Optimum Renewable Energy Investment Planning in Terms of Current Deficit: Turkey Model

Abstract

1. Introduction

2. Literature

2.1. Literature About the Energy-Based Current Deficit Problem

2.2. The Literature of Optimization in Terms of RES Planning

3. Materials and Methods

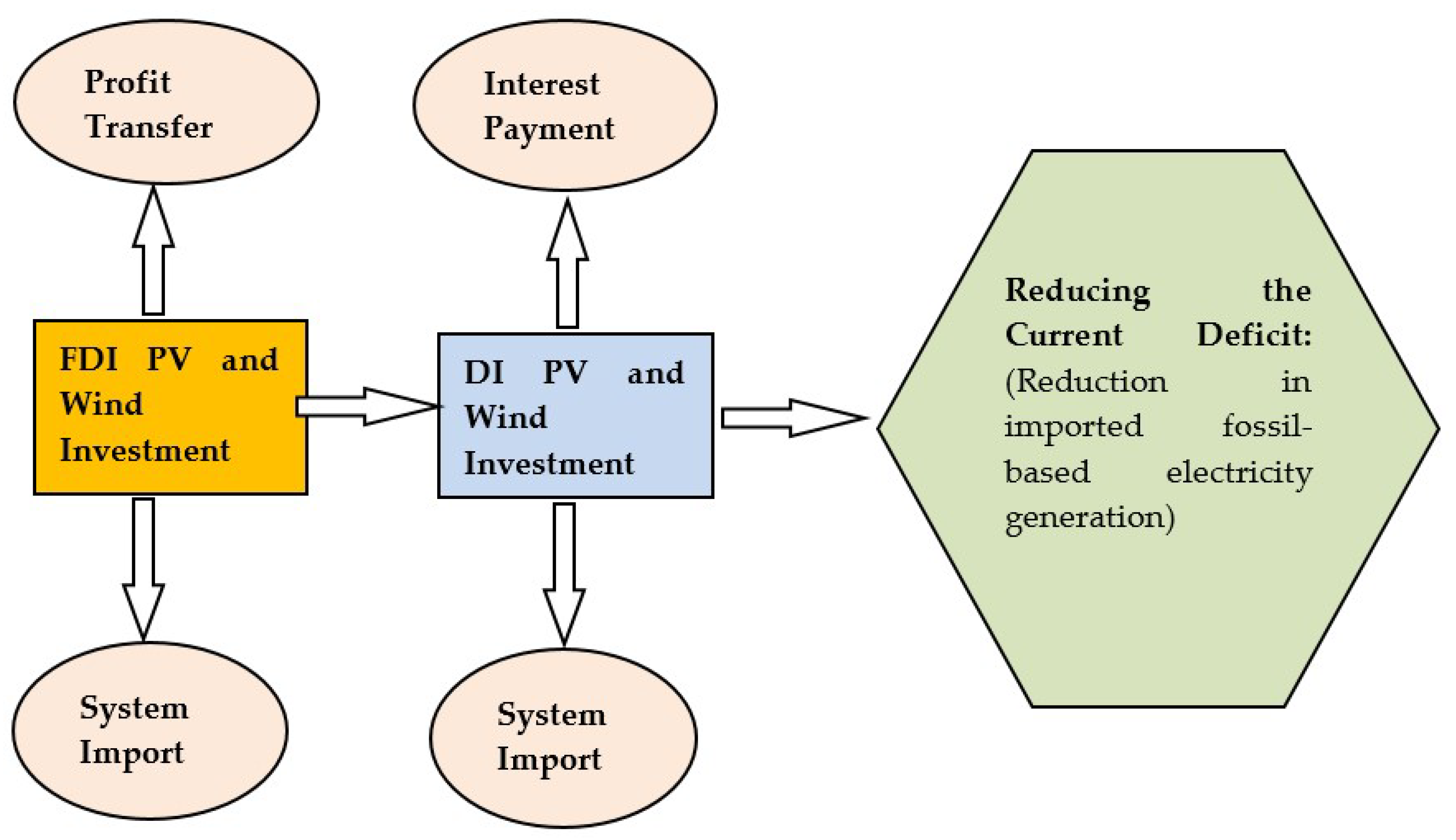

- Xi1: FDI PV installation in the i. year, Xi2: domestic investments (DI) PV installation in the i. year

- Xi3: FDI wind installation in the i. year, Xi4: DI wind installation in the i. year

3.1. Objective Function

3.2. Constraints

3.3. Assumptions and Limitation of the Model

- Concerning the wind and PV solar energy, there will be no change in parameters such as annual productivity loss, technological enhancements in the future, reductions in the cost, and seasonal production increases/decreases;

- In the next 12 years, the dollar-based increases and decreases of the imported resources, which influence the current deficit, will be the same with that of the last 12 years;

- For the political stabilization, there will be no constraint preventing the FDIs;

- The estimated energy demand increases are going to take place as estimated; and

- The necessary infrastructure investments for the wind and PV solar energy will be employed by the MENR.

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Nomenclature

| Selected abbreviations | |||

| Symbol | Explanation | ||

| RES | Renewable Energy Sources | ||

| W | Wind | ||

| PV | Photovoltaic | ||

| FDI | Foreign Direct Investments | ||

| DI | Domestic Investments | ||

| LCOE | Levelized Cost of Electricity | ||

| PPA | Power Purchase Agreement | ||

| GHG | Greenhouse Gas | ||

| MENR | Ministry of Energy and Natural Resources | ||

| TCMBEVDS | Central Bank of the Republic of Turkey the Electronic Data Delivery System | ||

| TÜİK | Turkish Statistical Institute | ||

| EİGM | Directorate General of Energy Affairs | ||

| TEİAŞ | Turkish Electricity Transmission Corporation | ||

| TETAŞ | Turkey Electric Trading and Contracting Corporation | ||

| Variables/Right Side Constants | |||

| Symbol | Unit | Equation | Explanation |

| Xi1 | GW, Billion $, Twh, tonnes/GWh | Objective function and all Constraints | FDI PV installation in the i. year |

| Xi2 | DI PV installation in the i. year | ||

| Xi3 | FDI wind installation in thei. year, | ||

| Xi4 | DI wind installation in the i. year | ||

| Net PVTi | GW | (5) | Each “i” year in terms of Net PV Installed Power Target Capacity |

| Net WTi | GW | (5) | Each “i” year in terms of Net Windy Installed Power Target Capacity |

| PPVT | GW | (6) | Turkey total potential capacity in PV solar energy |

| PWT | GW | (6) | Turkey total potential capacity in Wind energy |

| IBEG | TWh | (7) | Import-Based Electricity Generation |

| AED | TWh | (9), (10) | Annual electricity demand |

| EIBEDI | TWh | (11) | Estimated Import-Based Electricity Demand Increases |

References

- Dornbusch, R.; Stanley, F. Macroeconomics; McGraw-Hill International Editions: Chicago, IL, USA, 1990. [Google Scholar]

- Freund, C.L. Spaghetti Regionalism; Board of Governors of the Federal Reserve System: Washington, DC, USA, 2000. [Google Scholar]

- Bussiere, M.; Marcel, F. Towards a New Early Warning System of Financial Crise; European Central Bank: Frankfurt, Germany, 2002. [Google Scholar]

- Labonte, M. Is the U.S. Current Account Deficit Sustainable? Congressional Research Service: Washington, DC, USA, 2010. [Google Scholar]

- Swenson, L.D.; Wing, T.W. The Politics and Economics of the U.S.-China Trade War. Asian Econ. Pap. 2019, 18, 1–28. [Google Scholar] [CrossRef]

- Guo, M.; Lin, L.; Liugang, S.; Miaojie, Y. The Day After Tomorrow: Evaluating the Burden of Trump’s Trade. Asian Econ. Pap. 2018, 17, 101–120. [Google Scholar] [CrossRef]

- Liu, G.M. ‘The apostle of free trade’: Adam Smith and the nineteenth-century American trade debates. Hist. Eur. Ideas 2018, 44, 210–213. [Google Scholar] [CrossRef]

- Crucini, M.J.; Kahn, J. Tariffs and aggregate economic activity: Lessons from the Great Depression. J. Monet. Econ. 1996, 38, 427–467. [Google Scholar] [CrossRef]

- Li, C.; Chuantian, H.; Chuangwei, L. Economic Impacts of the Possible China–US Trade War. Emerg. Mark. Financ. Trade 2018, 54, 1557–1577. [Google Scholar] [CrossRef]

- Bucevska, V. Currency Crises in EU Candidate Countries: An Early Warning System Approach. Panoeconomicu 2015, 62, 493–510. [Google Scholar] [CrossRef]

- Chernyak, O.; Vasyl, K.; Yevgen, C. The Main Triggers of the Balance of Payment Crisis in the Eastern Europe. Procedia Technol. 2013, 8, 47–50. [Google Scholar] [CrossRef][Green Version]

- Licchetta, M. Common Determinants of Currency Crises: Role of External Balance Sheet Variables; Bank of England: London, UK, 2009. [Google Scholar]

- Türkiye Cumhuriyet Merkez Bankası Elektronik Veri Dağıtım Sistemi (TCMBEVDS). Available online: https://evds2.tcmb.gov.tr/ (accessed on 2 December 2018).

- Türkiye İstatistik Kurumu (TÜİK). Available online: http://www.tuik.gov.tr/PreTablo.do?alt_id=1108 (accessed on 19 February 2019).

- Enerji İşleri Genel Müdürlüğü (EİGM). Available online: http://www.eigm.gov.tr/tr-TR/Denge-Tablolari/Denge-Tablolari (accessed on 16 September 2016).

- Türkiye Elektrikİletim A.Ş. (TEİAŞ). Türkiye Elektrik Şebekesi Günlük Özet Raporu; Türkiye Elektrikİletim A.Ş. (TEİAŞ): Ankara, Turkey, 2018. [Google Scholar]

- Yokuş, T. Yayınlanmamış Yüksek Lisans Tezi. Enerji Kaynaklı Cari Açık: Güneş Enerjisi Yatrım Modeli İle Çözümü (2017–2030); Karamanoğlu Mehmetbey Üniversitesi Sosyal Bilimler Enstitüsü İktisat Anabilim Dalı, Temmuz: Karaman, Turkey, 2017. [Google Scholar]

- Türkiye Elektrik Ticaret ve Taahhüt A.Ş. (TETAŞ). 2017 Yılı Sektör Raporu; TETAŞ: Ankara, Turkey, 2018. [Google Scholar]

- Enerji ve Tabii Kaynaklar Bakanlığı (ETKB). Available online: http://www.enerji.gov.tr/tr-tr/bakanlik-haberleri/geste-1-milyar-dolari-asacak-yatirim-icin-ilk-adim (accessed on 10 September 2018).

- International Money Fund (IMF). Available online: https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD (accessed on 25 January 2019).

- Yanar, R.; Güldem, K. Türkiye’de Enerji Tüketimi, Ekonomik Büyüme Ve Cari Açık İlişkisi. Ekon. Bilimler Derg. 2011, 3, 191–201. [Google Scholar]

- Uysal, D.; Kubilay, Y.; Tener, T. Enerji İthalatı Cari Açık İlişkisi: Türkiye Örneği. Muş Alparslan Üniv. Sos. Bilimler Derg. 2015, 3, 63–78. [Google Scholar] [CrossRef]

- Soydal, H.; Zekeriya, M.; Murat, Ç. Makro Ekonomik Açıdan Türkiye’nin Alternatif Enerji İhtiyacının Önemi. Pamukkale Üniv. Sos. Bilimler Enst. Derg. 2012, 11, 117–137. [Google Scholar]

- Özsoy, C.E.; Ahmet, D. Türkiye’nin Fosil Enerji Kaynaklı Sorunlarına Düşük Karbonlu Bir Çözüm: Yeşil Ekonomi; EconWorld2016@ImperialCollege Proceedings: London, UK, 2016; pp. 1–15. [Google Scholar]

- Göçer, İ. Türkiye’de Cari Açığın Nedenleri, Finansman Kalitesi ve Sürdürülebilirliği: Ekonometrik Bir Analiz. Eskişehir Osman. İİBF Derg. 2013, 8, 213–242. [Google Scholar]

- Doğan, E. Türkiye’de Cari Açık Sorunun Yapısal Nedenleri ve Ekonomik Etkileri. Unpublished Master’s Thesis, Eskişehir Osmangazi Üniversitesi Sosyal Bilimler Enstitüsü İktisat Anabilim Dalı, Eskişehir, Turkey, 2014. [Google Scholar]

- Bayrak, M.; Ömer, E. Türkiye’nin Enerji Açığı Sorunu ve Çözümüne Yönelik Arayışlar. Atatürk Üniv. İktis. İdari Bilimler Derg. 2014, 28, 139–157. [Google Scholar]

- Karabulut, G.; Ayşe, Ç.D. Türkiye’de Cari İşlemler Açığının Büyümesini Etkileyen Faktörler. Gazi Üniv. İktis. İdari Bilimler Fak. Derg. 2006, 8, 47–63. [Google Scholar]

- Huntingto Hillard, G. Crude oil trade and current account deficits. Energy Econ. 2015, 50, 70–79. [Google Scholar] [CrossRef]

- Vaona, A. The effect of renewable energy generation on import demand. Renew. Energy 2016, 86, 354–359. [Google Scholar] [CrossRef]

- Van de Ven, D.J.; Roger, F. Historical Energy Price Shocks and Their Changing Effects on the Economy. Energy Econ. 2016, 62, 204–216. [Google Scholar] [CrossRef]

- Bixby, R.E. A brief history of linear and mixed-integer programming computation. Doc. Math. 2012, Extra Volume. 107–121. [Google Scholar]

- Taha, H.A. Operation Research: An Introduction; Pearson Education, Inc.: Hoboken, NJ, USA, 2007. [Google Scholar]

- Talbi, El-G. Metaheuristics: From Design to Implementation; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2009. [Google Scholar]

- Iqbal, M.; Azam, M.R.; Naeem, M.A.; Khwaja, S.; Anpalagan, A. Optimization classification, algorithms and tools for renewable energy: A review. Renew. Sustain. Energy Rev. 2014, 39, 640–654. [Google Scholar] [CrossRef]

- Müller, B.; Francesco, G.; Ludwig, H. Comprehensive representation of models for energy system analyses: Insights from the Energy Modelling Platform for Europe (EMP-E) 2017. Energy Strategy Rev. 2018, 21, 82–87. [Google Scholar] [CrossRef]

- Ringkjøb, H.K.; Peter, M.H.; Ida, M.S. A review of modelling tools for energy and electricity systems with large shares of variable renewables. Renew. Sustain. Energy Rev. 2018, 96, 440–459. [Google Scholar] [CrossRef]

- Kumbaroğlu, G.; Reinhard, M.; Mustafa, D. A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ. 2008, 30, 1882–1908. [Google Scholar] [CrossRef]

- Alagöz, M.; Yokuş, N.; Yokuş, T. Photovoltaic solar power plant investment optimization model for economic external balance: Model of Turkey. Energy Environ. 2018, 30, 522–541. [Google Scholar] [CrossRef]

- Dudhani, S.; Sinha, A.K.; Inamdar, S.S. Renewable energy sources for peak load demand management in India. Int. J. Electr. Power Energy Syst. 2006, 28, 396–400. [Google Scholar] [CrossRef]

- Iniyan, S.; Jebaraj, S.; Suganthi, L.; Anand, A.S. Energy Models for Renewable Energy Utilization and To Replace Fossil Fuels. Methodology 2006, 1–8. [Google Scholar]

- Rizzo, G.; Giancarlo, S. A Linear Programming model for the optimal assessment of Sustainable Energy Action Plans. In Proceedings of the ECOS 2012, Perugia, Italy, 26–29 June 2012. [Google Scholar]

- Mourmouris, J.C.; Potolias, C. A multi-criteria methodology for energy planning and developing renewable energy sources at a regional level: A case study Thassos, Greece. Energy Policy 2013, 52, 522–530. [Google Scholar] [CrossRef]

- Pereira, S.; Paula, F.; Vaz, A.I.F. Optimization modeling to support renewables integration in power systems. Renew. Sustain. Energy Rev. 2016, 55, 316–325. [Google Scholar] [CrossRef]

- Gulagi, A.; Dmitrii, B.; Mahdi, F.; Christian, B. Can Australia Power the Energy-Hungry Asia with Renewable Energy. Sustainability 2017, 9, 233. [Google Scholar] [CrossRef]

- Amrutha, A.A.; Balachandra, P.; Mathirajan, M. Model-based approach for planning renewable energy transition in a resource-constrained electricity system—A case study from India. Int. J. Energy Res. 2017, 42, 1023–1039. [Google Scholar] [CrossRef]

- Liu, H.; Gorm, B.A.; Martin, G. Cost-optimal design of a simplified highly renewable Chinese electricity network. Energy 2018, 147, 534–546. [Google Scholar] [CrossRef]

- Zhang, D.; Shujun, M.; Chan, C.C.; George, Y.Z. Optimization of Renewable energy penetration in Regional Energy System. Energy Procedia 2018, 152, 922–927. [Google Scholar] [CrossRef]

- Chen, S.; Zheng, G.; Pei, L.; Zheng, L. Advances in clean and low-carbon power generation planning. Comput. Chem. Eng. 2018, 116, 296–305. [Google Scholar] [CrossRef]

- Henao, F.; Yeny, R.; Juan, P.V.; Isaac, D. Optimising the insertion of renewables in the Colombian power sector. Renew. Energy 2019, 132, 81–92. [Google Scholar] [CrossRef]

- Zappa, W.; Martin, J.; Machteld, V.D.B. Is a 100% renewable European power system feasible by 2050? Appl. Energy 2019, 233, 1027–1050. [Google Scholar] [CrossRef]

- Thang, V.V.; Hien, N.T. Evaluating efficiency of renewable energy sources in planning micro-grids considering uncertainties. J. Energy Syst. 2019, 3, 14–25. [Google Scholar] [CrossRef][Green Version]

- Handayani, K.; Yoram, K.; Tatiana, F. From fossil fuels to renewables: Ananalysis of long-term scenarios considering technological learning. Energy Policy 2019, 127, 134–146. [Google Scholar] [CrossRef]

- Aghahosseini, A.; Dmitrii, B.; Larissa, S.N.S.B.; Christian, B. Analysing the feasibility of powering the Americas with renewable energy and inter-regional grid interconnections by 2030. Renew. Sustain. Energy Rev. 2019, 105, 187–205. [Google Scholar] [CrossRef]

- Alagöz, M. Cari Açık ve Enerji İthali İlişkisi: Güneş Enerjisi. In Proceedings of the 4th International Symposium on Development of KOP Region, Karaman, Turkey, 21–23 October 2016. [Google Scholar]

- Rüzgar Enerjisi ve Etkileşim Raporu; Türkiye Rüzgar Enerji Birliği (TREB): Ankara, Turkey, 2016.

- Türkiye Ulusal Yenilenebilir Enerji Eylem Planı; Yenilenebilir Enerji Genel Müdürlüğü (YEGM): Ankara, Turkey, 2014.

- Alagöz, M.; Yokuş, T. Kamu Özel İşbirliği Yatırımları ve Dış Borç Ödeme Projeksiyonu. Ank. Üniv. SBF Derg. 2018, 73, 867–889. [Google Scholar]

- Ekonomi Bakanlığı (EB). Available online: http://www.ekonomi.gov.tr/portal/faces/oracle/webcenter/portalapp/pages/content/docListViewer.jspx?folder=/Contribution%20Folders/web/Yat%C4%B1r%C4%B1m/%C4%B0statistikler%20ve%20Yay%C4%B1nlar/ekler/02.Yay%C4%B1nlar/&parentPage=yatirim&_afrLoop=85593528987 (accessed on 11 December 2017).

- Özcan, M.; Öztürk, S. Türkiye’nin Elektrik Enerjisi Üretimi Kaynaklı Sera Gazı Emisyonunda Beklenen Değişimler ve Karbon Vergisi Uygulaması. Available online: http://www.emo.org.tr/ekler/15ed8b43a250de0_ek.pdf (accessed on 20 December 2018).

- Fraunhofer Institute for Solar Energy Systems ISE (Fraunhofer ISE). Levelized Cost of Electricity Renewable Energy Technologies; Fraunhofer Institute for Solar Energy Systems ISE (Fraunhofer ISE): Freiburg, Germany, 2018. [Google Scholar]

- Frankel, J.A.; Rose, A.K. Currency Crashes Emerging Markets: Emprical Indicators; Working Paper; National Bureau of Economic Research: Cambridge, UK, 1996. [Google Scholar]

- Tour, A.D.; Glachant, M.; Meniere, Y. Innovation and international technology transfer: Thecaseof the Chinese photovoltaic industry. Energy Policy 2011, 39, 761–770. [Google Scholar] [CrossRef]

- Zhang, C.; Guo, B.; Jianke, W. The different impacts of home countries characteristics in FDI on Chinese. Econ. Model. 2014, 38, 572–580. [Google Scholar] [CrossRef]

- Nakatani, R. Real and financial shocks, exchange rate regimes and the probability of a currency crisis. J. Policy Model. 2018, 40, 60–73. [Google Scholar] [CrossRef]

- International Monetary Fund (IMF). World Economik Outlook; International Monetary Fund (IMF): Washington, DC, USA, 1999. [Google Scholar]

- Atems, B.; Hotaling, C. The effect of renewable and nonrenewable electricity generation on economic growth. Energy Policy 2018, 112, 111–118. [Google Scholar] [CrossRef]

- Enerji ve Tabi Kaynaklar Bakanlığı (ETKB). Mavi Kitap 2016; Enerji ve Tabi Kaynaklar Bakanlığı (ETKB): Ankara, Turkey, 2017. [Google Scholar]

- Çakmak, Ç.; Kurban, M.; Dokur, E. Hibrit Yenilenebilir Enerji Sistemlerinin Ekonomik Analizi. Available online: http://www.emo.org.tr/ekler/887f3eaeb0a7eff_ek.pdf (accessed on 15 September 2018).

- Yıldız, C.; ve Şekkeli, M. Türkiye gün öncesi elektrik piyasasında rüzgar enerjisi ve pompaj depolamalı hidroelektrik santral için optimum teklif oluşturulması. Pamukkale Üniv. Mühendis. Bilimleri Derg. 2016, 22, 361–366. [Google Scholar]

- Çevre Ve Şehircilik Bakanlığı (CSB). Available online: http://www.csb.gov.tr/db/iklim/editordosya/PMR_MBIs%20Calistayi_12052016.pdf (accessed on 19 September 2017).

| Coefficients of the Objective Function of Constraints the Model | Coefficient | Reference |

|---|---|---|

| 1 GW Wind Investment Cost (Billion $) | 1.20 | [56] |

| 1 GW PV Investment Cost (Billion $) | 1.00 | [39] |

| 1 GW Wind Annual Electricity Generation (TWh) | 2.50 | [57] |

| 1 GW PV Annual Electricity Generation (TWh) | 1.60 | [57] |

| 1 GW Wind-Investment-Based Reduction in the Import for the Electricity Generation (Billion $) | 0.27 | [14,15,57] * |

| 1 GW PV-Investment-Based Reduction in the Import for the Electricity Generation (Billion $) | 0.17 | |

| 1 GW Annual Profit Transfer of the Wind FDI Investment (Billion $) | 0.084 | [13] * |

| 1 GW Annual Profit Transfer of the PV FDI Investment (Billion $) | 0.070 | |

| 1 GW Annual Credit Instalments of the Wind DI Investments (Interest: 6%, Payback Period: 10 Years, 75% of the Credit Investment Amount) (Billion $) | 0.100 | [39,58] * |

| 1 GW Annual Credit Instalments of the PV DI Investments (Interest: 6%, Payback Period: 10 Years, 75% of the Credit Investment Amount) (Billion $) | 0.083 | |

| 1 GW 60% Import Rate of the Wind Investment in the 2019–2022 Period (Billion $) | 0.720 | [59] * |

| 1 GW 70% Import Rate of the PV Investment in the 2019–2022 Period (Billion $) | 0.700 | |

| 1 GW 35% Import Rate of the Wind Investment in the 2023–2030 Period (Billion $) | 0.480 | [19] * |

| 1 GW 30% Import Rate of the PV Investment in the 2023–2030 Period (Billion $) | 0.300 | |

| 1 GW CO2 Reduction of the Wind Investment (tonne/GWh) | 0.8 | [60] * |

| 1 GW CO2 Reduction of the PV Investment (tonne/GWh) | 1.25 |

| Objective Function Optimum Solution | 12-Year Capacity (GW) | 12-Year Investment Amount (Billion$) | Current Deficit Reduction Based on 25-Year Net Electricity Generation (Billion$) |

|---|---|---|---|

| Total | 124.365 | 131.673 | 466.422 |

| PV FDI | 40.208 | 40.208 | 100.520 |

| PV DI | 47.616 | 47.616 | 161.894 |

| Wind FDI | 5.092 | 6.1104 | 23.169 |

| Wind DI | 31.449 | 37.7388 | 180.832 |

| Years | Solar (GW) | Wind (GW) | Impacts of Investment on Current Deficit (Billion $) | ||||

|---|---|---|---|---|---|---|---|

| FDI | DI | FDI | DI | Reduction in the Total Import-Based Electricity Generation | FDI Profit Transfer and DI Interest Repayments | Net Reduction in Current Deficit | |

| 2019 | 1.000 | 1.286 | 1.274 | 0.861 | 0.305 | 0.556 | |

| 2020 | 0.947 | 1.218 | 1.207 | 1.677 | 0.595 | 1.082 | |

| 2021 | 0.984 | 1.265 | 1.254 | 2.524 | 0.895 | 1.629 | |

| 2022 | 1.029 | 1.323 | 1.311 | 3.410 | 1.210 | 2.201 | |

| 2023 | 3.961 | 6.602 | 5.866 | 2.147 | 3.719 | ||

| 2024 | 6.898 | 16.095 | 9.775 | 2.630 | 7.145 | ||

| 2025 | 1.497 | 2.495 | 10.703 | 2.984 | 7.719 | ||

| 2026 | 1.502 | 2.504 | 11.635 | 3.340 | 8.295 | ||

| 2027 | 1.512 | 2.520 | 12.572 | 3.698 | 8.875 | ||

| 2028 | 7.369 | 12.282 | 17.141 | 5.442 | 11.699 | ||

| 2029 * | 4.994 | 11.652 | 19.971 | 5.664 | 14.307 | ||

| 2030 * | 8.515 | 19.869 | 24.796 | 6.139 | 18.657 | ||

| Total | 40.208 | 47.616 | 5.092 | 31.449 | 120.933 | 35.048 | 85.885 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saçık, S.Y.; Yokuş, N.; Alagöz, M.; Yokuş, T. Optimum Renewable Energy Investment Planning in Terms of Current Deficit: Turkey Model. Energies 2020, 13, 1509. https://doi.org/10.3390/en13061509

Saçık SY, Yokuş N, Alagöz M, Yokuş T. Optimum Renewable Energy Investment Planning in Terms of Current Deficit: Turkey Model. Energies. 2020; 13(6):1509. https://doi.org/10.3390/en13061509

Chicago/Turabian StyleSaçık, Sinem Yapar, Nihal Yokuş, Mehmet Alagöz, and Turgut Yokuş. 2020. "Optimum Renewable Energy Investment Planning in Terms of Current Deficit: Turkey Model" Energies 13, no. 6: 1509. https://doi.org/10.3390/en13061509

APA StyleSaçık, S. Y., Yokuş, N., Alagöz, M., & Yokuş, T. (2020). Optimum Renewable Energy Investment Planning in Terms of Current Deficit: Turkey Model. Energies, 13(6), 1509. https://doi.org/10.3390/en13061509