Transaction Mechanism Based on Two-Dimensional Energy and Reliability Pricing for Energy Prosumers

Abstract

:1. Introduction

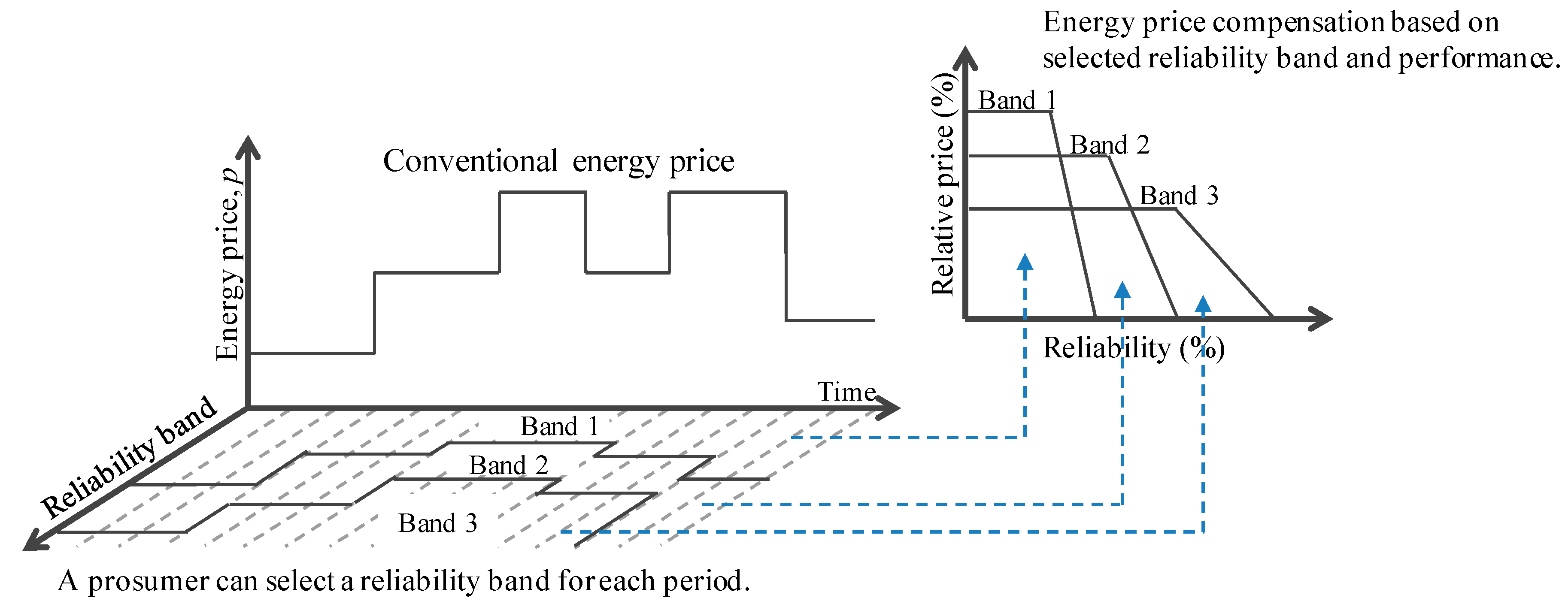

2. Dynamic Energy-Reliability Pricing-Based Transaction Mechanism

2.1. Energy-Reliability Pricing-Based Transaction Mechanism

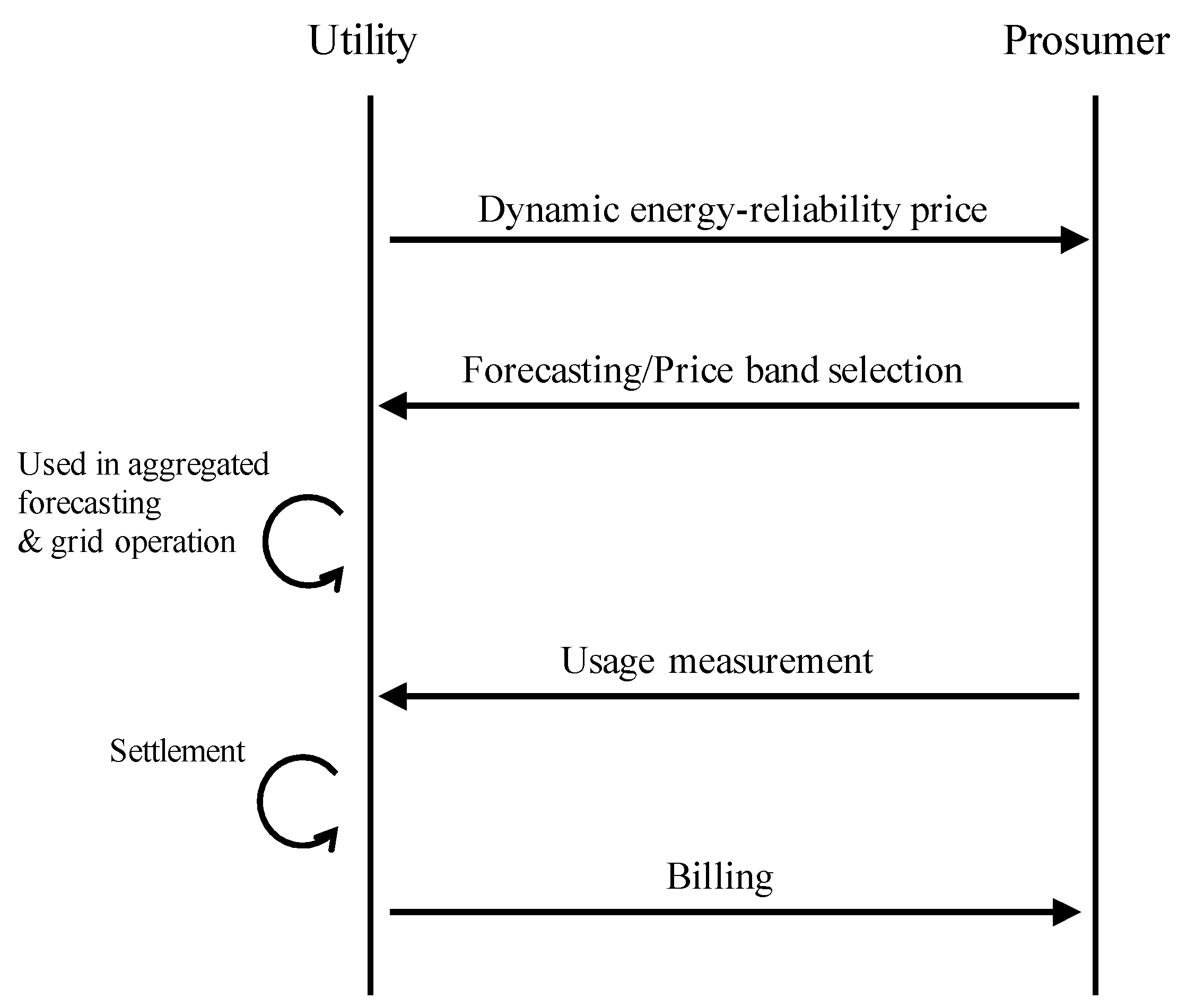

2.2. ERT Operation Procedure

- (Step 1.

- ERT announcement) First, a utility or retailer announces the ERT, , which consists of energy prices and corresponding reliability bands. Basically, the energy price would similarly change over time but should be differently rewarded depending on the quality of a prosumer’s resources.

- (Step 2.

- Reliability forecasting and band selection) Under the ERT, prosumers should forecast their energy consumption or production, ; this is an essential contribution from the prosumer. In addition, they need to forecast the uncertainty of their energy forecast . When a prosumer understands their own resource characteristics, they can select the most appropriate reliability band or strategically change their operation plans to maximize their expected benefit by deducing potential risks, as follows:Prosumers can even decide to invest in additional infrastructures, such as EES, to increase their forecast accuracy and to reduce their uncertainty. Once a prosumer forecasts their energy usage and uncertainty considering their resource characteristics and operation plan, the forecast and selected uncertainty level-based band are sent to the utility.

- (Step 3.

- Settlement and billing) The utility aggregates the individual prosumer forecasts and commitments, incorporating this information into its own forecasts and grid operation plans. The basic assumption here is that, by obtaining prosumers’ forecast and band selection information, a utility can increase its own forecasting accuracy regarding both amount and uncertainty. Even if the utility’s forecast based on this information includes errors, it can minimize its financial risk by penalizing prosumers for inaccurate forecasting. Based on a prosumers’ band price selection, the utility or prosumer can perform settlement based on the prosumer’s energy usage. Then, billing occurs as usual,

3. ERT Implementation Issues

3.1. Utility Side

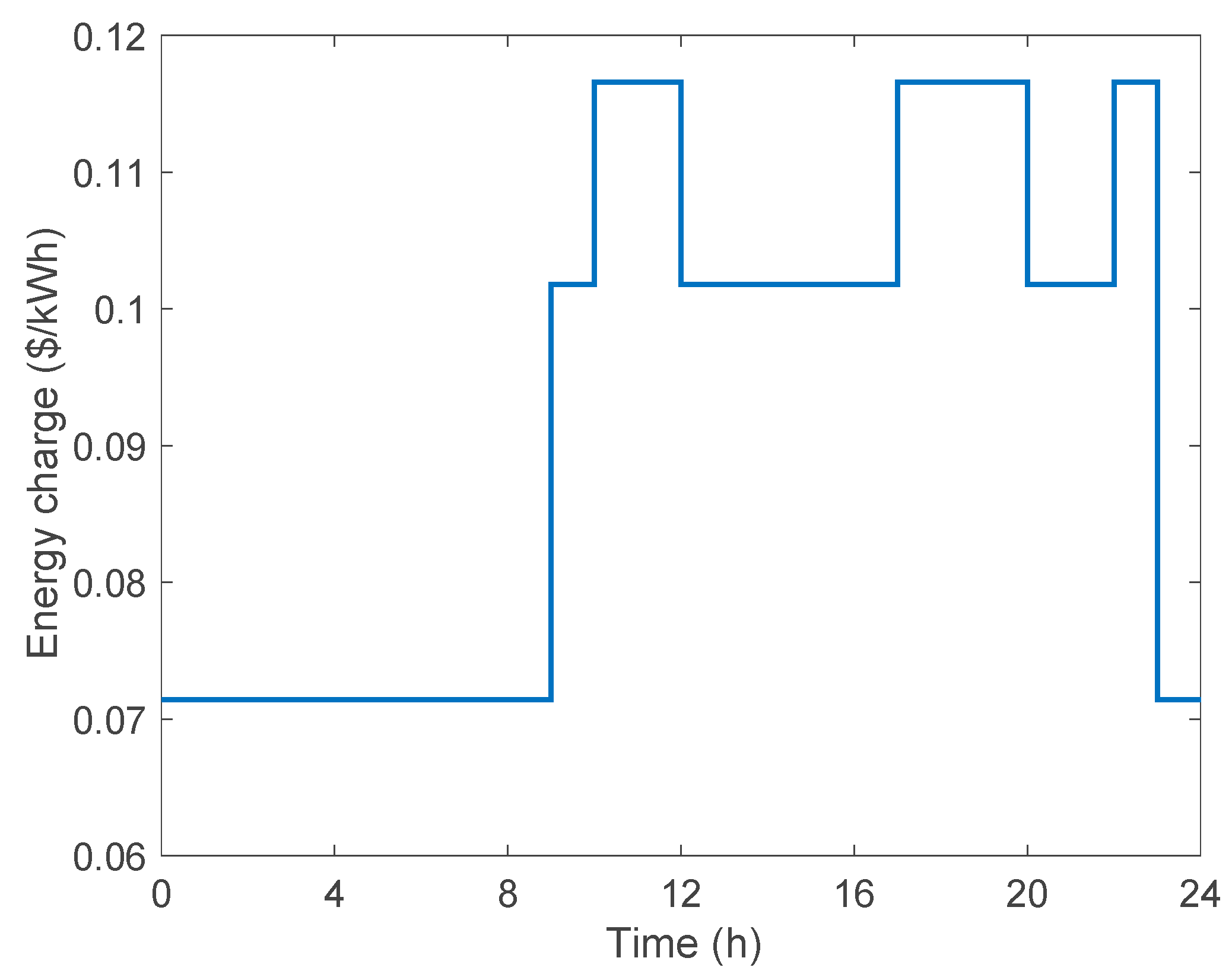

3.1.1. Energy Price Design

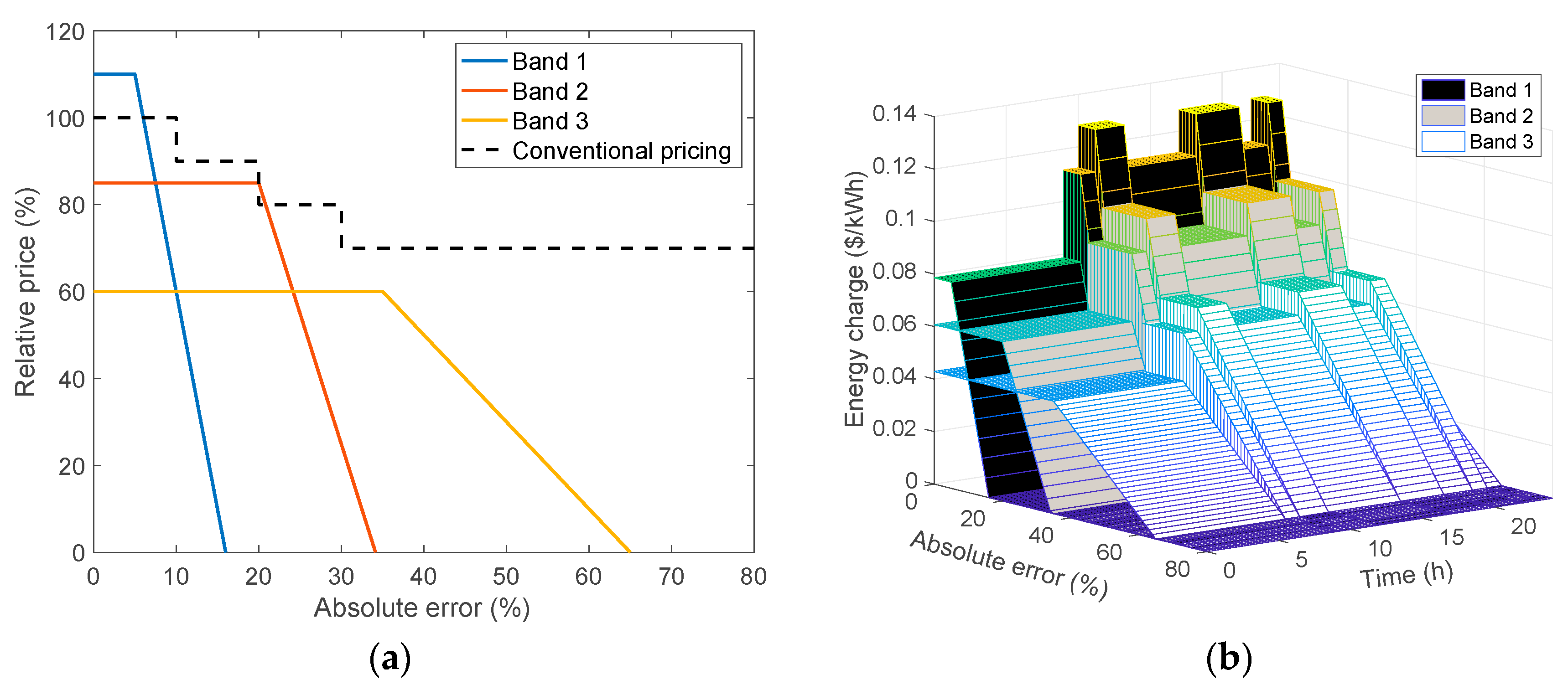

3.1.2. Reliability Band and Price Design

3.2. Prosumer Side

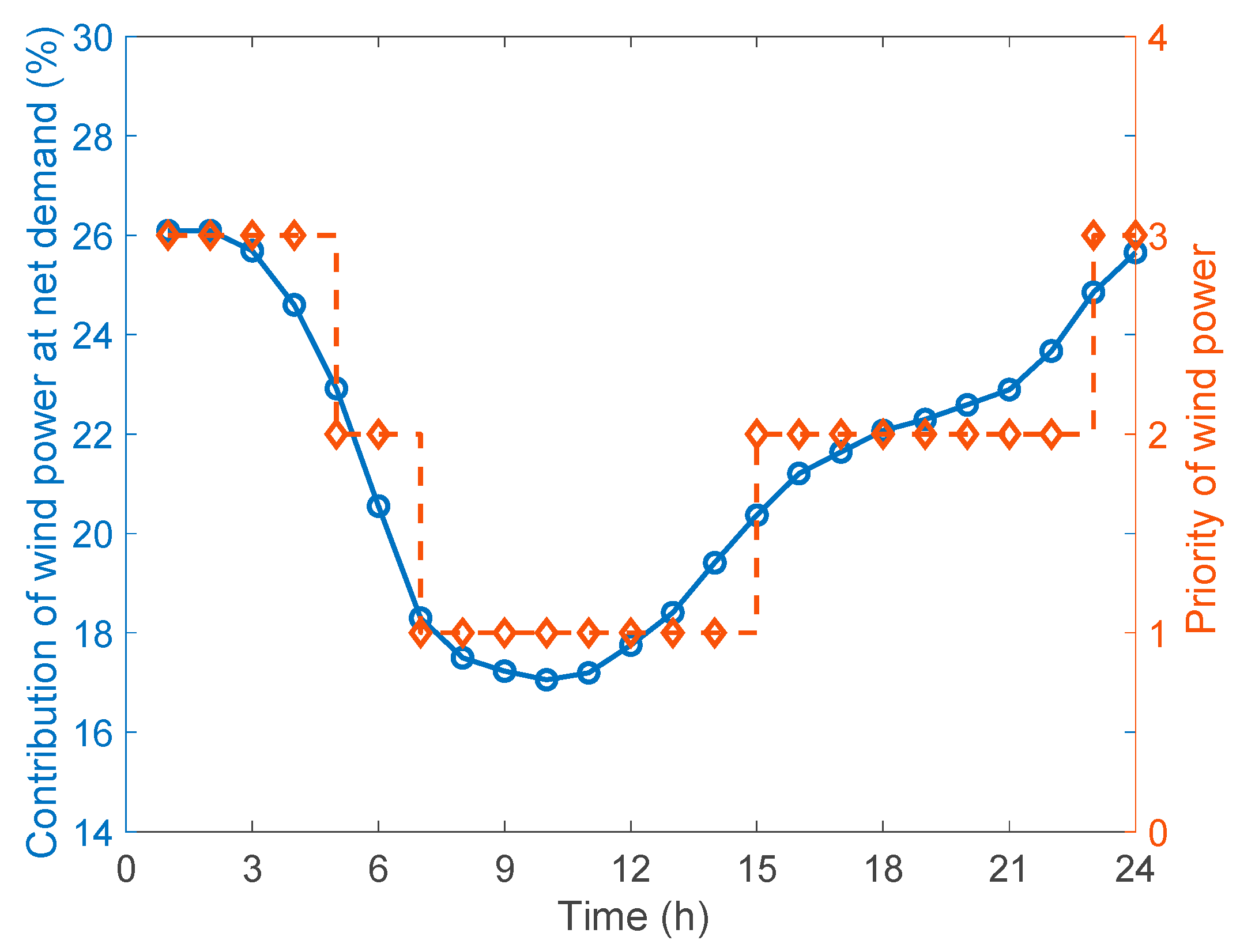

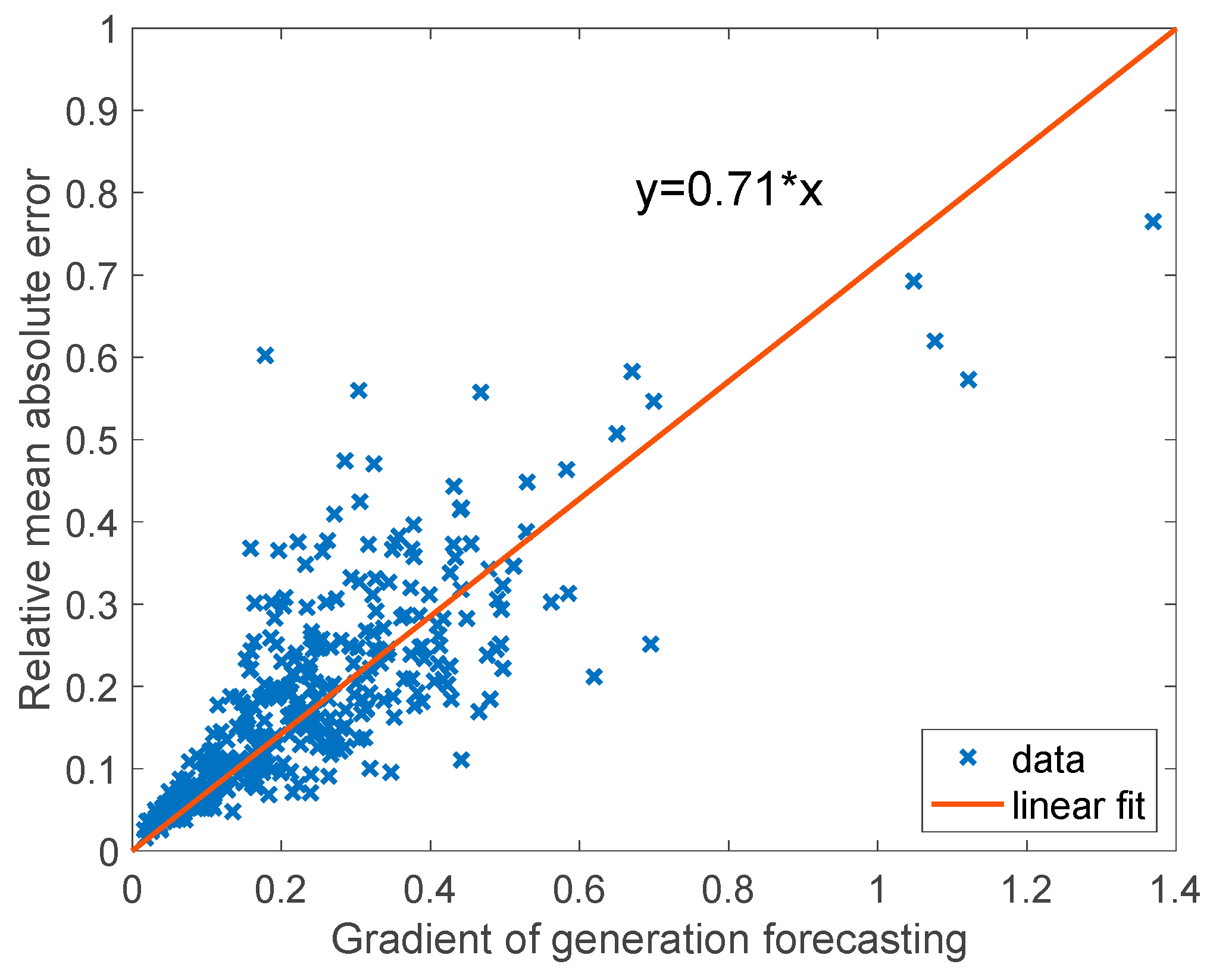

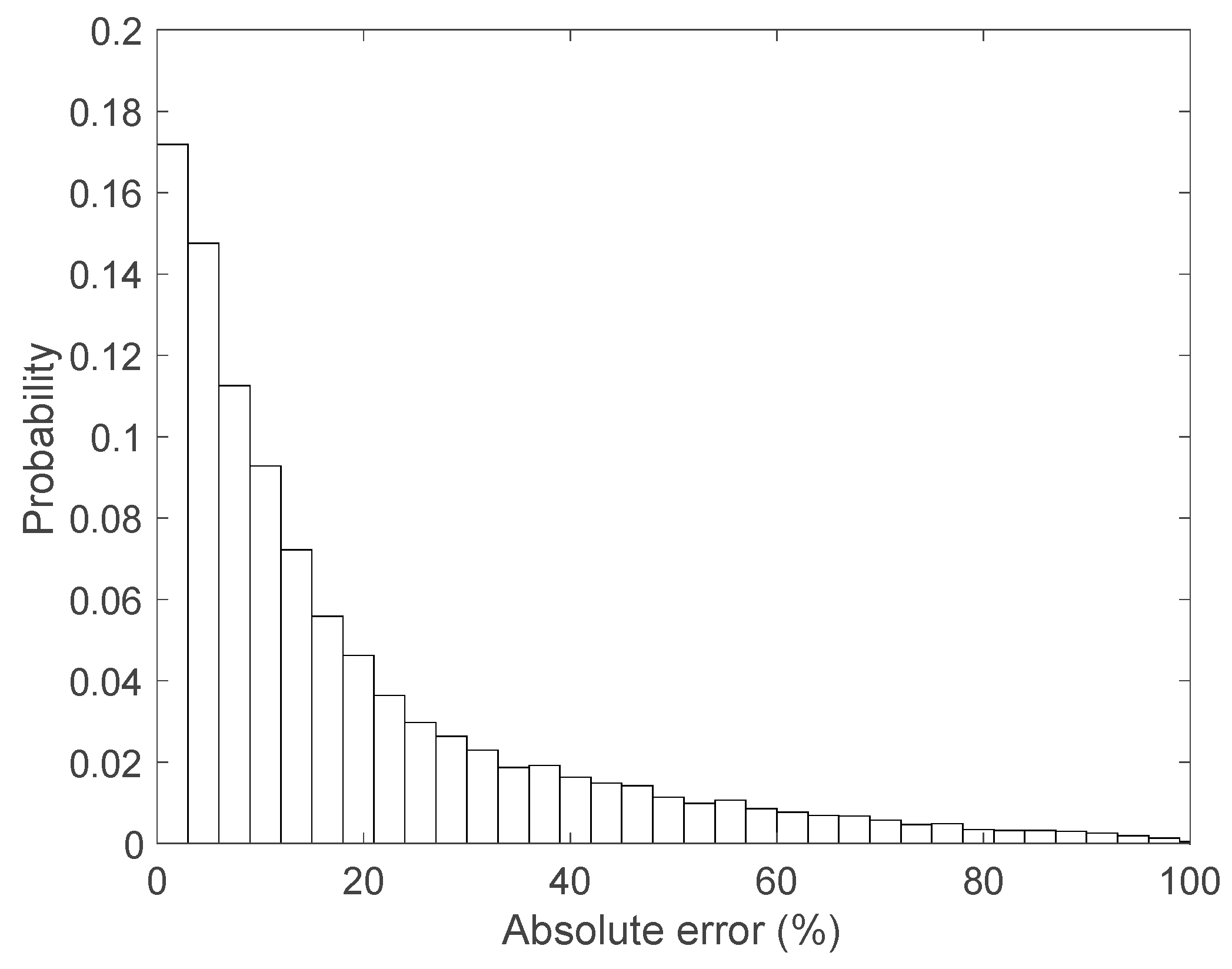

3.2.1. Demand Forecasting

3.2.2. Reliability Band Selection

4. Case Study

4.1. Experimental Environment

4.2. Performance Evaluation

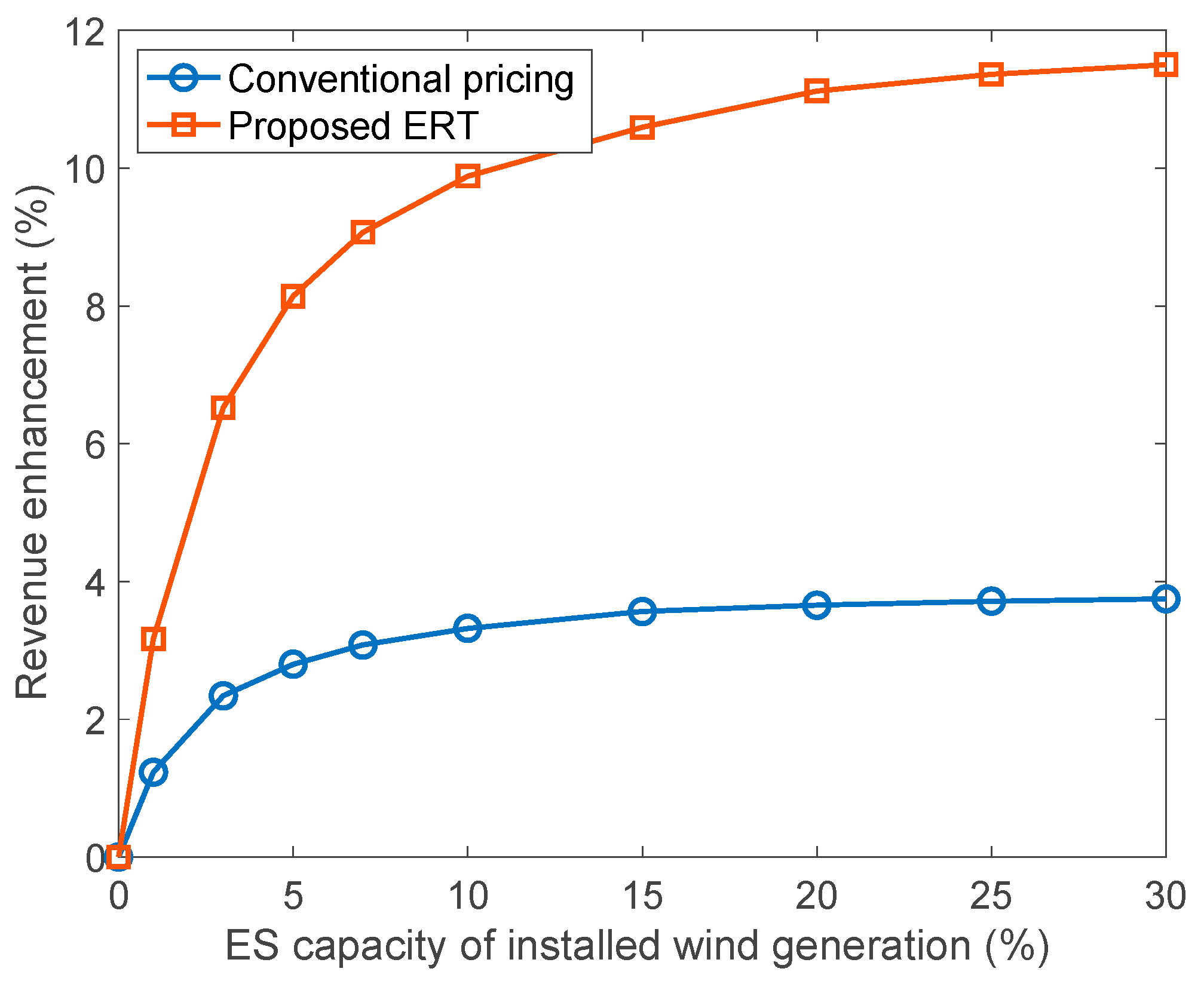

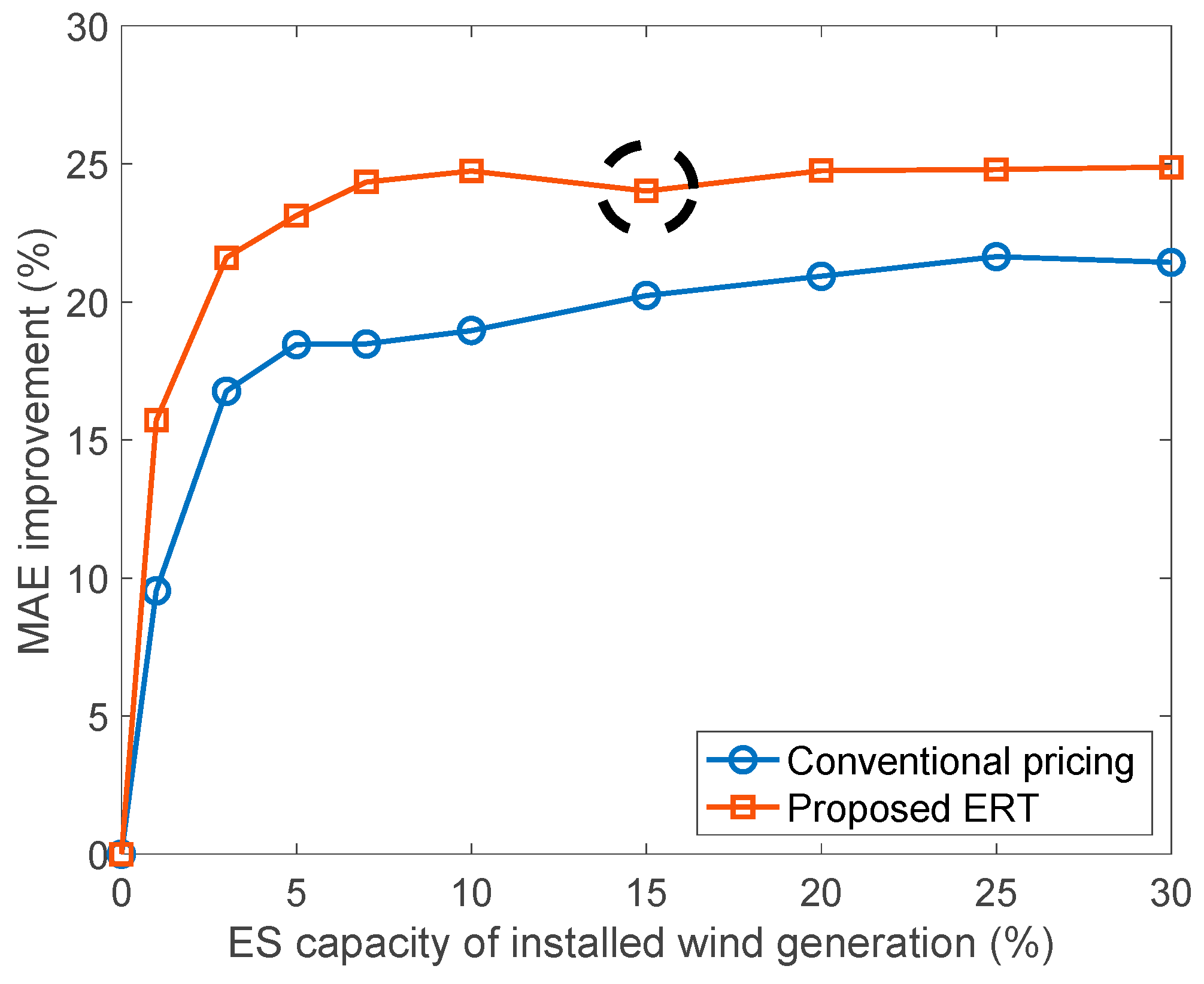

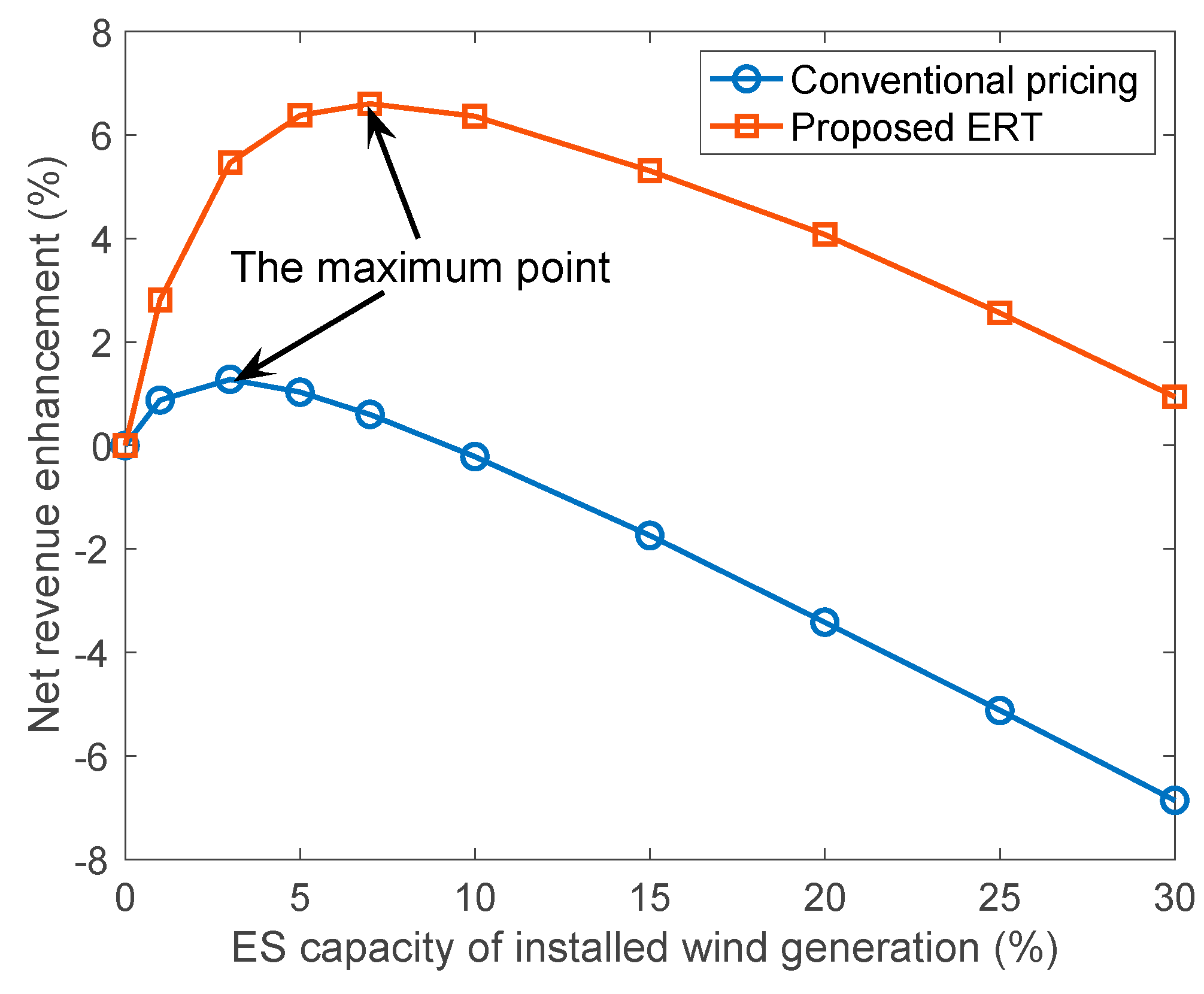

4.2.1. Prosumer Revenue

4.2.2. Grid Reliability

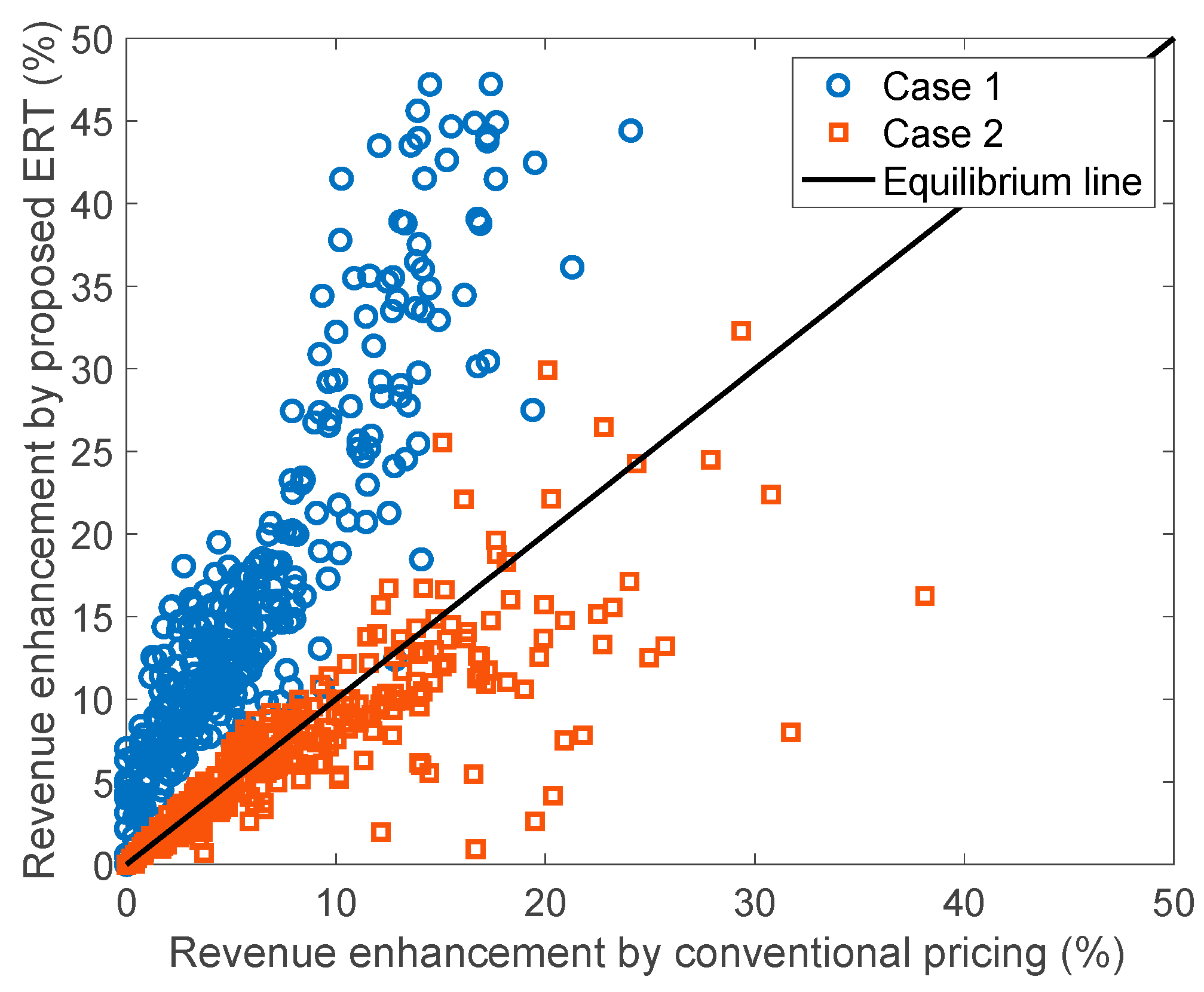

4.3. Characteristics

4.4. Economic Sensitivity Analysis

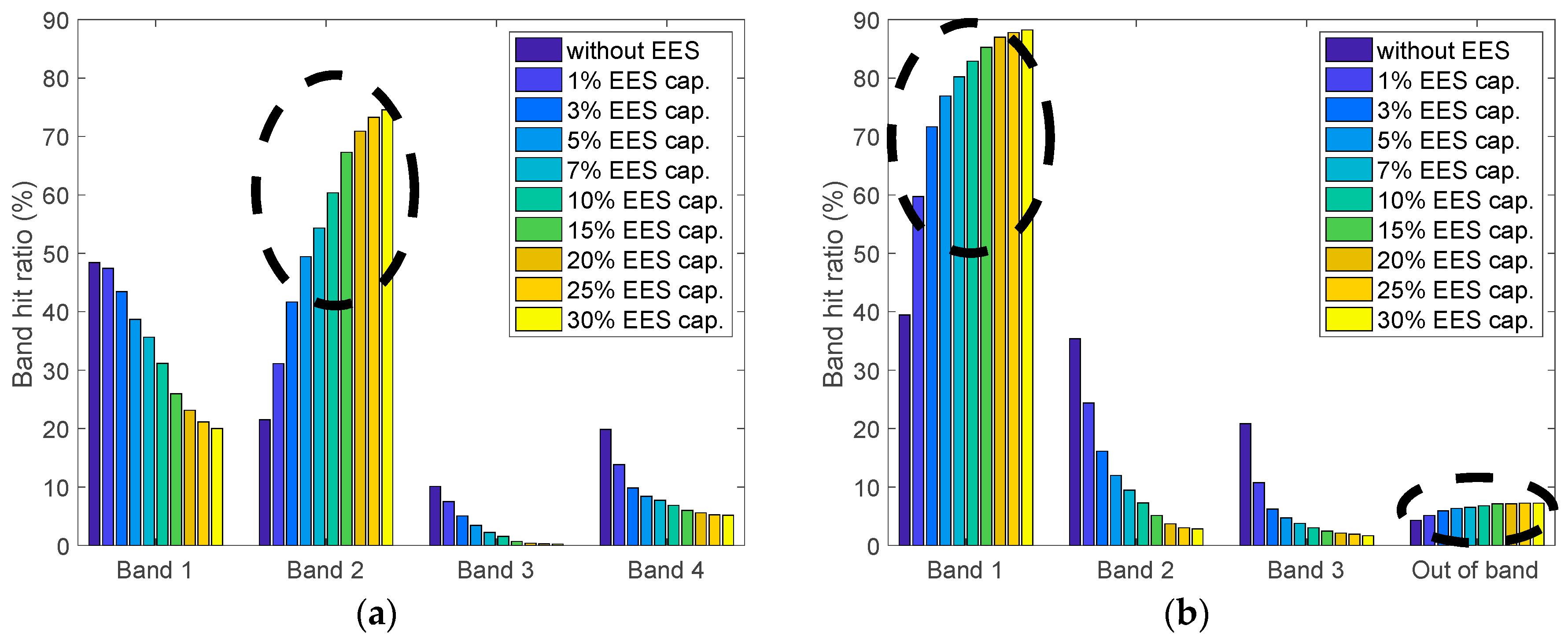

4.5. Other Reliability Band Design Case

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Hossain, M.S.; Madlool, N.A.; Rahim, N.A.; Selvaraj, J.; Pandey, A.K.; Khan, A.F. Role of smart grid in renewable energy: An overview. Renew. Sustain. Energy Rev. 2016, 60, 1168–1184. [Google Scholar] [CrossRef]

- Cai, Y.; Huang, T.; Bompard, E.; Cao, Y.; Li, Y. Self-sustainable community of electricity prosumers in the emerging distribution system. IEEE Trans. Smart Grid 2017, 8, 2207–2216. [Google Scholar] [CrossRef]

- Rathnayaka, A.J.D.; Potdar, V.M.; Dillon, T.S.; Hussain, O.K.; Chang, E. A methodology to find influential prosumers in prosumer community groups. IEEE Trans. Ind. Inform. 2014, 10, 706–713. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef] [Green Version]

- Moslehi, K.; Kumar, R. A reliability perspective of the smart grid. IEEE Trans. Smart Grid 2010, 1, 57–64. [Google Scholar] [CrossRef]

- Kamel, R.M. New inverter control for balancing standalone micro- grid phase voltages: A review on MG power quality improvement. Renew. Sustain. Energy Rev. 2016, 63, 520–532. [Google Scholar] [CrossRef]

- Sirjani, R.; Jordehi, A.R. Optimal placement and sizing of distribution static compensator (D-STATCOM) in electric distribution networks: A review. Renew. Sustain. Energy Rev. 2017, 77, 688–694. [Google Scholar] [CrossRef]

- Oh, E.; Son, S.-Y.; Hwang, H.; Park, J.-B.; Lee, K.Y. Impact of demand and price uncertainties on customer-side energy storage system operation with peak load limitation. Electr. Power Compon. Syst. 2015, 43, 1872–1881. [Google Scholar] [CrossRef]

- Tavakkoli, M.; Pouresmaeil, E.; Godina, R.; Vechiu, I.; Catalao, J.P.S. Optimal Management of an Energy Storage Unit in a PV-Based Microgrid Integrating Uncertainty and Risk. Appl. Sci. 2019, 9, 169. [Google Scholar] [CrossRef]

- Gungor, V.C.; Sahin, D.; Kocak, T.; Ergut, S.; Buccella, C.; Cecati, C.; Hancke, G.P. A survey on smart grid potential applications and communication requirements. IEEE Trans. Ind. Inform. 2013, 9, 28–42. [Google Scholar] [CrossRef]

- Khan, A.R.; Mahmood, A.; Safdar, A.; Khan, Z.A.; Khan, N.A. Load forecasting, dynamic pricing and DSM in smart grid: A review. Renew. Sustain. Energy Rev. 2016, 54, 1311–1322. [Google Scholar] [CrossRef]

- Bu, S.; Yu, F.R.; Liu, P.X. Dynamic pricing for demand-side management in the smart grid. In Proceedings of the 2011 IEEE Online Conference on Green Communications, New York, NY, USA, 26–29 September 2011. [Google Scholar]

- Dutta, G.; Mitra, K. A literature review on dynamic pricing of electricity. J. Oper. Res. Soc. 2017, 68, 1131–1145. [Google Scholar] [CrossRef]

- Simshauser, P. Distribution network prices and solar PV: Resolving rate instability and wealth transfers through demand tariffs. Energy Econ. 2016, 54, 108–122. [Google Scholar] [CrossRef]

- Siddiqi, S.N.; Baughman, M.L. Reliability differentiated real-time pricing of electricity. IEEE Trans. Power Syst. 1993, 8, 548–554. [Google Scholar] [CrossRef]

- Hamalainen, R.P.; Mantysaari, J.; Ruusunen, J.; Pineau, P.O. Cooperative consumers in a deregulated electricity market—Dynamic consumption strategies and price coordination. Energy 2000, 25, 857–875. [Google Scholar] [CrossRef]

- Oh, E.; Son, S.-Y. Pair Matching Strategies for Prosumer Market Under Guaranteed Minimum Trading. IEEE Access 2018, 6, 40325–40333. [Google Scholar] [CrossRef]

- da Silva, P.G.; Ilić, D.; Karnouskos, S. The impact of smart grid prosumer grouping on forecasting accuracy and its benefits for local electricity market trading. IEEE Trans. Smart Grid 2014, 5, 402–410. [Google Scholar] [CrossRef]

- Reneses, J.; Gomez, T.; Rivier, J.; Angarita, J.L. Electricity tariff design for transition economies: Application to the Libyan power system. Energy Econ. 2011, 33, 33–43. [Google Scholar] [CrossRef]

- Electric Rate Table; Korea Electric Power Company (KEPCO): Naju, Korea, November 2013.

- Wind Generation and TOTAL load in the BPA Balancing Authority. Bonneville Power Administration, U.S. Dept. of Energy. Available online: https://transmission.bpa.gov/Business/Operations/Wind/ (accessed on 12 February 2019).

- Mohajeryami, S.; Doostan, M.; Schwarz, P. The impact of customer baseline load (CBL) calculation methods on peak time rebate program offered to residential customers. Electr. Power Syst. Res. 2016, 137, 59–65. [Google Scholar] [CrossRef]

- Mohajeryami, S.; Doostan, M.; Asadinejad, A.; Schwarz, P. Error analysis of customer baseline load (CBL) calculation methods for residential customers. IEEE Trans. Ind. Appl. 2017, 53, 5–14. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, J.; Wang, X. Review on probabilistic forecasting of wind power generation. Renew. Sustain. Energy Rev. 2014, 32, 255–270. [Google Scholar] [CrossRef]

- Chitsaz, H.; Amjady, N.; Zareipour, H. Wind power forecast using wavelet neural network trained by improved clonal selection algorithm. Energy Convers. Manag. 2015, 89, 588–598. [Google Scholar] [CrossRef]

- Lange, M. On the uncertainty of wind power predictions—Analysis of the forecast accuracy and statistical distribution of errors. J. Sol. Energy Eng. 2005, 127, 177–184. [Google Scholar] [CrossRef]

- Oh, E.; Son, S.-Y. Energy-storage system sizing and operation strategies based on discrete Fourier transform for reliable wind-power generation. Renew. Energy 2018, 116, 786–794. [Google Scholar] [CrossRef]

- Alagappan, L.; Kahrl, F.; Bharvirkar, R. Regulatory Dimensions to Renewable Energy Forecasting, Scheduling, and Balancing in India; White Paper; National Association of Regulatory Utility Commissioners: Washington, DC, USA, March 2017. [Google Scholar]

- IEEE Guide for Electric Power Distribution Reliability Indices; IEEE std. 1366-2012; IEEE Std: New York, NY, USA, May 2012.

- Eyer, J.; Corey, G. Energy Storage for the Electricity Grid: Benefits and Market Potential Assessment Guide; Tech. Rep. SAND2010- 0815; Sandia National Laboratory: Albuquerque, NM, USA, February 2010.

| Communication | Pricing | |

|---|---|---|

| Conventional pricing | One-way | One-dimensional (Time) |

| Proposed ERT | Two-way | Two-dimensional (Time and reliability) |

| Band 1 | Band 2 | Band 3 | Band 4 | |||||

|---|---|---|---|---|---|---|---|---|

| Price | Range | Price | Range | Price | Range | Price | Range | |

| Case 0 | 100 | 0–10 | 90 | 10–20 | 80 | 20–30 | 70 | 30- |

| Case 1 | 110 | 0–5 | 85 | 0–20 | 60 | 0–35 | - | - |

| Case 2 | 100 | 0–10 | 85 | 0–40 | 70 | 0–70 | - | - |

| Case 0 expresses the conventional pricing case. | ||||||||

| EES Capacity of Installed Generation | |||||||

|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | 15% | 20% | 25% | 30% | |

| Revenue enhancement | |||||||

| Case 0 | 1.2 | 2.8 | 3.3 | 3.6 | 3.7 | 3.7 | 3.7 |

| Case 1 | 3.2 | 8.1 | 9.9 | 10.6 | 11.1 | 11.4 | 11.5 |

| Case 2 | 1.2 | 2.9 | 3.3 | 3.5 | 3.6 | 3.6 | 3.6 |

| MAE improvement | |||||||

| Case 0 | 9.5 | 18.5 | 19.0 | 20.2 | 20.9 | 21.6 | 21.6 |

| Case 1 | 15.7 | 23.1 | 24.7 | 24.0 | 24.8 | 24.8 | 24.9 |

| Case 2 | 15.2 | 23.7 | 25.1 | 25.9 | 26.2 | 27.6 | 27.8 |

| Utility/Retailer | Prosumer | |

|---|---|---|

| Advantages | Enhanced forecasting with additional information Promotes self-investment, deferring direct investment | Flexible investment and operation choices Increased opportunity to maximize benefits |

| Disadvantages | Increase in operational complexity Increased grid operation risks Increase in incentives | Increase in operational complexity Increased risk of penalty |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oh, E.; Son, S.-Y. Transaction Mechanism Based on Two-Dimensional Energy and Reliability Pricing for Energy Prosumers. Appl. Sci. 2019, 9, 1343. https://doi.org/10.3390/app9071343

Oh E, Son S-Y. Transaction Mechanism Based on Two-Dimensional Energy and Reliability Pricing for Energy Prosumers. Applied Sciences. 2019; 9(7):1343. https://doi.org/10.3390/app9071343

Chicago/Turabian StyleOh, Eunsung, and Sung-Yong Son. 2019. "Transaction Mechanism Based on Two-Dimensional Energy and Reliability Pricing for Energy Prosumers" Applied Sciences 9, no. 7: 1343. https://doi.org/10.3390/app9071343

APA StyleOh, E., & Son, S.-Y. (2019). Transaction Mechanism Based on Two-Dimensional Energy and Reliability Pricing for Energy Prosumers. Applied Sciences, 9(7), 1343. https://doi.org/10.3390/app9071343