Abstract

This paper examines relative stock market performance following the onset of the coronavirus pandemic for a sample of 80 stock markets. Weekly data on coronavirus cases and deaths are employed alongside Oxford indices on each nation’s stringency and government support intensity. The results are broken down both by month and by geographical region. The full sample results show that increased coronavirus cases exert the expected overall effect of worsening relative stock market performance, but with little consistent impact of rising deaths. There is some evidence of significantly negative stock market effects arising from lockdowns as reflected in the Oxford stringency index. There are also positive reactions to government support in March and December in the overall sample—combined with some additional pervasive effects seen in mid-2020 in Latin America.

I can’t abandon that [lockdown] tool any more than I would abandon a nuclear deterrent. But it is like a nuclear deterrent, I certainly don’t want to use it.(British Prime Minister Boris Johnson, 19 July 2020—as quoted in )

Speculative manias are in the air … Along with the other economic trends—a strong recovery, surging commodity prices and an uptick in inflation—those asset bubbles have a clear cause: the massive expansion of money and credit.()

1. Introduction

The coronavirus pandemic of 2020 represented the most devastating health crisis since the Spanish Flu of 1918–1919. Although stock markets reacted negatively to the spike in death rates at that time (), far more violent moves were seen in 2020. The record-breaking 33.7% drop in the S&P 500 stock market index between 19 February and 23 March 2020 was accompanied by massive declines in most other major stock markets around the world. This was quickly followed by record GDP declines in the second quarter of 2020 in the United States and many European countries. Nevertheless, most of these same countries then enjoyed a major stock market boom from the March lows in the face of massive central bank liquidity expansion ().1

The initial US stock market plunge following the onset of the 2020 pandemic greatly outpaced the earlier experience under the Spanish Flu. Even though the Spanish Flu appears to have been far deadlier (cf. ), the US stock market initially continued to rise following the outbreak in late 1918 and merely fell back to summer 1918 levels after monthly deaths peaked later in the year. There was a sharp rebound afterwards, however, and the Dow Jones Industrial Average gained around 50% from late February 1919 through the end of the year. Pent-up demand following the end of the pandemic may well have been a factor in this outcome ()—as could prove to be true once again in 2021. Nevertheless, a major difference between the 1918–1919 and 2020–2021 experiences remains the far lesser extent of the lockdowns and government intervention seen during the earlier episode.2

The main goal of this paper is to assess US stock market behavior not in isolation but in comparison with relative performance in other world stock markets. Additionally, in contrast to most prior empirical work, the analysis extends beyond the initial crisis period up until the final trades of December 2020. Following the next section’s discussion of the existing literature on stock market responses to the pandemic, Section 3 outlines the paper’s methodology. The data used to explain relative stock market performance on the basis of virus spread and government intervention are also detailed there. The main findings for our 80-country study are then presented in Section 4. Finally, Section 5 contains the paper’s conclusions.

2. Explaining the 2020 Stock Market Reactions

The enormous market turnaround after March 2020 occurred despite accelerating coronavirus spread around the world, with cases rising in every continent besides Antarctica. () conclude that the stock market rebound was largely driven by shifts in sentiment rather than fundamentals: “We find that the most likely candidate for explaining the market’s volatility during the early months of the pandemic is the pricing of stock market risk, driven by big fluctuations in risk aversion or sentiment unrelated to economic fundamentals or interest rates.” The rise in market volatility actually appears to precede the March shutdowns and travel bans, with (), for example, identifying a shift from a low volatility regime to a high volatility regime in late February 2020.3 () and () seek to quantify stock market responses to rising virus cases and deaths early in the pandemic across as many as 64 countries. Although they each identify a more significant role for cases than deaths, () find both of these variables significant in China over a 10 January—16 March 2020 sample period. Panel data analysis by (), using weekly data through the end of March 2020, confirms significant effects of coronavirus cases across sixteen stock markets.4

Although the pandemic continued to play a key role, the extreme shifts seen early on in the pandemic were not typical of the later experience. Indeed, () find support for a possible initial stock market over-reaction to the coronavirus that was already evident in data going through just early April 2020. This reflects () finding that initial negative reactions to new cases and deaths are often followed by positive responses later on, with half of the 25 stock markets seemingly evincing positive reactions after reaching 100,000 cases and 100 virus-related deaths. A case in point is the remarkable US market rally from the March 2020 lows even as virus cases and deaths continued to ratchet higher through the end of the year. Meanwhile, whereas contagion between markets appeared to soar with the onset of the pandemic, () find that this initial shock effect was already fading away by the end of March 2020.5 This only points to the importance of considering data extending beyond the initial crisis period.

In addition to the spread of the virus itself, other factors coming into play over time include government reactions to the public health emergency, such as the massive stimulus measures undertaken in the United States and Europe to provide economic support to individuals and businesses. The positive stock market effects themselves appear to have been far from uniform, with () finding the beneficial effects to have been concentrated on larger firms.6 These government spending initiatives were accompanied by widespread monetary easing, which, in the US case, resulted in annual M2 money supply growth of 28% after February 2020. This was far greater than during the global financial crisis, and the highest rate of money emission seen since 1943 at the height of World War II ().7 Australia was just one of many other countries embarking on similarly unprecedented stimulus efforts. Nevertheless, () find evidence of quite mixed stock market reactions with only the “JobKeeper” package (announced on 22 March 2020) eliciting a clearly significant, favorable stock market reaction.

Shifts in the level of economic support in either direction could be expected to trigger stock market reactions, with (), for example, emphasizing negative stock market reactions in cases where government stimulus was withdrawn when the number of daily COVID-19 cases remained relatively high. There is also the impact of government-ordered lockdowns, however, and () conclude that it was these government restrictions on commercial activity, combined with social distancing, that account for the US stock market reacting so much more forcefully to COVID-19 than to the Spanish Flu (or prior pandemics). Given that stock markets would be expected to react to both stimulus measures and lockdowns, this paper provides new comparative evidence on the impact of each assessed over a broad range of world stock markets. The effects of rising coronavirus cases and deaths are also controlled for in the analysis.

We compare relative market performance to each country’s relative levels of virus cases, virus deaths, government stringency and economic support. We examine these relationships not only in the aggregate but also on a continent-by-continent basis for each month between March and December 2020. This encompasses the span between the extreme pessimism evident in market reactions early in the pandemic to the greater optimism emerging later on, spurred also by encouraging vaccine news in November and December 2020. Following the release of favorable clinical trials data in November 2020, the Pfizer COVID-19 vaccine was approved for emergency use in the United Kingdom on 2 December and in the United States on December 12.

3. Methodology and Properties of the Data

This paper sets virus effects on stock market performance against the relative importance of government interventions. Whereas most prior work was limited to data through just the first quarter of 2020, this combination of factors is assessed over a sample period extended from March 2020 through the end of the year.8 Like (), we utilize weekly data and employ pooled OLS (ordinary least squares) analysis. In order to allow for varying relationships over the year, panel regression analysis is applied not only for the full sample and also for the individual months between March 2020 and December 2020. In order to make the analysis as broad-based as possible, we incorporate 80 stock market indices drawn from all corners of the globe (Appendix A Table A1). Our focus is on the relative strength of each market during 2020 and we essentially include every available stock market, with just Venezuela and Zimbabwe excluded owing to the distortions associated with their respective hyperinflations that predated the pandemic. The stock market data are drawn from the Bloomberg terminal (with the exception only of the Jamaican market index, which is directly downloaded from the Jamaica Stock Exchange website at www.jamstockex.com, accessed on 10 April 2021).

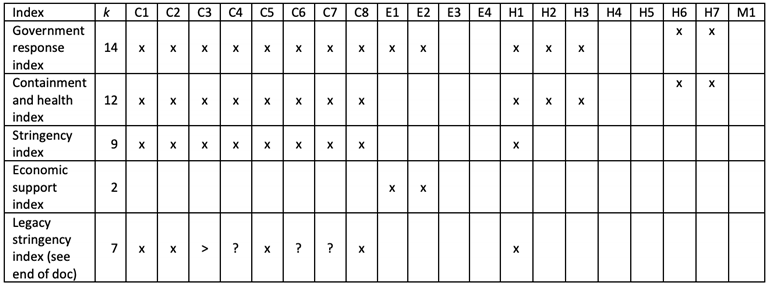

The paper’s panel estimation assesses how each market’s relative strength is affected by variations in virus conditions and government measures. We utilize publicly available data on coronavirus virus and deaths, in each case scaled by population in order to achieve comparability across countries. The government policy responses are quantified on the basis of the data series available in Oxford University’s “Coronavirus Government Response Tracker” (). The Oxford University data utilizes an ordinal scale reflecting the relative level of economic support and the relative level of stringency. Economic support encompasses income support, debt/contract relief for households, fiscal measures, and provision of international support. Meanwhile, the stringency index collates publicly available information on such policies as school and workplace closures, stay at home restrictions and travel bans to produce an additive score measured on an ordinal scale that varies from 0 to 100 (see Appendix A Table A2).

We regress each stock market’s relative strength index (market_RSI) on (i) increases in cases per 100,000 (g_cases100k), (ii) increases in deaths per 100,000 (g_deaths100k), and (iii) the Oxford series on the levels of government economic support (econsupport) and stringency measures (stringency). A lagged dependent variable and lagged cases and deaths are also included to allow for inertia. Increases in cases and deaths are used instead of cumulative cases and deaths owing to the non-stationarity of the latter series, which continuously rise over the sample period. Although cases and deaths are themselves both manifestations of the same virus spread, the timing of the two series is quite different. (), for example, show deaths typically not occurring until between two weeks and eight weeks after the onset of symptoms. Each of the Oxford series is measured on a scale of 0–100, with zero being lowest and 100 representing maximum intensity. The market_RSI puts each stock market on a scale from 1 to 80, with 1 being the top performer and 80 being the bottom performer. Relative strength is assessed on the basis of the dollar returns for each market index.9

In addition to the fluctuations in virus infections and policy responses over time, Table 1 reveals substantial geographical variation in 2020. Summary statistics over the March-December 2020 period for the full sample of 80 countries (Table 1a) are followed by summary statistics broken down according to the following geographical groupings:

Africa: Botswana, Egypt, Ghana, Kenya, Malawi, Mauritius, Morocco, Nigeria, South Africa, Tunisia and Zambia.Australasia: Australia and New Zealand.East Asia: China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.Eastern and Southern Europe: Bulgaria, Croatia, Czech Republic, Cyprus, Estonia, Greece, Hungary, Lithuania, Latvia, Poland, Romania, Russia, Slovakia, Slovenia and Ukraine.Latin America: Argentina, Barbados, Bermuda, Brazil, Chile, Colombia, Jamaica, Mexico, Peru and Trinidad.North America: Canada and United Sates.South Asia and Middle East: Bahrain, India, Israel, Kazakhstan, Kuwait, Lebanon, Oman, Pakistan, Qatar, Saudi Arabia, Turkey and United Arab Emirates.Western Europe: Austria, Belgium, Denmark, Finland, France, Germany, Iceland, Ireland, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and United Kingdom.

Table 1.

Summary statistics for full sample and by region.

The geographical groupings are primarily done by continent, but with Asia and Europe divided into two parts. In the case of Europe, the separation is between the more established nations of Western Europe and the primarily emerging economies of Eastern and Southern Europe. Although East Asia covers a range of development levels, all these nations share relative proximity with China and most are members of ASEAN (Association of Southeast Asian Nations). The countries in the South Asia and Middle East group are distinct both in terms of geographical location and by typically having lesser links with China.

The summary data broken down by region in Table 1b–i show some of the enormous variations in national experiences under the pandemic. For example, North America (Canada and United States) show an average 72.9 increase in cases per hundred thousand and 1.40 deaths per hundred thousand. Even with all these numbers scaled by population, the North America figures are over fifty times greater than the corresponding Australasia values. Cases and deaths in Africa and East Asia are also dramatically lower than in North America, while the other regions represent intermediate cases—but generally closer to the North American levels than Africa, Australasia, and East Asia.

The highest average levels of stringency are seen in Latin America, South Asia and Middle East, North America, and East Asia (in that order). The other regions are all below 50 on a scale of 0–100, with Australasia having the lowest average value of all. However, it should be emphasized that even Australia’s average stringency level of 44.6 is substantial, leaving it within 25% of the highest level of 59.0 registered in Latin America. Interestingly, despite having the lowest virus cases, virus deaths and average stringency levels, Australasia has the highest average level of government economic support (60.1). Western Europe is just behind with 59.4, followed by North America with 59.3 and Eastern and Southern Europe with 59.0. The nations of Africa and Latin America on average offered the least economic support, with index values of 37.9 and 41.6, respectively.

4. Empirical Findings

The panel estimation results have the relative strength of each market index is regressed on its own lagged value, current and lagged levels of additional cases (per hundred thousand of the population), current and lagged values of additional deaths (per hundred thousand of the population) and that country’s Oxford index values for stringency and economic support. As noted earlier, weekly data are employed in the regressions and the results are broken down both by month and by geographical region.10 Given that stronger market performance equates to a lower market_RSI value, the expected signs on virus cases and virus deaths is positive insofar as worse virus spread exerts a negative market effect. The expected sign on stringency would also be positive given that negative effects on economic activity should worsen the relative performance of the stock market. Finally, the expected sign on econsupport would be negative if the additional funding boosts relative market performance.

The full sample results in Table 2 show increased cases to exert the expected overall effect of worsening relative stock market performance. This effect is significant at the 95% confidence level or better overall as well as for April, August and October individually. Although there is some evidence of an offsetting effect of lagged cases, this may simply reflect the market impact of a rise in cases subsiding over the following month. New deaths are insignificant overall, but are significant and positive in May and August (while significant and negative in April and September). Such variation over the sample is unsurprising insofar as () noted swings from negative to positive effects even in a study limited to the early months of the pandemic alone. There are similarly mixed findings for lagged deaths and no clear systematic effect.

Table 2.

Stock market regressions for all 80 countries.

Stringency and econsupport are insignificant overall. This may reflect, in part, measurement error in the available Oxford indices, which would, in turn, bias down the estimated coefficients. Although stringency has the expected positive and significant effect in March and July, the significant negative effect for September suggests a favorable impact on relative market strength later in the year. Meanwhile, econsupport is significant with the expected negative sign in March and December, but significant with the opposite sign in May. With the major first and second waves of the virus in countries like the United States occurring in or around those same March and December months, it may well be that government support was seen as being more critical at those times; this could explain why there appear to be favorable market reactions in those particular months.

Appendix BTable A4, Table A5, Table A6, Table A7, Table A8 and Table A9 present results for the individual geographical groupings. Although Australasia and North America were included in the full sample results reported in Table 2, the number of countries in these two groups is insufficient for separate regression analysis. In terms of the overall findings across the different groupings, increased cases are significant with the expected positive sign for East Asia and Western Europe. Increased cases are insignificant overall in all other regions, with mixed significance observed in individual months. New deaths are significant overall only for Western Europe, with a negative sign. This counterintuitive finding seems to primarily derive from a strong effect indicated for July, when deaths were generally trending down, and may simply reflect a failure of markets to recover when the death rate improved. Elsewhere, there are generally very mixed findings across individual months that leaves little clear pattern. However, Africa has four months (March, April, September and December) for which deaths exert significant positive effects, i.e., weakening stock market RSI.

Stringency is significant overall with the expected positive (weakening RSI) effect only for Africa. Although it is otherwise significant overall just for East Asia, and with a negative sign, in terms of individual months it is significant there with the expected positive sign in March and only significant with a negative sign in September. In Eastern and Southern Europe as well as Latin America, stringency is significant with the expected positive sign in June and insignificant for other months. South Asia and Middle East also evinces a significant positive effect of stringency in June, but with offsetting indicated significant negative effects in May and September. Although the findings remain quite mixed, there is a tendency for stringency measures to hurt stock market performance earlier in the pandemic (as seen for March and June 2020).

Finally, economic support is never significant overall and the only clear case of beneficial stock market effects is seen for Latin America. In this region, econsupport is negative and significant in each of May, June and August (while positive and significant in July). Included here is the Brazilian support package of as much as USD 10 billion per month, more than for any other developing nation, that helped Brazil’s GDP exceed its pre-pandemic January 2020 levels by July—albeit it at the expense of potentially disastrous longer-term fiscal consequences (see ). The lack of more consistent overall findings for economic support may reflect the fact that such support is usually applied when times are darkest. If the such support is applied in the face of an already weakening market, it will only appear successful on a statistical basis if it is able to immediately turn this trend around. This will not always be the case, even if these same interventions do help lay the groundwork for subsequent recovery.

5. Conclusions

Whereas the existing literature on the stock market effects of the pandemic has primarily focused on just the early crisis period in the first quarter of 2020, this paper assesses virus effects and government policy effects through December 2020 for a broad sample of 80 world stock markets. The overall results offer some support for growth in coronavirus cases and stringency hurting stock market performance, together with some evidence that 2020 government support measures helped the market both in March and late in the year. However, there is considerable variation across the different geographical regions considered in this paper. Clear-cut adverse effects of new coronavirus cases are found only for East Asia and Western Europe, for example. There is more widespread evidence of adverse effects associated with stringency, in overall terms for Africa and during mid-year in Eastern and Southern Europe, Latin America and South Asia and Middle East. Economic support’s favorable effects in March and December in the overall sample are generally not mirrored over the different geographical groupings. However, there are several significant months for the Latin American grouping around mid-2020.

The empirical findings are limited both by the total coverage being only ten months and the impossibility of fully capturing the tumultuous events through the limited array of variables included in the regressions. Nevertheless, markets are seen to generally react to growth in cases in the expected fashion and there is some relatively widespread evidence of adverse stringency effects on relative stock market performance. Although it is possible that positive reactions to government support in March and December in the overall sample may be driven by the US experience, there are also some pervasive effects in mid-2020 evident elsewhere—especially in Latin America. More generally, it is clear that the substantial variation by region would make it unwise to draw too many general conclusions from analysis focused more narrowly on either the United States alone or just more advanced industrial countries. It is hoped that the wide-ranging sample covered in this study can serve as a starting point in unpacking what has driven market performance globally under the coronavirus pandemic. A similarly broad-based approach might be employed in assessing the impact of the vaccine rollout in 2021, which began much more rapidly in countries like Israel, the United Kingdom and the United States than in most of the rest of the world.

Author Contributions

Conceptualization, R.C.K.B.; methodology, R.C.K.B. and S.H.; software, R.C.K.B. and S.H.; validation, R.C.K.B. and S.H.; formal analysis, S.H.; investigation, R.C.K.B. and S.H.; resources, R.C.K.B. and S.H.; data curation, S.H.; writing—original draft preparation, R.C.K.B.; writing—review and editing, R.C.K.B.; visualization, R.C.K.B. and S.H.; supervision, R.C.K.B.; project administration, R.C.K.B.; funding acquisition, R.C.K.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

N/A.

Informed Consent Statement

N/A.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to the lack of a suitable depository.

Acknowledgments

The authors thank Thomas Willett and two anonymous referees for helpful comments and are grateful to the Lowe Institute at Claremont McKenna College for supporting this project under the Lowe Faculty Student Research Program.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

National stock market indices.

Table A1.

National stock market indices.

| Rank | Country | Market Index | Index Ticker |

|---|---|---|---|

| 1 | United States | S&P 500 | SPX Index |

| 2 | China | Shanghai Composite | SHCOMP Index |

| 3 | Japan | Nikkei 225 | NKY Index |

| 4 | Hong Kong | Hang Seng Index | HIS Index |

| 5 | United Kingdom | FTSE 100 | UKX Index |

| 6 | France | CAC 40 | CAC Index |

| 7 | Saudi Arabia | Tadawul All Share | SASEIDX |

| 8 | Germany | DAX | DAX Index |

| 9 | Canada | S&P/TSX Composite | SPTSX Index |

| 10 | India | Nifty 50 | NSEI |

| 11 | Switzerland | SMI | SMI Index |

| 12 | South Korea | KOPSI | KOSPI Index |

| 13 | Taiwan | Taiwain Weighted Index | TWSE Index |

| 14 | Australia | S&P/ASX 200 | AS51 Index |

| 15 | Sweden | OMX Stockholm 30 | OMX Index |

| 16 | Netherlands | AEX | AEX Index |

| 17 | Brazil | Bovespa | IBOV Index |

| 18 | Russia | MOEX Russia | IMOEX Index |

| 19 | Spain | IBEX 35 | IBEX Index |

| 20 | Italy | Italy 40 | FTSEMIB Index |

| 21 | Denmark | OMX Copenhagen 20 | OMXC20CP Index |

| 22 | Thailand | SET Index | SET Index |

| 23 | Indonesia | Jakarta SE Composite Index | JCI Index |

| 24 | Singapore | MSCI Singapore Index | MXSG Index |

| 25 | Malaysia | FTSE Malaysia KLCI | FBMKLCI Index |

| 26 | Belgium | BEL 20 | BFX |

| 27 | South Africa | South Africa Top 40 | TOP40 Index |

| 28 | Mexico | S&P BMV IPC | MEXBOL Index |

| 29 | Finland | OMX Helsinki 25 | OMXH25GI Index |

| 30 | Norway | OSE Benchmark | OSEBX Index |

| 31 | Philippine | PSEi Composite | PCOMP Index |

| 32 | UAE | DFM General Index | DFMGI Index |

| 33 | Vietnam | VN | VNI |

| 34 | Turkey | BIST 100 | XU100 |

| 35 | Israel | TA 35 | TA-35 Index |

| 36 | Chile | S&P CLX IPSA | IPSASD Index |

| 37 | Qatar | DSM Index | DSM Index |

| 38 | Poland | WIG20 | WIG20 Index |

| 39 | Austria | ATX | ATX Index |

| 40 | New Zealand | NZX 50 | NZSE50FG Index |

| 41 | Ireland | ISEQ Overall | ISEQ Index |

| 42 | Kuwait | Kuwait All-Share Index | KWSEAS Index |

| 43 | Colombia | COLCAP | COLCAP Index |

| 44 | Peru | S&P Lima General | SPBLPGPP |

| 45 | Portugal | PSI 20 | PSI20 Index |

| 46 | Morocco | MASI Free Float All-Shares Index | MOSENEW Index |

| 47 | Egypt | EGX 30 | EGX30 Index |

| 48 | Pakistan | Karachi 100 | KSE100 Index |

| 49 | Greece | Athens General Stock Index | ASE Index |

| 50 | Argentina | S&P Merval | MERVAL Index |

| 51 | Nigeria | NSE 30 | NGSE30 Index |

| 52 | Hungary | Budapest SE Index | BUX Index |

| 53 | Czech Republic | PX | PX Index |

| 54 | Romania | BET | BET Index |

| 55 | Croatia | CROBEX | CRO Index |

| 56 | Kenya | Nairobi SE All-Share Index | NSEASI Index |

| 57 | Bahrain | Bahrain Bourse All Share Index | BHSEASI Index |

| 58 | Oman | MSM 30 | MSI |

| 59 | Bulgaria | BSE SOFIX | SOFIX Index |

| 60 | Jamaica | JSE Market Index | JMSMX Index |

| 61 | Trinidad | TT Market Composite Index | TTCOMP |

| 62 | Iceland | OMX ICEX All Share PI | ICEXI Index |

| 63 | Slovenia | Blue-Chip SBITOP | SBITOP Index |

| 64 | Tunisia | Tunindex | TUSISE Index |

| 65 | Kazakhstan | KASE | KZKAK Index |

| 66 | Luxembourg | LUXX | LUXXX Index |

| 67 | Mauritius | Semdex | SEMDEX Index |

| 68 | Lebanon | BLOM Index | BLOM Index |

| 69 | Slovakia | SAX | SKSM Index |

| 70 | Lithuania | OMX Vilnius Index | VILSE Index |

| 71 | Cyprus | Cyprus Main Market | CYSMMAIN |

| 72 | Botswana | Botswana Gaborone Index | BGSMDC Index |

| 73 | Estonia | Tallinn TR Index | TALSE Index |

| 74 | Ghana | Ghana SE Composite Index | GGSECI Index |

| 75 | Bermuda | BSX Index | BSX Index |

| 76 | Barbados | BSE Market Index | BARBL Index |

| 77 | Malawi | Malawi Shares Domestic Index | MWSIDOM Index |

| 78 | Ukraine | PFTS | PFTS Index |

| 79 | Zambia | Lusaka SE All Share Index | LUSEIDX |

| 80 | Latvia | OMX Riga Index | RIGSE Index |

Table A2.

Oxford University indicators and basis for stringency index.

Table A2.

Oxford University indicators and basis for stringency index.

| Containment and closure | |

| C1 | School closing |

| C2 | Workplace closing |

| C3 | Cancel public events |

| C4 | Restrictions on gathering size |

| C5 | Close public transport |

| C6 | Stay at home requirements |

| C7 | Restrictions on internal movement |

| C8 | Restrictions on international travel |

| Economic response | |

| E1 | Income support |

| E2 | Debt/contract relief for households |

| E3 | Fiscal measures |

| E4 | Giving international support |

| Health systems | |

| H1 | Public information campaign |

| H2 | Testing policy |

| H3 | Contact tracing |

| H4 | Emergency investment in healthcare |

| H5 | Investment in COVID-19 vaccines |

| H6 | Facial coverings |

| H7 | Vaccination Policy |

| Overall indices | |

| |

Source: ().

Table A3.

Unit root tests.

Table A3.

Unit root tests.

| () test statistics: | |||

| Ho | Panels contain unit roots | Number of panels = 80 | |

| Ha | Panels are stationary | Number of periods = 52 | |

| AR parameter: Common | Asymptotics: N -> Infinity | ||

| Panel means: Included | T Fixed | ||

| Time trend: Not included | |||

| Test Statistic | z | p-value | |

| g_cases100k | 0.9292 | −2.1264 | 0.0167 |

| g_deaths100k | 0.9265 | −2.5296 | 0.0057 |

| econsupport | 0.9299 | −2.2308 | 0.0128 |

| stringency | 0.9161 | −4.3313 | 0.0000 |

Appendix B

Table A4.

Stock market regressions for Africa (11 countries).

Table A4.

Stock market regressions for Africa (11 countries).

| VARIABLES | March | April | May | June | July | August |

| L.market_RSI | −0.744 *** | −0.447 ** | −0.312 ** | −0.260 | −0.325 ** | 0.082 |

| (0.152) | (0.172) | (0.138) | (0.201) | (0.131) | (0.257) | |

| g_cases100k | 13.718 | −20.311 ** | 1.529 | 0.130 | −0.841 * | 1.020 |

| (8.696) | (8.069) | (4.515) | (4.215) | (0.401) | (1.194) | |

| L.g_cases100k | −142.701 ** | −8.377 * | 1.622 | 1.039 | 0.469 | −0.607 |

| (55.279) | (3.831) | (5.176) | (6.444) | (0.783) | (0.420) | |

| g_deaths100k | 480.140 *** | 235.157 ** | 86.765 | 32.621 | 35.143 | 15.499 |

| (120.150) | (90.527) | (180.701) | (56.367) | (30.337) | (69.784) | |

| L.g_deaths100k | −5412.173 ** | 300.498 | −472.027 ** | −68.911 | −5.399 | −7.206 |

| (1762.566) | (226.469) | (157.446) | (49.951) | (11.942) | (30.337) | |

| stringency | 0.236 | −0.745 | 0.221 | 0.409 | −0.628 | 2.002 |

| (0.172) | (1.432) | (0.466) | (0.450) | (1.750) | (3.224) | |

| econsupport | 0.619 ** | 0.199 | 1.348 ** | 0.932 *** | N.A. | 1.608 *** |

| (0.201) | (0.250) | (0.504) | (0.262) | (0.356) | ||

| Constant | 52.978 *** | 128.909 | −20.634 | −31.262 | 96.370 | −169.473 |

| (8.476) | (116.183) | (49.962) | (38.554) | (96.676) | (201.462) | |

| Observations | 44 | 44 | 55 | 44 | 55 | 44 |

| R-squared | 0.497 | 0.384 | 0.247 | 0.123 | 0.232 | 0.192 |

| VARIABLES | September | October | November | December | Overall | |

| L.market_RSI | −0.497 *** | −0.353 *** | −0.248 *** | 0.223 | −0.080 * | |

| (0.082) | (0.106) | (0.074) | (0.208) | (0.044) | ||

| g_cases100k | −0.864 *** | −0.129 | −0.229 | −0.538 | −0.077 | |

| (0.222) | (0.253) | (0.461) | (0.416) | (0.190) | ||

| L.g_cases100k | 2.892 *** | −0.441 *** | −0.200 | 0.165 | 0.079 | |

| (0.510) | (0.087) | (0.403) | (0.253) | (0.182) | ||

| g_deaths100k | 75.342 *** | 0.205 | −0.440 | 63.061 ** | 6.573 | |

| (22.311) | (10.781) | (5.295) | (27.461) | (5.506) | ||

| L.g_deaths100k | −113.612 *** | −23.332 ** | −5.711 | −51.258 ** | −4.990 | |

| (29.899) | (7.574) | (6.054) | (19.772) | (5.239) | ||

| stringency | −0.224 | 0.723 | −0.664 | 1.773 | 0.113 ** | |

| (0.335) | (0.834) | (1.975) | (1.053) | (0.043) | ||

| econsupport | −0.044 | −0.053 | −0.321 ** | N.A. | 0.004 | |

| (0.175) | (0.322) | (0.109) | (0.037) | |||

| Constant | 65.039 ** | 34.532 | 127.520 | −58.046 | 39.884 *** | |

| (24.355) | (42.385) | (115.204) | (52.808) | (3.485) | ||

| Observations | 44 | 55 | 44 | 55 | 561 | |

| R-squared | 0.456 | 0.220 | 0.204 | 0.198 | 0.026 |

Table A5.

Stock market regressions for East Asia (11 countries).

Table A5.

Stock market regressions for East Asia (11 countries).

| March | April | May | June | July | August | |

| L.market_RSI | −0.530 * | −0.536 *** | −0.294 ** | 0.110 | −0.165 | −0.299 ** |

| (0.254) | (0.097) | (0.117) | (0.140) | (0.122) | (0.097) | |

| g_cases100k | −4.509 | −1.108 | −0.701 | −3.563 *** | 1.280 * | 0.995 * |

| (2.679) | (0.941) | (0.488) | (1.087) | (0.665) | (0.520) | |

| L.g_cases100k | 3.252 | 2.896 | −0.116 | 3.816 *** | −0.122 | −1.329 ** |

| (2.168) | (2.244) | (0.583) | (1.172) | (1.088) | (0.554) | |

| g_deaths100k | −116.483 | −123.979 | −109.811 | 476.655 | 110.931 | 24.827 |

| (300.361) | (106.059) | (240.260) | (415.277) | (117.489) | (83.461) | |

| L.g_deaths100k | −792.754 ** | 226.992 | 253.016 | 267.141 | −4.059 | 165.591 |

| (303.131) | (196.603) | (305.944) | (247.474) | (75.972) | (181.660) | |

| stringency | 0.572 *** | −0.566 | 0.105 | −0.467 | 0.904 | 3.805 |

| (0.135) | (0.475) | (0.462) | (0.490) | (0.529) | (3.612) | |

| econsupport | 0.164 | 0.070 | 0.247 | N.A. | 0.675 | N.A. |

| (0.395) | (0.305) | (0.441) | (0.496) | |||

| Constant | 29.941 ** | 84.926 ** | 36.648 | 41.930 | −47.830 | −171.266 |

| (11.627) | (35.623) | (32.772) | (29.311) | (34.670) | (211.734) | |

| Observations | 44 | 44 | 55 | 44 | 55 | 44 |

| R−squared | 0.357 | 0.563 | 0.166 | 0.309 | 0.169 | 0.217 |

| VARIABLES | September | October | November | December | Overall | |

| L.market_RSI | −0.395 *** | −0.409 *** | −0.404 *** | −0.130 | −0.102 ** | |

| (0.069) | (0.105) | (0.093) | (0.089) | (0.045) | ||

| g_cases100k | −1.271 | 3.423 ** | 2.395 | −0.037 | 0.393 ** | |

| (4.036) | (1.138) | (2.120) | (2.640) | (0.128) | ||

| L.g_cases100k | −1.583 | −7.571 *** | −5.564 ** | 7.108 ** | −0.193 | |

| (2.304) | (0.837) | (2.488) | (3.070) | (0.109) | ||

| g_deaths100k | 92.402 | 209.814 *** | −267.268 * | −34.593 | 18.023 | |

| (72.386) | (26.199) | (136.796) | (121.723) | (12.643) | ||

| L.g_deaths100k | 20.187 | 379.406 *** | −519.049 ** | −283.198 ** | −30.654 * | |

| (57.935) | (47.946) | (230.209) | (111.966) | (14.542) | ||

| stringency | −1.394 ** | −0.192 | −0.544 | 0.634 | −0.120* | |

| (0.470) | (0.580) | (0.319) | (0.995) | (0.064) | ||

| econsupport | −0.838 * | 0.075 | −1.044 *** | N.A. | −0.013 | |

| (0.445) | (0.272) | (0.279) | (0.031) | |||

| Constant | 185.791 *** | 30.843 | 207.107 *** | −18.009 | 50.157 *** | |

| (42.899) | (17.288) | (39.709) | (60.508) | (3.483) | ||

| Observations | 44 | 55 | 44 | 55 | 561 | |

| R−squared | 0.378 | 0.310 | 0.544 | 0.237 | 0.028 |

Table A6.

Stock market regressions for Eastern/Southern Europe (15 countries).

Table A6.

Stock market regressions for Eastern/Southern Europe (15 countries).

| VARIABLES | March | April | May | June | July | August |

| L.market_RSI | −0.428 *** | −0.468 *** | −0.248 ** | −0.218 | −0.428 *** | −0.335 *** |

| (0.099) | (0.118) | (0.112) | (0.183) | (0.140) | (0.112) | |

| g_cases100k | −0.181 | 1.574 | −0.834 | 3.445 ** | −0.570 | −1.938 * |

| (1.416) | (0.942) | (0.886) | (1.261) | (1.718) | (0.960) | |

| L.g_cases100k | 0.620 | −0.639 | 0.022 | −1.218 | −1.718 | 3.280 ** |

| (1.678) | (0.908) | (0.573) | (1.402) | (2.570) | (1.483) | |

| g_deaths100k | −15.519 | −28.022 | 22.677 | −19.849 | 29.426 | −6.398 |

| (24.565) | (21.217) | (26.760) | (61.024) | (77.903) | (35.036) | |

| L.g_deaths100k | −656.247 ** | 11.441 | 4.998 | −38.381 | 22.175 | −6.396 |

| (254.080) | (15.646) | (24.329) | (70.173) | (50.650) | (29.155) | |

| stringency | 0.202 | 0.716 | 0.205 | 1.188 ** | 0.486 | −2.348 |

| (0.199) | (0.928) | (0.345) | (0.412) | (0.682) | (1.681) | |

| econsupport | 0.109 | −0.094 | −0.213 ** | −0.622 | −0.326 | −1.406 *** |

| (0.193) | (0.346) | (0.091) | (0.411) | (0.551) | (0.399) | |

| Constant | 46.634 *** | 4.741 | 46.776 ** | 30.250 | 68.592 | 241.655 *** |

| (5.823) | (72.788) | (20.599) | (42.737) | (66.061) | (43.420) | |

| Observations | 60 | 60 | 75 | 60 | 75 | 60 |

| R-squared | 0.299 | 0.299 | 0.105 | 0.244 | 0.227 | 0.290 |

| VARIABLES | September | October | November | December | Overall | |

| L.market_RSI | −0.363 ** | −0.341 ** | −0.068 | −0.226 | −0.087 ** | |

| (0.123) | (0.121) | (0.100) | (0.137) | (0.032) | ||

| g_cases100k | 0.675 | 0.290 *** | 0.004 | 0.042 | 0.054 | |

| (0.935) | (0.080) | (0.057) | (0.042) | (0.039) | ||

| L.g_cases100k | −0.071 | −0.635 ** | 0.055 | −0.093 | −0.048 | |

| (1.039) | (0.250) | (0.067) | (0.078) | (0.040) | ||

| g_deaths100k | 42.726 | 6.618 | −8.207 | 0.702 | −0.810 | |

| (36.303) | (11.298) | (4.938) | (3.306) | (2.483) | ||

| L.g_deaths100k | −53.162 | −2.505 | 5.420 | −0.064 | 0.210 | |

| (31.399) | (9.568) | (5.000) | (1.879) | (2.215) | ||

| stringency | 0.104 | 0.420 | −0.178 | 0.195 | −0.047 | |

| (0.857) | (0.572) | (0.769) | (0.575) | (0.039) | ||

| econsupport | 0.338 | 0.729 | 0.441 ** | 0.179 | 0.030 | |

| (0.349) | (0.418) | (0.180) | (0.599) | (0.026) | ||

| Constant | 22.225 | 4.157 | 26.000 | 31.965 | 45.128 *** | |

| (63.869) | (37.693) | (36.055) | (59.332) | (2.753) | ||

| Observations | 60 | 75 | 60 | 75 | 765 | |

| R-squared | 0.283 | 0.258 | 0.141 | 0.098 | 0.018 |

Table A7.

Stock market regressions for Latin America (10 countries).

Table A7.

Stock market regressions for Latin America (10 countries).

| VARIABLES | March | April | May | June | July | August |

| L.market_RSI | −0.670 *** | −0.203 | −0.266 *** | −0.410 * | −0.204 | −0.162 |

| (0.078) | (0.226) | (0.078) | (0.206) | (0.113) | (0.184) | |

| g_cases100k | 10.573 | −1.421 | 0.151 | 0.473 | 0.279 | 0.729 * |

| (11.344) | (1.577) | (0.527) | (0.564) | (0.857) | (0.368) | |

| L.g_cases100k | −18.246 | 1.166 | 0.047 | 0.364 | 0.093 | 0.285 |

| (36.549) | (3.572) | (0.605) | (0.726) | (0.470) | (0.620) | |

| g_deaths100k | 97.397 | 23.488 | 12.702 | 0.780 | −2.405 | 1.690 |

| (191.826) | (14.754) | (47.466) | (10.623) | (2.878) | (2.042) | |

| L.g_deaths100k | 1305.017 *** | 15.234 | −18.446 | 22.164 * | −4.318 * | 1.667 |

| (299.437) | (14.131) | (46.832) | (11.818) | (1.917) | (1.707) | |

| stringency | −0.167 | 0.117 | −0.411 | 1.919 ** | 1.623 | −1.604 |

| (0.266) | (0.189) | (0.644) | (0.675) | (1.082) | (1.380) | |

| econsupport | 0.072 | 1.024 | −1.503 *** | −1.496 * | 0.163 *** | −0.738 * |

| (0.202) | (0.840) | (0.191) | (0.763) | (0.014) | (0.361) | |

| Constant | 79.437 *** | −7.653 | 159.103 ** | −76.639 | −82.996 | 137.262 |

| (9.885) | (38.750) | (60.377) | (65.775) | (81.419) | (75.742) | |

| Observations | 40 | 40 | 50 | 40 | 50 | 40 |

| R-squared | 0.404 | 0.186 | 0.108 | 0.419 | 0.153 | 0.153 |

| VARIABLES | September | October | November | December | Overall | |

| L.market_RSI | −0.276 ** | −0.341 ** | 0.027 | −0.211 | −0.065 | |

| (0.121) | (0.107) | (0.080) | (0.164) | (0.051) | ||

| g_cases100k | −0.685 | −0.900 ** | 0.658 | 0.689 * | −0.187 | |

| (0.553) | (0.350) | (0.378) | (0.375) | (0.133) | ||

| L.g_cases100k | −0.424 | 0.560 | −1.352 * | 0.225 | 0.173 | |

| (0.378) | (0.398) | (0.666) | (0.289) | (0.133) | ||

| g_deaths100k | −16.887 ** | −0.590 | −1.091 | −13.964 | −0.380 | |

| (6.769) | (3.509) | (17.140) | (11.587) | (0.481) | ||

| L.g_deaths100k | 10.618 | −1.719 | 41.564 ** | 26.028 | −1.011 | |

| (13.972) | (1.916) | (17.820) | (16.944) | (0.554) | ||

| stringency | 0.451 | 1.211 | −0.641 | −1.847 | −0.018 | |

| (3.357) | (1.438) | (4.114) | (1.238) | (0.052) | ||

| econsupport | N.A. | 0.546 | 1.940 | 0.010 | −0.020 | |

| (0.384) | (1.178) | (0.199) | (0.048) | |||

| Constant | 109.093 | −36.296 | −51.570 | 102.468 | 50.040 *** | |

| (235.789) | (90.164) | (211.930) | (90.198) | (3.678) | ||

| Observations | 40 | 50 | 40 | 50 | 510 | |

| R-squared | 0.368 | 0.345 | 0.380 | 0.273 | 0.021 |

Table A8.

Stock market regressions for South Asia and Middle East (12 countries).

Table A8.

Stock market regressions for South Asia and Middle East (12 countries).

| VARIABLES | March | April | May | June | July | August |

| L.market_RSI | −0.568 *** | −0.346 ** | −0.304 ** | −0.393 ** | −0.451 *** | −0.373 ** |

| (0.119) | (0.125) | (0.136) | (0.146) | (0.064) | (0.146) | |

| g_cases100k | −1.833 *** | 0.307 | −0.116 | 0.206 | 0.036 | −0.095 |

| (0.311) | (0.228) | (0.089) | (0.276) | (0.170) | (0.304) | |

| L.g_cases100k | −6.225 *** | −0.500 | 0.079 | −0.414 | 0.078 | −0.003 |

| (1.282) | (0.530) | (0.097) | (0.337) | (0.110) | (0.274) | |

| g_deaths100k | 301.004 *** | −43.091 | 51.445 *** | 29.386 | −18.239 * | 41.388 * |

| (93.478) | (85.319) | (10.123) | (29.490) | (8.716) | (21.533) | |

| L.g_deaths100k | −304.246 | 16.517 | −23.748 | −15.818 | −1.660 | 21.193 |

| (370.710) | (47.538) | (16.573) | (22.477) | (7.496) | (32.716) | |

| stringency | 0.239 | 1.535 | −2.735 *** | 5.126 *** | −0.288 | −0.470 |

| (0.187) | (1.493) | (0.549) | (1.428) | (0.623) | (0.448) | |

| econsupport | −0.153 | 0.017 | 1.214 *** | N.A. | 0.205 | 2.043 *** |

| (0.489) | (0.398) | (0.312) | (0.181) | (0.310) | ||

| Constant | 60.284 *** | −74.888 | 211.773 *** | −322.243 ** | 68.880 | −77.688 ** |

| (9.090) | (139.403) | (52.258) | (110.870) | (50.708) | (28.648) | |

| Observations | 48 | 48 | 60 | 48 | 60 | 48 |

| R-squared | 0.391 | 0.139 | 0.338 | 0.243 | 0.239 | 0.232 |

| VARIABLES | September | October | November | December | Overall | |

| L.market_RSI | −0.481 *** | −0.376 *** | −0.147 | −0.177 | −0.091 ** | |

| (0.136) | (0.092) | (0.152) | (0.228) | (0.038) | ||

| g_cases100k | 0.578 *** | 0.085 | 0.316 | −0.008 | 0.003 | |

| (0.171) | (0.134) | (0.210) | (0.011) | (0.012) | ||

| L.g_cases100k | −0.256 ** | −0.216 ** | −0.426 | −0.028 *** | −0.029 ** | |

| (0.105) | (0.089) | (0.340) | (0.009) | (0.010) | ||

| g_deaths100k | −55.666 | 4.572 | 8.720 | −24.143 | 7.230 | |

| (46.227) | (19.869) | (9.381) | (16.088) | (5.575) | ||

| L.g_deaths100k | 11.466 | −12.941 | −2.006 | −3.493 | −7.233 * | |

| (48.205) | (26.220) | (8.550) | (25.960) | (3.677) | ||

| stringency | −1.780 *** | 0.828 | 0.119 | −0.874 | 0.020 | |

| (0.349) | (0.553) | (0.221) | (0.546) | (0.036) | ||

| econsupport | N.A. | −0.267 | −0.322 ** | −0.584* | 0.038 | |

| (0.472) | (0.126) | (0.288) | (0.041) | |||

| Constant | 159.008 *** | 36.473 ** | 70.664 *** | 153.390 *** | 42.441 *** | |

| (17.888) | (15.050) | (20.417) | (24.035) | (2.432) | ||

| Observations | 48 | 60 | 48 | 60 | 612 | |

| R-squared | 0.484 | 0.230 | 0.208 | 0.168 | 0.018 |

Table A9.

Stock market regressions for Western Europe (17 countries).

Table A9.

Stock market regressions for Western Europe (17 countries).

| VARIABLES | March | April | May | June | July | August |

| L.market_RSI | −0.498 *** | −0.483 *** | −0.117 | −0.319 *** | −0.107 | −0.379 *** |

| (0.096) | (0.140) | (0.074) | (0.109) | (0.076) | (0.039) | |

| g_cases100k | −0.114 | 0.147 | 1.694 | 5.975 ** | 1.064 *** | 0.136 ** |

| (0.265) | (0.091) | (1.237) | (2.200) | (0.346) | (0.059) | |

| L.g_cases100k | 0.025 | −0.135 * | −0.880 | −4.796 *** | 0.033 | −0.253 |

| (0.420) | (0.073) | (0.835) | (1.393) | (0.167) | (0.325) | |

| g_deaths100k | −0.891 | −3.102 *** | 7.139 *** | −6.858 | −114.578 *** | 10.443 |

| (3.503) | (0.698) | (2.252) | (6.785) | (30.085) | (7.862) | |

| L.g_deaths100k | −12.493 * | 3.020 ** | −3.941 | 2.587 | 28.716 | 35.886 |

| (7.105) | (1.257) | (5.521) | (4.790) | (34.079) | (33.406) | |

| stringency | −0.207 | −1.897 | −0.459 | −0.571 | 0.229 | 0.408 |

| (0.154) | (1.118) | (0.452) | (0.341) | (0.541) | (0.344) | |

| econsupport | −0.158 | −0.554 *** | 1.402 ** | N.A. | −0.272 | N.A. |

| (0.102) | (0.099) | (0.561) | (0.302) | |||

| Constant | 85.220 *** | 250.937 ** | −45.938 | 74.225 *** | 46.982 | 26.006 |

| (6.609) | (87.328) | (35.082) | (22.815) | (29.883) | (16.776) | |

| Observations | 68 | 68 | 85 | 68 | 85 | 68 |

| R-squared | 0.457 | 0.449 | 0.109 | 0.222 | 0.233 | 0.306 |

| VARIABLES | September | October | November | December | Overall | |

| L.market_RSI | −0.410 *** | −0.214 *** | −0.163 * | −0.396 *** | −0.160 *** | |

| (0.085) | (0.061) | (0.085) | (0.108) | (0.029) | ||

| g_cases100k | 0.004 | 0.080 | −0.052 | −0.043 | 0.051 *** | |

| (0.317) | (0.048) | (0.055) | (0.045) | (0.009) | ||

| L.g_cases100k | 0.176 ** | −0.034 | −0.026 | 0.021 | −0.059 *** | |

| (0.061) | (0.108) | (0.053) | (0.066) | (0.015) | ||

| g_deaths100k | −8.524 | −3.357 | 4.042 * | 3.119 | −1.251 ** | |

| (17.846) | (4.885) | (2.225) | (4.030) | (0.544) | ||

| L.g_deaths100k | 6.475 | 19.665 *** | −3.714 * | −4.854 * | 1.861 *** | |

| (17.787) | (6.074) | (1.775) | (2.395) | (0.378) | ||

| stringency | 0.173 | 0.121 | 0.829 | −0.863 * | −0.025 | |

| (0.948) | (0.483) | (1.213) | (0.476) | (0.056) | ||

| econsupport | −0.214 | −0.267 | −0.075 | −0.886 *** | −0.060 | |

| (0.407) | (0.390) | (0.479) | (0.103) | (0.041) | ||

| Constant | 62.757 | 44.764 | 5.512 | 189.460 *** | 49.459 *** | |

| (55.013) | (35.564) | (105.188) | (28.876) | (2.153) | ||

| Observations | 68 | 85 | 68 | 85 | 867 | |

| R-squared | 0.183 | 0.311 | 0.125 | 0.196 | 0.045 |

Notes

| 1 | This is itself consistent with the past experiences considered by (), who links the US stock market recovery from the post-1999 crash to rapid Federal Reserve monetary expansion and contrasts this with the effects of stagnant money supply in post-1989 Japan and monetary contraction in the post-1929 US case. Meanwhile, as with the late 1990s Nasdaq bubble, the effects of US monetary expansion in 2020–2021 may well have been channeled primarily into the stock market (whereas goods prices remained subdued). |

| 2 | An especially telling fact is () observation that, by the January 1919 issue of the Federal Reserve Bulletin, the Spanish Flu pandemic was no longer meriting even a mention in the Federal Reserve’s main publication. The contrast with the aftermath of the coronavirus pandemic in 2021 could not be more stark. |

| 3 | The onset of such high volatility regimes can itself produce significant sectoral effects, as seen in ’s () comparative Markov-switching analysis of gold’s hedging value in 2020 vs. 2008–2009. |

| 4 | A further factor considered by () is the potential for stronger virus-related stock market effects in countries with higher uncertainty avoidance (as proxied by survey data from employees and middle-managers of sampled firms). |

| 5 | Similarly, whereas contagion often emerged during past European crises, () find that this typically proved to to be a short-lived phenomenon and was not necessarily indicative of greater longer-run cointegration. |

| 6 | Further evidence on the differential stock market reactions around this time is provided by (), who, not surprisingly, find widespread sectoral variations. |

| 7 | Not only does experience from past pandemics suggest considerable risks of post-pandemic inflation owing to pent-up consumer demand (), but also such dangers have likely been greatly understated by Modern Monetary Theory proponents (). |

| 8 | Few countries outside of China exhibited meaningful virus case numbers and deaths prior to March. |

| 9 | Dollar returns, rather than returns in local currency, allows for more of an apples-to-apples comparison as the gains in value of a dollar invested in the US market are set against the gains realized from that same dollar invested abroad. |

| 10 | Stationarity of the variables entered in the regressions is confirmed by application of the () unit root test. This test is appliable to cases where the number of panels is large relative to the number of time periods. The results reject the presence of a unit root at better than the 98% confidence level or better in each case (Appendix A Table A3). |

References

- Al-Awadhi, Abdullah Khaled Alsaifi, Ahmad Al-Awadhi, and Salah Alhammadi. 2020. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance 27: 100326. [Google Scholar] [CrossRef] [PubMed]

- Alber, Nader. 2020. The Effect of Coronavirus Spread on Stock Markets: The Case of the Worst 6 Countries. Available online: https://ssrn.com/abstract=3578080 (accessed on 10 April 2021).

- Ashraf, Badar Nadeem. 2020. Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance 54: 101249. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2021. Stock markets’ reaction to COVID-19: Moderating role of national culture. Finance Research Letters. forthcoming. [Google Scholar]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle J. Kost, Marco C. Sammon, and Tasaneeya Viratyosin. 2020. The Unprecedented Stock Market Impact of COVID-19. Working Paper 26945. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Bird, Graham, Eric Pentecost, and Thomas Willett. 2021. Modern Monetary Theory and the policy response to COVID-19: Old wine in new bottles. World Economy. forthcoming. [Google Scholar]

- Boţoc, Claudio, and Sorin Gabriel Anton. 2020. New empirical evidence on CEE’s stock markets integration. World Economy 43: 2785–802. [Google Scholar] [CrossRef]

- Burdekin, Richard C. K. 2020a. The money explosion of 2020, monetarism and inflation: Plagued by history? Modern Economy 11: 1887–900. [Google Scholar] [CrossRef]

- Burdekin, Richard C. K. 2020b. Economic and financial effects of the 1918–1919 Spanish Flu pandemic. Journal of Infectious Diseases & Therapy 8: 1000439. [Google Scholar]

- Burdekin, Richard C. K. 2021. Death and the stock market: International evidence from the Spanish Flu. Applied Economics Letters. forthcoming. [Google Scholar]

- Burdekin, Richard C. K., and Ran Tao. 2021. The golden hedge: From global financial crisis to global pandemic. Economic Modelling 95: 170–80. [Google Scholar] [CrossRef]

- Chan-Lau, Jorge A., and Yunhui Zhao. 2020. Hang in There: Stock Market Reactions to Withdrawals of COVID-19 Stimulus Measures. Working Paper 20/285. Washington, DC: International Monetary Fund. [Google Scholar]

- Cox, Josue, Daniel L. Greenwald, and Sydney C. Ludvigson. 2020. What Explains the COVID-19 Stock Market? Working Paper 27784. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Friedman, Milton. 2005. A natural experiment in monetary policy covering three episodes of growth and decline in the economy and the stock market. Journal of Economic Perspectives 19: 145–50. [Google Scholar] [CrossRef]

- Greenwood, John, and Steve H. Hanke. 2021. The money boom is already here. Available online: https://www.wsj.com/articles/the-money-boom-is-already-here-11613944730 (accessed on 10 April 2021).

- Hale, Thomas, Noam Angrist, Thomas Boby, Emily Cameron-Blake, Laura Hallas, Beatriz Kira, Saptarshi Majumdar, Anna Petherick, Toby Phillips, Helen Tatlow, and et al. 2020. Variation in Government Responses to COVID-19. Working Paper 2020/032. Oxford, UK: Blavatnik School of Government, Oxford University. [Google Scholar]

- Harjoto, Maretno Agus, Fabrizio Rossi, and John K. Paglia. 2021. COVID-19: Stock market reactions to the shock and the stimulus. Applied Economics Letters. forthcoming. [Google Scholar]

- Harris, Richard D. F., and Elias Tzavalis. 1999. Inference for unit roots in dynamic panels where the time dimension is fixed. Journal of Econometrics 91: 201–26. [Google Scholar] [CrossRef]

- Just, Malgorzata, and Krzystof Echaust. 2020. Stock market returns, volatility, correlation and liquidity during the COVID-19 crisis: Evidence from the Markov switching approach. Finance Research Letters 37: 101775. [Google Scholar] [CrossRef] [PubMed]

- Khan, Karamat, Huawei Zhao, Han Zhang, Huilin Yang, Muhammad Haroon Shah, and Atif Jahanger. 2020. The impact of COVID-19 pandemic on stock markets: An empirical analysis of world major stock indices. Journal of Asian Finance, Economics, and Business 7: 463–74. [Google Scholar] [CrossRef]

- Magalhaes, Luciana, and Samantha Pearson. 2020. Brazil’s president promised economic change: Now he is writing Covid−19 relief checks. Available online: https://www.wsj.com/articles/brazils-president-promised-economic-change-now-he-is-writing-covid-19-relief-checks-11605186008 (accessed on 10 April 2021).

- Malnick, Edward. 2020. Boris Johnson exclusive interview: We will not need another national lockdown. Available online: https://www.telegraph.co.uk/politics/2020/07/18/boris-johnson-exclusive-interview-will-not-need-another-national/ (accessed on 10 April 2021).

- Mazur, Mieszko, Man Dang, and Miguel Vega. 2021. COVID-19 and the March 2020 stock market crash. Evidence from S&P1500. Finance Research Letters 38: 101690. [Google Scholar] [PubMed]

- Okorie, David Iheke, and Boqiang Lin. 2021. Stock markets and the COVID-19 fractal contagion effects. Finance Research Letters 38: 101640. [Google Scholar] [CrossRef] [PubMed]

- Phan, Dinh Hoang Bach, and Paresh Kumar Narayan. 2020. Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerging Markets Finance and Trade 56: 2138–50. [Google Scholar] [CrossRef]

- Rahman, Md Lutfur, Abu Amin, and Mohammed Abdullah Al Mamun. 2021. The COVID-19 outbreak and stock market reactions: Evidence from Australia. Finance Research Letters 38: 101832. [Google Scholar] [CrossRef]

- Testa, Christian C., Nancy Krieger, Jarvis T. Chen, and William P. Hanage. 2020. Visualizing the Lagged Connection between COVID-19 Cases and Deaths in the United States: An Animation Using Per Capita State-Level Data (January 22, 2020–July 8, 2020). Working Paper 19(4). Cambridge, MA: Harvard Center for Population and Development Studies. [Google Scholar]

- Velde, François R. 2020. What Happened to the US Economy during the 1918 Influenza Pandemic? A View through High-Frequency Data. WP 2020-11, Federal Reserve Bank of Chicago. Available online: https://www.chicagofed.org/publications/working-papers/2020/2020-11 (accessed on 10 April 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).