Abstract

Assessment of welfare effects of macroprudential policy seems the most important application of the Dynamic Stochastic General Equilibrium (DSGE) framework of macro-modelling. In particular, the DSGE-3D model, with three layers of default (3D), was developed and used by the European Systemic Risk Board and European Central Bank as a reference tool to formally model the financial cycle as well as to analyze effects of macroprudential policies. Despite the extreme importance of incorporating financial constraints in Real Business Cycle (RBC) models, the resulting DSGE-3D construct still embraces the representative agent idea, making serious analyses of diversity of economic entities impossible. In this paper, we present an alternative to DSGE modelling that seriously departs from the assumption of the representativeness of agents. Within an Agent Based Modelling (ABM) framework, we build an environment suitable for performing counterfactual simulations of the impact of macroprudential policy on the economy, financial system and society. We contribute to the existing literature by presenting an ABM model with broad insight into heterogeneity of agents. We show the stabilizing effects of macroprudential policies in the case of economic or financial distress.

1. Introduction

The new setting of financial supervision tailored after the global financial crisis of 2008–2009 has highlighted the need for research on the nature and measurement of risk in the financial system, also called systemic risk [1,2,3,4]. In response to the problems that occurred during the global financial crisis, the Basel III regulatory framework for financial institutions was adopted in 2010–2011. In the updated version of the Basel document the capital and liquidity requirements were established. In addition, the methods of conducting stress tests in the financial system have been subject to revision. Basel III was designed to strengthen the effects of banks’ capital requirements by increasing the liquidity of the banking sector and reducing leverage undertaken by banks. In the European Union (EU), the implementing act of the Basel Agreements has been issued in the form of a new legislative package covering CRD IV/CRR (i.e., CRD IV Directive No. 2013/36/EU on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms and CRR Regulation No. 575/2013 on prudential requirements for credit institutions and investment firms).

The literature on selected macroprudential policy tools [5,6] presented in Basel II and III has been mainly focused on theoretical and empirical research on linkages between real sector and the financial system. According to International Monetary Fund, Financial Stability Board and Bank for International Settlements (IMF-FSB-BIS) [7], the assessment of the effectiveness of macroprudential policies includes: the assessment of the extent to which the macroprudential instrument increases the resilience of the macro-financial system; and the assessment of the extent to which the macroprudential instrument has impact on credit dynamics and asset prices (the impact on the cycle). The adoption of the new institutional framework for macroprudential supervision in the EU Member States took place in most countries during last three years. Therefore, the results of empirical studies on the effectiveness of macroprudential instruments are biased by substantial uncertainty. Alternatively one may carry out counterfactual analyses on the impact of a combination of macroprudential instruments on a stylised economy using the following simulation methods: dynamic stochastic general equilibrium models (DSGE) or non-equilibrium models (e.g., ABMs) [8]. Although from the presentation of ABM models in opposition to DSGE models, the conclusion can be drawn that the DSGE models are always less useful, it is important to remember that DSGE models are an extremely important tool used mainly in central banking. A defence of the legitimacy of using DSGE models even after the financial crisis can be found in Christiano et al. [9].

Analyses of the impact of macroprudential policies on the financial system and the real part of the economy have been primarily focused on capital requirements [10,11,12,13], countercyclical capital buffer [14,15,16,17] and leverage [18]. In the literature, we can also observe successive attempts to incorporate stylised macroeconomic and macroprudential policies in the form of financial frictions into Dynamic Stochastic General Equilibrium (DSGE) models [19,20,21,22,23,24,25]. The main goal of these attempts was to examine the effects of monetary policy or the general equilibrium welfare effects of capital requirements and leverage. Despite the role these studies played in formulating theoretical background to design of macroprudential policy, the assumptions of DSGE models are subject to critique [26,27]. DSGE models share the assumption of a perfectly rational representative agent that dynamically optimizes the use of resources. Failure to take into account the heterogeneity of agents in most DSGE models is particularly acute from the perspective of social welfare analysis performed within an equilibrium environment [28].

Both empirical and theoretical studies on the effects of the Basel III have led to the formulation of criticisms of the adopted regulatory framework. In particular, some researchers highlighted insufficient risk and uncertainty sensitivity of macroprudential tools, over-reliance on external rating regulations, improper tool calibration and lack of synchronization of adopted rules at institutional and national level. EU expert groups are still working to incorporate changes within these areas into the Basel IV framework. New research tools are required to examine the impact of regulatory changes on the economy, financial sector and society. The new setting should allow greater flexibility in modelling of risk-taking, risk aversion and decision-making under uncertainty. Consequently assumptions of macromodels should be more realistic to allow for a study of changes in welfare in heterogeneous economy beyond the social planner framework.

The aim of this paper is to analyse the impact of selected macroprudential policy tools on the economic and financial system using agent-based modelling (ABM). Modelling of interactions between agents within the ABM approach was confronted with the DSGE model with three layers of default (‘3D’) [21], which is currently used by experts within the European Systemic Risk Board (ESRB) and European Central Bank (ECB).

This paper contributes to the existing literature of agent-based modelling through detailed and relatively broad insight into heterogeneity of agents. In the approach taken, decision-making rules, preferences and behaviours may vary across units. In our model, all agents, ie banks, individuals, households, consumers, firms, establishments, industries, suppliers, properties, are heterogenous.

We conducted extended simulation experiments that were based on an ABM model that had been calibrated to reflect the features of a small open economy. Our choice was Poland as an exemplar case. The reason for calibrating the model relying on Polish data is that among the EU countries, the Polish economy is relatively small, open and strongly connected to the rest of the European Union countries. Moreover, the Polish banking system still remains strongly influenced by investors from the European Union, who treat Poland as a host country. Generally, the smaller Central and Eastern European (CEE) countries that host foreign financial institutions are exposed to various dimensions of systemic risks more strongly. At the same time, the degree of the development of financial intermediation is relatively low, which results in a rather weak credit channel, especially in the case of investments. Although the financial system in Poland generates limited systemic risk, it is more vulnerable to regulatory arbitrage and the propagation of the shocks that are caused by the activity of international financial groups.

Consequently, the CEE economies and other emerging economies may need to conduct a more active macroprudential policy because of the higher risks that stem from volatile capital flows or credit booms and so forth. These issues also relate to the Polish economy and its financial system. Hence, both the ABM model and the simulations presented in our paper are valuable for gaining a detailed insight into the effects of macroprudential policy, especially in the case of small emerging open economies.

In order to study the macroeconomic effects of macroprudential instruments and their interaction with monetary policy in the case of a hypothetical small open economy, Aoki et al. [29] applied a DSGE framework. The analysed model captured some critical features of the emerging market economies with macroprudential instruments that were defined as the capital requirements that were imposed on banks and a tax on foreign currency (FX) lending. However, there are some relevant aspects that were not taken into consideration in the Aoki et al. [29] model. For example, the possibility of the government or central bank intervening in the foreign exchange markets through the use of official foreign reserves is not discussed. Moreover, what is missing in the model is a more flexible specification of international capital flows (no equity flows or foreign direct investment) and the role of cross border gross flows, which could play a destabilizing role for financial stability. The ABM construct that is presented in our paper and the simulation study seem to be a step forward in addressing some of these issues but in particular in relaxing the assumption of the homogeneity of the economic units that interact in a system.

2. Comparison of the ABM and DSGE-3D Model

The use of DSGE models historically has been primarily focused on the analysis of technological changes and their impact on the real economy [30,31] as well as the impact of monetary policy on the business cycle [32,33]. The first DSGE models with financial frictions were not used for impact studies of macroprudential policies on the macro-financial system and social welfare. The research has been mainly focused on the formal explanation of the financial accelerator hypothesis [34,35] and the role of the net worth channel in credit supply [23,36]. In a few models, the impact of LTV changes and capital requirements on the economy was analysed explicitly [25].

After the global financial crisis, interest in systemic risk assessment and macroprudential policies increased [37,38,39]. Currently, one of the most important examples showing the use of DSGE models in research on macroprudential policies is the DSGE model with 3 layers of default (‘3D’ model) [21] developed in ECB. The main goal of the ‘3D’ model was to create a framework for analysing positive and normative macroprudential policies. This model enables to set the optimal levels of capital requirements as well as to analyse welfare within the social planner framework. However, heterogeneity of agents within the model which seems more realistic would change the optimal values for capital requirements and would make the welfare analyses more meaningful.

The paper includes a comment on the ‘3D’ model, due to its similarity to the prepared heterogeneous agent-based simulation. In both cases, the behaviour and decisions of major market players are taken into account. The insolvency of individuals (households), companies and banks describe formally sources of systemic risk. In the ‘3D’ model and in the ABM model, stability of the financial sector is related to the default of agents. Nonetheless, the method of modelling agent’s decisions differs between both approaches. More importantly definition of the insolvency also differs. In the ‘3D’ model, individuals can deposit funds in banks and take loans for the purchase of real estate; entrepreneurs borrow from banks to accumulate capital. Business insolvency is associated with the occurrence of idiosyncratic and aggregate shocks. In the ABM model, the insolvency of agents is tied to internal market dynamics, driven by business and financial factors mainly the supply and investment finance policies of the banks and the demographic factors. The external shocks can be taken into account in the analyses but their significance is smaller than in the DSGE approach.

The ‘3D’ model has been a novelty in the DSGE literature. Traditionally, in the DSGE models, due to appropriately formulated contracts, insolvency at steady state was impossible. Risk of insolvency itself was fully hedged in the model [35]. In a ‘3D’ model, a borrower’s insolvency implies changes in the lender’s balance, which in turn affects his or her optimal behaviour in the market. Moreover, the bank’s insolvency also entails costs to individuals and businesses, in spite of deposit insurance, which in turn strengthens the impact of bank insolvency.

In both approaches, the entire chain of interconnections between agents is formally modelled. Households save and deposit their funds in banks, while other households and companies borrow funds from the same banks. The ABM model departs from the stylised division into two dynasties: savers and borrowers. In an agent-based simulation, each household is made up of individuals with their own heterogeneous profiles in terms of savings, income, spending or additional financing. The way households make decisions depends on the interaction of an individual with family members and other agents in the model. In this way it is possible to trace the way of transferring the risk of insolvency between sectors. However, the transmission of default risk between sectors in DSGE models is accomplished by further optimisation of resources by a representative agent assuming appropriate restrictions and rational expectations. In the ABM model, insolvency transmission is accomplished not only through actual economic and balance-sheet relations and constraints but also the perception of risk and uncertainty of heterogeneous agents in the system [40,41,42]. DelliGatti [41] binds DSGE models with the financial accelerator hypothesis, while ABM models utilise the instability hypothesis of H. Minsky, which take into account not only the financial accelerator hypothesis but also Knightian uncertainty [43]. Additionally, the ABM model presented includes not only the transmission of risk of insolvency between the agents but also between industries.

In the ‘3D’ model the attention is drawn to two types of distortions, which drive banks to excessive use of leverage and significant exposure to risk. They also explain the need for macroprudential policy. The first is related to the existence of deposit insurance agency. Banks run increased risk at the expense of an external agency, leading to higher credit supply and increased demand for deposits. The second distortion is related to the fact that the insolvency is expensive, not only for the lender but also for the borrowers. Occurrence of costly state verification [19] leads to lower demand for credit. The net effect of the two market distortions may be different for each sector. Consequently, the supply of credit for each sector may be lower or greater than the level that maximises the welfare of society.

According to the logic of the ‘3D’ model, in a steady state, when the probability of bank insolvency is high, the risk premium is raised. We assume in the ‘3D’ model that the risk premium is for the whole system and not for a given bank; therefore, banks are willing to take a higher risk because their funding cost is the result of decisions made by all participants within the market. These results seem obvious and a natural conclusion of homogeneity of individuals particularly banks. In the ‘3D’ model, we assume a certain probability of bank default, which is characteristic of the state of equilibrium that we analyse. In financial markets, the decisions of a bank depend on its perception of counterparty risk and estimation of the way a bank is assessed by other units (the >>perception of perception<< of uncertainty). One of the dimensions of the heterogeneity of agents is related to differences in perception of reality, inter alia the perception of counterparty risk, overall uncertainty in the market and the state of the economy. Those elements are clearly omitted in the aforementioned DSGE ‘3D’ model. General frameworks built upon an idea of equilibrium make it impossible to generalise existing DSGE models regarding the aforementioned issues. Also, assumption that a particular individual’s decision may or may not lead to achieving equilibrium seems more realistic. The ABM approach helps overcome these drawbacks. Analyses conducted only within the state of general equilibrium are departed from and the field of interest of non-equilibrium theories and the instability hypothesis is entered [44,45]. The ABM approach is therefore a step towards overcoming the DSGE modelling imperfections indicated by many authors [46,47]. According to empirical literature, the response of systems to the occurrence of shocks may be nonlinear and the financial system itself may be unstable. In addition, shock effects exhibit asymmetric nature. By design, mainly due to the use of log-linearisation, DSGE models are not able to accommodate non-linearity.

DSGE models with financial frictions [19,48], including the ‘3D’ model, refer to the hypothesis of the financial accelerator system. At the same time, the system is characterised by market failures, including the asymmetric information and externalities. A number of researchers highlight the presence of pecuniary externalities [49,50,51]. Pecuniary externalities complement technological externalities and aggregate demand externalities [52]. After the recent financial crisis, one may observe an increased interest in explaining the impact of pecuniary externalities on the system and social welfare. Pecuniary externalities are incorporated mainly into the models by means of credit restrictions. An example of pecuniary externality may be the lack of internalisation of effects of investment decisions in housing and capital prices, which in turn affects the required collateral. In the ‘3D’ model the level of leverage of households and firms is affected endogenously by prices, including real estate prices. At the same time, the direction and size of the impact of pecuniary externalities on allocation of resources are difficult to estimate using the ‘3D’ model.

In agent-based models, it is possible to go one step further to include the premises of instability hypothesis in the analysis. The instability hypothesis is closely tied to financial accelerator hypothesis and it can assume existence of pecuniary externalities. Nonetheless, it goes far beyond it. DelliGatti [41] distinguishes two ways of presenting Minsky’s hypothesis. The first does not refer explicitly to the heterogeneity of agents, and the second assumes the existence of three types of agents; hedging, speculative and Ponzi agents. According to the first explanation, the level of investment in the economy depends on the volume of internal finance and the difference between the market price of assets and the price of the final good. The market price of assets depends on long-term profit expectations. Final good price depends on the expected demand for that good. In the absence of heterogeneity of agents, the representative agent’s investment level decisions are a function of internal financing, which in principle is consistent with the financial accelerator hypothesis. In practice, investment decisions are also made according to how the agents perceive risk. Hence, according to Delli Gatti, in order to fully understand the Minsky’s hypothesis, we need to distinguish between three types of agents that have different attitudes towards external financing.

During the economic boom period, both the borrower and lender expect future cash flows to increase at a pace that will allow the borrower to repay their obligations. As the expectations develop, asset and product prices increase, stimulating investment growth. As a result, production, profits and employment in the economy increase. Banks increase the supply of credit, often requiring lower collateral. Companies are less cautious when they borrow money. Consequently, the proportion of speculative and Ponzi agents increase and the financial system resilience decreases. If the level of debt in relation to its service is perceived as too high on aggregate, the number of insolvency announcements in the system increases, leading to an eventual financial crisis.

Both the ‘3D’ model and the ABM simulation are examples of stochastic dynamic systems that describe the evolution of basic components of the economy. However, while in the ‘3D’ model the economic agents are homogeneous, fully rational and dynamically optimising, in the ABM simulation model, the agents are fully heterogeneous, bounded rational and they perform heuristic optimisation [53,54,55,56].

In order to include the conclusions of the Minsky’s hypothesis in analyses, heterogeneity of agents was included in the agent-based simulation. The heterogeneity of the economy is understood here, however, more broadly than the differentiation of attitudes towards external financing. It is understood as a differentiation of states, behaviour rules and expectations; this implies heterogeneous distributions of variables ex ante and ex post.

Both groups of researchers, working on the DSGE models and ABM models respectively have recognised the need to consider heterogeneity of the economy in order to analyse the optimality of policies as well as welfare implications. The heterogeneity of agents in the ABM approach is, however, understood differently than in DSGE models with heterogeneous agents [57,58,59]. In the DSGE models with heterogeneous agents, the discontinuation of the assumption of a representative agent is made primarily by allowing for idiosyncratic shocks and by removing the assumption of completeness of asset markets. In particular, such a definition of heterogeneity requires the redefinition of basic model and analyses elements, including the definition of steady state and equilibrium [58]. States of the economy are generally considered to be the realisation of a complex stochastic process with approximate properties to the Markov processes. Therefore, in such models, stationary equilibrium is considered, within which the stationary (ergodic) distribution exists. Within these model types, decision functions and price process realisations are approximated numerically. Some of these techniques were also adopted in the ABM approach [60,61,62].

The heterogeneity of agents in ABM is understood differently. This could be due to differentiation of attributes and states, differentiation of decision rules [63,64], attitudes towards risks or expectations [65,66,67]. In most ABM models with heterogeneous expectations, agents typically have adaptive expectations, as opposed to the rational expectations of representative agent within the DSGE approach. All these dimensions of heterogeneity appear in the simulation presented in the next section. Among others, the empirical distributions of basic economic categories such as income, expenses or credits were used to calibrate the states and the decision functions and procedures were selected after conducting the empirical research on the patterns of consumption and production on the market. The adaptive expectations were imposed as well on simulation design. A key difference between the presented simulation and other agent-based models is inclusion of varied attitudes towards risk and uncertainty in Knight’s sense and the risk sensitivities.

The final distinguishing element of the ABM approach is the possibility to introduce more realistic assumptions in the model than in the DSGE approach. Good examples are the assumption of visibility and satiation. This visibility means that agent decisions take into account not only purely economic conditions and factors, such as the price of the product but also the proximity of the supplier in a spatial sense. In the case of analysis of financial system, the idea of visibility has an additional dimension. It does not come down to visibility in a geographic or spatial sense but rather to the perception of banks as relatively safe institutions. The perception of banks does not have to be reflected in economic foundations or stances [42]. Adopting the saturation principle leads to a departure from the global optimisation of underlying criteria with restrictions on the choice of local maxima.

The presented ABM model is based on the traditions of the EURACE [68,69], FP7 MOSIPS and the population dynamics model in the EU regions models [70] as well as FP7 CRISIS models. Our ABM model is also consistent with the stock-flow approach [71,72]. Impact studies of macroprudential policies on the economy within the ABM approach is relatively new. However, the topic refers to the tradition of agent-based models within financial markets [73,74,75,76,77] as well as literature on credit and financial markets from the agent-based perspective [72,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97]. In the broader sense, the study also refers to the coevolution models successfully applied in [98,99] to explain the stylized fact of persistency in a time series. For more general reviews on complex network theory refer to References [100,101], while spatial interactions in agent-based modeling were discussed in Reference [102,103].

The purpose of the model is to bridge the gap in the literature on the role of macroprudential policies in systemic risk mitigation. In the following section, details of the ABM model, simulation results and an explanation of the logic behind robustness checks is provided. Comments on welfare analysis within the DSGE and ABM approach are also provided; hence a critical perspective on ‘3D’ modelling results is presented.

3. Model Description

Presented within this section is an ABM model suitable for performing simulations that provide detailed insight into the nature of the relationship between the financial system and the real part of the economy. Due to the specifics of agent-based modelling, initially presented is the software environment in which simulations were developed. Next, attributes and activities of agents are presented. Also discussed is the method of sequential updating of the states within simulation modules. The form used to present the model and simulation is consistent with ‘A Common Protocol for Agent-Based Social Simulations’ [104].

3.1. The Software

The simulation was developed using object-oriented programming in Java-NetBeans and Eclipse environments. Statistical data to determine the attributes of system agents were grouped in a relational database (PostGreSQL-pgAdmin III). The simulation was linked to the database using Hibernate and SQL queries. According to the logic of object-oriented programming, initially agents and their attributes are described, and then the simulation workings from the perspective of individual agents and their activities are discussed. In the next subsection, a sequential update of agents’ attributes in simulation modules is presented.

3.2. Agents and Attributes

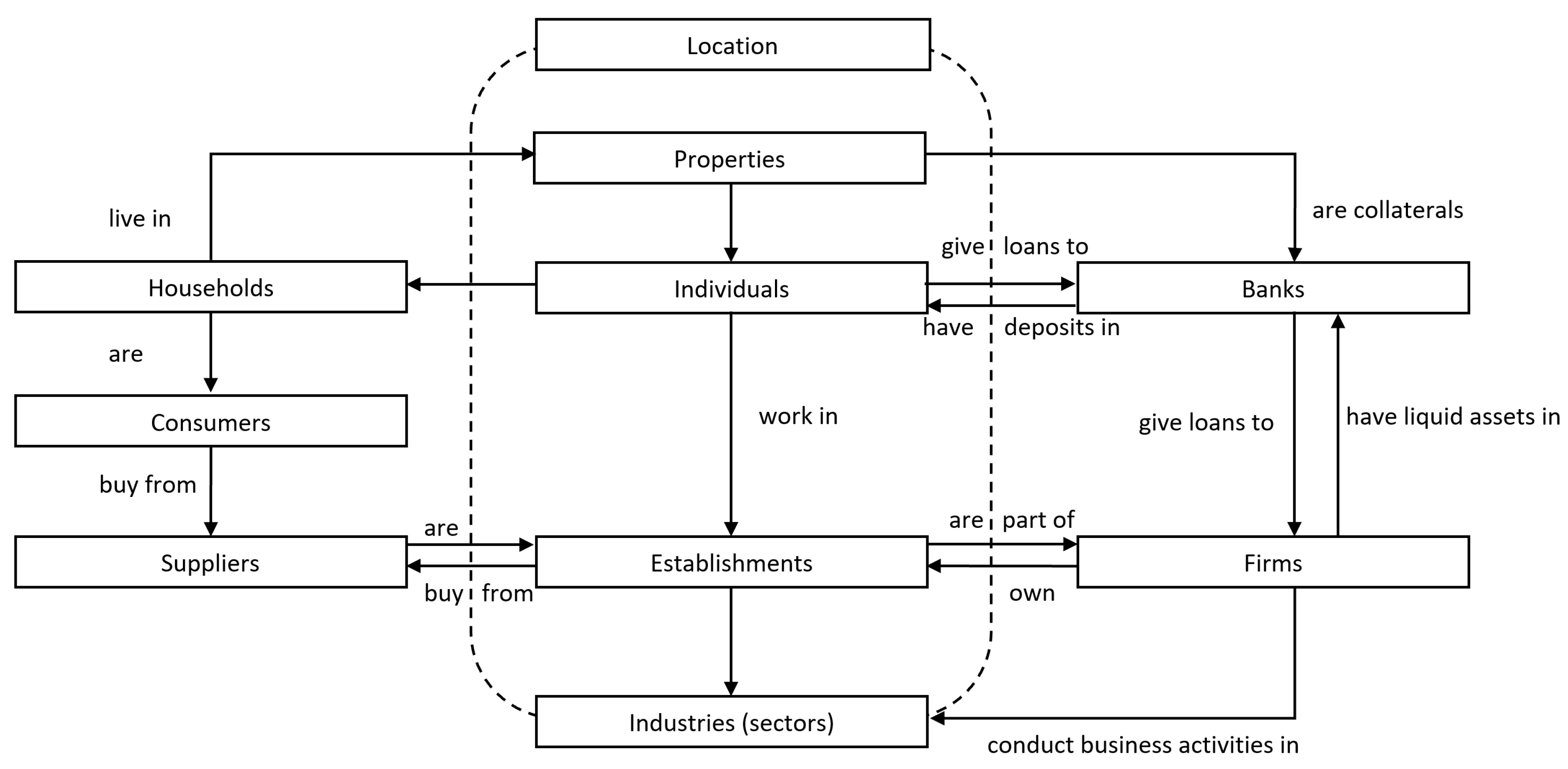

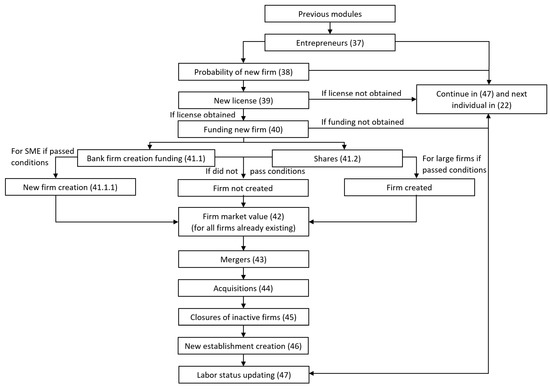

In the macro-finance model, 9 agents are distinguished: Banks, Individuals, Households, Consumers, Firms, Establishments, Suppliers, Properties and Industries. All Parameters in a separate object are also defined. The relations between agents in the model are presented in the Figure 1. The attributes of the agents can be found in the Table A1, Table A2, Table A3, Table A4, Table A5, Table A6, Table A7, Table A8, Table A9 and Table A10 in the Appendix A.

Figure 1.

Relations between agents in the model.

3.2.1. Individuals, Households, Consumers & Properties

Individuals do not determine the behaviour of the system in the initial Initialisation, Production, Supply chain and Public contracts modules. Their significance is enhanced only in the Households consumption, Households mobility and Individuals’ records updating modules. Nonetheless, individuals play a special role in the model because they determine the functioning of the program and the way data that describe agents’ attributes is mapped in the relational database.

In the Households consumption module, the sum of the income of individual entities forming the given household is initially calculated. Total household income is not only equal to the sum of family member income but also includes additional income from rental property and alimony payments. After calculating total household income, resources are divided between consumption and savings. The program counts the number of household consumers and their total disposable income. Depending on the level of disposable income, household savings are determined to update household members’ deposits. If a household consists of a couple (with or without children), then savings are distributed between them. Otherwise, if the household consists of a single adult or single parent, the savings are given to that adult. If the disposable income is exceptionally low, the scheme works similarly, with the common deposits used primarily to cover the basic needs. Decisions on the distribution of income between consumption and savings and the distribution of savings between household members are dynamic. For example, if the household changes as a result of divorce or death of the spouse, the states are updated.

Households represent different types of consumers in the model that determine the purchase of goods and services from a given industry. Households purchase products from suppliers according to the price offered by the supplier relative to the average industry price, quality of goods or services relative to average industry quality and depending on supplier’s spatial location. Households of a certain consumer type seek suppliers sequentially further from their location. Ultimately, they seek suppliers globally, taking into account only the price and quality of the product or service.

Purchases of goods and services do not need to be financed solely by funds deposited in a bank account. Households with creditworthiness are eligible for consumer credit. In the model, loan maturity depends on the amount of the loan.

In the Households mobility module, households decide the place of residence and purchase or lease the property. If the household already owns the property, the model verifies whether the cost of repaying the mortgaged loan relative to the household income is too high. If repayment cost is too high, the property is designated for sale. If the property in the previous iteration has already been marked for sale, the price is reduced.

If a household leases a property, rent is equal to the sum of the property owners bank loan repayment obligations; rent is calculated as the ratio of property price to the number of families renting the property. If the rental cost is too high, the household seeks a new rental property. Preference is given to properties near the current place of residence. If household members are not working, further conditions are laid down for disposable income and burdens on household loans. If income after deductions is relatively low and the person is over 25 and not working, then the individual defaults. The banks which have granted the loans to this individual update the non-performing loans value. In this module, income from renting real estate property to other households is also updated. If the property is not leased, it is marked for sale. If it is not purchased, subsequent iterations reduce the desired property sale value.

One of the most important elements of this module is the ability to purchase real estate. Households with high savings buy property in cash with a given probability. Nonetheless, some households, despite their resources, decide to apply for a mortgage loan. Households that do not have sufficient savings, but meet the requirements, also take a loan. If the household is already the owner of one of the properties, it may additionally take a non-residential loan on the pledge of the first property. In practice, either the household takes a residential or non-residential loan, taking into account whether it is already a property owner. Probabilities of taking a residential and non-residential loan were estimated based on empirical data.

Attributes of individual entities change their values in the Individuals’ records updating module. Depending on age and sex, the program determines the probability of death of an individual. If the probability is high, the person dies and the assets capital and deposits go to the heir. If the deceased person was the owner of a business, the heir can continue the business or forgo, depending on their previous income as an employee in one of the firms. Simultaneously, the division of capital in the economy changes. If the probability of individual’s death is low, the program directs the individual to the Education and Pairing modules. In the selected modules the consumer type of households is updated and in the final modules the remaining individuals’ records are updated.

3.2.2. Firms & Establishments

The role of Firms is highlighted primarily in the modules: Firm demography, Mergers & Acquisitions and Firm growth. An entrepreneur can open a new business according to a certain probability that depends on the experience of running the company, the age and level of education completed by the individual. When deciding to set up a new business, the entrepreneur takes into account the average profitability of individual industries in the economy, the ease of obtaining licenses for running a business in a given industry and the ability to raise additional funds for opening and running a business. In the case of small and medium-sized enterprises, these funds can be obtained from banks, while in the case of large companies, capital is obtained from many individuals, who are henceforth shareholders of this company. Obtaining funding from a bank requires a number of formal requirements to be met, including leverage, investment and industry risk, investment risk mitigation and a good credit history of the applicant. Implicitly, banks also take into account the cost of labour, equity and size of the enterprise relative to the average enterprise size in the industry.

As a result of the acquisition of another company or as a result of the company’s strategic development, firms can increase the number of establishments they own. In the model, it is possible to obtain additional funds from banks for expansion. Firms can also cease their business activity.

In the simulation, companies announce insolvency when the level of indebtedness and the risk of business exceed the acceptable level. A low percentage of business that has been run in the low-profit sector at high operating costs defaults as well. In the event of a company’s inactivity on the market for six quarters, the program automatically removes the company from the database and program. The adoption of such assumptions ensures adequate market dynamics in the simulation. Firms and establishments are auxiliary objects for the remaining agents in the model. In the final modules, other attributes of firms and establishments are updated.

3.2.3. Establishments & Suppliers

Establishments in the simulation allow for the spatial location of businesses. In the Initialisation module, the maximum potential production of goods and services of the establishment is computed. The price of the goods produced by the establishments changes depending on the demand. In each period, the optimal number of products to be stored for future sales is calculated. In the next period, the facility will only produce the number of goods equal to the number of goods demanded minus the number of goods stored. In addition, the production process takes into account the manufacturing risk and the overall level of corporate debt, which should not exceed the level specified by prudential regulation and policies. For the production of final goods, the establishments purchase inputs from others acting as suppliers. The choice of supplier is designed in such a way as to take into account economic categories such as price or product quality but also supplier availability in a geographical or spatial sense.

The demand from the private sector is supplemented by the need for goods from the public sector. It was assumed that the ability to sign a contract in a public sector depends on the size of the establishments producing the given good and the price and quality of the product offered compared to the average values in the industry. The establishments then decide on the destination of the final goods. Establishments may allocate all products for sale in a given sector or export some of their products to another sector and other spatial units.

In addition, the establishments play an auxiliary role in other modules. Individuals seek buildings near the workplace, that is, in the territorial unit within which the establishments are located. At the time of setting up a new company, new establishments are also created. Similarly, when a new company is created as a result of an acquisition or merger, the affiliation of the company and the owner of the establishments change. The owners of establishments decide to increase or decrease the workforce and firms with a strong market position increase the number of establishments. In addition, depending on the demand for work, the number of employees to be hired and fired in each establishment is calculated. In the final modules, firms pay salaries to establishments’ employees and the remaining attributes of establishments are updated.

3.2.4. Industries

The existence of major branches of the economy is assumed. The role of industries is crucial when calculating large exposures (LE) of banks to particular industries. Industries is an auxiliary object as well. Firms and establishments operate within the industries. The establishments may import and export goods between industries as part of the purchase of inputs for production. When firms apply for a loan, the total exposure to the industry is checked, which should not exceed the regulatory thresholds. The average values of variables for the industries are treated as a benchmark for business operations of firms and establishments. The main values calculated by the program are the number of units operating in the sector, average product price in the sector, average good quality, average firm size in the sector, average import and export, average industry earnings and average industry workforce. When entrepreneurs decide to run a business, first they attempt it in the relatively most profitable sector, and then in the next sectors.

3.2.5. Banks & Macroprudential Policies

Banks provide loans to individuals, households and companies. In the case of individuals and households, we distinguish between consumer loans and mortgages for residential and non-residential purposes. Companies can apply for a loan to purchase inputs and increase sales and business development (investment loans). Banks analyse loans granted to each of the industries and examine the risks associated with high exposures to the industry. According to regulatory requirements, banks are not allowed to lend to specific industries above certain thresholds.

Individuals and establishments accumulate funds in a bank account. To each individual and establishment at least one bank is matched based on survey data. The model assumes the existence of network and reputation effects. According to the results of empirical research, individuals and households are not guided solely by price in the decision to allocate funds. With relatively high probability, the entity will decide to remain with the bank assigned to them. On the other hand, if they decide to change bank, they will take into account interest rates and additional transaction costs. In the case of consumer credit and the purchase of inputs, agents are more driven by the reputation of the bank than the interest rate. On the other hand, in the case of residential and non-residential loans as well as investment loans, households and firms are primarily guided by the long-term interest rates of banks.

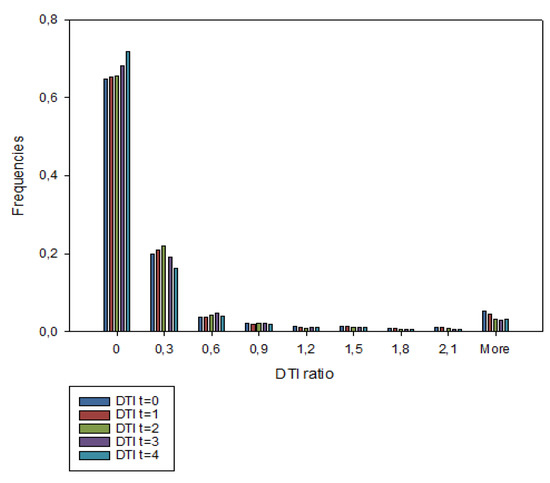

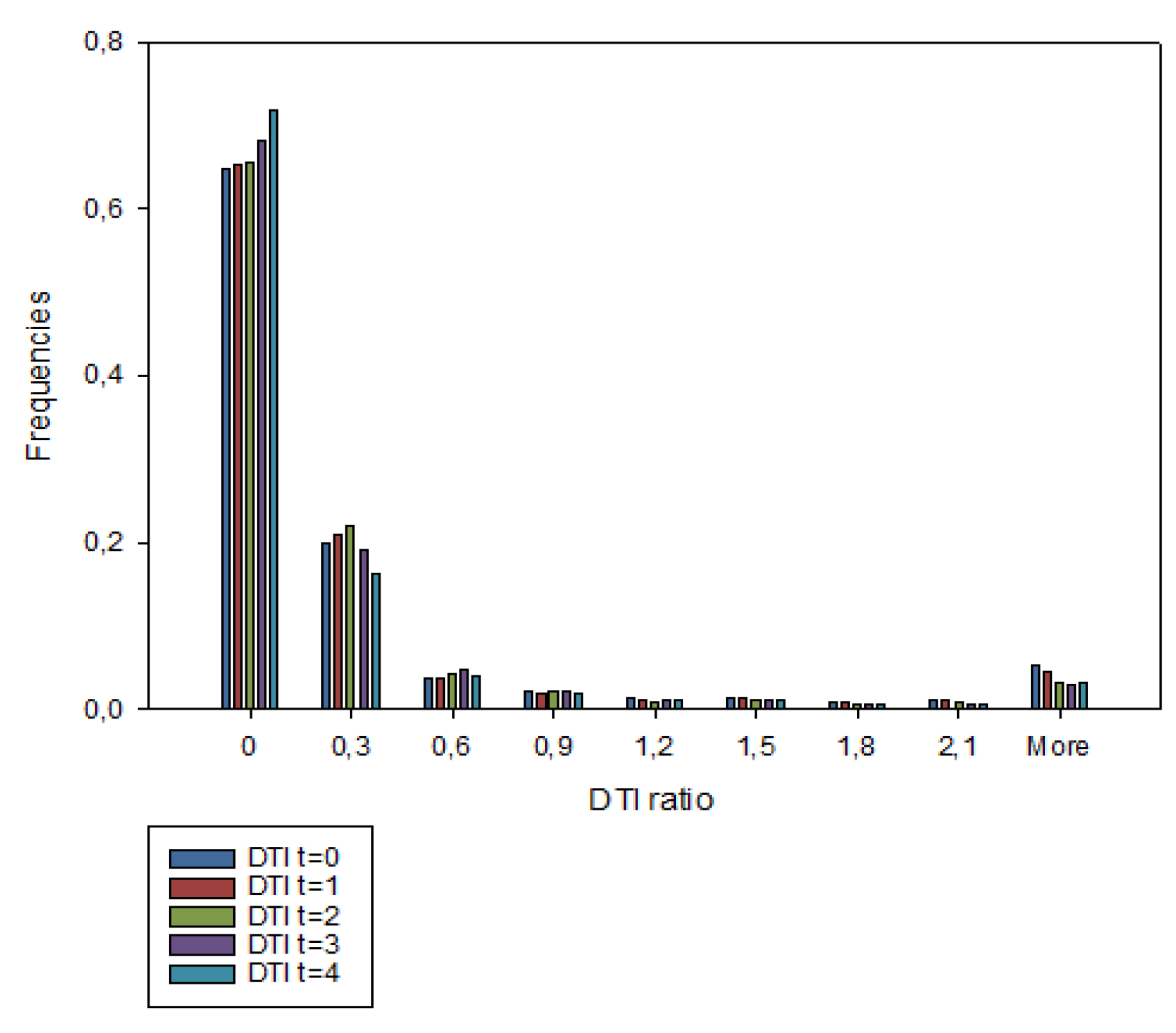

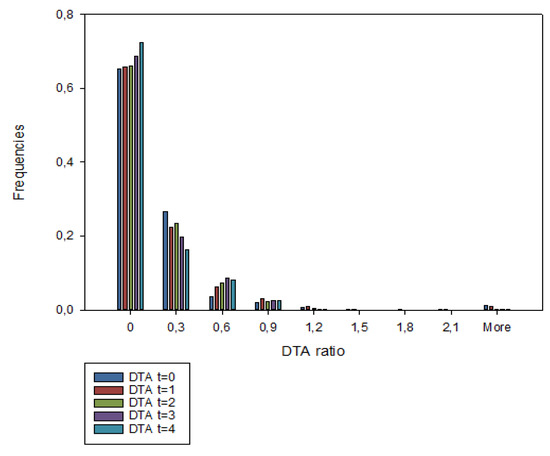

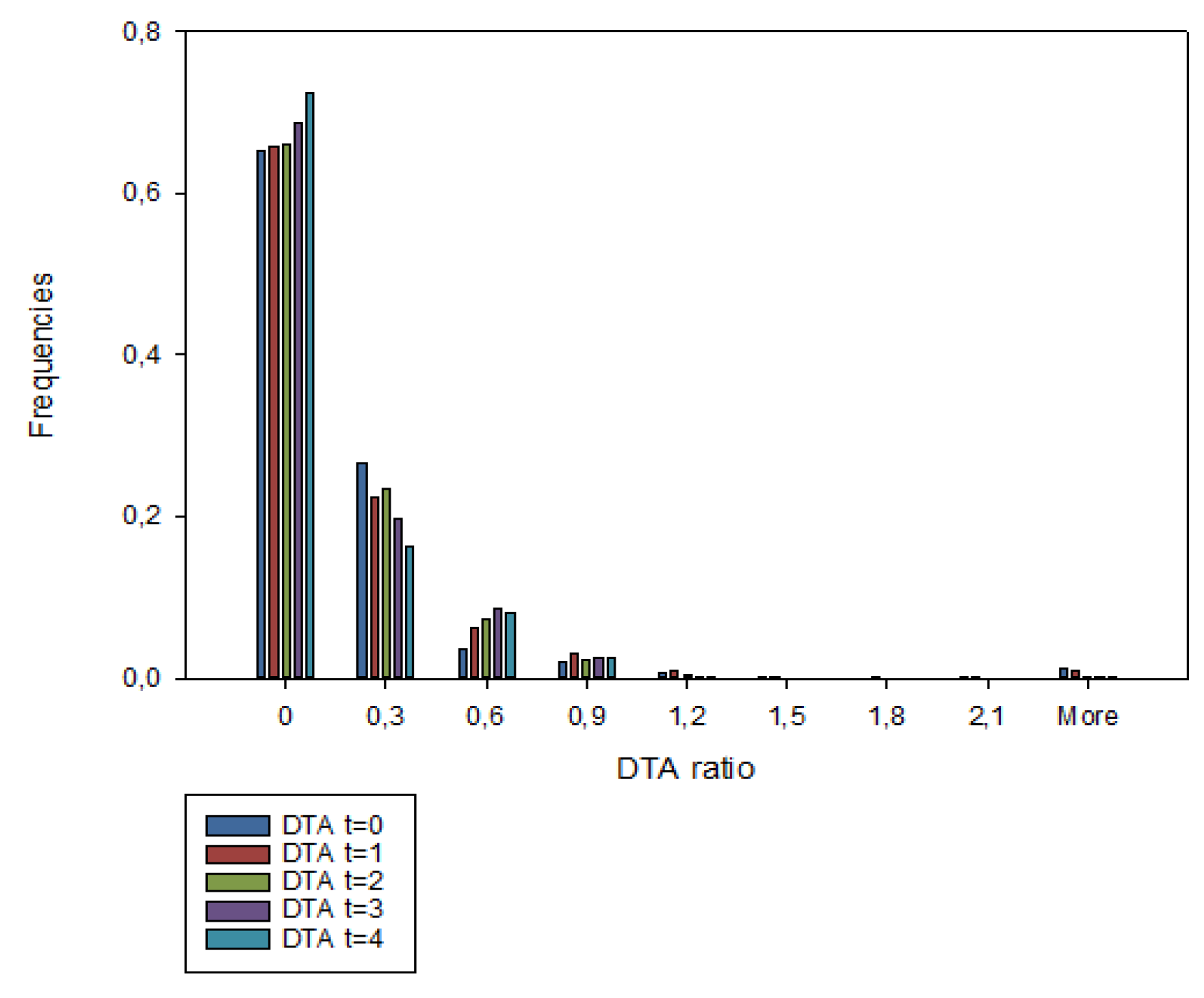

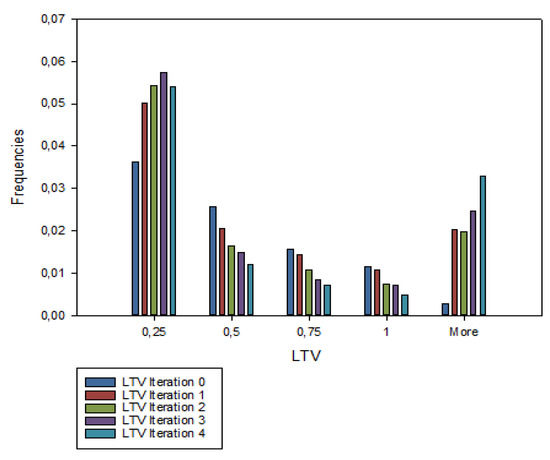

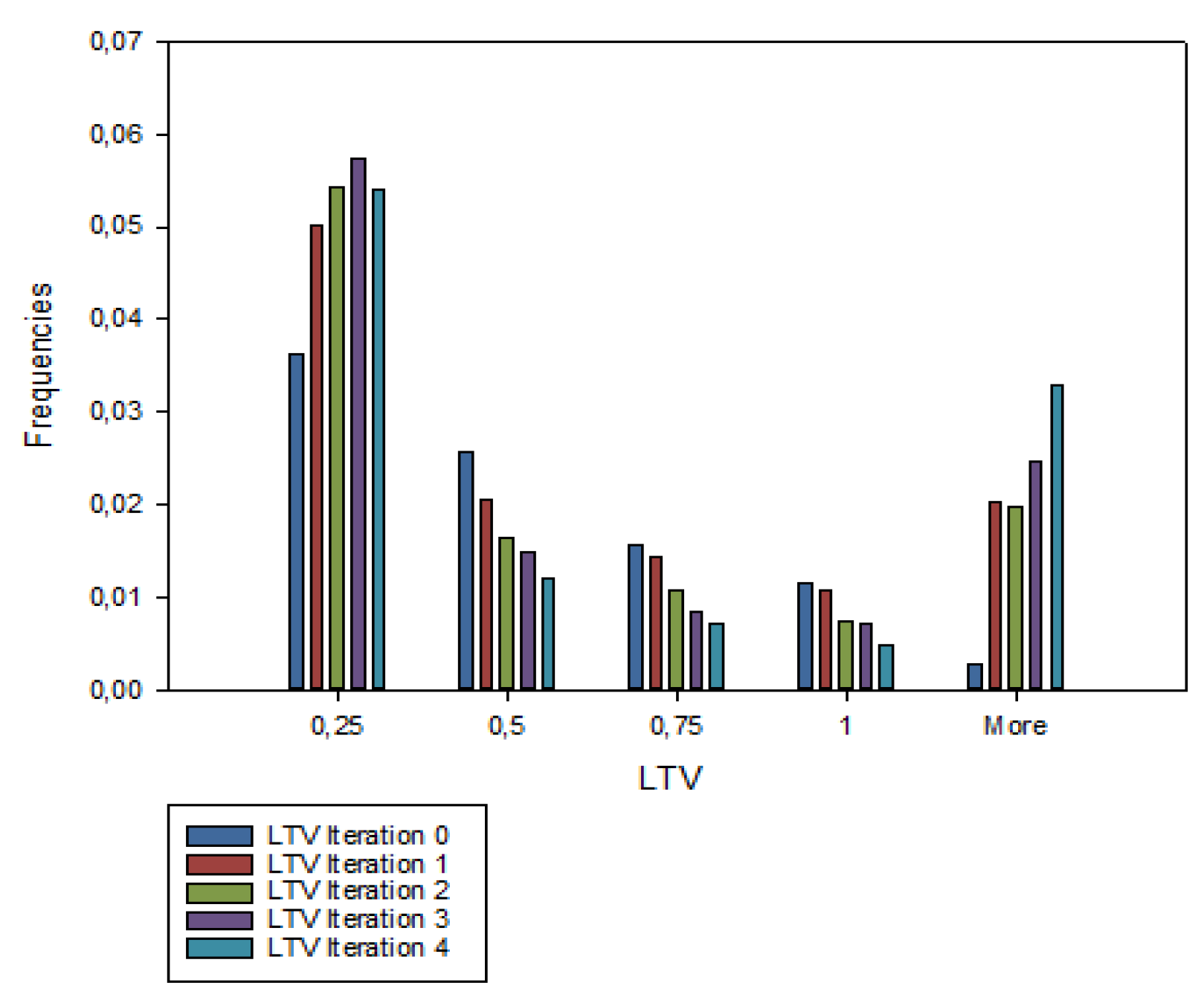

In the module Banks Supply side & regulatory requirements, banks set the supply of different types of loans. Banks compete with each other in terms of price, offering different interest rates on deposits and loans, as well as in terms of creditworthiness criteria. Risk-taking banks provide loans to individuals, households or companies with a lower credit history or lower creditworthiness (income or equity respectively). In the absence of macroprudential policy solutions, banks could be willing to lend to more risk-prone entities, which would jeopardise the stability of the financial sector. Thus, the model takes into account the examples of macroprudential policy tools. Firstly, the existence of capital requirements (CAR) and recommendations of the financial supervision authority regarding the capital maintained by banks were taken into account. The model then included the large exposures (LE) and exposures of risk to the industries. Banks cannot lend to a given industry over a specified amount and will not choose to lend to a company that runs risk-prone business without sufficient collateral. By providing housing and non-residential loans, banks pay attention to the following indicators: debt to assets (DTA), debt service to income (DSTI) and loan to value ratios (LTV). Moreover, the liquidity ratio (LCR) and leverage ratio (LR) have been taken into account as well.

From the supervisor’s point of view, it is extremely important to analyse the value of these indicators on aggregate for the economy. The survey data allows only for a static description of the level of these ratios for a given period. The simulation allows for the investigation of changes that occur in the indicator values as a result of dynamic interactions between fully heterogeneous agents. Similarly, for companies and premises leverage requirements (LR) are analysed.

Individuals, households, firms and establishments make decisions about depositing funds and obtaining a loan based on interest rates. In the system it is possible to introduce interest rates offered by banks. In this case, after taking into account the network and reputation effects, banks compete on interest rates. It is possible to take into account counterparty risk indicators and indicators of >>perception of perception<< in the analysis. It is then possible to integrate a macro-financial model into a financial model that simulates the role of risk perception and uncertainty in generating systemic risk in the interbank market [42].

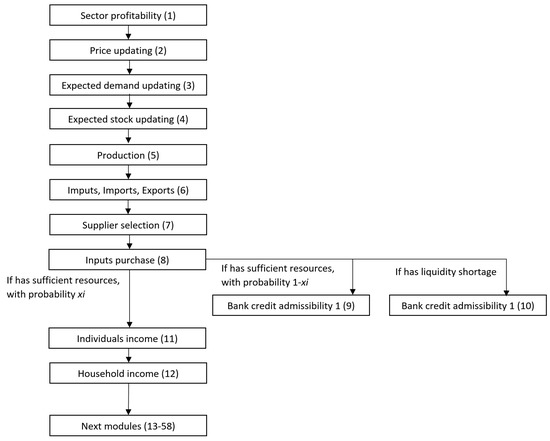

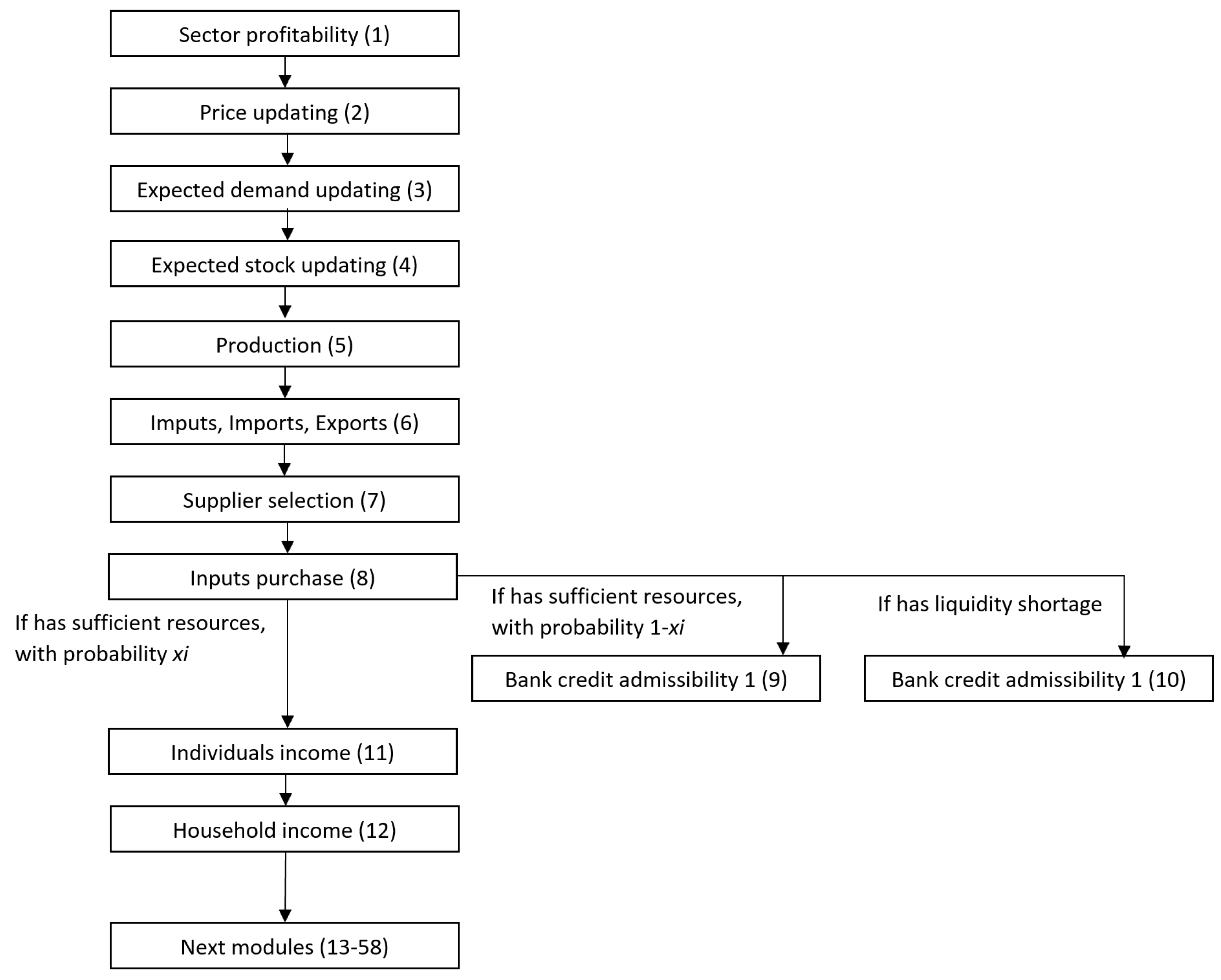

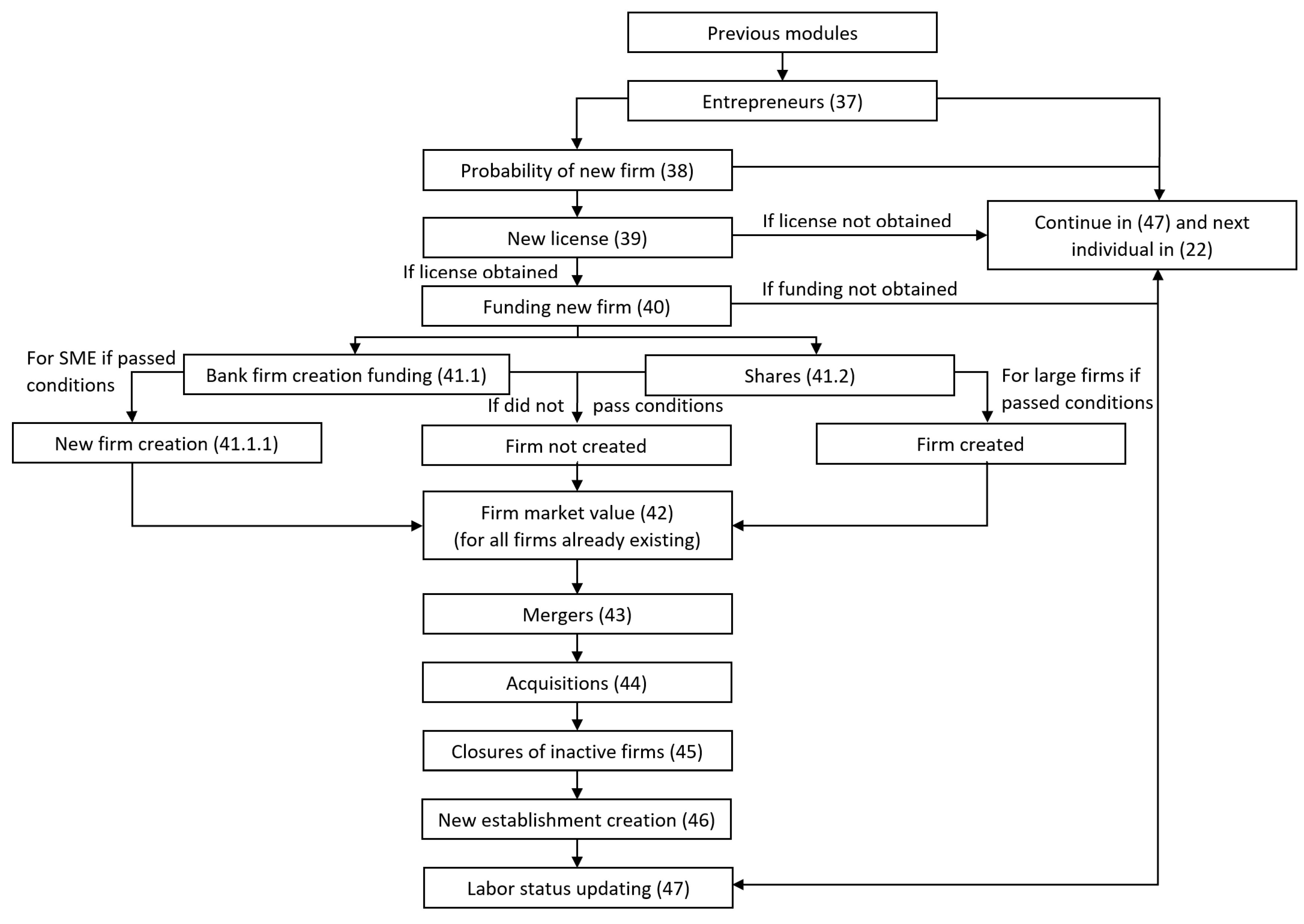

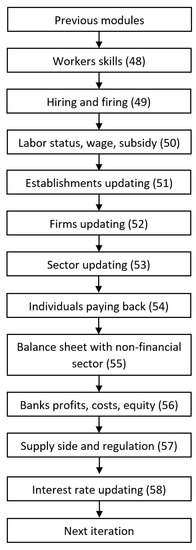

4. Sequential Updating of States in the Model

The graphical representation of sequential updating of states in the model is presented in Appendix B.

Module 0: Initialisation Sector Profitability (M.1)

In the Initialisation module, we calculate the average profit (that is ) of the firms doing business in the S industries () at time t. The procedure classifies sectors according to their average profitability. Information on average profitability is used by individuals when they decide to establish a new firm in a given industry. Each firm in the sector s generates profits ().

In this module, the model also stores the initial supply of different credit types (for each bank b): consumer loans , residential and non-residential loans (), firm investment loans and short-term loans for firms as temporal variables. This information is used later in module (M.55) to determine how much supply was used during this iteration by different agents.

Module 1: Production Price Updating (M.2)

In the Price updating submodule, the price ( is updated according to the demand for a given good or service in relation to the expected demand () and the level of production relative to the maximum potential production of each establishment (. In this sub-module, the values of variables determining the number of employees to be hired and fired in the current period in each establishment are set to zero.

The maximum production of premises in a given sector is then calculated according to the Cobb and Douglas production function:

where is the labour force, is the capital, is technology and represents the relative quality of the establishment’s product (or service) with respect to the average quality of product and services in the sector (industry). The value of parameters are specific to each industry. When initialising the system, the price is defined based on the initial conditions in the database. In subsequent iterations, the price of the previous period is assumed to be the initial value of the good (). This price may change depending on the demand relative to expected demand and production in comparison to the maximum capacity, that is to say the maximum potential production. If the demand for good produced by a given facility is greater than the expected demand for that good and production is greater than the specified part of maximum production, then the price increases in proportion to the given parameter . The . parameter is industry-specific. If the demand for a good is less than the part of expected demand for this good and output is less than the specified part of maximum output, the price drops by the percentage given by the parameter . The parameter is industry-specific. This procedure is consistent with the adoption of adaptive expectations in the model.

Module 1: Production Expected Demand Updating (M.3)

In this sub-module, we update the expected demand for the next iteration (). The formula of the expected demand for a good depends on the production experience of the establishment. If the premises have been operating on the market for at least a quarter, the expected demand for its good is calculated according to the following formula:

The expected demand depends on the price of the product relative to the average price in the industry within the periods t and , product quality relative to the average quality in the industry within the periods t and , given parameter values, and demand for the goods up to date. The parameters , and are industry-specific.

However, if the establishment is new, then the expected demand is calculated to take into account the workforce in the newly-created establishment and the average sales per worker in the industry within which it operates.

Module 1: Production Expected Stock Updating (M.4)

If the establishment is new (), we calculate the optimal level of stock ( as part of the expected demand, specified by the parameter . If the establishment is already established, the optimum stock level is calculated to take into account the expected demand for the good, the ratio of expected revenue from the sale of goods () to the costs of producing that good in the current period (), and the ratio of sales revenue in the current period to the total costs incurred in the previous period ().

Module 1: Production Production Decision Making (M.5)

If the optimum stock of products is less than or equal to the actual stock , the establishment will not produce goods in the current period. However, if the optimal stock is greater than the stored number of goods, the establishment should produce the difference between the optimum level and the current stock.

Nonetheless, these establishments will produce goods only when the level of leverage and financial risk associated with the debt of the establishments does not exceed the levels specified by the parameters and . If the establishment meets the conditions to produce goods, the production is equal to the lower value of either maximum production of the establishment or the difference between the optimum stock and the actual stock (inventory) of goods.

Module 2: Supply Chain Quantity of Inputs, Import & Export (M.6)

In this module, establishments buy inputs and decide on the import and export of goods between industries. In order to minimise costs, they choose a supplier from the nearest spatially located area, thus limiting the cost of transport. In addition, the adopted mechanism allows the modelling of continuation of transaction relationships between suppliers and recipients of goods. Each company is located spatially in the form of establishments. Each establishment is a supplier for another establishment. For each establishment in all sectors, the initial value of inputs , profits from sales ) and demand for goods are set to zero. Next, the amount of inputs (provided by suppliers from sectors ) necessary to ensure continuity of production, taking into account import and export of inputs between industries is calculated. If the facility imports or exports semi-finished products, the amount of inputs that the establishment is going to purchase is obtained using the following formula:

In the model there are values for parameters and (Cf. Calibration for the explanation how the values of parameters were obtained). For each establishment in the industry, the value of the parameter is the same but the values vary between sectors (industries). If the establishment does not import goods then the quantity of purchased goods is equal to the part of production specified by parameter :

The total quantity of inputs is the sum of inputs purchased from all suppliers in all sectors ().

Module 2: Supply Chain Supplier Selection (M.7)

When searching for a supplier, the establishment takes into account the amount of goods stored by the supplier ), and compares the ratio of quality to price of a supplier (establishment in the sector s) with the average ratio within the industry (sector):

In addition, it also takes into account supplier location (i.e., compares the spatial codes at NUTS 1-4 levels: ). If the current supplier has a sufficient number of inputs for sale, and the quality and price of the good are acceptable in relation to the average price and quality in the sector, then the establishment can buy inputs from the supplier. The model consolidates the network effects developed during the cooperation of businesses. If the supplier does not meet the requirements, the establishments seek a new supplier locally in increasingly distant locations and then globally. The parameter values from at time to are specific to the supplier’s sector.

Module 2: Supply Chain Inputs Purchase (M.8)

After selecting a supplier, the establishment purchases inputs. To purchase inputs, the establishment must have sufficient liquid assets to cover the wages and the cost of buying the inputs: , where is the binary variable expressing whether the cost of transportation should be added. If it has sufficient liquid assets, it can finance the purchase of inputs from accumulated funds. Therefore, in the model, with the probability the establishment will not apply for a loan. In that case, for the establishment-buyer inputs and liquid assets are updated to. The signs “+=” shall be interpreted as the incrementation of the value of the variable by the amount quantified by the formula given on the right-hand side. Respectively, “-=”, shall be interpreted as a decrease in the value.

While for all establishments-suppliers from each sector, the sales expressed in monetary terms , demand for goods , liquid assets and stock are updated.

In particular cases, with the probability of , despite sufficient liquid assets, the establishment may apply for a loan to purchase additional inputs that will allow the facility to increase its production capacity and sales. If the establishment applies for a loan, the applicant’s creditworthiness is checked even if its accumulated funds are sufficient to cover the purchase. In the submodule Bank credit admissibility 1 (M.9), conditions in addition to liquidity funds are checked. In accordance to the market dynamics of short-term loans, some of the applicants will not obtain a loan from the bank due to lack of creditworthiness. The possibility of establishments applying for a short-term loan in the case of temporary liquidity problems has also been included in the model (i.e., ). If, in spite of short-term liquidity problems, the establishment has not completely lost its creditworthiness, the bank may grant him credit for the purchase of inputs in the submodule Bank credit admissibility 2 (M.10). If the establishment has no creditworthiness, it has to adjust the quantity to buy :

After the purchase, the value of inputs ( and liquid assets of establishment-buyer ( are updated.

At the same time, we update the values of sales (), demand for a good , liquid assets () and stock of suppliers from all sectors that provided inputs to establishments () are updated:

where is the quantity of inputs that has been selected according to the adaptive algorithm.

Module 2: Supply Chain Short Term Credit Admissibility 1 (M.9)

In this submodule we analyse the case of an establishment without liquidity problems. The requested amount is given by the formula:

In the future, the model could also recognize different business types, similarly to the consumer types in the model, however at this stage, access to such disaggregated data was unavailable. Firstly, it is checked whether the matched bank in the database is able to loan this quantity (, as is the creditworthiness of the applicant. The values of ROA, ROE and leverage ratios as well as the value of average financial risk associated with the establishment operating in a given sector and its default history are checked. If the loan is granted, then the values of loans , quarterly payments (), interest to be paid (in total) ( and quarterly , inputs ( and liquidity assets are updated (for the establishment-buyer).

At the same time, the revenue of banks ( and supply of short-term credit for firms ( are updates as well as sales , demand , liquidity assets and stock of all establishments from sectors that provided inputs to establishments (buyers).

Short-term loans make it possible to guarantee the solvency of establishments in everyday business transactions. Restrictions to funding provision could result in an establishment’s loss of liquidity and production capacity. If the matched bank does not agree to grant credit, the same conditions are checked with other banks in the market. Firstly, the conditions are checked in the bank that offers the lowest interest rate. If none will grant the loan, the establishment needs to adjust the quantity of inputs to be purchased .

Module 2: Supply Chain Short Term Credit Admissibility 2 (M.10)

The requested amount is given by the formula:

Similar to the submodule 9, the supply conditions and creditworthiness are checked. In this case, the conditions for granting credit are also tightened, hence the differences in the parameters in the sub-modules Bank credit admissibility 1 (M.9) and Bank credit admissibility 2 (M.10). If a loan is not granted by a given bank, the establishment tries to obtain a loan from another bank. If there is no bank that is willing to supply a loan, the establishment is only able to purchase a portion of the planned amount of inputs. The logic of adaptive algorithms is used here. The values of variables are updated in the similar way as in the previous module (M.9). Purchases by establishments from the suppliers are supplemented by the purchases of consumers and the governmental sector.

Module 3: Household consumption - Individuals & households income (M.11) & (M.12)

Firstly, in the module, the individuals’ and households’ incomes (respectively are computed. Individual income includes income from various sources: wages, business activity, dividends, public pensions, pension benefits, pre-retirement benefits and training allowances. The model distinguishes three main categories: wage (), subsidy () and interest from bank savings (deposits) (). An individual’s income is expressed by the following formula:

Household income includes the sum of individual incomes, supplemental security income, alimony, donations, property rental income, interest and dividends from savings accounts, bonds, investment funds and income earned from participation in companies in which family members were investors or inactive partners. All items have been grouped into categories at the database level. The total income of the household (composed of individuals) is given by:

where are donations and is an additional income from renting apartments.

At the beginning of the cycle, at least two banks are assigned to each individual; the bank to which the individual entrusted their savings () and the bank that may grant consumer loans to the individual (). In the model, it is assumed that individuals are less prone to change the bank to which they entrusted their saving and current account funds than to change the ‘bank-lender.’ If they decide to change bank, when looking for a new bank, they take into account the offered interest rates on deposits and transaction costs, that is, the costs of changing the bank and opening a new bank account. The likelihood of a bank changing in the case of a consumer loan is higher than in the case of deposits. In the case of deposits, psychological factors such as habit formation or the perception of a bank as a reputable institution, which reinforce network effects, play a greater role. In the case of mortgages, households primarily rely on the interest rate on the loan.

Module 3: Households Consumption Net Savings (M.13)

After calculating household income, savings are calculated. Disposable income is the household income after deducting the cost of living (), which includes the cost of renting or repaying the mortgage. If the disposable income is higher than the specified income per person in the household, where the per person income is given by the parameter , then the savings are computed according to the following formula:

where is the minimum cost of food per person in the household according to Central Statistical Office statistics, counts the number of individuals in the household.

However, if disposable income is lower than the specified parameter (income per capita) multiplied by the number of consumers in the household (), two possibilities are considered. First, when the disposable income is positive, the savings are calculated according to the following formula:

Household savings are redistributed between the accounts of adult household members. If the household is a single person, then all savings are transferred to his or her account. If the household is a couple or an extended one (more than two adults in the family), then the corresponding parts of the savings are transferred to the adults’ bank accounts.

Second, if the disposable income is negative, household members spend their savings and current deposits on consumption and try to sell the properties on the real estate market. The algorithm looks for households which have sufficient funds after deducting the debt burden to pay for the property:

If this kind of household is found, then the values of deposits of buyers and sellers are updated as well as the status of the ownership of buyers .

If the household does not receive additional resources, this can eventually lead to default and the household is removed from the database. The program updates the value of non-performing loans (). The probability of default of the bank increases.

where is the sum of liabilities to the bank for outstanding investment loans that have to be repaid in the given iteration, is the sum of liabilities to the bank for outstanding consumer loans, is the sum of liabilities to the bank for outstanding housing loans and is the sum of liabilities to the bank for outstanding non-housing loans.

The bank may become a new temporary owner of the property if the household was removed from the database after the default. The property is marked for sale. After selling, we update the value of bank’s revenues:

Module 3: Households Consumption Consumer Loans Update (M.14)

In this submodule, the desired consumption of goods in the current period in a particular industry by the household is determined. Households can finance their consumption entirely by their own means or apply for consumer credit. The basic amount of good purchased from the industry is given by:

where parameter value is specific to industry and customer type. The parameter expresses the percentage of total consumption that is, household purchases from all industries. When buying from several industries, we assume where S is the number of industries. If the household consume only the quantity we proceed to the Supplier searching module.

In the case of taking a loan, consumption funds are increased by the amount of the loan less debt burden and service. The loan can only be granted if the following basic condition is met:

In this case the quantity of loans is given by the formula:

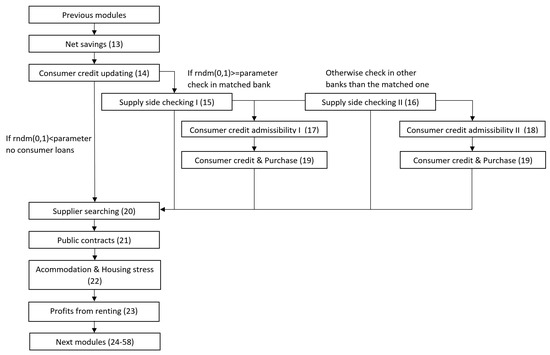

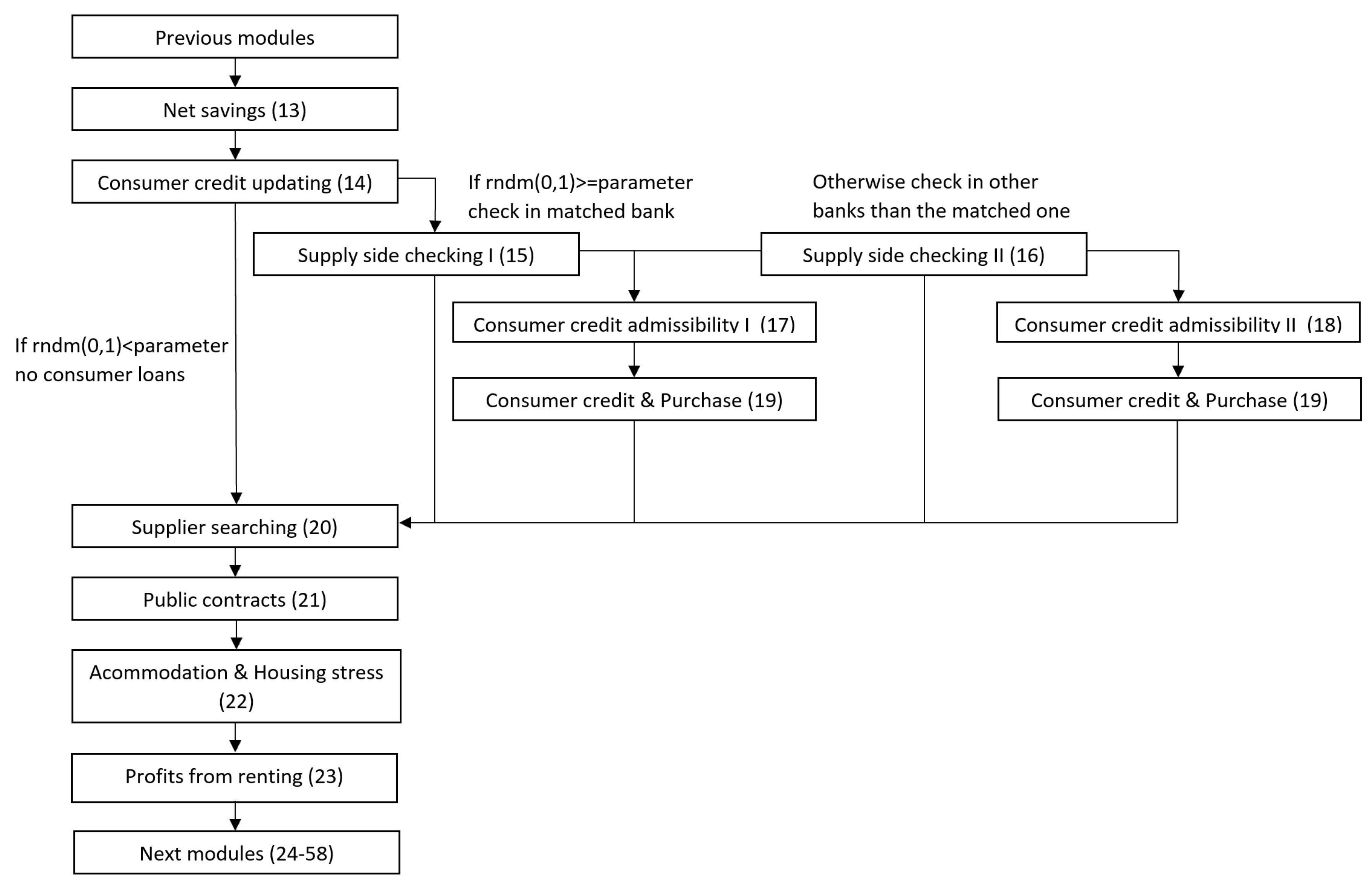

The parameter value is specific to industry and customer type, while is industry-specific. With a certain probability (), an individual tries to obtain the quantity in the matched bank in the database (). In this case, the supply from the bank and creditworthiness are checked in the Supply side checking 1 (M.15) and Consumer credit admissibility 1 (M.17). The individual can also try to obtain the loan from other banks. In such cases, interest rates are compared, and Supply side checking 2 (M.16) and Consumer credit admissibility 2 (M.18) are proceeded to.

Module 3: Households Consumption Supply Side Checking 1 & 2 (M.15) & (M.16)

In the Supply side checking 1 (M.15) submodule it is checked whether the bank assigned to the household has sufficient funds to grant the loan (), whether the bank’s policy will allow another loan to be granted, and whether the regulatory requirement for sectoral exposures is met (. In the Supply side checking 2 (M.16) submodule, we check whether any bank selected from the list of banks offering consumer loans at a specified interest rate has sufficient credit supply and that the regulatory requirements for sectoral exposures are met. If none is able to give this amount, the amount of loan is adjusted using adaptive algorithm ().

Module 3: Households Consumption Consumer Credit Admissibility 1 & 2 (M.17) & (M.18)

In submodules M.17 & M.18, household creditworthiness is checked with the bank assigned to the household or other bank (from the list of banks) selected in the Supply side checking 2 (M.18) submodule. The first condition relates to the level of income per person after deduction of repayments of other loans. This level is specific to each bank:

The next conditions relate to credit history of the household (the probability of default of members of the family) (), and the maximum number of loans that can be granted to one household. If all conditions are met, the loan can be granted. For all loans granted to individuals and households, the applicant age ( and status of the labour market () are also checked. It is also possible to include a variable which counts the elapsed time since the last change in status on the labour market. If the individual works less than 4 quarters and is under 30, it is assumed that they have a fixed-term contract and no creditworthiness.

Module 3: Households Consumption Consumer Credit and Purchase After Passing Supply Side Conditions and Credit Admissibility (M.19)

In this submodule, maturity is assigned to the loan () depending on the amount of loan granted. Next, the value of debt service is updated, taking into account the civil status of the household members.

The amount of credit granted by the bank, the supply of the credit and the revenues of the bank in the given period are also increased.

Finally, the amount of consumer goods to be purchased from different industries is computed.

Module 3: Households Consumption Supplier Searching & Purchase.hh (M.20)

The household next chooses the supplier. If the current supplier has sufficient stock of good () and the ratio of quality to price is higher than average ratio in the sector, then the household purchases the goods () from this supplier.

Otherwise, the household seeks a new supplier from incrementally more distant spatial locations. The requirements for the same spatial codes are loosened sequentially. Later, in the Purchase.hhs submodule, the profits from sales , demand (), stock (), liquid assets () of suppliers are updated. In addition, deposits of consumers are updated.

Module 4: Public Contracts (M.21)

In this module, we complement the demand of the private sector with demand from the public sector. Public contracts are usually signed by large companies. A public contract is awarded when the product price is lower than the average price of the product in the sector (). In addition, the probability of signing contracts increases with the size of the business and the quality of the product. If the terms of the contract are met, the value of the stored goods (), the demand for good (), liquid assets of the supplier and the value of sales are updated. The stock cannot be lower than the minimum fraction of production ) given by the parameter .

Module 5: Households Mobility Accommodation Cost and Housing Stress (M.22)

The term property refers to the value of apartment or houses, with or without land. Households live in properties they own ( or rent property from other households (. The household may own more than one property. Real estate may be subject to residential and non-residential loans (). If the household lives in their own property, then the cost of living is equal to the sum of the financial obligations of the owners of the building, that is, the adult individuals forming the household who bought the property:

where parameters and adjust the fixed and the variable parts of accommodation cost.

The cost of renting is calculated as a part of the sum of liabilities to the bank (loans) and the part of the cost of rent, calculated as the ratio of the price of the property to the number of households that rent this property.

In the first case of ownership, if the rental cost is greater than the specified parameter (part of the income ), the household decides to sell the property. If the property was already marked for sale (), then the price () has to be decreased by a percentage . In practice, the parameter reflects how much the price has to be lowered in order to sell the property in next iteration. In the second case, if a household rents a property and the cost of rent is too high, it will start looking for a new home. The household looks for another building considering the status on the labour market () and the age of the household members (). If two adults in the household are working, the program randomly selects one of them and searches for a building near the person’s workplace (the algorithm checks and compares the spatial codes: ). In addition to property locations, households take into account the price of the property from the appropriate price range and whether the building is for sale. If more than one property meets the criteria, one is selected at random and the spatial codes attributing the individual to the respective spatial units are updated.

If two adults are not working () and the difference between the sum of individual deposits and the sum of the individual liabilities of family members is less than the subsistence level expressed by the parameter , then the individuals are removed from the database, the household is removed from the database, and the corresponding records from the object Consumers are deleted as well.

The exception is a situation in which an adult is under 25. Then the assumption applies that they are still living with their parents. If individuals and households are removed from the database, all records related to insolvency are updated. Consequently, the non-performing loans for a given bank and sectors are increased. The probability of bank’s default increases as well. Especially,

where is the sum of liabilities to the bank for outstanding (respectively investment, consumer, housing and non-housing) loans that have to be repaid in the given iteration.

Module 5: Households Mobility Profits from Rent (Accommodation & Housing Stress) (M.23)

In this module, property attributes are updated if the household obtains profits from renting the property. The algorithm checks all household properties. The primary property () cannot be sublet to another household. If the household has a second property (), the number of households that live in the house is checked. If none live there, it is marked for sale (). If it was previously marked for sale (), its price is reduced by a certain percentage of the value that is specified by the parameter .

Revenues from renting second property () are updated according to:

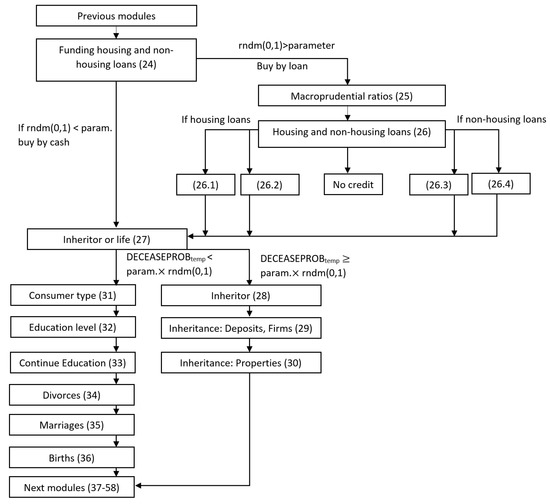

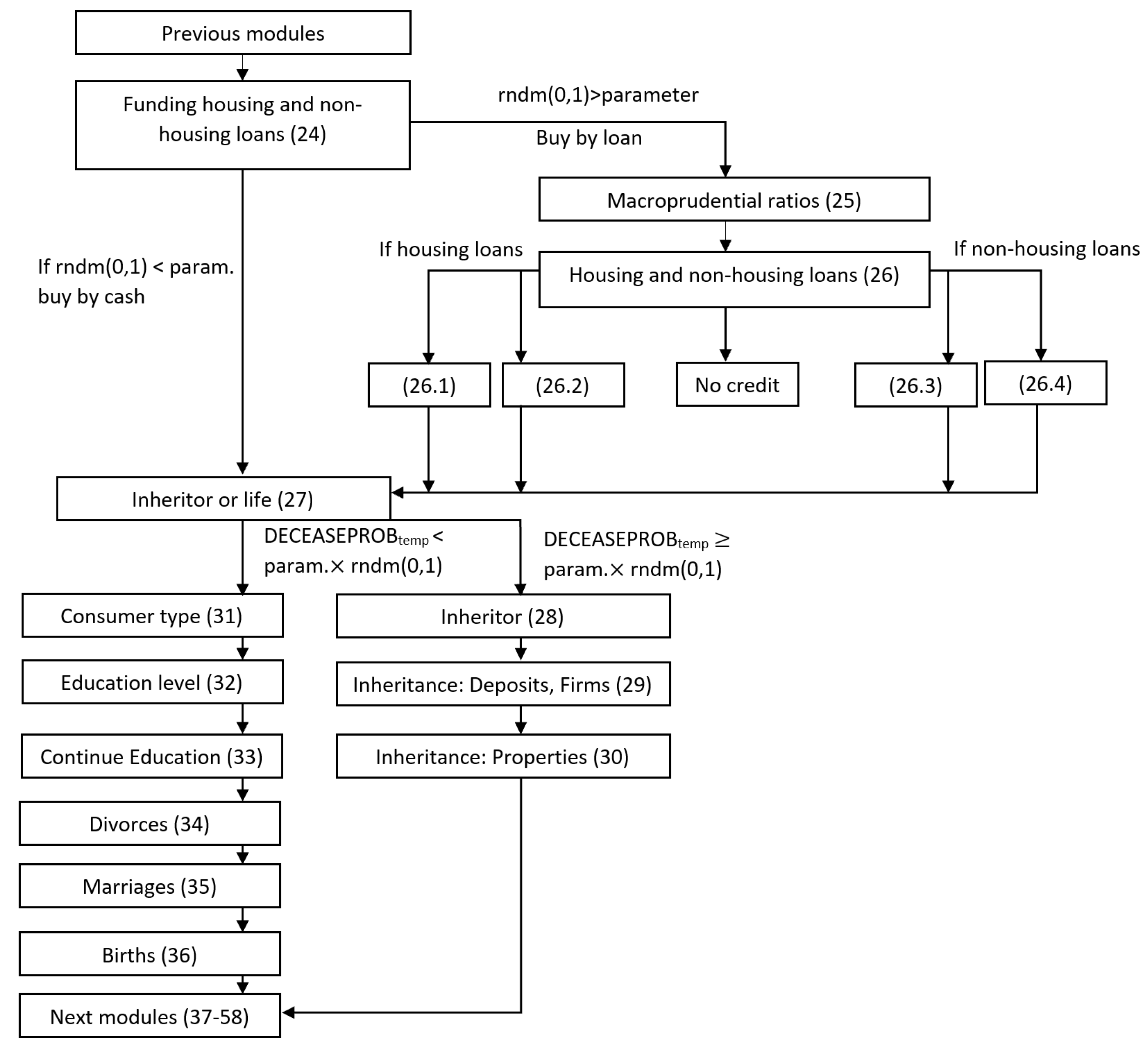

Module 5: Households Mobility - Decisions About Funding Housing and Non-Housing Purchase (M.24)

In this sub-module the household decides how to finance the purchase of houses and other non-housing purchases. If the current funds and savings in the bank account are greater than the price of the cheapest property on the market that has already been marked for sale (), it can potentially buy a property in cash.

In practice, we assume that a household buys a property in cash, only with a given probability () in the model. If a member of the household is an individual who owns the firm () or is unemployed () with a high entrepreneurial spirit (), then the funds will be first invested in the firm rather than housing or non-housing purchases. We update the status of individual as an entrepreneur . If a household does not have enough resources to buy a property in cash, it will apply for a loan and the sub-module Macroprudential ratios is moved to.

Module 5: Households Mobility Macroprudential Ratios (M.25)

In this submodule, macroprudential ratios are computed. In addition, the total indebtedness, debt servicing and total assets held by the household are computed as a temporal variables. The following macroprudential ratios were included in the system for residential and non-residential loans: total debt to assets ratio, debt to income ratio, debt service to income ratio, loan-to-value ratio.

Module 5: Households Mobility Housing and Non-Housing Loans (M.26)

In this sub-module, the household’s creditworthiness and supply side conditions are checked. Firstly, basic requirements are checked. If the household debt ratios exceed regulatory requirements, the household lacks creditworthiness (. Likewise, if all household members study, they are inactive on the labour market or are living on social benefits (). The model also takes into account the situation of people under the age of 30 who work less than 1 year in a company that also do not have creditworthiness && && . Then the value of collateral is estimated. For the all properties that the household owns, the property prices are summed up (). Households may apply for a residential or non-residential loan under a pledge of real estate. If the household owns at least one property, it will apply for a residential loan with a given probability, and for a non-residential loan with one minus that probability. On the other hand, if a household has rented a property (i.e., is not an owner), it will first apply for a residential loan. In most cases, the first property is bought in cash. The value of the mortgage loan is equal to the difference between the price of the cheapest real estate on the market, and the savings (less the charges for other loans); this is according to the following equation:

where are given by the expressions:

Households choose a bank with which to apply for a loan, taking into account the interest rate. At the same time, the bank must have sufficient funds and be willing to accept the LTV ratio of applicant (). If the household does not obtain credit in the bank that offers the lowest interest rate, it resubmits the request to another bank on the list that requires a higher interest rate. After receiving the loan, the household buys the property. The value of housing loans granted by the bank is also updated. The value of the household loans obtained is then updated. If the household consists of a marriage, the value of granted loans is halved. If the property is the main residence, the cost of accommodation is also updated. In the case of non-residential loans, the scheme works in an analogous way, with the value of the residential loan being equal to:

After checking the creditworthiness and credit supply of the selected bank, the value of non-residential loans obtained are updated, taking into account the civil status of household members.

Module 6: Individuals’ Records Updating

Individuals’ records updating module ensures the maintenance of demographic trends observed empirically in the simulation. The heterogeneity of individuals has been taken into account, as has population dynamics.

Module 6: Individuals’ Records Updating Inheritor or Life (M.27)

In the first sub-module the individuals may die with probabilities ) depending on age () and gender (). If a person dies, after the submodules Inheritor (M.28) and Inheritance (M.29 & M.30) have been applied, the individual is deleted from the database. This insolvency has a direct impact on the banks in the form of an increase in non-performing loans. In the case of survival of an individual, the program increases the age of the person () and the period since the last change of status on the labour market () and continues in the sub-module Updating consumer type (M.31).

Module 6: Individuals’ Records Updating Inheritor (M.28)

In this submodule, the heir in the event of death of an individual is determined. First, the age of the deceased person is checked. If the deceased person was an adult (), inheritance may be considered. Then, all members of the households and adults in the households are counted. If an adult over the age of 18 has died, who does not have family, the labor status of this individual is checked (). If this individual was an entrepreneur (), the number of employees (), in the company is checked. If it was a sole proprietorship, then the firm is for sale (). Otherwise, one of workers in their company who earned the highest wage in the previous period is selected. If the deceased person was not an entrepreneur, then the algorithm selects an inheritor at random from the group of working adults (). If a child dies (), they do not leave material property, rather the consumer type of the child’s parents changes. If the parents have no more children and if all household members are over 67 years old then we update the consumer type (). If both parents were under 67, they are also updated to another consumer type (). If the family consists of more than two adults then the consumer type is also updated (). If the deceased adult person has a family, then two cases must be differentiated. If they had children, the eldest person in the family is the inheritor and the consumer type does not change (). If there were no children, then the spouse is the inheritor and the consumer type changes depending on the age of the spouse . If the deceased adult was a single parent, then the adoption of a child is considered in the model in the module Adoption. The algorithm looks for a new couple or a single individual to be a parent and sum up deposits, ownership of properties and firms. If they own more than two properties, they are designated for sale (). We remove the deceased person from the database. We continue to the Inheritance modules (M.29 & M.30).

Module 6: Individuals’ Records Updating Inheritance: Deposits & Firms (M.29)

In this submodule, we pass the deposits and firms to the inheritor. Firstly, savings after deductions of housing loans pending to be paid are given to the inheritor. If these savings are greater than zero (), then the deposits of the heir are updated.

The parameter stands for taxes that must be paid. In the model we assumed that consumer loans are not inherited and hence the inflow of non-performing loans of banks () and the probability of default of bank () are updated.

If individual debts are greater than savings, then the variables are updated separately. In this way it is possible for the heir to inherit the debt from the loan taken in the past.

As the non-performing consumer loans increase, the probability of default of bank () increases as well. If the deceased person was not the owner of the firm, then we update savings (deposits) only. Otherwise, the inheritor may or may not run the business in the future. The decision on running a business depends on their previous earnings relative to the potential income from business activity.

If the inheritor decides to run the business, the status of entrepreneur (), the labor status () and the number of periods since the last change in labor status () are updated. The public assistance is ceased (). The inheritor is responsible for paying back the investment loans.

If the inheritor decides to sell, the company is marked for sale (). The inflow of non-performing loans is increased by the amount of investment loans that will not be paid. The probability of default of bank () is also increased in that case.

Module 6: Individuals’ Records Updating Inheritance: Properties (M.30)

In this module, the number of adults who were in the household of deceased person is checked, as is whether the deceased person rented () or owned their residence (). If the the deceased individual rented his residence, then the number of households that rents this property needs to decrease (). If the deceased person owned their residence and had no mortgage, then the property is marked for sale (). However, if the deceased person had a housing loan to buy the property, the bank receives the property and attempts to sell it (). The bank looks for any household which sum of deposits () is greater than the property price (). If it is found, then the bank updates the inflow of non-performing loans ( and the revenue from selling the property ().

where expresses the transaction costs.

The new owners of the property proportionally update the deposits () after the purchase.

If the bank is not able to sell the property, the price () is lowered gradually:

Module 6: Individuals’ Records Updating Updating Consumer Type (M.31)