The Relationship of Energy and CO2 Emissions with GDP per Capita in Colombia

Abstract

1. Introduction

2. Conceptual and Empirical Review

3. Data, Methods, and Model Specification

3.1. Data

3.2. Methods

3.3. Specification of the Model

4. Results

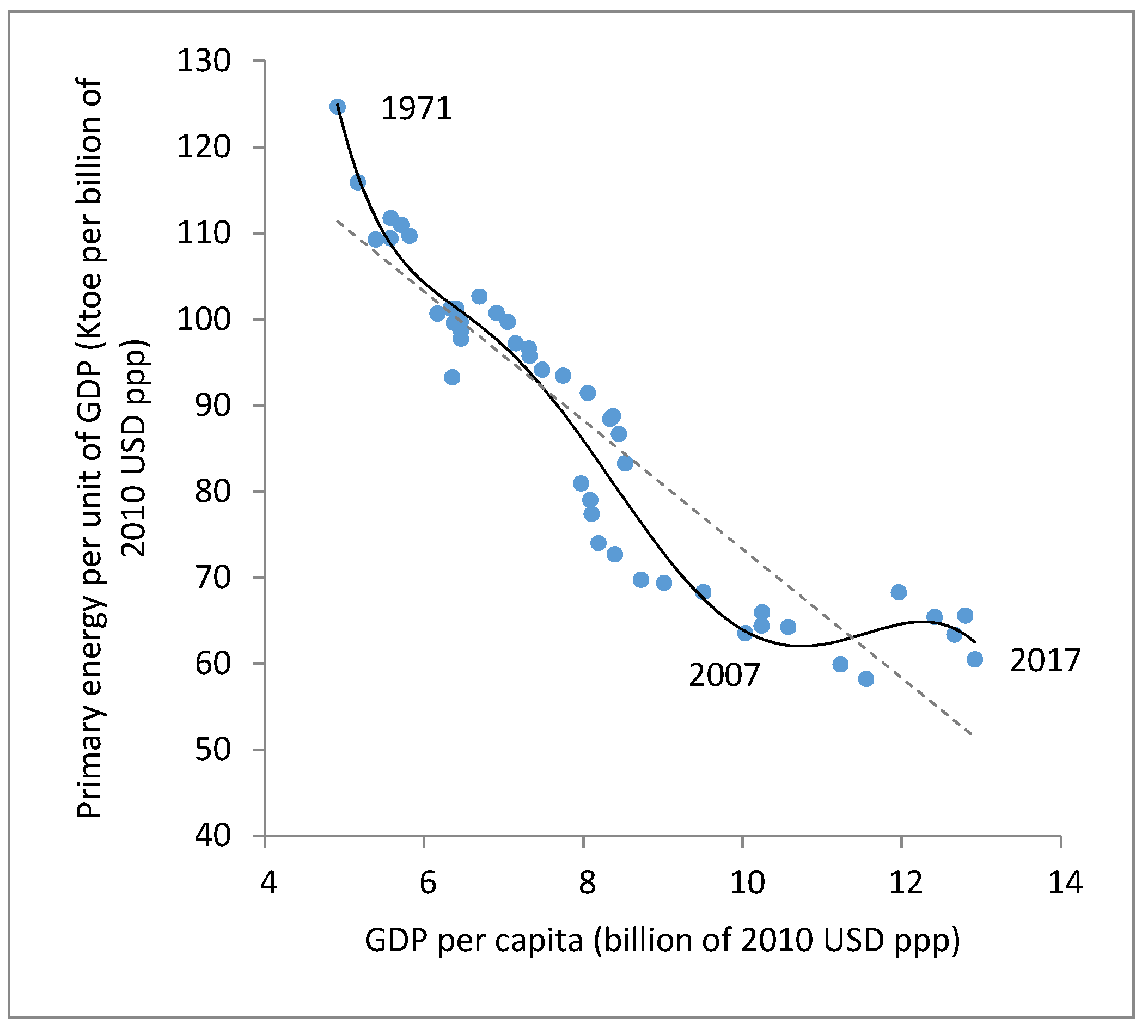

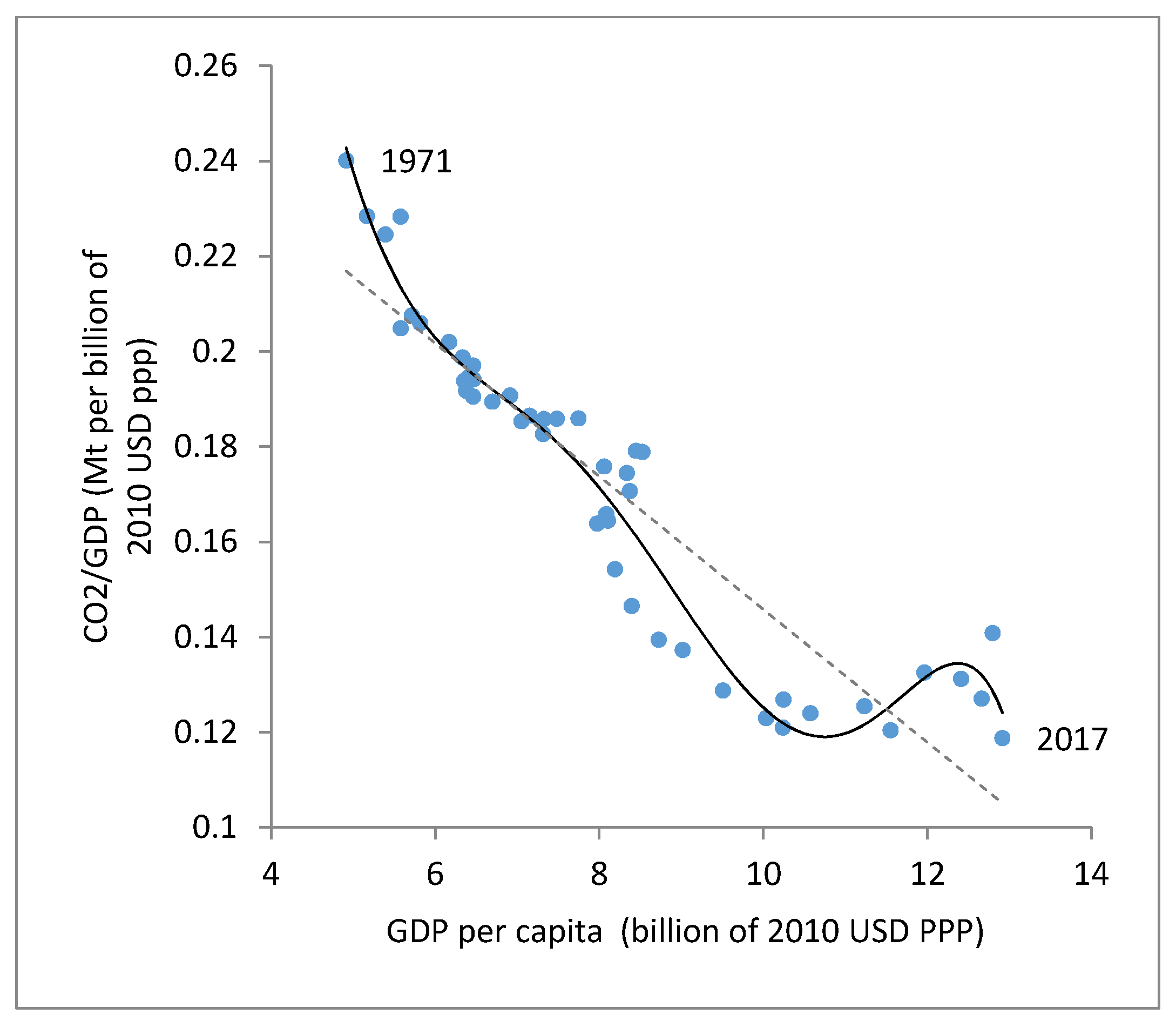

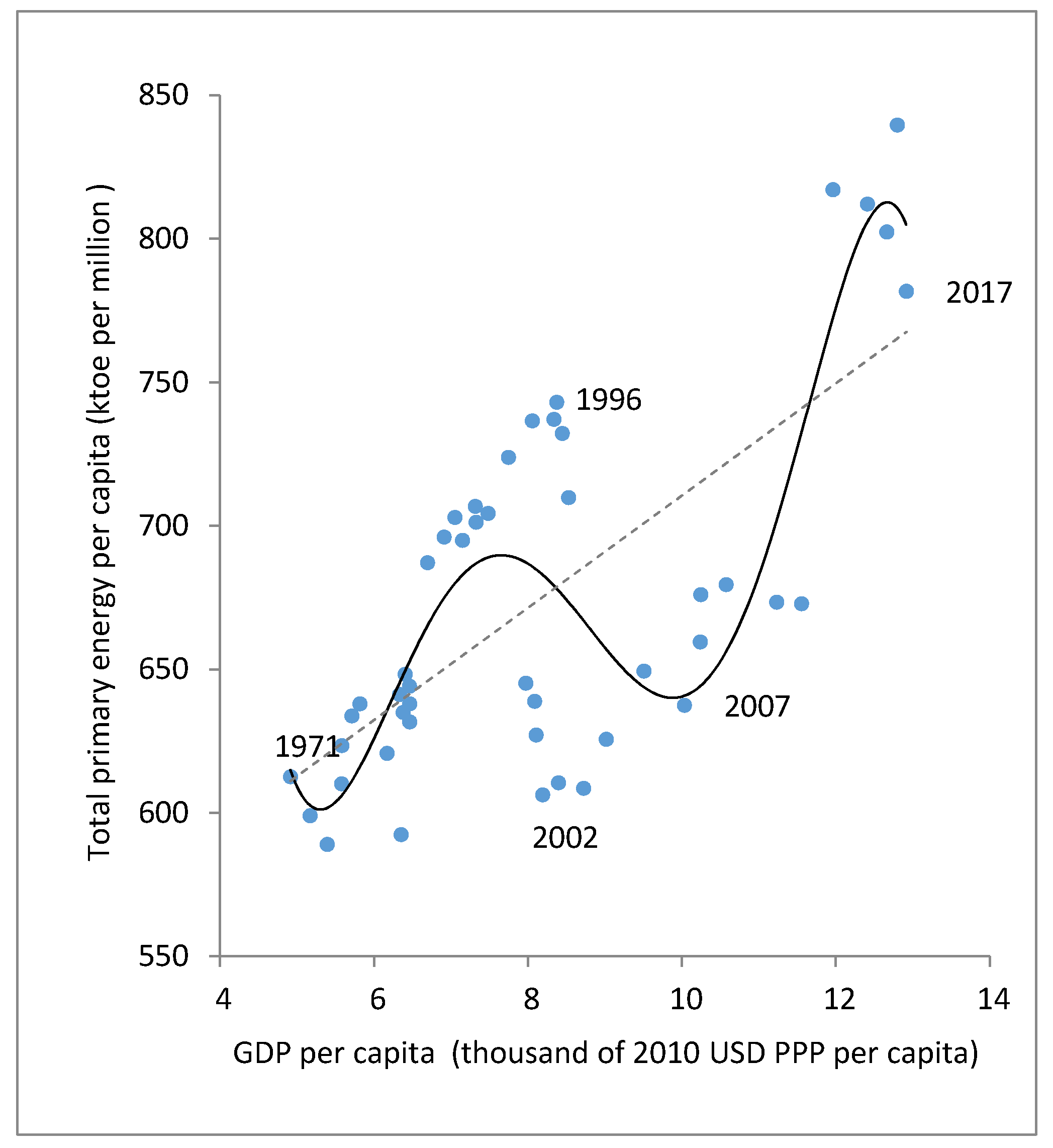

4.1. Graphical Analysis of the Relationships between Energy or CO2 Emissions and GDP in Colombia

4.2. Results of the Econometric Estimations

4.3. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Review of Selected Articles Related to Income Elasticity of Energy and CO2 Emissions with a Particular Focus on Studies on Colombia.

| Author | Model | Period | Data | Short-Run Elasticity CO2/GDP | Long-Run Elasticity CO2/GDP | Short-Run Elasticity Energy/GDP | Long-Run Elasticity Energy/GDP | Income Level Turning Point |

|---|---|---|---|---|---|---|---|---|

| [81] | Time series | NA | Colombia | 0.433 | 1.25 | EKC not estimated | ||

| [73] | Fixed and random effects | NA | Colombia’s electricity sector | (0.021; 0.484) | EKC not estimated | |||

| [73] | OLS | NA | Colombia’s electricity sector of high consump. | 0.059 | EKC not estimated | |||

| [73] | OLS | NA | Colombia’s electricity sector of low consump. | 0.64 | EKC not estimated | |||

| [74] | Non-linear least squares | NA | Colombia (Medellín and Bogotá) | 0.23 | EKC not estimated | |||

| [76] | Partial adjustment model | NA | Developing countries | 0.46 | 1.03 | EKC not estimated | ||

| [76] | Partial adjustment model | NA | Developed countries | 0.74 | 1.35 | EKC not estimated | ||

| [75] | Time series | 1948–1990 | Denmark | 0.66 | 1.21 | EKC not estimated | ||

| [12] | GLS | 1980–1992 | 22 countries | 3.88 | 9719 (U$ 1985) | |||

| [12] | GLS | 1960–1991 | 7 regions | 3.2 | 27,247 (U$1985) | |||

| [62] | Partial adjustment model | 1971–1989 | Developed and developing countries | 0.07 | 0.41 | 0.17 | 0.7 | 62,000 energy 13,630 CO2 |

| [38] | Time series | 1960–1999 | Austria | 1.63 | No evidence of EKC | |||

| [23] | OLS | 1980–2001 | Spain | 1.37 | No evidence of EKC | |||

| [84] | MCG | 1980–1997 | 21 Countries | 2.5 | 63,771 (US $1995) | |||

| [77] | ARDL and Bound test | NA | Australia | (0.32; 0.41) | 4.4 | EKC not estimated | ||

| [71] | Montecarlo | 2003 | Colombia (Medellín, Cali, Bucaramanga, Pasto, Pereira, Cartagena and Barranquilla) | 0.31 | EKC not estimated | |||

| [82] | Panel | 1980–2006 | 93 Countries | (−2.58; 1.43) | EKC not estimated | |||

| [72] | Panel | 1998–2006 | Colombia (Santa Marta) | 0.52 | EKC not estimated | |||

| [83] | Cointegration | 1980–2005 | 36 Countries | (−0.44; 1.81) | (−5.74; 4.19) | EKC not estimated | ||

| [79] | Log lineal | 1970–2008 | Senegal (gasoline) | 0.46 | 1.13 | EKC not estimated | ||

| [78] | ARDL | 1967–2009 | Iran | 0.04 | 0.58 | EKC not estimated | ||

| [70] | VARX Bayesian. VARX frequentist | 2000–2011 | Colombia | 0.002 | 0.008 | EKC not estimated | ||

| [80] | ECM | 1976–2010 | Iran | 0.3581 | 0.73 | EKC not estimated | ||

| [87] | VEC | 2003–2013 | Colombia (Medellín) | 0.063 | EKC not estimated | |||

| [65] | FMOLS | 1990–2011 | 14 Asian countries | 3.8 | 9496.2 (US $ 2005) | |||

| [65] | DOLS | 1990–2011 | 14 Asian countries | 3.4 | 9126.5 (US $ 2005) | |||

| [68] | Panel FMOLS and panel DOLS | 1977–2010 | 17 countries | 1.59 | No evidence of EKC | |||

| [40] | VEC | 1882–2010 | Uruguay | (0.008; 0.017) | (2.75; 6.45) | No evidence of EKC | ||

| [88] | Panel difference and GMM | 1978–2013 | 20 OECD countries | (0.082; 0.186) | (0.200; 0.669) | EKC no estimated | ||

| [89] | Dynamic panel | 1960–2016 | 37 OECD and 41 non-OECD countries | (0.21; 0.51) | (0.50; 0.64) | EKC no estimated |

Appendix B. The Choice between OLS and SURE Models

References

- Unidad de Planeación Minero Energética (UPME). Plan Energético Nacional 2006–2025; MINMINAS-UPME: Bogotá, DC, USA, 2007.

- Departamento Nacional de Planeación (DNP). Bases del Plan Nacional de Desarrollo 2014–2018. Todos por un Nuevo País; DNP: Bogotá, DC, USA, 2015.

- International Energy Agency (IEA). World Energy Balances. IEA World Energy Statistics and Balances (Database). 2020. Available online: https://doi-org.are.uab.cat/10.1787/data-00512-en (accessed on 24 June 2020).

- International Energy Agency (IEA). CO2 Emissions from Fuel Combustion; OCDE/IEA: Paris, France, 2019. [Google Scholar]

- Ocampo, J.A. El desarrollo Económico. In Introducción a la Macroeconomía Colombiana; Lora, E., Ocampo, J.A., Steiner, R., Eds.; FEDESARROLLO: Bogotá, Colombia, 1998; pp. 347–436. [Google Scholar]

- Esguerra Roa, C.; Castro Fernández, J.C.; González Quintero, N.I. Cambio Estructural y Competitividad: El Caso Colombiano; DANE: Bogotá, DC, USA, 2005. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Panayotou, T. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development; Working Paper WP238; Technology and Employment Program, International Labor Office: Geneva, Switzerland, 1993. [Google Scholar]

- Beckerman, W. Economic growth and the environment: Whose growth? Whose environment? World Dev. 1992, 20, 481–496. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the Environmental Kuznets curve. J. Econ. Perspect. 1992, 16, 147–168. [Google Scholar] [CrossRef]

- Ekins, P. The Kuznets curve for the environment and economic growth: Examining the evidence. Environ. Plan. A 1997, 29, 805–830. [Google Scholar] [CrossRef]

- Cole, M.A.; Rayner, A.J.; Bates, J.M. The environmental Kuznets curve: An empirical analysis. Environ. Dev. Econ. 1997, 2, 401–416. [Google Scholar] [CrossRef]

- Roca, J.; Padilla, E.; Farre, M.; Galletto, V. Economic growth and atmospheric pollution in Spain: Discussing the environmental Kuznets curve hypothesis. Ecol. Econ. 2001, 39, 85–99. [Google Scholar] [CrossRef]

- Shahbaz, M.; Sinha, A. Environmental Kuznets curve for CO2 emissions: A literature survey. J. Econ. Stud. 2019, 46, 106–168. [Google Scholar] [CrossRef]

- De Bruyn, S.M.; van den Bergh, J.C.J.M.; Opschoor, J.B. Economic growth and emissions: Reconsidering the empirical basis of environmental Kuznets curves. Ecol. Econ. 1998, 25, 161–175. [Google Scholar] [CrossRef]

- Dijkgraaf, E.; Vollebergh, H.J. A Test for parameter homogeneity in CO2 panel EKC estimations. Environ. Resour. Econ. 2005, 32, 229–239. [Google Scholar] [CrossRef]

- Piaggio, M.; Padilla, E. CO2 emissions and economic activity: Heterogeneity across countries and non-stationary series. Energy Policy 2012, 46, 370–381. [Google Scholar] [CrossRef]

- Correa-Restrepo, F.; Vasco-Ramírez, A.F.; Pérez-Montoya, C. La curva medioambiental de Kuznets: Evidencia empírica para Colombia. Semest. Económico 2005, 8, 13–30. [Google Scholar]

- Kuznets, S. Economic Growth and Income Inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Stern, D.I. Progress on the environmental Kuznets curve? Environ. Dev. Econ. 1998, 3, 173–196. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental Impacts of a North American Free Trade Agreement; NBER Working Paper; No. 3914; NBER: Cambridge, MA, USA, 1991. [Google Scholar]

- World Bank. Development and the Environment: World Development Report; Oxford University Press: New York, NY, USA, 1992. [Google Scholar]

- Roca, J.; Padilla, E. Emisiones atmosféricas y crecimiento económico en España. La curva de Kuznets Ambiental y el protocolo de Kyoto. Econ. Ind. 2003, 351, 73–86. [Google Scholar]

- Alcántara, V.; Padilla, E. Input–output subsystems and pollution: An application to the service sector and CO2 emissions in Spain. Ecol. Econ. 2009, 68, 905–914. [Google Scholar] [CrossRef]

- Piaggio, M.; Alcántara, V.; Padilla, E. Greenhouse gas emissions and economic structure in Uruguay. Econ. Syst. Res. 2014, 26, 155–176. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- McConnell, K. Income and demand for environmental quality. Environ. Dev. Econ. 1997, 2, 383–399. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Strezov, V. A review on Environmental Kuznets Curve hypothesis using bibliometric and meta-analysis. Sci. Total Environ. 2019, 649, 128–145. [Google Scholar] [CrossRef]

- Selden, T.M.; Song, D. Neoclassical growth, the J curve for abatement and the inverted U curve for pollution. J. Environ. Econ. Manag. 1995, 29, 162–168. [Google Scholar] [CrossRef]

- De Bruyn, S.M.; Opschoor, J.B. Developments in the throughput–income relationship: Theoretical and empirical observations. Ecol. Econ. 1997, 20, 255–268. [Google Scholar] [CrossRef]

- Boyce, J.K. Inequality as a cause of environmental degradation. Ecol. Econ. 1994, 11, 169–178. [Google Scholar] [CrossRef]

- Ravallion, M.; Heil, M.; Jalan, J. Carbon Emissions and Income Inequality. Oxf. Econ. Pap. 2000, 52, 651–669. [Google Scholar] [CrossRef]

- Torras, M.; Boyce, J.K. Income, inequality, and pollution: A reassessment of the environmental Kuznets Curve. Ecol. Econ. 1998, 25, 147–160. [Google Scholar] [CrossRef]

- Iwata, H.; Okada, K.; Samreth, S. Empirical study on the environmental Kuznets curve for CO2 in France: The role of nuclear energy. Energy Policy 2010, 38, 4057–4063. [Google Scholar] [CrossRef]

- Duro, J.A.; Teixidó-Figueras, J.; Padilla, E. The causal factors of international inequality in CO2 emissions per capita: A regression-based inequality decomposition analysis. Environ. Resour. Econ. 2017, 67, 683–700. [Google Scholar] [CrossRef]

- Jiang, L.; Hardee, K. How do recent population trends matter to climate change. Popul. Res. Policy Rev. 2011, 30, 287–312. [Google Scholar] [CrossRef]

- Salim, R.; Rafiq, S.; Shafiei, S.; Yao, Y. Does urbanization increase pollutant emission and energy intensity? Evidence from some Asian developing economies. Appl. Econ. 2019, 51, 4008–4024. [Google Scholar] [CrossRef]

- Friedl, B.; Getzner, M. Determinants of CO2 emissions in a small open economy. Ecol. Econ. 2003, 45, 133–148. [Google Scholar] [CrossRef]

- Panayotou, T. Demystifying the environmental Kuznets curve: Turning a black box into a policy tool. Environ. Dev. Econ. 1997, 2, 465–484. [Google Scholar] [CrossRef]

- Piaggio, M.; Padilla, E.; Román, C. The long-term relationship between CO2 emissions and economic activity in a small open economy: Uruguay 1882–2010. Energy Econ. 2017, 65, 271–282. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. North–South trade and the environment. Q. J. Econ. 1994, 109, 755–787. [Google Scholar] [CrossRef]

- Halicioglu, F. An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 2009, 37, 1156–1164. [Google Scholar] [CrossRef]

- Leitão, A. Corruption and the environmental Kuznets Curve: Empirical evidence for sulfur. Ecol. Econ. 2010, 69, 2191–2201. [Google Scholar] [CrossRef]

- He, J.; Wang, H. Economic structure, development policy and environmental quality: An empirical analysis of environmental Kuznets curves with Chinese municipal data. Ecol. Econ. 2012, 76, 49–59. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasreen, S.; Ahmedd, K.; Hammoudeh, S. Trade openness–carbon emissions nexus: The importance of turning points of trade openness for country panels. Energy Econ. 2017, 61, 221–232. [Google Scholar] [CrossRef]

- Alshubiri, F.; Elheddad, M. Foreign finance, economic growth and CO2 emissions Nexus in OECD countries. Int. J. Clim. Chang. Strateg. Manag. 2019, 12, 161–181. [Google Scholar] [CrossRef]

- Carattini, S.; Baranzini, A.; Roca, J. Unconventional Determinants of Greenhouse Gas Emissions: The role of trust. Environ. Policy Gov. 2015, 25, 243–257. [Google Scholar] [CrossRef]

- Bernauer, T.; Koubi, V. Effects of political institutions on air quality. Ecol. Econ. 2009, 68, 1355–1365. [Google Scholar] [CrossRef]

- Carson, R.T.; Jeon, Y.; McCubbin, D.R. The relationship between air pollution emissions and income: US Data. Environ. Dev. Econ. 1997, 2, 433–450. [Google Scholar] [CrossRef]

- Galeotti, M.; Lanza, A.; Pauli, F. Reassessing the environmental Kuznets curve for CO2 emissions: A robustness exercise. Ecol. Econ. 2006, 57, 152–163. [Google Scholar] [CrossRef]

- List, J.A.; Gallet, C.A. The environmental Kuznets curve: Does one size fit all? Ecol. Econ. 1999, 31, 409–423. [Google Scholar] [CrossRef]

- Gergel, S.E.; Bennett, E.M.; Greenfield, B.K.; King, S.; Overdevest, C.A.; Stumborg, B. A Test of the Environmental Kuznets Curve Using Long-Term Watershed Inputs. Ecol. Appl. 2004, 14, 555–570. [Google Scholar] [CrossRef]

- De Bruyn, S.M. Explaining the environmental Kuznets curve: Structural change and international agreements in reducing sulphur emissions. Environ. Dev. Econ. 1997, 2, 485–503. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tsionas, E.G. Environmental Kuznets curves: Bayesian evidence from switching regime models. Energy Econ. 2001, 23, 191–210. [Google Scholar] [CrossRef]

- Lindbeck. The Sveriges Riksbank (Bank of Sweden) Prize in Economic Sciences in Memory of Alfred Nobel 1969–1998; The Nobel Foundation: Stockholm, Sweden, 2000. [Google Scholar]

- Roca, J.; Alcántara, V. Energy intensity, CO2 emissions and the environmental Kuznets curve. The Spanish case. Energy Policy 2001, 29, 553–556. [Google Scholar] [CrossRef]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Kriström, B.; Lundgren, T. Swedish CO2 emissions 1900–2010: An exploratory note. Energy Policy 2005, 33, 1223–1230. [Google Scholar]

- Vincent, J. Testing for environmental Kuznets curves within a developing country. Environ. Dev. Econ. 1997, 2, 417–431. [Google Scholar] [CrossRef]

- Erdogdu, E. Electricity demand analysis using cointegration and ARIMA modelling: A case study of Turkey. Energy Policy 2007, 35, 1129–1146. [Google Scholar] [CrossRef]

- Yin, H.; Zhou, H.; Zhu, K. Long and short-run elasticities of residential electricity consumption in China: A partial adjustment model with panel data. Appl. Econ. 2015, 48, 2587–2599. [Google Scholar] [CrossRef]

- Agras, J.; Chapman, D. A dynamic approach to the Environmental Kuznets Curve hypothesis. Ecol. Econ. 1999, 28, 267–277. [Google Scholar] [CrossRef]

- Unidad de Planeación Minero Energética (UPME). Capacidad instalada de Autogeneración y Cogeneración en sector de Industria, Petróleo, Comercio y Público del País; Consorcio Hart–Re: Bogotá, Colombia, 2014.

- IPCC. Informe Especial sobre Fuentes de Energía Renovables y Mitigación del Cambio Climático; Organización Meteorológica Mundial y el Programa de las Naciones Unidas para el Medio Ambiente: Abu Dhabi, UAE, 2011. [Google Scholar]

- Apergis, N.; Ozturk, I. Testing Environmental Kuznets Curve hypothesis in Asian countries. Ecol. Indic. 2015, 52, 16–22. [Google Scholar] [CrossRef]

- Unidad de Planeación Minero Energética (UPME). Plan de Abastecimiento para el Suministro y Transporte de Gas Natural—Versión 2010; MINMINAS-UPME: Bogotá, Colombia, 2010.

- Unidad de Planeación Minero Energética (UPME). Programa de uso Racional y Eficiente de Energìa y Fuentes no Convencionales-PROURE. 2015. Available online: http://www1.upme.gov.co/DemandaEnergetica/MarcoNormatividad/plan.pdf (accessed on 15 May 2018).

- Bilgili, F.; Koçak, E.; Bulut, Ü. The dynamic impact of renewable energy consumption on CO2 emissions: A revisited Environmental Kuznets Curve approach. Renew. Sustain. Energy Rev. 2016, 54, 838–845. [Google Scholar] [CrossRef]

- Stern, D.I. Economic Growth and Energy. In Encyclopedia of Energy; Cleveland, C.J., Ed.; Elsevier: New York, NY, USA, 2004; pp. 35–51. [Google Scholar]

- Espinoza-Acuña, O.A.; Vaca Gonzalez, P.A.; Ávila Forero, R.A. Elasticidades de demanda por electricidad e impactos macroeconómicos del precio de la energía eléctrica en Colombia. Rev. De Métodos Cuantitativos Para La Econ. Y La Empresa 2013, 16, 216–249. [Google Scholar]

- Medina, C.; Morales, L.F. Demanda por servicios públicos domiciliarios en Colombia y subsidios: Implicaciones sobre el bienestar. Borradores de Economía, Banco de la República 2007, 467, 350–354. Available online: http://www.banrep.gov.co/sites/default/files/publicaciones/pdfs/borra467.pdf (accessed on 15 May 2018).

- Mendoza-Gutiérrez, J.F. Estimación de la demanda de energía eléctrica de la empresa Electricaribe S.A. de la ciudad de Santa Marta, durante el periodo comprendido entre 1998–2006. Master’s Thesis, Universidad Nacional de Colombia, Bogotá, Colombia, 2010. Available online: http://www.bdigital.unal.edu.co/6801/1/08407398.2010.pdf (accessed on 15 May 2018).

- Ramírez, G.A. La demanda de energía eléctrica en la industria Colombiana. Desarro. Y Soc. 1991, 27, 121–139. [Google Scholar]

- Vélez, C.E.; Botero, J.A.; Yánez, S. La demanda de energía de electricidad: Un caso colombiano. 1970–1983. Lect. De Econ. 1991, 34, 149–189. [Google Scholar]

- Bentzen, J.; Engsted, T. Short- and long-run elasticities in energy demand: A cointegration approach. Energy Econ. 1993, 15, 9–16. [Google Scholar] [CrossRef]

- Dahl, C. A survey of oil demand elasticities for developing countries. Opec. Energy Rev. 1993, 17, 399–420. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. The residential demand for electricity in Australia: An application of the bounds testing approach to cointegration. Energy Policy 2005, 33, 467–474. [Google Scholar] [CrossRef]

- Pourazarm, E.; Cooray, A. Estimating and forecasting residential electricity demand in Iran. Econ. Model. 2013, 35, 546–558. [Google Scholar] [CrossRef]

- Sene, S.O. Estimating the demand for gasoline in developing countries: Senegal. Energy Econ. 2012, 34, 189–194. [Google Scholar] [CrossRef]

- Taghvaee, V.M.; Ajiani, P. Price and Income Elasticities of Gasoline Demand in Iran: Using Static, ECM, and Dynamic Models in Short, Intermediate, and Long Run. Mod. Econ. 2014, 5, 939–950. [Google Scholar] [CrossRef]

- APEX Consultores. Estudio de Proyección de Demanda de Energía Eléctrica; UPME: Bogotá, Colombia, 1985. [Google Scholar]

- Narayan, P.K.; Narayan, S.; Popp, S. A note on the long-run elasticities from the energy consumption–GDP relationship. Appl. Energy 2010, 87, 1054–1057. [Google Scholar] [CrossRef]

- Jaunky, V.C. The CO2 emissions-income nexus: Evidence from rich countries. Energy Policy 2011, 39, 1228–1240. [Google Scholar] [CrossRef]

- Cole, M.A. Trade, the pollution haven hypothesis and the environmental Kuznets curve: Examining the linkages. Ecol. Econ. 2004, 48, 71–81. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J.; Mohd, S. Economic growth and CO2 emissions in Malaysia: A cointegration analysis of the Environmental Kuznets Curve. Energy Policy 2012, 51, 184–191. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J. Environmental degradation, economic growth and energy consumption: Evidence of the environmental Kuznets curve in Malaysia. Energy Policy 2013, 60, 892–905. [Google Scholar] [CrossRef]

- Laverde-Gaviria, N.; Ruíz-Guzmán, J.C. Elasticidades de la Demanda Residencial de Energía Eléctrica del estrato dos en el valle de Aburrá: Un caso de estudio 2003–2013. Master’s Thesis, Universidad EAFIT, Medellín, Colombia, 2014. [Google Scholar]

- Chang, B.; Kang, S.J.; Jung, T.Y. Price and output elasticities of energy demand for industrial sectors in OECD countries. Sustainability 2019, 11, 1786. [Google Scholar] [CrossRef]

- Liddle, B.; Huntington, H. Revisiting the income elasticity of energy consumption: A heterogeneous, common factor, dynamic OECD & non-OECD country panel analysis. Energy J. 2020, 41. [Google Scholar]

| Short-Run Coefficient | Standard Error | t-Statistic | p-Value | |

|---|---|---|---|---|

| Model 1 (dependent variable ln(PEt/POPt)) | ||||

| Intercept | 1.10 | 0.64 | 1.73 | 0.0880 * |

| ln(GDPt/POPt) | 0.92 | 0.46 | 2.00 | 0.0486 ** |

| (ln(GDPt/POPt))2 | −0.14 | 0.10 | −1.45 | 0.1514 |

| ln((PE_GNt+PE_HIDROt)/PE_TOTALt) | −0.18 | 0.05 | −3.86 | 0.0002 *** |

| ln(PEt−1/POPt−1) | 0.60 | 0.08 | 7.17 | 0.0000 *** |

| Model 2 (dependent variable ln(CO2t/POPt)) | ||||

| Intercept | −0.10 | 0.36 | −0.27 | 0.7893 |

| ln(GDPt/POPt) | −0.32 | 0.34 | −0.94 | 0.3481 |

| (ln(GDPt/POPt))2 | 0.12 | 0.08 | 1.51 | 0.1351 |

| ln(EP_RENOVt/EP_TOTALt) | −0.33 | 0.07 | −4.77 | 0.0000 *** |

| Gt | −0.13 | 0.02 | −5.73 | 0.0000 *** |

| ln(CO2t−1/POPt−1) | 0.57 | 0.07 | 7.9 | 0.0000 *** |

| Model 1 | Model 2 | |||

| R2 adjusted | 0.82 | 0.85 | ||

| DW | 1.75 | 2.16 | ||

| Determinant residual covariance | 1.08 × 10−6 | |||

| Short-Run Coefficient | Standard Error | t-Statistic | p-Value | |

|---|---|---|---|---|

| Model 1 (dependent variable ln(PEt/POPt)) | ||||

| Intercept | 1.65 | 0.47 | 3.50 | 0.0008 *** |

| ln(GDPt/POPt) | 0.22 | 0.06 | 3.86 | 0.0002 *** |

| ln((PE_GNt+PE_HIDROt)/PE_TOTALt) | −0.12 | 0.04 | −3.01 | 0.0035 *** |

| ln(PEt−1/POPt−1) | 0.65 | 0.08 | 7.78 | 0.0000 *** |

| Model 2 (dependent variable ln(CO2t/POPt)) | ||||

| Intercept | −0.59 | 0.10 | −5.66 | 0.0000 *** |

| ln(GDPt/POPt) | 0.18 | 0.04 | 4.21 | 0.0001 *** |

| ln(EP_RENOVt/EP_TOTALt) | −0.30 | 0.07 | −4.14 | 0.0001 *** |

| Gt | −0.12 | 0.02 | −5.17 | 0.0000 *** |

| ln(CO2t−1/POPt−1) | 0.60 | 0.07 | 8.02 | 0.0000 *** |

| Model 1 | Model 2 | |||

| R2 adjusted | 0.82 | 0.85 | ||

| DW | 1.89 | 2.16 | ||

| Determinant residual covariance | 1.28 × 10−6 | |||

| Long-Run Coefficient | Standard Error | Statistical Value | p-Value | |

|---|---|---|---|---|

| Model 1 (dependent variable ln(PEt/POPt)) | ||||

| Intercept | 4.75 | 0.42 | 11.24 | 0.0000 *** |

| ln(GDPt/POPt) | 0.64 | 0.14 | 4.58 | 0.0000 *** |

| ln((PE_GNt+PE_HIDROt)/PE_TOTALt) | −0.33 | 0.11 | −3.11 | 0.0019 *** |

| Model 2 (dependent variable ln(CO2t/POPt)) | ||||

| Intercept | −1.45 | 0.29 | −4.99 | 0.0000 *** |

| ln(GDPt/POPt) | 0.45 | 0.09 | 5.24 | 0.0000 *** |

| ln(PE_RENOVt/PE_TOTALt) | −0.75 | 0.22 | −3.45 | 0.0006 *** |

| Gt | −0.30 | 0.07 | −4.41 | 0.0000 *** |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Patiño, L.I.; Padilla, E.; Alcántara, V.; Raymond, J.L. The Relationship of Energy and CO2 Emissions with GDP per Capita in Colombia. Atmosphere 2020, 11, 778. https://doi.org/10.3390/atmos11080778

Patiño LI, Padilla E, Alcántara V, Raymond JL. The Relationship of Energy and CO2 Emissions with GDP per Capita in Colombia. Atmosphere. 2020; 11(8):778. https://doi.org/10.3390/atmos11080778

Chicago/Turabian StylePatiño, Lourdes Isabel, Emilio Padilla, Vicent Alcántara, and Josep Lluís Raymond. 2020. "The Relationship of Energy and CO2 Emissions with GDP per Capita in Colombia" Atmosphere 11, no. 8: 778. https://doi.org/10.3390/atmos11080778

APA StylePatiño, L. I., Padilla, E., Alcántara, V., & Raymond, J. L. (2020). The Relationship of Energy and CO2 Emissions with GDP per Capita in Colombia. Atmosphere, 11(8), 778. https://doi.org/10.3390/atmos11080778