Abstract

This research highlights how cloud platform as a service technologies host extended reality technologies and convergent technologies in integrated solutions. It was only around 2019 that scholarly literature conceptualized the role of extended reality, that is, augmented reality, virtual reality, and mixed reality, in the marketing function. This article is a multiple case study on the leading eleven platform as a service vendors. They provide the programming technology required to host software as a service in the cloud, making the software available from everywhere. Of the eleven cases, 10% integrate technologies in solutions. Research results show that extended reality technologies reinvent digital marketing; as part of this, they shape the customer delivery model in terms of customer value proposition; favor the choice of customer channel (the omnichannel); possibly lead to new customer relationships, such as cocreation; and reach global mass customers. Extended reality in the delivery model is complemented by other technologies in the operating model. These combinations provide the foundations of the business models, which are either network or platform business models. This study identifies a number of solutions enabled by extended reality, which have an integrated goal in the form of customer value contribution and are to be studied in further articles.

1. Introduction

In previous years, several platform as a service (PaaS) suppliers have hosted extended reality (ER) technologies, shaping customer relationship management processes. Extended reality (ER) includes augmented reality (AR), virtual reality (VR), and mixed reality (MR). Of them all, AR is deemed the most important. Scientific articles predict AR will become an important technology with several major contributions in key functional areas, one of which is marketing [1]. Scientific research on ER has been emerging since 2019. The goal of this article is to introduce the important role of ER-shaped customer experience processes to the academic world. The article aims to update theory with empirical data, highlighting the importance of ER in marketing as product or integrated in business process management solutions. The article presents an elaborate review of empirical data. Such data show that ER is set to become highly important, especially in marketing, on a stand-alone basis or integrated into solutions that create customer value through synergy. Empirical data analysis looks at the technologies hosted on a cloud PaaS, according to market analysts IDC, Gartner, and Forrester. Market analyses from Gartner show that of 360 PaaS vendors, 48% offer pure cloud services, while 90% only operate within a single PaaS market segment, and the remaining 36 vendors may offer integrated solutions, but none compete for a digital enterprise. Of these vendors, eleven are systematically reported by Forrester as being market leaders. Their cases have an abductive value for understanding the market as a whole.

The current methodology is an exploratory, descriptive, and instrumental multiple case study. It intends to bring to academia an empirical vision of a new Internet, the metaverse, from case study subjects like Microsoft [2]. The vision is expected to be completed by 2030 by computing capacity provider Samsung [3] and has just been launched by Facebook and Microsoft in late 2021 [4,5]. The listed vendors anticipate a hundred million to a billion customers in a few years. The technologies involved, including cloud PaaS, are rated by market analyst Gartner as emerging, also in the year 2021, with future potential to remain rated as emerging [6,7,8,9,10]. The ER cloud may be compatible with other technologies, especially digital twin technologies, as SAP claims [11]. The findings show that theoretical literature takes an individual approach to ER and its role in digital marketing. ER is one of the technologies used in a digital enterprise with an enterprise architecture shaped by digital technologies. So far, ER-based solutions have been insufficiently considered in scholarly literature. Taking a systemic view of technologies and their value contribution is, as of today, a seldom-used scientific methodology. Moreover, this requires an elaborate approach, which is difficult to fit into the scope of an article.

Empirical data show that ER reshapes the Internet, as argued in Figure 1. It is included in numerous solutions or use cases, such as those at IDC and AWS, which work together to shape business processes and attain value-based goals. A new approach with regard to the role of marketing is therefore applied, imported from empirical data, and in-tended to enrich theory. Complementing theory, empirical data show how ER shapes the vision of a new Internet and will converge with other technologies. This case study enriches the contemporary scholarly discussion with new empirical findings, which may guide practitioners in transforming existing operations or initiating ventures. This article is structured to include a scientific literature review, the methodology used, the results of the empirical data analysis, and a discussion on our conclusions. In order to construct this research, keywords were used to seek data on ER technology and elements of the delivery model that are shaped by marketing activities, such as defining customer value propositions, identifying customer segments, and managing customer relationships. The following scientific literature review comprises the role of ER in scientific literature, particularly marketing, and in enterprise architecture, where it is integrated into other business process management solutions that shape business models. Our empirical data analysis characterizes cloud PaaS providers that host ER on a stand-alone basis or integrated into solutions, and the findings indicate that various technologies are converging towards integrated customer value propositions. Both the scientific literature review and empirical data analysis focus on elements of the delivery model or business model. The difference between the two is that empirical data analysis shows that ER is integrated into cloud PaaS in relation to solutions and over fifty use cases that converge in terms of customer value propositions and business models, where-as scientific literature is focused on individual ER technologies, except for enterprise architecture, which was searched for using different keywords. The main finding, consistent in both the theoretical literature review and empirical data analysis, is that ER-based solutions shape the elements of the customer delivery model and create a pull effect on mass customers. This creates the prerequisite for business model innovation.

Figure 1.

Major vendor reports foresee ER will shape a new form of Internet interface to customers and employees, emerging late 2021.

2. State of the Art and Related Work

This section reviews scholarly literature with respect to the role of ER in marketing activities according to two categories: (1) research pertaining to ER and its role in the marketing discipline and (2) research pertaining to enterprise architecture or integrated business process management solutions and the role of ER and marketing therein. The latter category includes ER converging with other technologies to shape the marketing discipline and business processes and business models. The central argument is that the role of ER-based marketing may depend on the business model. Examples are advertising and selling existing products in push business models or advertising and cocreating configurable products in Internet network business models. This argument creates a new perspective on ER-based marketing as it converges with solutions.

2.1. Extended Reality and Its Role in the Marketing Discipline

Social media was first used to name the commercial Internet in 1994. In the meantime, the term has been used to describe “a variety of online platforms, including blogs, business networks, collaborative projects, enterprise social networks, forums, microblogs, photo sharing, products review, social bookmarking, social gaming, social networks, video sharing, and virtual worlds” [12]. Of all these technologies, electronic commerce is amongst the technologies that have the greatest impact [13]. With the advent of more sophisticated technologies that enable the high-fidelity reproduction of environments, objects, and persons, e-retailers see ER technologies as very promising technological tools, which are able to produce satisfactory consumer experiences resembling those experienced in physical stores. ER encompasses VR, AR, and MR. VR immerses users into completely virtual environments. AR creates an overlay of virtual content but does not allow the user to interact with the three-dimensional environment. MR combines VR and AR. The use of ER in retail in terms of creating new computer-mediated indirect experiences has been conceptualized as virtual commerce or v-commerce [13].

Social media is used in marketing strategy [14,15]. Information and communications management technologies have already been merged with marketing [16,17,18]. Mobile technologies are another technology that impacts marketing [19]. The focus of such research is on the emotional impact on the consumer [13]. Furthermore, by 2015, mobile devices and increasingly sophisticated replicas of digital twins or other virtual copies in two dimensions or three dimensions were being called AR and were being introduced for marketing purposes [19]. In the marketing function, AR is redefining the concept of showrooms and product demonstrations and transforming the customer experience. Arguments in favor are that when customers can virtually see how products will look or function in a real setting before buying them, they have more accurate expectations, more confidence in their purchase decisions, and greater product satisfaction. A further benefit is that AR may even reduce the need for physical showrooms as AR enables products to be viewed and configured in terms of different features and options. Some authors have a bolder vision, which is that AR will become the new interface between humans and machines [20,21]. Scientific literature notes there is a general consensus that AR, once it becomes a mainstream medium, will disrupt marketing and management in many ways.

AR is expected to be included holistically in marketing [21,22,23,24]. The smart phone is the most popular technology with regard to hosting AR. By late 2022, AR will have be-come a very popular topic for journal articles. Many such journal articles assess the like-lihood of technology acceptance and adoption. Due to AR in the form of mobile applications, brands can both provide consumers with detailed information about products and services and affect consumers’ perceptions. This is reported as a very new trend, and the technology acceptance model has been used to test it [25,26,27,28,29,30]. AR is one of the key technologies in digital transformation. In 2021, researchers reported the use of AR applications that would not have been possible three years before. Smart phones and tablet computers are devices that host AR applications. Other technologies are cameras and sensors, which input data into AR systems. The computing capacity involves AR technologies [31,32]. ER is expected to be used in several customer industries [33,34,35,36].

ER technologies comprise AR, VR, and MR. These technologies are classified as digital twin-related tools [37]. Digital twins are defined as the “virtualization of physical entities” and the “materialization of virtual processes,” which are made possible through the “interaction between virtual and reality” [37]. AR is defined by Acatech [38] as “imposing digital information on the real world. Digital information may be a computer aided design model, for example in three dimensions. It may be data captured by sensors or calculated by information technology systems that can be placed in context in a real-world environment. This creates a dramatically enlarged dataflow to the real world. AR is a technology that projects virtual objects in real physical environments in the real world. It can provide people with a more realistic and intuitive sensory experience by superimposing virtual objects on or compositing them with the environment”.

Alternatively, AR may be defined as “the visual alignment of the virtual content with real-world contexts” [39]. AR may also be described as “a type of VR in which digital devices are used to overlay supplementary sensory information (sounds, objects, avatars, graphics, labels, etc.) on the real world” [39]. AR has been defined in a number of ways, but it typically refers to “a combination of digital information with the real world that is presented in real-time” [40]. From some viewpoints, AR is a variation of VR [40]. VR is amongst the key technologies considered by Acatech [38].

AR experiences are described on a local-presence continuum ranging from assisted reality to MR [41]. VR experiences can be conceptualized on a telepresence continuum ranging from atomistic to holistic [39]. In VR, consumers are fully immersed in a virtual environment [39]. VR is defined as “a computer-generated simulation of a situation that incorporates the user, who perceives it via one or more of the senses (currently mostly vision, hearing and touch), and interacts with it in a manner that appears to be real” [41]. MR merges both VR and AR [41]. In MR, the virtual and real worlds come together to create new environments, in which both digital and physical objects—and their data—can coexist and interact with one another [41].

There are three types of AR displays: headworn, handheld, and spatial. A headworn AR application comprises a virtual retinal display, a projective head-mounted display, and a head-mounted display. They create visual projections connected to the head. A handheld AR display comprises screens held in one’s hand as well as optical and video see-through displays. Last but not least, the spatial type of AR display includes two types of see-through displays, namely screen-based video and special optical, as well as the category of projective displays. Traditional AR devices resemble television screens and computers. AR may be implemented through mobile applications [24].

Digital information and communication technologies have, in recent years, significantly improved marketing research [25]. Digital marketing is defined as “an adaptive, technology-enabled process by which firms collaborate with customers and partners to jointly create, communicate, deliver, and sustain value for all stakeholders” [12]. AR marketing is defined as “the strategic orientation of AR experiences, alone or in combination with other media- or brand-related cues, to achieve overarching marketing goals by creating value for the brand, its stakeholders, and society at large, when considering ethical implications” [39]. AR marketing may also be defined as “a strategic concept that integrates digital information or objects into the subject’s perception of the physical world, of-ten in combination with other media, to expose, articulate, or demonstrate consumer benefits to achieve organizational goals” [42]. First, this suggests that AR marketing is “a strategic firm capability that requires adequate planning as well as financial and organizational resources, which includes a profound understanding of user behavior from different perspectives and disciplines”. Second, by emphasizing the integration of different types of digital and physical content without specifying requirements for interactivity or levels of realism, the definition remains sufficiently open and flexible to subsume a large number of AR techniques and technologies. Third, by defining the purpose of AR marketing as the achievement of organizational goals, it is open to commercial, profit-driven activities as well as non-profit marketing, political campaigns, or (in a more general way) the marketing of ideas. Finally, AR marketing can build on and extend established marketing approaches, ranging from advertising to content marketing to storytelling. In this sense, it can be applied to technologies provided by the company (for example, virtual mirrors in stores) or by the user (for example, mobile devices, such as tablets and smart glasses). The cognitive and emotional impact of AR is frequently stronger than similar exposure to traditional television advertising or web browsing.

AR is expected to reshape mobile marketing [39], through which customer relationships are reinvented [16]. Authors argue for strong changes in marketing relationships with regard to economic, social, and relational factors. Relationships become network-based and more intimate, similar to the Chinese concept of guanxi. Credibility and trust become issues. These changes are incurred by the Internet of Things and by mobile marketing. AR marketing is a form of mobile marketing that shapes customers’ experiences [39,41]. A new channel, the omnichannel, creates this new type of relationship [16,39,41]. Transactions move towards mutually nurturing relationships [39,41]. Customer relationships may be characterized by dedicated personal assistance, self-service, automated services, communities, or cocreation [43]. These relationships are possible online. Intimate relationships, such as dedicated personal assistance or cocreation, are possible in global networks using the Internet of Things [43]. From a business process management perspective, marketing is called customer relationship management [39,43].

A customer journey model for AR marketing comprises the following phases: awareness, exploration, planning, purchase, use, and loyalty [39,43]. Marketing activities can be classified under the “big four” terminology: branding (e.g., building brand aware-ness, product knowledge, and brand image), inspiration (e.g., to trigger new needs and wants), convincing (e.g., driving purchases or other decisions), and keeping (e.g., loyalty and re-usage intention) [39,43]. ER applications [41] are found in three major areas of consumer marketing: communications and advertising; selling to consumers, that is, retailing; and creating or enhancing the consumption experience. These three areas roughly correspond to the pre-purchase, purchase, and post-purchase stages in the customer journey. Some add cocreation to the functions of ER [41]. Virtual marketing may involve virtu-al presentations of physical products, retail space design and analysis, consumer behavior research, and virtual experience quality measures.

The goal of AR marketing is value, which can be utilitarian (e.g., improving people’s efficiency), hedonic/experiential (e.g., engaging with brand stories or games), social (e.g., connecting with other brand fans in multi-user AR or through anthropomorphized brand mascots), eudemonic (e.g., improving well-being or personal growth), inspirational (e.g., fostering imagination or inspiration), or edutainic (e.g., gamified learning experiences or the feeling of being more competent consumers) [39,42].

2.2. Extended Reality and Its Role in the Marketing Discipline When Integrated into Business Process Management Solutions and Enterprise Architecture

Whereas the ER literature review focuses on the experience factor, the technologies may be used in integrated solutions that create value through synergy. For example, some researchers refer to AR as a digital twin technology that inputs customer orders into additive manufacturing [33]. Scientific authors [34,35] suggest that AR be used in integrated systems to design products. The proposal includes the design of an application that in-corporates a catalog of furniture for a living room, dining room, and bedroom. The user can modify size, color, and texture characteristics in a way that emphasizes interaction with the consumer. This allows a reduction in the uncertainty of the user. At the same time, this allows a participatory action where the user is the protagonist. ER may be one of many technologies that work together to shape a digital or intelligent enterprise. Mainframe scientific authors argue that enterprise architecture is digitally transformed by multiple technologies, including the Internet of Things, services computing, cloud computing, artificial intelligence, big data with analytics, mobile systems, collaboration networks, and cyber-physical systems. The new enterprise architecture shifts from the closed-world modeling perspective to a more flexible, open world of living software and system architectures, which is the context for adaptable and evolutionary software approaches [37].

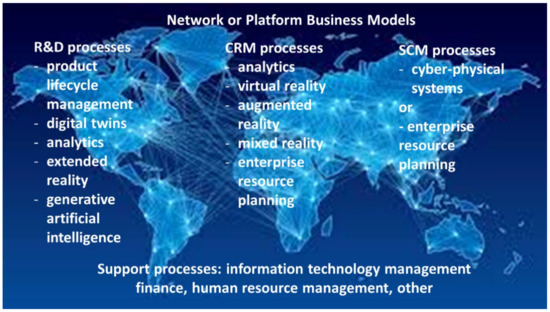

Business models are at the center of the new enterprise architecture [38,39]. Industry 4.0 is intended to cause a shift from push, pipeline, or rigid to pull platforms or flexible business models [38]. The intelligent enterprise concept was introduced as a new paradigm for enterprise architecture in 2012 [38,39]. Table 1 and Figure 2 synthesize the digital enterprise [38] approach to enterprise architecture, where the technologies evolve in digital maturity and provide raw data, then smart data, and finally, expert decisions. At all levels of business maturity, technologies shape business activities and business processes: product lifecycle management (PLM or R&D), customer relationship management (CRM), and supply chain management (SCM). Cloud infrastructure as a service (IaaS) and platform as a service (PaaS) first host computerization technologies, that is, enterprise resource planning and computer-aided manufacturing, as software as a service (SaaS) [38]. The technologies become available everywhere [38]. As maturity levels progress, the cloud uses raw data and transforms them into smart data via analytics and digital shadow technologies [38]. PLM hosted in the cloud creates open innovation networks [38]. CRM creates global customer networks [38]. Finally, cyber-physical systems create distributed SCM networks [38]. Direct processes move to open networks and create pull, network, or open business models in several stages [38]. Figure 2 exhibits these global network models and the related functional support processes. The correlation and integration of information technologies and operational technologies and the business activities, business processes, and business models they shape create a digital or intelligent enterprise [38].

Table 1.

ER-based marketing components.

Figure 2.

Technologies and supporting processes in network business models.

The intelligent enterprise concept is part of Industry 4.0 [40]. Intelligent enterprises merge enterprise resource planning, the Internet of Things, and artificial intelligence [38,39,41]. Enterprise architecture integrates technologies in the information and communications technology sector [35,44]. An intelligent enterprise is sometimes called a digital enterprise [45,46], describing the enterprise architecture after digital transformation. Enterprise architecture [47,48] cumulates the capabilities provided by digital transformation and represents the destination in the digital transformation journey. According to Acatech [38], the technologies used in a digital or intelligent enterprise have certain degrees of capability maturity, meaning that they progress from enterprise resource planning and computer-aided technologies to cloud, analytic (descriptive, diagnostic, or predictive), and digital twin technologies, including ER and cyber-physical systems. The progression from one level to the other depends on the completion of the former. Additive manufacturing uses computer-aided technologies. This is the Industry 4.0 classic view.

The basic business model is mass customization, which enables customers to use the Internet to view and choose a suitable option from trillions of pre-configured variants via electronic commerce sites [12]. This staple scenario means that consumers order online from a wide variety of options and receive the products they purchase. Business processes begin with research and development projects, where a product and its configurations are designed. They continue with (CRM) processes, whereby the customer order is placed via the Internet, which triggers (SCM) decisions. This creates pull or customer-driven business models. AR is the technology that allows market mass customization [12]. The list of technologies included in the referenced digital enterprise model [38] is presented in Table 2. This also shows how they correspond with the business processes. Figure 2 shows the order of the business processes and the technologies that under-pin them in the new platform business models. This is, again, in accordance with the referenced Acatech digital enterprise model [38]. Figure 2 shows the technologies and business processes that make up a digital enterprise in the classic Industry 4.0 scenario.

Table 2.

Digital enterprise architecture.

This enterprise architecture relies on the cloud, which hosts all other technologies, whether less mature or more mature. According to Acatech [38], connectivity is the second stage of digital transformation maturity. It is provided by the cloud and hosts all technologies. Connectivity provides access to the Internet of Things. Porter and Heppelmann [49,50] note that “smart, connected products require companies to build and support an entirely new technology infrastructure”. This “technology stack comprises the following multiple layers: new product hardware, embedded software, connectivity, a product cloud consisting of software running on remote servers, a suite of security tools, a gateway for external information sources, and integration with enterprise business systems”. In the original Porter and Heppelmann [49,50] article, the cloud gives smart connected products their capabilities: monitoring, control, optimization, and autonomy. Zimmermann, Schmidt, Jugel, and Möhring, [51,52,53] write about digital enterprise architecture and provide concepts for the new digital enterprise architecture as strategy, advancing Ross, Weill, and Robertson’s concepts cited as such in the book. In some versions of the new enterprise architecture, the old and the new technologies are complementary [54]. Connected devices are the first level in Lee’s cyber physical systems’ architecture and smart connected products’ architecture according to the referenced literature reviews [55,56,57,58,59,60]. There are three main types of cloud services: IaaS, PaaS, and SaaS [54,61].

It is the role of PaaS to enable, host, and operate software in the cloud. It is a key capability for PaaS solutions to host and integrate software and scientific literature tackles this topic as such. Software vendors increasingly use the SaaS delivery model in place of the traditional on-premise model. PaaS technologies, such as Google App Engine and Windows Azure, deliver a computing platform and solution stack as a service, but they also aim to facilitate the development of cloud applications. Such PaaS offerings should enable third parties to build and deliver multi-tenant SaaS applications while shielding the complexity of the underpinning middleware and infrastructure. Cloud PaaS are appraised based on their capability to host applications [62]. It is motivating to place software in the cloud, and scientific articles tackle such motivations [63]. The incentive to host software on platforms may be classified as technology, governance, and marketplace. Other articles similarly try to appraise the advantages and pitfalls of hosting SaaS on a cloud platform [64]. These technologies give users several advantages: cost effectiveness, efficient resource utilization, collaboration, disaster recovery, and high performance.

Scholarly literature reviews show some articles that tackle the individual issues of hosting software on PaaS. One research issue has been integrating design and analytics in the cloud platform [65]. Another topic for scientific articles is tackling simulation capabilities for cyber-physical systems [66]. Some articles address the integration of several technologies on the PaaS [67]. Some articles tackle the ontology of the programming that enables applications on the Internet of Things platform [68]. Other articles look at the PaaS as an environment for machine-to-machine communication [69]. More complex articles make public the contradictory system requirements from a variety of disciplines, such as technology, business models, and legal matters that have led to the design of cyber-physical systems and the cloud or fog solution to host or operate them [70]. These design requirements for cloud PaaS enable the cloud and fog scenarios. Other authors envision that system integration capabilities in the cloud enable the virtual enterprise to shape business processes [71]. PaaS environments can host advanced applications, such as a social collaborative integration platform for urban distribution, whose target is a flexible coordination between actors featured as the crowdsourcing and sharing economy [72]. In the following, the type of software hosted on cloud PaaS and adjacent technologies will be discussed in detail. This section deals with the argument that hosting SaaS is a capability that cloud PaaS needs to have first.

3. Materials and Methods

This section details a multiple case study on the most important Internet of Things platform providers. Through the case study, we sought to determine if and how the sellers integrate ER in their customer offerings. The multiple case study refers to a selection of the leaders on the cloud PaaS market, according to market analysts Gartner and Forrester. Details about these market analyses are to follow in the results section. The list of leading vendors includes: PTC, Siemens, Microsoft Azure, Hitachi, C3.AI, Software AG, SAP Hana, Amazon Web Services, Oracle, IBM Watson Internet of Things Platform, GE Predix, and Bosch. They have been systematically reported as market leaders by Forrester as well as some by Gartner. A detailed explanation in the empirical data analysis includes Gartner reports about 360 cloud PaaS vendors, 48% of which are pure cloud while some may host one digital technology on cloud PaaS. Gartner reports that 10% of these vendors offer integrated digitalization solutions, without naming them. This means that the eleven selected vendors are part of thirty-six system integrators. The two market research companies, discussed here include Gartner’s, dealing with technologies hosted on Internet of Things platforms, and Forrester’s, dealing with the Internet of Things platforms market leaders. The research issue here is whether, how, and why these leading Internet of Things platform providers host AR technologies or other ER technologies on their platforms. Adjacent research issues are whether and how these technologies shape customer relationship management processes and other business processes for business customers.

This case study is exploratory, descriptive, and instrumental. The novelty of the issue provides its exploratory nature. Empirical data refer to the impact that extended reality and related solutions are ascertained to have on business customers and mass consumers. This grants the case study instrumental value, in the sense that the technologies impact business customers, not vendors. Empirical data come from Internet-based sources and online presentations and are publicly available. These data are relied on as presented by the vendors, without the possibility to check the truthfulness of their statements. They are not structured by a questionnaire but they rely on the vendor data according to vendors, matching vendor statements and their structure. This offers strength to the exploratory approach and favors a discourse that is based on decisions without bias. Empirical data was obtained by searching Internet statements via various keywords across time; the keywords include: extended reality, augmented reality, virtual reality, mixed reality, enterprise architecture, customer relationship management, customer experience, capability maturity level, business process management, and bespoke products. The structure of the data is consistent with vendor discourse and shows the integration of many technologies, which may match many business units and are integrated in customer offerings and markets. The intention was to structure the data consistently with vendors. There are strong limitations to this approach in the sense that the assertions are elaborate, are relied on as per references, cannot be proven, and are difficult to synthesize. The technology claims cannot be verified. Moreover, the vendor data impact marketing activities for business customers and they are intended to guide their business processes and decisions; this is merely an assumption. This makes a descriptive case study opportune. The multiple cases have an instrumental nature, as it is business customers that matter, not vendors, and ER technologies shape customer business activities, business processes, and business models for business customers. The approach has benefits in the sense that the role that ER and other technologies play shapes digital marketing activities and the overall customer value proposition in the various business models. The case study is based on abductive reasoning for the vendors’ and customers’ market, with initial evidence of a recently emerging trend that will reshape the Internet overall.

4. Results

4.1. Market Reports about Internet of Things Platforms or Cloud Platforms as a Service

According to Statista [73], PaaS is the smallest segment of the global public cloud market but is expected to grow the most in the upcoming years. By definition, PaaS “builds on the concept of Infrastructure as a Service, offering supplementary services to the customer; these include an additional development environment, which allows for high-level programming. It contains exact specifications for programming language, interfaces, data storage, networks, and data processing systems and thus reduces complexity for the developer”.

Cloud computing is an Internet of Things technology and a market that was estimated by Gartner to be valued at 86.9 trillion USD in 2021, expected to reach 136.4 USD in 2022 [74]. Internet of Things project implementers cite integration as a top technical challenge [75]. To ensure successful deployment of Internet of Things projects, application leaders must understand that Internet of Things integration capabilities vary widely and they should seek providers with integration capabilities that fit their needs. Gartner tracks multiple types of PaaS, including, among many more, application PaaS, integration PaaS, application management PaaS, function PaaS, business analytics PaaS, Internet of Things PaaS, and database PaaS [76]. Gartner defines the information technology or operational technology integration market [77] as “the end state sought by organizations (most commonly, asset-intensive organizations) where instead of a separation of Information Technology and Operational Technology as technology areas with different areas of authority and responsibility, there is integrated process and information flow”. According to Gartner [78], the market of information technology or operational technology integration is classified as comprising enterprise software providers offering cloud PaaS: Fujitsu, Hitachi, Vantara, IBM, Oracle, SAP, and Software AG; manufacturers offering cloud PaaS: Bosch, Software Innovations, GE Digital, and Siemens; Internet of Things platform or edge specialists: Amazon, Ayla Networks, Eurotech, Particle, and PTC; integration middleware specialists: Adaptris, MuleSoft, Reekoh, and Skynet; API management specialists; and system integrators. Gartner also claims “the rise of the Internet of Things and digital transformation gives rise to the convergence of Information Technology and Operational Technology”. One of the key technologies needed to do this is the digital twin.

Gartner [79,80,81] names the following companies, Internet of Things platforms, or PaaS market leaders as visionaries: Microsoft, PTC, Hitachi, Microsoft, Software AG, and Siemens (2021); PTC, Hitachi, Microsoft, and Software AG (2020); PTC, Software AG, and Hitachi (2019); and PTC, SAP, and Hitachi (2018). Following these companies are Amazon Web Services, Davra, Lituns, ABB, Rootcloud, Envision Digital, Exosite, Flutura, Samsung, Altizen, Braincube, Knowledge Lens, and Eurotech (2021); Litmus, Altizon, Flutura, Oracle, IBM, Exosite, AWS, GE Digital, Rootcloud, Samsug SDS, Q10, Davra, Briancube, and Eurotech (2020); Accenture, Exosite, Altizon, IBM, Litmus Automation, Dava, Oracle, Flutura, QiO, Atos, Rootcloud, Euotech, and GE Digital (2019); and IBM, Software AG, Accenture, Oracle, Altizon, Atos, Q10, and Flutura (2018).

Complementarily, Forrester [82,83,84,85,86,87], has found Internet of Things platforms or PaaS a market worth researching since 2015. In 2014, Forrester noted an emerging market, Internet of Things platforms or PaaS. They announced several vendors: ARM, Cisco, GE, IBM, Intel, and PTC. The analysis spans years 2016–2022. Market leaders have always included PTC and Microsoft; in 2016, market leaders also included IBM and GE; in 2018, market leaders included IBM and SAP; and in 2020, market leaders included c3.ai and Siemens. In 2016, the strong performers were SAP, Amazon Web Services, and Cisco Jasper, and the contenders were Log Meln, Exosite, Ayla Networks, and Zebra Technologies. In 2018, the following companies were strong performers: Software AG, GE Digital, Hitachi, Siemens, Oracle, Atos, and Bosch, and contenders: Schneider Electric, Amazon Web Services, and Cisco. In 2019, the following companies were strong performers: IBM, Software AG, SAP, Amazon Web Services, GE Digital, Oracle, and Hitachi, and contenders: ABB, Samsung AG, and Bosch. In 2020, the following companies were strong performers: Software AG, PTC, Siemens, GE Digital, Hitachi, Samsung, Cisco, and Bosch.

The Markets and Markets [88] report also shows the main market players on the Internet of Things platforms or PaaS market and they are: AWS (US), Microsoft (US), Google (US), Cisco Systems (US), IBM (US), Oracle (US), Salesforce.com (US), SAP (Germany), PTC (US), Samsung (South Korea), Bosch.IO (Germany), Autodesk (US), AT&T (US), Alibaba Cloud (China), Telit (UK), Siemens (Germany), GE Digital (US), Ubidots (Colombia), Zoho Corporation (US), and Particle (US). The Internet of Things cloud platform combines the capabilities of devices enabled with Internet of Things and cloud computing technology; the combined capabilities of both technologies are delivered as a service over an end-to-end platform. Internet of Things devices have multiple sensors connected to cloud technology, typically via gateways. The platform’s major features include the management and security of widely installed connected devices, network connectivity management, application enablement, cloud-supported data collection, data analysis, and real-time business insights.

According to Gartner, the SaaS market [89] was valued at $225.6 billion in 2020, expected to grow to $397.5 billion in 2022. The market is classified in the following applications: customer relationship management software, enterprise resource planning software, human resource management software, manufacturing and operations software, and supply chain management software. The companies active in this market are Salesforce, ServiceNow, Microsoft, Google, Cisco, Slack, Adobe, Oracle, Amazon AWS, DocuSign, Zendesk, Dropbox, ADP, Atlassian Confluence, Shopify, Workday, Hubspot, SAP, IBM, Box, Concur, JIRA, GitHub, GoToMeeting, Twilio, Coupa Software, Xerox, and Zuora.

The social media management market size is projected to grow from 14.4 billion USD in 2021 to 41.6 billion USD in 2026, at a compound annual growth rate of 23.6% during the forecast period. Based on its components, the social media management market [90,91] includes marketing based on social media.

According to IDC [92], the mobile market comprises vendors Samsung, as the leading vendor; Xiaomi, with rising sales; Apple, with fluctuating sales; and Vivo and Oppo, with steady sales at approximately the same level.

The mainframe consultant for digital transformation, IDC, markets use cases that group technologies in goal-oriented solutions on a functional basis. Use cases may cover the retail area and strategic priorities: “Curated Merchandize Lifecycle Management”, “Digital Supply Chain Optimization”, “Omnichannel Commerce”, and “Omniexperience Customer Engagement” [93]. Strategic priority “Omnichannel Commerce” includes programs: “Augmented and Virtual Experience”, “Experiential Commerce”, and “Intelligent Order Fulfillment”.

Use case “Live Streaming Product Discovery and Purchase” [94] offers the opportunity to engage customers around a real-time product discovery and purchase experience that is shared with the referenced digital community on the hosting platform. The type of live video content can vary from pure product demonstration to narration-based approaches. Product availability is integrated in real time to inventory systems of record.

Use case “Virtual and Augmented Engagement” [95] involves AR and VR, which can create new multisensory paths to explore products and services to experience them in real-life contexts. Examples include fashion apparel (look and sizing), home furnishings (layout and configuration), and food (recipes and menus). AR and VR create rich contextualized experiences that “explain and describe” the value and uses of products. The technologies deployed are AR and VR, multiple digital and mobile devices, Internet of Things, mobile applications, loyalty applications, 5G connectivity, mobile device management, and edge infrastructure.

Use case “Digitally Connected Product Experiences” [96] enables customers and associates to access and execute against expanded connected store data sets and tools. Tools include visualization of different clothing and accessory choices, product information, and live interaction with sales associates. VR provides customers with the option to initiate and complete the purchase from within the fitting room. The use case includes solutions including mobile applications, smart displays and fitting rooms, and digital product codes.

Use case “Augmented and Virtual Product Discovery” [97] employs visual search functions with visual attribute discovery to create more on-target search results, allowing the customer to discover other products based on looks and complemented by materials, construction, design, and so forth. Images become a dominant search term supported by gesture and touch support. The technologies deployed are AR and VR, mobile consumer applications, advanced image and content analytics, video, 3D virtualization, photorealistic rendering, mobile infrastructure, hybrid multi-cloud management, serverless computing, high-performance distributed or scale-out storage, 5G connectivity, and edge infrastructure.

4.2. Leading Vendors’ Reports about Cloud PaaS

According to PTC, the way the digital world impacts the physical world moves along several digital maturity stages: digital defines physical via computer-aided design digital manages physical via product lifecycle management software, digital connects physical via Internet of Things and digital augments physical via AR [98]. All in all, digital disrupts physical. At PTC, Vuforia is the solution for AR [99]. This may involve several interface technologies: Vuforia Instruct via tablets, Vuforia Expert Capture via special glasses, Vuforia Studio also via special glasses, Vuforia Engine via mobile phone, Vuforia Chalk via a tablet, and Vuforia Spatial Toolbox [100]. AR may be used for manufacturing solutions, service solutions, sales and marketing solutions [100]. In sales and marketing solutions, Vuforia Ventana is ascertained to transform the marketing function [101,102,103,104,105,106,107,108,109,110,111,112]. AR is “an interactive experience that combines computer-generated perceptual overlays on real-world physical objects or environments with digitally presented information”. In recent years, its use has grown rapidly and the cost of developing AR experiences has declined significantly. The technology is widely available on mobile devices, such as smartphones and headset-based devices, reaching a much larger audience. According to PTC, AR can be used in electronic commerce with the following capabilities: getting more detailed product information (65%), reading product information (55%), accessing product information easily on mobile devices (52%). AR is a digital-twin-based product. AR is based on highly detailed digital twins. The solution is intended for build to order and configurable products, whose design is decided by the customer. Buyers use AR to understand the future product via a mobile phone. According to PTC, specific versions of configurable products are difficult to create with other technologies, which are often managed by sales personnel rather than the customer. AR allows the buyer to work with sales and configure the product in real time. The buyer may be shown how to operate the product. Furthermore, PTC Creo is a generative design solution that allows users to input their requirements and constraints for the product to be designed and then manufactured via additive manufacturing. Users may be customers. Requirements may refer to volume, material content, preferred material, the weight to be borne, and the price. The output is a product that conforms to customer requirements.

At Siemens, a designated AR solution, A Assist, is intended for manufacturing. Evidence of real-life solutions have shown the use of AR on mobile phones for marketing. The solution integrates several technologies: sensor suits, applications on mobile phones that enable the digital twin of the customer, the Mindsphere cloud, generative design, NX software, and the Additive Manufacturing Network. The customer experience is provided by the AR solution [113]. This creates a point cloud [114]. Siemens uses generative design, a combination of product lifecycle management software and artificial intelligence [115,116]. Generative design combines requirements with constraints, where constraints may be the necessary design space (or bounding volume) and design goals (such as minimizing weight). Additive Manufacturing systems execute this. Geometric constraints are identified together with additional values for nongeometric parameters, such as material and cost constraints. Software algorithms then do the job of automatically cycling through numerous geometric model permutations seeking an optimum solution based on all of the defined constraints. The new technologies, AR and generative design, are used together, where AR creates a point cloud (the customer’s head) that acts as a volumetric constraint for the size of the helmet producing a bespoke helmet. Working together, the technologies produce similar products, such bespoke shoes and spectacles.

Microsoft uses the Microsoft Azure Cloud to integrate technologies to build the metaverse [117]. The metaverse will impact both the consumer space and the enterprise space. Microsoft showcases the following architecture for the metaverse: as basis for connectivity, the Microsoft Azure Internet of Things platform; as basis for modelling, the Azure Digital Twins; as basis for location, the Azure Maps; as basis for data, Azure Synapse Data Analytics; as basis for intelligence, Azure Artificial Intelligence and Azure Autonomous Systems; as basis for logic, the Power Platform; as basis for MR, Microsoft HoloLens and Microsoft Mesh; and as basis for applications, Microsoft Teams and Microsoft Dynamics 365 connected spaces. This architecture will create platforms. According to Accenture, this creates omni-connected experiences. Whereas the metaverse allows immersive experiences, generative artificial intelligence allows the use of data from the immersive experience to create something new [118]. Microsoft takes a generic approach to enterprise architecture that is generally valid. The approach to address customers works via asking several questions: why? who? how? [119]; after this, the business strategy, goals, and scenarios are defined. The technology reaches its customers via use cases, which are technology solutions that support company goals and the business scenarios that drive them [120].

Oracle claims the most advanced form of cloud technology is the customer-centric cloud [121,122]. The integration of AR and cloud technology comes from Oracle in 2019 [123]. The AR cloud has been called “the single most important software infrastructure in computing”. Oracle furthermore explains, “the complex architecture of technologies enables a three-dimensional virtual map that is overlaid onto the real world, where information and experiences are augmented, shared, and tied to specific physical locations to occur and persist across apps and devices. This geospatial, geo-database environment will appear as a three-dimensional spatial web of the future and will eventually serve as the data framework that will enable hundreds of millions of digital devices to use shared spatial screens. These shared experiences (not just videos and messages) are augmented with information to visualize a dimensional universe of virtual data, objects, and logic. Such capabilities will inevitably transform the way enterprises serve and interact with customers, the way they work and collaborate with employees, and, ultimately, the whole way they conduct business. Put simply, instead of clicking on something, real-world participants will be able to visualize the item, person, or place and see all the information present about it”. Oracle intends to give this cloud global scale (Oracle, 2019). Consumers can visualize objects or scan them and report their malfunctions. There are numerous business benefits to be gleaned from engaging with customers and employees via the AR cloud. This will allow people to collaborate in gaming, design, marketing, and commerce. The architecture of Oracle Cloud comprises several layers: visual browser, Internet of Things, sensors, beacons, edge computing, AR cloud (point cloud, data storage, web services), the aesthetic layer (computer vision, image and remote sensing, cameras, facial recognition), the functional layer (visualization, mapping and analysis, localization), and the intelligence layer (artificial intelligence, object detection, spatial pattern detection, predictive modelling, clustering).

Retailers are enabled to have hyper-personalized experiences. Furthermore, Oracle asserts, “the capability to visualize products or get quick information on products right on the mobile screen enables retailers to personalize offers and drive engagement by using strategic techniques that allow customers and brands to connect in hyper-personalized ways”. Having the ability to place virtual objects in AR builds a value-based relationship when they are persistent and gamified. Oracle will launch the AR cloud in collaboration with Google AR Core and Apple AR Kit. By now, one of the applications is in construction via Linked [124]. Oracle’s AR cloud is used by Xerox as an information basis for customer orders for additive manufacturing. It generates the digital twin of the product order. The Oracle-Xerox collaboration also supports customer relationship management processes using enterprise resource planning software: online selling, customer ordering, invoice processing, and performance tracking [125]. Oracle also provides other customer experience technologies, like chatbots [126]. This is an integrated package to manage the dedicated processes.

In 2017, SAP launched its ER cloud, merging AR and VR. The ER cloud and Unity Integration Toolkit bring these worlds together. Unity developers and ER designers can easily integrate digital threads and other SAP data into Unity and build an ER application for SAP customers powered by enterprise resource planning, supporting them in operating at their best [127]. The cloud was initially intended to support workers. In 2020, SAP launched retail solutions based on AR and the SAP Commerce Cloud [128]. AR converts the surrounding environment into a digital interface and can place virtual three-dimensional objects into the real world, in real time. This is done by superimposing contextual data into space or onto a real object. There are numerous ways to use the AR experience, which is now built in for the latest devices. According to SAP, AR is set to be extensively used: by 2020, there will be 1 billion AR users; by 2022 there will be 3.5 billion users. Of these, 100 million users will shop using AR in-store and online by 2020. The following customer Industry 4.0 technologies are expected to rely on AR: furniture, 60%; clothes, 55%; food and beverage, 39%; footwear, 35%; cosmetics, 25%; jewelry, 25%; and toys, 22%. SAP unifies the Commerce Cloud with customer relationship management software processes in enterprise resource planning software and enables end-to-end processes, including cart checkout. The end-to-end processes include: product content management, promotions, and order management. Further customer experience is shaped by other technologies [129].

Software AG’s reference architecture for Industry 4.0 includes process of market to cash, which is driven by digital twins and cobots [130,131]. The enterprise architecture may begin with customer lifetime value, where the customer decides on a digital twin of the ordered product in the market to cash process; augmented sales bots assist the process. This process is integrated in the entire supply chain, via demand to operate and source to pay processes, where the digital twin ordered by the customer is sent to cyber-physical systems at the original equipment manufacturer and from there is sent to additive manufacturing at the original equipment suppliers. In 2017, Software AG listed AR and VR as disruptive technologies that will shape operational and commercial reality.

AWS is a subsidiary of Amazon, the largest electronic commerce provider in the world for retail and wholesale, according to Bloomberg. Amazon’s retail solutions are grouped by customer outcome [132]. AWS [132] groups solutions by the customer outcomes they provide: “Deliver on Your Brand Promise”, “Reach More Customers”, “Increase Conversions”, and “Build an Agile, Cost Effective Cloud Platform”. Use cases deliver these outcomes and correspond to solutions that group products.

The outcome “Delivering on Brand Promise” means AWS supports all the ways customers want to shop and provides the most efficient fulfillment of orders. This is achieved by use cases “Omnichannel Fulfillment” and “Last Mile and Reverse Logistics”.

The outcome “Capture More Sales” is achieved by use cases that give customers greater convenience and flexibility with broader fulfillment options, such as buy online and pick up in store and buy online and ship from store. AWS enables retailers to utilize intelligent insights to optimize efficiency and track inventory across all channels; this lowers costs and decreases delivery time. Retailers can also offer a larger range of products to customers and “save the sale” by allowing shoppers to place product orders in store and fulfill via online channels. AWS supports retailers in improving customer experience processes and reducing friction, even after purchase.

The outcome “Reach More Customers” means exploring more channels to interact with customers and removing friction from the discovery and buying experiences. Two cases, “Commerce Everywhere” and “Marketing Outreach”, assist in the design of the online shopping experience. “Commerce Everywhere” entails that, with digital commerce solutions from AWS, businesses can reach existing and new customers; it entails innovative interfaces that are optimized for easy transacting via social, mobile, and voice. Solutions are AWS Amplify, AWS Wavelength, and Amazon Polly. The use case “Marketing Outreach” involves standing out in a crowded market where customers must prioritize their attention as well as growing brand awareness and reaching new customers with targeted email campaigns, digital ads, and mobile notifications utilizing geofencing to increase message relevance and interactions.

The outcome “Increase Conversions” involves use cases “Personalization and Recommendations”, “Call Centers and Chatbots”, “Product Search”, “Product Interactions”, and “Website Optimization”. Use case “Personalization and Recommendations” involves tailoring digital experiences for customers with personalized product recommendations and offers to increase customer interactions, boost conversions, and drive more revenue. Solutions are Amazon Personalize and Amazon SageMaker. The use case “Call Centers and Chatbots” illustrates how AWS enables retailers to create highly engaging, meaningful interactions with customers over voice and chat in the contact center; easily design and build intelligent conversational bots to turn automated interactions into natural conversations, and capture caller sentiment in real time to surface insights, spot trends, and react to customer needs throughout their buying journeys. The solutions are Amazon Connect, Contact Lens for Amazon Connect, Amazon Lex, and Product Search. Use case “Product Search” means AWS makes it simple and cost-effective to set up, manage, and scale product search solutions for ecommerce websites and mobile apps that allow consumers to search and find fast. It involves solutions known as Amazon Cloud Search and Amazon Elastic Search Service. The use case “Product Interactions” means helping customers discover new products or better understand product features through engaging experiences, such as livestreams or demonstration videos, that can lead to increased sales and fewer returns. The solutions are Amazon Kinesis Video Streams, Amazon Interactive Video Service (Amazon IVS), and Website Optimization. Complementing the use case “Website Optimization” means that, for retailers, a fast, intuitive, secure website is mission critical. Digital commerce solutions from AWS automatically minimize application downtime and latency to ensure faster page loads so customers spend more time onsite—and making purchases—with security protections to defend against common web exploits that could affect site availability. Additionally, AWS helps improve customer experience with optimized site navigation, tailored to ensure customers find products quickly. Solutions are AWS Shield, AWS WAF, and Amazon CloudFront.

The outcome “Building an Agile, Cost Effective Platform” illustrates the deployment of the company website in the AWS Cloud and its subsequent modernization for greater agility, reliability, and innovation at scale. Use case “Migrate” clarifies that, by moving their existing ecommerce solution to the AWS Cloud, retailers gain improved flexibility, availability, and security, all while lowering costs by up to 50%. It involves solutions known as Amazon CloudFront, Amazon Route 53, and AWS Shield. Use case “Modernize” means AWS gives retailers the ability to move from monolithic systems to agile microservices that can be individually changed, tested, and reassembled for greater business agility and innovation at scale. It involves solutions known as AWS Lambda, Amazon EKS, Amazon Elastic Kubernetes Service (Amazon EKS), and Amazon Aurora.

At the IBM Institute for Business Value, IBM has an Interactive Experience Division. This has been named the largest digital agency network in the world by Ad Age. IBM IX is one of the largest digital and design consultancies in the world. It consists of nearly 60 studios. It employs a global network of strategists, designers, developers, and data architects [133]. This consultant tackles customer experience solution consulting and implementation spanning all domains: sales, service, marketing, and commerce. They help clients define their strategy, choose the optimal platforms based on need, and accelerate time to value. This consultant assesses that ER technologies will transform radically and level reinvention via their customer experience solution. In 2019, the consultant envisions that ER—grouping AR, VR, and MR—will provide a very different market place for electronic commerce [133]. ER will be used with smartphones. By 2020, it was expected 3.4 billion phones would have even more advanced AR capabilities, meaning billions of shoppers would be able to explore physical products with digitally integrated content and make better informed purchases. The main applications of these technologies are in retail. The IBM Watson assistant integrates chatbots in the customer experience solution included in the IBM Watson Cloud [134].

Hitachi markets customer experience technologies in the form of artificial intelligence applications [135]. These deliver personalization at scale across every brand touch-point. The cloud solution hosts low-code applications to build customer portals. At Hitachi, AR and VR are used to assist workers in their tasks [136,137]. Hitachi foresees several scenarios for ER, including new opportunities in gaming, education, medicine, retail, and real estate. As the technologies will be combined, ER may result in a perfect diagnosis. Oculus Quest VR Gaming headset, Xbox 360’s Kinect, Apple AR Kit, Android AR Core, HTC Vive Pro, Magic Leap, and Microsoft Hololens are some of the currently available ER devices, and AR and VR developers and artists are already experimenting with them [138].

C3.AI offers customers customer relationship management solutions [139] that combine traditional customer relationship management software, social, mobile, and artificial intelligence [140].

GE is not known to offer customer relationship management solutions and they boast using AR to make workers meet and share information, not in marketing [141].

5. Discussion

Cloud technology is the basic technology that hosts all of the others, IaaS, PaaS, and SaaS. The former two host the latter. PaaS solutions need to support the programming languages for the SaaS they support. The cloud markets consist as market segments with related sales. The Industry 4.0 working group, Acatech, argues that cloud provides the middleware to host automation technologies and digitalization technologies as well. Our theoretical literature review shows that PaaS or Internet of Things platforms host software applications and that a critical issue in their programming is their capability to host miscellaneous technologies and business processes. Our empirical data analysis concerns the leading Internet of Things platform providers according to Forrester market reports. It is noteworthy that digital transformation places strong constraints on IaaS and on the programming and hosting capacities of PaaS, and enables new types of SaaS. The literature review shows that requirements of the PaaS technology to support innovative SaaS solutions are either automation- or digitalization-related. This classification is important because the capacity and capabilities in the former markets enable the latter: this means that PaaS exist to the extent that there is storage capacity to host them; and SaaS exists to the extent that the programming languages on the PaaS enable them. Internet of Things platform is the technology that allows the programming language for all SaaS technologies hosted in the cloud. New technologies to be hosted, SaaS and their capabilities, impose requirements on PaaS programming capabilities. Amongst these technologies are ER technologies: AR, VR, and MR. They may function on a stand-alone basis or in synergy with other technologies in integrated solutions. The issue is if the PaaS or Internet of Things platforms integrate SaaS, that shapes business processes, business models, and enterprise architecture. AR is included amongst the technologies that the Acatech enterprise architecture maturity index hosts in the cloud. Social and mobile technologies contribute. The literature review and empirical data converge to attribute cloud PaaS with the role to host SaaS on a stand-alone basis and in integrated solutions. ER technologies and the solutions they form are scarcely researched at all, and the way that PaaS host these technologies paves the way to further research. To be noted, Samsung and Oracle argue that ER clouds are the most sophisticated form of cloud PaaS from a technology perspective.

It has only been recently that ER has received great emphasis in all functional areas, including customer relationship management. The theoretical literature review shows that this technology has recently gained momentum in the marketing function. Scholarly literature ties ER to the omnichannel, defined as the Internet of Things, social media, or electronic commerce. It is set to attract mass customer segments but this issue is not highlighted in the literature review. According to the literature review, ER has the following functionalities: communications and advertising; selling to consumers, that is, retailing; and creating or enhancing the consumption experience. These are the marketing activities that ER technologies support. In theory, ER may provide utilitarian (e.g., improving people’s efficiency), hedonic/experiential (e.g., engaging brand stories or games), social (e.g., connecting with other brand fans in multi-user AR or anthropomorphized brand mascots), eudemonic (e.g., improving well-being or personal growth), inspirational (e.g., fostering imagination or inspiration), or edutainic (e.g., gamified learning experiences or the feeling of being more competent consumers) value. Table 1 shows the elements of the customer delivery model: marketing activities, customer channels, customer segments, customer value propositions, customer relationships.

The empirical data have been structured into the same elements, as the most important issues discussed therein shown in Table 3. As of now, the empirical data for the eleven major vendors show that the customer value proposition complements marketing processes and is clearly defined. The empirical data furthermore show ER is used in solutions with other novel technologies to cocreate bespoke products available from anywhere, where the customer value proposition is a bespoke product mass produced at low cost. At IDC and AWS, some 50 use cases show the value proposition holistically in goal-oriented solutions; the goal is a type of customer value proposition; all these use cases are compatible with electronic commerce, the omnichannel. For example, AWS groups solutions by the customer outcomes they provide: “Deliver on Your Brand Promise”, “Reach More Customers”, “Increase Conversions”, “Build an Agile, Cost Effective Cloud Platform”. The customer value proposition is intended to attract customers to online shopping, offering what experiential commerce cannot. The empirical data show that, when integrated in solutions, ER may be used to place the customer order in electronic commerce, choosing from a trillion product variants or configurations available online; this is consistent with theory. ER marketing is used in conjunction with electronic commerce and it is intended to incentivize the omnichannel. Furthermore, practitioners estimate that a hundred million to a billion customers will use ER in electronic commerce. The elements of the delivery model, the customer value proposition, the customer channel (the omnichannel), the customer segments (mass customers), and the customer relationships (personal assistance, automated delivery, cocreation), are inferred to generate high customer attraction or pull effect. This may be measured by the number of customers anticipated to use ER in electronic commerce: mass global customers, estimated at a hundred million to a billion, by major vendors like Samsung, Microsoft, Facebook, SAP, and Oracle. The timing of the pull effect is uncertain and may be close to 2022 according to Facebook and Microsoft or close to 2030 according to Samsung. This will promote existing businesses or create new ones. Ultimately this will create new revenue streams. The new sales will replace past sales in successor business or create additional business opportunities for ventures; the brownfield versus greenfield scenarios are unclear. The same goes for customer loyalty at the timing of the research. ER marketing impacts marketing in all elements of the delivery model. Figure 3 summarizes the pull effect that ER has on the delivery model.

Table 3.

ER solutions.

Figure 3.

ER enables customer pull in delivery models and business models.

It is not just the delivery model that is digitally transformed by ER. The other elements of the business model, business activities, business resources, and business partners, will be transformed as well. The empirical data are rich, showing numerous use cases that may be functionally specific or may overarch all functional activities. These use cases are elaborate and may refer to enterprise architecture in all at Microsoft, Oracle, SAP, AWS, and IBM. The delivery model may be complemented by activities and resources that shape business models. Preconfigured products are the reference business model for the digital enterprise, which match a global value chain as shown in Figure 2, where customer relationship management processes globally initiate supply chain management. This is a platform business model, where the customer order dictates operations across the world. Another platform business model is based on the customer value proposition bespoke products, on mass customer segments reached via electronic commerce, and on customer cocreation. Business processes are initiated by the customer order via digital marketing and sent to cyber-physical systems directing additive manufacturing at PTC, Siemens, Software AG, and Oracle.

Digital marketing via electronic commerce is complementary with digital supply chain management. Physical locations traditionally involve the push of raw material to goods in progress and finished goods sold via wholesalers and retailers to the customer. The finished product specification is decided by the seller. Inventory is pushed alongside this value chain. In pull business models, the customer decides the product specification when placing the order, thereby transforming supply chain management. These technologies are hosted and functional on cloud PaaS, which provide the programming language. They enable the technologies to virtually function together, becoming available from anywhere in the world. This holds true for technologies that are less mature than digital enterprise, automation, or computerization technologies, which the literature review shows can be placed in the cloud and be available from everywhere.

The convergence of ER with other cloud-hosted technologies needs to be supported and enabled by cloud programming languages. Whereas the elements of pull business models are penciled in, dedicated research needs to be more elaborate. There are limits to performing research that challenges business models. One limit comes from researching solutions, as articles tend to be dedicated to one use case and not the over fifty use cases presented here. Furthermore, enterprise architecture is typically the topic of books along with the level at which the integration of technologies creates new business models and new customer value proposition. The word count limits this research and paves the way for further research. This work creates many directions for future research: the programming requirements for PaaS, enterprise architecture programming languages and requirements, marketing activities and competencies, other business processes, business process integration into operational models, business process integration into business models, importing market-based innovation into theory, and conceptualizing new products and new business models for new possibilities. Many of these are, at the time being, innovations on markets. As argued in the introduction, all technologies involved are emerging, whereas the mass use of ER has only recently developed.

Author Contributions

Conceptualization, R.W. and D.C.; methodology, R.W. and D.C.; software, R.W. and D.C.; validation, R.W. and D.C.; formal analysis, R.W. and D.C.; investigation, R.W. and D.C.; resources, R.W. and D.C.; data curation, R.W. and D.C.; writing—original draft preparation, R.W. and D.C.; writing—review and editing, R.W. and D.C.; visualization, R.W. and D.C.; supervision, R.W. and D.C.; project administration, R.W. and D.C.; funding acquisition, R.W. and D.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research is funded by the University of Kassel.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Porter, M.; Heppelmann, J.E. A Manager’s Guide to Augmented Reality. Harv. Bus. Rev. 2017, 95, 45–57. [Google Scholar]

- The Next Hyper-Connected Experience for All. Available online: https://cdn.codeground.org/nsr/downloads/researchareas/20201201_6G_Vision_web.pdf (accessed on 1 February 2022).

- Migliore, G.; Wagner, R.; Cechella, F.S.; Liébana-Cabanillas, F. Antecedents to the Adoption of Mobile Payment in China and Italy: An Integration of UTAUT2 and Innovation Resistance Theory. Inf. Syst. Front. 2022, 1–24. [Google Scholar] [CrossRef] [PubMed]

- The Metaverse Will Be Social. Available online: https://about.facebook.com/meta/ (accessed on 1 February 2022).

- IT/OT Integration. Available online: https://www.gartner.com/en/information-technology/glossary/it-ot-integration#:~:text=IT%2FOT%20integration%20is%20the,integrated%20process%20and%20information%20flow (accessed on 1 February 2022).

- Top Trends in the Gartner Hype Cycle for Emerging Technologies. 2017. Available online: https://www.gartner.com/smarterwithgartner/top-trends-in-the-gartner-hype-cycle-for-emerging-technologies-2017/ (accessed on 1 February 2022).

- Hype Cycle for Emerging Technologies. Available online: https://www.gartner.com/smarterwithgartner/5-trends-emerge-in-gartner-hype-cycle-for-emerging-technologies-2018/ (accessed on 1 February 2022).

- Trends Appear on the Gartner Hype Cycle for Emerging Technologies. 2019. Available online: https://www.gartner.com/smarterwithgartner/5-trends-appear-on-the-gartner-hype-cycle-for-emerging-technologies-2019/ (accessed on 1 February 2022).

- Trends Drive the Gartner Hype Cycle for Emerging Technologies. 2020. Available online: https://www.gartner.com/smarterwithgartner/5-trends-drive-the-gartner-hype-cycle-for-emerging-technologies-2020/ (accessed on 1 February 2022).

- Impactful Technologies from the Gartner Emerging Technologies and Trends Impact Radar for 2021. Available online: https://www.gartner.com/smarterwithgartner/4-impactful-technologies-from-the-gartner-emerging-technologies-and-trends-impact-radar-for-2021/ (accessed on 1 February 2022).

- The Intelligent Enterprise. Run at Your Best, with SAP—Grow more Resilient, more Profitable, and more Sustainable. Available online: https://www.sap.com/romania/products/intelligent-enterprise.html (accessed on 1 February 2022).

- Aichner, T.; Grunfelder, M.; Maurer, O.; Jegeni, D. Twenty-Five Years of Social Media: A Review of Social Media Applications and Definitions from 1994 to 2019. Cyberpsychol. Behav. Soc. Netw. 2020, 24, 215–222. [Google Scholar] [CrossRef] [PubMed]

- Kannan, P.K.; Li, H.A. Digital Marketing: A Framework, Review and Research Agenda. Int. J. Res. Mark. 2017, 34, 22–45. [Google Scholar] [CrossRef]

- Li, F.F.; Larimo, J.; Leonidou, L.C. Social Media Marketing Strategy: Definition, Conceptualization, Taxonomy, Validation, and Future Agenda. J. Acad. Mark. Sci. 2021, 49, 51–70. [Google Scholar] [CrossRef]

- Felix, R.; Rauschnabel, P.A.; Hinsch, C. Elements of Strategic Social Media Marketing: A Holistic Framework. J. Bus. Res. 2017, 70, 118–126. [Google Scholar] [CrossRef]

- Falkenreck, C.; Wagner, R. The Internet of Things–Chance and Challenge in Industrial Business Relationships. Ind. Mark. Manag. 2017, 66, 181–195. [Google Scholar] [CrossRef]

- De Keyser, S.K.; Arne, L.; Alkire, C.; Verbeeck, C.; Kandampully, J. Frontline Service Technology Infusion: Conceptual Archetypes and Future Research Directions. J. Serv. Manag. 2019, 30, 158–183. [Google Scholar] [CrossRef]

- Hofacker, C.F. Notes on the Growing Importance of Software as a Driver of Value Exchange. In Review of Marketing Research; Emerald Publishing Limited: Bingley, UK, 2019. [Google Scholar] [CrossRef]

- Shankar, V.; Balasubramanian, S. Mobile Marketing: A Synthesis and Prognosis. J. Interact. Mark. 2009, 23, 118–129. [Google Scholar] [CrossRef]

- Liao, T. Augmented or Admented reality? The Influence of Marketing on Augmented Reality Technologies. Inf. Commun. Soc. 2014, 18, 310–326. [Google Scholar] [CrossRef]

- Philipp, A.R.; Rauschnabel, P. Augmented Reality is Eating the Real-World! The Substitution of Physical Products by Holograms. Int. J. Inf. Manag. 2021, 57, 102279. [Google Scholar] [CrossRef]

- Chylinski, M.; Heller, J.; Hilken, T.; Keeling, D.I.; Mahr, D.; de Ruyter, K. Augmented Reality Marketing: A Technology-Enabled Approach to Situated Customer Experience. Australas. Mark. J. 2020, 28, 374–384. [Google Scholar] [CrossRef]

- Rauschnabel, P.A.; Babin, B.J.; Tom Dieck, M.C.; Krey, N.; Jung, T. What is augmented reality marketing? Its definition, complexity, and future. J. Bus. Res. 2022, 142, 1140–1150. [Google Scholar] [CrossRef]

- Mohanty, B.P.; Goswami, L. Augmented Reality is Defined as a Form to Visualize 3D Applications. Advancements in Augmented Reality. Mater. Today Proc. 2021. [Google Scholar] [CrossRef]

- Meißner, M.; Scholz, S.W.; Wagner, R. Marketing Research Using Multimedia Technologies. In Encyclopedia of Multimedia Technology and Networking, 2nd ed.; IGI Global: Hershey, PA, USA, 2009; pp. 880–886. [Google Scholar] [CrossRef]

- Bonetti, F.; Warnaby, G.; Quinn, L. Augmented Reality and Virtual Reality in Physical and Online Retailing: A Review, Synthesis and Research Agenda. In Augmented Reality and Virtual Reality; Jung, T., tom Dieck, M., Eds.; Progress in IS; Springer: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Nikhashemi, S.R.; Knight, H.H.; Nusair, K.; Liat, C.B. Augmented Reality in Smart Retailing: A (n) (A) Symmetric Approach to Continuous Intention to Use Retail Brands’ Mobile AR Apps. J. Retail. Consum. Serv. 2021, 60, 102464. [Google Scholar] [CrossRef]

- Mine, O.; Dondu, B.; Serhat, O. Extending the Technology Acceptance Model to Explain How Perceived Augmented Reality Affects Consumers’ Perceptions. Comput. Hum. Behav. 2022, 128, 107127. [Google Scholar] [CrossRef]