Abstract

The use of nitrogen (N) fertilizer substantially contributes to greenhouse gas (GHG) emissions due to N2O emissions from agricultural soils and energy-intensive fertilizer manufacturing. Thus, a reduction of mineral N fertilizer use can contribute to reduced GHG emissions. Fertilizer tax is a potential instrument to provide incentives to apply less fertilizer and contribute to the mitigation of GHG emissions. This study provides model results based on a production function analysis from field experiments in Brandenburg and Schleswig-Holstein, with respect to risk aversion by calculating certainty equivalents for different levels of risk aversion. The model results were used to identify effective and cost-efficient options considering farmers’ risk aversion to reduce N fertilizer, and to compare the potential and cost of GHG mitigation with different N fertilizer tax schemes. The results show that moderate N tax levels are effective in reducing N fertilizer levels, and thus, in curbing GHG emissions at costs below 100 €/t CO2eq for rye, barley and canola. However, in wheat production, N tax has limited effects on economically optimal N use due to the effects of N fertilizer on crop quality, which affect the sale prices of wheat. The findings indicate that the level of risk aversion does not have a consistent impact on the reduction of N fertilizer with a tax, even though the level of N fertilizer use is generally lower for risk-averse agents. The differences in N fertilizer response might have an impact on the relative advantage of different crops, which should be taken into account for an effective implementation of a tax on N fertilizer.

1. Introduction

For more than two decades, the United Nations Framework Convention on Climate Change (UNFCCC) has moderated the intergovernmental process of finding appropriate ways to combat climate change, especially by setting common goals, standards and policy recommendations for the member states. In 2015, the Conference of Parties agreed on ambitious goals to reduce greenhouse gas (GHG) emissions under the Paris Agreement []. The goals can only be achieved with the appropriate design of policies and response by producers and consumers. To model the implications of the Paris Agreement, “Shared Socioeconomic Pathways” (SSPs) have been suggested [] to provide narratives of possible future developments, including policies on GHG mitigation serving as inputs for economic analyses []. However, even before the COVID-19 crisis, the restriction to only a few specific scenarios has been criticized [] as being more relevant in the future than before 2020. Instead of focusing on specific socio-economic pathways for the future, analytical tools can identify the impacts of specific policy interventions (e.g., taxes) on actors in the markets to identify the most promising cost-efficient policies []. In this sense, this paper aims to investigate a tax on nitrogen (N) use in agriculture as a possible policy to mitigate GHG emissions from agriculture.

N fertilizer is an essential input to agricultural systems but causes substantial GHG emissions due to nitrification and denitrification processes in agricultural soils and the subsequent release of N2O into the atmosphere. The energy-intensive manufacturing of N fertilizer using the Haber–Bosch process also contributes to GHG emissions []. Thus, a reduction in mineral N fertilizer use can contribute to reduced GHG emissions []. A tax on N fertilizer, following the polluter pays principle, is a potential instrument to create incentives to apply less fertilizer which, in turn, contributes to a mitigation of GHG emissions []. In the 1970s and 1980s, some European countries including Sweden, Norway, Finland and Austria, implemented taxes on mineral N fertilizer to address the pollution of water bodies [,]. These tax policies were substituted by direct regulation of fertilizer use in the course of the EU harmonization process in the last decades. While the environmental effects of the tax in most of the countries have been small and difficult to detect, the financial effects for the farmers were evident []. Even though not explicitly stated, it can be assumed that the negative income effect on farmers had an impact on the abolishment of the policy. Furthermore, it has been stated that experiences with the N tax in various countries did not show clear effects on N use and the resulting increased demand for organic fertilizer has been seen as critical for an environmentally sound policy design []. Currently, the reimplementation of an N tax is receiving increased interest, which is fueled by the lack of implemented measures to reduce N use and its environmental damage [,]. Emission reductions with an N tax can be achieved by substituting crops with lower N fertilizer levels or by reducing N rates [,]. It has been reported that an input tax on N provides environmental co-benefits with various CO2eq tax rates (9, 30 and 50 €/t CO2eq) []. While negative income effects for farmers hamper the implementation of a fertilizer tax, it has been shown that GHG mitigation by N fertilizer reduction can be achieved at a low cost [,]. However, little is known about how farmers would respond to an N fertilizer tax, and low price elasticities suggest limited response in N application rates [,]. Anyhow, it can be assumed that crop farmers would adapt their N fertilizer levels to the profit-maximizing N input in the long run according to marginal cost and marginal benefits, unless other motivations determined the fertilizer level []. Economic optima for crop-specific N inputs can be identified from field experiments for specific locations and weather conditions. Multiple year observations of yield response to N fertilizer can provide information about expected yield response, which can be used to estimate yield loss due to reduced fertilizer levels following an increase in N fertilizer price due to N taxation.

Farmers’ attitude to risk may have an impact on N fertilizer use [,]. A risk-averse agent tends to fertilize less than a risk-neutral agent, considering the uncertainties attached to N fertilization. Thus, for a risk-averse decision maker, a fertilizer tax could result in a different level of reduction in fertilizer use than a risk-neutral decision maker. Consequently, different opportunity costs could occur due to differences in N tax-related adjusted N use. Finger reported that risk-averse farmers face lower abatement costs to realize a reduced level of fertilizer use and the effect of an N tax is slightly higher for risk-averse farmers than for risk-neutral farmers with maize production in Switzerland []. However, it is not yet clear how farmers would respond to an N tax in Germany and how this would impact the comparative advantage of different crops.

This study provides model results based on a production function analysis from field experiments in Brandenburg and Schleswig-Holstein, Germany. Based on yield response to different N rates, we calculated economically optimal N fertilizer rates for different N-tax-scenarios with respect to risk considerations due to uncertainties in yield response and crop prices. The aim of the study is to specify the effectivity and efficiency of a tax on N fertilizer to reduce GHG emissions from agriculture for major arable crops in Germany.

The hypothesis of this paper is that the effectivity and cost efficiency of a tax on mineral N fertilizer is different for different crops and is affected by the risk aversion of the farmer.

2. Materials and Methods

2.1. Yield and Profit Response Functions to N Fertilizer

Yield response data to different N fertilizer levels over five years were used to estimate production functions for different typical arable crops in Germany (Schleswig-Holstein and Brandenburg). These regions were selected because data sets on yield response to different N rates were available for a similar crop rotation over five years for both regions. The regions reflect the range of different climatic conditions and their variability in Germany quite well. Yield response data were taken from Henke et al. [] for Schleswig-Holstein and published reports on yield response to different N fertilizer applications in Brandenburg []. The field experiment in Schleswig-Holstein was realized at the Hohenschulen Experimental Farm of the University of Kiel from 1996 to 2002. Total rainfall in Kiel averaged 750 mm annually. Further details about the experiment have been described by Henke et al. [] and Sieling et al. []. In the experiment, 16 different N treatments were applied in three split applications varying from 0 to 280 kg/ha. The first and second N applications ranged from 0 to 120 kg/ha, and the third application ranged from 0 to 80 kg/ha with 40 kg/ha intervals, respectively. In Brandenburg, the field experiment was conducted in Paulinenaue, at an experimental station of the State of Brandenburg, from 2012 to 2016. The average precipitation was 536 mm. In Brandenburg, five N rates were applied, ranging from 0 to 200 kg/ha. Besides a reference rate which was calculated every year using a nitrogen balance model based on N mineralization in soil, 30% less and 30% more than that rate, as well as an increased N rate, were applied. The considered crops included winter wheat, winter rye, winter barley and canola. For wheat, data on protein response to N were used from the same experiments to estimate protein response functions as proxies for wheat quality. Three wheat prices were considered according to different qualities based on the protein concentration (%): A-quality (>13.5%), baking quality (13–13.5%) and feed quality (<13%). For the economic analysis, prices observed over nine years were used [].

2.2. Optimal N Fertilizer Rates and Economic Response to N Fertilizer Tax

Optimal N fertilizer rates were based on profit calculations for the different crops per unit area (Equation (1)).

where π = profit per ha, Y(N) = crop yield per ha as a function of N, p = crop price, r = price for N fertilizer, c = tax per kg N and C = assumed fixed costs per ha.

Profits were calculated for an array of different possible crop prices and five quadratic production functions from the field experiments to calculate the expected value for a range of possible N fertilizer applications. In addition, optimal N rates were determined with an expected utility approach for different levels of risk aversion. Therefore, we calculated the certainty equivalent for different risk aversion coefficients according to Hardaker et al. [], based on the assumption of an exponential utility function of the farmer. The certainty equivalent is the certain monetary value which equals the utility of expected profit from a farming operation. Utility-maximizing N rates were calculated based on the maximum certainty equivalent generating N rate with a low and high risk aversion attitude, following absolute risk aversion coefficients of 0.001 and 0.004, respectively.

Farmers’ opportunity cost was calculated as the change in farm profit or certainty equivalent as a response to N-tax-induced adjusted optimal N rates. Increased farm expenses for N fertilizer use due to N tax have to be considered as allocation effects rather than economic welfare losses which could be redistributed to farmers. Thus, farmers’ expenditures on input tax were deducted from the gross opportunity cost to define the net economic loss due to the deviation from the economic optimum without tax, indicated as net opportunity cost.

2.3. GHG Emissions and Mitigation Costs

The partial budgeting of GHG emissions was conducted for mineral N fertilizer use with assumed emissions of 9.91 kg CO2eq per kg of N fertilizer applied []. This total emission factor included N2O emissions due to N fertilizer application and further GHG emissions due to the production of N fertilizer. N2O emissions were converted into CO2eq following the 100-year global warming potential []. N2O emissions consisting of direct and indirect N2O emissions were calculated according to the internationally accepted default method of accounting national GHG emissions (Tier 1) []. Direct N2O emissions (4.68 kg CO2eq kg−1 N) are N fertilizer application related emissions that occur directly from soil as a result of N mineralization processes. Indirect N2O emissions (1.52 kg CO2eq kg−1 N) are due to volatilization, leaching and runoff of applied N fertilizer. Other emissions considered in this study stem from N fertilizer manufacturing. Calcium ammonium nitrate (CAN) with 27% N content was considered as the commonly applied N fertilizer type in Germany. Following Bentrup and Pallière [], an emission factor of 3.70 kg CO2eq kg−1 N was assumed for CAN manufactured using an average N fertilizer production technology in Europe. This was a conservative assumption and assumed modern industrial processes were used to produce N fertilizer via the Haber–Bosch process []. Recently suggested, refined climate-specific emission factors by IPCC [] were not taken into account, providing a conservative estimate of the emissions. Mitigation cost was expressed as the net opportunity cost per ton of CO2eq mitigated with the reduced fertilizer application.

2.4. Implementation of Tax on N Fertilizer

The economic and environmental impacts of 10 N tax scenarios (0.1 to 1.0 €/kg N) were investigated, which corresponded to approximately 10 to 100 €/t CO2eq, respectively. Only taxes on purchased mineral N fertilizer were considered. These still moderate tax rates were about 10% to 100% of the N cost and corresponded to the range of N taxes which were applied in European countries in the past.

3. Results

3.1. Optimal N Rates with Respect to a Tax on N Fertilizer

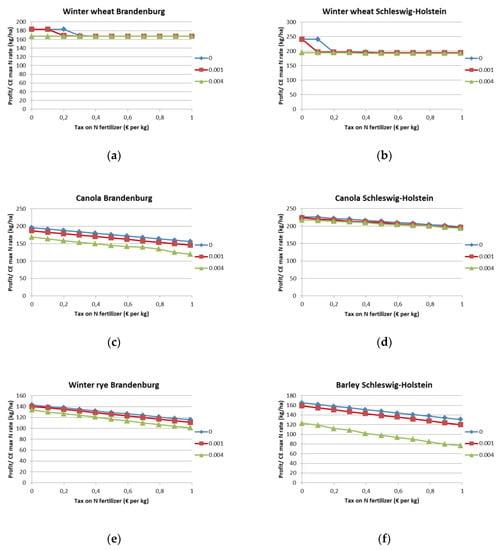

Economically optimal N rates were found to be lower with increasing levels of tax on N fertilizer for all considered crops in Brandenburg and Schleswig-Holstein (Figure 1). A linear reduction trend was observed for rye, barley and canola at similar magnitude compared to respective reference N fertilizer levels. However, the response to a tax was not linear for wheat since the economic returns were strongly linked to the wheat prices for different qualities. The reason is that maintaining certain grain quality generates higher profits for wheat, even at higher N fertilizer price levels due to N taxation. A further reduction in N fertilizer for wheat could only be observed at a tax level beyond 2.40 €/kg N and 1.90 €/kg N for Brandenburg and Schleswig-Holstein, respectively.

Figure 1.

Effect of an N tax on economically optimal N rates for different levels of risk aversion, based on field experiments in Brandenburg (a,c,e) and Schleswig-Holstein (b,d,f).

The pattern of response to a tax did not differ substantially between the two considered regions. Across all considered crops, the reduction of N input with a 1 € tax ranged between 16 and 46 kg/ha, which was 9 to 21% of the initial fertilizer level without tax. The consideration of risk aversion for most crops resulted in lower optimal N rates, but the response to the N tax was similar.

3.2. Economic Response to N Tax

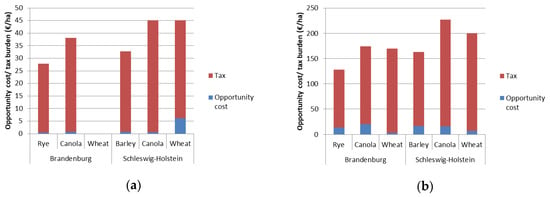

Additional N fertilizer expenditure due to a tax-induced higher N fertilizer price was found to be the dominant part (86–99%) of the gross opportunity cost (Figure 2) for a tax of 0.20 and 1.00 € per kg N. Opportunity cost due to lower crop yields at lower optimal N rates with a tax varied from 0.5 to 6.0 €/ha and from 3 to 17 €/ha for a tax of 0.20 and 1.00 €/kg N, respectively.

Figure 2.

Effect of a 0.20 € (a) and 1.00 € (b) tax on N fertilizer use on net opportunity cost and tax burden (risk neutral farmer), based on field experiments in Brandenburg and Schleswig-Holstein.

3.3. GHG Mitigation Potential and Mitigation Costs

GHG mitigation potential and GHG mitigation costs were rather low. The GHG mitigation potential for a tax of 0.20 €/kg N ranged between 0 and 436 kg CO2eq/ha (Table 1). For a tax of 1 €/kg N, the mitigation ranged from 159 to 456 kg CO2eq/ha. GHG mitigation costs for 0.20 €/kg N ranged between 9 and 45 €/t CO2eq, and for a tax of 1 €/kg N, the costs ranged from 19 to 212 €/t CO2eq. Due to the different response functions, mitigation costs were higher in Schleswig-Holstein than in Brandenburg. This was due to the higher yield penalties that occurred as a result of N-tax-induced higher N fertilizer prices.

Table 1.

Greenhouse gas (GHG) mitigation and mitigation cost with a tax of 0.20 and 1.00 € per kg N fertilizer.

Quality premiums, which are linked to the protein content in German wheat production, limit the response of N fertilizer to an N tax. However, if the incentives are effective, GHG mitigation costs are also low (below 20 €/t CO2eq).

4. Discussion

Even though the GHG mitigation effect per ha of a small tax would be moderate, the GHG mitigation costs per ton of CO2eq are low compared to other GHG mitigation options in agriculture [], providing a good argument to consider N taxation. The GHG mitigation costs are low because of flat profit functions close to the economic optimum [,]. Although quality premiums result in a non-linear GHG mitigation response [], GHG mitigation costs are still low. However, taxes may not be effective to create incentives for lower N application rates, because economically optimal N rates may not be affected by a tax, as is the case with the 0.20 € tax on N for wheat in Brandenburg. While the data suggest that a reduction of N supply is economically efficient at a higher N tax rate, this may not be the perception of a farmer selecting an N level at the time of fertilizer application due to lack of knowledge of economically optimal fertilizer levels. According to our findings, uncertainty and risk aversion generally result in lower economically efficient N rates. Similar to the impact of a tax, it is not clear how farmers would react to a non-linear response to the expected utility, which has also been discussed previously for different measures of risk []. Even though the effect of risk aversion had an impact on optimal N rates in contrast to the findings of Finger [], the attitude to risk did not show a different response to the taxes tested.

The calculations of the present study did not take into account possible leakage effects, which could be a substantial part of the GHG mitigation potential unless specific policies prevent these effects or the tax is effective internationally []. Economic losses caused by N taxation at farm level may reduce the domestic production of a crop, which in turn could stimulate an increase in its import. However, it is unclear to what extent a higher import level would impact net GHG emissions. It has been reported that input tax on N fertilizer is less cost-effective than the policy instruments that target all GHG emissions from farms []. However, besides contributing to reduced GHG emissions from agriculture, an N tax could further contribute to a cost-effective reduction of the pollution of water bodies [,].

The tax burden for farmers associated with the various N tax scenarios are much higher than the economic cost due to the reduced fertilizer rate. Theoretically, these burdens could be retransferred to farmers or compensated by a higher crop price. Complimentary policy instruments could be implemented to reallocate the tax money. A hybrid tax-subsidy mechanism has been suggested as a possible approach to recycle tax revenue back to producers []. Similar policy instruments have been shown to be effective in Europe to mitigate several emissions from industry []. The consideration of these effects is beyond the scope of this paper and deserves further analysis.

5. Conclusions

This paper shows the effectiveness and cost-efficiency of a tax on N fertilizer to create incentives for reduced N fertilizer levels and thus mitigate GHG emissions from agriculture. Moderate N tax levels can lead to N fertilizer reduction at costs below 100 €/t CO2eq for various crops in the climatically different regions of Brandenburg and Schleswig-Holstein, Germany. Similar cost patterns can be expected for arable systems in other regions of the temperate climate. The pattern of response to an N tax does not depend on the level of risk aversion of the farmer, even though the level of N fertilizer use is generally found to be lower for risk-averse agents. In contrast to cost-efficiency, the effectivity of an N tax is rather low, resulting in GHG mitigation potentials lower than 500 kg CO2eq/ha. However, the mutual benefits of reduced N inputs to agricultural systems provide a good argument for considering an N tax as a possible component of an efficient greenhouse gas mitigating policy.

Author Contributions

Conceptualization, A.M.-A., Y.N.K., A.N. and D.K.; methodology, A.M.-A. and Y.N.K.; writing—review and editing, A.M.-A., Y.N.K., A.N. and D.K. All authors have read and agreed to the published version of the manuscript.

Funding

The publication of this article was funded by the Open Access Fund of the Leibniz Association. The work of A.N. was supported by Deutsche Bundesstiftung Umwelt (DBU Scholarship Programme Central and Eastern Europe, MOE) 6 February 2019–5 December 2019.

Conflicts of Interest

The authors declare no conflict of interest.

References

- United Nations. The Paris Agreement. Paris, 2015. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 25 March 2020).

- Riahi, K.; van Vuuren, D.P.; Kriegler, E.; Edmonds, J.; O’Neill, B.C.; Fujimori, S.; Tavoni, M. The shared socioeconomic pathways and their energy, land use, and greenhouse gas emissions implications: An overview. Glob. Environ. Chang. 2017, 42, 153–168. [Google Scholar] [CrossRef]

- van Vuuren, D.P.; van der Wijst, K.-I.; Marsman, S.; van den Berg, M.; Hof, A.F.; Jones, C.D. The costs of achieving climate targets and the sources of uncertainty. Nat. Clim. Chang. 2020, 10, 329–334. [Google Scholar] [CrossRef]

- Schweizer, V. A few scenarios still do not fit all. Nat. Clim. Chang. 2018, 8, 361–362. [Google Scholar] [CrossRef]

- Freebairn, J. A portfolio policy package to reduce greenhouse gas emissions. Atmosphere 2020, 11, 337. [Google Scholar] [CrossRef]

- Brentrup, F.; Pallière, C. Energy Efficiency and Greenhouse Gas Emissions in European Nitrogen Fertilizer Production and Use; Reproduced and updated by kind permission of the International Fertiliser Society [www.fertilisersociety.org] from its Proceedings 63; International Fertiliser Society: Colchester, UK, 2008. [Google Scholar]

- Karatay, Y.N.; Meyer-Aurich, A. A model approach for yield-zone-specific cost estimation of greenhouse gas mitigation by nitrogen fertilizer reduction. Sustainability 2018, 10, 710. [Google Scholar] [CrossRef]

- OECD. Enhancing Climate Change Mitigation through Agriculture; OECD Publishing: Paris, France, 2019. [Google Scholar]

- Jayet, P.-A.; Petsakos, A. Evaluating the efficiency of a uniform N-input tax under different policy scenarios at different scales. Environ. Modeling Assess. 2013, 18, 57–72. [Google Scholar] [CrossRef]

- Hellsten, S.; Dalgaard, T.; Rankinen, K.; Tørseth, K.; Kulmala, A.; Turtola, E.; Bechmann, M. Nordic Nitrogen and Agriculture: Policy, Measures and Recommendations to Reduce Environmental Impact; Nordic Council of Ministers: Copenhagen, Denmark, 2017. [Google Scholar]

- European Commission. Study on the Economic and Environmental Implications of the Use of Environmental Taxes and Charges in the European Union and its Member States. Report by ECOTEC Research and Consulting, Brussels in association with CESAM, CLM, University of Gothenburg, UCD, IEEP. 2001. Available online: https://ec.europa.eu/environment/enveco/taxation/ (accessed on 29 May 2020).

- Hellsten, S.; Dalgaard, T.; Rankinen, K.; Tørseth, K.; Bakken, L.; Bechmann, M.; Turtola, E. Abating N in Nordic agriculture—Policy, measures and way forward. J. Environ. Manag. 2019, 236, 674–686. [Google Scholar] [CrossRef]

- Vermont, B.; De Cara, S. How costly is mitigation of non-CO2 greenhouse gas emissions from agriculture? A meta-analysis. Ecol. Econ. 2010, 69, 1373–1386. [Google Scholar] [CrossRef]

- Neufeldt, H.; Schäfer, M. Mitigation strategies for greenhouse gas emissions from agriculture using a regional economic-ecosystem model. Agric. Ecosyst. Environ. 2008, 123, 305–316. [Google Scholar] [CrossRef]

- Schmidt, A.; Necpalova, M.; Zimmermann, A.; Mann, S.; Six, J.; Mack, G. Direct and indirect economic incentives to mitigate nitrogen surpluses: A sensitivity analysis. J. Artif. Soc. Soc. Simul. 2017, 20, 7. [Google Scholar] [CrossRef]

- Finger, R. Nitrogen use and the effects of nitrogen taxation under consideration of production and price risks. Agric. Syst. 2012, 107, 13–20. [Google Scholar] [CrossRef]

- Streletskaya, N.A.; Bell, S.D.; Kecinski, M.; Li, T.; Banerjee, S.; Palm-Forster, L.H.; Pannell, D. Agricultural adoption and behavioral economics: Bridging the gap. Appl. Econ. Perspect. Policy 2020, 42, 54–66. [Google Scholar] [CrossRef]

- Monjardino, M.; McBeath, T.M.; Brennan, L.; Llewellyn, R.S. Are farmers in low-rainfall cropping regions under-fertilising with nitrogen? A risk analysis. Agric. Syst. 2013, 116, 37–51. [Google Scholar] [CrossRef]

- Meyer-Aurich, A.; Karatay, Y.N. Effects of uncertainty and farmers’ risk aversion on optimal N fertilizer supply in wheat production in Germany. Agric. Syst. 2019, 173, 130–139. [Google Scholar] [CrossRef]

- Henke, J.; Breustedt, G.; Sieling, K.; Kage, H. Impact of uncertainty on the optimum nitrogen fertilization rate and agronomic, ecological and economic factors in an oilseed rape based crop rotation. J. Agric. Sci. 2007, 145, 455–468. [Google Scholar] [CrossRef]

- Landesamt für Ländliche Entwicklung, Landwirtschaft und Flurneuordnung (LELF). Jahresbericht 2016 Landwirtschaft; Ministerium für Ländliche Entwicklung, Umwelt und Landwirtschaft: Potsdam, Germany, 2017; Available online: https://lelf.brandenburg.de/cms/detail.php/bb1.c.537225.de/bbo_products_list_product. (accessed on 26 May 2020).

- Sieling, K.; Günther-Borstel, O.; Hanus, H. Effect of slurry application and mineral nitrogen fertilization on N leaching in different crop combinations. J. Agric. Sci. 1997, 128, 79–86. [Google Scholar] [CrossRef]

- Bayerische Landesanstalt für Landwirtschaft. Deckungsbeiträge und Kalkulationsdaten. Available online: https://www.stmelf.bayern.de/idb/default.html (accessed on 31 March 2020).

- Hardaker, J.B.; Richardson, J.W.; Lien, G.; Schumann, K.D. Stochastic efficiency analysis with risk aversion bounds: A simplified approach. Aust. J. Agric. Res. 2004, 48, 253–270. [Google Scholar] [CrossRef]

- Forster, P.; Ramaswamy, V.; Artaxo, P.; Berntsen, T.; Betts, R.; Fahey, D.W.; Haywood, J.; Lean, J.; Lowe, D.C.; Myhre, G.; et al. Changes in Atmospheric Constituents and in Radiative Forcing; Cambridge University Press: Cambridge, UK, 2007; pp. 129–234. [Google Scholar]

- 2006 IPCC Guidelines for National Greenhouse Gas Inventories; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2006.

- 2019 Refinement to the 2006 IPCC Guidelines for National Greenhouse Gas Inventories; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2019.

- Smith, P.; Martino, D.; Cai, Z.; Gwary, D.; Janzen, H.; Kumar, P.; Smith, J. Greenhouse gas mitigation in agriculture. Philos. Trans. R. Soc. B Biol. Sci. 2008, 363, 789–813. [Google Scholar] [CrossRef]

- Pannell, D.J. Flat earth economics: The far-reaching consequences of flat payoff functions in economic decision making. Appl. Econ. Perspect. Policy 2006, 28, 553–566. [Google Scholar] [CrossRef]

- Martínez, Y.; Albiac, J. Nitrate pollution control under soil heterogeneity. Land Use Policy 2006, 23, 521–532. [Google Scholar] [CrossRef]

- Gazzani, F. Economic and environmental evaluation of nitrogen fertilizer taxation: A review. Int. J. Environ. Agric. Biotechnol. 2017, 2, 1829–1834. [Google Scholar] [CrossRef]

- Pezzey, J.C.V. Emission taxes and tradeable permits a comparison of views on long-run efficiency. Environ. Resour. Econ. 2003, 26, 329–342. [Google Scholar] [CrossRef]

- Millock, K.; Nauges, C. Ex post evaluation of an earmarked tax on air pollution. Land Econ. 2006, 82, 68–84. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).