1. Introduction

Global agricultural trade has entered an era of heightened volatility, shaped by the intersection of geopolitical tensions, climate shocks, and policy interventions. According to the World Bank [

1], the global agricultural commodity price index declined by nearly 7% in early 2025, continuing the downward trajectory observed in the previous year. These fluctuations highlight the fragility of international supply chains, where external shocks increasingly propagate through interconnected production and trade networks [

2].

Among globally traded agricultural commodities, soybeans occupy a central position, functioning simultaneously as a primary feed protein source and a key input for edible oil production. This dual role makes soybeans indispensable for sustaining both livestock production and household consumption patterns. However, China’s high import dependence—exceeding 85% of total domestic demand in recent years—exposes the country to external risks arising from policy conflicts and global market disturbances [

3]. This vulnerability has become more pronounced under rising global trade uncertainty, making soybean sourcing not only an economic decision but also a strategic security concern.

The escalation of the U.S.–China trade conflict in 2018, when China imposed retaliatory tariffs on U.S. soybeans, triggered a dramatic reconfiguration of the global soybean market. Brazil’s exports surged to fill the gap, while U.S. shipments to China declined by nearly half [

4,

5]. In 2025, renewed tariff escalation once again disrupted trade flows and tested the resilience of China’s soybean import system. While existing studies have examined the initial 2018 tariff shock, much less is known about how sequential and intensifying tariff measures shaped long-term sourcing patterns and price transmission dynamics.

In agricultural trade, path dependence refers to the persistence of historical sourcing patterns due to long-standing trade relationships, logistical infrastructure, and institutional inertia [

6,

7]. Prior to 2018, China’s soybean imports exhibited a strong dependence on the United States, sustained by stable price competitiveness and established logistical routes. The imposition of retaliatory tariffs disrupted this equilibrium by altering relative prices, thereby dismantling the pre-existing trade path. Building on this conceptual foundation, the study proposes a three-channel analytical framework through which tariff shocks influence agricultural trade. This multi-dimensional mechanism aligns with classical trade adjustment theory [

8], where policy shocks trigger re-optimization in sourcing portfolios subject to cost and risk constraints. The conceptual logic can be summarized as follows (

Figure 1).

This framework integrates insights from trade theory, policy-shock transmission, and agricultural market dynamics, linking macro-level tariff interventions with micro-level behavioral adjustments. Accordingly, this study focuses on three key dimensions of adjustment: import volumes, source-country shares, and landed import prices. Based on this framework, we derive three hypotheses to guide the empirical analysis. First, given the direct cost imposition, tariffs should immediately suppress import volumes from the targeted source. Second, as importers seek alternatives, the market share should shift toward non-targeted suppliers. Third, due to differences in market power and contract rigidity, the tariff cost may not be fully absorbed by exporters, leading to asymmetric pass-through to import prices. Specifically, we hypothesize that

H1. Tariff shocks exert a statistically significant negative effect on China’s soybean imports from the United States, disrupting long-standing trade dependence.

H2. Tariff escalation induces substitution among import sources, leading to an increased share of non-U.S. suppliers in China’s soybean imports.

H3. Tariff costs are asymmetrically passed through to import prices, producing a relative increase in the landed prices of U.S. soybeans compared with other origins.

Therefore, the overarching objective of this study is to comprehensively investigate the impact of sequential U.S.–China tariff escalations on the restructuring of China’s soybean import market. To achieve this, we empirically test the above three hypotheses by employing a novel multi-phase and continuous-intensity DID design on high-frequency monthly trade data from 2015 to 2025.

2. Literature Review

2.1. Macroeconomic Perspectives on the U.S.–China Trade Conflict

Existing research has analyzed the U.S.–China trade conflict from macroeconomic and global value chain perspectives. General equilibrium and structural trade models consistently show that tariff escalation generated measurable economic shocks for China, while imposing larger and asymmetric welfare losses on the United States and accelerating trade diversion toward third-party exporters [

9,

10,

11,

12]. Meanwhile, studies emphasize that tariff shocks propagate along global production networks rather than being confined to bilateral trade flows. In particular, trade disputes disrupt intermediate goods trade, alter cost structures, and influence comparative advantage in both upstream and downstream industries [

13,

14,

15,

16]. These findings suggest that trade frictions have system-wide impacts, reshaping sourcing networks, bargaining relations, and relative competitiveness [

17,

18,

19]. However, while this literature provides the macroeconomic backdrop for understanding soybean trade, it does not unpack the commodity-specific mechanisms by which tariff escalation influences sourcing decisions and price formation in markets characterized by high dependence and limited domestic substitutability.

2.2. Soybean Import Adjustment Under Tariff Shocks

In the agricultural sector, soybeans are especially exposed to external policy risks due to their central role in feed and oil processing and their high share of imported supply. Empirical studies indicate that trade policy uncertainty and tariff measures have weakened the stability and flexibility of China’s soybean import system [

20,

21,

22]. After China imposed retaliatory tariffs in 2018, Brazil and other South American countries expanded exports to China, while U.S. shipments declined significantly and did not fully recover in subsequent years [

4,

5]. At the same time, research emphasizes that source-country substitution is not costless and is shaped by logistics capacity, contractual arrangements, shipment timing, and product characteristics such as protein content [

23,

24,

25]. These constraints imply that source reallocation occurs gradually, requiring adjustment along supply, procurement, and processing links. Thus, soybean import responses should be understood as dynamic adjustments, rather than as instant reactions to tariff shocks.

2.3. Price Transmission and Market Volatility Under Policy Uncertainty

At the level of price mechanisms, existing studies investigate the effects of trade policy shocks on price transmission and market volatility. Trade policy uncertainty influences commodity pricing not only through physical supply and demand but also via expectations, market sentiment, and futures market linkages [

26,

27]. Price dynamics propagate along the soybean–meal–livestock value chain, affecting not only import costs but also feed margins, livestock supply responses, and downstream consumer prices [

28,

29,

30,

31]. Moreover, tariff escalation can alter the relative pricing between origin countries, creating asymmetric pass-through depending on market power and contract flexibility [

32,

33]. However, most research documents these outcomes descriptively and does not empirically quantify how tariff intensity interacts with price pass-through under repeated escalation.

2.4. Research Gaps and Theoretical Motivation

Although the literature provides valuable insights, three critical gaps remain. Firstly, most studies focus on the initial 2018 tariff escalation, overlooking the renewed escalation in 2025, which prevents assessment of sequential and cumulative adjustment processes under persistent trade frictions. Secondly, existing research tends to examine trade volume reductions, supplier substitution, or price effects separately, lacking a unified analytical framework that connects path dependence, reallocation of sourcing portfolios, and asymmetric cost pass-through. Thirdly, prior empirical strategies mainly rely on single-phase or static DID design, which cannot disentangle short-term shock responses from longer-term structural adjustments, nor evaluate how changes in tariff intensity shape import decisions.

To address these gaps, this study employs a novel multi-phase and continuous-intensity DID design. This empirical strategy allows us to quantify the dynamic effects of sequential tariff shocks on China’s soybean import volumes, source-country share reallocation, and asymmetric price pass-through, thereby directly testing the hypotheses derived in the introduction. This approach links macro-level trade interventions to micro-level sourcing and pricing adjustments, providing new evidence on the restructuring of China’s soybean import architecture under recurrent trade shocks and contributing to broader discussions of supply chain resilience and strategic import diversification.

3. Materials and Methods

This study empirically investigates the impact of sequential U.S.–China tariff shocks on China’s soybean imports from January 2015 to June 2025. The analysis focuses on six major suppliers—the United States (treatment group) and five non-U.S. exporters (Brazil, Argentina, Canada, Uruguay, and Russia, as the control group)—which collectively account for over 99% of China’s soybean imports during the sample period. The primary purpose of this econometric analysis is to quantitatively identify the causal effects of tariffs on three core dimensions of trade flows, import volumes, source-country shares, and landed import prices, thereby providing a comprehensive test of the hypotheses (H1–H3) outlined in the introduction. To achieve this, we employ a suite of DID models, as detailed below.

3.1. Methodology

DID is a canonical econometric approach for policy and program evaluation, widely applied in quasi-natural experiment settings. The method uses untreated units as a counterfactual and identifies causal effects by comparing changes over time between treated and control groups [

34]. To comprehensively capture both the occurrence and the magnitude of tariff shocks, this study adopts a three-tier DID framework. The baseline DID establishes the causal benchmark by comparing treated and control groups before and after the initial policy. The multi-phase DID extends this by aligning treatment periods with institutional tariff episodes, thus identifying stage-specific effects. The continuous-intensity DID further quantifies the heterogeneous impact of tariff magnitude, allowing us to examine whether stronger tariff exposure induces proportionally greater trade adjustments. Together, these models provide complementary perspectives on both the timing and intensity of policy shocks. A summary of the model specifications is provided in

Table 1.

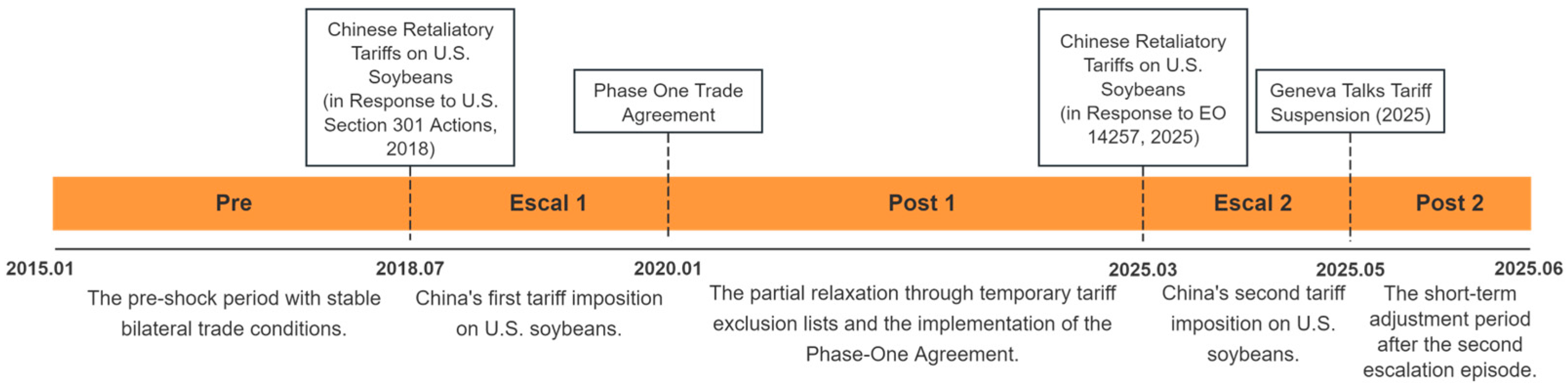

3.1.1. Multi-Phase DID Model

The tariff shocks were not a single instantaneous intervention but unfolded through discrete and well-documented escalation and adjustment stages. We therefore adopt a phased DID specification that aligns tariff exposure with institutional timelines. Phase 0 represents the pre-shock period with stable bilateral trade conditions (Pre, January 2015–June 2018). Phase 1 corresponds to China’s initial tariff imposition on U.S. soybeans (Escal1, July 2018–January 2020). Phase 2 reflects partial relaxation through temporary tariff exclusion lists and the implementation of the Phase-One Agreement (Post1, February 2020–February 2025). Phase 3 corresponds to China’s second tariff imposition on U.S. soybeans (Escal2, March–April 2025), while Phase 4 represents the short-term adjustment period after the second escalation episode (Post2, May–June 2025). Building on this segmentation, the regression specification is as follows:

where

denotes the dependent variable, which represents China’s soybean imports from country

at time

in terms of import volume, import share, or import price.

is the constant term.

is the country dummy variable, where

indicates the treatment group (the United States) and

indicates the control group (non-U.S. suppliers).

represents the time dummy variable. The interaction term

is the key explanatory variable, and its coefficient

captures the policy effect identified by the DID framework.

denotes the vector of control variables, included to purge observable heterogeneity that may affect imports. The main controls comprise political risk, economic scale (GDP), price, export-peak season, and harvest season. Although the imposition of tariffs is treated as an exogenous policy intervention, potential endogeneity cannot be fully ruled out, as trade policies may partially respond to preceding trade dynamics or geopolitical tensions. To mitigate this concern, the study employs fixed effects (

and

) at both the country and time levels, controlling for unobserved bilateral and temporal shocks. The error term is

.

3.1.2. Continuous-Intensity DID Model

In addition to the discrete policy phases identified in the multi-phase DID framework, tariff escalation also exhibits variation in magnitude, which may generate heterogeneous adjustment responses even within the same phase. To further quantify the intensity of tariff shocks, this study draws on the continuous-intensity DID model proposed by Callaway and Li et al. [

35,

36]. The model is specified as follows:

where

represents either the share of country

in China’s total soybean imports at time

or the corresponding landed import price.

refers to the ad valorem tariff rate imposed by China on U.S. soybeans at time

. The interaction term

captures the effective tariff burden specific to U.S. imports. The coefficient

measures the marginal impact of tariff intensity on import behavior. For example, A negative and statistically significant

indicates that higher tariff intensity leads to proportionately larger reductions in U.S. soybean imports, implying that the trade response is not only stage-specific but also intensity-dependent.

denotes the set of control variables.

and

represent country and time fixed effects, respectively, and

is the error term.

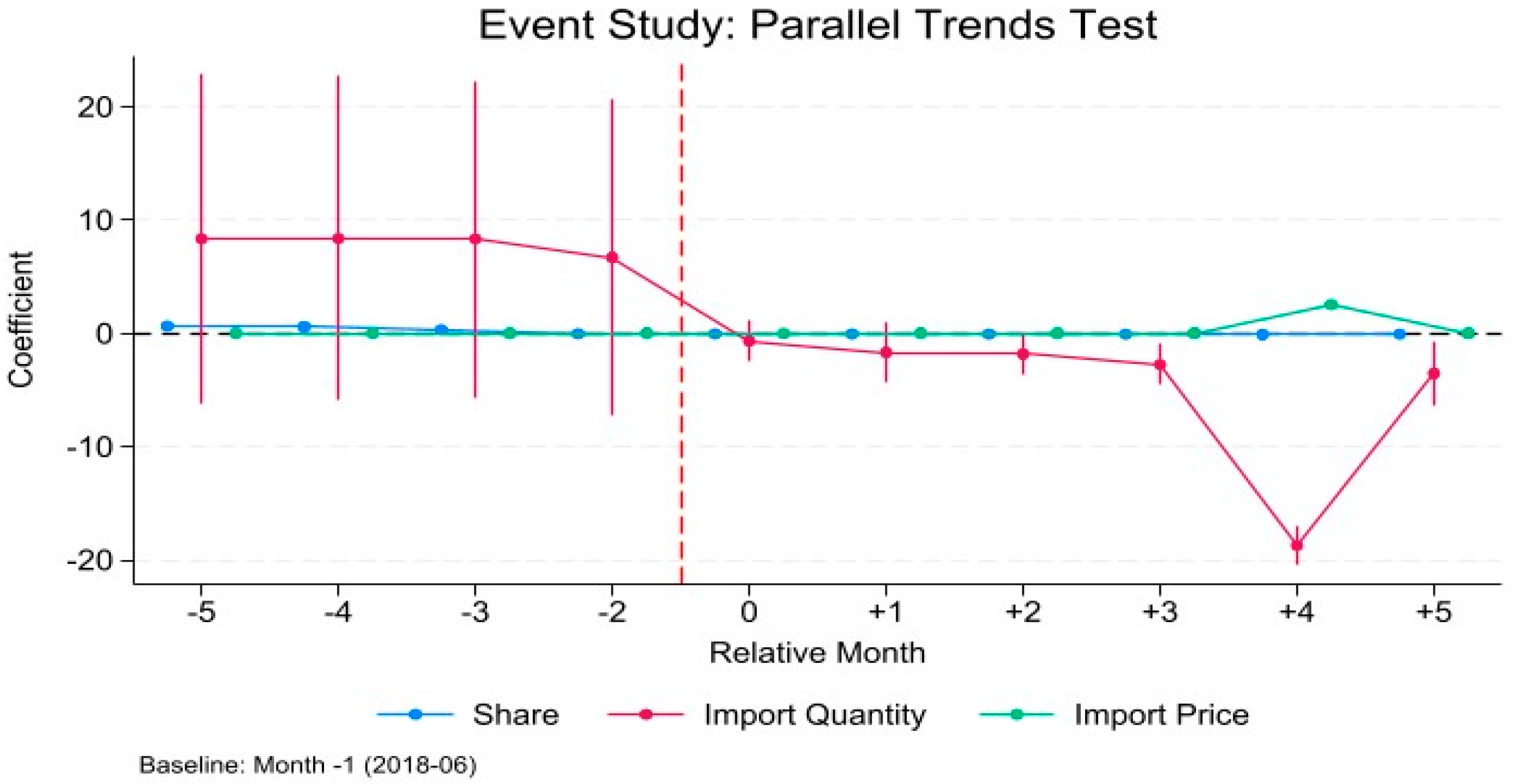

3.2. Robustness and Validity Tests

When applying the DID framework, the core model assumptions and the robustness of results are critical for ensuring the reliability of the conclusions. A key identification assumption in our DID framework is the exogeneity of the treatment assignment. While we treat the tariff impositions as exogenous policy shocks, we acknowledge the potential concern that these measures might correlate with broader geopolitical tensions or pre-existing trade trends. However, the timing and scale of the 2018 and 2025 tariff escalations were primarily driven by high-level political decisions rather than short-term fluctuations in soybean trade flows, supporting their quasi-random nature for our empirical purpose. To further mitigate endogeneity concerns and validate our identification strategy, we employ the following robustness checks. First, event-study pre-trend tests indicate parallel trends in the pre-shock period, supporting the DID identification assumption. Second, we conduct placebo tests using pseudo treatment dates and placebo treated countries that were not affected by the tariff change.

3.2.1. Event-Study Specification for Parallel Trends

The event-study specification is applied to test the dynamic treatment effects before and after the tariff shocks:

where

represents

,

and

, while

denotes the logarithmic forms of import volume, import share, and import price, respectively. The specification measures outcomes relative to the policy implementation date (July 2018). The period −1 (one period before the policy intervention) is omitted and serves as the baseline group.

3.2.2. Placebo Test

Following the approach of Zhang and Zhong [

37], both the sample period and the policy intervention date are shifted one year earlier. Specifically, the sample covers January 2017 to May 2018, with September 2017 artificially designated as the intervention date. The model specification remains consistent with the baseline DID framework, employing the same dependent and control variables.

3.3. Data and Variables

The soybean trade data are obtained from the United Nations Commodity Trade Statistics Database (UN Comtrade) and the General Administration of Customs of the People’s Republic of China. Data on domestic production are sourced from the National Bureau of Statistics of China and the FAOSTAT database. The analysis focuses on six principal suppliers—the United States and five non-U.S. exporters (Brazil, Argentina, Canada, Uruguay, and Russia), which collectively accounted for approximately 99% of China’s soybean imports during the sample period. The tariff rate data were drawn from the official Customs Tariff Schedule of the People’s Republic of China. The applied tariff on U.S. soybeans underwent prescribed variations from the standard MFN rate to multiple rounds of elevated retaliatory tariffs, as per official announcements from the State Council Tariff Commission, which defined the intensity of the trade shock across different phases. Other macroeconomic and control variables include the annual political risk index, constructed based on the International Country Risk Guide (ICRG) published by the Political Risk Services (PRS) Group. GDP indices are obtained from the International Monetary Fund (IMF). To ensure temporal alignment in monthly model, all annual variables were linearly interpolated to generate monthly frequency values. Considering the availability of all indicators, the sample period covers from January 2015 to June 2025.

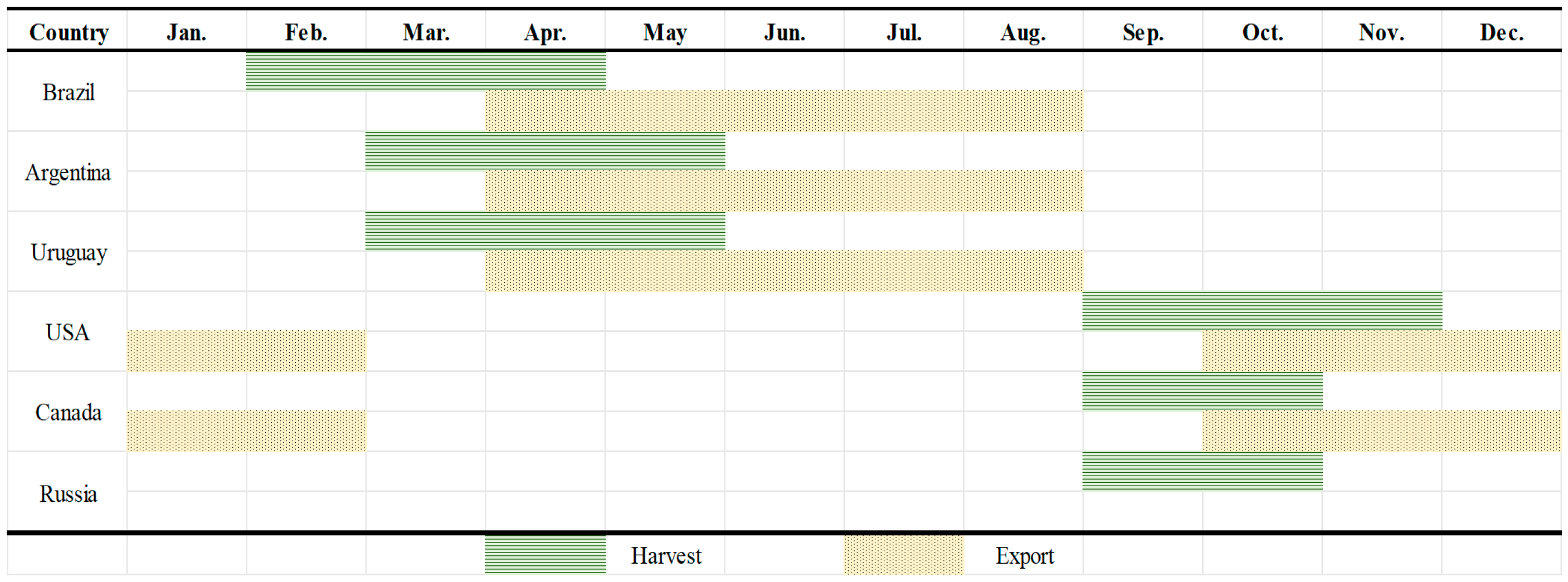

The selection of control variables is guided by economic theory and the need to isolate the causal effect of tariffs from other confounding factors. We control for Political Risk to account for geopolitical uncertainty that could independently influence bilateral trade flows. The exporter’s GDP is included to capture its macroeconomic conditions and overall supply capacity. The Price variable is crucial to isolate the pure tariff effect from general fluctuations in the global soybean market. Finally, the ExportPeak and Harvest seasonal dummies are incorporated to account for the strong inter-hemispheric seasonality inherent in agricultural trade, which systematically affects shipment volumes and sourcing patterns. In the Northern Hemisphere, led by the United States and other temperate producers, soybeans are typically harvested from September to November, with export peaks in October to February. In the Southern Hemisphere, dominated by Brazil, Argentina, and Uruguay, harvest occurs from February to April, and exports peak in April to August. This hemispheric staggering shapes the global arrival cadence, underpins predictable intra-annual price seasonality. The definitions and descriptions of all variables are presented in

Table 2 and

Figure 2 and

Figure 3.

4. Results

4.1. Effects of Tariff Shocks on Import Volumes

We estimate multi-phase DID model on the monthly panel using Stata 18 to test H1.

Table 3 presents the estimation results, where the dependent variable is the logarithm of soybean import volume—the United States is defined as the treatment group and other major exporters (e.g., Brazil, Argentina) as controls. Column (1) designated as the Baseline, which adopts a parsimonious setting to first identify the core causal effect of tariff shocks, excluding all control variables and retaining only the key explanatory variables and necessary fixed effects. Columns (2) to (5) progressively add seasonal dummies, price controls, and macro–political variables, allowing us to examine whether the core tariff effect remains stable after mitigating omitted variable bias.

Across all specifications, the escalation period in 2018–2019 (Escal1) yields negative and statistically significant coefficients. These estimates imply a 45–75% decline in China’s imports from the United States relative to the pre-escalation baseline, even after sequentially adding controls. This pattern indicates that the primary effect is not an artifact of seasonality or contemporaneous price dynamics but reflects a substantial, policy-induced contraction in U.S. shipments. In the Post1 phase, interaction terms are positive yet imprecisely estimated, pointing to stabilization or modest recovery without evidence of a material rebound. This rules out short-term trade noise and confirms the persistence of tariff impacts. During the second escalation episode (Escal2), imports display an uptick; however, statistical significance dissipates once additional controls are included, indicating that the apparent rebound is likely tied to short-run trade noise rather than a persistent shift. In the post-second phase (Post2), coefficients vary and estimates are uniformly insignificant, implying no systematic reversion to pre-dispute levels and underscoring the persistent, long-horizon constraints imposed by tariff measures—further confirming H1.

Results for the controls align with economic priors and support the reliability of the empirical design. The export-peak dummy loads positively and significantly, consistent with strong seasonal pull effects commonly observed in agricultural trade. By contrast, the harvest-season dummy suggests that when global supply is abundant, Chinese buyers re-time purchases or substitute across origins to secure better terms, leading to a systematic decline in U.S. arrivals—reflecting inter-hemispheric seasonal substitution. The price coefficient shows that a 1% increase in soybean prices is associated with a ~3.9% reduction in China’s imports from the United States, which is consistent with demand-elasticity theory in agricultural markets. Finally, macroeconomic (GDP) and political-risk controls are statistically insignificant, plausibly reflecting limited macro variation over the sample window and the coarse nature of risk indices in capturing time-varying policy uncertainty; importantly, their inclusion does not alter the main tariff-shock estimates.

4.2. Effects on Import Structure: Source Reallocation

This section employs both the multi-phase DID and continuous-intensity DID models to verify H2 from the dual perspectives of stage heterogeneity and intensity marginal effect, respectively. Multi-phase DID constructs interaction terms by dividing the tariff escalation phases to capture the dynamic impact of different policy stages on the import structure. Continuous-intensity DID uses the tariff rate as a continuous variable to quantify the marginal effect of each 1 percentage point change in tariff intensity on the import share of U.S. soybeans.

Table 4 reports the results.

Although the models do not separately identify changes in each non-U.S. supplier’s share, import shares sum to one; therefore, any decline in the U.S. share mechanically corresponds to a combined increase in the shares of non-U.S. exporters. The coefficient in column (1) reflects the share change (percentage points) of a certain policy stage relative to the base period. During the first tariff escalation (Escal1), the U.S. share of China’s soybean imports declined by 29.3 percentage points, and remained 10.6 points lower in the post1 phase. This is a phenomenon attributed to path dependence stickiness in agricultural trade; the sunk costs of switching prevented a full rebound in U.S. market share, even as tariff pressures eased. A brief rebound occurred during Escal2, which is interpreted as short-term speculative inventory adjustment—importers temporarily increased U.S. purchases to hedge against potential further tariff hikes, rather than a reversal of structural substitution. This rebound was again reversed in Post2, where the share fell by 32.4 points relative to baseline, reflecting the reinforcement effect of secondary tariff shocks. The continuous-intensity DID estimates reveal that each one-percentage-point increase in the tariff rate reduced the U.S. share by approximately 0.56 percentage points, confirming a proportional and persistent substitution effect. Both models validate H2 through dual perspectives of stage heterogeneity and intensity-graded effects, indicating that tariffs induced a durable reallocation of China’s import structure from the U.S. toward Brazil and other South American exporters. While consistent with prior studies showing that tariffs reduced the U.S. share of China’s soybean imports [

4,

5], our analysis reveals a stepwise rather than one-time decline and quantifies its dynamic adjustment under multi-phase shocks.

4.3. Tariff Effects on Price Mechanisms and Transmission Channels

Price adjustments represent the third mechanism through which tariff shocks propagate. This section uses two models to collaboratively verify the asymmetric price transmission of H3. The multi-phase DID uses interaction term to compare the price differences in non-U.S. soybeans relative to U.S. soybeans in different policy phases, while the continuous-intensity DID uses

to quantify the marginal transmission magnitude of tariff intensity on the import price of U.S. soybeans.

Table 5 reports the results.

The phased DID estimates in column (1) capture the relative price dynamics between U.S. and non-U.S. soybeans, reflecting how tariff shocks reshape the price competitiveness of different supply sources in China’s import market. During the first escalation episode (Escal1), the log price of non-U.S. soybeans relative to U.S. soybeans declined significantly by 0.185 units. After exponential conversion, this coefficient corresponds to a 20.3% reduction in the relative price premium of U.S. soybeans, essentially driven by the marginal cost increment of U.S. soybeans induced by ad valorem tariffs. This finding directly verifies the price pass-through effect of tariffs; tariffs raised the import cost of U.S. soybeans, while non-U.S. suppliers, unaffected by the shock, maintained their price competitiveness. In subsequent phases, the interaction terms are statistically insignificant and notably smaller in magnitude, suggesting that the tariff-induced price distortion of U.S. soybeans were short-lived, and that non-U.S. suppliers did not form a price markup from demand diversion in the medium to longer run. This pattern is consistent with a competitive global soybean market; the international supply of soybeans is sufficiently elastic, and when China redirects import demand to non-U.S. sources, new suppliers quickly enter or expand output to meet the demand, preventing a sustained rise in non-U.S. soybean prices.

The continuous-intensity DID estimates in column (2) quantify the gradient with respect to tariff levels; a one-unit increase in tariff intensity is associated with a 0.355 rise in the log price of U.S. soybeans, equivalent to an average price increase of roughly 43%. The pronounced price elasticity further reflects that tariff costs were almost entirely passed through to import prices, highlighting the passive pricing position of U.S. soybeans in the Chinese market.

In sum, tariffs did not induce a broad price surge among non-U.S. suppliers but directly and substantially increased the export price of U.S. soybeans to China. This pattern indicates that the loss of price competitiveness was concentrated on the U.S. side, while China’s import substitution was achieved mainly through adjustments in quantity and market share rather than price arbitrage. These results validate H3 and highlight the asymmetric incidence of tariff costs—borne largely by U.S. exporters, as China stabilized domestic import prices through diversified sourcing.

4.4. Robustness Checks

4.4.1. Parallel Trend Tests

The parallel trend assumption is a core requirement of the DID model. This section tests whether U.S. and non-U.S. soybeans exhibit parallel pre-tariff trends in import volume, share, and price. The results are shown in

Table 6 and visualized in

Figure 4.

The event-study evidence indicates that support for the parallel-trends assumption varies by outcome. For column (1), import volume, pre-policy coefficients are positive but statistically insignificant, suggesting no differential pre-trend between U.S. and non-U.S. imports. Notably, the significant turning point in the coefficient during the pre_2 phase resulted from the decline in import volume, which was driven by inventory digestion following the procurement boom triggered by tariff expectations in 2018. This is a short-term adjustment without trend divergence, consistent with the parallel trend assumption. After policy implementation, U.S. volumes declined sharply, particularly in the post_4 phase, consistent with the suppressing effect of retaliatory tariffs on bilateral flows and further validating the causal interpretation of H1.

For column (2), import share, several pre-policy coefficients are significantly positive, suggesting that the share of U.S. soybeans temporarily surged prior to the formal imposition of tariffs. This may reflect traders’ anticipatory behavior, such as stockpiling during peak export seasons to avoid future tariff costs. Although some pre-policy coefficients are statistically significant, they do not exhibit a systematic upward or downward trend, which implies that the treatment and control groups remain comparable in terms of trends and that the core requirement of the DID framework is not violated. After policy implementation, the coefficients for import share turn persistently negative and increasingly significant, confirming a sustained decline in the U.S. share and validating the durable reallocation hypothesis of H2.

For column (3), import price, the pre-policy coefficients are close to zero and statistically insignificant, suggesting that the price trends of U.S. and non-U.S. soybeans were highly consistent, thereby satisfying the parallel trend assumption. Following policy implementation, significant increases appear only from the post_4 period, reflecting a delayed pass-through of tariff costs. In the short run, Chinese importers buffered price shocks through inventory adjustments, while over time, as supply chain substitution was completed, tariff costs were gradually transmitted to final prices. This lag not only illustrates the stickiness of price adjustments in agricultural trade but also highlights the role of trade policy in reshaping market structures. These results validate H3 and confirm that the price effects are tariff-induced.

Overall, the results support the parallel-trends assumption for and . Although differences exist in the level of prior to policy implementation, there is no evidence of systematic divergence in trends. Therefore, applying the DID framework for empirical testing is valid.

4.4.2. Placebo Tests

To further assess robustness, we implement placebo tests. The idea is to construct a pseudo-treatment group or assume a pseudo-policy shock at an alternative point in time. If the estimated coefficients under this fictitious scenario are insignificant, it indicates that the observed effects in the baseline model are indeed attributable to the actual tariff shocks rather than spurious correlations. The test results are as follows.

This subsection follows the approach of Zhang and Zhong [

37] by advancing both the sample period and the policy shock date by one year to conduct a placebo test. Specifically, the sample period is set from January 2017 to May 2018, with September 2017 designated as the fictitious policy intervention. The regression results are reported in

Table 7. The findings indicate that none of the core variables exhibit significant effects under the placebo setting, while the coefficients of the control variables remain consistent in both sign and significance with those of the baseline regressions. This pattern indicates that the baseline effects are unlikely to be driven by contemporaneous confounders within the sample window and supports the interpretation that they reflect the impact of the actual U.S.–China tariff shocks, rather than spurious correlations.

5. Discussion

The empirical results confirm that sequential tariff interventions disrupted China’s long-standing reliance on U.S. soybeans through three interconnected channels—import suppression, source substitution, and price pass-through. The first tariff escalation in 2018 caused an immediate collapse in U.S. soybean shipments to China, supporting the hypothesis that tariffs act as exogenous shocks breaking established trade path dependence. Historically, this dependence had been reinforced by contractual inertia, logistical infrastructure, and trust-based relationships. Once tariffs altered relative prices, importers swiftly restructured purchasing portfolios to reduce procurement costs and hedge against policy uncertainty. In contrast, the 2025 escalation exerted milder quantitative effects, a pattern attributable to trade path hysteresis—sunk costs of switching (e.g., renegotiated South American supply contracts, adjusted port logistics) and established alternative sourcing networks prevented a rebound in U.S. dependence, even amid tariff fluctuations. The pattern echoes the hysteresis theory in trade economics [

6,

7], where sunk costs and switching frictions sustain long-term adjustments beyond the initial policy shock. Overall, these dynamics confirm the hypothesis that tariffs suppressed import volumes (H1), support the hypothesis that they induced a durable reallocation of sourcing toward South America (H2), and validate the hypothesis that their pass-through was asymmetric and concentrated on U.S. offers (H3).

These results both align with and extend existing literature on trade diversion and policy shocks in agricultural markets. First, relative to Adjemian et al. [

4] and Ferreira et al. [

5], who qualitatively documented post-2018 diversion, our multi-phase DID framework quantifies the dynamic substitution path and shows it is stepwise rather than one-off. Second, by estimating the proportional elasticity of U.S. import share to tariff intensity, we fill the literature’s gap in quantifying how policy magnitude shapes trade adjustment, providing an actionable benchmark for future studies on tariff-driven sourcing restructuring. Third, Khan et al. cautioned that diversification entails switching costs [

25]; our evidence supports this indirectly, showing that although non-U.S. suppliers expanded, substitution proceeded gradually.

Furthermore, our identification of asymmetric price pass-through provides new evidence on how tariff costs are transmitted along the supply chain. While Morgan showed that U.S. agricultural exporters partially absorbed retaliatory tariffs through margin compression and logistical adjustments [

38], our findings extend this asymmetry to actual landed import prices, indicating that competitive pressures constrained exporters’ ability to pass tariff costs downstream. This observation aligns with Contractor, who emphasized that firms and traders adapt strategically to mitigate tariff impacts rather than fully transferring them to buyers [

39]. Collectively, these results reinforce the view that tariff shocks exert non-neutral and asymmetric effects across countries, sectors, and market structures.

Overall, the study confirms that tariff shocks reconfigured bilateral trade flows and sourcing patterns and underscores the role of cost pass-through in shaping supply chain resilience. For import-dependent economies, diversifying supply sources and strategically engaging in international markets are practical avenues to buffer external shocks and contain economic costs. The results provide additional evidence on adaptive mechanisms in agricultural trade and carry policy implications for food-security strategy and supply chain optimization.

6. Conclusions

6.1. Main Conclusions

This study reveals that tariff shocks functioned as structural catalysts rather than temporary disturbances, fundamentally reshaping both the scale and composition of China’s soybean imports. The shocks sharply reduced U.S. soybean exports to China, dismantled long-standing trade path dependence, and reallocated sourcing toward Brazil and other South American suppliers, supported by capacity expansion and counter-seasonal complementarity. Beyond the immediate trade diversion, the analysis reveals a dynamic and asymmetric adjustment process in which market responses evolved across two distinct phases of the trade conflicts, exhibiting hysteresis effects consistent with trade-path dependence theory. Price analysis further demonstrates nonlinear and asymmetric pass-through effects; U.S. export prices increased by approximately 43%, reflecting the limited ability of exporters to absorb tariff-induced costs, whereas non-U.S. suppliers maintained relative price stability through enhanced supply elasticity and strategic repositioning. Together, these findings extend the existing literature by providing causal, multi-phase evidence that tariff shocks can permanently reconfigure agricultural trade networks, transforming temporary policy interventions into structural realignments of global agri-food supply chains.

6.2. Research Contributions

Beyond summarizing these findings, the study further clarifies its theoretical and empirical contributions. Methodologically, this study provides causal and multi-phase evidence on sequential tariff shocks by integrating phased and continuous-intensity DID models that are explicitly aligned with policy implementation timelines. Substantively, it quantifies the intensity-dependent reallocation of import sources, showing that the U.S. import share declines by about 0.56 percentage points for every one-percentage-point increase in the tariff rate, and identifies an asymmetric price pass-through effect, whereby U.S. export offers rise by approximately 43 percent. These findings confirm Hypothesis 1 regarding import suppression, support Hypothesis 2 concerning sourcing reallocation, and validate Hypothesis 3 on asymmetric price transmission across the dimensions of import volume, market share, and price adjustment. By incorporating these outcomes into a unified empirical framework with country and month fixed effects, event-study validation, placebo timing tests, and phase-boundary robustness checks, the study establishes a transparent and reproducible mechanism for understanding how tariff shocks reshape agricultural import systems over time. Finally, by providing quantitative benchmarks with direct policy relevance, it offers practical insights for promoting diversification and enhancing resilience under successive trade policy shocks.

6.3. Limitations of the Study

It should be noted that this study has certain limitations. Firstly, the sample period for the second tariff escalation and its post-adjustment phase remains relatively short, making it difficult to fully capture long-term structural adjustments in import behavior and potentially underestimating the cumulative effects of sequential tariff shocks. Secondly, despite controlling for key observable variables, the multi-phase DID framework cannot fully rule out bias from unobserved time-varying confounders. For instance, unrecorded policy communications or private sector expectations about tariff reversals could implicitly influence import decisions, introducing residual endogeneity into the estimates. Thirdly, the study relies primarily on macro-level trade data and does not account for non-tariff barriers such as technical standards and heterogeneous responses along downstream segments of the value chain, which constrains the ability to present the full supply chain impact of tariff shocks. These limitations suggest that the conclusions should be interpreted with caution when being generalized.

6.4. Directions for Future Research

To address these limitations, future research can be advanced in three directions. First, the sample period can be extended and non-tariff factors incorporated. As more post-second tariff war data become available, long-term effects can be further validated, while variables such as technical barriers and green trade standards may be included to capture the multidimensional impacts of trade policies. Second, it can extend to multi-treatment DID including non-tariff barriers or explore IV strategies such as political calendars or third-country shocks to further alleviate endogeneity. Third, an industry-chain perspective may be developed by integrating micro-level firm data—for example, from feed processors and livestock enterprises—to examine how tariff shocks are transmitted to downstream profitability and employment. Such an approach would provide more nuanced empirical evidence to support coordinated risk management along the agricultural value chain.