Abstract

Testing predictability is known to be an important issue for the balanced predictive regression model. Some unified testing statistics of desirable properties have been proposed, though their validity depends on a predefined assumption regarding whether or not an intercept term nevertheless exists. In fact, most financial data have endogenous or heteroscedasticity structure, and the existing intercept term test does not perform well in these cases. In this paper, we consider the testing for the intercept of the balanced predictive regression model. An empirical likelihood based testing statistic is developed, and its limit distribution is also derived under some mild conditions. We also provide some simulations and a real application to illustrate its merits in terms of both size and power properties.

Keywords:

balanced predictive regression model; intercept; empirical likelihood; stationary; non-stationary JEL Classification:

C12; C22

1. Introduction

Prediction of some important variables based on the other available predictors is a practice of great interest in many applications in finance and economics. Various predictive regression models have been suggested in the last few decades. Among them, the simplest one is the following linear predictive regression model:

where and are unknown parameters, denotes the response, and the predictor. In practice, may denote the stock return, and may be some financial indicators. , , with all of its roots are fixed and less than one in absolute value. are independent and identically distributed (hereafter i.i.d.) random vectors with zero mean. For the predictor , denotes the intercept term, and is the autoregressive coefficient. It is known that the limit distribution of the least squares estimators of and differs from each other when follows: (i) (stationary), (ii) and for some constant c, (iii) and for some constant c. When , is a unit root AR(1) process.

Predictive regression models are widely used in financial research (see [1,2,3,4,5,6,7,8], and references therein). It is noted that, when the predictor is non-stationary, the response can not be stationary. This is well known in the literature as the unbalanced problem for traditional predictive regression models. Due to the non-stationarity of most financial variables (see [9]), the problem of unbalance often appears in practical applications. To cover this problem, Ref. [10] proposed a balanced predictive regression (BPR) model by adding a difference term of to the conditional function part. In detail, it takes the form as follows:

where , and ’s are unknown parameters needing to be estimated. Compared to the original predictive regression model (1), the existence of ’s in (2) can balance the unmatched problem between and with when is non-stationary.

Similar practices are also considered by [11], which proposes a balanced predictive regression model by adding an additional lag of the predictors to the mean function. Through simple transformation, this model is the same as that considered in this paper when by noting that . Both for predictive regression and BPR models, an importation issue of great interest is to test the predictability, i.e., testing the null hypothesis or or . This issue has received extensive attention in the literature. The conventional method for testing predictability is the so-called t-test. Unfortunately, the standard t-test suffers from the issue of obvious over-rejection or ineffective when predictors have strong persistence. See [12,13] for more details. Note that [14] investigated the estimation of predictive regressions when the explanatory variable is nearly integrated. However, the limiting distributions of these tests depend on which Case of (i)–(iii) the predictor follows. Some unified predictability tests have been developed in the last decade to avoid this problem. Among others, Ref. [15] considered the predictability test for model (1) when macroeconomic data are non-stationary or heavy-tailed. For the BPR model, Ref. [10] extended the method of [15] and proposed a unified predictability test regardless of being stationary, nearly integrated, or unit root.

However, two statistics were developed in [10] to test predictability, which depends on a predefined assumption on whether or not there exists an intercept term . Although both testing statistics are shown to be chi-squared distributed asymptotically under mild conditions, their finite sample performances are quite different from each other because, when there is an intercept, their second testing statistic depends on the idea of data splitting in order to get rid of the effect of the existence of the intercept term . Note that both tests are applicable when the underlying true model has no intercept. We found that the p-values of these two tests are different, which may cause confusion when different p-values are obtained based on the same data set.

Hence, it is necessary to do the predefined test to check whether or not there exists a non-zero intercept in model (2) before conducting a predictability test. This motivates us to consider the current research. We propose an empirical likelihood test based on the idea of data splitting and proved that the asymptotic distribution of the test statistic is distribution, regardless of being stationary or nearly integrated or unit root. The empirical likelihood method was proposed by [16] and proved to have many excellent properties [17], including the distribution of the data that does not need to be assumed. Therefore, this method has been widely studied in the literature [18,19,20]. This also prompted this paper to propose a unified test of interception terms using the empirical likelihood method.

The rest of this article is organized as follows: Section 2 presents the methodologies and the main asymptotic results of our proposed test. Section 3 contains the finite sample simulation studies. An empirical application is discussed in Section 4. The detailed proofs of the main results are presented in Appendix A.

2. Methodology and Main Results

Suppose the random observations are generated from the model (2). The main interest of this paper is to develop a unified test for checking the intercept for model (2), i.e., the following hypothesis

Hereafter, denote as the true value of without confusion.

Since the empirical likelihood method enjoys many desirable properties as discussed in the literature, in the sequel, we are interested in developing a testing method for based on this method. Note that, when , we have

where . Then, following [16], one may construct an empirical likelihood function by using the auxiliary vectors , where

Unfortunately, this test will suffer from the trouble of the quantity not converging in probability as for Case (i), i.e., with and for some constant c, where , . Consequently, the quantity

does not converge in distribution to a chi-squared distributed variable, which in turn results in the related log-empirical likelihood function having a non-standard limit distribution.

As an improvement, although it is possible to construct a new empirical likelihood-based test statistic, which converges in a chi-squared distribution, for relying on the idea of data splitting as did in [21], the main interest of this paper is to test the intercept term, i.e., hypothesis , and we need to handle the redundant parameters by using the profile empirical likelihood method as in [17]. Once again, this profile method still does not work; see Theorem 3 in [21] for a detailed discussion.

This motivates us to consider the following testing procedure. Let , for , where with being the floor function, and

with , and with and , which are independent of the random observations. Through data splitting technology, we use the first half of the data to estimate redundant parameters, and the second half of the data to construct a likelihood function to reduce the challenges posed by noise in the data. To balance the size and the power, in practice, one may take with being the estimated error variance. Note that here is designed in order to let the quantity to vanish when follows the non-stationary Cases (ii). A similar weighting technique has also been used in [22]. which uses the profile empirical likelihood to consider the intercept test of the predictive regression model.

Based on above, a new empirical likelihood function for can be defined as follows:

Since we are only interested in , we further define a profile empirical likelihood function for as

The following theorem shows that Wilks’ theorem holds for the above proposed profile empirical likelihood method, which depends on some regular conditions as follows:

- (C1)

- is a sequence of i.i.d. random vectors with mean zero, and for some arbitrarily small positive constant ;

- (C2)

- The predictive variable , with the initial value of being constant or random variable of order , belongs to one of the persistence classes following Cases (i)–(iii);

- (C3)

- All roots of with respect to x are outside the unit circle.

Theorem 1.

Suppose that Conditions C1–C3 hold. Then, under the null hypothesis , we have that converges in distribution to a chi-squared distributed variable with one degree of freedom as .

Based on the above theorem, we can reject once

at the significance level , where denotes the ()-th quantile of a chi-squared distribution with one degree of freedom. In particular, when one is interested in testing , one may think that there is no intercept in model (2) if at the significance level .

Note that, similar to [23], one may take to construct the test. Here, we however use an another weight in in order to increase the local power of the proposed test for the non-stationary cases. The following theorem states the power property of our proposed empirical likelihood-based test.

Theorem 2.

Suppose the same conditions of Theorem 1 hold. Then, we have asthat:

- For Case (i), under the local alternative hypothesis for some constant ,where ‘’ denotes the convergence in distribution, and a non-central chi-squared distributed variable with non-central parameter , where is the second component of with , and

- For Case (ii), under the local alternative hypothesis for some constant ,where sgn denotes the sign function, ξ a standard normally distributed variable, which is independent of , and with being a Gaussian process with covariance function ;

- ForCase (iii), under the local alternative hypothesis for some constant ,where .

Theorem 2 indicates that the local power of the proposed test for Cases (ii) and (iii) is of order , which does not achieve the normally parametric order but is better than for any .

Remark 1.

Although we only consider in Theorems 1 and 2 the case that is a sequence of i.i.d. errors, it is possible to obtain similar results when follows a dependent process. In fact, when follows the AR(q) process, one can obtain similar limits as in Theorems 1 and 2 by taking into account the AR structure of .

Remark 2.

When follows a strictly stationary GARCH process or a linear process, Theorems 1 and 2 still hold.

3. Simulation Results

In this section, we investigate the finite sample performance of the proposed profile empirical likelihood test using simulated data sets and compare it with the traditional t-test. The random observations are generated from the predictive regression model (2), where , . indicates that the model has no intercept item and intercept item, respectively. , where 0.5 indicates that is a stationary process, 1 indicates a unit root process, and indicates a near unit root process. The innovations were considered in two cases.

Case (i): are from a bivariate Gaussian Copula , whose marginal distribution is a Student’s t-distribution with degrees of freedom . The dependence parameter is set to be {−0.2, −0.4, −0.6}, respectively, to explore the performance of two innovations under different degrees of dependence.

Case (ii): are from GARCH(1,1) structure, i.e.,

where . and are generated similarly to in Case (i). All simulating results are repeatedly carried 10,000 times with the sample size n ranging from 200 to 1200.

Table 1 reports the size performance of the proposed method with different settings in Case (i) under the significance level . For , the results show that, when is a stationary or unit root process, regardless of whether is 0 or not, with the increase of sample n, size values are closer to , and the performance of the method is robust under different . However, when is a near unit root process, it can be found that, when n is small, the method has the performance of oversize, especially when , and as n increases, it gradually converges to the significance level. For the t-test when is a stable process, the t-test has a good size performance, and its performance is relatively stable even with high dependency. However, when is a unit root or near unit root process, it gradually shows over-rejecting with the increase of , no matter whether there is an intercept or not. The behaves similarly to . Table 2 reports the size performance in Case (ii), in which the innovation of has a GARCH structure. The results show that the performances of the profile empirical likelihood and t-test are similar to that in Case (i).

Table 1.

The size performance of under Case (i) and .

Table 2.

The size performance of under Case (ii) and .

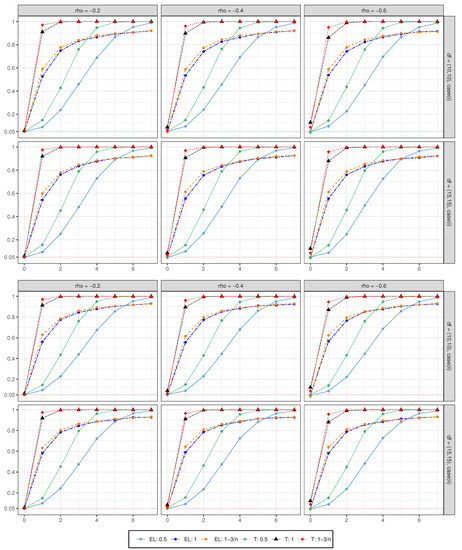

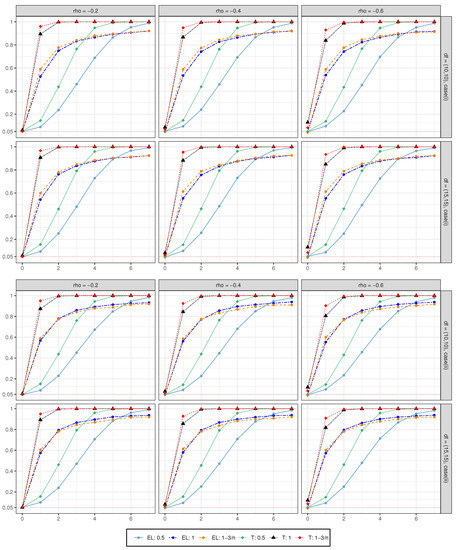

We also generate data with (stationary) or (unit root or near the unit root), , and other parameters are set the same as Case (i) and Case (ii), in order to investigate the power performance of the proposed method. The results are shown in Figure 1 () and Figure 2 (). Here, we only show the case where . The abscissa represents the constant value, and the ordinate is the power value. Different colors represent different processes of and tests. We can see that, under all settings, Figure 1 and Figure 2 show the same performance. Firstly, as the value of increases, the power converges quickly to 1. Secondly, when is a near unit root, the convergence rate is better than the unit root, and the unit root is better than the stationary. Last but not least, when , it can be seen that the value of the t-test is significantly higher than the significance level of 0.05 under all settings. This also indicates the poor size performance of the t-test, even though it has a good convergence rate in power performance.

Figure 1.

The power performance with .

Figure 2.

The power performance with .

In summary, the proposed method has good size and power performance when checking whether intercept exists and also has good robustness for different innovative distributions. The traditional t-test shows over-reject, which makes it easy to misjudge in real data analysis; therefore, the profile empirical likelihood method proposed in this paper is more recommended when real data are endogenous.

4. A Real Data Application

In this section, we illustrate our testing method on U.S. equity data, which has been explored by numerous scholars, such as [10,12,24], etc. We collected the data coming from the Center for Research in Security Prices (CRSP), and the sample period is January 1952 to December 2015 with monthly data (). Among them, the value-weighted excess returns of the S&P 500 index are used as the predicted variable , and the other 10 financial variables are dividend–price ratio, dividend yield, earnings–price ratio, dividend payout ratio, book-to-market value ratio, T-bill rate, default yield spread, long-term yield, term spread, and net equity expansion, which are used as predicting variables, respectively.

We know that predictability is one of the critical concerns in various fields, including finance, climatology, tourism, sociology, and so on (see, e.g., [25,26,27]). However, as [10] shows, a small intercept can change the predictability dramatically when the predicting variable is nearly integrated. Hence, the intercept term test is an important pre-test before the statistical inference. On the other hand, Refs. [12,28] showed that the innovation of financial data generally contains endogeneity, which will bring bias to relevant estimates. Therefore, it is undoubtedly very vital to obtain a unified test for the intercept test, no matter whether the predictive variables are stationary, nearly integrated, unit root, or innovation have endogeneity.

Firstly, we use the function in the R package to test the stationarity of each predictor variable. Then, the least square estimation was used to fit the model (2), in which is estimated based on the , in order to make uncorrelated. In addition, the correlation coefficient between and was tested. Before performing our test, the function was also used to test whether has a GARCH structure. Finally, the method proposed in this paper is used to test . Table 3 reports all the results for each predictor variable. The first column is the predictive variables. The second column is the estimators of intercept terms, and the third column is the estimators of the autoregressive coefficient of predictive variables. The fourth column is the p-values of the ADF test. The fifth column is the correlation coefficient between the two innovations and . The sixth column is the p-values of the GARCH test of sequence. The last two columns are the p-values of the test proposed in this paper and the traditional t-test.

Table 3.

Test results of 10 financial variables.

From Table 3, we can see that the of all variables are very close to 1, and the shows that only T-bill rate and long-term yield do not reject the null hypothesis of unit root, indicating that these variables are non-stationary. The results of the correlation coefficient show that and have different degrees of correlation under different predictive variables, and we have also carried out corresponding settings in the simulation. In addition, the results of the test show that under all predictor variables has a significant ARCH effect. The of ten variables obtained by the least square estimation are close to 0. The t-test showed that the intercept of Book-to-market, Default yield spread, and Term spread are 0. However, the results of the EL test are quite different from t-test, which shows that only the intercept of the Dividend payout ratio is not 0.

Overall, the t-test rejected the original hypothesis of alpha = 0 under most variables, which is consistent with the performance in the simulation. Notice that Ref. [12] mentioned that the t-test does not perform well when the predictor variable is persistent and its innovations are highly correlated. Furthermore, all the variables have a GARCH structure, which also will affect the t-test. In addition, Table 1 in [29] indicates the size distortion of the t-test for plausible parameter values. Hence, we recommend the EL test proposed in this paper over the traditional test.

5. Conclusions

Predictability testing is a common problem in the analysis of real data such as in the economic and financial fields. However, the validity of most existing tests depends on the assumption that the intercept term of the model exists. Therefore, the intercept term test is an important pre-test in practical application. However, it is worth noting that heteroscedasticity and endogeneity are common characteristics of financial data, which makes the existing intercept term test not perform well. In this paper, we develop a unified intercept test based on the empirical likelihood method under the balanced prediction regression model. The asymptotic distribution of the EL test is proved to be chi-squared, and the local power under stationary and non-stationary conditions is also proved. Simulation results verify the unified and effectiveness of the test and are superior to the t-test. Furthermore, in the empirical application, we performed an intercept term test on U.S. equity data. The results showed that the t-test rejected the null hypothesis in most variables, but the EL test shows the opposite. The relevant performance is consistent with the simulation. Therefore, when considering the intercept term test of financial data, the EL test is recommended.

Author Contributions

Conceptualization, X.L.; data curation, Y.F.; methodology, X.L.; investigation, Y.F.; writing—original draft preparation, Y.F., Q.W.; writing—review and editing, X.L., Y.F., Q.W., L.P.; visualization, Q.W.; supervision, L.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by NNSF of China grant numbers (11971208, 11601197), NSSF of China grant number (21BTJ035), National Major Social Science Project of China grant number (21&ZD152), the 17th student research project of Jiangxi University of Finance and Economics grant number (20220929165358818).

Institutional Review Board Statement

Not applicable.

Data Availability Statement

The data used in applications can be found in the Center for Research in Security Prices.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Detailed Proofs of the Main Results

In this appendix, we provide detailed proofs for the main results presented in Section 2. Before proceeding further, we specify some useful lemmas as follows:

Lemma A1.

Under the same conditions of Theorem 1, we have as that:

- (a)

- ,

- (b)

- holds uniformly for ,

- (c)

- holds uniformly for ,

where for some constant , and correspond toCases (i)–(iii), respectively.

Proof of Lemma A1.

In the sequel, we only prove Case (ii), as the rest of the cases can be proved similarly. We first prove Part (a). Note that, by [30], we have for any that

for Case (ii) as , where ‘’ stands for the convergence in space, and is the space of real-valued functions on the interval that are right continuous and have finite left limits. Since

we need only to check the upper bound for each component .

For the first component, rewrite . Trivially, based on Conditions C1–C2, we have . Next, using (A1), it is easy to check for any that

which implies , and in turn uniformly for . Using this, by , we have as that

and hence

uniformly for . This shows

Similarly, we can show that , for . This shows Part (a).

For Part (b), note that

where , and , . Then, by using a similar proof to that of Part (a), we have

uniformly for as .

The proof of Part (c) is similar to that of Part (b) based on (A2). We omit the details. This completes the proof of Lemma A1. □

Lemma A2.

Under the same conditions of Theorem 1, we have as that:

- (a)

- , and

- (b)

- ,

where ‘’ denotes the convergence in probability. ForCase (i), Σ is specified in Theorem 2, andCases (ii) and(iii),

Note that for Case (ii).

Proof of Lemma A2.

We only prove Part (a), as Part (b) follows a similar fashion. Put

Denote as the sigma field generated by . Then, it is easy to check that is a Martingale difference array with respect to the filtration .

For Case (i), noting that is stationary, the normality of follows immediately under Conditions C1–C3 by the center limit theory for Martingale differences of [31] and the Cramér–Wold device.

For Case (ii), trivially, we have

Next, note that , which results in as . Hence,

which implies .

For , by using a similar proof to [30], we have

and, for arbitrarily small ,

Based on this and (A3), a simple application of the center limit theory for Martingale differences of [31] leads to the fact that, as ,

By noting that is independent of the random observations, we can show that

for . Similar to (A3), it is easy to check that

for as . Hence, Part (a) follows immediately by using the Cramér–Wold device. This completes the proof of this lemma. □

Proof of Theorem 1.

We only prove Case (ii) as Cases (i) and (iii) are similar. For convenience, denote

with being the solution to with respect to for fixed .

The following proof is similar to that of Theorem 1 in [32]. Let with . Then, similar to [33], we have , by using the Lagrange multipliers method. Note that

Then, by Lemmas 1 and 2, we have

uniformly for . Hence,

uniformly for by noting that is positive definite. This, together with Part (a) of Lemma A1, shows

uniformly for . In turn,

where denotes the maximum eigenvalue of .

Next, by Lemma 1, we have

uniformly for . Then, we have

uniformly for as .

As did in the proof of Theorem 1 in [32], we can show by the Taylor expansion that

where , based on (A4) and Lemmas 1 and 2. Using this, we have that the minimizer of must lie in . Next, for any , write with and for some constant C given in . Then, by (A2), a similar proof to that of Part (a) in Lemma (A1) leads to the fact that

where , , are defined in (A2). Hence, we have

uniformly for . Then, the minimizer of satisfies

Using this, we further have

based on Lemmas 1 and 2 as . This completes the proof of this Theorem. □

Proof of Theorem 2.

We only show Case (i) as the other two cases can be proved in a similar fashion. Under the local alternative hypothesis , we have

where . Then, it is easy to show as that

and

Based on the quantities and given in (A6) and (A7), respectively, the rest of the proof is similar to that of Lemmas 1 and 2 and Theorem 1. We omit the details. □

References

- Amihud, Y. Illiquidity and stock returns cross-section and time-series effects. J. Financ. Mark. 2002, 5, 31–56. [Google Scholar] [CrossRef]

- Baker, M.; Stein, J.C. Market liquidity as a sentiment indicator. J. Financ. Mark. 2004, 7, 271–299. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Shiller, R.J. The dividend-price ratio and expectations of future dividends and discount factors. Rev. Financ. Stud. 1988, 1, 195–228. [Google Scholar] [CrossRef]

- Kaul, G. Predictable components in stock returns. Handb. Stat. 1996, 14, 269–296. [Google Scholar]

- Keim, D.B.; Stambaugh, R.F. Predicting returns in the stock and bond markets. J. Financ. Econ. 1986, 17, 357–390. [Google Scholar] [CrossRef]

- Lewellen, J. Predicting returns with financial ratios. J. Financ. Econ. 2004, 74, 209–235. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Business conditions and expected returns on stocks and bonds. J. Financ. Econ. 1989, 25, 23–49. [Google Scholar] [CrossRef]

- Zhu, F.; Liu, M.; Ling, S.; Cai, Z. Testing for structural change of predictive regression model to threshold predictive regression model. J. Bus. Econ. Stat. 2022. [Google Scholar] [CrossRef]

- Cai, Z.; Jing, B.; Kong, X.; Liu, Z. Nonparametric regression with nearly integrated regressors under long-run dependence. Econom. J. 2017, 20, 118–138. [Google Scholar] [CrossRef]

- Liu, X.; Yang, B.; Cai, Z.; Peng, L. A unified test for predictability of asset returns regardless of properties of predicting variables. J. Econom. 2019, 208, 141–159. [Google Scholar] [CrossRef]

- Ren, Y.; Tu, Y.; Yi, Y. Balanced predictive regressions. J. Empir. Financ. 2019, 54, 118–142. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Yogo, M. Efficient tests of stock return predictability. J. Financ. Econ. 2006, 81, 27–60. [Google Scholar] [CrossRef]

- Lanne, M. Testing the predictability of stock returns. Rev. Econ. Stat. 2002, 84, 407–415. [Google Scholar] [CrossRef]

- Torous, W.; Valkanov, R.; Yan, S. On predicting stock returns with nearly integrated explanatory variables. J. Bus. 2004, 77, 937–966. [Google Scholar] [CrossRef]

- Zhu, F.; Cai, Z.; Peng, L. Predictive regressions for macroeconomic data. Ann. Appl. Stat. 2014, 8, 577–594. [Google Scholar] [CrossRef]

- Owen, A.B. Empirical likelihood ratio confidence intervals for a single functional. Biometrika 1988, 75, 237–249. [Google Scholar] [CrossRef]

- Qin, J.; Lawless, J. Empirical likelihood and general estimating equations. Ann. Stat. 1994, 22, 300–325. [Google Scholar] [CrossRef]

- Chen, S.X.; Peng, L.; Qin, Y.L. Effects of data dimension on empirical likelihood. Biometrika 2009, 96, 711–722. [Google Scholar] [CrossRef]

- Chen, S.X.; Van Keilegom, I. A review on empirical likelihood methods for regression. Test 2009, 18, 415–447. [Google Scholar] [CrossRef]

- Kitamura, Y. Empirical likelihood methods with weakly dependent processes. Ann. Stat. 1997, 25, 2084–2102. [Google Scholar] [CrossRef]

- Liu, X.; Liu, Y.; Lu, F. Empirical likelihood-based unified confidence region for a predictive regression model. Commun. Stat.-Simul. Comput. 2022, 51, 2122–2139. [Google Scholar] [CrossRef]

- Liu, X.; Liu, Y.; Rao, Y.; Lu, F. A Unified test for the Intercept of a Predictive Regression Model. Oxf. Bull. Econ. Stat. 2021, 83, 571–588. [Google Scholar] [CrossRef]

- Li, C.; Li, D.; Peng, L. Uniform test for predictive regression with AR errors. J. Bus. Econ. Stat. 2017, 35, 29–39. [Google Scholar] [CrossRef]

- Kostakis, A.; Magdalinos, T.; Stamatogiannis, M.P. Robust econometric inference for stock return predictability. Rev. Financ. Stud. 2015, 28, 1506–1553. [Google Scholar] [CrossRef]

- Klaussner, C.; Vogel, C. Temporal predictive regression models for linguistic style analysis. J. Lang. Model. 2018, 6, 175–222. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Timmermann, A. Predictability of stock returns: Robustness and economic significance. J. Financ. 1995, 50, 1201–1228. [Google Scholar] [CrossRef]

- Ashby, S.A.; Taylor, M.A.; Chen, A.A. Statistical models for predicting rainfall in the Caribbean. Theor. Appl. Climatol. 2005, 82, 65–80. [Google Scholar] [CrossRef]

- Cai, Z.W.; Wang, Y.F. Testing predictive regression models with non-stationary regressors. J. Econom. 2014, 178, 4–14. [Google Scholar] [CrossRef]

- Elliott, G.; Stock, J.H. Inference in time series regression when the order of integration of a regressor is unknown. Econom. Theory 1994, 10, 672–700. [Google Scholar] [CrossRef]

- Phillips, P.C.B. Towards a unified asymptotic theory for autoregression. Biometrika 1987, 74, 535–547. [Google Scholar] [CrossRef]

- Hall, P.; Heyde, C.C. Martingale Limit Theory and Its Application; Academic Press: Boca Raton, FL, USA, 2014. [Google Scholar]

- Ma, Y.; Zhou, M.; Peng, L.; Zhang, R. Test for zero median of errors in an arma–garch model. Econom. Theory 2022, 38, 536–561. [Google Scholar] [CrossRef]

- Owen, A.B. Empirical Likelihood; Chapman and Hall/CRC: Boca Raton, FL, USA, 2001. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).