Abstract

This study explores the effect of fintech-driven inclusive finance on the profitability of banks using an unbalanced panel dataset from 660 banks across 40 developing countries between 2011 and 2021. We start with a fixed-effect estimate and subsequently validate our main findings using two-stage least squares (2SLS-IV), two-step system generalized method of moments (GMM), and generalized least squares (GLS) methodologies. Our analysis centers on three key profitability metrics: ROA, ROE, and NIM. Our findings suggest that fintech-backed inclusive finance boosts ROA by 9.10%, ROE by 18.87%, and NIM by 7.98%, highlighting the growing importance of mobile, internet, and agent banking in these nations. We also note that large banks benefit more from inclusive finance than small ones. Additionally, conventional banks see a more marked improvement in profitability than Islamic and savings banks. The relationship between inclusive finance and bank profitability is stronger in countries with higher GDP growth and those actively advancing financial inclusion through fintech, compared to countries with slower GDP growth and less emphasis on financial inclusion. When examining the interaction effects, the COVID-19 pandemic has further emphasized the positive connection between fintech and bank profitability. This suggests that fintech-driven inclusive finance can play a role in enhancing bank profitability, even in challenging times like the COVID-19 period. The transition towards fintech, however, mandates substantial investments, enhanced financial literacy, and heightened customer security, presenting persistent challenges for governments, policymakers, regulators, and financial institutions.

1. Introduction

In developing countries, the banking sector plays a pivotal role as a bridge between surplus capital and productive investments, facilitating resource allocation and driving economic growth (Issaka Jajah et al. 2022). Technological innovations now allow this sector to leverage digital platforms and fintech solutions, extending financial services to remote areas and addressing the needs of underserved communities. Broadly, fintech refers to the amalgamation of finance and technology by employing cutting-edge technologies to optimize financial activities, especially within the banking sector (Alkhwaldi et al. 2022). Notably, the adoption of fintech to broaden banking access to the previously unbanked populace fosters a more inclusive financial system in a country.

According to the World Bank, financial inclusion denotes the ability of individuals and businesses to access valuable and affordable financial products and services—encompassing transactions, payments, savings, credit, and insurance—that cater to their needs in a sustainable and responsible manner. Consequently, inclusive finance aims to broaden the accessibility and utility of these financial products across a diverse population (Yadav et al. 2021).

Inclusive finance is increasingly recognized in many developing countries as a means to enhance bank profitability and enhance overall performance (Issaka Jajah et al. 2022; Wang et al. 2022). The thrust of this concept is to empower marginalized and vulnerable populations to access a range of financial products, such as savings facilities, credit avenues, insurance services, and financial literacy tools. Such initiatives not only promote financial stability and capital-raising endeavors but also potentially boost bank profitability (Kumar et al. 2021). Indeed, the expansion of financial inclusion via fintech can result in an increased customer base, leading to heightened deposits, loans, and subsequent profitability (Banna et al. 2021b; Hakimi et al. 2021; Wu et al. 2023). Despite these insights, there is a noticeable gap in the literature exploring the relationship between inclusive finance and bank profitability (Issaka Jajah et al. 2022; Kumar et al. 2021; Yakubu and Musah 2022).

Numerous studies underscore the potential of fintech-driven inclusive finance as a means to alleviate poverty (Kelikume 2021; Lee et al. 2023). Beyond poverty reduction, this approach has implications for bank risk management (Banna and Alam 2021; Banna et al. 2021b; Deng et al. 2021; Wang et al. 2021), improving financial system stability (Jonker and Kosse 2022), and promoting economic growth and sustainability (Shen et al. 2021; Tay et al. 2022). Despite these insights, the connection between fintech-driven inclusive finance and bank profitability remains largely unexplored in the finance and development economics literature. This oversight signals a significant research gap, emphasizing the need to delve deeper into the impact of fintech-driven inclusive finance on bank profitability.

To the best of our knowledge, this study represents the first effort to explore the influence of fintech-centric inclusive finance on the profitability of 660 banks across 40 developing nations over the period from 2011 to 2021. In gauging profitability, we utilize metrics such as return on assets (ROA), return on equity (ROE), and net interest margin (NIM), as recommended by the prevailing literature (Issaka Jajah et al. 2022; Khatib et al. 2022; Kumar et al. 2021; Saif-Alyousfi and Saha 2021; Wang et al. 2022). In alignment with empirical studies (Khatib et al. 2022; Kumar et al. 2021; Neaime and Gaysset 2018), we control for various bank-specific variables—namely, cost efficiency, credit risk, liquidity risk, lending capacity, and bank size—all of which substantially influence bank profitability. This study seeks to lay the foundation for central banks, governments, and financial institutions to reconfigure public policies, thereby fostering financial inclusion via fintech.

This study offers several significant contributions to the broader literature of financial economics, with a special emphasis on fintech-driven inclusive finance. Primarily, it is pioneering in its focus on developing countries, examining the effect of fintech-driven inclusive finance on bank profitability. While prior research has delved into the relationship between inclusive finance and profitability—Issaka Jajah et al. (2022) in Sub-Saharan Africa; Kumar et al. (2021) in Japan; Lv et al. (2022) in China; Al-Eitan et al. (2022) and Shihadeh et al. (2018) in Jordan; Khatib et al. (2022) in Palestine; Oranga and Ondabu (2018) in Kenya; Ikram and Lohdi (2015) in Pakistan; and Wang et al. (2022) in emerging countries—there remains a noticeable dearth of such research in a broader context with regard to developing countries. Notably, the intersection of fintech-driven inclusive finance and bank profitability, especially in the digital age, has been largely overlooked. Our study addresses this research gap and enriches the literature on fintech-driven inclusive finance.

Secondly, while much existing research (Al-Eitan et al. 2022; Issaka Jajah et al. 2022; Jungo et al. 2022; Khatib et al. 2022; Kumar et al. 2021; Yakubu and Musah 2022) on inclusive finance employs traditional variables such as ATMs, bank branches, and loan accounts to formulate the inclusive finance index, it is pertinent to note the technological shift in developing countries. A significant 79% of the populace in these nations have access to a mobile phone (Demirgüç-Kunt et al. 2020). Furthermore, the availability of financial services on these mobile platforms is expanding rapidly (Cho et al. 2023; Mehrotra and Nadhanael 2016; Nguyen 2021). Concurrently, global internet user rates surged from 31% to 63% between 2011–2021 (World Bank 2022). In light of these transitions, our approach distinctively emphasizes fintech aspects, notably mobile and internet, when developing the indices.

Thirdly, a significant challenge in studying the relationship between inclusive finance and bank profitability lies in the utilization of insufficient and inappropriate financial inclusion metrics (Issaka Jajah et al. 2022). To address this, we constructed a composite inclusive finance index using three dimensions and a host of fintech proxies, implementing a two-stage principal component analysis (PCA). This methodology not only bridges the measurement gap but also provides a more comprehensive depiction of inclusive finance. Significantly, our two-stage PCA approach, employed in creating the fintech index, is identified as optimal (Nguyen 2021; Tram et al. 2023) as it circumvents biases in weighing both indicators and dimensions (Gharbi and Kammoun 2023).

Finally, investigating the relationship between inclusive finance and bank profitability, potential endogeneity issues emerge (Issaka Jajah et al. 2022), potentially leading to skewed outcomes if overlooked (Cameron and Trivedi 2013; Wooldridge 2010). In contrast to certain studies (Al-Eitan et al. 2022; Kumar et al. 2021; Wang et al. 2022) that neglect these concerns, our research rigorously addresses endogeneity, heteroscedasticity, and autocorrelation. We tackle these challenges through two methodologies: the instrumental variables estimation (2SLS-IV), drawing on Ahamed and Mallick (2019) and Banna et al. (2021b), and a dynamic two-step system GMM approach, informed by Hakimi et al. (2021), Khatib et al. (2022), and Vo et al. (2021), elucidating the relationship between fintech-driven inclusive finance and bank profitability.

2. Literature Review and Hypothesis Development

Building upon the diversification theory (Markowitz 1952; Ross et al. 2016), inclusive finance improves the diversity of loan portfolios, thereby reducing the incidence of non-performing loans. This, in turn, promotes the accrual of ample savings and consistent retail deposits, which are pivotal elements underpinning the stability of banks (Hakimi et al. 2021). Kumar et al. (2021) further corroborate that the proliferation of financial inclusion can tap into a more expansive customer base, resulting in increased deposits and loans, culminating in augmented profitability. Notably, the advent and progression of fintech play a pivotal role in propelling financial inclusion in emerging and developing nations (Lyons et al. 2021).

The exponential rise in financial technology (fintech) innovations has increasingly captivated researchers, prompting them to assess its implications for the banking sector (Yin et al. 2022). Yet, research that delves into fintech-driven inclusive finance and its correlation with bank profitability, especially in developing countries, remains limited.

Wang et al. (2022) explored the relationship between inclusive finance and bank profitability measured by ROA, ROE, and NIM across emerging countries from 2000 to 2019. Their findings underscored a unidirectional relationship, where inclusive finance enhances banks’ profitability. In a similar vein, Vo and Nguyen (2021) analyzed data from 1507 banks in Asian emerging markets spanning from 2008 to 2017. They posited that financial inclusion amplifies Asian bank performance. Akhisar et al. (2015) deduced that debit and credit cards, ATMs, and bank branches serve as catalysts for bank performance, as evidenced by ROA and ROE metrics. Contrarily, they observed that point of sale (POS) systems can adversely affect bank performance across both developing and developed regions.

Taking a different geographical focus, Yakubu and Musah (2022) leveraged country-level data from 30 Sub-Saharan African nations, covering 2000 to 2017, to gauge the influence of inclusive finance on bank profitability. Their research unveiled an inverse relationship between the two variables. Contradicting this, Issaka Jajah et al. (2022) endorsed a positive correlation between inclusive finance and bank profitability estimated by ROA, ROE, and NIM within the Sub-Saharan African context.

Further broadening the geographic scope, Shihadeh (2020) utilized data from 24 countries to ascertain the repercussions of inclusive finance on bank risk and overall performance, revealing a beneficial impact of bank branches on performance. Meanwhile, Jouini and Obeid (2021), through their investigation of a sample of 11 Arab nations between 2013 and 2019, found an inconclusive link between the presence of ATMs and bank branches and the resultant profitability.

Khatib et al. (2022) conducted an analysis of 11 Palestinian banks spanning from 2012 to 2020, aiming to discern the influence of financial inclusion on bank performance as indicated by ROA and NIM metrics. Their findings suggest that factors like ATMs, bank branches, and the quality of products bolster profitability. Interestingly, they noted that POS terminals had no tangible impact on profitability. Shihadeh (2021), in a similar vein, analyzed 15 Palestinian banks from 2006 to 2016 and found that financial inclusion not only enhanced bank performance but also drove increased revenue.

Turning the focus to Jordan, Al-Eitan et al. (2022) probed into the relationship between inclusive finance and bank profitability. Drawing from a sample of 13 banks between 2009 and 2019, they ascertained that bank profitability in Jordan suffered due to factors like the size of loans accounts and deposits. However, the number of branches and ATMs appeared to have no substantial influence on profitability. Further examining the Jordanian landscape, Shihadeh et al. (2018) studied 13 commercial banks from 2009 to 2014. Their framework for financial inclusion encompassed parameters like SME credit, ATM services, deposits, credit cards, and innovative services. Using ROA and gross revenue as performance indicators, they concluded that ATMs bolstered bank performance, whereas bank credit adversely affected earnings. Interestingly, the introduction of innovative banking services was linked with an upsurge in bank profitability.

Broadening the scope to Kenya, Nzyuko et al. (2018) deduced that tools like ATMs, mobile banking, and online banking played a pivotal role in augmenting bank performance. Finally, in a departure from the African and Middle Eastern context, Kumar et al. (2021) examined 122 Japanese banks from 2004 to 2018. Their findings highlighted that while bank branches were instrumental in enhancing profitability, loan accounts and ATMs did not significantly influence the profitability metric.

Despite numerous empirical studies exploring the relationship between inclusive finance and profitability, many have confined their investigations to specific inclusive finance indicators. Recognizing this limitation, our study pioneers the construction of a fintech-driven inclusive finance index. This index melds three critical dimensions—availability, penetration, and usage—with ten distinct indicators, providing a nuanced lens through which we can view inclusive finance. Our methodology harnesses the power of a two-stage principal component analysis (PCA) to ensure precision.

A survey of the existing literature reveals an ambiguous consensus on how inclusive finance influences bank profitability. Strikingly, amid this digital age, there seems to be a notable void in studies delving into the nexus between fintech-based inclusive finance and the profitability of banks in developing nations. Informed by the aforementioned literature and this observed gap, we propose the following hypothesis:

H1.

Fintech-driven inclusive finance induces bank profitability in developing countries.

3. Data and Methodology

3.1. Data

While this study focuses exclusively on the banking sector, the profitability of this sector is not merely a concern for individual banks and their shareholders. It also has systemic implications for the broader health of the economy and the entire financial system. To assess the impact of fintech-driven inclusive finance on bank profitability, we sourced secondary data from various databases: (a) Orbis Bank Focus (OBF) from Bureau van Dijk; (b) the Financial Access Survey (FAS-IMF); (c) the World Development Indicators (WDI); (d) the World Governance Indicators (WGI); and (e) the Global Findex database (Findex).

Our dataset is an unbalanced panel spanning from 2011 to 2021, encompassing 40 developing countries. To mitigate potential sample selection bias, we note the exclusion of several developing nations in Table 1 due to data limitations. A detailed list of the sample countries can be found in Table A1 in Appendix A. The final dataset includes 5991 observations, representing 660 banks: 593 conventional, 49 Islamic, 13 savings, and 5 cooperative banks. To mitigate the impact of outliers, we implemented winsorization on each variable, setting threshold values at the 5th and 95th percentiles. All values in the dataset are presented in thousands of USD.

Table 1.

Sample selection for developing countries.

3.2. Bank Profitability (Dependent Variables)

We measure profitability using return on assets (ROA), return on equity (ROE), and net interest margin (NIM), consistent with the existing literature (Issaka Jajah et al. 2022; Khatib et al. 2022; Kumar et al. 2021; Saif-Alyousfi and Saha 2021; Wang et al. 2022). These metrics offer insights into a bank’s financial performance, making them suitable indicators for evaluating profitability. Moreover, NIM directly reflects a bank’s ability to generate profit from its lending and investment activities compared to its funding costs (Issaka Jajah et al. 2022; Khatib et al. 2022). A higher NIM suggests better profitability and vice versa. Given the considerable fluctuations in banks’ balance sheets—attributed to seasonal factors, economic conditions, and other market imperfections—we employ average assets and average equity when calculating ROA and ROE. This approach provides a more consistent representation of a bank’s profitability over a specific timeframe.

3.3. Construction of Fintech-Driven Inclusive Finance Indices (Independent Variables)

Indices based on fintech for measuring inclusive finance are currently lacking (Banna et al. 2021b). In response, we developed a composite fintech-driven inclusive finance index that integrates the dimensions of availability, penetration, and usage, consistent with the recent literature (Cámara and Tuesta 2014; Nguyen 2021; Park and Mercado 2018; Tram et al. 2023). This index also emphasizes the fintech-related components, specifically mobile and internet, that were overlooked in previous studies (Ahamed and Mallick 2019; Hakimi et al. 2021; Li and Wang 2023; Sethy and Goyari 2022).

We begin by forming the availability dimension index (FIA), incorporating four indicators: mobile money agent outlets (active) per 100,000 adults, mobile money agent outlets (active) per 1000 km2, and percentages of mobile phone and internet users within the population. Next, the penetration dimension index (FIP) integrates three indicators: the number of active mobile money accounts per 1000 adults, mobile money transactions per 1000 adults, and mobile and internet banking transactions per 1000 adults. The usage dimension index (FIU) is devised using three metrics: the percentage of GDP represented by the value of mobile money transactions, the percentage of GDP represented by the value of mobile and internet banking transactions, and the percentage of GDP reflected by the balance on active mobile money accounts. By amalgamating FIA, FIP, and FIU, we formulate a new composite fintech index (FI) to gauge inclusive finance. We employ principal component analysis (PCA2) to meld these dimensions, mitigating the weighting bias inherent in non-parametric methods.

PCA is a multivariate statistical method to build indices that is well recognized in numerous studies (Tram et al. 2023; Nguyen 2021; Ahamed and Mallick 2019; Bali et al. 2014; Ellul and Yerramilli 2013). The model to build fintech indices is as follows:

where Fintechi = fintech indices (FIA, FIP, FIU, and FI); Wij = weight’s or component’s loadings for i = 1, 2, 3, …, n and j = 1, 2, 3, …, m; and Xi = (X1, X2, X3, …, Xn) variables related to each index. The fintech indices are normalized from 0 to 1, where 1 represents the highest degree of financial inclusion, and 0 signifies the lowest level. Table A1 in Appendix A summarizes the mean value of fintech-driven inclusive finance indices derived from Equation (1) from 2011 to 2021.

3.4. Control Variables

We incorporated a variety of control variables tailored to bank-specific attributes, which include the cost-to-income ratio, non-performing loan ratio, capital adequacy ratio, loan-to-deposit ratio, bank size, and liquidity ratio. The cost-to-income ratio is commonly recognized as a gauge of operational efficiency. Many studies, including those by Khatib et al. (2022) and Kumar et al. (2021), have utilized the cost-to-income ratio to discern its impact on bank profitability. Predominantly, the evidence suggests a negative correlation.

The capital adequacy ratio, intended to ensure banks hold adequate capital relative to their risk exposure (Sugianto et al. 2020), has been a focal point of various studies examining its influence on bank profitability (Forcadell et al. 2020; Khatib et al. 2022; Kumar et al. 2021). However, the nature of this relationship has been contested. While Lee and Hsieh (2013) and Athanasoglou et al. (2008) found it exerts a positive influence on profitability, as assessed by ROA, Dietrich and Wanzenried (2014) documented a negative impact when profitability is gauged using ROE. On another note, the non-performing loan ratio, a metric often used to evaluate credit risk, inherently suggests banks with elevated levels of such loans possess deficient credit risk management, potentially diminishing profitability. This association has been validated by studies like those of Khatib et al. (2022), Tran and Nguyen (2020), and Kumar et al. (2021), which unanimously identified a detrimental effect of non-performing loans on bank profitability.

The relationship between bank size and profitability remains a topic of contention. While Smirlock (1985) suggests a positive correlation, both Saif-Alyousfi and Saha (2021) and Kumar et al. (2021) observed a negative one. In contrast, Shehzad et al. (2013) found no clear relationship. The loan-to-deposit ratio offers insights into a bank’s liquidity and lending potential. Its impact on bank profitability has been debated. Tan and Floros (2012) have identified a negative relationship, whereas Heffernan and Fu (2010) noted a positive one. The interplay between liquidity ratios and bank profitability is complex. Alshatti (2015) demonstrated a negative influence on profitability. Conversely, Islam and Nishiyama (2016) detected a positive association. It is worth noting that achieving a balance between liquidity and profitability remains a persistent challenge for bank managers.

We consider three macroeconomic control variables: GDP growth rate, inflation rate, and institutional quality (IQ). IQ is quantified based on six components from the World Governance Indicators (WGI3), as validated by Kaufmann et al. (2011). To derive a composite score for IQ, we employ Principal Component Analysis (PCA), following the methodology of Banna et al. (2021b) and Ahamed and Mallick (2019). Previous studies suggest that during economic upswings, business activity and loan demand typically escalate. As such, Saif-Alyousfi and Saha (2021) and Kumar et al. (2021) identified a positive correlation between GDP growth and bank profits. Furthermore, while several studies (e.g., Athanasoglou et al. 2008; Kumar et al. 2021; Tan 2016; Yakubu and Musah 2022) propose that the inflation rate bolsters bank profitability, Saif-Alyousfi and Saha (2021) posit that banks often grapple with challenges during inflationary periods. Meanwhile, Bashiru et al. (2023) contended that institutional quality can significantly shape profitability. For a comprehensive understanding, Table 2 outlines the variables, their measurements, and their projected influences on bank profitability as deduced from the literature.

Table 2.

Variable measures, symbols, and data sources.

3.5. Model Specification

The development of the research models considered the following relevant studies: (Al-Eitan et al. 2022; Issaka Jajah et al. 2022; Khatib et al. 2022; Kumar et al. 2021). Hence, we developed the following baseline econometric models to evaluate the relationship between fintech-driven inclusive finance and bank profitability:

where the subscript i (number of banks) = 1, 2, …, 660; j (number of the country) = 1,2, …, 40; and t (time period) = 2011, 2012, …, 2021; ROA, ROE, and NIM are the proxy of bank profitability and refer to the dependent variables; Fintech = fintech-driven inclusive finance indices (FI, FIA, FIP, and FIU) and refers to the main explanatory variables; CIR, CAR, NPL, SIZE, LDR, and LR are bank-specific control variables; GDP, INF, and IQ are macro-specific variables; β0 represents a constant; β1 to β10 = coefficients of the variables; and Ɛijt is the error term.

3.6. Data Analysis Techniques

3.6.1. Fixed Effect Regression

For our analysis, we considered both fixed-effect (FE) and random-effect (RE) models to determine the most appropriate fit. The Hausman test stands out as the prevailing econometric tool to choose between FE and RE in panel data regression, as cited in multiple studies (Banna et al. 2021a; Hausman 1978; Khatib et al. 2022; Kumar et al. 2021). This test compares the estimates and their standard errors derived from both the FE and RE models. If the estimates from these models diverge significantly, it implies a correlation between the individual-specific effects and the explanatory variables. In our study, the results from the Hausman test (with a p-value > 0.10) robustly favored the fixed-effects model. Notably, the fixed-effect estimation effectively handles challenges stemming from unobserved heterogeneity across banks. This approach is particularly relevant when the unobserved variations within a bank remain stable over time (Schultz et al. 2010).

3.6.2. Two-Stage Least Squares (2SLS-IV) Regression

To address potential endogeneity concerns, we employ the two-stage least squares instrumental variables (2SLS-IV) regression method. We identify two instrumental variables for this analysis: (i) the proportion of mobile phone usage (MPS) in neighboring countries within the same region, and (ii) reliance on friends and family (FnF) as emergency financial sources. Our selection resonates with the prevalent literature on financial inclusion, as cited in works by Ahamed and Mallick (2019) and Banna et al. (2021b). Crucially, while MPS and FnF can potentially influence fintech-driven inclusive finance (our endogenous variable), they are unlikely to have a direct bearing on bank profitability, the dependent variable in our model.

3.6.3. Two-Step System GMM Estimation

We employ the two-step system GMM method, as proposed by Arellano and Bover (1995) and Blundell and Bond (1998), and further refined by Roodman (2009), to address prevalent challenges, such as endogeneity, heteroscedasticity, and autocorrelation, often encountered in cross-country studies. This method has been widely recognized by numerous scholars for its efficacy in resolving the endogeneity concern within banking datasets (Hakimi et al. 2021; Khatib et al. 2022; Vo et al. 2021). Our primary aim is to pinpoint instruments that are not correlated with bank profitability but are associated with relevant endogenous factors, specifically fintech-driven inclusive finance.

3.6.4. Generalized Least Squares (GLS) Estimation: Random Effects

The random-effects GLS method is a commonly used approach for panel data that involves multiple entities observed across different periods, as cited by Renzhi and Baek (2020). Such entities often possess unobserved heterogeneity, influencing the dependent variable. The random effects GLS method caters to this by introducing entity-specific random effects into the model. As articulated by Kharabsheh and Gharaibeh (2023) and Sodokin et al. (2022), these random effects capture the specific deviations from the mean of each entity, proving pivotal in elucidating the variations in the dependent variable.

4. Results and Discussion

4.1. Descriptive Statistics

Table 3 provides a comprehensive snapshot of the descriptive statistics for the variables employed in this study. This table sheds light on key details of both independent and dependent variables, highlighting the number of observations, standard deviation, mean, and minimum and maximum values.

Table 3.

Descriptive statistics.

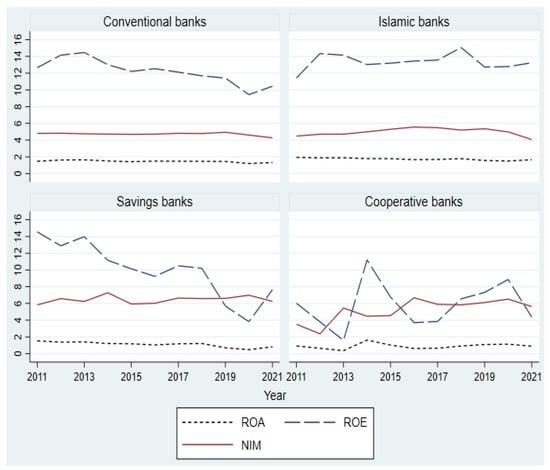

On average, the Return on Assets (ROA) stands at 1.45% with a standard deviation (SD) of 1.02. Return on Equity (ROE) averages 11.99% with an SD of 8.07, while the Net Interest Margin (NIM) averages 4.78% with an SD of 2.78. Figure 1 reveals that among the banking categories, Islamic banks lead in generating ROA and ROE, followed by conventional, savings, and cooperative banks. In contrast, savings banks register the highest NIM, followed by cooperative, Islamic, and conventional banks. However, the fluctuation in ROE and NIM is notably higher compared to ROA throughout the period from 2011 to 2021.

Figure 1.

ROA, ROE, and NIM of conventional, Islamic, savings, and cooperative banks: 2011–2021.

The mean value of the Fintech Index (FI) is 0.29 with an SD of 0.19. Breaking it down, the Availability Index (FIA) has a mean of 0.19 with an SD of 0.22, the Penetration Index (FIP) averages 0.40 with an SD of 0.19, and the Usage Index (FIU) stands at 0.14 with an SD of 0.19. In terms of macroeconomic indicators, the average GDP growth rate is 4.14% with an SD of 3.13%, and the inflation rate averages 4.68% with an SD of 4.20%. The relatively high standard deviations underscore significant variations across countries, a finding that resembles the observations of Ahamed and Mallick (2019).

4.2. Granger Causality Tests

To examine the potential bidirectional relationship between fintech-driven inclusive finance and bank profitability (as measured by ROA, ROE, and NIM), we conducted Granger causality tests, drawing inspiration from Kumar et al. (2021) and Wang et al. (2022). Nonetheless, our results (as depicted in Table A2 in Appendix A) suggest that it is the fintech index (FI), representing inclusive finance, that influences bank profitability, rather than the other way around. This implies a unidirectional link, underscoring the importance of inclusive finance as a catalyst for improving bank profitability in developing nations.

4.3. Regression Results: Fixed Effect

Table A3 in Appendix A confirms that our independent variables are free from multicollinearity concerns, with the mean Variance Inflation Factor (VIF) standing at 1.67 (as supported by Montgomery et al. 2021; Wooldridge 2015). The fixed-effect outcomes are detailed in Table 4, derived from Equations (2) through (4). We employ three proxies for bank profitability: ROA (Models I–IV), ROE (Models V–VIII), and NIM (Models IX–XII), and four for fintech-driven inclusive finance indices: FI (Models I, V, IX), FIA (Models II, VI, XI), FIP (Models III, VII, XI), and FIU (Models IV, VIII, XII). Our findings highlight that FI exerts a positive and significant impact on ROA, ROE, and NIM at both the 1% and 5% significance levels. Specifically, the coefficients reveal that a one-standard-deviation increase in FI (equivalent to 0.19 as presented in Table 3) augments ROA by 9.10% (0.19 × 0.477), ROE by 18.87% (0.19 × 0.993), and NIM by 7.98% (0.19 × 0.420). Moreover, the coefficients of FIA, FIP, and FIU consistently indicate a statistically significant positive relationship with ROA, ROE, and NIM at the 1%, 5%, and 10% levels. These results suggest that the integration of fintech in promoting financial inclusion has a positive impact on bank profitability, which is consistent with findings from earlier studies by Baker et al. (2023), Issaka Jajah et al. (2022), Khatib et al. (2022), and Kumar et al. (2021).

Table 4.

Fintech-driven financial inclusion and bank profitability: fixed effect.

Nevertheless, it is worth noting that the models’ R-squared values, which measure their overall explanatory power, are moderately robust. This observation is consistent with trends in academic research focusing on topics like financial inclusion, bank risk-taking, stability, and profitability, as evidenced by works such as Ahamed and Mallick (2019), Banna et al. (2021b), Khatib et al. (2022), and Kumar et al. (2021). Importantly, the coefficients of key variables, namely ROA, ROE, and NIM, remain consistent throughout various robust tests, pointing to the stability of these models.

In terms of bank-specific control variables, our analysis reveals that several variables, including cost-efficiency indicators (CIR), credit risk management (NPL), bank size (SIZE), lending capacity (LDR), and liquidity ratio (LR), play pivotal roles in shaping bank profitability. Specifically, banks with a higher cost-to-income ratio (CIR) typically exhibit reduced profitability. This is evidenced by the consistent negative coefficients for CIR with ROA, ROE, and NIM, confirming our expectations and aligning with prior findings (Khatib et al. 2022; Kumar et al. 2021). The CAR coefficient is positively associated with ROA, although it displays a negative association, albeit insignificant, with ROE, and a significant negative relationship with NIM. This suggests a complex relationship between CAR and bank profitability, a finding that resonates with the existing literature (Khatib et al. 2022; Kumar et al. 2021). The coefficient for NPL is negative and statistically significant across ROA, ROE, and NIM, replicating conclusions from earlier studies (Issaka Jajah et al. 2022; Khatib et al. 2022; Kumar et al. 2021; Tran and Nguyen 2020). Further, bank size (Kumar et al. 2021), loan-to-deposit ratio (Tan and Floros 2012), and liquidity ratio (Alshatti 2015) negatively influence bank profitability. On the other hand, country-specific control variables like GDP growth, inflation, and institutional quality appear to enhance bank profitability, a sentiment reflected by previous research (Bashiru et al. 2023; Kumar et al. 2021; Yakubu and Musah 2022).

4.4. Robustness Tests: 2SLS-IV Regression

To ensure the reliability of our instrumental variables, we applied two diagnostic tests, suggested by relevant studies (Ahamed and Mallick 2019; Banna et al. 2021b): the under-identification LM test proposed by Kleibergen and Paap (2006), and the over-identification test formulated by Hansen (1982).

In this analysis, we considered three measures representing bank profitability: ROA (Models I–IV), ROE (Models V–VIII), and NIM (Models IX–XII). Simultaneously, we looked at four metrics for fintech-driven inclusive finance indices: FI (Models I, V, and IX), FIA (Models II, VI, and XI), FIP (Models III, VII, and XI), and FIU (Models IV, VIII, and XII). From the outcomes of the 2SLS-IV regression presented in Table 5, it is evident that fintech-driven inclusive finance positively affects bank profitability. This outcome further supports our previous results.

Table 5.

Fintech-driven financial inclusion and bank profitability: 2SLS-IV.

4.5. Robustness Tests: A Dynamic Panel Model

Within the framework of the dynamic panel analysis, we employed three indicators representing bank profitability: ROA (Models I–IV), ROE (Models V–VIII), and NIM (Models IX–XII), in conjunction with four indicators for fintech-driven inclusive finance indices: FI (Models I, V, and IX), FIA (Models II, VI, and XI), FIP (Models III, VII, and XI), and FIU (Models IV, VIII, and XII). The GMM estimation results are illustrated in Table 6. The Arellano-Bond tests for AR(1) and AR(2) suggest an absence of second-order serial correlation. Furthermore, the over-identification restrictions test, as proposed by Hansen (1982), validates the appropriateness of the instrumental variables, signifying a suitable fit between endogenous variables and their instruments. Consequently, the specification of the GMM model is deemed accurate. The results suggest that fintech-driven inclusive finance positively impacts bank profitability, as measured by ROA, ROE, and NIM.

Table 6.

Fintech-driven inclusive finance and bank profitability: two-step system GMM.

4.6. Robustness Tests: Random-Effects Generalized Least Squares (GLS)

Within the GLS framework, we employ three metrics for bank profitability: ROA (Models I–IV), ROE (Models V–VIII), and NIM (Models IX–XII), along with four measures for fintech-driven inclusive finance indices: FI (Models I, V, and IX), FIA (Models II, VI, and XI), FIP (Models III, VII, and XI), and FIU (Models IV, VIII, and XII). The data presented in Table 7 reveal that fintech-centric inclusive finance promotes profitability, further confirming the credibility of our prior analyses.

Table 7.

Fintech-driven inclusive finance and bank profitability: GLS (random effects).

4.7. Robustness Tests: Split Samples Based on FI Intensity (High FI vs. Low FI)

To show the influence of fintech-enabled inclusive finance on bank profitability across regions with varied financial inclusion, we segregate our fintech index (FI) into two distinct categories: those above the sample mean, termed high FI, and those below, termed low FI. Thereafter, we execute a fixed-effect regression analysis for both low FI (Models I, II, and III) and high FI (Models IV, V, and VI) utilizing three profitability indices: ROA (Models I and IV), ROE (Models II and V), and NIM (Models III and VI). Data from Table 8 convey that while the impact of FI remains positive across all models, it attains significance (at the 1% level) for high FI across ROA, ROE, and NIM. This complements our earlier conclusions regarding the beneficial effects of intensified fintech-driven inclusive finance on banking profitability.

Table 8.

FI and bank profitability: split samples based on FI (fixed effect).

4.8. Sample Segmentation Based on Economic Development (High GDP vs. Low GDP)

To investigate the influence of fintech-driven inclusive finance on bank profitability as per the economic development stages measured by the GDP growth rate of countries, we first segment our FI dataset into two categories: high GDP growth (above sample mean) and low GDP growth (below sample mean). We then employ fixed-effect regression for the low GDP segment (Models I, II, and III) and the high GDP segment (Models IV, V, and VI) using three profitability indicators: ROA (Models I and IV), ROE (Models II and V), and NIM (Models III and VI). Table 9 reveals that while there is a general positive association between FI and profitability across all models, it is notably significant (at the 1% level) for the high GDP growth segment across all profitability metrics (ROA, ROE, and NIM). This suggests that fintech-driven inclusive finance plays a notably effective role in enhancing bank profitability in countries experiencing higher GDP growth compared to others.

Table 9.

FI and bank profitability: split samples based on GDP growth (fixed effect).

4.9. Further Insights: FI and Profitability Nexus Considering the Size and Type of Banks

In a further exploration, we examine the relationship between FI and bank profitability, taking into account both the size and type of banks. We employ a threshold of USD 1 billion in total assets to categorize banks as either small or large, a classification approach informed by Banna et al. (2021b) and Čihák and Hesse (2010). In examining the correlation between FI and bank profitability, we consider a range of bank types, including conventional, Islamic, and savings banks. Cooperative banks were excluded from this analysis due to an insufficient number of such entities.

The findings presented in Table 10 show that while there is a universally positive relationship between FI and profitability metrics (ROA, ROE, and NIM) for both small and large banks, the association is notably significant (at the 1% level) for the large banks. This implies that large banks could potentially overshadow their small counterparts, which may introduce instability within the broader financial ecosystem. Furthermore, the data in Table 11 highlights that the effect of FI on profitability measures (ROA, ROE, and NIM) is positively significant (at the 1% level) for conventional banks when contrasted with their Islamic and savings bank peers.

Table 10.

FI and bank profitability by bank size: fixed effect.

Table 11.

FI and bank profitability by bank type: fixed effect.

4.10. Effect of Interaction between FI and COVID-19 (2020–2021) on Bank Profitability

To understand the interaction effects of FI and the COVID-19 pandemic (2020–2021) on bank profitability, we assigned a value of 1 to the pandemic years (2020–2021) and 0 to the pre-pandemic phase (2011–2019). Four fintech-driven inclusive finance indices (FI, FIA, FIP, and FIU) are utilized to measure the impacts on profitability, as represented by ROA. The findings presented in Table 12 suggest that FI exerts a significant (at both 1% and 5% levels) positive influence on bank profitability across all indices (Models I–IV). In terms of the interaction effect, the pandemic amplifies the favorable association between the fintech indices (FI, FIA, FIP, and FIU) and bank profitability. This implies that fintech-enabled inclusive finance can boost bank profitability even during disruptive events like the COVID-19 pandemic.

Table 12.

FI and COVID-19 interaction effects on bank profitability (fixed effect).

5. Conclusions, Policy Implications, and Limitations

This study investigates the connection between fintech-driven inclusive finance and bank profitability, analyzing 660 banks from 40 developing nations over the period of 2011 to 2021. We employed a diverse set of methodologies, including fixed-effect regression, 2SLS-IV, two-step system GMM, and fixed-effects GLS estimation, to probe the relationship. Our research establishes a clear unidirectional relationship between inclusive finance and bank profitability. Specifically, the findings highlight that advancing inclusive finance through fintech results in elevated profitability (as measured by ROA, ROE, and NIM) among the sampled banks in these developing countries. Fintech’s influence translates to a significant 9.10% increase in ROA, a commendable 18.87% rise in ROE, and a noteworthy 7.98% jump in NIM, indicating the era of mobile, internet, and agent banking. Additionally, the impact of fintech-driven inclusive finance on profitability metrics is more pronounced for large banks compared to small ones. Conversely, the positive effect on profitability metrics is more evident for conventional banks than Islamic and savings banks. Moreover, the robust connection between inclusive finance and bank profitability is more apparent in countries actively promoting fintech-based inclusive finance.

Importantly, several bank-specific control variables, such as cost efficiency, credit risk, bank size, lending capacity, and liquidity ratio, have a marked effect on banks’ profitability. On a country level, factors like GDP growth, inflation, and institutional quality also have a positive bearing on bank profitability. The relationship between fintech-driven inclusive finance and bank profitability is more positive in countries with higher GDP growth compared to those with slower growth. The era of COVID-19 further strengthened the positive relationship between fintech and bank profitability. Thus, while fintech plays a beneficial role in amplifying profitability during economic upswings, it retains its importance even during anomalous periods. However, the increasing reliance of banks on fintech can also pave the way for potential challenges, notably heightened competition. Consequently, large banks may overshadow small ones, potentially leading to disruptions in the broader financial landscape.

From a theoretical perspective, the influence of fintech-driven inclusive finance on bank profitability manifests in numerous advantages. These include the broadening of the customer base, an enhanced range of services, cost-effective retail deposits, the diversification of loan portfolios, and efficient risk management strategies. On the practical front, while there are evident merits, there also exist certain challenges. Financial institutions may encounter the initial establishment costs, the potential for lower margins, stringent regulatory compliances, and increased credit risks. Moreover, the optimal harnessing of fintech’s potential necessitates a comprehensive approach. It calls for promoting financial literacy among consumers, fortifying cybersecurity measures, and ensuring adequate safeguards to cultivate confidence in individuals venturing into the realm of fintech. These multifaceted challenges serve as essential considerations for decision makers, regulators, and financial institutions.

While our study offers significant insights, it does not account for other potential indicators of financial inclusion, such as credit scores or blockchain adoption, due to the scope of the research. Subsequent studies can seek to incorporate these variables. There is also a need for an in-depth analysis of the varied influences of fintech on economic growth and sustainability, incorporating additional macroeconomic control variables like unemployment rates, interest rates, and stock market trends. Upcoming research might also investigate possible nonlinear connections between fintech and bank profitability.

Author Contributions

Conceptualization, C.Z. and M.A.R.; Methodology, M.A.R. and S.M.-U.-H.; Software, M.A.R.; Formal analysis, M.A.R.; Data curation, S.H.; Writing—original draft, M.A.R.; Writing—review & editing, S.H. and S.M.-U.-H.; Supervision, C.Z. All the authors have played a significant role in providing critical feedback, which helped shape the research, analysis, review and editing, and preparation of the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

FAS data are available at: https://data.imf.org/?sk=e5dcab7e-a5ca-4892-a6ea-598b5463a34c (accessed on 15 January 2023). WDI data are available at: https://databank.worldbank.org/source/world-development-indicators (accessed on 15 January 2023). Findex data are available at: https://www.worldbank.org/en/publication/globalfindex/Data (accessed on 15 January 2023). Orbis Bank Focus (OBF) data link (not publicly available): https://login.bvdinfo.com/R0/BankFocus (accessed on 10 January 2022).

Acknowledgments

The authors extend gratitude to the editor and the four anonymous reviewers for their invaluable and constructive feedback and suggestions, which played a pivotal role in enhancing the quality of this paper. We are also thankful to the editorial office of the Journal of Risk and Financial Management for waiving the article processing charge (APC).

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

List of countries with mean value of fintech-driven inclusive finance indices.

Table A1.

List of countries with mean value of fintech-driven inclusive finance indices.

| Country | FI | FIA | FIP | FIU |

|---|---|---|---|---|

| (1) Afghanistan | 0.0491 | 0.0031 | 0.1278 | 0.0011 |

| (2) Albania | 0.1871 | 0.0658 | 0.4118 | 0.0161 |

| (3) Armenia | 0.2579 | 0.1312 | 0.4603 | 0.0790 |

| (4) Bangladesh | 0.4016 | 0.5918 | 0.2801 | 0.1088 |

| (5) Benin | 0.3242 | 0.2012 | 0.3644 | 0.2614 |

| (6) Botswana | 0.4137 | 0.0541 | 0.6876 | 0.3463 |

| (7) Burkina Faso | 0.2900 | 0.1205 | 0.3156 | 0.3090 |

| (8) Cambodia | 0.2209 | 0.0838 | 0.3669 | 0.1247 |

| (9) Cameroon | 0.2330 | 0.1043 | 0.3123 | 0.1845 |

| (10) Chad | 0.0419 | 0.0120 | 0.0969 | 0.0022 |

| (11) Eswatini | 0.3227 | 0.1731 | 0.4540 | 0.2039 |

| (12) Fiji | 0.2877 | 0.0717 | 0.6474 | 0.0438 |

| (13) Ghana | 0.4688 | 0.3187 | 0.5534 | 0.3225 |

| (14) Guinea | 0.1955 | 0.1065 | 0.2664 | 0.1298 |

| (15) Guyana | 0.1391 | 0.0226 | 0.3189 | 0.0287 |

| (16) Jordan | 0.1642 | 0.0406 | 0.3863 | 0.0094 |

| (17) Lesotho | 0.2919 | 0.1398 | 0.4227 | 0.1914 |

| (18) Madagascar | 0.0809 | 0.0360 | 0.1304 | 0.0436 |

| (19) Malawi | 0.1643 | 0.1129 | 0.1919 | 0.1136 |

| (20) Maldives | 0.4162 | 0.3797 | 0.5764 | 0.0997 |

| (21) Mali | 0.2420 | 0.1005 | 0.3360 | 0.1893 |

| (22) Mauritius | 0.3569 | 0.2885 | 0.5550 | 0.0691 |

| (23) Myanmar | 0.0892 | 0.0258 | 0.2039 | 0.0067 |

| (24) Namibia | 0.3661 | 0.0656 | 0.6036 | 0.2914 |

| (25) Nepal | 0.1730 | 0.1477 | 0.2722 | 0.0219 |

| (26) Niger | 0.0668 | 0.0288 | 0.1252 | 0.0206 |

| (27) Pakistan | 0.1476 | 0.1122 | 0.2031 | 0.0613 |

| (28) Panama | 0.2390 | 0.0795 | 0.4590 | 0.0886 |

| (29) Philippines | 0.2212 | 0.0953 | 0.4054 | 0.0765 |

| (30) Qatar | 0.3191 | 0.1351 | 0.6790 | 0.0243 |

| (31) Rwanda | 0.4855 | 0.5331 | 0.3901 | 0.2834 |

| (32) Senegal | 0.3443 | 0.2108 | 0.3921 | 0.2759 |

| (33) Seychelles | 0.3269 | 0.1843 | 0.6522 | 0.0153 |

| (34) South Africa | 0.2451 | 0.0746 | 0.5552 | 0.0189 |

| (35) Sudan | 0.1004 | 0.0129 | 0.2242 | 0.0302 |

| (36) Thailand | 0.4815 | 0.3407 | 0.6352 | 0.2535 |

| (37) Togo | 0.1875 | 0.0847 | 0.2719 | 0.1283 |

| (38) Uganda | 0.4906 | 0.3024 | 0.3779 | 0.5614 |

| (39) Zambia | 0.2577 | 0.1159 | 0.3651 | 0.1849 |

| (40) Zimbabwe | 0.4351 | 0.1273 | 0.4760 | 0.5198 |

Note: FI = fintech-driven financial inclusion index; FIA = availability dimension index; FIP = penetration dimension index; and FIU = usage dimension index. FIA, FIP, and FIU indices are estimated using first-stage principal component analysis (PCA), and FI is calculated by combining FIA, FIP, and FIU employing two-stage PCA. Mean values are calculated based on the yearly index from 2011 to 2021.

Table A2.

Granger causality results.

Table A2.

Granger causality results.

| Null Hypothesis | p-Value | |

|---|---|---|

| H0 | FI does not Granger cause ROA | 0.000 *** |

| H0 | ROA does not Granger cause FI | 0.258 |

| H0 | FI does not Granger cause ROE | 0.002 *** |

| H0 | ROE does not Granger cause FI | 0.541 |

| H0 | FI does not Granger cause NIM | 0.000 *** |

| H0 | NIM does not Granger cause FI | 0.397 |

Note: FI = fintech-driven financial inclusion index. *** Significance at 1%.

Table A3.

VIF and correlations matrix among independent variables.

Table A3.

VIF and correlations matrix among independent variables.

| Variables | VIF | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) FI | - | 1.000 | ||||||||||||

| (2) FIA | 1.50 | 0.804 * | 1.000 | |||||||||||

| (3) FIP | 3.04 | 0.729 * | 0.334 * | 1.000 | ||||||||||

| (4) FIU | 2.41 | 0.813 * | 0.462 * | 0.575 * | 1.000 | |||||||||

| (5) CIR | 1.30 | −0.016 | −0.082 * | −0.023 | 0.090 * | 1.000 | ||||||||

| (6) CAR | 1.32 | 0.167 * | 0.058 * | 0.144 * | 0.203 * | 0.077 * | 1.000 | |||||||

| (7) NPL | 1.18 | 0.026 | 0.054 * | −0.069 * | 0.059 * | 0.240 * | 0.024 | 1.000 | ||||||

| (8) SIZE | 1.56 | 0.161 * | 0.152 * | 0.231 * | 0.036 * | −0.320 * | −0.390 * | −0.143 * | 1.000 | |||||

| (9) LDR | 1.54 | 0.027 * | 0.033 * | 0.078 * | −0.063 * | −0.102 * | −0.068 * | −0.298 * | 0.007 | 1.000 | ||||

| (10) LR | 1.46 | −0.057 * | −0.157 * | −0.046 * | 0.064 * | 0.090 * | 0.228 * | 0.118 * | −0.155 * | −0.452 * | 1.000 | |||

| (11) GDP | 1.18 | −0.016 | 0.109 * | −0.220 * | −0.071 * | −0.002 | −0.052 * | −0.020 | −0.063 * | 0.090 * | −0.047 * | 1.00 | ||

| (12) INF | 1.26 | −0.118 * | 0.004 | −0.283 * | −0.019 | −0.076 * | 0.059 * | 0.109 * | −0.150 * | −0.260 * | −0.011 | −0.10 * | 1.00 | |

| (13) IQ | 2.33 | 0.225 * | 0.013 | 0.609 * | 0.050 * | −0.015 | −0.012 | −0.078 * | 0.166 * | 0.083 * | −0.045 * | −0.02 | −0.40 * | 1.00 |

| Mean VIF | 1.67 |

Note: VIF = variance inflation factor; FI = fintech-driven financial inclusion index; FIA = availability dimension index; FIP = penetration dimension index; FIU = usage dimension index; CIR = cost-to-income ratio; CAR = capital adequacy ratio; NPL = non-performing loan ratio; SIZE = ln(total assets); LDR = loan-to-deposit ratio; LR = liquidity ratio; GDP = annual increase rate of GDP; INF = inflation rate; and IQ = institutional quality index. * p < 0.05.

Notes

| 1 | Financial Access Survey (FAS) of International Monetary Fund (IMF), available online: https://data.imf.org/regular.aspx?key=61063968 (accessed on 15 January 2023). |

| 2 | The detailed results of fintech indices (FI, FIA, FIP, and FIU) constructed by PCA are available from the corresponding author on reasonable request. We also calculated fintech indices based on alternative methods of measurement (weighted average method) and found almost the same results (92.42% correlation). |

| 3 | We constructed the institutional quality (IQ) index as one of the control variables using PCA, including six components of world governance indicators: (i) Rule of Law, (ii) Regulatory Quality, (iii) Control of Corruption, (iv) Accountability, (v) Political Stability, and (vi) Government Effectiveness. |

References

- Ahamed, M. Mostak, and Sushanta K. Mallick. 2019. Is financial inclusion good for bank stability? International evidence. Journal of Economic Behavior & Organization 157: 403–27. [Google Scholar]

- Akhisar, Ilyas, K. Batu Tunay, and Necla Tunay. 2015. The effects of innovations on bank performance: The case of electronic banking services. Procedia-Social and Behavioral Sciences 195: 369–75. [Google Scholar] [CrossRef]

- Al-Eitan, Ghaith N., Bassam Al-Own, and Tareq Bani-Khalid. 2022. Financial inclusion indicators affect profitability of Jordanian commercial Banks: Panel data analysis. Economies 10: 38. [Google Scholar] [CrossRef]

- Alkhwaldi, Abeer F., Esraa Esam Alharasis, Maha Shehadeh, Ibrahim A. Abu-AlSondos, Mohammad Salem Oudat, and Anas Ahmad Bani Atta. 2022. Towards an understanding of FinTech users’ adoption: Intention and e-loyalty post-COVID-19 from a developing country perspective. Sustainability 14: 12616. [Google Scholar] [CrossRef]

- Alshatti, Ali Sulieman. 2015. The effect of the liquidity management on profitability in the Jordanian commercial banks. International Journal of Business and Management 10: 62. [Google Scholar]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Athanasoglou, Panayiotis P., Sophocles N. Brissimis, and Matthaios D. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money 18: 121–36. [Google Scholar] [CrossRef]

- Baker, Hafez, Thair A. Kaddumi, Mahmoud Daoud Nassar, and Riham Suleiman Muqattash. 2023. Impact of Financial Technology on Improvement of Banks’ Financial Performance. Journal of Risk and Financial Management 16: 230. [Google Scholar] [CrossRef]

- Bali, Turan G., Stephen J. Brown, and Mustafa O. Caglayan. 2014. Macroeconomic risk and hedge fund returns. Journal of Financial Economics 114: 1–19. [Google Scholar] [CrossRef]

- Banna, Hasanul, and Md Rabiul Alam. 2021. Does digital financial inclusion matter for bank risk-taking? Evidence from the dual-banking system. Journal of Islamic Monetary Economics and Finance 7: 401–30. [Google Scholar] [CrossRef]

- Banna, Hasanul, Md Aslam Mia, Mohammad Nourani, and Larisa Yarovaya. 2021a. Fintech-based Financial Inclusion and Risk-taking of Microfinance Institutions (MFIs): Evidence from Sub-Saharan Africa. Finance Research Letters 45: 102149. [Google Scholar] [CrossRef]

- Banna, Hasanul, M. Kabir Hassan, and Mamunur Rashid. 2021b. Fintech-based financial inclusion and bank risk-taking: Evidence from OIC countries. Journal of International Financial Markets, Institutions and Money 75: 101447. [Google Scholar] [CrossRef]

- Bashiru, Shani, Alhassan Bunyaminu, Ibrahim Nandom Yakubu, Mamdouh Abdulaziz Saleh Al-Faryan, John Mac Carthy, and Kofi Afriyie Nyamekye. 2023. Quantifying the Link between Financial Development and Bank Profitability. Theoretical Economics Letters 13: 284–96. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Cameron, A. Colin, and Pravin K. Trivedi. 2013. Regression Analysis of Count Data. Cambridge: Cambridge University Press, vol. 53. [Google Scholar]

- Cámara, Noelia, and David Tuesta. 2014. Measuring Financial Inclusion: A Multidimensional Index. Bilbao: BBVA Research. [Google Scholar]

- Cho, Soohyung, Zoonky Lee, Sewoong Hwang, and Jonghyuk Kim. 2023. Determinants of Bank Closures: What Ensures Sustainable Profitability in Mobile Banking? Electronics 12: 1196. [Google Scholar] [CrossRef]

- Čihák, Martin, and Heiko Hesse. 2010. Islamic banks and financial stability: An empirical analysis. Journal of Financial Services Research 38: 95–113. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2020. The global Findex database 2017: Measuring financial inclusion and opportunities to expand access to and use of financial services. The World Bank Economic Review 34: S2–S8. [Google Scholar] [CrossRef]

- Deng, Liurui, Yongbin Lv, Ye Liu, and Yiwen Zhao. 2021. Impact of Fintech on Bank Risk-Taking: Evidence from China. Risks 9: 99. [Google Scholar] [CrossRef]

- Dietrich, Andreas, and Gabrielle Wanzenried. 2014. The determinants of commercial banking profitability in low-, middle-, and high-income countries. The Quarterly Review of Economics and Finance 54: 337–54. [Google Scholar] [CrossRef]

- Ellul, Andrew, and Vijay Yerramilli. 2013. Stronger risk controls, lower risk: Evidence from US bank holding companies. The Journal of Finance 68: 1757–803. [Google Scholar] [CrossRef]

- Forcadell, Francisco Javier, Elisa Aracil, and Fernando Úbeda. 2020. The impact of corporate sustainability and digitalization on international banks’ performance. Global Policy 11: 18–27. [Google Scholar] [CrossRef]

- Gharbi, Inès, and Aïda Kammoun. 2023. Developing a Multidimensional Financial Inclusion Index: A Comparison Based on Income Groups. Journal of Risk and Financial Management 16: 296. [Google Scholar] [CrossRef]

- Hakimi, Abdelaziz, Rim Boussaada, and Majdi Karmani. 2021. Are financial inclusion and bank stability friends or enemies? Evidence from MENA banks. Applied Economics 54: 2473–89. [Google Scholar] [CrossRef]

- Hansen, Lars Peter. 1982. Large sample properties of generalized method of moments estimators. Econometrica: Journal of the Econometric Society 50: 1029–54. [Google Scholar] [CrossRef]

- Hausman, Jerry A. 1978. Specification tests in econometrics. Econometrica: Journal of the Econometric Society 46: 1251–1271. [Google Scholar] [CrossRef]

- Heffernan, Shelagh A., and Xiaoqing Fu. 2010. Determinants of financial performance in Chinese banking. Applied Financial Economics 20: 1585–600. [Google Scholar] [CrossRef]

- Ikram, Iqra, and Samreen Lohdi. 2015. Impact of financial inclusion on banks profitability: An empirical study of banking sector of Karachi, Pakistan. International Journal of Management Sciences and Business Research 4: 88–98. [Google Scholar]

- Islam, Md Shahidul, and Shin-Ichi Nishiyama. 2016. The determinants of bank net interest margins: A panel evidence from South Asian countries. Research in International Business and Finance 37: 501–14. [Google Scholar] [CrossRef]

- Issaka Jajah, Yussif, Ebenezer B. Anarfo, and Felix K. Aveh. 2022. Financial inclusion and bank profitability in Sub-Saharan Africa. International Journal of Finance & Economics 27: 32–44. [Google Scholar]

- Jonker, Nicole, and Anneke Kosse. 2022. The interplay of financial education, financial inclusion and financial stability and the role of Big Tech. Contemporary Economic Policy 40: 612–35. [Google Scholar] [CrossRef]

- Jouini, Jamel, and Rami Obeid. 2021. Do Financial Inclusion Indicators Affect Banks’ Profitability? Evidence from Selected Arab Countries. Arab Monetary Fund Working Paper. Available online: https://cutt.ly/2jFdZvT (accessed on 1 June 2023).

- Jungo, João, Mara Madaleno, and Anabela Botelho. 2022. The effect of financial inclusion and competitiveness on financial stability: Why financial regulation matters in developing countries? Journal of Risk and Financial Management 15: 122. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, Aart Kraay, and Massimo Mastruzzi. 2011. The worldwide governance indicators: Methodology and analytical issues1. Hague Journal on the Rule of Law 3: 220–46. [Google Scholar] [CrossRef]

- Kelikume, Ikechukwu. 2021. Digital financial inclusion, informal economy and poverty reduction in Africa. Journal of Enterprising Communities: People and Places in the Global Economy 15: 626–40. [Google Scholar] [CrossRef]

- Kharabsheh, Buthiena, and Omar Gharaibeh. 2023. Does Financial Inclusion Affect Banks’ Efficiency? ELIT–Economic Laboratory for Transition Research 19: 125. [Google Scholar] [CrossRef]

- Khatib, Saleh F. A., Ernie Hendrawaty, Ayman Hassan Bazhair, Ibraheem A. Abu Rahma, and Hamzeh Al Amosh. 2022. Financial inclusion and the performance of banking sector in Palestine. Economies 10: 247. [Google Scholar] [CrossRef]

- Kleibergen, Frank, and Richard Paap. 2006. Generalized reduced rank tests using the singular value decomposition. Journal of Econometrics 133: 97–126. [Google Scholar] [CrossRef]

- Kumar, Vijay, Sujani Thrikawala, and Sanjeev Acharya. 2021. Financial inclusion and bank profitability: Evidence from a developed market. Global Finance Journal 2020: 100609. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, and Meng-Fen Hsieh. 2013. The impact of bank capital on profitability and risk in Asian banking. Journal of International Money and Finance 32: 251–81. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, Runchi Lou, and Fuhao Wang. 2023. Digital financial inclusion and poverty alleviation: Evidence from the sustainable development of China. Economic Analysis and Policy 77: 418–34. [Google Scholar] [CrossRef]

- Li, Dan Dan, and Zheng Xin Wang. 2023. Measurement Methods for Relative Index of Financial Inclusion. Applied Economics Letters 30: 827–33. [Google Scholar] [CrossRef]

- Lv, Shuli, Yangran Du, and Yong Liu. 2022. How do fintechs impact banks’ profitability?—An empirical study based on banks in China. FinTech 1: 155–63. [Google Scholar] [CrossRef]

- Lyons, Angela C., Josephine Kass-Hanna, and Ana Fava. 2021. Fintech development and savings, borrowing, and remittances: A comparative study of emerging economies. Emerging Markets Review 51: 100842. [Google Scholar]

- Markowitz, Harry. 1952. Portfolio Selection. The Journal of Finance 7: 77–91. [Google Scholar]

- Mehrotra, Aaron, and G. V. Nadhanael. 2016. Financial inclusion and monetary policy in emerging Asia. In Financial Inclusion in Asia: Issues and Policy Concerns. Berlin and Heidelberg: Springer, pp. 93–127. [Google Scholar]

- Montgomery, Douglas C., Elizabeth A. Peck, and G. Geoffrey Vining. 2021. Introduction to Linear Regression Analysis. Hoboken: John Wiley & Sons. [Google Scholar]

- Neaime, Simon, and Isabelle Gaysset. 2018. Financial inclusion and stability in MENA: Evidence from poverty and inequality. Finance Research Letters 24: 230–37. [Google Scholar] [CrossRef]

- Nguyen, Thi Truc Huong. 2021. Measuring financial inclusion: A composite FI index for the developing countries. Journal of Economics and Development 23: 77–99. [Google Scholar] [CrossRef]

- Nzyuko, Joseph Mutinda, Ambrose Jagongo, and Husborn Kenyanya. 2018. Financial inclusion innovations and financial performance of commercial banks in Kenya. International Journal of Management and Commerce Innovations 5: 849–56. [Google Scholar]

- Oranga, Odero Joshua, and Ibrahim Tirimba Ondabu. 2018. Effect of financial inclusion on financial performance of banks listed at the Nairobi securities exchange in Kenya. International Journal of Scientific and Research Publications 8: 624–49. [Google Scholar] [CrossRef]

- Park, Cyn Young, and Rogelio V Mercado. 2018. Financial inclusion: New measurement and cross-country impact assessment. Asian Development Bank 539: 1–29. [Google Scholar]

- Renzhi, Nuobu, and Yong Jun Baek. 2020. Can financial inclusion be an effective mitigation measure? evidence from panel data analysis of the environmental Kuznets curve. Finance Research Letters 37: 101725. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Ross, Stephen A., Randolph W. Westerfield, Bradford D. Jordan, Joseph Lim, and Ruth Tan. 2016. Fundamentals of Corporate Finance. Asia Global Edition. New York: McGraw Hill Education. [Google Scholar]

- Saif-Alyousfi, Abdulazeez Y. H., and Asish Saha. 2021. Determinants of banks’ risk-taking behavior, stability and profitability: Evidence from GCC countries. International Journal of Islamic and Middle Eastern Finance and Management 14: 874–907. [Google Scholar] [CrossRef]

- Schultz, Emma L., David T. Tan, and Kathleen D. Walsh. 2010. Endogeneity and the corporate governance-performance relation. Australian Journal of Management 35: 145–63. [Google Scholar] [CrossRef]

- Sethy, Susanta Kumar, and Phanindra Goyari. 2022. Financial inclusion and financial stability nexus revisited in South Asian countries: Evidence from a new multidimensional financial inclusion index. Journal of Financial Economic Policy 14: 674–93. [Google Scholar] [CrossRef]

- Shehzad, Choudhry Tanveer, Jakob De Haan, and Bert Scholtens. 2013. The relationship between size, growth and profitability of commercial banks. Applied Economics 45: 1751–65. [Google Scholar] [CrossRef]

- Shen, Yan, Wenxiu Hu, and C. James Hueng. 2021. Digital Financial Inclusion and Economic Growth: A Cross-country Study. Procedia Computer Science 187: 218–23. [Google Scholar] [CrossRef]

- Shihadeh, Fadi. 2020. The influence of financial inclusion on banks’ performance and risk: New evidence from MENAP. Banks and Bank Systems 15: 59–71. [Google Scholar] [CrossRef]

- Shihadeh, Fadi. 2021. Financial inclusion and banks’ performance: Evidence from Palestine. Investment Management and Financial Innovation 18: 126–38. [Google Scholar] [CrossRef]

- Shihadeh, Fadi Hassan, Azzam M. T. Hannon, Jian Guan, Ihtisham Ul Haq, and Xiuhua Wang. 2018. Does financial inclusion improve the banks’ performance? Evidence from Jordan. In Global Tensions in Financial Markets. Bingley: Emerald Publishing Limited, pp. 117–38. [Google Scholar]

- Smirlock, Michael. 1985. Evidence on the (non) relationship between concentration and profitability in banking. Journal of Money, Credit and Banking 17: 69–83. [Google Scholar] [CrossRef]

- Sodokin, Koffi, Moubarak Koriko, Dzidzogbé Hechely Lawson, and Mawuli K. Couchoro. 2022. Digital transformation, banking stability, and financial inclusion in Sub-Saharan Africa. Strategic Change 31: 623–37. [Google Scholar] [CrossRef]

- Sugianto, Sugianto, Fahmi Oemar, Luqman Hakim, and Endri Endri. 2020. Determinants of firm value in the banking sector: Random effects model. International Journal of Innovation, Creativity and Change 12: 208–18. [Google Scholar]

- Tan, Yong. 2016. The impacts of risk and competition on bank profitability in China. Journal of International Financial Markets, Institutions and Money 40: 85–110. [Google Scholar] [CrossRef]

- Tan, Yong, and Christos Floros. 2012. Bank profitability and GDP growth in China: A note. Journal of Chinese Economic and Business Studies 10: 267–73. [Google Scholar] [CrossRef]

- Tay, Lee Ying, Hen Toong Tai, and Gek Siang Tan. 2022. Digital financial inclusion: A gateway to sustainable development. Heliyon 8: e09766. [Google Scholar] [CrossRef] [PubMed]

- Tram, Thi Xuan Huong, Tien Dinh Lai, and Thi Truc Huong Nguyen. 2023. Constructing a composite financial inclusion index for developing economies. The Quarterly Review of Economics and Finance 87: 257–265. [Google Scholar] [CrossRef]

- Tran, Son Hung, and Liem Thanh Nguyen. 2020. Financial development, business cycle and bank risk in Southeast Asian countries. The Journal of Asian Finance, Economics and Business 7: 127–35. [Google Scholar] [CrossRef]

- Vo, Duc H., and Nhan T. Nguyen. 2021. Does financial inclusion improve bank performance in the Asian region? Asian-Pacific Economic Literature 35: 123–35. [Google Scholar] [CrossRef]

- Vo, Duc Hong, Nhan Thien Nguyen, and Loan Thi-Hong Van. 2021. Financial inclusion and stability in the Asian region using bank-level data. Borsa Istanbul Review 21: 36–43. [Google Scholar] [CrossRef]

- Wang, Rui, Jiangtao Liu, and Hang Luo. 2021. Fintech development and bank risk taking in China. The European Journal of Finance 27: 397–418. [Google Scholar] [CrossRef]

- Wang, Yanqi, Muhammad Ali, Asadullah Khaskheli, Komal Akram Khan, and Chin-Hong Puah. 2022. The interconnectedness of financial inclusion and bank profitability in rising economic powers: Evidence from heterogeneous panel analysis. International Journal of Social Economics. Available online: https://www.emerald.com/insight/content/doi/10.1108/IJSE-05-2022-0364/full/html (accessed on 25 February 2023).

- Wooldridge, Jeffrey M. 2010. Econometric Analysis of Cross Section and Panel Data. Cambridge: MIT Press. [Google Scholar]

- Wooldridge, Jeffrey M. 2015. Introductory Econometrics: A Modern Approach. Boston: Cengage Learning. [Google Scholar]

- World Bank. 2022. World Development Indicators. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 15 January 2023).

- Wu, Guo, Jiadong Luo, and Kejing Tao. 2023. Research on the influence of FinTech development on credit supply of commercial banks: The case of China. Applied Economics, 1–17. [Google Scholar] [CrossRef]

- Yadav, Vishal, Bhanu Pratap Singh, and Nirmala Velan. 2021. Multidimensional financial inclusion index for Indian states. Journal of Public Affairs 21: e2238. [Google Scholar] [CrossRef]

- Yakubu, Ibrahim Nandom, and Alhassan Musah. 2022. The nexus between financial inclusion and bank profitability: A dynamic panel approach. Journal of Sustainable Finance & Investment, 1–14. [Google Scholar] [CrossRef]

- Yin, Fang, Xiaomei Jiao, Jincheng Zhou, Xiong Yin, Ebuka Ibeke, Marvellous GodsPraise Iwendi, and Cresantus Biamba. 2022. Fintech application on banking stability using Big Data of an emerging economy. Journal of Cloud Computing 11: 43. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).