OFDI Entry Modes and Firms’ Innovation: Evidence from Chinese A-Share Listed Firms

Abstract

1. Introduction

2. Theoretical Background and Hypotheses

2.1. OFDI and Firms’ Innovation

2.1.1. No OFDI Occurs

2.1.2. OFDI Occurs

2.2. The Relationship between OFDI’s Different Entry Modes and Firms’ Innovation

2.3. The Mediating Role of Government Resources

3. Methods

3.1. Samples and Data

3.2. Key Variables

3.2.1. Dependent Variables

3.2.2. Independent Variables

3.2.3. Control Variables

3.3. Model

4. Empirical Analysis

4.1. Balance Test for Matching

4.2. Different in Different Results and Analysis

4.3. Comparison of Innovation Effects of Different Entry Modes of OFDI

4.4. The Mediating Role of Government Resources

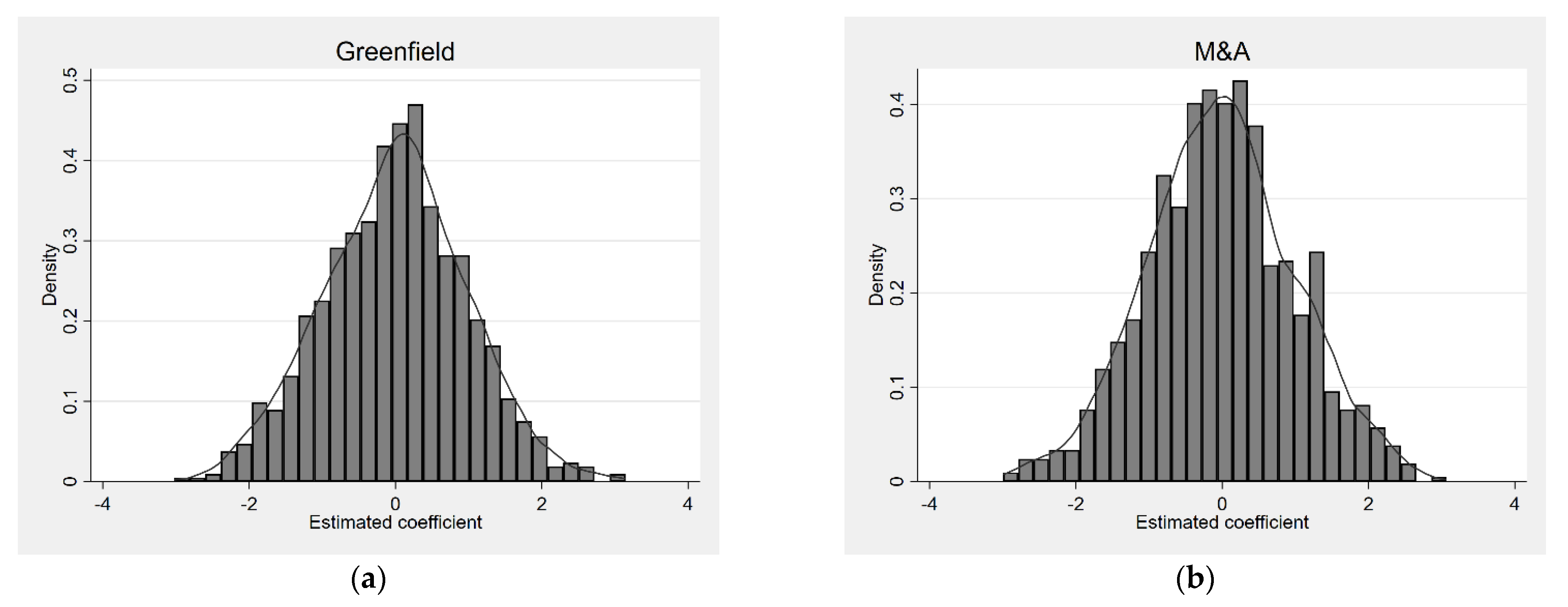

4.5. Robustness Checks

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhuang, Z.; Jia, H.; Xiao, C. Research Progress on Breakthrough Innovations. Econ. Perspect. 2020, 9, 145–160. [Google Scholar]

- Chen, J. Newly National Innovation System for S&T Powerhouse. Bull. Chin. Acad. Sci. 2018, 33, 479–483. [Google Scholar]

- Zhu, Z.; Huang, X.; Wang, Y. FDI Entry and the Solution to the Double Low Dilemma of Chinese Innovation. Econ. Res. J. 2020, 55, 99–115. [Google Scholar]

- Fu, X.; Hou, J.; Liu, X. Unpacking the Relationship between Outward Direct Investment and Innovation Performance: Evidence from Chinese firms. World Dev. 2018, 102, 111–123. [Google Scholar] [CrossRef]

- Wu, J.; Wang, C.Q.; Hong, J.J.; Piperopoulos, P.; Zhuo, S.H. Internationalization and innovation performance of emerging market enterprises: The role of host-country institutional development. J. World Bus. 2016, 51, 251–263. [Google Scholar] [CrossRef]

- Ai, Q.; Tan, H. Acquirers’ prior related knowledge and post-acquisition integration Evidences from four Chinese firms. J. Organ. Chang. Manag. 2017, 30, 647–662. [Google Scholar] [CrossRef]

- Luo, Y.D.; Tung, R.L. International expansion of emerging market enterprises: A springboard perspective. J. Int. Bus. Stud. 2007, 38, 481–498. [Google Scholar] [CrossRef]

- Mathews, J.A. Dragon multinationals: New players in 21 st century globalization. Asia Pac. J. Manag. 2006, 23, 5–27. [Google Scholar] [CrossRef]

- Zheng, N.; Wei, Y.; Zhang, Y.; Yang, J. In search of strategic assets through cross-border merger and acquisitions: Evidence from Chinese multinational enterprises in developed economies. Int. Bus. Rev. 2015, 25, 177–186, S0969593114001887. [Google Scholar] [CrossRef]

- Stiebale, J. The impact of cross-border mergers and acquisitions on the acquirers’ R&D—Firm-level evidence. Int. J. Ind. Organ. 2013, 31, 307–321. [Google Scholar]

- Li, Y.; He, C.; Liu, Y.; Kong, L. Can direct investment in the Belt and Road countries promote innovation of Chinese listed companies? Stud. Sci. Sci. 2020, 38, 1509–1525. [Google Scholar]

- Jia, N.; Han, Y.; Lei, H. A research on the innovation effect of China’s outward foreign direct investment. Sci. Res. Manag. 2020, 41, 122–130. [Google Scholar]

- Bitzer, J.; Kerekes, M. Does foreign direct investment transfer technology across borders? New evidence. Econ. Lett. 2008, 99, 355–358. [Google Scholar] [CrossRef]

- Edamura, K.; Haneda, S.; Inui, T.; Tan, X.; Todo, Y. Impact of Chinese cross-border outbound M&As on firm performance: Econometric analysis using firm-level data. China Econ. Rev. 2014, 30, 169–179. [Google Scholar]

- Pradhan, J.P.; Singh, N. Outward FDI and Knowledge Flows: A Study of the Indian Automotive Sector. Int. J. Inst. Econ. 2008, 1, 155–186. [Google Scholar]

- Cowling, K.; Tomlinson, P.R. The Problem of Regional ‘hollowing Out’ in Japan: Lessons for Regional Industrial Policy; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2003; pp. 33–58. [Google Scholar]

- Ma, C.L.; Liu, Z.Y. Effects of M&As on innovation performance: Empirical evidence from Chinese listed manufacturing enterprises. Technol. Anal. Strateg. Manag. 2017, 29, 960–972. [Google Scholar]

- Zhou, C.Y.; Hong, J.; Wu, Y.R.; Marinova, D. Outward foreign direct investment and domestic innovation performance: Evidence from China. Technol. Anal. Strateg. Manag. 2019, 31, 81–95. [Google Scholar] [CrossRef]

- Kolstad, I.; Wiig, A. What determines Chinese outward FDI? J. World Bus. 2012, 47, 26–34. [Google Scholar] [CrossRef]

- Ping, D. Why do Chinese firms tend to acquire strategic assets in international expansion? J. World Bus. 2009, 44, 74–84. [Google Scholar]

- Rossi, M.; Yedidia Tarba, S.; Raviv, A. Mergers and acquisitions in the hightech industry: A literature review. Int. J. Organ. Anal. 2013, 21, 66–82. [Google Scholar] [CrossRef]

- Barney, J. Firms resources and sustained competitive advantages. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Rossi, M.; Demetris Vrontis, D.M.C.P.; Thrassou, A.; Vrontis, D. Biotechnological mergers and acquisitions: Features, trends and new dynamics. J. Res. Mark. Entrep. 2015, 17, 91–109. [Google Scholar] [CrossRef]

- Ossorio, M. Does R&D investment affect export intensity? The moderating effect of ownership. Int. J. Manag. Financ. Account. 2018, 10, 65–83. [Google Scholar]

- Anand, J.; Delios, A. Absolute and relative resources as determinants of international acquisitions. Strateg. Manag. J. 2002, 23, 119–134. [Google Scholar] [CrossRef]

- Becker, J.; Fuest, C. Tax Competition—Greenfield Investment versus Mergers and Acquisitions. CESifo Work. Pap. Ser. 2008, 41, 476–486. [Google Scholar] [CrossRef][Green Version]

- Brouthers, K.D. Institutional, Cultural and Transaction Cost Influences on Entry Mode Choice and Performance. J. Int. Bus. Stud. 2013, 44, 14–22. [Google Scholar] [CrossRef]

- Brouthers, K.D.; Brouthers, L.E. Acquisition or greenfield start-up? Institutional, cultural and transaction cost influences. Strateg. Manag. J. 2000, 21, 89–97. [Google Scholar] [CrossRef]

- Buch, C.M.; Kesternich, I.; Lipponer, A.; Schnitzer, M. Financial constraints and foreign direct investment: Firm-level evidence. Rev. World Econ. 2014, 150, 393–420. [Google Scholar] [CrossRef]

- Jiang, G.; Jiang, D. Greenfield Investment or Cross border Mergers and Acquisitions: A Research on Chinese Companies outward Investments. J. World Econ. 2017, 40, 126–146. [Google Scholar]

- Nocke, V.; Yeaple, S. Cross-border mergers and acquisitions vs. greenfield foreign direct investment: The role of firm heterogeneity—ScienceDirect. J. Int. Econ. 2007, 72, 336–365. [Google Scholar] [CrossRef]

- Yan, Z.J.; Zhu, J.C.; Fan, D.; Kalfadellis, P. An institutional work view toward the internationalization of emerging market firms. J. World Bus. 2018, 53, 682–694. [Google Scholar] [CrossRef]

- Wang, J.; Huang, L.Y. Effect of Policy Subsidy on OFDI Firms’ Product Innovation. R. D. Manag. 2017, 29, 87–97. [Google Scholar]

- Buitrago, R.R.E.; Barbosa Camargo, M.I. Home Country Institutions and Outward FDI: An Exploratory Analysis in Emerging Economies. Sustainability 2020, 12, 10010. [Google Scholar] [CrossRef]

- Chen, A.-Z.; Zhang, P.-F. M&A Mode and Enterprise’s Innovation. China Ind. Econ. 2019, 12, 115–133. [Google Scholar]

- D’Aspremont, C.; Jacquemin, A. Cooperative and noncooperative R&D in duopoly with spillovers: Erratum. Am. Econ. Rev. 1990, 80, 641–642. [Google Scholar]

- Hennart, J.-F.; Park, Y.-R. Greenfield vs. acquisition: The strategy of Japanese investors in the United States. Manag. Sci. 1993, 39, 1054–1070. [Google Scholar] [CrossRef]

- Drogendijk, R.; Andersson, U. Relationship development in Greenfield expansions. Int. Bus. Rev. 2013, 22, 381–391. [Google Scholar] [CrossRef]

- Yi, R.; Ping, L. Dynamic Performance Comparison of Greenfield and Cross-border Acquisition. Bus. Manag. J. 2014, 36, 146–156. [Google Scholar]

- Liu, C.; Tian, L. Can Talent Policy Endorsement Promote Firm Innovation. China Ind. Econ. 2021, 3, 156–173. [Google Scholar]

- Zhou, J.; Li, J.; Li, B.; Liu, Z. Cooperation and firm international innovation: The moderating role of government involvement. Sci. Res. Manag. 2018, 39, 46–55. [Google Scholar]

- Zhang, Y.; Cheng, Y.; She, G. Can Government Subsidy Improve High-tech Firms’ Independent Innovation? Evidence from Zhongguancun Firm Panel Data. J. Financ. Res. 2018, 10, 123–140. [Google Scholar]

- Bhattacharya, U.; Hsu, P.H.; Tian, X.; Xu, Y. What Affects Innovation More: Policy or Policy Uncertainty? J. Financ. Quant. Anal. 2017, 52, 1869–1901. [Google Scholar] [CrossRef]

- Kogan, L.; Papanikolaou, D.; Seru, A.; Stoffman, N. Technological innovation, resource allocation, and growth. Q. J. Econ. 2017, 132, 665–712. [Google Scholar] [CrossRef]

- Li, J.; Xia, J.; Zajac, E.J. On the duality of political and economic stakeholder influence on firm innovation performance: Theory and evidence from Chinese firms. Strateg. Manag. J. 2017, 39, 193–216. [Google Scholar] [CrossRef]

- Jiang, G.; Zeng, J. Financial Constraint and the Mode of Outward Foreign Direct Investment: Cross-border Merge or Green Field Investment. Financ. Trade Econ. 2020, 41, 134–147. [Google Scholar]

- Fagerberg, J.; Mowery, D.C.; Nelson, R.R. The Oxford Handbook of Innovation; Oxford University Press: Oxford, UK, 2005; pp. 148–168. [Google Scholar]

- Denicolò, V.; Polo, M. Duplicative research, mergers and innovation. Econ. Lett. 2018, 166, 56–59. [Google Scholar] [CrossRef]

- Shi, J.; Li, X. Government Subsidies and Corporate Innovation Capability: A New Empirical Finding. Bus. Manag. J. 2021, 43, 113–128. [Google Scholar]

- Liu, S.; Lin, Z.; Leng, Z. Whether Tax Incentives Stimulate Corporate Innovation: Empirical Evidence Based on Corporate Life Cycle Theory. Econ. Res. J. 2020, 55, 105–121. [Google Scholar]

- Yao, L.; Zhou, Y. Managerial Ability, Innovation Ability and Innovation Efficiency. Account. Res. 2018, 6, 70–77. [Google Scholar]

- Li, W.; Zheng, M. Is it Substantive Innovation or Strategic Innovation?—Impact of Macroeconomic Policies on Micro-enterprises’ Innovation. Econ. Res. J. 2016, 51, 60–73. [Google Scholar]

- Heyman, F.; Sjholm, F.; Tingvall, P.G. Is there really a foreign ownership wage premium? Evidence from matched employer–employee data. J. Int. Econ. 2007, 73, 355–376. [Google Scholar] [CrossRef]

- Stiebale, J.; Vencappa, D. Acquisitions, markups, efficiency, and product quality: Evidence from India. Dice Discuss. Pap. 2016, 112, 70–87. [Google Scholar] [CrossRef]

- Cantoni, D.; Chen, Y.; Yang, D.; Yuchtman, N.; Zhang, Y.J. Curriculum and Ideology. J. Political Econ. 2017, 125, 338–392. [Google Scholar] [CrossRef]

- Li, P.; Lu, Y.; Wang, J. Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 2016, 123, 18–37. [Google Scholar] [CrossRef]

| Variable | Variable Name | Variable Measurement |

|---|---|---|

| Dependent variable | LnIQ | Innovation quantity, natural log of the number of patent applications plus 1 |

| LnIQ1 | Innovation quality, natural log of the number of patent for invention applications plus 1 | |

| LnIE | Innovation efficiency, the number of patent applications/(total R&D expenditure for the current year and the previous two years/current total assets) | |

| LnSI | Strategic innovation, number of non-invention patents/total number of patent applications | |

| Dependent variable | Dummy variable coded as 1 if OFDI occurs in current year and 0 otherwise | |

| is the cross-border M&A companies and is the greenfield firms | ||

| Control variables | Rdrate | Commercial credit, R&D spending/ operating income |

| Ownship | Dummy variable coded as 1 if the company is a state-owned firm and 0 otherwise | |

| ROA | Return on assets | |

| Lnw | Natural log of the number of workers | |

| Lntfp | Natural log of total factor productivity (LP method) |

| Variable | Mean | %Bias | t-Value | p > |t| | |

|---|---|---|---|---|---|

| Treated | Control | ||||

| 2010 | |||||

| Lnw | 7.703 | 7.679 | 2 | 0.12 | 0.903 |

| Ownship | 0.365 | 0.383 | −3.8 | −0.23 | 0.822 |

| Rdrate | 3.259 | 3.356 | −3.2 | −0.20 | 0.844 |

| Years | 12.270 | 12.477 | −5.1 | −0.28 | 0.783 |

| Siz | 21.486 | 21.482 | 0.3 | 0.02 | 0.986 |

| 2011 | |||||

| Lnw | 7.700 | 7.713 | −1.0 | −0.10 | 0.918 |

| Ownship | 0.314 | 0.312 | 0.4 | 0.04 | 0.969 |

| Rdrate | 3.652 | 3.514 | 4.4 | 0.41 | 0.683 |

| Years | 12.564 | 12.407 | 3.7 | 0.35 | 0.724 |

| Siz | 21.582 | 21.611 | −2.3 | −0.23 | 0.819 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | LnIQ | LnIQ1 | LnIE | LnSI |

| 0.155 *** | 0.136 *** | 0.075 *** | 0.004 | |

| (0.038) | (0.038) | (0.029) | (0.011) | |

| Rdrate | 0.038 *** | 0.056 *** | −0.016 *** | −0.011 *** |

| (0.006) | (0.009) | (0.003) | (0.002) | |

| Ownship | 0.077 * | 0.166 *** | 0.128 *** | −0.037 *** |

| (0.040) | (0.041) | (0.032) | (0.011) | |

| ROA | 0.015 *** | 0.015 *** | −0.000 | −0.003 *** |

| (0.003) | (0.003) | (0.002) | (0.001) | |

| Lnw | 0.464 *** | 0.354 *** | 0.287 *** | 0.047 *** |

| (0.026) | (0.025) | (0.023) | (0.006) | |

| Lntfp | 0.064 ** | 0.170 *** | 0.331 *** | −0.060 *** |

| (0.032) | (0.034) | (0.027) | (0.009) | |

| Constant | −2.083 *** | −2.841 *** | −4.027 *** | 0.662 *** |

| (0.228) | (0.257) | (0.176) | (0.063) | |

| R-squared | 0.189 | 0.202 | 0.372 | 0.045 |

| Company FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | LnIQ1 | LnIQ | LnIE | LnSI |

| 0.113 *** | 0.138 *** | 0.068 ** | 0.012 | |

| (0.037) | (0.038) | (0.029) | (0.010) | |

| 0.149 *** | 0.129 *** | 0.071 * | −0.020 | |

| (0.047) | (0.049) | (0.036) | (0.013) | |

| Constant | −2.834 *** | −2.105 *** | −4.032 *** | 0.644 *** |

| (0.254) | (0.226) | (0.173) | (0.063) | |

| R-squared | 0.202 | 0.189 | 0.373 | 0.046 |

| Control variable | YES | YES | YES | YES |

| Company FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| t Stage | t + 1 Stage | t + 2 Stage | t Stage | t + 1 Stage | t + 2 Stage | |

| Variable | LnIQ | LnIQ | LnIQ | LnIQ1 | LnIQ1 | LnIQ1 |

| 0.138 *** | 0.158 *** | 0.152 *** | 0.113 *** | 0.124 *** | 0.109 *** | |

| (0.038) | (0.037) | (0.041) | (0.037) | (0.037) | (0.040) | |

| 0.129 *** | 0.093 * | 0.099 * | 0.149 *** | 0.108 ** | 0.128 ** | |

| (0.049) | (0.050) | (0.056) | (0.047) | (0.046) | (0.054) | |

| Constant | −2.105 *** | −2.095 *** | −2.441 *** | −2.834 *** | −2.520 *** | −2.751 *** |

| (0.226) | (0.227) | (0.222) | (0.254) | (0.244) | (0.247) | |

| R-squared | 0.189 | 0.172 | 0.188 | 0.202 | 0.168 | 0.180 |

| Control variable | YES | YES | YES | YES | YES | YES |

| Company FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Greenfield | M&A | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Variable | GovRD | LnIQ1 | LnIQ1 | GovRD | LnIQ1 | LnIQ1 |

| 0.623 *** | 0.442 *** | 0.379 *** | ||||

| (0.054) | (0.037) | (0.040) | ||||

| 0.392 *** | 0.304 *** | 0.148 ** | ||||

| (0.085) | (0.078) | (0.074) | ||||

| GovRD | 0.120 *** | 0.358 *** | ||||

| (0.012) | (0.022) | |||||

| Constant | 13.027 *** | 1.406 *** | −0.178 | 4.014 *** | 0.988 *** | −0.484 ** |

| (0.189) | (0.105) | (0.207) | (0.249) | (0.172) | (0.220) | |

| R-squared | 0.254 | 0.091 | 0.119 | 0.251 | 0.088 | 0.247 |

| Control variable | YES | YES | YES | YES | YES | YES |

| Company FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiao, C.; Zhuang, Z.; Feng, A. OFDI Entry Modes and Firms’ Innovation: Evidence from Chinese A-Share Listed Firms. Sustainability 2021, 13, 7922. https://doi.org/10.3390/su13147922

Xiao C, Zhuang Z, Feng A. OFDI Entry Modes and Firms’ Innovation: Evidence from Chinese A-Share Listed Firms. Sustainability. 2021; 13(14):7922. https://doi.org/10.3390/su13147922

Chicago/Turabian StyleXiao, Chunhuan, Ziyin Zhuang, and Amei Feng. 2021. "OFDI Entry Modes and Firms’ Innovation: Evidence from Chinese A-Share Listed Firms" Sustainability 13, no. 14: 7922. https://doi.org/10.3390/su13147922

APA StyleXiao, C., Zhuang, Z., & Feng, A. (2021). OFDI Entry Modes and Firms’ Innovation: Evidence from Chinese A-Share Listed Firms. Sustainability, 13(14), 7922. https://doi.org/10.3390/su13147922