1. Introduction

Urban green spaces (UGSs) play a crucial role in fostering vibrant, sustainable urban ecosystems, serving as outdoor recreation spaces where individuals can engage in physical activities, social interactions, and leisure pursuits [

1,

2]. The UGSs provide individuals with an opportunity to immerse themselves in nature, alleviate stress, enhance their mental well-being, partake in physical activities, promote their fitness and health, and develop social bonds, further strengthening community cohesion [

3]. Since they offer significant benefits for people’s mental and physical health, access to UGSs is paramount. Compared to residential areas with scarce UGSs, people tend to prefer residing in locations with superior UGS access, striving for enhanced UGS accessibility (UGSA) [

4,

5]. In pursuit of accessible UGS provision, individuals are often willing to pay a premium, which leads to increased housing prices in areas with better UGS access [

6,

7]. This phenomenon signifies that housing prices are inherently influenced by UGS access, leading to a surplus value on housing estates. Moreover, the property values of housing estates exhibit marginal fluctuations based on their distance from UGSs [

8,

9].

Marginal willingness to pay (WTP) for UGS provision and accessibility—i.e., the additional amount of money that individuals are willing to pay for the attribute’s level of UGSA in a residential property—indicates how much individuals are ready to pay to upgrade the accessible UGS resources of their residential property; in other words, it reflects the price premium that they are willing to pay [

7,

10]. Grasping the correlation between UGSA and housing prices is essential. Understanding the surplus value that UGSA adds to housing estates, or quantifying the additional cost that residents are willing to incur (i.e., WTP) for accessible UGS provisions, can provide comprehensive insights into the allocation of UGS resources, so that the structure of housing prices can be determined. Such knowledge is indispensable for enhancing urban planning, steering urban development, and shaping policy decisions. By meticulously examining the interconnections between UGS provision/accessibility and property values, urban planning can be aligned more adeptly with the inhabitants’ needs, helping to foster balanced, healthy, and sustainable urban habitats.

The hedonic price model is a classical method that is widely applied to estimate the economic value of the factors influencing housing prices [

11,

12], and to determine the benefit values and estimate economic values of marginal WTP for UGSs or natural environments [

13,

14]. Previous studies examining the benefits and economic values or marginal WTP estimations for UGS provisions/accessibility often focused on various factors related to UGS access, such as distance from the housing property to the closest UGS [

15,

16] or specific UGSs [

17,

18], and whether UGSs exist or are visible [

19,

20], as well as UGS quantity (e.g., UGS area, number, and ratio) [

21,

22,

23] and type [

24,

25]. These factors are often incorporated into the hedonic model as the only variables, or as multiple individual variables, to calculate their impact on housing prices [

26,

27,

28]. However, in reality, all of these factors not only have an impact on housing prices but also have a combined effect. In other words, people are not simply paying for UGSs because they are closer in proximity, large in surface area, high quality, or highly attractive; rather, they are paying for UGSs that are generally satisfactory in terms of UGS provision/accessibility under the combined action of these factors. Therefore, the most appropriate approach is to characterize the obtained accessible UGS resources by referring to comprehensive accessibility indicators that can be input as variables into the hedonic model to analyze their impact on housing prices.

In various previous studies, the distance between UGSs and residential locations, and other UGS-related factors (e.g., area), has been represented as composite variables by means of multiplication, acting as elements that reflect the accessibility characteristics of UGSs surrounding a housing property [

29,

30,

31]. These are integrated into the hedonic model to study the economic value or marginal WTP of UGSs. However, such composite indicators do not represent a single UGS characteristic; they only reflect the resource allocation of the nearest UGS or a specifically accessible UGS around a housing property, rather than the overall resource allocation of all accessible UGSs. Some previous studies have composed factors that reflect the characteristics of UGSs from the supply side; these studies incorporate a combination of either the UGS area and the reciprocal of distance [

32,

33] or the number of recreational UGSs and the distance decay coefficient [

7,

34], and the gravity model is applied to sum up these factors for all UGSs or a certain range of UGS types around the housing property. These are then included as variables representing UGS provision and accessibility in a hedonic model for studies examining the economic value or marginal WTP of UGS. In addition to considering UGS area and distance, which are on the supply side, some studies also incorporate the population served by UGS in order to capture the demand side; this is then input into the calculation of UGS characteristics, allowing for the construction of a gravity-based model [

35]. In addition, some studies consider both supply-side factors (e.g., UGS area and distance) and demand-side factors (e.g., the population served by UGS), and the factors reflecting UGS characteristics are calculated by means of the floating catchment area (SFCA) method [

36,

37,

38]. These are then incorporated into the hedonic model as variables representing UGS provision and accessibility in order to study the economic value or marginal WTP of UGS. When computing the factors reflecting UGS characteristics, these studies consider the area, distance, and population served by UGS. In reality, the accessible UGS resources enjoyed by residents are more complicated and involve multiple factors [

5]. To more comprehensively reflect the characteristics of accessible UGS resources around a housing property, the indicators need to incorporate more extensive and holistic dimensions.

Therefore, this study aims to move beyond a simple valuation exercise by intervening in two key academic debates. First, by differentiating Urban Green Space Accessibility (UGSA) into ‘neighborhood’ and ‘utmost’ levels, we directly address the ongoing scholarly discussion on the spatial scale of amenity valuation, questioning whether residents prioritize immediate, local access over broader, city-wide availability. Second, by conducting a decade-long longitudinal analysis of both homebuyers and renters, we explore how different property rights regimes influence the capitalization of non-market public goods, a critical question in urban and institutional economics, particularly within China’s unique housing market context. Through a robust spatial econometric framework, we seek to provide nuanced empirical evidence that can inform both urban theory and planning practice. Therefore, this study provides deeper insights into the economic value of accessible UGSs, bridging a knowledge gap in the urban planning and real estate sectors. As urbanization trends continue to accelerate, it is imperative to understand the tangible and intangible benefits of UGSs. By elucidating residents’ WTP for accessible UGS provisions, urban planners and policymakers can make more informed decisions about UGS allocation and city planning, and real estate developers can have a clearer view of pricing in relation to UGSA. Moreover, this study could help to refine methods and provide robust empirical evidence in the fields of environmental economics and urban planning. The methodological advancements achieved in this study can be employed in similar contexts globally, making the findings and approach universally applicable.

2. Study Site

Shanghai is a rapidly developing city and a prominent global financial and cultural center. Covering an area of 6340.50 km

2, it is home to a population of approximately 24.89 million as of 2022, showcasing its status as one of the largest and most populous cities in the world. Shanghai’s growth trajectory is marked by its fast-paced urbanization, thriving economy, and diverse cultural landscape [

39]. Its urban spatial structure is characterized by four major ring roads: the Inner Ring Road (47.7 km), the Middle Ring Road (53.8 km), the Outer Ring Road (99 km), and the Suburban Ring Road (189 km). These ring roads define the city’s geographic boundaries and play a pivotal role in traffic management, urban planning, and the delineation of different urban zones, facilitating the city’s orderly expansion and development (

http://tjj.sh.gov.cn/, accessed on 1 January 2024).

In the past decade, Shanghai has experienced significant growth in UGSs. The city has expanded its green coverage from 375 UGSs in 2012 to 532 in 2021, with the per capita recreation green space area increasing from 7.1 m

2 to 8.8 m

2 [

40]. This expansion demonstrates Shanghai’s commitment to enhancing the urban environment and promoting green, sustainable urban living. Shanghai has implemented a comprehensive strategy for the development and management of its green spaces. The Shanghai Administration Department of Afforestation and City Appearance rates these UGSs according to a five-star scale published on the official website (

http://lhsr.sh.gov.cn/, accessed on 1 January 2024). The “Shanghai Specialized Planning for Ecological Spaces (2021–2035)” aims to ensure that every resident is within a 500 m access radius of a green space, underscoring the city’s focus on accessible and quality green spaces for its citizens (

https://lhsr.sh.gov.cn/ghjhl/, accessed on 1 January 2024).

The real estate market in Shanghai is notable for its significant regional disparities, large fluctuations, and substantial increases. Data indicate that from 2012 to 2021, Shanghai’s average housing prices more than doubled, with some central areas experiencing even higher growth rates (

https://fgj.sh.gov.cn/, accessed on 1 January 2024). For instance, in prime locations like Xuhui and Jing’an Districts, prices can exceed CNY 100,000 per square meter. This contrast is stark compared to more suburban areas, where prices are considerably lower. These disparities might be driven by factors such as urban development, proximity to amenities, and the availability of UGSs. Shanghai’s rapid transformation and development have led to these variations in housing prices, reflecting the city’s dynamic economic and social landscape. These dynamics have a profound impact on domains such as urban planning, social equity, and residents’ living standards.

3. Materials and Methods

3.1. Data Collection and Preprocessing

This study analyzed residents’ WTP for UGSA in Shanghai from 2012 to 2021. It utilized data encompassing geographic spatial information on traffic networks, housing, residential areas, and UGSs, as well as transaction records of house buying and renting in all residential areas of Shanghai during this decade. The UGSA in this study was calculated using the shortest travel time, based on real-world road networks and actual traffic behaviors and trips (details provided in

Supplementary Material) [

41,

42]. This analysis incorporated multiple travel modes, including walking, cycling, driving, and public transport, to provide a comprehensive understanding of UGSA in Shanghai, as elaborated in our previous studies [

5,

43]. The study gathered transaction records of all house renting and buying in Shanghai’s residential areas from 2012 to 2021. The vast dataset included numerous records from major real estate agencies and platforms such as Lianjia, Wo Ai Wo Jia, and Beike. Each transaction record contained details about the rental or purchase price, relevant information about the housing property and residential location, including the physical characteristics of each housing property (e.g., layout, orientation, and area), basic residential location information (e.g., plot ratio, green space ratio, and property management fees), surrounding amenities (e.g., schools, hospitals, and lifestyle facilities), and the city location within Shanghai’s four-ring urban spatial structure.

3.2. UGSA Measurement

Using the 3 Step Floating Catchment Area (3SFCA) approach proposed in our previous studies [

5,

43], the UGSA was estimated by considering the neighborhood and utmost radii within which amenities can be accessed. To access UGSs within a short threshold distance (i.e., 500 m spatial distance by walking in this study) of their neighborhood, the residents preferred to walk, as proposed in our previous studies [

44,

45], rather than use other travel modes for daily recreational activities (details provided in

Supplementary Material). Access to UGSs within the radius of the neighborhood (

) for residents at each residential location (

i) was estimated based on walking within a radius of 500 m, as elaborated in our previous studies [

43]. However, to access the UGSs at a greater distance, residents might not rely solely on walking as a transport mode. As proposed in our previous studies [

5,

43], accessibility to UGSAs within the utmost radius (

) for residents at each residential location (

i) was estimated based on multiple travel modes, including walking, cycling, driving, and public transport, where the psychological limit of travel time was regarded as 30 min for each travel mode.

3.3. Estimation Strategy

To initially understand the relationship between housing prices and UGSA within neighborhood and utmost access radii, a series of hedonic models were employed, taking the natural logarithm of housing prices (including rental and sale prices) as the dependent variable (

Table 1). The independent variables in

Table 1 were taken as explanatory variables. Transaction data from 2012–2021 were incorporated into the models to estimate annual WTP using hedonic regression. The ordinary least squares (OLS) model was adopted as the estimation method in the basic hedonic model for a residential property

d in a community

i and can be expressed as follows:

where

denotes the natural logarithm of the housing price of property

d;

represents the vector of structural attributes of property

d, such as size, number of rooms, and orientation;

denotes the vector of neighborhood attributes of property

d in residential location

i, such as the school district and nearby amenities;

represents the vector of community attributes of property

d in residential location

i, such as the plot ratio, green rate, and property fees;

α is the constant term;

ρ denotes the vector of UGSA attributes of property

d in residential location

i;

β,

γ, and

δ are associated parameter vectors; and

is the error term.

To capture the fixed effects (FEs) of locations, a panel data analysis was carried out, integrating parameters of location-fixed specific effects to capture variations in location (i.e., being inside the Inner Ring, between the Inner and Middle Rings, between the Middle and Outer Rings, or between the Outer and Suburban Rings) and time (2012–2021) for residential property

d in residential location

i being rented or sold in year

y. The OLS models with location-specific effects can be expressed as follows:

where

are dummy variables for location

r fixed effects for residential location

i to be estimated for different sections divided by the four major ring roads.

The Lagrange multiplier (LM) and robust Lagrange multiplier (Robust LM) tests were conducted to determine if building either spatial lag models (i.e., dominated by spatial dependence in the dependent variable) or spatial error models (i.e., dominated by spatial dependence in the error terms) could better address spatial dependence bias. Depending on the spatial dependence situation, models that could be chosen include spatial autoregressive (SAR) (or the spatial lag model, SLM), the spatial Durbin model (SDM), the spatial error model (SEM), the spatial Durbin error model (SDEM), spatial autoregressive combined (SAC) (or spatial autoregressive with spatial autoregressive disturbance, SARAR), generalized nested spatial (GNS), and the spatial lag of X (SLX) models, with selection criteria shown in

Table 2. The Durbin–Wu–Hausman test (DWHT) and Breusch–Pagan test (BPT) were applied to check for endogeneity, heteroscedasticity, and serial correlation in the model residuals and dependent variables so as to determine the choice of methods or models (e.g., maximum likelihood estimation (MLE), generalized two-stage spatial regression (GS2SLS), or generalized method of moments (GMM)) that could be applied for the regression. The selection criteria are shown in

Table 2. Our primary analytical tool is the Spatial Durbin Model with Fixed Effects (SDM-FE), as it is theoretically best suited to capture the spatial spillover effects that are central to our research. To ensure the robustness of our findings, we also employed a suite of other specifications, including OLS-FE and SAC-FE models, as robustness checks. All models were estimated annually from 2012 to 2021 for the four categories of UGSA: (1) UGSA within the neighborhood access radius for homebuyers; (2) UGSA within the utmost access radius for homebuyers; (3) UGSA within the neighborhood access radius for renters; and (4) UGSA within the utmost access radius for renters.

The use of spatial regression models can reduce not only bias but also directly quantify the spillover effects caused by spatial or neighbor interactions. To distinguish between direct and indirect WTP, the spatial Durbin model (SDM) with location-specific FEs was employed by incorporating spatial spillovers. The model can be expressed as follows:

where

,

, and

are the spatial weight matrices of structural attributes, neighborhood attributes, and community attributes;

and

are the spatial weight matrices of the UGSA attribute within the neighborhood and utmost access radii for the residential location

i;

,

,

, and

are the spatial autocorrelation parameters of structural attributes, neighborhood attributes, community attributes, and the UGSA attribute.

In the real world, the WTP for each residential property might vary across different segments of the housing market. Based on the above models, location-specific FEs were included to examine the housing price distribution and the differences in the WTP for UGSA within neighborhoods, as well as utmost access radii for property owners or renters, by applying quantile regression (QR) and spatial quantile regression (SQR) as follows:

where

is the log housing price in the τth percentile;

,

,

, and

are the marginal changes in the τth percentile due to the marginal changes in

,

,

, and

, respectively. The housing price distributions are subdivided into four quantiles (i.e., 0.2, 0.4, 0.6, and 0.8), with each quantile representing the economic level of a specific submarket.

3.4. WTP Calculation

The WTP for UGSA can be derived from hedonic models by estimating the marginal change in the given variable representing the characteristic of UGSA for a residential property, compared to a marginal change in price. The model can be expressed as follows:

where

is the average housing price of property

d,

is the housing price of property

d in the τth percentile, and

represents the parameter vectors of associated attributes. The WTP for UGSA within a neighborhood and utmost access radius for renters and owners in Shanghai from 2012 to 2021 was computed based on the coefficients of the UGSA variables obtained from our primary analytical model, the SDM-FE. This consistent approach ensures that the WTP estimates are comparable across all years and categories. Furthermore, the direct and indirect effects derived from the SDM-FE model were utilized to distinguish the localized and spillover WTP of UGSA, providing a more nuanced understanding of the economic value of UGS resources. Lastly, the results from the quantile regression models, QR and SQR, were employed to investigate the heterogeneous effects of UGSA across different segments of the housing market, revealing potential variations in WTP for accessible UGS resources among various income groups or housing price levels.

4. Results

4.1. Hedonic Models

To estimate the impact of UGSA on housing prices, this study employed a comprehensive econometric framework. Given the panel nature of our data and the confirmed presence of spatial autocorrelation (see Moran’s I and LM test results in

Supplementary Table S1), we established the Spatial Durbin Model with Fixed Effects (SDM-FE) as our primary analytical tool. The SDM-FE is theoretically superior for this research as it simultaneously accounts for endogenous interaction effects (spatial lags in housing prices) and exogenous interaction effects (spatial lags in explanatory variables) and uniquely allows for the decomposition of price effects into direct and indirect (spillover) components.

In addition to our primary model, a suite of other models—including Ordinary Least Squares with Fixed Effects (OLS-FE), Spatial Autoregressive Model with Fixed Effects (SAR-FE), and Spatial Autoregressive Combined Model with Fixed Effects (SAC-FE)—was employed as robustness checks to ensure the consistency of our findings across different specifications. Furthermore, to investigate heterogeneous effects across different market segments, Spatial Quantile Regression (SQR) models were applied. The detailed mathematical specifications for all models used in this study are provided in

Supplementary Materials.

4.2. Main Regression Results

This section presents the core findings from our econometric analysis. As established in our methodology (

Section 3.3), the Spatial Durbin Model with Fixed Effects (SDM-FE) serves as our primary model for all years and categories. This choice is theoretically grounded in the model’s ability to account for spatial dependencies and to decompose effects into direct and indirect (spillover) components, which are central to our research questions. The detailed regression outputs from the SDM-FE model are presented in

Table 3a–d.

To ensure the reliability of our findings, we conducted a series of robustness checks using alternative specifications, including OLS-FE and SAC-FE models. The results of these checks, which are broadly consistent with our primary findings, are provided in

Supplementary Material. A comprehensive comparison of model performance metrics (e.g., Adjusted R

2, Log-likelihood) across all models is available in

Table S2, further justifying the choice of SDM-FE as the most appropriate and robust model.

For sale prices and utmost UGSA (

Table 3a), the direct effect of

is consistently negative and statistically significant in most years after 2015. This suggests that, for homebuyers, a higher level of city-wide green space accessibility is associated with a lower property price at the margin, a counterintuitive finding that will be explored in the Discussion section. For sale prices and neighborhood UGSA (

Table 3b), the direct effect of

is positive and significant in the majority of the study years, particularly from 2013 to 2019. This indicates a strong and persistent willingness to pay among homebuyers for green spaces that are conveniently located within their immediate neighborhood. For rental prices and utmost UGSA (

Table 3c), the direct effect of

shows a positive and significant relationship in several years, notably 2014–2015 and 2018–2021. This suggests that renters are willing to pay a premium for better access to the city’s overall green space network, although this preference is less consistent than that of homebuyers. For rental prices and neighborhood UGSA (

Table 3d), the direct effect of

is positive and significant across most years of the decade. This finding mirrors the preference of homebuyers, confirming that easily accessible local green spaces are a valued amenity for renters as well. In summary, our primary SDM-FE model reveals distinct valuation patterns for different types of UGSA and between homebuyers and renters. Neighborhood accessibility is consistently valued positively by both groups, while the valuation of city-wide accessibility is more complex and even negative for homebuyers in later years.

According to the global Moran’s I test results (

Table S1), spatial autocorrelation was detected in the dependent variables and model residuals of the four categories of UGSA from 2012 to 2021. This indicates that, when using quantile models, spatial effects should also be considered to correct for the bias caused by spatial autocorrelation. The goodness-of-fit results shown in

Table S3 are consistent with this finding, showing that the SQR model generally outperformed the QR model in terms of adjusted R

2 values across all quantiles for the four categories of UGSA in each year. Therefore, this study focused on the results of the SQR model for quantile analysis (

Table 4). For sale prices and utmost UGSA, the SQR model showed significant negative coefficients for

in the lower quantiles (q = 20% and 40%) and the highest quantile (q = 80%) in most years, suggesting that increased utmost UGSA is associated with lower sale prices for properties in the lower and upper ends of the price distribution. For sale prices and neighborhood UGSA, the SQR model revealed significant positive coefficients for

in all quantiles for most years, with the significance being more consistent in the middle and upper quantiles (q = 40%, 60%, and 80%). This indicates that higher neighborhood UGSA is related to higher sale prices across the entire price distribution, with a more pronounced effect on properties in the middle and upper segments. For rental prices and utmost UGSA, the SQR model showed significant positive coefficients for

in the upper quantiles (q = 60% and 80%) in some years, particularly from 2015 to 2021, suggesting that increased utmost UGSA is associated with higher rental prices for properties in the upper segments of the price distribution. For rental prices and neighborhood UGSA, the SQR model revealed significant positive coefficients for

in various quantiles across the years, with no clear pattern in the distribution of significance.

4.3. WTP Analyses

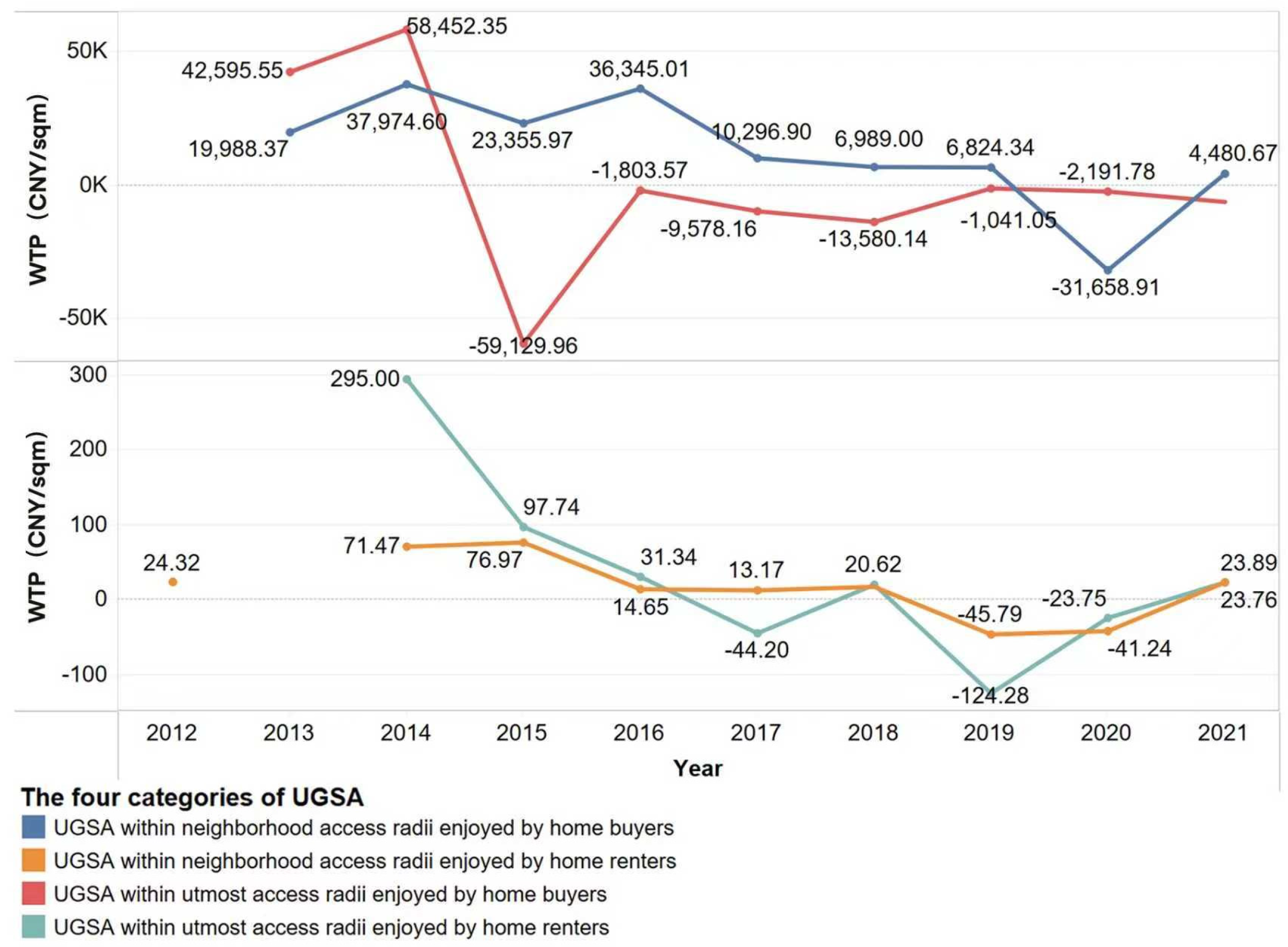

Based on the coefficients from our primary and methodologically consistent SDM-FE model, we calculated the marginal Willingness to Pay (WTP) for UGSA in monetary terms (CNY per square meter) for each year from 2012 to 2021. The results, visualized in

Figure 1, offer a clear and intuitive understanding of how residents value green space accessibility. For homebuyers and UGSA within the utmost access radius, the WTP shows significant fluctuations and a notable decreasing trend, becoming strongly negative in later years. For instance, in 2020, homebuyers exhibited a negative WTP of approximately 31,659 CNY/sqm for this attribute, suggesting that extreme city-wide accessibility may be associated with disamenities in the high-end market. In stark contrast, for homebuyers and UGSA within the neighborhood access radius, the WTP is consistently positive and substantial. It peaked in 2014 at 295 CNY/sqm for a one-unit increase in the neighborhood UGSA index, before stabilizing at a significant positive value, such as 20.62 CNY/sqm in 2018. This demonstrates a strong and persistent market premium for conveniently located local green spaces. For renters, the WTP for both categories is considerably lower, reflecting their different housing motivations. The WTP for neighborhood UGSA, for example, was a modest 23.76 CNY/sqm in 2021, far below the premiums paid by homebuyers but still consistently positive. This detailed monetary analysis underscores the varying and dynamic valuation of UGSA across different market segments and accessibility types.

Direct WTP represents the WTP for UGSA surrounding a property, while indirect WTP represents the WTP for UGSA in neighboring areas. Direct and indirect WTP were calculated based on results of the direct effect and the indirect effect of UGSA variables (

Table S4). Total WTP is the sum of direct and indirect WTP. As shown in

Figure 2, the direct WTP is mostly negative or low for utmost UGSA and positive for neighborhood UGSA, with some exceptions in certain years. The direct WTP for both utmost and neighborhood UGSA shows minor fluctuations over time, with a mix of positive and negative values. The indirect WTP shows significant variations, with high positive and negative values for utmost UGSA and mostly positive values for neighborhood UGSA. The indirect WTP for both utmost and neighborhood UGSA shows significant fluctuations over time, with extreme values in certain years. The total WTP shows a wide range of values, with significant positive and negative values for utmost UGSA and mostly positive values for neighborhood UGSA. The total WTP for both utmost and neighborhood UGSA shows significant variations over time, largely influenced by the indirect WTP. Homebuyers generally have much higher total, direct, and indirect WTP for both utmost and neighborhood UGSA compared to renters. The difference in WTP between homebuyers and renters is more pronounced for indirect WTP, especially for neighborhood UGSA. The results indicate that for both homebuyers and renters, the total, direct, and indirect WTP levels for neighborhood UGSA are generally higher and consistently more positive than those for utmost UGSA. The difference in WTP between utmost and neighborhood UGSA is more pronounced for indirect WTP, especially for renters. The indirect WTP for both utmost and neighborhood UGSA tends to be more significant and volatile than the direct WTP, especially for homebuyers. Indirect WTP plays a dominant role in determining total WTP, particularly for neighborhood UGSA. In terms of the total, direct, and indirect WTP for both utmost and neighborhood UGSA, the gap between homebuyers and renters has widened over time, with homebuyers showing higher WTP levels. In regard to the total, direct, and indirect WTP, the difference between utmost and neighborhood UGSA has become more pronounced over time, with neighborhood UGSA being more preferred. The dominance of indirect WTP over direct WTP has increased over time, particularly for neighborhood UGSA and among homebuyers. In summary, the WTP for UGSA varies significantly across direct, indirect, and total effects, with indirect WTP showing the most substantial variations and influence on total WTP.

As shown in

Figure 3, in the low-income group (q = 20%), the WTP is generally negative or low for utmost UGSA and positive for neighborhood UGSA, with some negative values in recent years. The WTP for utmost UGSA shows a decreasing trend over time, while the WTP for neighborhood UGSA fluctuates with a mix of positive and negative values. In the lower-middle-income group (q = 40%), the WTP is mostly negative or not significant for utmost UGSA, though it is positive for neighborhood UGSA, with some negative values in recent years. The WTP for utmost UGSA remains relatively stable with negative values, while the WTP for neighborhood UGSA shows some fluctuations. In the upper-middle-income group (q = 60%), the WTP is mostly not significant for utmost UGSA; however, it is positive for neighborhood UGSA, with higher values compared to lower-income groups. The WTP for utmost UGSA shows minor fluctuations, while the WTP for neighborhood UGSA remains relatively stable with positive values. In the high-income group (q = 80%), the WTP is mixed for utmost UGSA, with some high positive values and negative values in recent years; however, it is consistently positive for neighborhood UGSA, with the highest values observed among all income groups. The WTP for utmost UGSA fluctuates significantly, while the WTP for neighborhood UGSA remains relatively stable with positive values. Homebuyers generally have higher WTP for both utmost and neighborhood UGSA compared to renters across all income levels. The difference in WTP between homebuyers and renters is more pronounced in the higher-income groups (q = 60% and 80%). For both homebuyers and renters, the WTP for neighborhood UGSA is generally higher and consistently more positive than that of utmost UGSA across all income levels. The difference in WTP between utmost and neighborhood UGSA is more pronounced in the higher-income groups (60th and 80th percentiles). The gap between homebuyers and renters in terms of WTP for both utmost and neighborhood UGSA has widened over time, particularly in the higher-income groups. In terms of WTP, the difference between utmost and neighborhood UGSA has become more pronounced over time, with neighborhood UGSA being increasingly preferred, especially among higher-income groups. In summary, the WTP for UGSA varies across different economic levels, with higher-income groups generally showing a higher WTP for both utmost and neighborhood UGSA. Homebuyers have a higher WTP compared to renters, and neighborhood UGSA is more preferred than utmost UGSA across all income levels. The preferences and WTP for UGSA have evolved over time, with the disparities becoming more apparent among higher-income groups.

5. Discussion

This study’s findings, grounded in a methodologically consistent framework, offer several key insights into the valuation of urban green space in Shanghai. This section discusses the theoretical contributions of our findings by situating them within the broader literature, explores the institutional drivers behind the observed homebuyer–renter disparity, interprets other key findings, and outlines specific policy implications.

To contextualize our findings and assess their generalizability, we compare our WTP estimates with those from other major Chinese metropolises. Our core finding—that neighborhood-level green space accessibility commands a significant positive premium—aligns with the general consensus from research in Beijing and Shenzhen, which also identifies positive price effects for proximity to community and city parks. This consistency across cities undergoing rapid urbanization suggests a shared and growing valuation of accessible, local green amenities, lending external validity to our results. However, the theoretical contribution of this study is most evident in its novel findings. First, by differentiating UGSA into two tiers, we provide empirical evidence for the spatial scaling of amenity valuation. The consistent preference for “neighborhood” over “utmost” UGSA suggests that for residents’ daily life and housing decisions, the immediate, convenient access to local green spaces is valued more highly than the abstract availability of city-wide resources. Second, and more strikingly, our discovery of a negative WTP for ‘utmost’ UGSA among homebuyers is a significant deviation from the existing literature, which predominantly reports positive or neutral effects. This counterintuitive result, possibly unique to a hyper-dense urban core like Shanghai’s, suggests a critical theoretical point: at a certain threshold of urban density and development, macro-level accessibility indicators may begin to act as proxies for disamenities such as traffic congestion, noise, and lack of privacy, thereby generating a negative marginal valuation. This finding challenges the monotonic positive assumption often implicit in hedonic studies and highlights a potential “congestion effect” in the valuation of urban-wide amenities, marking a key theoretical contribution to the field.

The substantial and persistent gap in WTP for UGSA between homebuyers and renters is a key finding that cannot be explained by mere preference differences alone. It is deeply rooted in China’s unique institutional, economic, and market context. First, institutional factors play a paramount role. In China, homeownership is not merely about securing shelter; it is intrinsically linked to a bundle of critical public services and social rights through the hukou (household registration) system. Access to high-quality public schools, certain healthcare benefits, and other social welfare programs is often contingent upon local property ownership. Therefore, purchasing a home is an investment in a ‘rights package’ that secures future stability and opportunities for the family. In this context, UGSA, as a permanent environmental amenity that enhances community quality and property value, is highly capitalized into the purchase price by forward-looking homebuyers. Second, from an economic perspective, housing in China has long been the primary vehicle for household wealth accumulation and investment, given the limited alternative investment channels. Homebuyers, acting as investors, naturally have a longer time horizon and are thus more willing to pay a premium for durable amenities like green spaces that promise long-term capital appreciation. In contrast, the rental market is predominantly driven by consumption needs. Renters, who are often younger, more mobile, and have shorter-term residency plans, prioritize immediate functional attributes such as proximity to employment and public transport over long-term environmental quality. Finally, the developmental stage of the rental market contributes to this disparity. China’s rental market is still maturing, with a regulatory framework that is continuously evolving to better protect tenants’ rights. The historical lack of robust tenant protections and the transient nature of rental agreements reduce renters’ sense of belonging and their willingness to invest in community-level amenities like UGSs through higher rent.

Our empirical findings offer two specific and actionable policy recommendations for urban planners and municipal governments in Shanghai and other high-density cities. (1) Prioritize a “Small, Beautiful, and Widespread” Network of Neighborhood Parks: The strong and consistent preference for ‘neighborhood UGSA’ over ‘utmost UGSA’ sends a clear signal for urban-planning investment. Rather than focusing solely on large, iconic central parks, municipal resources should be strategically allocated to developing a decentralized, high-coverage network of local green spaces, such as pocket parks, community gardens, and linear greenways. This ‘small, beautiful, and widespread’ approach appears to be more effective in translating public funds into tangible residential value and well-being, consistent with findings that spreading green areas can result in higher housing value than centralizing them. This implies that in urban renewal and community regeneration projects, embedding accessible green spaces should be a mandatory planning requirement. (2) Implement “Value Capture” for Sustainable Green Space Financing: The significant WTP for UGSA quantified in this study provides a solid economic rationale for implementing ‘Value Capture’ financing mechanisms. As public investment in parks demonstrably increases the value of nearby private properties, a portion of this ‘unearned’ windfall can be recaptured to fund the green space system. We specifically recommend that local authorities explore tools such as Special Assessment Districts, where properties within a defined benefit area pay a levy to fund local improvements, and Tax Increment Financing, where future increases in property tax revenues from a designated area are used to finance the public works that spurred the growth. These instruments can create a sustainable, self-financing cycle—“funding the green with the green”—that ensures the long-term, high-quality development and maintenance of the city’s vital green infrastructure.

6. Conclusions

This study investigated residents’ marginal WTP for accessible UGS resources in Shanghai from 2012 to 2021, utilizing a comprehensive indicator that reflects UGS provision on accessibility. The research employed an improved nSFCA method to measure accessible UGS resources and estimate the indicator of UGS provision on accessibility, which was then incorporated as a variable affecting housing prices in the hedonic pricing model, along with various relevant factors selected based on the theory underpinning this model. The results revealed that the WTP for UGSA varied significantly across categories and years, as well as between homebuyers and renters, with homebuyers having a much higher WTP for UGSA compared to renters, and neighborhood UGSA being generally more preferred than utmost UGSA. The study innovates by differentiating UGSA at two levels (utmost and neighborhood), conducting a longitudinal analysis of both homebuyers and renters over a 10-year period, and employing a wide range of advanced modeling techniques, including spatial econometric models, quantile regression, and spillover effect analysis. The research contributes to understanding the economic value of UGSA by providing insights for urban planning, policy-making, and real estate development, highlighting the importance of considering the spatial, temporal, and heterogeneous aspects of UGSA when estimating its economic value.

While this study provides valuable insights, we acknowledge its limitations, which in turn open avenues for future research. First, regarding data, our UGSA metric, while comprehensive, does not capture the qualitative aspects of green spaces, such as the quality of facilities, maintenance levels, or perceived safety. Future research could leverage multi-source data, such as social media check-ins or street-view imagery analysis, to construct more nuanced quality indices. Second, concerning the model, the hedonic price method relies on the assumption of rational economic actors. However, insights from behavioral economics suggest that cognitive biases may play a role in complex housing decisions, potentially affecting WTP estimates. Future work could employ stated preference methods to complement our approach. Lastly, establishing clear causality is challenging. Future research could utilize quasi-experimental designs, such as Difference-in-Differences, to better isolate the causal effect of UGSA on property values.

Supplementary Materials

The following supporting information can be downloaded at:

https://www.mdpi.com/article/10.3390/land14091835/s1, Table S1: Test results of significance using the model estimation strategy; Table S2: Results of (adj.) R

2 for Models A to F in 2012–2021; Table S3: Results of (adj.) R

2 for Model G and H; Table S4: Direct effect and indirect effect of variables of UGSA within the utmost (

) and neighborhood (

) access radius for Model F (SDM-FE) in 2012–2021. References [

5,

46,

47,

48,

49,

50,

51] are cited in the

Supplementary Materials.

Author Contributions

Conceptualization, H.L. (Huilin Liang); methodology, H.L. (Huilin Liang) and Q.Y.; software, L.Z. and H.L. (Hao Liu); validation, Q.Y. and Y.G.; formal analysis, L.Z. and H.L. (Hao Liu); investigation, L.Z. and H.L. (Hao Liu); data curation, L.Z., H.L. (Hao Liu), and Y.G.; writing—original draft preparation, H.L. (Huilin Liang); writing—review and editing, H.L. (Huilin Liang); visualization, L.Z. and H.L. (Hao Liu); supervision, Y.G.; project administration, H.L. (Huilin Liang); funding acquisition, H.L. (Huilin Liang). All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Natural Science Foundation of China, grant number 32371940; Humanities and Social Science Fund of Ministry of Education of China, grant number 23YJCZH119; Priority Academic Program Development of Jiangsu Higher Education Institutions (PAPD).

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Acknowledgments

During the preparation of this manuscript, the authors used GenAI for the purposes of polishing the language. The authors have reviewed and edited the output and take full responsibility for the content of this publication.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| UGS | Urban green space |

| UGSA | Urban green space accessibility |

| WTP | Marginal willingness to pay |

References

- Reyes-Riveros, R.; Altamirano, A.; De La Barrera, F.; Rozas-Vásquez, D.; Vieli, L.; Meli, P. Linking public urban green spaces and human well-being: A systematic review. Urban For. Urban Green. 2021, 61, 127105. [Google Scholar] [CrossRef]

- Spotswood, E.N.; Benjamin, M.; Stoneburner, L.; Wheeler, M.M.; Beller, E.E.; Balk, D.; McPhearson, T.; Kuo, M.; McDonald, R.I. Nature inequity and higher COVID-19 case rates in less-green neighbourhoods in the United States. Nat. Sustain. 2021, 4, 1092–1098. [Google Scholar] [CrossRef]

- Opdam, P. Implementing human health as a landscape service in collaborative landscape approaches. Landsc. Urban Plan. 2020, 199, 103819. [Google Scholar] [CrossRef]

- Wu, J.; Peng, Y.; Liu, P.; Weng, Y.; Lin, J. Is the green inequality overestimated? Quality reevaluation of green space accessibility. Cities 2022, 130, 103871. [Google Scholar] [CrossRef]

- Liang, H.; Yan, Q.; Yan, Y.; Zhang, Q. Using an improved 3SFCA method to assess inequities associated with multimodal accessibility to green spaces based on mismatches between supply and demand in the metropolitan of Shanghai, China. Sustain. Cities Soc. 2023, 91, 104456. [Google Scholar] [CrossRef]

- Zhang, P.; Park, S. Investigating spatial heterogeneity of park inequity using three access measures: A case study in Hartford, Connecticut. Appl. Geogr. 2023, 151, 102857. [Google Scholar] [CrossRef]

- Tuffery, L. Preferences for forest proximity and recreational amenities revealed by the random bidding model. Landsc. Urban Plan. 2019, 189, 181–188. [Google Scholar] [CrossRef]

- Parton, L.C. Measuring the effects of public land use change: An analysis of greenways in Raleigh, North Carolina. Land Use Policy 2023, 131, 106689. [Google Scholar] [CrossRef]

- Laszkiewicz, E.; Czembrowski, P.; Kronenberg, J. Can proximity to urban green spaces be considered a luxury? Classifying a non-tradable good with the use of hedonic pricing method. Ecol. Econ. 2019, 161, 237–247. [Google Scholar] [CrossRef]

- Li, X.; Chen, W.Y.; Hu, F.Z.Y.; Cho, F.H.T. Homebuyers’ heterogeneous preferences for urban green-blue spaces: A spatial multilevel autoregressive analysis. Landsc. Urban Plan. 2021, 216, 104250. [Google Scholar] [CrossRef]

- Chen, K.D.; Lin, H.M.; You, S.Y.; Han, Y. Review of the impact of urban parks and green spaces on residence prices in the environmental health context. Front. Public Health 2022, 10, 993801. [Google Scholar] [CrossRef]

- Doan, Q.C. Determining the optimal land valuation model: A case study of Hanoi, Vietnam. Land Use Policy 2023, 127, 106578. [Google Scholar] [CrossRef]

- Jensen, C.U.; Panduro, T.E.; Lundhede, T.H.; von Graevenitz, K.; Thorsen, B.J. Who demands peri-urban nature? A second stage hedonic house price estimation of household’s preference for peri-urban nature. Landsc. Urban Plan. 2021, 207, 104016. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Zhang, T.Z.; Zeng, Y.X.; Yu, C.; Zheng, S.Q. The rising and heterogeneous demand for urban green space by Chinese urban residents: Evidence from Beijing. J. Clean. Prod. 2021, 313, 127781. [Google Scholar] [CrossRef]

- Dell’Anna, F.; Bravi, M.; Bottero, M. Urban Green infrastructures: How much did they affect property prices in Singapore? Urban For. Urban Green. 2022, 68, 127475. [Google Scholar] [CrossRef]

- Tuofu, H.; Qingyun, H.; Xiao, O.Y. The Capitalization Effect of Natural Amenities on Housing Price in Urban China: New Evidence from Changsha. Front. Environ. Sci. 2022, 10, 833831. [Google Scholar] [CrossRef]

- Shi, D.Q.; Zhang, Y.H.; Liang, Z.X. The effects of park and sea landscape on property value in a tourist city. Front. Environ. Sci. 2022, 10, 967094. [Google Scholar] [CrossRef]

- Chwialkowski, C.; Zydron, A. Socio-Economic and Spatial Characteristics of Wielkopolski National Park: Application of the Hedonic Pricing Method. Sustainability 2021, 13, 5001. [Google Scholar] [CrossRef]

- Bottero, M.; Caprioli, C.; Foth, M.; Mitchell, P.; Rittenbruch, M.; Santangelo, M. Urban parks, value uplift and green gentrification: An application of the spatial hedonic model in the city of Brisbane. Urban For. Urban Green. 2022, 74, 127618. [Google Scholar] [CrossRef]

- Heyman, A.V.; Sommervoll, D.E. House prices and relative location. Cities 2019, 95, 102373. [Google Scholar] [CrossRef]

- Ramirez-Juidias, E.; Amaro-Mellado, J.L.; Leiva-Piedra, J.L. Influence of the Urban Green Spaces of Seville (Spain) on Housing Prices through the Hedonic Assessment Methodology and Geospatial Analysis. Sustainability 2022, 14, 6613. [Google Scholar] [CrossRef]

- Du, M.B.; Zhang, X.L. Urban greening: A new paradox of economic or social sustainability? Land Use Policy 2020, 92, 104487. [Google Scholar] [CrossRef]

- Doll, C.; Polyakov, M.; Pannell, D.J.; Burton, M.P. Rethinking urban park irrigation under climate change. J. Environ. Manag. 2022, 314, 115012. [Google Scholar] [CrossRef]

- Kim, H.S.; Lee, G.E.; Lee, J.S.; Choi, Y. Understanding the local impact of urban park plans and park typology on housing price: A case study of the Busan metropolitan region, Korea. Landsc. Urban Plan. 2019, 184, 1–11. [Google Scholar] [CrossRef]

- Janeczko, E.; Budnicka-Kosior, J.; Dawidziuk, A.; Woznicka, M.; Kwasny, L.; Fornal-Pieniak, B.; Chylinski, F.; Goljan, A. Impact of Forest Landscape on the Price of Development Plots in the Otwock Region, Poland. Sustainability 2022, 14, 14426. [Google Scholar] [CrossRef]

- Zambrano-Monserrate, M.A.; Ruano, M.A.; Yoong-Parraga, C.; Silva, C.A. Urban green spaces and housing prices in developing countries: A Two-stage quantile spatial regression analysis. For. Policy Econ. 2021, 125, 102420. [Google Scholar] [CrossRef]

- Stromberg, P.M.; Ohrner, E.; Brockwell, E.; Liu, Z.Y. Valuing urban green amenities with an inequality lens. Ecol. Econ. 2021, 186, 107067. [Google Scholar] [CrossRef]

- Kim, H.; Yoon, H. The impact of the urban park sunset rule on land value: The case of Yongin in Gyeonggi Province, South Korea. Habitat Int. 2023, 132, 102746. [Google Scholar] [CrossRef]

- Tapsuwan, S.; Polyakov, M. Correctly Specifying Environmental Assets in Spatial Hedonic Pricing Models. Soc. Nat. Resour. 2016, 29, 233–249. [Google Scholar] [CrossRef]

- Kong, F.; Yin, H.; Nakagoshi, N. Using GIS and landscape metrics in the hedonic price modeling of the amenity value of urban green space: A case study in Jinan City, China. Landsc. Urban Plan. 2007, 79, 240–252. [Google Scholar] [CrossRef]

- Turner, T.M.; Seo, Y. House Prices, Open Space, and Household Characteristics. J. Real Estate Res. 2021, 43, 204–225. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, L.; Huang, Y.; Wilson, B.; Mosey, G.; Deal, B. Spatial impacts of multimodal accessibility to green spaces on housing price in Cook County, Illinois. Urban For. Urban Green. 2022, 67, 127370. [Google Scholar] [CrossRef]

- Pandit, R.; Polyakov, M.; Sadler, R. Valuing public and private urban tree canopy cover. Aust. J. Agr. Resour. Econ. 2014, 58, 453–470. [Google Scholar] [CrossRef]

- Tuffery, L. The recreational services value of the nearby periurban forest versus the regional forest environment. J. For. Econ. 2017, 28, 33–41. [Google Scholar] [CrossRef]

- Wu, C.; Ye, X.Y.; Du, Q.Y.; Luo, P. Spatial effects of accessibility to parks on housing prices in Shenzhen, China. Habitat Int. 2017, 63, 45–54. [Google Scholar] [CrossRef]

- Liu, L.B.; Yu, H.C.; Zhao, J.; Wu, H.; Peng, Z.H.; Wang, R. Multiscale Effects of Multimodal Public Facilities Accessibility on Housing Prices Based on MGWR: A Case Study of Wuhan, China. ISPRS Int. J. Geo-Inf. 2022, 11, 57. [Google Scholar] [CrossRef]

- Cao, M.; Yao, H.T.; Xia, J.Y.; Fu, G.; Chen, Y.; Wang, W.; Li, J.S.; Zhang, Y.Y. Accessibility-Based Equity Assessment of Urban Parks in Beijing. J. Urban Plan. Dev. 2021, 147, 05021018. [Google Scholar] [CrossRef]

- Ben, S.; Zhu, H.; Lu, J.; Wang, R. Valuing the Accessibility of Green Spaces in the Housing Market: A Spatial Hedonic Analysis in Shanghai, China. Land 2023, 12, 1660. [Google Scholar] [CrossRef]

- Liang, H.; Zhang, Q. Temporal and spatial assessment of urban park visits from multiple social media data sets: A case study of Shanghai, China. J. Clean. Prod. 2021, 297, 126682. [Google Scholar] [CrossRef]

- Statistics, Shanghai Bureau of Statistics. Shanghai Statistical Yearbook (2021); China Statistics Press: Beijing, China, 2021. [Google Scholar]

- Liang, H.; Yan, Q.; Yan, Y. Evaluating green space provision development in Shanghai (2012–2021): A focus on accessibility and service efficiency. Sustain. Cities Soc. 2024, 103, 105269. [Google Scholar] [CrossRef]

- Liang, H.; Yan, Q.; Yan, Y.; Zhang, Q. Exploring the provision, efficiency and improvements of urban green spaces on accessibility at the metropolitan scale. J. Environ. Manag. 2024, 352, 120118. [Google Scholar] [CrossRef]

- Liang, H.; Yan, Q.; Yan, Y. A novel spatiotemporal framework for accessing green space accessibility change in adequacy and equity: Evidence from a rapidly urbanizing Chinese City in 2012–2021. Cities 2024, 151, 105112. [Google Scholar] [CrossRef]

- Liang, H.; Yan, Y.; Yan, Q.; Zhang, Q. Development of green space provision for housing estates at metropolitan scale: A spatiotemporal assessment of proximity in a rapidly urbanizing Chinese city during the last 10 years. Land Use Policy 2024, 140, 107119. [Google Scholar] [CrossRef]

- Liang, H.; Yan, Y.; Yan, Q.; Zhang, Q. A planning framework to explore shortages and improvements of urban green space provision at the metropolitan scale using novel nSFCA proximity indices. Ecol. Indic. 2024, 160, 111822. [Google Scholar] [CrossRef]

- Dai, D. Racial/ethnic and socioeconomic disparities in urban green space accessibility: Where to intervene? Landsc. Urban Plan. 2011, 102, 234–244. [Google Scholar] [CrossRef]

- Huang, Y.Y.; Lin, T.; Xue, X.Z.; Zhang, G.Q.; Liu, Y.Q.; Zeng, Z.W.; Zhang, J.M.; Sui, J.L. Spatial patterns and inequity of urban green space supply in China. Ecol. Indic. 2021, 132, 108275. [Google Scholar] [CrossRef]

- Luo, J. Integrating the Huff Model and Floating Catchment Area Methods to Analyze Spatial Access to Healthcare Services. Trans. GIS 2014, 18, 436–448. [Google Scholar] [CrossRef]

- Reyes, M.; Páez, A.; Morency, C. Walking accessibility to urban parks by children: A case study of Montreal. Landsc. Urban Plan. 2014, 125, 38–47. [Google Scholar] [CrossRef]

- Wang, H.; Huang, J.; Li, Y.; Yan, X.; Xu, W. Evaluating and mapping the walking accessibility, bus availability and car dependence in urban space: A case study of Xiamen, China. Acta Geogr. Sin. 2013, 68, 477–490. [Google Scholar]

- Wolff, M. Taking one step further? Advancing the measurement of green and blue area accessibility using spatial network analysis. Ecol. Indic. 2021, 126, 107665. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).