S) inventory policy is optimal, and that the offline price is decreasing in the stock decision.

The following three papers explore the dual-channel retailer’s single-period inventory policy with demand uncertainty: The study by Gao and Su [12] argues that the retailer should lower the stock level of the offline channel to increase the risk of stock availability for the case of physical showrooms. Gao and Su [13] argue that BOPS mode would decrease a retailer’s profit when the product sells well in the offline channel. Radhi and Zhang [14] test the effect of products that are returned and then resold on the replenishment quantity of each channel. These three studies assume that the pricing decision is an exogenous fixed variable that does not need to be optimized. However, we endogenize both the pricing and stock decisions into the optimization model. We argue that the corresponding inventory decision relies on the initial inventory instead of given pricing levels. In addition, we also show that if the dual-channel retailer’s optimal inventory level is low (high), only the price of the offline (online) channel needs to be determined, otherwise prices of both channels need to be optimized. There are a few papers that study the dual-channel retailer’s stock and pricing decisions simultaneously. Sun et al. [15] develop a dual-channel retailer’s multi-product stock and pricing decisions with the service level constraint. They mainly focus on how the solution of the optimization problem can be obtained. Moreover, they only consider the single-period problem. In contrast, our goal is to maximize the long-term profit over multiple periods. We have shown that the performance under the multi-period policy is obviously better than that under the one-period policy. Moreover, all the above literature referring to dual-channel retailing concentrates on the unit-sales mode but ignores the quantity-sales mode that has yet to be considered by this study.

The second literature stream is the periodic-review coordinated inventory and pricing model. Based on this model, various forms of periodic-review inventory policies have been shown as optimal, such as the base-stock policy [16,17,18,19,20], the modified base-stock policy [21], the (s, S) policy [22], and the multi-threshold inventory policy [23,24]. The structure of our inventory policy is in accord with the base-stock policy. Different from that in literature [16], our policy parameter S depends on the customer utility, customer cost parameters, and quantity-sales parameters. Regarding the pricing policy, some literature analyzes how the selling price changes with system parameters. For example, Li and Zheng [16] argue that the optimum price increases with the initial stock. Moreover, the randomness of the yield will lead to a higher pricing level. Yang and Zhang [21] indicate that the optimum decisions rely on the customer-observable stock when scarcity effects are considered. Chen et al. [17] argue that the current reference price increases with the previous reference price, and the price decreases with the initial inventory. Xu et al. [18] demonstrate that the service price increases with past sales and the service cost. The above studies only make pricing decisions for the single channel. However, this study needs to decide the selling prices of both channels when the retailer’s stock level is neither too high nor too low. Specifically, we find that the online price is invariant with the retailer’s inventory, but increases with the customer valuation and decreases with the return fee and visit cost. In addition, the offline price is decreasing in the retailer’s optimal stock level.

The third literature stream is related to models with the quantity-sales mode. Most of these models only focus on specific forms of the quantity-sales mode, such as “buy-one-get-one” (abbr. BOGO) [25,26,27,28], “buy-one-get-more” [26], and “buy-x-get-one” [29]. Li et al. [25] find that the BOGO sales mode is better for products that are hard to stock. Yen et al. [26] compare two special quantity-sales modes, BOGO and buy-one-get-more, and provide the conditions that each quantity-sales mode can generate the more social welfare. They only focus on pricing decision problems. Under the setting of the inventory decision and the stochastic customer demand, Par et al. [27] have compared a retailer’s inventory model in the BOGO sales mode with that in the traditional sales mode, and presented conditions under which the BOGO sales mode is optimal. For the multi-period case, Kim et al. [28] establish a discrete-time dynamic pricing model and consider three specific forms of the quantity-sales mode. They provide sufficient conditions for the optimality of three forms. Literature [25,26,27,28] mainly discusses the choice of several specific forms of the quantity-sales mode, and the inventory and price are not determined simultaneously. For the inventory and pricing joint decision problem with a general form of the quantity-sales mode over multiple periods, Lu et al. [30] have developed a demand model depending on the pricing level and customer valuation. Lu et al. [30] is also the study most related to our research. In contrast with their study, we have four key different points: First, we consider the dual-channel retailer, and analyze when to operate dual channels simultaneously and how to price the dual channels. However, they only consider the single channel. Second, we find that the price for the quantity-sales mode does not change with the stock level. This is different from their result that the price for the quantity-sales mode decreases with the stock level. Third, we find that an increase in the customer’s return cost does not always lead to a profit loss, while the return cost is not considered in Lu et al. [30]. Fourth, we consider the effect of the sales channel, sales mode and dynamic decisions on the retailer’s profit, while they only consider the effect of the sales mode.

In summary, the main contributions of our research include three points: First, our research is the first to study the dual-channel retailer’s dynamic stock and pricing model considering the quantity-sales mode over multiple periods. This can motivate scholars to do further research in this direction. Second, the characterization of the related stock and price policy is complete. To do this, we develop novel sufficient conditions for concavity and supermodularity of a two-dimensional function. These conditions could be adopted to handle similar optimization problems. Third, we numerically verify values of the quantity-sales mode, the dual-channel sales model, and the dynamic decisions. Moreover, effects of customer returns and inventory costs are tested. These research results will help dual-channel retailers to optimize their long-term profits by adopting sales modes and dynamic decisions flexibly.

3. Model Formulation

Consider a dual-channel retailer’s integrated decision-making model for the stock and price policy, targeting with optimizing the total profit over periods. At the beginning of period , on the basis of the initial stock , the dual-channel retailer decides the ordering quantity and places an order with a per-unit regular cost . Next, the dual-channel retailer’s on-hand inventory becomes immediately, where the lead time is zero. At the same time, prices of both sales channels are determined. Specifically, the quantity-sales mode is adopted online with a price for units of products, where and units are sold as a whole and not allowed to split; the unit-sales mode is deployed offline with a price . After deciding inventory and pricing levels, the dual-channel retailer’s on-hand inventory is used to satisfy customer demand of both channels. When period ends, the initial stock in period is generated.

Following Gao and Su [12,13], we assume that a customer’s online visit cost is constant, which is denoted by . It is incurred by a long wait before receiving the product and the anxiety about the transaction security in the online channel. If a customer purchases in the offline store, the offline visit cost (or the related hassle cost) will include the time cost and transportation cost. Since different customers have different distances from the physical store, their offline visit costs are also different. It leads to different inclinations to offline purchase. The Customers’ difference in the offline visit cost will lead to their variations in the channel selection. To specify this difference, we introduce a nonnegative stochastic variable to represent a customer’s offline visit cost [9], where the mean is and the variance is . We also denote the related density and distribution by and , respectively. To facilitate the analysis, Assumption 1 is considered as below:

Assumption 1.

is increasing in , whereis the support of the random variable .

Assumption 1 is reasonable since it could be satisfied by many common distributions including Uniform, Exponential, Gamma with shape parameter ≤1, Beta with mode ≤0 and the truncated normal distribution. Note that under the first four distributions the related density function is decreasing in . Together with the increasing property of , it ensures the increasing property of function . Thus, the first four distributions satisfy Assumption 1. It remains to explain why the truncated normal distribution satisfies Assumption 1. This would hold if the normal distribution satisfied Assumption 1. Note that for the uniform distribution, the density , and . Thus , where . Moreover, and imply that for any , and hence for any . Therefore, is increasing, and then the truncated normal distribution satisfies Assumption 1.

Since a customer who is interested in the product could be not sure if the product fits his/her taste and needs, we introduce a constant to represent the likelihood that a customer likes the product [10]. If a customer dislikes the product, then the corresponding valuation is 0. Otherwise, the valuation for the unit-sales mode is and the valuation for the quantity-sales mode ( units) is . In agreement with Lu et al. [30], we assume that . It implies that the customer valuation for units is higher than that for one unit, and that the customer’s margin utility decreases with quantity. Compared with purchasing online, customers purchasing in the offline store could feel and touch the product directly, and hence can get more product information. Thus, customers purchasing offline can determine whether they really like the product immediately, but customers buying online can determine it only after receiving the product. Therefore, it is assumed that returns are not allowed for customers buying offline, while customers buying online can return their disliked products to the retailer with paying a return fee [10,12].

Customers maximize their utilities by choosing to purchase products online or offline. When a customer chooses to buy online, the utility will be if the product is liked, otherwise utility will be obtained. Thus, when buying online, the customer’s expected utility is:

where . When a customer chooses to buy offline, the utility is if the product is liked, otherwise it is . Thus, when buying offline, the customer’s expected utility is:

Hence, a customer purchases online if, and only if, and , while a customer purchases offline if, and only if, and . Therefore, the online market share and offline market share are:

respectively. Note that if , i.e., , then . This implies that no customers purchase online and thus the corresponding result is trivial. To avoid it, this paper only focuses the case . Then, we have:

where . The strictly increasing property of the distribution function and the expression of can ensure that:

Moreover, expressions of and can establish equality .

Assume that the market size is a nonnegative random variable with a mean and is independent across time. Recall that and are the online market share and offline market share, respectively. Hence, customers buying online and offline are and , respectively. Note that the retailer could meet customer demand by placing an expedited order [31,32,33] if the on-hand stock is below the customer demand. Thus, all the demand can be satisfied in each period [34]. The dual-channel retailer’s revenue in period is:

To facilitate discussion similar to literature by Wang et al. [9] and Mutlu and Bish [35], we assume that each customer buys at most one unit or one batch including units. Then the total number of products which the dual-channel retailer sells in period is:

where the total demand rate . If we denote and as the expedited ordering cost and holding cost , then the expedited cost and the stock holding cost in period are and , respectively, where . In addition to the inventory cost, the dual-channel retailer can also incur a loss if units of returns are received. Moreover, a fraction of customers buying online will dislike products and return them back while receiving a full refund. Thus, in period , the dual-channel retailer’s loss from customer returns is .

After satisfying customer demand in period , the number of remaining products is and the number of customer returns is . Thus, the dual-channel retailer’s inventory at the end of period :

where , , and .

Denote the expected operator related to the stochastic market size by . In period , the dual-channel retailer’s regular ordering cost, expedited ordering cost, stock holding cost, revenue and cost from customer returns are , , , and , respectively. Since only the single-period revenue and the cost from customer returns are related to the decision variable , to simplify the analysis we introduce the following auxiliary optimization problem:

In this problem, the objective function is the dual-channel retailer’s one-period expected revenue minus the loss from returns, which can also be called modified one-period revenue. It is increasing in , which ensures that the optimal online price:

Moreover, the modified one-period revenue related to the online market share can be expressed as Recall that and hence:

Therefore, if given the initial inventory level of period , the total profit accumulated from period to period is:

where the discount factor and the terminal value function . To facilitate the subsequent analysis, let , and then an equivalent transformation of the original optimization problem is as below:

where , and . To simplify symbols, denote the objective function and the optimal solution of the above dynamic programming (14) by and , respectively.

4. Model Analysis

This section first analyzes the concavity and supermodularity of the objective function in the main optimization problem (14). Next, we characterize the inventory and price policy.

4.1. Concavity and Supermodularity of the Objective Function

To analyze the concavity and supermodularity of the objective function in the main problem (14), we first present some sufficient conditions for these properties:

Lemma 1.

(i) Given any one-dimensional function , suppose that its derivative function and inverse function exist. If both and are increasing, then function is concave. (ii) Given any two-dimensional concave function , if its partial derivative function , then is concave. (iii) If a one-dimensional differentiable function is decreasing and concave, and two nonnegative parameters satisfy , then is a supermodular function.

Proof.

(i) To simplify notations, let and then . Taking derivative of in terms of and defining , we can obtain . Hence:

Taking derivative of about , we get that:

Inserting Formulas (15) into (16), we yield that:

Note also the assumptions that both and are increasing. As a result, is decreasing, which further ensures the concavity of function .

(ii) For notation conciseness, define . When , we have:

The first equality holds because of the expression of function , the first inequality is from the concavity in of function , the second inequality can be yielded by and , and the last equality can be established by the expression of . When , we have:

The first two equalities can be derived by definitions of and , the first inequality is from and , and the second inequality can be obtained in accordance with the concavity of in . Formulas (18) and (19) imply that . Note also that both and are concave, and the concavity is preserved under the minimization operator. Therefore, function is concave.

(iii) If one-sided derivative of function is increasing in , and one-sided derivative of function increases with , then has increasing differences. Together with Theorem 2.2.2 in Topkis [36], it ensures the supermodularity of function . Thus, it suffices to show that is increasing in and is increasing in . Since methods to show the increasing property of and in are similar, and methods to prove the monotonicity of and in are similar, we only present the proof of the monotonicity of and .

We first show the increasing property of with respect to . According to the definition of function , its left derivative regarding is:

Note that the concavity of and inequality can establish that function is increasing in . Moreover, the decreasing property of function implies that . Therefore, following the expression of in (20), we yield that increases with .

Next, we show the increasing property of in . By the definition of function :

Note that the decreasing property of and indicate that:

Moreover, the concavity of and inequality can establish that increases with . Therefore, with the expression of in (21), we conclude that is increasing in . The proof is completed.

Lemma 1 (i) presents a sufficient condition to establish that the product of two one-dimensional increasing functions is concave. From Lemma 1 (ii), we know that the nonlinear transformation of a two-dimensional concave function is still concave under some conditions. Lemma 1 (iii) develops a sufficient condition to ensure that the nonlinear transformation of a one-dimensional decreasing concave function is supermodular. These results will be utilized to analyze the concavity and supermodularity of the objective function in the main optimization problem (14). □

Proposition 1.

For given the optimal value function is decreasing and concave. Moreover, the objective function is concave and supermodular.

Proof.

For preparation, we first show the concavity of function . Lemma 1 (i) indicates that function is concave. Moreover, the concavity under a linear transformation is preserved according to Proposition 2.1.3 (b) in literature [37]. We thus obtain the concavity of function in . Together with the expression of , it ensures the concavity of . Accordingly, from the definition of , we have that is concave.

Next, we prove that the concavity of optimum value function by the induction related to , and the concavity of objective function . Note that is a decreasing and concave function, and hence we assume so is . In the following, we will prove that also has these properties. To simplify notations, let:

Then applying definitions of and , we can derive:

If is a joint concave function, then in accordance with the concavity of we know that is jointly concave in . Moreover, note that Proposition 2.1.3 (b) and (c) of literature [37] state that the concavity is preserved under the linear transformation and the expectation operator. Thus, is jointly concave in , which together with the concavity of ensures the concavity of in Formula (24). Therefore, we only need to show the concavity of in the following. Following the inductive assumption, we have that is concave, which ensures the concavity of in . Moreover, the inductive assumption ensures that the decreasing property of function , implying . As a result, according to Lemma 1 (ii), we can establish the concavity of .

Recall that it has been proved that the concavity of the objective function in problem (14). Moreover, the constraint set of problem (14) is convex. Thus, is concave by Proposition 2.1.15 (b) in Simchi-Levi et al. [37].

Next, we show the decreasing property of the optimal value function . The objective function of optimization problem is independent of state variable and the constraint set is decreasing in . Consequently, the optimal value function is decreasing.

Finally, we show the supermodularity of function . On the one hand, since functions and are convex, and inequalities and hold, from expression of we have that is concave. Together with Theorem 2.2.6 (b) and 2.2.5 (d) in Simchi-Levi et al. [37], it establishes that is supermodular in . On the other hand, the decreasing property and concavity of , the definition of system dynamic , and Lemma 1 (iii) ensure that is supermodular in . Together with Proposition 2.2.5 (d) in literature [37] it can verify the supermodularity of in . Therefore, by the expression of function in problem (14), the supermodularity of can be derived. We complete the proof. □

Proposition 1 states that the objective function of optimization problem (14) is concave and supermodular. These results will be instrumental to characterize the dual-channel retailer’s optimum inventory and pricing policy.

4.2. The Optimal Inventory and Pricing Policy

In this subsection, we first characterize the optimum stock policy with the concavity of objective function derived in Proposition 1. Next, we characterize the optimum pricing policy with the supermodularity of . For ease of exposition, let be the optimum solution of problem , and denote the minimum maximizer of function by , that is:

Theorem 1.

If the initial inventory , then the optimum order-up-to level ; otherwise , i.e., no ordering is optimum.

Proof.

By Proposition 1, the objective function of problem is concave and the corresponding constraint set is convex. Thus, by Proposition 2.1.15 (a) in literature [37] we derive the concavity of . Therefore, from Lemma 7.3 in Porteus [38], the optimal solution of satisfies that if and if . We complete the proof. □

From Theorem 1, we know that the base-stock policy is optimum. Specifically, there is a threshold point, such that ordering up to this point is optimum if the initial inventory is below this point and ordering nothing is optimum otherwise.

To analyze the relationship between the optimal price levels and the optimum order-up-to level, we define two threshold points and . Specifically, is the infimum of sets with inventory levels ensuring that the optimal total demand rate is above , and is the supremum of sets with inventory levels ensuring that the optimal total demand rate is below . That is:

About the total demand rate and these two threshold points, we have the following results.

Proposition 2.

The optimal total demand rate is increasing, and thresholds points .

Proof.

By Proposition 1, the objective function of problem is supermodular. Moreover, the constraint set is a lattice. Thus, by Lemma 2.8.1 in Topkis [36], we have that the optimal solution is increasing. Together with definitions of threshold points and , it establishes that inequality holds. We complete the proof. □

Proposition 2 states that the optimum total demand rate is decreasing in the stock level. Moreover, two threshold points satisfy that . The following Theorem 2 will apply these two results to study the optimum pricing policy.

Theorem 2.

When the optimal order-up-to level , only the operating offline channel is optimal; when , only the operating online channel is optimal; when , operating both channels is optimal.

Proof.

Based on Proposition 2, we obtain that the optimum total demand rate increases. This, together with the definition of , ensures that if, and only if, . Moreover, recall that and . It implies that and hence if, and only if, . Therefore, the optimal online demand rate if, and only if, , i.e., the dual-channel retailer sells online. In a similar way, we can show that the offline demand rate if, and only if, , i.e., the dual-channel retailer sells offline. As a result, only operating the offline channel is optimal when ; only operating the online channel is optimal when ; operating both channels is optimal when . We complete the proof. □

Theorem 2 shows that the retailer only operates online (resp. offline) if the optimal inventory is below (resp. above) point (resp. ), otherwise operating both the online channel and the offline channel is optimal. Recall that the quantity-sales mode and the unit-based sales mode are deployed online and offline, respectively. Thus, if a customer switches to the online (resp. offline) channel from offline (resp. online), the retailer’s total sales will increase (resp. decrease); in addition, high (resp. low) sales naturally need high (resp. low) stock level to match. Accordingly, when the inventory is high (resp. low), the retailer operates the online (resp. offline) channel.

The following theorem analyzes the relation between dual-channel prices and the optimal inventory level.

Theorem 3.

The optimal pricing level online , and the optimal pricing level offline decrease with the optimal stock level . Thus, the price difference is decreasing in .

Proof.

From Formula (12), we obtain that the optimum price online . We next show that the optimal pricing level offline decreases with the optimal stock level . In accordance with the expression of in Formula (7) and in Formula (12), we have . Recall that and , implying . Therefore:

Note that function is increasing. Thus, is increasing in . Moreover, increases with by Proposition 2. Therefore, is increasing in . Together with the expression of it ensures that the price difference is decreasing in . We complete the proof. □

Theorem 3 shows that the optimal pricing level online (i.e., the price for the quantity-sales mode) is increasing in the customer valuation and the probability that the customer likes the product. However, it is decreasing in the customer return fee and the online visit cost . Moreover, as the optimal stock increases, the optimum price online is unchanged, but the optimal pricing level offline (i.e., the price for the unit-sales mode) increases. Theorem 3 also states that with the optimal inventory level increasing, the difference decreases between the online per-unit price and the offline per-unit price.

5. Numerical Study

This section verifies advantages of the quantity-sales mode, the dual-channel sales model and the dynamic decisions. Moreover, we also test impacts of the customer return cost and inventory costs on the dual-channel retailer’s profit. In all the numerical instances, we set , , , , , . Both the market size and the offline visit cost follow the uniform distribution, where and . We also set the baseline setting as , , , , , .

5.1. Impacts of the Quantity-Sales Mode

This subsection tests impacts of the quantity-sales mode on the dual-channel retailer’s profit. Assume that the inventory level at the beginning of the whole planning horizon. For ease of description, define as the total expected profit with the unit-sales mode online and offline (a = 1, k = 1). Recall that is the total expected profit with the quantity-sales mode online and unit-sales mode offline. Thus, the performance of the quantity-sales mode can be measured by parameter . It represents the ratio of the profit improvement after the unit-sales mode online is replaced with the quantity-sales mode online.

Table 3 presents the performance of the quantity-sales mode when the utility parameter , the per-unit inventory holding cost , and the per-unit expedited cost vary. It is observed in Table 3 that the ratio of the profit improvement is positive and varies from 17.30% to 68.08%. This means that the quantity-sales mode could benefit the dual-channel retailer significantly. Moreover, the effect of the utility parameter on the performance is more obvious than that of cost parameters and . For example, the ratio of improvement increases by more than 48% with the utility parameter increasing from to . However, the ratio varies by less than 1% when the unit holding cost increases from 1.2 to 1.5, while the ratio varies by less than 5% when the unit expedited cost increases from 1.2 to 1.5. Note that is the utility of units of products, which implies that a small increase in parameter induces a greater increase in the customer utility. Accordingly, with a small increase in parameter , the dual-channel retailer can largely enhance the online pricing level without any loss of sales, and hence the profit can be improved significantly. However, the unit inventory holding cost and the unit expedited cost indirectly affect the ratio of profit improvement by influencing the optimal inventory level. Thus, these two cost parameters and are less sensitive than the utility parameter . As a result, to earn more profit, the dual-channel retailer needs to attach great importance to increase the utility parameter instead of changing cost parameters and . In addition, we can observe from Table 2 that as cost parameters increase, the ratio of the profit improvement is increasing. This is because the profit decreases more steeply than when cost parameters and increase.

Table 3.

Impacts of the utility and cost parameters on the performance of the quantity-based price differentiation.

5.2. Impacts of the Dual-Channel Sales Model

To verify impacts of the dual-channel sales model, in this subsection two single-channel sales models are introduced as benchmarks: only operating online (i.e., the pure E-retailer), and only operating offline (i.e., the physical retailer). The related total expected profits under both benchmarks are denoted by and , respectively, where is the dual-channel retailer’s initial inventory level. Recall that is the expected total profit under the dual-channel sales model. Thus, we can introduce:

to measure the performance of the dual-channel sales. Specifically, (resp. ) denotes the ratio of the profit improvement after only operating online (resp. offline) is changed to operate both the online channel and the offline channel. Both ratios are presented in Table 4 and Table 5 in the case where the dual-channel retailer’s initial inventory level .

Table 4.

The performance of the dual-channel sales: (%).

Table 5.

The performance of the dual-channel sales: (%).

From Table 4 and Table 5, the ratio of the profit improvement is positive after the change from the single sales channel to the dual sales channel. It means that operating the dual sales channel can increase profits significantly. Table 4 also shows that the ratio is increasing in the online visit cost . That is, as the online visit cost increases, the profit with only operating online decreases more steeply than the profit with operating the dual channel. In fact, as the online visit cost increases, the customer utility purchasing online reduces correspondingly. Thus, the retailer must decrease the online price or face lost sales when only operating online, while the retailer’s sales online could switch to the offline channel when operating both sales channels. Therefore, compared with the dual-channel retailer, the profit of the pure E-retailer decreases faster as the online visit cost increases. In addition, in Table 4 it is also found that as the upper bound of the offline visit cost increases, the ratio of the profit improvement is decreasing. Moreover, from Table 5, after only operating offline is changed to the dual-channel operation, and as the online visit cost (resp. the upper bound of the offline visit cost) increases, the ratio of the profit improvement decreases (resp. increases).

5.3. Impacts of Dynamic Decisions

This subsection verifies the performance of the multi-period dynamic inventory and pricing decisions. To do this, we choose the myopic policy (i.e., the optimum policy for one period) as a benchmark. Under this policy, the related profit over periods is denoted by with the initial stock . The performance of the dynamic decisions is measured by ratio:

That is, it is the ratio of the profit improvement after the myopic policy is replaced by the optimal policy. This ratio is presented in Table 6 when the time period and the stock vary in sets and , respectively.

Table 6.

Performance: (%).

From Table 6, it can be observed that the effect of the multi-period dynamic decisions becomes obvious as the length of the horizon increases. For example, when , the ratio of the profit improvement = 0. This is because the myopic policy is the optimum policy for one period. When , the ratio of the profit improvement = 295.13%. In fact, the inventory and pricing decisions of the current period can affect the dual-channel retailer’s decisions for the next period by the ending stock of the current period. This leads to differences in stock and price decisions in the different periods. However, the myopic policy is optimal only for the one-period case and cannot vary with time period. Therefore, adopting the multi-period dynamic decisions can benefit the retailer, and the added profit will be accumulated over time periods. It further implies that in the process of the actual operation, the dual-channel retailer should adopt multi-period dynamic decisions instead of the myopic policy to optimize the long-term expected profit. In addition, we can also observe that the effect of the dynamic decisions is weakened as the initial inventory level increases.

5.4. Impacts of Cost Parameters

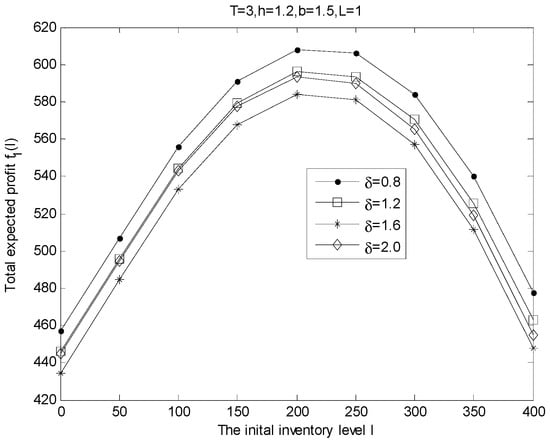

This subsection will verify impacts of customer return cost , the unit inventory holding cost , and the unit expedited cost on the dual-channel retailer’s total profit .

Figure 1 presents effects of the customer return cost on the total profit . It is observed that the dual-channel retailer’s profit is not always decreasing in customer return cost . For instance, at , the profit is strictly less than 440 when return cost , while the profit is strictly greater than 440 when return cost . In fact, as customer return cost increases, customer utility purchasing online decreases. This leads that they switch to the offline channel to purchases at a higher per-unit price. It could cause the retailer’s increased profit online to dominate the decreased profit online, and hence the total profit increases. Therefore, the dual-channel retailer can enhance the total profit by an increase in customer return fee.

Figure 1.

Impacts of customer return cost on the total profit.

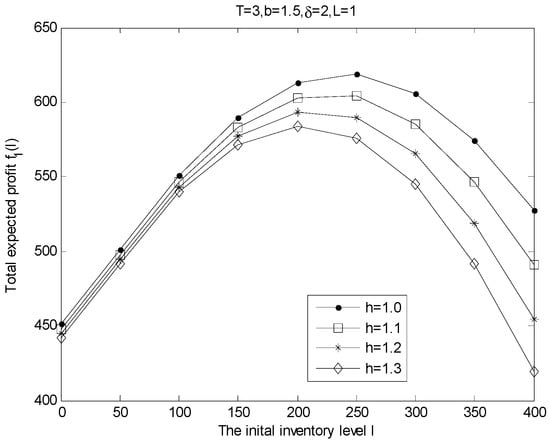

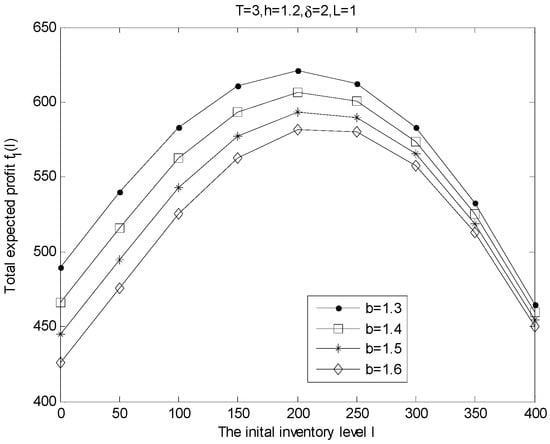

From Figure 2 and Figure 3, it is observed that the profit decreases with the unit inventory cost and the unit expedited cost . Moreover, we find that at a low (resp. high) inventory level, the influence of the unit holding cost is less (resp. more) obvious than the unit expedited cost . This is because the retailer is more likely to overstock at a higher inventory level, while the retailer is more likely to be out of stock at a lower inventory level. Therefore, for the case with a high (resp. low) initial inventory level, the dual-channel retailer should put more emphasis on decreasing the per-unit expedited (resp. holding) cost.

Figure 2.

Impacts of the per-unit holding cost on the total profit.

Figure 3.

Impacts of the per-unit expedited cost on the total profit.

6. Conclusions

This is the first research to study a dual-channel retailer’s integrated stock and pricing problem with the quantity-sales mode over multiple periods. Products are sold in the quantity-sales mode online and in the unit-sales mode offline. Moreover, customer valuations, the market size, and the visit cost offline are stochastic. To derive the maximum long-term profit, in each period the retailer needs to determine price levels of both sales channels and the inventory level. To solve it, a stochastic dynamic programming problem is developed, and the concavity and supermodularity of the objective function are derived. With these properties, the optimality of the base-stock policy is shown. The optimum pricing policy satisfies that only operating the online (resp. offline) channel is optimal if the optimal inventory level is low (resp. high), otherwise operating both sales channels is needed. Moreover, the per-unit price difference between online and offline decreases with the optimal inventory level.

Some interesting management enlightenments are obtained. First, the dual-channel retailer needs to order up to some threshold point if the initial stock is low, otherwise there is no need to order. Second, the retailer only operates offline if the optimal stock level is low, only operates the online channel if the optimal stock level is high, and otherwise operates both channels. Third, the quantity-sales mode, the dual-channel sales model, and the multi-period dynamic decisions could improve the profit. Fourth, the dual-channel retailer’s profit is not always decreasing in the customer return cost. Fifth, in the process of actual operation, when the dual-channel retailer’s initial inventory is high (low), it is better to lay emphasis on decreasing the holding cost (the expedited cost).

There are two limitations in this research. The dual-channel retailer meets the customer demand in both channels by the same warehouse. Though this setting is common for the physical store with online APP, there still exist some retailers who own two separate warehouses, with one satisfying online customers and the other satisfying offline customers. If two separate warehouses are considered, then the dimension of the state space needs to be added to specify the stock level of the added warehouse. It will be difficult to analyze the related multi-period stochastic dynamic programming problem. Therefore, it is still open to make optimal dynamic stock and pricing decisions under the case with separate warehouses.

Another limitation is the assumption that only the quantity-sales mode is online and only the unit-sales mode is offline. Yet, some products can be sold in the quantity-sales mode and unit-sales mode in the similar channel. Therefore, the dual-channel retailer’s multi-period stock and pricing problem with two sales modes in each channel is an interesting research direction.

Author Contributions

Formal analysis, L.Z., J.L. and M.X.; Methodology, L.Z., J.L. and A.Z.; Writing—original draft, L.Z.; Writing—review & editing, L.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Radhi, M.; Zhang, G. Pricing policies for a dual-channel retailer with cross-channel returns. Comput. Ind. Engl. 2018, 119, 63–75. [Google Scholar] [CrossRef]

- Jiang, Y.; Liu, Y.; Shang, J.; Yildirim, P.; Zhang, Q. Optimizing online recurring promotions for dual-channel retailers: Segmented markets with multiple objectives. Eur. J. Oper. Res. 2018, 267, 612–627. [Google Scholar] [CrossRef]

- Zhang, J.; Farris, P.; Irvin, J.; Kushwaha, T.; Steenburgh, T.; Weitz, B. Crafting integrated multi-channel retailing strategies. J. Interact. Market. 2010, 24, 168–180. [Google Scholar] [CrossRef]

- Chen, X.; Pang, Z.; Pan, L. Coordinating inventory control and pricing strategies for perishable products. Oper. Res. 2014, 62, 284–300. [Google Scholar] [CrossRef]

- Liu, J.; Sun, X.; Liu, Y. Products pricing and return strategies for the dual channel retailers. Oper. Res. 2021, 22, 3841–3867. [Google Scholar] [CrossRef]

- Guo, J.; Zhou, Y.; Li, B. The optimal pricing and service strategies of a dual-channel retailer under free riding. J. Ind. Manag. Optim. 2022, 18, 2049–2076. [Google Scholar] [CrossRef]

- Zhang, P.; He, Y.; Zhao, X. “Preorder-online, pickup-in-store” strategy for a dual-channel retailer. Transp. Res. Pt. E-Logist. Transp. Rev. 2019, 122, 27–47. [Google Scholar] [CrossRef]

- Xu, J.; Huang, Y.; Avgerinos, E.; Feng, G.; Chu, F. Dual-channel competition: The role of quality improvement and price-matching. Int. J. Prod. Res. 2022, 60, 3705–3727. [Google Scholar] [CrossRef]

- Wang, R.; Nan, G.; Chen, L.; Li, M. Channel integration choices and pricing strategies for competing dual-channel retailers. IEEE T. Eng. Manag. 2020, 69, 2260–2274. [Google Scholar] [CrossRef]

- Balakrishnan, A.; Sundaresan, S.; Zhang, B. Browse-and-switch: Retail-online competition under value uncertainty. Prod. Oper. Manag. 2014, 23, 1129–1145. [Google Scholar] [CrossRef]

- Kong, R.; Luo, L.; Chen, L.; Keblis, M.F. The effects of BOPS implementation under different pricing strategies in omnichannel retailing. Transp. Res. Pt. E-Logist. Transp. Rev. 2020, 141, 102014. [Google Scholar] [CrossRef]

- Gao, F.; Su, X. Online and offline information for omnichannel retailing. Manuf. Serv. Oper. Manag. 2017, 19, 84–98. [Google Scholar] [CrossRef]

- Gao, F.; Su, X. Omnichannel retail operations with buy-online-and-pick-up-in-store. Manag. Sci. 2017, 63, 2478–2492. [Google Scholar] [CrossRef]

- Radhi, M.; Zhang, G. Optimal cross-channel return policy in dual-channel retailing systems. Int. J. Prod. Econ. 2019, 210, 184–198. [Google Scholar] [CrossRef]

- Sun, Y.; Qiu, R.; Sun, M. Optimizing decisions for a dual-channel retailer with service level requirements and demand uncertainties: A Wasserstein metric-based distributionally robust optimization approach. Comput. Oper. Res. 2022, 138, 105589. [Google Scholar] [CrossRef]

- Li, Q.; Zheng, S. Joint inventory replenishment and pricing control for systems with uncertain yield and demand. Oper. Res. 2006, 54, 696–705. [Google Scholar] [CrossRef]

- Chen, X.; Hu, P.; Shum, S.; Zhang, Y. Dynamic stochastic inventory management with reference price effects. Oper. Res. 2016, 64, 1529–1536. [Google Scholar] [CrossRef]

- Xu, C.; Duan, Y.; Huo, J. Joint pricing and inventory management under servitisation. J. Oper. Res. Soc. 2020, 71, 893–909. [Google Scholar] [CrossRef]

- Gong, X.; Chen, Y.; Yuan, Q. Coordinating inventory and pricing decisions under total minimum commitment contracts. Prod. Oper. Manag. 2022, 31, v511–v528. [Google Scholar] [CrossRef]

- Yang, N.; Zhang, R.P. Dynamic pricing and inventory management in the presence of online reviews. Prod. Oper. Manag. 2022, 31, 3180–3197. [Google Scholar] [CrossRef]

- Yang, N.; Zhang, R. Dynamic pricing and inventory management under inventory-dependent demand. Oper. Res. 2014, 62, 1077–1094. [Google Scholar] [CrossRef]

- Song, Y.; Ray, S.; Boyaci, T. Optimal dynamic joint inventory-pricing control for multiplicative demand with fixed order costs and lost sales. Oper. Res. 2009, 57, 245–250. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, Y.; Zhou, S.X. Preservation of quasi-K-concavity and its applications. Oper. Res. 2010, 58, 1012–1016. [Google Scholar] [CrossRef]

- Hu, P.; Lu, Y.; Song, M. Joint pricing and inventory control with fixed and convex/concave variable production costs. Prod. Oper. Manag. 2019, 28, 847–877. [Google Scholar] [CrossRef]

- Li, Y.; Khouja, M.; Pan, J.; Zhou, J. Buy-one-get-one promotions in a two-echelon supply chain (June 5, 2019, working paper). SSRN 2019. [Google Scholar] [CrossRef]

- Yen, P.; Chen, Y.; He, Q. A better buy-one-give-one business model. Nav. Res. Logist. 2021, 68, 1070–1081. [Google Scholar] [CrossRef]

- Park, S.; Huh, W.T.; Kim, B.C. Optimal inventory management with buy-one-give-one promotion. IISE Trans. 2021, 54, 198–209. [Google Scholar] [CrossRef]

- Kim, K.K.; Lee, C.G.; Park, S. Dynamic pricing with ‘BOGO’ promotion in revenue management. Int. J. Prod. Res. 2016, 54, 5283–5302. [Google Scholar] [CrossRef]

- Liu, Y.; Sun, Y.; Zhang, D. An analysis of “buy x, get one free” reward programs. Oper. Res. 2021, 69, 1823–1841. [Google Scholar] [CrossRef]

- Lu, Y.; Chen, Y.; Song, M.; Yan, X. Optimal pricing and inventory control policy with quantity-based price differentiation. Oper. Res. 2014, 62, 512–523. [Google Scholar] [CrossRef]

- Zhou, S.X.; Chao, X. Dynamic pricing and inventory management with regular and expedited supplies. Prod. Oper. Manag. 2014, 23, 65–80. [Google Scholar] [CrossRef]

- Zhang, B.; Duan, D.; Ma, Y. Multi-product expedited ordering with demand forecast updates. Int. J. Prod. Econ. 2018, 206, 196–208. [Google Scholar] [CrossRef]

- Li, Y.; Hou, Y.M. Joint pricing and inventory management with regular and expedited supplies under reference price effects. Int. J. Inf. Manag. 2019, 30, 123–141. [Google Scholar]

- Ye, Q.; Duenyas, I. Optimal capacity investment decisions with two-sided fixed-capacity adjustment costs. Oper. Res. 2007, 55, 272–283. [Google Scholar] [CrossRef]

- Mutlu, N.; Bish, E.K. Optimal demand shaping for a dual-channel retailer under growing e-commerce adoption. IISE Trans. 2019, 51, 92–106. [Google Scholar] [CrossRef]

- Topkis, D. Supermodularity and Complementary; Princeton University Press: Princeton, NJ, USA, 1998; pp. 42–83. [Google Scholar]

- Simchi-Levi, D.; Chen, X.; Bramel, J. The Logic of Logistics: Theory, Algorithms, and Applications for Logistics Management; Springer Series in Operations Research and Financial Engineering: New York, NY, USA, 2014; pp. 26–27. [Google Scholar]

- Porteus, E.L. Foundations of Stochastic Inventory Theory; Stanford University Press: Redwood City, CA, USA, 2002; pp. 133–150. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).