1. Introduction

Since the beginning of the 21st century, carbon dioxide emissions and climate change have aroused widespread concern around the world. The European Union has established carbon market and carbon emission transaction mechanisms that provide new ideas and methods to cope with climate and environmental issues [

1]. In 2019, the trading volume and turnover of the European carbon market ranked first in the world, reaching 6777 million tons and 168 billion euros, respectively. Simultaneously, with the increase in carbon trading demand, the Korean market transaction price is constantly pushed up. Therefore, aiming to improve the trading mechanism of the market and improve management levels, it is necessary to predict carbon price accurately and efficiently [

2]. Through the establishment of carbon price prediction methods and technologies, the carbon market trading system and mechanism is improved, which has prominent significance in guiding rational investment and regulating carbon market transactions [

3].

The fluctuation of carbon price shows strong instability and nonlinearity. Aiming to accurately identify the internal law of carbon price series, many scholars use a variety of time series decomposition techniques to study the internal law of carbon price. Variational mode decomposition (VMD) [

4], wavelet transform (WT) [

5], and empirical mode decomposition (EMD) [

6] are widely used in the study of carbon price characteristics. Zhu et al. used EMD to realize the multi frequency decomposition of European Climate Exchange (ECX) carbon price [

7]. Xiong et al. obtained the regular pattern component of carbon price by VMD [

8], which greatly reduced the obstacles of carbon price prediction and achieved high prediction stability. Sun et al. used WT to realize the filtering analysis of original sequence of carbon price, reducing the impact of noise sequence on carbon price prediction [

9].

Although many time series analysis and decomposition methods are used to reduce difficulty of carbon price prediction, the existence of an original noise sequence affects the effect of carbon price decomposition. With the development of time series research, ensemble decomposition provides a new noise reduction analysis method. Ensemble empirical mode decomposition (EEMD) decomposes the unstable sequence by adding white noise many times, and averages the decomposition results to get the final decomposition results [

10], which effectively reduces the noise components of carbon price and improves accuracy in modal identification [

11]. In addition, EEMD can adaptively decompose carbon price according to data characteristics, which enhances the flexibility and stability of carbon price decomposition [

12].

With the increasing trading volume of the carbon market, the fluctuation of carbon price shows significant complexity and is non-stationary. In order to establish a scientific and effective carbon price prediction method, neural network and machine learning are extensively used in the carbon price prediction field. Back propagation (BP) neural network [

13], support vector machine (SVM) [

14], and extreme learning machine (ELM) [

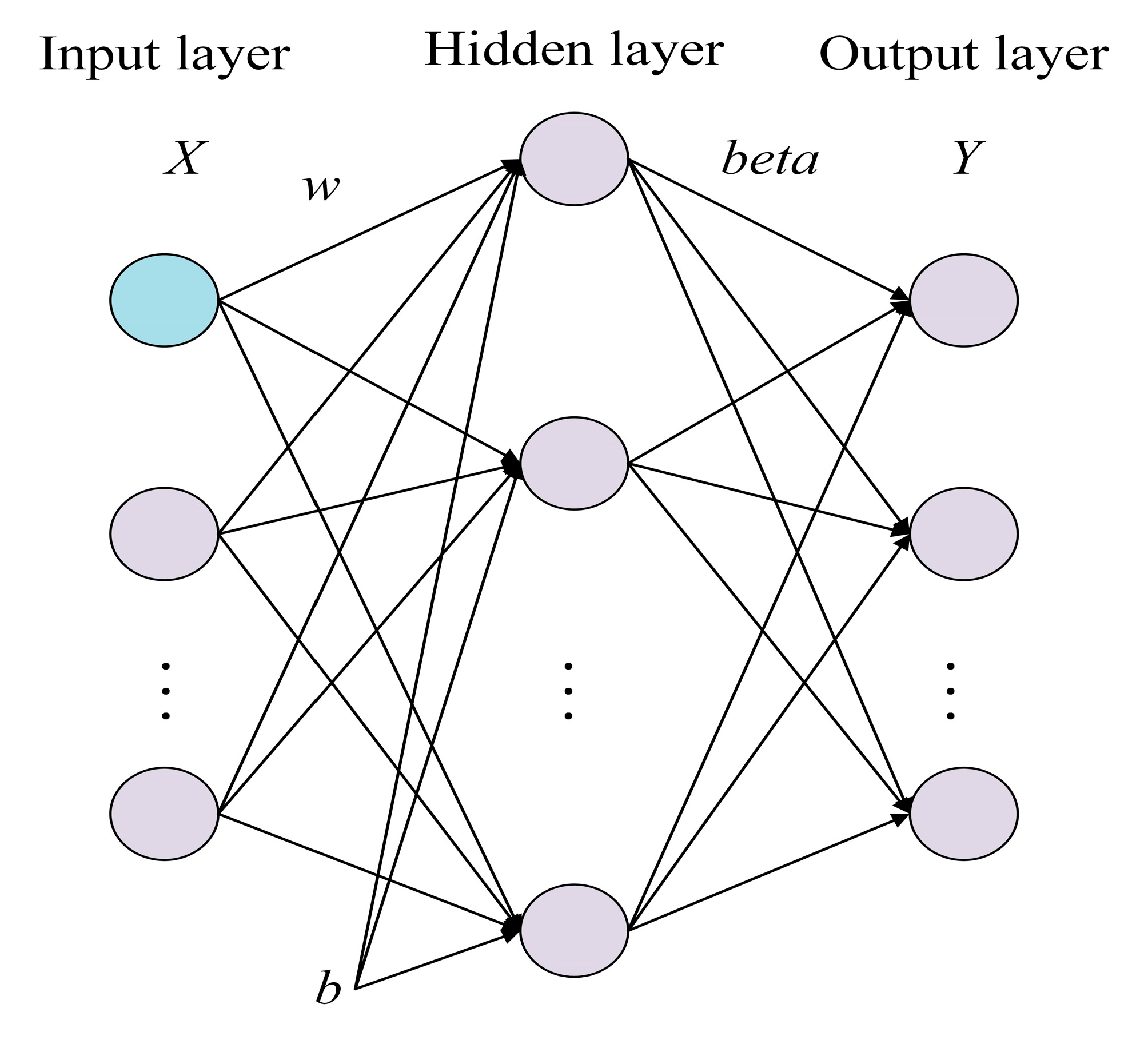

15] are common and effective basic prediction models. Among these intelligent prediction models, ELM is the most widely used because of its strong feature recognition ability, generalization, and ease of operation.

However, since the connection parameters between feature input and the ELM hidden layer will not be adjusted once they are determined, the ELM is apt to be caught in local optimal value. ELM reduces stability and robustness of the model, while increasing the optimization ability and learning rate. Therefore, many scholars use swarm intelligence algorithm to assist the optimization of ELM so as to effectively improve its optimization ability and robustness. Sun et al. adopted the particle swarm optimum principle to optimize ELM and applied the optimization model to predict carbon price in the Chinese regional market [

16]. Hao et al. used the optimization strategy of combination of multi-objective optimization and grasshopper algorithm to optimize ELM. The effectiveness of the multi-objective grasshopper joint optimization strategy was verified in an empirical analysis of China and the European Union [

17]. In addition, the adaptive and global optimization ability of ELM optimized by bat algorithm (BA) is significantly enhanced, and is widely used in feature recognition and prediction of various nonlinear and unstable sequences, for example, dew point temperature [

18], rainfall [

19], and solar radiation [

20]. Although bat algorithm significantly reduces the risk of ELM falling into local extremum and enhances the carbon price prediction effect of ELM, each individual in bat algorithm searches for optimization results independently, while there is less information exchange and sharing between individuals, which results in instability and slow convergence speed of the BA-ELM carbon price model. In this paper, BA is improved and the information sharing mechanism between bat individuals is established based on genetic idea, so as to speed up ELM optimization and enhance model robustness [

21]. The ELM carbon price prediction model optimized by improved BA (IBA) is named IBA-ELM.

In addition, the impact of energy price on carbon price has been a hot research topic in recent years. Many scholars have conducted research on correlation between energy and carbon price [

22]. In this paper, energy price fluctuations are introduced into the carbon price prediction model, so as to heighten accuracy of carbon price prediction. The main contributions of this paper are as follows:

- (1)

EEMD is used to decompose the historical carbon price data of ECX and Korea Exchange (KRX). Through adaptive ensemble decomposition of original carbon price sequence, the obtained carbon price components are more regular and accurate, which effectively reduces carbon price noise components and improves decomposition efficiency.

- (2)

The bat algorithm is improved by using the horizontal cross strategy. After the improvement, the information interaction mechanism is increased and the optimization efficiency is enhanced. Simultaneously, ELM optimized by improved bat algorithm is applied to carbon price prediction. Combined with the carbon price decomposition strategy, the EEMD-IBA-ELM carbon price prediction model is established. The results of empirical analysis show that the prediction model improves the accuracy of carbon price prediction.

- (3)

The correlation between energy price variables and carbon price is calculated by statistical method, and the energy price factors are introduced into the prediction model of the EEMD-IBA-ELM carbon price prediction model. The empirical results show that the energy price factor increases input information of the model, which further improves carbon price prediction accurateness.

3. Data Preprocessing

3.1. Data Sources

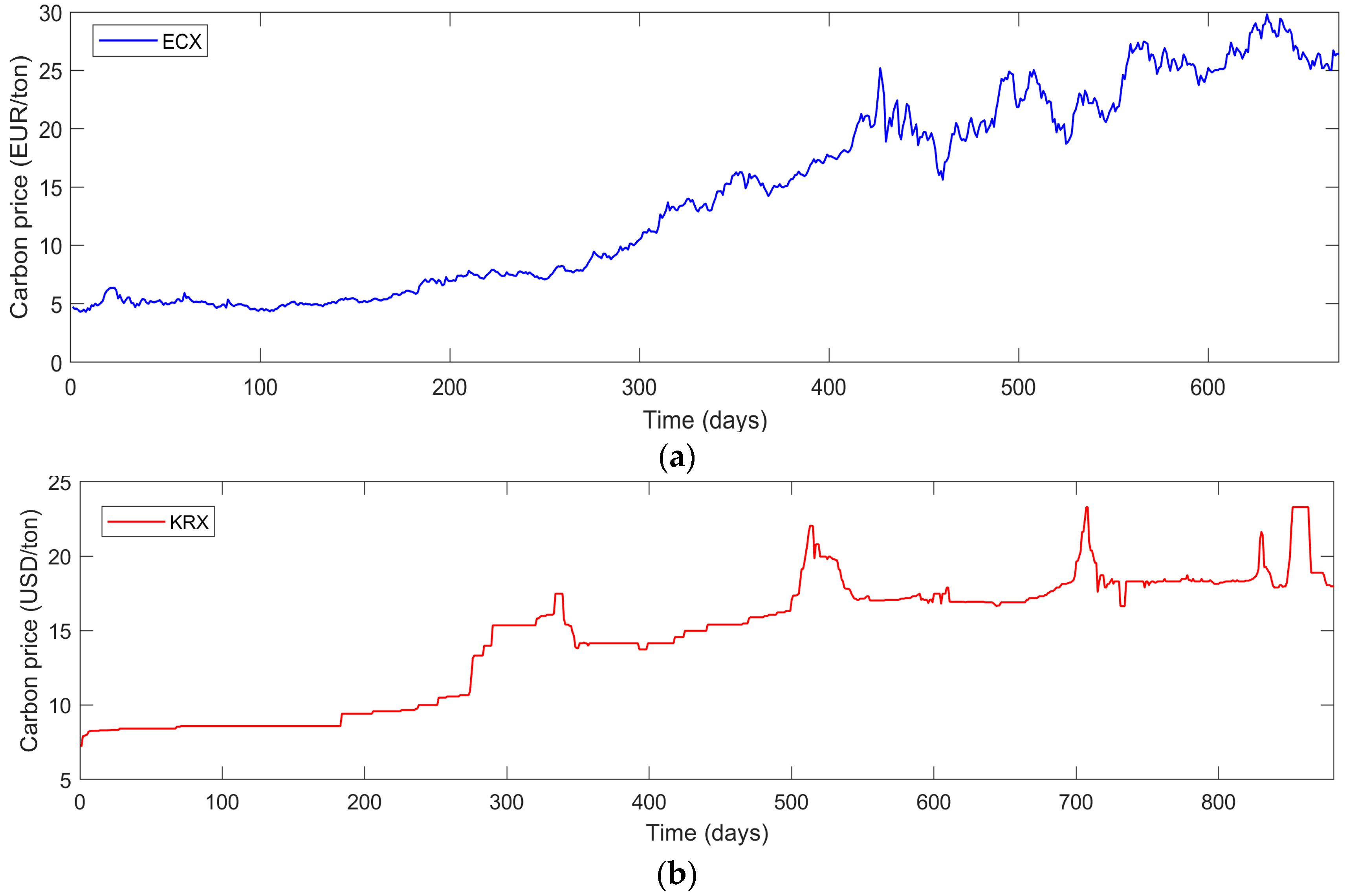

Based on historical trading data of the European Climate Exchange (ECX) and Korea Exchange (KRX) carbon markets, this paper makes an empirical study of carbon price prediction. The transaction data from 28 November 2016 to 13 September 2019 is selected as the ECX data set, while the transaction data from 12 January 2015 to 9 August 2018 is selected as the KRX data set. Simultaneously, the last 130 days and 180 days transaction prices of the two data sets are used as test sets, respectively, while the rest are used as training sets.

Table 1 and

Table 2 describe the basic information and statistical characteristics of empirical analysis samples, respectively.

The two selected samples’ data have high volatility and long time periods, which is conducive to in-depth identification of carbon price fluctuations. The sample data contains carbon price data of different days in the same week, which is conducive to study week-end effect of carbon price. The training sample sizes of ECX and KRX are 539 and 701, respectively, which can effectively verify the influence of differentiated samples on the stability of carbon price prediction. Therefore, the selected carbon price samples are representative, verifying the stability and superiority of the proposed carbon price prediction model.

Take ECX and KRX carbon prices as empirical data to test the accuracy and stability of the EEMD-IBA-ELM model. Considering the currency unit universality, the carbon price of KRX is converted to international currency USD. The conversion relationship between KRW and USD is expressed as Equation (18), where,

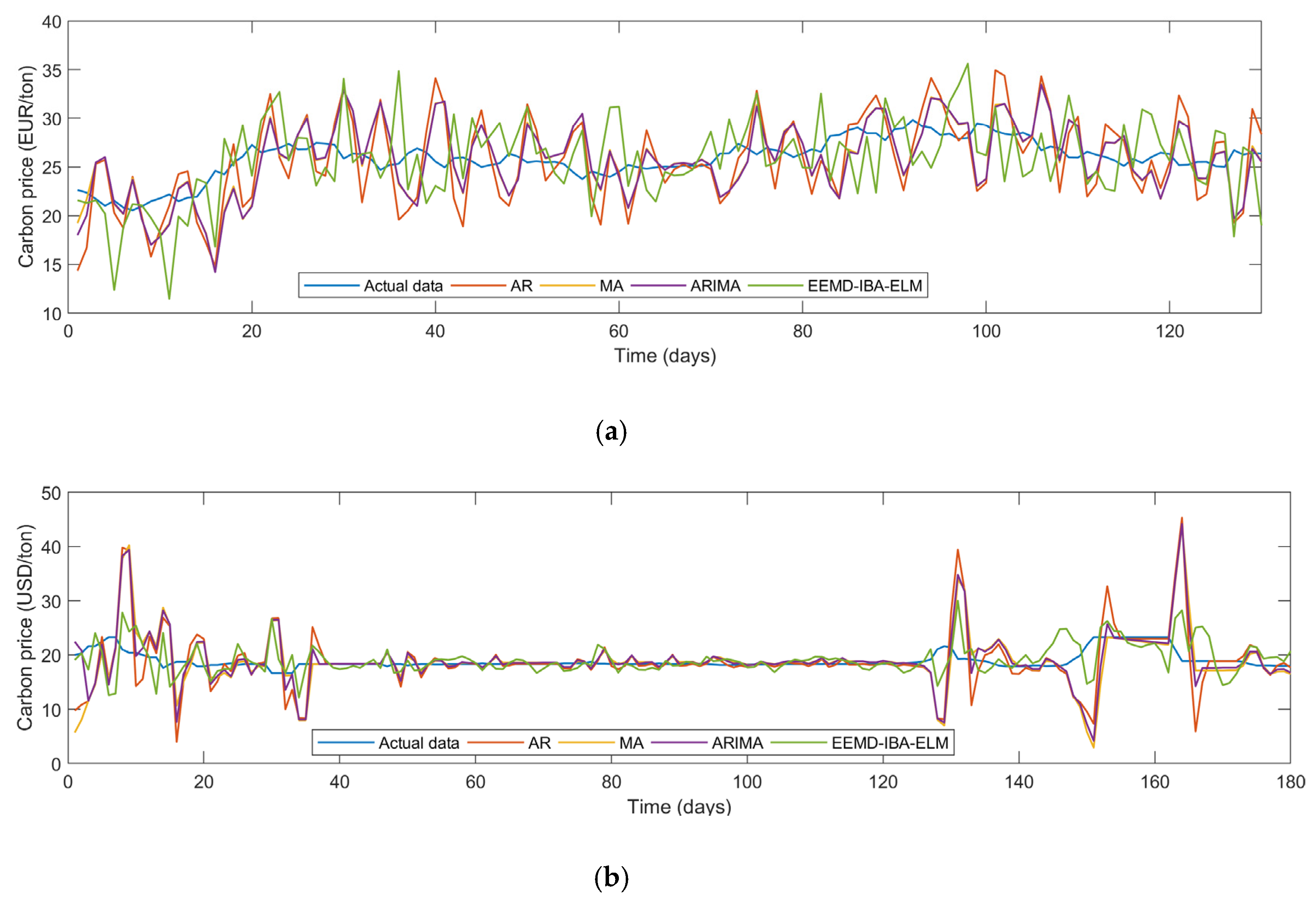

λ represents the exchange rate between KRW and USD in corresponding date of carbon price. The carbon price data of ECX and KRX are shown in

Figure 3.

In addition, the historical data of Brent crude oil futures price (BCOFP), New York Mercantile Exchange (NYMEX) natural futures price (NGFP), and West Texas Intermediate (WTI) crude oil future price (WTOFP) are used to reflect the fluctuation of energy prices in the world, so as to verify whether the introduction of energy price factors can improve carbon price prediction accuracy.

3.2. BDS Test and Carbon Price Structure Analysis

The BDS test is a classic time series nonlinear feature diagnosis method. It is the basis of carbon price research to analyze the internal law and dynamic structure of carbon price sequence. Therefore, the BDS method is used to test random walk fitting residuals of carbon prices in ECX and KRX [

30]. In the BDS test, m represents dimension, n represents replication number, and

Wm, n represents test statistics. Aiming to effectively identify the non-linear trend of carbon price, the autoregressive model (AR) model is first used to fit linear characteristics of carbon price. Secondly, carbon price residuals are calculated and standardized to form standard residuals. Original values, linear parts, and standard residuals of carbon prices in ECX and KRX are shown in

Figure 4. Simultaneously, the BDS method is used to test standard residuals of carbon prices in the two markets and

Table 3 shows BDS test results. In

Table 3, the values of test parameters

Wm, n of carbon price in ECX and KRX are significantly not equal to zero, which indicates that there are obvious nonlinear characteristics and dynamic structure in carbon price series.

3.3. Weekend Effect Analysis

The weekend effect will affect carbon price volatility and characteristics, so carbon price weekend effect of ECX and KRX are tested in

Table 4. The average carbon price of ECX and KRX on Fridays are significantly different from the other four weekdays. Meanwhile, the SD value of Friday’s carbon price was significantly higher than those of the other four weekdays. In particular, in the KRX carbon market, the value reached 17.22, which indicates that a weekend effect caused abnormal fluctuations in carbon prices. When the weekend approaches, carbon price skewness value shows an upward trend, which shows that the symmetry of carbon price is weakened by the weekend effect.

Considering day-of-the-week effect and weekend effect of carbon price data, day type of carbon price is quantified: {Monday, Tuesday, Wednesday, Thursday, Friday} = {1, 2, 3, 4, 5}. Simultaneously, the day type and carbon price value of the same weekday in the last three weeks are taken as input variables of EEMD-IBA-ELM to strength the prediction effect.

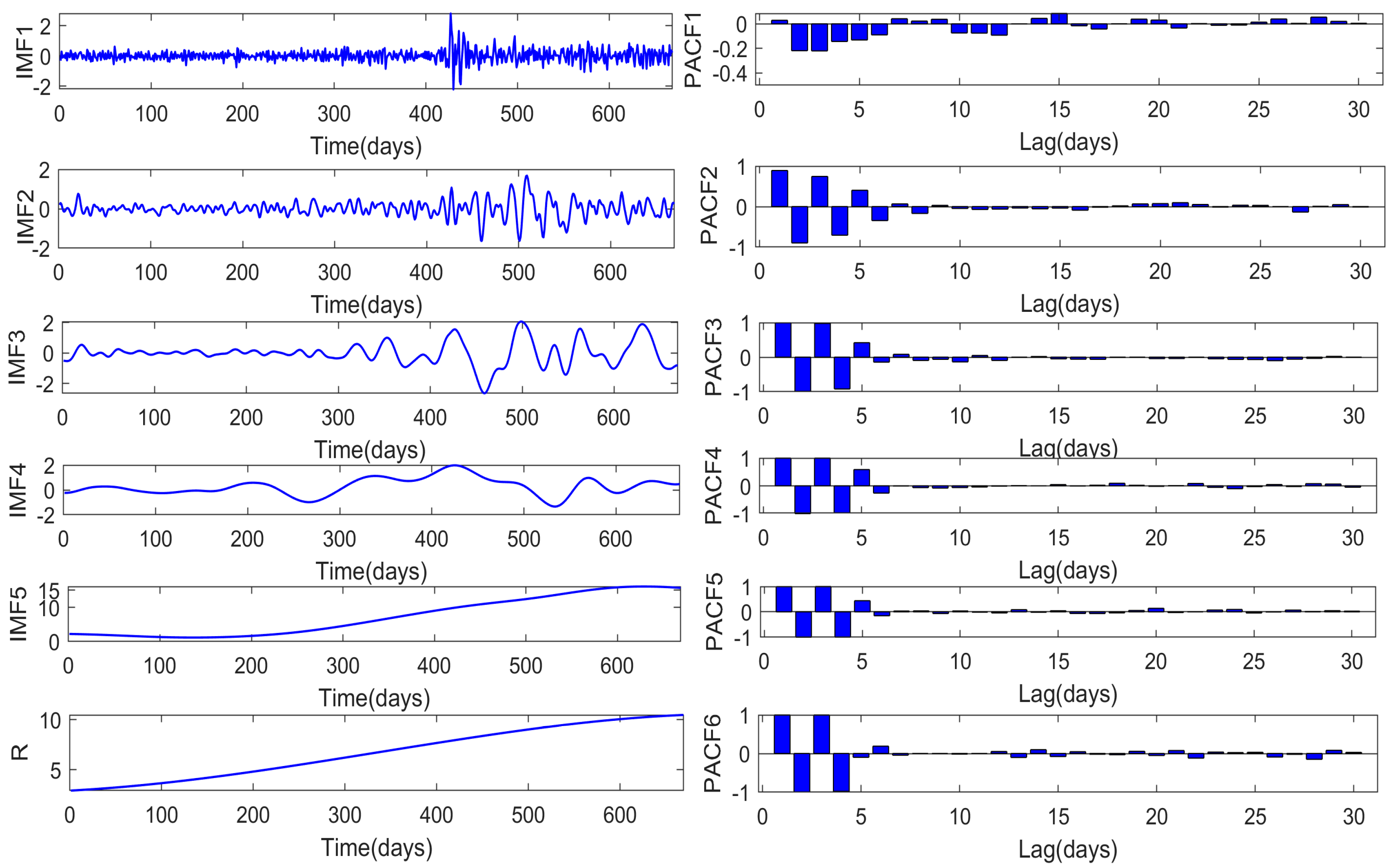

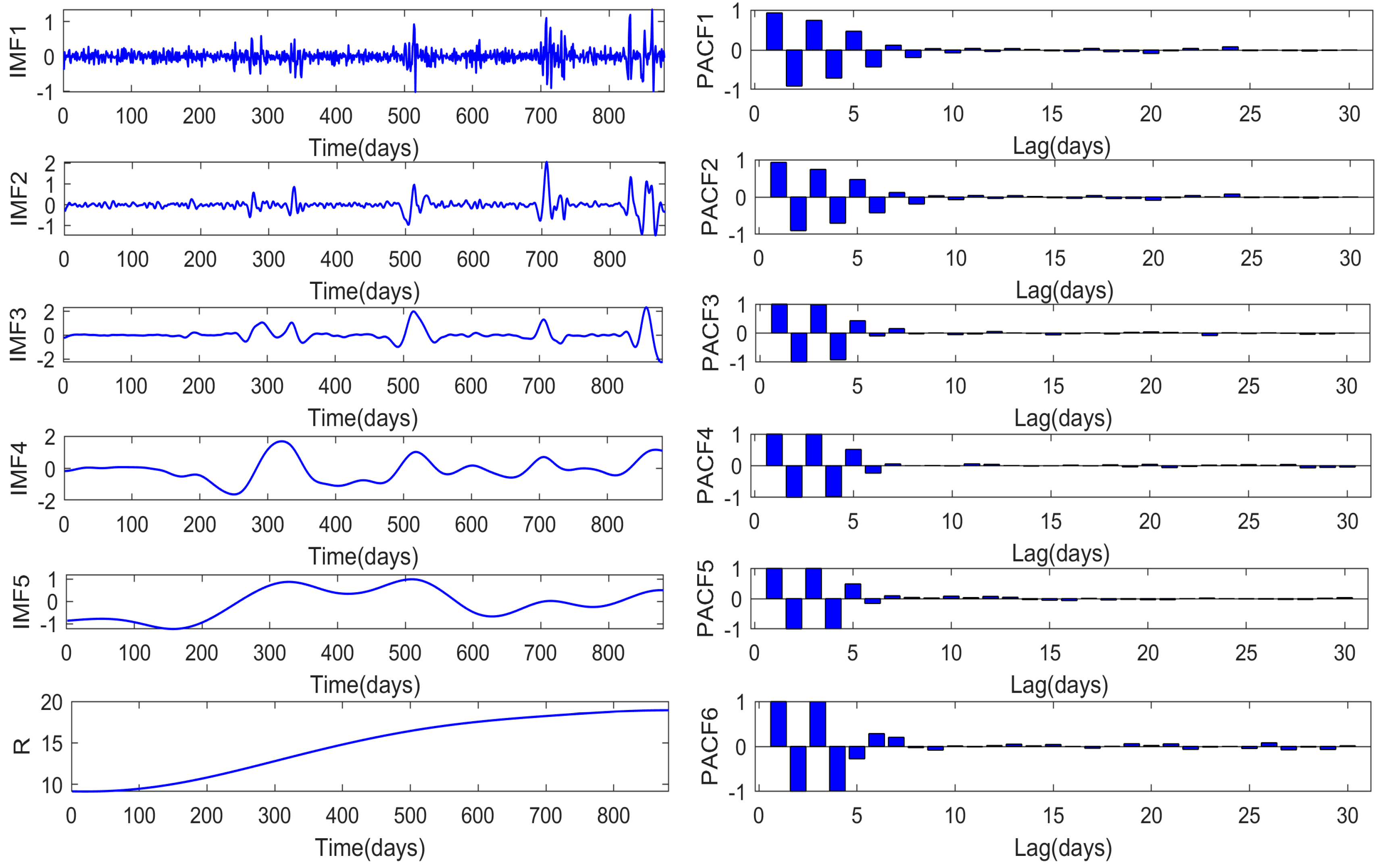

3.4. Carbon Price Decomposition

Aiming to separate carbon price series with higher accuracy and enhance the independence of each mode effectively to reduce information overlap, EEMD is used to realize carbon price decomposition of ECX and KRX. Evenly distributed white noise sequences with amplitude center of 0 are added to the original sequence many times, and each noise sequence is decomposed by EMD. Finally, multiple decomposition results of each mode are integrated into the final mode sequence according to the EEMD principle.

Figure 5 and

Figure 6 show the EEMD decomposition results of two carbon markets. It can be seen from the EEMD decomposition results of carbon price that the regularity of each IMF is more obvious than that of single EMD, which shows that noise-assisted EEMD is effective in carbon price decomposition.

In

Figure 5 and

Figure 6, the carbon price IMF components have obvious symmetry law, and the frequency of the obtained IMFs gradually decreases as the IMF’s serial number rises. In different time periods, the IMF has a regular frequency and amplitude range, which shows that EEMD effectively captures the law of carbon price and realizes modal decomposition.

By further checking the carbon price decomposition effect of EEMD, the description characteristics of EEMD components of two carbon markets in ECX and KRX are calculated; the results are shown in

Table 5. When comparing the standard deviation (SD) of the two markets carbon prices before and after EEMD decomposition, the SD of the decomposed data is smaller than that of the original data. The results show that EEMD significantly reduces the dispersion and irregularity of carbon price. Simultaneously, by comparing the skewness of carbon price before and after EEMD decomposition, it can be found that the skewness of EEMD components is lower than that of the original data, except for the residual component R. This shows that the IMFs obtained from EEMD decomposition have significant symmetry characteristics, when compared to the original carbon price. In addition, R has no obvious symmetry because it represents the main trend of carbon price change. Therefore, EEMD can effectively identify the internal law of carbon price and improve the decomposition effect.

3.5. Selection of Factors Influencing Carbon Price

From autocorrelation of carbon price and influence of energy price, we search for influencing factors of carbon price and determine input variables of the EEMD-IBA-ELM carbon price model. In terms of historical carbon price, PACF is applied to measure correlation between current carbon price and historical carbon price. Simultaneously, the autocorrelation factors of carbon price were determined according to PACF analysis. The autocorrelation influence variables of EEMD decomposition components in the ECX and KRX carbon markets are shown in

Table 6,

Figure 5, and

Figure 6.

Table 7 shows partial correlation coefficients of ECX carbon price IMFs.

According to PACF analysis in

Figure 5 and

Figure 6, we can find that carbon price IMFs are mainly affected by the first several lag variables. When the lag period is greater than 6, correlation between lag variable and IMF decreases significantly. Therefore, the sixth lag variable can be used as an interface of IMF autocorrelation factors. In

Table 7, the autocorrelation factors of IMF are selected from the first six lag variables, according a PACF coefficient.

In

Figure 5, there is a strong autocorrelation between the IMF1 of ECX carbon price and its second and third lagged variables, and there is a significant negative correlation between the two influencing factors and carbon price. From the fourth lag variable, there is only a weak correlation between the lag variable and carbon price. Therefore, the second and third lagged variables can be taken as the influencing factors of IMF1 of ECX carbon price. In the same way, the remaining IMFs and R of ECX carbon price are strongly correlated with the previous lagged variables, and there is a clear boundary between the strongly correlated lagged variables and the weakly correlated lagged variables. In

Figure 6, a similar conclusion can be drawn from the PACF analysis of KRX carbon market. Therefore, by extracting the influencing factors of carbon price IMFs and R according to partial correlation coefficient, the main internal influencing factors of carbon price are included in a few selected variables, which reduces the number of input variables of carbon price prediction model and increases representativeness of the influencing factors of carbon price.

BCOFP, NGFP, and WTOFP reflect price fluctuation of world major energy futures. BCOFP and WTOFP represent the fluctuation of international oil price, while NGFP represents natural gas price information. Changes in energy prices influence the relationship between energy supply and demand and lead to changes in carbon emissions, which promotes the fluctuation of carbon demand and price.

In addition, person correlation coefficients of BCOFP, NGFP, and WTOFP with ECX carbon price were 0.742, 0.598, and 0.748, respectively. The person correlation coefficients of BCOFP, NGFP, and WTOFP with KRX carbon price were 0.729, 0.522, and 0.865, respectively. The results show that there is evident correlation between the three selected variables reflecting energy prices and carbon prices. Therefore, BCOFP, NGFP, and WTOFP are used as input variables of the EEMD-IBA-ELM carbon price model to enhance information capture ability of the model and improve prediction effect.

4. Empirical Analysis of Carbon Price Prediction

Aiming to test accuracy and stability of the carbon price model, ECX and KRX carbon trading prices were selected as data samples. These two carbon markets have significant differences in trading volume and carbon price volatility, which can effectively test the prediction effect of the carbon price model on differentiated carbon price and universality of the model. Simultaneously, the classic BP and SVM intelligent prediction methods are used as comparison methods in this part to verify superiority of the EEMD-IBA-ELM carbon price model.

4.1. Parameter Setting

Compared to the traditional neural network, single ELM has a higher learning speed and better optimization strategy, but the model lacks stability and depth optimization ability. The weight and threshold parameters generated randomly cannot ensure that ELM can build superior intelligent structure every time. Here, sigmoid is used to realize the kernal mapping of ELM. Combining ELM with the improved BA algorithm, the IBA-ELM carbon price prediction model is established.

The number of hidden layers is the basic parameter of ELM. For different data types and practical problems, the number of hidden layers of elm should be set according to specific needs. Too few hidden layers make it difficult to extract the effective information of input variables, and a large number of useful information is over compressed. Simultaneously, too many hidden layers will lead to over fitting of ELM, and the effect of a large number of invalid information will be magnified, resulting in nonideal final model output. Referring to the number of input variables of the IBA-ELM carbon price model, the hidden layer node of ELM is set to 9.

In bat algorithm, pulse loudness and emissivity affect the speed and accuracy of individual bat optimization. The number of bat individuals and iterations should be large enough. Too few bats impact the stability of the algorithm, and cannot produce ideal output results in some optimization processes. Simultaneously, lack of iterations will also lead to the current global optimal solution not meeting the set requirements. In addition, sufficient bat individuals are the basis and condition for the realization of information interaction mechanism, and also guarantee the effectiveness of the IBA algorithm. Combined with the effective IBA algorithm and ELM, IBA-ELM will produce stable prediction results.

4.2. Training Carbon Price Model

Aiming to optimize the IBA-ELM algorithm and build a robust IBA-ELM carbon price model, the influencing factors of carbon price are taken as the eigenvalues of bats in the IBA algorithm, and ELM prediction error is taken as a fitness function value of the IBA algorithm.

Figure 7a,b shows parameter space and iterative curve of the IBA algorithm, respectively. In

Figure 7a, weight

w, threshold

b, and fitness of ELM constitute parameter space of ELM. A global optimal fitness value is seen. Single ELM has randomness of parameters and it is difficult to find the parameters w and b corresponding to the optimal fitness effectively. Therefore, IBA is used to quickly find the optimal values of ELM parameters

w and

b and

Figure 7b shows the search process of IBA. The iteration curve of IBA shows that the error of IBA-ELM decreases gradually with increase in calculation times and tends to be stable after the 25th iteration, indicating that the model has found a better solution. Although the solution is not necessarily the optimal solution, the error of the solution is infinitely close to the global optimal solution and meets the needs of carbon price prediction.

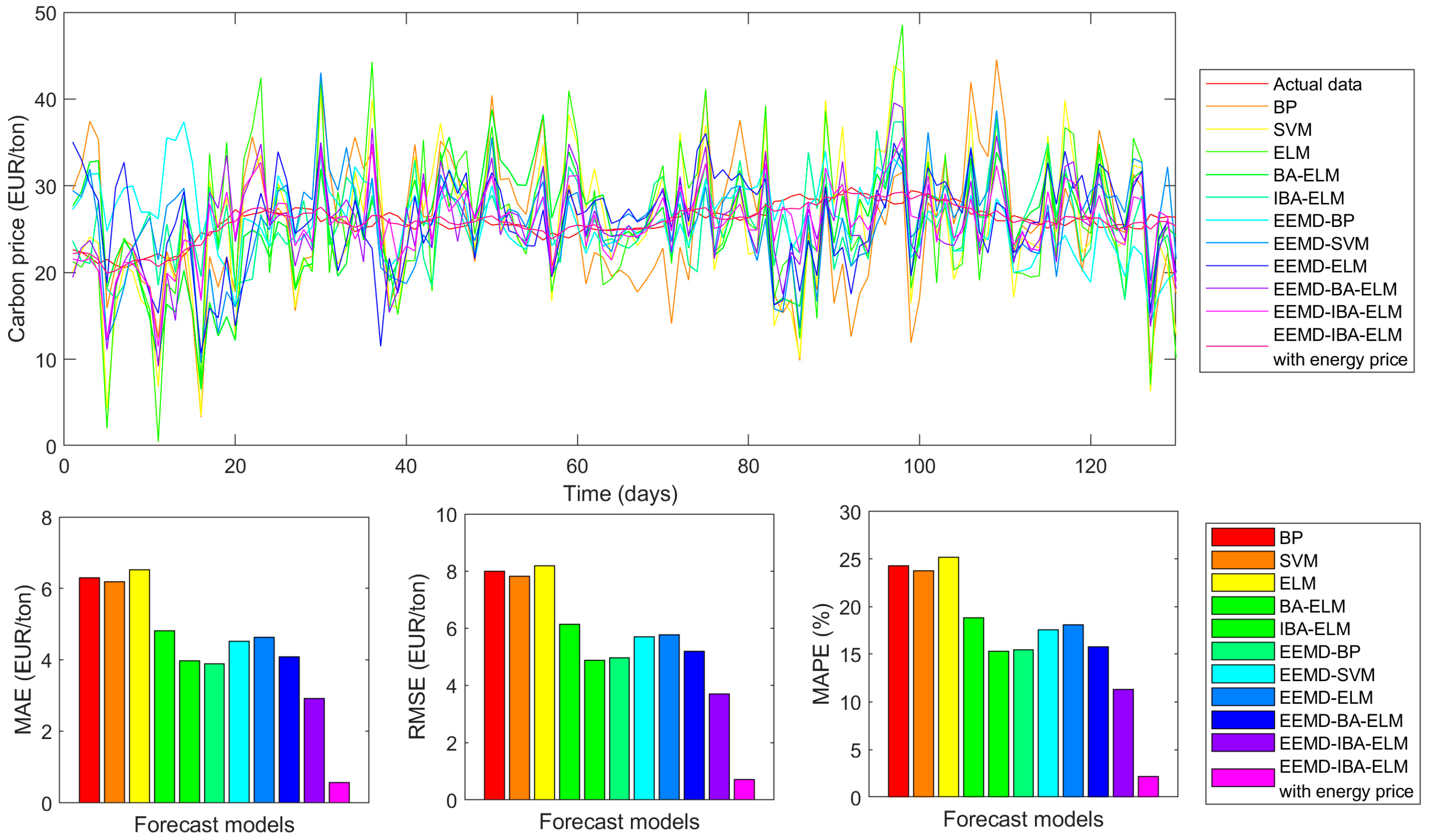

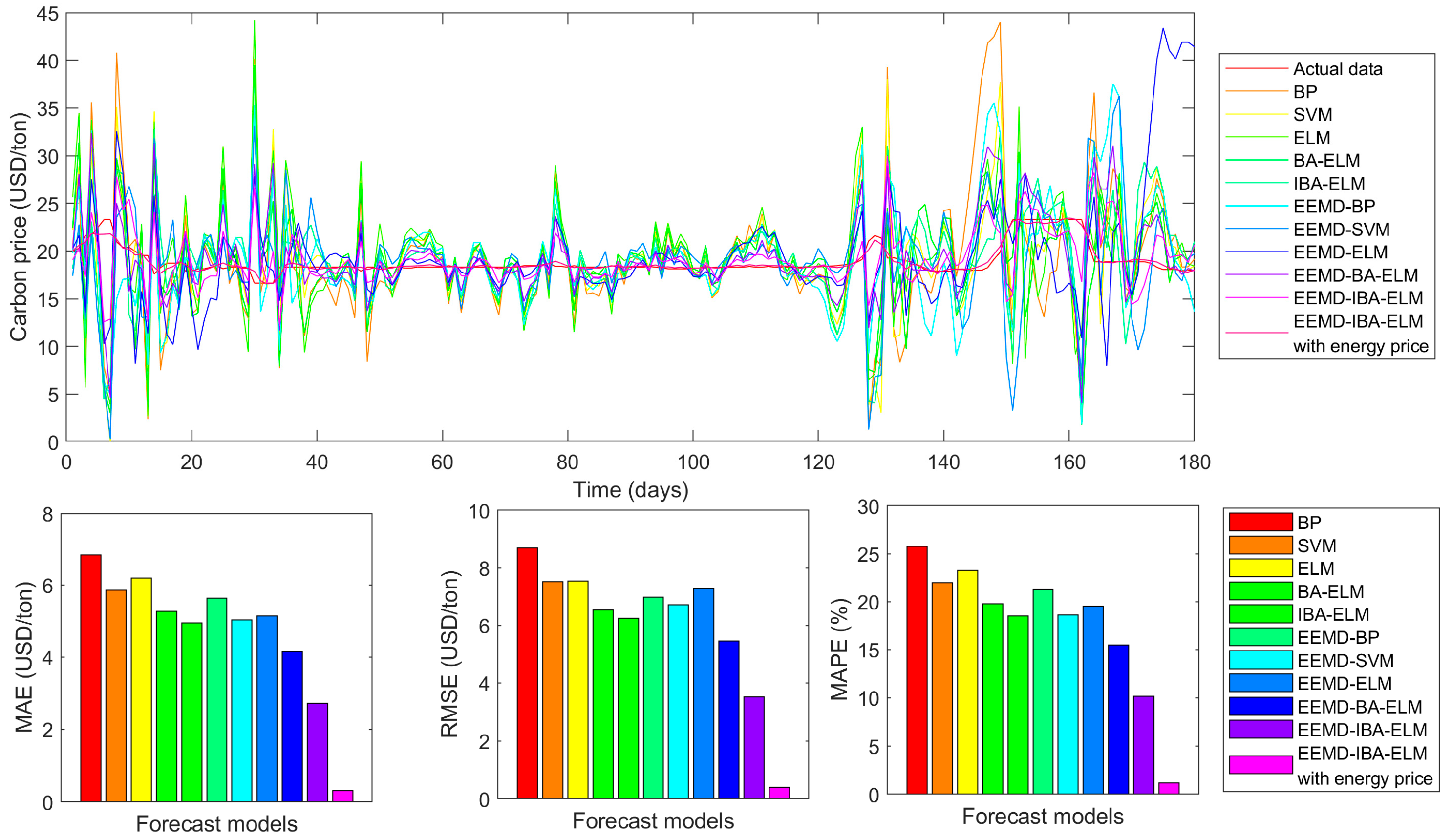

4.3. Carbon Price Prediction and Error Evaluation

As the selection of parameters affects the convergence effect of BA and stability of ELM, the basic parameters of BA and ELM are selected as shown in

Table 8. The EEMD-IBA-ELM prediction model is set with the parameters in

Table 8, and the carbon prices of ECX and KRX are empirically predicted. Simultaneously, mean absolute error (MAE), root mean square error (RMSE), and mean absolute percent error (MAPE) are used to measure prediction effect as Equations (19)–(21) when P

MAE, P

RMSE and P

MAPE are used to measure improvement degree as Equations (22)–(24):

where,

and

represents predicted value and actual value, respectively. Simultaneously, a represents the basic model and b represents the optimization model.

6. Conclusions

A novel carbon price prediction method is constructed based on EEMD, IBA, and ELM in this paper. First, EEMD improves the separation efficiency of carbon price components and high-precision carbon price characteristic IMFs are acquired. Secondly, IBA establishes the information sharing mechanism of the BA algorithm and improves its optimization efficiency by using horizontal cross strategy. Simultaneously, ELM is optimized by IBA to enhance the stability and prediction accuracy of the model. Finally, EEMD-IBA-ELLM is proven to be effective in carbon price prediction by comparing with the comparison model, and the introduction of BCOFP, NGFP, and WTOFP can further improve the prediction effect. The main conclusions of this study are as follows:

- (1)

The carbon price sequence has significant complexity and irregularity. With the aid of white noise decomposition, the carbon price is decomposed into several independent feature components, which greatly reduces the difficulty of carbon price prediction and improves the prediction accuracy.

- (2)

In the empirical analysis of the ECX and KRX carbon markets, EEMD-IBA-ELM has the best prediction accuracy and effect. Therefore, EEMD-IBA-ELM is an effective and feasible carbon price forecasting tool, which will help carbon market managers to supervise market operation and help carbon trading investors make investment decisions. At present, carbon markets are becoming more and more active and ECX and KRX carbon markets are typical representatives of the active carbon market. Therefore, EEMD-IBA-ELM is an effective method to predict current price fluctuation of carbon trading.

- (3)

There is a high correlation between energy prices and carbon prices, which reflects that changes in energy systems have a significant impact on carbon emissions and carbon trading. By introducing the energy price factor into the EEMD-IBA-ELM carbon price model, we can achieve a more accurate prediction. In addition, the energy sectors can effectively reduce carbon emissions and promote development of the carbon market by adjusting energy supply and consumption structure.

In this study, a new method of carbon price analysis and prediction is established, which improves accuracy of carbon price prediction. Simultaneously, introduction of energy price can improve the prediction effect of carbon price. However, energy spot price is not considered due to lack of historical data. In the future, energy spot price can be considered in carbon price prediction.