Abstract

The need to pay some attention to the issues of investment processes undertaken in enterprises and explore this topic is a direct result of the important role that enterprises play in the economy—with particular emphasis on the SMEs. From the company’s point of view, it is crucial to obtain economic effects as a result of the implemented investment. The aim of the study was to analyze the results of tangible investments in enterprises in Małopolska province in Poland, in two groups of entities—those that implemented investments using EU subsidies and those that financed investments from other sources without using EU aid. This is a unique research in the field of analysis and presentation of investment data in enterprises, especially in relation to companies using EU funds. There is no comparative assessment of investments in enterprises on this topic in the scientific literature (concerning EU subsidies). For this reason, comparing the effects of investment activities between the two groups of enterprises studied—using and not using EU subsidies—fills the research gap in this regard. The study was based on the critical analysis of domestic and foreign literature, and quantitative and qualitative analyses of the results of a survey among 160 enterprises using the CSAQ method, additionally extended by interviews with selected respondents. Data presentation uses a descriptive approach in combination with statistical analysis. A multiple linear regression model (MLR) was also used to verify hypotheses. Research results show that undertaking investment activities contributes to obtaining favorable results in enterprises, regardless of the source of investment financing. The source of financing the investment is not important for the results achieved in the enterprise. However, representatives of companies who received EU subsidies assess their market position higher after investment relative to companies that used other sources of financing for this purpose. Entities that have received EU subsidies have a stronger perception of investment as an important factor determining the company’s development. In addition, variables were identified using the MLR model that affect the assessment of the financial position of enterprises in both groups of entities. This article supplements the knowledge on the economic effects of investments implemented by enterprises in the SME sector in Poland in a situation where these entities used and did not benefit from EU subsidies during 2007–2015.

1. Introduction

The purpose of activities undertaken in the process of management of an economic entity should be to strive to maximize the income of its owners, resulting in an increase of the market value of an enterprise (Żurek 2003; Obłój 2007; Suszyński 2007; Borowiecki 2009). Achieving the desired effect is only possible by taking development decisions that include investments, treating them as one of the more important ways to grow the capital of an enterprise. For this reason, a special role in the development of an enterprise is attributed to investment processes having their effect in the future economic situation of this economic entity (Żurek 2003).

In the present-day free market economy, in a situation of intensified competitive activity of both domestic and international enterprises, the vast majority of economic entities put emphasis on tangible investments, which are intended to contribute to the development of the enterprise as well as to the increase in its efficiency. For this reason, the role of small- and medium-sized enterprises is to thoroughly understand their current market situation and, on this basis, choose the right directions and size of investments to achieve the desired effect of stable and long-term growth and development.

Tangible (real) investments include commitment of capital in order to grow or replace tangible assets of an enterprise, listed in balance sheets as fixed assets, e.g., purchase of machines and equipment, land, means of transport, buildings, and expenditures on design and cost estimation documentation. This type of investment is the basis for internal growth of the enterprise that consists in increasing its the production potential through tangible investments (Czerwonka 2015). This increase is possible by growth of the scale or scope of this economic entity’s activity or improvement of its competitive position, i.e., profitability.

Investment decisions play a key role for further operation and development of a company, which involves freezing financial resources for a longer time, whereas the effects of their use will be observable only in the long term, and they should, in turn, result in an improved competitive position of this enterprise on the market (Bień 2000; Wildowicz-Giegel 2013). Gains achieved by the enterprise can be economic, organizational, or social in nature. This means that investments are to be combined directly with the intention to develop the enterprise, defined as a more advantageous situation than the one it is currently in.

Many studies pay attention to the SME sector and emphasize that enterprises from this sector play an important role in national economies, thus becoming the driving force for the development of the entire economy (Van Stel et al. 2005; Bosma and Schutjens 2007; Al-Tit et al. 2019). Much attention is also paid to the SME sector in the European Union. To create the best conditions for the creation and development of small- and medium-sized enterprises and to stimulate entrepreneurial behavior in the European Union, financial instruments are used as a source of implementation of cohesion policy (Huttmanová and Kisel’áková 2010; Piątkowski 2010b; Janků 2012; Spoz 2014). Entrepreneurs can apply for non-returnable EU subsidies from operational programs in individual support areas. The financial aid provided to the company in the competition mode is to help it in difficult competitive conditions, motivate companies to develop, and strengthen the region in which the company operates (Brzakova and Pridalova 2016; Gwizdała 2017). Financial resources from operational programs of European funds are a valuable source of external financing for small- and medium-sized enterprises. These funds allow supporting investment activities in the SME sector, especially in the form of development investments as well as innovative and modernization investments.

As already mentioned, the effect of investment activities of enterprises should be to improve their economic results and competitive position. In connection with the intensive activities undertaken by the EU in the context of supporting small- and medium-sized enterprises, the author asked the following research questions: Do the economic effects of investments made by small- and medium-sized enterprises differ in the assessment of their owners depending on whether the companies used EU subsidies or financed position from other sources? Does the assessment of the financial standing of enterprises after implemented investments depend on the same variables in both examined groups of companies?

Based on the research question formulated in this way, the following research hypotheses were formulated:

H1. The economic effects of investing activities do not differ significantly between the groups of enterprises studied, regardless of whether they received an EU subsidy or not.

H2. The assessment of the financial position of enterprises as a result of investments made during 2007–2015 in both groups of entities studied depended on various explanatory variables.

Research on this issue was conducted using quantitative and qualitative analyses based on research results among 160 enterprises from Małopolska province using the CSAQ method (questionnaires being completed by the respondents), additionally supplemented with interviews with selected respondents. A descriptive approach was used in data analysis. A multiple linear regression model (MLR) was also used. The analysis period concerns investments carried out by micro-, small- and medium-sized enterprises during 2007–2015, which corresponds to the full period of Poland’s participation in the EU perspective and the possibility of using EU subsidies by enterprises. The terms “EU assistance”, “EU funds”, and “non-repayable aid”, used in the text, should be treated as synonyms of non-repayable assistance from EU subsidies for enterprises.

This study helps to clarify the economic impact of investments made in enterprises in the context of the granting of EU aid and to compare these effects with enterprises that have not benefited from such aid. The presented comparative method in the use of European funds is unique in this type of research and is hardly used in scientific studies. For this reason, the chosen research method can be considered interesting and extremely needed. In addition, it is readable for the reader and allows clear presentation of results for both groups of enterprises studied.

In the introductory part, the author presents the theoretical background for discussion and definition of the concept of investment, as well as their importance for enterprises (with particular emphasis on the role of tangible investments) and methodological framework, followed by research result. The whole study ends with a discussion of the research and the conclusions derived therefrom.

2. Literature Review

2.1. Defining the Issue of “Investment” and Its Importance in Enterprise Development

There are many definitions of investments in the literature on the subject, depending on the purpose they were assigned. Manikowski and Tarapata (2001), citing world literature, indicate two basic approaches to investments: the tangible approach—examined as the movement of goods and the financial approach—investigated as the movement of money. Until the end of the 1980s, investments were understood in economic literature as organized economic activity whose goal was to create new or grow existing tangible assets, or as a change of these assets resulting in more effective use thereof. In the 1990s, this concept was expanded to include financial investments, defining them as investing free financial resources on the capital and money market in order to increase own capital (equity) (Ostrowska 2002). In this way, the following aspects of the investment can be distinguished: tangible (fixed assets, machinery, and equipment), financial (acquisition of securities or shares), and intangible assets (Michalak 2007).

A popular definition found in the literature is that put forward by Hirshleifer (1965) where the author concludes that “an investment is, in essence, a current sacrifice for future gains, (…) the present is relatively well known, whereas the future is a mystery. That is why an investment is a sacrifice of something that is certain for an uncertain gain”. This definition includes an element of purpose and essence of investing. In addition, the author indicates therein an important element accompanying investments, namely risk.

However, Tarczyński and Carsberg call into question definitions of investment where emphasis is put on the necessity to temporarily give up consumption for gains achieved in the future, pointing out the option to finance investments with outside capital. On the other hand, Rówińska (2012) states that “investments constitute the basic way to increase capital. They include economic expenditures intended to grow or replace assets that will bring positive effects in the future. They include expenditures to create new production capacity by erecting new facilities, expanding the existing ones and investing free cash in a way that will bring increased income in the future”. According to Różański (2006), “an investment is most often understood as a cash outflow, which is to generate income for the one that undertakes the investment (i.e., the investor) or a process whereby cash is converted into other goods”. Thus, he presents the definition of an investment in both its tangible and financial aspects. Kamerschen et al. (1991) describe investments excluding the income criterion, distinguishing only the tangible aspect, as “purchase of capital goods—production plants, equipment, residential buildings as well as changes in inventories that can be used in the manufacture of other goods and services”. An investment, as understood by Reilly and Brown (2011), is interpreted as a commitment of a specific amount of money for a specific period of time that allows investors to obtain compensation in the future, taking into account the time for which they committed their money, the inflation rate, and the investment risk.

From the point of view of the purpose of investing under material investments, the literature on the subject most often indicates: exchange, modernization, development, innovative, strategic, social, and socially useful investments (Sierpińska and Jachna 2009).

It is precisely for the purposes of creation of conditions to conduct and further develop an economic activity that investment of capital is necessary, i.e., investing mostly in tangible assets as well as in intangible assets and investments of a financial nature. At the same time, it is worth indicating the approach by Żurek (2003), who points out that investing in an enterprise should not be an occasional, short-term activity, but it should be perceived as a process of continuous nature.

The effect of conducted investment activities is to achieve gains planned by an enterprise and, from the viewpoint of the investment’s objective, they should contribute to an increased competitive advantage of an economic entity or prevent loss of the current market position. An enterprise can achieve gains in respect of implemented investments in economic, organizational, and social areas (Rogowski 2011). Investment gains in the economic dimension are observable through: increased sales revenue, reduced operating expenses of an enterprise, improved quality of offered products and services as well as through minimization of risk of the conducted economic activity. In the organizational dimension, an enterprise can achieve gains in respect of improved quality of completed processes, increased flexibility towards changes occurring in its environment, and faster reacting to current and future needs of the enterprise. The last (social) dimension of gains can be observed on the basis of organizational culture created in an enterprise through development and training of staff, building and improving of the motivation system, and increased integration of employees with their employer (Rębilas 2014).

Investment activities should be based on the planning and implementation of projects that can contribute to the development of the enterprise in the long term. Nevertheless, companies that will be able to flexibly respond to changes in their distant and closer environment will have the chance to strengthen their competitive position (Piątkowski 2010a). On the other hand, the investment decisions themselves should be made by owners of enterprises based on the results of the economic balance, including an analysis of the diverse economic environment (Rosłon and Ciupiński 2014). Economic effectiveness balance of an investment includes an investment undertaking profitability assessment along with an analysis of risk associated with its execution and a process of choice of an investment decision out of the presented options (Rogowski and Michalczewski 2005; Lesáková et al. 2019).

Factors determining the direction and scale of investment include having capital to finance the investment needs of the enterprise, and thus the source of investment financing (Mendes et al. 2014). For many enterprises, having sufficient capital resources for the implementation of investments is a serious problem that they have to face (Firlej 2018). The enterprise in which the investment is planned may finance them on its own, based on funds included in equity, generated by the company itself or provided by external entities or financed on the basis of debt instruments by borrowing funds from specialized entities. This means that the investment process is a necessary condition for the efficient operation of the company on the market, but it is also a huge financial and organizational challenge for its owners (Spoz 2014). Looking at the classification of sources of financing investment activity of enterprises indicated in the literature, the most important criterion concerns the source of capital, dividing them into internal and external. Research in this area was conducted, among others, by Myers and Majluf (1984), representing the view that there is a relationship between the process of investing in an enterprise and the use of specific sources of financing by these entities.

In summary, it should be emphasized that, in the absence of investments, an enterprise does not develop, and this entails the risk of its liquidation, bankruptcy, or insolvency. This is a consequence of the fact that stagnation in terms of company development is equivalent to regression relative to the developing environment. Therefore, efficient functioning of an enterprise in the long run, without incurring investment expenditures and thus thinking about development, is impossible.

2.2. The Importance of EU Funds in Supporting Investment in Enterprises

In the literature, the issue of investment in combination with EU funds as the subject of research is an analysis of the level of use of EU funds at regional or national level (Zaman and Georgescu 2009; Hapenciuc et al. 2013; Lucian 2014; Vasile and Mihai 2015; Tănase et al. 2017), as well as the issue of effectiveness in their absorption and capabilities, and barriers in the use of EU funds (Epuran et al. 2011; Zaman and Cristea 2011; Marinescu 2013; Tiţa et al. 2013; Brzáková and Přidalová 2015; Wildowicz-Giegiel and Wyszkowski 2015; Wokoun et al. 2016; Konopielko and Rusak 2017; Żuchowski 2017). Research is also being carried out in the EU aid aspect for starting a business (Skawiński 2016). This is due, inter alia, to the fact that the Structural Funds are the main tool of EU regional policy, and the level of absorption is recognized as an important indicator of the successful implementation of this policy at regional level and economic development (Vega Flores 2008; Mohl and Hagen 2010; Kalfova 2019). Such effects of implementing EU funds are observed especially in the short term, when investments support economic growth and stimulate the economy in most of the new EU member states (Marzinotto 2011). However, as Lungu’s (2013) results show in the long term, the impact of EU funds on GDP growth is not always in line with expectations.

EU funds support small- and medium-sized enterprises in development, but research shows that access to them is limited, and one of the main barriers for this sector is the need to make their own contribution. For this reason, access to EU funds in the form of non-returnable subsidies is an important source of investment financing for SMEs, especially since obtaining EU aid is cheaper than when using financing from other sources on the commercial market (Dorożyński et al. 2013; Mikołajczak 2014; Vasile and Mihai 2015). In addition, in macroeconomic terms, EU funds are considered an attractive tool to finance investment opportunities, especially in times of crisis when private investment is declining (Albulescu and Goyeau 2013).

EU funds have a positive impact on the development of the enterprise, playing an important role in improving its competitive position on the market. Completed projects with the support of the EU allow the expansion of companies, modernization of production through the purchase of machinery and the use of new technologies, as well as increasing production capacity (Dorożyński et al. 2013). The wide range of support available to the SME sector enables the purchase of fixed assets, land, and intangible assets as well as the use of consultancy services. Such a wide spectrum of support is expected to contribute to increasing the investment capacity of entities. To this end, business owners can introduce significant changes to individual products or the entire production process, especially through rationalization, diversification, or modernization.

It should be remembered that the use of EU funds for business development is a long-term process. Achieving the desired effect requires business owners to develop a long-term enterprise development strategy based on a detailed analysis of the current situation of the entity, taking into account its market position in relation to competing companies, and to provide a source of financing as part of their own contribution (Kornet 2008).

The vast majority of scientists note that small- and medium-sized enterprises benefit from EU assistance, and operational programs under the 2007–2013 financial perspective have fulfilled their role. This allowed improving the financial situation and increase the competitiveness and innovation of business entities. They enabled enterprises to survive in a difficult competitive struggle on the open European market and further develop internationally. It is emphasized that there is a positive relationship between the use of EU funds for the implementation of investments and the increase in export activity in the implementation and implementation of innovations (Mikołajczak 2014). The effect of the investment is an increase in revenues and creation of new jobs. Cooperation with subcontractors as well as scientific and research units is also developing (Ostrowska 2002).

Research by the Polish Agency for Enterprise Development (Żołnierski 2008) has shown that the vast majority of Polish entrepreneurs who co-financed their projects using EU subsidies show overall development of their activity, improvement of competitiveness and innovation, higher quality of products and services, and management efficiency. The positive correlation between economic effects related to access to European funds and the competitiveness of enterprises that were able to use them is also confirmed by research by Czauderna et al. (2016), Dubel (2017), and Bostan et al. (2019).

Similar results were obtained in studies conducted by Peszko (2014) in Małopolska province. The surveyed entrepreneurs indicated: an increase in their competitive position (47%), better customer service (38%), and better product quality (36%). Among the surveyed enterprises of the SME sector from Lubelskie province, as a result of investment activities undertaken with the use of EU assistance, employment (13%), revenues (23%), and exports (24%) increased (Kamińska 2010). In Łódź province, 60% of the surveyed companies increased sales, although mainly only at the national level, and 85% achieved the investment objective of modernizing production and products (Dorożyński et al. 2013).

The application of the Hermin macroeconomic model to study the impact of EU funds on the economy has confirmed that expenditure on direct investment aid for the SME sector (both fixed assets support and human resources development) is an effective way to improve the competitiveness of both enterprises and regions (Kamińska 2010; Opritescu 2012). The positive impact of EU funds on the development of small- and medium-sized enterprises from eastern Poland (Podkarpackie, Świętokrzyskie, Lubelskie, Podlaskie, and Warmińsko-Mazurskie provinces) has been confirmed statistically. However, in this case, the positive impact at the macroeconomic level has not been confirmed among these five voivodships (Czauderna et al. 2016).

Research conducted by InfoCredit during 2007–2011 confirmed that, in addition to the increase in sales revenues and assets, the EU funds also influenced the long-term profitability of enterprises (Igielski 2014). However, looking at the effects of implemented investments using EU funds in Polish companies in relation to other EU Member States, according to Wildowicz-Giegiel and Wyszkowski (2015), there was no expected increase in profitability ratios.

Entrepreneurs also point out that a significant limitation of the use of EU subsidies is the possibility of obtaining financing only for investments whose objectives are set in advance under individual operational programs and which are not necessarily compatible with the investment needs of enterprises (Peszko 2014). In addition, despite the fact that EU funds are a valuable source of investment financing for the SME sector, research by Jurevičienė and Pileckaitė (2013) showed that companies would carry out investments even without EU aid (“idle loss effect”, i.e., an investment would also be carried out without receiving a grant). However, the owners of these companies would look for ways to reduce project costs. The authors also point out that EU aid may distort the incentives of entrepreneurs to invest, putting aside the most important investment projects in favor of those that allow additional funding.

Despite the critical aspects, the importance of subsidies from the European Union funds in the development of small- and medium-sized enterprises is strongly emphasized in domestic and foreign literature. Most studies confirm that, from a microeconomic point of view, EU resources have been rationally used. Subsidies are valuable support for SME sector entities that face the problem of insufficient capital. The need to compete on the market in an international environment is associated with the need for investments requiring significant financial resources. For this reason, EU funds directed to the SME sector are of great importance for these entities. Mikołajczak (2012) and Wolański (2013) even claim that EU funds are determinants of the development of the SME sector, thanks to which an improvement in the competitive position of the Polish economy and its innovation can be observed, and thus Polish enterprises are becoming an “important player” in European and global market. In addition, the positive experience and acquired skills in managing EU projects encourage entrepreneurs to apply for further grants (Dorożyński et al. 2013), and investments are part of the long-term development strategy plan in these entities (Spoz 2014).

3. Research Methodology

3.1. Purpose and Method of Research

The purpose of the article is to compare the economic effects of implemented investment activities in the opinion of the owners of the surveyed enterprises from Małopolska province during 2007–2015, depending on whether they used EU funds for investment purposes. Based on the presented research problem of this article, only companies that implemented tangible investments were considered in the study. This period corresponds to the full programming perspective of EU funds for 2007–2013. However, due to the valid n+2 rule allowing the settlement of operational programs with the allocated European funds in two consecutive years, the period covered by the analysis was extended to 2015. The survey was conducted from December 2016 to March 2017. The actual study was preceded by a pilot study in November 2016.

The uniqueness of the research and the indicated period are related to the fact that the assessment concerns the comparison of investment effects between two groups of enterprises. The first group are enterprises that used European funds for the implementation of investments. The second group are companies that have implemented investments using other sources of financing. This is a unique study in the field of analysis and presentation of data on investments in enterprises, especially in relation to companies using EU funds. There are no articles in the scientific literature in which the effects of implemented investments in enterprises by the comparative method would be discussed, especially in the case of using EU aid. Most often, the authors present the results in quantitative and quota terms, referring to the level of absorption of funds or in relation to different regions or impact on the economy. For this reason, this study fills a research gap in this area.

The article presents the following hypotheses:

Hypothesis 1.

The economic effects of investment activities differ significantly between groups of enterprises depending on whether they received EU aid or not.

Hypothesis 2.

The assessment of the financial situation of enterprises as a result of investments made during 2007–2015 in both groups of entities studied depended on various explanatory variables.

The empirical part of the article was prepared using surveys based on a questionnaire completed by the respondent—CSAQ. The owners of companies participating in the survey completed a questionnaire themselves, which contained the following types of questions:

- single- and multiple-choice questions;

- questions based on a balanced scale (Likert scale); and

- questions using the semantic scale 0–10 in the form of tabular questions (allowing to assess the respondent’s attitude in the research area related to investments)—where, in the research on the assessment of the effects of investment activities undertaken in enterprises, the respondents used a scale from 1 to 10, with 1 indicating “insignificant position” and 10 “dominant position”.

In addition, in-depth research was conducted in the form of individual telephone conversations with entrepreneurs. Statistical analyses based on the collected research material were carried out using electronic calculation techniques with the following programs: Statistica v.13.3 and Microsoft Excel 2016.

The following tools in the field of statistics were used for the analysis: descriptive statistics: average, median, lower quartile, upper quartile, U Mann–Whitney test, independence test χ2, Fi-squared correlation coefficient, multiple linear regression model (MLR).

To verify whether the economic effects and assessment of the financial situation of enterprises based on implemented investments during 2007–2015 depend on the same variables in each of the examined groups of entities (using and not using EU subsidies), a multiple regression linear model was developed (separately for each group) using the least squares method.

The regression model is the basis for many analyses carried out in the field of economics (Fałda and Zając 2012). Its purpose is to quantify the relationships between many independent (explanatory) and dependent (explained) variables. The MLR model is determined by the equation (Maddala 2006):

where is the explained variable, is the model parameters (regression coefficients) describing the influence of the ith variable, for i = 1,…,k, and is the random component.

MLR model and its verification was carried out as described by Aczel and Sounderpandian (2018). Regression analysis allows answering the question of what is the impact of independent variables on the course of phenomena. Therefore, regression is a quantitative description of the dependence of phenomena on certain independent variables (Zieliński 1998). The regression method, which uses the analysis of variance in regression, allows the selection of statistically significant variables, i.e., those whose impact on the examined explained variable is the strongest (Foryś and Gaca 2016).

The significance of the obtained regression coefficients was assessed on the basis of the F test.

The F statistics, used to verify the significance hypothesis of the whole model, verifies the hypothesis that all coefficients of the regression equation are simultaneously equal to zero:

The null hypothesis (H0) says that no jth independent variable in the model has a significant impact on the dependent variable. The alternative hypothesis (HA) means that there is at least one variable that is significantly related to the variable Y. In the analyzed example, the null hypothesis was rejected at the assumed significance level α = 0.05 in favor of the alternative hypothesis (Maddala 2006).

The phenomenon under study is influenced by many other phenomena and factors, of both an economic and non-economic nature, and the relationships between the phenomena are usually very complex and multifaceted (Borkowski and Stańko 2010). For this reason, to select the optimal set of explanatory variables, the method of single removal of those variables that in the given step had the least significant impact on the dependent variable was used. Initially, all independent variables were introduced into the general multiple regression equation (). Then, in the next steps, the independent variable with the highest probability p, verified by F test, was removed from the model, provided that the probability was higher than the assumed significance level (α = 0.05). The procedure was completed when there were no more variables matching the removal criteria in the equation.

A set of independent variables (x) were accepted for analysis:

- is the SME size (type).

- is the company revenue.

- is the market share.

- x4 is the range (space) of business activity.

- is the existence of development strategy and its length.

- is the company age.

- is the running a business in the area of advanced technologies.

- is the range (space) of innovation.

- is the observation of competitors’ activities.

- is the enterprise development phase.

- is the cooperation with business environment institutions.

- is the seeking support for investment activities.

- is the investment value.

The model was verified by checking whether the model assumptions in the form of:

- significance of linear regression;

- significance of partial regression coefficients;

- no collinearity (redundancy) between independent variables;

- assumption of homoscedasticity, which means that the variance of the random component (residues ) is the same for all observations;

- no autocorrelation of residues;

- normality of residue distribution; and

- the random component (residual ) has the expected value of 0.

The hypothesis about the lack of autocorrelation of residues was verified using Durbin–Watson d statistics, which is determined by the formula (Rabiej 2012):

where , are experimental values, and is the theoretical values

Durbin–Watson statistics are in the range from 0 to 4; when d > 2, negative autocorrelation is assumed, and, when d < 2, positive autocorrelation. It is assumed that values close to 2 mean no autocorrelation.

The Fi-squared factor is a measure of correlation and takes values from 0 (meaning no relationship between variables) to 1 (means total relationship between variables) (Siegel and Castellan 1988). The U Mann–Whitney test is a nonparametric test for independent random tests used in the event of failure to meet the assumption regarding the normality of the distribution of the statistical feature considered. This test is used when the data are measurable but the distribution is not normal and the data are ordinal. In the case of ordinal data, the null hypothesis assumes that the types of distribution of the analyzed groups do not differ significantly from each other. In the U Mann–Whitney test, the observation results have the appropriate rank (consecutive natural numbers). If the same values occur, the associated ranks are assigned (equal to the arithmetic mean of subsequent ranks). The next step is to calculate the sum of ranks for each gup. The calculated values are compared with the critical values of the U Mann–Whitney test (Malska 2017). The chi-square test of independence is a nonparametric statistical analyzing method that is used to check whether there is a relationship between the nominal variables X and Y. The null hypothesis and the alternative hypothesis for this test can be written as follows: H0: variables X and Y are independent; and HA: variables X and Y are not independent. The chi-square test is based on a comparison of observed values (obtained in the study) and theoretical values calculated on the assumption that there is no relationship between the variables (Kończak and Chmielińska 2013; McHugh 2013).

In many studies, a significance level of 0.05 is taken as the typical value of an acceptable level of error (Szreder 2010). There is also a detailed classification covering three threshold values (p < 0.01; p < 0.05; p < 0.10) (Weerahandi 1993). For the purposes of the study, a typical level of p < 0.05 was adopted. The following graphic methods of data presentation were used: tables, radar charts, and plot boxes.

3.2. Research Group and Research Area

In terms of investment outlays incurred in the SME sector across the country (8.1%), Małopolska province took the fourth place in 2015. It is located in the southern part of Poland and covers 4.9% of the country’s area. From the east it borders Podkarpackie province, from the north Świętokrzyskie province, from the west Śląskie province, and from the south the Republic of Slovakia. Małopolska belongs to the leading Polish provinces in terms of the number of enterprises and invariably ranks fourth. Given the spatial diversity, Krakow has a dominant position as a province city, in which almost 36% of SME sector entities from all over Małopolska are located. In addition, Małopolska was the first province in Poland to receive the title “European Entrepreneurial Region 2016”. It is an award promoting EU regions that are distinguished by a unique and innovative strategy for entrepreneurship that can achieve the goals of the Europe 2020 strategy for smart, sustainable and inclusive growth, and enables the successful implementation of the Small Business Act for Europe.

The research group consists of 160 enterprises that belong to the SME sector, i.e., employing fewer than 250 workers and who made investments during 2007–2015. The first group consisted of 78 enterprises and the second group consisted of 83 companies that served as a comparative group in relation to enterprises from the first set (Table 1).

Table 1.

Description of the research group.

The set of entities using operational programs is created by those companies that used EU funds during the 2007–2013 perspective and completed the project by 31 December 2015. In addition, enterprises had to implement projects whose specific objective under the operational program was directed at investment activities and enterprise development. An additional limiting condition was the year of establishment of the company, according to which the surveys completed by companies established after 2013 were disqualified. Information on enterprises was taken from the National Information System SIMIK07-13. The adopted assumptions allowed to select enterprises from Małopolska province under two operational programs in the EU 2007–2013 perspective: Operational Program Innovative Economy with a national range and the Małopolska Regional Operational Program with a regional scope implemented only in the Małopolska region. The second set of enterprises was selected on the basis of e-mail addresses located in the EMIS and ORBIS databases, based in Małopolska province. As indicated by Sudman (1976) and Churchill (2002), and in the case of regional research (as is the case in this article) for a small number of subgroups in enterprise research, a sufficient sample is considered when it is already in the range of 50–200 entities.

Microenterprises dominate among all companies surveyed using the survey method (58%), followed by small- and medium-sized enterprises (27% and 13%, respectively). This is consistent with the structure of enterprises in the Polish national economy, in which the share of the smallest companies prevails. Considering the distribution of enterprises in Małopolska province in terms of the size of entities that implemented investments co-financed from EU funds, also in this case, attempts were made to ensure the appropriate representation of entities from individual size groups in the study.

In the survey sample covered by the survey method, in the case of both companies using EU funds and in the comparative group, the majority of companies were run as a limited liability company and as a sole proprietorship, which in both subgroups constituted 70% of all enterprises. Taking into account the year of establishing the enterprise, among companies benefiting from financial aid from EU funds for investment purposes, more than half of the companies were established after 2000 (52%), and almost every fifth entity appeared on the market before the political transformation in 1990. When separating entities in the five-year establishment periods, companies from 8 to 12 years old dominate, which constitute 29% of all surveyed enterprises. In second place with a 19% share can be distinguished companies established in the last five years of the last century, whose number is similar to the group of the oldest enterprises. Companies that incurred investment outlays for development needs, but without financial aid by EU funds and were founded over the last 17 years, constitute 71% of this group of entities.

The division of companies in both groups due to the area of their activity is relatively identical. International companies have the largest share. In the case of 33% of the surveyed companies, their activity is nationwide, and the offer of 12% of entities is targeted at recipients only at the local level. Among enterprises that did not use EU funds there is a higher percentage of companies operating at regional level (10%) than among companies that used subsidies.

4. Research Results

4.1. Evaluation of the Results of Undertaken Investment Activities

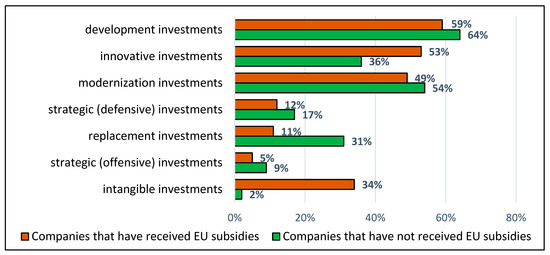

In a classification based on the types of the investments made by the enterprises in the SME sector in both groups included in the survey during 2007–2015, it was investments of a developmental character that were most frequently indicated (Figure 1). The noticeable difference between the two groups in the survey concerns investments the result of which was implementation of innovation. This kind of investment was made by over half of the entrepreneurs (53%) who received subsidies from the operational programs.

Figure 1.

Investments implemented in the surveyed enterprises by type. The results do not add up to 100%, because the respondents could indicate several variants of the answer. Source: Own study based on research.

On the other hand, among the firms that did not take advantage of such assistance, only 36% of the respondents gave a positive answer. In this group, every second entrepreneur (54%) undertook actions regarding modernization. A high percentage of responses related to modernization investments also concern firms taking advantage of the EU subsidies. This means that, even though the owners of these enterprises were more active in the field of investments in development innovations, which was necessitated due to the provisions of the operational programs, they allocated an equal portion of the non-repayable funds they were granted to modernization of their machinery.

In the group of enterprises that did not take advantage of the EU aid, a high percentage of responses also concerned replacement investments, i.e., such that belong to the worst type of investments from the point of view of economic efficiency. This stems from the fact that replacement of an asset does not imply any element of streamlining or improving the economic efficiency in the manufacturing process and even more so fails to add any element of novelty that would increase the level of competitiveness in the enterprise.

It is worth emphasizing that the vast majority of investments implemented in enterprises covered by the EU assistance from the operational programs were non-material investments, which was pointed out by every third entrepreneur (34%) in this group of respondents, as opposed to merely 2% in the group of firms that did not take advantage of the EU aid. This result can be interpreted as a positive effect of the assistance granted from the operational programs in the form of increased awareness among entrepreneur as regards the necessity to continuously educate employees and improve their skills. Such results were predetermined by the projects implemented mainly within the framework of the operational program Human Capital. Another aspect of such a high percentage of responses indicating non-material investments may include the effects of the subsidy assistance granted in connection with patent protection as well as promotion in foreign markets.

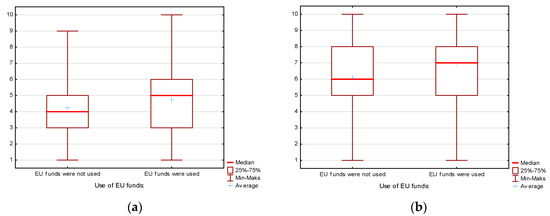

To evaluate the effects of the investment actions undertaken in enterprises benefited from EU subsidies, a comparison was made concerning market positions of those enterprises defined as the situation in which they are in relation to the firms with which they compete within the framework of their current activity. Subject to evaluation was the position of the enterprises both before and after the investment implemented, and the values obtained were compared with the results for the group of enterprises that did not use financial support from EU funds in their investment activity. The respondents rated the company’s position on a scale of 1 to 10, where 1 indicates an insignificant position and 10 a dominant position. The range of assessments is on the y-axis of both graphs (Figure 2).

Figure 2.

Assessment of the position of the surveyed enterprises on the market: (a) before the investment; (b) after the investment. On the y-axis, 1 indicates an insignificant position and 10 a dominant position. Source: Own study based on research.

To check whether there are statistically significant differences between the averages, the U Mann–Whitney test was used. Because the t-test assumptions for independent tests (regarding distribution compatibility with the normal distribution and homogeneity of variance in groups) were not met, the non-parametric U Mann–Whitney test was used to assess differences between means. The null H0 hypothesis is: there are no differences between the means. The alternative HA hypothesis is: there are differences between the means. The value of test probability (p = 0.0244) at the adopted significance level (α = 0.05) for the evaluation of the market position of enterprises after incurring investment expenditure indicates a statistically significant difference between the entities that used EU funds for this purpose in relation to those that did not use that source of funding.

Based on measures of descriptive statistics, it can be seen that the enterprises that took advantage of the EU funds as well as the firms belonging to the comparator group evaluated their situation after accomplishing the investment as stronger in comparison to the position before its implementation (Table 2). However, the averages and the median for the enterprises not taking advantage of the operational programs were lower (= 4.23, Me = 4.00) relative to the entities that received the subsidy aid ( = 4.73, Me = 5.00). At the same time, the indications provided in both groups of entities after the implementation differed. Enterprises that did not used EU funds provided a lower rating of their market position (= 6.10, Me = 6.00) relative to those that took advantage of this type of financial aid ( = 6.89, Me = 7.00).

Table 2.

Selected descriptive statistics describing the market position of enterprises participating in the study in relation to the use of EU subsidies.

It can thus be stated, based on the population surveyed that the enterprises that took advantage of financial aid from the operational programs in order to implement their investments rate their position in the market higher relative to the firms that used other sources of funding for the same purpose.

With regard to the financial standing of the enterprises as of the end of 2015 as the post investment moment in relation to the pre-investment situation, the results of the U Mann–Whitney test (p = 0.2087) at the adopted significance level (α = 0.05) indicate absence of grounds for rejecting the null hypothesis saying that the level of the phenomenon examined is the same in both groups, which means that the averages do not differ from each other.

Although the null hypothesis was not rejected in the statistical analysis, it can be stated that, based on the tables of breakdowns of descriptive statistics (Table 3), the financial standing of the enterprises after implementing the investments with funding from the operational programs under UE funds was on average higher (= 6.75) than that of the enterprises that did not have such a support ( = 6.36). At the same time, enterprises from both groups confirm that the expenditure incurred on investment activity made their financial standing better ( = 6.54) than before the implementation ( = 5.40).

Table 3.

Selected descriptive statistics describing the financial situation of enterprises participating in the study in relation to the use of EU subsidies.

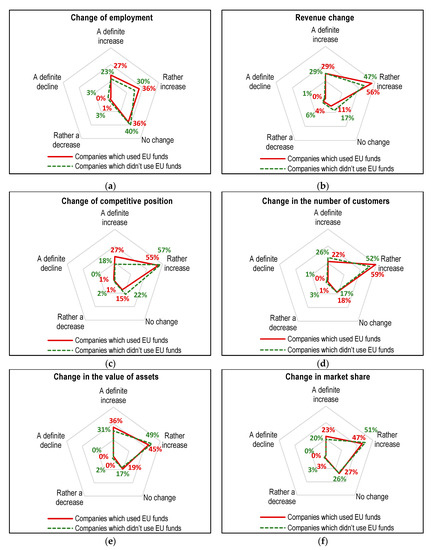

Furthermore, entrepreneurs from both groups were asked to express their opinion concerning their evaluation of the effects of the investments undertaken by them in the enterprises during 2007–2015, after completing the investment activities relative to the pre-implementation situation. Results of the U Mann–Whitney test (p > 0.05) for all the categories being the result of the investment activity of the enterprises, presented in the radar chart (Figure 3), at the adopted significance level (α = 0.05) indicate absence of grounds for rejecting the null hypothesis saying that the groups of enterprises under investigation are the same.

Figure 3.

Results of investment activities in individual areas of business operations in enterprises which participated in the study: (a) change of employment; (b) change in company revenues; (c) change of competitive position; (d) change in the number of customers; (e) change in the value of assets; and (f) change in market share. Source: Own study based on research.

The values presented in the chart and the results of the U Mann–Whitney test are further confirmed by the results of the chi-squared test of independence that was run to verify if the distributions of the groups are similar. The value of test probability for each variant of questions is greater than 0.05 (p = 0.999), thus the distributions are consistent.

Nevertheless, some differences were observed in the responses given by the owners of the entities taking advantage of the EU funds for the purpose of implementing the investments and the entities belonging to the comparator group. Among the enterprises that were included in the subsidy support for investment accomplishment, 63% reported a significant increase in the number of people employed by them. Among the firms that did not use the operational programs, employment growth was found in 53% of them. This group also had a greater percentage of entities (by 9%) in which the situation concerning the level of employment remained unchanged (Table 4).

Table 4.

Descriptive statistics in terms of investment results of enterprises that have used and did not use EU subsidies in entities which participated in the study.

A similar distribution of responses concerns the change in revenues from the activity. A definite increase was confirmed by 85% of the enterprises that used a non-repayable external source of funding in the form of subsidies from the operational programs. Absence of visible changes in the revenues in the firm was indicated by 11% of the entities included in the support.

Among enterprises belonging to the comparator group (not using EU funds), lack of effects was noticed by 17% of the firm owners and a decrease in revenues by 7% in the whole group. On the other hand, a visible increase in revenues was confirmed by three out of four respondents.

The good situation regarding the level of turnover and an increased number of customers is confirmed by the noticeable improvement in the competitive position of the enterprises. An increase or significant increase in this respect was indicated by 82% of the firms that took advantage of the operational programs, which can be interpreted as a sign of the effectiveness of the funding granted to the enterprises. At the same time, merely 15% of them did not notice any change in the competitive position of the firm. In the comparator group of firms that did not take advantage of the operational programs, absence of noticeable effects was indicated by every fourth respondent. On the other hand, 75% of them noticed an improvement in the competitive position of their enterprise relative to other firms in the same branch.

Similar results in both groups of enterprises were found for the following variables: market share, number of customers, and asset value of the firm. The significant share (80%) of both the entrepreneurs that used the operational programs and the respondents who belong to the comparator group indicates that the consequence of the investment expenditure incurred is the observed significant increase in assets in their firms. A similar level was observed in responses concerning an increase in the number of customers being the beneficial result of the investments incurred in the enterprise. Seventy percent of firms from both groups also confirm an increase in the market share as an outcome of the investment activities while for nearly 30% of firms such an effect was not observed.

Although the responses presented by the entrepreneurs with regard to investment expenditure were similar irrespective of whether the investments were included in the subsidy aid from the operational programs or were funded from other sources, it can be stated that the average value of the responses provided was lower among the firms that took advantage of the EU aid, which firms also place more emphasis on the positive effect of the investments implemented.

Entrepreneurs were also asked to refer to the statements concerning the way they perceive the investment activities and the possibility of obtaining financial support for this purpose, also from the EU funds.

The results of the chi-squared test of independence (p = 0.0374) run at the adopted significance level (α = 0.05) permit the conclusion that both groups of enterprises differ statistically with regard to perceiving investment as the key factor determining the development of the firm. All representatives of the firms that received the EU assistance confirmed that investments are crucial for development. On the other hand, 6% of respondents from the comparator group considered that the development of enterprises is not determined by investments that are accomplished in them. Correlation coefficient phi-square (0.16) informs about a weak correlation between the development of firm and the fact of incurring expenditure on investments.

In addition, a greater percentage of enterprises included in the subsidy support (97%) confirmed the thesis that undertaking investments is a prerequisite for a firm to stay in the market, and that investment activities contribute to improving the competitive position of such an entity. A similar opinion was expressed by 92% of firms from the comparator group. In this area, both groups of firms are in agreement, and no differentiation is observed in statistical terms.

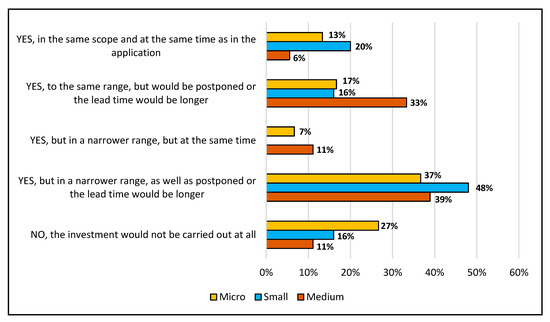

In this regard, attention should be paid to how the support from the EU funds provided to the enterprises affected, in their assessment, their possibilities regarding implementation of investments. It turns out that as many as 80–94% of the respondents, depending on the size of the enterprise, admitted that lack of investment funding from the EU resources would imply various consequences for the process of implementation (Figure 4).

Figure 4.

Consequences in the implementation of the investment without using the EU subsidy in the enterprises that participated in the study. Source: Own study based on research.

Approximately 17% of owners of micro- and small-sized enterprises expressed the view that this would result in extended lead time for the investment implementation. Similar opinion was voiced by every third representative of enterprises employing fewer than 250 people. The largest percentage of owners of the firms in the survey (37–39% of micro- and small-sized enterprises) declared that if they had not been granted a subsidy they would have been forced to reduce the volume of the investment or to postpone its implementation, and the lead time might have been longer. That opinion was shared by almost half (48%) of respondents representing small firms. The possibility of implementing the investment was particularly enhanced by provision of financial resources to the smallest firms employing fewer than 10 people. Almost every third respondent (27%) in the group of micro-enterprises admitted that without the financial support they would not have been able to implement the investment, which would have had an adverse effect on the development of the firm.

In addition, over half of the respondents (53%) who obtained the EU aid expressed the view that innovation must not be treated as the only and crucial area of investment intended to serve the purpose of increasing the competitive advantage of enterprises. The same number of respondents, albeit from the comparator group, took the opposite view.

Entrepreneurs from both groups also challenged the thesis that taking advantage of European funds within the framework of the operational programs is a source of funding investments only suitable for firms being in the initial phase of development. This view was opposed by 75% and 85% of respondents, respectively. Every fourth representative of a firm that did not take advantage of the operational programs had an affirmative view on this issue.

There is a divergence in responses between the groups concerning the thesis that firms from the SME sector have an easy access to a lot of forms of external funding of investments. The results of the chi-squared test of independence, where the value p = 0.0197 is less than the adopted significance level (α = 0.05), mean that there is a correlation between the variables, and the responses presented draw a distinction between the entrepreneurs in the two groups. A more negative stand on this issue is demonstrated by firm owners who did not obtain any form of financial aid from EU funds (84%). In opposition to this group are those entrepreneurs who took advantage of this aid, which is confirmed by every third respondent in this group of enterprises.

Furthermore, the results of the chi-squared test of independence, where test probability value is less than 0.05, permit the conclusion that there is a statistically significant difference between belonging to a particular group of enterprises, whether or not taking advantage of the operational programs, and the assessment of acceptability of the costs involved in acquiring external funding for investments in the SME sector. The results of the survey show that as many as 66% of the entrepreneurs who had the opportunity of receiving subsidy support for their investments accept the costs of acquiring external funding while 61% of firm owners in the comparator group had the opposite view. Using the correlation coefficient phi-square (0.27), we can state that this is a moderate correlation.

4.2. Multiple Linear Regression Model—Findings

The regression procedure using the initial set of variables allowed building the appropriate model after nine steps—in the group of enterprises using EU subsidies for investments. Of all the variables included in the analysis, five turned out to be significant and eight variables were ejected (Table 5).

Table 5.

Summary of dependent variable regression in the group of surveyed enterprises that implemented investments using EU subsidies.

The regression model describing the impact of variables on the financial situation of the surveyed enterprises after the implementation of the investment and the use of non-returnable EU aid for this purpose is as follows:

The obtained regression equation showed that five factors had a significant impact on the financial situation of enterprises after the implementation of investments co-financed from EU subsidies during 2007–2015 ( (company revenue), (market share), (range (space) of business activity), (running a business in the area of advanced technologies), and (enterprise development phase)). The value of the coefficient of determination was , which means that 44% of the total variability of the assessment of the financial situation in this group of enterprises is explained by the applied multiple linear regression model.

The regression equation is important (p < 0.00001). In addition, t statistics indicate that free expression and regression coefficients differ from zero (p < 0.05) and are significant. The multiple correlation coefficient is 0.69 and means that there is a fairly strong linear relationship between the variables. The assumption of no collinearity (redundancy) between independent variables and homoscedasticity was fulfilled. The distribution of normality of residues is described by the formula (; p < 0.00001; ), and the points on the graph are arranged along a straight line, which confirms distribution of normality of residues. The Durbin–Watson test value allows concluding that there is no autocorrelation of residues, with the expected average residue value of 0.

The same model determination procedure was carried out for the second group of enterprises that carried out investments without obtaining EU aid. The final regression model was created in 11 steps. Of all the variables included in the analysis, three of them turned out to be significant and ten variables were ejected (Table 6).

Table 6.

Summary of regression of dependent variables in the group of surveyed enterprises that implemented investments without EU subsidies.

The regression model describing the impact of variables on the financial situation of the surveyed enterprises after the implementation of the investment without the use of non-returnable EU aid is as follows:

The regression equation obtained showed that three factors had a significant impact on the assessment of the financial standing of enterprises in the control group after the implementation of the investment without using EU subsidy ( (comny revenue), (existence of the enterprise development strategy and the period for which it was written), and (range (space) of innovative investments implemented in the enterprise)). The value of the determination coefficient was , which means that 48% of the total variability of the financial result is explained by the multiple linear regression model used.

The regression equation is important (p < 0.00001). In addition, t statistics indicate that free expression and regression coefficients differ from zero (p < 0.05) and are significant. The multiple correlation coefficient is 0.71 and means that there is a fairly strong linear relationship between the variables. The assumption of no collinearity (redundancy) between independent variables and homoscedasticity was fulfilled. The distribution of normality of residues is described by the formula (; p < 0.00001; ), and the points on the graph are arranged along a straight line, which confirms distribution of normality of residues. The Durbin–Watson test value allows concluding that there is no autocorrelation of residues, with the expected average residue value of 0.

Comparing the linear multiple regression models for both study groups of enterprises, it can be stated that the hypothesis H2 has been confirmed, i.e., that the assessment of the financial situation of enterprises as a result of investments made during 2007–2015 in both examined groups of entities depended on various explanatory variables.

5. Discussion and Conclusions

The findings presented in the article have a significant impact on the perception of investments from the point of view of effects and variables explaining the economic effects of implemented investments in enterprises. In addition, the results significantly describe the issue of entrepreneurs’ approach to investment, depending on the sources of investment financing (if EU subsidies are used or not).

The analysis carried out and the results obtained based on it allowed answering the research questions:

RQ1: Do the economic effects of investments made by small- and medium-sized enterprises differ in the assessment of their owners depending on whether the companies used EU subsidies or financed position from other sources?

RQ2: Does the assessment of the financial standing of enterprises after implemented investments depend on the same variables in both examined groups of companies?

The analysis makes a significant contribution to researching the investment effects of enterprises in comparative categories, which are definitely missing in the literature.

Secondly, empirical analysis showed that there are two separate groups of variables affecting the assessment of the financial situation of enterprises—different for entities using EU subsidies and for a group of entities that did not benefit from subsidies. From this point of view, this study extends existing literature with research results presenting the effects of investment activities of enterprises. In this way, this study shows a much broader perspective than the study of other researchers who usually indicate investment results in only one of the groups of enterprises studied. The study using the linear multiple regression model was intended to identify the main explanatory variables that affect the assessment of the economic effects of investments, which is a new approach compared to other studies.

Business development without investment is practically impossible. As a result of implemented investments, the company can improve its competitive position in relation to other enterprises and stand out as a leader in the region or on a national or global scale. The source of financing also plays a key role in terms of investment effectiveness. Many companies have difficulties in obtaining sufficient capital, so they must postpone the decision to implement the investment. Because the SME sector plays a key role in the economy of each EU country, as well as due to the problems of enterprises with access to capital, the European Union supports these entities through aid funds and operational programs dedicated specifically to the SME sector. Therefore, the article attempts to analyze whether the effects of corporate investment activities and investment perceptions are the same, taking into account the source of funding. The presented research result and research method can be considered unique because they include a comparative analysis of significant investments between two groups of enterprises—those that received an EU subsidy and those that financed investments from other sources. The most important conclusions from the study are presented below.

Enterprises using EU funds as well as companies belonging to the comparative group assessed their situation after the investment as stronger in relation to the market position occupied by both groups before its implementation. Despite this, enterprises that did not use UE aid rated their market position lower after the completed investment.

When assessing the market position of enterprises after the investment is realized, there is a statistically significant difference between the examined groups of enterprises. This allows us to state that companies that used EU subsidies for investment purposes assess their competitive position over those that did not use such a source of financing.

Eighty-two percent of surveyed companies using EU subsidies indicated an increase or a clear increase in turnover from operations and an increase in the number of customers, which can be interpreted as a sign of the effectiveness of investment financing granted to enterprises. At the same time, only 15% of them did not notice a change in the company’s competitive position. In the comparative group that did not benefit from subsidies, every fourth respondent did not indicate any visible effects. However, 75% of them reported an improvement in the company’s competitive position compared to other companies in the same industry.

Respondents from both surveyed groups similarly confirmed that expenditure on investment activities resulted in their current financial situation being better than before the investment. The financial situation of enterprises after the implementation of investments benefiting from subsidies from operational programs was on average higher than that of enterprises using other sources of financing.

In the lack of financial support from EU funds by the surveyed enterprises, it would be impossible to fully implement investments in these companies. As many as 67% of respondents said that without subsidies the scope of investments would be much narrower or the implementation period would be longer. At the same time, the results of the study showed that in every fifth enterprise the investment would not be realized at all. Only a small part of the owners of the surveyed companies (13%) admitted that even without external financing in the form of EU subsidies, the planned investment can be implemented.

There were differences in the responses given by the owners of entities using EU funds and entities belonging to the comparative group. When it comes to assessing the impact of investment activities, the average response values are higher for enterprises that have received EU aid. Companies using subsidies also strongly emphasize the positive effect of implemented investments.

Among 63% of the surveyed companies using EU subsidies, a significant increase in the number of people employed in the surveyed entities as a result of implemented investments was indicated. Among the companies that used other sources of investment financing, this state of affairs in the form of employment growth was found in half of them. In this group, a larger number of entities indicated that the employment situation in the enterprise did not improve or was worse. A similar distribution of responses applies to changes in revenues from business operations. Their significant increase was confirmed by 85% of enterprises using a non-returnable external source of financing.

The situation in the following areas: market share, number of customers, and the value of the company’s assets are assessed by both groups of companies at a similarly high level. This indicates a beneficial effect of implemented investments. At the same time, from the point of view of statistical analysis, the tested hypothesis was confirmed. This means that the study groups do not differ statistically in terms of economic effects obtained, despite some deviations in the response in favor of companies using EU funds. This result can be perceived positively that, despite the EU aid received by some companies, this does not significantly distort competition, and the effects of the investment are positively received by every enterprise, regardless of the source of financing for this investment. On the other hand, before the survey it was expected that the difference would be visible in favor of companies receiving EU aid. Namely, it was expected that these entities would have a stronger economic effect due to the aid received.

The study has both theoretical and practical input. The theoretical implications focus on explaining differences in the entrepreneurs’ approach to investment and using the MLR model to identify variables explaining economic effects in enterprises.

According to the theory of hierarchy of sources of financing (theory of choice) formulated by (Myers and Majluf 1984; Myers 1984), the investment process involves the availability of specific sources of capital for investment financing. At the same time, the purpose of selection theory is not to optimize the capital structure, but to find the cheapest sources of capital, as evidenced by the avoidance of unnecessary brokerage costs associated with external financing. In theory, the number of new tangible investments undertaken is determined by the amount of internal sources of capital (Brealey and Myers 2003). The research results confirm the observations of Myers and Najluf, as well as Mendes et al. (2014) who believe that the direction and scale of investment depends on access to capital to finance the investment needs of the company. If the companies did not receive a subsidy, their owners would have to reduce the size of the investment or the investment would have to be postponed and the implementation period could be extended. This would be particularly severe for micro-enterprise owners who admitted that, without the financial support they received, they would not be able to implement the investment, which would have a negative impact on the company’s development. This also confirms the results of research of other researchers (Dorożyński et al. 2013; Mikołajczak 2014; Vasile and Mihai 2015) that access to EU funds in the form of subsidies is an important source of financing investments among SMEs, especially obtaining EU aid is cheaper than in when using financing from other sources on the commercial market.

Research results have been confirmed (Ostrowska 2002; Dorożyński et al. 2013) that EU funds have a positive impact on the development of an enterprise, playing an important role in improving its competitive position on the market. Implemented investment projects with the support of the EU allow the expansion of companies, modernization of production through the purchase of machinery and the use of new technologies, and increasing production capacity. The effect of the investment is also an increase in revenues and creation of new jobs. The broad spectrum of support contributes to increasing the investment capacity of entities. Such results are in line with Chandler’s (1962) theory of investment, according to which conscious planned investments are the basis for establishing and developing an enterprise. Thanks to successful investments, the company achieves competitive advantage on the market. The research effects presented by the author indicate a positive correlation between economic effects related to access to European funds and the competitiveness of enterprises that were able to use them. This is also confirmed by the research of Dorożyński et al. (2013), Peszko (2014), Czauderna et al. (2016), Dubel (2017), and Bostan et al. (2019).

In turn, taking into account the aspect of information asymmetry in the case of signaling theory—discussed for the first time by Spence (1973)—the study shows statistical diversity between the examined groups in terms of availability of financing forms for external investments. Owners of companies that have not received EU subsidies negatively assess the availability of external financing. Opposition to this group includes entrepreneurs who have benefited from such support. Entities with an information advantage can use them to achieve additional benefits, including better access to capital. The study showed that entrepreneurs who had the opportunity to receive investment support through subsidies accepted the costs of obtaining external financing, while the owners of companies from the comparative group were of the opposite opinion. Based on signaling theory, the company’s high competitive advantage shows the company’s current situation and future growth potential (Connelly et al. 2011). A positive signal can increase the price of share prices and thus positively affect goodwill (Standfield 2005).

In addition, it was possible to determine by means of a linear multiple regression model whether, of the twelve explanatory variables initially selected for the model, the same variables affect the financial assessment of enterprises in the groups of entities studied. In the case of a group of enterprises that have benefited from EU subsidies for investments, the assessment of the financial situation can be explained by such variables as: company revenue, market share, range (space) of business activity, running a business in the area of advanced technologies, and the enterprise development phase. On the other hand, in the control group (enterprises that carried out investments without the use of EU subsidies), the change in the assessment of the financial situation as a result of the investment depended on: company revenue (same as in the first group), the existence of a development strategy, and the period for which they were written, range (space) of innovation implemented in the enterprise.

It should be emphasized that the entities that have received EU aid have a stronger perception of investment as an important factor determining the company’s development. On the other hand, both groups of respondents agree with each other and confirm the thesis that undertaking an investment is a condition for the company to remain on the market, and investment activity contributes to increasing the competitive position of such an entity. In addition, in both examined groups, half of the respondents express the view that innovation cannot be treated as the only area of investment aimed at increasing the competitive advantage of an enterprise. However, there is a visible difference in the responses between the examined groups in the event of a problem that companies from the SME sector have easy access to using many forms of external investment financing. Only 16% of respondents who did not receive EU subsidies were of this opinion, and 61% of them do not accept the amount of costs incurred to obtain external financing. However, one in three entrepreneurs from the group that received the EU grant think that it is easy to obtain external financing, and 66% of this group of respondents accept the cost of obtaining external financing.

From a practical point of view, these studies can provide detailed guidelines for institutions managing operational programs and for business environment institutions and other entities supporting enterprises in accessing capital for investment purposes.

Funding

This article came into being within a research project which was financed by the Ministry of Science and Higher Education in the Republic of Poland from the funds allocated to the Faculty of Economics and International Relations of the Cracow University of Economics (Project No. 121/WE-KPI/04/2016/M/6121).

Conflicts of Interest

The author declares no conflict of interest. The funder had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Aczel, Amir Dan, and Jayavel Sounderpandian. 2018. Complete Business Statistics (Statystyka w Zarządzaniu). Warszawa: PWN. [Google Scholar]