Abstract

An increase in non-performing loans and bad debts in the banking sector can make banks vulnerable to a loss of confidence among customers and other banks and a banking collapse. The recent pandemic (COVID-19) and the evolving globalisation can affect bank operations, although the effects may depend on the type of banks and other bank-specific factors. In this paper, we revisit the topic on the determinants of non-performing loans of banks in a small island economy of Fiji over the period 2000 to 2022. We apply a fixed-effect method and consider seven banks (five commercial banks and two non-bank financial institutions). In our estimations, we examine the effect of bank-specific factors and control for the social and economic globalisation, the GFC, the COVID-19 pandemic, and bank-type effects, as well as the effect of the interaction between the bank type and the pandemic, as key contributions of the study. Overall, our results are consistent in terms of the effects noted from the bank-specific factors. From the extended model estimations, we note that COVID-19 had a more adverse effect on loan losses than the GFC, and the interaction between the bank type and COVID-19 indicates that non-banks were highly vulnerable to loan losses, whereas commercial banks exhibited greater preparedness. Economic globalisation reduces bank losses, whereas social globalisation exacerbates NPLs.

Keywords:

bank profitability; institutions; globalisation; COVID-19; fixed-effect; island economy; South Pacific; Oceania; Fiji 1. Introduction

Investigating the impact of bank losses is an important issue for regulators, banks, and other key stakeholders, including shareholders. The level of non-performing loans (NPLs) can indicate the degree of stability in the banking system and the overall financial stability. Therefore, monitoring NPLs is in the interest of both the banks and the regulators. For instance, studies have noted that during the COVID-19 pandemic, job losses and economic contraction were evident, and banks faced higher non-performing loans (Kryzanowski et al. 2023; Berger and DeYoung 1997). Another important dimension that can create some degree of instability in the banking system is the role of non-bank financial institutions (cf. Pascual et al. 2023). Non-bank financial institutions (NBFIs) are highly interconnected with the global banking system and the real economy and hence can contribute to growing losses, which in turn can jeopardise the banking system and affect the whole economy (Cetorelli et al. 2023; Choudhary et al. 2023).

The banking sector in the Pacific remains a critical medium of channelling finance for economic activities. Moreover, the stability of a country’s banking sector is necessary to foster economic growth and sustainable development (Chand et al. 2021; Kumar et al. 2018). However, one of the most significant challenges that financial institutions face is the rise in non-performing loans (NPLs). High NPLs can have adverse effects on both the banking system and the overall economy, as noted by recent studies (Loang et al. 2023). The level of NPLs can serve as an indicator of both a bank’s low credit quality and the effectiveness of its risk management in handling its loan portfolio within the banking sector (Cortavarria et al. 2000).

Moreover, high levels of NPLs can directly impact banks’ profitability, as it reduces the income generated from interest payments (Ahiase et al. 2023; Gashi et al. 2022; Küçük 2022; Loang et al. 2023). Non-performing loans can signal the need for greater managerial attention and hence become the primary focus of a bank, which in turn can divert resources away from the pursuit of new and profitable activities (Cucinelli 2015; Khairi et al. 2021; Serrano 2021). Additionally, NPLs tie-up a bank’s capital, thus limiting its ability to extend new loans to creditworthy borrowers (Constant and Ngomsi 2012; Foglia 2022; Khan et al. 2020). This, in turn, can stifle economic growth as businesses and individuals may struggle to access financing (Messai and Jouini 2013)

An increase in NPLs can diminish banks’ investor confidence and affect the stability of the banking sector (Adeyemi 2011). Investors may become wary of such a bank and hence sell its stocks or bonds, which could lead to a decline in the bank’s market value and potentially to a liquidity crisis (Abata 2014). In extreme cases, a bank with a high level of NPLs may face a loss of depositor trust, leading to a bank run and, ultimately, to bank failure (Adeyemi 2011; Curak et al. 2013).

Another important aspect is the different types of financial institutions that operate in the financial sector. Generally, although banks and non-bank financial institutions (NBFIs) may engage in deposit-taking and lending activities, they tend to have different features and purposes in the market system. The commercial banks tend to have a more conservative approach to lending and tend to adhere to stricter underwriting standards. As a result, they tend to have lower or manageable levels of non-performing loans compared to the NBFIs, which becomes evident especially in times of economic crisis. Moreover, commercial banks focus on traditional lending activities, such as mortgage loans, personal loans, and business loans. However, NBFIs have narrow revenue streams because they tend to focus on a specific type of loans, which can be more aligned to the national agenda (Pascual et al. 2023; Rahman et al. 2022; Duho et al. 2020; Cheng and Degryse 2010). In any case, the regulatory authorities and banks in general must monitor the level of NPLs to ensure sound operations. Bank regulators also set specific thresholds and guidelines for banks’ non-performing assets. As such, both commercial banks and NBFIs are obligated to accurately classify and provision non-performing loans (NPLs). This ensures preparedness for potential losses and helps safeguard the stability of the financial system.

While recent studies on NPLs abound (Bayar 2019; Ozili 2019; Khan et al. 2020; Misman and Bhatti 2020; Fallanca et al. 2021; Karadima and Louri 2021; Phung et al. 2022; Golitsis et al. 2022; Fakhrunnas et al. 2022; Hakimi et al. 2022; El-Chaarani and Abraham 2022; Foglia 2022; Erdas and Ezanoglu 2022; Alnabulsi et al. 2022; Jubilee et al. 2022; Mdaghri 2022; Giammanco et al. 2022; Apergis 2022; Akhter 2023), they mainly examine the banking sector of developed, large, and developing and emerging economies. Notably, just a few studies have focused on small island countries (Kumar et al. 2018; Chand et al. 2021), and these are generally restrictive in terms of the model specification, sample, and scope.

Against this background, we focus on the banking sector of a small island economy of Fiji, with a relatively larger sample size (2000–2022). Although Fiji’s economy is relatively small and the banking sector is less sophisticated compared to developed countries in the region, the sector has witnessed the collapse of a major bank some decades ago. In 1995, the state-owned bank—National Bank of Fiji (NBF)—collapsed, largely due to poor management and high losses (Siwatibau 1996; Jayaraman et al. 2004). It was observed that the NBF accumulated a significant sum of bad and doubtful debts, initially amounting to FJ$90 million, which later surged to FJ$220 million, approximately 8% of the country’s GDP (Lodhia and Burritt 2004). Since then, there have been no bank failures, although the sector noted episodes of rising non-performing loans (Chand et al. 2021).

Subsequently, investigating the determinants of NPLs in Fiji remains essential. In this study, we provide a more nuanced, up-to-date, and context-specific understanding of NPLs, which can benefit both policymakers and the academic community and contribute to Fiji’s economic well-being. Identification of the factors could facilitate the implementation of preventive measures and targeted solutions.

It must be noted that the current socio-economic and geo-political climate, coupled with the recent pandemic of 2019, has put immense pressure on banks’ ability to raise funds to support their operations or recover loans. Against this background, the study contributes to the literature on non-performing loans in a small island Pacific economy in the following ways. First, besides examining the effect of the global financial crisis of 2007–2008 (GFC), we account for the impact of the recent pandemic (COVID-19). Second, we account the bank-type effects, i.e., the effect of a commercial bank and the non-bank financial institutions. Third, we examine the role of globalisation, i.e., the social and economic globalisation. Finally, we investigate the interaction effects between bank types and COVID-19, to examine the degree of resilience exhibited by different bank types (commercial banks and non-bank financial institutions). Through our analyses, we have identified a set of crucial factors that plays a significant role in explaining the occurrence of non-performing loans in Fiji’s financial sector. In addition to providing deeper insights on banks’ stability through multiple extensions of the base model, our analyses show consistency and robustness of the results. The remainder of the paper is organised as follows: Section 2 draws on relevant theories and empirical studies. Section 3 presents data and methodology, and Section 4 presents the results. Section 5 concludes the paper.

2. Literature Review

NPLs are classified as bad loans. When a borrower is unlikely to repay a loan or the borrower has elapsed the agreed instalments for at least 90 days, this indicates that the loan is non-performing.1 Non-performing loans entail cost to banks, and therefore, banks have a strong interest to minimise the level of bad loans. NPLs erode a bank’s profitability by causing losses in their lending operations and necessitating increased provisions, which, in turn, diminishes the potential volume of future loans and accordingly banks’ profits. More NPLs reduce banks earnings, weaken their financial position, and in cases where the situation is systemic, this can create an economy-wide catastrophe. NPLs can be an impediment to the development of the banking sector (Zhang et al. 2016), as more NPLs can potentially cause a collapse of the financial sector (Greenidge and Grosvenor 2010; Ghosh 2015).

It is well known in the literature that bank-specific and macroeconomic factors influence NPLs. In a study on banks in China over the period 2005–2014, Umar and Sun (2018) noted that factors, like the GDP, interest rate, inflation rate, foreign exchange rate, bank type, bank’s risk-taking behaviour, ownership concentration, leverage, and credit quality are critical determinants of NPLs. Moreover, Kuzucu and Kuzucu (2019) examined the determinants of NPLs in emerging and advanced countries, both in the pre- and post GFC periods. They noted the finding that the GDP is negatively associated with NPLs in both countries in both periods; however, foreign direct investment and the exchange rate influenced the NPLs of banks in the post-GFC period and for banks in the emerging countries. Several studies confirm the negative association between the ROA and NPLs (Rachman et al. 2018; Kjosevski et al. 2019; Farooq et al. 2019). In Bayar’s (2019) research on emerging countries, it was reported that macroeconomic indicators, such as GDP and inflation, bank-specific metrics, like the return on assets (ROA) and return of equity (ROE), regulatory capital, noninterest income, and global factors, like economic freedom, exhibit negative associations with NPLs. Additionally, the study revealed that unemployment, public debt, credit growth, lagged nonperforming loans, operational costs, and financial crises are factors that contribute to an increase in NPLs. Rachman et al.’s (2018) study on 36 commercial banks in Indonesia over the period 2008–2015 shows that the return on asset (ROA) and credit growth are negatively associated with non-performing loans. Focusing on banks in Macedonia, Kjosevski et al. (2019) found that the ROA, growth of loans, and GDP reduce NPLs, whereas solvency and unemployment are positively associated with NPLs. Factors, like the capital adequacy ratio (CAR), were noted to have a negative effect on NPLs in India over the period 1996–2011 (Bardhan et al. 2019).

In a study conducted on banks in the Euro area during the period 2005–2017, Karadima and Louri (2020) observed that post-crisis consolidation accelerates the reduction in non-performing loans (NPLs), especially in peripheral countries. Furthermore, they note that competition and the presence of foreign banks reduce NPLs. Asiama et al. (2020) conducted an analysis using quarterly data spanning from 2000Q1 to 2018Q4 based on banks in Ghana. Their findings indicate a positive association between mobile money business operations and non-performing loans (NPLs). Tatarici et al.’s (2020) study on the European Economic countries over the period 2005–2017 shows that NPLs, as a ratio of total loans, increase with the deterioration of macroeconomic conditions, whereas government effectiveness reduces the NPL ratio. Similarly, Staehr and Uusküla (2020) show that economic growth, lower inflation, and lower debt are negatively associated with NPLs of banks in the EU countries.

In a more recent study on banks in Poland, Petkovski et al. (2021) noted that the ROA, growth of gross loans, economic growth, domestic credit to the private sector, public debt, and unemployment are significant determinants of NPLs. Žunić et al. (2021) noted that in Bosina and Herzegovina, economic growth, loan loss provision, and COVID-19 were positively associated with the effect of NPLs. In the case of Tanzania, Pastory (2021) reports a host of factors positively associated with NPLs (effective tax rate, unemployment rate, inflation and lending rates, poor credit appraisal, insider lending, inadequate market information, and compromised integrity).

Kjosevski and Petkovski (2021) considered 21 commercial banks from the Baltic states over the period 2005–2016. They show that economic growth, public debt, inflation, and unemployment are positively associated with NPLs. Bank-specific factors, like equity to total assets, return on assets, return on equity, and the growth of gross loans, have an impact on the amount of NPLs. Moreover, considering banks in the Balkans, Krasniqi-Pervetica and Ahmeti (2022) found that economic growth and inflation have a negative effect, whereas government debt and unemployment have a positive effect, on NPLs.

Factors, like the bank size and competition, have a positive effect on NPLs in Nigeria (Bolarinwa and Akinlo 2022). In their 2022 analysis, Ben Bouheni et al. (2022) examined the fluctuations in NPLs across the economic cycle and the influence of past profitability within the largest Islamic banks in the United Kingdom and Turkey during 2010 to 2019. Their findings indicate a modest variation in NPLs, which correlates with an ascending ROA and a descending ROE. In Hajja’s (2022) study examining the influence of bank capital on non-performing loans (NPLs) across 109 commercial banks in Malaysia, the analysis reveals threshold effects. It indicates that an initial increase in capital leads to a rise in NPLs up to a certain point. However, beyond that threshold, as additional capital accumulates, NPLs tend to decrease. In Küçük’s (2022) analysis of monthly data in Turkey, it was demonstrated that rising interest rates and unemployment rates correlate with an increase in NPLs. Conversely, only escalations of deposit interest rates and the dollar exchange rate are associated with a decrease in NPLs.

Ofria and Mucciardi (2022) studied the effects of corruption and public debt on NPLs in European countries. They show that public debt and higher levels of institutional corruption exert upward pressure on NPLs. Syed et al. (2022) examined the impact of financial development on NPLs for 12 emerging economies over the period 1995–2020 and note that financial sector development and NPLs move together in the long run, and there is significant evidence of the asymmetric relationship. Akhter (2023) notes that NPLs of banks in Bangladesh are positively associated with loan loss provisions, equity-to-total assets, the capital adequacy ratio, net loans, return on equity, inflation, and economic growth. Saliba et al. (2023) analysed the impact of country risks (financial, economic, and political risks) on NPLs of banks in Brazil, Russia, India, China, and South Africa over the period 2004–2020. The findings revealed that all three types of risks increase credit risk leading to more NPLs.

Background and Some Related Studies on Fiji’s Banking Sector

Unlike other Pacific Island Countries, Fiji has a well-developed banking system regulated by the Reserve Bank of Fiji (RBF). The Reserve Bank oversees the monetary and banking system of Fiji, supervises currency issuance, enforces exchange controls, and offers various financial services to the government. It is responsible for maintaining the liquidity of trading banks through the implementation of the government’s monetary policy. Alongside its role in shaping the credit landscape, the RBF oversees the foreign exchange regulations and oversees Fiji’s global reserves.

Essentially, there are five commercial banks—Westpac Banking Corporation (WBC, established in 1901), Australia and New Zealand Banking Corporation Ltd. (ANZ, established in 1953), Bank of Baroda (BOB, established in 1961), Bank of the South Pacific (BSP, established in 1996), BRED Bank (BRED, established in 2012) (cf. Sharma et al. 2014), and Home Finance Corporation Ltd. (HFC, established in 2014), which was previously a non-bank financial institution. In its early days, HFC was a non-banking institution established in June of 1962 by the government of Fiji and the British Overseas Development Corporation (BODC), now known as the Commonwealth Development Corporation (CDC). It was subsequently incorporated as a local company under the name Fiji Development Company (FDC). Initially, the government of Fiji owned 33% of the bank’s shares, and 67% of the shares were hold by FDC. Later, in 1979, Fiji National Provident Fund (FNPF) became its third shareholder. By 1987, the Unit Trust of Fiji (UToF) joined as the fourth shareholder, with all four owners having equal shares by 1989. In 1995, the government of Fiji sold its shares to FNPF, making FNPF a major shareholder (50%), with management rights still intact with FDC. In 2002, FNPF bought FDC’s share, hence having a 75% stake in the ownership. In 2014, HFC became a full-fledged bank. As of now, HFC is a locally owned bank, with 75% ownership by the Fiji National Provident Fund (FNPF) and the remaining 25% owned by the UToF. The other five banks are foreign-owned banks. The two non-bank institutions with saving and lending functions are Merchant Finance Ltd. (MFL, established in 1986) and Credit Corporation Ltd. (CFL, established in 1978).2

In Fiji, non-Bank financial institutions (NBFIs) comprise credit institutions, insurance companies, and the Fiji National Provident Fund (FNPF). Together, these NBFIs represent 63 percent of the total assets within the financial system.3 At present, three licensed credit institutions (LCIs) are operational: Merchant Finance Limited (MFL), Credit Corporation (Fiji) Limited (CCFL), and Kontiki Finance Limited (KFL).4 Alongside these licensed entities, there are non-licensed NBFIs, such as the Fiji Development Bank (FDB), Housing Authority (HA), Unit Trust of Fiji (UToF), and Fijian Holdings Unit Trust (FHUT). Additionally, Fiji hosts nine insurance companies. The licensed credit institutions deliver a diverse array of services. While some primarily finance the acquisition of machinery, equipment, and vehicles, others provide housing mortgage loans and various personal loans. The roles of licensed NBFIs are multifaceted. The FDB and HA focus on lending, whereas the UToF and FHUT function as investment vehicles for their unit holders. The insurance companies aim to safeguard policyholders against potential losses from uncertain events and offer alternative savings plans.5

A few studies have investigated different aspects of banking, such as bank stability (Chand et al. 2021), profitability (Gounder and Sharma 2012; Sharma and Gounder 2012), competition (Kumar and Patel 2014), and non-performing loans (Kumar et al. 2018).6 Kumar et al. (2018) considered annual data on bank-specific and macro-economic variables over the period 2000–2013 and found that the ROE, CAR, market share (measured based on the HHI), unemployment, and trend variables are negatively associated with NPLs, whereas NIM is positively associated with NPLs. In this study, we extend Kumar et al.’s (2018) study in terms of the latest available data size (2000–2022), controlling for non-bank financial institutions, the specific type of globalisation (social and economic globalisation), and the recent pandemic (COVID-19). During the pandemic, banks had to undertake measures to support existing customers and clients who were not able to meet-up their loan obligations. Some critical measures included granting extensions on repayments, extending loans without additional fees, and options to repay interest only on the loan over a specified period.

3. Data

Hence, our dataset was extracted from multiple sources. Data on bank specific variables were extracted from the key disclosure statements published by banks to the Reserve Bank of Fiji (RBF 2023). The macroeconomic variables were obtained from the (World Bank 2023). The globalisation index was based on KOF globalisation index data (ETH-Zurich 2023). Specifically, we consider data based on two indices—economic and social (cf. Dreher 2006; Dreher et al. 2008). Our sample comprises seven financial institutions. Although there are six commercial banks, we take five commercial banks and two non-bank financial institutions (NBFIs), over the period 2000–2022.7 The two NBFIs are Credit Cooperation Fiji Limited (CCFL) and Merchant Finance Limited (MFL). Both institutions have lending and deposit functions; hence, similar to commercial banks, they are mandated by the RBF to furnish key disclosure statements. The five commercial banks are Australia and New Zealand Banking Group (ANZ), Westpac Banking Corporation (WBC), Bank of the South Pacific (BSP), Bank of Baroda (BOB), and Home Finance Corporation (HFC). The data used are a balanced panel sample covering the period from 2000 to 2022. Table A1 (Appendix A) reports a summary of the dependent and independent variables utilised in the model for estimation. The dependent variable is NPLs, which is a ratio of total bad debts to total loans (Khan et al. 2020; Küçük 2022; Kryzanowski et al. 2023). The descriptive statistics and correlation matrix for all banks (commercial banks and NBFIs) are presented in Table 1, and in Table 2, we present the statistics for NBFI’s only.

Table 1.

Descriptive statistics and correlation matrix (Commercial banks and NBFIs).

Table 2.

Descriptive statistics and correlation matrix for NBFI.

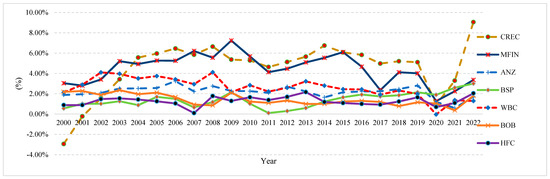

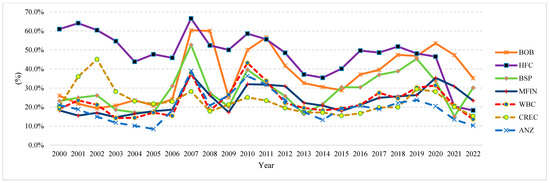

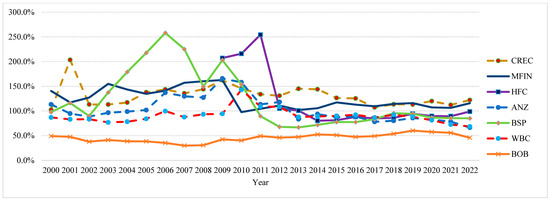

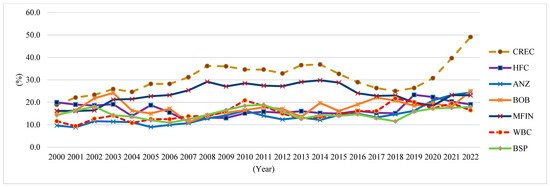

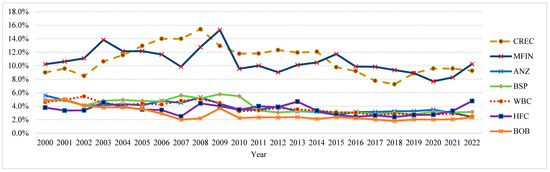

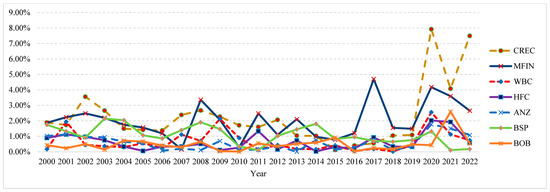

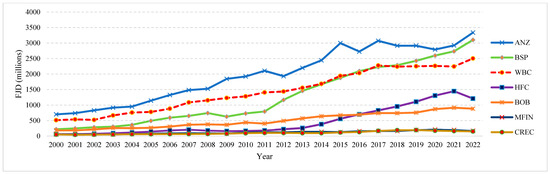

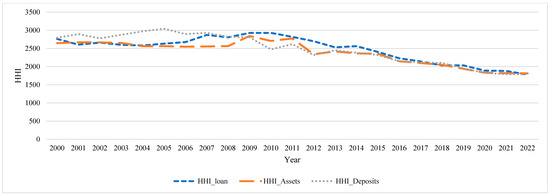

The trends of key bank-specific factors are provided in Figure A1, Figure A2, Figure A3, Figure A4, Figure A5, Figure A6, Figure A7 and Figure A8 (see Appendix A). Figure A1 illustrates the return on assets (ROA). Notably, CREC (non-bank) has negative ROA values for the years 2000 and 2001, and WBC (commercial bank) displays a negative value in 2020. Figure A2 shows the ratio of operating expenses to revenue (measures of inefficiency). HFC (commercial bank) has the highest expenses-to-revenue ratio and CREC had the lowest ratio. In Figure A3, we note that the loan-to-deposit ratio of the commercial banks HFC and BSP are generally positive and high, while BOB exhibits the lowest ratio. In Figure A4, it is evident that NBFIs had the highest levels of the capital adequacy ratio. Both NBFIs (CREC and MFIN) maintained high levels of interest margins compared to the commercial banks (Figure A5). Furthermore, in Figure A6, we note that the two NBFIs were leading in terms of the non-performing loans, although we note a uniform increase in NPLs since 2019 for all banks. Notably, commercial banks’ assets are larger than NBFIs’ (Figure A7). Particularly, we note that ANZ is the largest bank based on assets, followed by BSP, WBC, HFC, and BOB. The size of ANZ and WBC have slightly decreased, although ANZ remains the largest bank in Fiji. BSP, which was relatively small in 2011, surpassed WBC in 2018, becoming the second largest bank in Fiji. It is interesting to note that both NBFIs (CREC and MFIN) have been relatively small, and their size remained generally constant size since 2000. From Figure A8, we note a marginal decline in the Herfindahl–Hirschman Index (HHI) by approximately 1.7% annually, which signals some level of competition in the banking sector.

4. Method

The model setup is an extension of Demirgüç-Kunt and Huizinga (1999). The general equation takes the following form:

whereby NPL denotes the amount of NPLs (bad debts) as a percentage of total volume of loans of bank i at time t; contains the set of coefficients of the bank-specific factors, contains the set of a bank-specific factor m, comprises the coefficient of NBFI variables, contains the coefficients of the respective macroeconomic variables, contains the coefficients of globalisation and a structural variable (see Appendix A, Table A1 for variable definitions) and is the error term. We specify our base mode as follows:

where BSIZE = bank size, NIM = net interest margin, ROA = return on assets, INEF = inefficiency measured based on the ratio of the operating expense to operating revenue, CAR = capital adequacy ratio, HHI = Herfindahl–Hirschman index, LTD = loan to deposit ratio, (see Appendix A, Table A1 for variable definitions), the unobserved (cross-section) firm-dependent error term, and = the idiosyncratic error term. The extended base model (2) also includes globalisation indexes, non-bank and commercial bank dummies, GFC, and the COVID-19 pandemic, and it can be specified as follows:

Finally, we modify model (3) to incorporate the interaction between COVID-19 and a specific type of banks (i.e., commercial banks and non-bank financial institution, and bank-specific dummies).

To determine the appropriate regression technique to use, we conducted a Hausman test using the base model (Model 2) with our sample data spanning from 2000 to 2022. In the pooled OLS estimation, it is assumed that the regression coefficients are uniform across all firms, meaning that the regressors are non-stochastic, and errors are uncorrelated with the explanatory variables. This implies that , and the error term . To assess the appropriateness of choosing between pooled OLS and fixed-effect methods, we conducted a Wald test with the null hypothesis that the differences between the coefficients of the firm dummy variables are equal to zero (i.e., there is no firm-level heterogeneity). The choice of applying the pooled OLS is made by examining the F-statistic (and -statistics) and the respective p-values. We report the results in Table A2 (See Appendix A). We note that and , with p-values of less than 0.01, respectively.8 The statistically significant p-values imply that banks are not homogeneous across the sample. Thus, there are banking characteristics that are not accounted for by the OLS model. Hence, we reject the null hypothesis in favour of the fixed-effect method (or random-effect method) to account for firm-level effects (unobserved heterogeneity ). Additionally, the fixed-effect model assumes that the differences in the intercepts vary across groups or time periods. Rejecting the OLS estimation and determining the suitability of the fixed-effect against the random-effect method requires the execution of the Hausman test (Ali and Puah 2019; Chand et al. 2021; Theiri and Hadoussa 2023). In this case, the null hypothesis is that the covariance between the explanatory variable and firm heterogeneity is zero, denoted as , which would indicate support for the random-effect model. This decision requires examining the -statistics and the respective p-value. A statistically significant p-value () will reject the null at the 1% level, in support of applying the fixed-effect method. Upon conducting Hausman tests on the two base models (refer to Appendix A, Table A2, panel b), we observe and , both with p-values below 0.01. Based on the results, we reject the random-effect method in support of the fixed-effect method at the 1% level of significance.9 Subsequently, we apply the fixed-effect method on the base model (Equation (2)), and then, we incorporate other variables (such as bank-types, COVID-19, globalisation, and pandemic and bank-type interactions).

5. Results and Discussion

5.1. Base Model (Model I–III)

The results of the fixed effects estimation are reported in Table 3 below. In model I, we estimated the bank-specific variables only and note that the R-squared is 0.43, implying that the base model could explain 43% of the relationship between the NPL and the associated explanatory factors. Starting with Model I, we observe that bank size, as measured based on total assets (BSIZE) and the ROA, are negative and significant. This suggests that as a bank’s size or profitability increases, its non-performing loans tend to decrease. This result aligns with the argument that larger and more profitable banks typically possess greater resources and funds to effectively manage risk, implement robust credit assessment practices to either prevent or mitigate risk, and diversify their loan portfolios, thereby keeping their losses at relatively lower levels. (Ahmed et al. 2021; Akhter 2023; Yulianti et al. 2018; Alnabulsi et al. 2022). Furthermore, we note that the ratio of the operative expense to operating revenue (INEF) has a negative effect on the NPL. This confirms Kumar et al.’s (2018) finding, but here, the coefficient is not statistically significant at the conventional level (1–10 percent level of significance).

Table 3.

Fixed effects: the dependent variable is NPLs (base model).

Moreover, we note that the net interest margin (NIM) and loan to deposit ratio (LTD) are positive, although they are not statistically significant. Nevertheless, the positive effects of the NIM and loan (relative to deposits) on losses can be due to the higher interest rates charged on loans, compared to those offered on deposits, and the greater uses of funds (loans) than the sources of funds (deposits) available. Which could potentially increase the risk of default and the possibility of losses (Adusei 2018; Ozili 2019; Silaban 2017; Nguyen 2012). Consistent results are also noted in Models II and III, where we control for NBFI (with positive effect on NPL) in Model II and we control for commercial banks (with negative effect on NPL) in Model III. Although the effect of bank type is opposite, we note that in both cases, the coefficients are not statistically significant.

We note that the concentration ratio (HHI), a measure of the market concentration (a higher HHI indicates a more concentrated market), has a marginally positive impact and is significant in Model I; the opposite (negative impact and not significant) is true in Models II and III. The positive association implies that a higher HHI tends to lower competition and in turn disincentivises efficient and sound management practices based on lending. When we control for bank types, we note that the HHI exhibits a negligibly negative effect, which is statistically insignificant. Because of the negligible effect of the HHI on NPL (close to zero), we can conclude that the degree of competition does not necessarily influence the loan losses of Fijian banks. In this regard, trying to increase the market share is not a strategy for banks to minimise losses. Furthermore, we note that the capital adequacy requirement (CAR) has a positive effect on NLP, which is a statistically significant effect at the 1% level in all three models (Table 3). While an increase in CAR buffers the potential losses, this does not restrict banks from expanding their loan portfolio. Therefore, with higher capital adequacy requirements, on one hand, banks’ safety-net increases; on the other hand, this increases confidence among banks to increase their lending activities, which can in turn increase the NPL. In Models II and III, we control for the bank-types, i.e., non-bank financial institutions (NBFIs) and commercial banks (COMBs), respectively. As noted in both the models, the coefficient of NBFI is negative, and COMB is positive, although they are not statistically significant. Also, we note that controlling for bank-types per se (Models II-III) does not improve the adjusted R-squares (they remain around 42%).

5.2. Economic Growth, Bank Type, GFC, and COVID-19

Next, in models IV-IX (Table 4), we account for economic growth (GDPG), the bank type (i.e., NBFI or COMB), GFC, and the pandemic (COVID-19). Notably, the results with respect to bank types (Models V and VI) remain consistent with the results reported in Table 3. Interestingly, including GDPG, GFC, and COVID-19, we observe an improvement in the adjusted R-squares from 42% from the base model (Table 3) to 48% (Model IX). Also, the statistical significance, magnitudes, and the signs of the coefficients of BSIZE, NIM, ROA, INEF, CAR, HHI, and LTD, are consistent with the base model, further supporting the robustness of the results. Specifically, we note that economic growth or the increase in per capita GDP (GDPG) has a negative effect on the NPLs in all six estimations (see Models IV-IX). The negative coefficient implies that when the economy is growing, borrowers’ ability to repay loans tends to improve, leading to fewer defaults or delayed payments. This might happen because during economic expansion, businesses and individuals have better financial prospects, the incomes of those already employed have a higher chance to grow, and there are more job opportunities and overall economic stability. Consequently, the favourable economic conditions make it more likely that borrowers are in a better position to take up new loans, refinance their loans, and regularly meet their loan repayment obligations—all of which supports the reduction in NPLs for banks (Akhter 2023; Krasniqi-Pervetica and Ahmeti 2022).

Table 4.

Fixed effects: the dependent variable is NPLs (controlling for economic growth, bank type, the GFC, and Covid).

As noted from model VII, the impact of the GFC on NPL was positive, and it is statistically significant at the 10% level, implying that the global financial crisis increased the potential for loan losses and vulnerability in the banking sector. The result is quite intuitive because at least three of the large banks (ANZ, WBC, and BSP) have foreign ownership and hence are linked to developed country markets. Also, with global economic slowdown due to the GFC, business consolidation and closures could have had negative repercussions on high-end clients (i.e., large businesses and mortgage holders), thereby inflicting difficulty in their ability to meet loan repayments. As noted from Model VII, the effect of COVID-19 was positive and significant at the 1% level. We note that both the GFC and COVID-19 (Model IX) had positive and significant effects, although the effects from COVID-19 on loan losses were stronger than the effects induced by the GFC. One explanation for the greater impact of COVID-19 is its economy-wide effect, which was deeply and directly experienced by the entire country. In contrast, the Global Financial Crisis (GFC) may have had secondary effects owing to the remoteness of Fiji’s banking sector and stronger connections with only a few sectors, primarily financial and real estate. On the contrary, as a consequence of the pandemic, nationwide lockdowns significantly impacted virtually all business operations, irrespective of their size, as well as major sectors, like manufacturing and tourism. Notably, the pandemic ignited a widespread economic upheaval, leading to business closures, disruptions in supply chains, and reduced consumer spending. These disruptions, in turn, led to income losses for both businesses and individuals, affecting their capacity to meet financial obligations, including loan repayments. The positive effect of COVID-19 on NPLs is consistent with some recent studies (Žunić et al. 2021; Kryzanowski et al. 2023).

5.3. Social and Economic Globalisation

In Table 5 (Model X and XI), we include social (SINDX) and economic (EINDX) globalisation, together with the GFC and COVID-19. Moreover, the influence of the GFC and COVID-19 remain positive, although only the latter is statistically significant. In terms of the globalisation index, we note that SINDX is positively, and EINDX is negatively, associated with NPLs, implying that, ceteris paribus, social globalisation (example, information flows via internet and social media) increases loan losses, whereas economic globalisation reduces loan losses. The positive impact of SINDX aligns with the argument that social globalisation, while promoting diversity and mutual understanding, can also expose economies to various social and economic practices (Chareonwongsak 2002). These practices may have a negative influence on business operations. The exposure to diverse cultural norms and consumer lifestyles can impact individual spending patterns and savings behaviour, potentially exacerbating a risk-taking attitude. For instance, individuals seeking loans or credit cards to enhance their lifestyles, facilitated by easy access to unsecured loans, may increase the likelihood of banks experiencing more NPLs.10 However, intuitively, an increase in economic globalisation implies an increasing trade volume, and this requires the greater engagement of financial institutions (banks) to facilitate transactions, which increase banks’ revenue-generating potential. When countries engage in international trade and investment, they benefit from access to larger markets, technological advancements, and the potential to diversify their portfolios (Carr and Chen 2002)—all of which require banking and financial services. Moreover, an increasing trade volume contributes to economic growth, increasing job opportunities, and higher income levels, supporting loan repayments through technological advancement, and subsequently, lessens the likelihood of loan defaults.

Table 5.

Fixed effects: the dependent variable is NPLs (controlling for economic and social globalisation).

5.4. Interaction Effect with COVID-19

The final set of estimations aims to gain further insights into how the pandemic affected losses based on the specific type of banks (see Table 6). We examined the effects of the GFC, COVID-19, and the interaction effect between the bank type and the pandemic on NPLs. Some interesting results are noted. The impact of the GFC remains positive (see Models XII–XV) as before, although it is not statistically significant. The effect of COVID-19 is still positive (as before) and significant in most of the models (Models XII, XIII, and XV). Moreover, the factors applied in the base model (Model I) remain generally consistent in terms of the magnitude, thereby further supporting the robustness of the results. Moreover, we note that accounting for the interaction effect also improved the adjusted R-square values, implying that extended models explain the relationship relatively better than the base model.

Table 6.

Fixed effects: the dependent variable is NPLs (controlling for the interaction effects of COVID with bank types).

We note that the effect caused by the interaction between NBFIs and COVID-19 is positive (0.0216) and the interaction effect of COMBs and COVID-19 is negative (−0.0216), and they are both statistically significant (Models XII and XIII, respectively). Looking at the interaction of COVID-19 and specific banks within NBFIs (CREC, MFIN, and HFC11) and COMBs (ANZ, BOB, BSP, and WBC), we note consistent results. Each specific NBFI interacting with COVID-19 exacerbated losses in the banking sector (Model XIV), whereas each commercial bank interacting with COVID-19 lowered the NPL in the banking sector (Model XV). These results indicate that non-banks were vulnerable to losses during the pandemic, whereas commercial banks were generally resilient and in fact could have had adequate measures in place to recover loan losses.

6. Conclusions

In this study, we examine the determinants of non-performing loans of banks in Fiji. Based on the Wald-test and Hausman test, we apply the fixed-effect method of regression. While our base model follows Kumar et al.’s (2018) approach, we extend the model with specific bank types (non-banks and commercial banks), the COVID-19 pandemic, social and economic globalisation, and the interaction effects from bank types and the pandemic. In our analysis, we consider the seven banks (i.e., five commercial banks and two non-bank financial institutions) over the period 2000–2022 (see footnote 7).

The results presented in the extended models are consistent with the base model, which duly supports the robustness of the results. Additional insights are also generated from the extended models.12 As our analysis emphasises, the pandemic exacerbated the potential for loan losses for all banks in Fiji. Moreover, the interactive effects reveal some distinct patterns across different bank types. Notably, commercial banks demonstrated significant resilience and preparedness in their efforts to effectively navigate the challenges posed by the pandemic on its losses. However, non-bank financial institutions seem to have been the hardest hit. The susceptibility of NBFIs to a high number of NPLs and their subsequent vulnerability became more evident when we examined the interaction of bank types with the pandemic. Moreover, we noted that social globalisation tends to increase the possibility of bank losses, whereas economic globalisation support reduces the potential for losses.

By shedding light on the interplay of bank-specific factors, external factors, like globalisation (economic and social), and the disruptive impacts of the COVID-19 pandemic, this study is the first to provide in-depth insights into plausible determinants of non-performing loans, in a small island economy of Fiji. The results can be useful for managers and regulators in effectively managing NPLs and in strengthening their resilience to internal and global shocks. Overcoming data constraints, future studies could specifically examine the performance of NBFIs and incorporate a broader definition of the non-bank financial institutions to include pension funds (FNPF), development banks (FDB), trust funds (UTOF and FHUT), the housing authority of Fiji, and insurance companies. Moreover, since our study is at the bank-level and is country-specific, we are careful not to generalise the outcome to financial institutions that operate in large and/or developed countries. Nevertheless, at least for countries that are small, remote, and developing, our findings can offer insights into important factors viz. financial management of the banking sector. Accordingly, a comparative study can be undertaken on financial institutions in similar and different settings to gain further insights.

Author Contributions

Conceptualization, S.A.C. and R.R.K.; methodology, S.A.C. and R.R.K.; software, S.A.C. and R.R.K.; validation, S.A.C., R.R.K. and P.J.S.; formal analysis, S.A.C., R.R.K. and P.J.S.; investigation, S.A.C., R.R.K. and P.J.S.; resources, S.A.C., R.R.K. and P.J.S.; data curation, S.A.C. writing—original draft preparation, S.A.C., R.R.K. and P.J.S.; writing—review and editing, S.A.C., R.R.K. and P.J.S.; visualization, S.A.C., R.R.K. and P.J.S.; supervision, R.R.K.; project administration, R.R.K. All authors have read and agreed to the published version of the manuscript.

Funding

There was no external funding received for this project.

Data Availability Statement

All data is publicly available, and at the time of writing and publication, the data were accessible from the respective websites mentioned in the Data section of the paper.

Acknowledgments

All the authors sincerely thank the editors and the anonymous reviewers for their useful suggestions and recommendations; all remaining errors are ours. Peter J. Stauvermann sincerely acknowledges the financial support of the Changwon National University 2023–2024.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

Return on asset. Source: authors’ calculation with data from RBF (2023).

Figure A2.

Expense to operating revenue. Source: authors’ calculation with data from RBF (2023).

Figure A3.

Loan-to-deposit ratio. Source: authors’ calculation with data from RBF (2023).

Figure A4.

Capital adequacy ratio. Source: authors’ calculation with data from RBF (2023).

Figure A5.

Net interest margin (%). Source: authors’ calculation with data from RBF (2023).

Figure A6.

Non-performing loans (% of total loans). Source: authors’ calculation with data from RBF (2023).

Figure A7.

Bank assets (size). Source: authors’ calculation with data from RBF (2023).

Figure A8.

HHI based on loans, assets, and deposits. Source: authors’ calculation with data from RBF (2023).

Table A1.

Variable descriptions.

Table A1.

Variable descriptions.

| Variable | Definition | Symbol | Expected Sign | Source |

|---|---|---|---|---|

| Dependent Variable | ||||

| Non-performing loans | Bad debts/Total loans | NPLs | N/A | RBF |

| Independent/Control Variables | ||||

| Bank-Specific | ||||

| Bank size | Natural logarithm of total assets | SIZE | − | RBF |

| Net interest margin | (Interest income-interest expense)/total assets | NIM | − | RBF |

| Return on assets | Profit/total assets | ROA | − | RBF |

| Inefficiency ratio | Operating expenses/operating revenue | INEF | + | RBF |

| Capital adequacy ratio | Sum of tier capital and tier 2 capital divided by risk weighted assets | CAR | − | RBF |

| Concentration (HHI) | Herfindahl–Hirschman index based on loans | HHI_LOAN | − | RBF |

| Loan-to-deposit ratio | Total loans/total deposits | LTD | + | RBF |

| Non-bank financial institutions | 1 = NBFI, otherwise 0 | NBFI | ? | RBF |

| Commercial banks | 1 = Commercial bank, otherwise 0 | COMBANK | ? | RBF |

| Bank dummy | ||||

| ANZ | 1 = ANZ, otherwise 0 | ANZD | ? | |

| BOB | 1 = BOB, otherwise 0 | BOBD | ? | |

| BSP | 1 = BSP, otherwise 0 | BSPD | ? | |

| CRC | 1 = CREC, otherwise 0 | CRCD | ? | |

| HFC | 1 = HFC, otherwise 0 | HFCD | ? | |

| MFIN | 1 = MFIN, otherwise 0 | MFIND | ? | |

| WBC | 1 = WBC, otherwise 0 | WBCD | ? | |

| Macroeconomic | ||||

| GDP | Annual percentage change in GDP based on local currency unit (FJD) | GDPP | + | World Bank (2023) |

| Globalisation | ||||

| Economic | Economic globalisation index | EINDX | ? | KOF |

| Social | Political globalisation index | PINDX | ? | KOF |

| Structural dummy | ||||

| COVID-19 | 2019–2020 were taken as dummy variables for COVID as these were the years where there was COVID | COVID | + | Authors |

| Global Financial Crisis | The financial crisis of 2007–2008 denoted by a dummy variable | GFC | + | Authors |

Notes: RBF = Reserve Bank of Fiji (RBF 2023); WDI = World Development Indicators (World Bank 2023); N/A = not applicable. Each category of the globalisation index is measured on a scale of 1–100, where a higher value implies a greater level of globalisation; ‘+’ and ‘−’ indicate the signs based on a theoretical relationship, and ‘?’ = indicates that the sign can be + or −, hence based on the empirical results. Source: authors’ compilation

Table A2.

Wald test and Hausman test for panel estimation.

Table A2.

Wald test and Hausman test for panel estimation.

| (a) Wald Test | |||

| Test Stat. | Value | d.f. | Prob. |

| F-stat. | 14.447 ※ | (6, 153) | <0.0001 |

| Chi-square | 101.132 ※ | 7 | <0.0001 |

| (b) Cross-section random (Hausman test) | |||

| Base models | Chi-square | df | Prob. |

| Equation (A1): | 19.365 † | 6 | 0.0036 |

| Equation (A2): | 27.748 † | 6 | 0.0001 |

Notes: ※ based on Wald-test, p-values imply the rejection of OLS at the 1% level in support of a fixed- or random-effect model; † based on Hausman test, the p-values imply the rejection of random effects, in support of fixed-effect regression. Source: authors’ own computations using EViews 13.

Table A3.

OLS: the dependent variable is NPLs (base model).

Table A3.

OLS: the dependent variable is NPLs (base model).

| Independent Var. | Model I | Model II | Model III |

|---|---|---|---|

| Constant | 0.058343 *** (0.020499) | 0.051934 ** (0.025084) | 0.053348 ** (0.023409) |

| BSIZE | −0.002631 *** (0.000962) | −0.002187 (0.001391) | −0.002187 (0.001391) |

| NIM | 0.041126 * (0.023367) | 0.043847 ** (0.024211) | 0.043847 ** (0.024211) |

| ROA | −0.172920 *** (0.070262) | −0.178528 *** (0.071561) | −0.178528 *** (0.071561) |

| INEF | −0.003160 (0.070262) | −0.003546 (0.007228) | −0.003546 (0.007228) |

| CAR | 0.000574 *** (0.000161) | 0.000559 *** (0.000165) | 0.000559 *** (0.000165) |

| HHI_LOAN | −0.000010 *** (0.001828) | −0.000010 *** (0.000003) | −0.000010 *** (0.000003) |

| LTD | 0.005436 *** (0.001828) | 0.005295 *** (0.001860) | 0.005295 *** (0.001860) |

| NBFI | - | 0.001414 (0.003173) | - |

| COMB | - | - | −0.001414 (0.003173) |

| Adj-R2 | 0.370405 | 0.367090 | 0.367090 |

| F-stat | 14.447350 | 12.600060 | 12.600060 |

| DW-stat | 1.432011 | 1.426605 | 1.426605 |

| Observations | 161 | 161 | 161 |

Note: ***, **, and * denote a 1, 5, and 10% level of statistical significance. Values in the parentheses (.) are standard errors. Source: authors’ estimation using EViews 13.

Table A4.

OLS: the dependent variable is NPLs (controlling for economic growth, bank type, the GFC, and Covid).

Table A4.

OLS: the dependent variable is NPLs (controlling for economic growth, bank type, the GFC, and Covid).

| Independent | Model IV | Model V | Model VI | Model VII | Model VIII | Model IX |

|---|---|---|---|---|---|---|

| Constant | 0.053765 *** (0.020077) | 0.051220 ** (0.022880) | 0.051220 ** (0.022880) | 0.060704 *** (0.021096) | 0.051828 *** (0.019655) | 0.059533 *** (0.020621) |

| BSIZE | −0.002513 *** (0.000940) | −0.002284 * (0.001359) | −0.002284 * (0.001359) | −0.002757 *** (0.000967) | −0.003075 *** (0.000941) | −0.003358 *** (0.000968) |

| NIM | 0.027540 (0.023287) | 0.029026 (0.024205) | 0.029026 (0.024205) | 0.022958 (0.023669) | 0.024730 (0.022805) | 0.019564 (0.023162) |

| ROA | −0.103087 (0.072668) | −0.152845 ** (0.072220) | −0.152845 ** (0.072220) | −0.117663 (0.073910) | −0.090805 (0.071233) | −0.106831 (0.072331) |

| INEF | 0.000836 (0.007121) | 0.000611 (0.007207) | 0.000611 (0.007207) | −0.001243 (0.007380) | −0.002971 (0.007099) | −0.005364 (0.007356) |

| CAR | 0.000549 *** (0.000158) | 0.000542 *** (0.000198) | 0.000542 *** (0.000198) | 0.000550 *** (0.000157) | 0.000424 *** (0.000161) | 0.000423 *** (0.000160) |

| HHI_LOAN | 0.0000009 *** (0.000002) | −0.000009 *** (0.000003) | −0.000009 *** (0.000003) | −0.000010 *** (0.000002) | −0.000005 * (0.000003) | −0.000006 ** (0.000003) |

| LTD | 0.004944 *** (0.001791) | 0.004924 *** (0.001822) | 0.004924 *** (0.001822) | 0.005405 *** (0.001831) | 0.005013 *** (0.001753) | 0.005471 *** (0.001790) |

| GDPG | −0.000403 *** (0.000138) | −0.000401 *** (0.000133) | −0.000401 *** (0.000133) | −0.000378 *** (0.000140) | 0.000230 (0.000222) | 0.000153 (0.000231) |

| NBFI | - | −0.000728 (0.003109) | - | - | - | - |

| COMB | - | - | −0.000728 (0.003109) | - | - | - |

| GFC | - | - | - | 0.003152 (0.002956) | - | 0.003516 (0.002891) |

| COVID | - | - | - | - | 0.014800 *** (0.005302) | 0.001508 *** (0.005298) |

| Adj-R2 | 0.399793 | 0.396037 | 0.396037 | 0.400333 | 0.425468 | 0.427286 |

| F-stat | 14.32181 | 12.65745 | 12.65745 | 12.86833 | 14.16526 | 12.93714 |

| DW-stat | 1.423518 | 1.420422 | 1.420422 | 1.416154 | 1.506611 | 1.501339 |

| Observations | 161 | 161 | 161 | 161 | 161 | 161 |

Note: ***, **, and * denote a 1, 5, and 10% level of statistical significance. Values in the parentheses (.) are standard errors. Source: authors’ estimation using EViews 13.

Table A5.

OLS: the dependent variable is NPLs (controlling for economic and social globalisation).

Table A5.

OLS: the dependent variable is NPLs (controlling for economic and social globalisation).

| Independent Var. | Model X | Model XI |

|---|---|---|

| Constant | 0.026421 (0.028909) | 0.017789 (0.027654) |

| BSIZE | −0.002768 *** (0.001088) | −0.0022657 ** (0.001083) |

| NIM | 0.033852 (0.020478) | 0.037405 * (0.020185) |

| ROA | −0.118644 * (0.068314) | −0.105948 (0.067188) |

| INEF | −0.006252 (0.007361) | −0.004518 (0.007164) |

| CAR | 0.000239 (0.000176) | 0.000220 (0.000175) |

| HHI_LOAN | 0.000002 (0.000004) | 0.000004 (0.000004) |

| LTD | 0.005336 *** (0.001574) | 0.004969 *** (0.001532) |

| GFC | 0.002602 (0.002543) | - |

| COVID | 0.018054 *** (0.003734) | 0.018712 *** (0.003678) |

| SINDX | 0.000879 (0.000562) | 0.000930 * (0.000560) |

| EINDX | −0.001009 ** (0.000414) | −0.001011 ** (0.000414) |

| Adj-R2 | 0.447563 | 0.447375 |

| F-stat | 11.75306 | 12.81936 |

| DW-stat | 1.484985 | 1.486485 |

| Observations | 147 | 147 |

Note: ***, **, and * denote a 1, 5, and 10% level of statistical significance. Values in the parentheses (.) are standard errors. Source: authors’ estimation using EViews 13.

Table A6.

OLS: the dependent variable is NPLs (controlling for the interaction effects of COVID with bank types).

Table A6.

OLS: the dependent variable is NPLs (controlling for the interaction effects of COVID with bank types).

| Independent Var. | Model XII | Model XIII | Model XIV | Model XV |

|---|---|---|---|---|

| Constant | 0.031068 (0.020284) | 0.031068 (0.020284) | 0.030729 (0.020146) | 0.029320 (0.020840) |

| BSIZE | −0.002039 ** (0.000924) | −0.002039 ** (0.000924) | −0.002087 ** (0.000918) | −0.001984 ** (0.000948) |

| NIM | 0.011345 (0.021787) | 0.011345 (0.021787) | 0.006751 (0.021743) | 0.009236 (0.022015) |

| ROA | −0.017512 (0.069394) | −0.017512 (0.069394) | 0.017422 (0.070912) | −0.000299 (0.070896) |

| INEF | 0.006841 (0.007029) | 0.006841 (0.007029) | 0.010237 (0.007167) | 0.008103 (0.007197) |

| CAR | 0.000420 *** (0.000148) | 0.000420 *** (0.000148) | 0.000343 ** (0.000151) | 0.000403 *** (0.000150) |

| HHI_LOAN | −0.000004 (0.000002) | −0.000004 (0.000002) | −0.000006 (0.000002) | −0.000004 (0.000002) |

| LTD | 0.004288 *** (0.001693) | 0.004288 *** (0.001693) | 0.004110 ** (0.001684) | 0.004201 *** (0.001708) |

| GFC | 0.001928 (0.002707) | 0.001928 (0.002707) | 0.001553 (0.002693) | 0.001757 (0.002731) |

| COVID | 0.005921 * (0.003266) | 0.006047 * (0.003165) | 0.005390 (0.003494) | 0.031334 *** (0.005096) |

| NBFI※COVID | 0.024866 *** (0.005497) | - | - | - |

| COMB※COVID | - | −0.024866 *** (0.005497) | - | - |

| CRECD※COVID | - | - | 0.035455 *** (0.007486) | - |

| MFINCD※COVID | - | - | 0.017770 *** (0.006856) | - |

| HFCD※COVID | - | - | 0.003422 (0.006602) | −0.022710 *** (0.007598) |

| ANZD※COVID | - | - | - | −0.025246 *** (0.007972) |

| BOBD※COVID | - | - | - | −0.025665 *** (0.007593) |

| BSPD※COVID | - | - | - | −0.032257 *** (0.007944) |

| WBCD※COVID | - | - | - | −0.020733 *** (0.007591) |

| Adj-R2 | 0.494567 | 0.494567 | 0.502140 | 0.487988 |

| F-stat | 16.65601 | 16.65601 | 14.44796 | 11.89234 |

| DW-stat | 1.758679 | 1.758679 | 1.851695 | 1.776930 |

| Observations | 161 | 161 | 161 | 161 |

Notes: ***, **, and * denote a 1, 5, and 10% level of statistical significance. ※ indicates interaction between two terms. Values in the parentheses (.) are standard errors. Source: authors’ estimation using EViews 13.

Appendix B

Table A7.

Descriptive statistics and correlation matrix (six commercial banks and two NBFIs).

Table A7.

Descriptive statistics and correlation matrix (six commercial banks and two NBFIs).

| Descriptive statistics | |||||||||||

| Variable Statistics | NPLs | BSIZE | NIM | ROA | INEF | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX |

| Mean | 0.01 | 13.42 | 0.04 | 0.02 | 1.09 | 48.97 | 2198.84 | 0.97 | 1.93 | 51.44 | 67.64 |

| Median | 0.01 | 13.58 | 0.03 | 0.02 | 0.58 | 18.33 | 2143.10 | 0.88 | 3.81 | 51.58 | 67.16 |

| Maximum | 0.08 | 15.02 | 0.12 | 0.14 | 38.40 | 1876.00 | 2698.07 | 8.09 | 16.10 | 53.59 | 69.15 |

| Minimum | 0.00 | 11.14 | 0.00 | −0.08 | 0.31 | 11.51 | 1780.24 | 0.01 | −17.00 | 48.52 | 66.53 |

| Std. Dev. | 0.01 | 1.18 | 0.03 | 0.03 | 4.04 | 208.60 | 297.96 | 0.80 | 7.78 | 1.59 | 0.99 |

| Skewness | 2.99 | −0.30 | 1.17 | 0.41 | 9.11 | 8.05 | 0.26 | 7.99 | −0.82 | −0.31 | 0.38 |

| Kurtosis | 13.46 | 1.65 | 2.90 | 8.72 | 84.60 | 69.27 | 1.72 | 71.50 | 4.35 | 2.02 | 1.50 |

| Probability | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Observation | 88 | 88 | 88 | 88 | 88 | 88 | 88 | 88 | 88 | 72 | 72 |

| Correlation | |||||||||||

| NPLs | BSIZE | NIM | ROA | INEF | CAR | HHI_LOAN | LTD | GDPG | EINDX | SINDX | |

| NPLs | 1 | ||||||||||

| BSIZE | −0.26 | 1 | |||||||||

| NIM | 0.42 | −0.62 | 1 | ||||||||

| ROA | 0.02 | −0.12 | 0.75 | 1 | |||||||

| INEF | 0.02 | −0.25 | −0.19 | −0.41 | 1 | ||||||

| CAR | 0.05 | −0.29 | −0.11 | −0.34 | 1.00 | 1 | |||||

| HHI_LOAN | −0.25 | −0.26 | 0.10 | 0.01 | 0.19 | 0.20 | 1 | ||||

| LTD | 0.13 | −0.09 | 0.14 | 0.07 | −0.12 | −0.13 | −0.18 | 1 | |||

| GDPG | −0.51 | −0.12 | 0.04 | 0.14 | 0.01 | 0.01 | 0.56 | −0.31 | 1 | ||

| EINDX | −0.38 | −0.21 | 0.09 | 0.08 | 0.14 | 0.14 | 0.88 | −0.21 | 0.64 | 1 | |

| SINDX | 0.09 | 0.21 | −0.10 | 0.03 | −0.14 | −0.14 | −0.78 | 0.03 | −0.12 | −0.74 | 1 |

Notes: data for globalisation indexes are from 2000 to 2020, and for all other variables, the sample is from 2000 to 2022; data for the BRED bank are from 2012 to 2022. Source: authors’ computation using data compiled from different databases.

Table A8.

Fixed effect: the dependent variable is NPLs (base model).

Table A8.

Fixed effect: the dependent variable is NPLs (base model).

| Independent Var. | Model I | Model II | Model III |

|---|---|---|---|

| Constant | 0.050226 (0.098110) | −0.007693 (0.124417) | 0.001337 (0.117526) |

| BSIZE | −0.000236 (0.006343) | 0.003555 (0.008081) | 0.003555 (0.008081) |

| NIM | 0.113911 (0.183518) | 0.117570 (0.184113) | 0.117570 (0.184113) |

| ROA | −0.146427 * (0.082954) | −0.178253 * (0.093123) | −0.178253 * (0.093123) |

| INEF | 0.000252 (0.000423) | 0.000368 (0.000450) | 0.000368 (0.000450) |

| CAR | 0.000002 ** (0.000007) | 0.000002 (0.000007) | 0.000002 (0.000007) |

| HHI_LOAN | −0.000017 (0.000007) | −0.000001 * (0.000007) | −0.000001 * (0.000007) |

| LTD | 0.000518 (0.001749) | 0.000223 (0.001797) | 0.000223 (0.001797) |

| NBFI | - | 0.009030 (0.011872) | - |

| COMB | - | - | −0.009030 (0.011872) |

| Adj-R2 | 0.319537 | 0.315586 | 0.315586 |

| F-stat | 3.918148 | 3.674399 | 3.674399 |

| DW-stat | 1.398449 | 1.375623 | 1.375623 |

| Observations | 88 | 88 | 88 |

Notes: ** and * denote a 5 and 10% level of statistical significance. Values in the parentheses (.) are standard errors. Data for the BRED bank are from 2012 to 2022. Source: authors’ estimation using EViews 13.

Table A9.

Fixed effect: the dependent variable is NPLs (controlling for economic growth, bank type, and Covid).

Table A9.

Fixed effect: the dependent variable is NPLs (controlling for economic growth, bank type, and Covid).

| Independent | Model IV | Model V | Model VI | Model VII |

|---|---|---|---|---|

| Constant | 0.089980 (0.099416) | 0.060641 (0.130376) | 0.064895 (0.122952) | 0.047803 (0.095801) |

| BSIZE | −0.003017 (0.006456) | −0.001087 (0.008511) | −0.001087 (0.008511) | −0.001693 (0.006166) |

| NIM | 0.096887 (0.181269) | 0.099491 (0.182534) | 0.099491 (0.182534) | 0.005131 (0.175532) |

| ROA | −0.077367 (0.090901) | −0.095929 (0.105658) | −0.095929 (0.105658) | −0.068458 (0.086630) |

| INEF | 0.000191 (0.000419) | 0.000248 (0.000452) | 0.000248 (0.000452) | 0.000206 (0.000399) |

| CAR | 0.000001 (0.000007) | 0.000001 (0.000007) | 0.000001 (0.000007) | −0.000003 (0.000007) |

| HHI_LOAN | −0.000018 *** (0.000007) | −0.000017 ** (0.000007) | −0.000017 ** (0.000007) | −0.000007 (0.000007) |

| LTD | −0.000251 (0.001781) | −0.000351 (0.001814) | −0.000351 (0.001814) | −0.000281 (0.001696) |

| GDPG | −0.000325 (0.000186) | −0.000308 (0.000194) | −0.000308 (0.000194) | 0.000328 (0.000287) |

| NBFI | - | 0.004254 (0.012124) | - | - |

| COMB | - | - | −0.004254 (0.012124) | - |

| COVID | - | - | - | 0.018432 *** (0.006370) |

| Adj-R2 | 0.338039 | 0.329878 | 0.329878 | 0.399533 |

| F-stat | 3.961845 | 3.676689 | 3.676689 | 4.617951 |

| DW-stat | 1.381886 | 1.370285 | 1.370285 | 1.544449 |

| Observations | 88 | 88 | 88 | 88 |

Notes: *** and **, denote a 1 and 5 level of statistical significance. Values in the parentheses (.) are standard errors. Data for the BRED bank are from 2012 to 2022. Source: authors’ estimation using EViews 13.

Table A10.

Fixed effect: the dependent variable is NPLs (with SINDX and EINDX).

Table A10.

Fixed effect: the dependent variable is NPLs (with SINDX and EINDX).

| Independent Var. | Model VIII |

|---|---|

| Constant | −0.358831 * (0.200225) |

| BSIZE | 0.019394 *** (0.004475) |

| NIM | 0.658651 *** (0.141892) |

| ROA | −0.661328 *** (0.094243) |

| INEF | 0.007157 (0.004946) |

| CAR | −0.000384 (0.000284) |

| HHI_LOAN | 0.000014 0.000008 |

| LTD | −0.001161 (0.001126) |

| COVID | 0.011977 ** (0.005545) |

| SINDX | 0.001245 (0.001990) |

| EINDX | −0.000410 (0.001537) |

| Adj-R2 | 0.718157 |

| F-stat | 11.64197 |

| DW-stat | 1.583276 |

| Observations | 72 |

Notes: ***, **, and * denote a 1, 5, and 10% level of statistical significance. Values in the parentheses (.) are standard errors. Data for the BRED bank are from 2012 to 2022. Source: authors’ estimation using EViews 13.

Table A11.

Fixed effect: the dependent variable is NPLs (with interaction effects of COVID with bank types).

Table A11.

Fixed effect: the dependent variable is NPLs (with interaction effects of COVID with bank types).

| Independent Var. | Model IX | Model X | Model XI | Model XII |

|---|---|---|---|---|

| Constant | 0.087495 (0.087310) | 0.087495 (0.087310) | 0.147588 (0.092946) | 0.147737 (0.099707) |

| BSIZE | −0.004220 (0.005693) | −0.004220 (0.005693) | −0.008152 (0.006073) | −0.007861 (0.006355) |

| NIM | 0.106784 (0.166400) | 0.106784 (0.005693) | 0.002960 (0.168730) | 0.136812 (0.185866) |

| ROA | −0.005639 (0.080199) | −0.005639 (0.080199) | 0.046259 (0.081919) | 0.033141 (0.083570) |

| INEF | 0.000225 (0.000375) | 0.000225 (0.000375) | 0.0000059 (0.000377) | 0.000516 (0.000763) |

| CAR | 0.000001 (0.000006) | 0.000001 (0.000006) | 0.000004 (0.000006) | −0.0000028 (0.0000057) |

| HHI_LOAN | −0.000012 * (0.000006) | −0.000012 * (0.000006) | −0.000014 * (0.000006) | −0.000015 ** (0.000007) |

| LTD | 0.000227 (0.001601) | 0.000227 (0.001601) | 0.000832 (0.001611) | −0.007599 (0.016899) |

| COVID | 0.007121 * (0.004103) | 0.029332 *** (0.006370) | 0.005561 (0.004363) | 0.030340 *** (0.006418) |

| NBFI※COVID | 0.022212 *** (0.006917) | - | - | - |

| COMB※COVID | - | −0.022212 *** (0.006917) | - | - |

| CRECD※COVID | - | - | 0.036040 *** (0.008994) | - |

| MFINCD※COVID | - | - | 0.012892 (0.009141) | - |

| HFCD※COVID | - | - | 0.011737 (0.009420) | −0.013306 (0.010284) |

| ANZD※COVID | - | - | - | −0.023651 ** (0.010169) |

| BOBD※COVID | - | - | - | −0.022381 ** (0.010020) |

| BRED※COVID | - | - | - | 0.057969 (0.105880) |

| BSPD※COVID | - | - | - | −0.035771 *** (0.010200) |

| WBCD※COVID | - | - | - | −0.019712 * (0.010120) |

| Adj-R2 | 0.466044 | 0.466044 | 0.491639 | 0.461386 |

| F-stat | 5.745933 | 5.745933 | 5.674340 | 4.548849 |

| DW-stat | 1.785511 | 1.785511 | 2.050825 | 1.905205 |

| Observations | 88 | 88 | 88 | 88 |

Notes: ***, **, and * denote a 1, 5, and 10% level of statistical significance. Values in the parentheses (.) are standard errors. ※ indicates interaction between two terms. Data for the BRED bank are from 2012 to 2022. Source: authors’ estimation using EViews 13.

Notes

| 1 | https://www.bankingsupervision.europa.eu/about/ssmexplained/html/npl.en.html, accessed on 5 August 2023. |

| 2 | Credit Corporation was established in 1978 and originated from Papua New Guinea and with operations in Fiji, Solomon Islands, and Vanuatu. |

| 3 | https://www.rbf.gov.fj/wp-content/uploads/2019/06/NA2005_03.pdf, accessed on 5 August 2023. |

| 4 | https://www.trade.gov/country-commercial-guides/fiji-trade-financing, accessed on 5 August 2023. |

| 5 | |

| 6 | Additionally, other aspects, such as insurance companies (Kumar et al. 2022b) and the stock market analysis (Kumar et al. 2022a; Kumar and Stauvermann 2022), are important for a robust operation of the financial system. |

| 7 | We have excluded the BRED bank from the sample because of the small sample size (2012–2022). Including the BRED bank reduces the total sample in the panel for all other banks, which have data since 2000 and do not capture the effect of the GFC. Nevertheless, we include the estimations with the BRED bank in Appendix B (respective tables) for additional insights. We note that the results obtained are generally consistent with the main results. |

| 8 | We set the HFC bank as a reference, hence dropping its dummy to avoid the “dummy-trap”. |

| 9 | To avoid the problem where of the number of cross-sections is less than the number of coefficients, we dropped HHI_LOAN in the first case and then we included HHI_LOAN in the second case and dropped LTD. In both cases, the results consistently support the fixed-effect method. |

| 10 | Kumar (2014) noted that the demand and growth of second-hand cars have increased dramatically, surpassing the growth rate of per capita income. It is possible that most of these cars are financed though (unsecured) bank loans and can add to banks’ non-performing loans. |

| 11 | Note that HFC was a non-bank until 2014. |

| 12 | As an aside, we also provide OLS-based results (see Appendix A, Table A3, Table A4, Table A5 and Table A6), which are generally consistent with the results obtained from the fixed-effect estimation method. |

References

- Abata, Matthew Adeolu. 2014. Asset quality and bank performance: A study of commercial banks in Nigeria. Research Journal of Finance and Accounting 5: 39–44. [Google Scholar]

- Adeyemi, Babalola. 2011. Bank failure in Nigeria: A consequence of capital inadequacy, lack of transparency and non-performing loans? Banks & Bank Systems 6: 99–109. [Google Scholar]

- Adusei, Charles. 2018. Determinants of non-performing loans in the banking sector of Ghana between 1998 and 2013. Asian Development Policy Review 6: 142–54. [Google Scholar] [CrossRef]

- Ahiase, Godwin, Denny Andriana, Edinam Agbemava, and Bright Adonai. 2023. Macroeconomic cyclical indicators and bank non-performing loans: Does country governance matter in African countries? International Journal of Social Economics. Available online: https://www.emerald.com/insight/content/doi/10.1108/IJSE-11-2022-0729/full/html (accessed on 5 August 2023).

- Ahmed, Shakeel, M. Ejaz Majeed, Eleftherios Thalassinos, and Yannis Thalassinos. 2021. The impact of bank specific and macro-economic factors on non-performing loans in the banking sector: Evidence from an emerging economy. Journal of Risk and Financial Management 14: 217. [Google Scholar] [CrossRef]

- Akhter, Nazmoon. 2023. Determinants of commercial bank’s non-performing loans in Bangladesh: An empirical evidence. Cogent Economics & Finance 11: 2194128. [Google Scholar]

- Ali, Muhammad, and Chin Hong Puah. 2019. The internal determinants of bank profitability and stability: An insight from banking sector of Pakistan. Management Research Review 42: 49–67. [Google Scholar] [CrossRef]

- Alnabulsi, Khalil, Emira Kozarević, and Abdelaziz Hakimi. 2022. Assessing the determinants of non-performing loans under financial crisis and health crisis: Evidence from the MENA banks. Cogent Economics & Finance 10: 2124665. [Google Scholar]

- Apergis, Nicholas. 2022. Convergence in non-performing loans across EU banks: The role of COVID-19. Cogent Economics & Finance 10: 2024952. [Google Scholar]

- Asiama, Rexford Kweku, Anthony Amoah, and Godson Ahiabor. 2020. Does mobile money business influence non-performing loans in the traditional banking sector? Evidence from Ghana. African Journal of Business and Economic Research 15: 171. [Google Scholar] [CrossRef]

- Bardhan, Samaresh, Rajesh Sharma, and Vivekananda Mukherjee. 2019. Threshold effect of bank-specific determinants of non-performing assets: An application in Indian banking. Journal of Emerging Market Finance 18: S1–S34. [Google Scholar] [CrossRef]

- Bayar, Yilmaz. 2019. Macroeconomic, institutional and bank-specific determinants of non-performing loans in emerging market economies: A dynamic panel regression analysis. Journal of Central Banking Theory and Practice 8: 95–110. [Google Scholar] [CrossRef]

- Ben Bouheni, Faten, Hassan Obeid, and Elena Margarint. 2022. Nonperforming loan of European Islamic banks over the economic cycle. Annals of Operations Research 313: 773–808. [Google Scholar] [CrossRef]

- Berger, Allen N., and Robert DeYoung. 1997. Problem loans and cost efficiency in commercial banks. Journal of Banking & Finance 21: 849–70. [Google Scholar]

- Bolarinwa, Segun Thompson, and Anthony Enisan Akinlo. 2022. Determinants of nonperforming loans after recapitalization in the Nigerian banking industry: Does competition matter? African Development Review 34: 309–23. [Google Scholar] [CrossRef]

- Carr, Marilyn, and Martha Alter Chen. 2002. Globalization and the Informal Economy: How Global Trade and Investment Impact on the Working Poor? Geneva: International Labour Office. Available online: https://www.ilo.org/employment/Whatwedo/Publications/WCMS_122053/lang--en/index.htm (accessed on 5 August 2023).

- Cetorelli, Nicola, Mattia Landoni, and Lina Lu. 2023. Non-Bank Financial Institutions and Banks’ Fire-Sale Vulnerabilities (March 2023). FRB of New York Staff Report No. 1057 2023. Available online: https://ssrn.cm/abstract=4384353 (accessed on 5 August 2023).

- Chand, Shasnil Avinesh, Ronald Ravinesh Kumar, and Peter Josef Stauvermann. 2021. Determinants of bank stability in a small island economy: A study of Fiji. Accounting Research Journal 34: 22–42. [Google Scholar] [CrossRef]

- Chandra, Aman, Tiru K. Jayaraman, and Filimone Waqabaca. 2004. Reforms in banking supervision in Fiji: A review of progress. Pacific Economic Bulletin 19: 102–14. [Google Scholar]

- Chareonwongsak, Kriengsak. 2002. Globalization and technology: How will they change society? Technology in Society 24: 191–206. [Google Scholar] [CrossRef]

- Cheng, Xiaoqiang, and Hans Degryse. 2010. The impact of bank and non-bank financial institutions on local economic growth in China. Journal of Financial Services Research 37: 179–99. [Google Scholar] [CrossRef]

- Choudhary, Rhea, Suchita Mathur, and Peter Wallis. 2023. Leverage, Liquidity and Non-Bank Financial Institutions: Key Lessons from Recent Market Events. In Financial Stability Bulletin; June. Available online: https://www.rba.gov.au/publications/bulletin/2023/jun/leverage-liquidity-and-non-bank-financial-institutions.html (accessed on 5 August 2023).

- Constant, Fouopi Djiogap, and Augustin Ngomsi. 2012. Determinants of bank long-term lending behavior in the Central African Economic and Monetary Community (CEMAC). Review of Economics & Finance 2: 107–14. [Google Scholar]

- Cortavarria-Checkley, Luis, Claudia Dziobek, Akihiro Kanaya, and Inwon Song. 2000. Loan Review, Provisioning, and Macroeconomic Linkages. WP/OO/195, IMF. Available online: https://www.imf.org/external/pubs/ft/wp/2000/wp00195.pdf (accessed on 5 August 2023).

- Cucinelli, Doriana. 2015. The impact of non-performing loans on bank lending behavior: Evidence from the Italian banking sector. Eurasian Journal of Business and Economics 8: 59–71. [Google Scholar] [CrossRef]

- Curak, Marijana, Sandra Pepur, and Klime Poposki. 2013. Determinants of non-performing loans–evidence from Southeastern European banking systems. Banks and Bank Systems 8: 45–53. [Google Scholar]

- Demirgüç-Kunt, Ash, and Harry Huizinga. 1999. Determinants of commercial bank interest margins and profitability: Some international evidence. The World Bank Economic Review 13: 379–408. [Google Scholar] [CrossRef]

- Dreher, Axel. 2006. Does globalization affect growth? Evidence from a new index of globalization. Applied Economics 38: 1091–110. [Google Scholar] [CrossRef]

- Dreher, Axel, Noel Gaston, and Pim Martens. 2008. Measuring globalisation. Gauging Its Consequences. New York: Springer. [Google Scholar]

- Duho, King Carl Tornam, Joseph Mensah Onumah, and Raymond Agbesi Owodo. 2020. Bank diversification and performance in an emerging market. International Journal of Managerial Finance 16: 120–38. [Google Scholar] [CrossRef]

- El-Chaarani, Hani, and Rebecca Abraham. 2022. The impact of corporate governance and political connectedness on the financial performance of Lebanese banks during the financial crisis of 2019–2021. Journal of Risk and Financial Management 15: 203. [Google Scholar] [CrossRef]

- Erdas, Mehmet Levent, and Zeynep Ezanoglu. 2022. How do bank-specific factors impact non-performing loans: Evidence from G20 countries. Journal of Central Banking Theory and Practice 11: 97–122. [Google Scholar] [CrossRef]

- ETH-Zurich. 2023. KOF Index of Globalization. Switzerland: KOF Swiss Economic Institute. Available online: https://kof.ethz.ch/en/forecasts-and-indicators/indicators/kof-globalisation-index.html (accessed on 5 August 2023).

- Fakhrunnas, Faaza, Rindang Nuri Isnaini Nugrohowati, Razali Haron, and Mohammad Bekti Hendrie Anto. 2022. The determinants of non-performing loans in the Indonesian banking industry: An asymmetric approach before and during the pandemic crisis. SAGE Open 12: 21582440221102421. [Google Scholar] [CrossRef]

- Fallanca, Mariagrazia, Antonio Fabio Forgione, and Edoardo Otranto. 2021. Do the determinants of non-performing loans have a different effect over time? A conditional correlation approach. Journal of Risk and Financial Management 14: 21. [Google Scholar] [CrossRef]

- Farooq, Mohammad Omar, Mohammed Elseoud, Seref Turen, and Mohamed Abdulla. 2019. Causes of non-performing loans: The experience of gulf cooperation council countries. Entrepreneurship and Sustainability Issues 6: 1955–74. [Google Scholar] [CrossRef]

- Foglia, Matteo. 2022. Non-performing loans and macroeconomics factors: The Italian case. Risks 10: 21. [Google Scholar] [CrossRef]

- Gashi, Adelina, Saranda Tafa, and Roberta Bajrami. 2022. The Impact of Macroeconomic Factors on Non-performing Loans in the Western Balkans. Emerging Science Journal 6: 1032–45. [Google Scholar] [CrossRef]

- Ghosh, Amit. 2015. Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. Journal of Financial Stability 20: 93–104. [Google Scholar] [CrossRef]

- Giammanco, Maria Daniela, Lara Gitto, and Ferdinando Ofria. 2022. Government failures and non-performing loans in Asian countries. Journal of Economic Studies, ahead-of-print. [Google Scholar] [CrossRef]

- Golitsis, Petros, Khurshid Khudoykulov, and Savica Palanov. 2022. Determinants of non-performing loans in North Macedonia. Cogent Business & Management 9: 2140488. [Google Scholar]

- Gounder, Neelesh, and Parmendra Sharma. 2012. Determinants of bank net interest margins in Fiji, a small island developing state. Applied Financial Economics 22: 1647–54. [Google Scholar] [CrossRef]

- Greenidge, Kevin, and Tiffany Grosvenor. 2010. Forecasting non-perproming loans in Barbados. Journal of Business, Finance & Economics in Emerging Economies 5: 1–30. Available online: https://www.cert-net.com/files/publications/journal/2010_1_5/79_108.pdf (accessed on 5 August 2023).

- Hajja, Yaman. 2022. Impact of bank capital on non-performing loans: New evidence of concave capital from dynamic panel-data and time series analysis in Malaysia. International Journal of Finance & Economics 27: 2921–48. [Google Scholar]

- Hakimi, Abdelaziz, Rim Boussaada, and Majdi Karmani. 2022. Is the relationship between corruption, government stability and non-performing loans non-linear? A threshold analysis for the MENA region. International Journal of Finance & Economics 27: 4383–98. [Google Scholar]

- Jubilee, Ribed Vianneca, Fakarudin Kamarudin, Ahmed Razman Abdul Latiff, Hafezali Iqbal Hussain, and Nazratul Aina Mohamad Anwar. 2022. Does globalisation have an impact on dual banking system productivity in selected Southeast Asian banking industry? Asia-Pacific Journal of Business Administration 14: 479–515. [Google Scholar] [CrossRef]

- Karadima, Maria, and Helen Louri. 2020. Non-performing loans in the euro area: Does bank market power matter? International Review of Financial Analysis 72: 101593. [Google Scholar] [CrossRef]

- Karadima, Maria, and Helen Louri. 2021. Economic policy uncertainty and non-performing loans: The moderating role of bank concentration. Finance Research Letters 38: 101458. [Google Scholar] [CrossRef]

- Khairi, Ardhi, Bahri Bahri, and Bhenu Artha. 2021. A literature review of non-performing loan. Journal of Business and Management Review 2: 366–73. [Google Scholar] [CrossRef]