Abstract

A company’s base, or physical location, is often a criterion or condition for inclusion in regional development programmes that offer investment incentives such as reduced taxes, subsidised loan rates, or funding for research and development projects. However, these programmes, aimed at strengthening communities lagging behind in economic development, are often the target of malicious exploitation by companies that have a virtual headquarters in the region without actually contributing to local economies. This study proposes the use of the Expenses Localness Indicators (ELI) model as a reliable indicator of a company’s real contribution to a local economy. The ELI model can measure and highlight attempts to erode a company’s headquarters, and also assess a company’s integration into the local economy. By simulating a virtual economic environment and generating synthetic transaction data, the effectiveness of the ELI model in detecting false location claims and quantifying regional participation is evaluated. The results show that companies that prioritise local partnerships maintain higher locality scores, while those that partner with low locality entities weaken their local economic footprint, regardless of physical location. The ELI model provides a transparent and reliable tool that can be used both to grant regional incentives and to monitor their performance. Its integration into policy design can support more equitable, evidence-based approaches to regional economic development and social investment.

1. Introduction

Associations of countries, such as the European Union, create programmes for the convergence of regions with low economic development, providing incentives and support for the establishment of businesses in these regions. Governments want to help regions that are lagging behind in economic development by offering investment incentives such as reduced taxes, subsidised loan rates or funding for research and development projects.

Local authorities support the establishment of businesses in their region by providing services or developing infrastructure. Banks and other financial institutions that want to increase their social impact create programmes to support businesses in specific, often underdeveloped, regions. Small cooperative banks are set up with the aim of supporting businesses in their area. The utilisation of geographically targeted incentives enables policymakers to concentrate on regions experiencing high levels of unemployment and socioeconomic challenges, with the objective of enhancing economic activity in areas where it is most required. The concentration of businesses and individuals in specific geographical locations, through these incentives, can bring about economies of scale and positive externalities at the local level, enhancing productivity, innovation, and growth (Pinto, 2024).

In all these cases, the location of the company is the most basic criterion for a company to be eligible for support. In order to benefit from these incentives, many companies declare these regions as their headquarters without actually having any significant economic activity in the region and, ultimately, without contributing to local development. This tactic, known as base erosion, is designed either to avoid taxation or to take advantage of subsidies and other incentives, to the detriment of genuine local companies and local development. Place-based policies have been identified as a critical factor in enhancing the value chain and fostering the industrialisation of provincial zones (Zheng & Pan, 2024). In addition, place-based policies have been shown to promote local innovation and entrepreneurship by facilitating access to financial resources, reducing administrative burdens, and cultivating talent (Tian & Xu, 2022).

ESG’s social criteria, which emphasise the fair management of relationships with employees, suppliers and communities, are directly linked to localness in the supply chain. The selection of local suppliers has been demonstrated to enhance sustainable development and social impact. This approach enables fintech companies to promote socially responsible ESG investments, thereby shaping a novel, transparent, and technology-enabled investment model. This raises the following question: Should the location of a company be a criterion for its inclusion in actions to strengthen a specific region? The location of a company is a pivotal factor in determining its inclusion in regional development policies. Recent research has demonstrated the efficacy of place-based incentives, including tax relief and regional aid, in fostering employment, enhancing infrastructure, and promoting entrepreneurship. The Organisation for Economic Co-operation and Development (OECD) emphasises in the policy paper (OECD, 2023) that geographically targeted interventions are only effective when accompanied by authentic local economic activity and incorporated into comprehensive regional development strategies. The verification of a company’s local presence is imperative to ensure the efficacy and fairness of regional development policies.

The locality indicators of the Expenses Localness Indicators (ELI) model (Parastatidou & Chatzis, 2025) can measure the real contribution of a company to the economic development of a geographical region or a country. This article examines the potential of using the ELI model to detect attempts to mislead about the company’s location, and also proposes and investigates the use of the ELI model as a criterion in business incentive programmes when the objective of the programmes is the economic development of a specific geographical region.

The model employs data concerning the amount and dispersion of a company’s expenditure with the objective of extracting information that may indicate the presence of problematic circumstances potentially concealing fraud. This approach has the potential to address fraud in financial statements, which could otherwise have an adverse impact on the authorities.

Given the propensity of companies to declare false headquarters with a view to exploit tax benefits and other advantages, the objective is to detect fraud in the location of companies. The ELI model is used to identify deceptive practices through the detection of inconsistencies in local expenditures and activities. Moreover, an awareness of the local context facilitates institutions in more accurately assessing credit risk for specific business activities. Moreover, the ELI model succeeds in ensuring merit-based business incentives in the sense that public incentives given for local economic development go to firms that actually operate locally.

The research objectives of this study are approached by developing a valid model for managing information available to firms within their information systems for the emergence of new knowledge. The model functions as an innovative communication mechanism, with the aim of highlighting indicators that are related to the economic citizenship of materials, services and, more generally, to the identity of firms. The research objectives are summarised as follows:

- Evaluate the effectiveness of the ELI model in identifying cases of fraud related to the declared location of businesses.

- Assess the ability of the ELI model to enhance the supervision of credit operations.

- Investigate the use of the ELI model as a mechanism to enhance confidence in the control mechanisms, with the aim of providing merit-based business incentives.

The rest of the document is structured as follows: Section 2 reviews the literature on the effectiveness of location-based incentives in promoting local economic development. It also discusses the mechanisms and theoretical foundations of base erosion, proposes potential solutions involving technology, data analysis, and detection tools, and examines international regulatory approaches. Finally, it presents empirical findings and explores the broader economic implications. Section 3 outlines the methodology, provides a detailed description of the Expenses Localness Indicators model, and presents a simulation of a virtual economic environment. Section 4 presents the experiments conducted, along with the results and a discussion of their implications. Finally, Section 5 presents the conclusions of this research.

2. Literature Review

2.1. The Effectiveness of Location-Based Incentives on Local Economic Development

The efficacy of location-based incentives in promoting local development is contingent upon their proper targeting and consistent implementation. Alecke and Mitze (2023) revealed that increased subsidies in Germany led to heightened investment and employment, with the effectiveness of these measures diminishing when financial resources are constrained. Amankwaah et al. (2022) found that tax incentives supported rural development in Ghana, although investments remained concentrated in certain regions, limiting their redistributive effect. In Slovakia, Bobenič Hintošová et al. (2021) concluded that economic incentives need to be linked to the fulfillment of specific strategic objectives in the longer term and in relation to other post-incentive benefits that would more intensively connect the investor with the host country. Parilla and Liu (2018) similarly underscore the point that incentives become less effective when companies misuse them. The authors illustrate this point by examining the phenomenon of companies that relocate their headquarters with the primary objective of benefiting from regional support, without making a significant economic contribution to the local economy. Therefore, the company’s location should serve not only as a qualifying condition for access to incentives but also as a monitoring tool to prevent misuse. These findings suggest that geographically targeted incentives can enhance regional development if implemented with precision, duration, and social sensitivity.

Conversely, companies worldwide are pursuing innovative financial and tax strategies to maximise their competitive advantages. They exploit the prices of their intra-company transactions by reallocating costs to high-tax countries with the objective of achieving tax reductions in those countries. In addition to the phenomena of taxation, tax pressure, and tax evasion, there is an increasing concealment of illicit money by making it appear to have been obtained from legitimate sources. These practices have serious consequences for public revenues, distributive justice, and market competition, and they also contribute to the growth of the shadow economy (Ofoeda et al., 2023; Șargu et al., 2023; Zucman, 2015).

2.2. Mechanisms and Theoretical Foundations of the Base Erosion

The digital economy provides fertile ground for companies to engage in financial crimes such as money laundering and tax evasion. Profit shifting and base erosion practices are commonly adopted, which encourage the transfer of capital to a location other than that of the company. The process by which firms shift their profits is characterised by transaction manipulation, including transfer pricing, debt financing, research and development credits, royalty payments, and investments in intangible assets (Barrios & D’Andria, 2020; Friedrich & Tepperova, 2021; Latulippe et al., 2023).

The analysis of profit transfer and base erosion is frequently approached from the vantage point of tax avoidance theory. This theoretical framework posits that corporate entities will endeavor to mitigate their tax obligations by strategically transferring profits to nations with more favorable tax rates (Desai et al., 2006). The elimination of profit shifting has the additional benefit of increasing tax revenues, which in turn has a positive impact on welfare and activates the circular flow of the economy (Álvarez Martínez et al., 2022; Romano et al., 2021).

2.3. Proposals for a Solution to the Problem of Base Erosion

Enhancing transparency regarding the global allocation of income, economic activity, and taxes paid across jurisdictions is widely recognised as a key step toward fostering more sustainable corporate tax behavior (Cho, 2020). In this context, scholars have emphasised the need for systemic and structural reforms to address the underlying causes of tax base erosion and profit shifting (Devereux & Vella, 2014; Noonan & Plekhanova, 2023). As a result, recent studies have sought to assess the extent of tax evasion and to develop more effective mechanisms for detecting and managing transaction manipulation.

One of the most promising strategies involves the implementation of a unified, data-driven framework for monitoring financial crime on a global scale (Rowley, 2024). By analysing tax-related data and consumption records, authorities can more accurately identify cases of business fraud and tax base erosion. This analytical capability enables more comprehensive and streamlined oversight of both credit and financial operations, serving as a stronger deterrent to practices such as credit corruption (Su & Xu, 2023).

The integration of financial technology (fintech) plays a critical role in these efforts. Fintech innovations can expand firms’ access to diverse financing channels and accelerate capital approval processes, thereby easing financing constraints and reducing reliance on debt. This, in turn, enhances business productivity and strengthens market competitiveness (Lai et al., 2023).

To fully realise the potential of fintech, it is recommended that banks digitally restructure their internal control and risk management systems. Such restructuring can help optimise the use of intelligent technologies to better detect irregularities and mitigate financial misconduct (Su & Xu, 2023). Moreover, the adoption of artificial intelligence in fintech applications has been shown to positively influence user perceptions of support, satisfaction, and continued engagement in digital banking platforms (Lin & Lee, 2023).

Finally, the broader development of financial technology contributes to lowering credit costs for firms by alleviating external financing barriers and intensifying internal competition within the banking sector (Chen et al., 2023). These advances collectively provide a robust foundation for more accountable, transparent, and efficient financial systems, which are essential to tackling the persistent challenge of base erosion.

2.4. Technology, Data Analysis, and Detection Tools

The nature of the digital economy has enabled illicit financial behavior, including money laundering and tax evasion, through opaque and decentralised systems. However, financial technology (fintech) also provides tools that enhance transparency and regulatory oversight. Digital analysis of corporate expenditures and investments supports improved internal control systems, risk management, and cost allocation. These technologies improve the geographic traceability of income and assets and support real-time monitoring for tax compliance.

To detect base erosion and profit shifting (BEPS), researchers have developed a variety of analytical tools and indicators. Brada and Buus (2009) developed a Tax Evasion Rate index with the objective of estimating the potential for tax evasion through intra-company transactions. The index was tested for appropriateness by Friedrich and Tepperova (2021), who revealed that the reliability of the TER index results is contingent upon the corroboration of other methods. In their study, Moravec et al. (2019) employed income tax efficiency ratios to compare and estimate the revenue loss from corporate taxes across EU member states. Legenzova et al. (2017) employ data to estimate the impact of BEPS countermeasures at the financial group level and conclude that the effect of the countermeasures was not significant. Popescu (2020) employs secondary data from OECD reports to conclude, through statistical treatment, that the existence of legal requirements favors income transfer to jurisdictions that offer favorable taxation of intellectual property rights and other intangible assets, the estimation of which is challenging. In order to address the issues that have arisen from base erosion, it is recommended that regulators utilise risk monitoring indicators as a tool when carrying out their supervisory duties in the banking and financial technology sector (Cheng & Qu, 2020). These approaches underscore the significance of integrating technology and economic modeling to enhance the detection and mitigation of tax avoidance behaviors (Lin & Lee, 2023; Su & Xu, 2023).

2.5. International Regulation, Empirical Findings, and Financial Impact

A significant number of companies engage in the manipulation of their transactions with the objective of shifting their profits to countries with lower tax rates. This practice, which is known as profit shifting, has been identified as a key factor contributing to the erosion of government revenues (Dharmapala, 2014; Gill et al., 2024). In the fight against international tax avoidance, the OECD and the Group of Twenty (G20) have launched a plan with 15 actions to erode the tax base and shift profits (BEPS) (OECD, 2013). The proposed policies encompass a range of measures intended to enhance the regulatory framework across borders, address the practice of profit shifting through the exercise of pricing discretion, and strengthen the monitoring of corporate finance through international cooperation and the implementation of regulatory controls. However, the presence of a legislative gap in certain countries, along with national mismatches, imperfections in the rules, weaknesses within and across systems, and non-binding instruments, serves to reinforce profit shifting practices (Botha et al., 2023; Eukeria & Mpofu, 2024; Hernández González-Barreda, 2023; Matsuoka, 2018).

Empirical studies further demonstrate the uneven regional impacts of such measures. In China, the implementation of value-added tax (VAT) reform in the northeastern provinces has been observed to have a positive effect on investment. However, this reform has frequently fallen short in terms of enhancing productivity. This is primarily due to the opportunistic exploitation of regional incentives by firms without a concomitant emphasis on substantive innovation (Zhao et al., 2024). In the European Union, profit shifting frequently occurs through the movement of operational revenues and expenses (Nerudova et al., 2020). As indicated by Nerudova et al. (2020) and Legenzova et al. (2017), micro-level analysis is imperative in comprehending these behaviors and adapting policy accordingly.

The prevalence of financial statement fraud has a considerable detrimental effect on the overall economic development of countries. The effective utilisation of financial resources is an essential component in the acceleration of economic growth and the stabilisation of the economy, and necessitates the input of institutions (Arthur et al., 2024). The implementation of loan guarantee schemes by governments can facilitate the provision of liquidity to distressed financial markets, thereby stimulating economic activity. Nevertheless, these schemes can also result in the government being exposed to considerable credit risks (Andrew Austin & Levit, 2011). The supervision of credit operations may prove an effective means of preventing this outcome.

The extant literature confirms that tax evasion and profit shifting are complex phenomena that require multidimensional and coordinated responses. A range of effective responses have been identified, including legislative harmonisation, international cooperation, the use of technological tools, and the application of empirical models for policy-making. An evidence-based approach and international synergy are critical not only for closing legal gaps, but also for restoring fiscal fairness, strengthening public finance, and stabilising macroeconomic fundamentals.

The digital analysis of expenditure and investment, as considered in this study, facilitates the efficiency of corporate investment through the application of fair funding rules. The presented evidence lends support to the assertion that technologies found upon novel financial service models serve to enhance financial activities. The proposed model facilitates the digital and smart transformation of internal controls and risk management through expense allocation analysis, thereby enhancing company locality. It functions as an indicator for monitoring the risk of tax evasion through localisation, employing the probability of such evasion as a criterion for monitoring tax, credit, and financial operations.

3. Methodology

3.1. Description of the Expenses Localness Indicators Model

The Expenses Localness Indicators (ELI) model has been defined in Parastatidou and Chatzis (2025) and gives valid and reliable measures of localness for companies or any other financial entity. The Indicators are calculated by recursive mathematical equations, which use as data the expenses paid to other financial entities and their localnesses. All indicators express localness as a percentage, taking values from 0% (non-local) to 100% (fully-local). The definition of Localness Indicators is given by the following Equation:

where N is the number of entities that are paid by the company, j is the index that shows the entity, t is the time period for which the Localness Indicator is calculated, T is the number of the previous time periods that will be taken into account, y is the index that shows the previous time periods from to , is the sum of expenses paid to the entity j during the time period y, is the Localness Indicator of the entity j for the time period y, and is the weight factor for the time period y.

The ELI values change over time periods, and in Parastatidou and Chatzis (2025), proper weights () are used to ensure smooth changes over time. In this study, however, sharp changes are desirable since the values of indicators will be used as alerts for possible frauds. Thus, is set to 1, and all the other weights are set to 0. Now, the values of the Indicators are only dependent on the data from the previous time period (), and Equation (1) is simplified as follows:

The ELI model defines three levels of localness: region, state/country, and union. In this study, it is applied to detect base erosion or profit shifting tactics, which are usually carried out by shifting expenses from the company’s base to other countries (state level of localness) or to other regions of the same country (region level of localness). There are no significant differences between these two cases, and for simplicity reasons, it has been decided to analyse only the regional level. Moreover, sharp changes are desirable, so similar to Equation (2), the region-level Localness Indicator is given by the following:

where symbolise the same as in Equation (1), R declares the region-level Localness Indicator, r is the index that defines a certain region taking all the possible values, and is the value of the region-level Localness Indicator for the entity j in time period in region r.

Since Equation (3) is recursive, at the start of the implementation of the ELI model, the needed values of regional locality for the previous year are not available. So, for the initial time period (), only the physical address of a company is used to define its localness, and will be given by Equation (4):

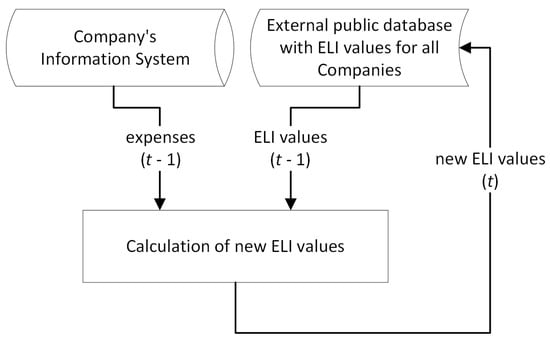

Figure 1 shows a diagram where the calculation process of ELI values is presented. This process uses the expenses coming from the company’s information system and the ELI values of the corresponding cooperating companies which are publicly available. The calculation uses Equation (3), and the new ELI values are announced and sent back in the external public database.

Figure 1.

Schematic illustration of the ELI value calculation process.

3.2. Simulation of Virtual Economic Environment

The next step is to simulate a virtual economic environment from which synthetic data will be generated. This synthetic data records the interconnection of financial entities through expenses and will be used in analytical experiments that will reveal how the ELI model is applied for the assessment of base erosion tactics. It is assumed that there are N active financial entities in the economic environment, each located in one of the R regions of a country. Each financial entity is identified by the index and each region by the index . The distribution of financial entities across regions is uniform so that each region contains approximately the same number of financial entities.

For each time period (t), each financial entity (n) incurs expenses to E other entities (E < N). The amount of each expense sums up all payments of entity n for the time period t to another entity j. These expense values follow a lognormal distribution which is typically employed in economic analyses and ensures that the values will be positive and that high values are less probable than low values. Another important parameter that determines the behaviour of any entity n in the economic environment is the threshold that defines the percentage of expenses spent on other entities located within the region of n. This threshold determines how local the entities operate in the given environment.

4. Experiments, Results, and Discussion

4.1. Description of Experiments

The simulation creates two virtual economic worlds to examine how the Expenses Localness Indicators (ELI) model works. In these environments, financial entities make expenditures to other entities, and the ELI measures how much of these payments are directed to local companies. In this way, it assesses whether a company is making a substantial contribution to the local economy or merely displaying a virtual local presence. The simulation highlights changes in company behaviour and confirms that the indicator can reveal misleading practices. It is a powerful tool for testing the model without the need to access sensitive real data and helps to shape policies that foster authentic local development.

The economic environment under consideration in the following example is a country divided into regions. The total number of financial entities operating in the country is (100 in each region). The number of cooperating entities to which each entity pays money is (same for all entities). Although the above values are small compared to reality, they are able to demonstrate how the ELI model can be used to detect base erosion without excessively increasing the computational requirements.

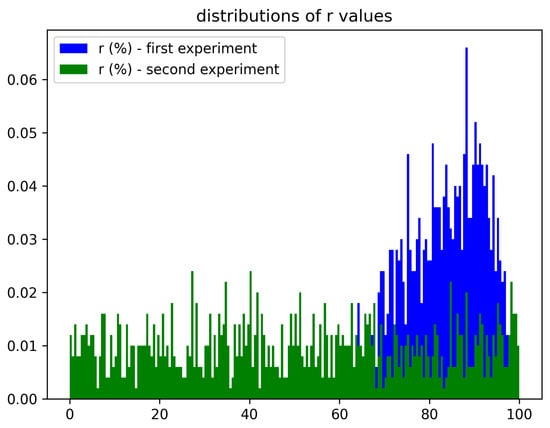

In the first experiment, the thresholds for 70% of the financial entities are chosen in such a way as to create a very local economic environment. Each one of these entities will choose to pay a large percentage of its supplies and services to partner entities located in the same region. The values of are percentages, and if a company n has a value of , for example, it means that this entity pays 80% of its expenses to other entities located in the same region. These values for all entities are randomly coming from a triangular distribution with lower limit , upper limit , and mode . An example of such a distribution in shown in blue in Figure 2. Based on the limits chosen, a financial entity is more likely to spend more in its own region than in other regions. The remaining expenses are paid randomly to other entities located to other regions. The remaining 30% of the financial entities obtain values of from the same distribution, but they choose to pay these expenses to entities from another random region.

Figure 2.

Example of distributions for the values of thresholds , .

In the second experiment, the chosen thresholds create a less, but still quite local, economic environment. The values of are now randomly drawn from a uniform distribution with a lower limit of 0 and an upper limit of 100, as shown in green in Figure 2. On average, 70% of the entities pay 50% of their expenses to other entities in the same region, and the remaining expenses are paid randomly to other entities located in other regions. For the remaining 30% of the entities, they pay 50% of their expenses to other entities in another region, and the remaining expenses are paid randomly to other entities located in other or in the same region of n.

The changes in the distribution parameters affect the creation of the virtual economic worlds used in the two experiments. More specifically, depending on the application of a normal or triangular distribution, the population of companies that follow specific partner selection behaviours based on locality is affected. The important thing is to create virtual worlds where there are companies that operate taking into account the locality criterion and others that do not so that the new companies created in the experiment can implement their own strategy.

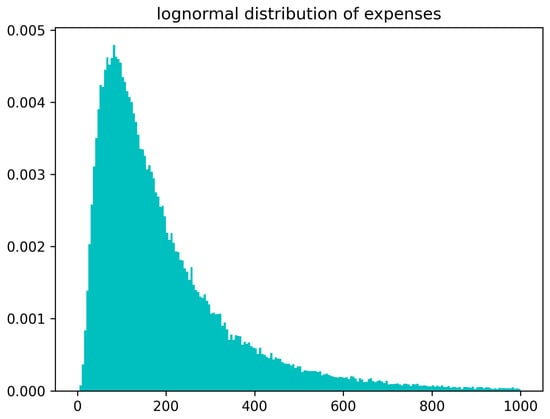

After the random selection of the thresholds, the list of expenses should be simulated for each financial entity. We assume that for each time period, each entity incurs expenses on other entities. The amount of each expense summarises all payments of the current time period to that entity. These expense values will be derived from a lognormal distribution that is commonly used in economic analysis and ensures that, on the one hand, the values will be positive and, on the other hand, that high values will be less likely. The logarithmic parameters chosen are the mean of the underlying normal distribution () and the standard deviation of the underlying normal distribution (), which give a mean value for the logarithmic distribution of approximately 200. Therefore, the sum of expenses per year for each economic entity will be approximately 20,000. These numbers can be considered to express any monetary unit. An example of such a distribution of expenses is shown in Figure 3.

Figure 3.

Example of a lognormal distribution for the values of expenses.

Then, for each entity , each expense is matched to a paid entity. First, expenses are paid to random entities that are in the same region of n, until the sum of the expenses reaches the threshold . Then, the remaining expenses are paid to random entities that are not in the same region of n. Note that the thresholds values may vary from one financial entity to another and follow the distributions shown in Figure 2 for the two experiments.

4.2. Results

For both experiments, the initial locality values are calculated using the Equations (3) and (4). After the calculations, all entities have locality values for all regions. Typical examples of the values of localities for some entities are given in Table 1.

Table 1.

The locality values of various financial entities, for all regions, for , for both experiments (1: triangular (60, 90, 100) 2: uniform (0, 100).

Entities 5, 135, 733, and 570 are presented for the first experiment. Entity 5, located in region 1, has a locality value of 93.7% for its own region and much lower locality values for the other regions. Entities 135 and 733, located in regions 2 and 8, respectively, also act locally, as they have high locality values (81.6% and 74.3%) for their own regions. These three entities belong to the 70% that act locally. However, entity 570, which belongs to the remaining 30%, does not spend in its own region but mainly in region 9, with a value of 80.9%.

Entities 307, 602, 772, and 959 are presented for the second experiment, where entities act less locally. The first three belong to the 70% that try to act more locally, and entity 959 belongs to the remaining 30%. Entity 307 is located in region 4 and has a locality value of 48.6% for its own region. Entity 602 is located in region 7 and has a locality value of 14.3% for its own region, but acts more locally for region 1 () and for region 9 (). Entity 772 located in region 8 acts very locally (). Finally, entity 959 acts more locally for region 2 () than for its own region 10 ().

The mean and the standard deviation of the values of are presented in Table 2. These statistics are derived from the values of the localities of all financial entities only in their own region, and express how much the entities as a whole act locally in their own region. In the first experiment, 70% of the entities act locally according to the triangular distribution of Figure 2 (in blue), and thus, the mean is 84.0%. The remaining 30% of the entities do not act locally, and their mean is 2.4%. The mean for all entities in the first experiment is 59.4%. The second experiment simulates a less local environment. Also, 70% of the entities act locally according to the uniform distribution of Figure 2 (in green), and thus, the mean is 49.8%. The remaining 30% of the entities do not act locally, and their mean is 5.9%. The mean for all entities in the second experiment is 36.4%.

Table 2.

The mean and standard deviation (stdev) of the values of on their own region for all financial entities, and separately for the 70% of local and the 30% of non-local entities, for the two experiments (1: triangular (60, 90, 100) 2: uniform (0, 100).

We then assume that in one of these regions (i.e., region 1), certain incentives are announced for operating companies, such as reduced taxation, funding for research and development, interest rate subsidies, exemptions from obligations, etc. To benefit from these incentives, 60 new companies will be set up in region 1. We will divide the companies into six groups of 10 (from Group A to Group F), and each group will adopt a specific behaviour in terms of the choice of personnel, suppliers, and, in general, entities to whom it will pay expenses.

In Group A, companies pay 90% of their expenses to entities from the same region (region 1), and these entities are selected to have a locality in region 1 greater than 70%. The remaining 10% of the expenses is paid to entities located outside their regions, but these entities are also selected to have a locality in region 1 greater than 70%. Thus, companies in Group A choose to cooperate to a very large extent with entities in the same region, and in fact, they choose their partners on the basis of a high value (>70%) in their ELI.

In Group B, companies pay 90% of their expenses to random entities from the same region (region 1), without a criterion regarding their locality. The remaining 10% of the expenses is randomly paid to entities located in other regions. Thus, companies in Group B choose to cooperate to a very large extent with entities located in the same region, without applying any other criterion.

In Group C, companies pay 90% of their expenses to entities from the same region (region 1), and these entities are also selected to have a locality in region 1 less than 30%. The remaining 10% of the expenses is paid to entities located in other regions, but these entities are also selected to have a locality in region 1 less than 30%. Although companies in Group C choose to cooperate to a very large extent with entities in the same region, in fact, they choose their partners on the basis of a low value (<30%) in their ELI.

In Group D, companies pay 50% of their expenses to entities from the same region (region 1), and these entities are selected to have a locality in region 1 greater than 70%. The remaining 50% of the expenses is paid to entities located outside their regions, but these entities are also selected to have a locality in region 1 greater than 70%. Thus, companies in Group D choose to cooperate moderately with entities located in the same region, but in fact, they choose all their partners on the basis of a high value (>70%) in their ELI.

In Group E, companies pay 50% of their expenses to random entities from the same region (region 1), without a criterion regarding their locality. The remaining 50% of the expenses is randomly paid to entities located in other regions. Thus, companies in Group E choose to cooperate moderately with entities located in the same region, without applying any other criterion.

In Group F, companies pay 50% of their expenses to entities from the same region (region 1), and these entities are also selected to have a locality in region 1 less than 30%. The remaining 10% of the expenses is paid to entities located in other regions, but these entities are also selected to have a locality in region 1 less than 30%. Although companies in Group F choose to cooperate moderately with entities located in the same region, in fact, they choose their partners on the basis of a low value (<30%) in their ELI.

The operation of the above companies is simulated by creating expenses paid to other entities, and distributing them appropriately according to the above parameters. Then, after one time period (), the localness of each company for region 1 is calculated according to the ELI model. The two experiments are carried out by applying this process to the first (more local) and the second (less local) economic environments.

The localness values for region 1 are calculated using Equation (3). Table 3 summarises statistics (mean, min and max) of the values per group (Groups A–F), for both experiments.

Table 3.

The mean, min, and max of the values for region 1, for companies belonging in Groups A to F, for the two experiments (1: triangular (60, 90, 100) 2: uniform (0, 100).

4.3. Discussion

We first compare Groups B and E using the results from Table 3. In Groups B and E, newly created companies do not use the values of localness indicator as a criterion for selecting partners (suppliers, employees, etc.) but only their headquarters.

In the environment of Experiment 1, entities generally act largely on the basis of the location of their partners, in a percentage resulting from the triangular distribution shown in Figure 2 in blue (60–100%). In this environment, new companies in Group B act even more locally, selecting 90% of their partners from their region, while companies in Group E act less locally, selecting 50% of their partners from their region. Thus, the average localness for Group B is calculated at 72.3%, while for Group E, it is calculated at 54.8%, which clearly reflects this different choice of partners.

In the environment of Experiment 2, entities generally act based on the location of their partners to a moderate extent, with a percentage resulting from the uniform distribution shown in Figure 2 in green (0–100%). In this environment, the new companies of Groups B and E have localness values of 53.3% and 41.2% respectively, again reflecting the different choice of partners.

Comparing the results between the two different environments, we see that there is a decrease in the localness value for Group B from 72.3% to 53.3% and for Group E from 54.8% to 41.2%. These decreases are generally due to the lower localness values for all companies in the environment of Experiment 1 compared to the environment of Experiment 2.

Next, the companies in Groups A and D are studied, where the criterion for selecting partners is not only the location, but also the localness value of the collaborating entities, which must be greater than 70%. These companies operate more locally than the others, which is reflected in the results of the localness indicators as presented below.

In the environment of Experiment 1, the average localness values are 87.9% for Group A and 65.7% for Group D, significantly increased compared to the corresponding values of Groups B (72.3%) and E (54.8%). Similarly, in the environment of Experiment 2, the average localness values are 85.9% for Group A and 64.0% for Group D, significantly increased compared to the corresponding values of Groups B (53.3%) and E (41.2%).

It is worth emphasising that since the application of the localness value criterion, the influence of the environment has been significantly reduced, as the values of Group A (87.9% and 85.9%) and Group D (65.7% and 64.0%) are now almost independent of the environment.

We then look at the companies in Groups C and F, where the criterion for selecting partners is not only the location, but also the localness value of the collaborating entities, which must be less than 30%. These companies operate less locally than all the others, which is reflected in the results of the localness indicators as presented below.

In the environment of Experiment 1, the average localness values are 15.1% for Group C and 11.2% for Group F, significantly reduced compared to the corresponding values of Groups B (72.3%) and E (54.8%). Similarly, in the environment of Experiment 2, the average localness values are 31.4% for Group C and 23.3% for Group F, significantly reduced compared to the corresponding values of Groups B (53.3%) and E (41.2%).

Here, it is observed that localness values for region 1 are greater in environment 2 than in environment 1. This is due to the fact that in environment 2, there is a greater probability of finding companies with localities close to 30% because the distribution is uniform.

According to the results, it can be concluded that the selection of partners based on their location affects the value of localness indicator. However, the selection based on the value of localness is a stronger criterion. Companies that choose to operate more locally and use a high localness value as a criterion for their cooperation with other entities maintain a high localness indicator regardless of the environment. Companies that, although they are based in a region, choose to cooperate with companies outside this region or with companies that have a low localness values for the region receive low localness scores.

The value of the ELI represents a distribution of values proportional to the behaviour of the company. In this way, the localness indicator can measure the actual participation of the company in the economy of a region, and on the basis of this indicator a company can receive the corresponding quota of tax exemptions or development incentives.

Theoretically, the paper provides additional support for the extant literature linking firm location to the effectiveness of public aid. The study proposes an innovative approach to assessing the authenticity of business localness (Bobenič Hintošová et al., 2021; Parilla & Liu, 2018). Moreover, it integrates and extends the theoretical debate around the tax base erosion strategy (BEPS), linking it to the implications for territorial equity and incentive allocation. Given that the primary objective of some firms is to maximise the absorption of tax incentives without concomitantly generating value-added, a phenomenon known as "moral hazard" arises, as does the misallocation of resources. It is incumbent upon states to provide guidance to firms, steering them away from illicit innovative practices. Targeted design and oversight in the provision of tax incentives will prevent incentives from turning into passive survival mechanisms (Zhao et al., 2024). The research provides a novel analytical framework, through the localness indicator, that can be utilised in future empirical studies to assess regional business integration (Noonan & Plekhanova, 2023).

On a practical level, the study proposes a methodologically sound assessment tool that can support policy decisions on the granting of tax incentives, subsidies, or other financial incentives (Chen et al., 2023; Lin & Lee, 2023; Su & Xu, 2023). The proposed Expenses Localness indicator has the capacity to accurately measure a company’s genuine economic contribution to a local community while also preventing the undesirable practice of abusive relocation. This indicator functions independently of other methods, thereby eliminating the necessity for external validation (Friedrich & Tepperova, 2021). Concurrently, it furnishes public authorities with a dependable instrument for the supervision of the efficacy of regional interventions, thereby augmenting transparency and efficiency in the administration of development resources (Arthur et al., 2024).

It is recommended that public authorities consider incorporating the ELI score into existing audit frameworks, with a view to use this tool to assess the substantial local contribution of companies. The use of the indicator can be applied both in the approval of public aid and in the context of fiscal or administrative controls, identifying cases of companies that maintain a formal but not real presence in a region. For example, if ELI values fall below a threshold (e.g., 20%) or suffer a sharp annual decline, in particular when accompanied by high turnover in assisted areas, an alert for further investigation may arise. An alternative approach could involve applying a factor to the funding of companies from subsidised programs with the ELI index determining the funding rate. For example, if a company’s ELI is 70%, this would be the funding rate, while the remaining 30% would have to be covered by the company’s own funds. Such a system could act as an incentive to strengthen their local activity. The incorporation of these thresholds would serve to enhance transparency, prevent abusive practices, and improve the effectiveness of public policy in the field of investment and aid.

5. Conclusions

The present paper puts forth a novel, digitally recorded indicator for the quantitative evaluation of the degree of local business integration in specific geographical areas. Through the evaluation of each company’s network of partnerships and suppliers, a localness indicator is developed on a scale of 0–100%. This indicator reflects the genuine presence and contribution of the company to the local economy. The indicator is derived by taking into account payments to any partner companies and their localness. This process forms an impact factor that reveals the depth of regional integration. The study further posits that the location of a company should not be considered as the only criterion for access to aid, but also a control tool is needed to prevent irregularities and abusive practices. The authenticity of local presence is a fundamental prerequisite for the effectiveness, transparency, and fairness of regional policies. In this context, the phenomenon of base erosion, which refers to the strategies that some companies implement in order to exploit differences between tax, incentives, or subsidies, is of particular importance. By virtually transferring their headquarters or accounting activities, companies effectively reduce their tax burden and gain unfair advantages from subsidies, credits, or other incentives designed to support specific regions. While such practices may offer temporary benefits to the companies involved, they have serious implications for states, causing a loss of tax revenue and limiting the ability to fund public services and development programmes. The ELI model used in this paper has the potential to contribute both to equity and legitimacy into economic systems.

The findings of the survey conducted by applying the ELI model to simulated synthetic data show a reliable means of determining whether the allocation of spending on materials, services, human resources, and other areas corresponds to the stated geographic location of the company. At the same time, potential irregularities are identified, including significant spending in areas outside the headquarters, which may be indicative of misstatements or even fraud. It also examines whether a company is entitled to financial incentives based on its actual local contribution. Through this process, the ELI model turns the analysis of financial data into an essential transparency and evaluation tool that helps to identify misleading business practices, allocate public resources more fairly, and increase confidence in control mechanisms.

The proposed model provides a transparent and reliable mechanism for documenting the performance of regional development incentives, such as tax breaks or public subsidies, based on the actual contribution of each firm to the local economy. Furthermore, the indicator can be utilised by policymakers to evaluate the efficacy of regional interventions, facilitating the development of more targeted and equitable policies.

Further use of the ELI model can be a starting point for exploring the relationship between environmental, social, and governance (ESG) criteria and the promotion of equitable relations and sustainable development through the empowerment of local suppliers. Strategic selection of local suppliers may substantially enhance both the sustainability and social impact of firms, which is worth studying empirically. Moreover, future research can examine how financial technology (fintech) companies implementing the ELI model contribute to promoting socially responsible investment. This field offers the potential to formulate a new paradigm of investment strategy based on transparency, technological innovation, and social sensitivity.

The application of the ELI model to real data necessitates the incorporation of specific elements that facilitate the transition from theoretical design to operational practice. Practical guidance in this direction includes the identification of the minimum requirements in terms of input data, such as the geographical location of partners, the amounts of expenditure, and their temporal distribution. These can be extracted from the information or accounting systems of enterprises. The computational complexity of this process is subject to variation between businesses and is dependent on two principal factors: the number of transacting entities and the depth of the historical record. The implementation flow is indicative of this and comprises firstly the cleansing of the data, followed by the calculation of the locality levels and finally the extraction of the ELI values on an annual basis. The incorporation of these elements will enable the model to be applied in real-world settings, enhancing its reliability and usefulness in the professional domain.

This study can be further extended by empirically applying the Expenses Localness Indicator in different geographical and institutional contexts to assess its reliability and practical value. It is further recommended to use it as a tool for development policy formulation and risk assessment. Finally, the study of companies’ behaviour towards local integration can provide additional information for the formulation of more targeted regional policies.

Author Contributions

Conceptualisation, methodology, validation, and formal analysis, G.P. and V.C.; writing—original draft preparation, G.P.; writing—review and editing, V.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| BEPS | Base Erosion and Profit Shifting |

| ELI | Expenses Localness Indicators |

| ESG | Environmental, Social, and Governance |

| EU | European Union |

| OECD | Organisation for Economic Co-operation and Development |

References

- Alecke, B., & Mitze, T. (2023). Institutional reforms and the employment effects of spatially targeted investment grants: The case of Germany’s GRW. arXiv, arXiv:2302.11376. [Google Scholar]

- Amankwaah, E., Mensah, N., & Baidoo, N. O. (2022). The impact of location tax incentives on the growth of rural economy: Evidence from Ghana. Future Business Journal, 8, 54. [Google Scholar] [CrossRef]

- Andrew Austin, D., & Levit, M. R. (2011). The federal budget: Current and upcoming issues. Congressional Research Service, Library of Congress. [Google Scholar]

- Arthur, K. K., Asongu, S. A., Darko, P., Ansah, M. O., Adom, S., & Hlortu, O. (2024). Financial crimes in Africa and economic growth: Implications for achieving sustainable development goals (SDGs). Journal of Economic Surveys, 39(3), 1212–1251. [Google Scholar] [CrossRef]

- Álvarez Martínez, M. T., Barrios, S., d’Andria, D., Gesualdo, M., Nicodeme, G., & Pycroft, J. (2022). How large is the corporate tax base erosion and profit shifting? A general equilibrium approach. Economic Systems Research, 34(2), 167–198. [Google Scholar] [CrossRef]

- Barrios, S., & D’Andria, D. (2020). Profit shifting and industrial heterogeneity. CESifo Economic Studies, 66(2), 134–156. [Google Scholar] [CrossRef]

- Bobenič Hintošová, A., Sudzina, F., & Barlašová, T. (2021). Direct and indirect effects of investment incentives in Slovakia. Journal of Risk and Financial Management, 14(2), 56. [Google Scholar] [CrossRef]

- Botha, C., Ramfol, R., & Swart, O. (2023). The impact of multilateral and unilateral measures on profit-shifting from South Africa to Mauritius. Intertax, 51(3), 232–249. [Google Scholar] [CrossRef]

- Brada, J., & Buus, T. (2009). Detection of possible tax-evasive transfer pricing in multinational enterprises. European Financial and Accounting Journal, 4(2), 65–78. [Google Scholar] [CrossRef]

- Chen, W., Wu, W., & Zhang, T. (2023). Fintech development, firm digitalization, and bank loan pricing. Journal of Behavioral and Experimental Finance, 39, 100838. [Google Scholar] [CrossRef]

- Cheng, M., & Qu, Y. (2020). Does bank fintech reduce credit risk? Evidence from China. Pacific Basin Finance Journal, 63, 101398. [Google Scholar] [CrossRef]

- Cho, H. (2020). Sustainable tax behavior of mnes: Effect of international tax law reform. Sustainability, 12(18), 7738. [Google Scholar] [CrossRef]

- Desai, M. A., Foley, C. F., & Hines, J. R., Jr. (2006). The demand for tax haven operations. Journal of Public Economics, 90(3), 513–531. [Google Scholar] [CrossRef]

- Devereux, M. P., & Vella, J. (2014). Are we heading towards a corporate tax system fit for the 21st century? Fiscal Studies, 35(4), 449–475. [Google Scholar] [CrossRef]

- Dharmapala, D. (2014). What do we know about base erosion and profit shifting? A review of the empirical literature. Fiscal Studies, 35(4), 421–448. [Google Scholar] [CrossRef]

- Eukeria, W., & Mpofu, F. Y. (2024). Manipulation of transfer pricing rules by multinational enterprises in developing countries: The challenges and solutions. Journal of Tax Reform, 10(1), 181–207. [Google Scholar] [CrossRef]

- Friedrich, M., & Tepperova, J. (2021). Identification of base erosion and profit shifting using tax evasion rate. Society and Economy, 43(1), 75–92. [Google Scholar] [CrossRef]

- Gill, S., Arora, T. S., & Gandhi, K. (2024). Tax rate motivated profit shifting and base erosion by multinational corporations: Indian evidence. International Journal of Emerging Markets, 19(8), 2152–2178. [Google Scholar] [CrossRef]

- Hernández González-Barreda, P. A. (2023). The anti-avoidance rule regarding permanent establishments in third countries of the OECD/G20 base erosion and profit shifting project: Is it necessary? Bulletin for International Taxation, 77(5), 188–201. [Google Scholar] [CrossRef]

- Lai, X., Yue, S., Guo, C., & Zhang, X. (2023). Does fintech reduce corporate excess leverage? Evidence from China. Economic Analysis and Policy, 77, 281–299. [Google Scholar] [CrossRef]

- Latulippe, L., Ally, C., & Gosselin, J. S. (2023). The revised case of ip regimes under the globe rules: A canadian perspective. Canadian Tax Journal, 71(1), 159–188. [Google Scholar] [CrossRef]

- Legenzova, R., Levišauskaite, K., & Kundelis, E. (2017). Estimating an impact of base erosion and profit shifting (BEPS) countermeasures—A case of business group. Oeconomia Copernicana, 8(4), 621–642. [Google Scholar] [CrossRef]

- Lin, R.-R., & Lee, J.-C. (2023). The supports provided by artificial intelligence to continuous usage intention of mobile banking: Evidence from China. Aslib Journal of Information Management, 76(2), 293–310. [Google Scholar] [CrossRef]

- Matsuoka, A. (2018). What made base erosion and profit shifting project possible?: Identifying factors for building momentum for reform of international taxation. Journal of Financial Crime, 25(3), 795–810. [Google Scholar] [CrossRef]

- Moravec, L., Rohan, J., & Hinke, J. (2019). Estimation of international tax planning impact on corporate tax gap in the Czech republic. E a M: Ekonomie a Management, 22(1), 157–171. [Google Scholar] [CrossRef]

- Nerudova, D., Solilova, V., Litzman, M., & Janský, P. (2020). International tax planning within the structure of corporate entities owned by the shareholder-individuals through panama papers destinations. Development Policy Review, 38(1), 124–139. [Google Scholar] [CrossRef]

- Noonan, C., & Plekhanova, V. (2023). Mandatory binding dispute resolution in the base erosion and profit shifting (BEPS) two pillar solution. International and Comparative Law Quarterly, 72(2), 437–476. [Google Scholar] [CrossRef]

- OECD. (2013). Addressing base erosion and profit shifting. OECD Publishing. [Google Scholar] [CrossRef]

- OECD. (2023). Best practices in investment promotion: An overview of regional state aid and special economic zones in Europe (Number 27). OECD Publishing. [Google Scholar] [CrossRef]

- Ofoeda, I., Tufour, J. K., & Nketia, E. A. (2023). The impact of anti-money laundering regulations on inclusive finance: Evidence from sub-saharan Africa. Cogent Economics and Finance, 11(2), 2235821. [Google Scholar] [CrossRef]

- Parastatidou, G., & Chatzis, V. (2025). Measuring localness in e-commerce using the expenses localness indicators model. Journal of Theoretical and Applied Electronic Commerce Research, 20(2), 67. [Google Scholar] [CrossRef]

- Parilla, J., & Liu, S. (2018). Examining the local value of economic development incentives. Evidence from four U.S. cities. Brookings Institution. Available online: https://www.brookings.edu/articles/examining-the-local-value-of-economic-development-incentives (accessed on 10 May 2025).

- Pinto, S. (2024). Are place-based policies a boon for everyone? Federal Reserve Bank of Richmond, Economic Brief. Available online: https://www.richmondfed.org/publications/research/economic_brief/2024/eb_24-07 (accessed on 10 May 2025).

- Popescu, C. R. G. (2020). Sustainability assessment: Does the OECD/G20 inclusive framework for BEPS (base erosion and profit shifting project) put an end to disputes over the recognition and measurement of intellectual capital? Sustainability, 12(23), 10004. [Google Scholar] [CrossRef]

- Romano, D., Rocchi, B., Sadiddin, A., Stefani, G., Zucaro, R., & Manganiello, V. (2021). A SAM-based analysis of the economic impact of frauds in the italian wine value chain. Italian Economic Journal, 7(2), 297–321. [Google Scholar] [CrossRef]

- Rowley, C. (2024). Leveraging the legal entity identifier to mitigate the risk of financial crime and enhance fraud prevention in cross-border payments. Journal of Payments Strategy and Systems, 18(1), 39–50. [Google Scholar] [CrossRef]

- Su, F., & Xu, C. (2023). Curbing credit corruption in China: The role of fintech. Journal of Innovation and Knowledge, 8(1), 100292. [Google Scholar] [CrossRef]

- Șargu, N., Valeeva, Y., Timus, A., & Yelesin, E. (2023). Analysis of the estimation and impact methodology of tax evasion for industrial entities (pp. 283–295). Springer Nature. [Google Scholar] [CrossRef]

- Tian, X., & Xu, J. (2022). Do place-based policies promote local innovation and entrepreneurship? Review of Finance, 26(3), 595–635. [Google Scholar] [CrossRef]

- Zhao, M., Xiao, X., Yang, J., & Chen, H. (2024). Do regional tax incentive policies improve productivity? PLoS ONE, 19(8), e0307561. [Google Scholar] [CrossRef]

- Zheng, L., & Pan, F. (2024). Does place-based policy increase new firm births? Evidence from special economic zones in China. Applied Geography, 168, 103303. [Google Scholar] [CrossRef]

- Zucman, G. (2015). The hidden wealth of nations: The scourge of tax havens. The University of Chicago Press. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).