Abstract

The mid-term framework of global aviation is shaped by air travel demand growth rates of 2–5% p.a. and ambitious targets to reduce aviation-related CO2 emissions by up to 50% until 2050. Alternative jet fuels such as bio- or electrofuels can be considered as a potential means towards low-emission aviation. While these fuels offer significant emission reduction potential, their market success depends on manifold influencing factors like the maturity of the production technology or the development of the price of conventional jet fuel. To study the potential for adoption of alternative jet fuels in aviation and the extent to which alternative fuels can contribute to the reduction targets, we deploy a System Dynamics approach. The results indicate that the adoption of alternative fuels and therefore their potential towards low-emissions aviation is rather limited in most scenarios considered since current production processes do not allow for competitive prices compared to conventional jet fuel. This calls for the development of new production processes that allow for economic feasibility of converting biomass or hydrogen into drop-in fuels as well as political measures to promote the adoption of alternative fuels.

1. Introduction

Today, air transport accounts for approximately 12% of transport-related and 2% of all human-induced CO2 emissions [1]. Due to the expected growth of air travel demand of 2–5% p.a. [2,3], CO2 emissions from aviation are projected to triple by 2050 compared to today’s level unless substantial efforts are made to reduce the environmental impact of aviation [4]. For that reason, the International Air Transport Association (IATA), for instance, strives to improve fleet-wide fuel efficiency by 1.5% p.a. from 2009 to 2020, cap net emissions from 2020 (carbon-neutral growth) and reduce net emissions by 50% until 2050, relative to 2005 levels [1,5]. As a consequence, airlines are forced to modernize their fleet either by replacing old aircraft or by retrofitting new fuel-efficient airframe and engine technologies (e.g., blended winglets, geared turbofan) into existing aircraft of the fleet [6,7]. However, fulfilling the emission reduction targets solely by fleet modernization will not be possible and even approaching them would be a substantial economic burden for airlines as long as aircraft are purely powered by conventional jet fuels [4,5,6,8].

Alternative jet fuels produced from biomass or hydrogen from electrolysis powered by renewable electricity have received considerable attention as a potential means towards low-emission aviation [8,9,10]. For biofuels, five different production pathways have already been certified for use in current aircraft engines by the American Society for Testing and Materials (ASTM) International as drop-in alternative fuels. The resulting variety of feedstock (e.g., corn grain, soybean oil, cellulosic biomass) and conversion processes affect the mitigation potential of these alternative fuel types significantly. Biofuels that are based on cellulosic biomass, for instance, allow for a reduction of lifecycle CO2 emissions by up to 80% compared to petroleum-derived fuels [8,11]. However, the large land areas that are required to grow biomass as well as additional resources such as water and fertilizer pose an obstacle for the rise of biofuels in aviation. Electrofuels are a promising alternative to resolve these issues since they only rely on renewable electricity, water, and CO2 that can be obtained from concentrated sources or extracted from the air as main constituents. Over the entire life cycle, the CO2 mitigation potential of electrofuels from renewable electricity and CO2 is estimated to range between 70% and 87% compared to petroleum-derived fuels [8,12,13,14].

In contrast to operational and technological improvements, alternative jet fuels are not yet available on a commercial scale since production costs are much higher than those for conventional jet fuels [9,15]. One of the main challenges to ensure the market success of alternative jet fuels is thus to allow for an economically feasible conversion of biomass or hydrogen from electrolysis into drop-in alternative fuels. For that, the maturity of the production technology, the available production capacities, the price development of conventional jet fuel, as well as the air travel and jet fuel demand can be considered as main determinants. Due to these manifold influencing factors, understanding the forces of successfully introducing alternative fuels in aviation is a complex challenge. To this end, a model that allows for adequately investigating the evolution of the market share of alternative jet fuel is required. Such a model must depict the behavior of the different actors of the air transport system (ATS), i.e., passengers, airlines, airports, aircraft manufacturers, and fuel producers. Moreover, the structure of the ATS including all relevant influencing factors, interdependencies, and feedback loops that affect the adoption of alternative jet fuels have to be taken into account.

System Dynamics is a simulation approach that allows for the study of dynamic complex systems such as the ATS. In the past, several System Dynamics models have been developed to simulate the aggregated and endogenous behavior of the ATS. Causes and strategies to manage aviation’s cyclical behavior are examined by Pierson and Sterman [16], Liehr et al. [17], and Weil [18]. Lyneis and Glucksman [19] evaluate the inclusion of feedback for simulation-based forecasts and Kleer et al. [20] study different pricing strategies for aviation. Pfänder et al. [21] focus on tradeoffs between fleet technology and policy alternatives. Urban et al. [22] study the development of the air transport demand as well as the required fleet size under consideration of the main interactions between passengers, airlines, airports, and aircraft manufacturers. Only one System Dynamics model by Sgouridis et al. [23] evaluates alternative jet fuels as a means to reduce aviation emissions. However, this model assumes an exogenous development of alternative jet fuel availability instead of integrating the development of the production technology into the modeling approach. In addition to these System Dynamics models, several techno-economic studies have been carried out to assess the potential of alternative jet fuels [5,9,12,13].These studies only consider the production costs of alternative fuels and neglect important factors of the ATS that affect the adoption of alternative fuels in the aviation sector and their potential towards low-emission aviation.

The objective of this paper is thus to thoroughly investigate the adoption of alternative jet fuels and assess their potential towards low-emission aviation from the perspective of the ATS. In particular, we are interested in answering the following two questions: (1) What is the potential for adoption of alternative jet fuels in aviation? (2) To which extent can alternative fuels contribute to the air transport industry’s reduction targets?

To answer these questions, we deploy a System Dynamics model of the ATS. Based on existing simulation models, we develop a novel approach that includes the main actors of the ATS, namely passengers, airlines, aircraft manufacturers, as well as producers of alternative jet fuels. Uncertainties inherent to our study are addressed by defining alternative future scenarios for the development of the ATS and conducting sensitivity analyses as well as Monte Carlo simulations. The contribution of our work is twofold. First, we extend existing System Dynamics models from the literature by integrating feedback loops related to the production of alternative jet fuels, resulting in a novel System Dynamics model of the ATS. Second, by applying the model, a better understanding of possible obstacles for the introduction of alternative fuel types as well as the potential of alternative fuels towards low-emission aviation is gained taking into account relevant endogenous system behavior. This facilitates, amongst others, the development of suitable policy measures to accompany the introduction of alternative jet fuels for decision makers from policy.

The remainder of the paper is organized as follows: We describe the concept and mechanisms of the System Dynamics model in Section 2, continue by specifying the database, validating the model, and presenting and discussing the results of our simulation study in Section 3, and finally summarize our findings and give directions for further research in Section 4.

2. Modeling Approach

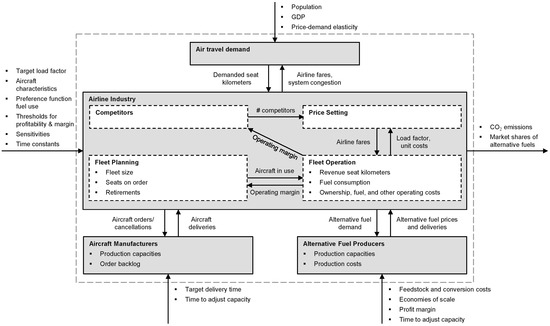

The System Dynamics model of the ATS consists of four modules, namely air travel demand, airline industry, aircraft manufacturer, and alternative fuel producers. Between these modules several interdependencies exist, which mainly determine the endogenous behavior of the ATS and thus also the adoption of alternative jet fuels in aviation. Moreover, the behavior is influenced by several exogenous parameters (cf. Figure 1).

Figure 1.

Concept of the simulation model.

In a nutshell, air travel demand depends on the external development of the gross-domestic product (GDP) and population as well as endogenous effects due to price elasticity of demand and system congestion. Based on the development of travel demand, the airline industry adjusts the necessary fleet sizes (long-term decision) as well as the airline fares (short-term decision). Decisions on the fleet size are additionally influenced by the operating margin, which is determined under consideration of aircraft ownership, fuel, and other operating costs. The operating margin also has an impact on the number of competitors entering or exiting the market. In turn, the number of competitors exhibits an influence on the price setting. The same holds true for the load factor and the unit costs of operating the aircraft fleet per revenue seat kilometer. In order to adjust the fleet size, aircraft orders can be placed. These orders are fulfilled by the aircraft manufacturers taking into account production capacities and delivery delays in the supply chain. Together with the average fleet age, the fleet size constitutes the central determinant for fuel consumption and thus aviation’s CO2 emissions. The CO2 emissions further depend on the market shares of alternative jet fuels and their mitigation potential. The adoption decision of the airline industry is influenced by the price difference between alternative and conventional jet fuels as well as supply capacities and mandatory drop-in quotas. The price and production capacities for alternative jet fuels are adjusted by the alternative fuel producers due to changes in fuel demand as well as feedstock and conversion costs.

In the following, the four modules are described in detail. Thereby, the modules depicting the customer demand, the behavior of the airline industry, and the aircraft manufacturers are in particular based on previous work by Pierson and Sterman [16]. This work is extended by taking into account dynamic manufacturing capacities for aircraft, a detailed breakdown of aircraft costs, the influence of competition on airline fares, and decisions regarding the production and adoption of alternative jet fuels.

2.1. Air Travel Demand

The module depicting the air travel demand is based on the work of Pierson and Sterman [16]. Air travel demand depends on the population size , a reference demand per capita , which corresponds to the initial demand per capita, the gross domestic product per capita , the airline fares , and the system congestion .

While the population is exogenously given, effects of gross domestic product, airline fares, and system congestion are determined within the model. The effect of system congestion , modeled by the load factor, is accounted for by comparing the current load factor to the perceived load factor . Since passengers perceive the current load factor with a delay , a first-order smooth function is used. Additionally, the ratio of perceived to reference load factor is smoothed to take into account that passengers change their flying habits due to congestion with some delay. The effects of gross domestic product and airline fares are captured similarly, albeit without smoothing.

and indicate the sensitivities of demand to gross domestic product, airline fares, and congestion, respectively.

2.2. Airline Industry

The modeling of the order behavior of airlines is based on a standard stock management structure and similar to the model used by Pierson and Sterman [16]. Both stocks (aircraft orders and fleet capacity ) are measured in seats, assuming a constant flight distance per seat. Airlines place aircraft orders at the order rate . Aircraft in use are discarded after a fixed lifetime . The indicated order rate is based on the desired acquisition rate , the supply line adjustment , expected growth rate , and aircraft returning into service .

The desired acquisition rate is the sum of retirements , adjustments for capacity , and capacity growth adjustment . The adjustment for capacity is given by the difference between the desired capacity and the aircraft in use divided by the time to adjust capacity . The desired capacity is based on estimated demand taking into account the airlines’ target load factor .

Similarly to the adjustment for capacity, the adjustment for supply line is given by the difference between the desired supply line and seats on order divided by the time to adjust supply line . The desired supply line is estimated using Little’s Law by multiplying estimated delivery time and desired acquisition rate [24].

A desired acquisition rate solely considering current demand and supply line delays would yield a steady state error in the case of exponential growth [16]. In the present study, airlines are assumed to consider demand growth, which is taken into account by two growth adjustment factors, and . They are calculated by the product of seats on order or aircraft in use , estimated growth rates , and a weighting factor .

The constant allows for partial consideration of demand growth rates. Estimated growth rates are calculated by a standard trend function [24].

The standard stock management structure is extended by order cancellations and the possibility to store aircraft. Aircraft seat orders are canceled at rate if the indicated order rate falls below zero. The cancellation rate is the minimum of the indicated order rate and the seats on order divided by the time to cancel an order .

Airlines can shift seats between the stocks aircraft in use and aircraft in storage at the rates into storage and return into service . The rate into storage is given by the minimum of the indicated order rate and the aircraft used divided by the time it takes to store an aircraft if is below zero and the operating margin is below the reference margin . The return rate into service is similarly given by the aircraft used divided by the time it takes to put an aircraft into service again if the indicated order rate is above zero.

Airline unit costs are broken down into three different components: aircraft ownership costs, fuel costs, and other operating costs. Aircraft ownership costs represent cost components independent of the aircraft utilization, e.g., depreciations and insurances. Fuel costs relate to the sales prices of conventional and alternative jet fuels. Other operating costs sum up remaining cost components related to, e.g., flight crews, landing fees, and administrative costs. The development of these cost components is modeled using coflow structures [24]. This allows for differentiation between cost components that depend on the number of aircraft in use (fuel and other operating costs) and cost components that depend on the total number of aircraft, regardless of whether these aircraft are used or stored.

The fleet’s fuel use per kilometer increases with deliveries of new aircraft and decreases with retirements of used aircraft . Thereby, the fuel consumption of new aircraft is set to a reference value at the start of the simulation and assumed to decrease over time due to technology improvements . In order to derive the annual fuel use of the airlines , the fleet’s fuel use is divided by the average yearly flight distance per seat .

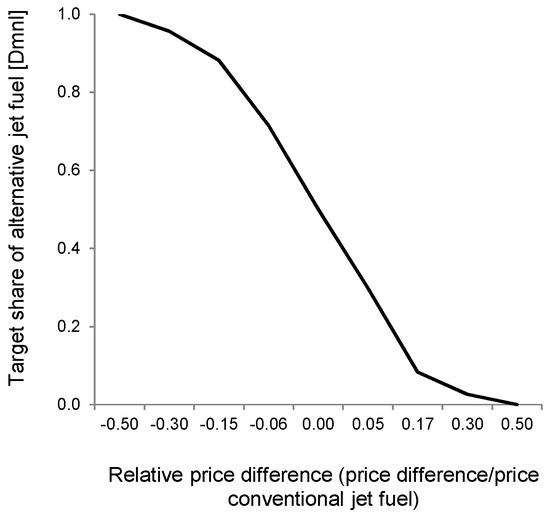

The airlines’ decision behavior with regard to use of alternative fuels relies on a cost comparison. For both fuel types, the sales price is calculated on a per liter basis and compared. As soon as alternative fuels provide a cost advantage against conventional jet fuels, they are preferred. In reality, the sales prices of fuels will differ for each airline due to regional price differences. This effect is included by using a table function which represents a continuous change in the preference function for one fuel type instead of a binary step (“either-or”, [24]). Figure 2 depicts the effect of relative price difference on the target share of alternative fuels .

Figure 2.

Table function for the effect of relative price difference between conventional and alternative fuel on target share of alternative jet fuel.

Based on the total annual fuel consumption , the target share of alternative fuels , a predefined drop-in quota for alternative fuels , and the available production capacity for alternative fuels , the annual consumption of alternative jet fuels is determined. From this, the annual emissions are computed, taking into account the mitigation potential of alternative jet fuels and an emission index for conventional jet fuels .

Also, the modelling of the airline industry’s pricing mechanism is closely related to the work by Pierson and Sterman [16]. We assume that airlines use an anchoring-and-adjustment heuristic to determine appropriate fares [24,25]. The airline fares adjust to a reference level as a goal-seeking process with adjustment time .

Current airline fares form the anchor to estimate the reference airline fares . The fares are adjusted to cost changes, competition, and load factors. The adjustment for cost changes calculates a minimum airline fare by correcting unit costs for a minimum profitability and the perceived load factor . The latter is included to consider that it takes airlines some time to measure the actual load factor. The adjustment factor for competition describes how airline fares change if the number of airline competitors changes compared to an initial reference value . We assume that fares are reduced if the number of competitors increases and vice versa. The adjustment factor for load factors captures the behavior of airlines to increase the load factor by means of yield management. That is, if the perceived load factor is below the target value , airline fares are reduced in order to increase the load factor. The parameters , and indicate the sensitivities of airline fares to unit costs, competition, and load factors, respectively.

The change of the number of competitors can be described by the airline market entries or exits , which depend on the effect of the operating margin and the time to launch or close an airline . The effect of operating margin consists of the ratio of the current operating margin and a reference margin above which airlines are expected to enter the market. The parameter represents the sensitivity to the effect of operating margin. Since it is greater than zero, operating margins above the reference margin will cause higher competition and vice versa.

2.3. Aircraft Manufacturer

The aircraft manufacturer module depicts how the manufacturing capacity for new aircraft evolves over time in response to sudden changes of aircraft order backlogs as they occur frequently. In our model, we assume that these sudden changes significantly influence aircraft manufacturing capacity leading to shifts in aircraft delivery times. is modeled as a goal-seeking process in which aircraft manufacturers seek to achieve a certain target delivery time . Hence, the target manufacturing capacity can be estimated by dividing the actual backlog by the target delivery time . The difference between current manufacturing capacity and target manufacturing capacity divided by the time to adjust manufacturing capacity yields the manufacturing capacity change rate.

2.4. Alternative Fuel Producers

One of the main challenges for alternative jet fuels is the economic feasibility of converting biomass or hydrogen from electrolysis into drop-in alternative fuels in order to ensure low costs [9,15]. Currently, production capacities are too low to supply relevant amounts of fuel and production costs are too high to compete with conventional jet fuel. If production capacities increase, economies of scale reduce the costs of alternative fuels. This effect is depicted by the module of the production of alternative fuels. The production capacity of alternative fuels is modeled by first-order goal-seeking behavior, which adjusts to a target production volume . This target volume is equal to the demand for alternative fuels. The time to adjust production capacity causes a constant delay, which takes into account the time required to install or expand capacities for the production of alternative fuels.

Economies of scale depend upon the ratio of the initial production capacity , which is taken as a reference value, the current production capacity , and the degression exponent , which aggregates effects due to capital costs, learning, and plant operation and depends on the used technology [13,14].

The costs of alternative fuels are subdivided into conversion and resource costs and , respectively. Conversion costs comprise costs of components due to plant installation and operation while resource costs comprise the costs of the feedstock used. Thus, only conversion costs are subject to economies of scale. Both fuel types are influenced by the consumer price index in order to account for inflation. The sum of conversion and resource costs subtracted by financial incentives per liter constitutes production costs . Based on the profit margin , the sales price of alternative fuels can be determined.

3. Validation and Computational Results

3.1. Data Base and Simulation Set Up

The system of ordinary differential equations described in Section 2 is implemented in the software Vensim DSS 6.2 (Ventana Systems, Harvard, MA, USA). Since the high shares of international and intercontinental flights create difficulties in defining consistent regional boundaries, a global framework is chosen for the simulation experiments. All simulation runs start in 1991 because no structural changes to the ATS have been indicated since liberalization took place in the early 1990s. In order to capture each of the IATA targets, simulations end in 2050. Alternative jet fuels are assumed to become available on a commercial scale from 2020 onwards. For the numerical integration of the differential equations, Euler-integration method with a time step of 0.015625 years is applied.

The data base for the simulation experiments is compiled from publicly available sources. Airline unit costs are estimated by means of an approach described by Liebeck et al. [26]. Their development is determined under consideration of improvements in operational and fuel efficiency as well as the development of the CPI and the price for conventional jet fuels. The improvement rate for operational and fuel efficiency is set to 1.5% per year according to the IATA reduction targets and in line with historic improvement rates [15]. Time series data related to the development of conventional jet fuel price, population, GDP per capita, and CPI is based on information from the Energy Information Administration (Washington, DC, USA) [27], United Nations (New York, NY, USA) [28], and World Bank (Washington, DC, USA) [29,30], respectively. Moreover, many parameters of the model are calibrated as these parameters are either not directly observable or cannot be obtained from scientific literature with sufficient accuracy. To this end, time series of demand taken from Boeing (Chicago, IL, USA) [31,32,33], of load factors taken from ICAO (Montreal, QC, Canada) [34], of operating margins taken from Sgouridis [35], and of aviation emissions taken from IATA (Montreal, QC, Canada) [36] are used.

Calibration followed a two-step procedure. First, data ranges were obtained from scientific literature wherever possible. The parameters were then calibrated within these ranges to minimize the differences between historic data and model output by means of maximum-likelihood estimation. For this step, a timeframe from 1991 to 2007 was chosen, which allows for the inclusion of an ex-post forecast during validation. Six variables were used for calibration, i.e., aircraft in use, annual aviation emissions, demand, load factor, operating margin, and airline fares. The resulting set of parameter values can be considered to be consistent with other studies, causes plausible model behavior, and does not interfere with physical laws. For that reason, we believe that the calibrated values are appropriate for the purpose of our study.

In order to take into account uncertainties when investigating the adoption of alternative jet fuels and assess their potential towards low-emission aviation, the following input parameters are systematically altered in the simulation model: feedstock costs of alternative jet fuels, conversion costs of alternative jet fuels, time to adjust production capacity for alternative jet fuels, mitigation potential of alternative jet fuels, drop-in quota for alternative jet fuels, and growth factor of conventional jet fuel prices. Biofuels as well as electrofuels are considered. Table 1 gives an overview of all relevant parameters and value ranges.

Table 1.

Selection of parameters related to the adoption of alternative jet fuels that are altered in the simulation experiments.

Conversion and feedstock costs for biofuels were derived from Schäfer et al. [5]. The feedstock costs depend on the biomass used for the production of alternative jet fuels, ranging from low-cost biomass waste to expensive plantation wood. Also, the mitigation potential of biofuels differs amongst the alternative feedstock as indicated by the German Environment Agency [8]. For electrofuels, the cost factors stem from Moser et al. [37]. Here, feedstock costs are heavily influenced by the energy prices, which are assumed to range between 0.0 €/L (excess energy free of charge) and 0.15 €/L. Regarding the mitigation potential of electrofuels, it is assumed that production fully relies on renewable energies. The drop-in quota is based on several types of alternative fuels that have been certified according to ASTM D7566 (standard specification for aviation turbine fuels) [8]. The time to adjust production capacity for alternative jet fuels is derived from a production start-up schedule for renewable jet fuels given in de Jong et al. and varied in order to take into account uncertainties [38]. Similarly, uncertainties related to the development of conventional jet fuel prices are taken into account by varying prices to grow at different growth rates of their past average.

The System Dynamics model including the required data file is provided in the Supplementary Materials.

3.2. Model Validation

Several validation tests following procedures suggested by Forrester and Senge [39] and Sterman [24] were performed. Based on tests of the model structure, we ensured that the structure of the model corresponds to its real-world counterpart and that system boundaries are chosen adequately. This is in particular given since the structure follows existing model structures of the ATS (cf. Section 2) that can be found in the scientific literature. Relevant feedback loops and influencing factors related to the adoption of alternative jet fuels are modeled at an appropriate aggregation level. The same holds true for the model parameters and parameter values. For each parameter a real-world correspondence can be identified and the values are in line with findings reported in literature and what is known from industry (cf. Section 3.1). Moreover, the model is consistent with regard to its dimensionality, it shows plausible behavior for extreme conditions, and it was is successfully tested against integration errors.

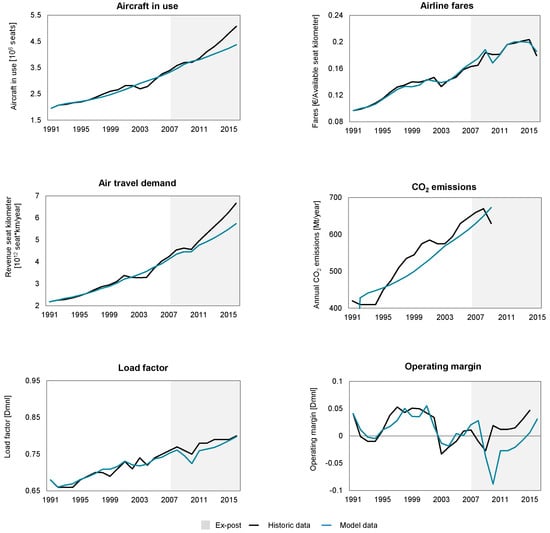

Regarding the model behavior, the model allows to reproduce modes of behavior that can be observed in the ATS. For instance, the model exhibits cyclical behavior when disturbed from equilibrium state by a sudden demand decrease of 25%. Cyclical dynamics are a very typical characteristic of the ATS [17]. Moreover, the model is able to reproduce historic system behavior that is of particular interest for the purpose of our study. That is, the ex-post timeframe from 2007 to 2016 of the variable used for calibration (cf. Section 3.1) is consistent with historic data (cf. Figure 3). For these variables, we additionally applied Theil inequality statistics [24] to identify the sources of error when comparing the historic data with the model behavior from 1991 to 2016. The results of this test reveal that most of the error is rather unsystematic with regard to the model purpose. Only the statistics for CO2 emissions indicate a higher degree of systematic error (cf. Table 2). This error, however, is of minor importance for the model purpose since the simulated emissions reveal the same trend as the historic data.

Figure 3.

Comparison between model behavior and historic development for aircraft in use, airline fares, air travel demand, CO2 emission, load factor, and operating margin.

Table 2.

Theil inequality statistics to compare model behavior with historical data between 1991 and 2016.

Because alternative jet fuels have not been produced and used at a commercial scale so far, the corresponding model variables cannot be obtained by means of model calibration methods. Additionally, the long-term horizon of this simulation study leads to high uncertainties with regard to the development of important exogenous influencing factors. For that reason, we also conducted sensitivity analyses. The results indicate that especially external factors such as economic growth rates, feedstock costs and the mitigation potential of alternative fuels, as well as the time required to adjust fuel production capacities have a substantial influence on the model behavior. Overall, the model reveals a high degree of numerical sensitivity, while it can be considered robust in terms of behavior mode sensitivity [40]. The high uncertainty regarding the future development of the ATS is also reflected by other studies, e.g., the CONSAVE scenarios (Constrained Scenarios on Aviation and Emissions) [41]. Thereby, our simulation results regarding the development of emissions and demand levels in the ATS lie within the range of forecasts of these studies.

Based on the conducted validation tests, we are confident that the model can be used to gain new insights with regard to adoption of alternative jet fuels and their potential towards low-emission aviation. In order to take into account the uncertainties associated with the development of external influencing factors, we will make use of Monte Carlo simulation and sensitivity analyses in the following simulation experiments. Moreover, different scenarios of the development of the ATS will be analyzed.

3.3. Simulation Experiments and Discussion

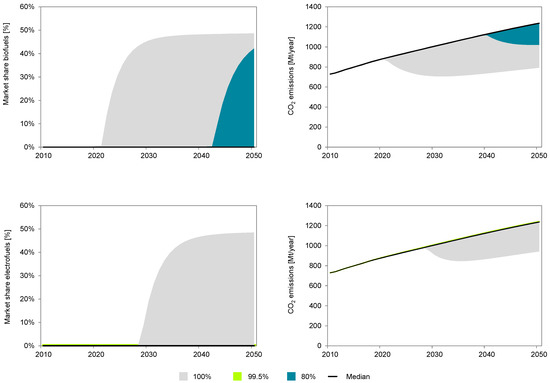

Various simulation experiments are carried out in order to answer the two research questions raised in the introduction. The first question addresses the potential for adoption of alternative jet fuels in aviation while the second question is concerned with the extent to which alternative fuels can contribute to the CO2 emissions reduction targets for the aviation sector. First, a Monte Carlo simulation with 1000 runs is conducted. During the Monte Carlo simulation, the values of feedstock costs, mitigation potential, time to adjust capacity, and the growth factor of conventional jet fuel prices are varied within the ranges reported in Table 1. The values for biofuels are varied using a uniform distribution. For electrofuels, time to adjust capacity and the growth factor of conventional jet fuel prices are also varied using a uniform distribution while a triangular distribution (with a peak at 1.67 €2012/L [37]) is used to vary feedstock costs. The mitigation potential of electrofuels is not varied, assuming that electricity from renewable sources is used and thus no emissions are caused by production (cf. Section 3.1).

As outlined in Section 1, several institutions and organizations have set ambitious targets to mitigate CO2 emissions from air transport such as a reduction of net emissions by 50% until 2050, relative to 2005 levels as proposed by IATA. The results of the Monte Carlo simulation in Figure 4 indicate that achieving this target will require further mitigation measures since alternative fuels, if at all, only allow for decoupling air travel demand and CO2 emissions for a limited time span. Even the largest reduction of CO2 emissions, observed for the case of biofuels in our simulation study, only allows to reduce emissions to approximately 710 Mt/year between 2030 and 2035, which is still an increase of approximately 13% compared to 2005 emissions (630 Mt/year), followed by an increase to 2014 levels until 2050. The increase in emissions is due to an increase in demand of 280% between 2016 and 2050, which is in line with forecasts from the CONSAVE scenarios (cf. Section 3.2). One of the main reasons for the limited mitigation potential is the drop-in quota of alternative fuels, which is limited to 50% and thus restricting the possible market share. In order to improve the mitigation potential, options to increase the drop-in quota should be explored by engine manufacturers as well as certification authorities.

Figure 4.

Results of the Monte Carlo simulation for biofuels (top) and electrofuels (bottom). Grey areas indicate 100%, green areas 99.5%, and blue areas the 80% of simulated values, which are closest to the median (black line).

When comparing the adoption for the two investigated types of alternative fuel, it can be seen that biofuels have an advantage over electrofuels, i.e., biofuels gain market shares more often and also at an earlier point in time than electrofuels. This is mainly due to the lower feedstock costs of biofuels compared to electrofuels. Current production processes for electrofuels require significant amounts of electricity and are therefore highly dependent on the electricity price. Even moderate increases of the electricity price lead to significant cost benefits of biofuels over electrofuels. In order to exploit the higher mitigation potential of electrofuels, new production processes that are more energy-efficient should be developed. The relevance of such processes is further underlined as electrofuels do not rely on biomass that requires large areas of land and has to be transported to the production facilities. Instead, hydrogen from water electrolysis can be supplied easily for the production of electrofuels. Thus, especially in areas where biomass has to be transported over long distances or the area to cultivate biomass is very limited, electrofuels are a promising alternative, provided that economically feasible production processes exist.

Since the results of the analysis suggest that biofuels provide a higher potential towards low-emission aviation, this fuel type is further investigated. To this end, three different scenarios are defined, namely a baseline scenario, a scenario favoring alternative fuels (pro alternative) and a scenario favoring conventional fuel (pro conventional). The scenarios differ in the values of the mitigation potential of biofuels, the growth factor of conventional jet fuel, the time to adjust capacity, and the feedstock cost, as reported in Table 3.

Table 3.

Parameter values that define the three scenarios considered in the analysis of biofuels.

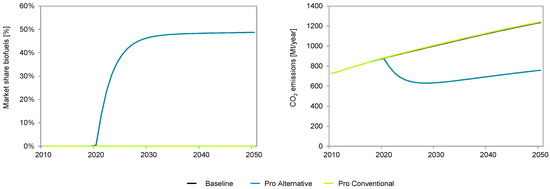

The pro alternative scenario is the only setting where biofuels gain market shares (cf. Figure 5). Thus, a contribution of alternative fuels towards reducing CO2 emissions from aviation can only be achieved if the general conditions favor biofuels significantly. This requires very low feedstock costs that can only be realized if biomass is obtained from waste and if the available amount of biomass from this source suffices to satisfy fuel demand from the aviation sector. Additionally, a high growth rate of the price of conventional jet fuel is necessary for biofuels to gain substantial market shares. Provided that market shares are gained, the reduction of CO2 emissions as shown in Figure 4 can only be realized if the mitigation potential of biofuels is high. Since the adoption of biofuels requires them to be produced from waste to ensure low feedstock costs, a high mitigation potential can be achieved.

Figure 5.

Market shares and CO2 emissions for biofuels for the baseline (black), pro alternative (blue), and pro conventional (green) scenario.

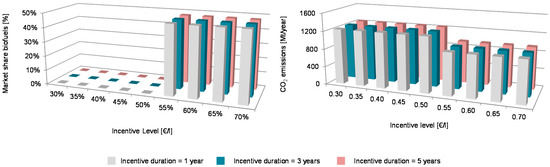

In order to trigger demand for biofuels in a less favorable setting, incentives are required. To study the effect of incentives on market shares of biofuels and CO2 emissions from aviation, we introduce an incentive on the production costs (incentive level in €/L) of biofuels for a predefined time period (incentive duration) in the baseline scenario. A full factorial simulation experiment is conducted to study all combinations of incentive level (step size of 0.05 €/L) and duration (step size of 1 year). The results of this experiment are shown in Figure 6. It can be seen that an incentive level of 0.55 €/L is required to trigger demand for biofuels. A further increase of the incentive does not result in additional demand in 2050. The same holds true for the incentive duration. An incentive that supports biofuels for one year is sufficient as an extension of the duration does not result in additional market shares. This underlines the importance of political measures to steer the development of the aviation sector. Such measures are currently explored (e.g., Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) as proposed by IATA) or already implemented (e.g., inclusion of the European aviation sector in the European Emission Trading System (ETS)).

Figure 6.

2050 levels of market shares and CO2 emissions for biofuels for different incentives levels and an incentive duration of one year (grey), three years (blue), and five years (red), respectively.

4. Summary

In this paper, a System Dynamics model of the ATS has been developed in order to investigate the adoption of alternative jet fuels in aviation and their potential towards low-emission aviation. Real-world data is used to calibrate the model by means of maximum-likelihood estimation methods, to thoroughly validate the model, and to conduct Monte Carlo simulations as well as scenario and sensitivity analyses. Based on the simulation experiments, we show that the adoption of alternative fuels is rather unlikely for the currently certified production pathways. These pathways do not allow for competitive prices compared to conventional jet fuel, which holds especially true for electrofuels. In contrast, high growth rates of conventional jet fuel prices, short durations to increase production capacities, and monetary incentives are identified as the main drivers for the adoption of alternative jet fuels. Even if alternative jet fuels are adopted, their potential to achieve long-term reduction targets for aviation is limited, which is especially due to existing restrictions regarding the blend of alternative jet fuels with conventional jet fuel. The results emphasize the need for the development of new production pathways that allow for a more efficient conversion of biomass or hydrogen into drop-in fuels. Additionally, the application of policy measures seems to be a promising measure to promote the adoption of alternative fuels.

One limitation to our study is that we do not take into account constraints on the availability of the feedstock, which is especially important for biofuels. The same holds true for the impact of an increase in biofuel demand on land use changes and transport distances between biomass sources and conversion facilities. Including these results would most likely further limit the adoption of alternative jet fuels and their potential towards low-emission aviation. Future research should investigate these effects in more detail. Integrating aspects of fuel availability at the airports would be another way to extend the model. Additionally, the decisions of fuel producers concerning the deployment of production facilities for alternative jet fuels, of airlines concerning the adoption of alternative jet fuels, and of policymakers concerning the application of policy measures could be modeled and analyzed in more detail. With regard to the passengers, the influence of more sustainable fuels on the willingness to pay and, thus, overall demand for alternative jet fuels might be a promising way to extend the scope of the model.

Supplementary Materials

The following are available online at www.mdpi.com/1996-1073/11/1/186/s1. The System Dynamics model including the required data file.

Acknowledgments

We would like to acknowledge the support of the Ministry for Science and Culture of Lower Saxony (Grant No. VWZN3177) for funding the research project “Energy System Transformation in Aviation” in the initiative “Niedersächsisches Vorab”.

Author Contributions

Gunnar Quante developed the main parts of the System Dynamics model of the air transport system, gathered most of the data, and collected the literature of existing System Dynamics models that are related to the subject of this paper. Karsten Kieckhäfer and Christoph Müller performed the simulation experiments, analyzed the results, and wrote the majority of the paper. Matthias Lossau and Wolfgang Jonas contributed to the development of the investigated scenarios. Thomas Spengler contributed by drafting and critical revisions.

Conflicts of Interest

The authors declare no conflict of interest. The founding sponsors had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, and in the decision to publish the results.

References

- ATAG. Facts & Figures. Available online: http://www.atag.org/facts-and-figures.html (accessed on 16 March 2017).

- Airbus. Global Market Forecast—Growing Horizons 2017/2035. Available online: http://bit.ly/2zGgJT9 (accessed on 25 July 2017).

- Meleo, L.; Nava, C.R.; Pozzi, C. Aviation and the costs of the European Emission Trading Scheme: The case of Italy. Energy Policy 2016, 88, 138–147. [Google Scholar] [CrossRef]

- Kharina, A.; Rutherford, D.; Zeinali, M. Cost Assessment of Near- and Mid-Term Technologies to Improve New Aircraft Fuel Efficiency. 2017. Available online: http://bit.ly/2heQg43 (accessed on 8 November 2017).

- Schäfer, A.W.; Evans, A.D.; Reynolds, T.G.; Dray, L. Costs of mitigating CO2 emissions from passenger aircraft. Nat. Clim. Chang. 2016, 6, 412–417. [Google Scholar] [CrossRef]

- Müller, C.; Kieckhäfer, K.; Spengler, T.S. The influence of emission thresholds and retrofit options on airline fleet planning: An optimization approach. Energy Policy 2018, 112, 242–257. [Google Scholar] [CrossRef]

- Cansino, J.M.; Román, R. Energy efficiency improvements in air traffic: The case of Airbus A320 in Spain. Energy Policy 2017, 101, 109–122. [Google Scholar] [CrossRef]

- German Environment Agency. Power-to-Liquids: Potentials and Perspectives for the Future Supply of Renewable Aviation Fuel. Available online: http://bit.ly/2zJkxk3 (accessed on 14 November 2017).

- Bann, S.J.; Malina, R.; Staples, M.D.; Suresh, P.; Pearlson, M.; Tyner, W.E.; Hileman, J.I.; Barrett, S. The costs of production of alternative jet fuel: A harmonized stochastic assessment. Bioresour. Technol. 2017, 227, 179–187. [Google Scholar] [CrossRef] [PubMed]

- International Civil Aviation Organization (ICAO). Global Emissions: Sustainable Alternative Fuels; ICAO Environmental Report, Chapter 4; International Civil Aviation Organization: Montreal, QC, Canada, 2016; pp. 153–177. [Google Scholar]

- Stratton, R.W.; Wong, H.M.; Hileman, J.I. Quantifying variability in life cycle greenhouse gas inventories of alternative middle distillate transportation fuels. Environ. Sci. Technol. 2011, 45, 4637–4644. [Google Scholar] [CrossRef] [PubMed]

- König, D.H.; Baucks, N.; Dietrich, R.-U.; Wörner, A. Simulation and evaluation of a process concept for the generation of synthetic fuel from CO2 and H2. Energy 2015, 91, 833–841. [Google Scholar] [CrossRef]

- König, D.H.; Freiberg, M.; Dietrich, R.-U.; Wörner, A. Techno-economic study of the storage of fluctuating renewable energy in liquid hydrocarbons. Fuel 2015, 159, 289–297. [Google Scholar] [CrossRef]

- Tremel, A.; Wasserscheid, P.; Baldauf, M.; Hammer, T. Techno-economic analysis for the synthesis of liquid and gaseous fuels based on hydrogen production via electrolysis. Int. J. Hydrogen Energy 2015, 40, 11457–11464. [Google Scholar] [CrossRef]

- Kousoulidou, M.; Lonza, L. Biofuels in aviation: Fuel demand and CO2 emissions evolution in Europe toward 2030. Transp. Res. Part D Transp. Environ. 2016, 46, 166–181. [Google Scholar] [CrossRef]

- Pierson, K.; Sterman, J.D. Cyclical dynamics of airline industry earnings. Syst. Dyn. Rev. 2013, 29, 129–156. [Google Scholar] [CrossRef]

- Liehr, M.; Größler, A.; Klein, M.; Milling, P.M. Cycles in the sky: Understanding and managing business cycles in the airline market. Syst. Dyn. Rev. 2001, 17, 311–332. [Google Scholar] [CrossRef]

- Weil, H.B. Commodization of Technology-Based Products and Services: A Generic Model of Market Dynamics; Sloan School of Management, Massachusetts Institute of Technology: Cambridge, MA, USA, 1996. [Google Scholar]

- Lyneis, J.M.; Glucksman, M.A. Market Analysis and Forecasting as a Strategic Business Tool. In Computer-Based Management of Complex Systems, Proceedings of the 1989 International Conference of the System Dynamics Society, Stuttgart, Germany, 10–14 July 1989; Milling, P.M., Zahn, E.O.K., Eds.; Springer: Berlin/Heidelberg, Germany, 1989; pp. 136–143. [Google Scholar]

- Kleer, B.; Cronrath, E.-M.; Zock, A. Market development of airline companies: A system dynamics view on strategic movements. In Proceedings of the 26th International Conference of the System Dynamics Society, Athens, Greece, 20–24 July 2008. [Google Scholar]

- Pfänder, H.; Jimenez, H.; Mavris, D. Environmental impact analysis of fleet and policy options of aircraft operators using system dynamics. In Proceedings of the 10th AIAA Technology, Integration and Operations (ATIO) Conference, Fort Worth, TX, USA, 13–15 September 2010. [Google Scholar]

- Urban, M.; Kluge, U.; Plötner, K.O.; Barbeito, G.; Pickl, S.; Hornung, M. Modelling the European air transport system: A System Dynamics approach. In Proceedings of the Deutscher Luft- und Raumfahrtkongress 2017, Munich, Germany, 5–7 September 2017. [Google Scholar]

- Sgouridis, S.; Bonnefoy, P.A.; Hansman, R.J. Air transportation in a carbon constrained world: Long-term dynamics of policies and strategies for mitigating the carbon footprint of commercial aviation. Transp. Res. Part A Policy Pract. 2011, 45, 1077–1091. [Google Scholar] [CrossRef]

- Sterman, J.D. Business Dynamics: Systems Thinking and Modeling for a Complex World; Irwin/McGraw-Hill: Boston, MA, USA, 2000. [Google Scholar]

- Sterman, J.D.; Henderson, R.; Beinhocker, E.D.; Newman, L.I. Getting big too fast: Strategic dynamics with increasing returns and bounded rationality. Manag. Sci. 2007, 53, 683–696. [Google Scholar] [CrossRef]

- Liebeck, R.H.; Andrastek, D.A.; Chau, J.; Girvin, R.; Lyon, R.; Rawdon, B.K.; Scott, P.W.; Wright, R.A. Advanced Subsonic Airplane Design and Economic Studies; CR-195443; National Aeronautics and Space Administration, Lewis Research Center National Technical Information Service: Cleveland, OH, USA, 1995.

- Energy Information Administration (EIA). U.S. Gulf Coast Kerosene-Type Jet Fuel Spot Price FOB. Available online: http://bit.ly/2BAyemi (accessed on 19 December 2017).

- United Nations (UN). World Population Prospects: The 2015 Revision—Key Findings and Advance Tables; Working Paper No. ESA/P/WP.241; United Nations (UN): New York, NY, USA, 2015. [Google Scholar]

- World Bank. GDP Per Capita (Constant 2010 US$). Available online: http://bit.ly/2D5egjF (accessed on 19 December 2017).

- World Bank. Consumer Prices for the World. Available online: http://bit.ly/2oLcwcp (accessed on 19 December 2017).

- Boeing. Current Market Outlook; Boeing: Seattle, WA, USA, 2005; Available online: http://bit.ly/2BySmVO (accessed on 19 December 2017).

- Boeing. Current Market Outlook: 2009–2028; Boeing: Seattle, WA, USA, 2009; Available online: http://bit.ly/2BeE3sn (accessed on 19 December 2017).

- Boeing. Current Market Outlook: 2016–2035; Boeing: Seattle, WA, USA, 2016; Available online: http://bit.ly/2usBHiK (accessed on 19 December 2017).

- International Civil Aviation Organization (ICAO). ICAO Data+ Demo: Passenger Load Factor. Available online: http://bit.ly/2kMtzFB (accessed on 19 December 2017).

- Sgouridis, S.P. Symbiotic Strategies in Enterprise Ecology: Modeling Commercial Aviation as an Enterprise of Enterprises. Ph.D. Thesis, Massachussetts Institute of Technology, Cambridge, MA, USA, 2007. [Google Scholar]

- International Air Transport Association (IATA). Technology Roadmap. 2013. Available online: http://bit.ly/2D8EEte (accessed on 20 March 2017).

- Moser, M.; Pregger, T.; Simon, S.; König, D.H.; Wörner, A.; Dietrich, R.-U.; Köhler, M.; Oßwald, P.; Grohmann, J.; Kathrotia, T.; et al. Synthetic liquid hydrocarbons from renewable energy: Results of the Helmholtz energy alliance. Chem. Ing. Tech. 2017, 89, 274–288. [Google Scholar] [CrossRef]

- De Jong, S.; Hoefnagels, R.; Faaij, A.; Slade, R.; Mawhood, R.; Junginger, M. The feasibility of short-term production strategies for renewable jet fuels: A comprehensive techno-economic comparison. Biofuels Bioprod. Biorefin. 2015, 9, 778–800. [Google Scholar] [CrossRef]

- Forrester, J.W.; Senge, P.M. Tests for building confidence in system dynamics models. In System Dynamics; Legasto, A.A., Forrester, J.W., Lyneis, J.M., Eds.; North-Holland: Amsterdam, The Netherlands, 1980; pp. 209–228. [Google Scholar]

- Hekimoğlu, M.; Barlas, Y.; Luna-Reyes, L. Sensitivity analysis for models with multiple behavior modes: A method based on behavior pattern measures. Syst. Dyn. Rev. 2016, 32, 332–362. [Google Scholar] [CrossRef]

- Berghof, R.; Schmitt, A.; Middel, J.; Eyers, C.; Hancox, R.; Gruebler, A.; Hepting, M. CONSAVE 2050. Final Technical Report. 2005. Available online: http://bit.ly/2kNdVdg (accessed on 19 December 2017).

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).