Optimal Battery Energy Storage System Scheduling within Renewable Energy Communities

Abstract

:1. Introduction

2. Review on the State of the Art

2.1. Machine Learning for Battery Energy Storage Systems

2.2. Renewable Energy Communities Management Using MILP Techniques

2.3. BESS CAPEX Evaluation

3. Materials and Methods

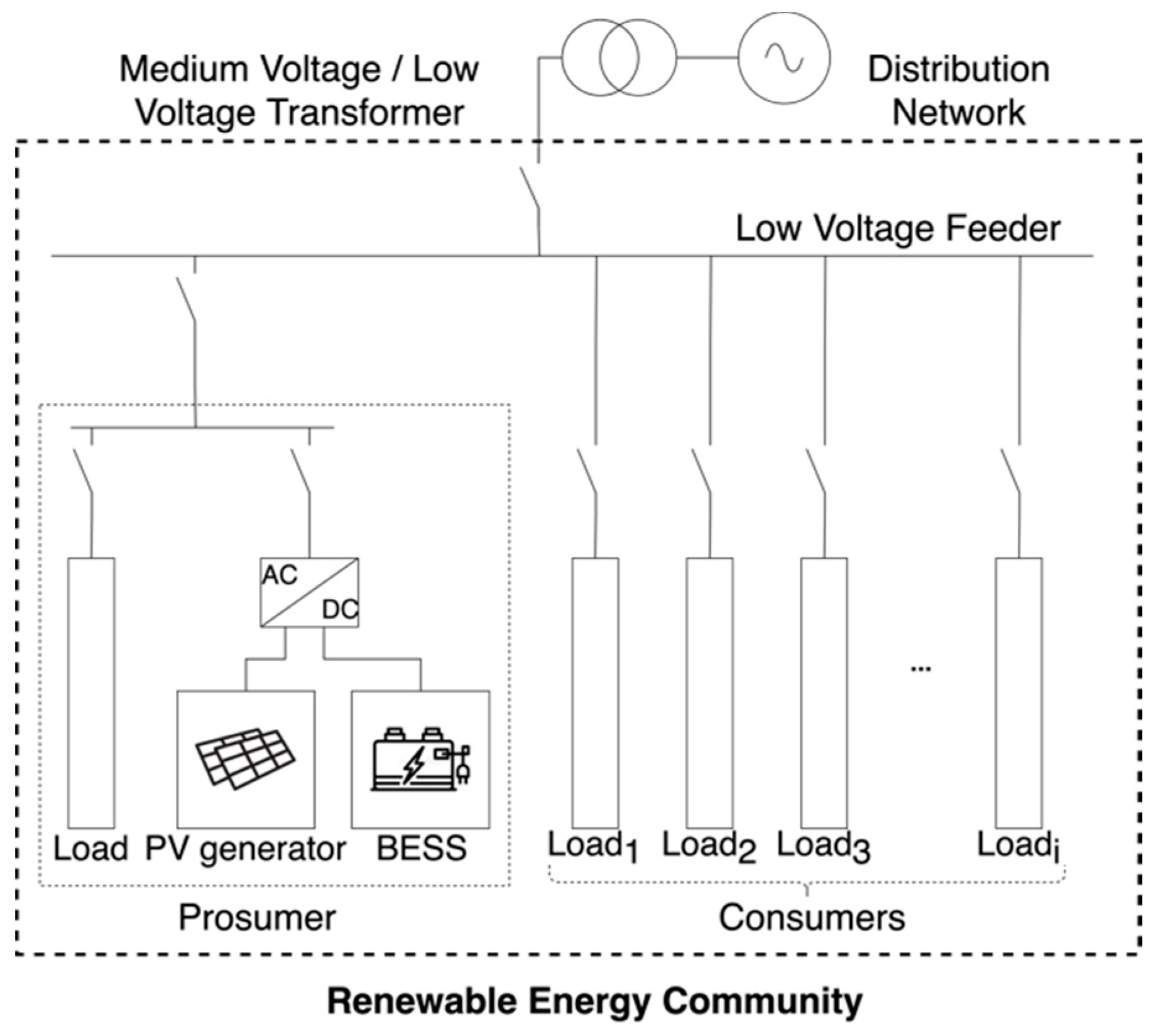

3.1. Italian Renewable Energy Communities: The General Framework and the Analyzed Community

3.2. Case of Study: Simulation of a 5-Households REC Based on Real Measurements

3.3. Optimal BESS Scheduling Process: Methodology Overview

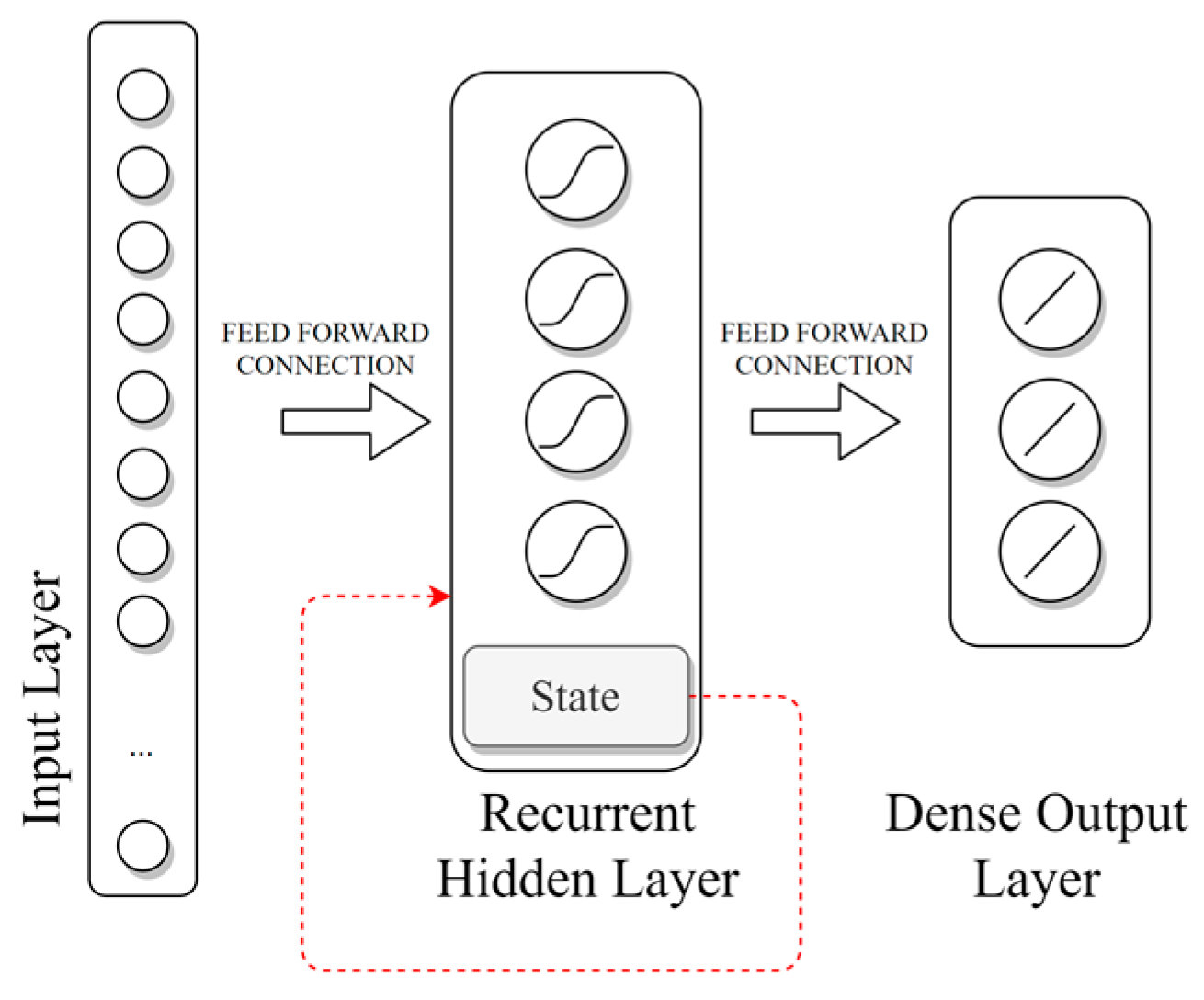

- Definition of 24-h ahead forecast of the hourly trends for PV produced power, prosumer load profile, and aggregated power demand from the rest of the REC. The forecast is obtained with a layer-recurrent neural network, using as inputs the 48 past hourly samples of the quantity to forecast, and the weather forecast for the coming 24 h.

- Optimization of the BESS scheduling within the previously defined REC. The optimization is carried out for the upcoming 24 h with a Mixed Integer Linear Programming (MILP) approach, using as inputs the 24-h ahead forecasts as obtained in Step 1, together with information on PV energy sale price, cost of electricity, LCOS and specific values of BESS characteristics (capacity and rated power). The optimization is obtained by maximizing a revenue function, and the output is the BESS scheduling for the following 24 h in terms of power exchanges with both the PV system, the REC and the grid, with a 1-h timestep.

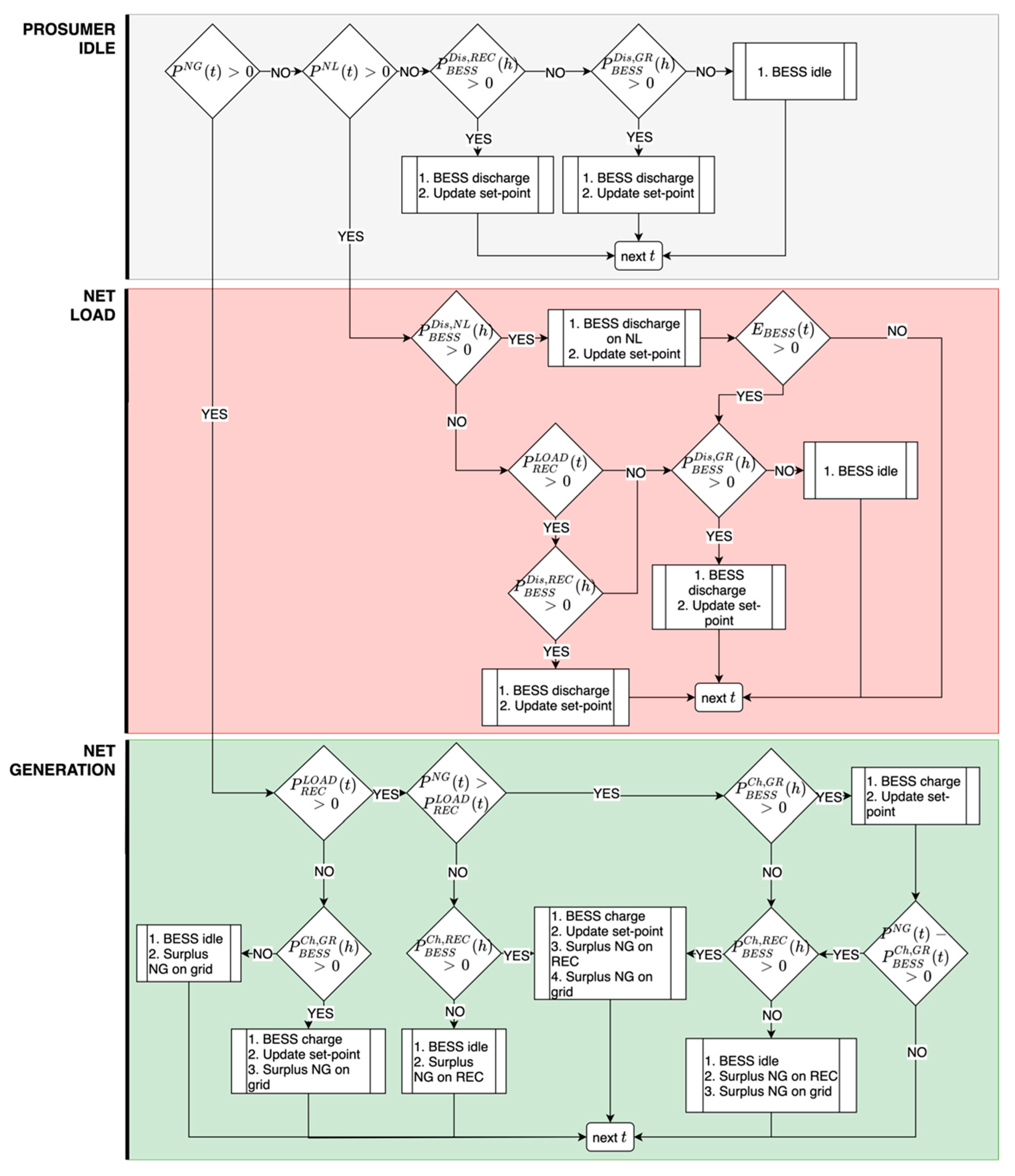

- Real-time BESS management across the 24 h forecasted in Step 1 and 2. The 24-h ahead BESS schedule obtained with the MILP-based, forecast-based optimization is used as a baseline for a real-time BESS management, using real PV production and load curves, with 1-min timestep resolution. A decision-tree algorithm is used to manage BESS charge and discharge phases, with the objective to reach the set points scheduled by the MILP optimization and coping with forecast errors. The final BESS SOC obtained as output from this step is then fed to Step 2 as the initial BESS SOC for the next 24-h ahead optimization process.

3.4. Enriching the Dataset with 24-h Ahead Forecasts: Methodology Overview

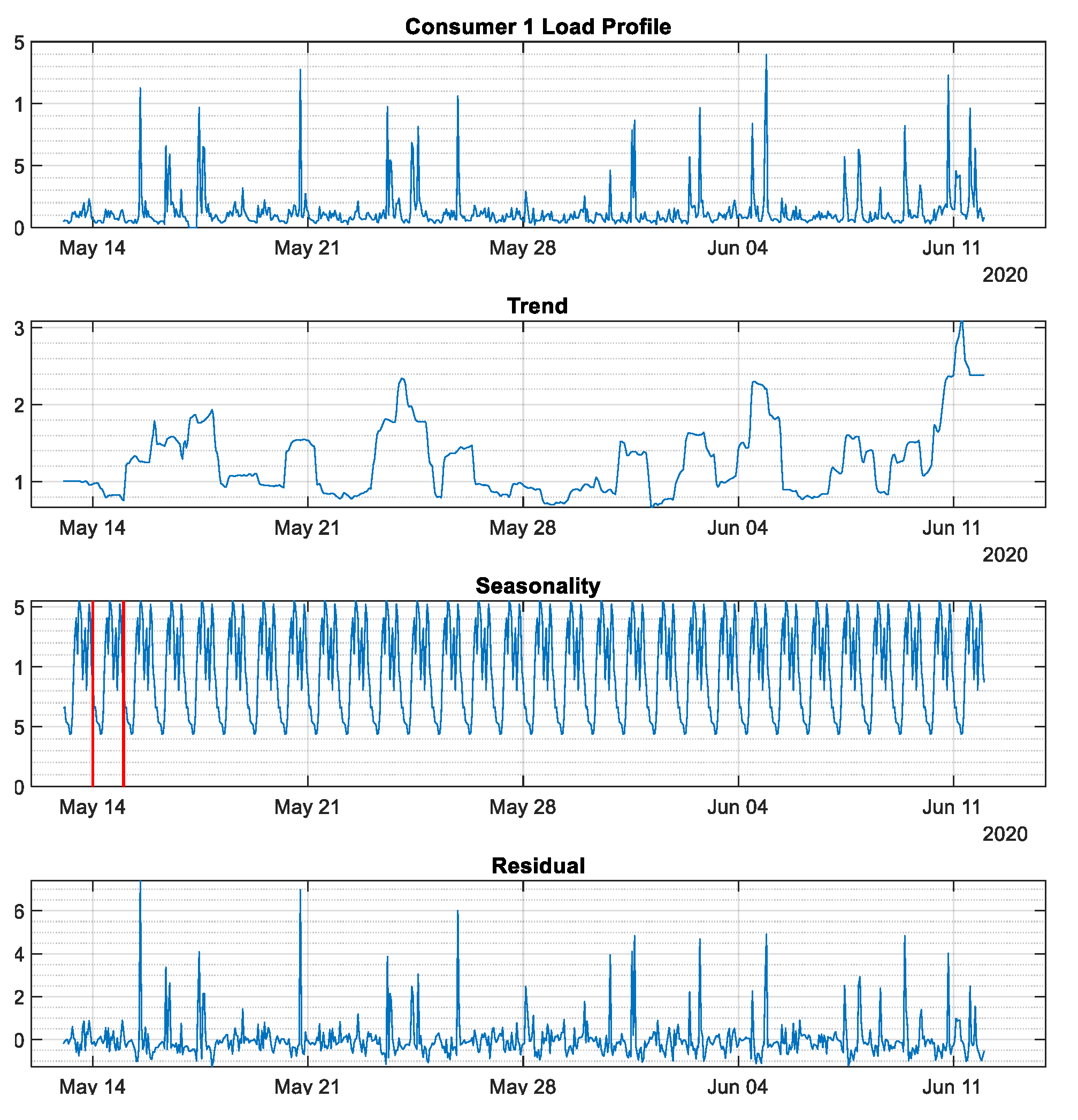

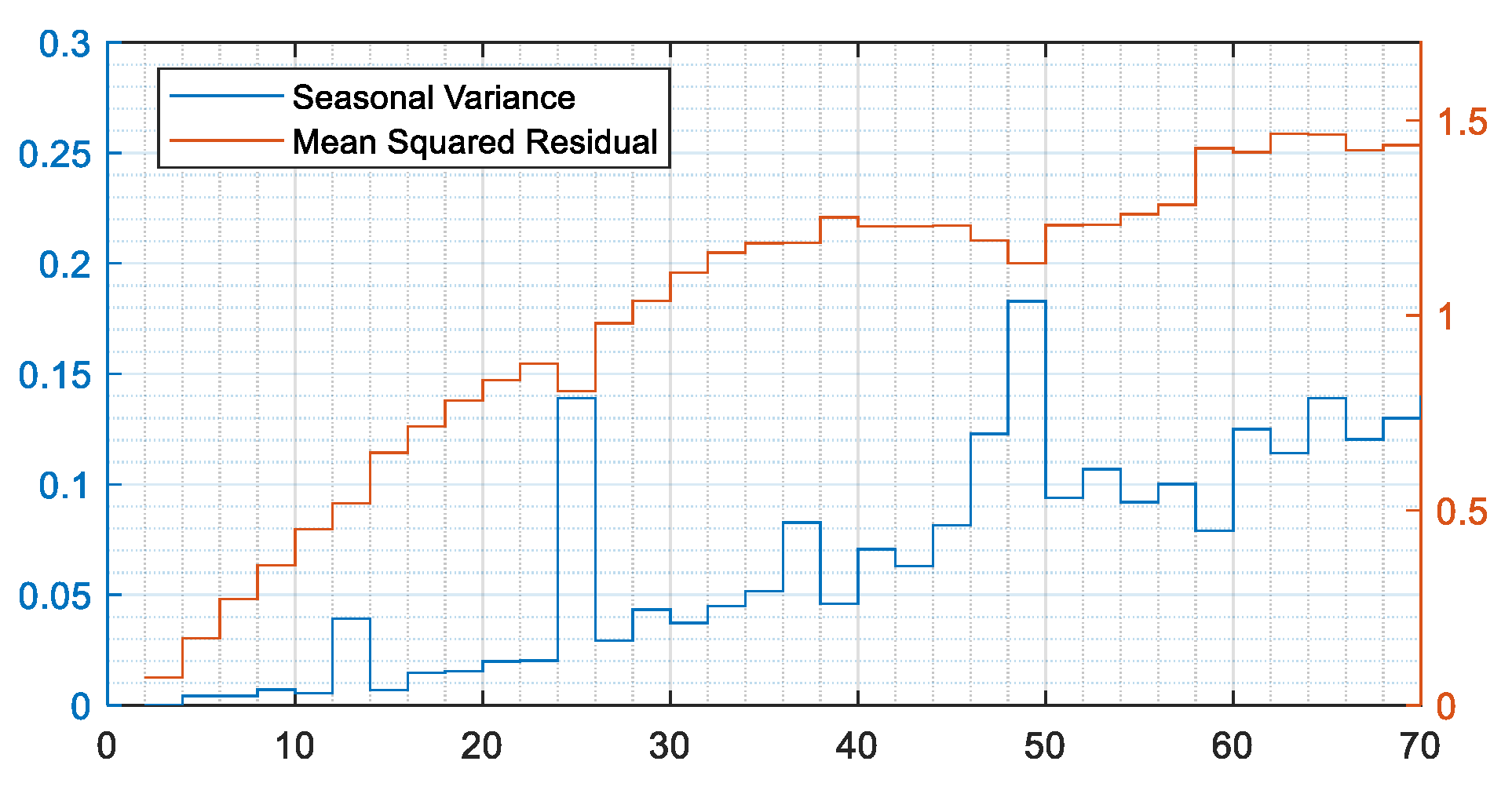

3.5. Trend-Seasonality-Residual Test

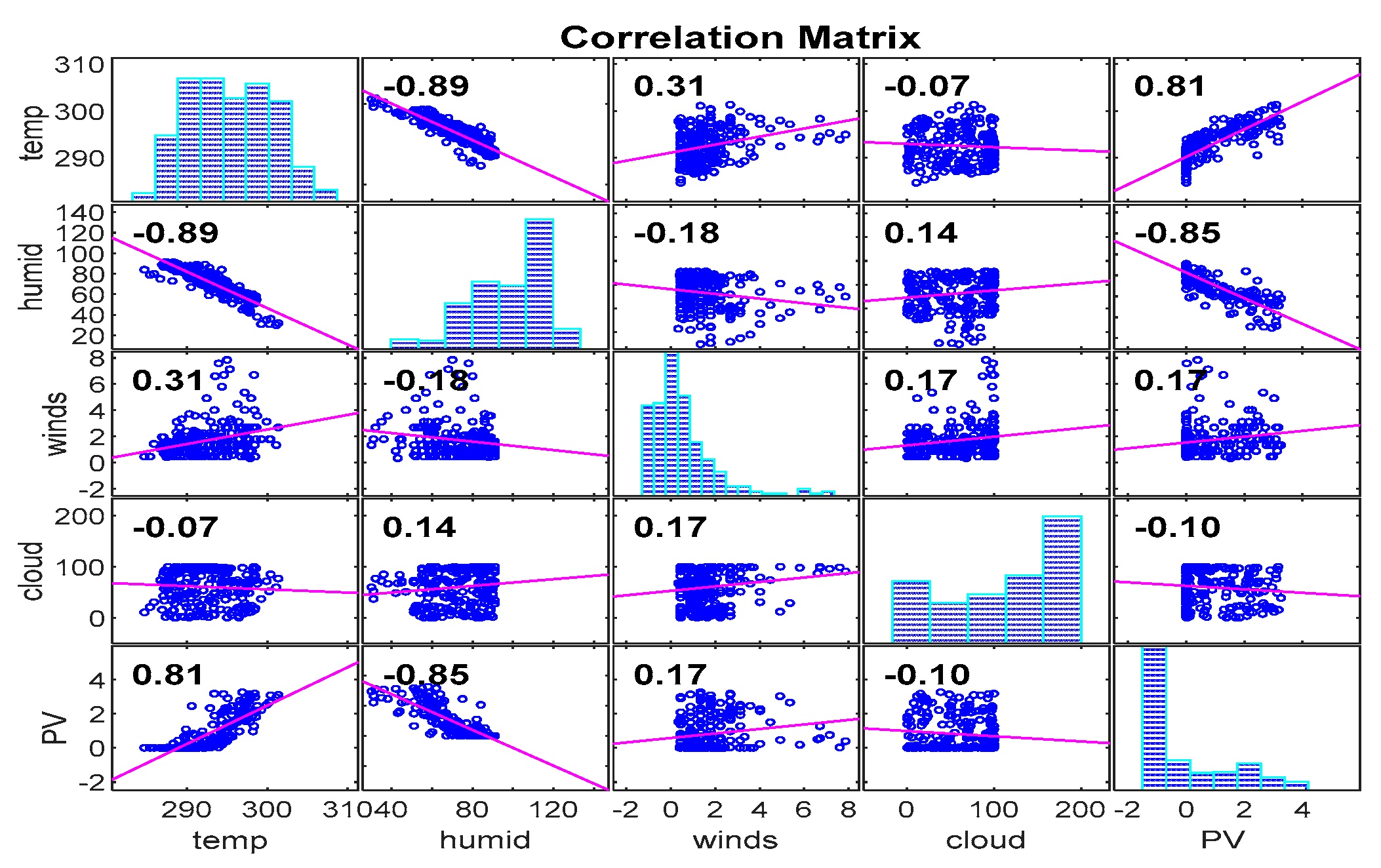

3.6. Exogenous Data Selection

3.7. Neural Architecture Determination

3.8. REC Power Balance

3.9. Mixed Integer Linear Programming-Based Economical Optimization of BESS Scheduling

3.10. Real-Time BESS Management: Methodology

3.11. Description of the Macro-Scenarios and the Operative Scenarios

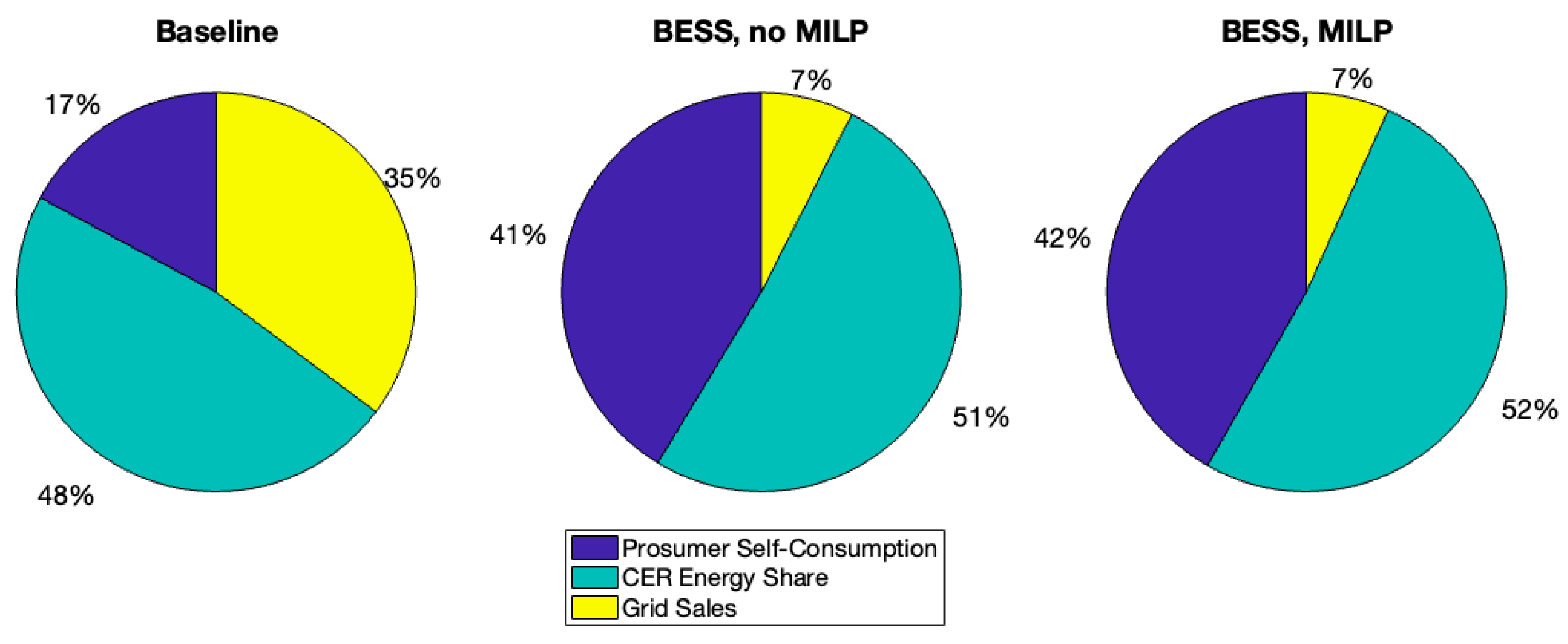

- Baseline: in this scenario, the REC is composed by only PV generator and loads, and no management is applied. This represents the minimal set-up for REC operation.

- BESS, no MILP: in this scenario, the BESS is deployed in the REC, owned by the prosumer and installed within the PV system. No generation and loads forecast, nor BESS management is applied (except for keeping within power and SoC limits), just the basic opportunity charging with the BESS charging whenever , and discharging whenever or , or both.

- BESS, MILP: all the previously explained three-steps methodology is applied in this scenario, the load and generation forecasts, the MILP optimization and the real-time BESS management.

4. Results

4.1. Dataset Enrichment: Optimal Neural Network Hyperparameters Sizing

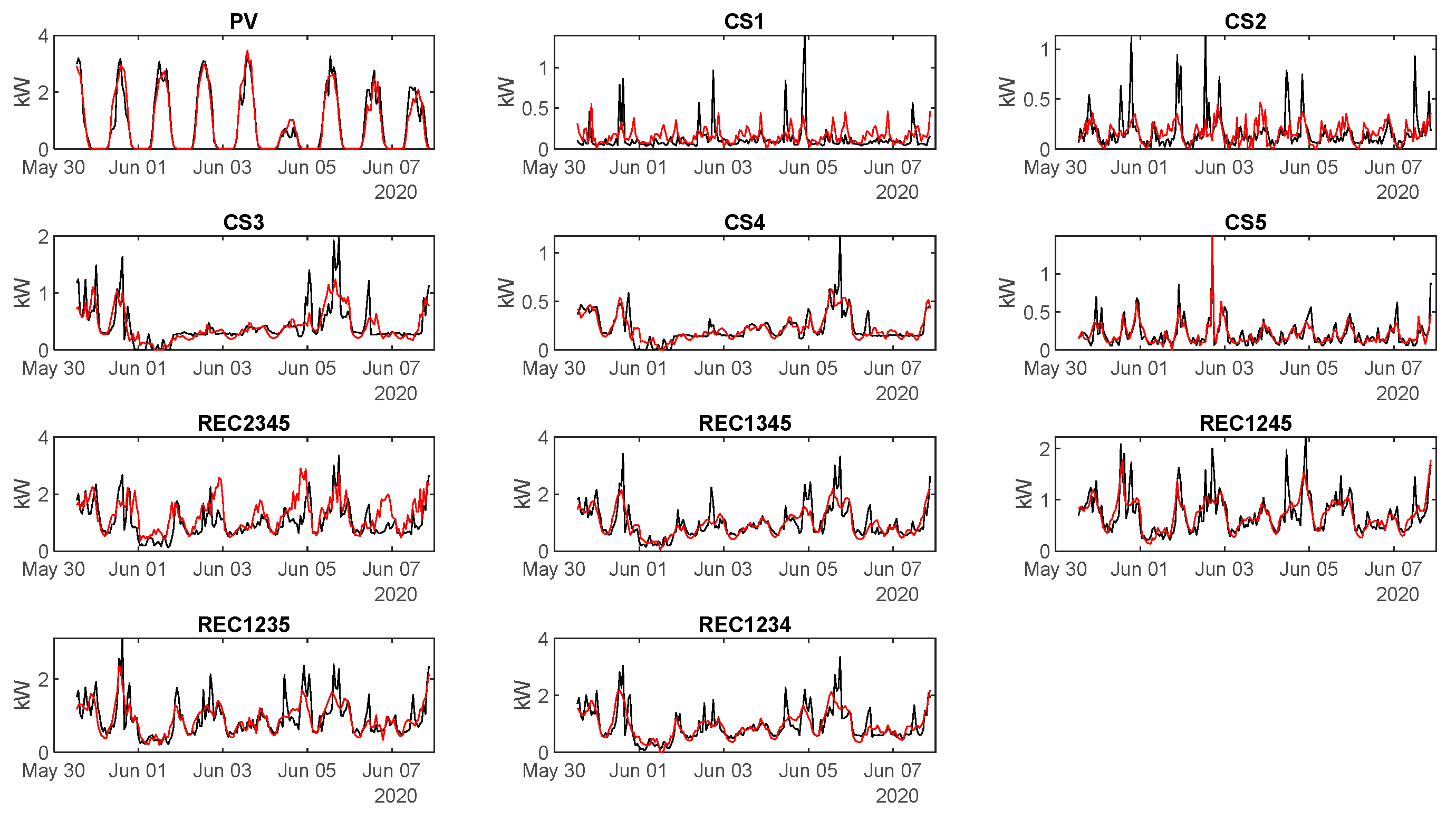

4.2. Dataset Enrichment: Forecasting Accuracy

- 1 PV power production

- 5 Consumed Power from the individual households

- 5 REC Consumed Power from the remaining households

- Single household load MAPE: 19.9–34.3%

- REC composed by the remaining households MAPE: 26.1–29.7%

- PV power production MAPE: 8.2%

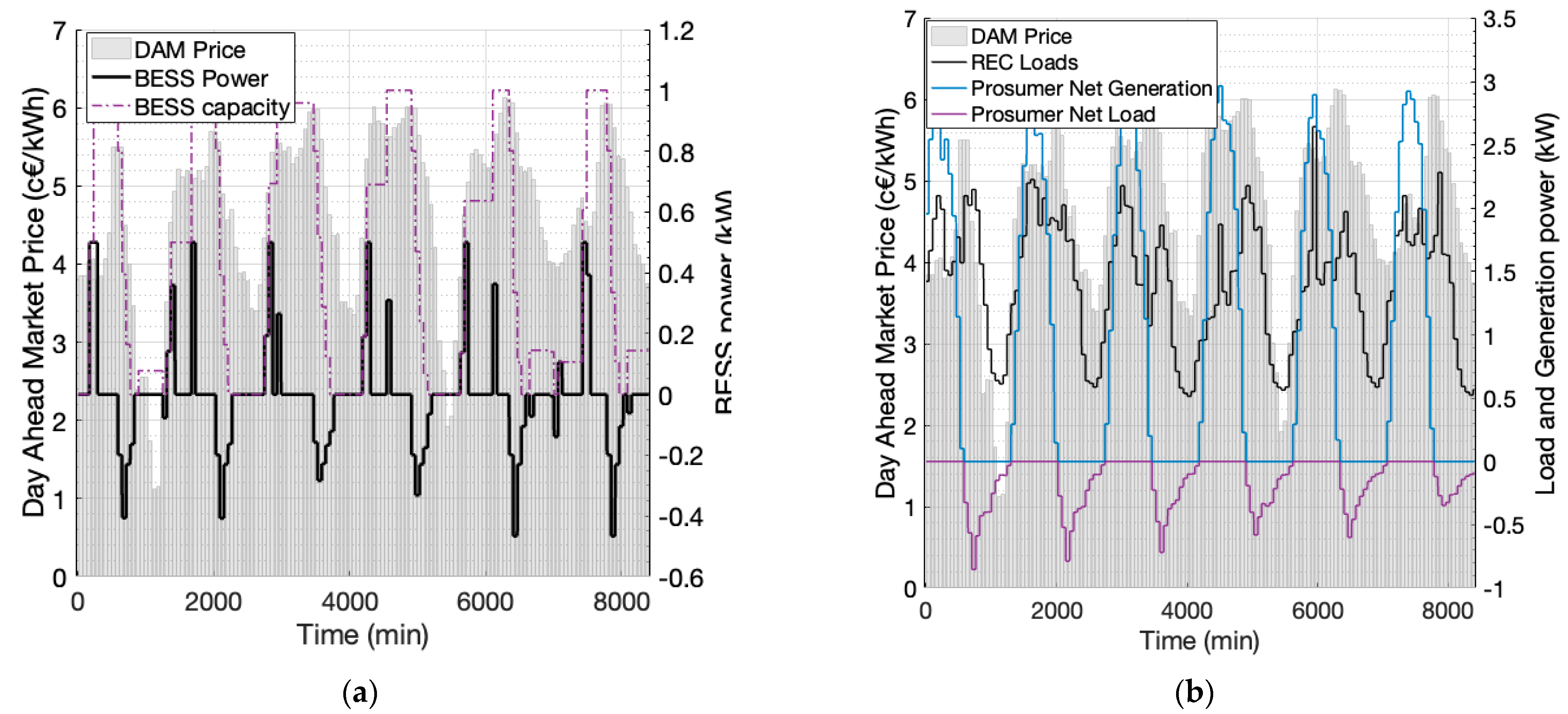

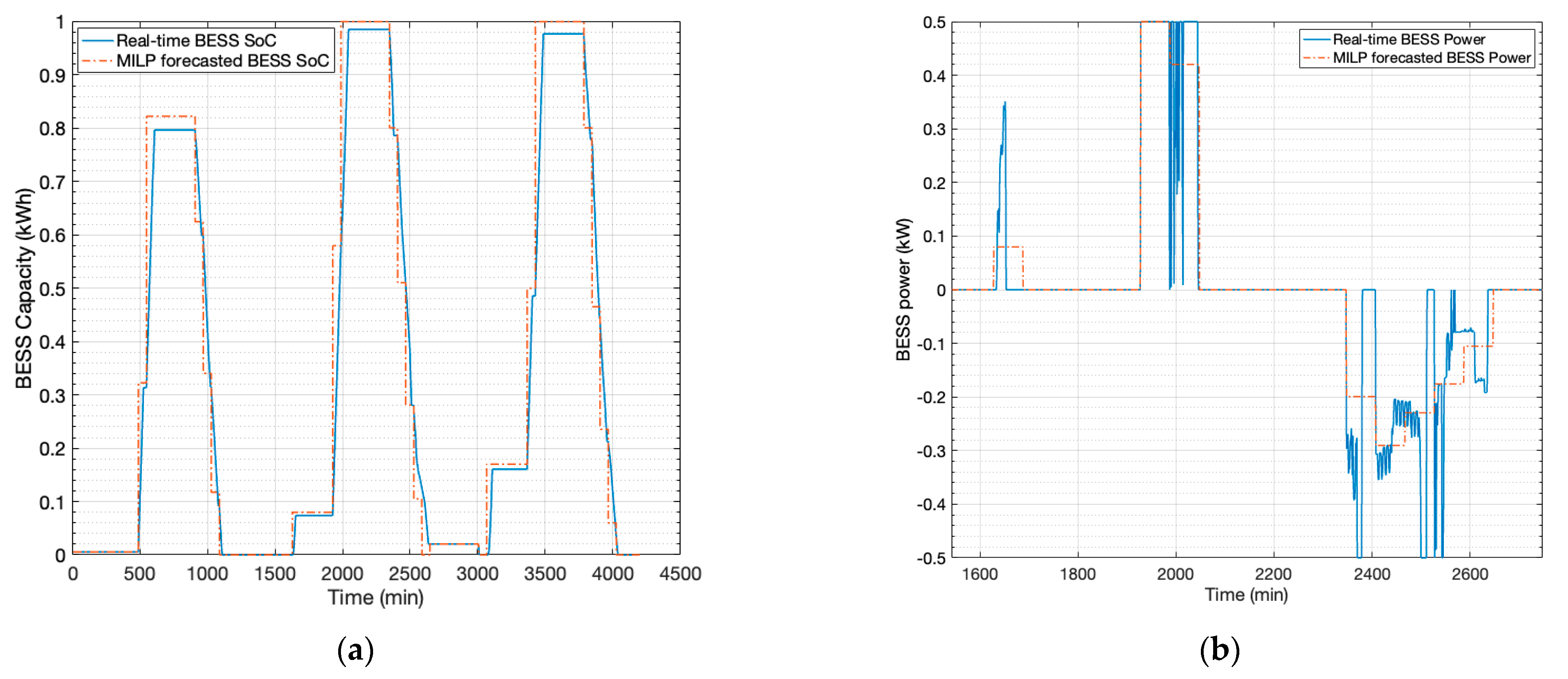

4.3. MILP Optimal Scheduling

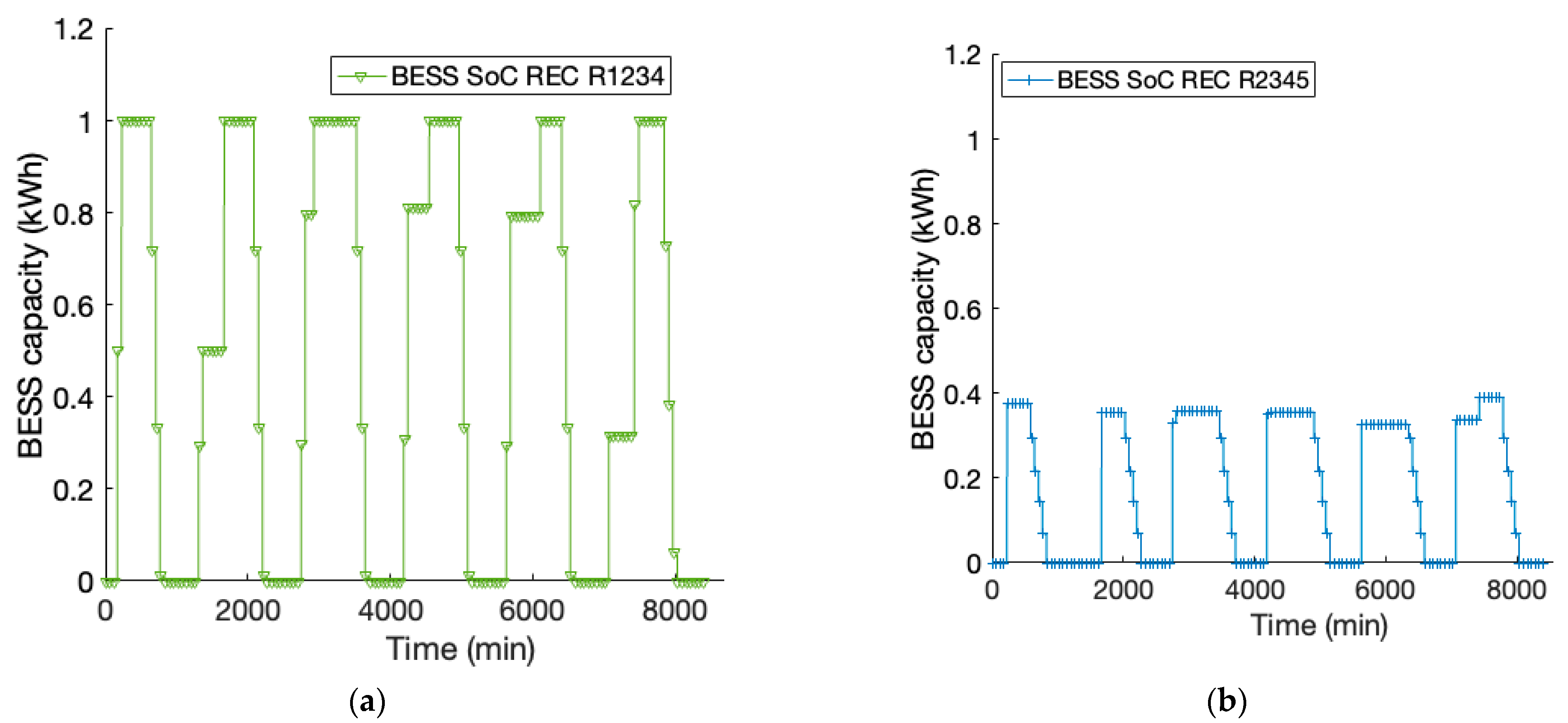

4.4. Real-Time BESS Management Operation

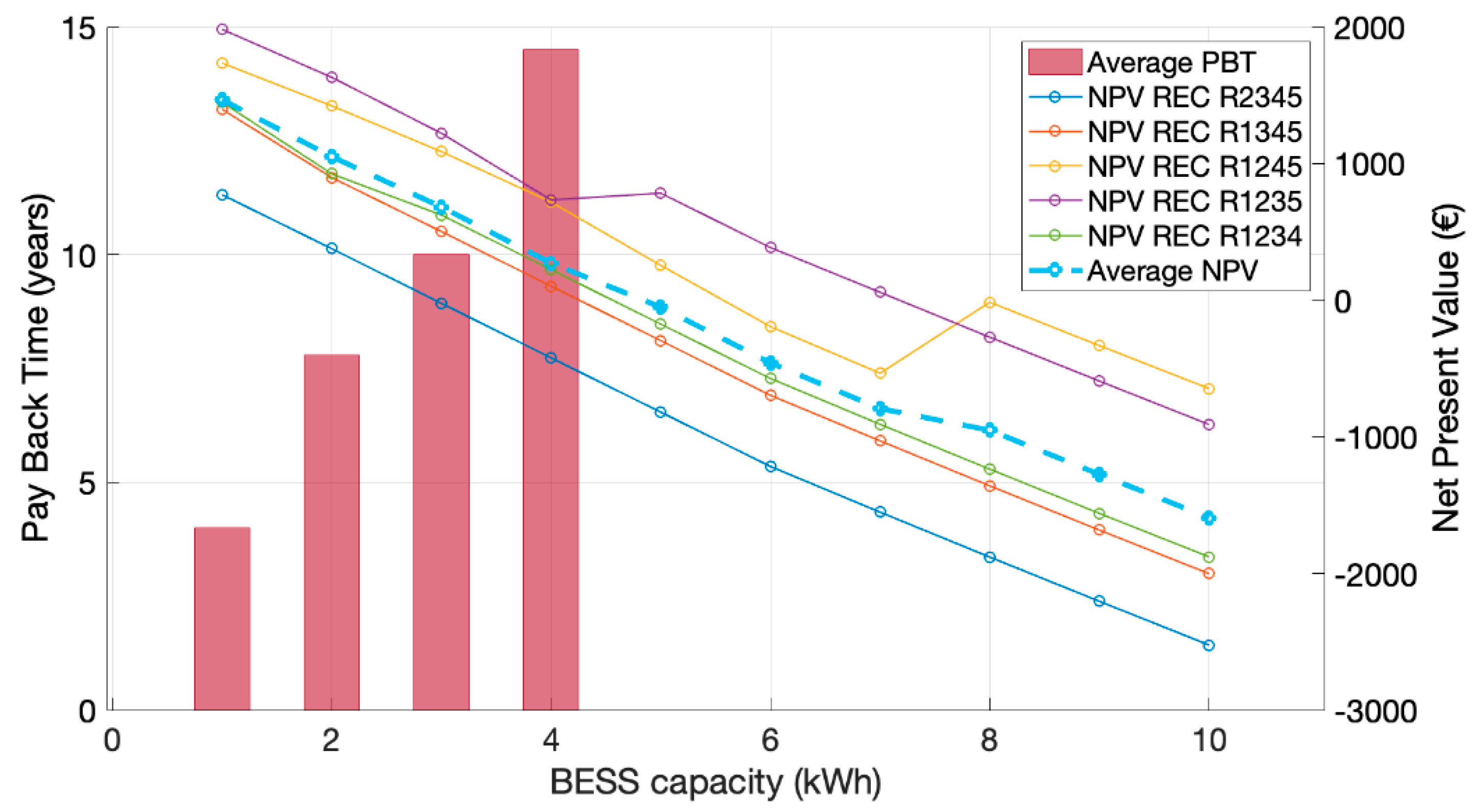

4.5. Techno-Economic Outcomes for the Analyzed Scenarios

5. Conclusions

- BESS implementation could help to improve both prosumer self-consumption and virtual energy exchanges within the REC. Anyway, only a careful charging and discharging scheduling allows to optimize its usage and the related revenues.

- By applying the MILP-based, forecast-based scheduling optimization presented in this work, a 10% average revenue increase could be obtained for the prosumer alone when compared to the non-optimized BESS usage scenario.

- Such revenue increase is obtained by reducing the BESS usage by around 30%, thus guaranteeing longer lifetime and, in perspective, the possibility to use the remaining overall capacity for providing different, non-energy-related services to the grid (i.e., flexibility and distributed balancing services).

- The optimal BESS sizing analysis carried out for the considered REC, considering net present value over a 20-year investment lifetime as the main target, described as the optimal choice a 1 kWh / 0.5 kW BESS;

- Such finding could be mainly related to the small size of the considered REC on the one hand, and on the other hand to the combination of little price arbitrage possibility on the Italian day-ahead market and high BESS CAPEX.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Nouicer, A.-M.; Kehoe, J.; Nysten, D.; Fouquet, L.; Hancher, L.; Meeus, L. The EU Clean Energy Package; Florence School of Regulation: Firenze, Italy, 2020. [Google Scholar]

- European Commission. COM (2021) 550 final—“Fit for 55”: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality. 2021. Available online: https://ec.europa.eu/clima/citizens/support_en (accessed on 10 October 2021).

- European Commission. COM (2019) 640 Final—The European Green New Deal. 2019. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:b828d165-1c22-11ea-8c1f-01aa75ed71a1.0002.02/DOC_1&format=PDF (accessed on 10 October 2021).

- Council of the European Union. European Parliament. Directive (EU) 2018/2001 on the promotion of the use of energy from renewable sources (recast). Off. J. Eur. Union 2018, 328, 82–209. [Google Scholar]

- European Parliament. Directive (EU) 2019/944—On common rules for the internal market for electricity and amending Directive 2012/27/EU (recast). Off. J. Eur. Union 2019, 50, 30. Available online: http://eur-lex.europa.eu/pri/en/oj/dat/2003/l_285/l_28520031101en00330037.pdf (accessed on 10 October 2021).

- Italian Parliament. Law n.8 28/02/2020; Italian Parliament: Rome, Italy, 2020.

- Ministry for Economic Development. Decreto Ministeriale D.M. 16/09/2020. Off. J. Eur. Union 2020, 285, 37–41. [Google Scholar]

- ARERA. Deliberazione 4 Agosto 2020 318/2020/R/EEL—Regolazione delle Partite Economiche Relative All’energia Elettrica Condivisa da un Gruppo di Autoconsumatori di Energia Rinnovabile che Agiscono Collettivamente in Edifici e Condomini Oppure Condivisa in una Comunità di Energia Rinnovabile. 2020. Available online: https://www.arera.it/allegati/docs/20/318-20.pdf (accessed on 15 October 2021).

- Grasso, F.; Abdollahi, M.; Talluri, G.; Paolucci, L. Power control and energy management of grid-scale energy storage systems for smart users. In Proceedings of the 2019 AEIT International Annual Conference (AEIT), Firenze, Italy, 18–20 September 2019. [Google Scholar] [CrossRef]

- Grasso, F.; Abdollahi, M.; Talluri, G.; Paolucci, L. Techno-economic control of energy storage system for demand side management. In Proceedings of the 2019 AEIT International Annual Conference (AEIT), Firenze, Italy, 18–20 September 2019. [Google Scholar] [CrossRef]

- Grasso, F.; Talluri, G.; Giorgi, A.; Luchetta, A.; Paolucci, L. Peer-to-peer energy exchanges model to optimize the integration of renewable energy sources: The E-Cube project. Energ. Elettr. Suppl. J. 2019, 96, 1–8. [Google Scholar] [CrossRef]

- Corti, F.; Gulino, M.-S.; Laschi, M.; Lozito, G.M.; Pugi, L.; Reatti, A.; Vangi, D. Time-domain circuit modelling for hybrid supercapacitors. Energies 2021, 14, 6837. [Google Scholar] [CrossRef]

- Li, S.; Ju, C.; Li, J.; Fang, R.; Tao, Z.; Li, B.; Zhang, T. State-of-charge estimation of lithium-ion batteries in the battery degradation process based on recurrent neural network. Energies 2021, 14, 306. [Google Scholar] [CrossRef]

- Li, C.; Xiao, F.; Fan, Y. An approach to state of charge estimation of lithium-ion batteries based on recurrent neural networks with gated recurrent unit. Energies 2019, 12, 1592. [Google Scholar] [CrossRef] [Green Version]

- Xiao, B.; Liu, Y. Accurate state-of-charge estimation approach for lithium-ion batteries by gated recurrent unit with ensemble optimizer. IEEE Access 2019, 7, 54192–54202. [Google Scholar] [CrossRef]

- Bonfitto, A. A method for the combined estimation of battery state of charge and state of health based on artificial neural networks. Energies 2020, 13, 2548. [Google Scholar] [CrossRef]

- Corti, F.; Reatti, A.; Lozito, G.M.; Cardelli, E.; Laudani, A. Influence of non-linearity in losses estimation of magnetic components for DC-DC converters. Energies 2021, 14, 6498. [Google Scholar] [CrossRef]

- Antonio, S.Q.; Faba, A.; Rimal, H.P.; Cardelli, E. On the analysis of the dynamic energy losses in NGO electrical steels under non-sinusoidal polarization waveforms. IEEE Trans. Magn. 2020, 56, 1–15. [Google Scholar] [CrossRef]

- Cardelli, E.; Faba, A.; Laudani, A.; Antonio, S.Q.; Fulginei, F.R.; Salvini, A. Computer modeling of nickel–iron alloy in power electronics applications. IEEE Trans. Ind. Electron. 2016, 64, 2494–2501. [Google Scholar] [CrossRef]

- Henri, G.; Lu, N. A supervised machine learning approach to control energy storage devices. IEEE Trans. Smart Grid 2019, 10, 5910–5919. [Google Scholar] [CrossRef]

- Gil-González, W.; Montoya, O.D.; Grisales-Noreña, L.F.; Cruz-Peragón, F.; Alcalá, G. economic dispatch of renewable generators and BESS in DC microgrids using second-order cone optimization. Energies 2020, 13, 1703. [Google Scholar] [CrossRef] [Green Version]

- Cao, B.; Dong, W.; Lv, Z.; Gu, Y.; Singh, S.; Kumar, P. Hybrid microgrid many-objective sizing optimization with fuzzy decision. IEEE Trans. Fuzzy Syst. 2020, 28, 2702–2710. [Google Scholar] [CrossRef]

- Alramlawi, M.; Li, P. Design optimization of a residential PV-battery microgrid with a detailed battery lifetime estimation model. IEEE Trans. Ind. Appl. 2020, 56, 2020–2030. [Google Scholar] [CrossRef]

- Qiu, H.; Gu, W.; Xu, Y.; Yu, W.; Pan, G.; Liu, P. Tri-level mixed-integer optimization for two-stage microgrid dispatch with multi-uncertainties. IEEE Trans. Power Syst. 2020, 35, 3636–3647. [Google Scholar] [CrossRef]

- Montoya, O.D.; Arias-Londoño, A.; Garrido, V.M.; Gil-González, W.; Grisales-Noreña, L.F. A quadratic convex approximation for optimal operation of battery energy storage systems in DC distribution networks. Energy Syst. 2021, 1–21. [Google Scholar] [CrossRef]

- Sheha, M.; Powell, K. Using real-time electricity prices to leverage electrical energy storage and flexible loads in a smart grid environment utilizing machine learning techniques. Processes 2019, 7, 870. [Google Scholar] [CrossRef] [Green Version]

- Kong, W.; Dong, Z.Y.; Jia, Y.; Hill, D.J.; Xu, Y.; Zhang, Y. Short-term residential load forecasting based on LSTM recurrent neural network. IEEE Trans. Smart Grid 2017, 10, 841–851. [Google Scholar] [CrossRef]

- Kong, W.; Dong, Z.Y.; Hill, D.J.; Luo, F.; Xu, Y. Short-term residential load forecasting based on resident behaviour learning. IEEE Trans. Power Syst. 2017, 33, 1087–1088. [Google Scholar] [CrossRef]

- Tian, C.; Ma, J.; Zhang, C.; Zhan, P. A deep neural network model for short-term load forecast based on long short-term memory network and convolutional neural network. Energies 2018, 11, 3493. [Google Scholar] [CrossRef] [Green Version]

- Deng, Z.; Wang, B.; Xu, Y.; Xu, T.; Liu, C.; Zhu, Z. Multi-scale convolutional neural network with time-cognition for multi-step short-term load forecasting. IEEE Access 2019, 7, 88058–88071. [Google Scholar] [CrossRef]

- Sadaei, H.J.; Silva, P.C.D.L.E.; Guimarães, F.G.; Lee, M.H. Short-term load forecasting by using a combined method of convolutional neural networks and fuzzy time series. Energy 2019, 175, 365–377. [Google Scholar] [CrossRef]

- Garcia, C.I.; Grasso, F.; Luchetta, A.; Piccirilli, M.C.; Paolucci, L.; Talluri, G. A comparison of power quality disturbance detection and classification methods using CNN, LSTM and CNN-LSTM. Appl. Sci. 2020, 10, 6755. [Google Scholar] [CrossRef]

- Jalali, S.M.J.; Ahmadian, S.; Khosravi, A.; Shafie-Khah, M.; Nahavandi, S.; Catalao, J.P.S. A novel evolutionary-based deep convolutional neural network model for intelligent load forecasting. IEEE Trans. Ind. Inform. 2021, 17, 8243–8253. [Google Scholar] [CrossRef]

- Li, Y.; Huang, Y.; Zhang, M. Short-term load forecasting for electric vehicle charging station based on niche immunity lion algorithm and convolutional neural network. Energies 2018, 11, 1253. [Google Scholar] [CrossRef] [Green Version]

- Grasso, F.; Luchetta, A.; Manetti, S. A multi-valued neuron based complex ELM neural network. Neural Process. Lett. 2017, 48, 389–401. [Google Scholar] [CrossRef]

- Zahid, M.; Ahmed, F.; Javaid, N.; Abbasi, R.A.; Zainab Kazmi, H.S.; Javaid, A.; Bilal, M.; Akbar, M.; Ilahi, M. Electricity price and load forecasting using enhanced convolutional neural network and enhanced support vector regression in smart grids. Electronics 2019, 8, 122. [Google Scholar] [CrossRef] [Green Version]

- Alanis, A.Y. Electricity prices forecasting using artificial neural networks. IEEE Lat. Am. Trans. 2018, 16, 105–111. [Google Scholar] [CrossRef]

- Fraunholz, C.; Kraft, E.; Keles, D.; Fichtner, W. Advanced price forecasting in agent-based electricity market simulation. Appl. Energy 2021, 290, 116688. [Google Scholar] [CrossRef]

- Wang, Z.; Hong, T. Generating realistic building electrical load profiles through the Generative Adversarial Network (GAN). Energy Build. 2020, 224, 110299. [Google Scholar] [CrossRef]

- Gu, Y.; Chen, Q.; Liu, K.; Xie, L.; Kang, C. GAN-based model for residential load generation considering typical consumption patterns. In Proceedings of the 2019 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 18–21 February 2019. [Google Scholar] [CrossRef]

- Ge, L.; Liao, W.; Wang, S.; Bak-Jensen, B.; Pillai, J.R. Modeling daily load profiles of distribution network for scenario generation using flow-based generative network. IEEE Access 2020, 8, 77587–77597. [Google Scholar] [CrossRef]

- Pan, Z.; Wang, J.; Liao, W.; Chen, H.; Yuan, D.; Zhu, W.; Fang, X.; Zhu, Z. Data-driven EV load profiles generation using a variational auto-encoder. Energies 2019, 12, 849. [Google Scholar] [CrossRef] [Green Version]

- Talluri, G.; Grasso, F.; Chiaramonti, D. Is deployment of charging station the barrier to electric vehicle fleet development in EU urban areas? An analytical assessment model for large-scale municipality-level EV charging infrastructures. Appl. Sci. 2019, 9, 4704. [Google Scholar] [CrossRef] [Green Version]

- Moncecchi, M.; Meneghello, S.; Merlo, M. Energy sharing in renewable energy communities: The Italian case. In Proceedings of the 2020 55th International Universities Power Engineering Conference (UPEC), Turin, Italy, 1–4 September 2020. [Google Scholar] [CrossRef]

- Verde, S.; Rossetto, N. The Future of Renewable Energy Communities in the EU—An Investigation at the Time of the Clean Energy Package; European University Institute: Florence, Italy, 2020. [Google Scholar] [CrossRef]

- Barbour, E.; Parra, D.; Awwad, Z.; González, M.C. Community energy storage: A smart choice for the smart grid? Appl. Energy 2018, 212, 489–497. [Google Scholar] [CrossRef] [Green Version]

- Bartolini, A.; Carducci, F.; Muñoz, C.B.; Comodi, G. Energy storage and multi energy systems in local energy communities with high renewable energy penetration. Renew. Energy 2020, 159, 595–609. [Google Scholar] [CrossRef]

- Dukovska, I.; Slootweg, H.J.; Paterakis, N.G. Decentralized optimization and power flow analysis for a local energy community. In Proceedings of the 2021 IEEE Madrid PowerTech, Madrid, Spain, 28 June–2 July 2021. [Google Scholar] [CrossRef]

- Malysz, P.; Sirouspour, S.; Emadi, A. An optimal energy storage control strategy for grid-connected microgrids. IEEE Trans. Smart Grid 2014, 5, 1785–1796. [Google Scholar] [CrossRef]

- Elkazaz, M.; Sumner, M.; Pholboon, S.; Thomas, D. Microgrid energy management using a two stage rolling horizon technique for controlling an energy storage system. In Proceedings of the 7th International Conference on Renewable Energy Research and Applications (ICRERA), Paris, France, 14–17 October 2018; pp. 324–329. [Google Scholar] [CrossRef]

- Jung, S.; Yoon, Y.T.; Huh, J.-H. An efficient micro grid optimization theory. Mathematics 2020, 8, 560. [Google Scholar] [CrossRef] [Green Version]

- Chis, A.; Koivunen, V. Collaborative approach for energy cost minimization in smart grid communities. In Proceedings of the 2017 IEEE Global Conference on Signal and Information Processing (GlobalSIP), Montreal, QC, Canada, 14–6 November 2017. [Google Scholar]

- Al Skaif, T.; Luna, A.C.; Zapata, M.G.; Guerrero, J.; Bellalta, B. Reputation-based joint scheduling of households appliances and storage in a microgrid with a shared battery. Energy Build. 2017, 138, 228–239. [Google Scholar] [CrossRef] [Green Version]

- Bandara, K.Y.; Thakur, S.; Breslin, J. Renewable energy integration through coalition formation for P2P energy trading. In Proceedings of the 2020 IEEE 3rd International Conference on Renewable Energy and Power Engineering (REPE), Edmonton, AB, Canada, 9–11 October 2020; pp. 56–60. [Google Scholar] [CrossRef]

- Cui, S.; Wang, Y.-W.; Li, C.; Xiao, J.-W. Prosumer community: A risk aversion energy sharing model. IEEE Trans. Sustain. Energy 2019, 11, 828–838. [Google Scholar] [CrossRef]

- Xing, X.; Xie, L.; Meng, H.; Guo, X.; Yue, L.; Guerrero, J.M. Multi-time-scale energy management strategy considering battery operation modes for grid-connected microgrids community. CSEE J. Power Energy Syst. 2019, 6, 1–10. [Google Scholar] [CrossRef]

- Chaouachi, A.; Kamel, R.M.; Andoulsi, R.; Nagasaka, K. Multiobjective intelligent energy management for a microgrid. IEEE Trans. Ind. Electron. 2013, 60, 1688–1699. [Google Scholar] [CrossRef]

- Elshurafa, A.M. The value of storage in electricity generation: A qualitative and quantitative review. J. Energy Storage 2020, 32, 101872. [Google Scholar] [CrossRef]

- Beltran, H.; Ayuso, P.; Pérez, E. Lifetime expectancy of li-ion batteries used for residential solar storage. Energies 2020, 13, 568. [Google Scholar] [CrossRef] [Green Version]

- d’Halluin, P.; Rossi, R.; Schmela, M. European Market Outlook for Residential Battery Storage 2020–2024. 2020. Available online: https://resource-platform.eu/wp-content/uploads/files/statements/2820-SPE-EU-Residential-Market-Outlook-07-mr.pdf (accessed on 16 October 2021).

- Koskela, J.; Rautiainen, A.; Järventausta, P. Using electrical energy storage in residential buildings—Sizing of battery and photovoltaic panels based on electricity cost optimization. Appl. Energy 2019, 239, 1175–1189. [Google Scholar] [CrossRef]

- De Lia, F. Incentivi e Norme di Connessione Degli Impianti Fotovoltaici con Accumulo alla Rete Elettrica—Report RdS/PAR2018/100. 2018. Available online: https://www.enea.it/it/Ricerca_sviluppo/documenti/ricerca-di-sistema-elettrico/adp-mise-enea-2015-2017/accumulo-di-energia/report-2018/rds_par2018_100.pdf (accessed on 18 October 2021).

- Gestore Mercati Energetici. Database of Day-Ahead Electricity Market Prices. 2021. Available online: https://www.mercatoelettrico.org/it/Statistiche/ME/DatiSintesi.aspx (accessed on 7 November 2021).

- ARERA. Economic Settlements for Residential Customer—Electricity. 2021. Available online: https://www.arera.it/it/dati/condec.htm (accessed on 7 November 2021).

| Property | Value of Function | Ref |

|---|---|---|

| REC load peak power | 13.5 kW | Database |

| Single household load peak power | 2.9 ÷ 4.5 kW | |

| PV gen. peak power | 4.6 kW | |

| BESS net capacity | 1 ÷ 10 kWh | Own assumption |

| BESS rated power | 0.5 ÷ 5 kW | |

| BESS lifetime cycles | 3000 | [46] |

| BESS CAPEX | 400 ÷ 3700 € | [46] |

| BESS LCOS | 0.013 ÷ 0.025 €/kWh | Calculated |

| PV energy value (Day-ahead IT Market) | 0.05 ÷ 0.11 €/kWh | [63] |

| Electricity cost for residential consumers | 0.20 €/kWh | [64] |

| Subsidy on RES electricity shared in REC | 0.06 €/kWh (prosumer) | [7], Own assumption |

| Subsidy on RES electricity shared in REC | 0.05 €/kWh (all consumers) |

| Levelized Cost of Storage (€/kWh) | |

| Capital Expenditure for BESS (€) | |

| Lifetime charge/discharge cycles | |

| BESS Max capacity (kWh) | |

| BESS max. charge power (kW) | |

| BESS max. discharge power (kW) | |

| Prosumer load (kW) | |

| Photovoltaic generation (kW) | |

| Prosumer Net Load (kW) | |

| Prosumer Net Generation (kW) | |

| Aggregate REC consumers load (kW) | |

| i-th REC consumers load (kW) | |

| Total power virtually exchanged with grid (kW) | |

| Net Generation power on REC load (kW) | |

| Total BESS charging power (kW) | |

| BESS charge from grid (kW) | |

| BESS charge when REC load is present (kW) | |

| Total BESS discharging power (kW) | |

| BESS discharge on grid (kW) | |

| BESS discharge on REC load (kW) | |

| BESS discharge on prosumer net load (kW) | |

| BESS State of Charge (kWh) | |

| Multiplying coefficient for BESS charging | |

| Multiplying coefficient for BESS discharging | |

| Incentive value (€) | |

| Electricity price for residential customer (€/kWh) | |

| Electricity price on DAM (€/kWh) | |

| Total daily REC revenues (€) | |

| REC hourly incomes (€) | |

| REC hourly costs (€) | |

| Net Present Value (€) | |

| Discount Rate (%) |

| Hidden Layer Size | Delay-Taps | |

|---|---|---|

| PV Production | 3 | 1 |

| Consumed Power | 9 | 2 |

| REC Consumed Power | 5 | 1 |

| Baseline | BESS—No MILP | BESS—MILP | |

|---|---|---|---|

| Total REC demand (MWh) | 13.03 | ||

| Prosumer demand (MWh) | 2.606 (1.296–5.323) | ||

| Other REC members demand (MWh) | 10.424 (7.707–11.734) | ||

| PV generation (MWh) | 6.744 | ||

| Prosumer Self-consumption (MWh) | 1.157 (0.628–2.293) | 1.367 (0.78–2.613) | 1.405 (0.749–2.605) |

| Shared energy within REC (MWh) | 3.211 (2.074–3.738) | 3.35 (2.15–4.05) | 3.29 (2.074–3.922) |

| Exports to grid (MWh) | 2.376 | 2.41 | 2.37 |

| Imports from grid (MWh) | 8.662 | 8.43 | 8.412 |

| Total BESS use–capacity: 1 kWh, power 0.5 kW(kWh) | - | 0.772 (0.714–0.836) | 0.496 (0.242–0.625) |

| REC yearly revenues (€/year) | 733 (595–819) | 806 (733–884) | 859 (671–947) |

| Prosumer revenues (€/year) | 574 (493–636) | 576 (564–625) | 627 (495–687) |

| Other REC members tot. rev. (€/year) | 158 (102–184) | 230 (169–259) | 232 (176–260) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Talluri, G.; Lozito, G.M.; Grasso, F.; Iturrino Garcia, C.; Luchetta, A. Optimal Battery Energy Storage System Scheduling within Renewable Energy Communities. Energies 2021, 14, 8480. https://doi.org/10.3390/en14248480

Talluri G, Lozito GM, Grasso F, Iturrino Garcia C, Luchetta A. Optimal Battery Energy Storage System Scheduling within Renewable Energy Communities. Energies. 2021; 14(24):8480. https://doi.org/10.3390/en14248480

Chicago/Turabian StyleTalluri, Giacomo, Gabriele Maria Lozito, Francesco Grasso, Carlos Iturrino Garcia, and Antonio Luchetta. 2021. "Optimal Battery Energy Storage System Scheduling within Renewable Energy Communities" Energies 14, no. 24: 8480. https://doi.org/10.3390/en14248480

APA StyleTalluri, G., Lozito, G. M., Grasso, F., Iturrino Garcia, C., & Luchetta, A. (2021). Optimal Battery Energy Storage System Scheduling within Renewable Energy Communities. Energies, 14(24), 8480. https://doi.org/10.3390/en14248480