A GIS-Based Web Approach for Serving Land Price Information

Abstract

:1. Introduction

2. Backgrounds

3. Data Sources

| Name of Data Set | Feature Layers | Attribute Data |

|---|---|---|

| Basic geographic data | Road, river, topography, building, etc. | Name, category, code, grade, etc. |

| Land use planning | Land use situation, overall plan for land utilization, city planning. | Land use type, city function zones, land use conditions, degree of development, etc. |

| Benchmark land price | Benchmark land price of commercial, residential, industrial land. | Land price, grade, average condition, table of adjustment factors, appraisal time, etc. |

| Land price monitoring | Monitoring points of commercial, residential, industrial land. | Land use type, land price, location, tenure, ownership, appraisal time, etc. |

4. Analysis Models

4.1. Land Price Index

4.2. Spatial Distribution Model

4.3. Parcel Appraisal Model

5. System Design and Prototyping

5.1. System Design

5.1.1. System Architecture

5.1.2. Users and User Requirements

5.2. Prototype Development

5.2.1. Data Preparation

5.2.2. System Implementation

5.2.3. Main Functions

(1) Information publishing

(2) LPI calculation

(3) Spatial distribution modeling

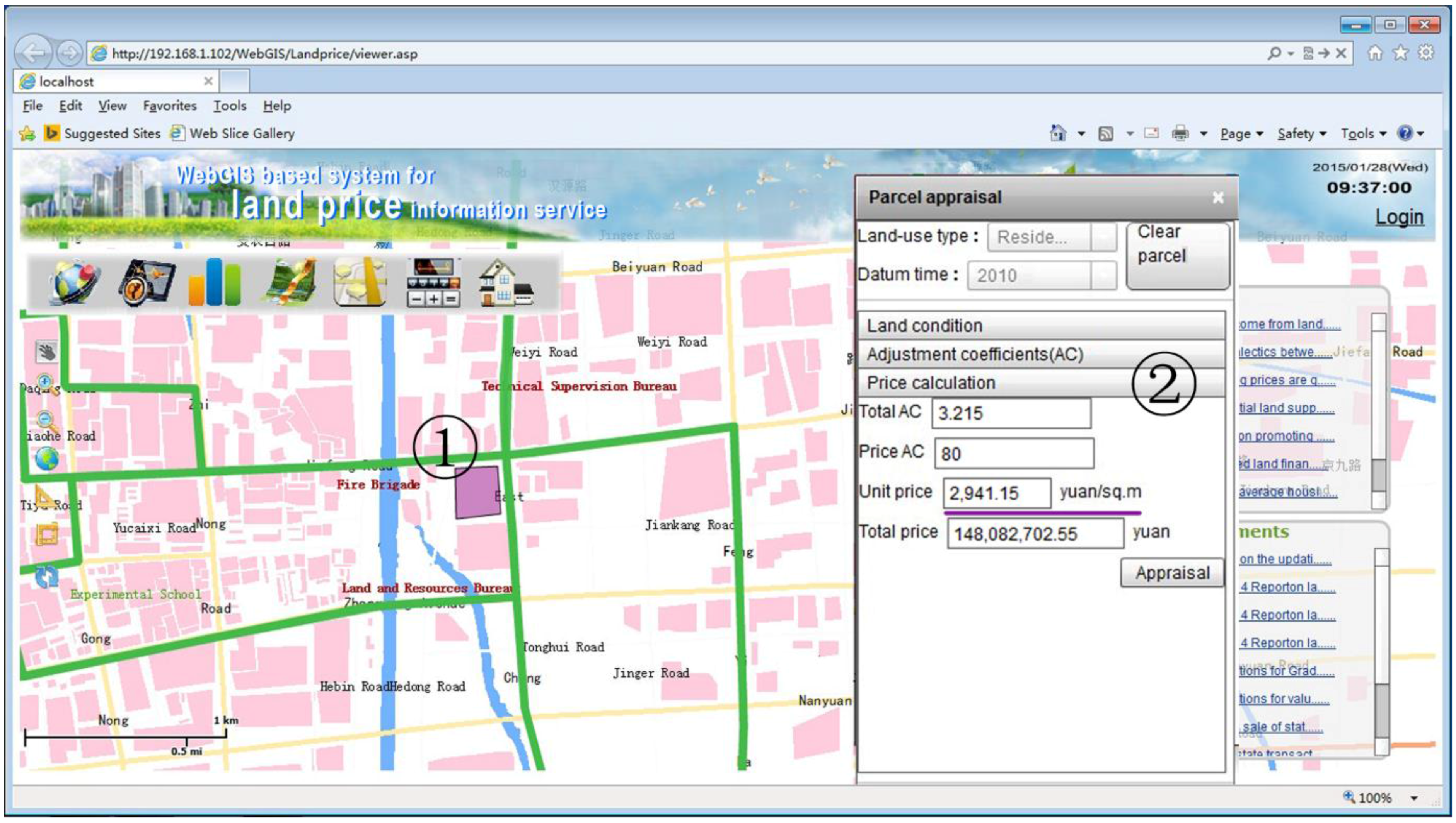

(4) Parcel appraisal

6. Conclusion

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Kettani, O.; Oral, M.; Siskos, Y. A multiple criteria analysis model for real estate evaluation. J. Glob. Optim. 1998, 12, 197–214. [Google Scholar] [CrossRef]

- Cao, G.; Feng, C.; Tao, R. Local “land finance” in China’s urban expansion: Challenges and solutions. China World Econ. 2008, 16, 19–30. [Google Scholar] [CrossRef]

- Tao, R.; Su, F.; Liu, M.; Cao, G. Land leasing and local public finance in China’s regional development: Evidence from prefecture-level cities. Urban Stud. 2010, 47, 2217–2236. [Google Scholar]

- Lin, G.; Yi, F. Urbanization of capital or capitalization on urban land? Land development and local public finance in urbanizing China. Urban Geogr. 2011, 32, 50–79. [Google Scholar] [CrossRef]

- Buitelaar, E. A transaction-cost analysis of the land development process. Urban Stud. 2004, 41, 2539–2553. [Google Scholar] [CrossRef]

- Deininger, K.; Savastano, S.; Carletto, C. Land fragmentation, cropland abandonment, and land market operation in Albania. World Dev. 2012, 40, 2108–2122. [Google Scholar] [CrossRef]

- Dahlman, C.J. The problem of externality. J. Law Econ. 1979, 22, 141–162. [Google Scholar] [CrossRef]

- Zevenbergen, J.; Bogaerts, T. Alternative approaches for successful cadastral systems. In Proceedings of the 22nd Urban and Regional Data Management Symposium, Delft, The Netherlands, 11–15 September 2000; pp. 67–76.

- Paz, P. Determinants of housing prices in Spanish cities. J. Prop. Invest. Financ. 2003, 21, 109–135. [Google Scholar]

- Cichociński, P.; Dąbrowski, J. Spatio-temporal analysis of the real estate market using geographic information systems. Real Estate Manag. Valuat. 2013, 21, 72–82. [Google Scholar] [CrossRef]

- Nanda, A.; Yeh, J. Spatio-temporal diffusion of residential land prices across Taipei regions. SpringerPlus 2014, 3, 505–520. [Google Scholar] [CrossRef] [PubMed]

- Saefuddin, A.; Widyaningsih, Y.; Ginting, A.; Mamat, M. Land price model considering spatial factors. Asian J. Math. Stat. 2012, 5, 132–141. [Google Scholar] [CrossRef]

- Williamson, I.; Ting, L. Land administration and cadastral trends—A framework for re-engineering. Comput. Environ. Urban Syst. 2011, 25, 339–366. [Google Scholar] [CrossRef]

- Bennett, R.; Wallace, J.; Williamson, I. Organising land information for sustainable land administration. Land Use Policy 2008, 25, 126–138. [Google Scholar] [CrossRef]

- Mađer, M. Land information management-Cadastre. Cartogr. Geoinf. 2012, 11, 186. [Google Scholar]

- Bordyuzha, A. Development of land cadastral system in Ukraine. Balanc. Nat. Using 2012, 5, 65–69. [Google Scholar]

- Divithure, H.; Tang, C. Evolution of land registration and cadastral survey systems in Sri Lanka. Surv. Rev. 2013, 45, 126–135. [Google Scholar]

- Kurwakumire, E. Digital cadastres facilitating land information management. South Afr. J. Geomat. 2014, 3, 64–77. [Google Scholar]

- Hanstad, T. Designing land registration systems for developing countries. Am. Univ. Int. Law Rev. 1997, 13, 647–703. [Google Scholar]

- Azad, B.; Faraj, S. E-Government institutionalizing practices of a land registration mapping system. Gov. Inf. Q. 2009, 26, 5–14. [Google Scholar] [CrossRef]

- Nasralla, Z.H.; Aleqabie, H.J.; Thamer, Z. Design and implementation of Karbala real estate information system. J. Kerbala Univ. 2013, 1, 240–248. [Google Scholar]

- De Vries, P.; Faber, R. Towards a real estate monitoring information system in Romania. Romanian Econ. J. 2009, 32, 187–214. [Google Scholar]

- Stanfield, D.; Raço, M. Land markets, information, and a property registration system in Albania. Comput. Environ. Urban Syst. 1994, 18, 133–141. [Google Scholar] [CrossRef]

- Kisilevich, S.; Keim, D.; Rokach, L. A GIS-based decision support system for hotel room rate estimation and temporal price prediction: The hotel brokers’ context. Decis. Support Syst. 2013, 54, 1119–1133. [Google Scholar] [CrossRef]

- Porta, J.; Parapar, J.; García, P.; Fernández, G.; Touriño, J.; Doallo, R.; Ónega, F.; Santé, I.; Díaz, P.; Miranda, D.; et al. Web-gis tool for the management of rural land markets application to the land bank of Galicia (NW Spain). Earth Sci. Inf. 2013, 6, 209–226. [Google Scholar] [CrossRef]

- Pagourtzi, E.; Assimakopoulos, V.; Hatzichristos, T.; French, N. Real estate appraisal: A review of valuation methods. J. Prop. Invest. Financ. 2003, 21, 383–401. [Google Scholar] [CrossRef]

- Zeng, T.Q.; Zhou, Q.M. Optimal spatial decision making using GIS: A prototype of a real estate geographical information system (REGIS). Int. J. Geogr. Inf. Sci. 2001, 15, 307–321. [Google Scholar] [CrossRef]

- Rodriguez, M.; Sirmans, C.F.; Marks, A.P. Using geographic information systems to improve real estate analysis. J. Real Estate Res. 1995, 10, 163–173. [Google Scholar]

- Li, H.; Yu, L.; Cheng, E.W. A GIS-based site selection system for real estate projects. Constr. Innov. 2005, 5, 231–241. [Google Scholar] [CrossRef]

- Pagourtzi, E.; Nikolopoulos, K.; Assimakopoulos, V. Architecture for a real estate analysis information system using GIS techniques integrated with fuzzy theory. J. Prop. Invest. Financ. 2006, 24, 68–78. [Google Scholar]

- Tsutsumi, M.; Shimada, A.; Murakami, D. Land price maps of Tokyo metropolitan area. Procedia Soi. Behav. Sci. 2011, 21, 193–202. [Google Scholar] [CrossRef]

- Hu, S.; Cheng, Q.; Wang, L.; Xu, D. Modeling land price distribution using multifractal IDW interpolation and fractal filtering method. Landsc. Urban Plann. 2013, 110, 25–35. [Google Scholar] [CrossRef]

- Tsutsumi, M.; Seya, H. Measuring the impact of large-scale transportation projects on land price using spatial statistical models. Pap. Reg. Sci. 2008, 87, 385–401. [Google Scholar] [CrossRef]

- Xie, Q.; Parsa, A.R.G.; Redding, B. The emergence of the urban land market in China evolution, structure constraints and perspectives. Urban Stud. 2002, 39, 1375–1398. [Google Scholar] [CrossRef]

- Liu, Y.; Zheng, B.; Huang, L.; Tang, X. Urban residential land value analysis: Case Danyang, China. Geo-Spat. Inf. Sci. 2007, 10, 228–234. [Google Scholar] [CrossRef]

- Li, L.H.; Walker, A. Benchmark pricing behaviour of land in China’s reforms. J. Prop. Res. 1996, 13, 183–196. [Google Scholar] [CrossRef]

- Xu, Z.; Li, Q. Integrating the empirical models of benchmark land price and GIS technology for sustainability analysis of urban residential development. Habitat Int. 2014, 44, 79–92. [Google Scholar] [CrossRef]

- Wang, R. The structure of Chinese urban land prices: Estimates from benchmark land price data. J. Real Estate Financ. Econ. 2009, 39, 24–38. [Google Scholar] [CrossRef]

- Ding, C. The benchmark land price system and urban land use efficiency in China. Chin. Geogr. Sci. 2001, 11, 306–314. [Google Scholar] [CrossRef]

- China Land Surveying and Planning Institute. China Urban Land Price Dynamic Monitor. Available online: http://www.landvalue.com.cn/ (accessed on 3 July 2015).

- Jiangsu Land and Resources Department. Jiangsu Land Market Website. Available online: http://www.landjs.com/ (accessed on 3 July 2015).

- Martinez, M.G.; Lorenzo, J.M.M.; Rubio, N.G. Kriging methodology for regional economic analysis: Estimating the housing price in Albacete. Int. Adv. Econ. Res. 2000, 6, 438–450. [Google Scholar] [CrossRef]

- José-Ma, M.; Beatriz, L. Estimating housing price: Kriging the mean. Int. Adv. Econ. Res. 2006, 12, 419. [Google Scholar]

- Johnston, K.; Ver Hoef, J.M.; Krivoruchko, K.; Lucas, N. Using ArcGIS Geostatistical Analyst; ESRI: Redlands, CA, USA, 2001; Volume 300. [Google Scholar]

- Dong, W. Benchmark Land Price in China: Present State and Outlook. Available online: http://www.fig.net/pub/fig2013/ppt/ts06e/TS06E_dong_6561_ppt.pdf (accessed on 3 July 2015).

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, Y.; Sun, Y.; Li, S.; Zhang, S.; Wang, K.; Hou, H.; Xu, S. A GIS-Based Web Approach for Serving Land Price Information. ISPRS Int. J. Geo-Inf. 2015, 4, 2078-2093. https://doi.org/10.3390/ijgi4042078

Yang Y, Sun Y, Li S, Zhang S, Wang K, Hou H, Xu S. A GIS-Based Web Approach for Serving Land Price Information. ISPRS International Journal of Geo-Information. 2015; 4(4):2078-2093. https://doi.org/10.3390/ijgi4042078

Chicago/Turabian StyleYang, Yongjun, Yaqin Sun, Songnian Li, Shaoliang Zhang, Kuoyin Wang, Huping Hou, and Shishuo Xu. 2015. "A GIS-Based Web Approach for Serving Land Price Information" ISPRS International Journal of Geo-Information 4, no. 4: 2078-2093. https://doi.org/10.3390/ijgi4042078