Study on the Impact of Climate Change on China’s Import Trade of Major Agricultural Products and Adaptation Strategies

Abstract

1. Introduction

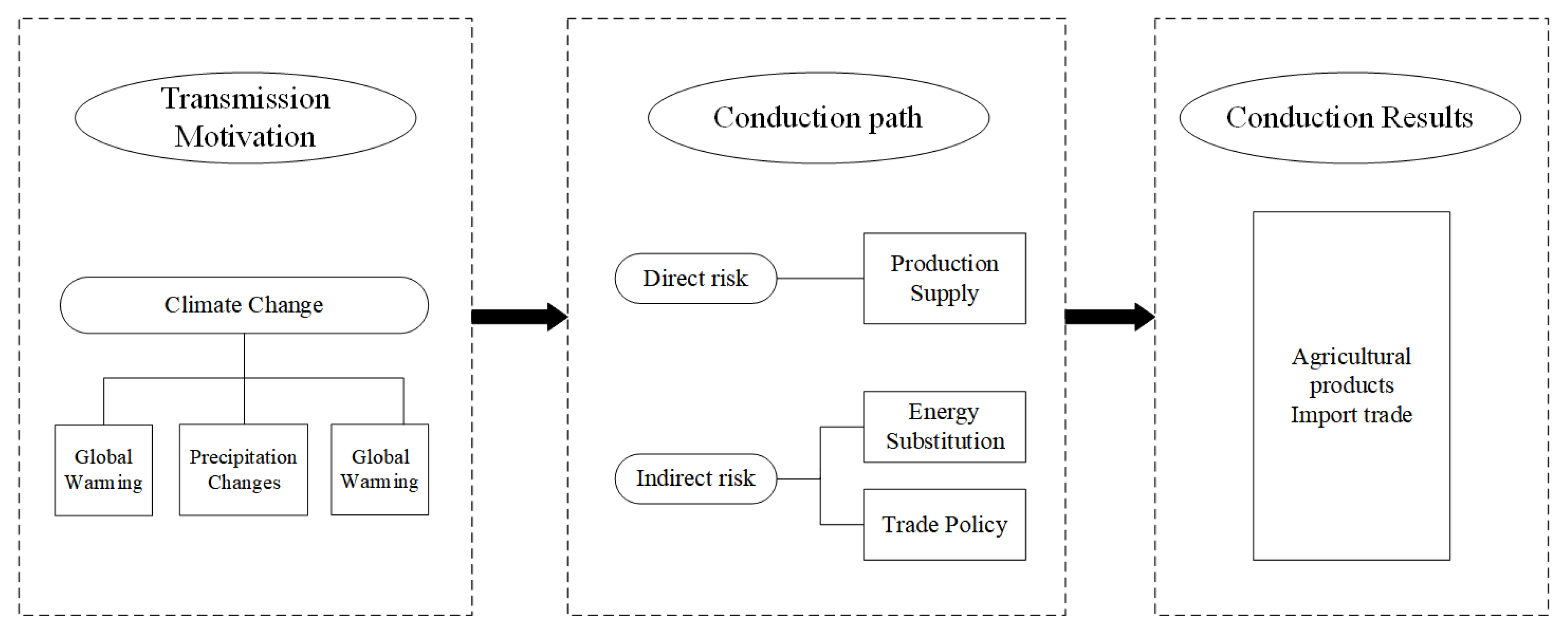

2. Theoretical Foundation and Research Hypothesis

2.1. Theoretical Foundation

2.2. Research Hypothesis

2.2.1. Climate Change-Production Supply-Import Trade

2.2.2. Climate Change-Energy Substitution-Import Trade

2.2.3. Climate Change-Trade Policy-Import Trade

3. Materials and Methods

3.1. Model Method

3.2. Data Material Description

3.2.1. Regional Division

3.2.2. Department Division

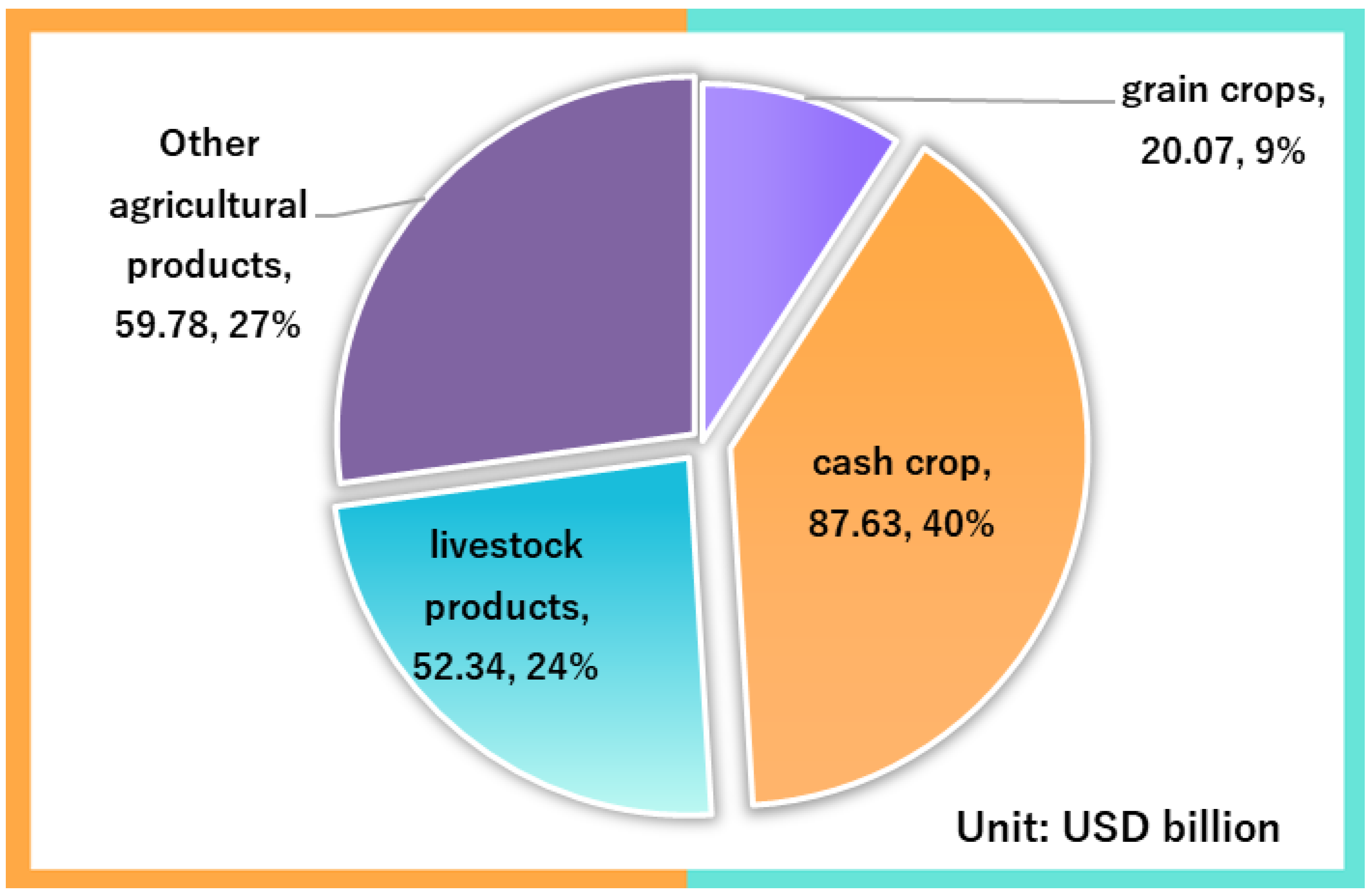

3.2.3. Data Analysis

3.3. Simulation Scheme and Specific Scenario Design

3.3.1. Production Supply Risk Simulation and Scenario Design

3.3.2. Energy Substitution Risk Simulation and Scenario Design

3.3.3. Trade Policy Risk Simulation and Scenario Design

4. Multi-Scenario Simulation Results and Discussion

4.1. Scenario 1: Yield Change

4.2. Scenario 2: Price Change

4.3. Scenario 3: Economic Risk

5. Conclusions and Recommendations

5.1. Conclusion and Discussion

5.2. Policy Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ivanova, M. Everyone, everywhere: The global challenge of climate change. Nature 2020, 579, 488–490. [Google Scholar] [CrossRef]

- Olesen, J.E.; Bindi, M. Consequences of climate change for European agricultural productivity, land use and policy. Eur. J. Agron. 2002, 16, 239–262. [Google Scholar] [CrossRef]

- Guerena, A.; Ruiz-Ramos, M.; Diaz-Ambrona, C.H.; Conde, J.R.; Mínguez, M.I. Assessment of climate change and agriculture in Spain using climate models. Agron. J. 2001, 93, 237–249. [Google Scholar] [CrossRef]

- Caubel, J.; Cortazar-Atauri, I.G.D.; Launay, M.; de Noblet-Ducoudré, N.; Huard, F.; Bertuzzi, P.; Graux, A.-I. Broadening the scope for ecoclimatic indicators to assess crop climate suitability according to ecophysiological, technical and quality criteria. Agr. Forest. Meteorol. 2015, 207, 94–106. [Google Scholar] [CrossRef]

- Challinor, A.J.; Wheeler, T.R. Crop Yield Reduction in the Tropics under Climate Change: Processes and Uncertainties. Agr. Forest Meteorol. 2008, 148, 343–356. [Google Scholar] [CrossRef]

- Zhang, Y. Scale, Technique and composition effects in Trade-related Carbon Emissions in China. Environ. Resourc. Econ. 2012, 51, 371–389. [Google Scholar] [CrossRef]

- Fischer, W.; Hake, J.-F.; Kuckshinrichs, W.; Schröder, T.; Venghaus, S. German Energy Policy and the Way to Sustainability: Five Controversial Issues in the Debate on the “Energiewende”. Energy 2016, 115, 1580–1591. [Google Scholar] [CrossRef]

- Climate Change 2022: Impacts, Adaptation, and Vulnerability. Available online: https://www.ipcc.ch/report/ar6/wg2/ (accessed on 28 February 2022).

- Li, X.X.; Zhao, Y.; Cheng, Y. Climate change risks in agricultural products trade and their countermeasures. Int. Trade 2011, 11, 23–27. [Google Scholar]

- Zhao, Y.; Xiao, D.P.; Tang, J.Z.; Bai, H.Z. The impact of climate change on the output of major grain crops in China and adaptive measures. Resour. Water Soil Conser. 2019, 26, 317–326. [Google Scholar]

- Chen, S.; Xu, J.T.; Zhang, H.P. The impact of climate change on China’s grain production—Empirical analysis based on county-level panel data. China Rural Econ. 2016, 5, 2–15. [Google Scholar]

- Peng, J.J. Overview of the Impact of Climate Change on Global Grain Yield. World Agr. 2017, 5, 19–24. [Google Scholar]

- Spracklen, D.V. China’s Contribution to Climate Change. Nature 2016, 531, 310–311. [Google Scholar] [CrossRef] [PubMed]

- Mao, G.; Huang, N.; Chen, L.; Wang, H. Research on Biomass Energy and Environment from the Past to the Future: A Bibliometric Analysis. Sci. Total Environ. 2018, 635, 1081–1090. [Google Scholar] [CrossRef]

- Ma, L.L.; Tang, Z.H.; Wang, C.W.; Sun, Y.M.; Lv, X.F.; Chen, Y. Research Status and Future Development Strategy of Biomass Energy. J. Chin. Acad. Sci. 2019, 34, 434–442. [Google Scholar]

- Toreti, A.; Deryng, D.; Tubiello, F.N.; Müller, C.; Kimball, B.A.; Moser, G.; Boote, K.; Asseng, S.; Pugh, T.A.M.; Vanuytrecht, E.; et al. Narrowing Uncertainties in the Effects of Elevated CO2 on Crops. Nat. Food 2020, 1, 775–782. [Google Scholar] [CrossRef]

- Ortiz-Bobea, A.; Ault, T.R.; Carrillo, C.M.; Chambers, R.G.; Lobell, D.B. Anthropogenic Climate Change Has Slowed Global Agricultural Productivity Growth. Nat. Clim. Chang. 2021, 11, 306–312. [Google Scholar] [CrossRef]

- Ochieng, J.; Kirimi, L.; Mathenge, M. Effects of Climate Variability and Change on Agricultural Production: The Case of Small Scale Farmers in Kenya. NJAS—Wagen. J. Life Sci. 2016, 77, 71–78. [Google Scholar] [CrossRef]

- Baldos, U.L.C.; Hertel, T.W.; Moore, F.C. Understanding the spatial distribution of welfare impacts of global warming on agriculture and its drivers. Am. J. Agr. Econ. 2019, 101, 1455–1472. [Google Scholar] [CrossRef]

- Shindell, D.T. Crop yield changes induced by emissions of individual climate-altering pollutants. Earth Future 2016, 4, 373–380. [Google Scholar] [CrossRef]

- Mills, E.N. Implicating fisheries justice movements in food and climate politics. Third World Q. 2018, 39, 1270–1289. [Google Scholar] [CrossRef]

- Iizumi, T.; Shiogama, H.; Imada, Y.; Hanasaki, N.; Takikawa, H.; Nishimori, M. Crop Production Losses Associated with Anthropogenic Climate Change for 1981–2010 Compared with Preindustrial Levels. Int. J. Climatol. 2018, 38, 5405–5417. [Google Scholar] [CrossRef]

- Qin, T.F.; Xing, X.R.; Ma, J.L.; Liu, S.Y.; Chen, N.L. Overview of International Seminar on Agricultural Trade Policy and Agricultural Sustainable Development. World Agr. 2019, 3, 111–114. [Google Scholar]

- Sultan, B.; Defrance, D.; Iizumi, T. Evidence of crop production losses in West Africa due to historical global warming in two crop models. Sci. Rep. 2019, 9, 12834. [Google Scholar] [CrossRef] [PubMed]

- Matzrafi, M. Climate change exacerbates pest damage through reduced pesticide efficacy. Pest. Manag. Sci. 2019, 75, 9–13. [Google Scholar] [CrossRef] [PubMed]

- Refatti, J.P.; de Avila, L.A.; Camargo, E.R.; Ziska, L.H.; Oliveira, C.; Salas-Perez, R.; Rouse, C.E.; Roma-Burgos, N. High [CO2] and Temperature Increase Resistance to Cyhalofop-Butyl in Multiple-Resistant Echinochloa Colona. Front Plant Sci. 2019, 10, 529. [Google Scholar] [CrossRef]

- Bongaarts, J. IPBES, 2019. Summary for Policymakers of the Global Assessment Report on Biodiversity and Ecosystem Services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. Popul. Dev. Rev. 2019, 45, 680–681. [Google Scholar] [CrossRef]

- Schauberger, B.; Rolinski, S.; Schaphoff, S.; Müller, C. Global Historical Soybean and Wheat Yield Loss Estimates from Ozone Pollution Considering Water and Temperature as Modifying Effects. Agr. Forest. Meteorol. 2019, 265, 1–15. [Google Scholar] [CrossRef]

- Larch, M.; Wanner, J. Carbon Tariffs: An Analysis of the Trade, Welfare, and Emission Effects. J. Int. Econ. 2017, 109, 195–213. [Google Scholar] [CrossRef]

- Hu, Y.Y. Quantitative Analysis of the Impact of Carbon Tariff on China’s Economy Based on CGE Model. Int. Trade Iss. 2013, 2, 92–99. [Google Scholar]

- Mckibben, W.; Wilcoxenp, P. The Economic and Environmental Effects of Border Tax Adjustments for Climate Policy; Brookings Institution: Washington, DC, USA, 2009. [Google Scholar]

- Huang, J.K.; Xie, W. Future Food Supply and Demand Outlook and Policy Orientation in China. Front. Eng. Manage. Sci. Technol. 2022, 41, 17–25. [Google Scholar]

- Hu, Y.; Zhou, Y.H.; Han, Y.J.; Xu, R.Z. Analysis on Resources and Economic Effects of Reducing Food Waste. China Popul. Recourc. Enviorn. 2013, 23, 150–155. [Google Scholar]

- Walmsley, T.L.; Strutt, A. Trade and Sectoral Impacts of the Financial Crisis: A Dynamic CGE Analysis. In Proceedings of the 13th Annual Conference on Global Economic Analysis, Penang, Malaysia, 4 September 2010. [Google Scholar]

- Li, X.X.; Cai, H.L.; Cai, S.F.; Xie, J.Q. Research on the Future Development Prospect and Potential Impact of RCEP—Based on GTAP Model. Macroecon. Res. 2020, 7, 165–175. [Google Scholar]

- Tirado, M.C.; Clarke, R.; Jaykus, L.A.; McQuatters-Gollop, A.; Frank, J.M. Climate Change and Food Safety: A Review. Food Res. Int. 2010, 43, 1745–1765. [Google Scholar] [CrossRef]

- Liu, T.T.; Wang, L.Q.; Wang, H.; Liu, W.; Wen, C.; Li, N. Atmospheric CO2. Effect of concentration on rice eating quality. Northeast Agr. Sci. 2017, 42, 49–52. [Google Scholar]

- Zeng, Z.Y. Research review on the impact of climate change on rice production. Northeast Agr. Sci. 2021, 46, 89–93. [Google Scholar]

- Wu, H.; Li, Y.D. Research on the dynamic relationship between climate change and China’s food security based on state space model. China Agr. Resour. Zoning 2015, 36, 1–8. [Google Scholar]

- Fu, L.; Qiang, Y.C. World non-tariff barrier situation and China’s strategic choice. Theor. Explor. 2018, 4, 98–106. [Google Scholar]

- Tian, Y.H.; Wang, L.F.; Zhou, Y.P. How China’s non-tariff measures affect the import of goods—An empirical test based on HS—6 products from 1992 to 2012. Int. Econ. Trade Explor. 2021, 37, 20–34. [Google Scholar]

- Bao, X.H.; Zhu, Z.D. Measurement of TBT and its impact on China’s import trade. World Econ. 2006, 7, 3–14. [Google Scholar]

- Bao, X.H.; Qiu, L.D. Do technical barriers to trade promote or restrict trade? evidence from China. Asia Pacific J. Account Econ. 2010, 17, 253–280. [Google Scholar] [CrossRef]

- Dong, Y.G.; Wu, Y.T.; Yao, X.C. Measurement of trade protection level of SPS measures based on tariff equivalence. J. Huazhong Agr. Univ. 2021, 6, 54–64. [Google Scholar]

- Bao, X.H.; Zhu, D.M. Technical barriers to trade and the marginal effect of exports—A test based on industrial trade flow. Economy 2014, 13, 1393–1414. [Google Scholar]

| Regional Settings | Area Included |

|---|---|

| China | Mainland China |

| United States | United States |

| Russia | Russia |

| Canada | Canada |

| Australia | Australia |

| New Zealand | New Zealand |

| EU | France, Germany, Italy, Netherlands, Belgium, Luxembourg, Denmark, Ireland, Greece, Spain, Portugal, Austria, Sweden, Finland, Cyprus, Hungary, Czech Republic, Estonia, Latvia, Lithuania, Malta, Poland, Slovakia, Slovenia, Bulgaria, Romania, Croatia |

| ASEAN | Indonesia, Malaysia, Philippines, Thailand, Singapore, Brunei, Cambodia, Laos, Vietnam |

| Other Countries | Other countries and regions |

| Industrial Sector | Industries Included |

|---|---|

| Food production sector | Rice, wheat, grains and other related products |

| Crop production sector | Oilseeds, sugar, vegetables, fruits, nuts, etc. |

| Meat and milk production sector | Beef, horse and sheep meat, milk, dairy products, meat products and other related products |

| Simulation Scheme | Scenario Setting | Description of Simulation Results |

|---|---|---|

| Production supply | 1. The yield of grain crops decreased by 1%; the yield of cash crops decreased by 1%; the yield of livestock products decreased by 1%. 2. The yield of grain crops decreased by 2%; the yield of cash crops decreased by 2%; the yield of livestock products decreased by 2%. 3. The yield of grain crops decreased by 3%; the yield of cash crops decreased by 3%; the yield of livestock products decreased by 3%. | 1. For each specific scenario, simulate its independent impact on specific indicators. 2. The comprehensive impact of all specific scenarios of each simulation scheme is the total impact of the scheme. 3. The overall impact of the three schemes is the potential value of the project for setting indicators. |

| Industry Sector | 1% Reduction in Production | 2% Reduction in Production | 3% Reduction in Production |

|---|---|---|---|

| Rice | 11.257 | 22.514 | 33.772 |

| Wheat | 8.401 | 16.801 | 25.202 |

| Grain and other related products | 1.586 | 3.172 | 4.758 |

| Oilseeds | 0.318 | 0.635 | 0.953 |

| Sugar | 6.934 | 13.869 | 20.803 |

| Vegetables, fruits, nuts, etc. | 3.578 | 7.157 | 10.735 |

| Beef, horse and lamb | 8.723 | 17.446 | 26.169 |

| Meat products and other related products | 12.280 | 24.559 | 36.839 |

| Milk | 1.957 | 3.914 | 5.871 |

| Dairy products | 10.083 | 20.166 | 30.249 |

| Country | 1% Reduction in Production | 2% Reduction in Production | 3% Reduction in Production |

|---|---|---|---|

| United States | 9.755 | 19.510 | 2.927 |

| Russia | 7.700 | 15.401 | 2.310 |

| Canada | 9.682 | 19.363 | 2.905 |

| Australia | 8.595 | 17.190 | 2.579 |

| New Zealand | 6.693 | 13.385 | 2.008 |

| ASEAN | 6.772 | 13.544 | 2.032 |

| European Union | 7.930 | 15.860 | 2.379 |

| Other Countries | 7.990 | 15.980 | 2.397 |

| 1% Reduction in Production | 2% Reduction in Production | 3% Reduction in Production | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Country | Trade Balance | Benefit Level | Terms of Trade | Trade Balance | Benefit Level | Terms of Trade | Trade Balance | Benefit Level | Terms of Trade |

| China | −45,456.57 | 22,653.69 | 0.28 | −90,913.14 | 45,307.39 | 0.55 | −136,369.83 | 67,961.14 | 0.83 |

| United States | 14,189.89 | −2622.75 | −0.10 | 28,379.78 | −5245.49 | −0.21 | 42,569.70 | −7868.24 | −0.31 |

| Russia | 724.41 | 62.53 | −0.01 | 1448.83 | 125.06 | −0.02 | 2173.24 | 187.59 | −0.02 |

| Canada | 1555.28 | −131.39 | −0.02 | 3110.56 | −262.77 | −0.05 | 4665.84 | −394.16 | −0.07 |

| Australia | 906.33 | −78.14 | −0.05 | 1812.65 | −156.27 | −0.09 | 2718.98 | −234.41 | −0.14 |

| New Zealand | 119.42 | −12.80 | −0.03 | 238.85 | −25.60 | −0.07 | 358.27 | −38.40 | −0.10 |

| ASEAN | 1459.62 | −349.89 | −0.03 | 2919.25 | −699.78 | −0.06 | 4378.87 | −1049.67 | −0.09 |

| European Union | 9558.99 | −1226.37 | −0.02 | 19,117.98 | −2452.74 | −0.05 | 28,676.99 | −3679.12 | −0.07 |

| Industry Sector | Price Increase of 1% | Price Increase of 2% | Price Increase of 3% |

|---|---|---|---|

| Rice | 37.613 | 75.225 | 112.838 |

| Wheat | 29.035 | 58.071 | 87.106 |

| Grain and other related products | 5.569 | 11.137 | 16.706 |

| Oilseeds | 4.332 | 8.664 | 12.996 |

| Sugar | 18.128 | 36.257 | 54.385 |

| Vegetables, fruits, nuts, etc. | 12.296 | 24.591 | 36.887 |

| Beef, horse and lamb | 25.588 | 51.177 | 76.765 |

| Meat products and other related products | 29.453 | 58.906 | 88.359 |

| Milk | 4.310 | 8.619 | 12.929 |

| Dairy products | 26.317 | 52.634 | 78.951 |

| Country | Price Increase of 1% | Price Increase of 2% | Price Increase of 3% |

|---|---|---|---|

| United States | 28.549 | 57.098 | 85.647 |

| Russia | 23.812 | 47.624 | 71.436 |

| Canada | 26.754 | 53.508 | 80.262 |

| Australia | 19.205 | 38.409 | 57.614 |

| New Zealand | 19.845 | 39.690 | 59.535 |

| ASEAN | 22.176 | 44.351 | 66.527 |

| European Union | 27.507 | 55.014 | 82.521 |

| Other Countries | 24.793 | 49.587 | 74.380 |

| Price Increase of 1% | Price Increase of 2% | Price Increase of 3% | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Country | Trade Balance | Benefit Level | Terms of Trade | Trade Balance | Benefit Level | Terms of Trade | Trade Balance | Benefit Level | Terms of Trade |

| China | −1531.83 | −9687.32 | −0.27 | −19,374.63 | −3063.66 | −0.54 | −29,061.96 | −4595.46 | −0.80 |

| United States | −12,057.40 | 8701.70 | −0.08 | 17,403.41 | −24,114.80 | −0.16 | 26,105.16 | −36,172.24 | −0.24 |

| Russia | 1547.78 | 2276.61 | 0.18 | 4553.22 | 3095.55 | 0.36 | 6829.83 | 4643.33 | 0.55 |

| Canada | 2998.45 | −1432.43 | 0.10 | −2864.86 | 5996.90 | 0.19 | −4297.28 | 8995.35 | 0.29 |

| Australia | 953.28 | 1212.70 | 0.28 | 2425.41 | 1906.56 | 0.55 | 3638.12 | 2859.84 | 0.83 |

| New Zealand | 134.54 | 127.02 | 0.09 | 254.05 | 269.08 | 0.18 | 381.07 | 403.62 | 0.27 |

| ASEAN | 2106.75 | −2339.45 | 0.07 | −4678.90 | 4213.50 | 0.15 | −7018.37 | 6320.26 | 0.22 |

| European Union | 3995.35 | −11,895.81 | −0.03 | −23,791.63 | 7990.69 | −0.05 | −35,687.54 | 11,986.11 | −0.08 |

| Other Countries | 1853.07 | 13,036.97 | 0.09 | 26,073.93 | 3706.15 | 0.17 | 39,110.91 | 5559.20 | 0.26 |

| Industry Sector | Non-Tariff Barriers Up 1% | Non-Tariff Barriers Up 2% | Non-Tariff Barriers Up 3% |

|---|---|---|---|

| Rice | 4.909 | 9.819 | 14.728 |

| Wheat | −13.928 | −27.856 | −41.783 |

| Grain and other related products | −9.192 | −18.384 | −27.577 |

| Oilseeds | −7.458 | −14.916 | −22.374 |

| Sugar | −8.408 | −16.817 | −25.225 |

| Vegetables, fruits, nuts, etc. | −3.692 | −7.384 | −11.075 |

| Beef, horse and lamb | −11.670 | −23.341 | −35.011 |

| Meat products and other related products | −4.505 | −9.009 | −13.514 |

| Milk | −1.573 | −3.147 | −4.720 |

| Dairy products | −7.427 | −14.854 | −22.281 |

| Country | Non-Tariff Barriers Up 1% | Non-Tariff Barriers Up 2% | Non-Tariff Barriers Up 3% |

|---|---|---|---|

| United States | −14.014 | −28.028 | −42.042 |

| Russia | 3.773 | 7.546 | 11.319 |

| Canada | −5.180 | −10.359 | −15.539 |

| Australia | 4.409 | 8.819 | 13.228 |

| New Zealand | −6.884 | −13.768 | −20.652 |

| ASEAN | −23.065 | −46.131 | −69.196 |

| European Union | −6.371 | −12.742 | −19.113 |

| Other Countries | −15.613 | −31.226 | −46.839 |

| Non-Tariff Barriers Up 1% | Non-Tariff Barriers Up 2% | Non-Tariff Barriers Up 3% | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Country | Trade Balance | Benefit Level | Terms of Trade | Trade Balance | Benefit Level | Terms of Trade | Trade Balance | Benefit Level | Terms of Trade |

| China | 3129.31 | 883.28 | 0.08 | 6258.62 | 1766.56 | 0.17 | 9387.96 | 2649.84 | 0.25 |

| United States | −11,453.08 | 7954.11 | 0.30 | −22,906.16 | 15,908.22 | 0.59 | −34,359.26 | 23,862.34 | 0.89 |

| Russia | −2358.43 | −3015.76 | −0.61 | −4716.86 | −6031.52 | −1.23 | −7075.29 | −9047.29 | −1.84 |

| Canada | 1044.05 | −1747.15 | −0.33 | 2088.10 | −3494.29 | −0.65 | 3132.15 | −5241.44 | −0.98 |

| Australia | −205.01 | −1631.03 | −0.56 | −410.03 | −3262.06 | −1.11 | −615.05 | −4893.09 | −1.67 |

| New Zealand | −25.40 | 24.10 | 0.06 | −50.80 | 48.20 | 0.12 | −76.19 | 72.30 | 0.17 |

| ASEAN | 2543.57 | 173.92 | 0.02 | 5087.13 | 347.83 | 0.04 | 7630.68 | 521.75 | 0.06 |

| European Union | 13,596.04 | 3169.77 | 0.06 | 27,192.08 | 6339.54 | 0.11 | 40,788.10 | 9509.34 | 0.17 |

| Other Countries | −6271.03 | −5811.27 | −0.07 | −12,542.05 | −11,622.53 | −0.14 | −18,813.06 | −17,433.79 | −0.21 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ding, C.; Xia, Y.; Su, Y.; Li, F.; Xiong, C.; Xu, J. Study on the Impact of Climate Change on China’s Import Trade of Major Agricultural Products and Adaptation Strategies. Int. J. Environ. Res. Public Health 2022, 19, 14374. https://doi.org/10.3390/ijerph192114374

Ding C, Xia Y, Su Y, Li F, Xiong C, Xu J. Study on the Impact of Climate Change on China’s Import Trade of Major Agricultural Products and Adaptation Strategies. International Journal of Environmental Research and Public Health. 2022; 19(21):14374. https://doi.org/10.3390/ijerph192114374

Chicago/Turabian StyleDing, Chenchen, Yong Xia, Yang Su, Feng Li, Changjiang Xiong, and Jingwen Xu. 2022. "Study on the Impact of Climate Change on China’s Import Trade of Major Agricultural Products and Adaptation Strategies" International Journal of Environmental Research and Public Health 19, no. 21: 14374. https://doi.org/10.3390/ijerph192114374

APA StyleDing, C., Xia, Y., Su, Y., Li, F., Xiong, C., & Xu, J. (2022). Study on the Impact of Climate Change on China’s Import Trade of Major Agricultural Products and Adaptation Strategies. International Journal of Environmental Research and Public Health, 19(21), 14374. https://doi.org/10.3390/ijerph192114374