1. Introduction

As the first heavy industry base built after the founding of the People’s Republic of China, the Northeast has formed a complete industry system centred on steel, machinery, petroleum and chemicals. Since the 1990s in Northeast China resource-based cities, the Northeast has successively entered the mature and recession period of urban resource development

1. Since 2003, in order to promote the economic recovery of old industrial bases such as those located in the Northeast, the state has developed a series of targeted recovery strategies for these areas. Under the active promotion of various strategies to revitalize the old industrial bases in Northeast China, the economic growth rate of the Northeast region increased by over 8% during the period between 2011 and 2014 and the revitalization strategy achieved initial results. However, according to the economic statistics from the end of 2014 to the first quarter of 2016, the economic growth rate of the three north-eastern provinces had not maintained the same rapid growth as the previous period, instead, there had been a big decline. In response to the problems in the north-eastern region, the National Development and Reformation Commission publicly released a plan called “Promoting the Three-Year Rolling Implementation Plan for the Revitalization of Old Industrial Bases in Northeast China (2016–2018)” on 22 August 2016, clarifying 137 key tasks and 127 major projects related to Northeast China, which are expected to have a total investment of around 1.6 trillion. That shows the Chinese government’s support for the north-eastern regions’ economic transformation policy in resource-based cities.

However, referring to the effects of the public policies on the industrial transformation of resource-based cities in Northeast China, quite a few scholars have conducted research to evaluate and analyses the development of resource-based cities and their transformation effects. Qi Jianzhen (

Qi 2004) proposed a relatively completed indicator system of resource-based cities using four aspects of economy, resources, society and environment. Other scholars not only constructed an evaluation system but also carried out empirical analysis of the economic transformation of the Daqing and Yangjiazhangzi economic and technological development zone in Huludao, Liaoning Province (

Che and Zhang 2011;

Cao and Wang 2011). Further, 11 indicators were adopted to evaluate the effect of industrial transformation of 11 mineral resource-based urban areas in China and the bottleneck of industrial transformation was analysed (

Sun 2014). In this way, the innovation path of industrial transformation of resource-based urban areas was obtained. A transformation evaluation index system was constructed and used to evaluate the low-carbon transformation effect of Panzhihua, which was taken as an example (

Zhang et al. 2016).

From the perspective of industrial transformation to evaluate the effect of transformation of resource-based cities, scholars adopted different indexes. As

Yang et al. (

2019) reviewed in the earlier research literature, the industrial transformation usually only refers to industrial structure upgrading, which refers to the dominant industry shifts from the primary industry to the secondary industry and then turns to the tertiary industry. When selecting an indicator of industrial structure upgrading,

Zhang and Zhang (

2015) selected the ratio of the added value of the secondary and tertiary industries to the total GDP value of the current year as the measurement index. While

Duarte and Restuccia (

2010) and

Gan et al. (

2011) thought that the proportion of the added value of the tertiary industry may not be suitable for calculating the industrial structure upgrading of all countries except for China. Li Lei et al. chose an index of structural upgrading with the ratios of the output values in the primary industry and the secondary industry (PI1, SI1) accounting for GDP (

Li et al. 2018).

Later on, some scholars suggested that industrial structure changing should include two dimensions: the industrial structure upgrading and the industrial structure rationalization, since industrial structure changing can optimize resource allocation and promote the development of industrial structure rationalization (

Gan and Zheng 2009;

Chong et al. 2013;

Yang et al. 2019).

Gan and Zheng (

2009) used the “Theil index” to measure industrial structure rationalization and it is the prevailing method at present.

Considering that resource-based cities are usually dependent on one or a few industries, industrial diversification can be very different even between regions and cities that operate under similar national institutional conditions. This has led to a general interest in the role that local economic and industrial structures play in fostering (or hampering) industrial diversification (

Shi and He 2011;

Gan et al. 2011).

Based on previous studies of the industrial structure transformation of prefecture-level resource-based cities in Northeast China, this paper selects three indicators of industrial structure diversification, rationalization and upgrading, conducting an empirical analysis on the transformation of industrial structure of these resource-based cities, exploring the existing problems in the process of the industrial structure transformation of these cities and providing in-depth analysis of urban industrial development issues in the context of the coordinated development of the regional economy. Most of the previous research literature only considered industrial structure upgrading but neglected indicators of industrial structure diversification and rationalization. Much research targeted specific types of resource-based cities such as coal cities, forest cities and oil cities. The industrial transformation strategies proposed are narrowly applicable. Most studies focused on industrial restructuring but did not pay attention to specific industrial transformation paths, which may limit the effectiveness of policy recommendations.

This article contributes to the previous literature by selecting three indicators of industrial structure diversification, rationalization and upgrading instead of one or two indicators and by comparing all different types of resource-based cities in Northeast China instead of analysing just one type of resource-based city. The effects of industrial transformation on resource-based cities of the same kind are analysed and the development of industrial structure among provinces is compared. We expand the study in the area by conducting broader and more comprehensive research. In addition, instead of giving a general advice of industrial restructuring, the article tries to provide restructuring path by analysing the effect of industrial structure changing including industrial structure upgrading and rationalization on economic growth with the previous calculation results. We hope our research will provide more targeted policy recommendations for the industrial transformation path of resource-based cities in Northeast China.

The main purpose of the article is to analyse the problems in industrial structure evolution from a more comprehensive and comparative perspective and try to give advice on the restructuring path by analysing the influence of industrial transformation on economic growth. The outline of this article is as follows: In

Section 2, the overview of resource-based cities classification in Northeast China and sample selected in the article will be introduced. In

Section 3, analysis of industrial structure transition from diversification, rationalization and upgrading will be examined and compared. In

Section 4, with calculation results from the above section, an empirical model will be used to analyse the impact of industrial transformation on economic growth. In

Section 5, we will conclude with recommendations to facilitate industrial reconstructing and shed light on the sustainable development of resource-based cities in Northeast China.

3. Analysis of Industrial Structure Transition from Diversification, Rationalization and Upgrading

3.1. Analysis of Industrial Structure Diversification

Entropy is an important concept in thermodynamics and a parameter derived from the second law of thermodynamics. Entropy was originally used in physics to measure the degree of chaos in the system. It was originally proposed in 1854 by Clausius (T. Clausius) and in 1923 the Chinese physicist Professor Hu Gangfu translated it into “entropy.” Entropy was later used in information economics to measure uncertainty, the degree of disorder of events or the degree of dispersion of indicators. In the industrial structure, the use of industrial structure entropy can describe the state of industrial structure system evolution, especially for single-function cities, using entropy to measure the diversification of industrial structure is also widely accepted by some scholars. The expression of industrial structure entropy is as follows:

Among them: indicates the industrial structure entropy, indicates the number of industries in the selected area and indicates the proportion of industry output value in all industries in the region. A larger indicates that the industrial structure is more disorder, out of order and diverse.

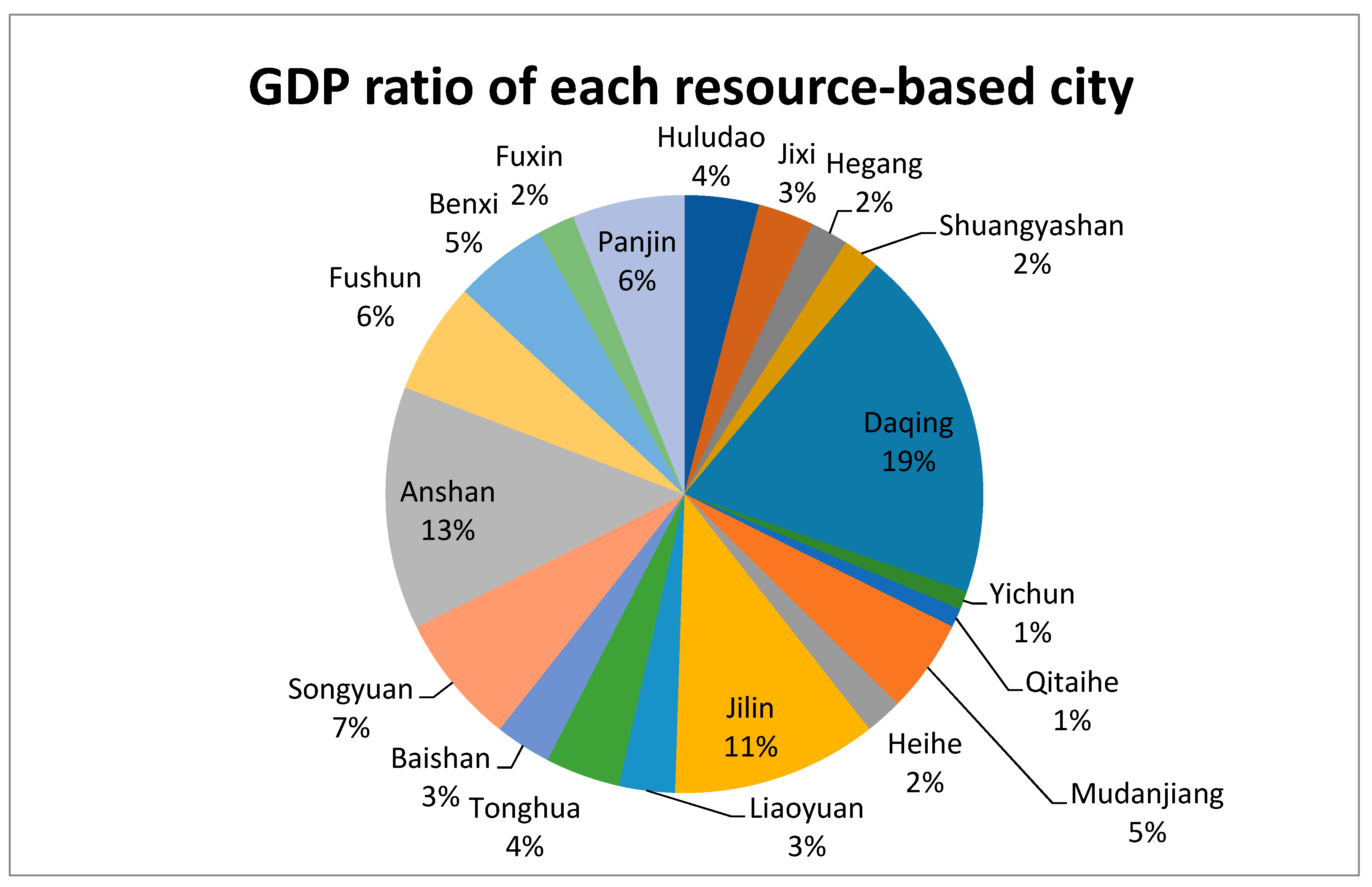

By selecting the GDP and the output value of each industry in the prefecture-level resource-based cities in Northeast China, the industrial structure entropy of each city is calculated through these data and the results of the calculation can analyse the diversification of the industrial structure of resource-based cities in Northeast China, which can discover the problems these resource-based cities have with their industrial transformation process.

The data used in this section are derived from China Statistical Yearbook 1996–2016, China City Statistical Yearbook 1996–2016, Liaoning Statistical Yearbook 1996–2016, Heilongjiang Statistical Yearbook 1996–2016, Jilin Statistical Yearbook 1996–2016 and the corresponding years of the relevant cities Statistical Yearbook.

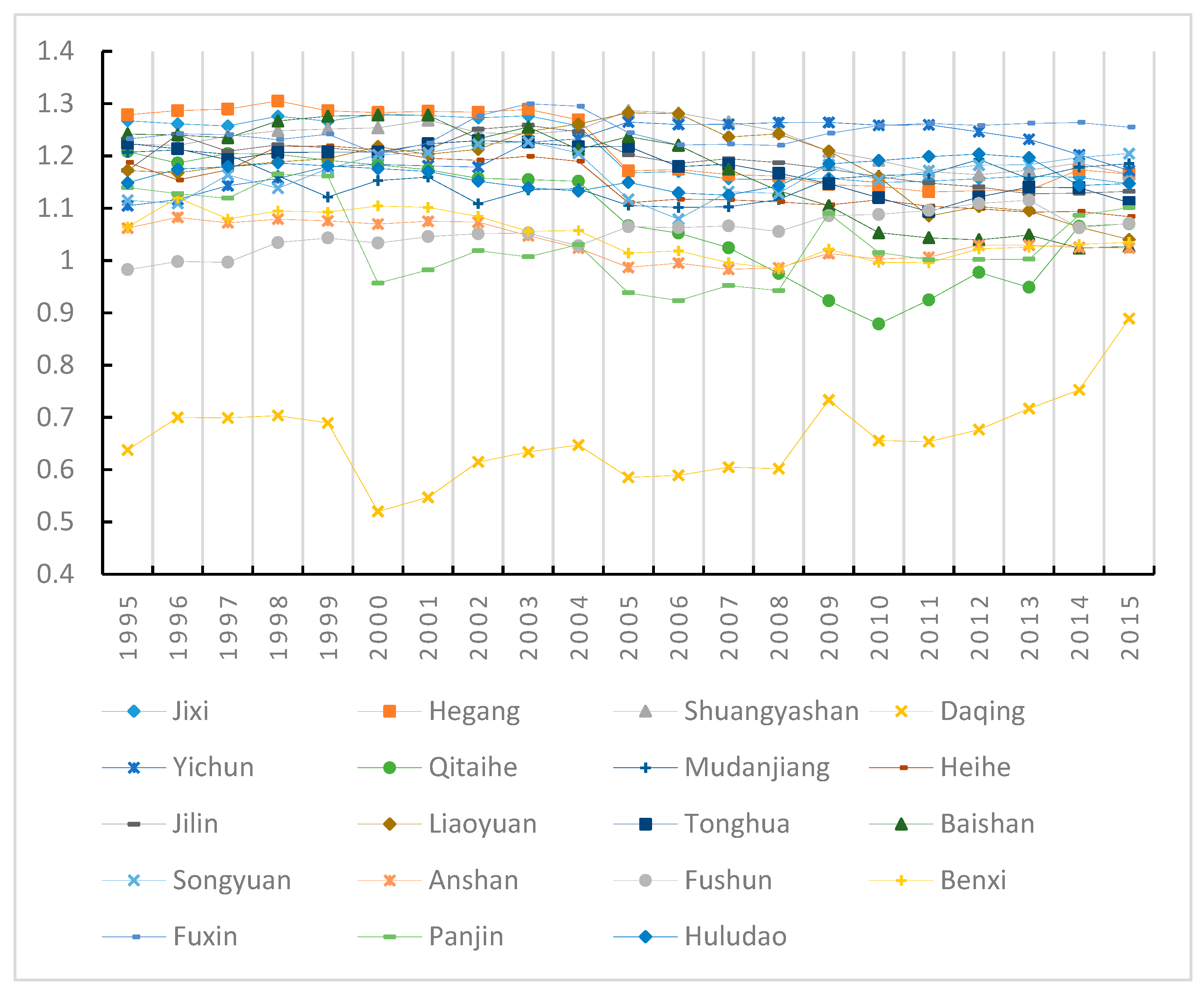

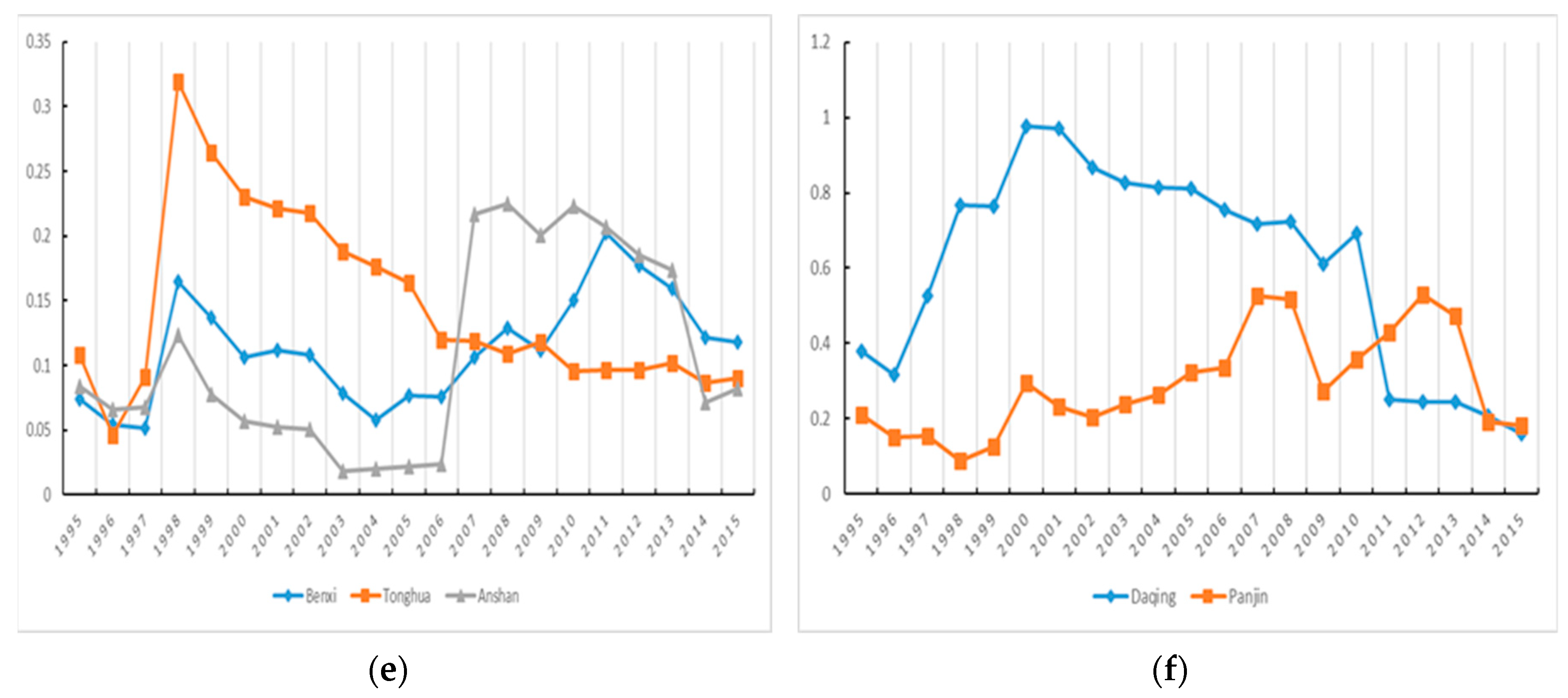

By calculating the industrial structure entropy of resource-based cities in Northeast China, we can find the structural changes in 1995–2015. The results are shown in

Figure 2 and

Figure 3. It can be seen from the calculation results that the overall industrial structure entropy of resource-based cities in Northeast China was concentrated between 0.8 and 1.4, the fluctuations were different in different periods. Between 1995 and 2003, the industrial structure entropy of most resource-based cities fluctuated less, indicating that there were fewer types of industries within these cities and the similarities between industries were high. Between 2003 and 2009, the industrial structure entropy of resource-based cities in Northeast China fluctuated greatly, indicating that the industrial diversification within the city had been constructed and the industrial structure entropy first declined and then increased, which indicates the deep development and close linkage of the industries and at the same time as the development of the tertiary industry was being promoted.

As for coal cities, the industrial structure entropy of Fushun City was at the lowest level in the initial stage but the industrial structure entropy had been gradually increased with the passage of time and was finally at the same level as the other coal cities, indicating that its industrial structure had been diversified since then. However, the economic entropy of Qitaihe in 2005 showed a greater decline than before and a downward trend between 2005 and 2010, the overall level was in the last position among all the coal cities, which indicates the diversified development of the industrial structure of Qitaihe had caused greater problems than in other coal cities. In 2011, the industrial structure entropy of Qitaihe began to rise and was at the same level as other coal cities in 2014, indicating that between 2011 and 2015, Qitaihe adjusted and the level of industrial structure diversification was restored; the industrial diversification development levels of the other five coal cities were basically at the same level in different years, including Fuxin as the first national pilot transformation city in the near future, with the best level of industrial structure diversification.

Among the non-ferrous metallurgical cities, the industrial structure entropy of Jilin and Huludao increased between 1995 and 2000, indicating that the industrial structure of these two cities had gradually diversified; between 2001 and 2005, the industrial structure entropy of Jilin showed a trend of decline after rise, while the city of Huludao showed the opposite trend. The two cities experienced a big gap in the diversification of industrial structure during the five years; before 2009, the industrial diversification level of Jilin was better than that of Huludao and after 2009, the industrial structure diversification level of Huludao began to exceed that of Jilin. The industrial diversification of Jilin showed a downward trend, while Huludao showed an upward trend and the industrial diversification gap between the two cities had increased year by year. However, in 2014, the industrial structure entropy of Huludao showed a significant decline, indicating that the city’s industrial structure diversification decreased but the level of diversification was still better than that of Jilin.

In the ferrous metallurgical cities, the development trends of industrial structure diversification in the three cities were basically the same and the overall fluctuations were not large. The industrial structure of Tonghua had always been better than the other two cities. Benxi and Anshan were basically at the same level as the diversified development of the industry.

Among the oil cities, the industrial structure entropy of Daqing and Panjin showed the same trend but Panjin was significantly better than Daqing in terms of diversified industrial structure development. Daqing was also the most backward of all selected cities in the development of diversified industrial structure.

In terms of forest industry cities, the industrial diversification of the four cities before 2004 was basically at the same level of development. The industrial structure entropy of Mudanjiang showed a fluctuating downward trend and began to fall behind the other three cities in 1999.

After 2006, the industrial structure entropy of Mudanjiang began to show a growth trend and eventually returned to the original level; the industrial structure entropy of the remaining three cities except Yichun had declined and after 2008 the industrial structure entropy of the three cities had risen. The industrial diversification level of Yichun between 2004 and 2013 was the best among the 4 forest industry cities; the industrial structure entropy of Heihe showed an overall slowdown after a significant decline in 2005, which had been falling behind the other three forestry cities in terms of industrial structure diversification since 2009.

As a comprehensive development city, combining coal, iron, forest and other variety of resources, Baishan, the industrial diversification, appeared a downward trend after 2005. After 2010, it showed a steady development and stopped declining. The industrial diversification of Baishan before 2005 was at a higher level among all selected cities, however, the industrial diversification after 2005 of Baishan had been gradually lowered than the overall level of selected cities.

It can be seen from the comparison of different resource-based cities that the average industrial structure entropy of non-ferrous metallurgical cities was 1.178 and the development of industrial diversification was fine, while the average industrial structure entropy of petroleum cities was 0.848 and the development was relatively poor comparing between provinces, it is shown that the development of resource-based cities in the Northeast is different. Liaoning Province had the best industrial diversification, followed by Heilongjiang Province, with Jilin Province showing the smallest gap in industrial structure entropy and the worst performance of industrial diversification. Among all the resource-based cities surveyed, Fuxin, as the country’s first pilot city for transformation and reform, had a higher industrial structure entropy and the best development in industrial diversification. Although the industrial structure of Daqing had been adjusted, it was still dominated by industry. Its industrial structure entropy had been lowered than other resource-based cities and its performance in industrial diversification was slightly worse.

3.2. Analysis of Industrial Structure Rationalization

The Theil Index is named after

Theil and Scholes (

1967), which uses the entropy concept of information theory to calculate income inequality, also known as the Theil’s entropy measure. As for information theory, assuming that an event E will occur with a certain probability

and then receive a confirmation message to verify the occurrence of the event E, the amount of information contained in the message can be expressed by the formula:

Let the probability of occurrence of a complete event group be

,

, …

, consisting of events

,

, …

, therefore

entropy or the expected amount of information equals to the sum of the products of the information of each event and its corresponding probability, then the formula comes to be:

When the concept of Entropy index in information theory is used to measure the income gap, it can be interpreted as the amount of information contained in the message that converts the population share into income share. The Theil index is only a special case of the widely used Entropy index. The expression of the Theil index is:

In the formula, T is the Theil index to measure the degree of income gap,

is the income and

is the average income of all individuals. For grouped data, another expression for the Theil index is:

In the formula, is the proportion of the k-th sample’s income among the overall income, is the proportion of the k-th sample’s population among the overall population.

This paper uses the Theil index to measure the rationality of the industrial structure. Through the redefinition of the Theil index, the rationality of the industrial structure is measured. Some Chinese scholars have used the newly defined Theil index to analyse the rationalization of industrial structure (

Gan et al. 2011). The new calculation formula is as follows:

In the formula, represents the output value, means employment, expresses productivity, when the economy develops in a balanced manner, , = 0. Moreover, the use of this index takes the relative importance of the industry into consideration, retaining the theoretical basis and economic implications of structural deviation and avoiding the calculation of absolute values. The closer the Theil index is to zero, the more reasonable the industrial structure.

By selecting the total output value, the three industries’ output values and the number of employees in the tertiary industry of the prefecture-level resource-based cities in Northeast China in relevant years, the calculation of the Theil index is carried out and the development of the industrial structure rationalization of resource-based cities in Northeast China can be analysed from the results of the calculation, to find out the problems that these resource-based cities have in the process of industrial transformation.

The data used in this section are derived from China Statistical Yearbook 1996–2016, China City Statistical Yearbook 1996–2016, Liaoning Province Statistical Yearbook 1996–2016, Heilongjiang Province Statistical Yearbook 1996–2016, Jilin Province Statistical Yearbook 1996–2016 and the corresponding years’ Yearbook of relevant cities.

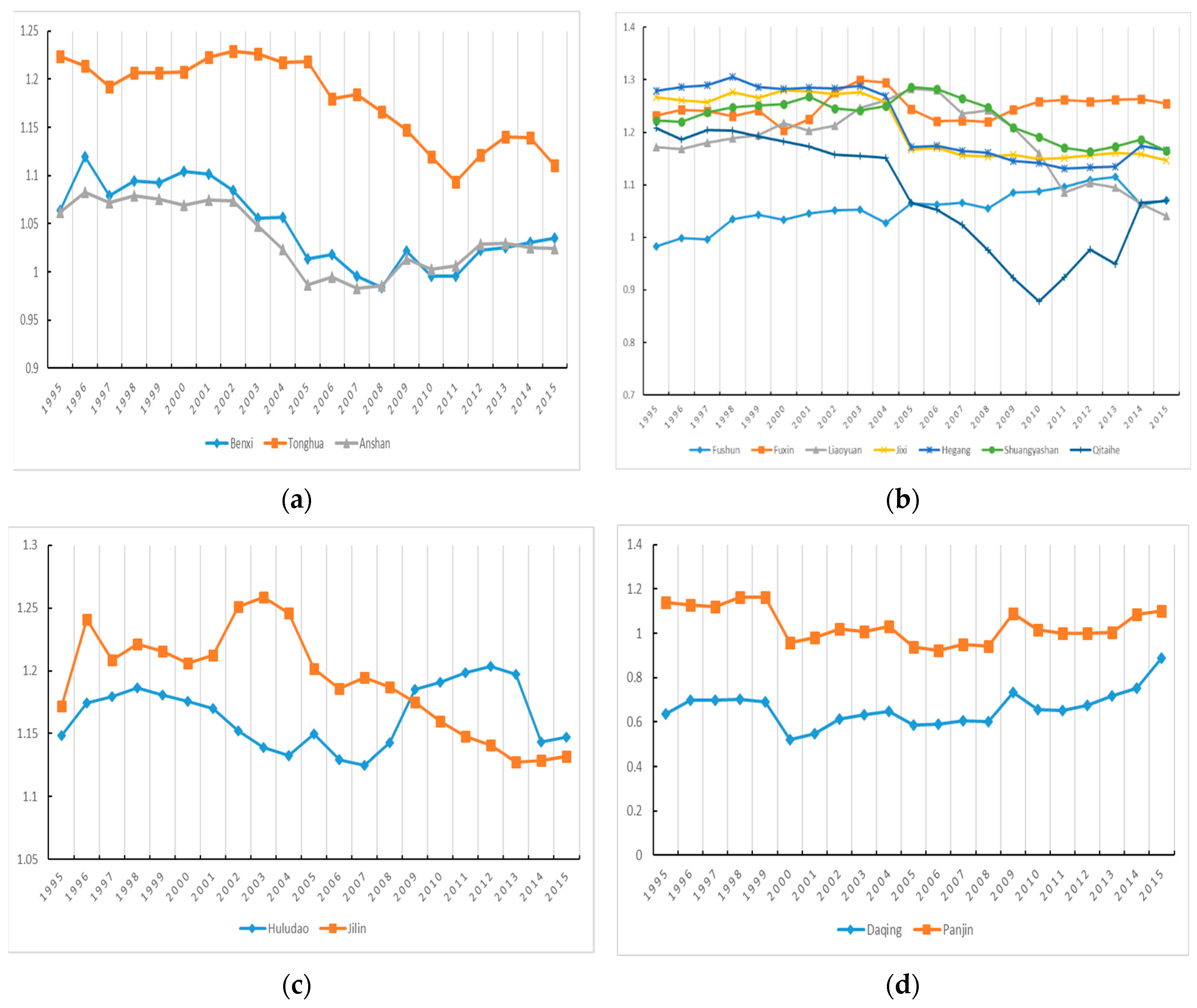

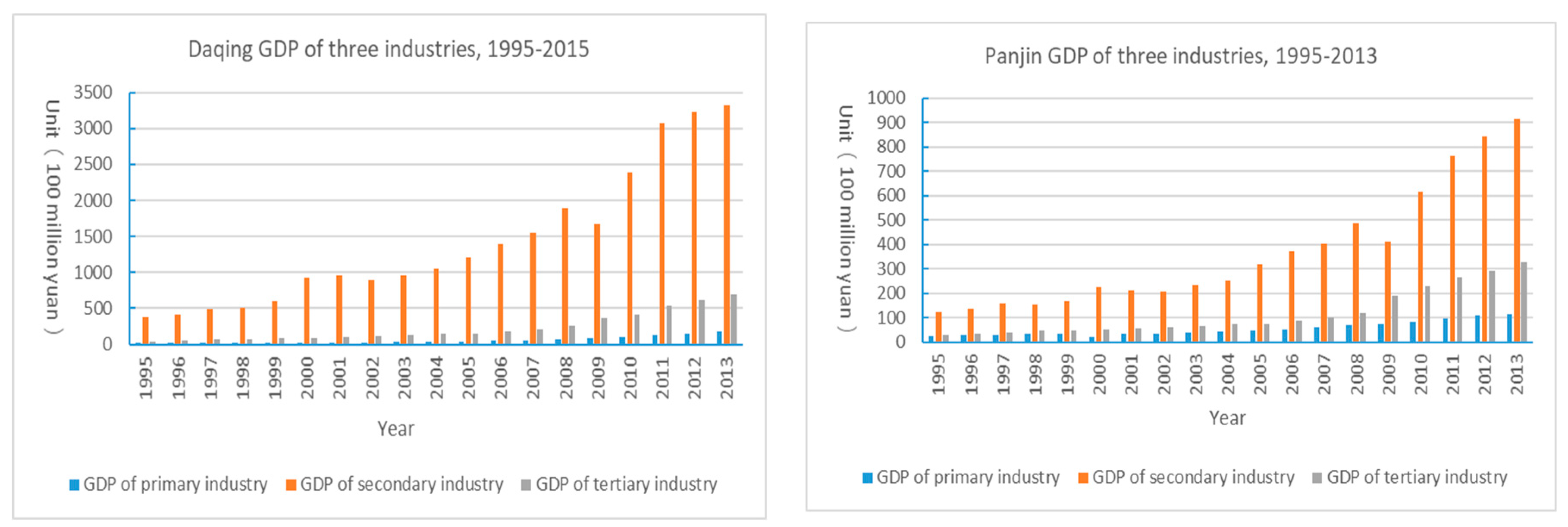

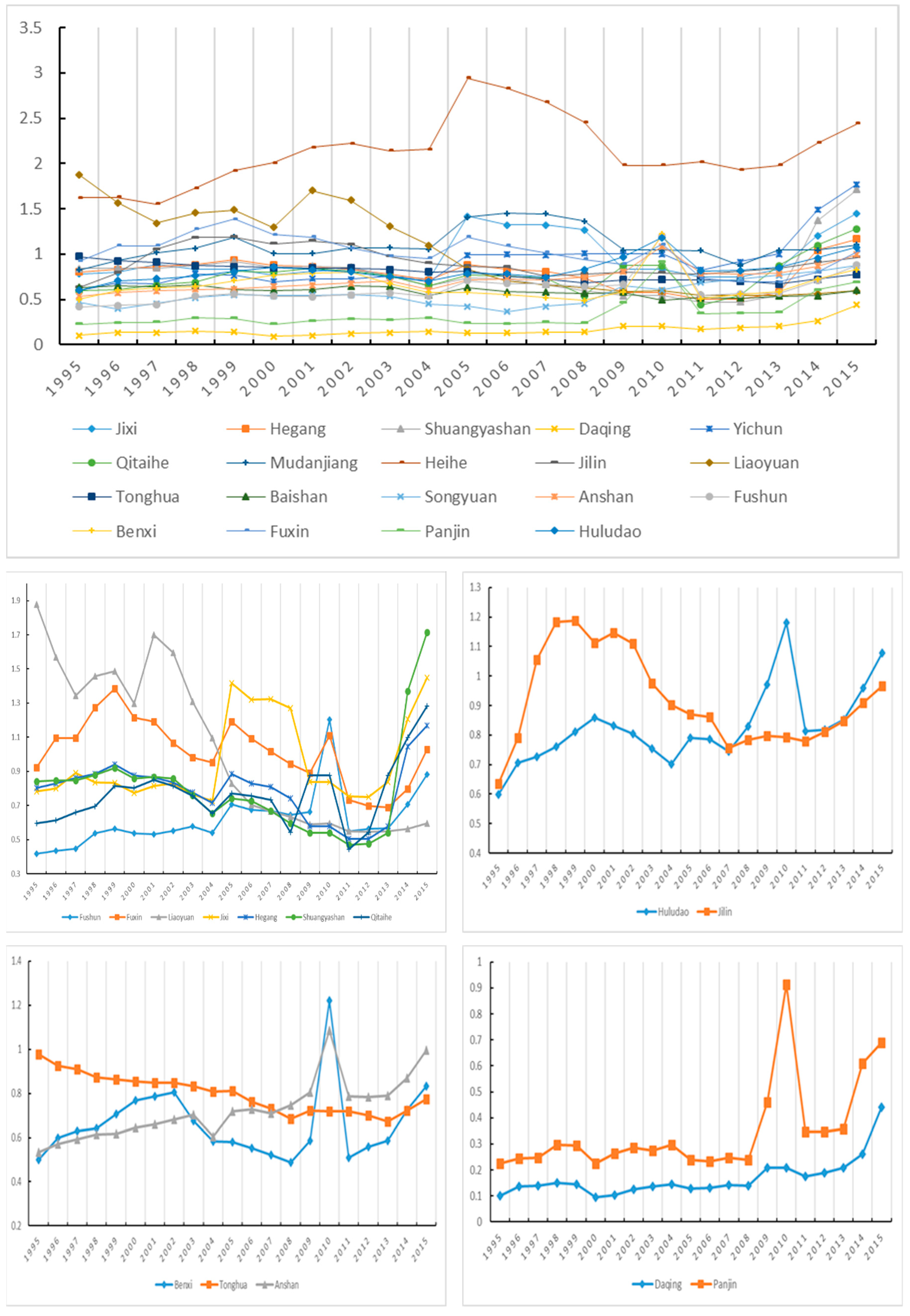

By calculating the Theil index of the resource-based cities in the northeast region, we can find the changes in the industrial structure rationalization of the resource-based cities selected from 1995 to 2015. The results are shown in

Figure 4. It can be seen from the calculation results that the Theil index for the selected resource-based cities was mostly less than 0.8. Between 1995 and 1997, the Theil index of the resource-based cities generally fluctuated slightly, indicating that the industrial structure was relatively reasonable. Between 1998 and 2003, the Theil index showed large fluctuations, indicating that the original industrial structure had changed and the degree of industrial rationalization had decreased. The reason for this change was that the city carries out economic reforms, which promotes changes in the industrial structure. The employment situation had changed in a certain period of time and the employees of related industries had shifted to the tertiary industry, breaking the layout of the original industrial structure. The Theil index did not fluctuate a lot between 2004 and 2009 and the index value was smaller than before. This indicates that the industrial structure was developing in a rational direction. The reason for this change was that the relevant industry employees continue to shift to the tertiary industry and the industrial chain had been strengthened, so that the industrial output value continues to increase. In addition to individual cities between 2010 and 2015, the changes in the Theil index tended to be flat, indicating that the industrial structure was reasonable and stable. The reason was that the three industrial structures had gradually stabilized after adjustment and the GDP growth slowed down.

Among coal cities, before 1997, Fuxin and Qitaihe’s Theil Index showed an increasing trend but the growth rate was not large. In other cities between 1995 and 1997, the Theil index did not show obvious change, indicating that there was no significant change in the industrial structure rationalization of coal cities between 1995 and 1997. Between 1997 and 1998, Fuxin, Liaoyuan, Shuangyashan and Qitaihe’s Theil index showed a relatively obvious growth compared to previous stage and the growth rates of Liaoyuan and Fuxin were significantly higher than that of Shuangyashan and Qitaihe. It showed that Fuxin and Liao had conducted the relatively obvious industrial restructuring since 1997 and the development of industrial structure rationalization had undergone great changes. Between 1997 and 2015, the trend of the Theil index of Fuxin and Liaoyuan was more consistent, while the Theil index of Fuxin showed a significant decline in 2007 and the performance was stable between 2007 and 2010, at a relatively low level. It showed that the industrial structure reformation of Fuxin was basically completed in 2007 and the industrial structure was comparatively reasonable. Since 2011, the Theil Index of Fuxin City had shown an upward trend and it saw a significant increase in 2014, indicating that Fuxin had started new industrial restructuring in 2014. In 2006, Fushun began to show an apparent upward trend in the Theil index, indicating that Fushun began to adjust its industrial structure in 2006 and the industrial structure rationality was affected. However, in 2014, the Theil index of Fushun fell from 0.04 in 2013 to 0.06. In 2015, it was only 0.07, indicating that Fushun’s industrial restructuring has been completed since 2006 and the industrial structure had been quite reasonable. The Theil index of Shuangyashan began to show a relatively significant increase in 2010 and it had shown an upward trend in the following years. It reflected that in 2010, Shuangyashan began to undergo a large degree of industrial restructuring. The Theil index of other coal cities did not show a large change, basically within 0.2, indicating that the industrial structure had not changed obviously and the industrial structure is relatively reasonable.

Among the non-ferrous metallurgical cities, the degree of deviation from the coordinate axis of the Theil index of Huludao is higher than that of Jilin, indicating that Jilin was superior to Huludao in terms of industrial structure rationality. The Theil index of Jilin showed relatively obvious growth in 1997 and began to decline in 1999, since then the downward trend had continued. It showed that between 1997 and 1999, the industrial structure of Jilin had undergone obvious adjustment and industrial structure rationality had undergone significant changes. Between 1999 and 2012, the Theil index of Jilin City showed a downward trend as a whole, from 0.23 to 0.04 and the industrial structure gradually became reasonable. Since 2013, the Theil index of Jilin had shown an upward trend but the increase was relatively low. The industrial structure was still more reasonable than that of Huludao. The Theil index of Huludao showed an upward trend in 1997 and a significant decline in 2007, indicating that the industrial structure adjustment occurred in Huludao from 1997 to 2007. Between 2007 and 2012, the Theil index of Huludao was relatively stable, with no major changes, indicating that there was no significant change in the industrial structure rationality in Huludao. In 2014, the Theil index of Huludao began to show an upward trend and the level of industrial structure rationalization was worse than that of 2007 to 2012.

Among the ferrous metallurgical cities, the development trend of industrial structure rationalization of the three cities was basically the same between 1995 and 2006. In 1997, the Theil index of the three cities showed a significant increase and began to decline in 1998. Between 1997 and 2006, the industrial structure rationalization of Tonghua was significantly better than that of Benxi and Anshan. After 2006, the Theil index of Anshan and Tonghua showed a downward trend, while that of Benxi showed an upward trend, indicating that the industrial structure of Anshan and Tonghua was gradually more reasonable and Benxi had an adjustment of industrial structure. In 2014, the Theil index of Benxi declined significantly and the Theil index was smaller than the other two ferrous metallurgical cities later, which was the best in terms of industrial structure rationalization.

Among the oil cities, the Theil Index of Daqing showed an upward trend in 1996 and began to decline in 2010 but between 1996 and 2010, the Theil index of Daqing was much higher than that of Panjin and the Theil index of Daqing was also relatively high in all selected cities, indicating that there was a seriously unreasonable phenomenon in the industrial structure of Daqing. After 2010, the Theil index of Daqing showed a large decline but it was still higher than other selected cities in the same period. By analysing the three industries’ proportion in GDP of Daqing, it could be found that despite the adjustment of industrial structure in Daqing and the decline in the proportion of secondary industry since 2014 and the further narrowed gap between the proportion of secondary and tertiary industry in 2015, the GDP contribution rate of the secondary industry had been much higher than that of the primary industry. Daqing had always been a resource-based city with the petroleum industry as its pillar industry. The Theil index of Panjin was generally on the rise but its own change was not large, indicating that Panjin had undergone industrial restructuring but the industrial structure had not been reasonably adjusted. Through the three industries’ GDP ratio with Panjin, it can be found that after 2009, in Panjin, also an oil city, the proportion of GDP of the tertiary industry began to increase significantly and the industrial structure showed a relatively obvious adjustment. Since 2014, the proportion of secondary production had started to decline and the proportion of tertiary production had obviously begun to increase. In 2014 and 2015, Daqing and Panjin were at the same level in terms of the industrial structure rationalization, as shown in

Figure 5.

Among the forest industry cities, the Theil index of Songyuan, Mudanjiang and Heihe showed a trend of first increasing and then decreasing but the changes of the three cities occurred in different years and the Theil index of Songyuan and Mudanjiang had the largest change. After 2004, the industrial structure rationalization in Heihe was optimal among the forest industry cities. The Theil Index of Yichun had fluctuated and was at a low level in 2014 and 2015, indicating that the industrial structure was relatively reasonable.

Baishan, as a coal, iron and forest comprehensive city, the Theil Index showed a large change between 1997 and 2003, indicating that Baishan had undergone a large industrial restructuring during this period and the adjustment range was greater than other selected cities. After 2003, the Theil index of Baishan re-emerged and began to decline in 2011, reaching a relatively low level in 2012, indicating that the assignment in rationalizing the industrial structure of Baishan was effective.

It can be seen from the comparison of different resource-based cities that the average value of the forest industry cities’ Theil index was 0.111 and the development of industrial rationalization was relatively good, while the average value of the oil cities’ Theil index was 0.446 and the development was relatively poor. Through the comparison among provinces, it can be found that there were large differences in the rational development of the industrial structure of resource-based cities in various provinces. The Theil index of Heilongjiang Province differed a lot, presenting polarization characteristics but the overall volatility trend was relatively flat and the entire industrial structure was better than that of Jilin Province and Liaoning Province.

3.3. Analysis of Industrial Upgrading

Referring to the measurement of industrial upgrading, two indicators are usually mainly used. The first indicator is based on Clark’s law, which measures the degree of industrial upgrading by the proportion of the secondary industry and the tertiary industry’s output value in GDP; the second indicator is the ratio of tertiary industry to secondary industry output value used by

Gan et al. (

2011). The first indicator measures the proportion of non-agricultural industries, which is more traditional. The second indicator takes into account that nowadays many countries have basically achieved industrialization and the tertiary industry has exceeded the secondary industry. This paper selects the second indicator to measure the degree of industrial structure upgrading because it is simpler and direct, which can be called TS value and the formula is as follows:

The higher the TS value, the more upgraded the industry.

The data used in this section are derived from China Statistical Yearbook 1996–2016, China City Statistical Yearbook 1996–2016, Liaoning Province Statistical Yearbook 1996–2016, Heilongjiang Province Statistical Yearbook 1996–2016, Jilin Province Statistical Yearbook 1996–2016 and the corresponding years’ Yearbook of relevant cities.

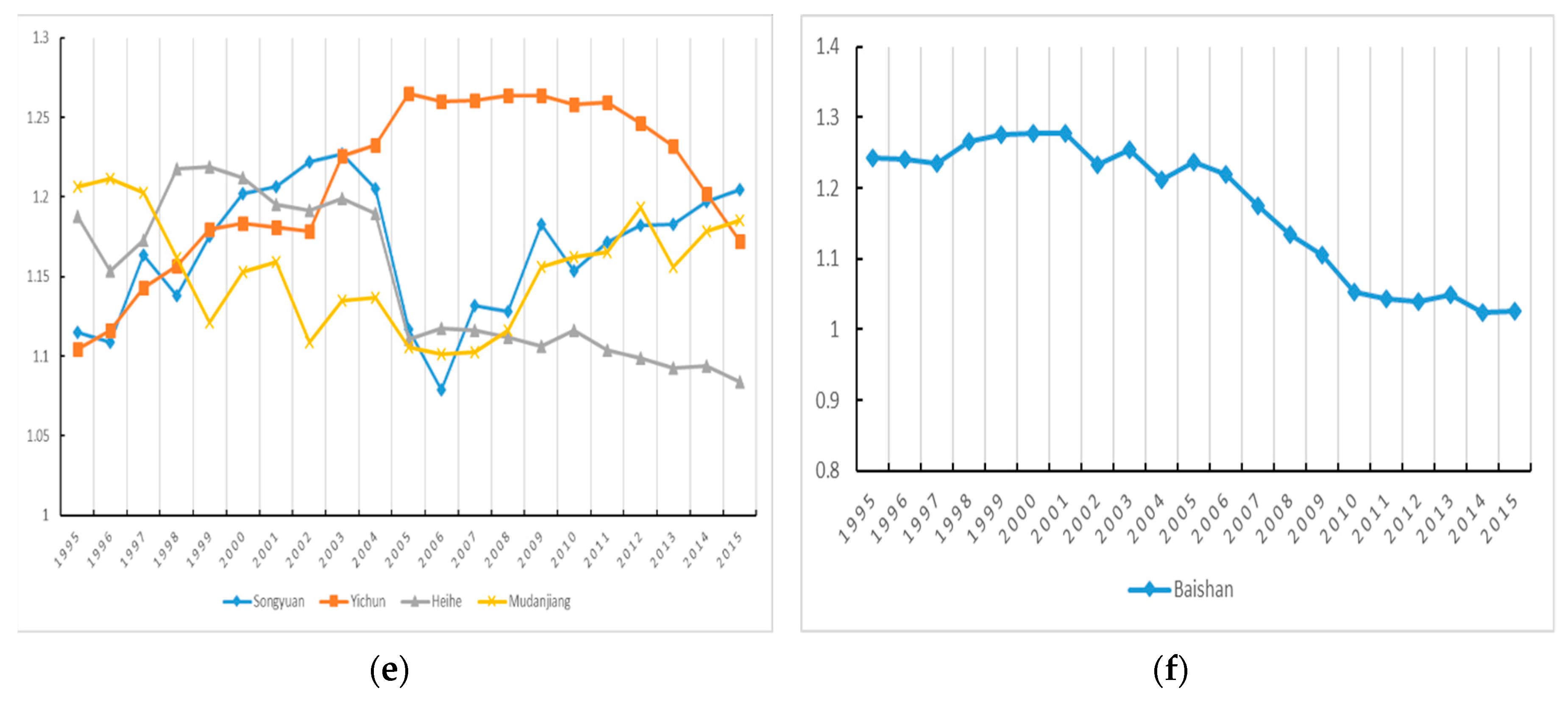

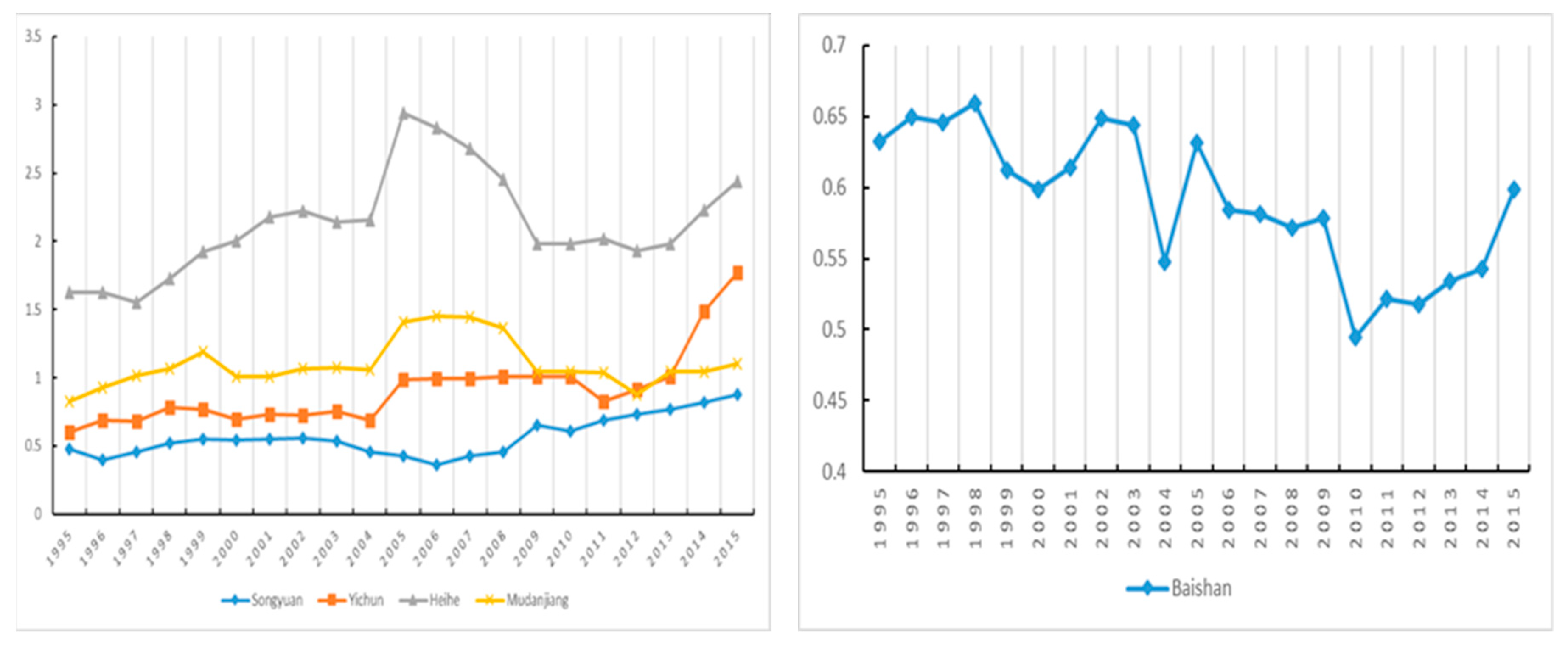

The calculation found that the TS values of most resource-based cities in Northeast China were less than 1 between 1995 and 1999 and the volatility was relatively stable, as shown in

Figure 6. This reflected that the main industry of resource-based cities in the Northeast was the secondary industry and the development of the tertiary industry was relatively slow. Between 2000 and 2004, TS value showed a slight decline. Between 2005 and 2009, TS experienced a large fluctuation and showed a trend of rising first and then decreasing, indicating the adjustment of industrial structure of resource-based cities in Northeast China, the output value of the tertiary industry had developed considerably and then there had been a certain decline. Between 2010 and 2015, TS value changed slightly and it showed a trend of decreasing first and then rising. It showed that the industrial structure had returned to a stable state and the upgrading process had developed steadily. Among the provinces, the average value of industrial upgrading index of the resource-based cities selected by Heilongjiang Province was 0.95 and the average value of industrial upgrading index of the resource-based cities selected by Jilin Province was 0.83, while the average value of industrial upgrading index of the resource-based cities selected by Liaoning Province was 0.69. In general, the level of industrial upgrading of Heilongjiang Province was at an optimal position.

Since 1995, the degree of industrial upgrading of Liaoyuan had reached a high level of 1.88 compared to the other coal cities. However, the overall level of industrial upgrading had shown a downward trend. Although the industrial upgrading of Liaoyuan had developed positively in two periods of 1997 to 1999 and 2000 to 2001, it was still not as good as the previous level. Since 2001, the industrial upgrading had shown negative development, only about 0.55 between 2010 and 2013. The industrial upgrading degree of Fuxin was at a high level among the coal cities, which reached the level around 1 before 2011, indicating that the output contribution of the secondary industry and the tertiary industry in Fuxin was roughly the same. After 2011, the level of industrial upgrading of Fuxin had decreased, fluctuating around 0.7. Between 2004 and 2008, Jixi had a great development in industrial degrading and there had been a significant decline since 2008. The level of industrial upgrading of other coal cities had been greatly improved between 2008 and 2010 and there had been a significant decline in 2011. In addition to Liaoyuan, the other six coal cities, had a large increase in industrial upgrading level in 2014 and showed an upward trend, indicating that the tertiary industry of these cities had experienced great development.

Among the non-ferrous metallurgical cities, Jilin and Huludao had started at a similar level since 1995. In Jilin, the degree of industrial upgrading had developed greatly between 1995 and 2002, while the industrial upgrading of Huludao had developed rapidly between 2007 and 2010. Between 2012 and 2013, the development level of industrial upgrading of the two cities was at a similar level and after 2011, they both showed an upward trend. In 2014, Huludao surpassed Jilin in terms of the development of industrial upgrading.

Among the ferrous metallurgical cities, the level of industrial upgrading of Tonghua fluctuated relatively stable but the overall development was negative. In 1995, Tonghua’s industrial upgrading level was the highest in the ferrous metallurgical cities, reaching 0.98, while in 2013 Tonghua’s industrial upgrading level was only 0.67. During the period of 2008 to 2010, the degree of industrial upgrading of Benxi and Anshan was greatly developed. The industrial upgrading degree of Benxi and Anshan both had improved between 1995 and 2013, the industrial upgrading index of Benxi changed from 0.50 in 1995 to 0.59 in 2013 and that of Anshan changed from 0.53 in 1995 to 0.79 in 2013. The overall industrial upgrading of Anshan had changed more than Benxi

Among the oil cities, the industrial upgrading degree of Panjin had always been better than that of Daqing. However, between 1995 and 2013, neither of the two cities was obvious in the improvement of industrial upgrading. From 2014, the degree of industrial upgrading of the two cities began to greatly improve. The degree of industrial upgrading of Panjin changed from 0.23 in 1995 to 0.36 in 2013. Although Panjin achieved a high level of industrial upgrading development in the period of 2008 to 2010, even reaching 0.91 in 2010, other years before 2014, the development was always at a relatively low level. The degree of industrial upgrading of Daqing changed from 0.10 in 1995 to 0.21 in 2013, which was also at a lower level in the selected resource-based cities.

Among the forest industry cities, the level of the industrial upgrading of Heihe had always been above 1.5, which was basically at the optimal level in all forest industry cities. The level of industrial upgrading of Mudanjiang had always been around 1. The level of industrial upgrading of Songyuan had always been at the last position in the forest industry cities. As a whole, all the forest industry cities had experienced a great development of industrial upgrading between 2004 and 2009 and after 2013, the industrial upgrading grew with a more upward trend compared to that during 2010 to 2013.

As a comprehensive city of coal, iron and forest, Baishan’s development of industrial upgrading was relatively stable but in the period of 2010 to 2014, the level of industrial upgrading declined, from the average of 0.61 from 1995 to 2009, changed to the average of 0.52 from 2010 to 2014. However, in 2015, the industrial upgrading level of Baishan increased to 0.60, returning to the previous stage.

It can be seen from the comparison of different resource-based cities that the average TS value of the forest industry cities was 1.174 and the development of industrial upgrading was relatively good, while the average TS value of oil cities was 0.258 and the development was relatively poor. It can be found from the inter-provincial comparison that the degree of industrial upgrading of Heilongjiang Province was generally better than that of Jilin Province and Liaoning Province. However, among the selected resource-based cities, Heihe, which had the best industrialization level and the worst Daqing both belong to Heilongjiang Province and the industrial upgrading levels of the two cities are quite different. Among the three provinces, the overall level of industrial upgrading development of Jilin Province was relatively stable. The overall development of industrial upgrading of Heilongjiang Province and Liaoning Province was generally on the rise but the total extent was not very large.

3.4. Summary

In this section, the value of 3 indexes of industrial structure entropy, the Theil index and TS of 19 resource-based cities during the period of 1995–2015 were calculated and compared.

It has been found that, in respect of the diversification of industrial structure, the development of non-ferrous metallurgical cities was relatively fine and the development of petroleum cities was relatively poor. The development of Liaoning Province was better than that of Heilongjiang Province and Jilin Province.

As for the rationalization, the forest industry cities was relatively good, while the oil cities was relatively poor. Among provinces, there were large differences. Heilongjiang Province presented polarization characteristics but the overall volatility trend was relatively flat and the entire industrial structure was better than Jilin Province and Liaoning Province.

As for industrial upgrading, the forest industry cities was relatively good, while the oil cities was relatively poor. Heilongjiang Province was generally better than that of Jilin and Liaoning Province, though the best and worst industrialization level cities both belong to Heilongjiang Province. The overall level of industrial upgrading development of Jilin Province was relatively stable among the three provinces. On the whole, although the tertiary industry had a certain degree of development, only several individual cities’ industrial adjustment was ideal and the secondary industries of some cities still occupy a relatively high share. Thus it can be seen, the industrial upgrading should be a long-term project for the resource-based cities in the Northeast China.

Through analysis, it was also found that the changes of the industrial structure of these resource-based cities coincided with the implementation of the state’s revitalization strategy for the Northeast region. In October 2003, the State Council issued “Opinions on the Implementation of Revitalization Strategies for the Old Industrial Bases in Northeast China” and afterwards resource-based cities in Northeast China gradually began to transform their industries. Between 2004 and 2009, more and more resource-based cities in the Northeast such as Baishan and Liaoyuan began to transform their industries. In September 2009, the State Council issued “Opinions on Further Implementation of Revitalization Strategies for the Old Industrial Bases in Northeast China,” which clearly defined further transformation of resource-based cities and promoted sustainable development. Between 2010 and 2014, the resource-based cities in the Northeast had entered the stage of all-around industrial transformation, each city had developed relevant industries based on its own advantages and conditions and the economy had achieved great development. However, how the industrial transformation impacted economic development should be examined further.

5. Conclusions

This article comparatively analyses the development of industrial structure from three aspects: industrial structure diversification, rationalization and upgrading and the impact of rationality and upgrading on economic growth of resource-based cities economy in Northeast China is empirically analysed. In order to promote the sustainable development and solve problems in the process of these cities’ development, two suggestions are proposed for the transformation of industrial structure of resource-based cities in Northeast China:

Firstly, in the adjustment of industrial structure, should pay great attention to the rationalization of industrial structures. The development of resource-based cities mainly relied on the exploitation of special resources and develop resource-based industries, which made the layout of industrial structures were usually not reasonable. During the period of industrial transition, though the proportion of pillar industry will decrease and the substitute industries will increase, but the whole outlay of industrial structures may be not reasonable. So it is a must for the resource-based cities to pay attention the rationalization of industrial structures during industrial transformation, which can be achieved by strengthening the industrial linkage and promoting horizontal cooperation. At the provincial level, there are same kind of resource-type cities belong to different provinces. For example, the coal cities—Jixi City, Liaoyuan City and Fushun City—belong to Heilongjiang Province, Jilin Province and Liaoning Province, respectively. By comparing the development of the industrial structure of resource-based cities in Northeast China, we can learn that the development of industrial structure of the three north-eastern provinces was different. This situation had led to limited resource consumption in the Northeast region in the repeated development among industries. Therefore, it is necessary to strengthen the overall planning of resource-based cities in the Northeast region, promote regional coordination and rationally arrange and adjust the industrial structure from the overall scope of the region, improve the labour division and cooperation between regions, thereby improving the level of rationalization of the industrial structure between provinces.

Secondly, continue to promote the process of industrial structure upgrading. While the resource-based cities in Northeast China are carrying out the transformation and upgrading of original industrial technology, it is possible to combine the characteristics of its own city and vigorously develop the tertiary industry with urban characteristics, thus promoting the development process of industrial structure upgrading. Since most resource-based cities in Northeast China belong to a declining type and new industries impact traditional industries, in the development of industry, the resource-based cities in the Northeast need to introduce substitute industries to gradually reduce their dependence on traditional resource-based industries. In the choice of industry, high-tech industries through preferential policies should be introduced and develop relevant industries based on the advantages of the cities. This will upgrade the industrial structure and change the original single resource-based industrial layout. For example, Fushun City, a coal city, relied on coal resources to develop deep-processing industries such as coal chemical industry and electric power industry in addition to developing characteristic industries, had achieved a good transformation effect. While Daqing City, where the industrial structure adjustment effect was not very good, relied on the advantages of the original petrochemical industry, vigorously developed the petrochemical equipment manufacturing industry, formed an industrial cluster and extended the original industry. It can be seen that successful industrial transformation is difficult to achieve by relying on the original industry and extending the original industry only. More importantly, the traditional industries should carry out technology upgrading and enterprise reorganization and develop upgraded industrial clusters, improve the production efficiency of enterprises and the technological content and competitiveness of products.