Abstract

This paper explores the impact of the Israel–Palestine conflict on the stock performance of U.S. companies and their public positions on the conflict. In an era where corporate positions on geopolitical issues are increasingly scrutinized, understanding the market implications of such statements is critical. This research aims to capture the complex, non-linear relationships between corporate actions, media coverage, and financial outcomes by integrating traditional statistical techniques with advanced machine learning models. To achieve this, we constructed a novel dataset combining public corporate announcements, media sentiment (including headline and article body tone), and philanthropic activities. Using both classification and regression models, we predicted whether companies had affiliations with Israel and then analyzed how these affiliations, combined with other features, affected their stock returns over a 30-day period. Among the models tested, ensemble learning methods such as stacking and boosting achieved the highest classification accuracy, while a Multi-Layer Perceptron (MLP) model proved most effective in forecasting abnormal stock returns. Our findings highlight the growing relevance of machine learning in financial forecasting, particularly in contexts shaped by geopolitical dynamics and public discourse. By demonstrating how sentiment and corporate stance influence investor behavior, this research offers valuable insights for investors, analysts, and corporate decision-makers navigating sensitive political landscapes.

1. Introduction

The current Israel–Hamas conflict was ignited by a surprise attack on October 7, with thousands of armed Hamas (Islamist militant movement) fighters breaching a border security fence and indiscriminately targeting Israeli civilians and unprepared soldiers (). The conflicts have resulted in heavy casualties and significant strategic and political developments, including a ceasefire and peace negotiations over the years (). The tension significantly affects young people, resulting in heightened levels of mental health issues such as traumatic stress. Factors contributing to this include exposure to violence and destruction, as well as the profound loss of family members and friends among the youth ().

The ongoing conflict had a severe impact on the global economy as well. Researchers have assessed that it has significantly impacted the markets for WTI oil, natural gas, and gold, with the observed increases surpassing those seen during the Russia–Ukraine conflict (). Another study examined the effects of this conflict on the happiness levels of different countries, analyzing 71 indices (). It suggested that countries with higher happiness scores exhibit greater resilience, while markets in Europe, the Middle East, and Africa showed increased vulnerability to the conflict. As evidence of further global contagion, the Dow Jones Global Index was identified as a primary shock transmitter evaluated using intra-day data with 15 min intervals ().

In response to the tragic loss of human life from the conflict, companies have taken various actions igniting substantial discussions among consumers, leading to boycotts against companies based on their stance towards the conflict (). Notably, consumers have shown a tendency to boycott firms that align with Israel, highlighting the importance of corporate positions in times of geopolitical tensions (). Despite this growing scrutiny, prior research has not examined how such public stances by U.S. companies influence their stock performance—an omission this study aims to address. Unlike prior work that broadly connects sentiment to financial outcomes, this research uniquely investigates the financial implications of geopolitical positioning, combining corporate announcements with media sentiment analysis. The study also introduces a novel comparison between traditional statistical approaches and advanced machine learning models to predict both firm affiliations and stock returns.

Our findings reveal that ensemble learning methods such as stacking and boosting outperform traditional logistic regression in classifying firm affiliations, while a Multi-Layer Perceptron model demonstrates the best performance in forecasting stock returns. Moreover, media sentiment, particularly the tone of article titles, was a significant predictor of both corporate affiliations and financial outcomes. These results highlight the importance of incorporating real-time public discourse and machine learning in financial modeling.

The remainder of the paper is organized as follows: Section 2 presents a review of the relevant literature; Section 3 details the dataset and outlines the statistical and machine learning methodologies employed; Section 4 reports the empirical results; and Section 5 concludes with implications for investors, corporate strategists, limitations and future research directions.

2. Literature Review

The onset of the war in Ukraine has had a measurable impact on financial markets, with geographical proximity, both across and within national borders, emerging as a significant factor in the negative performance of equity returns (). This effect is further amplified during periods of heightened conflict, as demonstrated in a study analyzing intra-day movements across diverse financial assets such as bonds, Bitcoin, the U.S. dollar, gold, and equities (). Notably, while these disruptions tend to peak during acute phases of conflict, they gradually subside over time. Understanding these short-term, non-linear dynamics is essential for investors and financial strategists navigating turbulent geopolitical environments, and machine learning has emerged as a vital tool in supporting this effort.

As outlined by (), machine learning is fundamentally discipline-agnostic, designed to perform tasks and improve through experience, a principle that has propelled its application across an array of disciplines from nanotechnology to astrophysics (). The conventional method of leveraging historical data to predict future outcomes is categorized under the supervised learning domain of machine learning. This domain primarily includes two key techniques: regression, which is applied to continuous dependent variables, and classification, designed for categorical dependent variables (). At its essence, machine learning involves non-linear mapping between variables, making it applicable across a broad spectrum of disciplines ().

Machine learning is increasingly being adopted in the financial industry for a variety of applications. Among the most prominent uses are predicting stock market trends and classifying bankruptcy or credit risk (). These methods enable more accurate forecasting and risk assessment, providing valuable insights for investors and financial institutions alike. Various strategies are employed in analyzing the stock market, including the prediction of prices and returns, as well as the extraction and utilization of sentiment related to different financial subjects from public discussions. Public sentiment is a key variable that can help in understanding trends in financial data, especially index and stock returns. Researchers explored the correlation between collective mood states from Twitter feeds and the Dow Jones Industrial Average (DJIA) values, finding that including mood dimensions (positive and negative sentiment) with a Fuzzy Neural Network improved DJIA predictions (). By leveraging Twitter message characteristics to gauge public sentiment towards four technology companies, this approach utilized a decision tree to predict their NASDAQ stock price movements, achieving over 75% accuracy in forecasting whether the stocks would rise or fall for all companies examined (). Including sentiment of relevant topic and measuring the accuracy average over 18 stocks in one year of transactions, a study achieved 2.07% better performance than the model using historical prices using a Support Vector Machine model ().

One of the key techniques applied to improve machine learning algorithms is known as ensemble learning, where we train multiple models and use the average results. With this approach, the prediction accuracy increased significantly when using a combination of an artificial neural network, decision tree, and k-nearest neighbor on the DJIA index (). Numerous scholars have adopted this methodology, and a 2020 study explored the application of different ensemble methods to forecast the performance of the Ghana Stock Exchange (GSE), Johannesburg Stock Exchange (JSE), Bombay Stock Exchange (BSE-SENSEX), and New York Stock Exchange (NYSE) over the period from January 2012 to December 2018. The findings revealed that stacking and blending ensemble strategies yield superior predictive accuracies, ranging between 90% and 100% ().

Historically, the opacity of ML models has presented significant interpretative challenges, particularly within the finance sector where they are often perceived as ‘black boxes’. This notion is a focal point in the discourse on ML explainability in finance, where early efforts to elucidate ML models employed logistic regression methods to assess default risk (). Recent advancements have seen the introduction of more sophisticated models, such as Extreme Gradient Boosted Decision Trees (XG Boost), which have outperformed traditional models in credit risk evaluation and have been explicated through the lens of Shapley values (). These values, which originated in cooperative game theory as a means to quantify the marginal contribution of players within all possible coalitions, provide a robust framework for interpreting ML decisions ().

This study seeks to investigate the use of machine learning techniques in assessing the stock market’s reaction to companies’ responses to the Russia–Ukraine conflict. To this end, we reviewed existing literature on the application of computational intelligence methods in analyzing conflict response. Research conducted across 14 emerging countries, utilizing Support Vector Machines to predict various asset outcomes, indicated that gold prices are influenced by changes in geopolitical risk (). In exploring the nexus between conflicts, finance, and machine learning, researchers have previously applied pre-trained transformer-based natural language processing models to evaluate public emotions concerning the Russia–Ukraine conflict through Twitter data analysis (). Researchers have applied correlation analysis and machine learning-driven regression models to predict the US Dollar index and WTI (oil) following the beginning of the conflict initiated by Russia. They discovered a notable influence of the conflict on these indices and demonstrated that machine learning techniques are effective in forecasting complex interactions ().

Our research focuses on evaluating how U.S. companies’ public positions on the Israel–Palestine conflict influence their stock performance. This research addresses an unexplored area in existing literature by examining the reactions of companies to the Israel–Palestine conflict and the subsequent impact of their decisions. This investigation represents a novel contribution, as no previous studies have focused on this aspect. We aim to compare statistical methods with machine learning models to assess whether a company’s connection to Israel, as inferred from their public statements, can predict stock returns. Moreover, we intend to analyze the sentiment of articles regarding companies’ stances to determine its predictive power on stock performance.

Upon examining the literature, we discovered that several studies have conducted comparisons and determined that machine learning (ML) techniques surpass conventional statistical methods in forecasting and classification tasks in finance applications (; ). Encouraged by these findings, our objective is to assess this assertion within the realm of firms’ stock returns concerning the Israel–Palestine conflict. Additionally, we propose employing ensemble methods to corroborate these results, as they have shown superior performance compared to individual ML models in previous research (). Existing literature also suggests that sentiment analysis can serve as a reliable predictor for financial data (; ). Hence, we plan to leverage sentiment analysis on news articles related to firms and their statements concerning the Israel–Palestine conflict to evaluate its predictive efficacy. In this article, we aim to investigate the following questions:

- How do machine learning models compare to logistic regression in terms of accurately predicting a company’s connections to Israel?

- Which variables play a crucial role in determining the likelihood of a company having Israeli ties?

- Can machine learning algorithms surpass linear regression when it comes to forecasting stock returns?

- Are methods that combine multiple models, such as ensemble techniques, effective for both classification and regression tasks related to this specific issue?

3. Data and Methodology

3.1. Data

Our research analyzes the short-term impact (within 30 days from the onset of the conflict) of various factors on the stock returns of companies. Specifically, we are interested in the influence of a company’s presence in Israel, the timing and nature of their public statements regarding the conflict, the volume and sentiment of related news articles, and their philanthropic efforts towards Israel. The methodologies for collecting and analyzing data relevant to each of these factors are discussed below.

3.1.1. Announcements

The dataset related to company announcements was sourced from the website of Yale School of Management (). Initially, this dataset encompassed a diverse group of 198 companies, spanning various countries globally. We limited our scope to companies that are not only headquartered in the United States but also publicly listed. Through this targeted selection process, we refined our dataset to include 110 distinct observations. This subset of data allows us to concentrate on analyzing the public statements of these U.S.-based, publicly traded companies, providing a more focused scope for our study.

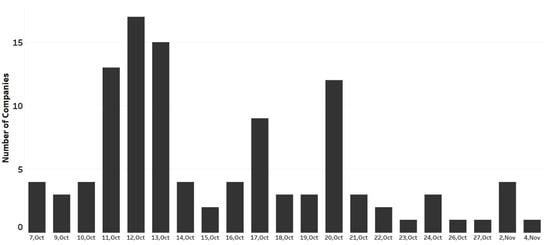

The bar chart in Figure 1 illustrates the distribution of public statements released by the selected 110 U.S. public companies over specific dates in October and November. Each bar represents the number of companies that made a public statement on a given date. The vertical axis denotes the number of companies, while the horizontal axis shows the dates on which the statements were released. An interesting insight is a noticeable peak around the 13th of October, where the highest number of companies (17) released statements, followed by 12th and 11th of the same month. This pattern suggests most companies have reacted within a week of the incident. In our analysis, we adapted the variable to represent the “days since conflict,” quantifying it as the number of days that elapsed from the onset of the conflict to when the announcement was made.

Figure 1.

Distribution of public announcements made by 110 U.S. publicly traded companies in response to the Israel–Palestine conflict, showing the number of statements released per day from early October to November 2023.

The announcements made by the companies were further classified based on the type of statement issued. We have delineated four categories for this variable: ‘Aid’, which denotes announcements of financial donations; ‘Support’, which refers to forms of assistance other than financial; ‘Business Update’, which encompasses neutral statements regarding the impact of the conflict on the company’s operations, including those found in quarterly filings; and ‘Call for Action’, used for statements where companies advocate for serious efforts to condemn and respond to the conflict, either by government officials or by urging organizations and universities to take a stand. Within the scope of our study, which examines 110 companies, the distribution of the types of statements made in response to the conflict is as follows: ‘Support’ accounts for 54 observations, ‘Aid’ comprises 33, ‘Business Update’ includes 17, and ‘Call for Action’ is the category for 6 instances. The methodology is as shown in the figure below.

3.1.2. Stock Returns

We then proceeded to gather the daily stock returns of our target companies. To assess the impact surrounding their announcement dates, we opted for a time frame that extends from five days before to thirty days after these events, encapsulated by the (−5, +30) window. This methodology allows us to closely examine the influence of announcements on the financial performance of companies. Our approach draws inspiration from previous research, which analyzed the impact of the Russia-Ukraine conflict on the European stock markets (). This precedent reinforces the validity of our time window selection for evaluating the announcements’ effects on stock returns.

In the period immediately preceding the announcements (−5, −1), we observed a mean return of −0.22 among the 110 companies under consideration, as shown in Table 1. This period was characterized by substantial negative skewness (−2.72) and high kurtosis (14.11), indicating a tendency toward larger negative returns. A short-term increase in mean return to 0.60 was noticed in the three days leading up to the announcement (−3, −1), with decreased negative skewness (−1.48) and kurtosis (9.97). However, the immediate aftermath showed a decline in mean return (−0.30) between days +1 and +3, with a negative skew and high kurtosis, indicating a persistence of negative returns. This trend of negative returns continues but lessens over the longer term, with a slight positive mean return (0.12) observed from day +1 to +30, although this period also showed extreme negative skewness (−4.26) and the highest kurtosis (32.57), pointing to significant outliers and a distribution with pronounced tails. These varied movements in stock returns suggest that market reactions to company announcements are not uniform and are subject to extreme variations over different time intervals post-announcement.

Table 1.

Summary statistics for daily stock returns from 5 days before to 30 days after public announcements.

In the analysis of the SP500 returns presented in Table 2, segmented by Israel’s involvement and the presence of donations, the data reveals distinct market behaviors across various event windows. The period immediately preceding the event, specifically in the [−5, −1] window, exhibited a significant negative trend across all categories, reflecting a market bracing for adverse events. Interestingly, the market’s response to Israel’s involvement is nuanced; significant negative reactions are more pronounced with companies that do not have ties with Israel, particularly in the [−5, −1], [−3, −1], and [+1, +30] windows.

Table 2.

Cumulative abnormal returns segmented by Israeli affiliations and donation activity. Results show differential market responses based on corporate engagement, with notable negative reactions for firms without Israeli ties.

3.1.3. News Articles

Following the collection of stock return data, we further enriched our dataset by incorporating discussions from news articles that covered the companies and their positions. News articles were sourced using the GNews library in the 3.8 version of Python, which interfaces with Google News to aggregate recent articles from diverse global media outlets. Data collection covered a time window from 5 days before to 30 days after the onset of the Israel conflict (1 October 2023), using keyword queries that combined company names with “Israel” (e.g., “Starbucks AND Israel”) to focus on conflict-related coverage, with a maximum of 10,000 results per search. While this approach enabled broad access, it may reflect algorithmic biases inherent to Google News, such as regional or editorial preferences. The number of articles retrieved varied by company, with publication date and source metadata retained for subsequent analysis. This comprehensive review allowed us to assess the public and media perception of each company over an extended period. The rationale behind integrating news article analysis stems from findings highlighted in our literature review, where researchers have demonstrated that information disseminated through news articles serves as a reliable indicator of stock price movements (; ). This correlation suggests that the sentiment and frequency of news coverage can significantly influence investor perceptions and, consequently, the financial market’s response to a company. By evaluating the sentiment of news articles, we aim to gain insights into how media coverage aligns with stock performance trends, thereby providing a more nuanced understanding of the factors driving stock price fluctuations. This expanded dataset not only enriches our analysis but also aligns with established research methodologies that underscore the importance of media influence on market dynamics. For processing the headlines to identify the sentiment, we have used TextBlob, a Python NLP library. It evaluates sentiment by assigning a polarity score ranging from −1 to 1 to classify texts as positive, negative, or neutral, necessitating adjustments for tools with different polarity scales.

The descriptive statistics presented in Table 3 cover the total number of articles published in various news outlets in the English language related to each company (articles), the sentiment of the news article descriptions (Text Sentiment), and the sentiment of the news article titles (Title Sentiment), revealing varied distribution patterns and insights. The volume of articles demonstrates significant dispersion, with a mean of 783.4941, ranging widely from 0 to 3528, and a moderate right skew, indicating a predominance of lower article counts. Text Sentiment analysis yields a mean score of 0.135298, spanning from strongly negative to positive, with a slight left skew suggesting a mild negative sentiment bias. Title Sentiment, slightly negative on average (−0.06964), exhibits a narrower range of sentiment and a moderate right skew, indicating a concentration of lower sentiment scores. These statistics underscore the diverse distribution trends within our data, crucial for understanding the influence of media on public perception and the stock performance of U.S.-based, publicly traded companies. This foundational analysis is essential for exploring how media coverage correlates with market dynamics, aligning with established research that emphasizes the significant impact of media on market movements.

Table 3.

Summary statistics of media coverage volume and sentiment for each company, based on article body and title tone.

3.1.4. Israel Presence and Philanthropy

We identified two critical factors for each company in our study: their presence in Israel and their philanthropic contributions. Presence in Israel was defined as having a headquarters, office, planned expansion, or operations in the country, or having high-ranking officials (such as CEO, president, or vice-president) of Israeli origin. Furthermore, we assessed the contributions made by these companies, as documented by the U.S. Chamber of Commerce Foundation.

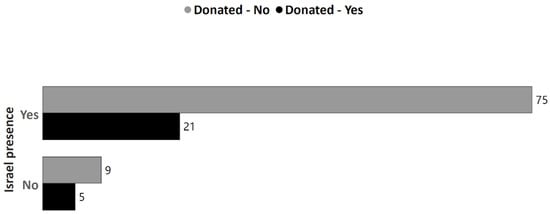

In the clustered bar chart (Figure 2), we observe the donation patterns of companies in relation to their ties with Israel. It is evident that companies with a presence in Israel are more likely to donate, as shown by 75 companies having done so compared to 21 that have not. This contrast is markedly pronounced when compared to companies without a presence in Israel, where only five have donated while nine have not. The visualization underscores a discernible trend: companies engaged with Israel demonstrate a higher propensity to announce support and make donations. This pattern may suggest that corporate philanthropy is potentially influenced by the geographical and operational interests of the companies in question, with those having a stake in Israel showing a greater inclination towards charitable contributions.

Figure 2.

Clustered bar chart showing the relationship between U.S. companies’ operational presence in Israel and their philanthropic donations following the onset of the Israel–Palestine conflict.

3.2. Methodology

We aimed to address two primary questions using the data on company announcements (both date and type), volume and sentiment of news articles, philanthropic efforts, and the presence of ties to Israel. The first question investigates whether we can predict a company’s ties to Israel based on these variables. Given that the presence of Israeli ties is a binary outcome (yes or no), we framed this as a classification problem. To establish a baseline for performance, we conducted a preliminary analysis using logistic regression given by Equation (1) before applying more advanced machine learning (ML) methods.

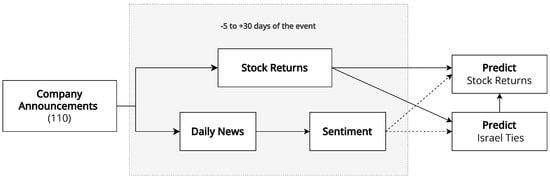

The second objective of our study is to predict stock returns, taking into account the variables previously mentioned, as well as the outcomes from the model predicting a company’s ties to Israel. We started with a standard regression model (Equation (2)) before exploring more advanced methods. This task is theoretically suited to a hybrid analytical framework, where the first model determines the presence of Israeli ties, which is subsequently incorporated into another model designed to predict stock returns, as shown in Figure 3. To address these complex questions, we explored a range of ML techniques, assessing their appropriateness and efficacy for the given tasks. Our methodology section elaborates on the application of these techniques, illustrating how they can be utilized to gain insights into the relationship between company actions, media sentiment, and market performance.

Figure 3.

Overview of the analytical framework combining classification and regression models to assess how corporate statements, media coverage, and philanthropic actions influence U.S. stock market returns during the Israel–Palestine conflict.

Machine Learning Models

Our research questions are designed to be tackled using regression and classification models, which are two fundamental strategies within the supervised learning domain of machine learning. Throughout this discussion, we delve into various methods applied to both types of models. In the context of classification, logistic regression served as the foundational approach for estimating the likelihood of a company maintaining connections with Israel, utilizing the specified set of independent variables.

log(p/(1 − p)) = β0 + β1 days since conflict + β2 Announcement type + β3 Tweets + β4 No of Articles + β5 Title Sentiment + Tweets + β6 Text Sentiment + β8 Donation + ε

For regression, we begin with linear regression to predict the short-term (30 days after the announcement date) stock returns for the companies, choosing gradient descent as a more dynamic alternative to the traditional statistical method of the normal equation for calculating coefficients, as represented in Equation (2).

Returns = β0 + β1 days since conflict + β2 Announcement type + β3 Tweets + β4 No of Articles + β5 Title Sentiment + Tweets + β6 Text Sentiment + β7 Israel Presence + β8 Donation + ε

To enhance our model, we incorporated regularization techniques such as Lasso (Least Absolute Shrinkage and Selection Operator), depicted in Equation (3), which diminishes the magnitude of larger coefficients, and Ridge (shown in Equation (4)), which uniformly reduces all coefficients, thus filtering out less significant features or independent variables. Additionally, ElasticNet, outlined in Equation (5), strikes a balance between the L1 (Lasso) and L2 (Ridge) regularization terms within the mean squared error loss function. These modifications to the loss function are instrumental in averting overfitting. These approaches have proven to be an improvement over traditional regression for various macroeconomic time series variables ().

To evaluate the effectiveness of different machine learning techniques, we included Support Vector Machines (SVM), which are particularly well-suited for complex classification tasks, often requiring as few as a dozen training examples and showing strong performance even in high-dimensional feature spaces (). Decision Trees and their ensemble extension, Random Forests, were favored for their intuitive structure, and they mitigate overfitting by averaging predictions across multiple decision paths (). To further enhance model accuracy, we implemented ensemble methods such as boosting and stacking. Boosting, through methods like Adaboost and XGBoost, sequentially improves predictions by focusing on previously misclassified cases, while stacking combines multiple model outputs to generate a more robust final prediction. We also incorporated Naive Bayes and K-Nearest Neighbors (KNN), which, although traditionally used for classification, were adapted for regression by leveraging probabilistic assumptions and local averaging, respectively (). Lastly, we included Multi-Layer Perceptrons (MLPs), a class of neural networks capable of modeling complex, non-linear relationships, particularly useful in capturing the intricacies of stock market behavior ().

4. Results

4.1. Classification

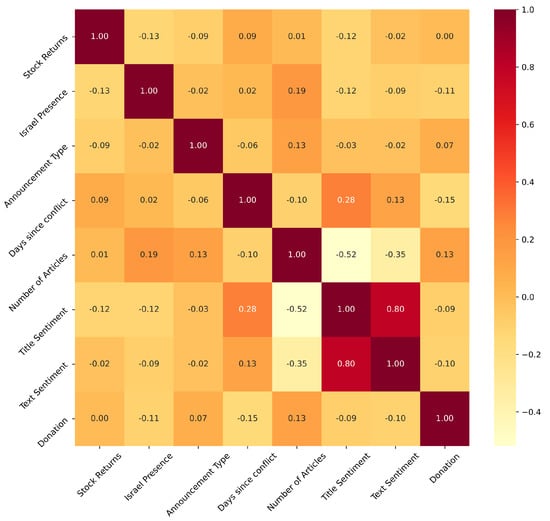

The heatmap (Figure 4) indicates the Pearson correlation coefficients between various variables, including ‘Stock Returns’ and ‘Israel Presence’, which are of particular interest in this analysis. These two variables are being considered as dependent variables in separate contexts: ‘Stock Returns’ for regression problems and ‘Israel Presence’ for classification problems. From the heatmap, it seems that neither ‘Stock Returns’ nor ‘Israel Presence’ exhibits a strong correlation coefficient (near 0.7 or −0.7) with any other variables, suggesting that predictive models for both will likely need to consider a combination of factors, rather than relying on a single predictor. In the regression model for ‘Stock Returns’, variables with higher absolute correlations might be weighted more heavily, while for the classification model predicting ‘Israel Presence’, the choice of variables might also depend on domain knowledge and model interpretability, not just on the correlation values. The absence of a strong linear relationship between the independent variables and the dependent variables in both the regression and classification scenarios presents a challenge for traditional modeling techniques, which often rely on such associations to make accurate predictions.

Figure 4.

Correlation heatmap showing relationships among key features such as donation activity, article sentiment, number of articles, and their association with two outcomes—Israel presence and stock returns. No strong linear correlations are observed, suggesting the need for non-linear models.

The results from the logistic regression in Table 4 suggest that the examined variables lack statistically significant connections with the predicted outcome. The other predictors, including the announcement date, donation presence, donation amount, number of articles, Text Sentiment, Title Sentiment, and type of statement, have odds ratios around 1 or indicate a reduced likelihood of the outcome, but their p-values, which range from 0.135 to 0.916, fail to reach statistical significance. Furthermore, the broad confidence intervals encompass a range of potential outcomes, both positive and negative. The collective insignificance of these variables suggests that the current logistic regression model does not adequately identify the factors that influence the outcome, indicating a need for further analysis or the exploration of different modeling approaches to discover impactful predictors.

Table 4.

Logistic regression coefficients and confidence intervals evaluating the influence of donations, announcement types, and sentiment on predicting whether a company has ties to Israel. None of the variables reach statistical significance.

Building on this foundational analysis, further investigations employed alternative classification techniques to assess their predictive capabilities in the same dataset. These methods—Decision Tree, Gradient Boosting, K-Nearest Neighbors, Naive Bayes, neural network, and Random Forest—were evaluated across several metrics, including accuracy, sensitivity, specificity, ROC AUC, and F1 Score, to provide a comprehensive comparison.

The results (Table 5) revealed a spectrum of performance across these models. For instance, the Random Forest model emerged as the most effective, with the highest scores in accuracy (0.871795), sensitivity (0.95), and F1 Score (0.857143), indicating its robustness in capturing the nuances of the dataset. Similarly, the Gradient Boosting and neural network models also demonstrated strong predictive power, each with distinct advantages in terms of sensitivity and overall accuracy. In contrast, models like the Naive Bayes and K-Nearest Neighbors exhibited lower performance metrics, highlighting their relative limitations in this specific context.

Table 5.

Performance metrics of various classification models used to predict corporate ties to Israel. Ensemble and tree-based models outperform logistic regression, especially in sensitivity and F1 Score.

This comparative analysis underscores the varied strengths and weaknesses of different classification approaches in handling binary outcome predictions. While logistic regression provided valuable insights into the influence of specific predictors, the subsequent exploration of alternative models highlighted the potential for achieving higher accuracy and predictive performance. Such findings advocate for a multifaceted approach in classification problems, where initial insights from logistic regression can inform more nuanced analyses using a range of advanced machine learning techniques.

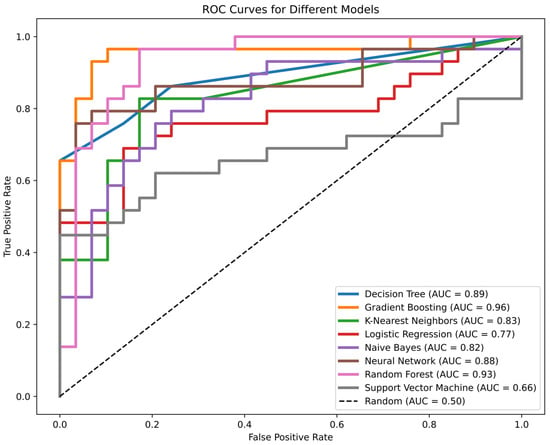

The analysis of ROC (Receiver Operating Characteristic) curves in Figure 5 for various classification models applied to the context of actions, news discussions, and donations in the Israel–Palestine scenario reveals significant insights into the performance of these models in distinguishing between binary classes. The Gradient Boosting model stands out with the highest AUC (Area Under the Curve) score of 0.90, indicating its superior capability to correctly classify the positive cases (related to actions, news discussion, and donations) with a high true positive rate (TPR) across various thresholds while maintaining a low false positive rate (FPR). This suggests that Gradient Boosting is particularly effective for this complex problem, likely due to its ability to capture non-linear patterns through the combination of multiple Decision Trees.

Figure 5.

ROC curves comparing the performance of various classification algorithms in predicting a company’s ties to Israel based on actions, media coverage, and donations. Gradient Boosting and neural networks show the highest AUC, indicating strong discriminative power.

Following Gradient Boosting, the neural network, with an AUC of 0.85, shows a good discrimination ability, suggesting that it can effectively capture the underlying patterns in the data through its complex architecture. The Decision Tree and Support Vector Machine (SVM) models, both with an AUC of 0.84, also demonstrate solid performance. The Decision Tree’s ‘stepped’ ROC curve reflects its binary decision-making process, which can result in sudden changes in TPR and FPR at certain thresholds. In contrast, the smooth ROC curve of the SVM indicates its consistent performance across different thresholds, likely due to its ability to find the optimal hyperplane that separates the classes.

The Naive Bayes model, with an AUC of 0.82, and the logistic regression model, with an AUC of 0.77, show reasonable but comparatively lower performance. The slightly lesser ability of the Naive Bayes model to discriminate between the classes might stem from its assumption of feature independence, which may not hold true in complex scenarios like this. The logistic regression model’s moderate performance could be attributed to its linear nature, which might not effectively capture the complexity of the relationships in the data as well as the other models.

These results signify that for the specific problem of classifying actions, news discussions, and donations in the Israel–Palestine context, Gradient Boosting is the most effective model, followed by the neural network, Decision Tree, SVM, Naive Bayes, and logistic regression. The varying AUC scores and the characteristics of the ROC curves provide valuable insights into each model’s ability to handle the intricacies of real-world data, guiding the selection of the most appropriate model based on the specific requirements and nuances of the classification task at hand.

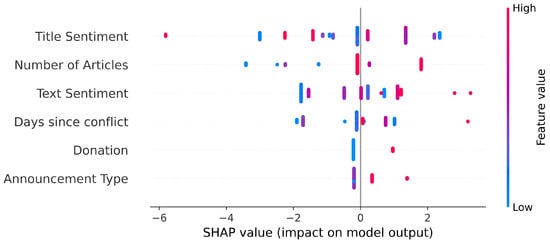

The SHAP values shown in Figure 6 serve as an interpretive tool to gauge feature importance within the predictive model for Israeli affiliations. A negative skew for ‘Title Sentiment’ suggests an inverse relationship; more optimistic Title Sentiments tend to decrease the model’s likelihood of associating a company with Israel. Conversely, the ‘Number of Articles’ displays a broad influence on the predictive outcomes, where an increased article count appears to elevate the probability of a company’s linkage to Israel, as per the model’s assessment. Further, ‘Text Sentiment’ mirrors the trend of ‘Title Sentiment’, where more positive sentiments within the body text of articles tend to reduce the model’s prediction of a firm’s presence in Israel. ‘Days since conflict’ has a cluster of values around the center, indicating that the time elapsed since the start of the conflict has a less pronounced effect on the model’s output.

Figure 6.

SHAP value summary plot highlighting the importance of features in predicting corporate ties to Israel. Features like the number of articles, donation status, and sentiment scores significantly influence the model’s predictions.

Interestingly, ‘Donation’ shows a notable shift towards negative SHAP values, which could imply that the model associates the act of donating with a lower probability of a firm’s presence in Israel. Finally, ‘Announcement Type’ exhibits a significant spread across both positive and negative values, reflecting the varied ways in which the nature of a company’s announcements influences the model’s predictions.

In evaluating different ensemble learning models for predicting companies’ connections to Israel, Table 6 shows the stacking model as the top performer with 91.38% accuracy, showing strong sensitivity and specificity. In contrast, bagging and boosting both achieved 90.13% accuracy, with high sensitivity but lower specificity, indicating possible overestimation of ties to Israel. The voting model had the least accuracy at 82.76% and lower specificity, suggesting challenges in correctly identifying companies without links to Israel. The stacking ensemble method outshines previous individual machine learning approaches detailed in Table 5, proving to be the most effective for the given problem.

Table 6.

Evaluation of ensemble methods for classifying corporate Israel ties. Stacking achieves the highest overall performance with balanced sensitivity and specificity.

In our study within the Multifaceted Analysis of Conflict framework, focusing on the Israel–Palestine scenario, we explored the impact of various features, actions taken (A), media sentiment and volume (B), and financial donations (C), both individually and in combination, to understand their predictive power in conflict outcomes. The ablation study results from Table 7 revealed that individual features, such as actions taken, demonstrated high accuracy, sensitivity, and a respectable ROC AUC score, underscoring the significance of the nature and intensity of actions within the conflict. In contrast, media sentiment and volume alone showed lower predictive accuracy and sensitivity but higher specificity, indicating their utility in identifying non-significant events rather than predicting conflict outcomes directly. Donations, while exhibiting the lowest accuracy and sensitivity among the individual features, had the highest specificity, suggesting their effectiveness in recognizing instances without external support. The combination of features, particularly actions and news articles and the comprehensive integration of all three features (A + B + C), significantly enhanced model performance, achieving higher accuracy and sensitivity. This suggests that the content and sentiment of public announcements and news articles play a critical role in the model’s ability to predict a firm’s ties to Israel, highlighting their predominant influence in such geopolitical association analyses.

Table 7.

Ablation study evaluating how combinations of actions, news articles, and donations affect classification performance. Combining actions with news coverage yields the highest predictive accuracy.

4.2. Regression

In analyzing complex geopolitical scenarios, such as the Israel–Palestine conflict, it is crucial to employ a variety of analytical techniques to capture the multifaceted nature of the environment. Initially, we focus on classification models to discern the presence of Israel-related events within the conflict. The classification stage is critical in filtering the vast amounts of data to identify those instances that have marked relevance to Israel’s involvement in the conflict. Upon establishing a reliable classification model that can accurately identify the presence of Israel in the conflict-related events, we proceed to leverage these predictions to construct a regression model aimed at forecasting future stock returns. The rationale behind this approach is grounded in the observation that geopolitical events, particularly those involving Israel in the context of the Middle East, can have significant ripple effects on financial markets.

The regression model integrates the outputs from the classification model as a key input variable, hypothesizing that the frequency, nature, and scale of Israel’s involvement in the conflict may have predictive power over market fluctuations. It also considers additional quantitative metrics and market indicators to forecast stock returns, thus providing investors and analysts with insights that can guide investment strategies. By combining the classification and regression models, we create a comprehensive analytical toolset. The classification model serves as a preliminary filter, distilling the vast landscape of conflict data into focused instances with potential market impact. Subsequently, the regression model takes these instances as a base to forecast economic outcomes, embodying a sophisticated synthesis of geopolitical and financial analysis. The resulting forecasts represent a convergence of political science and economic prediction, providing a nuanced perspective on the interplay between conflict events and their economic ramifications.

We constructed a regression model with the daily stock returns of various corporations serving as the dependent variable. We meticulously tracked the stock performance over a period of 30 days after the events, treating each day as an independent observation to capture the immediate and short-term effects on stock valuation. Our independent variables comprised outputs from our classification models, which included indicators of Israel’s presence in media coverage and associated actions, alongside financial metrics and sentiment analyses derived from our comprehensive dataset.

The analysis presented in Table 8 draws from a linear regression model, which investigates the impact of various factors on stock returns, with a particular focus on the presence of Israel-related variables. The model incorporates a diverse set of predictors, including announcement dates, the number of articles, Text and Title Sentiment, types of statements, and the presence or absence of donations, alongside the binary state of Israel’s presence as a specific interest. The coefficients, alongside their standard errors (in parentheses), provide insights into the magnitude and significance of each predictor’s effect on stock returns.

Table 8.

Linear regression results comparing the effect of donations and Israel ties on daily cumulative abnormal returns. While some variables show small significant effects, the overall explanatory power remains low.

The positive coefficients for the announcement date in contexts where Israel’s presence is considered and a donation was made (0.0183 and 0.019, both significant at ** level) suggest that announcement dates in these specific scenarios have a statistically significant, albeit small, positive effect on stock returns. These variables show varying effects across different scenarios, but most lack statistical significance, indicated by the absence of asterisks. This suggests that their impact on stock returns is not consistently strong or detectable across all scenarios. The F-statistic is significant (* level) only in the scenario where Israel’s presence is considered, and a donation was made, indicating that the model is overall significant in this specific scenario. In other contexts, the F-statistics are below the threshold for significance, suggesting that the model does not explain a significant portion of the variance in stock returns. These values are very low across all scenarios, ranging from 0.004 to 0.021. While they indicate that the model accounts for a very small fraction of the variance in stock returns, this is not uncommon in financial data analysis, where stock returns can be influenced by myriad unpredictable factors.

Given the limitations of the traditional linear regression model in capturing the complexities and dynamics of stock returns, as evidenced by low adjusted R-squared values and limited predictive power, machine learning (ML)-based regression methods offer a promising alternative. These methods can handle non-linear relationships, interact with a high number of features, and better capture the intricacies of financial market data.

The evaluation of machine learning models for predicting daily cumulative abnormal stock returns over a 30-day post-announcement period has yielded a range of performance outcomes. The models were assessed based on mean squared error (MSE), Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), and the R-squared (R2) value.

Random Forest Regression demonstrated the best performance with the lowest error, suggesting a strong fit relative to other models as shown in Table 9. This indicates its robustness in capturing the variability of stock returns with a higher degree of precision. The Multi-Layer Perceptron (MLP) model performed commendably, with a positive R2 score suggesting its proficiency in deciphering complex stock return patterns. Linear models like Lasso, ElasticNet, and Ridge Regression, as well as linear regression, had comparable results but slightly underperformed based on the performance metrics.

Table 9.

Performance comparison of machine learning regressors predicting daily abnormal stock returns. Random Forest outperforms others, with the lowest MSE and highest R2 among tested models.

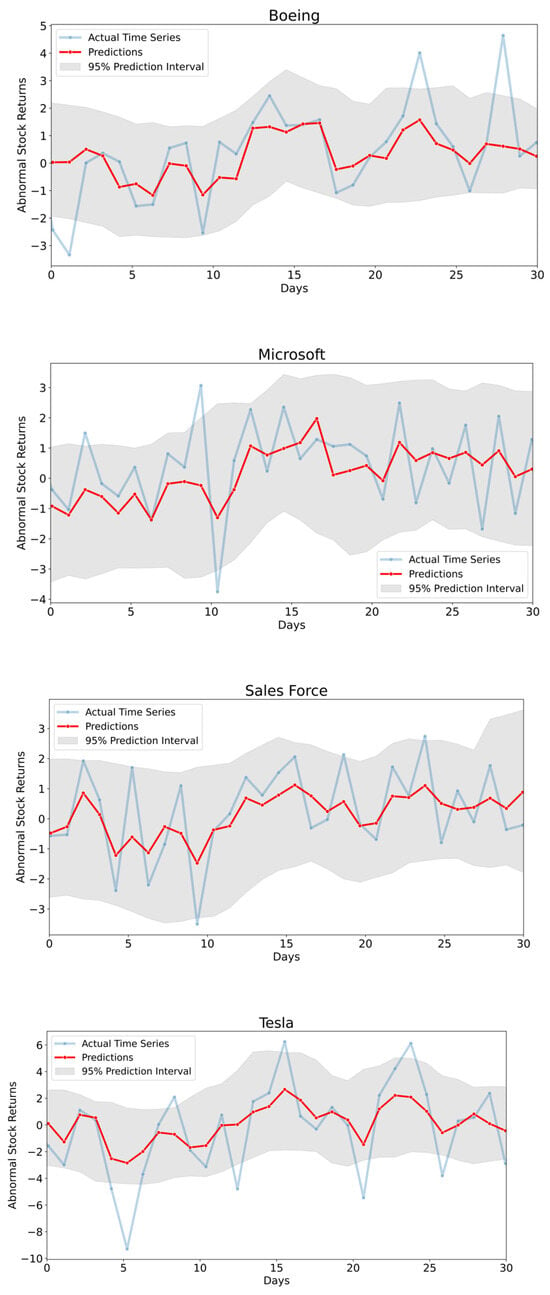

The process of rigorously testing our Random Forest model involved the careful exclusion of a subset of data from four distinct companies, ensuring that the model’s proficiency in predicting market behavior was thoroughly assessed in diverse market scenarios and business environments. The resulting time series plots (Figure 7) showcase the model’s performance in forecasting daily abnormal returns for these corporations, an endeavor crucial for gauging stock behavior and potential investment risks.

Figure 7.

Time series plots of out-of-sample cumulative abnormal return (CAR) forecasts using the Random Forest model for selected companies. The shaded confidence intervals and observed vs. predicted curves show varying model accuracy and illustrate post-conflict volatility.

The predictions outlined in the visualizations highlight that the model holds the capability to forecast stock returns anomalously, though the degree of precision and reliability of these predictions can substantially fluctuate, as evidenced by the expansive 95% confidence intervals. In the immediate aftermath of the onset of the Israel–Palestine conflict—a period ranging from 5 to 10 days—all selected companies registered a downturn, with varying intensities. Notably, the model’s predictions did not fully anticipate the extent of the downturn for Microsoft, Sales Force, and Tesla, in contrast to Boeing, which exhibited an initial dip in its stock returns. Overall, the erratic nature of daily stock returns poses a considerable challenge; however, the Random Forest algorithm, identified as the superior method from our previous analyses, demonstrated a reasonable capacity to capture these fluctuations to a certain extent.

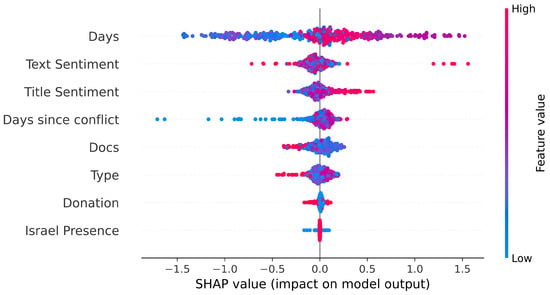

The displayed SHAP summary plot in Figure 8 provides a visual representation of the influence that various features exert on the predictive model’s output for daily cumulative abnormal returns. Each data point, color-coded to indicate the magnitude of the feature value, conveys the SHAP value assigned to a feature for a specific instance. Features are ranked by their importance based on the distribution breadth of their SHAP values; a wider dispersal signifies a more pronounced effect on the model’s predictions.

Figure 8.

SHAP summary plot for the Random Forest Regression model forecasting daily stock returns. Sentiment variables and media volume exhibit the most influence, while the effect of announcement type and donation varies.

For instance, the ‘Days’ feature exhibits a diverse range of impacts, with SHAP values straddling both sides of the zero mark, hinting at how the elapsed time since the initial incident affects returns differently as the situation progresses. ‘Docs’, which could denote the count of relevant documents or articles, also displays a considerable spread around the zero point, indicating its variable influence on returns, both positively and negatively. Notably, sentiment-related features such as ‘Title Sentiment’ and ‘Text Sentiment’ are generally skewed towards the negative, suggesting that adverse media narratives typically suppress predicted returns. ‘Type’ presents a balanced array of positive and negative SHAP values, implying its impact can sway in either direction depending on other factors.

Reflecting on the empirical results provided in Table 10, it is evident that the Multi-Layer Perceptron (MLP) model, with a specific configuration of an activation function ‘tanh’ and hidden layer sizes of 50, significantly outperforms other models in predicting daily cumulative abnormal stock returns.

Table 10.

Evaluation of machine learning models predicting 30-day average stock returns. The Multi-Layer Perceptron yields the best fit with the highest R2, indicating strong non-linear modeling capacity.

We found significant performance disparities among the models. Linear models, despite their simplicity, struggled with the complex, non-linear nature of stock returns. Ridge Regression showed modest success due to its regularization approach, but like Lasso and ElasticNet, it failed to capture the market’s volatility fully. Non-linear models like Decision Tree and Random Forest offered better predictions, with Random Forest emerging as particularly effective due to its ensemble approach, reducing overfitting and capturing stock return movements more accurately.

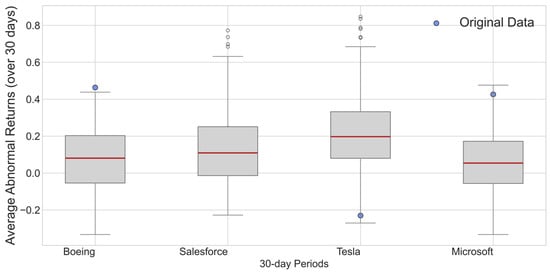

In Figure 9, the boxplot illustrates the distribution of predicted average abnormal stock returns over a 30-day span following pivotal developments in the Israel–Palestine conflict. These returns account for corporate responses and social media activity. Employing the Multi-Layer Perceptron algorithm for our regression analysis reveals varied predictive accuracy for different companies. The model tends to overestimate the returns for Tesla, while it underestimates the returns for the remaining three firms. Specifically, the actual observed returns for Salesforce align within the interquartile range, denoting predictions that are consistent with the actual performance. Conversely, the predictions diverge significantly for Tesla and Microsoft, where the observed returns fall just outside the anticipated range of the boxplot. This suggests the model’s predictions do not entirely encapsulate the market’s actual response for these companies, potentially indicating the influence of external variables not accounted for by the model. The observed discrepancies between predicted and actual stock returns indicate that the Random Forest model may not be comprehensively accounting for all determinants that swayed the average abnormal stock returns in the 30-day period following the respective announcements concerning the Israel–Palestine conflict. A significant contributing factor to this could be the restricted dataset size; with only one record per company as opposed to 30 observations per entity in prior models, the model is constrained by a smaller sample size. This reduction in data points limits the model’s ability to learn and adapt to the complexities of the stock market’s behavior. Additionally, the substantial variability among companies’ returns presents an inherent challenge, suggesting that stock performance is subject to a diverse array of influences, possibly extending beyond the scope of the model’s features. Factors such as unquantified market sentiments, undisclosed financial strategies, or evolving geopolitical scenarios might play pivotal roles in shaping the returns, thereby impacting the precision of the model’s forecasts.

Figure 9.

Boxplots of predicted versus actual average abnormal stock returns over 30 days using a Multi-Layer Perceptron model. Discrepancies across firms such as Tesla and Microsoft highlight model limitations and data variability.

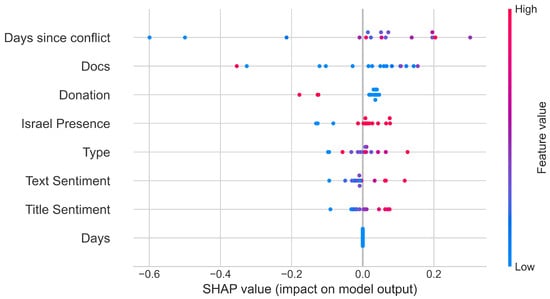

In the short-term regression analysis, as visualized by the SHAP summary plot (Figure 10), the sentiment of titles and textual content within documents (‘Title Sentiment’ and ‘Text Sentiment’) is depicted as having an influence on the model’s predictions. However, the relatively confined spread of the SHAP values, gravitating towards zero, suggests that the effect of sentiment on the model’s output is moderate. ‘Docs’, representing the count of related documents or articles, exhibits a mix of positive and negative SHAP values, indicating an inconsistent contribution to the prediction of returns, which could be indicative of the varying influence of media coverage on stock performance.

Figure 10.

SHAP plot showing feature contributions to predictions of 30-day average cumulative abnormal returns. Title and Text Sentiment have modest effects, while variables like donations show a more consistent directional impact.

‘Days since conflict’ shows a notable aggregation of SHAP values around the zero mark, implying a negligible or very limited effect on the predictive output. This could be due to the market’s desensitization to the conflict over time or the incorporation of its effects into stock prices. On the other hand, ‘Donation’ predominantly aligns with negative SHAP values, inferring a potential adverse impact on returns when a company engages in philanthropic activities, perhaps reflecting investor concerns over the allocation of resources.

The ‘Type’ feature spans across both sides of the SHAP value spectrum, denoting an inconsistent impact on the model’s predictions. This inconsistency may reflect the complexity of the model’s interaction with various types or categories of data. Similarly, ‘Israel Presence’ congregates around a neutral SHAP value, suggesting it does not substantially affect the model’s output in this scenario.

Contrasting with the previous SHAP plot, ‘Days’ here demonstrates a concentration of SHAP values at zero, leading to the conclusion that in this model’s configuration, the temporal aspect does not significantly affect the prediction of cumulative abnormal returns. This is a departure from the earlier plot, where ‘Days’ exhibited a wider range of SHAP values.

The overall tighter clustering of SHAP values around the zero baseline in this plot compared to the previous one indicates a more balanced and potentially more nuanced model output. The implications of these findings are multifaceted; while the contributions of some features to stock return predictions remain consistently impactful, others show variable influence. These distinctions may arise from changes in the data, adjustments in the model’s parameters, or different market conditions under review, each altering the relative importance and impact of the features.

When analyzing combinations of variables, the predictive power of the model exhibits nuanced differences, as shown in Table 11. For instance, the combination of actions and news articles and the combination of actions and donations show marginally different outcomes in terms of MSE, RMSE, and MAE, albeit with a slight decrease in the R² value, suggesting a complex relationship between these variables when predicting stock returns. In the context of our analysis on the predictive modeling of stock returns, it is noteworthy that the incorporation of all three factors—actions (A), news articles (B), and donations (C)—collectively does not substantially improve the model’s performance according to the observed performance metrics. This finding suggests that the combined influence of these variables, when analyzed together, does not provide a significantly better prediction of stock returns than when these factors are considered individually or in other combinations.

Table 11.

Ablation analysis of 30-day return prediction using different feature sets. News articles alone offer the best predictive performance, while combined features do not significantly improve outcomes.

Among the individual factors, the analysis reveals that news articles, characterized by the number of mentions, as well as the sentiment of the title and text, exhibit the most predictive performance. This holds true not only when news articles are considered as a standalone factor but also in comparison with other individual or combined factors. This indicates the considerable impact of media sentiment and exposure on stock market dynamics, suggesting that news articles alone offer a strong predictive signal for stock returns. Furthermore, the slight decline observed in the adjusted R-squared values across different combinations of factors indicates the presence of multicollinearity.

This analysis highlights the nuanced and interconnected nature of the factors influencing stock market movements. While news articles emerge as a particularly strong predictor, the interaction between different types of data reflective of market actions, media sentiment, and financial support highlight the complexity of accurately forecasting stock returns. Further investigation into these dynamics, possibly through more advanced modeling techniques or the inclusion of additional variables, may help in clarifying these relationships and improving the predictive accuracy of the model.

5. Conclusions

This study contributes to the growing body of research on the financial implications of corporate responses to geopolitical conflicts by investigating how U.S. companies’ public positions on the Israel–Palestine conflict affect their stock performance. By combining media sentiment analysis with predictive modeling, we demonstrate that the sentiment expressed in news article titles serves as a significant indicator of both a company’s affiliation with Israel and its short-term stock returns. Our results further support the utility of machine learning techniques, especially ensemble models and neural networks, in outperforming traditional statistical methods when forecasting complex, sentiment-driven financial behavior.

In line with earlier studies that found media sentiment to be a strong predictor of stock movements (e.g., ; ), our analysis confirms that sentiment embedded in article titles significantly contributes to predicting both a company’s ties to Israel and its short-term stock performance. Moreover, our findings support the broader assertion in financial literature that machine learning models often outperform traditional statistical approaches in capturing complex, non-linear relationships (; ). Specifically, ensemble methods such as boosting and stacking yielded the highest classification accuracy for predicting Israeli affiliations, while the Multi-Layer Perceptron (MLP) model demonstrated superior performance in forecasting stock returns. These outcomes reinforce the idea that integrating sentiment analysis and machine learning can enhance financial forecasting, particularly in contexts influenced by socio-political dynamics. Our study contributes to this growing body of evidence by demonstrating the predictive power of media sentiment and corporate stance in the unique setting of the Israel–Palestine conflict.

The research highlights the critical role of media perception and corporate communication in shaping investor sentiment and market outcomes during times of geopolitical tension. It also underscores the effectiveness of combining structured financial data with unstructured textual data to enhance prediction accuracy in financial markets. However, this study is not without limitations. The analysis relies on data collected within a narrow time window and focuses primarily on publicly listed U.S. companies, which may limit the generalizability of the findings. Additionally, potential biases in media coverage and limitations in sentiment analysis tools may affect the robustness of the sentiment signals used in the models. Future research could extend this work by incorporating social media sentiment, expanding the geographic scope, and exploring long-term impacts of corporate alignment in geopolitical contexts.

Author Contributions

V.G. contributed to the conceptualization, methodology, formal analysis, data collection, original draft writing, and visualization. D.H. contributed to reviewing and editing the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

This study uses publicly available data sources, including company lists derived from the Yale School of Management website (), news articles accessed via Google News, and stock market data obtained from Yahoo Finance. The compiled dataset used in the analysis is available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abudayya, A., Bruaset, G. T. F., Nyhus, H. B., Aburukba, R., & Tofthagen, R. (2023). Consequences of war-related traumatic stress among Palestinian young people in the Gaza Strip: A scoping review. In Mental health and prevention (Vol. 32). Elsevier GmbH. [Google Scholar] [CrossRef]

- Adekoya, O. B., Oliyide, J. A., Yaya, O. O. S., & Al-Faryan, M. A. S. (2022). Does oil connect differently with prominent assets during war? Analysis of intra-day data during the Russia-Ukraine saga. Resources Policy, 77, 102728. [Google Scholar] [CrossRef]

- Bahrammirzaee, A. (2010). A comparative survey of artificial intelligence applications in finance: Artificial neural networks, expert system and hybrid intelligent systems. Neural Computing and Applications, 19(8), 1165–1195. [Google Scholar] [CrossRef]

- Bayer, Y. (2023). Socioeconomic factors, rocket sirens, and PTSD: Insights from the Israel-Hamas conflict. Preprints. [Google Scholar] [CrossRef]

- Bollen, J., Mao, H., & Zeng, X.-J. (2010). Twitter mood predicts the stock market. arXiv, arXiv:1010.3003. [Google Scholar] [CrossRef]

- Bracke, P., Datta, A., Jung, C., & Sen, S. (2019). Staff working paper No. 816 machine learning explainability in finance: An application to default risk analysis. Available online: www.bankofengland.co.uk/working-paper/staff-working-papers (accessed on 10 November 2024).

- Buheji, M., & Ahmed, D. (2023). Keeping the Boycott Momentum-from ‘WAR on GAZA’ till ‘Free-Palestine’. International Journal of Management (IJM), 14(7), 205–229. [Google Scholar]

- Bussmann, N., Giudici, P., Marinelli, D., & Papenbrock, J. (2021). Explainable machine learning in credit risk management. Computational Economics, 57(1), 203–216. [Google Scholar] [CrossRef]

- Cui, J., & Maghyereh, A. (2024). Higher-order moment risk spillovers across various financial and commodity markets: Insights from the Israeli–Palestinian conflict. Finance Research Letters, 59, 104832. [Google Scholar] [CrossRef]

- Derakhshan, A., & Beigy, H. (2019). Sentiment analysis on stock social media for stock price movement prediction. Engineering Applications of Artificial Intelligence, 85, 569–578. [Google Scholar] [CrossRef]

- Federle, J., Müller, G. J., Meier, A., & Sehn, V. (2022). Proximity to war: The stock market response to the Russian invasion of Ukraine. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4060222 (accessed on 3 February 2023).

- Firouzjaee, J. T., & Khaliliyan, P. (2022). Machine learning model to project the impact of Ukraine crisis. arXiv, arXiv:2203.01738. [Google Scholar]

- Getmansky, A., & Weiss, C. M. (2023). War-time military service can affect Partisan preferences. Comparative Political Studies, 56(10), 1475–1505. [Google Scholar] [CrossRef]

- Guresen, E., Kayakutlu, G., & Daim, T. U. (2011). Using artificial neural network models in stock market index prediction. Expert Systems with Applications, 38(8), 10389–10397. [Google Scholar] [CrossRef]

- Hastie, T., Tibshirani, R., Friedman, J., Hastie, T., Tibshirani, R., & Friedman, J. (2009). Random forests. In The elements of statistical learning: Data mining, inference, and prediction (pp. 587–604). Springer. [Google Scholar]

- Islam, M. J., Wu, Q. J., Ahmadi, M., & Sid-Ahmed, M. A. (2007, November 21–23). Investigating the performance of Naive-Bayes classifiers and K-nearest neighbor classifiers. 2007 International Conference on Convergence Information Technology (ICCIT 2007) (pp. 1541–1546), Gwangju, Republic of Korea. [Google Scholar] [CrossRef]

- Jiang, T., Gradus, J. L., & Rosellini, A. J. (2020). Supervised machine learning: A brief primer. Available online: www.elsevier.com/locate/bt (accessed on 10 November 2024).

- Khan, S., & Rehman, M. Z. (2023). The impact of the Israel-Palestine conflict on the GCC-Israel and the leading global stock market indices. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4658577 (accessed on 10 November 2024).

- Kumari, V., Kumar, G., & Pandey, D. K. (2023). Are the European Union stock markets vulnerable to the Russia–Ukraine war? Journal of Behavioral and Experimental Finance, 37, 100793. [Google Scholar] [CrossRef]

- Li, J., & Chen, W. (2014). Forecasting macroeconomic time series: LASSO-based approaches and their forecast combinations with dynamic factor models. International Journal of Forecasting, 30(4), 996–1015. [Google Scholar] [CrossRef]

- Meckler, L., Craig, T., & Gregg, A. (2023, October 14). U.S. institutions under fire for their support or silence on Israel. The Washington Post. Available online: https://www.washingtonpost.com/nation/2023/10/14/colleges-companies-israel-hammas-conflict/ (accessed on 10 November 2024).

- Mitchell, T. M. (1997). Machine learning. McGraw-hill. [Google Scholar]

- Nemes, L., & Kiss, A. (2021). Prediction of stock values changes using sentiment analysis of stock news headlines. Journal of Information and Telecommunication, 5(3), 375–394. [Google Scholar] [CrossRef]

- Nti, I. K., Adekoya, A. F., & Weyori, B. A. (2020). A comprehensive evaluation of ensemble learning for stock-market prediction. Journal of Big Data, 7(1), 20. [Google Scholar] [CrossRef]

- Pandey, D. K., Kumari, V., Palma, A., & Goodell, J. W. (2024). Are markets in happier countries less affected by tragic events? Evidence from market reaction to the Israel–Hamas conflict. Finance Research Letters, 60, 104893. [Google Scholar] [CrossRef]

- Plakandaras, V., Gogas, P., & Papadimitriou, T. (2019). The effects of geopolitical uncertainty in forecasting financial markets: A machine learning approach. Algorithms, 12(1), 1. [Google Scholar] [CrossRef]

- Qian, B., & Rasheed, K. (2007). Stock market prediction with multiple classifiers. Applied Intelligence, 26, 25–33. [Google Scholar] [CrossRef]

- Ravikumar, S., & Saraf, P. (2020, June 5–7). Prediction of stock prices using machine learning (regression, classification) algorithms. 2020 International Conference for Emerging Technology (INCET) (pp. 1–5), Belgaum, India. [Google Scholar]

- Sarker, I. H. (2021). Machine learning: Algorithms, real-world applications and research directions. In SN computer science (Vol. 2). Issue 3. Springer. [Google Scholar] [CrossRef]

- Schumaker, R. P., & Chen, H. (2009). Textual analysis of stock market prediction using breaking financial news: The AZFin text system. ACM Transactions on Information Systems, 27, 12:1–12:19. [Google Scholar] [CrossRef]

- Shapley, L. S. (1953). A value for n-person games. Available online: https://www.degruyterbrill.com/document/doi/10.1515/9781400829156-012/pdf?licenseType=restricted (accessed on 10 November 2024).

- Sonnenfeld, J. (2024, January 28). List of companies that have condemned Hamas’ terrorist attack on Israel. Yale School of Management. Available online: https://som.yale.edu/story/2023/list-companies-have-condemned-hamas-terrorist-attack-israel (accessed on 10 November 2024).

- Vu, T.-T., Chang, S.-H., Ha, Q.-T., & Collier, N. (2012). An experiment in integrating sentiment features for tech stock prediction in Twitter. Available online: https://www.semanticscholar.org/paper/150427a18d3cef266fb10b889e5bef802a3e2f6f (accessed on 10 November 2024).

- Vyas, P., Vyas, G., & Dhiman, G. (2023). RUemo—The classification framework for Russia-Ukraine war-related societal emotions on Twitter through machine learning. Algorithms, 16(2), 69. [Google Scholar] [CrossRef]

- Xue, H., Yang, Q., & Chen, S. (2009). SVM: Support vector machines. In The top ten algorithms in data mining (pp. 51–74). Chapman and Hall/CRC. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).