1. Introduction

Globally, takaful operators have been in operation for more than four decades if we take the Sudanese takaful operator, the Islamic Insurance Company of Sudan that was established in 1979, as the benchmark. The company is regarded by many as the first modern takaful in the world. Since then, many takaful operators have been established in various countries; yet, they have always been measured based on their corporate financial performance (CFP).

In the last decade, more studies have been dedicated to assessing the takaful operators’ performance from another angle, which is based on their social contribution, derived mostly from the corporate social responsibilities (CSRs) activities that eventually produced the corporate social performance (CSP).

This study aims to discuss the contemporary issue that affects the insurance companies and takaful operators, which is the adoption of drones in their operations, to link this to the disaster victims’ identification (DVI), and the potential of this initiative to be incorporated by takaful operators. Previous studies in this area revealed that there is a paucity of research concerning this emerging issue in Islamic finance particularly for the takaful industry, especially with the impact brought by the Industrial Revolution (IR) 4.0 and now progressing toward IR 5.0. Likewise, takaful operators need to focus on this essential issue, which is further discussed in the forthcoming section.

This issue is important for investigation because climate change has caused environmental issues, particularly with regard to weather, which has greatly influenced the nature of the insurance industry. Adverse weather is closely associated with natural disasters such as floods, typhoons, hurricanes, volcanoes, and earthquakes, in addition to man-made disasters that can possibly take place at any time without warning. Thus, as illustrated n the forthcoming section, an innovative approach to disaster management that engages the quintuple helix: government; private industry; university; community; and environment, must be investigated [

1]. The drone-assisted DVI initiative is perhaps the one that is suitable for disaster management. Drones are now frequently employed by insurance companies in developed economies such as the United States of America, Japan, the United Kingdom, and China. In contrast, such progress is not being demonstrated by takaful operators, who primarily operate in emerging markets, even though the relevance of using drones is just as important to them as it is to their counterparts in developed economies.

Furthermore, the study is guided by four primary research questions, which are discussed in greater detail in the findings section:

RQ1. What are the benefits of drone-assisted DVI?

RQ2. Do takaful operators require drone-assisted DVI?

RQ3. How can drone-assisted DVI improve takaful operators’ CSP?

RQ4. What are the challenges faced by the drone-assisted DVI initiative?

As a result, the article is structured as follows: immediately following this section is an overview of the takaful industry, followed by a discussion of corporate social performance (CSP), which is then viewed from the perspective of takaful operators against the backdrop of the drone-assisted DVI initiative. The following section discusses drone-assisted DVI and the possibility of takaful operators adopting it. Following that, there is a discussion of the research method used for this study, as well as the presentation of findings and contextualization based on the scope of the study. Last, but not least, is the conclusion.

1.1. An Overview of Takaful

This niche industry has been reported by the Islamic Financial Services Board (IFSB) in their Islamic Financial Services Industry Stability Report 2020 to be the global takaful industry that has consistently recorded a growth from 2011 to 2018 of around 8.5%, and countries such as Iran, Saudi Arabia, Malaysia, the UAE, and Indonesia were the main contributors at 91%. Globally, takaful assets were reported to be approximately USD 51 billion and the top three global takaful markets are Saudi Arabia, Iran, and Malaysia representing 80% of takaful operators’ assets as reported by ICD-Refinitiv in the Islamic Finance Development Report 2020.

The Takaful business is segregated into two main business segments, which are family takaful (comparatively similar to life insurance) and general takaful. Yet, in terms of concentration, the takaful operators in the Gulf Cooperation Council countries are gaining more contributions from the general takaful business, while their counterparts from South-East Asia such as Malaysia and Indonesia are generating more income from the family takaful business.

In the context of disaster, while takaful operators in Malaysia offer numerous takaful policies for the risk, compared to countries such as Japan, Australia, and the United States, they have more comprehensive policies or products. It is understandable that those mentioned countries are prone to natural disasters, but we cannot dismiss the impact of man-made disasters that can strike even the remotely affected natural disasters countries such Malaysia, which is discussed in the following section. Even though the scope of this study is on takaful operators in Malaysia toward the initiative of drone-assisted DVI, the findings are useful to other takaful operators in other countries.

The crux of takaful business is to provide financial assistance or compensation through mutual cooperation among the participants based on the Islamic precepts derived from the Shariah. The risks covered by the takaful operators are specified in the agreement (takaful’s certificate or policy).

1.2. Principles of Takaful

Takaful derived its

muamalat (business) principles from

Shariah (the Islamic law). The main considerations for

takaful are that it must avoid from engaging in activities that are deemed as prohibited in Islam such as pork-related products, pornography, and tobacco [

2,

3]. In the context of business transaction, the unlawful activities are interest or

riba, excessive uncertainty or

gharar, and the element of gambling or

maysir.

Equitably, takaful, which is part of the essential components of Islamic finance, is also considered as ethical finance because this industry must uphold high moral values, while, at the same time, it is required to adhere to the Shariah and country’s legal procedures. For instance, the conventional insurance offers social protection that is based on a risk transfer mechanism through the payment of a premium from policyholders to the insurance company.

In contrast, the takaful operator works under the concept of risk sharing, in which the policyholders (takaful participants) contribute funds under the concept of tabarru’ (donation), where they agree to assist each other upon the infliction of calamity as per the contract (takaful policy).

Accordingly, takaful operators such as Islamic financial institutions must be able to serve two main expectations of the stakeholders: commercially viable and socially responsible.

2. Corporate Social Performance (CSP) of Takaful Operators

The CSP is interchangeably used with the CSR [

4], with the latter appearing more in academic journals as well as mainstream media. Nevertheless, this study prefers the CSP as the theme or title because it is comparable with another set of performance that companies always refer to, which is the CFP. Ref. [

5] has clarified clearly that the CSP is beyond the CSR activities, and it can be categorised into three main components before the CSP is considered to be achieved. The components are:

CSR1 (a stage developing and planning for the strategies and CSR activities to be implemented);

CSR2 (implementation stage of the plans and strategies of CSR1);

CSP (the outcomes or results of the implementation of CSR2).

Ref. [

4] denotes CSR

3 as the companies’ CSP, while [

6] describes that the companies must fulfil the fundamentals of CSR1 before CSP can be achieved by adhering or delivering their responsibilities in four essential areas, which are economic, legal, ethical, and philanthropic or discretionary responsibilities, refer

Figure 1.

The pinnacle of the CSP of a company is the discretionary responsibilities that occur when a company is involved in activity that is not expected from them. For instance, an electrical company is not expected to build an orphanage house, because that is not related to the company’s core business activity. Instead, it is a CSR activity but categorised as under the discretionary responsibilities. Likewise, this article discusses the role of takaful operators in the context of drone-assisted DVI—is it part of the takaful operators common business activities?

As mentioned in the previous section,

takaful operators are commercial entities that manage insurance business based on the Islamic insurance or

takaful concepts. Therefore, the initiative of drone-assisted DVI is not their core business activities, because such an important task is under the purview of government agencies that are involved in disaster management and search and rescue (S&R) operations. Moreover, the

takaful operators according to the study [

7] on 11

takaful operators in Malaysia representing the

takaful industry suggested that the

takaful operators achieved their CSP through various CSR activities that they had carried out as per the study’s duration, including Eid Fitr and hajj assistance, scholarships, assistance for primary and secondary school pupils, and assistance for single mothers and orphans. This claim is supported by [

8] and [

9] who reaffirmed the

takaful operators to focus more on the CSR activities as being encouraged by Shariah.

Furthermore, takaful operators must pay both the zakah (alms tax) and the corporate tax; in contrast, conventional insurance businesses in Malaysia are only required to pay the corporate tax at the same rate as takaful operators. As a result, drone-assisted disaster DVI is a novel effort that has piqued the interest of Malaysian disaster management stakeholders, as well as takaful operators, particularly in terms of how this programme will help the country and the takaful business.

Previous research by [

10] recommended

takaful operators to continuously reinvent their services, but their suggestions were confined to the innovation of common

takaful operator’s business operations, but the idea of drone-assisted DVI goes beyond that. As previously stated, drone-assisted DVI has numerous benefits that can be classified into quintuple helix components: government, industry, community, university, and environment.

Thus, this can be a reference case for other

takaful operators in other countries even for the conventional insurance companies if the initiative is suitable to be implemented. Importantly, the CSP is connected to the companies’ reputation as established by [

11], which indicates that institutions such as

takaful operators require the reputation so that the companies are not only financially profitable but socially responsible—recognised by others. Likewise, strong CSP leads to lucrative CFP as suggested by [

12], due to the strong reputation of the firms that will enhance stakeholders’ confidence especially to the public and government to continue patronising the firms.

3. Drone-Assisted Disaster Victim Identification (DVI)

The unmanned aerial vehicle (UAV) also known as a drone is manoeuvred by a remote station without a human pilot on board. The technology has developed rapidly by having lighter and sturdier drones with better customised features to be used for various activities including recreational, scientific, agricultural, military, and commercial [

13]. Worldwide, the price of drones is also becoming affordable because a lot of drones are manufactured in China as drones are one of the key productions under the Made in China 2025 [

14]. In addition, drones are receiving more attention and usage due to their inherent features including their relatively simple operation [

15], which makes it flexible and accompanied by the various functions that can be adjusted to suit the terrain or condition. Likewise, drones offer advantages to the humanitarian and government agencies to use this “electronic bird” for their S&R missions [

16,

17]. Thus far, drones have shown high success rates for humanitarian and post-disaster missions [

18].

During the S&R mission, drones fly by using remote sensing technology [

19]. The wireless communication permits drones to be manoeuvred over the disaster area to identify the location and the scale of disaster before dispatching the S&R team [

20]. The drone technology is suitable for the S&R because it can transmit real-time images and photos through spatial-temporal resolution by having high-definition cameras installed on the drone [

21]. Furthermore, it can be operated in the dark through infrared night vision equipment, thermal imagers, and other devices that the S&R authority deemed as necessary [

22]. It can also carry gas detectors to map and detect gas leakages [

16].

The use of drones during disasters can notably be seen from previous disaster experiences that has happened in various countries. For instance, in 2011, after the earthquake in Japan that caused severe damage to the Fukushima nuclear power plants that then emitted nuclear radiation, drones were sent to detect the radiation produced from the site to prepare for evacuation and to mark the safety zone [

23,

24]. In China, the Sichuan earthquake caused nearly 90,000 thousand deaths or missing persons [

25]; and drones were employed to map the disaster areas, locating the victims and sending rescuers because the tremors had damaged most of the infrastructure in the province including roads, houses, schools, hospitals, and water dams.

A resemblance to the humanitarian missions in China and Japan also took place in the United States in 2005 for S&R operations when Hurricane Katrina hit the country, and drones were flown to identify the victims and rescue them, and even to assess the damages by the insurance companies to quantify their losses for compensation [

26,

27].

The DVI is a process of identifying victims of disaster, which may involve a few or a large scale of victims that [

28] remarked as critical to fulfil the legal and humanitarian requirements through rigorous scientific and forensic process. Ref. [

29] emphasised that such disasters can take place due to environmental, medical, vehicle, industrial, or even terrorist factors. Therefore, even though a country such as Malaysia might be remotely affected by the natural disasters that can cause death or damage in large quantities to human lives or properties, it is possible for the man-made disasters as mentioned before to give such bad consequences.

Moreover, once the incident takes place, the forensic golden rule of 48 hours is critical to identify the victims before the bodies decay and become difficult to recognise [

30]. With that as the precursor, this study explores the drone-assisted DVI from the business perspective on the potential of this initiative to be jointly supported by the

takaful operators.

Accordingly, the performance of using drones can be improved over time, not only due to the advancement of drone technology but also facilitated by the historical data gathered from the previous drone-assisted humanitarian works that will improve the efficiency of S&R operations—lower rate of mortality and morbidity of the victims [

14].

3.1. Drones for Takaful Operators

Ref. [

26] described that, currently, drones are not being used by

takaful operators globally, even in mature

takaful markets such as Malaysia, Indonesia, and the Gulf Cooperation Council countries (GCC). Yet, in developed countries such as the United States (US), the United Kingdom (UK), and the European Union (EU), the insurance companies there have used drones in their operations for quite some time [

31,

32,

33]. This is evidenced in the US when drones were used by a few insurance companies to assess the damages as a result of Hurricane Katrina that hit the country, and the practices have continued for other natural disasters as well as for other insurance purposes such as inspection for pre-underwriting processes. In [

13], it was suggested that for insurance or

takaful drones, the devices would be installed with a customised sensor device to gather the relevant insurance data for analysis that would be disseminated to the insurance processor through a wireless communication device.

Based on the experiences of conventional insurance companies in developed countries, drones bring positive outcomes to the insurance companies as well as their policyholders in the forms of fast and timely response toward damage inspection and insurance claims [

32,

34], reducing fraud in claims [

35,

36], better customer experience as the claim process is faster than before [

33], and higher accuracy of data for analysis to determine the damages for compensation due to the accessibility to the remote and difficult area, high definition photos, etc. [

31,

37]. These benefits are expected to be extended to the

takaful participants if the

takaful operators decide to adopt drones in their operations.

Nevertheless, this article probes an issue that is beyond the ordinary business routines of the takaful operators or even the conventional insurance companies—involvement in DVI.

It is imperative to note that takaful operators are not part of the government agencies involved in the S&R operations when a disaster occurs. To reiterate from the previous discussion, takaful operators are the companies established by the shareholders to offer takaful products by pooling the funds from the takaful participants to help each other during an unfortunate event—compensation will be issued based on the submitted financial claims given after thorough inspection.

Therefore, this study aims to emphasise the significant impact that takaful operators could bring if the companies collectively become part of the joint-effort or coalition to face the disasters that involve humans as victims.

3.2. Claim Process and Disaster Management

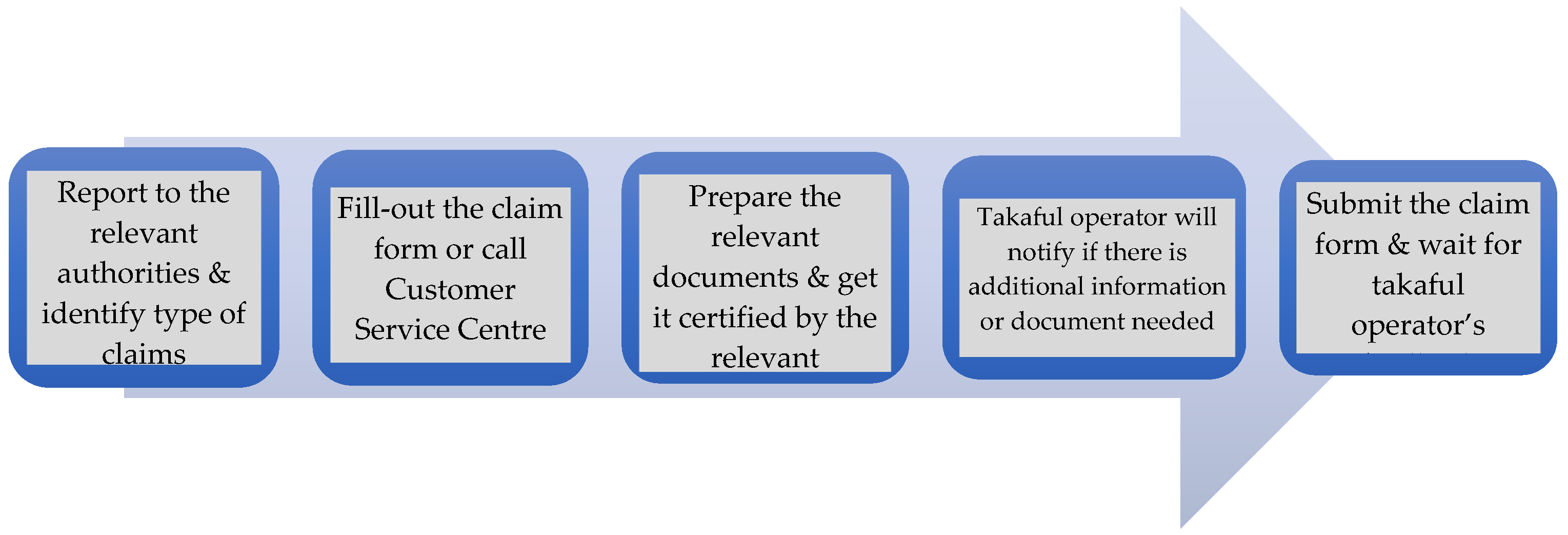

The first figure depicts the claim process that most of the

takaful operators impose to their clients (see

Figure 2).

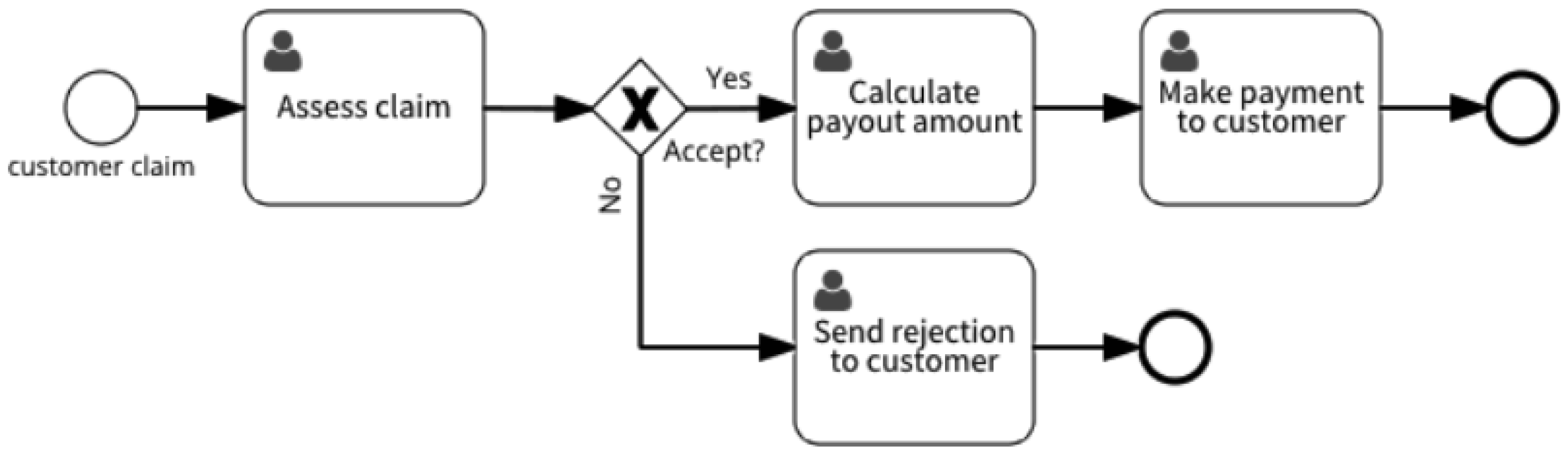

In addition,

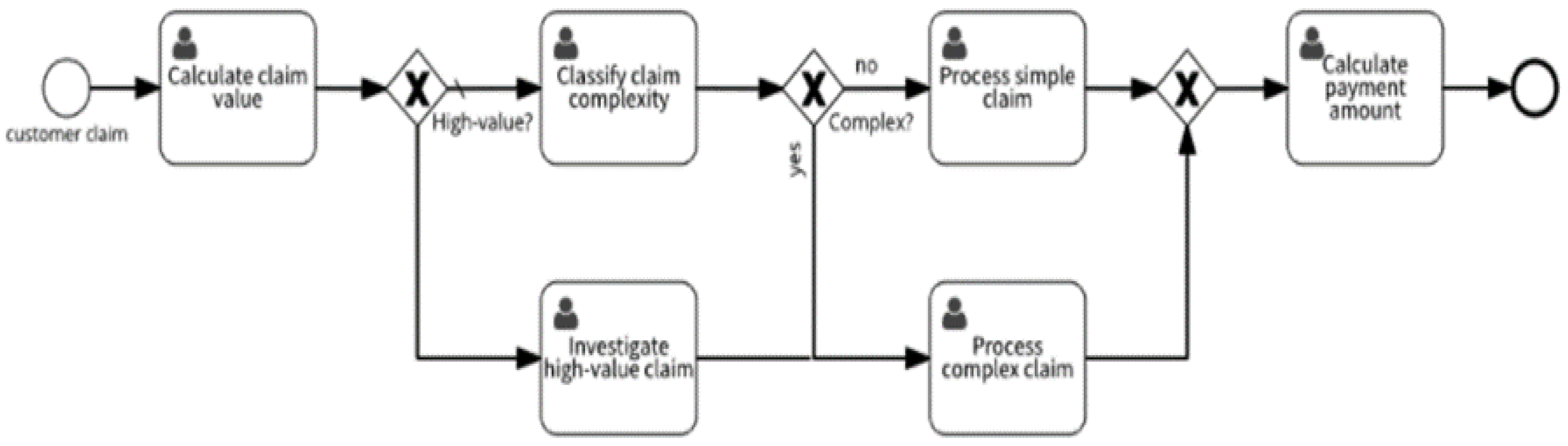

Figure 3 shows the ordinary claim process, while

Figure 4 shows the complex claim process (which requires a lot of documentation and verification from the relevant authorities).

Figure 3 and

Figure 4 show the ordinary

takaful business affairs. The missing elements in

Figure 3 and

Figure 4 are presented in Figure 7 that depicts the earlier disaster management procedures that can be extended to

Figure 3 and

Figure 4, which illustrates the whole chain of disaster procedures. The process can be expedited through cooperation by the

takaful operators. Hence, this can contribute to a better CSP for the

takaful operators.

Figure 3 and

Figure 4 depict the customer or policyholder claim process that can be categorised into simple and complex types of claims. A simple claim is the submission of forms and documents on the damages or injuries that are straight-forward such as those that do not involve other parties except the policyholder alone and the amount of compensation that is not that high. In contrast, the complex claim is due to the high amount of compensation that needs to be issued by the

takaful operator if such a claim is approved, as well as requiring verification by various parties such as the hospital, police, local council, or even court.

It is important to highlight here that even for a simple claim process, it might take several weeks to be approved and for compensation to be distributed, indicating that the complex claim is longer. If we are the policyholders, time is of the essence because it involves mental and physical fatigue as a result of injuries and/or property damage.

Likewise, if we extend

Figure 3 and

Figure 4 by including the earlier part, which is the disaster procedure, it will help us to analyse the situation from a macro perspective by focusing on the drone-assisted DVI and the role of

takaful operators during disaster, as well as its impact toward their CSP.

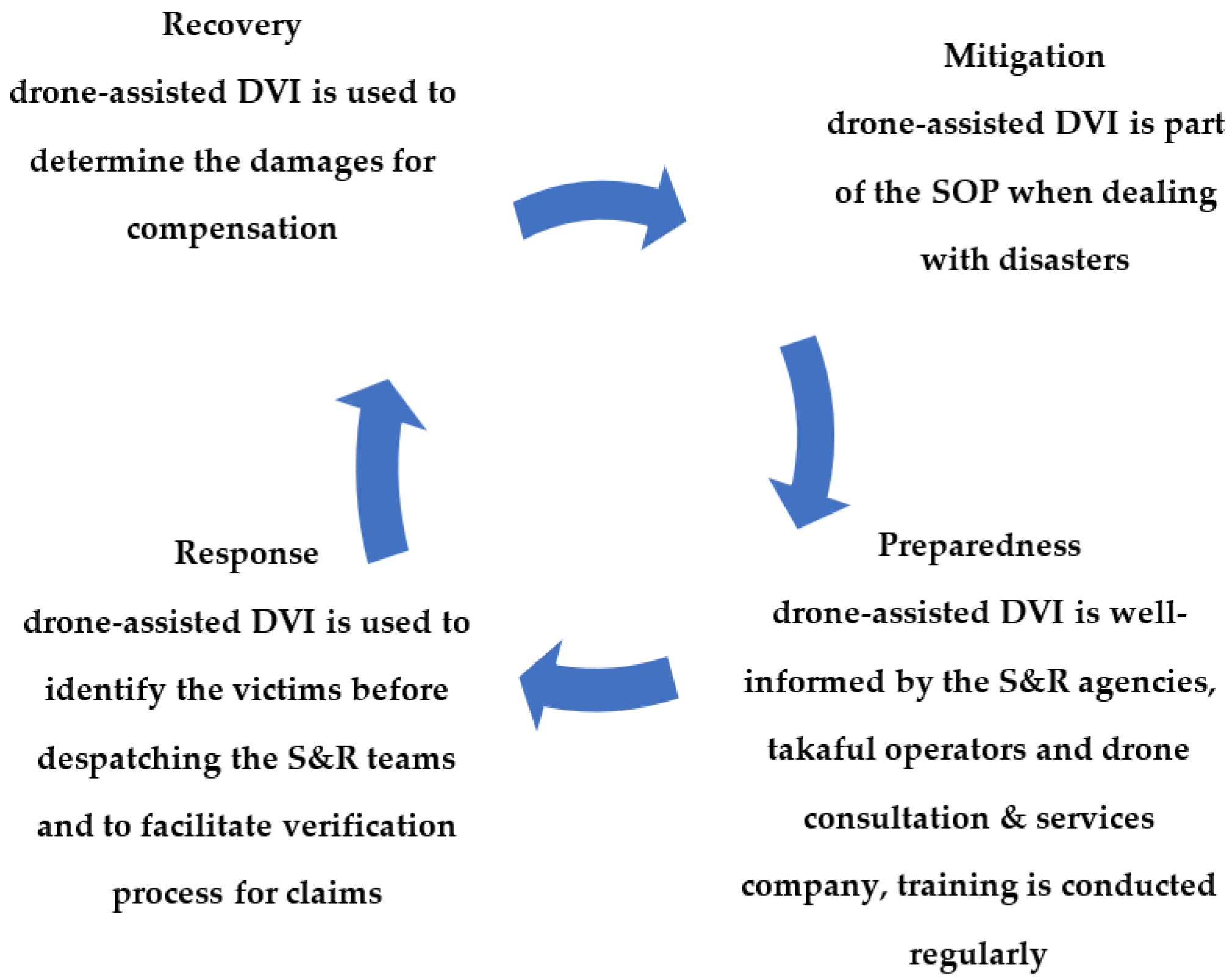

Most of the previous literature highlights that for disaster management, four major components must be adhered to ensure that the disaster is under control: mitigation; preparedness; response; and recovery [

38,

39,

40], as well as prevention as another component based on Malaysia’s disaster management process.

Likewise, to some, the prevention element is considered as part of the mitigation component and, to another, the focus is on the three major components, which are response, preparedness, and recovery [

41]—but the detailed explanations actually comprise every necessary step that must be taken by any disaster management agency.

The mitigation phase focuses on preventing such a disaster from happening, as well as mitigating and reducing the consequences of the disaster in terms of loss of life, injuries, and damages if it occurs. The essential element here is to ensure that the vulnerability condition of the public and properties can be reduced. The next phase is preparedness, which is to ensure that the necessary standard operating procedures (SOPs) are available and understood by the stakeholders such as the government agencies, public, NGOs, and others. Training, drills, campaigns, and education are organized regularly to prepare them to face such disasters. Both mitigation and preparedness are developed before the incident happens.

The third phase, response, aims to protect the stakeholders, especially the public, during a disaster by ensuring the first responders are dispatched timely, with the ultimate focus to save lives and then only the properties, etc. Medical aid, food and drink, as well as other assistance, aim to be delivered to the disaster area and at the relief centre. At this level, the recovery process is also emphasised once the disaster ends by focusing on restoring the public amenities, cleaning-up, re-opening businesses, and re-building the infrastructures. The last component is recovery in which the locality has some degree of stability as a result of the actions implemented during the third phase. Thus, this stage aims to speed up the recovery process of the social and economic conditions to the level prior to disaster.

The drone-assisted DVI procedures can be incorporated as early as at the mitigation phase by including it as part of the planning that is executed when disaster strikes because it can assist in identifying the victims (live or dead). It is then embedded as part of the SOP at the preparedness level, before being deployed and executed at the response stage. For the recovery stage, the drone-assisted DVI is still expected to contribute by facilitating the necessary information of the victims to be submitted to the takaful operators for financial claims, even to the relevant agency that is tasked by the government to offer financial assistance. In fact, such a process can be commenced at the third stage (response stage), which will assist the victims as well as their next of kin during such a distressing situation.

As mentioned earlier,

takaful operators are not government agencies that are part of the S&R operations. Likewise, based on

Figure 5, the role of

takaful operators starts at the last stage of disaster management by distributing the financial claims. Even that is also limited to their policyholders only.

This is the gap that this study intends to explore by probing that

takaful operators as the Islamic financial institutions have two sacred roles that they need to deliver by being commercially viable and socially responsible. Ref. [

26] in their preliminary findings informed that such actions by the

takaful operators are parallel with the

maqasid of Shariah that rally on the good deeds and prohibit wrong-doings, which formed the basis for

takaful operators.

4. Method

This study adopts a qualitative method in order to achieve the research objective of this study by using a case study to explore and probe this issue, as suggested by [

42,

43]. Therefore, a series of semi-structured interview sessions with the 21 key informants were conducted who were selected through purposive sampling. The key informants are listed in

Table 1:

The COVID-19 pandemic has influenced people’s interaction in various events including research. Likewise, the interview sessions were conducted in hybrid modes, online as well as face-to-face sessions. The face-to-face sessions were conducted after most of the Malaysians were vaccinated.

The interview questions were developed prior to the interview session and validated by the experts of Shariah, accounting, and the research method. In addition, the research protocol for this study was established and mapped to the study’s objective so that the study was properly guided and to avoid mistakes from occurring. This increased the validity and reliability of the interview questions, which helped to achieve the study’s objective, as advised by [

44,

45]. The ethical conduct was followed, and the study was granted the university’s ethics approval; Research Ethics Committee of UiTM, protocol code REC/08/2021 (MR/694).

The data gathered were then transcribed and analysed by using thematic analysis, an approach for identifying, analysing, and reporting patterns or themes. The saturation point is essential to determine that the study has been able to capture the required and valid information without biasness or missing essential information. This is critical so that such a study will be able to provide meaningful results that represent the information as well as understanding on the issue. The saturation point is always associated with the number of key informants that is regarded by many to represent the sufficient size of key informants for data collection [

46].

This is arguable because, apart from the size or number of key informants, the detailed background of the key informants is equally important because their expertise and experiences are the repository of information that the researchers intend to “download” or obtain so that meaningful results can be derived from them [

47,

48].

Accordingly, ref. [

44] suggested that a single key informant can be sufficient for a study if the “richness” of data or information is able to meet the research objective; yet, this window must be taken with serious consideration. In addition, many qualitative research experts have discussed this, and it can be concluded that the saturation point is closely related to the research objective and depends on the purpose of the study, either consultation, PhD study (minimum of 15 key informants depending on the type of research), or research grant [

49,

50].

Ref. [

51] denoted that saturation is not in terms of raw data but rather the themes that can be derived from the key informants—this idea was proposed by [

46,

52] to have sample or key informants who have the least variation but exhibit strong cohesiveness, in other words, the relevancy to the issue being investigated that will be expedited for faster saturation.

Likewise, this study had a sufficient number of key informants: 21 experts who had contributed feedback that had been categorised into various themes. Thus, the issues of saturation point, validity, and reliability of data were addressed to maintain the study’s rigorousness.

Process

There were 14 interview sessions that were conducted as per

Table 1, comprising face-to-face and online sessions. Based on the established research protocol, the key informants were briefed about the purpose of the research and that they could, at any time, withdraw from the session, as well as their feedback being kept confidential and only being used for academic purposes.

Validated questions were posed to them, and the moderator encouraged them to speak freely, occasionally prodding the key informants for more information or to explain further. Following the meetings, all verbatim input was analysed using the Atlas.Ti and went through back-to-back translation from Bahasa Melayu (Malaysia’s official language) to English, and then coded before being mapped to the relevant theme as recommended by the thematic analysis. As a result, while some of the themes were congruent with past research findings, there were also new themes that were uncovered that differ from earlier research.

5. Findings and Discussion

This section derives its findings from the 21 key informants who had participated in this study, and they were probed by a list of questions during the series of semi-structured interview sessions. These interview questions were mapped to the research objective and to address the primary research questions of this study.

- i.

RQ1: What are the benefits of drone-assisted DVI?

The thematic analysis for RQ1 indicates that the key informants were in consensus that drone-assisted DVI has many benefits to the people, specifically in the event of a mass disaster that comprises a large area and many victims. In addition, drones have capabilities that humans are not able to deliver during S&R operations, due to physical limitations such as covering a large area in short duration, penetrating to gain access to remote or disaster areas, and obtaining close-up real activity or photos. In other words, the benefits of drones as highlighted and discussed by the key informants are consistent with the previous literature.

KI 10 described that drones have been utilised by the government agencies that are involved in S&R operations, but the drone-assisted DVI to identify and recover victims (whether live or dead) is quite new to them. Nonetheless, he agreed that the drone-assisted DVI will assist a lot and have significant impact on the current S&R operations.

- ii.

RQ2: Is drone-assisted DVI needed by the takaful operators?

For RQ2, mixed responses were received from the key informants and such responses can be broadly categorised into takaful industry practitioners and the nonpractitioners. In general, 28% of the key informants showed their concerns on the initiative, while 72% were receptive toward the proposal. The takaful industry practitioners highlighted that they cannot see the connectivity between the use of drones and the role of takaful operators. This is not a surprise, as we had emphasised in the early section that takaful operators are commercial entities that manage the takaful business, and they are not part of the government agencies that are involved in S&R. Accordingly, we further probed the key informants by bringing into discussion the use of drones by insurance companies in the developed countries, especially pre- and post-disaster.

The key informants (takaful industry practitioners) agreed on the wide use of drones by insurance companies in the developed countries, but they emphasised that such practices are not yet implemented in Malaysia (KI 1 and KI 2); moreover, even though the takaful industry is growing, it is still small in terms of assets and capital, and the funds also generated from the disaster type of takaful policies are miniscule. They also mentioned that Malaysia is a country that does not experience harsh natural disasters such as earthquakes, volcanoes, or typhoons, except floods. Thus, presently, the need to use drones by takaful operators is not critical. They asked the researchers to obtain the Malaysian Takaful Association (MTA) feedback on this (which this study has sought after based on their suggestion).

KI 15 who was from the MTA informed that the association in general is receptive to any suggestion that can improve the industry performance, as well as to assist society. He advised that such drone-assisted DVI is noble; yet, the association needs to obtain collective agreement from the members as well as to have further discussion on the relevant government agencies.

Interestingly, KI 15 also informed that the association had liaised with the National Registration Department (NRD) to collaborate in terms of information and data sharing so that the takaful operators can immediately distribute compensation and related benefits in the event of death of the policyholders without requiring the information to be submitted by the next of kin. This is an exciting development because such an initiative can be linked with the drone-assisted DVI as the ultimate purpose of drone-assisted DVI for takaful operators is to facilitate and expedite claims for the victims, and this can be performed if the victims can be identified and rescued faster. KI 15 agreed on this proposition that there is potential to incorporate the ongoing discussion on the cooperation with the NRD to include drone-assisted DVI.

Next, KI 11, KI 16, and KI 17 also shared the same feedback by emphasising on the role of takaful operators as commercial entities and the companies’ responsibilities to the shareholders, while, at the same time, he acknowledged the benefits of drone-assisted DVI. KI 11 suggested that the drone-assisted DVI can be put under the corporate social responsibilities (CSRs) of the takaful operators if such an initiative wants to be put forward. On the CSR note, we had brought into perspective the takaful operators’ collective effort to put aside funds for COVID-19 compensation to the infected policyholders because COVID-19 is an unexpected pandemic and is not in the coverage list of diseases. Thus, we probed by comparing the COVID-19 funds with the drone-assisted DVI. The KI 11 agreed and informed that for COVID-19 funds, it is a CSR initiative and such a concept can be extended to drone-assisted DVI.

KI 3 and KI 4 linked the maqasid al-Shariah to the benefits that drones can offer to the takaful operators and the policyholders that further enhanced the fulfilment of the maqasid al-Shariah. Nevertheless, they reminded us that the drone-assisted DVI will incur additional costs, and whether the costs should be borne by the takaful operators alone (from the shareholders’ funds) or be spread to the takaful participants/policyholders through takaful participants’ funds must be considered meticulously because Shariah does not want any injustice to occur. This is consistent with previous feedback by other practitioners as, in the context of Malaysia, the need to adopt drones in takaful operation is “not a must; rather it is a nice to have”.

Meanwhile, the key informants who are the non-takaful industry practitioners applauded the idea of drone-assisted DVI because they regard that as timely and will facilitate various humanitarian works. However, on the need for takaful operators to adopt drone-assisted DVI, they responded by focusing on the immediate information that the takaful operators will receive, which is required by them for injuries assessment before compensation can be granted.

We felt that the non-takaful industry practitioners’ key informants responded based on their experiences (which is valid) in the S&R operations, disaster management, and drone industry. Thus, they had the assumption that takaful operators have abundant funds that can be used for the drone-assisted DVI initiative, which is not correct, because the takaful operators must ensure that every money spent is worth it for the companies. Nonetheless, this does not mean the drone-assisted DVI initiative is not worth investing, but to reiterate from the industry practitioners’ feedback, the current practices work well for the industry.

- iii.

RQ3. How does drone-assisted DVI enhance takaful operators’ CSP?

The drone-assisted DVI can be alternatively viewed as a CSR initiative that, if implemented, will further enhance the CSP of takaful operators. Currently, the drone-assisted DVI initiative is not appropriate to be part of the common practice of takaful operators in Malaysia, because the industry feels such a requirement is not needed. Yet, they did not entirely reject the idea of drone-assisted DVI, because they were aware of the global development of the insurance market and the use of drones by the insurance companies.

Previous discussion indicates that the pinnacle of CSP is discretionary responsibility, and in the context of the drone-assisted DVI initiative, it falls under this concept because the S&R operations or humanitarian works are not the core business of takaful operators. Likewise, if takaful operators contribute and become part of the drone-assisted DVI initiative, surely this can be regarded as a fulfilment of their CSP.

Thus, for the drone-assisted DVI initiative to be incorporated as part of the disaster management in Malaysia, the industry can collectively contribute or allocate funds for this purpose. The funds can be channelled to the government agency that manages and coordinates disaster management in Malaysia, which is the National Disaster Management Agency (NADMA). By incorporating takaful operators into the SOP of disaster management, through funding for the drone-assisted DVI initiative, in the event of mass disaster, drones can be deployed, and victims can be rescued or recovered at once. Likewise, if the victims are takaful participants, the compensation can be distributed as soon as the identification and verification of the victims are made.

KI 12 suggested that while the initiative might be costly, the advantages specifically on the drone-assisted DVI cannot be dismissed due to cost, because it can be viewed from the perspective of social-cost benefits analysis (SCBA) that emphasises the tangible and intangible benefits that can be delivered to the masses.

- iv.

RQ4. What are the challenges faced by the drone-assisted DVI initiative?

All key informants agreed that costs would be one of the main challenges, but such a priority can be seen as different between the takaful industry practitioners and the nonpractitioners. This is related with the previous discussion on the different feedback given by the two groups of key informants. Another important challenge is to have a dedicated platform to ensure such an initiative can begin smoothly and sustainably. This requires the quintuple helix engagement, but the anchor to this initiative must be from the government and supported strongly by the takaful operators before it can be extended to other components as prescribed by the quintuple helix model. This suggestion is strongly encouraged by all key informants.

Furthermore, the

takaful operators must be supported by the public and government in terms of subscribing to the disasters’ type of policies such as floods, fire, householders, and landslides. These policies are least subscribed by the

takaful participants in various markets. For instance, in Malaysia, 74% of houses are not covered by a flood policy, while 4.8 million people live in flood-prone areas, and ironically, floods are the main natural disaster in the country [

53].

This is consistent with the KI 1 and KI 2 responses that the takaful policy for floods is not well subscribed by the Malaysians; thus, in the event of a flood disaster, only a minority of victims who have the respective policy can be assisted, while the rest will be at the sympathy of the government, NGOs, and other members of society to help, which is not enough to reinstate their lives back to pre-flood disaster.

The takaful operators must be supported in such a way so that they will be able to enlarge their funds’ base so that they can plan for various programmes and develop suitable benefits for the takaful participants. In addition, they can contribute actively to the society and country, and this drone-assisted DVI can be part of the takaful operators’ contribution. It is a win-win situation for everyone. KI 15, 16, and 17 also concurred that takaful operators must be supported because, as commercial entities, they must be able to generate income and to ensure the core business is taken care of well before embarking on any CSR activities. Likewise, they agreed that through the joint-effort under the association, the force will be greater, and much can be consolidated.

Another challenge is to provide necessary training for the pilots and maintenance of the drones. KI 19 described that while drones are sophisticated devices that can be deployed in various conditions, the specifications must be correct to suit the conditions, and this will require a hefty amount of money. Therefore, he suggested that, to achieve economies of scale, it would be better for the drone to be outsourced to drones consultation or services companies because the companies have the experience, skills, technology, and technical capabilities to operate drones in various situations.

This is related to the KI 5, 6, 7, and 14 feedback that a drone pilot requires sufficient training hours and is regularly involved in flying the "bird" because, if this part is lacking, the drone will not be able to fully maximize its functions; thus, the benefits will not be fully attainable. If this initiative is adopted, with funds contributed by the takaful operators for the drone-assisted DVI programme, in the event of a disaster, the S&R operations will not be able to deliver the expected tasks, due to the lack of professionalism on the part of drone pilots.

KI 6 emphasised that this is not to look-down on part of government agencies that have the drone units, but in terms of flying hours, the drone pilots from the drone consultation or services companies are more experienced and regularly fly drones for business purposes, and are involved in various trainings and exhibitions. The drone pilots at the government agencies will be flying the drones during their training session and when a disaster occurs that requires the drones to be used. Other than that, we can assume such usage will be minimal.

KI 14 informed that the maintenance of drones is not too high but the initial capital to buy a suitable drone would be expensive. This is consistent with the KI 19 explanation that the price of a decent drone can be around RM 10,000 (and above); thus, once the drone is in possession, it should be used regularly to achieve economies of scale. By engaging with the drone consultation and services companies, the costing part can be lowered because the drone is not only being used for S&R operations (which rarely happens) but that drone is also being flown for other purposes such as commercial. However, through proper planning between the government agencies, takaful operators, and the drone consultation and services companies, an agreement can be worked out to ensure that in the event of a disaster that requires drones, such services can be rendered timely.

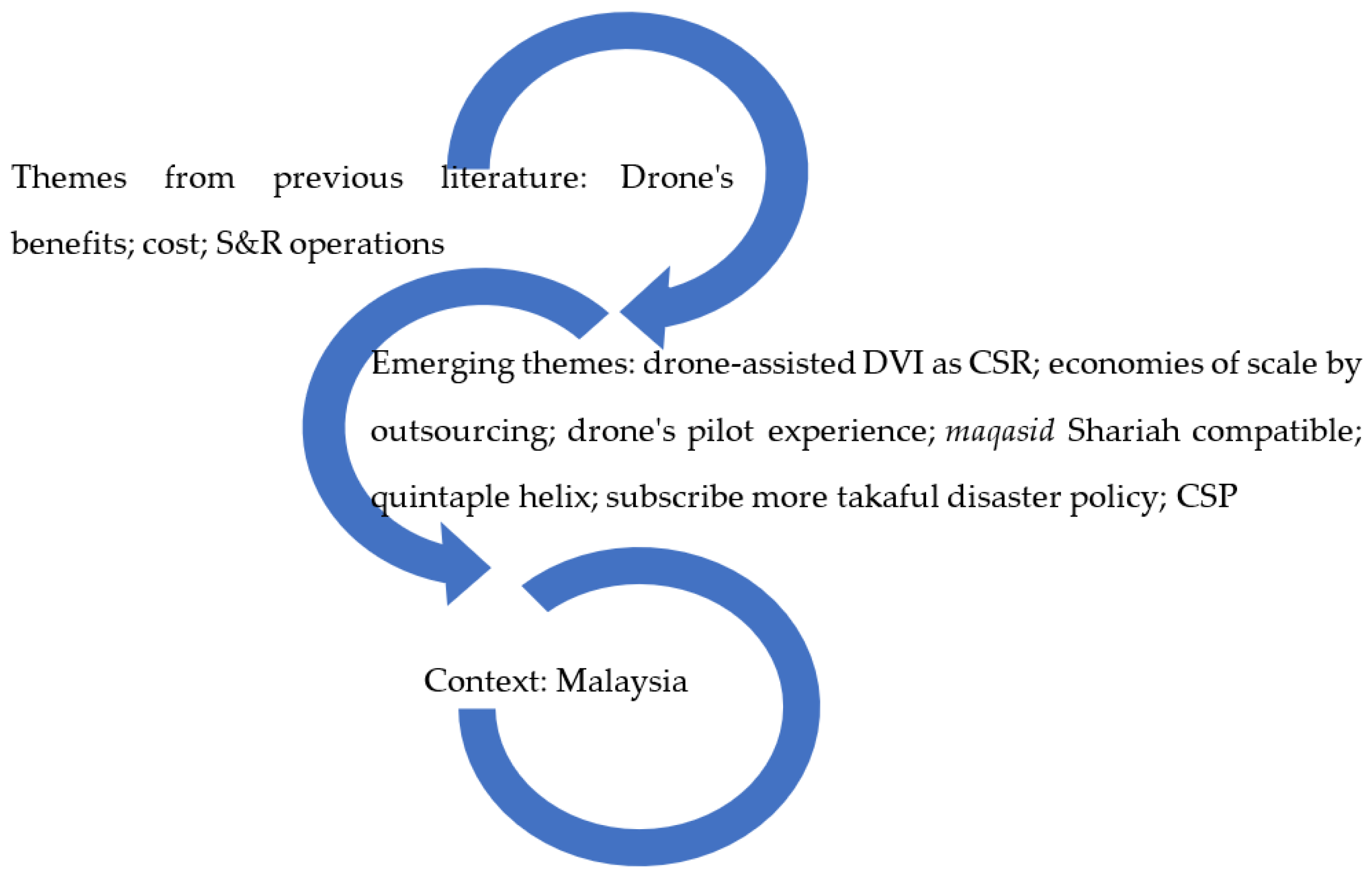

Therefore,

Figure 6 depicts the themes that were gathered from the interview sessions with 21 key informants. Some of the issues that were highlighted by the key informants are consistent with the previous literature but there were also numerous emerging themes that were discovered during the study, as presented vis-à-vis the research questions above.

In addition,

Figure 7 presents the suggestions that can be adapted into the disaster management process by incorporating the drone-assisted DVI at each stage of the disaster management process that can be reflected based on key informants’ feedback.