Abstract

The purpose of this study is to investigate the relationship between working capital and firm profitability for a sample of 719 Polish listed firms over the period of 2007–2016. The scarcity of empirical evidence for emerging economies and the importance of working capital efficiency motivate the research on the working capital–financial performance relationship. The paper adopts a quantitative approach using different panel data techniques (ordinary least squares, fixed effects, and panel-corrected standard errors models). The empirical results report an inverted U-shape relationship between working capital level and firm profitability, meaning that working capital has a positive effect on the profitability of Polish firms to a break-even point (optimum level). After the break-even point, working capital starts to negatively affect firm profitability. The study brings theoretical and practical contributions. It extends and complements the literature on the field by highlighting new evidence on the non-linear interrelation between working capital management (WCM) and corporate performance in Poland. From the practitioners’ perspective, the results highlight the importance of WCM for firm profitability.

1. Introduction

The corporate finance literature recognizes the importance of short-term financial decisions for the firm’s profitability. In a global context, the problematics of working capital management represent an ongoing topic because of its importance in ensuring the optimal route for businesses. Being able to act as a buffer of liquidity (Baños-Caballero et al. 2020), working capital plays a valuable role during economic turmoil (Enqvist et al. 2014). In a recent report about all globally listed companies (PWC Annual Report 2019), PWC Global highlights that improving working capital may release €1.3 trillion of cash, which may boost capital investment by 55%. Moreover, the report highlights new challenges for the financial performance of globally listed companies for the last five years: capital expenditure has declined, cash has become more expensive and harder to convert, and working capital has improved only marginally. Given this backdrop, businesses need to have a working capital culture as support for financial performance.

However, empirical evidence on the relationship between working capital and corporate performance is rather mixed. On the one hand, investments in working capital are supposed to have a positive influence on firm profitability because they support growth in terms of sales and earnings (Baños-Caballero et al. 2020; Aktas et al. 2015). Sales are positively influenced by trade credit, improving customer relationships, while holding more inventories secures the business from the perspective of price fluctuations. Moreover, short-term debts used to finance working capital have low-interest rates and are free from inflationary risk (Mahmood et al. 2019). On the other hand, overinvestment in working capital requires financing and, consequently, supplementary costs, and may also generate adverse effects and financial losses for shareholders (Chang 2018; Aktas et al. 2015). Therefore, a rapid increase in the cost of working capital investments relative to the benefits of holding larger inventories or allowing for trade credit to customers lowers the firm’s profitability levels. Recently, a few papers argued that there was a non-linear interrelation between investment in working capital and firm profitability (Mahmood et al. 2019; Tsuruta 2018; Boțoc and Anton 2017; Aktas et al. 2015; Mun and Jang 2015; Baños-Caballero et al. 2014). The non-linear relationship supposes that investments in working capital have a positive influence on corporate profitability until a certain point, called the optimum level of working capital (or the break-even point). Above the optimum, working capital may become a negative determinant of firm performance. The positive and negative combination with a break-even point is called an inverted U-shaped relationship (Mahmood et al. 2019). Taking into account that “entrepreneurial success can refer to the mere fact of continuing to run the business” (Staniewski and Awruk 2019), the trade-off between working capital and firm profitability can be acknowledged as of important significance in the context of entrepreneurial success.

This study seeks to examine the profit creating potential of working capital for a sample of firms from Poland over the period of 2007–2016. The first motivation behind the study is represented by market characteristics. The Polish market was developing dynamically and may have different characteristics than the patterns of mature markets (Mielcarz et al. 2018). Moreover, it is worth to know that according to FTSE Russell Agency, Poland was qualified as a developed country in 2018. Second, Poland’s economic outlook motivates the present research. Over the analyzed period, inflation had an upward trend, leading to an increase in interest rates, which impacts the corporate cost of capital. In light of this threat, businesses may focus on the areas under their control, covering working capital. The third motivation behind this paper is the fact that a large body of recent research studies has investigated the impact of working capital on corporate performance from the perspective of developed economies especially the US, the UK, and China (i.e., Dalci et al. 2019; Ren et al. 2019; Laghari and Chengang 2019; Mahmood et al. 2019; Goncalves et al. 2018; Tsuruta 2018; Aktas et al. 2015; Mun and Jang 2015; Enqvist et al. 2014; Baños-Caballero et al. 2014). Specifically, a small number of studies have focused on emerging economies: Uganda (Kabuye et al. 2019), Egypt (Moussa 2018), Vietnam (Le 2019; Nguyen and Nguyen 2018), Malaysia (Yusoff et al. 2018), high-growth firms from emerging Europe (Boțoc and Anton 2017), Pakistan (Habib and Huang 2016), Ghana (Amponsah-Kwatiah and Asiamah 2020), Egypt, Kenya, Nigeria, and South Africa (Ukaegbu 2014). Golas (2020) analyzes the impact of working capital management on firm profitability only for the Polish dairy industry, from the perspective of different elements of working capital. The authors find that inventories and cash conversion cycle relate inversely with Return on Assets (ROA), while days sales outstanding and days payable outstanding have a positive influence on profitability. Therefore, the scarce empirical literature for emerging economies highlights contradictory results. The present paper attempts to fill in this gap in the literature. Therefore, the importance of working capital efficiency and the monetary policy tightening motivate the research on working capital–corporate performance interrelation, to enhance companies’ working capital culture.

The analysis is conducted on 719 firms listed on the Warsaw Stock Exchange and different panel data methodologies are employed. The results indicate an inverted U-shaped (concave) relationship between working capital ratio and firm profitability and the findings are robust for different proxies and methodologies, namely a panel model with fixed effects and the panel-corrected standard errors (PCSE) estimation, respectively.

We identify several arguments to assess the nexus between working capital and firm performance on the example of Polish listed firms. Firstly, the Polish stock market is the most developed in Central and Eastern Europe in terms of listed firms and trading volumes. Secondly, being a developing economy, the cost of capital is higher and the capital market is less developed when compared to Western economies, therefore, firms that hold high working capital on their balance sheet are exposed to higher interest charges and, therefore, to bankruptcy risk. On the other hand, similar to other countries in the region, in Poland, the banking sector represents the largest share of the financial system. Both lending standards and lending terms were tightened since the start of the financial crisis of 2008 and, therefore, the firms may face credit constraints and cannot acquire sufficient credit to invest in working capital (Tsuruta 2019). Moreover, Chen and Kieschnick (2018) demonstrate that the availability of bank credit has a significant impact on firms’ working capital policies.

Our study brings new theoretical and practical contributions to the relationship between working capital management and firm profitability. Firstly, the research extends and complements the literature on the field by highlighting new evidence on the non-linear interrelation between working capital management and corporate performance in Poland. The results reveal a concave working capital–firm profitability relationship, meaning that working capital has a positive effect on profit up to a break-even point (optimum level). After the break-even point, working capital starts to negatively affect the firm profitability. The findings highlight that proactive working capital policies are profit-enhancing. Secondly, the study brings relevant corporate policy implications for an emerging economy framework. The results are suitable for use in business practice. In other words, corporate financial executives should avoid greater net investment in working capital and target its optimal level, while internally-generated funds can be oriented towards more profitable investment opportunities. Therefore, corporate managers should focus on maintaining accounts payable, accounts receivable, and inventory turnover at a certain level, to maximize the effects of working capital, for the benefit of the shareholders. From the practitioner’s perspective, working capital represents a potential tool to optimize financial performance and also indicates the areas requiring improvement and supervision to ensure financial performance. Policymakers can use this knowledge for profit maximization. We consider that the results push forward the understanding of treasury management, a complex and dynamic domain, oriented towards the highest performance and simplification of all treasury activities (Polak et al. 2018). The research highlights that, above the optimal level, working capital harms business performance. As working capital can be viewed as an adequate forecasting indicator about future economic issues (Michalski 2014), we consider that our research could offer a macroeconomic signal if most of the public firms hold higher levels of working capital.

The remainder of this article is organized as follows: Section 2 presents the relevant literature on the working capital management–firm profitability relationship. Section 3 describes the sample used in the empirical analysis and the considered empirical methods. Section 4 presents the empirical results and robustness checks. Section 5 concludes the paper and offers some policy implications.

2. Literature Review

The academic literature proposes different competing views to explain the relationship between working capital and firm performance. On the one hand, most of the previous studies find a positive relationship between the two measures, based on firms from developed economies—the US (Lyngstadaas 2020), the UK (Goncalves et al. 2018), Finland (Enqvist et al. 2014), or from developing economies—Uganda (Kabuye et al. 2019), Egypt (Moussa 2018), Vietnam (Nguyen and Nguyen 2018), Ghana (Amponsah-Kwatiah and Asiamah 2020). Kabuye et al. (2019) analyze the impact of internal control systems and working capital management on the financial performance of 110 supermarkets from Uganda and find that working capital management is a significant predictor of financial performance. Moussa (2018) examines the impact of working capital management on the performance of 68 industrial firms from Egypt for the period of 2000–2010 and documents a positive relationship between working capital management (measured by the cash conversion cycle) and firm profitability. The author points out that stock markets in less developed economies do not realize the optimum efficiency of their WCM. Nguyen and Nguyen (2018) analyze the relationship between working capital management and corporate profitability and document a positive nexus between working capital management and the performance of Vietnamese listed firms over the period of 2008–2014. Listed manufacturing firms in Ghana exhibit a positive relationship between different components of working capital and profitability, as reported by Amponsah-Kwatiah and Asiamah (2020). Moreover, Goncalves et al. (2018) confirm that WCM efficiency increases profitability on the example of UK unlisted companies between 2006 and 2014. For the US, effective working capital management is found to be associated with the higher financial performance of listed manufacturing firms, as reported by Lyngstadaas (2020). Enqvist et al. (2014) examine the impact of working capital management on firm profitability in different business cycles, on the example of Finland between 1990 and 2008, and highlight that firms can enhance their profitability by improving working capital efficiency. This first point of view is explained by the fact that working capital offers the firms the opportunity to grow by increasing sales and revenues. There are firms with large exposure to risk connected to small levels of inventory (Michalski 2016). Therefore, in the case of those firms, holding a low level of inventory leads to negative modifications of sale levels and weaker profits (Michalski 2016).

On the other hand, an alternative strand of research reports that WCM negatively influences profitability, using samples for developed economies (Fernandez-Lopez et al. 2020; Ren et al. 2019; Dalci et al. 2019), European Union (Akgun and Karatas 2020), or for developing economies (Pham et al. 2020; Wang et al. 2020; Le 2019; Yusoff et al. 2018; Habib and Huang 2016; Ukaegbu 2014). Fernandez-Lopez et al. (2020) report a negative relationship between different components of working capital and firm performance for a sample of Spanish manufacturing companies during the period of 2010–2016. Dalci et al. (2019) analyze the relationship between cash conversion cycle and profitability over 2006–2013 for 285 German non-financial firms and found that shortening the length of cash conversion cycle has a positive effect on the profitability of small and medium-sized firms, based on different methodologies: pooled ordinary least squares (OLS), fixed effects, random effects, and generalized method of moments (GMM). A negative relationship between working capital and business performance is found by Akgun and Karatas (2020) for a sample of European Union-28 listed firms during the 2008 financial crisis. Moreover, an inverse link between the cash conversion cycle and profitability of Chinese non-state-owned enterprises is found by Ren et al. (2019). Le (2019) reports a negative impact of working capital management on firm valuation, profitability, and risk for a sample of 497 firms from Vietnam over the period of 2007–2016. The same negative relationship for Vietnamese steel companies is also reported by Pham et al. (2020). Yusoff et al. (2018) investigate the relationship between working capital management and firm performance for 100 selected manufacturing companies in Malaysia. The authors show that the inventory conversion period, average collection period, and cash conversion cycle are significantly and negatively correlated with profitability. Improving firm performance by a conservative working capital management policy is also confirmed by Chang (2018), based on a sample of 31,612 companies from 46 countries over the period of 1994–2011. A detrimental influence of a longer cash conversion period on profitability is reported also for India by Shrivastava et al. (2017) based on both classical panel analysis and Bayesian techniques. Habib and Huang (2016) find that positive working capital harms profitability, while a negative working capital affects profitability positively, on the example of Pakistan, by employing panel least squares estimation, panel fixed effect, and panel generalized method of movement. A negative association between WCM and performance of non-financial listed firms in Pakistan is also highlighted by Wang et al. (2020). Using data on Brazilian public companies over the period of 1995–2009, De Almeida and Eid (2014) find that increasing the level of working capital at the beginning of a fiscal year diminishes company value. Moreover, a negative effect of cash conversion cycles on firm profitability, measured as net operating profit, is documented by Ukaegbu (2014), based on a panel of manufacturing firms in Egypt, Kenya, Nigeria, and South Africa for the period of 2005–2009. The second point of view is explained by the fact that higher investments in working capital involve more financing and, therefore, the interest expenses of firms might increase, being more exposed to bankruptcy risk. It is appreciated that an increase in the level of working capital generates higher costs of holding and managing working capital, with a negative effect on firm value (Michalski 2014). However, the relationship of working capital components with the firm value depends on the risk-sensitivity level of firms (Michalski 2014). Before, during, and after a financial crisis, Michalski (2016) demonstrates that the level of working capital is higher and acts as a hedging instrument against the cost of disruptive productivity.

Recently, the third point of view emerged and focused on the functional form of the relationship between working capital and firm profitability. A few studies report a concave relationship between the two measures, most of them on the example of firms from developed economies (Mahmood et al. 2019; Tsuruta 2018; Aktas et al. 2015; Baños-Caballero et al. 2014) followed by a sample of firms from emerging European countries (Boțoc and Anton 2017) or firms from a certain sector (Mun and Jang 2015). Mahmood et al. (2019) report an inverted U-shaped working capital–profitability relationship using GMM as methodology, for a sample of Chinese companies over the period of 2000–2017. Empirical evidence of inverted U-shaped relationship between working capital and profitability of Chinese listed companies is also reported by Laghari and Chengang (2019), based on the same GMM methodology. Using data from over 100,000 small businesses in Japan, Tsuruta (2018) reports a negative impact of working capital on firm performance in the short run, but positive over longer periods. Altaf and Shah (2018) provide evidence of the inverted U-shape relationship between WCM and firm profitability for a sample of 437 non-financial Indian companies, based on GMM methodology. Boțoc and Anton (2017) report an inverted U-shape relationship between working capital level and firm profitability, based on a panel of high-growth firms from Central, Eastern, and South-Eastern Europe over the period of 2006–2015. The concave relationship between working capital level (measured by the cash conversion cycle) and firm profitability is also reported by Afrifa and Padachi (2016), using panel data regression methods, for a sample of 160 listed firms during the period of 2005–2010. Aktas et al. (2015) document the relationship between WCM and firm performance on a sample of firms from the US over the period of 1982–2011 using fixed-effects regressions. The authors highlight an optimal point of working capital investment, towards which firms may converge to improve their overall performance. Moreover, Mun and Jang (2015) report a concave impact of working capital on firm value, which supports the idea of an optimal working capital level for US firms from a specific industry (restaurants), over the period of 1963–2012, based on static and dynamic panel data methodologies. For a sample of firms from the UK, Baños-Caballero et al. (2014) point out a non-linear relationship between working capital and firm value, meaning that there is an optimal level of working capital that maximizes firm revenues. Additionally, the optimal level depends on the financing constraints, the authors indicating that the optimal working capital level is lower for firms under financial constraints.

As can be noticed, corporate finance literature does not provide a general agreement on how working capital affects firm performance. The divergence can be explained by different measures used for working capital: cash conversion cycle (Dalci et al. 2019; Shrivastava et al. 2017; Ukaegbu 2014), most popular indicator used as proxy, net trade cycle (Baños-Caballero et al. 2014) or other measures (Inventory Turnover Ratio, Working Capital Turnover Ratio). Using these measures, in most of the studies, working capital is expressed as a composite measure (Prasad et al. 2019), but there are also a few studies that have examined the impact of working capital on profit, at the level of individual components of cash conversion cycle or net trade cycle (Enqvist et al. 2014). Moreover, Mahmood et al. (2019) provide several reasons to explain why companies may exhibit a different working capital–profitability: ownership structures, financial flexibility, tax provisions, and leverage. Moreover, the mixed results highlight that the relationship between working capital components and firm profitability may be more complex, and the empirical studies have not found the underlying mechanisms (Peng and Zhou 2019). In a recent paper, Peng and Zhou (2019) propose to consider different discount rates of companies to encounter the inconsistency in the relationship between working capital components and corporate profitability.

Maximization of the business profitability is an effect of working capital management, but also the reverse causality is plausible when firms are profitable, they have more cash to invest in working capital. Moreover, both firm profitability and working capital are determined by multiple factors. From the perspective of potential endogeneity issue, the study of Seth et al. (2020) is probably among the first that evaluates the impact of several exogenous variables on the WCM efficiency and firms’ performance. Based on data envelopment analysis and structural equation modeling, the authors find that the following variables have a direct effect on WCM efficiency, and, therefore, on firms’ performance: interest coverage, leverage, net fixed asset ratio, and asset turnover ratio. The literature recognizes some relevant channels that moderates the relationship between working capital and firm performance. One relevant channel is corporate governance. Kayani et al. (2019) provide evidence on the collective empirical impact of WCM and corporate governance on financial performance for the US listed firms. The authors recommend considering the collective effects of short-term (WCM) and long-term (corporate governance) indicators, on financial performance. Giroud and Mueller (2011) take into account market competition and highlight, that, weak corporate governance lowers firm value in non-competitive industries. Moreover, the endogeneity problem can be driven by CEO characteristics. The firm’s chief executives are more focused on achieving short-term profitability, rather than long-term performance (Kayani et al. 2019).

From the methodology perspective, the empirical findings are, mostly, documented on static panel data methods (regression analysis) and correlation analysis. Recently, some studies use methods, like GMM to control for endogeneity challenges (Dalci et al. 2019; Mahmood et al. 2019; Laghari and Chengang 2019; Altaf and Shah 2018; Boțoc and Anton 2017). Endogeneity is recognized as being a challenge in corporate finance, and thus Li (2016) proposes several methods to deal with it, as follows: GMM, instrumental variables, fixed effects models, lagged dependent variables, and control variables. The current econometric analysis is performed using, behind ordinary least squares, two additional panel data techniques, the fixed-effects, and panel-corrected standard errors models. The justification is represented by the advantages of fixed-effects regression analysis, which takes full account of factors that might influence firm profitability in a certain year, and respectively of panel-corrected standard errors model, which accounts for firm-level heteroscedasticity and contemporaneous correlations across firms. Moreover, the combination of the methods (fixed effects and meaningful control variables) appears to work in mitigating endogeneity issues, according to Li (2016).

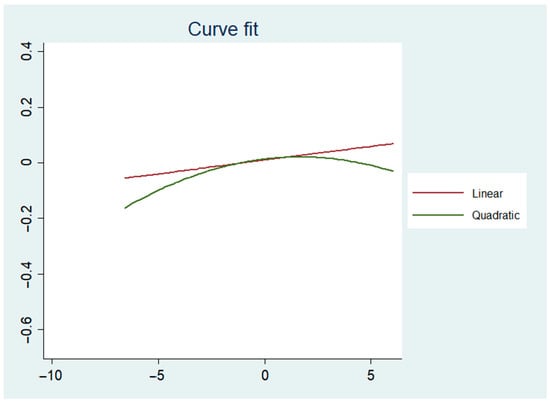

The mixed results regarding the effects of working capital indicate that short-term financial decisions should recognize working capital as a determining factor of financial performance. Therefore, the current research assumes the existence of an optimal working capital level for firms in Poland that maximizes their benefits. Figure 1 displays the relationship between the level of working capital (WKCR) and profitability (ROA). We notice a non-linear relationship (inverted U-shape) between WKCR and ROA suggesting that the inclusion of WKCR square in the model is necessary. Specifically, in line with the previous studies (Boțoc and Anton 2017), the authors propose the following hypothesis:

Figure 1.

Curve estimation regression models between the level of working capital (WKCR) and profitability (ROA).

Hypothesis 1.

There is a non-linear relationship between working capital and financial performance, with an optimal working capital level that maximizes firm profitability.

3. Data and Methodology

Data were collected from the Amadeus database and the final sample comprised 719 listed firms on the Warsaw Stock Exchange for the period of 2007–2016, which corresponds to 3043 firm-year observations. We exclude from the initial sample financial firms and firms with missing observations for our variables of interest.

In line with previous research (Baños-Caballero et al. 2014), a quadratic model is analyzed. The research is based on the working capital ratio (WKCR), a proxy variable for working capital management, calculated as (Inventories + Debtors − Creditors)/Sales in line with previous studies (Aktas et al. 2015; Boțoc and Anton 2017). Thus, the study employs a variable that indicates the amount of money that the operating cycle implies (Boțoc and Anton 2017), rather than variables that reflect a length of time, such as cash conversion cycle (Dalci et al. 2019; Shrivastava et al. 2017; Ukaegbu 2014) or net trade cycle (Baños-Caballero et al. 2014).

The econometric analysis regresses firm profitability against the working capital ratio (WKCR) and its square (WKCR2). Firm performance is measured by return on assets (ROA), an overall indicator of profitability, calculated as net income to total assets, consistent with the previous studies (Dalci et al. 2019; Enqvist et al. 2014). For the robustness purpose, operating return on assets (OROA) has been considered as an alternative measure for profitability, defined as earnings before interest and taxes (EBIT) to total assets ratio. Supplementary independent variables are also considered in the regression model to account for additional determinants of corporate performance, as follows: debt ratio (DEBTR) calculated as the sum of non-current liabilities and loans over total assets; cash ratio (CASHR) computed as cash and cash equivalents divided to total assets; the one-year growth rate in sales (SALESGR), computed as (Sales1 − Sales0)/Sales0, as a proxy for growth opportunities; firm size (SIZE), measured as the logarithm of total assets. The independent variables are described in Table 1.

Table 1.

Description of the exogenous variables and the expected sign.

Table 2 displays the descriptive statistics for firm profitability, working capital ratio, and the control variables. Table 2 shows that for Polish firms under the analyzed period, return on assets is, on average, around 1%, while the working capital ratio represents, on average, 19.71% of sales. The value for ROA is comparable with those reported for the German non-financial firms (1.1% reported by Dalci et al. 2019) but considerably lower than those reported for the Finnish firms (8.4% reported by Enqvist et al. 2014) or for the Spanish SMEs (7.9% reported by Garcia-Teruel and Martinez-Solano 2007). The sales of Polish firms on average increased by almost 13% annually and debt represents 23.46% of total assets.

Table 2.

Summary statistics.

Table 3 shows correlations among the dependent and independent variables of the econometric model. It can be noticed that the coefficient between ROA and WKCR is positive, while the coefficient between ROA and WKCR2 is negative, which shows that working capital management, above its optimal level, has a less efficient effect on corporate profitability. The results also indicate a negative effect of debt ratio on the working capital level. Growth opportunities relate positively to working capital. The correlation matrix highlights low correlations between independent regressors, therefore the analysis does not suffer because of multicollinearity.

Table 3.

Correlation matrix.

The following econometric specification is used to test the hypothesis regarding the impact of working capital management on firm profitability:

where the dependent variable ROA is the return on assets; the independent variables of interest are WKCRi,t, measured as (inventories + debtors − creditors)/sales for the firm i at time t, and its square term (WKCR2i,t) used to test for the non-linearity of our model; as control variables, we employ DEBTRi,t (debt ratio), CASHRi,t (cash ratio) and SALESGRi,t (one-year growth rate in sales); μi,t denotes the unobservable firm and time effects; λj is an industry unobservable effect; εi,t represents the error term.

ROAi,t = α + β1WKCRi,t + β2WKCR2i,t + β3DEBTRi,t + β4CASHRi,t +β5SALESGRi,t +μi,t +λj+ εi,t

The study employs three different panel data techniques to estimate Equation (1). Firstly, a pooled ordinary least-squares regression model (OLS) with robust standard errors is estimated to get heteroscedasticity-robust estimators. Secondly, a static panel model with fixed-effects (FE) is defined. The Hausman test was employed to detect the endogenous predictor variables and to choose between fixed-effects or random-effects models. The null hypothesis states that there is no correlation between the error term and the regressors, and, therefore, the preferred model is random effects. In our case, the test rejects the random-effects specification so fixed-effects estimations are employed. Thirdly, in line with Beck and Katz (1995), the research also employs a panel-corrected standard errors (PCSE) to account for firm-level heteroscedasticity and contemporaneous correlations across firms. Following Petersen (2009), the robust standard errors clustered at the firm level were used to simultaneously relax both the assumption of homoscedasticity and the assumption of no autocorrelation in the panel dataset. Time fixed effects are included to control for macroeconomic shocks that might influence firm profitability in a certain year.

4. Discussion

4.1. The Non-Linear Relationship between Working Capital and Firm Profitability

Table 4 presents the firm performance regressions, where columns 1 to 3 report the results derived from Equation (1) for the ordinary least square model (OLS), the fixed effects model (FE), and panel corrected standard errors (PCSE), respectively. The dependent variable is represented by ROA. In line with the hypothesis assumed, the findings confirm the non-linear relationship between firm profitability and working capital. It is observable that the coefficient for the WKCR variable is positive (β1 > 0), which indicates a positive working capital-profit nexus, while for its square is negative (β2 < 0), which shows a negative working capital–profit relationship.

Table 4.

The relationship between working capital and firm profitability (measured by ROA).

The positive and negative trends, together with the optimal level, form an inverted U-shaped relationship, which validates the research hypothesis. The findings are statistically significant at conventional levels. Consistent with the results of Baños-Caballero et al. (2014), below the optimal level, working capital has a positive impact on firm profitability, due to an increase in sales and discounts for payments in advance. Above the optimal level, working capital harms firm profitability, because of the opportunity cost, financing cost, and refinancing uncertainties.

The results for the control variables show that the debt ratio and cash ratio are statistically significant determinants of performance. In line with the Pecking Order Theory of capital structure, firm profitability is negatively associated with debt (Aktas et al. 2015; Enqvist et al. 2014). Pecking Order Theory predicts that firms prioritize their sources of financing, from internal financing to equity, considering the cost of resources. This research is contributing to the literature, by providing out-of-sample evidence of the above theory on the example of an emerging market. Moreover, Allini et al. (2018) demonstrate that the most profitable firms are less likely to prefer external financing. Moreover, a change in short-term debt impacts the working capital as stated by De Jong et al. (2011).

Sales growth, which could be an indicator of a firm’s business opportunities, and cash ratio are an important factor allowing firms to enjoy improved profitability, as it is highlighted by the positive sign correspondent coefficients (Boțoc and Anton 2017; Garcia-Teruel and Martinez-Solano 2007).

4.2. Robustness Checks

The robustness of the effect of WCM on firm performance is evaluated by performing two complementary tests. First, an alternative measure for the dependent variable is employed, namely, operating return on assets (OROA) keeping the econometric approach and the set of independent regressors. The results are displayed in Table 5. Second, an additional independent variable is added in Equation (1), namely firm size, measured as the logarithm of total assets. Table 6 reports these additional results.

Table 5.

The relationship between working capital and firm profitability (measured by OROA).

Table 6.

The augmented model of the relationship between working capital and firm profitability (ROA).

The results displayed in Table 5 indicate that the sign of the coefficients for the WKCR variable and its square do not suffer any modification. The findings confirm the non-linear relation between firm profitability and working capital levels, for all econometric specifications, in line with the baseline results. The coefficient estimates show that firms that hold excessive working capital (above the optimal level) face a decrease in the efficiency in allocating the capital to profitable investments.

Further, we employ the same econometric approach, but we add firm size to the set of control variables. Firm size is a variable that captures firm transparency, market access, and creditworthiness (Tsuruta 2018). Smaller firms face can face financial constraints, because of information asymmetry between borrowers and lenders. Taking into account that, in Poland, the banking sector has the largest part of the financial system, the firms may have problems to obtain enough funds to invest in working capital. Therefore, firm size is expected to be a positive determinant of profitability and the results confirm the expectations. The positive sign of SIZE shows that large size seems to favor the generation of profitability, as confirmed by Garcia-Teruel and Martinez-Solano (2007) for SMEs in Spain. Moreover, the results displayed in Table 6 indicate that the relationship between WKCR and ROA is a concave one, with an optimal working capital level.

Therefore, the findings of all models are consistent with the hypothesis of a concave relationship between working capital management and firm profitability, which implies the existence of an optimal level that maximizes Polish firm performance. Each model with WKCR2 tests the effects of the square term of WKCR on firm performance and confirm the functional form between working capital management and corporate profitability, supported by previous studies (Tsuruta 2018; Boțoc and Anton 2017; Afrifa and Padachi 2016; Aktas et al. 2015; Baños-Caballero et al. 2014).

5. Conclusions

Our paper provides empirical evidence on the working capital-profitability relationship for a sample of 719 listed firms from Poland over the period of 2007–2016. Based on different panel data techniques, the relationship proved to be inverted U-shaped. The empirical results highlight that, at a low level of working capital, increasing sales and discounts on early payments significantly influence positively corporate profitability. However, a further increase in working capital above its optimum level establishes a negative working capital–profitability trend, which indicates the disadvantages of working capital financing, respectively opportunity cost and high-interest charges. Firm-specific variables were considered. The findings show that the debt ratio and cash ratio are statistically significant determinants of profitability. In line with the Pecking Order Theory of capital structure, firm profitability is negatively associated with debt. Other control variables (sales growth, cash ratio, and firm size) are found to be important determinants of firm profitability. The empirical findings proved to be robust while using an alternative proxy for the dependent variable–operating return on assets (OROA), and when additional firm-related control variables were considered.

The current study brings theoretical and practical implications. For researchers, our results suggest that a quadratic model needs to be tested for any sample of firms. In terms of practical implications, Polish firms exhibit an inverted U-shaped relationship between working capital and corporate performance, meaning that managers should avoid negative effects on firm profitability through lost sales, lost discounts for early payments, or supplementary financing expenses. The results suggest that corporate financial executives should avoid greater net investment in working capital and target its optimal level, while internally-generated funds can be oriented towards more profitable investment opportunities. Reducing unnecessary working capital releases unnecessary cash invested to fund daily operating activities and increases the firm financial flexibility. Therefore, corporate managers should focus on maintaining accounts payable, accounts receivable, and inventory turnover at a certain level, to maximize the effects of working capital for the benefit of the shareholders. Our results highlight the importance of WCM for profit maximization. The results are suitable for use in business practice, highlighting the importance of finding and attaining the optimal level of working capital.

The study is not without limitations. Firstly, the empirical findings are limited to the listed firms from one emerging country (Poland). Moreover, from the endogeneity perspective, most of the financial variables at the firm level are determined in a network of relationships. Future research extending the sample of countries and controlling for macroeconomic factors and endogeneity issues could bring a valuable contribution to the field. New directions of research should include the role of corporate governance and compensation incentives in mediating the relationship between working capital management and firm profitability (Coles and Li 2019; Coles and Li 2020).

Author Contributions

Conceptualization, S.G.A. and A.E.A.N.; methodology, S.G.A. and A.E.A.N.; software, A.E.A.N.; validation, S.G.A. and A.E.A.N.; formal analysis, S.G.A. and A.E.A.N.; investigation, S.G.A. and A.E.A.N.; data curation, S.G.A.; writing—original draft preparation, S.G.A. and A.E.A.N.; writing—review and editing, S.G.A. and A.E.A.N.; supervision, S.G.A.; project administration, S.G.A. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by a grant of the “Alexandru Ioan Cuza” University of Iasi, within the Research Grants program, Grant UAIC, code GI-UAIC-2018-06.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Afrifa, Godfred Adjapong, and Kesseven Padachi. 2016. Working capital level influence on SME profitability. Journal of Small Business and Enterprise Development 23: 44–63. [Google Scholar] [CrossRef]

- Akgun, Ali Ihsan, and Ayyuce Memis Karatas. 2020. Investigating the relationship between working capital management and business performance: Evidence from the 2008 financial crisis of EU-28. International Journal of Managerial Finance. [Google Scholar] [CrossRef]

- Aktas, Nihat, Ettor Croci, and Dimitris Petmezas. 2015. Is working capital management value-enhancing? Evidence from firm performance and investments. Journal of Corporate Finance 30: 98–113. [Google Scholar] [CrossRef]

- Allini, Alessandra, Soliman Rakha, David McMillan, and Adele Caldarelli. 2018. Pecking order and market timing theory in emerging markets: The case of Egyptian firms. Research in International Business and Finance 44: 297–308. [Google Scholar] [CrossRef]

- Altaf, Nufazi, and Farooq Ahmad Shah. 2018. How does working capital management affect the profitability of Indian companies? Journal of Advances in Management Research 15: 347–66. [Google Scholar] [CrossRef]

- Amponsah-Kwatiah, Kofi, and Michael Asiamah. 2020. Working capital management and profitability of listed manufacturing firms in Ghana. International Journal of Productivity and Performance Management. [Google Scholar] [CrossRef]

- Baños-Caballero, Sonia, Pedro García-Teruel, and Pedro Martínez-Solano. 2014. Working capital management, corporate performance, and financial constraints. Journal of Business Research 67: 332–38. [Google Scholar] [CrossRef]

- Baños-Caballero, Sonia, Pedro J. García-Teruel, and Pedro Martínez-Solano. 2020. Net operating working capital and firm value: A cross-country analysis. BRQ Business Research Quarterly 23: 234–251. [Google Scholar] [CrossRef]

- Beck, Nathaniel, and Jonathan Katz. 1995. What to do (and not to do) with Time-Series Cross-Section Data. The American Political Science Review 89: 634–47. [Google Scholar] [CrossRef]

- Boțoc, Claudiu, and Sorin Gabriel Anton. 2017. Is profitability driven by working capital management? Evidence for high-growth firms from emerging Europe. Journal of Business Economics and Management 18: 1135–55. [Google Scholar] [CrossRef]

- Chang, Chong-Chuo. 2018. Cash conversion cycle and corporate performance: Global evidence. International Review of Economics and Finance 56: 568–81. [Google Scholar] [CrossRef]

- Chen, Chongyang, and Robert Kieschnick. 2018. Bank credit and corporate working capital management. Journal of Corporate Finance 48: 579–96. [Google Scholar] [CrossRef]

- Coles, Jeffrey L., and Zhichuan Li. 2019. An Empirical Assessment of Empirical Corporate Finance. Available online: https://ssrn.com/abstract=1787143 (accessed on 13 December 2020).

- Coles, Jeffrey L., and Zhichuan Li. 2020. Managerial Attributes, Incentives, and Performance. The Review of Corporate Finance Studies 9: 256–301. [Google Scholar] [CrossRef]

- Dalci, Ilhan, Ozyapici Hasan, Tanova Cem, and Murad Bein. 2019. The Moderating Impact of Firm Size on the Relationship between Working Capital Management and Profitability. Prague Economic Papers 28: 296–312. [Google Scholar] [CrossRef]

- De Almeida, Juliano Ribeiro, and William Eid, Jr. 2014. Access to finance, working capital management and company value: Evidences from Brazilian companies listed on BM&FBOVESPA. Journal of Business Research 67: 924–34. [Google Scholar] [CrossRef]

- De Jong, Abe, Marno Verbeek, and Patrick Verwijmeren. 2011. Firms’ debt–equity decisions when the static tradeoff theory and the pecking order theory disagree. Journal of Banking and Finance 35: 1303–14. [Google Scholar] [CrossRef]

- Enqvist, Julius, Michael Graham, and Jussi Nikkinen. 2014. The impact of working capital management on firm profitability in different business cycles: Evidence from Finland. Research in International Business and Finance 32: 36–49. [Google Scholar] [CrossRef]

- Fernandez-Lopez, Sara, David Rodeiro-Pazos, and Lucia Rey-Ares. 2020. Effects of working capital management on firms’ profitability: Evidence from cheese-producing companies. Agribusiness 36: 770–91. [Google Scholar] [CrossRef]

- Garcia-Teruel, Pedro Juan, and Pedro Martinez-Solano. 2007. Effects of working capital management on SME profitability. International Journal of Managerial Finance 3: 164–77. [Google Scholar] [CrossRef]

- Giroud, Xavier, and Holger M. Mueller. 2011. Corporate Governance, Product Market Competition, and Equity Prices. Journal of Finance 66: 563–600. [Google Scholar] [CrossRef]

- Golas, Zbigniew. 2020. Impact of working capital management on business profitability: Evidence from the Polish dairy industry. Agricultural Economics-Zemedelska Ekonomika 66: 278–85. [Google Scholar] [CrossRef]

- Goncalves, Tiago Cruzz, Cristina Gaio, and Frederico Robles. 2018. The impact of Working Capital Management on firm profitability in different economic cycles: Evidence from the United Kingdom. Economics and Business Letters 7: 70–75. [Google Scholar] [CrossRef]

- Habib, Ashfaq, and Xiaoxia Huang. 2016. Determining the optimal working capital to enhance firms’ profitability. Human Systems Management 35: 279–89. [Google Scholar] [CrossRef]

- Kabuye, Frank, Joachim Kato, Irene Akugizibwe, and Nicholas Bugambiro. 2019. Internal control systems, working capital management and financial performance of supermarkets. Cogent Business and Management 6: 1573524. [Google Scholar] [CrossRef]

- Kayani, Umar Nawaz, Tracy-Anne De Silva, and Christopher Gan. 2019. Working capital management and corporate governance: A new pathway for assessing firm performance. Applied Economics Letters 26: 938–42. [Google Scholar] [CrossRef]

- Laghari, Fahmida, and Ye Chengang. 2019. Investment in working capital and financial constraints: Empirical evidence on corporate performance. International Journal of Managerial Finance 15: 164–90. [Google Scholar] [CrossRef]

- Le, Ben. 2019. Working capital management and firm’s valuation, profitability and risk Evidence from a developing market. International Journal of Managerial Finance 15: 191–204. [Google Scholar] [CrossRef]

- Li, Frank. 2016. Endogeneity in CEO power: A survey and experiment. Investment Analysts Journal 45: 149–62. [Google Scholar] [CrossRef]

- Lyngstadaas, Hakim. 2020. Packages or systems? Working capital management and financial performance among listed U.S. manufacturing firms. Journal of Management Control. [Google Scholar] [CrossRef]

- Mahmood, Faisal, Dongping Han, Nazakat Ali, Riaqa Mubeen, and Umeair Shahzad. 2019. Moderating Effects of Firm Size and Leverage on the Working Capital Finance–Profitability Relationship: Evidence from China. Sustainability 11: 2029. [Google Scholar] [CrossRef]

- Michalski, Grzegorz. 2014. Value-Based Working Capital Management: Determining Liquid Asset Levels in Entrepreneurial Environments. New York: Palgrave Macmillan, pp. 1–179. [Google Scholar]

- Michalski, Grzegorz. 2016. Risk pressure and inventories levels. Influence of risk sensitivity on working capital levels. Economic Computation and Economic Cybernetics Studies and Research 50: 189–96. [Google Scholar]

- Mielcarz, Pawel, Dmytro Osiichuk, and Pawel Wnuczak. 2018. Working capital management through the business cycle: Evidence from the corporate sector in Poland. Contemporary Economics 12: 223–36. [Google Scholar]

- Moussa, Amr Ahmed. 2018. The impact of working capital management on firms’ performance and value: Evidence from Egypt. Journal of Asset Management 19: 259–73. [Google Scholar] [CrossRef]

- Mun, Sung Gyun, and SooCheong Jang. 2015. Working capital, cash holding, and profitability of restaurant firms. International Journal of Hospitality Management 48: 1–11. [Google Scholar] [CrossRef]

- Nguyen, An Thanh Hong, and Tuan Van Nguyen. 2018. Working capital management and corporate profitability: Empirical evidence from Vietnam. Foundations of Management 10: 195–206. [Google Scholar] [CrossRef]

- Peng, Juan, and Zhili Zhou. 2019. Working capital optimization in a supply chain perspective. European Journal of Operational Research 277: 846–56. [Google Scholar] [CrossRef]

- Petersen, Mitchell. 2009. Estimating standard errors in finance panel data sets: Comparing approaches. Review of Financial Studies 22: 435–80. [Google Scholar] [CrossRef]

- Pham, Kien Xuan, Quang Ngoc Nguyen, and Cong Van Nguyen. 2020. Effect of Working Capital Management on the Profitability of Steel Companies on Vietnam Stock Exchanges. Journal of Asian Finance Economics and Business 7: 741–50. [Google Scholar] [CrossRef]

- Polak, Petr, Francois Masquelier, and Grzegorz Michalski. 2018. Towards Treasury 4.0/The evolving role of corporate treasury management for 2020. Management-Journal of Contemporary Management Issues 23: 189–97. [Google Scholar] [CrossRef]

- Prasad, Punam, Sivasankaran Narayanasamy, Samit Paul, Subir Chattopadhyay, and Palanisamy Saravanan. 2019. Review of literature on working capital management and future research agenda. Journal of Economic Surveys 33: 827–861. [Google Scholar] [CrossRef]

- PWC Annual Report. 2019. Navigating Uncertainty: PwC’s Annual Global Working Capital Study 2018/19 Unlocking Cash to Shore Up Your Business. Available online: https://www.pwc.com/gx/en/working-capital-management-services/assets/pwc-working-capital-survey-2018-2019.pdf (accessed on 12 August 2020).

- Ren, Ting, Nan Liu, Hongyan Yang, Youzhi Xiao, and Yijun Hu. 2019. Working capital management and firm performance in China. Asian Review of Accounting 27: 546–62. [Google Scholar] [CrossRef]

- Seth, Himanshu, Saurabh Chadha, Satyendra Kumar Sharma, and Namita Ruparel. 2020. Exploring predictors of working capital management efficiency and their influence on firm performance: An integrated DEA-SEM approach. Benchmarking-An International Journal. [Google Scholar] [CrossRef]

- Shrivastava, Arvind, Nitin Kumar, and Purnendu Kumar. 2017. Bayesian analysis of working capital management on corporate profitability: Evidence from India. Journal of Economic Studies 44: 568–84. [Google Scholar] [CrossRef]

- Staniewski, Marcin, and Katarzyna Awruk. 2019. Entrepreneurial success and achievement motivation—A preliminary report on a validation study of the questionnaire of entrepreneurial success. Journal of Business Research 101: 433–40. [Google Scholar] [CrossRef]

- Tsuruta, Daisuke. 2018. Do Working Capital Strategies Matter? Evidence from Small Business Data in Japan. Asia-Pacific Journal of Financial Studies 47: 824–57. [Google Scholar] [CrossRef]

- Tsuruta, Daisuke. 2019. Working capital management during the global financial crisis: Evidence from Japan. Japan and the World Economy 49: 206–19. [Google Scholar] [CrossRef]

- Ukaegbu, Ben. 2014. The significance of working capital management in determining firm profitability: Evidence from developing economies in Africa. Research in International Business and Finance 31: 1–16. [Google Scholar] [CrossRef]

- Wang, Zanxin, Minhas Akbar, and Ahsan Akbar. 2020. The Interplay between Working Capital Management and a Firm’s Financial Performance across the Corporate Life Cycle. Sustainability 12: 1661. [Google Scholar] [CrossRef]

- Yusoff, Hanaffie, Kamilah Ahmad, Ong Yi Qing, and Shafie Mohamed Zabri. 2018. The relationship between working capital management and firm performance. Advanced Science Letters 24: 3244–48. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).