1. Introduction

The transition toward low-carbon production is a pivotal component of efforts to foster a more sustainable future. In an era marked by escalating environmental challenges, the imperative of ecological sustainability has surged to the forefront of global concerns [

1,

2,

3,

4,

5]. However, recent global crises have diverted attention and resources away from climate change, making it more difficult to progress on this critical issue. The challenge is unequivocal: how can policymakers efficiently marshal limited resources to achieve Sustainable Development Goals (SDGs) amidst unprecedented change?

The answer lies in formulating astute policy mechanisms that navigate this complex terrain, steering the course toward environmental integrity. The United Nations Framework Convention on Climate Change has instigated Climate Change Conferences (COP meetings) that prominently present climate mitigation strategies, indicating that achieving pathways to mitigate global warming necessitates reconfigurations in energy and industrial systems [

6,

7]. These conferences emphasize changing production inputs and relying more on cleaner energy forms, necessitating a profound paradigm shift in production systems.

Climate change and environmental crises require enterprises to actively forge pathways toward green economies characterized by the harmonization of economic expansion and ecological sustainability. However, encouraging companies to embrace environmentally conscious practices while safeguarding profitability represents a pivotal conundrum confronting businesses within rapidly industrializing nations. The energy transition process encompasses not only technological modifications but also intricate societal, conceptual, and political transformations due to the profound interconnection of energy systems with societal structures and economies. A central challenge impeding energy transition is the persistent reliance on fossil fuel-based infrastructure, sustained by substantial existing investments, the political influence of fossil fuel industries, and entrenched social and economic systems.

The literature encompasses two predominant narratives regarding energy transitions: rapid transformation versus gradual shifts [

8,

9]. Some researchers argue that attributing acceleration solely to intermittent cleaner energy sources is irrational due to expensive infrastructure requirements and historical policies favoring gradual transformations [

2,

10,

11]. Conversely, others argue that compelling evidence supports swift transitions under specific circumstances, particularly when considering accelerated factors such as climate change, resource scarcity, and technological innovations [

12,

13].

Numerous strategies exist to mitigate resource consumption and pollution within sustainable resource management frameworks [

3,

14,

15]. One approach involves adopting environmentally responsible techniques for resource extraction, minimizing environmental footprints. Additionally, redirecting financial gains from resource extraction toward investments in clean energy technologies and sustainable development represents a pivotal strategy [

5,

16]. This multifaceted approach aligns with eco-efficiency and environmental stewardship principles, contributing to more ecologically balanced and economically viable resource utilization frameworks.

Government participation is essential in finding and implementing approaches to tackle environmental issues, as governments are primary decision-makers. However, this is often missing in carbon neutrality research, leading to slow ratification of international agreements. Government supervision can help prevent spillover effects by promoting transparency and accountability. When firms are required to report carbon emissions, they become more accountable for their environmental impact, potentially leading to emission reductions as firms seek to avoid public scrutiny and negative publicity.

The evolution of locations, landscapes, and territorial arrangements in energy transitions creates novel disparities in development, providing valuable insights into how geography can serve as a foundational framework for systematically addressing spatial aspects of transitions toward cleaner energy and technology. The specific focus on the MENA (Middle East and North Africa) region is particularly significant given its strategic importance in global energy production and consumption, serving as a critical case study for understanding challenges and opportunities associated with transitioning to cleaner energy sources.

Governance of energy policies in the MENA region is pivotal because it shapes energy transition trajectories. Effective governance mechanisms can facilitate alignment between policymaking and spatial planning, ensuring well-coordinated implementation of sustainable energy development strategies. In contrast, inadequate or misaligned governance can hinder progress and exacerbate existing development disparities. This framework underscores the pressing need for cohesive alignment between policymaking, planning, and governance in the MENA region, with aspects that collectively play pivotal roles in shaping strategies for sustainable energy development with both regional and global significance.

Extensive prior research has investigated carbon neutrality goals and factors influencing their achievement. However, research gaps exist regarding green technology adoption and renewable energy consumption patterns in carbon neutrality contexts, especially within emerging economies. Moreover, investigations into nonlinear relationships and moderating effects have yielded incongruous findings attributable to disparities in employed panel modeling methodologies. Past inquiries have predominantly relied on conventional panel models that inadequately address cross-sectional interdependencies and slope variations, resulting in potentially biased estimations.

This study endeavors to fill this void by quantifying the enduring impacts of green technology adoption and renewable energy utilization on carbon emissions across 18 emerging economies within the MENA region from 2000 to 2022. To ensure reliability and robustness, we employ diverse econometric methodologies, encompassing Quantile Regression with method of moments and Driscoll–Kraay standard estimators. Our study encompasses three primary objectives: ascertaining the most efficacious strategies for attaining carbon neutrality with emphasis on green technology, renewable energy, oil rents, institutional quality, and trade policy; examining moderating influences of oil rents and trade policy on relationships between renewable energy, green technology, and carbon emissions; and scrutinizing roles of renewable energy and green technology as potential mediators within environmental Kuznets curve relationships.

The subsequent sections are structured as follows.

Section 2 offers an extensive literature review pertaining to carbon neutrality, green technology, and renewable energy.

Section 3 elucidates theoretical foundations and articulated hypotheses.

Section 4 outlines methodologies and details the dataset utilized.

Section 5 engages in comprehensive discussion of findings and provides theoretical elucidation. Finally,

Section 6 summarizes conclusions and explores policy implications arising from our research.

2. Literature Review

2.1. Theoretical Background of the Study

The theoretical foundation for understanding carbon neutrality in developing economies rests on two complementary frameworks that address both technological adoption and institutional quality. The pursuit of carbon neutrality represents a complex socio-technical transition that requires comprehensive theoretical grounding to understand the multifaceted relationships between governance, technology, and environmental outcomes.

Drawing upon reports from COP meetings, it becomes abundantly clear that the global community is confronted with the pressing challenge of climate change. These reports underscore the urgency of reducing non-renewable energy consumption, as it emerges as a conspicuous driver of climate change and its deleterious consequences. Simultaneously, the imperative of sustaining economic growth remains undeniably prominent within the discourse. The COP meetings consistently emphasize the need for a harmonious and pragmatic approach. However, the reports also illuminate the inexorable linkage between energy consumption and climate change, emphasizing the necessity of transitioning to cleaner and more sustainable energy sources. This synthesis of insights from COP meetings compels us to recognize the intricate balance that must be struck between these seemingly disparate objectives. It underscores the imperative to heed the guidance provided in these reports, forging a path toward a sustainable future that accommodates both environmental preservation and economic progress.

This study draws on two classical theories—Diffusion of Innovation Theory and Institutional Theory or neo-institutional economic theory. Rogers’ Diffusion of Innovation Theory serves as a valuable framework for comprehending the dynamics of innovation adoption in the realm of sustainable energy, patents, and the transition to a low-carbon economy. It underscores the significance of user-centric approaches, communication, and social dynamics in driving the diffusion of clean and environmentally sustainable technologies. Rogers’ Diffusion of Innovation Theory has been extensively applied to understand renewable energy adoption patterns globally [

17,

18]. However, critical assessment reveals limitations when applied to resource-rich economies. While the theory effectively explains technology adoption in market-driven contexts, it may not fully capture the complex political economy dynamics in MENA countries where state-led decisions often override market mechanisms.

Recent studies have attempted to address these limitations by incorporating institutional factors into diffusion models [

19]. For instance, Abdel-Rahman and El-Sharkawy [

20] found that institutional quality significantly moderates technology diffusion rates in Middle Eastern countries, suggesting that Rogers’ original framework requires adaptation for the MENA context.

Also, neo-institutional economic theory serves as an analytical framework for investigating the intricate relationship between institutional quality and the pivotal transition to a low-carbon economy, marked by the adoption of clean energy and advanced technologies. Within the purview of neo-institutional economics, institutions are comprehensively defined as the amalgamation of formal and informal rules that govern human interactions, as delineated by seminal works including North [

21]. This conceptualization posits that institutions wield substantial influence over a nation’s developmental trajectory and, significantly, policy outcomes.

The application of neo-institutional economics to environmental outcomes has evolved significantly since North’s foundational work [

22,

23]. Critical evaluation of this literature reveals both strengths and limitations. While institutional theory effectively explains long-term environmental performance differences across countries [

24,

25], it faces challenges in explaining short-term policy volatility and the complex interactions between formal and informal institutions in developing countries [

26,

27]. Recent MENA-specific studies challenge some assumptions of neo-institutional theory. Ross [

28] and Hertog [

29] argue that traditional governance indicators may not adequately capture the unique institutional arrangements in Gulf states, where informal networks and clan-based governance structures play crucial roles. This suggests that our analysis must interpret governance-environment relationships within the specific institutional context of MENA countries.

In the ensuing subsections, we delve into a rigorous examination of the intricate nexus existing between political institutions and the attainment of carbon neutrality, with a specific focus on the promotion of cleaner energy sources. Within this analytical framework, we endeavor to explicate the hypotheses that will be subjected to empirical scrutiny within the ambit of this study. Furthermore, we embark on an exploration of the mechanisms through which revenues stemming from natural resource endowments can be judiciously and efficaciously redirected toward sustainable energy initiatives and technological advancements, thereby fostering the overarching objective of carbon neutrality.

2.2. Hypothesis Development

The conceptual framework of this study is depicted in

Figure 1, showing all the relationship and their hypotheses.

2.2.1. Green Energy and Carbon Neutrality

Despite the Brundtland Report’s warning over 35 years ago, the debate on energy remains the same: we still need to find a safe and sustainable way to generate and use energy. The transition from conventional energy to renewable energy is essential for achieving sustainable development and carbon neutrality [

1,

30,

31]. Renewable energy has a positive environmental impact, reducing CO

2 emissions and improving air quality [

4,

32]. However, the impact of renewable energy on carbon emissions may vary depending on income level, with only higher-income countries experiencing a reduction in emissions with increases in renewable energy consumption [

33]. Income inequality may also negatively affect the long-term relationship between renewable energy and carbon neutrality [

34].

Also, Omri and Nguyen [

35] used dynamic panel data analysis to examine the determinants of renewable energy consumption in 64 countries from 1990 to 2011. They found that CO

2 emissions are a significant positive determinant of renewable energy consumption, while oil prices have a significant negative determinant of renewable energy consumption only in middle-income countries. These findings suggest that policies aimed at reducing CO

2 emissions are likely to have a positive impact on renewable energy consumption, but policymakers in middle-income countries should be careful about pursuing policies that reduce oil prices, as this could have a negative impact on renewable energy consumption.

Yao et al. [

36] investigated the relationship between clean energy, carbon dioxide emissions, and economic growth for 17 major developing and developed economies and the world’s 6 geo-economic regions from 1990 to 2014. They found that both the Environmental Kuznets Curve (EKC) and the Renewable Energy Kuznets Curve (RKC) frameworks hold for both panels, meaning that as GDP increases, renewable energy decreases carbon emissions. They also found that the RKC turning points for each country and the entire sample occur before the corresponding EKC turning points.

2.2.2. Green Innovation and Carbon Neutrality

Sustainable economic advancement necessitates the perpetual pursuit of innovation and the incorporation of cutting-edge technologies into the economic landscape [

30]. This practice enhances the learning dynamics inherent in the economic system, concurrently diminishing exposure to risks and volatilities that have the potential to undermine financial and operational returns. Furthermore, the cultivation of novel, intricate products with inherent barriers to replication represents a pivotal facet of the ongoing economic learning process, which is instrumental in propelling economic development forward [

22]. This undertaking necessitates substantial investments in low-carbon technologies and products, thereby reinforcing the symbiotic relationship between economic progress and sustainable innovation.

The aspiration for carbon neutrality, characterized by the equilibrium between carbon emissions and removals, is a pivotal objective pursued by numerous nations in the contemporary global discourse on environmental sustainability [

18]. In their pursuit of this overarching goal, governments have undertaken a multifaceted policy-driven approach, wielding an array of instruments and strategies to galvanize the advancement of green energy consumption, green technological innovations, and heightened energy efficiency. The ultimate aim of these concerted efforts is to attain a state of carbon neutrality [

13].

2.2.3. Green Innovation Is a Key Strategy for Reducing the Environmental Impact of Economic Activities

The relationship between green innovation and environmental outcomes has been extensively studied with mixed findings. Porter and Linde [

37] introduced the “Porter Hypothesis,” suggesting that environmental regulations can trigger innovation that offsets compliance costs. Subsequent empirical studies by Jaffe and Palmer [

38], Brunnermeier and Cohen [

39], and, more recently, Dechezleprêtre and Glachant [

40] provide varying degrees of support for innovation–environment linkages. Research using patent applications as innovation proxies generally finds positive environmental effects [

41,

42]. However, critical assessment reveals measurement challenges. Traditional patent counts may underestimate innovation in developing countries where formal IP protection is weak [

43,

44]. This limitation is particularly relevant for MENA countries where much technological development occurs through technology transfer rather than domestic innovation. The “green paradox” aligns with recent theoretical and empirical work by Sinn [

45] and empirical validation by Zhang et al. [

46]. While the green paradox provides a plausible explanation for short-term emission increases during green transitions, critics argue it may not apply universally [

47,

48]. The paradox may be more pronounced in resource-rich economies like many MENA countries, where green technology adoption coincides with continued fossil fuel production. Companies are developing new ways of production that consume fewer resources, generate less waste, and produce fewer emissions. This is leading to a more sustainable and efficient use of natural resources [

49].

Green innovations play a pivotal role in mitigating the adverse impacts of anthropogenic activities on the environment, particularly through the reduction in greenhouse gas emissions and other harmful pollutants. This assertion is underpinned by a substantial body of empirical research, including investigations conducted [

50,

51,

52,

53].

Nonetheless, the intricate relationship between green innovation and environmental outcomes warrants a nuanced evaluation. Some scholarly inquiries, such as the study conducted by Zhang et al. [

46], have proffered an alternative perspective, suggesting that the implementation of green innovation and technological advancements may yield counterintuitive outcomes in the short term. This phenomenon, notably prevalent in emerging economies with stringent environmental regulations, has been designated as the “green paradox”.

In essence, the “green paradox” postulates that the pursuit of green innovation and technological advancement, while aimed at environmental amelioration, may paradoxically lead to increased CO2 in specific contexts and timeframes. Such occurrences can be attributed to multifaceted factors, including the transitional nature of green technologies, potential rebound effects, and the intricate interplay of economic dynamics with environmental objectives. Consequently, the “green paradox” underscores the need for a comprehensive and context-sensitive approach to green innovation strategies and environmental policy formulation to achieve sustainable and desirable outcomes in the long term.

2.2.4. Governance and Carbon Neutrality

Global climate change governance typically begins at the international level and filters down to the national level. However, a substantial research gap exists concerning the failure of many countries to effectively incorporate international climate treaties into their national policies. As such, Biswas et al. [

54] posit that the presence of weak institutional frameworks, exemplified by elevated instances of corruption, can result in the expansion of an informal (shadow)economic sector, which, in turn, is associated with amplified levels of carbon emissions. In essence, when there exists insufficient regulatory oversight of the informal economy, coupled with conspicuous political corruption, it engenders deleterious repercussions for the natural environment. Their argument aligns with established economic theories that emphasize the importance of institutions in shaping economic behavior especially under the framework of EKC

Other studies that agree with this position includes [

55,

56,

57,

58,

59]. Danish et al. [

56] unveil a marked negative association between institutional quality and CO

2 emissions while concurrently establishing a positive correlation between the shadow economy and carbon emissions. Cao et al. [

55], in their study, elucidate the moderating role of institutional quality in the relationship between financial development and CO

2 emissions, indicating that robust institutions can mitigate the adverse environmental consequences of financial development. Ntow-Gyamfi et al. [

57] provide further support by demonstrating that urbanization, in isolation, tends to increase CO

2 emissions. However, they underscore the mitigating influence of institutional quality, which can ameliorate the adverse environmental effects associated with urbanization. Zhang et al. [

59] reiterate the inverse relationship between institutional quality and CO

2 emissions, emphasizing its robustness even when controlling for confounding factors such as economic growth and energy consumption.

2.2.5. Carbon Neutrality and Energy Transition in MENA Region

Recent studies have begun examining the specific challenges of achieving carbon neutrality in the MENA region. Oil-Rich vs. Oil-Poor Dynamics: MENA countries present a unique laboratory for studying carbon neutrality due to their heterogeneous resource endowments. Omri et al. [

60] demonstrate significant differences between oil-rich countries (UAE, Saudi Arabia, Kuwait) and oil-poor countries (Jordan, Morocco, Tunisia) in their renewable energy adoption patterns. Oil-rich countries face the “resource curse” dilemma where hydrocarbon wealth creates disincentives for renewable investment [

61] while oil-poor countries are driven by energy security concerns [

62]. Institutional quality varies dramatically across MENA countries, creating different pathways to carbon neutrality. Studies by Ibrahim and Law [

63] and Tamazian et al. [

64] found that governance-environment relationships in MENA differ significantly from global patterns. Traditional governance indicators may not capture the unique institutional arrangements in MENA countries, where informal networks and resource rent distribution mechanisms play crucial roles. The literature emphasizes increasing regional cooperation in renewable energy development. The Arab League’s renewable energy framework and GCC grid interconnection projects represent important institutional innovations. However, assessment reveals that regional cooperation faces significant political and economic barriers [

65].

2.3. Research Gaps

The pursuit of carbon neutrality has gained significant momentum in recent years as the world grapples with the urgent need to combat climate change. Various international agreements and commitments, such as the Paris Agreement, have set ambitious targets for achieving carbon neutrality by mid-century. Despite these efforts, the outcomes of recent climate conferences, including COP 17, indicate that the world is still far from reaching the 2023 goal.

One prominent research gap lies in the interactions among various governance policies aimed at achieving carbon neutrality. While individual policies have been extensively studied, there is a lack of comprehensive analysis regarding how these policies interact and potentially conflict with each other. Investigating these interactions is essential to ensure policy coherence and effectiveness.

The Green Paradox, a phenomenon where climate policies inadvertently lead to increased emissions in the short term, deserves more attention. This concept has significant implications for the efficacy of carbon neutrality policies and requires thorough examination to develop mitigation strategies and refine policy designs.

Also, the role of technological innovation in achieving carbon neutrality is undeniable. However, there is a research gap in understanding the dynamics of innovative ecosystems and their alignment with carbon neutrality goals. Further exploration is needed to facilitate technology transfer and diffusion in the pursuit of sustainability.

3. Materials and Methods

Global warming has emerged as a paramount concern within the purview of environmental specialists and economic scholars [

4]. The imperative at hand resides in the necessity to curtail nonrenewable energy consumption, given its pronounced role as a prominent driver of climate change. However, this imperative coexists in tandem with the overarching objective of sustaining and bolstering economic growth. To navigate this complex terrain, a dual-pronged strategy is necessary, characterized by a concerted effort to enhance productivity levels and a strategic pivot toward the utilization of cleaner and more sustainable energy sources. This multifaceted approach is poised to harmonize the often competing imperatives of environmental preservation and economic advancement.

3.1. Conceptual Framework

The COP meetings’ reports collectively serve as a call to action, guiding us toward a future where productivity gains and cleaner energy sources coalesce to mitigate the perils of global warming while facilitating economic prosperity. COP27 provides an opportunity to demonstrate collective solidarity in the face of an existential challenge that we can only surmount through collaborative efforts and the efficient execution of strategies. Such interaction efforts are merged with the proposed theorem to identify which model works best. Also, COPS 27 literature offers great insights into carbon neutrality, but empirical evidence is needed to substantiate or refute that literature. Thus, investigating the connections between COP27, clean energy, technology, governance, oil rent payments, and carbon neutrality in MENA countries is indispensable. As the world grapples with an escalating climate crisis, COP27 represents a critical international endeavor to mitigate climate change and secure a sustainable future. The MENA region’s distinct vulnerabilities, characterized by arid climates and socio-economic dynamics, necessitate focused research on how these nations can transition to carbon neutrality. Clean energy and innovative technologies are central to reducing greenhouse gas emissions, making it vital to examine their influence on MENA countries. Effective governance and policy frameworks are essential for implementing climate action plans, warranting an assessment of their role in these nations. The heavy reliance on oil revenues in MENA countries poses unique challenges, demanding an understanding of oil rent payments’ impact on their economies and climate efforts. COP conferences provide a platform for global collaboration and negotiations on climate goals, making an analysis of MENA countries’ participation at COP27 crucial. Achieving carbon neutrality offers numerous socio-economic and environmental benefits, underscoring the importance of MENA countries’ involvement in COP27. This research contributes valuable insights to inform policy decisions and international climate negotiations. Carbon neutrality aligns with broader sustainable development objectives, promoting economic prosperity and environmental stewardship. It reflects our ethical and moral responsibility to protect future generations from the perils of climate change, emphasizing the significance of this investigation in the pursuit of global environmental justice.

Emerging economies, many of which are industrialized, face significant challenges in achieving economic growth without harming the environment. Therefore, it is important to study these economies to develop effective solutions to this problem.

3.2. Data Source, Model Specification, and Econometric Methodology

Data curation is an essential preliminary step in any research or analysis. In this document, we have provided an overview of the data curation process that we obtained from World Development Indicators (WDIs) spanning the years 2000 to 2022. The dataset encompasses a wide array of variables, each offering unique insights into the socio-economic, environmental, and governance aspects of countries.

The comprehensive data collection process for this study was conducted systematically to ensure robust empirical analysis of carbon neutrality determinants across 18 MENA countries. The sample includes Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia, Turkey, and the United Arab Emirates. These countries were selected based on their classification as MENA region members by the World Bank, availability of sufficient time-series data covering the study period, and their significance in global energy markets either as major hydrocarbon producers or countries with substantial renewable energy potential.

The data collection strategy involved accessing multiple international databases to construct a comprehensive panel dataset. Primary reliance was placed on the World Bank’s World Development Indicators database for macroeconomic, environmental, and basic energy variables. This was supplemented by the World Bank’s Worldwide Governance Indicators project for institutional quality measures. This study employs logarithmic transformations for most variables to address potential heteroskedasticity concerns and to facilitate the interpretation of coefficients as elasticities, which is particularly valuable when examining relationships across countries with varying economic scales.

The temporal scope of 2000–2022 was chosen to capture both the pre- and post-Paris Agreement periods, allowing for analysis of how international climate commitments may have influenced the relationships under investigation. This timeframe also encompasses several significant events that may have affected MENA countries’ environmental and energy policies, including the 2008 global financial crisis, the Arab Spring period (2010–2012), the oil price collapse of 2014–2016, and the COVID-19 pandemic’s economic impacts. The study period provides sufficient temporal variation to identify both short-term adjustments and long-term trends in the variables of interest.

3.3. Variable Description

The curated dataset encompasses a diverse set of variables, each of which provides unique insights into the socio-economic landscape of countries. Below, we provide a brief description of key variables included in the dataset:

CO2 Emissions (kg per 2015 USD of GDP) (lnco2): This variable measures carbon dioxide emissions per unit of GDP, reflecting the environmental impact of economic activities.

Renewable Energy Consumption (% of Total Final Energy Consumption) (lnren): It represents the proportion of renewable energy in the total energy consumption, highlighting the transition towards cleaner energy sources.

Patent Applications, Residents (lnpatr): This variable reflects a country’s innovation and technological advancement through the number of patent applications from residents.

Services, Value Added (constant 2015 USD) (lnser): It signifies the value added by the services sector, providing insights into economic diversification and stability.

Oil Rents (% of GDP) (lnoilren): It indicates the proportion of oil rents in a country’s GDP, reflecting its reliance on oil revenues.

Trade (% of GDP) (lntrade): This variable measures the importance of international trade in a country’s economy.

Control of Corruption: Estimate (lncc): It assesses the control of corruption within a country’s governance structure.

Government Effectiveness: Estimate (lnge): It reflects the effectiveness of government actions and policies.

Voice and Accountability: Estimate (lnvoa): This variable gauges citizen involvement in decision-making processes.

Rule of Law: Estimate (lnrul): It assesses the strength of the legal framework within a country.

Political Stability and Absence of Violence/Terrorism: Estimate (lnps): It measures political stability and the absence of violence or terrorism.

Regulatory Quality: Estimate (lnrq): This variable reflects the quality and effectiveness of regulatory frameworks.

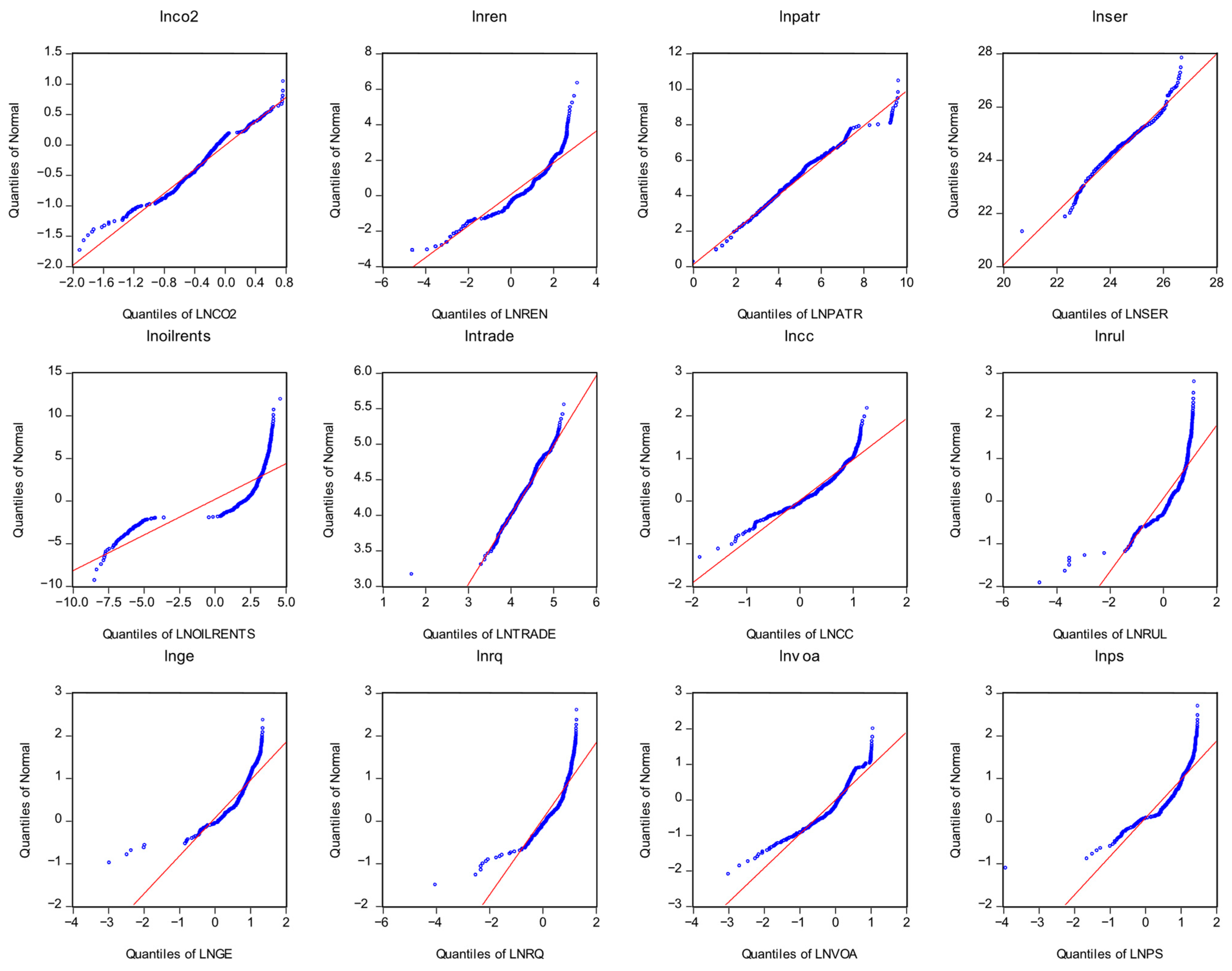

A table summary is shown in

Appendix A. Also, the behavior of its quantile distribution is shown in

Figure 1 3.4. Empirical Model

Following the previous works of Khalfaoui et al. [

66], Sun et al. [

67], and Ofori et al. [

4], the comprehensive empirical model for assessing the impact of green energy and technology, governance, and oil rent payments within the specified timeframes is outlined in the equation below.

The comprehensive empirical model for assessing the impact of green energy and technology, governance, and oil rent payments within the specified timeframes as outlined in the equation

Here, the dependent variable is lnco2 which expresses the assessment of carbon neutrality,

The parameters to be estimated are denoted by β1, β2…β3…… Which is unknown.

Four central models are investigated.

Model 1—Such focus on looking at the effects of the variables has on either promoting carbon neutrality or impeding it.

Model 1 aims to shed light on the factors that either promote carbon neutrality or pose impediments to it. The variables under investigation include renewable energy (Lnren), patent applications (Lnpatr), services value added (Lnser), oil rents (Lnoilrents), and trade (Lntrade). The model examines how these factors, in various locations and scales, influence the likelihood of achieving carbon neutrality.

Model 2—Assessing the Role of Governance towards Cops 27.

Model 2 explores the intricate relationship between various dimensions of governance—specifically, institutional quality, economic governance, and political governance—and carbon dioxide emissions (lnco2) within the context of the 27th Conference of the Parties (COP27). This analysis is driven by a commitment to understand the role that governance plays in shaping environmental outcomes, particularly in the context of global climate change negotiations and agreements.

Model 3—Interaction terms and the moderating role of OIL rents and trade policy within the confines of COPS 27.

Model 3 is designed to examine the nuanced relationship between carbon dioxide emissions (lnco2) and various key factors, including renewable energy (Lnren), patent applications (Lnpatr), services value added (Lnser), oil rents (Lnoilrents), and trade policy (Lntrade). In particular, it explores the moderating effect of interaction terms involving oil rents and trade policy within the framework of the 27th Conference of the Parties (COP27). This analysis aims to provide a comprehensive understanding of how these factors collectively influence carbon emissions.

Model 4—Analysis assessing the EKC theorem using renewable energy and technological innovation.

We embark on a rigorous examination of the intricate connection between carbon dioxide emissions (lnco2) and two pivotal determinants of environmental sustainability: renewable energy consumption (lnren) and technological innovation (lnpatr). This study aspires to unravel the presence of an Environmental Kuznets Curve (EKC) pattern, a crucial hypothesis in the realm of environmental economics, by employing nonlinear terms in the form of squared (lnren^2) and cubed (lnren^3 and lnpatr^3) scenarios.

3.5. Methods of Moments Quantile Regression

Quantile regression, specifically Methods of Moments Quantile Regression, offers a unique approach compared to traditional methods. Traditional methods typically estimate linear relationships by calculating averages of variables. However, this approach overlooks the conditional distribution of variables. The Method of Moments Quantile Regression approach offers several advantages particularly relevant to the MENA context. First, it allows for examination of how renewable energy, governance quality, and other policy variables affect countries differently depending on their position in the conditional emission distribution. This is particularly important for MENA countries given the substantial heterogeneity between high-emission oil producers and lower-emission diversified economies. Second, the method is robust to outliers and extreme observations, which is valuable given the presence of countries with exceptional characteristics such as Qatar’s extremely high per capita emissions or Syria’s conflict-affected data patterns.

Furthermore, the quantile regression framework permits investigation of whether policy interventions have differential effectiveness for high-emitting versus low-emitting countries, providing crucial insights for targeted policy design. The method’s ability to capture the entire conditional distribution of carbon emissions, rather than just central tendencies, aligns well with the policy objective of understanding how to move countries across the emission distribution toward carbon neutrality. This methodological choice also addresses recent calls in the environmental economics literature for greater attention to distributional effects of environmental policies, particularly in developing country contexts where one-size-fits-all approaches may be ineffective. In contrast, quantile regression for panel research explores relationships by examining different quantiles of the criterion variable. This methodology, first introduced by Koenker [

68] and Koenker and Bassett Jr [

69], evaluates coefficients that capture variations in the quantiles of the criterion variable. These coefficients are influenced by the simultaneous averages of predictor variables. Importantly, this technique is robust, even when dealing with potential outliers that might disrupt the overall data distribution. It can produce reliable results, even in situations where conditional means have minimal or no impact. Conventional quantile regression, on the other hand, lacks the capability to explore various percentiles across different cross-sections, potentially leading to an inadequate representation of the criterion variable’s distribution.

3.6. Econometric Strategy

Different preliminary tests were performed to ascertain if the data obtained is fit for the purpose of the hypothesis of the study. First, it must be known that missing data was filled using the mean value approach which ensures no drift from normality. Thus, the utilization of the mean approach in this study was grounded in statistical principles, as it serves to maintain both the central tendency (mean) and variability (variance) of the dataset. This approach was employed due to its fundamental properties that align with statistical stability and ease of application.

Subsequently, the study undertook a comprehensive battery of statistical tests, including the Cross-Dependency Test, the Slope Heterogeneity Test, the Unit Root Test, and the Panel Cointegration Test, with the overarching aim of characterizing the inherent attributes of the dataset and elucidating its interrelationships. The meticulous application of these tests served as a crucial preparatory step in aligning the research methodology with the precise characteristics of the data, thus facilitating a rigorous evaluation of the formulated hypotheses.

4. Data Analysis, Results, and Interpretations

4.1. Results of Cross-Sectional Dependence and Homogeneity Tests

The cross-sectional dependency and homogeneity test findings are displayed in

Table 1 and

Table 2.

Table 1 provides information on the CD test, including the associated probability values and correlation. Based on the presented findings, we strongly reject the null hypothesis of cross-sectional independence in all cases except for LnCO2 and LnRul for the Pesaran CD model. Hence, it may be inferred that there are lingering concerns regarding the interconnections among different sections within the used panel dataset. From an economic standpoint, the existence of cross-sectional dependency in panel data indicates that a disturbance in one MENA country can propagate to other member states due to their interconnected economic relationships.

Table 2, on the other hand, provides a detailed overview of the results obtained from the homogeneity test. Based on the results obtained from the delta tilde and modified delta methods, together with their corresponding

p-values, we once again reject the null hypothesis of homogeneity among the slope coefficients for the research variables in question. The results indicate that all models exhibit heterogeneity issues, suggesting the need for a second-generation unit root test to assess the stationarity qualities of the variables in the panel data used.

4.2. Unit Root Text

The researchers employed the Pesaran [

70] cross-sectional Im, Pesaran, and Shin (CIPS) panel unit root test to ascertain the presence of stationarity in the dataset. The outcomes of the CIPS unit root test presented in

Table 3 indicate that the variables exhibit non-stationarity at their original values, except for LnSer and Lncc which were significant at these levels. However, they become stationary when subjected to first-order differencing (I(1)). This finding suggests that all variables under observation exhibit integration at the same level.

4.3. Results of Panel Cointegration Test

The Durbin–Hausman Cointegration test is then used to ascertain the variables’ long-term relationships with one another. To study the cointegrating relationship between the variables regarding the levels of integration of the variables, the Choi [

71] cointegration test was used. The test results are shown in

Table 4. Due to the panel’s observed heterogeneity, the Durbin–Hausman group statistic was considered. As a result, the null hypothesis was disproved at the 1% level of significance, and we found evidence of a cointegrating relationship between the variables.

4.4. Long-Term Outcome

In this part, the panel quantile regression approach is employed to address the limitations of the conditional mean regression method. The study used the approach of moment panel quantile regression to assess the diverse effects of REN, PATR, SER, OILRENTS, and TRADE on CO

2. The findings are provided in

Table 5 and

Figure 1, showcasing the various effects of these variables. The findings are shown for the deciles (10th, 20th, 30th, 40th, 50th, 60th, 70th, 80th, and 90th percentiles) of the conditional carbon emission. The regression analysis findings presented in

Table 5 and

Figure 1 demonstrate that the effects of different variables on CO

2 emissions exhibit heterogeneity.

The outcomes from

Table 5 reveal that renewable energy decreases carbon emissions for all the quantiles. Moreover, except qtile_90, which is insignificant, all the remaining quantiles produced a significant connection between renewable energy and carbon emissions for the MENA countries. Likewise, green technological innovations and service value added from all the quantiles show a negative connection with carbon emissions. Again, all these variables of oil rents produced a significant connection with carbon emissions, except qtile_10, qtile_20, and qtile_30, which show an insignificant negative connection with carbon emissions. Furthermore, trade flow also produced a significantly positive connection with carbon emissions for all the quantiles.

4.4.1. Statistical Significance Patterns and Economic Interpretation

The statistical significance patterns across quantiles reveal important insights into policy effectiveness heterogeneity in MENA countries. Renewable energy consumption (lnren) demonstrates consistently strong statistical significance across the lower to middle quantiles (10th through 80th percentiles), with coefficients ranging from −0.113 to −0.038, all significant at conventional levels. However, the loss of statistical significance at the 90th quantile (coefficient = −0.027, p > 0.10) suggests that renewable energy policies may be less effective for the highest-emitting countries in the sample. This pattern indicates that countries with extremely high carbon intensities may require additional complementary policies beyond renewable energy promotion alone.

Green technological innovation (lnpatr) exhibits robust statistical significance across all quantiles except the 90th, with coefficients consistently negative and significant at the 1% or 5% level. The magnitude of coefficients shows relatively stable effects across the distribution (−0.068 to −0.036), suggesting that patent-based innovation provides consistent emission reduction benefits regardless of a country’s position in the emission distribution. This finding supports the theoretical prediction from diffusion of innovation theory that technological capabilities provide broad-based environmental benefits.

Service sector development (lnser) demonstrates the strongest and most consistent statistical significance across all quantiles, with coefficients significant at the 1% level throughout the distribution. The systematic decline in coefficient magnitude from −0.225 (10th percentile) to −0.126 (90th percentile) indicates that structural transformation toward services provides larger emission reduction benefits for countries starting from lower emission levels, consistent with environmental Kuznets curve predictions.

4.4.2. Resource Rents and Trade Effects: Quantile-Specific Insights

Oil rents (lnoilrents) exhibit an interesting statistical significance pattern that merits careful interpretation. The variable is statistically insignificant at the 10th, 20th, and 30th percentiles but becomes significant from the 40th percentile onward. This pattern suggests that oil rents only begin to influence emission outcomes meaningfully for countries with moderate to high emission levels. The increasingly negative and significant coefficients at higher quantiles (−0.031 to −0.047) indicate that oil revenues can contribute to emission reductions, possibly through funding of diversification efforts or green technology investments in higher-emitting oil-producing countries.

Trade openness (lntrade) maintains statistical significance across all quantiles with consistently positive coefficients, providing strong support for the pollution haven hypothesis in the MENA context. The coefficients range from 0.255 (10th percentile) to 0.144 (90th percentile), all statistically significant, indicating that increased trade integration systematically increases carbon emissions across the emission distribution. This finding contradicts claims in some literature that trade can reduce emissions through technology transfer, at least in the MENA regional context.

4.5. Sensitivity and Robustness Analysis Outcome

For sensitivity and robustness, the authors used the Driscoll–Kraay Panel-Corrected Estimator to analyze the estimated variables, while governance indicators were introduced into this estimation.

From the analysis in

Table 6, it was observed that renewable energy, green technological innovation, service value added, and oil rents all decrease carbon emission for the understudy countries which also affirms the outcomes of the baseline technique, while trade openness, on the other hand, increases carbon emission for the said countries.

However, for the six (6) governance indicators, it was observed that control of corruption, rule of law, government effectiveness, voice and accountability, political stability, and regulatory quality for models 1, 2, 3, 4, 5, and 6 all decrease carbon emissions for the understudy countries. This indicates that governance has a negative connection with carbon emissions for the MENA countries.

4.6. Reconciling Quantile Regression and Driscoll–Kraay Results

The apparent contradiction between our quantile regression (

Table 5) and Driscoll–Kraay results (

Table 6) regarding governance indicators reflects methodological differences rather than analytical inconsistencies. The positive governance-emission coefficients across quantiles capture conditional distribution effects specific to MENA countries. This reflects three key phenomena: (1) development stage effects where better governance initially facilitates economic activities that increase emissions before enabling cleaner transitions, consistent with early stages of the Environmental Kuznets Curve; (2) measurement accuracy improvements where better governance leads to more complete emission reporting rather than actual increases; and (3) short-term economic stimulation where effective institutions temporarily boost emission-generating activities while building foundations for long-term green transitions.

Driscoll–Kraay Results: The negative governance coefficients (−0.190 for institutional quality, −0.131 for government effectiveness) represent average long-term effects across the entire sample, indicating that better governance ultimately reduces emissions when accounting for cross-sectional dependence and temporal dynamics.

These results are complementary, not contradictory. Quantile regression reveals heterogeneous short-term effects across emission levels, while Driscoll–Kraay estimates show average long-term tendencies. For policy purposes, governance reforms may have different immediate impacts depending on a country’s current emission level, but the long-term average effect remains environmentally beneficial. Countries should expect varied short-term outcomes from governance improvements while maintaining confidence in long-term environmental benefits.

4.7. Outcome from Interaction Terms

From the analysis of

Table 7, it was observed that renewable energy, green technological innovation, service value added, and oil rent all have a negative connection with carbon emissions, while trade openness enhances carbon emissions for the understudy countries which confirms the findings of the baseline technique.

Moreover, from Model 1 in

Table 7, the interaction between oil rents and trade produces a significantly negative connection with carbon emissions. Nevertheless, the interaction between oil rent and green technological innovation, as well as trade and green technological innovation, produced a negative but insignificant connection with carbon emissions, while trade and renewable energy also produced an insignificant positive connection with carbon emissions for the understudy countries.

5. Discussion of the Findings

The regression analysis produced a statistically significant negative relationship between the availability of renewable energy and carbon emissions from all the outcomes obtained in the various tables. These present findings provide support for the previous research conducted by Appiah et al. [

72], Lee et al. [

73], and Baloch and Wang [

74], which also demonstrated the correlation between renewable energy utilization and the reduction of carbon dioxide emissions in countries within the. The MENA region possesses a significant abundance of renewable energy resources, including solar, wind, and hydro. In addition to its capacity for producing hydroelectric and geothermal energy, the majority of nations in the MENA region rely on solar energy as a primary source of power. In response to the persistent issue of sustainable energy provision and pollution mitigation, a number of MENA nations have recently committed themselves to the pursuit of renewable energy as a viable substitute for conventional fossil fuel resources, thereby achieving the desired environmental standards [

75]. Hence, it is crucial for MENA governments to provide backing for the ongoing expansion of contemporary sustainable energy advancements, such as renewable energy sources, within the MENA economies, with the aim of enhancing environmental conditions. In addition, the implementation of regulatory measures aimed at promoting the use of renewable energy sources will significantly contribute to the enhancement of environmental sustainability within the MENA region.

Again, it is noteworthy that the implementation of green technological innovation has been found to exert an adverse and statistically significant effect on the levels of carbon emissions. The findings are in line with the MENA region research by Obobisa et al. [

76], Ibrahiem [

77], and Khan et al. [

78]. However, they diverge from the outcomes reported by Khattak [

79] who provided evidence suggesting that innovation leads to an escalation in environmental pollution within MENA nations. Thus, it can be deduced that the implementation of green technology innovation has a role in reducing carbon emissions in MENA countries. Furthermore, it can facilitate the shift towards more sustainable economic and industrial frameworks in these nations. Nevertheless, it is important to note that there are substantial disparities in technical innovation, with several nations in the MENA region often lagging behind the forefront of technological advancements. Furthermore, it should be noted that the MENA region faces insignificant investment in research and development, which hinders the capacity of many inventors in the region to effectively transfer their innovations. As a result, Budhwar et al. [

80] highlighted that the MENA region has not yet reached the anticipated level of innovation. Hence, the potential progress in green technology innovation in the foreseeable future is poised to exert a substantial impact on the environmental well-being of MENA nations.

In addition, it is shown from the outcomes that there exists a statistically significant negative relationship between changes in structure and carbon emissions across all models. The result implies that the implementation of structural changes in the MENA region leads to a decrease in carbon emissions. From an economic standpoint, a structural transition has considerable importance as it facilitates the shift in a nation’s economic activities from low-pollution agricultural practices to more environmentally burdensome secondary sectors and then allows for a transition back to the relatively less polluting tertiary sector. The observed rise in the service sector within the economies of the MENA region is a predictable outcome. Based on the findings, it can be observed that the MENA region possesses an economy primarily driven by the provision of services. This economic sector has exerted a substantial influence on the overall world gross domestic product (GDP) in recent years. The service industry encompasses several sectors such as transportation, education, real estate, retail, healthcare, and banking. The environmental consequences associated with the service industry in the MENA region align with anticipated outcomes since this sector demonstrates lower energy consumption compared to other industries. Both the research of Sarpong et al. [

31] and Ofori et al. [

4] produced similar findings.

Additionally, the findings suggest a negative correlation between oil rent utilization and emissions in the MENA region’s economies. This finding corroborates the research conducted by Gyamfi and Adebayo [

81] and Adabor et al. [

82]. This finding demonstrates that across all quantiles, the presence of oil rent serves to alleviate CO

2 emissions. The potential explanation is linked to the concept that oil rents in the economies of the MENA region are relatively low in comparison to other energy sources, such as coal, which produce substantial amounts of pollution. Moreover, a conceivable rationale for the association between oil revenue and carbon emissions lies in the oil-exporting country’s recognition of the need to adhere to global environmental conservation standards to preserve the ecosystem. Another plausible explanation is that countries have grown increasingly aware of the importance of adopting clean and sustainable energy sources, especially given the recent Paris accord.

Moreover, it was shown that trade had a statistically significant positive correlation with emissions across all outcomes. The favorable relationship between trade openness and CO

2 emissions supports both our conceptual prediction and hypothesis. This implies that the promotion of trade liberalization within the MENA economies is likely to result in an increase in carbon emissions, in accordance with the predictions put forward by the pollution paradise hypothesis. On one hand, the MENA economies would experience various effects, such as removing barriers and import tariffs, reducing obstacles to the unrestricted movement of goods and supplies, and promoting trade openness. These measures would contribute to the enhancement of the country’s overall economic productivity through the gradual increase in production volumes, acceleration of economic growth, and reduction in the cost of conducting business activities. Nevertheless, utilizing this manufacturing technique necessitates significant quantities of fossil energy, leading to an inevitable escalation in greenhouse gas emissions. The MENA region’s competitive advantage as a significant industrial force stems from the production of labor- and resource-intensive goods [

83,

84]. On the other hand, it is noteworthy that affluent nations in the MENA region possess a discernible edge in sectors that largely depend on substantial investments in both financial resources and innovative practices. Consequently, the nations have experienced an enhancement in their commercial relations and the establishment of product synergy. The inevitability of CO

2 emissions resulting from free trade is acknowledged, although their reduction is hindered by the protracted period required for economic adaptation and technological advancements. Hence, the present trade agreement in the MENA region might potentially have a significant hindering impact on the promotion of decarbonization.

Furthermore, the findings presented in

Table 5 indicate that governance exerts a statistically significant negative influence on CO

2 emissions. The effectiveness of limiting environmental deterioration may be linked to the government’s approach to implementing and formulating solid laws and regulations. Reducing resource wastage might be facilitated by effective measures to curb corruption. Moreover, corruption serves as a moderating factor in the association between income and CO

2 emissions, attenuating the link by diminishing the inherently beneficial impact of wealth on CO

2 emissions [

74]. Mature economic systems have the capacity to effectively regulate illicit activities that contribute to the deterioration of environmental conditions. Transparency pertains to the adherence to norms and laws in a manner that facilitates the unrestricted availability and direct accessibility of information. Moreover, governments that are inclined to view environmental rules as a significant contributor to environmental degradation often fail to effectively enforce them. As the economy expands, governments implement appropriate regulatory measures to mitigate any instances of market failure that might result in heightened levels of pollution while also addressing the growing public concern over environmental degradation. Governance facilitates the implementation of environmental rules aimed at mitigating CO

2 emissions. Hence, the countries in question demonstrate efficiency in their decision-making processes regarding the control and management of natural resources and the environment. The findings of the research align with the conclusions drawn by Albitar et al. [

85]. However, the outcomes obtained in our analysis are more robust and trustworthy due to the utilization of estimation approaches that address both cross-sectional dependency and heterogeneity. This is in contrast to the approach utilized by Ozturk and Al-Mulali [

86], which does not appear to account for these factors.

6. Conclusions and Policy Recommendation

The effects of the control variables were evaluated on economies in the Middle East and North Africa (MENA) region from 2000 to 2022. The present analysis rigorously accounts for essential variables such as renewable energy, green technical advancements, service value added, trade flow, and oil rents while analyzing the impacts of the six governance indicators on the specific environmental conditions of the MENA nations. The study contributes to the existing literature by examining the factors influencing emissions. This is achieved by utilizing several methodologies, such as moment quantile regressions and the Driscoll–Kraay Panel-Corrected Estimator, to address the research question.

From the analysis, it was revealed that, from both techniques employed, renewable energy, green technological innovation, oil rents, and services value added all decrease emissions for the MENA countries, while trade flow activities increase carbon emissions within the countries studied. Moreover, the six governance indicators all produce a negative connection with carbon emissions. Also, it was observed that the interaction between oil rents and trade produces a significantly negative connection with carbon emissions. Furthermore, the interaction between oil rent and green technological innovation, as well as trade and green technological innovation, produced a negative but insignificant connection with carbon emission, while trade and renewable energy also produced an insignificant positive connection with carbon emission for the countries studied.

Based on the empirical evidence obtained from our study, we have formulated the primary policy suggestions in the subsequent sections. Green technology innovation and the utilization of renewable energy sources have been acknowledged as effective means of mitigating carbon emissions, thus contributing to the promotion of sustainable development. Therefore, the implementation of substantial investments in green technological advancements and the adoption of renewable energy sources, along with effective economic activity management, have the potential to support a significant decrease in carbon emissions levels throughout the MENA region. Considering this matter, it is recommended that governments in the MENA region enhance their investment in green technical advancements. In order to tackle the problem of environmental degradation, it is imperative to advocate for the adoption of renewable energy at both the business and home scales through the provision of incentives, such as price subsidies for renewable energy sources. Furthermore, it is important for organizations to demonstrate awareness of the ecological consequences of their operations through the use of renewable energy sources and the advancement of technological breakthroughs that foster a sustainable ecosystem.

The MENA region’s states should establish strong collaborations with other nations to effectively adopt and implement advanced technology. It is crucial to emphasize the benefits of political globalization in this process. It is imperative to prioritize the prevention of emissions from their origin. Consequently, the prevailing mindset of “pollute first, then remediate” and the trajectory of economic advancement at the cost of environmental degradation necessitate a thorough reassessment. However, it is important for these nations to consider the environmental impact and prioritize the development of technologies that contribute to ecological sustainability while enhancing their degree of technical innovation. Simultaneously, the phenomena of economic, political, and social globalization need comprehensive deliberations on the difficulties pertaining to environmental safety. In this regard, it is imperative to use their distinctive technical capabilities to facilitate the advancement of technological innovation.

Again, it is possible to attain enhancements in environmental quality by implementing structural modifications. Hence, prioritizing activities in the tertiary sector as opposed to the secondary sector might contribute to the mitigation of environmental degradation eventually. Therefore, it is believed that the movement of the MENA region towards a service sector-driven expansion will have positive implications for the preservation of air quality since it reduces reliance on fossil fuels for production purposes. Furthermore, it is recommended that the MENA region should actively promote trade promotional activities, provide corporate incentives, and foster international collaboration within the service sector. The service sector plays a vital role in the economies of all nations due to its significant and quick contribution to both GDP growth and employment creation. The nations in the MENA area should prioritize efforts to stimulate investment in the service sector, as it is expected to play a crucial role in driving the region’s future economic growth. Enhancing ecological integrity in the MENA economies can be achieved by implementing policies contingent on the results of structural transformation. The service industry has the potential to effectively support other sectors of the economy while maintaining the integrity of the environment, particularly in terms of air quality.

Lastly, the conservation of the natural environment is contingent upon the establishment and maintenance of a robust governmental framework. The efficacy of governmental endeavors aimed at addressing ecological concerns indicates the condition of institutional frameworks. Institutional frameworks that are well-defined and transparent play a crucial role in promoting ecological responsibility by effectively managing disputes and fostering results that are advantageous to all parties involved. To proficiently regulate emissions and enhance their practical integrity, it is imperative for authorities to prioritize several facets of governance and their interrelationships.

7. Limitations of the Study

The study only focused on the states in the MENA region. The analysis only partially assessed the influence of renewable energy, green technological innovation, oil rent, service value added, trade flow, and governance indicators on carbon emissions. Potential areas of future research might encompass variables such as financial development, economic complexity, and human capital within the existing model. To enhance the precision of policy implications, it would be beneficial to conduct assessments at both the state and local levels. In order to ensure regulatory stability, the implementation of sustainable policies, and the advancement of research pertaining to the Sustainable Development Goals (SDGs), it is imperative to possess accurate and comprehensive access to data. There exist several opportunities for additional research that can enhance our understanding of the extent to which the SDGs can fulfill their commitment.