1. Introduction

Despite the efforts of governments around the world, access to electric energy in isolated regions remains a challenge [

1,

2]. Isolated/Islanded Microgrids (IMGs) could play a significant role in providing power to these areas where extending the utility grid is not economically feasible [

3]. The implementation of Demand-Side Management (DSM) in the planning of Microgrids (MGs) reduces total costs, Levelized Cost of Energy (LCOE), and customer payments, or increases renewable energy utilization [

4,

5,

6,

7,

8,

9]. In this regard, it seems interesting to investigate if the application of DSMs in the planning of IMGs can bring similar benefits. Despite this, there is a paucity of literature exploring how DSMs can affect IMGs’ planning and operation.

The implementation of DSM aims to affect the patterns of consumer consumption using direct or indirect strategies [

10,

11]. Direct strategies are composed of Direct Load Control and Interruptible/Curtailable Programs. In Direct Load Control strategies, there is a remote controller sending signals to customers’ appliances, like air conditioners, heating systems, water heaters, or public lighting, on short notice. The signals can turn the appliances on/off, switch tariffs, or inform about current electricity prices. Interruptible/Curtailable Programs offer alternatives as biding programs, Emergency Demand Response (DR) programs, Capacity Market programs, and ancillary services, such as frequency support [

12,

13]. Indirect DSMs are composed of pricing programs, rebates/subsidies, and education programs. Pricing programs charge dynamic tariffs for energy, which can be power-based, energy-based, or a combination of both [

14,

15]. Energy-based tariffs incentivize energy conservation, and, therefore, are desired in IMG applications, where the energy generation is limited [

16]. Instead of having a fixed flat rate, dynamic fares vary in time to reveal the actual costs of producing energy. These rates include the Time of Use (ToU) rate, Critical Peak Pricing (CPP), Extreme Day Pricing (EDP), Extreme Day Critical Peak Pricing (ED-CPP), Day-Ahead Dynamic Pricing (DADP), and Real-Time Pricing (RTP). Properly designed tariffs motivate the customers to shift their demand to off-peak periods, when the electricity price is lower and it is more convenient to produce electricity [

17].

Some works in the literature explore how DSM affects the planning of MGs. Kahrobaee et al. propose a sizing approach to determine the capacity of a Wind Turbine and a Battery Energy Storage System (BESS) for a smart household considering price variations in the tariffs [

18]. The authors designed a three-step process combining a rule-based controller, a Monte Carlo approach, and a Particle Swarm Optimization to perform the sizing of the components. However, the uncoordinated combination of multiple stages and the lack of an optimization formulation for energy management can lead to sub-optimal results. Erdinc et al. [

19] aimed to address these drawbacks by providing a Mixed Integer Linear Programming (MILP) formulation to design an optimal energy management strategy. The work considers the seasonal and weekly variations in the load profiles in the presence of a Real-Time Pricing tariff scheme. However, it does not consider how to design the DSM itself and how different DSMs will impact the sizing of the energy sources. Kerdphol et al. propose a sizing approach for BESS using Particle Swarm Optimization to improve the frequency stability of an MG [

20]. The work integrates a dynamic DSM considering load shedding of non-critical loads to rapidly restore the system frequency and reduce the BESS capacity. A rule-based controller used for the load shedding and a Particle Swarm Optimization formulation used for the sizing of the BESS prove to be adequate to regulate the frequency of the MG. However, the rule-based controller and the lack of forecast models to anticipate the critical events can lead to sub-optimal results.

Nojavan et al. [

21] propose a bi-objective Mixed-Integer Non-Linear Programming (MINLP) formulation to optimally site and size a BESS in an MG considering DSM. The authors designed two optimization objectives to reduce total costs and Loss of Load Expectation. The work uses an

-constraint method to draw the Pareto optimal curve and a fuzzy satisfying technique to find the best solution. Nevertheless, the authors assume that

of the load reacts to a Time of Use (ToU) tariff, ignoring the effects of the demand’s self-elasticity. Majidi et al. use a Monte Carlo Scenario reduction technique to determine the size of a BESS in an MG [

22]. The work considers the effects of uncertainties in the forecasted renewable generated power and forecasted consumption. However, similarly to [

21], the authors do not consider how the customers react to the DSM; they assume that

of the load will react to a ToU tariff. Amir et al. [

23] propose a combined algorithm to find the size and energy management strategy of a Multi-Carrier Microgrid. The work proposes a mathematical model with high sophistication that uses an MINLP formulation to obtain the optimum dispatch strategy and Genetic Algorithms to obtain the capacities of the energy sources. The work measures the changes in the patterns of consumption of the customers considering varying prices for the different forms of energy. The planning of the Multi-Carrier Microgrid considers demand and price growth over a five-year optimization horizon. Nevertheless, this work does not design the DSM. It only considers the effects of the prices of the energy providers on the Multi-Carrier Microgrid.

Planning of IMGs refers to the set of decisions that the planner must make to design an IMG project. Such decisions include: Setting the energy mix, computing the sizing of the energy sources, and defining the energy dispatch strategy, the economic incentives, and the energy tariffs, amongst others [

24,

25,

26]. This set of decisions has significant consequences on the performance of IMG projects, where high penetration of renewable energy sources can reduce system inertia, thus challenging system frequency regulation, control schemes, and transient stability [

13]. DSMs can partially solve some of the inherent challenges of planning IMGs.

Chauhan et al. propose to compute the sizing of the energy sources of an IMG considering a DSM that reschedules shiftable loads depending on if it is the winter or summer season [

27]. The work uses an Integer Linear Programming (ILP) formulation to find the optimal rescheduling of shiftable loads and a Discrete Harmony Search algorithm to compute the sizing. A considerable drawback of the work is that the DSM only focuses on reducing the peak demand while ignoring maximizing exploitation of renewable energy. Amrollahi et al. combine an MILP formulation and the capabilities of HOMER software to compute the sizing of an IMG composed only of renewable energy sources [

28]. Due to the lack of dispatchable energy sources, the authors propose the use of a DSM to reschedule shiftable loads. Rescheduling helps to balance mismatch between electric energy generation and consumption. Mehra et al. propose a work to measure the economic value of applying DSM in the sizing of a nanogrid [

29,

30]. The work considers the dis-aggregation of electrical demand in critical and non-critical appliances. In addition, the work takes advantage of low-cost computation intelligent devices, such as the “utility-in-a-box” solution, to implement active DSM [

31]. The authors use an exhaustive search algorithm to determine the capacities of the Photo-Voltaic (PV) system and the BESS. Nevertheless, the work considers the effects of only one kind of DSM over a small-sized grid.

Prathapaneni et al. propose a multi-objective stochastic sizing algorithm that aims to minimize lifetime costs and degradation of the energy sources [

32]. The work considers the effects of a DSM that uses shiftable loads, like electric vehicles or pumped hydro storage in an IMG. The work uses an Accelerated Particle Swarm Optimization (APSO) to compute the sizing of energy sources. Despite considering lifetime costs of the IMG and degradation of energy sources, the work considers a basic DSM over reduced amounts of loads that are not always present in IMG applications. Luo et al. propose a sizing methodology for an IMG using a bi-level optimization algorithm [

33]. The first level computes the energy sources’ capacities, considering the effects of different combinations of public subsidies for the installation of energy sources. The second level performs the dispatch strategy for the energy sources of the IMG using an MINLP formulation. In the second level of optimization, the authors implement a rescheduling mechanism of shiftable loads. A study case shows that DSM reduces installed capacities of the energy sources for the IMG.

Kiptoo et al., similarly to [

28], aimed to implement a DSM to balance generation and electricity demand in an IMG only composed of renewable energy sources [

34]. The DSMs consider rescheduling shiftable loads. However, the authors aim to improve the work of [

28] by adding an electrical demand forecasting module using a Random Forest (RF) regression forecasting approach. The work shows that the proposed methodology reduces the total costs of the IMG project by

. Rehman et al. used HOMER software to find capacities of energy sources in an IMG [

35]. The work considers a DSM capable of rescheduling shiftable loads and uses Simulink to evaluate the operation of the IMG. The use of Simulink allows the authors to design and test a model predictive control. The model predictive control controls the power during grid-connected operation and regulates load voltage in the islanding operation of the MG.

Table 1 summarizes the works found in the literature that deal with the integration of DSM in the planning of IMGs, and that highlight knowledge gaps and the characteristics of the present work. It is vital to notice that

Table 1 presents only the articles that consider IMGs because they are strictly related to the present work.

Despite that some of the works found in the literature evaluate the effects of DSM in the planning phase of MGs and IMGs, none of them compare the effects of different DSMs using the same test-bench. The works found by authors do not focus on design and impact evaluation of DSM over total costs and operational aspects of IMG projects. Moreover, few of the works consider the financial aspects of the cooperation between private and public capital to fund IMG projects. Additionally, none of them allow defining tariffs that guarantee the sustainability of the IMG project over time. In this regard, the present article aims to fulfill gaps found in the literature review by providing a methodology capable of:

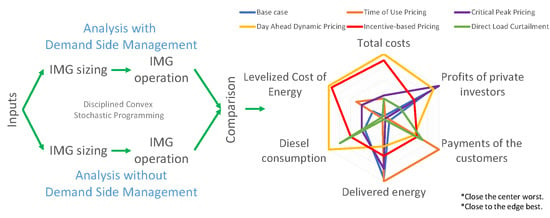

Obtaining the optimal sizing and the optimal energy dispatch strategy of an IMG project using a Disciplined Convex Stochastic Programming formulation.

Obtaining the optimal energy tariffs and stimulus for the DSM to guarantee the financial viability of an IMG project.

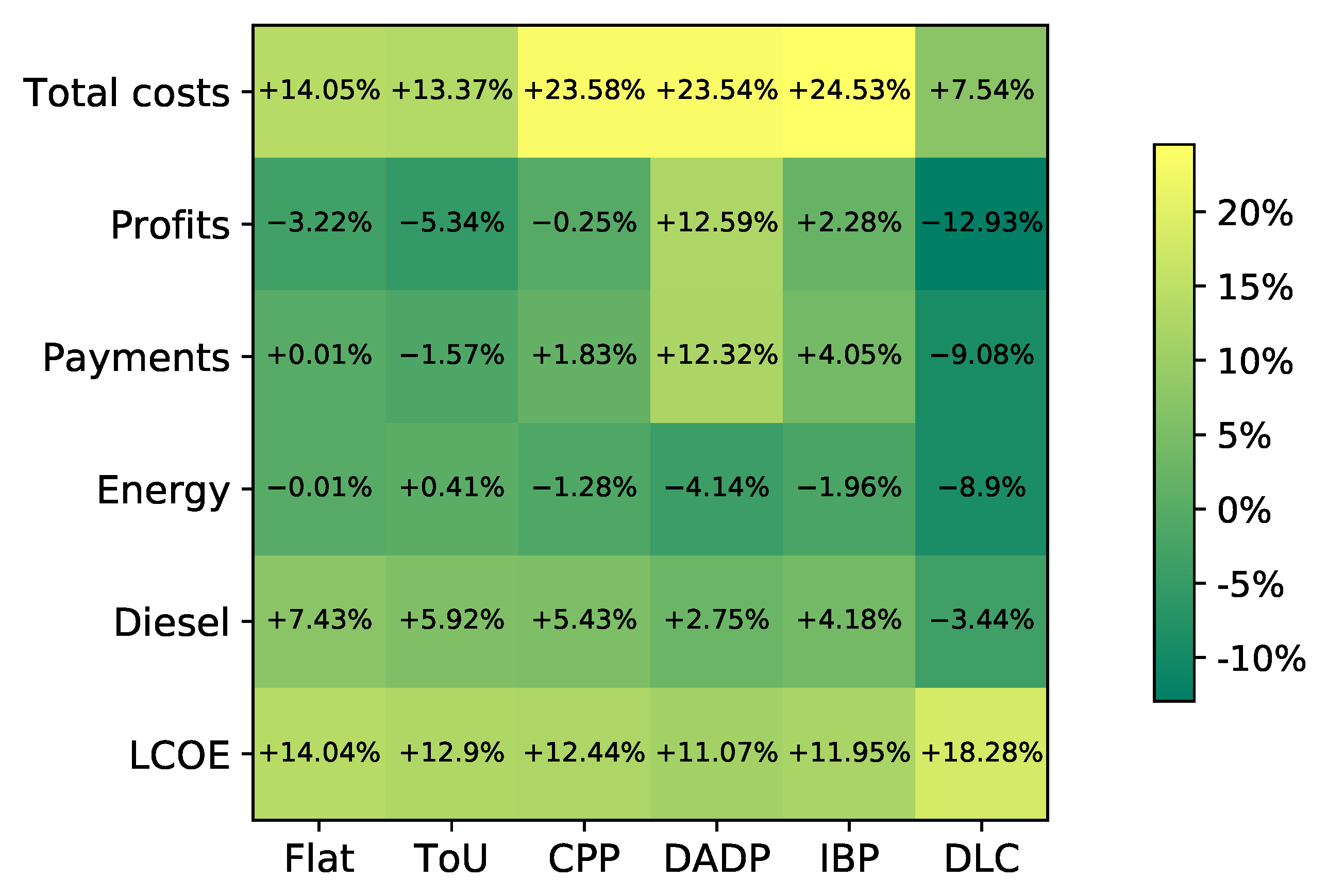

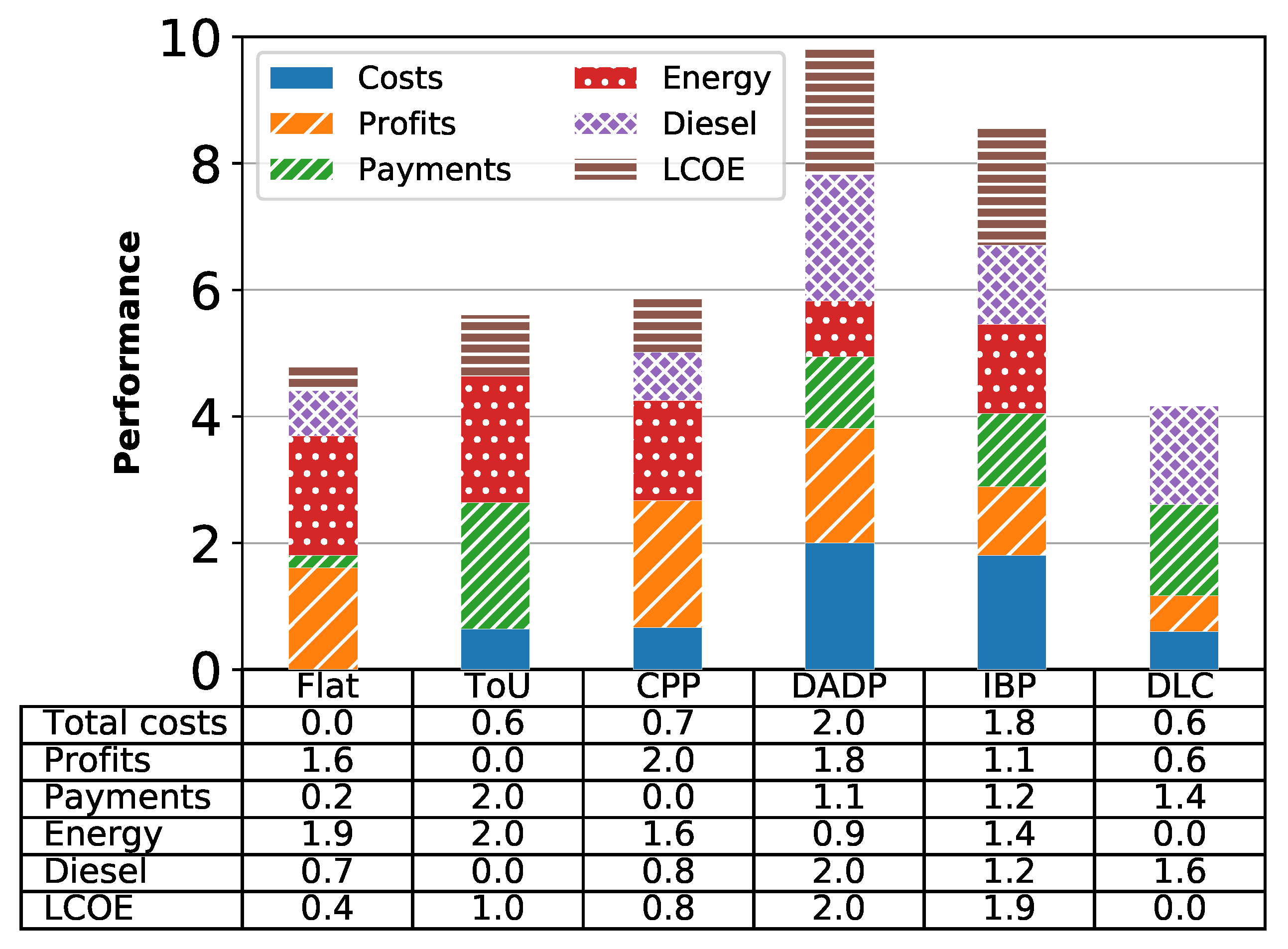

Evaluating the impacts of different strategies of DSMs over sizing, energy management, and costs of an IMG project in a case study.

Implementing and evaluating different DSMs in the planning of IMGs using the same test-bench.

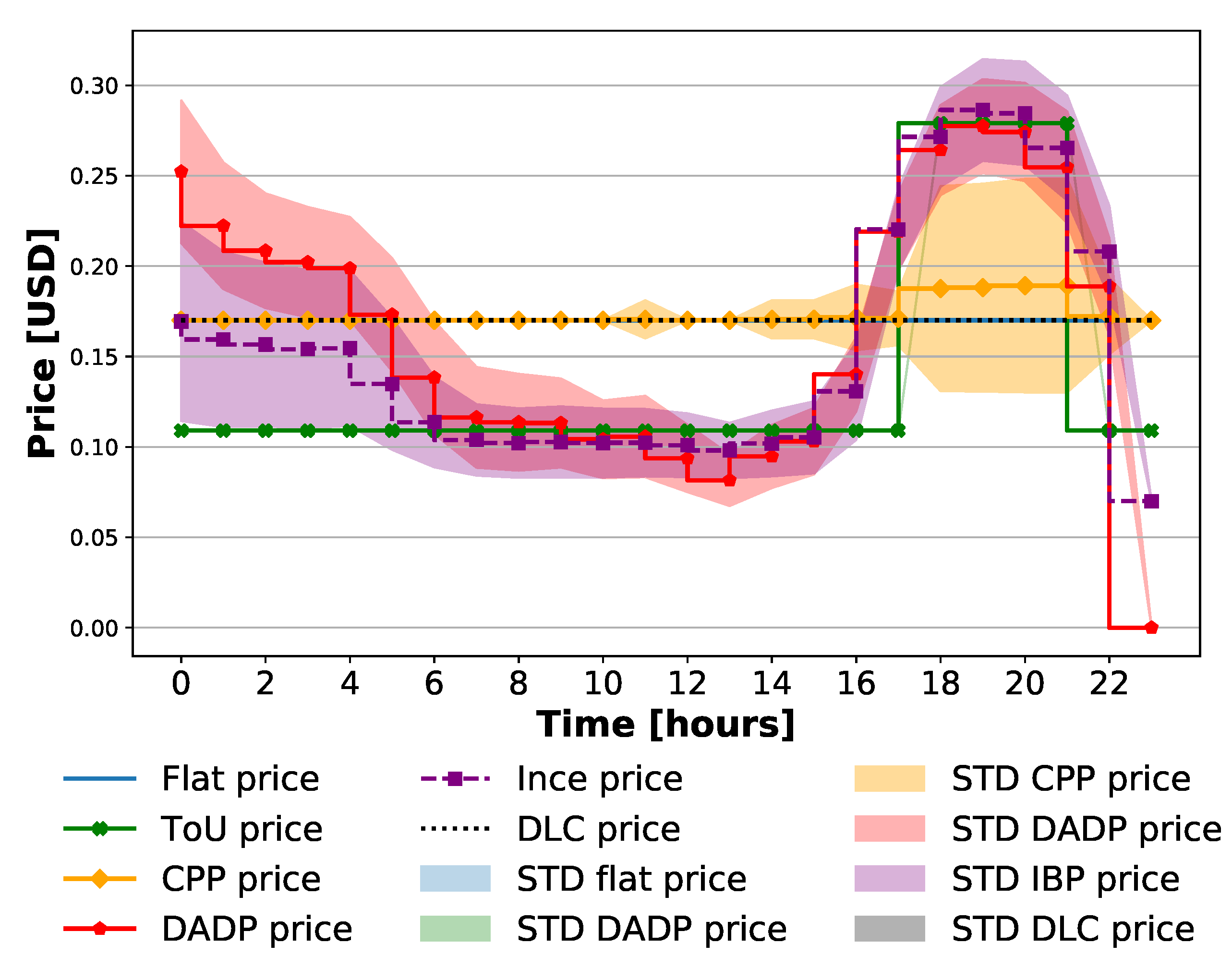

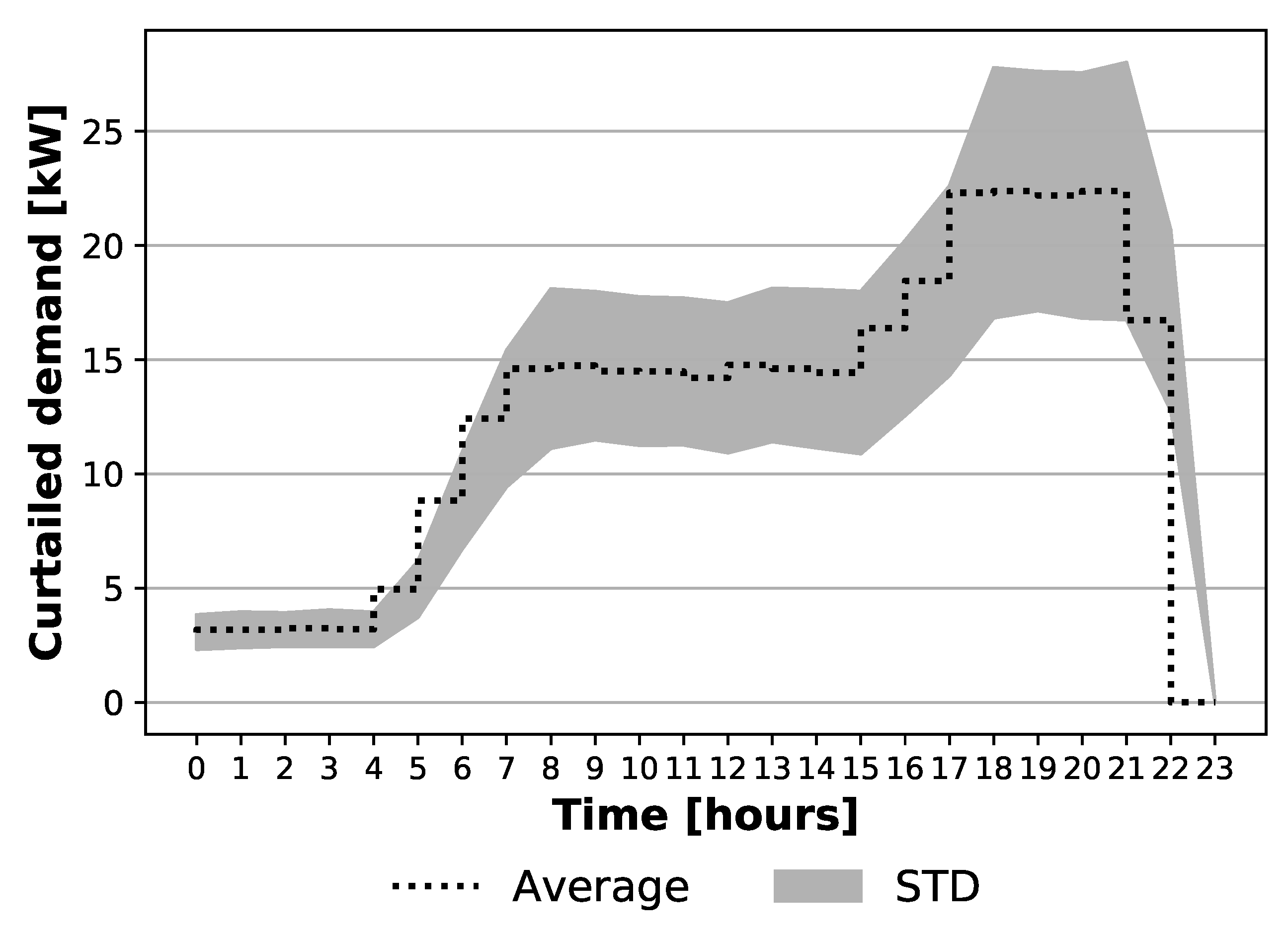

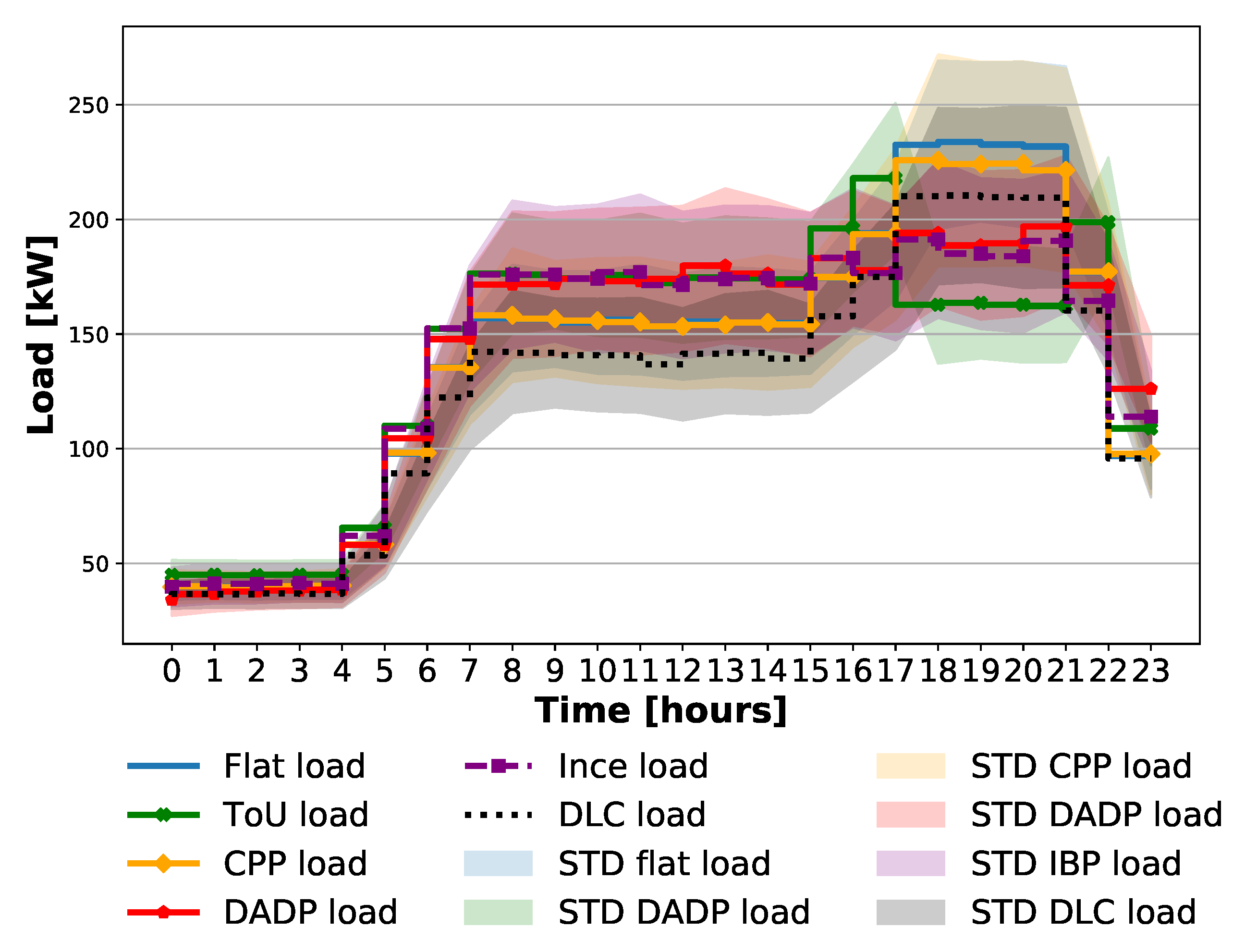

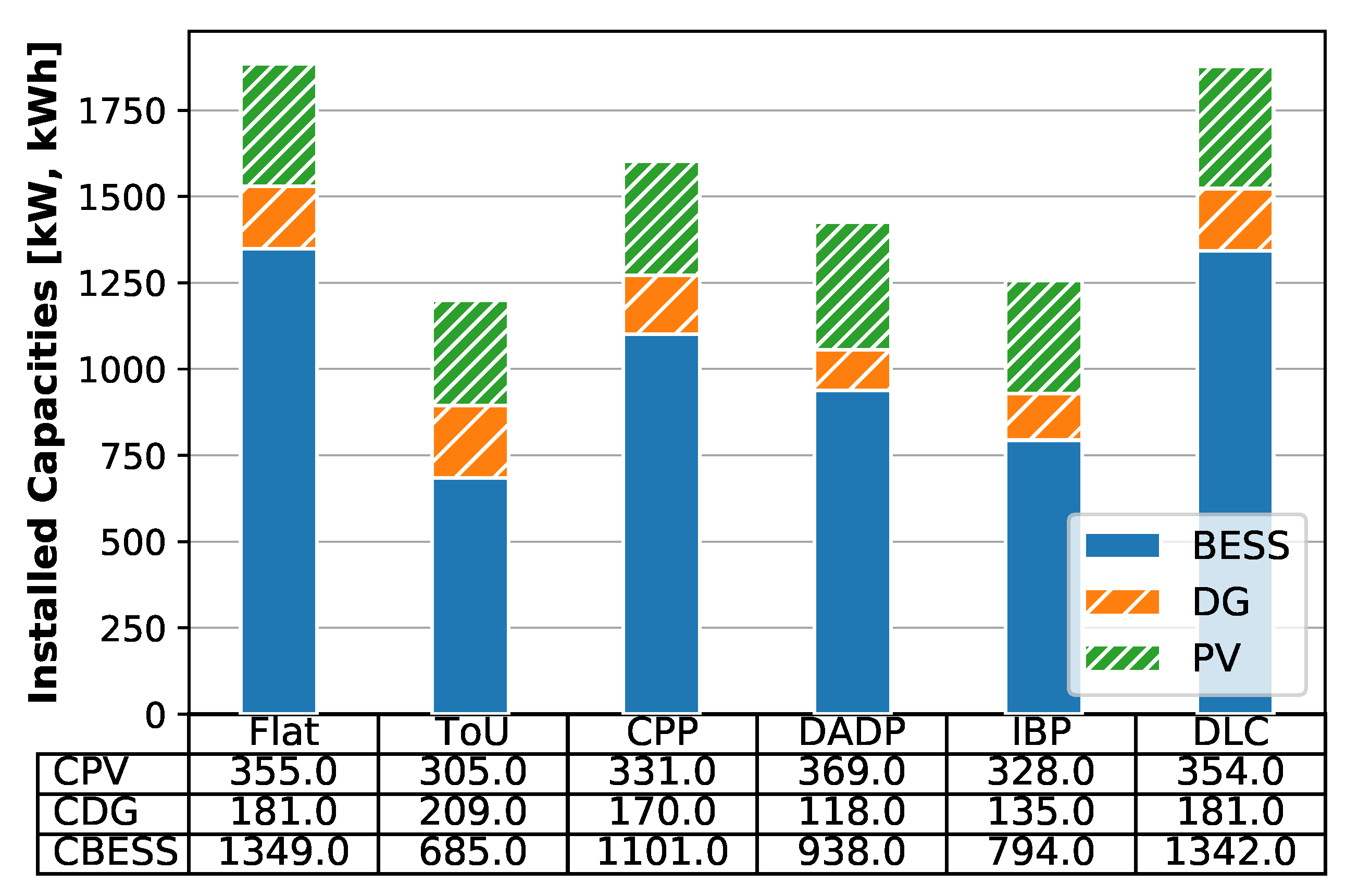

The formulation uses flat, ToU, CPP, DADP, and Incentive-Based Pricing (IBP) tariffs as DSM strategies. It also proposes a Direct Load Curtailment (DLC) strategy that curtails customers’ electrical demand if required.

The formulation assumes that the DSMs modify the patterns of consumption of the customers, which will lead to a change in the capacities of energy sources [

36,

37,

38,

39]. The results of the application of the methodology provide the optimal size of the energy sources, the optimal energy dispatch, the optimal tariffs, the economic incentives, and the load curtailment. The rest of the article proceeds as follows:

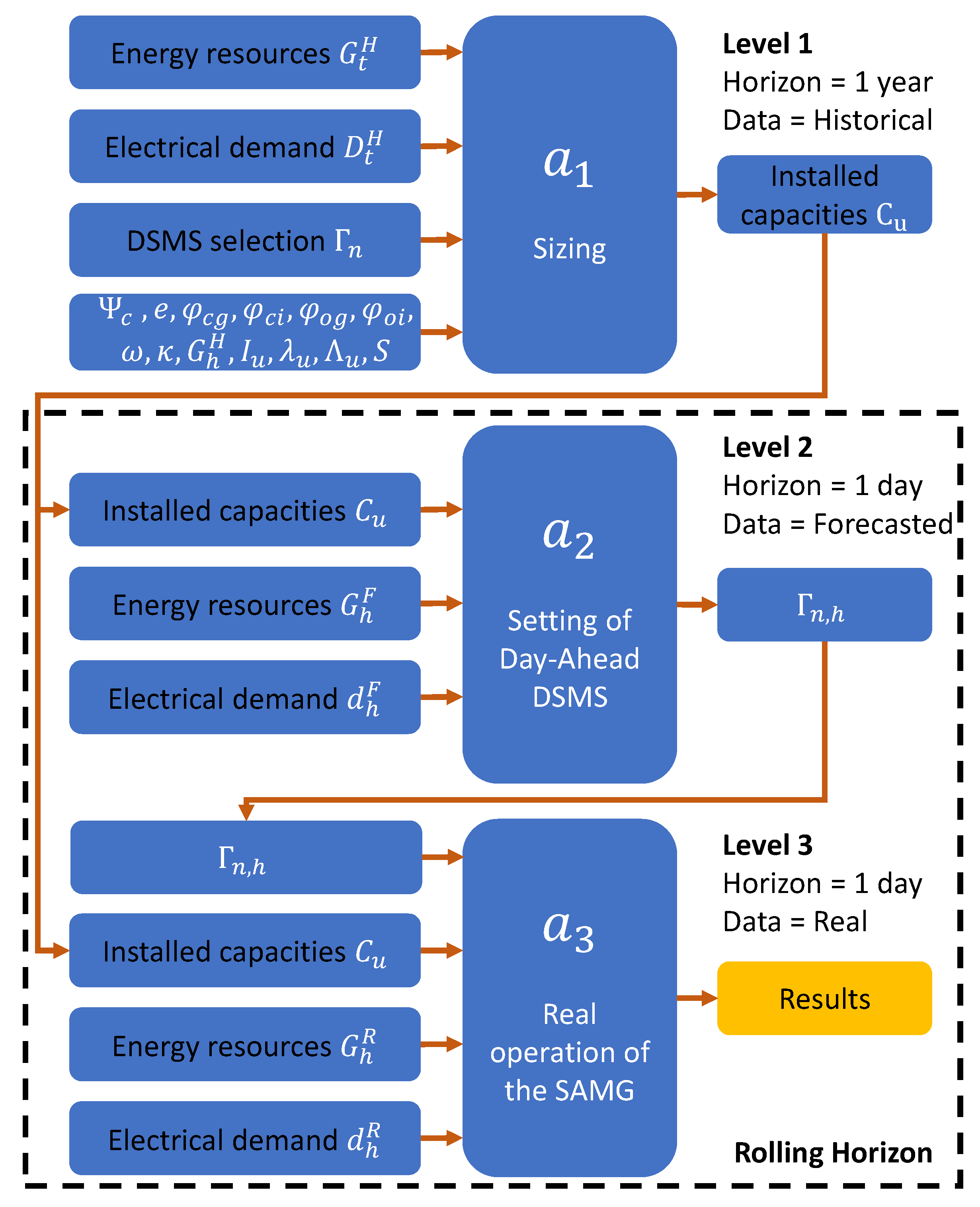

Section 2 presents the definition of the problem and the proposed solution.

Section 3 presents a case study as an example of the application of the methodology, and

Section 4 includes its results and analysis. Finally,

Section 5 presents the conclusions of the work and future directions.

3. Case Study

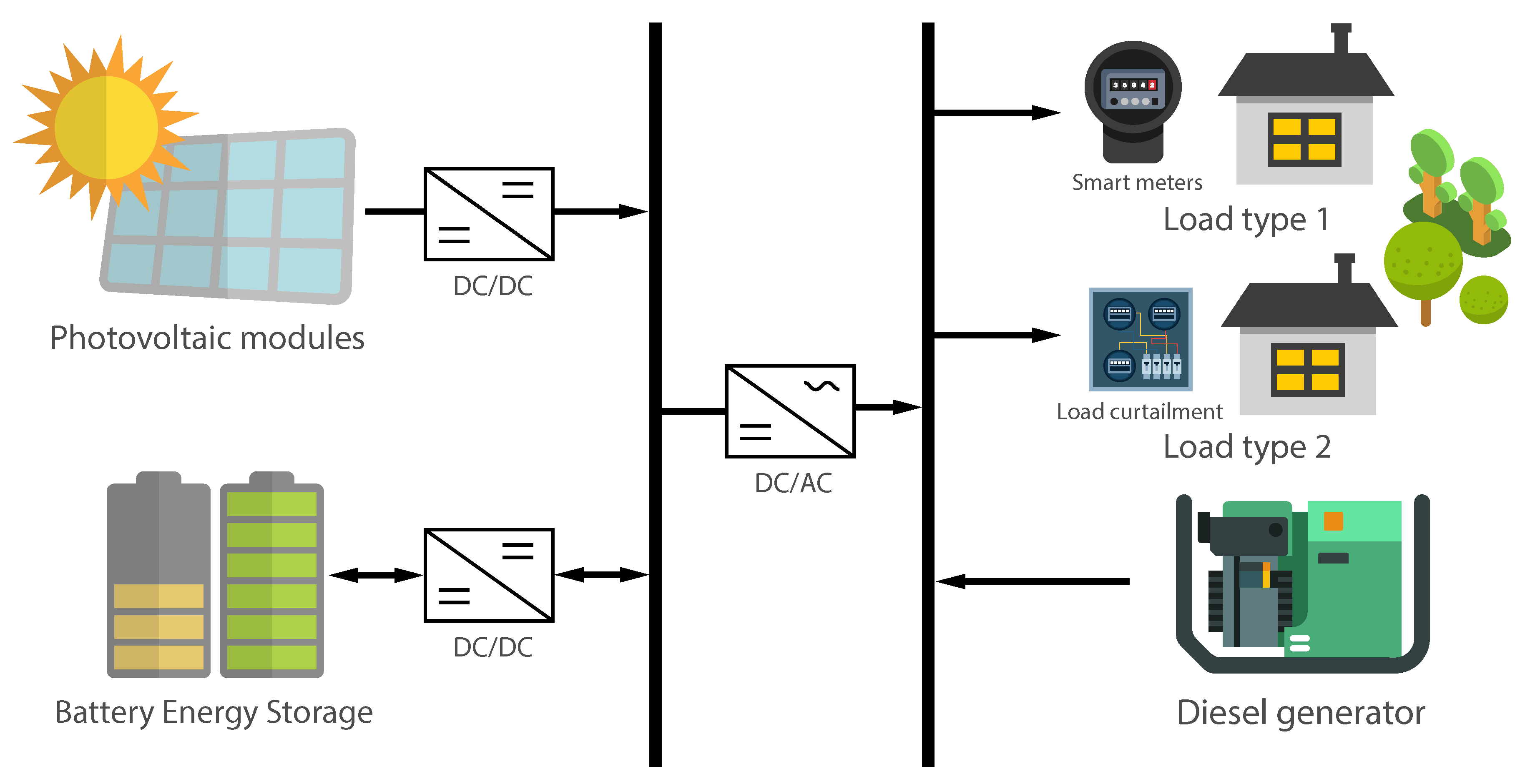

The case study aims to illustrate the capabilities and performance of the proposed methodology and considers the design of an IMG composed of a PV, a BESS, and a Diesel Generator (DG) System, as

Figure 2 shows. The case study assumes that the microgrid can have two different types of load. The case study uses the load type one when the planner chooses a DSM based on price. The load type one has Smart Meters. The case study uses the second type of load when the planner decides to use the DSM based on DLC. The second type of load has a device as “GridShare” to perform the curtailment of the electrical demand [

31]. The case study considers six IMG designs: Baseline case (flat tariff and no DSM) and one design for each of the proposed DSM (ToU, CPP, DADP, IBP, DLC). The results of the designs using DSM are compared with the baseline case design. All of the optimization formulation was written in Python 3.7 using the CVXPY 1.0 package [

49,

50]. The selected solver is MOSEK, due to its flexibility, speed, and accuracy [

51,

52].

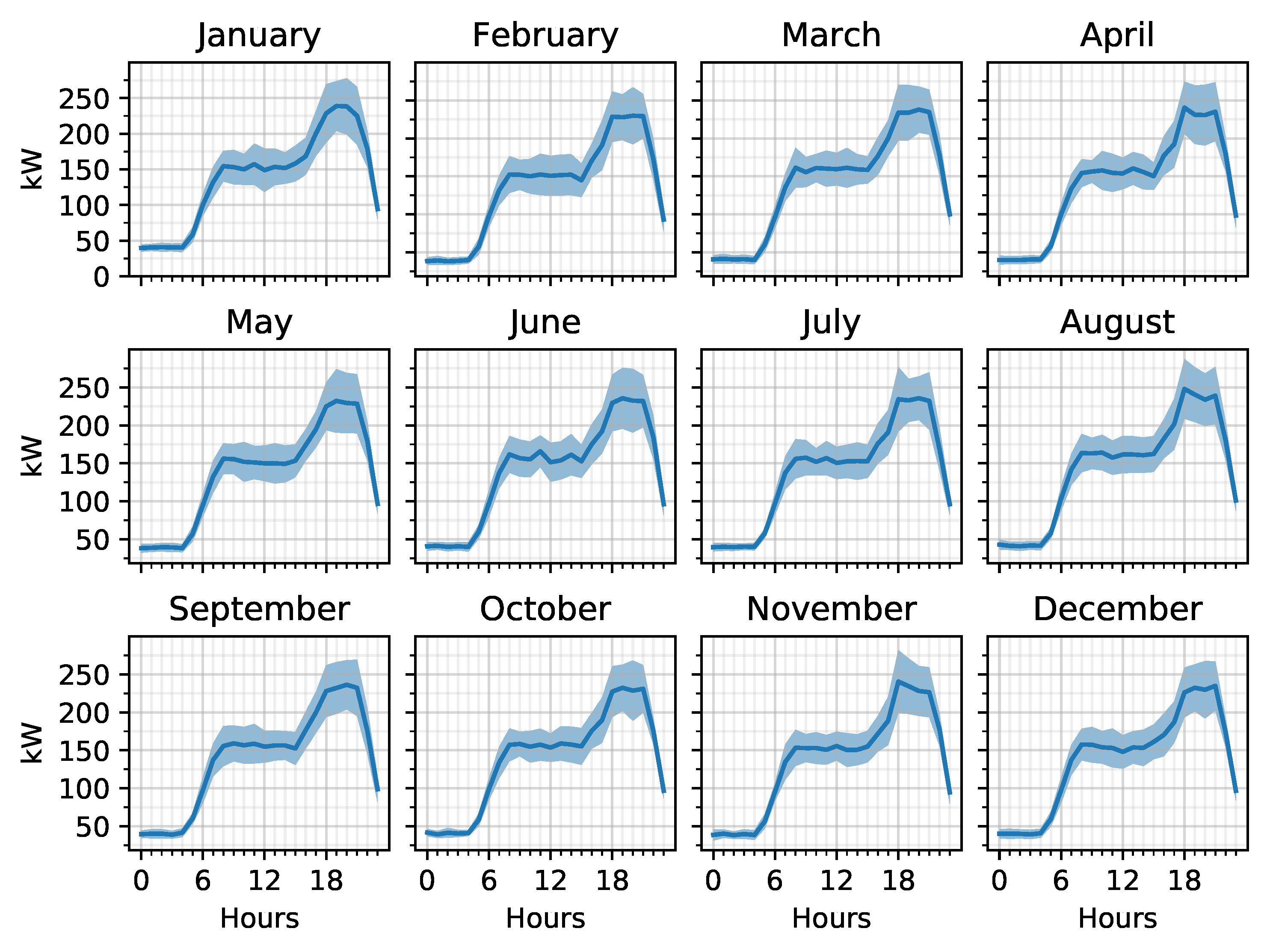

The case study includes a Monte Carlo Sampling (MCS) approach to deal with the uncertainties of the stochastic formulation. The MCS approach builds different scenarios by sampling the Probability Distribution Functions (PDFs) of electrical demand. In order to build scenarios, a pre-processing step fits the historic electrical demand into monthly/hourly PDFs. For simplicity and for the sake of reduction in computational burden, the case study assumes the demand follows a Gaussian process without a covariance matrix. Afterwards, a random sampling process of the monthly/hourly PDFs builds the demand for each sample

s of the MCS approach. Equation (

29) describes the sampling process.

Figure 3 shows monthly/hourly fitted distributions using a continuous line to represent the mean and a shaded area to represent the standard deviation.

In Equations (

2), (

11) and (

27),

,

, and

represent the

S solutions of minimizing

,

, and

, respectively. The

capacities of the energy sources selected for the IMG in the first level must supply

of the

S electrical demands with

z level of reliability (as defined by Equation (

10)). A post-processing step fits the

results to a PDF

, and obtains the Cumulative Distribution Function (CDF)

. The evaluation of the inverse of the CDF

at

provides the values of energy source capacities

. These values will supply electrical demand with the desired reliability level

of the time (

of all the scenarios).

Geographic and Weather Conditions of the Case Study

The case study is located at longitude

West and latitude

North (Nuquí, Colombia). The study case uses the Meteonorm database of the PvSyst software to obtain the Global Horizontal Radiation (GHI) and temperature conditions of the geographical region. Additionally, the study case uses Homer Pro software to obtain a standard community electrical demand. The standard community electrical demand that Homer Pro provides has hourly steps over a one-year horizon.

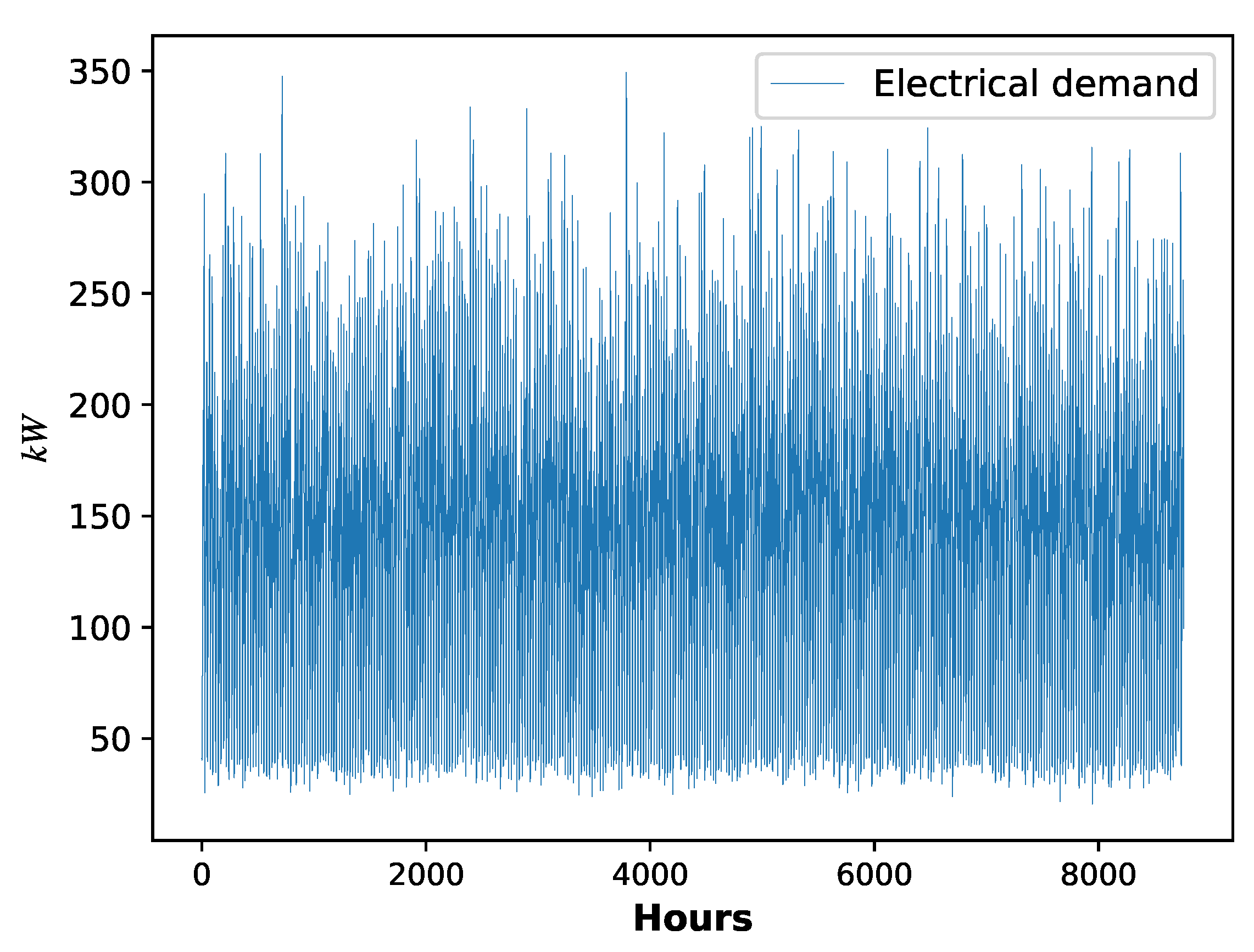

Figure 4 shows the historic yearly standard profile of the electrical demand that Homer Pro provides.

Figure 5 shows the yearly GHI.

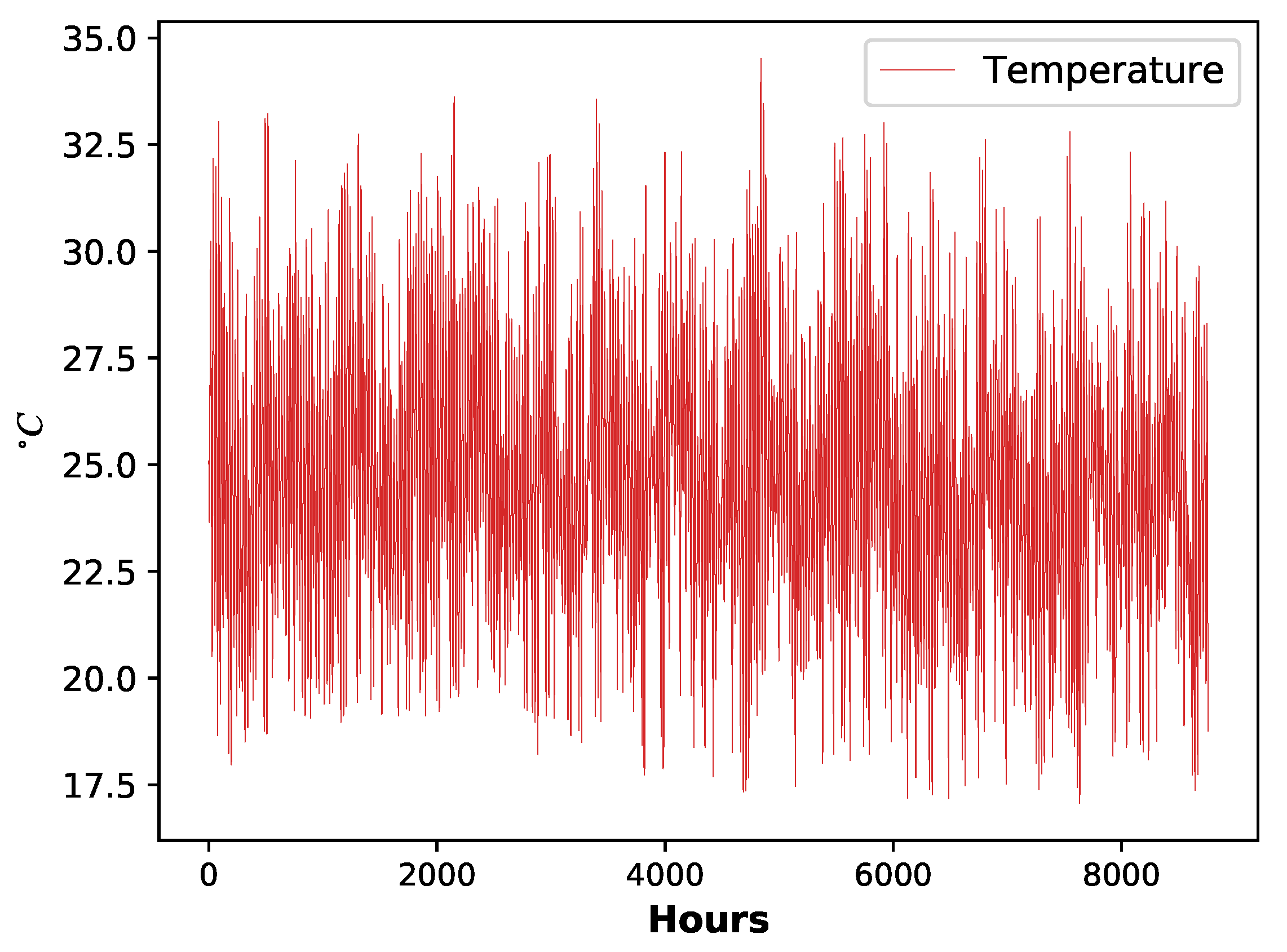

Figure 6 shows the yearly temperature.

The Monte Carlo Sampling analysis shown in Equation (

29) builds the scenarios for the stochastic analysis using the standard community electrical demand obtained from Homer Pro (shown in

Figure 4) and a scale factor of 20. The cost of diesel used for the optimization is

USD/liter. The case study takes the Diesel Generator model from [

53], the PV system model from [

54,

55,

56], and the BESS model from [

57].

Table 2 summarizes the unitary installation and maintenance costs of the equipment obtained from regional providers. The values assigned to

and

in constraint (

22) are 0 USD/kWh, and two times the price of the current flat tariff of urban areas in Colombia,

USD/kWh, respectively [

58].

Additionally, the methodology takes as inputs the values of

,

e,

,

,

,

,

,

,

,

,

,

, and

S. Planners or policymakers can decide these values or perform sensitivity analyses over each of them.

Table 3 shows the values used for simulations in this work. The following section uses the MCS approach and the inputs of

Table 3 to compute the results and for the case study.

5. Conclusions

The present work proposes a methodology to design and evaluate five DSMs in the planning and operation of IMGs. The methodology allows determination of the optimal size, optimal energy dispatch strategy, and optimal stimulus for the DSMs using a Disciplined Convex Stochastic Programming approach. The work designs and evaluates the effects of the five DSMs using one case study as a test-bench, which makes this work the first attempt to do so in the literature known by the authors.

The proposed methodology can help policymakers design proper regulations for IMG projects that consider the social conditions of customers and private investors. Additionally, the methodology can be useful for IMG planners or entrepreneurs that want to build profitable business models providing energy to isolated communities. In this regard, the methodology allows policymakers to:

Compute the effects of applying one of the five DSMs over the total costs of IMG projects in the planning phase.

Control the revenue of private investors or entrepreneurs to prevent excessive profits.

Minimize the total amount of subsidies paid by the government for IMG projects.

Compute the effects over the sizing and the total costs of IMG projects for different values of customer elasticities.

Additionally, the methodology allows IMG planners or entrepreneurs to:

Compute the expected expenses and revenues of an IMG project considering any of the five DSMs.

Compute the sizing of the energy sources considering any of the five DSMs.

Consider the effects of using different combinations of energy sources to supply the electrical demand.

Obtain the optimal day-ahead energy dispatch strategy for the microgrid considering any of the five DSMs.

The methodology can provide the benefits mentioned above to its users if the assumptions that it was built upon are fulfilled. In this regard, by sharpening the assumptions, the methodology will adapt better to the conditions of IMG projects. Considering more energy sources, sophisticated models of customer elasticities, and demand response models adapted to local conditions, among others, will improve the methodology as well.

Finally, it is essential to highlight the technical characteristic of the present study, which aims to inform planners and policymakers about the benefits of applying DSMs in the planning of IMGs. However, policymakers should perform comprehensive social and behavioral studies to evaluate the potential of acceptance of price-based or direct load curtailment DSMs in the context of IMGs.