Abstract

In accordance with ISA 240, it is the responsibility of external auditors to obtain reasonable assurance that financial statements are free from material misstatement, whether caused by fraud or error. Recently, the auditing profession in Malaysia has been significantly challenged by the explosion of fraud cases and by auditors’ failure to determine the “true and fair view” of the financial statement. This incident has tarnished the reputation of the audit profession. The effectiveness of the external auditor function, especially when related to fraud risk assessment, is commonly called into question. Hence, this study aims to assess individual factors (personality traits, digital technology skills, and competency) that may contribute to the effectiveness of fraud risk assessment among external auditors. A total of 455 questionnaires were distributed to external auditors, and a total of 150 (32.96%) responses were received. Data were thoroughly analyzed using Smart-PLS 4.0. This study found that digital technology skills contribute to the effectiveness of fraud risk assessment, whereas personality traits and competency do not. The findings implied that an effective technique of fraud risk assessment among external auditors requires digital technology skills. This study contributes to the literature by confirming the critical role of digital technology skills in enhancing the effectiveness of fraud risk assessments.

JEL Classification:

M4; O3

1. Introduction

Recently, there has been growing criticism of external auditors’ ability to assess fraud risk effectively, as evidenced by an increase in public scrutiny and a number of legal suits filed against external auditors. Corporate fraud and its encompassing elements are an evolving threat to the global economy. In Malaysia, the corporate fraud rate has persisted at perturbing levels, affecting businesses in various ways. PricewaterhouseCoopers (PwC)’s Global Economic Crime and Fraud Survey (PwC 2020) reported a significant increase in corporate fraud incidents amongst the respondents, from 28% in 2016 to 43% in 2020. Continuous reports of financial scandals in Malaysia (i.e., Port Klang Free Zone (PKFZ) and 1Malaysia Development Berhad (1MDB), Transmile Group, NasionCom Holdings, Megan Media Holdings and Ho Hup Construction (The Sun 2007, as cited in Paino 2012)), have tarnished the auditors’ reputations badly. In most cases, failure to detect fraud leads to huge financial losses, which in turn, leads to litigation against auditors; for example, in the case of Satyam Computers Limited, PwC India was fined $7.5 million for not following the code of conduct and auditing standards in the performance of its duties (Lal Bhasin 2013).

Therefore, there is a crucial need for a study that can enhance the quality of external auditors, especially the effectiveness of fraud risk assessment. Extensive studies have been conducted to examine factors contributing to external auditors’ effectiveness in fraud risk assessment (Mansour et al. 2020; Popoola et al. 2014; Payne and Ramsay 2005; Knapp and Knapp 2001), especially individual factors; however, the results have been inconclusive. Samagaio and Felício (2022) highlight the need for a study that can investigate the impact of individual factors on an external auditor’s ability to effectively assess fraud risk assessment. Therefore, the present study aims to examine the individual factors, namely personal traits, competency, and digital technology skills, which impact the external auditor’s effectiveness in combating the fraud risk. These factors have limited positive input in the context of Malaysia, where fraud cases are highly reported. This study is motivated by the call to strengthen the auditing profession to regain public trust in the external auditor as an independent assurance provider. Three research questions are addressed through data analysis using partial least-squares structural equation model (PLS-SEM). The research found that digital technology skills are the most influential factors that could enhance the effectiveness of an external auditor’s fraud risk assessment.

Theoretically, this study extends the previous research on external auditor’s judgment and decision making (JDM). Most studies on JDM have focused on an auditor’s performance of audit tasks, such as risk assessment, analytical procedures, and evidence evaluation—which represents a growing concern regarding judgment (Sulaiman et al. 2018). In addition, auditors’ recognition of and response to fraud risk cues (Herron and Cornell 2021) and materiality judgment (Samagaio and Felício 2022) have come under scrutiny. Observing an increase in public scrutiny and the number of legal suits filed against external auditors in Malaysia, it is apparent that there is a crucial need for a study on factors influencing external auditors’ judgment performance, something which is currently lacking. While most studies on JDM focus on the consensus of an auditor’s judgment, this study extends the previous literature by measuring fraud risk assessment in the form of judgment accuracy. This is suggested by Bonner (2008), who argues that stakeholders are more concerned about the accuracy of one’s judgment compared to the extent to which one’s judgment is consistent with another judgment.

As for the determinant of judgment performance, a recent study by Samagaio and Felício (2022) revealed that the traits of agreeableness, conscientiousness, and openness are positively associated with the professional skepticism of auditors, while conscientiousness and neuroticism negatively affect reduced audit quality practices; however, they found no evidence that the dimension of personality traits influences materiality judgments. Hence, this study intends to extend the literature by examining personality traits as a second-order construct to prove that personality traits influence auditor judgment performance, specifically fraud risk assessment. Practically, in this era of digitalization, an external auditor must invest in upskilling their digital technology skills to create value through effective fraud risk assessment. The Malaysia Institute of Accountants (MIA) should focus on building the profession towards digitalization, where digital technology skills are vital.

2. Literature Review and Hypothesis Development

Numerous incidents of continuous corporate collapses caused by external auditor failure to detect fraud have diminished the public’s trust in external auditors. External auditors have recently come under criticism for failing to discharge their responsibilities diligently. From observing the severity of failure to assessing the existence of fraud to the auditee, auditor, and public, it is apparent that there is a crucial need for a study that could influence an external auditor’s ability to effectively assess fraud risk. Samagaio and Felício (2022) highlight the need for a study that could provide empirical evidence on the impact of individual differences on fraud risk effectiveness, seeing as the results are still inconsistent. The extent to which individual factors—personality traits, competency, and digital technology skill—influence an external auditor’s fraud risk assessment is yet to be explored; thus, this will be investigated in this study.

2.1. Fraud Risk Assessment

External auditors are defined as third-party auditing professionals who are not affiliated with any corporate organization and are responsible for determining the accuracy of business accounts and the organization’s financial status (Lee et al. 2008). In the past, especially in the 19th century, external audits’ main objective was fraud detection (Alleyne and Howard 2005). Later, the weight has altered to stipulate only a reasonable assurance that financial statements are free from any material misstatement.

The International Auditing and Assurance Standards Board (IAASB 2013), the body that stipulates the role of auditors in International Standard on Auditing (ISA) 240, explains that “An auditor conducting an audit in accordance with ISA is responsible for obtaining reasonable assurance that the financial statements are free from material misstatement, whether caused by fraud or error”. Financial statement fraud is the least common kind, but results in the highest loss compared to other frauds, such as asset misappropriation and corruption (Association of Certified Fraud Examiners 2020). The scope of practice of external auditors, according to this definition, includes the identification and assessment of the risk of material misstatement of the financial statements as a consequence of fraud; the documentation and professional presentation of appropriate audit evidence related to the assessed fraud risk; and the need to sufficiently and appropriately respond to the identified fraud during the audit (IAASB 2013).

Fraud risk assessments should be measured during the audit engagement, where auditors acquire new information and evidence at every stage of the audit, and some of the information is related to the likelihood of fraud occurrence. Consequently, auditors have to frequently update their assessment of the likelihood of fraud occurrence at preliminary stages, fieldwork stages when they conduct analytical procedures, a test of control, and a substantive test until recommendation follow-up stages (IAASB 2013). Auditors with high personality traits and competence are able to make appropriate revisions based on the evidence collected. As a result, their final fraud probability assessments will be accurately determined; therefore, the probability of detecting or preventing fraud will increase.

The past literature argued that auditors’ competencies enable auditors to detect fraud (Mui 2018; Knapp and Knapp 2001). The efficacy and competence of auditors depends on several factors ranging from personality traits (a person’s psychophysical system that determines individual behavior and thinking distinctively (Kristianti 2012)) to various core competencies and experiences. Emerson and Yang (2012) argued that the personality traits of auditors should be regarded as one of the most fundamental qualities determining their efficacy in assessing fraud risk. Clements (2020) corroborated this postulation by stating that personality traits underpin the progression of a fraud investigation and often determine the outcome of the cases. This significance is validated by the fact that auditors who demonstrate certain types of personality traits are often more efficient than those who lack these traits. Clements (2020) stated that the five personality traits required according to the Ten Item Personality Indicators are openness, conscientiousness, extroversion, agreeableness, and neuroticism. However, amongst auditors, it has been determined that higher levels of conscientiousness, increased openness, and less neuroticism are considered to be the personality traits of more experienced fraud investigators. An evaluation of the structural impact of personality traits (such as conscientiousness) on the ability of auditors to detect fraud in early stages requires information regarding both the dimensionality of the traits and their correlation to auditing outcomes.

IAASB (2013) stated that auditors are required to assess the risk of fraudulent material misstatement in the financial statements during the audit process. It is also important that external auditors have the knowledge and skills concerning information systems, similarly to internal auditors. Every business in the digital era is mostly maintained by appropriate information technologies that fit different sizes of databases depending on the type of industry the company operates in (Vona 2017). For this reason, auditors have to learn and need to have better knowledge about sophisticated digital technology. With the massive use of digital technology in different business types, external auditors’ can no longer conduct conventional audits (Al-Ansi et al. 2013). The aforementioned fact implies that digital technology skills become more crucial to the conduct of an effective audit and the assessment of potential fraud risk. Perpetrators sometimes hide fraud in a company’s databases, making it difficult to detect fraudulent activity manually without sophisticated tools (Vona 2017).

2.2. Personality Traits and Fraud Risk Assessment

While there has been an explosion in academic and public discourse centered on fraud detection and risk assessment in corporations, a significant literature gap exists on the relationship between an auditor’s inherent traits and competencies, and their efficacy. Studies have maintained that the capabilities and competency of auditors are related to their capability to encode, retrieve, and analyze information, which is inherently rooted in their personality traits and experience (Gullkvist and Jokipii 2015). Such postulations are reinforced by prior studies on the assessment of fraud risks which have identified many factors that may influence the auditor’s ability in fraud risk assessment, including personality traits, experience, and ethical reasoning (Emerson and Yang 2012). A study conducted by Clements (2020) corroborated this postulation by deducing that there are personality traits that are common among highly experienced fraud investigators, including internal and external auditors, such as a high level of conscientiousness and openness and less neuroticism, which support the idea of the correlation between auditor effectiveness in fraud detection and personality traits. Furthermore, Emerson and Yang (2012) suggested that auditors with personality traits like conscientiousness “are theorized to engage in a more diligent, perseverant, organized and systematic approach to evidence evaluation than their less conscientious counterparts.” Concurrently, research by Mansour et al. (2020) also proposed that conscientiousness is a personality factor in fraud risk assessment. Among the latest finding, Abdo et al. (2022) found that personality traits contributed to strengthening the effectiveness of internal control in Lebanese companies. Verwey Inez and Asare (2022) demonstrated that, for auditors with a strong ethical stance, there was a positive association between trait skepticism and fraud detection. Both an ethical stance and skepticism reflected the personality traits of auditors in making decisions. Thus, building on these studies, the accompanying hypothesis is created:

H1.

There is a significant positive relationship between personality traits and the effectiveness of fraud risk assessment.

2.3. Competency and Fraud Risk Assessment

Globalization has sped up innovative progress, digital transformation of data, and communicational advancements. Therefore, risk controls, administrations, and consistency processes continually experience critical changes. The caliber of the audit is determined by the auditors’ competencies (Aslan 2021). To deal with the expanding refinement and intricacies of global business, auditors need to have the required abilities, experiences, and knowledge to direct internal and external auditors. The analysis conducted by Mui (2018) reported that auditors need to guarantee they have sufficient knowledge and mastery of assessing fraud properly. Auditors with higher capabilities tend to maintain their professionalism and need to carry out checks in as detailed as possible so that material misstatements in financial reporting can be avoided.

Knapp and Knapp’s (2001) research showed that auditors’ knowledge of audit assignments increases the auditor’s performance in selecting and weighing analytical determinative reception compilations. Knapp and Knapp (2001) also revealed that auditors could find more unusual items in financial reports from inexperienced auditors. Another study by Suraida (2005) showed that professional ethics, auditor competence, and auditor experience are the main factors needed to conduct an audit. In this study, auditor capability is measured by professional ethics, auditor competence, and auditor experience. These are the main factors needed to conduct an audit (Kusumawati and Syamsuddin 2018). Hamilah et al. (2019) found that auditors’ experience was related to the auditor’s ability to detect fraud. Similarly, Natsir et al. (2021) showed that auditors’ experience directly influences the auditing performance in the Supervisory Agency of Central Sulawesi, Indonesia. Furthermore, Renschler (2020) found that competencies ensure the quality of enterprise risk management (ERM). As the process in ERM requires auditors to assess risk, highly competent auditors would be able to monitor deviations and misrepresentations. Consequently, experience and knowledge were major factors in successful fraud detection. This leads to the second hypothesis:

H2.

There is a significant positive relationship between competency and the effectiveness of fraud risk assessment.

2.4. Digital Technology Skills and Fraud Risk Assessment

Because of progress and the vast use of IT in different businesses, auditors’ skills must be adjusted accordingly (Al-Ansi et al. 2013; Héroux and Fortin 2013). Actual archives are presently changing into advanced data set confirmations. In today’s information technology (IT) environment, fraud turns out to be more complex and harder to recognize. Different changes in the bookkeeping environment (e.g., expansion in the utilized mechanized financial announcing process and the transaction volume) may impact the auditor’s fraud location execution, especially in settling on the nature, timing, and size of the auditor test. Big data surrounding business organizations further make combating accounting fraud more challenging, which requires the use of big data tools (Chiang et al. 2021). The fraudster might conceal fraud in knowledge bases, making it extremely challenging to detect without sufficient digital technology skills (Vona 2017). Subsequently, the requirement for digital technology skills is important, insofar as knowledge mining is concerned. Different specialists focused on the positive critical impact of digital technology skills in assessing fraud risk.

In daily practice, failure to detect fraud might have resulted from a lack of competency in handling databases. Fraudsters sometimes hide their fraudulent activities in companies’ databases so that it is difficult for the auditor to reveal it before it becomes a big scandal that ruins the company’s reputation; a case in point is fraud in Satyam Computer Limited (Lal Bhasin 2013). IT has changed how auditors evaluate evidence and has impacted the knowledge and competencies that an auditor must have (Mui 2018). However, limited research has examined the influence of information technology capability and competency of the external auditor on assessing fraud risks. In a study conducted by Allbabidi (2021), it was found that auditors’ performance was affected by leveraging digital technology. Technological advancements, such as the blockchain, are perceived to be crucial in determining the overall audit quality (Meiryani et al. 2021). Chiang et al. (2021) determined that data visualization, data extraction, and analytics are the essential digital skills needed by auditors. Meanwhile, Nora et al. (2022) found that artificial intelligence has the capacity to analyze vast amounts of data quickly and improve the robustness of risk assessment. Curtis (2022) concurred that auditors’ lack of practical experience in deploying technology substantially impacted their capacity to analyze technical evidence and lessen the likelihood of data breaches. All of these research findings converge into the same implication: the need for auditors to equip themselves with digital skills to ensure the quality of the audit process, including the effectiveness of fraud risk assessment. Plenty of research has demonstrated that knowledge-mining techniques and approaches improve the effectiveness of fraud risk assessment. This leads to the third hypothesis:

H3.

There is a significant positive relationship between digital technology skills and the effectiveness of fraud risk assessment.

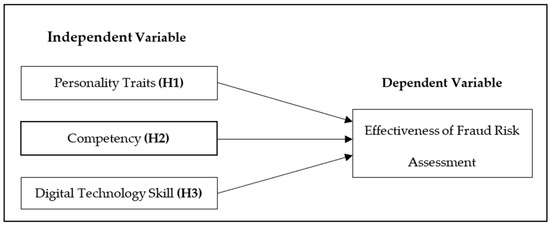

Figure 1 Presents the theoretical framework for this study based on the discussion of personality traits (H1), competency (H2), and digital technology (H3).

Figure 1.

Theoretical Framework.

3. Methodology

3.1. Data Collection

This study distributed 455 online questionnaire surveys to external auditors who were registered members of the Malaysian Institute of Accountants (MIA) and were attached to audit firms located in Selangor, which has the highest density of audit firms in Malaysia. The basis for selecting MIA members as the target population is that auditors are considered the main line of defense for giving reasonable assurance that the financial statements are free from material misstatement due to fraud or error detection fraud (IAASB 2013). Based on the MIA’s website, the number of MIA members in Malaysia is 33,315, and the number of members in the state of Selangor is 13,714. The questionnaire was pre-tested and pilot-tested prior to final data collection to ensure that the questionnaire was professionally designed, clearly structured, reasonably short, and easy to complete.

3.2. Data Analysis

The present research employed the partial least-squares structural equation model (PLS-SEM) using the SmartPLS 4.0 software to perform the statistical analysis. PLS-SEM is an SEM approach for estimating a theoretically established cause–effect model using the variance-based partial least-squares technique. The model technique is based on an iterative approach, which operates like a multiple regression analysis (Hair et al. 2011). PLS-SEM’s main objective is to maximize the explained variance of endogenous constructs (Fornell and Bookstein 1982). The selection of PLS-SEM suits the study objectives of exploring the theoretical extension of established theory, as suggested by Hair et al. (2019). PLS-SEM is chosen rather than CB-SEM as the path model of the study, which includes one or more formative measured constructs.

3.3. Measurement of Variables

3.3.1. Effectiveness of Fraud Assessment

The effectiveness of fraud assessment can be measured by giving the auditors an assessment that requires them to match each of the six events/transactions with the six potential risk types that could occur for each event/transaction. The items in this assessment are adapted with modifications from Razali (2019). This instrument is the most suitable for measuring fraud risk assessment as it allows the respondents to identify the potential fraud risk that might occur during the audit process. Table 1 exhibits the six potential risks and their matching events. Respondents were asked to identify the potential type of risk that could occur for each event/transaction in Table 1 and match it with risk in Table 2 via labeling with a specific alphabet.

Table 1.

Items for Fraud Risk Assessment.

Table 2.

Event/Transaction Related to Fraud Risk.

3.3.2. Personality Traits

There are a number of personality traits that may or may not apply to auditors. Respondents were asked to choose the number that indicates the extent to which the respondent agree or disagree with the statement using a seven-point Likert scale (1 = strongly disagree, 2 = somewhat disagree, 3 = slightly disagree, 4 = neutral, 5 = slightly agree, 6 = somewhat agree, 7 = strongly agree). Respondents should rate the extent to which the pair of traits applies to them, even if one characteristic applies more strongly than the other. The list of personality traits is as follows: extraverted, critical, dependable, anxious, open to new experiences, reserved, sympathetic, disorganized, calm, and conventional. Questions for each item were adopted from Personality Traits Common to Fraud Investigators by Clements (2020).

3.3.3. Competency (Knowledge and Experience)

In detecting fraud, auditors must have the essential knowledge and experience. Siriwardane et al. (2014) signified auditor competency as being the ability of the auditor to depict the experience and knowledge in every individual auditing task conducted consistently to attain the auditing goals. A valuation of competency can be determined through an assessment of working experience, educational background, qualification, position level, and frequency of performing techniques to search for fraud in fraud investigation. Respondents were asked to choose the number that indicates the extent to which the respondent agrees or disagrees with the statement using a seven-point Likert scale (1 = strongly disagree) to (7 = strongly agree). Respondents should rate the extent to which the state of general competencies in auditing apply to them. Questions for each item were adopted from Personality Traits Common to Fraud Investigators by Clements (2020), which help evaluate one’s competency and personality traits.

3.3.4. Digital Technology Skills

Digital technology skills involve the capability of evaluating an entity’s overall IT control and environment, the ability to plan accounting and reporting systems evaluation, the ability to evaluate accounting and reporting systems, and the ability to communicate results of evaluations and follow-ups (IAESB 2007). This part of the questionnaire adapted the dimensions to external auditors’ working circumstances and the variable definition applied in this study. Therefore, the dimensions demonstrated ability in evaluating overall IT control and environment, demonstrated ability in planning an audit using IT, demonstrated ability in executing an audit using IT, and demonstrated ability in communicating the result and following up using IT. Respondents were asked to choose the number that indicates the extent to which the respondent agrees or disagrees with the statement using a seven-point Likert scale (1 = not capable at all) to (7 = strongly capable). The items in this part of the questionnaire were adapted from the Global Internal Audit Common Body of Knowledge by Cangemi (2015).

4. Findings

A total of 150 or 32.96% of responses were received in the SurveyMonkey database from the 455 questionnaire links sent via e-mail, WhatsApp, and Telegram. According to Alreck and Settle (1995), gaining a response rate of 5% to 10% has become a common value in research. Most respondents were female, with such 100 respondents (66.7%), while only 50 (33.3%) were male. Meanwhile, 106 (70.7%) respondents were in the age group of 21 to 30 years old, the highest percentage of respondents compared to other age groups. This was followed by 36 respondents (24%) in the age group between 31 to 40 years old, while the rest, with 8 respondents (5.3%), were in the age group above 41 years old. In terms of the highest level of education, more than half of the respondents, or 114 (76%), had a bachelor’s degree, while 21 respondents (14%) had other qualifications, such as a professional certificate or A-level; the rest of the 15 respondents (10%) had a diploma.

The majority of respondents held senior positions, and audit associates with both positions had an equal percentage of 44% (66). This was followed by managers, and junior audit positions, which also had an equal percentage of 3.3% or 5 respondents, respectively; 4 respondents, or 2.7% of respondents, were partners. The remaining 4 respondents (2.6%) were senior managers or held other positions, such as senior consultant and analyst. In terms of years of audit experience, the highest percentage was those under 10 years of experience, with 52 respondents (34.7%). This is followed by 11 to 20 years of service with 8 respondents (5.3%); lastly, 3 respondents (2%) had more than 21 years of auditing experience. Meanwhile, the remaining 87 respondents (58%) did not indicate their positions in the feedback received.

More than half of the respondents, or 88 respondents (58.7%), claimed that they had validation and registration other than by possessing Association of Chartered Certified Accountants (ACCA) and Certified Public Accountant (CPA) certificates, such as by belonging to the Institute of Chartered Accountants in England and Wales (ICAEW) and Malaysian Institute of Certified Public Accountants (MICPA)-Chartered Accountants Australia and New Zealand (CAANZ). Indeed, 31 respondents (20.7%) had ACCA, 19 respondents (12.7%) did not have any certificate, and only 12 respondents (8%) had a CPA certificate. For average monthly income, the largest proportion was 51 respondents (34%), who were earning less than RM5000. This group was followed in size by that of those earning between RM5000 (USD1200) to RM10,000 (USD2300) average monthly income with 27 respondents (18%), above RM15,000 (USD3500) with 8 respondents (5.3%), and from RM10,000 to RM15,000 with 2 respondents (1.3%). Meanwhile, the remaining 62 respondents (41.3%) refused to answer this question. For the frequency of performing techniques to search for fraud, based on the data collected, 23 respondents (15.3%) rarely performed the techniques, 25 respondents (16.7%) sometimes performed the techniques, 24 respondents (16%) often performed the techniques, and 16 respondents (10.7%) indicated performing the techniques in most of their jobs.

We used partial least-squares (PLS) modeling using the SmartPLS 4.0 version (Ringle et al. 2022) as the statistical tool to examine the measurement and structural model, as it did not require normality assumption and its survey research was not normally distributed (Chin et al. 2003). We followed the suggestions of Anderson and Gerbing (1988) to test the model developed using a 2-step approach. First, we tested the measurement model to test the validity and reliability of the instruments, used following the guidelines of Hair et al. (2019) and Thurasamy et al. (2018); then, we ran the structural model to test the hypotheses developed.

4.1. Measurement Model

We assessed the loadings, average variance extracted (AVE), and composite reliability (CR) for the measurement model. The values of loadings should be ≥0.5, the AVE should be ≥ 0.5, and the CR should be ≥ 0.7. As shown in Table 3 and Table 4, the AVEs are all higher than 0.5, and the CRs are all higher than 0.7. The loadings were also acceptable, with few loadings less than 0.708, which is an acceptable value (Hair et al. 2019). Thus, we concluded that the constructs meet reliability and convergent validity requirement.

Table 3.

Measurement Model for First-Order Construct.

Table 4.

Measurement Model for Second-Order Construct.

Then, in step 2, we assessed the discriminant validity using the Fornell and Larker (1981) criterion. In PLS-SEM, discriminant validity can be assessed by comparing the square root of AVE values for two factors against the correlation estimates (r) between the same two factors. In order to achieve discriminant validity, the square root of AVE must be larger than the correlation estimate of the two factors (√AVE > r). Table 5 depicts the assessment of discriminant validity using the Fornell and Larcker criterion, which indicate that the square root of AVE of each construct was larger than the correlation estimates of the factors. This indicated that all constructs exhibited discriminant validity and were distinct from one another. These validity tests show that the measurement items are both valid and reliable.

Table 5.

Discriminant Validity (Fornell and Larker Criterion).

4.2. Structural Model

As suggested by Hair et al. (2019), we reported the path coefficients, the standard errors, t values, and p values for the structural model using a 5,000-sample re-sample bootstrapping procedure (Thurasamy et al. 2018). Additionally, based on the criticism of Hahn and Ang (2017) that p values are not a good criterion for testing the significance of a hypothesis and that researchers ought to use a combination of criteria, such as p values, confidence intervals, and effect sizes, we expanded our criteria to include these. Table 6 summarizes the criteria we used to test the hypotheses developed.

Table 6.

Hypothesis Testing.

First, we tested the effect of the 3 predictors on EFRA; the R2 was 0.178, which shows that all the 3 predictors explained 17.8% of the variance in EFRA. Digital technology skills (β = 0.278, p < 0.05) were positively related to EFRA; thus, H3 was supported. However, both personality traits (β = 0.158, p > 0.05) and competency (β = 0.051, p > 0.01) were not significant; hence HI and H2 were not supported. We also assessed the model fit using SRMR. The SRMR value is 0.119 (saturated model) and 0.122 (estimated model), exceeding the threshold value of 0.08, thus indicating a lack of fit (Henseler et al. 2014).

5. Discussion and Conclusions

The effectiveness of the external auditor function, especially related to fraud risk assessment and fraud detection, is commonly questioned. The incidents of large companies’ bankruptcy due to negligence of corporate governance actors have caused public confidence in the audit profession to drop dramatically. The flaws in judgment that put auditors into litigation processes also happened in the British Petroleum (BP), London Inter-Bank Offered Rate (LIBOR), and Olympus cases. Thus, this study aims to assess individual factors contributing to the effectiveness of fraud risk assessment among external auditors. This study proposed three hypotheses.

Hypothesis 1 suggested no positive significant relationship between personality traits and effectiveness in assessing risk. Based on Table 6, it is deduced that personality traits had no significant relationship with effectiveness in assessing risk; hence, H1 is rejected. This contradicts an earlier study by Clements (2020), who discovered that experienced fraud investigators, such as internal and external auditor, have high level sof conscientiousness, are organized, reliable, hardworking, self-directed, punctual, scrupulous, ambitious, and persevering. The accounting literature offers some context on the impact of personality traits on variables like auditors’ behavior and judgment (Clements 2020; Mansour et al. 2020). These studies all corroborate the deduction that the personality traits of external auditors can directly affect their ability in fraud risk assessments. Moreover, Emerson and Yang (2012) and Mansour et al. (2020) determined that a high level of conscientiousness affects auditors’ efficiency in fraud risk assessments and fraud detection. However, this finding proved that auditors’ personality traits are not an influencing factor that helps them assess fraud risk.

Hypothesis 2 suggested no positive significant relationship exists between auditors’ competency and effectiveness in assessing fraud risk. These findings depict that competency had no significant relationship with effectiveness in assessing risk. Due to the pervasive and highly evolving nature of fraud, external auditors are required to demonstrate a level of competency being regulated and stipulated by regulatory agencies because of the need to align a certain skill set with evolving fiscal needs. A study by Mansour et al. (2020) deduced that competent auditors and accountants, whose competency was measured in terms of educational qualification and number of years in service (experience), were more likely to detect fraudulent activity than less competent professionals. This postulation was supported by Asmara (2016), who established a significant relationship between the competency of external auditors and their effectiveness in fraud risk assessments. Asmara (2016) concluded that the competency of external auditors had a 7.8% positive effect on auditing quality, which denotes the ability of the auditor to detect and prevent fraud.

Hypothesis 3 proposed a positive significant relationship between auditors’ digital technology skills and effectiveness in assessing fraud risk. Ismail and Abidin (2009) argued that integrating IT into the business sector means that auditors are no longer required to have basic computer skills, but rather make use of highly advanced digital technology skills that enable them to detect potential fraud risks. This postulation is reinforced by numerous studies showing a paradigm shift in conventional auditing to highly complex and dynamic systems that require auditors to go above and beyond digital skills to include assessing the adequacy of control software systems used by businesses in fraud prevention and detection (Paino 2012). Ismail and Abidin (2009) and Al-Ansi et al. (2013) asserted that, in contemporary work settings, external auditors are required to implant and utilize technology during the audit process. For instance, blockchain technology (Meiryani et al. 2021), data visualization, data extraction, analytics (Chiang et al. 2021), and artificial intelligence (Nora et al. 2022) are the essential digital skills needed by auditors to be able to ascertain and recognize fraudulent patterns embedded in digital fiscal statements. This postulation is reinforced by Ismail and Abidin (2009), who deduced that highly competent and effective auditors are conversant with ways through which IT advancements can be integrated into their processes to enhance the outcomes for both the client and the process. All of these research findings converge into the same implication: the need for auditors to equip themselves with digital skills to ensure the quality of the audit process, including the effectiveness of fraud risk assessment.

This study contributes to identifying important factors affecting the effectiveness of fraud risk assessment. Practically, the findings could benefit audit firms by highlighting the key skills that need further development among external auditors. Thus, the Malaysian Institute of Accountants (MIA), as a body that governs the external audit profession, could highlight the importance of digital technology skills to enhance external auditors’ fraud risk assessment. However, the article has some limitations, namely the small research sample size, which means it cannot represent all populations of external auditors. Moreover, the study only evaluated three main individual factors and did not mention other related factors. Therefore, future studies should take note of these points, extend this study and overcome its limitations.

Author Contributions

Conceptualization, Investigation, Methodology, Writing—original draft, N.I.M.R., J.S. and F.M.R., Formal analysis, F.M.R., Supervision, J.S. and writing—review and editing, D.I.A.M. and N.S. All authors have read and agreed to the published version of the manuscript.

Funding

The funding was provided by Kolej Universiti Poly-Tech MARA.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Institutional Review Board (or Ethics Committee) of Universiti Technology MARA (REC/12/2020 (MR/446) on 23 December 2020.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abdo, Manale, Khalil Feghali, and Mona Akram Zgheib. 2022. The role of emotional intelligence and personality on the overall internal control effectiveness: Applied on internal audit team member’s behavior in Lebanese companies. Asian Journal of Accounting Research 7: 195–207. [Google Scholar] [CrossRef]

- Al-Ansi, Ali Ali, Noor Azizi Bin Ismail, and Abdullah Kaid Al-Swidi. 2013. The effect of IT knowledge and IT training on the IT utilization among external auditors: Evidence from Yemen. Asian Social Science 9: 307. [Google Scholar]

- Allbabidi, Mohamad Hesham Adnan. 2021. Hype or hope: Digital technologies in auditing process. Asian Journal of Business and Accounting 14: 59–85. [Google Scholar] [CrossRef]

- Alleyne, Philmore, and Michael Howard. 2005. An exploratory study of auditors’ responsibility for fraud detection in Barbados. Managerial Auditing Journal 20: 284–303. [Google Scholar] [CrossRef]

- Alreck, Pamela L., and Robert B. Settle. 1995. The Survey Research Handbook: Guidelines and Strategies for Conducting a Survey. New York: IRWIN Professional Publishing. [Google Scholar]

- Anderson, James C., and David W. Gerbing. 1988. Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin 103: 411–23. [Google Scholar] [CrossRef]

- Aslan, Lale. 2021. The evolving competencies of the public auditor and the future of public sector auditing. In Contemporary Issues in Public Sector Accounting and Auditing, Contemporary Studies in Economic and Financial Analysis. Edited by Simon Grima and Engin Boztepe. Bingley: Emerald Publishing Limited, vol. 105, pp. 103–29. [Google Scholar]

- Asmara, Rina Yuliastuty. 2016. Effect of competence and motivation of auditors of the quality of audit: Survey on the external auditor registered public accounting firm in Jakarta in Indonesia. European Journal of Accounting, Auditing, and Finance Research 4: 43–76. [Google Scholar]

- Association of Certified Fraud Examiners. 2020. Report to the Nations: 2020 Global Study on Occupational Fraud and Abuse. Austin: Association of Certified Fraud Examiner. [Google Scholar]

- Bonner, Sarah E. 2008. Judgment and Decision Making in Accounting. Upper Saddle River: Pearson Prentice Hall. [Google Scholar]

- Cangemi, Michael. P. 2015. An Internal Audit Common Body of Knowledge: Brink’s Modern Internal Auditing. Hoboken: John Wiley & Sons, Incorporated, pp. 11–26. [Google Scholar] [CrossRef]

- Chiang, Catherine Chiang, Kevin S. Agnew, and Katherine Korol. 2021. Knowledge and skills essential for auditors in the age of big data–the early evidence from a survey. International Journal of Organizational Innovation 13: 110–29. Available online: https://www.proquest.com/scholarly-journals/knowledge-skills-essential-auditors-age-big-data/docview/2521122576/se-2 (accessed on 27 October 2022).

- Chin, Wynne W., Barbara L. Marcolin, and Peter R. Newsted. 2003. Partial Least Squares Latent Variable Modeling Approach for Measuring Interaction Effects: Results from a Monte Carlo Simulation Study and an Electronic-Mail Emotion/Adoption Study. Information Systems Research 14: 189–217. [Google Scholar] [CrossRef]

- Clements, Lynn H. 2020. Personality traits common to fraud investigators. Journal of Financial Crime 27: 119–29. [Google Scholar] [CrossRef]

- Curtis, Blake. 2022. Creating the Next Generation Cybersecurity Auditor: Examining the Relationship between It Auditors’ Competency, Audit Quality, & Data Breaches (Publication No: 2680312317). ProQuest Dissertations and Theses Global. Available online: https://www.proquest.com/dissertations-theses/creating-next-generation-cybersecurity-auditor/docview/2680312317/se-2 (accessed on 27 October 2022).

- Emerson, David J., and Ling Yang. 2012. Perceptions of auditor conscientiousness and fraud detection. Journal of Forensic & Investigative Accounting 4: 110–41. [Google Scholar]

- Fornell, Claes, and Fred L. Bookstein. 1982. Two Structural Equation Models: LISREL and PLS Applied to Consumer Exit-Voice Theory. Journal of Marketing Research 19: 440–52. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larker. 1981. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Gullkvist, Benita, and Annukka Jokipii. 2015. Factors Influencing auditors’ self-perceived ability to assess fraud risk. Nordic Journal of Business 64: 40–63. [Google Scholar]

- Hahn, Eugene D., and Siah Hwee Ang. 2017. From the editors: New directions in the reporting of statistical results in the Journal of World Business. Journal of World Business 52: 125–126. [Google Scholar] [CrossRef]

- Hair, Joe. F., Christian M. Ringle, and Marko Sarstedt. 2011. PLS-SEM: Indeed a Silver Bullet. The Journal of Marketing Theory and Practice 19: 139–51. [Google Scholar] [CrossRef]

- Hair, Joe F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hamilah, Hamilah, Denny Bagus Sukma Bagus Sukma, and Evi Handayani. 2019. The effect of professional education, experience, and independence on the ability of internal auditors in detecting fraud in the pharmaceutical industry company in Central Jakarta. International Journal of Economics and Financial Issues 9: 55–62. Available online: https://www.proquest.com/scholarly-journals/effect-professional-education-experience/docview/2288739552/se-2 (accessed on 27 October 2022).

- Henseler, Jörg, Theo K. Dijkstra, Marko Sarstedt, Christian M. Ringle, Adamantios Diamantopoulos, Detmar W. Straub, David J. Ketchen, Jr., Joseph F. Hair, G. Tomas M. Hult, and Roger J. Calantone. 2014. Common beliefs and reality about PLS: Comments on Rönkkö and Evermann (2013). Organizational Research Methods 17: 182–209. [Google Scholar] [CrossRef]

- Héroux, Sylvie, and Anne Fortin. 2013. The internal audit function in information technology governance: A holistic perspective. Journal of Information Systems 27: 189. [Google Scholar] [CrossRef]

- Herron, Eddward T., and Robert M. Cornell. 2021. Creativity amidst standardization: Is creativity related to auditors’ recognition of and responses to fraud risk cues? Journal of Business Research 132: 314–26. [Google Scholar] [CrossRef]

- International Auditing and Assurance Standards Board (IAASB). 2013. Handbook of International Quality Control, Auditing, Review, Other Assurance, and Related Services Pronouncements. New York: International Federation of Accountants. [Google Scholar]

- International Accounting Education Standards Board IAESB (IAESB). 2007. International Education Practice Statement 2: Information Technology for Professional Accountants. New York: International Federation of Accountants. [Google Scholar]

- Ismail, Noor Azizi, and Azlan Zainol Abidin. 2009. Perception towards the importance and knowledge of information technology among auditors in Malaysia. Journal of Accounting and Taxation 1: 61–69. [Google Scholar]

- Knapp, Carol A., and Michael C. Knapp. 2001. The effects of experience and explicit fraud risk assessment in detecting fraud with analytical procedures. Accounting, Organizations and Society 26: 25–37. [Google Scholar] [CrossRef]

- Kristianti, Ika. 2012. Pengaruh Tipe Kepribadian dan Penerimaan Perilaku Disfungsional Terhadap Audit Judgement. Doctoral dissertation, Magister Akuntansi Program Pascasarjana FEB-UKSW, Salatiga, Indonesia. [Google Scholar]

- Kusumawati, Andi, and Syamsuddin Syamsuddin. 2018. The effect of auditor quality to professional skepticism and its relationship to audit quality. International Journal of Law and Management 60: 998–1008. [Google Scholar] [CrossRef]

- Lal Bhasin, Madan. 2013. Corporate accounting fraud: A case study of Satyam Computers Limited. Open Journal of Accounting 2: 26–38. [Google Scholar] [CrossRef]

- Lee, T. H., A. Md Ali, and Juergen Dieter Gloeck. 2008. A study of auditors’ responsibility for fraud detection in Malaysia. Southern African Journal of Accountability and Auditing Research 8: 27–34. [Google Scholar]

- Mansour, Ala’a Zuhair, Aidi Ahmi, and Oluwatoyin Muse Johnson Popoola. 2020. The personality factor of conscientiousness on skills requirement and fraud risk assessment performance. International Journal of Financial Research 11: 405. [Google Scholar] [CrossRef]

- Meiryani, Sujanto Monika, Ang Swat Lin Lindawati, Arif Zulkarnain, and Suryadiputra Liawatimena. 2021. Auditor’s perception on technology transformation: Blockchain and CAATS on audit quality in Indonesia. International Journal of Advanced Computer Science and Applications 12: 526–33. [Google Scholar] [CrossRef]

- Mui, Grace Y. 2018. Defining auditor expertise in fraud detection. Journal of Forensic and Investigative Accounting 10: 168–86. [Google Scholar]

- Natsir, Muhammad, Abdul Pattawe, Nurhayati Haris, Femilia Zahra, and Tenripada. 2021. The effects of work experience, ethical profession, and auditor independence on auditing performance of supervisory agency in Central Sulawesi Indonesia. Academy of Entrepreneurship Journal 27: 1–9. Available online: https://www.proquest.com/scholarly-journals/effects-work-experience-ethical-profession/docview/2565210042/se-2 (accessed on 27 October 2022).

- Nora, Azima Nor, Khaled Hussainey, and Ahmad Faisal Hayek. 2022. The use of artificial intelligence and audit quality: An analysis from the perspectives of external auditors in the UAE. Journal of Risk and Financial Management 15: 339. [Google Scholar] [CrossRef]

- Paino, Halil. 2012. Financial reporting risk assessment and audit pricing. Global Journal of Management and Business Research 12: 9–13. [Google Scholar]

- Payne, Elizabeth A., and Robert J. Ramsay. 2005. Fraud risk assessments and auditors’ professional scepticism. Managerial Auditing Journal 20: 321–30. [Google Scholar] [CrossRef]

- Popoola, Oluwatoyin Muse Johnson, Ayoib Che-Ahmad, and Rose Shamsiah Samsudin. 2014. Task performance fraud risk assessment on forensic accountant and auditor knowledge and mindset in Nigerian public sector. Risk Governance and Control: Financial Markets and Institutions 4: 83–89. [Google Scholar] [CrossRef]

- PricewaterhouseCoopers (PwC). 2020. Economic crime—When the boardroom becomes the battlefield. In PwC’s Global Economic Crime and Fraud Survey, 7th South African ed. London: PwC. [Google Scholar]

- Razali, Fazlida Mohd. 2019. The Effect of Individual and Environmental Factors on Internal Auditor’s Risk Judgment Performance. Doctoral dissertation, Universiti Teknologi MARA, Shah Alam, Malaysia. [Google Scholar]

- Renschler, Melissa E. 2020. The Influence of Internal Audit Competency on Financial Reporting Quality and Enterprise Risk Management (Publication No: 2680312317). ProQuest Dissertations and Theses Global. Available online: https://www.proquest.com/dissertations-theses/influence-internal-audit-competency-on-financial/docview/2405151856/se-2 (accessed on 27 October 2022).

- Ringle, Christian M., Sven Wende, and Jan-Michael Becker. 2022. “SmartPLS 4.” Oststeinbek: SmartPLS GmbH. Available online: http://www.smartpls.com (accessed on 15 October 2022).

- Samagaio, António, and Teresa Felício. 2022. The influence of the auditor’s personality in audit quality. Journal of Business Research 141: 794–807. [Google Scholar] [CrossRef]

- Siriwardane, Harshini P., Billy Kin Hoi Hu, and Kin Yeow Low. 2014. Skills, knowledge, and attitudes important for present-day auditors. International Journal of Auditing 18: 193–205. [Google Scholar] [CrossRef]

- Sulaiman, Nor Adwa, Fatimah Mat Yasin, and Rusnah Muhamad. 2018. Perspectives on Audit Quality. Asian Journal of Accounting Perspectives 11: 1–27. [Google Scholar] [CrossRef]

- Suraida, Ida. 2005. Pengaruh etika, kompetensi, pengalaman audit dan risiko audit terhadap skeptisisme profesional auditor dan ketepatan pemberian opini akuntan public. Journal of Social Sciences and Humanities 7: 186–202. [Google Scholar]

- Thurasamy, Ramayah, Jacky Cheah, Francis Chuah, Hiram Ting, and Mumtaz Ali Memon. 2018. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using SmartPLS 3.0, 2nd ed. Kuala Lumpur: Pearson Malaysia Sdn Bhd. [Google Scholar]

- Verwey Inez, G. F., and Steephen K. Asare. 2022. The joint effect of ethical idealism and trait skepticism on auditors’ fraud detection. Journal of Business Ethics 176: 381–95. [Google Scholar] [CrossRef]

- Vona, Leonard W. 2017. Fraud Data Analytics Methodology: The Fraud Scenario Approach to Uncovering Fraud in Core Business Systems. Hoboken: John Wiley & Sons. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).