1. Introduction

In the last 10 years, there has been exceptional growth in Islamic finance even though it is an evolving industry, and this has been a period of financial and economic uncertainty. This is evidenced by the recent report published by the Islamic Corporation for the Development of the Private Sector (ICD) and Refinitiv projecting that global Islamic finance assets would reach USD 5.9 trillion by 2026, more than double the assets recorded in 2018 (USD 2.61 trillion) [

1]. The increase in Islamic finance is due to the huge rise in demand from the Middle East and other Muslim countries, as well as from other non-Muslim countries across the world [

2]. Attracted by its ethical principles, such as the prohibition of interest and the promotion of fairness and justice, the UK has also recognised the growing appeal of Islamic finance. In this vein, the government established the Islamic Finance Task Force (IFTF) in 2013 with the aim of positioning London as a hub for Islamic finance in Europe. As a measure of the success, Islamic banks in the UK have expanded and now have assets of over GBP 7.5bn [

3]. However, it must be pointed out that the reported growth in Islamic home finance has been somewhat anecdotal. According to a recent figure, a mere 2500–3000 residential and buy-to-let Islamic mortgages are issued in the UK each year [

4]. This growth seems to be quite discouraging, bearing in mind that Islamic housing finance has been freely available since 2004 when the UK’s first standalone Sharia’h-compliant bank, Al Rayan Bank (formerly known as Islamic Bank of Britain), started its operation in the country. Moreover, the withdrawal of Lloyds and HSBC from the Islamic home finance market in 2010 and 2012, respectively, has raised questions about the prospects for Islamic home finance in the UK [

5].

There is no doubt that Islamic finance still has a small share of the global financial market [

1]; nevertheless, it is becoming an alternative option due to its principles based on partnerships and fairness. The equitable nature of Islamic home finance makes it unique and promotes a healthier and more stable financial system. Despite this, there appears to have been very little upward trend in the UK. Nevertheless, with the rapidly changing financial environment, the government’s ambitious plan to promote London as an Islamic finance hub and the changing attitude of consumers towards ethical finance, there may be a change in the prospects for Islamic home finance in the UK. This scenario presents an opportunity to explore the prospects of Islamic finance in the UK in the current context. Over the decades, Islamic home finance has attracted considerable attention in the Islamic finance literature. In the context of the UK, a number of empirical studies [

6,

7,

8] have attempted to assess the challenges, scope, potential and demand for Islamic home finance. However, these studies and the vast majority of the extant studies [

9,

10,

11] failed to take account of opinions voiced by independent and industry-led experts. Similarly, other studies [

12,

13,

14,

15,

16,

17] adopted a one-size-fits-all approach by focusing on an overall picture of Islamic finance without any real emphasis on Islamic home finance. For example, Akbar, Shah, and Kalmadi [

12] evaluated user perceptions of Islamic banking practices in the UK. Their survey results revealed that Islamic banking and finance is not fully aligned with traditional Islamic finance principles. However, the study had structural limitations due to its small sample size of 35 respondents as well as a significant proportion of the respondents (54%, or 18 out of 35) coming from a low-income bracket (e.g., GBP 12,000 per annum). These limitations indicate that the participants in the study may not have a strong financial understanding of Islamic finance, particularly Islamic home finance. As a result, conclusions drawn from the study restrict its scientific validity and generalisability. Another study [

13] assessed the size of the market for Islamic finance and home finance. Here, it was found that only 9% of the sample had a positive attitude towards Islamic home finance. However, the sample included a large proportion of students (79 participants out of 503), which may have affected the results as students are not considered ideal participants to comply with home finance-related aspects.

An alternative study [

14] examined customers’ attitudes towards Islamic finance in the UK. The survey findings from everyday Muslim and non-Muslim participants revealed that a bank’s reputation, convenience and quality of services were the most decisive factors, followed by competitive interest rates (for conventional banking only). The study simply focused on general Islamic banking products and services, such as current or deposit accounts, without giving importance to competitive interest (or profit) rates, which could not be downplayed in the case of home finance. Following a similar pattern, [

15] also examined the perception and awareness of Islamic finance in the UK from a non-Muslim perspective. The findings of the study overwhelmingly demonstrated that non-Muslims had a very positive attitude towards Islamic financial services. However, these findings were somewhat affected by the lack of critical question(s) in the survey, especially regarding the cost aspect, which is a key factor, particularly in the context of Islamic home financing.

Other studies [

16,

17] critically examined the perceptions, experiences and expectations of British-based Muslims regarding Islamic banking and finance by surveying a diverse sample of Islamic banking employees, everyday Muslims and religious scholars. These studies claimed to have found that the existing Islamic banking and finance products and services in the UK did not truly reflect the real essence of the principles of social justice and equality. However, such claims may limit the general findings bearing in mind that the surveyed Islamic scholars and mosque imams were more likely to have been religiously motivated and may have lacked knowledge of contemporary Islamic home finance. There has been some secondary research (e.g., [

6,

18]) that focused solely on Islamic home finance, but these studies are essentially out of date owing to changes in the demographic landscape of the Muslim population and developments in the financial environment.

In summary, the current literature has a high degree of sampling bias and is largely focused on Muslim customers and Islamic scholars [

8,

16]. Furthermore, many of the participants in the existing studies appear to be everyday Muslim customers with low socioeconomic backgrounds [

7,

12,

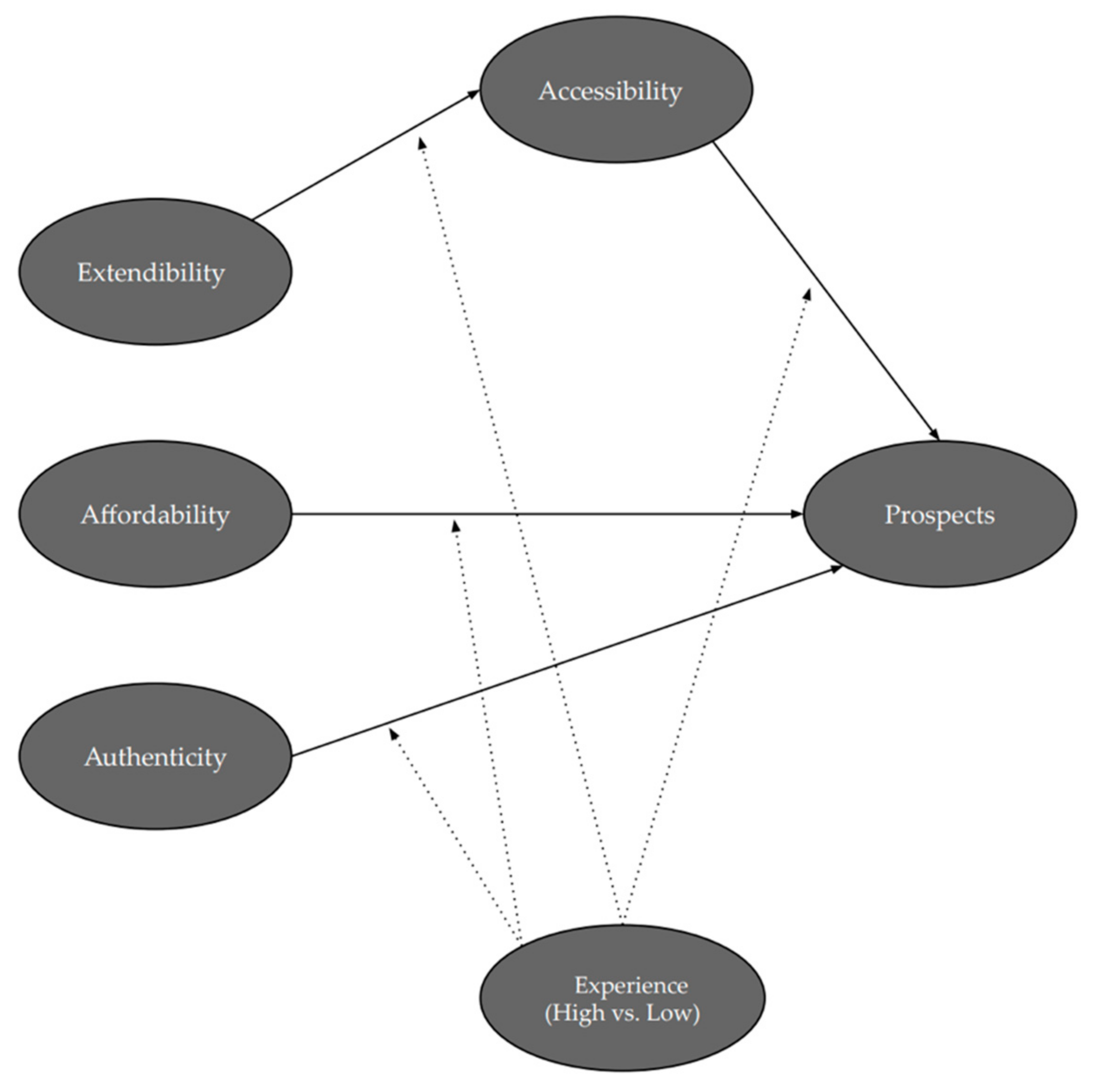

13] who lack a basic understanding or the required knowledge to provide useful insights into Islamic home finance. In addition, the lack of support from industry experts, recent developments in the industry and the absence of robust research frameworks further undermine the reliability, generality and practical relevance of the literature in the current scenario. Taken together, these limitations have created huge and important gaps in the literature on Islamic home finance in the UK. The purpose of this study is to address these gaps. As a result, unlike the majority of previous studies, which are narrowly confined to the customer segment and communities or small geographical areas, this research shifts the focus and examines the prospects for Islamic home finance in the UK from the perspective of the most neglected yet important stakeholders: fully qualified mortgage consultants. Moreover, this study also develops an up-to-date research framework constituting four key predicting constructs of extendibility, accessibility, affordability and authenticity, as well as the target construct prospects (for Islamic home finance in the UK). The proposed research framework aims to investigate the impact of authenticity and affordability on the prospects for Islamic home finance from an industry perspective. In addition, the study seeks to evaluate the extendibility of Islamic home finance and how it affects its accessibility, which in turn could ultimately shape its long-term prospects. The examination of the vital role of accessibility as a mediator will provide a valuable insight into the future outlook for Islamic home finance in the UK.

Furthermore, our study takes account of the impact of past events such as the sub-prime mortgage crisis and the development of Islamic home finance through the lens of mortgage brokers’ lived experiences as a moderator. The moderation analysis will not only provide a more accurate assessment, but it will also allow us to assess whether these past events have had a significant impact on mortgage brokers’ views regarding the long-term prospects for Islamic home finance in the UK. The remainder of the paper is structured as follows. In

Section 2, we discuss the theoretical background and develop hypotheses.

Section 3 outlines the methodology of the study. In

Section 4, we present the data analysis and results of the direct path coefficients.

Section 5 discusses the mediation analysis, while in

Section 6, multi-group analysis is conducted.

Section 7 presents the importance–performance matrix analysis (IPMA). Finally, in

Section 8, we outline a detailed discussion of the results, research contribution and future directions.

6. Multi-Group Analysis

To test H

6, the final hypothesis—

experience as a moderator significantly affects the relationships among the model’s construct—we conducted a multi-group analysis (MGA). MGA is a prominent way of assessing moderator effects as it provides a holistic view of the moderator’s influence on the analysis results. Unlike testing each path coefficient separately, which can lead to false or incorrect conclusions because this approach does not take account of the interrelated nature of the variables in the model, MGA shifts the focus from examining the moderator’s impact on one specific model relationship to assessing its impact on all model relationships. This results in a complete understanding of the relationships among all the variables in the research model [

42,

56].

Prior to conducting the MGA, the Measurement Invariance of Composite Models (MICOM) was executed as recommended in the literature [

42,

56,

57]. The MICOM procedure consisted of three steps: (1) configural invariance; (2) compositional invariance and (3) the equality of composite mean values and variances. To achieve configural invariance we ensured that each measurement model employed the similar items across all data groups and all measurement items were incorporated in the latent variables across all groups. Similarly, all indicators’ data were treated identically across all groups including the coding, and all outliers were detected and treated in a similar manner. Finally, all algorithm settings and optimisation criteria were applied identically to verify that differences in the group-specific model estimate do not arise from different algorithm settings.

To examine compositional invariance, a permutation test in Smart-PLS was carried out that assesses and compares the composite scores of two groups to establish whether the correlation

“c” varies substantially from the empirical distribution of c

u (denoted by the 5.00% quantile) [

42,

57]. In simple terms, compositional invariance requires that the correlation c is equal to 1 [

58].

The MICOM results (see

Table 10) suggest the establishment of the compositional invariance across all constructs in the experienced vs. less experienced group, as all original correlations are found to be equal to or larger than the quantile correlations of 5.0%, as visible in the 5% column. In addition,

p values higher than 0.05 also support this finding, meaning the correlation is not significantly lower than 1. This also means that partial measurement invariance has been established. This allows us to proceed with comparing the standardised path coefficients across the groups by applying multi-group analysis with confidence.

In order to establish whether the full invariance has been achieved, the composite means and variances were examined in Step 3 of the MICOM procedure in SmartPLS. If there are no significant differences in mean values and (logarithms of) variances across the groups, then full measurement invariance is claimed to be established [

56,

58]. To check whether even full measurement invariance holds, full measurement invariance (composite equality) was conducted in PLS-SEM.

To establish the equal means and variances, the mean original differences and variance original differences should fall between the lower (2.5%) and upper (97.5%) boundaries of the 95% confidence interval of the scores’ mean differences [

58]. As can be seen in

Table 11, the original difference in mean values falls within the range of the lower and upper boundaries. For example, for

authenticity, the original difference in mean values is −0.028, which is within the corresponding confidence interval with a lower boundary of −0.353 and upper boundary of 0.308. In addition, Permutation

p -Values (0.867) further support this finding for

authenticity and every other construct (i.e.,

accessibility = 0.862;

affordability = 1.000;

extendibility = 0.187; and

prospects = 0.749) in the PLS path model, as all

p values are considerably larger than 0.05.

However, when comparing the analogous results for the composite variances (variance original difference) to the lower (2.5%) and upper (97.5%) confidence interval, it was noticed that the variance original difference value (0.521) for the construct

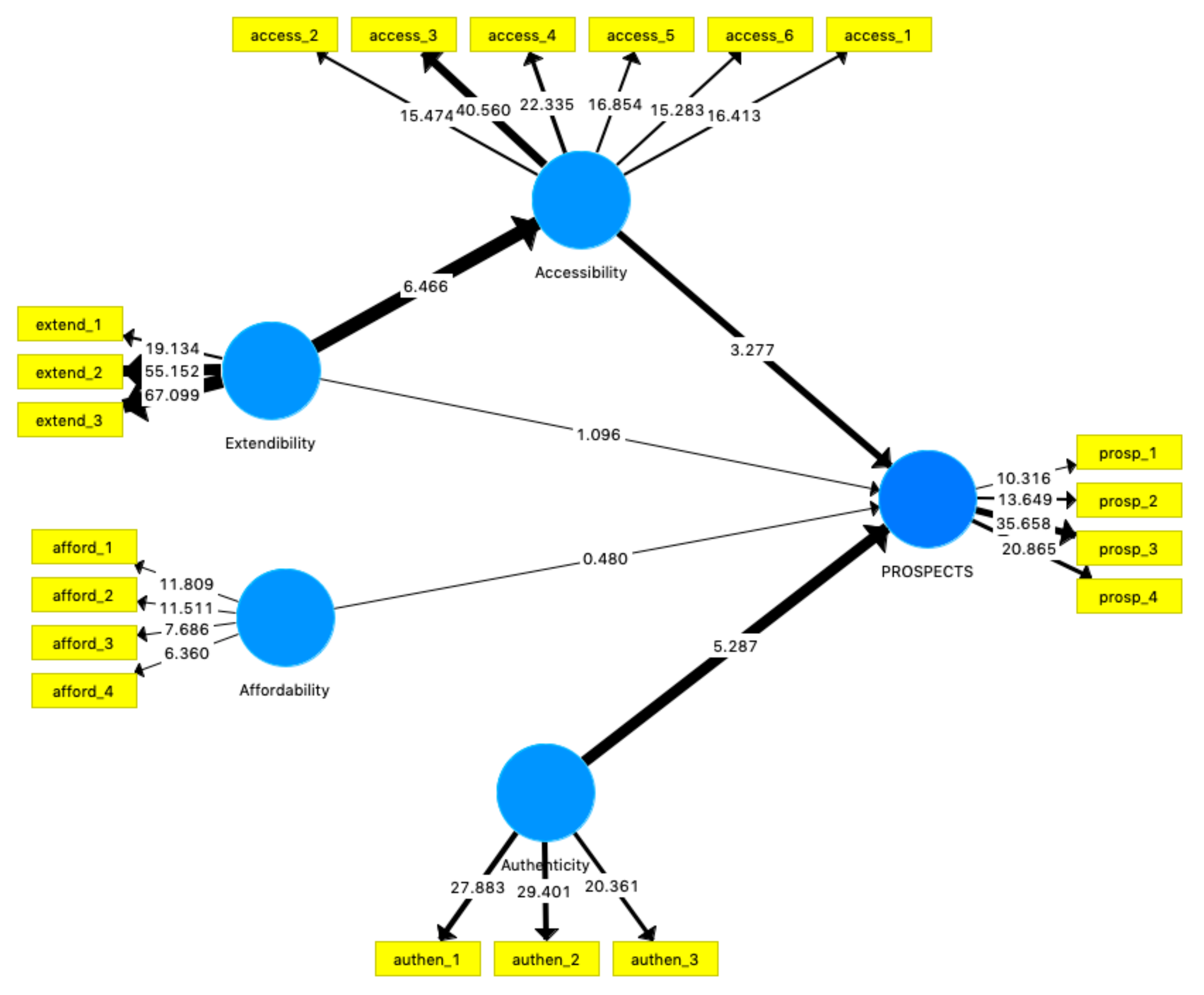

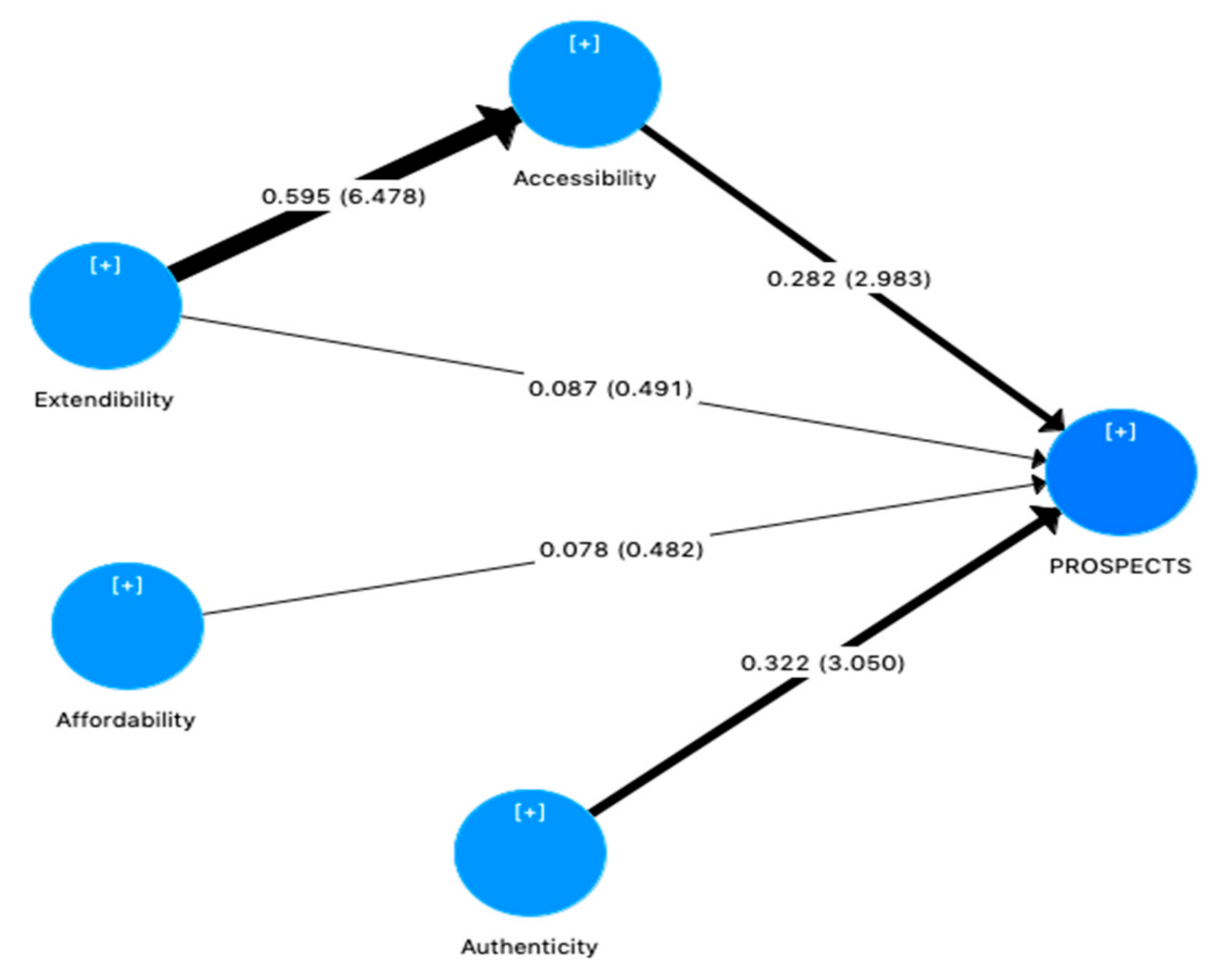

authenticity did not fall within the 95% confidence interval (−0.428–0.484). Therefore, the construct did not meet the guidelines for establishing full invariance. Hence, the partial measurement invariance has been established, paving the way for the feasibility of multi-group analysis. Consequently, multi-group analysis was conducted to identify meaningful and significant differences in multiple relationships across group-specific results. Prior to carrying out multi-group analysis, a bootstrapping analysis using 5000 subsamples on each group was conducted to analyse the path coefficient of each group. The group-specific results (see

Table 12 and

Table 13) for the more experienced group (>10 years’ experience) revealed a significant impact of

accessibility (β = 0.282,

t = 2.983) and

authenticity (β = 0.322, t = 3.05,

p < 0.05) on the

prospects, whereas

extendibility was found to have a strong impact on the

accessibility construct, i.e.,

t = 6.478 and

p < 0.001.

In contrast, the path coefficients of the subsample of the less experienced group (<10 years’ experience) showed a non-significant effect of

accessibility, affordability and extendibility on the

prospects whereas

authenticity exerted the strongest effect (

t = 5.337,

p < 0.001) on the

prospects. Similarly,

extendibility showed a relatively strong effect on the

accessibility construct. These effects are also evident from each group’s structural model, where significant effects can be seen in thicker lines (see

Figure 4 and

Figure 5). (There may be slight differences between the Tables’ and Figures’ structural path coefficients due to the bootstrapping procedure).

The results of multi-group analysis, applying the widely adopted [

59] Welch–Satterthwait

t test, in

Table 14 and

Table 15 reveal that all path coefficients were found to be insignificant, i.e.,

p > 0.05. Hypothesis 6—

experience as a moderator would have a significant effect on the relationship among model constructs—is not supported.

8. Discussion

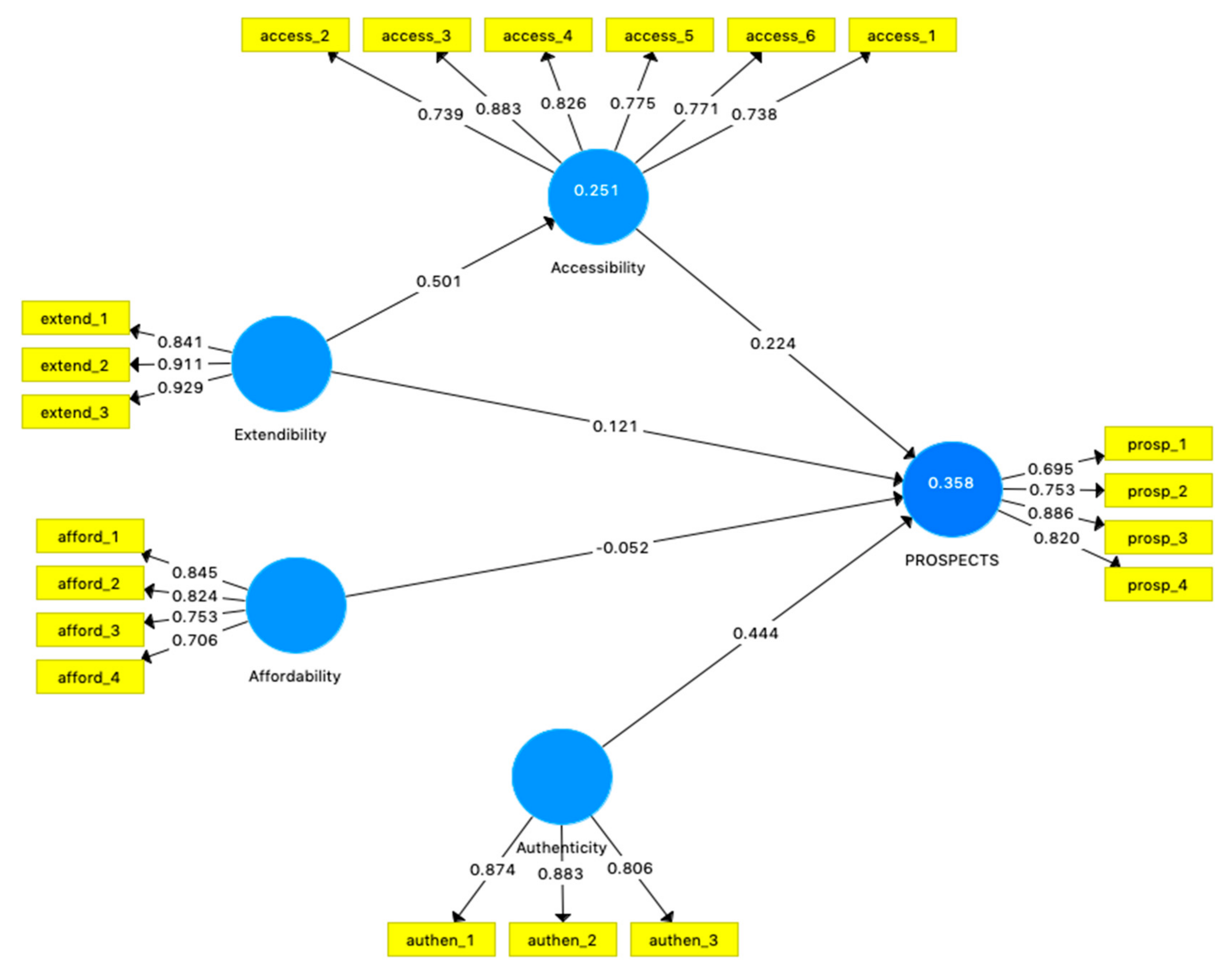

The path analysis revealed that H

1 accessibility had a positive significant effect on the

prospects for Islamic home finance in the UK. The standardised path coefficient for H

1 was (β = 0.224,

t-value = 3.277) and supported the relationship between

accessibility and the

prospects for the Islamic home finance in the UK. This result corroborates with previous studies [

7,

8,

64] that minorities are particularly vulnerable to access to finance, claiming that accessibility is a serious issue for potential Muslim customers and acts as a real impediment to the prospects for Islamic home finance. For anyone, being a homeowner is an important component of wealth acquisition that can increase one’s status and standing in a society. The lack of access to home finance to potential Muslim customers may significantly hinder their household wealth and aggravate the social exclusion of Muslims in the UK’s society [

65].

The findings of H

1 also confirm the arguments that the accessibility is one of the most important factors for British Muslims, especially for less affluent Muslims [

16,

22]. This result is also in line with the study [

5], which claimed that accessibility still presents a huge challenge for Islamic banks, especially when a quarter of the Muslim population possess no qualifications and lack financial literacy skills, with many struggling to comprehend the fundamental basics of Islamic home finance. This finding is discouraging for the UK government, which, despite its efforts to bring Islamic home finance into the mainstream sector, faces severe grassroot problems that are inherent within the Muslim market segment.

The second hypothesis, that

affordability has a positive significant effect on the

prospects for Islamic home finance in the UK, was not supported. Surprisingly, this finding contradicts the commonly held view that Islamic home finance is more expensive than conventional home financing. To date, the vast majority of studies have frequently claimed affordability as being one of the key impediments to the prospects for Islamic home finance in the UK. For example, studies [

7,

8], which surveyed Muslims’ perceptions of Islamic home finance suggested that broader social factors and lifestyle choices made by the Muslim community may have increased the demand for Islamic home finance products if they were priced at a similar or lower level than conventional home finance. Another study [

10] also discovered that while UK Muslims prefer Islamic finance to conventional banking, the high cost was a real cause for concern. In addition, a considerably wider-ranging survey also concluded that potential customers of Islamic home financing in the UK were deterred from proceeding due to the higher costs associated with it [

13]. Similar views were highlighted by secondary-based research claiming that Islamic home financing is notably more expensive than conventional home finance products in the UK [

66,

67].

The finding of the second hypothesis also opposes views that one of the greatest concerns for British Muslims is the inability to pay the higher initial deposit required by Islamic banks, arguing that higher cost is one of the main reasons for the low uptake of Islamic home finance among Muslims [

7,

5]. The path relationship between

affordability and the

prospects for Islamic home finance contradicts the widespread perception that Islamic home finance is expensive. This suggests that potential clients may be less concerned about the high costs associated with Islamic home financing than was previously believed. This positive shift could potentially enhance the prospects for Islamic home finance in the UK as previous studies [

7,

10,

13] indicated that high costs were a key factor. However, this change in perception has not been effectively communicated to potential customers as Islamic home finance products are still widely perceived as expensive. This finding presents an excellent opportunity for Islamic banks and policymakers to dispel this long-held misconception and improve the prospects for the industry in the UK market.

The standard coefficient of H

3,

authenticity, is found to have the strongest direct effect (β = 0.444,

t-value = 5.287;

p < 0.001) on the

prospects for Islamic home finance in the UK, thus supporting the proposed hypothesis. This finding endorses the findings of [

10,

27], that the most apparent fault of the Islamic home finance industry has been its failure, in the eyes of observant Muslims, to comply with the basic ethical principles of Islamic jurisprudence, which has added to the mistrust of Islamic home finance in the UK. This finding is alarming for Islamic banks in the UK as authenticity is regarded as a competitive advantage in the industry [

41]. However, it appears that these banks have not been able to effectively communicate the authenticity of their home finance products to the UK market. This poses a significant threat to the Islamic home finance sector in the UK, especially when authenticity is perceived as a major issue by industry experts. It is also surprising that, despite the fact that Islamic home finance largely avoided the sub-prime crisis and strengthened the relationship between financial stability and Islamic banking due to its focus on principles of partnership, transparency and fairness [

29], it is still struggling to gain trust not only among potential customers, but also among industry experts in the UK.

Hypothesis 4, that

extendibility has a positive significant effect on

accessibility, and Hypothesis 5, that the effect of

extendibility on the

prospects for Islamic home finance is mediated by the

accessibility, have both been supported by this research. This finding supports the view [

5] that the

extendibility of Islamic home finance has become a cause of concern for many potential UK customers, which is largely attributed to the careful risk appraisal and complexity involved in Islamic home finance. This issue is mainly due to the conservative approach taken by Islamic banks. Unlike conventional banks that are able to lend cash by borrowing from the wholesale money markets, Islamic finance is much more reliant on utilising its depositors’ savings accounts [

7,

8,

38]. Therefore, to fulfil its role as a partner rather than merely a lender, Islamic banks arguably assess risks more deeply, or certainly assess risks differently in a more personalised manner to effectively monitor the use of funds by borrowers for the mutual benefits of all stakeholders [

31]. There is no doubt that the double assessment of risk by both the financier and the borrower injects greater discipline into the system and restrains excessive lending and borrowing [

39], and that this principle safeguarded banks during the sub-prime crisis [

30,

31]. However, this rigid approach to business raises questions over the

extendibility of Islamic home finance, particularly in the UK market, which strongly affects the

accessibility of Islamic home finance (β = 0.501,

t-value = 6.46) and (

accessibility) in turn eventually affects the

prospects for Islamic home finance in UK. These findings pose an immense challenge for small Islamic banks with limited resources. On one hand, Islamic banks face a dilemma, for being restrictive makes Islamic home finance less extendible, while on the other hand small Islamic banks target the Muslim market, where one fourth of the population is financially illiterate and struggles to comprehend the fundamentals of Islamic home finance.

Hypothesis 4 can be linked to findings that found that many potential Muslim clients interested in home financing do not access it due to a perception that success may be difficult, because of the strict criteria applied by the Islamic banks [

8]. Hypothesis 4 also reinforces the view that the home finance process is overly complicated, thus placing the complex structure of Islamic finance beyond the understanding of customers who have previously lacked engagement with financial institutions or who may be financially illiterate [

68]. Similar support is argued that Islamic home finance is not only considered to be overly complicated, but can also be difficult to secure, raising questions over the

extendibility of Islamic home finance [

5]. This signifies that

extendibility acts as a key determinant to the

accessibility of Islamic home finance and also indicates that the effect of

extendibility on the

prospects for Islamic home finance is transmitted through

accessibility. In other words,

accessibility as a mediator plays an important underlying mechanism in the relationship between

extendibility and the

prospects for Islamic home finance. This has also been supported by the H

5 path relationship showing the significant indirect effect of

extendibility on the

prospects for Islamic home finance (

t = 2.763) via the

accessibility construct, while the relationship between

extendibility and

prospects was found to be statistically non-significant (

t = 1.096;

p > 0.05). In light of these findings, the study suggests that one possible solution for small Islamic banks in the UK is to simplify their products and expand beyond the minority Muslim market to a much wider market. This approach may enable them to increase their portfolio and reach a larger customer base, including those who may not be familiar with the principles of Islamic home finance.

With regard to Hypothesis 6, that experience will have a significant categorical moderating effect on the relationship among the model constructs, was also unexpectedly found to be insignificant across all relationships between the high- and low-experience groups. Thus, H6 was not supported. While the uniformity of the perceptions between experienced and novice mortgage brokers provides a more accurate assessment of Islamic home finance in the UK, it may be discouraging for Islamic banks as it suggests that the transformation, resilience and sustainability of Islamic home financing over the years have not led to any significant differences in industry experts’ opinions regarding its prospects in the UK. This finding highlights the need for Islamic banks to effectively communicate the authenticity of their products and the advantages they offer in order to gain the trust and support of industry experts, and ultimately potential clients.

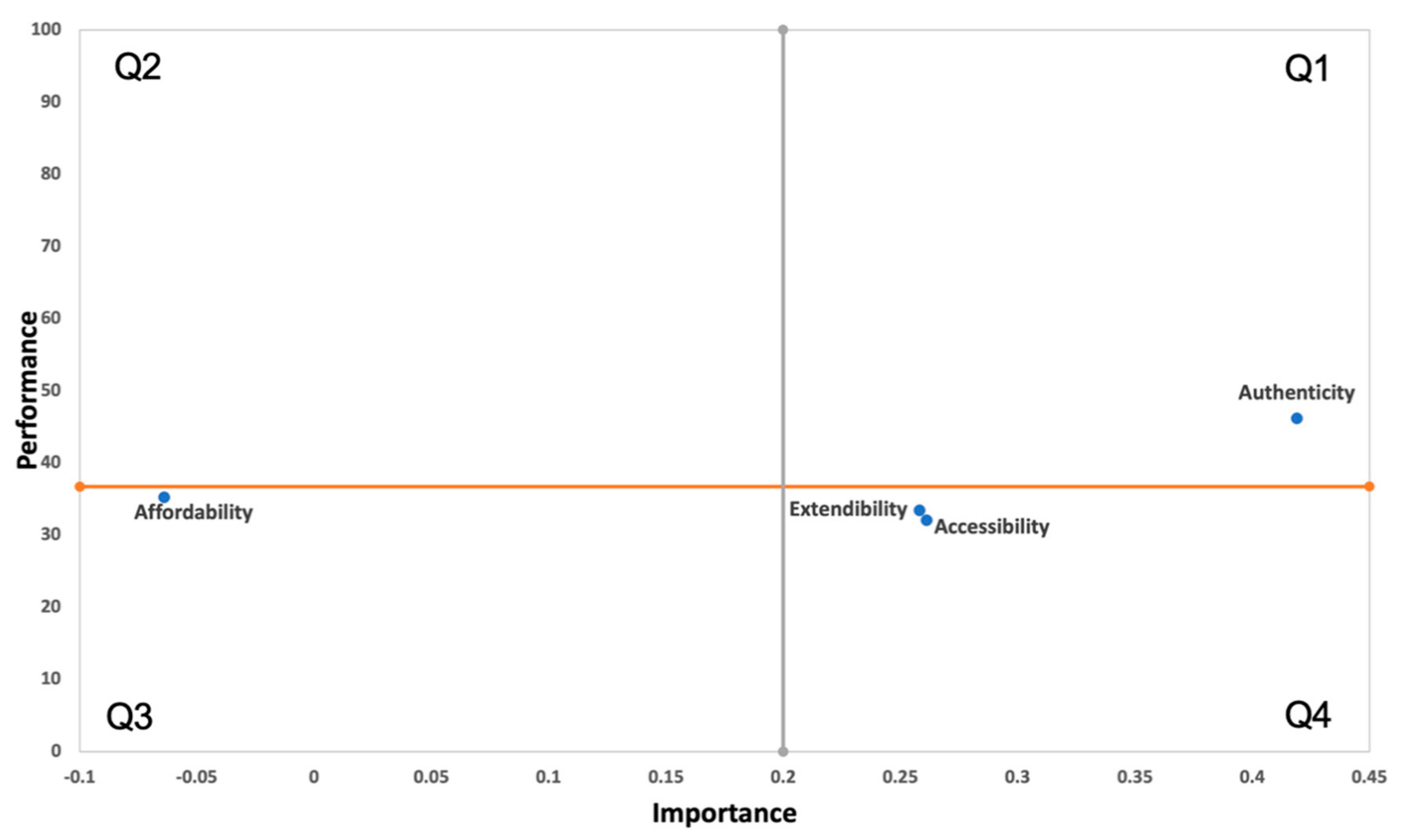

The study also conducted a post-hoc importance–performance matrix analysis (IPMA) to explore the performance and importance of each construct on the

prospects for Islamic home finance so that policymakers and key stakeholders can take appropriate actions. Interestingly, the

authenticity construct fell in Quadrant 1 of the IPMA plot (see

Figure 6). This demonstrates that the mortgage brokers attached particularly high importance (0.419) and relatively high performance (46.13) to the

authenticity of Islamic home finance, as compared to the other constructs. This is possibly a good sign for Islamic banks, as the industry’s experts believe that

authenticity performs relatively well against other constructs. It is also the most relevant factor to the

prospects for Islamic home finance. Based on this outcome, the policymakers should strive to preserve the

authenticity construct with continued investments, as this could offer a potential competitive advantage for Islamic home finance. The

accessibility and

extendibility constructs fell in Quadrant 4, ‘concentrate here’, the most critical area of the priority matrix. This means that these constructs were considered very important by the mortgage brokers (importance scores of 0.261 and 0.258, respectively), but with a lower average level performance (32.02 and 33.41, respectively). Any constructs situated in this quadrant are considered to be performing less well than expected, representing major deficiencies in the products offered and posing a serious challenge to their competitiveness. Thus, Islamic banks and policymakers should implement urgent corrective measures with the highest investment priority to improve the performance levels of

accessibility and

extendibility.

In contrast, the affordability construct landed in Quadrant 3, a low-priority area. This signifies that the mortgage brokers considered this construct to be of low priority in the current scenario, suggesting that the affordability of Islamic home finance is performing well and perceived as relatively unimportant by mortgage brokers. Despite this shift in mortgage brokers’ perceptions, potential clients may still perceive Islamic home finance as an expensive option. Therefore, it is important for Islamic banks, the financial community and policymakers to work together to educate potential clients about the true cost of Islamic home finance and the benefits it offers. This outcome also suggests that management or policymakers within Islamic banks should not place too much emphasis on affordability factors and should instead focus on other important constructs, such as extendibility and accessibility.

In summary, the above findings have sparked a fresh debate in the research community by providing a comprehensive and up-to-date assessment of the current state of Islamic home finance in the UK, taking account of the current financial environment. By diverging from previous customer-oriented literature that presented out-of-date, inconclusive and anecdotal evidence, this study offers a more robust and industry-driven assessment of the prospects for Islamic home finance in the UK market by involving mortgage brokers as industry experts. The examination of the impact of past events such as the sub-prime mortgage crisis and the transformation of Islamic home finance through the lens of mortgage brokers’ experiences as a moderator in this study represents a significant contribution to the field of Islamic home finance research. The application of advanced analytical techniques, such as PLS-SEM and IPMA, further adds to the originality and rigour of this study. The results from these analyses provide valuable insights for higher management of Islamic banks in the UK to align their marketing and strategic directions. The study also makes a substantial contribution to the existing literature by introducing a robust research framework and providing valuable insights for the research community, policymakers and Islamic banks in the UK.

The proposed research model should not be envisaged as an ultimate framework, but rather as a starting point towards an optimal framework. The constructs incorporated in the research model were derived from the literature—the researchers’ and experts’ opinions and logic that may not form a comprehensive set of constructs and may be expanded on by others. The findings of this study can also be cross examined and compared by employing different seasonal participants such as bankers, academics, property lawyers and scholars who are experts in the field of Islamic home finance. In addition, the proposed conceptual model might be applied (with relevant modifications) in other nations, especially those with similar demographic settings, i.e., Germany, France, Singapore, and the USA. Finally, although this study is up to date, the findings may vary due to the constantly changing economic and financial environment. In this case, further research would be needed in the wake of the fluctuating economic and financial events.