Abstract

This paper examines the impact of agent banking activities, a recent FinTech development, influencing the profitability and financial outcomes of commercial banks operating in Bangladesh, as agent banking has been receiving significant global attention due to its technology-driven approach, cost-effectiveness and easy accessibility, and broader coverage of the unbanked population. Through the application of penal data regression methods, the study estimates a random-effect model using panel data comprising quarterly observations from nine Bangladeshi commercial banks that maintained uninterrupted agent banking activities, covering both deposit mobilization and lending during the period from 2018Q1 to 2024Q4. The empirical findings indicate that credit disbursement by agent banks has a positive and statistically significant impact on bank profitability measures, return on assets (ROA), and return on equity (ROE). Similarly, the expansion of agent banking outlets positively and significantly influences ROA. Therefore, an appropriate agent banking policy aimed at increasing agent banking outlets using digital platforms based on FinTech is vital for ensuring positive growth in credit disbursement to achieve improved financial outcomes for the banking sector in a developing country like Bangladesh.

JEL Classification:

G21; C23; E51

1. Introduction

The rapid advancement of financial technology (FinTech) has significantly reshaped the global banking industry by enabling more cost-effective, inclusive, and scalable service delivery models. FinTech encompasses the use of modern digital innovations, such as mobile banking, blockchain, cloud computing, and artificial intelligence [1], to enhance accessibility, efficiency, security, and cost-effectiveness through software, mobile apps, and digital platforms. It has revolutionized financial services by providing greater accessibility to individuals and businesses, streamlining operations, and reducing costs. One of the most significant innovations within the FinTech sector is agent banking, particularly in developing economies, which allows banks to extend financial services utilizing digital platforms through local agents in areas where conventional bank branches are not available [2]. The agent banking model was formalized in 2013 through guidelines issued by Bangladesh Bank, with full-scale operations commencing in 2016 (PSD Circular No. 05: Guidelines on Agent Banking for the Banks dated 9 December 2013). This model has become increasingly prevalent and represents a transformative approach to bridging financial service gaps in Bangladesh, where it has been instrumental in addressing the challenges faced by underserved populations and promoting financial inclusion. The agent banking model has been a major development in the financial landscape of Bangladesh. The agent banks act as small-scale representatives of commercial banks, equipped with point-of-sale (POS) terminals, mobile phones, barcode scanners, electronic data-processing equipment, and biometric devices to facilitate a wide range of banking services. This innovative banking model is 86 percent more cost-effective than establishing a traditional bank branch, as it leverages the existing business infrastructure, reducing the need for significant investment in physical infrastructure and fixed operational costs [3]. As of December 2024, 31 commercial banks in Bangladesh are operating agent banking services through a network of 16,021 agents and 21,248 outlets, with the majority of these agents and outlets located in rural areas [4]. In terms of banking service offerings, agent banking covers a wide range of financial services, including cash deposits, withdrawals, account opening, utility bill payments, fund transfer, and savings products. Unlike conventional banking, agent banking does not require the establishment of expensive brick-and-mortar branches, making it a more affordable and scalable solution for reaching the doorstep of the unbanked population in rural, underserved areas. The agent banking model conducts banking transactions on behalf of commercial banks (as a mother bank), including deposit mobilization, loan disbursement, collection of utility bills, payments related to government programs, and handling domestic and international remittances. All transactions conducted through agents are recorded in the financial statements of the respective mother banks, ensuring transparency and regulatory compliance. Therefore, agent banking, being an innovative FinTech platform, facilitates digital financial solutions using advanced technology and eventually increases financial activities and employment generation in rural areas.

Globally, various models of agent banking exist, with agents operating in diverse settings such as pharmacies, supermarkets, corner stores, and post offices. For example, post offices act as banking agents in Australia, while corner stores serve this role in France. Brazil delivers financial services through lottery outlets. Mobile-based branchless banking and agency banking are prominent in countries like Senegal, Pakistan, India, Kenya, Nigeria, the Democratic Republic of Congo, South Africa, and the Philippines [5,6,7,8,9,10]. Despite the varying models, agent banking is generally recognized as a cost-effective banking solution that offers greater accessibility to underserved market segments and thereby promotes broader financial inclusion.

Despite the rapid spread of agent banking and its potential to enhance financial inclusion, its impact on the financial performance of commercial banks remains ambiguous and under-researched, particularly in Bangladesh. While it is commonly assumed that FinTech-based banking models, agent banking in particular, have increased outreach, reduced transaction costs, and a larger customer base, which should translate into improved profitability and operational efficiency, empirical evidence on this relationship is mixed. Several studies [11,12] report positive associations between agent banking variables and bank profitability metrics such as return on assets (ROA) and return on equity (ROE). However, other findings suggest that the effect may be negative or statistically insignificant, depending on factors such as agent efficiency, remittance handling, or the bank’s fund utilization strategies [13,14]. Addressing this empirical gap in the existing literature is conducted by examining whether and how FinTech-enabled agent banking activities influence the financial performance of commercial banks in Bangladesh. Unlike earlier studies that rely on limited periods or do not differentiate between partial and full-fledged agent banking operations, this research focuses on a panel of nine banks operating comprehensive agent banking services, including deposit mobilization and credit disbursement over the period from Q1 2018 to Q4 2024. Utilizing a random-effects panel data regression model, the study evaluates the effect of six key agent banking indicators: number of agents, number of outlets, number of accounts, total deposits, total credit disbursed, and processed remittances. It is essential to uncover the strategic value of FinTech innovations for the sustainable growth, profitability, and competitiveness of the banking sector in Bangladesh. These relationships also provide valuable insights into the broader economic impacts of FinTech adoption in emerging markets. This study, therefore, not only offers theoretical contributions by aligning agent banking with agency theory [15] and financial intermediation theory [16] but also generates practical implications for bank managers and policymakers. By evaluating the agent banking model through a FinTech lens, the study contributes to strategic discussions on how technological innovations can promote both financial inclusion and institutional profitability in emerging economies. Based on the stated objective, the following research questions are outlined:

- RQ1: How does agent banking influence the accessibility and financial performance of commercial banks in Bangladesh?

- RQ2: What is the impact of agent banking outlets on the financial performance of commercial banks in Bangladesh?

- RQ3: How does deposit mobilization influence the financial performance of commercial banks in Bangladesh?

- RQ4: What is the effect of credit disbursement through agent banking on the financial performance of commercial banks in Bangladesh?

The rest of the paper is organized as follows: Section 2 reviews the existing literature, including the theoretical and empirical literature. Section 3 constructs a conceptual framework and develops hypotheses. Section 4 illustrates the research design, data and methodology, and model specification. Section 5 discusses the empirical results. In Section 6, the robustness of the empirical analysis is assessed, followed by the conclusion in Section 7.

2. Literature Review

This section briefly discusses both the theoretical and empirical literature on agent banking models.

2.1. Theories on Agent Banking Model

The agent banking model is based on agency theory [15]. The model defines an agency relationship as a contract between a commercial bank (principal) and an agent hired to provide banking services on their behalf. Consequently, agents provide banking services on behalf of commercial banks under officially sanctioned agency agreements. An agent is typically the owner of a designated outlet who is contracted to execute banking services on a bank’s behalf. These agents use FinTech platforms to process banking transactions, such as money transfer, bill payments, deposit mobilization, and loan disbursement. The agent points are equipped with FinTech to provide banking services to unbanked populations of the remote areas in a cost-effective way. Therefore, commercial banks can reach the underserved or unbanked population through their agents, utilizing advanced FinTech with less overhead costs instead of setting up a full-fledged bank branch. This model permits seamless connectivity between an agent’s transaction software and the bank’s core system, thereby recording all transactions in real time on the customer’s bank statement [17]. The agent banking model offers significant benefits to the parent bank by facilitating customer acquisition, enhancing market penetration, reducing operational costs, and boosting earnings from various financial and fee-based sources.

The agent banking model also follows the theory of financial intermediation [16]. The theory reveals how agent banking strengthens the intermediation role of banks, i.e., mobilizing deposits and disbursing loans in remote areas, and thus extends financial inclusion. The Technology Acceptance Model explains the impact of agent banking on key performance indicators, including return on asset (ROA) and return on equity (ROE), operational efficiency (cost-to-income ratio), market expansion (customer acquisition), and risk management [18]. The framework offers a comprehensive understanding of how agent banking enhances financial performance in the digital economy.

According to their [19] observation, agent banking provides financial and payment services via postal offices and various retail outlets, including grocery shops, pharmacies, agricultural input suppliers, and fuel stations, rather than relying on traditional bank branches and in-house field officers. In India, under the Business Correspondent model, banks are entitled to engage intermediaries. For example, agents may be engaged in disbursing small-value loans, recovering principal and interest payments, collecting small deposits, selling microinsurance and pension products, and facilitating the receipt or delivery of low-value remittances [7].

2.2. Empirical Literature

The impact of agent banking on the financial performance of commercial banks has brought in increasing attention in recent years. Although numerous studies have been conducted, a unified conclusion has yet to emerge. Many studies suggest that agent banking positively influences key performance indicators, such as return on assets (ROA) and return on equity (ROE), primarily by enhancing financial accessibility, operational efficiency, and profitability [11,12,20,21,22]. For instance, Ref. [20] found that expanding agent networks improves profitability by extending service outreach, while [23] linked performance improvements in Kenyan banks to wider market access and lower transaction costs. Similarly, Ref. [5] highlighted that agent banking increases clients’ financial activity and savings, and [8] showed improvements in business performance through higher turnover, customer numbers, and transaction volumes. Ref. [24] confirmed a positive link between agency banking and profit growth in Kenyan banks, while [9] emphasized that agent banking enhances profitability by reaching grassroots-level customers.

However, empirical evidence on the relationship between the number of agents and bank performance remains mixed. While several studies report a significant positive association between agent numbers and profitability metrics (ROA/ROE) [14,25,26,27], others present contrasting results. For instance, Ref. [28] found a statistically significant negative relationship, suggesting that expanding the agent network may increase operational costs without proportionately increasing returns. These disparities may stem from differences in agent productivity, transaction volume, or regional financial demand. Thus, while agent expansion theoretically supports greater outreach and revenue, its effectiveness is contingent upon strategic management and operational efficiency.

By contrast, the literature reveals more consistent findings regarding deposit mobilization through agent banking. Several studies confirm a positive and significant impact of total deposits on banks’ financial performance [11,14,26,28,29]. Agent banking serves as a cost-effective mechanism to mobilize deposits in underserved areas, enabling banks to expand their customer base without incurring high infrastructure costs. Refs. [11,28] observed that such deposits contribute to higher ROA and ROE, as they are reinvested in interest-bearing assets like loans and advances. Nonetheless, some studies caution that increased deposits may not always translate into profitability gains. For example, Ref. [30] argues that unproductive liquidity from short-term or inactive deposits may reduce earnings, while [14] notes that limited lending capacity and inefficient fund use through agents may damage performance. Ref. [13] further adds that high funding costs and a large share of foreign currency deposits can reduce ROA despite growth in deposits.

Findings on the impact of agent banking outlets are similarly mixed. While several studies highlight a positive and statistically significant influence of outlet numbers on ROA [11,14,31], others report negative or diminishing returns associated with excessive outlet expansion, citing potential inefficiencies [28,32,33].

The effect of credit disbursement through agents is largely viewed as positive. Numerous empirical studies demonstrate that agent-based lending improves ROA and ROE by expanding financial inclusion and improving income-generating activities [21,26,28,34,35,36]. However, some studies, such as [26,29], find no significant impact, suggesting that credit outcomes vary depending on institutional frameworks, regulatory contexts, and the maturity of agent networks. This emphasizes the need for contextual analysis when evaluating the effectiveness of agent-delivered credit.

Remittance inflows also play a strategic role in influencing financial performance. Studies by [26,28,37,38,39] find that remittances serve as a stable and significant source of funds that boost deposit bases and facilitate credit expansion. Refs. [40,41,42] support the view that remittances foster financial intermediation and inclusion. However, challenges such as compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) standards [43], as well as the effective integration of digital tools, are critical to optimizing remittance benefits. Refs. [44,45] note that FinTech platforms can reduce transaction costs and formalize financial behavior among remittance recipients.

Regarding the number of accounts maintained through agent banking, the evidence is inconclusive. Some studies find a positive and significant relationship between ROA and ROE, suggesting that more accounts reflect broader outreach and improved profitability [6,25,29,32,46]. Ref. [28], for example, demonstrates a positive association between account growth and financial performance. Ref. [47] further asserts that more active accounts per agent improve intermediation and service delivery. In contrast, other studies identify a negative or insignificant relationship [13,28,29,37], pointing to high maintenance costs, short deposit tenures, and inefficiencies in fund utilization as potential drawbacks.

Taken together, the literature highlights the complex and context-specific nature of agent banking’s impact on bank performance. Despite promising results, there is a lack of comprehensive evaluation specific to Bangladesh, where full-scale agent banking was launched in 2016. This gap underscores the importance and originality of the present study, which aims to assess how FinTech-enabled agent banking activities have influenced key financial performance metrics—namely ROA and ROE—among commercial banks in Bangladesh.

Scholars widely agree that agent banking represents a FinTech-driven innovation, particularly in developing economies [48,49,50,51]. Agent banking is an important determinant of FinTech [26]. According to [51], banks use FinTech to offer various services to their customers, including agent banking and software upgrades. Other research shows that FinTech plays a key role in supporting how agent banking works [52,53]. The connection between FinTech and agent banking is often shown through the use of technology tools like mobile phones and digital financial platforms [54,55]. For instance, Ref. [54] explains that agent banking depends on tools like digital identity checks (KYC), mobile wallets, and fingerprint systems, all elements of FinTech. Similarly, Ref. [55] emphasizes that agent banking represents a FinTech-enabled model, built on mobile, cloud, and digital platforms. As [52] notes, FinTech provides the digital foundation that agent banking needs, especially in areas with limited banking access. Theoretically, ideas from agency theory and financial intermediation theory show that agent banking helps reduce information gaps, builds trust, and makes it easier for people in rural areas to save money or obtain loans [15,16]. Research supports this by showing that agent banking can improve a bank’s financial performance, like return on assets (ROA) and return on equity (ROE), through better loan access and more service outlets [11,14]. However, the results regarding the number of agents and how much money they collect in deposits vary depending upon how agent banking is used [13]. Around the world, examples from countries like Australia (postal agents) and Kenya (mobile platforms) show that agent banking is flexible and effective [56]. In Bangladesh, combining FinTech with agent banking has helped reach unbanked people, improve banking services, and boost financial inclusion. In summary, FinTech is the key technology behind agent banking, making it possible to offer safe, wide-reaching, and inclusive financial services.

3. Conceptual Framework

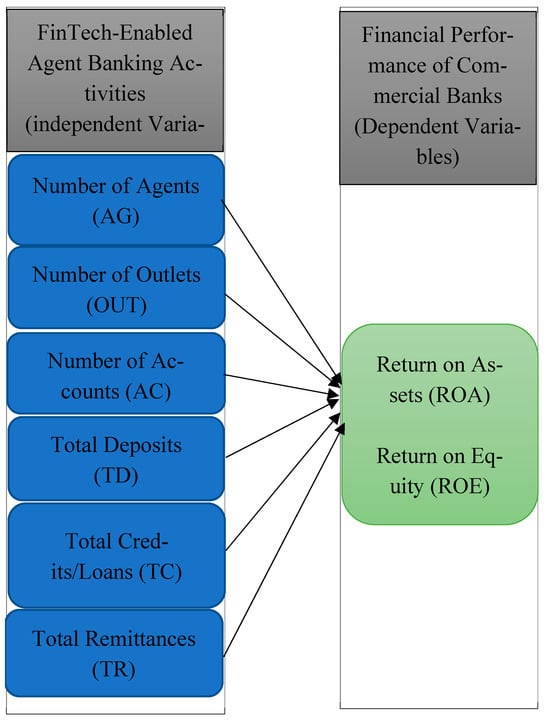

Based on the literature review presented in Section 2, this study develops the research framework illustrated in Figure 1, which hypothesizes a direct relationship between FinTech-based agent banking variables and the financial performance of commercial banks. The conceptual framework captures the core constructs of FinTech-driven agent banking and commercial bank performance, aiming to address the research questions outlined in Section 1.

Figure 1.

Framework for the proposed model (Source: figure created by authors).

Hypotheses Development

Grounded in the conceptual framework and the existing literature, the following hypotheses are developed to examine the effect of FinTech-enabled agent banking on the financial outcomes of Bangladesh’s commercial banks:

H1.

An increase in the number of agent banking agents (AG) is linked to a decline in both ROA and ROE for commercial banks in Bangladesh;

H2.

An increase in the number of agent banking outlets (OUT) is positively associated with both ROA and ROE for commercial banks in Bangladesh;

H3.

A higher number of agent banking accounts (AC) corresponds to lower financial performance, as reflected in both ROA and ROE, for commercial banks in Bangladesh;

H4.

The total deposit (TD) mobilized through agent banking is positively and significantly associated with both return on assets (ROA) and return on equity (ROE) for commercial banks in Bangladesh;

H5.

Total credit disbursement (TC) through agent banking has a significant positive effect on both ROA and ROE for commercial banks in Bangladesh;

H6.

Total remittance collection (REM) positively affects the financial performance, as measured by the ROA and ROE of commercial banks in Bangladesh.

4. Empirical Design: Methodology, Data, and Variables

The study analyzes how agent banking operations influence the profitability of sampled commercial banks in Bangladesh. In the regression analysis, two different profitability measures, return on assets (ROA) and return on equity (ROE) of the sample banks are considered as dependent variables and, six agent banking-specific independent variables are the number of agents, the number of agent banking outlets, the total number of accounts held with agent banks, the total amount of deposits collected, the amount of credit disbursed, and the total remittance amount processed by agent banks. NIM mainly reflects the interest spread between income from loans and costs of deposits, offering a narrow view focused on traditional intermediation efficiency. This study excludes net interest margin (NIM) as a measure of financial performance because it does not fully capture the strategic and operational outcomes of FinTech-enabled agent banking activities [14,57,58]. For example, Ref. [14] reported that agent banking contributes significantly to non-interest income through services like remittances and deposit collection, making NIM an incomplete measure of profitability. Similarly, Ref. [57] reported that non-interest income plays a growing role in bank performance in Asia. Traditional NIM-based analysis fails to reflect this shift, especially in digital and FinTech environments. Moreover, Ref. [58] provides evidence that the rise of FinTech-driven models like agent banking reduces reliance on net interest-based income, shifting performance measurement towards non-interest income streams. However, agent banking in Bangladesh encompasses a broader set of services, such as remittance processing, bill payments, and deposit collection, that often generate non-interest income or operate outside conventional loan–deposit mechanisms. As a result, NIM may underestimate the financial contributions of these services. Moreover, NIM is highly sensitive to fluctuations in interest rates and regulatory policies, which may obscure the effects of agent banking initiatives. In contrast, return on assets (ROA) and return on equity (ROE) offer a more comprehensive view of profitability and operational efficiency, accounting for both income generation and resource utilization. These indicators are better suited to evaluate the financial impact of FinTech-driven innovations that aim to enhance financial inclusion and extend service outreach. Therefore, to more accurately assess the performance implications of agent banking in a developing economy like Bangladesh, this study uses ROA and ROE as more appropriate and robust measures of bank performance. The detailed definitions of the variables are presented in Appendix A, Table A1.

For this study, a sample of nine commercial banks in Bangladesh was selected. These banks are the only ones, out of 62 scheduled banks regulated by Bangladesh Bank, that operated full-fledged agent banking services, including both deposit mobilization and credit disbursement throughout the study period (2018 Q1 to 2024 Q4). This sample is representative of the full population of banks engaged in comprehensive agent banking during this time. The selected period reflects a phase of rapid FinTech adoption and technological development in Bangladesh’s banking sector. Focusing on these years ensures data completeness, maximizes sample relevance, and provides a reliable basis for analyzing the relationship between FinTech-driven agent banking and bank profitability. The study employs a panel data regression model using the quarterly data from these nine (09) commercial banks at the bank level. The banks are Bank Asia, Dutch-Bangla Bank, Al-Arafah Islami Bank, Islami Bank Bangladesh, Mutual Trust Bank, The City Bank, Brac Bank, NRB Bank, and Modhumoti Bank Limited (Appendix A Table A2). The study has constructed a uniquely structured balanced panel dataset with 234 observations for the period 2018Q1–2024Q4 and estimated both the fixed-effect (FE) model and the random-effect (RE) model, and also a pooled regression model (as robustness check) to examine the effects of agent banking activities on the financial outcomes of the selected commercial banks, using return on assets (ROA) and return on equity (ROE) as measures of profitability. Measuring the financial performance of commercial banks solely with ROA provides an incomplete picture of their financial health. The authors argue that relying solely on one metric (i.e., ROA) can be misleading, as it may not capture the full scope of a bank’s financial health. They claim that return on equity (ROE) alongside ROA allows for a more comprehensive analysis that considers both operational efficiency and how well equity is being used, highlighting the impact of leverage and overall risk–return trade-off. This dual approach ensures that stakeholders, including investors and regulators, can better assess both profitability and financial stability.

The sample constitutes bank-level quarterly data of nine private commercial banks in Bangladesh, covering the period from 2018Q1–2024Q4. These data were sourced from the financial statements of the sample banks and from the central bank of Bangladesh (Bangladesh Bank).

4.1. Overview of Variable Statistics

Table 1 displays the overview of statistics of the variables used in the empirical analysis.

Table 1.

Overview statistics of the variables.

4.2. Model Specification

The regression model is expressed as:

where Zit represents the profitability measures, ROA, and ROE for bank i. Yit indicates the selected explanatory variables, Vit denotes the error term, β is the constant term, and γ is the vector of regression coefficients.

Zit = βi + γYit + Vit

The empirical models to be estimated are as follows:

where the explanatory variables are the number of agents (AG), number of agent banking outlets (OUT), total credit disbursed by agent banks (TC), total deposit mobilization by agent banks (TD), number of accounts with agent banks (AC), and total remittances through agent banks (REM). β is the constant term, and γ is the vector of coefficients. e denotes the error term. Equations (2) and (3) are estimated using both random-effects (RE) and fixed-effects (FE) models. The Hausman specification test is conducted to determine the most appropriate models for the sample data. The results indicate that the RE model is the appropriate one (the probability for the chi-square statistic is given in Appendix A, Table A2). The results for the RE model are presented in the text (Table 2). The full regression results for both the FE model and the RE model are presented in Appendix A, Table A3. To check the robustness of the RE model, a pooled OLS regression model is estimated for Equations (2) and (3). The estimated pooled regression model results are presented in Table 3.

ROAit = β0 + γ1AG + γ2OUT + γ3TC + γ4TD + γ5AC + γ6REM + eit

ROEit = β0 + γ1AG + γ2OUT + γ3TC + γ4TD + γ5AC + γ6REM + eit

Table 2.

Random-effect model results: ROA and ROE as dependent variables.

Table 3.

Pooled regression results: ROA and ROE as dependent variables.

5. Results and Discussion

Table 2 reports the results of the estimated random-effect regression models for ROA (Equation (2)) and ROE (Equation (3)). The estimated positive and statistically significant coefficients of total credit (TC) for both ROA and ROE indicate that loan disbursement through agent banking has a positive impact on the profitability of a bank in terms of ROA and ROE, which is in line with hypotheses H5 (Section Hypotheses Development) and is also strongly supported by the previous studies [21,26,28,34,35,36]. One possible reason for the increased profitability is the higher income earned from loan disbursement by agent banks. Since agent banking outlets are widely spread across the country, especially in the remote areas, clients prefer conducting banking transactions through agents rather than a formal bank branch due to closer travel distance, lower transaction cost, and a trustworthy personal relationship. Moreover, the same person (owner of the outlet) deals with clients who are small entrepreneurs within the locality, and therefore, gradually, a trustworthy relationship is developed between them over time. In addition, the poorer section of clients lacking adequate financial transaction knowledge also depends on a one-to-one relationship with the agent for their financial needs, such as loans. Furthermore, gender can significantly influence trust in financial transactions. For example, financial transactions may be more comfortable for female clients when handled by female agents [6].

For both ROA and ROE, the estimated coefficient for the number of agents is negative and statistically significant, indicating that an increase in the number of agents does not necessarily increase bank profit. The findings are in line with hypothesis H1 (Section Hypotheses Development) and are also similar to the results outlined in the previous studies [28,37]. In the context of Bangladesh, one plausible explanation for our results is that expanding the number of agents does not automatically enhance bank profitability. This is because a higher number of agents does not necessarily lead to increased liabilities through customer deposits, nor does it reduce operational expenses. Moreover, agents in remote areas may struggle to identify viable borrowers, limiting credit growth. Although agent banking was introduced in Bangladesh in 2016, most banks were unable to initiate loan disbursement through agents until 2018. As noted in Section 4, paragraph 2 of the manuscript, only nine banks had a transaction history involving both deposits and credit disbursements via agent banking outlets during our study period (2018Q1–2024Q4). To ensure a comprehensive analysis of agent banking’s impact on bank performance, we selected banks with fully operational agent banking services covering both deposit mobilization and lending activities.

Many researchers, including [11,12,14,21,25,26,27,59,60], find a significant positive link between the number of agents and the financial performance of banks. The divergence from earlier studies may also be due to variations in sample selection, study periods, data sets, and methodological approaches. Specifically, the differences between the findings of this study and those of [11] can be attributed to several contextual and methodological factors. Alam et al. analyzed data from the early growth phase of agent banking in Bangladesh, during which expansion likely contributed to new market penetration and asset accumulation. In contrast, this study examines a more recent period marked by potential agent saturation, where further expansion may not yield proportional gains due to diminishing returns. Moreover, the current research adopts a more rigorous methodological framework by incorporating comprehensive performance metrics (ROA and ROE) and accounting for cost burdens, such as network maintenance and oversight. Additionally, our study restricts its analysis to banks that have fully functional agent banking operations (i.e., both deposits and lending), which was not a consideration in [11] sample selection. Finally, differences in macroeconomic conditions and institutional characteristics may further explain the conflicting outcomes. Thus, the originality of our research lies in its comprehensive approach, updated dataset, focus on matured operational phases, and a nuanced evaluation of both the positive and negative implications of agent banking on financial performance—advancing the understanding beyond the foundational insights provided by [11]. Overall, the results of this study suggest that the effectiveness of agent banking depends not only on the number of agents deployed but also on their operational efficiency, utilization levels, and alignment with the bank’s broader strategic objectives.

The estimated coefficient for deposit mobilization by agent banks is positive for both ROA and ROE. However, the coefficient is not statistically significant. The positive magnitude of the coefficient supports hypotheses H4 (Section Hypotheses Development) and is also similar to the results reported in previous empirical studies [11,14,26,28,29]. The potential reasons for such positive magnitude could be that most of the commercial banks in Bangladesh utilize their agent banking network for deposit mobilization, especially from rural areas, since agent banking has emerged as an effective channel for deposit mobilization, especially in underserved and rural regions, enabling banks to expand their customer base at a lower operational cost.

The estimated coefficients for total remittance collection are negative for both ROA and ROE, where the result is statistically significant for ROA. The negative magnitude of the coefficient for total remittance is opposite to hypotheses H6 (Section Hypotheses Development) and also dissimilar to the previous studies where the authors find a positive relationship between remittance flow and the financial performance of commercial banks [26,28,37,38,39]. This unexpected finding may be explained by several contextual factors specific to Bangladesh’s banking environment. First, while remittance inflows are substantial in volume, banks often act merely as intermediaries in these transactions, earning relatively low margins. The fees associated with processing remittances are regulated and capped, limiting profit generation despite high volumes. Second, remittance funds are typically directed toward household consumption rather than savings or investment products, which constrains the banks’ ability to mobilize these funds for revenue-generating loans or financial instruments. In Bangladesh, especially in rural areas, foreign remittances are received by agents using mobile phone banking, and these remittances are deposited into the customers’ accounts. Therefore, the increase in remittances increases the liability of the agents. Moreover, the high competition among banks and non-bank financial institutions for remittance services often leads to promotional costs and incentives that further erode potential profitability. These dynamics suggest that an increase in remittance volumes does not necessarily translate into improved financial performance for banks. On the contrary, operational costs related to remittance services may outweigh the benefits, particularly when not accompanied by broader financial intermediation strategies. This finding holds important implications for policymakers and bank managers, indicating a need to redesign remittance-linked products that go beyond transactional services and foster deeper financial engagement with remittance-receiving clients.

The estimated coefficient for the number of agent banking outlets is positive for both ROA and ROE, and the coefficient is statistically significant for ROA but not for ROE. The findings support hypothesis H2 (Section Hypotheses Development) and also similar results found in several empirical studies [11,14,31]. Both deposit mobilization and loan disbursement increase, and eventually, more financial intermediation is possible due to the increased number of agent banking outlets across the country. Therefore, bank profit increases due to more earnings from bank assets, i.e., loans and advances through agent banking services utilizing the bank deposit.

The estimated coefficient for the number of agent banking accounts is negative for ROA and positive for ROE. However, the coefficients are not statistically significant for both ROA and ROE. The findings support hypothesis H3 (Section Hypotheses Development) for ROA. Several empirical studies also find a significant negative relation between the number of agent banking accounts and bank profitability [13,28,29,30]. The reason for such a negative relationship could be high maintenance costs and the short tenure of deposits, and also, banks may not utilize or allocate the funds deposited in the agent banking accounts effectively.

6. Robustness Check

To verify the robustness of the findings presented in Section 5, a pooled ordinary least squares (OLS) regression model is estimated using the sample data. Table 3 reports the results obtained from the OLS regression. Table 3 presents the OLS results, which show that the signs, magnitudes, and statistical significance levels of the estimated coefficients largely correspond to those from the random-effect model demonstrated in Table 2.

To assess multicollinearity in STATA, common approaches include the variance inflation factor (VIF) and correlation matrix analysis. In this study, a correlation matrix was generated using the appropriate STATA command to examine the potential collinearity among the independent variables. As shown in Table 4, none of the correlation coefficients approach ±1, indicating low multicollinearity and supporting the statistical reliability of the regression models.

Table 4.

Correlation matrix of variables.

7. Theoretical and Practical Implications

This study provides both theoretical and practical implications that enhance the understanding of FinTech-enabled agent banking in emerging economies, particularly Bangladesh. Theoretically, the findings reinforce the agency theory [15] by illustrating how agent banking functions through a principal–agent framework, where agents extend banking services on behalf of commercial banks. The study also affirms financial intermediation theory [16], demonstrating that agent banking strengthens the intermediary role of banks by mobilizing deposits and disbursing credit in rural and underserved regions.

Moreover, the study contributes to the broader FinTech and banking literature by empirically validating that not all agent banking indicators yield uniform performance outcomes, a conclusion consistent with the mixed results observed in prior research. For instance, the significant positive impact of credit disbursement and agent outlets on ROA and ROE corroborates earlier findings [21,26,28,34], which emphasized the role of targeted loan delivery and geographical accessibility in improving bank performance. Conversely, the negative association between the number of agents and profitability challenges the generalized belief in expansion-driven growth, aligning instead with [28,37], who caution that indiscriminate agent growth can inflate costs without proportional returns.

Additionally, the insignificant effect of deposit mobilization and account numbers on ROA and ROE reflects the earlier literature, which suggests that such inputs may not translate directly into improved profitability without efficient fund allocation or product diversification [13,30]. Similarly, the unexpected negative effect of remittance flows on ROA contradicts much of the existing literature [26,38,39], suggesting that remittance-led profitability depends on broader institutional contexts, pricing structures, and utilization strategies.

Practically, these findings underscore the importance of strategic agent deployment and efficient resource use over sheer expansion. Banks should prioritize productivity-enhancing technologies and agent training rather than expanding the agent base indiscriminately. Additionally, remittance-linked strategies should be redesigned to channel funds into savings or investment instruments rather than mere transactional services. From a policy standpoint, regulators should support agent banking through capacity-building, digital literacy programs, and gender-sensitive outreach to ensure that FinTech deployment enhances both inclusion and performance. Finally, this study contributed a context-specific understanding of FinTech-enabled agent banking’s varied impacts on commercial bank performance in developing economies.

8. Conclusions and Policy Implications

The paper evaluates the effects of agent banking services utilizing FinTech platforms on the financial performance of nine commercial banks in Bangladesh that have been operating full-fledged agent banking services. Employing a panel data regression framework, the study employs bank-level quarterly data for the period 2018Q1–2024Q4 to estimate a random-effects model. The empirical findings indicate that credit disbursement by agent banks has a positive and statistically significant impact on the bank profitability measures, return on assets (ROA), and return on equity (ROE). Similarly, agent banking outlets have a significant positive impact on ROA. However, the number of agents and deposit mobilization do not necessarily affect the profitability of the mother bank. The findings of this study would help the policy makers, bank management, and other stakeholders in their decision-making and in improving the performance of agent banking. Therefore, an appropriate agent banking policy aimed at increasing agent banking outlets using digital platforms based on FinTech is vital for ensuring positive growth in credit disbursement, in order to improve the financial performance of the banking sector in a developing country like Bangladesh.

We acknowledge that, while our dataset covers a recent and extended time period (2018Q1–2024Q4), it includes only those commercial banks in Bangladesh with operational agent banking services offering both deposit and credit disbursement. This sample selection enhances the quality of the analysis but may limit generalizability to banks that have not yet reached this level of operational maturity. Additionally, the study is based on secondary financial data and does not incorporate qualitative insights from bank management or field-level agents. Future studies could extend this research by incorporating primary data, including surveys or interviews with bank officials, agents, and customers, to better capture the behavioral and operational challenges that affect agent banking outcomes. Moreover, exploring regional or rural–urban differences in agent performance could further refine the understanding of agent banking’s impact on financial inclusion and profitability.

Author Contributions

Conceptualization, M.M.I., M.A. and I.A.R.; methodology, I.A.R.; software, I.A.R.; validation, I.A.R.; formal analysis, I.A.R.; investigation, I.A.R.; resources, I.A.R.; data curation, I.A.R.; writing—original draft preparation, M.M.I. and I.A.R.; writing—review and editing, M.M.I., M.A. and I.A.R.; visualization, M.M.I.; supervision, M.M.I. and M.A.; project administration, I.A.R., M.M.I. and M.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data sets that support the findings of this study are openly available upon request. Data is available at https://www.bb.org.bd/en/index.php/publication/publictn/2/68 (accessed on 4 August 2025).

Conflicts of Interest

Iftekhar Ahmed Robin was employed by Central Bank of Bangladesh. The authors declare no conflicts of interest.

Appendix A

Table A1.

Sources and definitions of measurement variables.

Table A1.

Sources and definitions of measurement variables.

| Variables | Definition/Measures | Sources for Measurement Variables |

|---|---|---|

| Dependent Variables | ||

| ROA | Net Profit after tax/Total Assets | [21,28] |

| ROE | Net Profit after tax/Total Equity | [11,21,28] |

| Independent Variables | ||

| AG | Number of Agents | [11,21,28] |

| AC | Number of accounts | [28] |

| OUT | Number of Outlets | [28] |

| TC | Total Credit/loans | [11,28] |

| TD | Total Deposits | [11,21,28] |

| REM | Total Remittance | [26,28] |

Table A2.

List of sample banks.

Table A2.

List of sample banks.

| Name of the Sample Banks | Sample Period |

|---|---|

| Bank Asia PLC | 2018Q1–2024Q4 |

| Dutch-Bangla Bank PLC | 2018Q1–2024Q4 |

| Al-Arafah Islami Bank PLC | 2018Q1–2024Q4 |

| Islami Bank Bangladesh PLC | 2018Q1–2024Q4 |

| Mutual Trust Bank PLC | 2018Q1–2024Q4 |

| The City Bank PLC | 2018Q1–2024Q4 |

| Brac Bank PLC | 2018Q1–2024Q4 |

| NRB Bank PLC | 2018Q1–2024Q4 |

| Modhumoti Bank PLC | 2018Q1–2024Q4 |

Source: Authors’ compilation.

Table A3.

Fixed-effect and random-effect model results: ROA and ROE.

Table A3.

Fixed-effect and random-effect model results: ROA and ROE.

| ROA | ROE | |||

|---|---|---|---|---|

| FE | RE | FE | FE | |

| Number of Agents (AG) | −0.001 (0.004) | −0.003 ** (0.001) | −0.003 (0.052) | −0.036 ** (0.018) |

| Number of Outlets (OUT) | 0.002 (0.006) | 0.005 *** (0.002) | 0.011 (0.073) | 0.028 (0.023) |

| Total Credit (TC) | −0.000 (0.001) | 0.001 *** (0.009) | −0.010 (0.009) | 0.011 *** (0.004) |

| Total Deposit (TD) | 0.001 (0.002) | 0.002 (0.001) | 0.005 (0.022) | 0.005 (0.014) |

| Number of Accounts (AC) | 0.000 (0.001) | −0.001 (0.001) | 0.011 (0.019) | 0.008 (0.012) |

| Total Remittance (REM) | 0.001 (0.002) | −0.002 ** (0.001) | 0.019 (0.024) | −0.003 (0.011) |

| Constant | −0.004 (0.006) | 0.001 (0.003) | −0.096 (0.078) | −0.005 (0.034) |

| R-squared | 0.005 | 0.123 | 0.037 | 0.113 |

| Hausman test | Prob = 0.003:RE | Prob = 0.000:RE | ||

| Total observations | 234 | 234 | ||

Source: Authors’ estimation using STATA. FE stands for fixed-effect model, and RE is random-effect model. Standard errors are in parentheses. *** denotes statistical significance level at 1%; ** denotes the level of statistical significance at 5%.

References

- Zhu, Z. The Role of fintech in the Innovation and Transformation of the Banking Industry. Adv. Econ. Manag. Political Sci. 2023, 16, 9–16. [Google Scholar] [CrossRef]

- Gupta, R.; Gupta, A. Agent banking in the FinTech era: Opportunities for financial inclusion. J. Financ. Technol. 2020, 15, 25–38. [Google Scholar]

- Veniard, C. How Agent Banking Changes the Economics of Small Accounts. 2010. Available online: https://docs.gatesfoundation.org/documents/agent-banking.pdf (accessed on 22 December 2024).

- Bangladesh Bank. Quarterly Report on Agent Banking, October–December; Financial Inclusion Department, Bangladesh Bank: Dhaka, Bangladesh, 2024. [Google Scholar]

- Buri, S.; Cull, R.; Gine, X.; Harten, S.; Heitmann, S. Banking with Agents: Experimental Evidence from Senegal; World Bank: Washinton, DC, USA, 2018. [Google Scholar]

- Cull, R.; Gine, X.; Harten, S.; Heitmann, S.; Rusu, A.B. Agent banking in a highly under-developed financial sector: Evidence from Democratic Republic of Congo. World Dev. 2018, 107, 54–74. [Google Scholar] [CrossRef]

- Kumar, A.; Nair, A.; Parsons, A.; Urdapilleta, E. Expanding Bank Outreach Through Retail Partnerships: Correspondent Banking in Brazil; World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Margaret, K.G.; Ruth, N.K. The effect of banking services on the business performance of bank agents in Kenya. Cogent Bus. Manag. 2019, 6, 16844420. [Google Scholar] [CrossRef]

- Nezianya, N.P.; Izuchukwu, D. Impact of agent banking on the performance of deposit money banks in Nigeria. Res. J. Financ. Account. 2014, 5, 35–41. [Google Scholar]

- Zaffar, M.A.; Kumar, R.L.; Zhao, K. Using agent-based modelling to investigate diffusion of mobile-based branchless banking services in a developing country. Decis. Support Syst. 2019, 117, 62–74. [Google Scholar] [CrossRef]

- Alam, M.M.; Bhowmik, D.; Bhowmik, D. The impact of agent banking on financial performance of commercial banks in Bangladesh. IOSR J. Econ. Financ. 2020, 11, 13–20. [Google Scholar]

- Ndambuki, D. The Effect of Agency Banking on Profitability of Commercial Banks in Kenya. Ph.D. Thesis, University of Nairobi, Nairobi, Kenya, 2016. [Google Scholar]

- Balaylar, N.A.; Karımlı, T.; Bulut, A.E. The effect of non-interest income on bank profitability and risk: Evidence from Turkey. Rev. Galega De Econ. Publicación Interdiscip. Da Fac. De Cienc. Económicas E Empres. 2025, 34, 1. [Google Scholar] [CrossRef]

- Hasan, Z. The Effects of Agent Banking on the Profitability of Commercial Banks in Bangladesh. Ph.D. Thesis, Brac University, Dhaka, Bangladesh, 2019. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Diamond, D.W. Financial intermediation and delegated monitoring. Rev. Econ. Stud. 1984, 51, 393–414. [Google Scholar] [CrossRef]

- Siddiquie, M.R. Agent banking, the revolution in financial service sector of Bangladesh. IOSR J. Econ. Financ. 2014, 5, 28–32. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Lyman, T.; Ivatury, G.; Staschen, S. Use of agents in branchless banking for the poor: Rewards, risks, and regulation. Focus Note 2006, 38, 1. [Google Scholar]

- Ogoti, K.I.; Omwenga, Q.J. Influence of agency banking on the financial performance of commercial banks in kisii county, Kenya. Int. J. Soc. Sci. Inf. Technol. 2023, 9, 172–181. [Google Scholar]

- Karangwa, F.; Mulyungi, D.P. Effect of agency banking services on financial performance of commercial banks: A case of equity bank. Int. J. Manag. Commer. Innov. 2018, 6, 758–765. [Google Scholar]

- Idoko, E.C.; Chukwu, M.A. Does Agency Banking Trigger Financial Inclusion? Perspective of Residents in Rural Setting. Sch. Bull. 2022, 8, 180–188. [Google Scholar] [CrossRef]

- Mwando, S. Contribution of agency banking on financial performance of commercial banks in Kenya. J. Econ. Sustain. Dev. 2013, 20, 26–34. [Google Scholar]

- Aduda, J.; Kiragu, P.; Ndwiga, J.M. The relationship between agency banking and financial performance of commercial banks in Kenya. J. Financ. Invest. Anal. 2013, 2, 97–117. [Google Scholar]

- Ayadi, O.F.; Oke, B.; Oladimeji, A.; Aladejebi, O. Agency Banking in Nigeria: Impact and Impediments. SEDME Small Enterp. Dev. Manag. Ext. J. 2023, 50, 227–247. [Google Scholar] [CrossRef]

- Hossain, M.I.; Al-Amin, M.; Toha, M.A. Are commercial agent banking services worthwhile for financial inclusion? Bus. Manag. Strategy 2021, 12, 206–227. [Google Scholar] [CrossRef]

- Waithanji, M.N. The Impact of Agent Banking as a Financial Deepening Initiative in Kenya. Ph.D. Thesis, University of Nairobi, Nairobi, Kenya, 2012. Available online: https://erepository.uonbi.ac.ke/handle/11295/6933?utm_source=chatgpt.com (accessed on 7 February 2025).

- Hasan, M.K. Agent Banks Make a Notable Contribution. The Financial Express, Bangladesh. 2023. Available online: https://thefinancialexpress.com.bd/views/reviews/agent-banks-make-a-notable-contribution (accessed on 7 February 2025).

- Dotun, O.V.; Adesugba, A.K. The impact of agency banking on financial performance of listed deposit money banks in Nigeria. J. Corp. Financ. Manag. Bank. Syst. 2022, 2, 14–24. [Google Scholar] [CrossRef]

- Pasiouras, F.; Kosmidou, K. Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Res. Int. Bus. Financ. 2007, 21, 222–237. [Google Scholar] [CrossRef]

- Oburu, K.N. Effect of Agency Banking on the Financial Performance of Commercial Banks in Kenya. Ph.D. Thesis, University of Nairobi, Nairobi, Kenya, 2018. Available online: https://erepository.uonbi.ac.ke/bitstream/handle/11295/94726/Kambua%2CBelita%20D_The%20effect%20of%20agency%20banking%20on%20financial%20performance%20of%20commercial%20banks%20in%20kenya.pdf?sequence=1 (accessed on 8 February 2025).

- Nisha, N.; Nawrin, K.; Bushra, A. Agent banking and financial inclusion: The case of Bangladesh. Int. J. Asian Bus. Inf. Manag. 2020, 11, 127–141. [Google Scholar] [CrossRef]

- Hirtle, B. The impact of network size on bank branch performance. J. Bank. Financ. 2007, 31, 3782–3805. [Google Scholar] [CrossRef]

- Hasan, M.S.A.; Manurung, A.H.; Usman, B. Determinants of bank profitability with size as moderating variable. J. Appl. Financ. Bank. 2020, 10, 153–166. [Google Scholar]

- Hasan, J. Agent Banking Lending up 56PC, Deposit 15.4pc in Q4’24. The Financial Express, Bangladesh. 2025. Available online: https://thefinancialexpress.com.bd/economy/agent-banking-lending-up-56pc-deposit-154pc-in-q424 (accessed on 8 February 2025).

- Khan, T.A. Agent Banking’s Impact on Financial Inclusion in Bangladesh. Asian Banking & Finance. 2024. Available online: https://asianbankingandfinance.net/retail-banking/commentary/agent-bankings-impact-financial-inclusion-in-bangladesh?utm_source=chatgpt.com (accessed on 12 February 2025).

- Das, B. Impact of Agent Banking on Bank Profitability in Bangladesh. Master’s Thesis, University of Dhaka, Dhaka, Bangladesh, 2021. Available online: https://www.scribd.com/document/745526778/IMPACT-OF-AGENT-BANKING-ON-BANK-PROFITABILITY-IN-BANGLADESH? (accessed on 12 February 2025).

- Aggarwal, R.; Demirgüç-Kunt, A.; Pería, M.S.M. Do remittances promote financial development? J. Dev. Econ. 2011, 96, 255–264. [Google Scholar] [CrossRef]

- World Bank. COVID-19 Crisis Through a Migration Lens; Migration and Development Brief 32; World Bank: Washington, DC, USA, 2020; Available online: https://documents1.worldbank.org/curated/en/989721587512418006/pdf/COVID-19-Crisis-Through-a-Migration-Lens.pdf (accessed on 12 February 2025).

- Giuliano, P.; Ruiz-Arranz, M. Remittances, financial development, and growth. J. Dev. Econ. 2009, 90, 144–152. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; López Córdova, E.; Martínez Pería, M.S.; Woodruff, C. Remittances and banking sector breadth and depth: Evidence from Mexico. J. Dev. Econ. 2011, 95, 229–241. [Google Scholar] [CrossRef]

- Mundaca, B.G. Remittances, financial market development, and economic growth: The case of Latin America and the Caribbean. Rev. Dev. Econ. 2009, 13, 288–303. [Google Scholar] [CrossRef]

- FATF. International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation; Financial Action Task Force (FATF): Paris, France, 2012; Available online: https://www.fatf-gafi.org/content/dam/fatf-gafi/recommendations/FATF%20Recommendations%202012.pdf (accessed on 12 February 2025).

- Ramadugu, R. Fintech, Remittances, and Financial Inclusion: A Case Study of Cross-Border Payments in Developing Economies. J. Comput. Inf. Technol. 2023, 3. Available online: https://universe-publisher.com/index.php/jcit/issue/view/3 (accessed on 12 February 2025).

- Zins, A.; Weill, L. The determinants of financial inclusion in Africa. Rev. Dev. Financ. 2016, 6, 46–57. [Google Scholar] [CrossRef]

- Irura, N.; Munjiru, M. Technology Adoption and the Banking Agency in Rural Kenya. J. Sociol. Res. 2013, 4, 249–266. [Google Scholar] [CrossRef]

- Darda, A. From Shops to Service Centers: The Rise of Agent Banking in Africa. 2024. Available online: https://amitdarda.com/from-shops-to-service-centers-the-rise-of-agent-banking-in-africa/?utm_source (accessed on 12 February 2025).

- Coffie, C.P.K.; Hongjiang, Z. FinTech market development and financial inclusion in Ghana: The role of heterogeneous actors. Technol. Forecast. Soc. Change 2023, 186, 122127. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Glavee-Geo, R.; Karjaluoto, H.; Hinson, R.E. Mobile money as a driver of digital financial inclusion. Technol. Forecast. Soc. Change 2023, 186, 122158. [Google Scholar] [CrossRef]

- Senyo, P.K.; Osabutey, E.L.; Seny Kan, K.A. Pathways to improving financial inclusion through mobile money: A fuzzy set qualitative comparative analysis. Inf. Technol. People 2021, 34, 1997–2017. [Google Scholar] [CrossRef]

- Al-Amin, M.; Mia, R.; Hasan, S.M. Fintech adoption and its impact on bank profitability: A study of Bangladeshi commercial banks. Cost Manag. 2024, 52, 27–40. [Google Scholar]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Shaikh, N.A. Fintech: A changing agent for the banking, financial industry. In Pakistan & Gulf Economist; Economist Publications Limited: Karachi, Pakistan, 2023; Volume 42, pp. 30–32. [Google Scholar]

- Ha, D.; Le, P.; Nguyen, D.K. Financial inclusion and fintech: A state-of-the-art systematic literature review. Financ. Innov. 2025, 11, 69. [Google Scholar] [CrossRef]

- Rahmani, M.S.; Azam, M.K. FinTech and digital transformation in the banking sector: A systematic literature review. Int. J. Res. Financ. Manag. 2025, 8, 639–649. [Google Scholar] [CrossRef]

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. In Material Cultures of Financialization; Routledge: Abingdon, UK, 2020; pp. 69–82. [Google Scholar]

- Antao, S.; Karnik, A. Bank performance and noninterest income: Evidence from countries in the Asian region. Asia-Pac. Financ. Mark. 2022, 29, 477–505. [Google Scholar] [CrossRef]

- Zhang, X.; Li, Z. FinTech: The disruptive force reducing bank competition pressure. Emerg. Mark. Rev. 2025, 65, 101237. [Google Scholar] [CrossRef]

- Seda, M.A. Effects of Agency Banking on the Financial Performance of Commercial Banks in Kenya. Ph.D. Thesis, University of Nairobi, Nairobi, Kenya, 2016. [Google Scholar]

- Kambua, B.D. The Effect of Agency Banking on Financial Performance of Commercial Banks in Kenya. Ph.D. Thesis, United States International University Africa, Nairobi, Kenya, 2015. Available online: https://erepo.usiu.ac.ke/bitstream/handle/11732/3198/SIMBOLEY%20BRENDA%20CHEMUTAI%20MBA%202017.pdf?sequence=1 (accessed on 7 February 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).