Abstract

The promise of artificial intelligence (AI) to drive economic growth and improve quality of life has ushered in a new AI arms race. Investments of risk capital fuel this emerging technology. We examine the role that venture capital (VC) and corporate investments of risk capital play in the emergence of AI-related technologies. Drawing upon a dataset of 29,954 U.S. patents from 1970 to 2018, including 1484 U.S. patents granted to 224 VC-backed start-ups, we identify AI-related innovation and investment characteristics. Furthermore, we develop a new measure of knowledge coupling at the firm-level and use this to explore how knowledge coupling influences VC risk capital decisions in emerging AI technologies. Our findings show that knowledge coupling is a better predictor of VC investment in emerging technologies than the breadth of a patent’s technological domains. Furthermore, our results show that there are differences in knowledge coupling between private start-ups and public corporations. These findings enhance our understanding of what types of AI innovations are more likely to be selected by VCs and have important implications for our understanding of how risk capital induces the emergence of new technologies.

1. Introduction

Artificial intelligence (AI) refers to any device that perceives its environment and takes actions that maximize its chance of successfully achieving its goals (Russell and Norvig 2016). As such, AI describes the ability of machines to mirror human cognitive abilities, including decision-making, problem solving, reasoning, planning, and learning (Russell and Norvig 2016). Artificial intelligence is a knowledge-intensive technology whose history has been punctuated by periods of exuberant optimism and demoralizing failure due to unrealistically high expectations. The defeat of chess master Garry Kasparov by DEEP BLUE in 1997, however, ushered in a new wave of optimism and interest towards AI. This spurred technological advances in data-driven AI, language analysis and facial recognition algorithms, and machine learning, especially deep learning and neural networks. While basic and applied research into AI continues to increase, the focus appears to be shifting from theoretical research towards the commercialization of AI-enabled products, such as Apple’s Siri and Amazon’s Alexa digital assistants, with autonomous vehicles on the horizon. These advances are accompanied by increasing levels of interconnectivity (i.e., knowledge coupling) and interaction between AI-enabled products and their environment that form the genesis of an emerging AI ecosystem that spans multiple disciplines and cuts across many technological domains.

While early AI research was primarily funded by government agencies, investments of risk capital by VCs and corporations are what sustained the field when government funding dried up in the late 1970s and continues to fuel the growth of this emerging technology today. In 2018, VC investments in U.S. AI-related technologies increased to a record USD 9.3 billion, growing 72% year-over-year (CB Insights 2019). Furthermore, 2018 also saw an increase in the number of firms that received large deals, including Zymergen (USD 400M), Datamir (USD 392M), Automation Anywhere (USD 300M), Tanium (USD 175M), ZipRecruiter (USD 156M), and UiPath (USD 153M) (Su 2019). As an instrumental catalyst of this emerging technology, we seek to better understand how risk capital investments influenced the emergence of AI.

Emerging technologies, such as AI, clean tech, and 3-D printing, provide unique contexts in which to study many different business phenomena. The extant literature has examined decision making (Petkova et al. 2014), institutional logics (York et al. 2016), and opportunity recognition (Shane 2000), for example, within the context of emerging technologies. However, a more important question is: What role does risk capital play in the emergence of these new technologies? With the exception of a few studies, research into how new technologies emerge and create new industries with risk capital has received less attention. Venture capital also plays an important role in encouraging innovation and entrepreneurship. However, while prior studies have examined the role that risk capital plays in encouraging entrepreneurship (Gaston 1989; Landström 1993; Mason et al. 1991), these studies do not address how risk capital influences the emergence of new technologies.

While it may be difficult to assess the impact of a new technology until after it has matured, the potential state of disequilibria that new technologies may introduce into the market makes it critically important to develop a better understanding of how new technologies influence existing and emerging industries. Artificial intelligence, for example, threatens to disrupt existing value chains through the re-allocation of resources and shifting views of its social acceptance. Despite a plethora of research into how venture capital stimulates innovation and economic growth, how risk capital investments influence the development of new technologies remains underdeveloped. As a result, many questions remain as to the factors that contribute to translating an emerging technology into a mature technology, the role that risk capital plays in stimulating innovation, and what boundary conditions may influence the acceptance or obsolescence of an emerging technology.

In this study, we examine the role that risk capital plays in selecting AI-related technologies based on U.S. patent data. In particular, we examine how characteristics of a firm’s intellectual property (i.e., knowledge coupling) influence VC decisions to invest their risk capital in emerging AI technologies. This study contributes to the extant literature on new technology emergence in several ways. First, it expounds our understanding of which aspects of a firm’s intellectual property are more (or less) attractive for risk capital investments in emerging AI technologies. Second, the study advances a new measure of knowledge coupling at the firm-level. Third, we demonstrate how globalization has influenced AI technologies. Our findings highlight the instrumental role that risk capital investments play in the development of new AI technologies.

The remainder of the paper is organized as follows. The following section provides an overview of the evolution of AI, risk capital, and reviews the relevant literature for developing our hypotheses. We then describe the data and constructs as well as our findings. The paper concludes with a discussion of the study’s contributions, limitations, and avenues for future research.

2. Theory Development and Hypotheses

2.1. Search

According to the resource-based view of the firm, competitive advantage originates from the development of firm-specific competences and capabilities (Barney 1991; Peteraf 1993). Searches are a fundamental part of organizational learning and developing these competences and capabilities. A search is the process of solving problems in an ambiguous world (Huber 1991) and is a determinant of how firms innovate (Dosi 1988). However, sustained competitive advantage is more dependent on a firm’s ability to move beyond local searching and reconfigure its knowledge base. This ability has been termed “combinative capability” (Kogut and Zander 1992, p. 391) or “architectural competence” (Henderson and Cockburn 1994, p. 64). Hence, new technologies are the novel combinations of existing technologies, and how well a firm can form these combinations is what allows them to develop a sustained competitive advantage.

Forming these meaningful combinations, however, involves the process of search (Nelson and Winter 1982). Searching can be thought of as a tradeoff between exploration and exploitation activities. Firms that emphasize exploration focus on searching peripheral technological domains and are more likely to produce radical innovations. Radical innovations may have little in common with existing architectures. Firms that emphasize exploitation, on the other hand, focus on local searches in technological domains that are proximate to their core capabilities, often resulting in incremental improvements to existing architectures. The stance that firms take towards searching, therefore, influences how interconnected its knowledge base is.

Searches also influence the rate of technological progress among industries, and even within technological domains (Nelson 2003). Technologies evolve “through periods of incremental change punctuated by technological break-throughs that either enhance or destroy the competence of firms in an industry” (Tushman and Anderson 1986, p. 439). New technological breakthroughs usher in a period of intense technological ferment that is characterized by firms experimenting with many different technological combinations (i.e., exploratory search), which ultimately culminates in the emergence of a single dominant design (i.e., architecture) (Anderson and Tushman 1990). The emergence of a dominant design can profoundly impact the path of technological advance, the rate of technology adoption, the structure of the industry, and its competitive dynamics (Utterback and Suárez 1993). Once a dominant design emerges, incremental improvements and refinements are made to the technology in order to exploit it.

2.2. Risk Capital and the Emergence of AI

Venture capital has been indispensable in the development of new technologies. Emerging technologies, such as AI, rely on investors who are willing to make capital investments in start-ups with promising, but unproven technologies. In this context, we refer to the allocation of capital towards high-risk/high-return investments as risk capital. Risk capital represents the portion of an investor’s portfolio that is allocated towards speculative investments and serves “as a buffer to absorb unexpected losses” (Turnbull 2018, p. 2). Representing money that the investor can afford to lose, risk capital is what fuels emerging technologies because it is patient (i.e., it is not required to generate a return on the investment within a specified time period).

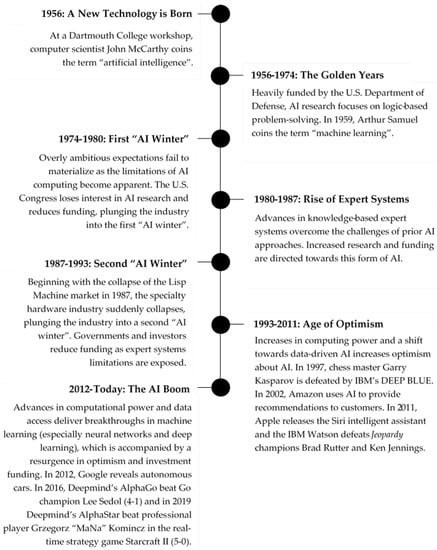

Emerging technologies go through cycles of investment exuberance and apathy. AI technologies also experienced these volatile investment cycles, often referred to as “AI summers and winters” (World Intellectual Property Organization 2019, p. 19). Referring to Figure 1, early investments in AI technologies were predominantly funded through government programs associated with the U.S. Department of Defense. At the time, economist Herbert Simon predicted that “machines will be capable, within twenty years, of doing any work a man can do” (Crevier 1993, p. 109). This Golden Age of AI came to an abrupt end in 1974 when it became clear that these expectations could not be met, ushering in the first, but not the last, “AI winter” (Crevier 1993, p. 202). Each AI winter was accompanied by a substantial reduction in the amount of financial investment in AI technologies. However, investments of risk capital during these periods allowed for disruptive new approaches to be explored and developed (e.g., first AI winter → expert systems; second AI winter → data-driven AI), which ultimately allowed this new technology to emerge from its hiatus, directing it down new technological paths.

Figure 1.

A brief history of the emergence of AI. Adapted from World Intellectual Property Organization (2019). The secretariat of WIPO assumes no liability or responsibility with regard to the transformation or translation of the original content.

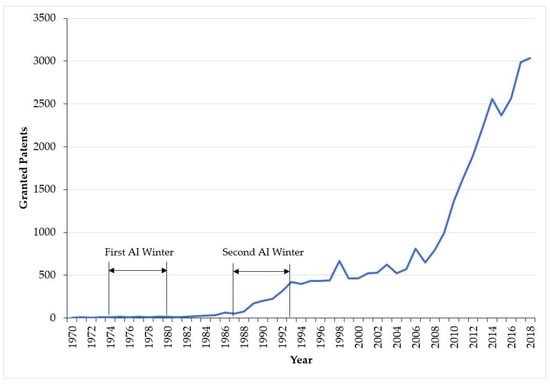

Figure 2 illustrates the growth of AI-related patent grants in the U.S. from 1970 to 2018. It is worth noting the difference in patenting activity during the periods that correspond to the two AI winters. During the first AI winter (1974–1980), there was little change in the rate of AI patenting. During this timeframe, research into AI was still predominantly an academic driven endeavor. However, during the second AI winter (1987–1993), there was a significant increase in AI-related patent grants, primarily driven by research conducted by Japanese (e.g., Hitachi and Toshiba) and U.S. (e.g., IBM) corporations.

Figure 2.

U.S. AI-related patent grants (1970–2018).

2.3. Peculiarities of Patenting AI Software

Knowledge embedded in new inventions is often codified in the form of patents. A patent is a grant of rights by a government that allows an inventor to exclude others from making, using, selling, offering for sale, or importing into the U.S. the patented technology for a limited duration, usually 20 years. Regardless of the technological domain, all patents have to meet a minimum set of criteria in order to be patent eligible. In the U.S., this means that the invention must be (1) statutory (i.e., the subject matter must be eligible for a patent), (2) novel, (3) useful, and (4) non-obvious. While each country has slightly different laws and interpretations of what can be claimed as an invention, many have similar requirements. Patenting software, however, can be problematic because of different interpretations of the statutory requirement.

The U.S. has traditionally set a high bar for AI software patents because software inventions are often directed towards abstract ideas (e.g., a mathematical algorithm implemented on a generic computer). The European Patent Office (EPO) as well as many other countries also have similar limitations on the patentability of software. In general, only applications of mathematical methods that produce effects external to the computer may be eligible for a patent, assuming that they also meet all of the other patentability criteria set forth by the patent office (Liyanage and Berry 2019). In China, obtaining a software patent has traditionally been an uphill battle. However, following the landmark Alice Corporation v. CLS Bank International ruling by the U.S. Supreme Court (see Alice Corp. v. CLS Bank International 2014) whereby it made it more difficult to obtain a software patent in the U.S., the Chinese State Intellectual Property Office (SIPO) has relaxed some of its rules pertaining to software patents, which may make the SIPO the place to file AI-related software patents in the future.

While patent laws are intended to apply to all technological domains equally, their execution sometimes leads to different results. The development of new technologies, in particular, may challenge a nation’s current system of intellectual property laws, as was the case in the software and biotechnology industries. While U.S. courts have been lax in their enforcement of the statutory and non-obviousness requirements in regards to software patents, it has “bent over backwards to find biotechnological inventions nonobvious, even if the prior art demonstrates a clear plan for producing the invention” (Burk and Lemley 2002, p. 1156). Such discrepancies in the uniform application of patent laws is not isolated to the U.S., but can also be found in other countries as well.

2.4. Characteristics of AI Patents That Are Selected by VCs

Due to the presence of information asymmetries between VC investors and entrepreneurs, VCs routinely look for signals of a start-up’s quality. One such signal is whether a start-up holds any patents. The United States Patent and Trademark Office (USPTO) uses hierarchical systems for classifying each patent based on its technological domain. Firms with more diverse technologies (i.e., those that cut across multiple technological domains) tend to be more innovative (Garcia-Vega 2006), which increases their attractiveness to would-be investors. Furthermore, Hsu and Ziedonis (2008) find that early stage patents convey a greater signaling value of the firm’s capabilities and quality. Therefore, we suggest that start-up firms whose AI patents encompass more diverse technological domains will be more likely to be selected by VCs for early round investment. This forms the basis for the following hypothesis:

Hypothesis 1.

AI patents filed by start-up firms that encompass more technological domains are more likely to be selected by VCs for early round investment.

2.5. Knowledge Coupling across Technological Boundaries

Fleming and Sorenson (2004, p. 910) view invention as “a process of searching for better combinations of existing components”. Knowledge coupling refers to the extent to which a firm is likely to combine interdependent elements within knowledge domains when searching for innovation (Fleming and Sorenson 2004; Yayavaram and Ahuja 2008). A high level of coupling implies that the firm is searching among more combinations and across different knowledge domains, whereas a low level implies that this is less. The couplings between all pairs of knowledge domains over which a firm conducts its technological search can be specified, and this set of couplings can be used to characterize the firm’s knowledge base. Couplings guide the combinations a firm considers, and they play an important role in knowledge reconfiguration.

Firms typically develop and refine their knowledge by searching for neighborhoods in existing areas of knowledge (Levinthal and March 1993). Firms tend to recombine elements of knowledge from familiar technological domains to generate inventions that did not previously exist (Fleming and Sorenson 2004; Schumpeter 1934). However, start-up firms are under pressure to change their knowledge bases to keep pace with the external technological environment and to compensate for the exhaustion of recombinant opportunities in existing domains (Fleming 2001; Kim and Kogut 1996).

New knowledge is created by combining elements of technology in novel ways (Arthur 2009; Fleming 2001; Nelson and Winter 1982). Thus, all technologies, including novel ones, descend from technologies that preceded them (Arthur 2009). This suggests that there must be meaningful linkages, or couplings, between elements of technology, representing a technology’s heredity (Arthur 2009). Technological elements can be thought of as building blocks that, when combined into assemblies or functional groups, create novel and (often) more complex elements of technology. In other words, “The collective of technology in this way forms a network of elements where novel elements are created from existing ones and where more complicated elements evolve from simpler ones” (Arthur and Polak 2006, p. 23).

When novel elements emerge as potential replacements for existing technologies and components in existing technologies, they create new “’needs’ or opportunity niches for supporting technologies and organizational arrangements” (Arthur 2009, p. 178), thereafter becoming “available as a potential component in further technologies—further elements” (Arthur 2009, p. 179). What emerges is an inherently modular technology architecture that not only allows for the technology to be reconfigured to suit different needs, but also accelerates the pace at which the technology evolves, building momentum and increased sophistication around a particular technological approach. The constant recombination of new elements to form more complex systems is what drives an economic system characterized by perpetual novelty (Arthur 2014).

In the 2018 Alphabet 10-K filing, it states:

Across the company, machine learning and artificial intelligence (AI) are increasingly driving many of our latest innovations. Within Google, our investments in machine learning over a decade have enabled us to build products that are smarter and more useful—it’s what allows you to use your voice to ask the Google Assistant for information, to translate the web from one language to another, to see better YouTube recommendations, and to search for people and events in Google Photos. Our advertising tools also use machine learning to help marketers find the right audience, deliver the right creative, and optimize their campaigns through better auto-bidding and measurement tools. Machine learning is also showing great promise in helping us tackle big issues, like dramatically improving the energy efficiency of our data centers. Across other bets, machine learning helps self-driving cars better detect and respond to others on the road, assists delivery drones in determining whether a location is safe for drop off, and can also help clinicians more accurately detect sight-threatening eye diseases (Alphabet, Inc. 2018, p. 3).

Google’s success in introducing AI-based technologies to the market stems from early investments in developing modular systems that combined knowledge from unfamiliar, distant knowledge domains. The manner in which these novel technology elements were coupled together formed a larger, modular architecture that enabled Google to scale up these technologies in later years, an important characteristic of technologies that investors look for when making investment decisions. These arguments form the basis for the following hypothesis:

Hypothesis 2.

AI patents filed by start-up firms with a higher degree of knowledge coupling are more likely to be selected by VCs for early round investment.

Given the fact that knowledge is dispersed, meaning that different organizations know different things, components of knowledge may remain both within the internal network of the firm and outside its boundaries. Combinations of dispersed components of knowledge that are superior to other firms may lead to temporary competitive advantages and diverse opportunities for production and innovation (Hayek 1945; Kirzner 1973; Schumpeter 1934). Over time, as firms strive to enhance their competitive positions through knowledge combination, knowledge becomes heterogeneously distributed across firms, which makes their assortments of knowledge at least in some way unique (Barney 1991). Thus, in order to obtain certain beneficial assortments of knowledge components that belong to others, firms may conduct knowledge coupling across organization boundaries. As a result, firms whose coupled knowledge provides them with a long-term sustained competitive advantage will likely be perceived as a less risky investment. Thus, we hypothesize:

Hypothesis 3.

Start-up firms with highly coupled knowledge are more likely to be selected by VCs for early round investment.

Searching can be viewed as a tradeoff between exploration and exploitation (March 1991). Exploration involves experimentation and iteration whereas exploitation involves refinements and incremental improvements. Exploration and exploitation activities compete for the same finite firm-level resources. Due to a scarcity of resources and driven by a need to meet shareholder expectations, established corporations often opt for the relative certainty of pursuing exploitation-related activities. However, doing so often reduces the incentive for these established corporations to invest in exploration activities in the future (Christensen and Bower 1996). Start-up firms, on the other hand, tend to focus on more exploratory activities in an attempt to develop and prove out the feasibility of a new idea, often resulting in the development of a radically new technology. As a result, we expect that differences will exist between the knowledge coupling attributes of patents filed by start-ups and established corporations. In particular, start-up patent filings are expected to be more novel and encompass a more diverse array of knowledge domains while those filed by established corporations are expected to be related to incremental improvements that build upon their existing knowledge base. Therefore, we hypothesize:

Hypothesis 4.

Whether receiving VC investment or not, the knowledge coupling attributes of patents filed by start-up firms differ from those filed by established public corporations.

3. Sample and Technology Innovation Characteristics

We examine risk capital investments in emerging AI technologies in the United States. This provides a suitable context for examining the emergence of new technologies because the U.S. has been a pioneer in AI development from the outset, has world-class research institutions, a thriving business ecosystem, an established tech culture, and a strong venture capital market. As a result, the U.S. has the largest number of AI-related patents of any nation. We collected 29,954 U.S. patents granted between 1970 and 2018 from the United States Patent and Trademark Office (USPTO) to examine the development of AI technologies. We limited the scope of data collection to United States patent classification (USPC) 706 (artificial intelligence) and cooperative patent classification (CPC) technology classes associated with AI (see Table A1 in the Appendix A). The USPTO discontinued the use of the USPC classification system in January of 2013, thereby necessitating a search of CPC technology classes to capture AI-related patents from 2013 to 2018. Of the 29,954 patents in our sample, 16,286 patents were granted to public corporations and 1484 patents were granted to VC-backed start-ups. The patent data was combined with venture capital data obtained from the Securities Data Corporation (SDC) VentureXpert database.

Technology Innovation Characteristics

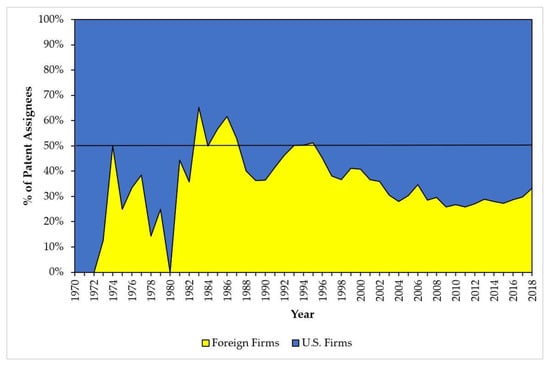

Figure 3 illustrates the percentage of AI-related patents that were granted to U.S. and foreign firms from 1970 to 2018. Following the end of the first AI winter (1974–1980), grants of AI-related patents to foreign firms saw an increase (≥50% share). A similar increase was seen towards the end of the second AI winter (1987–1993). The foreign filings during these periods, however, were predominantly from a single country—Japan. Japan was an early proponent of AI. At a time when nations were curtailing their investments in AI, in 1982, Japan invested ¥50 billion (approximately USD 462 million in 2019 dollars) over 10 years in the Fifth Generation Computer Systems (FGCS) project to provide a platform for the development of future AI technologies.

Figure 3.

Distribution of AI-related patent grants among U.S. and foreign firms (1970–2018).

The AI winter periods were accompanied by the demise of many firms involved in AI research. For example, the second AI winter (1987–1993) saw the demise of over 300 AI firms (Newquist 1994). However, following the end of the second AI winter, grants of AI-related patents to U.S. firms, as a percentage of total granted patents, continued to increase even though the number of U.S. and foreign firms engaged in AI research also increased. Thus, although emerging AI technologies became an increasingly crowded space, the U.S. continued to maintain its innovation leadership position.

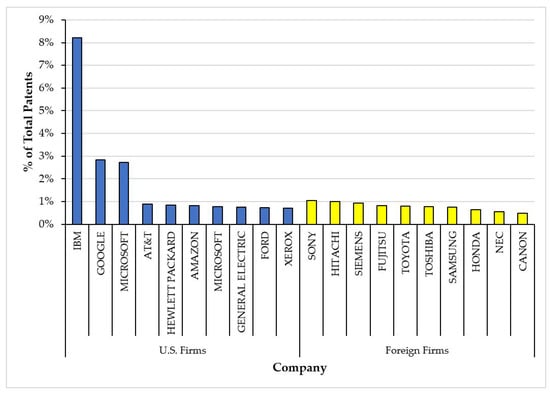

The top 10 U.S. and foreign firms with the largest AI-related U.S. patent portfolios from 1970 to 2018 are shown in Figure 4. Among U.S. firms, IBM has the greatest share of AI-related patents with over 8% of the total. Its nearest rivals, Microsoft and Google, each hold less than a 3% share of AI-related patents. Among foreign firms, the company with the greatest share of patents is Sony, with just over 1% of the total AI-related patents. The majority of these foreign firms were located in Japan, with one also located in Germany and another in South Korea. Interestingly, none of the foreign firms come close to approaching the size of the AI-related patent portfolios owned by IBM, Google, and Microsoft.

Figure 4.

Top 10 U.S. and foreign companies with the largest AI-related U.S. patent portfolios (1970–2018).

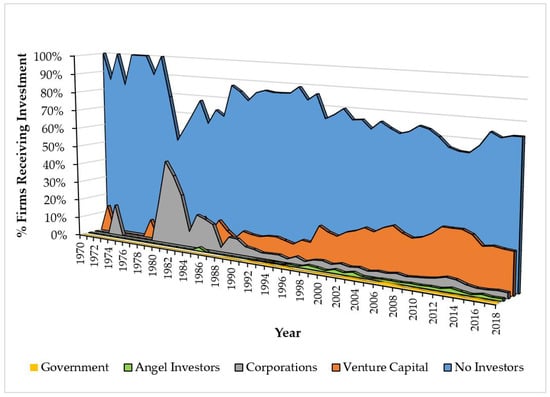

Figure 5 illustrates the distribution of investors in AI companies in the U.S. from 1970 to 2018. The majority of firms that hold AI-related patents did not receive capital investments from angel investors, venture capital, corporate venture capital, or government venture capital. An increasing number of start-ups are turning to VC investors for funding. Corporate venture capital (CVC) appears to have been a more important source of capital in the period following the first AI winter. However, it is now secondary to venture capital. Angel investors and government venture capital (GVC) also play a minor role as a source of capital.

Figure 5.

Distribution of investors in AI companies (1970–2018).

4. Globalization, Spillovers, and a Changing Game

Economic globalization has opened national borders to the flow of commerce, foreign direct investment, and the mobility of human capital. However, it has also enabled cross-border flows of knowledge and technology. Knowledge spillovers occur when knowledge from one domain surpasses its boundaries and “spills over” into another domain. Knowledge is inherently “leaky” and may be transferred via a variety of means (e.g., publications, patents, spinoffs, etc.). The efficient exploitation of home-grown knowledge by incumbents results in fewer opportunities for new entrants (Agarwal et al. 2010). However, when incumbents fail to adequately use their knowledge, because of high degrees of uncertainty, asymmetries, or transaction costs, it may leak out and make it possible for new entrants to exploit it (e.g., via entrepreneurship) (Audretsch and Lehmann 2005). Unwanted knowledge spillovers could lessen a firm’s competitive advantage by leaking its intellectual property to competitors (e.g., Anton and Yao 1994). However, prior studies suggest that entrepreneurial activity will be greater in industries where the investment needed to generate new knowledge is high (Acs et al. 2009).

In technology driven industries, knowledge spillovers related to new technologies provide emerging economies with an opportunity to not only participate in the industry, but also become influential players. Between 1970 and 2018, more than 50 foreign countries filed for AI-related patents in the U.S., accounting for approximately 30% of the total granted patents.

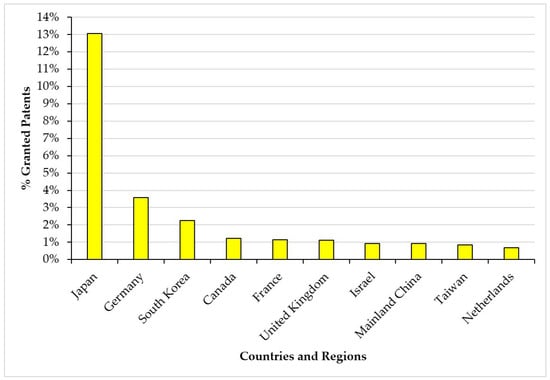

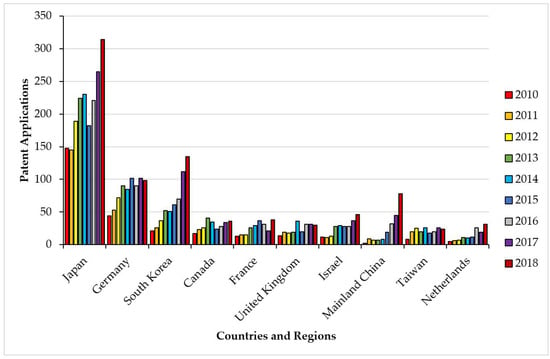

Figure 6 illustrates the top 10 foreign countries granted AI-related patents in the U.S. from 1970 to 2018. Japan is the top foreign recipient of U.S. patents in AI, accounting for approximately 13% of AI-related patents—more than the next nine countries combined. Figure 7 illustrates the patent application filings by these top 10 foreign countries from 2010 to 2018. While the majority of AI-related patents originated in developed countries with high-income economies, the last decade has seen China, although beginning later than the U.S., emerging as an influential player in AI, driven by innovations developed by Alibaba, Baidu, DJL, Huawei, and Tencent.

Figure 6.

Top 10 foreign countries and religions granted AI patents in the U.S. (1970–2018).

Figure 7.

Top 10 foreign countries and religions applying for AI patents in the U.S. (2010–2018).

China’s emergence as an influential player within the field of AI suggests that the market is changing. The knowledge and capability gap between emerging and developed countries is narrowing. While knowledge spillovers can help firms overcome initial resource constraints to develop new technological innovations (e.g., Acs et al. 2009; Agarwal et al. 2010; Audretsch and Lehmann 2005), China’s rise is also driven by government policy. In 2017, China’s government unveiled the New Generation Artificial Intelligence Development Plan, which outlined policies and the investment of billions of dollars to make China the world leader in AI by 2030 (O’Meara 2019). China’s focus on AI is not unique. Across the globe, AI is increasingly being recognized as a national priority and source of future competitive advantage. As a result, the development of AI technologies is increasingly becoming a new global game.

The changing dynamics of AI technologies combined with its promise to drive economic growth and improved quality of life prompted the U.S. to double down on its commitment to investing in this emerging technology. On 11 February 2019, U.S. President Donald J. Trump signed an Executive Order on Maintaining American Leadership in Artificial Intelligence. Its purpose is to reaffirm the U.S.’s commitment to being the global leader in AI. It states: “Continued American leadership in AI is of paramount importance to maintaining the economic and national security of the United States and to shaping the global evolution of AI in a manner consistent with our Nation’s values, policies, and priorities” (Executive Order No. 13859 2019, p. 3967).

5. Methods

5.1. Dependent Variable

Because we are interested in understanding the characteristics of those AI-related technologies that a start-up held that contributed to the firm receiving a risk capital investment, we constructed a binary variable Early Round Investment that takes a value of 1 if the start-up received early round financing from a VC, and 0 otherwise.

5.2. Independent Variables

5.2.1. Technology Classes

Technology classes provide a fine-grained classification of inventions (Trajtenberg et al. 1997). Technology classes often correspond to components that, when combined, create a complete system. Technology classes also differentiate between the various technological domains to which the invention belongs. Patents with more technology classes tend to be associated with more diverse technological domains. We measured technology classes as the count of different CPC classes associated with each individual patent.

5.2.2. Coupling

We examined coupling at both the patent-level, using Fleming and Sorenson’s (2004) approach, and the firm-level by developing a new measure of firm-level knowledge combination. Inspired by Fleming and Sorenson (2004), our measure of firm-level knowledge coupling can capture how a firm’s characteristics influence knowledge coupling (i.e., how firm-level factors affect patent-level coupling). This new measure represents the degree to which a firm can recombine knowledge within a domain and implies the innovation difficulty of a firm according to the degree of coupling among knowledge components.

To calculate this new firm-level measure of knowledge coupling, we used the CPC technology classes assigned to each patent. The use of patent technology classes has been shown to be a reliable proxy for the underlying components that, when combined together, form the invention (Fleming and Sorenson 2004; Yayavaram and Chen 2015). While technology classes often correspond to physical components quite closely, this is not always the case. Our measure overcomes this obstacle by only requiring that these technology classes define elements of knowledge rather than identifiable physical components. It is more difficult to combine elements of knowledge that are highly interdependent with other elements of knowledge than it is to combine elements of knowledge that are relatively independent.

Thus, we constructed our new measure of firm-level coupling, based on patent technology classes, in three steps. Referring to Equation (1), we first calculated the ease of recombination, or inverse of coupling, of an individual technology class i used in patent j. To do this, we identified every prior use of technology class i among all prior patents. The sum of the number of prior uses of technology class i provides the denominator. For the numerator, we counted the number of different technology classes appearing with technology class i among all prior patents. Hence, the measure increases as a particular technology class combines with a greater number of other technology classes, controlling for the total number of patents. This equation captures the ease of combining a particular technology class with other technology classes.

Second, since the majority of patents belong to more than one technology class (Fleming and Sorenson 2004), we created a measure of the ease of recombination for a focal patent j. Referring to Equation (2), we divided the sum of the ease of recombination scores for all technology classes belonging to patent j by the total number of technology classes associated with patent j.

Third, to create the measure of knowledge coupling for a focal firm, we divided the number of patents belonging to firm x by the sum of the ease of recombination score for all patents belonging to firm x as shown in Equation (3). That is, we inverted the average of the ease of recombination scores for the patents to which it belongs. An example of these calculations is shown in Appendix B.

- Ei is the ease of recombination of technology class i;

- Ej is the ease of recombination of patent j;

- Cx is the coupling of firm x.

5.2.3. Control Variables

To minimize the possibility of omitted variable bias, we controlled for certain observable variables that could affect a VC’s decision to provide risk capital to a firm developing AI-related technologies. Differences in economic output between developed and emerging economies are influenced by the availability of indigenous resources. Wealthier economies typically have access to higher quality resources, which may not only influence the industries in which economic actors are active, but also the technology paths that they are able to pursue. Hence, we controlled for this by incorporating GDP per Capita, which is measured as the log transformed GDP per capita dollar amount associated with the country where each company is headquartered. The U.S. continues to be the most important market for intellectual property worldwide. This, combined with a thriving VC ecosystem that fuels the growth of high-tech start-ups, makes the U.S. an attractive market in which to launch a new venture. Thus, we controlled for whether the company is headquartered in the U.S. or abroad by including the measure U.S. Firm, which is a binary variable that takes a value of 1 if the firm is headquartered in the United States, and 0 otherwise. Furthermore, because VC investors often form syndicates with other investors from around the globe, we included a Foreign Investor Ratio measure that represents the number of foreign investors in the syndicate divided by the number of domestic (i.e., U.S.) investors in the syndicate. Prior studies have shown that different types of investors have different motivations, norms, and institutional logics (e.g., Pahnke et al. 2015). These differences may influence what types of technologies are more likely to be selected in the first round by each of these different types of investors. Therefore, we included variables to capture the type of investor, including angel investors (Angel), venture capitalists (VC), corporate venture capital (CVC), and government venture capital (GVC). Each of these variables is a count of the number of investors of that type that are present in the syndicate.

5.2.4. Estimation Approach

Our interest is in understanding the likelihood of VCs investing risk capital in start-up firms developing AI-related technologies. However, within our sample, the number of VC investments in start-ups occurs infrequently compared to the overall sample. Therefore, to test Hypotheses 1–3, we used a rare events logit regression to model the odds associated with VC investment because our dependent variable is binary. Traditional logit models suffer from small sample bias associated with the maximum likelihood estimation. Rare events logit regression uses a penalized maximum likelihood technique to overcome this problem (King and Zeng 2001). To test Hypothesis 4, we used a t-test to compare the means between groups of start-ups and established public corporations.

6. Findings

We take a two-pronged approach to explore how knowledge coupling influences VC risk capital decisions in emerging AI technologies. First, we examine how individual patents combine elements of technological knowledge and how this may influence VC investment decisions (Models 1 to 3). This patent-level analysis follows in the footsteps of Fleming and Sorenson (2004) who ignore firm-level factors that may affect patent-level coupling. This micro-level analysis is followed by a more holistic examination of the degree to which all of a firm’s patents, and their associated technological domains, are interrelated using our new measure of firm-level knowledge coupling (Models 4 and 5). Unlike Fleming and Sorenson (2004), our new measure captures how firm-level factors affect patent-level coupling. This meso-level analysis allows us to see, in aggregate, how a firm’s patent portfolio influences VC investments of risk capital.

We report descriptive statistics and pairwise correlations between variables at the individual patent-level in Table 1a and at the firm-level in Table 1b. All correlations were below 0.8 (largest was 0.390). To assess whether multicollinearity was an issue, we calculated both the variance inflation factor (VIF) and condition number for each equation. The largest mean VIF value was 1.180 and the largest condition number was 1.935. The VIF and condition number are indicative of multicollinearity when their values are greater than 10 and 15 respectively. Therefore, multicollinearity is not a significant concern.

Table 1.

(a) Descriptive statistics and correlations (individual patent level); (b) descriptive statistics and correlations (firm level).

Table 2 reports the results of the rare events logit regression models. We specify the baseline model with only the control variables in Model 1. In Model 2, we build upon Model 1 to examine the effect of having patents that encompass many technology classes on the likelihood of receiving a VC investment. We find that the coefficient for Technology Classes (β = −0.072, n.s.) is negative but insignificant. This implies that for each additional technology class, there is no significant effect on the log-odds of a firm receiving VC investment. Hypothesis 1 suggested that AI patents filed by start-up firms that encompass more technological domains would be more likely to be selected by VCs for early round investment. However, this is clearly not the case. As a result, we do not find support for Hypothesis 1.

Table 2.

Rare events logit regression analysis results.

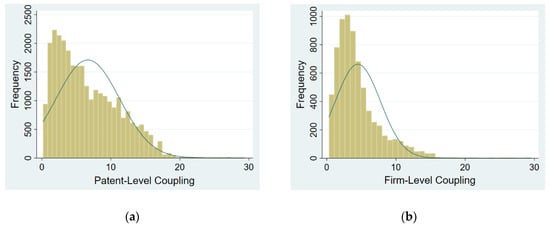

The distribution of patent-level coupling is illustrated in Figure 8a. In Model 3, we examine the effect of having patents that have a high degree of knowledge coupling on the likelihood of receiving a VC investment. We find that the coefficient for Coupling (β = 0.010, p < 0.10) is positive and significant. This implies that for a one-unit change in coupling, there is a 0.010-unit increase in the log-odds of a firm receiving VC investment. Hypothesis 2 suggested that AI patents with a higher degree of knowledge coupling would be more likely to be selected by VCs for early round investment. Hence, we find support for Hypothesis 2.

Figure 8.

Panel (a) shows the distribution of the patent-level coupling measure. Panel (b) shows the distribution of the firm-level coupling measure.

Unlike Models 1–3 that were at the patent-level of analysis, in Models 4 and 5, we examine knowledge coupling at the firm-level and its influence on the likelihood of receiving a VC investment. Figure 8b illustrates the distribution of firm-level coupling. In Model 4, we specify the baseline model with only the control variables. In Model 5, we build upon Model 4 and find that the coefficient for Coupling (β = 0.020, p < 0.05) is positive and significant. This implies that for a one-unit change in coupling, there is a 0.020-unit increase in the log-odds of a firm receiving VC investment. Hypothesis 3 suggested that firms with highly coupled knowledge would be more likely to be selected by VCs for early round investment. Therefore, Hypothesis 3 is supported.

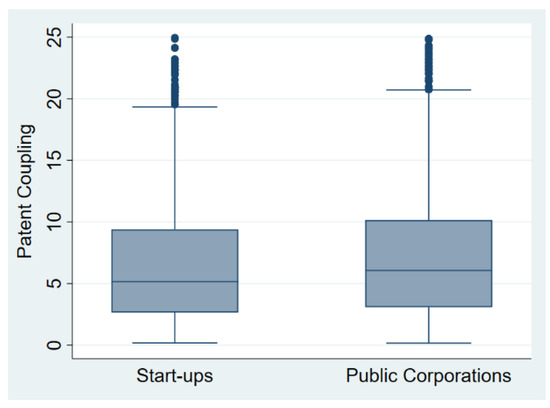

To test Hypothesis 4, we conduct a t-test to compare the sample means between the knowledge coupling of those patents filed by start-ups and those filed by established public corporations. Figure 9 shows box plots of firm-level coupling with respect to start-ups and public corporations. The results show that there is a statistically significant difference among start-ups and established corporations with regards to the knowledge coupling attributes of the AI patents they file (t = −4.619, p < 0.01). Therefore, we reject the null hypothesis that whether receiving VC investment or not, there is no difference between the knowledge coupling attributes of patents filed by start-up firms and those filed by established public corporations. Therefore, we find support for Hypothesis 4.

Figure 9.

Box plots of patent-level coupling between start-ups and public corporations.

7. Discussion

Our findings show counterintuitive evidence that the breadth of an AI startup’s patent stocks (i.e., patents that encompass more technological domains) are not a significant factor in VC investment decisions. Just because a technology from one technological domain can be combined with another technology from a different domain, as noted by additional technology classes, does not necessarily mean that this will translate into other technologies following suit. On the one hand, while it is advantageous for AI start-ups to have patents that are technologically broad in nature in order the provide broad patent protection for their innovation, investors may be aware of this strategy such that they may not put much weight behind the number of technology classes assigned to a patent alone. Furthermore, overly broad patent portfolios may signal that the AI start-up is good at generating general knowledge, which is easier to copy and design around, rather than specific knowledge, which is more likely to be idiosyncratic and a source of sustained competitive advantage.

Both patent-level and firm-level measures of knowledge coupling capture how technologies span across multiple domains. While a fine-grained analysis approach to examining knowledge coupling may be suitable to better understand the technology side, when examining how this coupled knowledge influences VC decisions, a less fine-grained analysis approach may offer better insights. This is what our new measure of firm-level knowledge coupling offers. We found that knowledge coupling at both the patent-level and firm-level was positively associated with an increased likelihood of receiving VC investment. However, our results showed that this association was stronger and more significant at the firm-level. What these findings highlight is that it is more about how knowledge works in an integrated manner that is more important to investors than technological domain diversity alone. Thus, when making investment decisions, VCs consider the firm’s intellectual property portfolio as a whole, how the patents build upon each other, and what capabilities it may signal. Therefore, start-ups should look beyond their existing knowledge base to find beneficial assortments of knowledge components that can be integrated in a logical manner.

We found that there is a significant difference between AI-related patents that are filed by start-ups and public corporations. For start-ups, the ability to create novel new technologies is paramount to their very survival. Furthermore, because start-ups often lack adequate resources and require investments of capital to turn their ideas into commercial products, their innovations, and subsequent patent filings, may demonstrate the firm’s novelty in order to attract investment to enter a new market. Conversely, established public corporations are less likely to need VC investments to survive, but may seek investments to fuel expansion and scale-up.

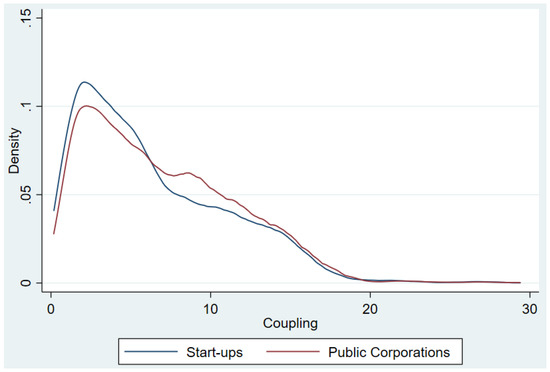

Furthermore, established public corporations are expected to operate in a manner that is in the best interest of its shareholders. Therefore, these firms are more likely to continue to make incremental improvements to existing products or introduce product line extensions, which manifest themselves as patents that are narrower in scope and applicability. These patents may also create a “patent thicket” (Shapiro 2000, p. 119), an overlapping set of patent rights that makes it difficult for competitors to design around. We illustrate the difference between AI-related patents that are filed by start-ups and public corporations by plotting their corresponding kernel density functions as seen in Figure 10.

Figure 10.

Kernel density of coupling between start-ups and corporations.

While VC investments in AI continue to increase, there may be early indications of a shift in the market. From Q4 2017 to Q4 2018, the number of seed-stage investments saw a 10% decline while expansion stage investments saw a 10% increase (CB Insights 2019). This may signal a shift in VC perceptions of the risk associated with investing in emerging AI technologies. With so much risk capital poured into exploratory seed-stage rounds over the last decade, AI technologies may have matured sufficiently to now attract non-risk capital investments as more and more mature companies begin to deliver AI-based technologies to the market. The shift towards VC funding of knowledge exploitation business activities may signal that this emerging technology is becoming a mainstream investment opportunity. Whereas the pace of technological advancement may accelerate when the focus is on exploration, a shift towards exploitation may be accompanied by a slowing of the pace of AI technological advancement as a dominant design emerges and smaller competitors fall by the wayside.

7.1. Contributions

This study makes several contributions. First, since investors have a great deal of latitude in where to invest their risk capital, this study elucidates our understanding of which aspects of a firm’s intellectual property are more (or less) attractive for risk capital investments in emerging AI technologies. In particular, we show that the number of technology classes associated with a start-up’s granted patents is not a significant factor in VC investment decisions. However, we also show that start-ups that demonstrate higher knowledge coupling across their granted patents are more likely to receive VC investment. Therefore, we find that it is not about how many technological domains your patents span that is important for investors, but rather the extent to which you can recombine the technological domains associated with those patents with other patents in other technological domains.

Second, we introduce a new method of measuring knowledge coupling at the firm-level that aggregates micro-level (patent technology class) scores to meso-level (firm) scores. This new measure represents the degree to which a firm can recombine knowledge within a domain and implies how difficult it is for a firm to innovate based on the degree of coupling among knowledge components. As this study has shown, this is an important characteristic of emerging technologies, such as AI, that can influence VC investment decisions. Furthermore, the flexibility of this measure allows it to be used to explore other firm-level factors, such as a firm’s network, expertise, or skills, which may affect its ability to recombine knowledge and innovate. This measure can also be used to explore a firm’s performance or innovation outcomes, such as its innovation rate and innovation impact.

Third, we demonstrate how globalization has influenced the development of AI-related technologies. Artificial intelligence has historically fallen within the realm of the technological capabilities of developed economies. However, the combination of cross-border spillovers and focused government policies have helped to level the playing field for emerging economies, such as China, especially within the last decade. This may signal a paradigm shift in the competitive dynamics of this emerging technology. As ever-increasing numbers of AI-related patents are filed, this voluntary disclosure of knowledge reduces search costs for new entrants, thereby allowing emerging economies to catch up while spending only a fraction of the resources that it would have taken to develop the new technology from scratch.

7.2. Practical Implications

According to Ren Zhengfei, CEO and founder of Huawei, “Advances in individual disciplines are creating new opportunities at dizzying rates, but the impact of interdisciplinary breakthroughs will be even more astonishing” (Crow 2019). “A novel characteristic of this new wave of technological innovation is “chain reactions” that span multiple disciplines” (Crow 2019). For firms that are involved in the development of AI-related technologies, it is not enough to develop products that cut across multiple technological domains. Instead, it is important to consider how knowledge from those technological domains can be connected in meaningful ways to enhance the likelihood of receiving VC investment. This interconnectedness among technologies from multiple technological domains represents an opportunity to quickly scale the business through multiple avenues and, therefore, is why coupling is a more attractive characteristic of patents than the number of technology classes alone. For firm managers, having a defined intellectual property strategy that complements their product development strategy is particularly important to generate these meaningful knowledge couplings.

7.3. Limitations and Future Research

This study is not without its limitations. First, as of January 2013, the USPTO discontinued the use of the USPC classification system in favor of the CPC system. Hence, USPC technology class 706 (artificial intelligence) is no longer in use. Unfortunately, there is no direct concordance between the USPC and CPC classification schemes. Furthermore, because the patent office routinely creates, reclassifies, and obsoletes patent technology classes to reflect the emergence of new technologies or new definitions of evolving technologies, it is possible that our sample does not include all AI-related patents available. Similarly, there may also be AI-related patents that are not classified in one of the CPC technology classes associated with AI because that class did not previously exist and the USPTO has not reclassified those patents yet. Furthermore, because many AI technologies are not patented, this makes a comprehensive analysis more difficult. Future studies may consider examining AI-related non-patent publications in journals to provide a more comprehensive understanding of how these may influence risk capital investments in firms developing AI-related technologies.

Second, because the amount of funding is not always disclosed during a financing round, this lack of information served to reduce the overall sample of VC-backed firms included in the analysis. Likewise, not all participants in a financing round are disclosed. We attempted to minimize these deficiencies in the VentureXpert data by tapping into other sources, such as Crunchbase, Pitchbook, and corporate press releases for additional investment details.

Third, while our intent was to provide an in-depth understanding of risk capital as it relates to emerging AI technologies, future studies may enhance the generalizability of the findings by examining other emerging technologies, such as marine energy, autonomous drones, and electric mobility. Future studies may also explore how heterogeneity among VC syndicates may influence the risk tolerance for investing in emerging technologies. Another promising avenue of research would be to further explore how different funding sources approach making capital investments in emerging technologies with long development horizons.

Fourth, although our measure has its unique advantages, there are also some limitations. An important limitation of this measure of coupling is that it does not capture all of the couplings that were attempted, but did not result in patentable inventions. A firm’s innovation involves diverse knowledge, such as knowledge of business model innovation or marketing knowledge. Our measure can only catch those portions of knowledge coupling on technology innovation by using patent data. Furthermore, our measure focuses on a firm’s knowledge coupling within a specific domain, limiting the scope of research. Building coupling matrices using technological classes may lead to sparse matrices and an overestimation of changes from one time period to another. Future research may focus on this issue.

8. Conclusions

Our study aims to contribute to the discussion about how new technologies emerge. This study highlights the instrumental role that risk capital investments play in the development of AI technologies. We show that characteristics of a firm’s patents can influence VC risk capital investment decisions. In particular, firms whose patents encompass a higher degree of knowledge coupling are more likely to be selected for VC investments. Furthermore, this study highlighted the fact that there are differences in knowledge coupling between start-ups and public corporations. The field of AI is attracting increasing amounts of VC financing which, in turn, contributes to the accelerating pace of patenting in AI-related technologies. As this emerging field continues to grow and more AI-based technologies are commercialized, AI will increasingly become part of our everyday lives.

Author Contributions

Conceptualization, R.S.S. and L.Q.; Methodology, R.S.S. and L.Q.; Validation, R.S.S. and L.Q.; Formal analysis, R.S.S. and L.Q.; Investigation, R.S.S., and L.Q.; Resources, R.S.S. and L.Q.; Data curation, R.S.S.; Writing—original draft preparation, R.S.S.; Writing—review and editing, L.Q.; Visualization, R.S.S.; Supervision, R.S.S. and L.Q.; Project Administration, R.S.S. and L.Q.

Funding

This research received no external funding.

Acknowledgments

Roberto Santos and Lingling Qin would like to thank Sunny Li Sun for his encouragement and guidance. The authors would also like to thank Kaia Lv, Managing Editor of the Journal of Risk and Financial Management, Wenting Lv, and three anonymous reviewers for their helpful suggestions for improving the quality of this manuscript.

Conflicts of Interest

Sunny Li Sun and Yi Yang are guest editors of the Journal of Risk and Financial Management special issue on Venture Capital and Private Equity. To avoid any conflict of interest, the two authors requested another editor to handle the review of this paper. Neither Professor Sunny Li Sun nor Professor Yi Yang had a role in the decision to publish this manuscript.

Appendix A

The AI-related Cooperative Patent Classification (CPC) technology classes listed in Table A1 were selected following with the methodology used by the World Intellectual Property Organization (WIPO) to generate the WIPO Technology Trends 2019: Artificial Intelligence report.

Table A1.

Artificial intelligence cooperative patent classification (CPC) technology classes.

Table A1.

Artificial intelligence cooperative patent classification (CPC) technology classes.

| A61B5/7264 | G01N2201/1296 | G06F17/289 | G06N5/027 | H01J2237/30427 |

| A61B5/7267 | G01N29/4481 | G06F17/30029 | G06N5/04 | H01M8/04992 |

| A63F13/67 | G01N33/0034 | G06F17/30247 | G06N5/043 | H02H1/0092 |

| B23K31/006 | G01R31/2846 | G06F17/30522 | G06N5/048 | H02P21/0014 |

| B25J9/161 | G01R31/2848 | G06F17/3053 | G06N7/005 | H02P23/0018 |

| B29C2945/76979 | G01R31/3651 | G06F17/30654 | G06N7/02 | H03H2017/0208 |

| B29C66/965 | G01S7/417 | G06F17/30663 | G06N7/046 | H03H2222/04 |

| B60G2600/1876 | G05B13/027 | G06F17/30702 | G06N7/06 | H042012/5686 |

| B60G2600/1878 | G05B13/0275 | G06F17/30705 | G06T2207/20081 | H042025/03464 |

| B60G2600/1879 | G05B13/028 | G06F17/30713 | G06T2207/20084 | H04L2025/03554 |

| B60W30/06 | G05B13/0285 | G06F17/30743 | G06T2207/30236 | H04L25/0254 |

| B60W30/10 | G05B13/029 | G06F2207/4824 | G06T2207/30248 | H04L25/03165 |

| B60W30/12 | G05B13/0295 | G06K7/1482 | G06T2207/30268 | H04L41/16 |

| B60W30/14 | G05B2219/33002 | G06K9 | G06T3/4046 | H04L45/08 |

| B60W30/17 | G05D1/00 | G06N/20 | G06T9/002 | H04N21/4662 |

| B62D15/0285 | G05D1/0088 | G06N20/00 | G08B29/186 | H04N21/4666 |

| B64G2001/247 | G06F11/1476 | G06N3 | G10H2250/151 | H04Q2213/054 |

| E21B2041/0028 | G06F11/2257 | G06N3/004 | G10H2250/311 | H04Q2213/13343 |

| F02D41/1405 | G06F11/2263 | G06N3/008 | G10K2210/3024 | H04Q2213/343 |

| F03D7/046 | G06F15/18 | G06N3/02 | G10K2210/3038 | H04R25/507 |

| F05B2270/707 | G06F17/16 | G06N3/0427 | G10L15/00 | Y10S128/924 |

| F05B2270/709 | G06F17/2282 | G06N3/0436 | G10L15/16 | Y10S128/925 |

| F05D2270/709 | G06F17/27 | G06N3/0454 | G10L17/00 | Y10S706 |

| F16H2061/0081 | G06F17/2795 | G06N3/088 | G10L25/30 | |

| F16H2061/0084 | G06F17/28 | G06N5/003 | G11B20/10518 |

Appendix B

The following is an example of the firm-level coupling calculation. We consistently use the CPC class as a proxy of the patent’s technological domains.

- Consider A9.com Inc. patent US9928466 that was granted in 2018. Patent US9928466 is associated with two technological domains as indicated by CPC classes G06F16 and G06N7. Each CPC class represents a knowledge component. Prior to the firm’s use of class G06F16, within the whole set of AI-related patents, it had been recombined 3718 times with 188 other components. This results in an observed ease of recombination score of 188/3718 = 0.051 (see Equation (A1) below). Similarly, CPC class G06N7 had been recombined 1769 times with 176 other components. This results in an observed ease of recombination score of 176/1769 = 0.099 (see Equation (A2) below).

- Using the values calculated above, we can then determine the patent’s observed ease of recombination. This is calculated as the sum of the individual class recombination scores divided by the number of classes assigned to the patent. This results in a patent ease of recombination score of (0.051 + 0.099)/2 = 0.075 (see Equation (A3) below).

- Finally, we compute the firm-level measure of coupling. For example, A9.com Inc. had 9 patents granted up to 2018 and the sum of observed ease of recombination of these patents was 1.439 (following the same procedure as outlined above). Thus, the coupling of A9.com Inc. in 2018 was 9/1.439 = 6.254 (see Equation (A4) below).

References

- Acs, Zoltan J., Pontus Braunerhjelm, David B. Audretsch, and Bo Carlsson. 2009. The knowledge spillover theory of entrepreneurship. Small Business Economics 32: 15–30. [Google Scholar] [CrossRef]

- Agarwal, Rajshree, David Audretsch, and Mitra Barun Sarkar. 2010. Knowledge spillovers and strategic entrepreneurship. Strategic Entrepreneurship Journal 4: 271–83. [Google Scholar] [CrossRef]

- Alice Corp. v. CLS Bank International. 2014. 573 U.S. 208. Supreme Court. Available online: https://www.supremecourt.gov/opinions/13pdf/13-298_7lh8.pdf (accessed on 13 December 2019).

- Alphabet, Inc. 2018. Form 10-K 2018. Available online: https://www.sec.gov/Archives/edgar/data/1652044/000165204419000004/goog10-kq42018.htm#s6C1DB95EDB3C5C7998B5E96D339C677B (accessed on 13 December 2019).

- Anderson, Philip, and Michael L. Tushman. 1990. Technological discontinuities and dominant designs: A cyclical model of technological change. Administrative Science Quarterly 35: 604–33. [Google Scholar] [CrossRef]

- Anton, James J., and Dennis A. Yao. 1994. Expropriation and inventions: Appropriable rents in the absence of property rights. The American Economic Review 84: 190–209. [Google Scholar]

- Arthur, W. Brian. 2009. The Nature of Technology: What It Is and How It Evolves. New York: Simon and Schuster. [Google Scholar]

- Arthur, W. Brian. 2014. Complexity and the Economy. New York: Oxford University Press. [Google Scholar]

- Arthur, W. Brian, and Wolfgang Polak. 2006. The evolution of technology within a simple computer model. Complexity 11: 23–31. [Google Scholar] [CrossRef]

- Audretsch, David B., and Erik E. Lehmann. 2005. Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy 34: 1191–202. [Google Scholar] [CrossRef]

- Barney, Jay. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Burk, Dan L., and Mark A. Lemley. 2002. Is patent law technology-specific. Berkeley Technology Law Journal 17: 1155–206. [Google Scholar] [CrossRef]

- CB Insights. 2019. VCs Nearly Doubled Their Investment in This Tech Last Year. Available online: https://www.cbinsights.com/research/artificial-intelligence-funding-venture-capital-2018/ (accessed on 13 December 2019).

- Christensen, Clayton M., and Joseph L. Bower. 1996. Customer power, strategic investment, and the failure of leading firms. Strategic Management Journal 17: 197–218. [Google Scholar] [CrossRef]

- Crevier, Daniel. 1993. AI: The Tumultuous History of the Search for Artificial Intelligence. New York: Basic Books. [Google Scholar]

- Crow, Lauren. 2019. The Coming Innovation Explosion. Available online: https://worldin.economist.com/article/17389/edition2020ren-zhengfei-coming-innovation-explosion (accessed on 1 December 2019).

- Dosi, Giovanni. 1988. Sources, procedures, and microeconomic effects of innovation. Journal of Economic Literature 26: 1120–71. [Google Scholar]

- Executive Order No. 13859, 84 FR 3967. 2019. Available online: https://www.federalregister.gov/documents/2019/02/14/2019-02544/maintaining-american-leadership-in-artificial-intelligence (accessed on 13 December 2019).

- Fleming, Lee. 2001. Recombinant uncertainty in technological search. Management Science 47: 117–32. [Google Scholar] [CrossRef]

- Fleming, Lee, and Olav Sorenson. 2004. Science as a map in technological search. Strategic Management Journal 25: 909–28. [Google Scholar] [CrossRef]

- Garcia-Vega, Maria. 2006. Does technological diversification promote innovation?: An empirical analysis for European firms. Research Policy 35: 230–46. [Google Scholar] [CrossRef]

- Gaston, Robert J. 1989. Finding Private Venture Capital for Your Firm. New York: John Wiley and Sons. [Google Scholar]

- Hayek, Friedrich August. 1945. The use of knowledge in society. The American Economic Review 35: 519–30. [Google Scholar]

- Henderson, Rebecca, and Iain Cockburn. 1994. Measuring competence? Exploring firm effects in pharmaceutical research. Strategic Management Journal 15: 63–84. [Google Scholar] [CrossRef]

- Hsu, David H., and Rosemarie H. Ziedonis. 2008. Patents as quality signals for entrepreneurial ventures. Academy of Management Proceedings 2008: 1–6. [Google Scholar] [CrossRef]

- Huber, George P. 1991. Organizational learning: The contributing processes and the literatures. Organization Science 2: 88–115. [Google Scholar] [CrossRef]

- Kim, Dong-Jae, and Bruce Kogut. 1996. Technological platforms and diversification. Organization Science 7: 283–301. [Google Scholar] [CrossRef]

- King, Gary, and Langche Zeng. 2001. Explaining rare events in international relations. International Organization 55: 693–715. [Google Scholar] [CrossRef]

- Kirzner, Israel M. 1973. Competition and Entrepreneurship. Chicago: University of Chicago Press. [Google Scholar]

- Kogut, Bruce, and Udo Zander. 1992. Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science 3: 383–97. [Google Scholar] [CrossRef]

- Landström, Hans. 1993. Informal risk capital in Sweden and some international comparisons. Journal of Business Venturing 8: 525–40. [Google Scholar] [CrossRef]

- Levinthal, Daniel A., and James G. March. 1993. The myopia of learning. Strategic Management Journal 14: 95–112. [Google Scholar] [CrossRef]

- Liyanage, Yohan, and Kathy Berry. 2019. Insight: Intellectual Property Challenges during an AI Boom. Available online: https://news.bloomberglaw.com/ip-law/insight-intellectual-property-challenges-during-an-ai-boom (accessed on 29 November 2019).

- March, James G. 1991. Exploration and exploitation in organizational learning. Organization Science 2: 71–87. [Google Scholar] [CrossRef]

- Mason, Colin, Richard Harrison, and Jennifer Chaloner. 1991. Informal Risk Capital in the UK: A Study of Investor Characteristics, Investment Preferences and Investment Decision-Making. Working paper. Southampton: University of Southampton. [Google Scholar]

- Nelson, Richard R. 2003. On the uneven evolution of human know-how. Research Policy 32: 909–22. [Google Scholar] [CrossRef]

- Nelson, Richard R., and Sidney G. Winter. 1982. An Evolutionary Theory of Technical Change. Cambridge: Harvard University Press. [Google Scholar]

- Newquist, Harvey P. 1994. The Brain Makers: Genius, Ego, and Greed in the Quest for Machines That Think. New York: Macmillan/SAMS. [Google Scholar]

- O’Meara, Sarah. 2019. Will China Lead the World in AI by 2030? Available online: https://www.nature.com/articles/d41586-019-02360-7 (accessed on 27 October 2019).

- Pahnke, Emily Cox, Riitta Katila, and Kathleen M. Eisenhardt. 2015. Who takes you to the dance? How partners’ institutional logics influence innovation in young firms. Administrative Science Quarterly 60: 596–633. [Google Scholar] [CrossRef]

- Peteraf, Margaret A. 1993. The cornerstones of competitive advantage: A resource-based view. Strategic Management Journal 14: 179–91. [Google Scholar] [CrossRef]

- Petkova, Antoaneta P., Anu Wadhwa, Xin Yao, and Sanjay Jain. 2014. Reputation and decision making under ambiguity: A study of US venture capital firms’ investments in the emerging clean energy sector. Academy of Management Journal 57: 422–48. [Google Scholar] [CrossRef]

- Russell, Stuart J., and Peter Norvig. 2016. Artificial Intelligence: A Modern Approach, 3rd ed. Harlow: Pearson Education Limited. [Google Scholar]

- Schumpeter, Joseph A. 1934. Capitalism, Socialism and Democracy. New York: Harper & Row. [Google Scholar]

- Shane, Scott. 2000. Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science 11: 448–69. [Google Scholar] [CrossRef]

- Shapiro, Carl. 2000. Navigating the patent thicket: Cross licenses, patent pools, and standard setting. Innovation Policy and the Economy 1: 119–50. [Google Scholar] [CrossRef]

- Su, Jeb. 2019. Venture Capital Funding for Artificial Intelligence Startups Hit Record High in 2018. Available online: https://www.forbes.com/sites/jeanbaptiste/2019/02/12/venture-capital-funding-for-artificial-intelligence-startups-hit-record-high-in-2018/#550daf8a41f7 (accessed on 13 December 2019).

- Trajtenberg, Manuel, Rebecca Henderson, and Adam Jaffe. 1997. University versus corporate patents: A window on the basicness of invention. Economics of Innovation and New Technology 5: 19–50. [Google Scholar] [CrossRef]

- Turnbull, Stuart. 2018. Capital allocation in decentralized businesses. Journal of Risk and Financial Management 11: 82. [Google Scholar] [CrossRef]

- Tushman, Michael L., and Philip Anderson. 1986. Technological discontinuities and organizational environments. Administrative Science Quarterly 31: 439–65. [Google Scholar] [CrossRef]

- Utterback, James M., and Fernando F. Suárez. 1993. Innovation, competition, and industry structure. Research Policy 22: 1–21. [Google Scholar] [CrossRef]

- World Intellectual Property Organization. 2019. WIPO Technology Trends 2019: Artificial Intelligence. Geneva: World Intellectual Property Organization. [Google Scholar]

- Yayavaram, Sai, and Gautam Ahuja. 2008. Decomposability in knowledge structures and its impact on the usefulness of inventions and knowledge-base malleability. Administrative Science Quarterly 53: 333–62. [Google Scholar] [CrossRef]

- Yayavaram, Sai, and Wei-Ru Chen. 2015. Changes in firm knowledge couplings and firm innovation performance: The moderating role of technological complexity. Strategic Management Journal 36: 377–96. [Google Scholar] [CrossRef]

- York, Jeffrey G., Timothy J. Hargrave, and Desirée F. Pacheco. 2016. Converging winds: Logic hybridization in the Colorado wind energy field. Academy of Management Journal 59: 579–610. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).