1. Introduction

Financial inclusion remains a critical challenge in Indonesia, where around 91 million adults are still unbanked or underbanked (

OJK, 2024), lacking access to basic financial services like savings, credit, and insurance. This exclusion weakens individual financial resilience and constrains micro, small, and medium enterprise (MSME) growth, despite the sector contributing over 60% of GDP and employing nearly 97% of the workforce (

Kemenkop UMKM Republik Indonesia, 2024). Many MSMEs, particularly in the informal sector, are excluded from credit due to rigid requirements like credit histories, collateral, and documented income. Closing these financial gaps is vital for fostering inclusive economic growth and financial equity.

Innovative credit scoring (ICS) offers a potential breakthrough. By leveraging alternative data, such as utility payments, mobile phone usage, social media activity, and e-commerce transactions, ICS allows financial institutions to assess creditworthiness beyond conventional metrics. These non-traditional indicators enable more accurate profiling of individuals and businesses with limited formal financial footprints, thus extending credit access to previously unbanked and underbanked (

World Bank, 2022).

While ICS presents significant opportunities for expanding credit, fostering MSME growth, and promoting digital financial inclusion, it also introduces complex challenges. Key concerns include data privacy, algorithmic bias, regulatory ambiguity, and unequal access to digital infrastructure. Addressing these risks requires coordinated efforts among regulators, data providers, processors, and financial institutions to ensure ethical, secure, and inclusive adoption (

Rachbini et al., 2023;

Wijaya, 2023).

This paper examines systemic barriers to ICS implementation in Indonesia, particularly its capacity to expand credit access for underserved groups and support inclusive digital finance. It highlights four key challenges—privacy concerns, regulatory fragmentation, algorithmic opacity, and the digital divide—and examines how these issues interact with Indonesia’s institutional dynamics. Although the potential of ICS is widely acknowledged in the literature, there is limited empirical research on how competing interests, especially between data commercialization and inclusion goals, impede its adoption in Indonesia’s unique context. This study addresses that gap using insights from focus group discussions (FGDs) with key stakeholders across sectors.

This paper’s contribution is threefold. First, it offers a timely analysis into how technology and innovation can bridge gaps in financial inclusion in emerging markets like Indonesia. The Indonesian case offers insights that could shape global best practices for financial inclusion through ICS. Second, it draws on Indonesia’s case to highlight broader tensions between digital innovation, regulation, and equity, offering insights relevant to global financial inclusion debates. Third, it aligns with Indonesia’s national development agenda, which prioritizes inclusive finance as a foundation for sustainable and equitable economic growth.

This paper is structured as follows:

Section 2 reviews the literature on financial inclusion in Indonesia, the evolution of credit scoring, and ICS ecosystems.

Section 3 outlines the research methods and methodology employed.

Section 4 explores empirical findings from qualitative FGDs.

Section 5 discusses structural opportunities and governance challenges that undermine the inclusive potential of ICS in Indonesia.

Section 6 concludes with key insights and policy recommendations.

2. Literature Review

ICS is a transformative approach that leverages advanced technologies and alternative data to assess creditworthiness beyond traditional financial histories. It helps overcome barriers faced by the unbanked and underbanked, supporting financial inclusion. This literature review explores the evolution of ICS, its benefits, challenges, and implications for expanding access to inclusive financial services.

2.1. Financial Inclusion and Inclusive Growth

Financial inclusion is increasingly recognized as a critical enabler of economic development, contributing to household welfare, enterprise growth, and macroeconomic stability (

Demirgüç-Kunt et al., 2022;

Mostafa et al., 2023). Despite notable progress, financial exclusion remains pervasive. According to the Global Findex, 2021, 1.4 billion adults remain unbanked, with more than half residing in populous developing countries such as Indonesia, India, and Nigeria (

Simatele & Kabange, 2022;

Demirgüç-Kunt et al., 2022). Exclusion disproportionately affects women, informal workers, rural communities, and micro-entrepreneurs due to barriers such as lack of collateral, geographic isolation, and low financial or digital literacy (

Lopez & Winkler, 2018;

Erlando et al., 2020;

Simatele & Kabange, 2022).

In the Indonesian context, exclusion constrains household consumption smoothing, risk management, and investment in human capital. It also limits the potential of the country’s 64 million MSMEs, contributing approximately 61% of GDP and 97% of employment, who face a formal credit gap exceeding IDR 1600 trillion (

International Finance Corporation [IFC], 2025;

Bank Indonesia, 2022). Without access to affordable finance, many MSMEs remain informal, undercapitalized, and unable to adopt productivity-enhancing technologies (

Sugandi, 2021).

Informal financial mechanisms, typically associated with high interest rates and limited consumer protection, reinforce inequality and inefficiency. At the macroeconomic level, a large informal sector, comprising 44% of national employment (

Badan Pusat Statistik [BPS], 2023), reduces tax capacity and weakens fiscal and monetary transmission channels. Cross-country evidence further suggests that higher levels of account ownership are positively associated with GDP growth among low-income countries (

International Monetary Fund [IMF], 2020). Closing Indonesia’s financial inclusion gap is thus both a social and economic imperative.

2.2. Institutionalizing Financial Inclusion in Indonesia

Indonesia has institutionalized its financial inclusion agenda through the National Financial Inclusion Strategy (NFIS), which promotes inter-agency coordination, performance monitoring, and evidence-based policy-making (

Purnagunawan et al., 2023;

World Bank, 2018). Anchored in Presidential Regulation No. 114/2020, the NFIS defines financial inclusion as equitable access to quality financial services that support economic well-being, emphasizing three dimensions: access (availability), usage (adoption), and quality (effectiveness, including literacy and complaints handling). These pillars aim to foster an inclusive financial ecosystem.

Progress has been made: the national financial inclusion index increased from 59.7% in 2013 to 75.02% in 2024 (

OJK, 2024). However, structural gaps persist. Only 49% of adults actively use formal financial services (

OJK, 2021), and many MSMEs remain excluded due to traditional credit assessments reliant on collateral and formal documentation.

To address this, alternative data—such as utility payments, mobile usage, and e-commerce activity—can support more inclusive credit scoring. These innovations offer financial institutions new ways to assess creditworthiness, expand access for underserved groups, and strengthen financial resilience across the economy.

2.3. Evolution of Credit Scoring

Credit scoring emerged in the 1960s as a means to assess loan default risk, initially relying on subjective judgments by loan officers (

Aji & Dhini, 2019;

Onay & Öztürk, 2018). This changed with the introduction of the FICO (Fair Isaac Corporation) score in 1989, which standardized risk evaluation using data on repayment history, credit utilization, and loan types (

Njuguna & Sowon, 2021). Originally applied to credit cards, FICO scoring quickly expanded to mortgages, personal loans, and other sectors, replacing human judgment with algorithmic assessments and reshaping global lending (

Smith & Henderson, 2018;

Thomas, 2000).

However, FICO and similar models depend on formal financial histories, excluding those with limited records (“credit unscored”) or none at all (“credit invisible”)—groups that include many underbanked and unbanked individuals (

Njuguna & Sowon, 2021;

Smith & Henderson, 2018). To address this, Alternative Credit Scoring (ACS) emerged, incorporating non-traditional data such as job tenure, income, and residence duration (

Onay & Öztürk, 2018). While ACS has improved access for the underbanked, its reach remains limited in low-income and rural contexts, where informal lending remains prevalent and data scarcity persists (

Ebong & Babu, 2020;

Leong et al., 2017).

Recent advances in big data and machine learning have enabled more inclusive models through ICS. ICS leverages diverse alternative data—including utility payments, mobile usage, e-commerce, and social media behavior—while reinterpreting conventional financial data in real time (

Hlongwane et al., 2024;

Tan et al., 2021;

Wijaya, 2023). By applying advanced analytics, ICS enhances the accuracy of credit assessments and broadens access to finance, particularly for those excluded by traditional methods. Its adoption by governments, fintechs, and NGOs in developing countries signals a growing shift toward inclusive and dynamic risk evaluation systems (

Rachbini et al., 2023;

Njuguna & Sowon, 2021).

2.4. Innovative Credit Scoring Ecosystems

ICS integrates alternative data, processed through AI and big data analytics, to deliver more accurate and inclusive credit assessments (

Njuguna & Sowon, 2021;

Smith & Henderson, 2018;

Wijaya, 2023). This shift is particularly impactful for underserved groups like MSMEs and the unbanked, whose digital footprints now support credit evaluations previously inaccessible through conventional methods (

Rachbini et al., 2023).

ICS offers several advantages over traditional models. First, by utilizing alternative data, it expands access to credit for individuals with limited or no formal financial histories (

Rachbini et al., 2023;

Njuguna & Sowon, 2021;

Wijaya, 2023;

World Bank, 2022). Second, AI-driven analytics detect behavioral patterns that improve risk profiling and help lower default rates (

Aitken, 2017;

Lainez & Gardner, 2023). Third, ICS reduces assessment costs, enabling financial institutions to serve low-income individuals and small businesses more affordably (

Lainez & Gardner, 2023). Fourth, it supports real-time, dynamic evaluations and streamlines loan processing, facilitating faster, scalable credit delivery (

Berg et al., 2019). Collectively, these features make ICS a powerful tool for financial inclusion in emerging markets.

However, these benefits rely on institutional conditions often absent in emerging economies. Indonesia’s experience reveals persistent implementation barriers. The use of alternative data raises privacy and security concerns, while opaque algorithms risk reinforcing social biases. Regulatory ambiguity further complicates implementation, as many jurisdictions lack clear frameworks for data usage, consent, and algorithmic accountability (

Lainez & Gardner, 2023;

Onay & Öztürk, 2018;

Wijaya, 2023).

Addressing these challenges is essential for ICS to scale sustainably. Financial institutions must invest in data analytics, machine learning, and responsible risk management. Regulators must ensure data protection and algorithmic transparency. When governed effectively, ICS can expand credit access for historically excluded groups while enhancing operational efficiency and portfolio diversification for lenders (

Berg et al., 2019;

Lainez & Gardner, 2023;

Smith & Henderson, 2018;

World Bank, 2022).

Ultimately, the future of ICS depends on collaborative governance and ethical innovation. If properly implemented, ICS can reshape financial ecosystems by enabling inclusive, secure, and equitable credit systems—benefiting both borrowers and financial institutions across Indonesia and other emerging markets (

Berg et al., 2019;

Lainez & Gardner, 2023).

3. Methodology

3.1. Research Design

This study adopts a qualitative, exploratory research design, motivated by the early-stage development of ICS in Indonesia and the limited availability of quantitative baseline data. The absence of reliable figures—like how many financial institutions use ICS or the number of MSMEs benefitting from such systems—poses significant barriers to empirical measurement. Consequently, qualitative inquiry is deemed the most appropriate approach to investigate the contextual, institutional, and operational dimensions of ICS adoption.

Focus Group Discussions (FGDs) were selected as the primary data collection method due to their suitability for exploratory studies seeking to capture multi-stakeholder perspectives and dynamic group interactions (

Krueger & Casey, 2014). This method helps reveal emerging themes, collective concerns, and possible solutions that structured surveys or one-on-one interviews may fail to uncover. The aim is not to generalize statistically, but to produce rich, grounded insights into the evolving ICS ecosystem, especially its potential and challenges in promoting financial inclusion.

3.2. FGD Design, Participant Recruitment, and Sampling

Eight FGDs were conducted in Jakarta between September and October 2024, involving participants from all five key stakeholder groups to generate focused yet comparable cross-sectoral insights. Each session, lasting 90 to 120 min, followed a semi-structured protocol that balanced consistency across discussions with flexibility to probe emerging issues in depth.

Four key issues were identified to guide the FGDs, drawing from literature gaps, policy documents—especially Indonesia’s National Financial Inclusion Strategy—and preliminary consultations with experts. These included (1) benefits and incentives for adopting ICS; (2) supporting infrastructure, ecosystem, and regulation; (3) data structure, quality, and management; and (4) implementation challenges and risks. Each FGD was led by the principal investigator and supported by a trained note-taker to ensure accurate and consistent documentation.

To ensure the collection of relevant and diverse insights, a purposive sampling strategy was used. Participants were selected based on their direct engagement with ICS-related activities and their institutional role in shaping its development in Indonesia. Five primary stakeholder categories were identified: (i) data controllers, (ii) data processors, (iii) data users, (iv) regulators, and (v) academics.

Eligibility criteria for participation included a minimum of two years’ professional experience in roles related to credit scoring, financial technology, or financial inclusion. Furthermore, participants were required to represent organizations that are actively involved in or directly affected by ICS implementation.

Recruitment began through official directories (e.g., OJK), fintech associations, and academic networks. Snowball sampling followed, with initial participants recommending peers who met the criteria. Recruitment ended upon reaching thematic saturation—when two consecutive FGDs yielded no new themes (

Hennink et al., 2017). The final sample consisted of 36 participants across the five stakeholder groups (

Table 1).

Although qualitative research does not aim for statistical representativeness, the sample was designed to reflect the diversity of actors influencing the ICS landscape. The distribution of participants across the five stakeholder groups ensured a holistic view of institutional perspectives, operational experiences, and policy considerations.

3.3. Data Processing and Analysis

Data were processed and analyzed using thematic analysis. Collection, processing, and interpretation occurred iteratively, with researchers repeatedly engaging with the data—moving back and forth between raw input, emerging insights, and contextual understanding—until coherent themes were identified. This thematic analysis followed the framework outlined by

Braun and Clarke (

2006), consisting of the following steps:

- ▪

Familiarization, researchers transcribed the FGD results and read all transcripts multiple times to deeply understand the data and its context.

- ▪

Initial Coding, extracting the FGD transcripts and grouping them into relevant codes. This open coding process was applied to identify key phrases and concepts pertinent to the research focus area.

- ▪

Theme Generation, codes with similar meaning and relatedness were combined into initial themes. The resulting themes reflected the pre-defined categories and insights emerging from the data.

- ▪

Review and Refinement, to ensure consistency across stakeholders and an accurate representation of the complete dataset, the researchers conducted iterative reviews.

- ▪

Defining and Naming Themes, the core meaning of each defined theme was identified and then described. This stage also ensured there was no overlap between themes. The four themes generated are as follows:

- (1)

The effectiveness of ICS Implementation in Indonesia: Examines how ICS compares to traditional credit scoring in terms of predictive accuracy, cost-efficiency, and adaptability.

- (2)

Inclusive Potential and Advantages of ICS for MSME Financing: This theme explores how ICS leverages alternative data—like utility bills, mobile usage, and e-commerce activity—to expand credit access for underserved groups, particularly MSMEs lacking formal credit histories. It also examines the perceived benefits and risks for both borrowers and lenders within the specific context of MSME financing.

- (3)

Implementation Challenges: Identifying various barriers to the ICS adoption process, including data privacy and consent, algorithmic bias, limited digital infrastructure, and the lack of a clear regulatory framework to ensure fairness and accountability.

- (4)

Future Strategies: Captures stakeholder perspectives on the future of ICS, including priorities for ethical governance, scalability, interoperability, and institutional coordination to ensure inclusive and responsible growth.

- ▪

Reporting, final themes were synthesized into findings and illustrated with direct quotations to reflect participants’ perspectives.

To enhance the credibility of the findings, three quality assurance strategies were employed. First, observer triangulation (

Newman, 2014) was used to minimize individual bias by involving multiple researchers in data collection and interpretation. The research was conducted jointly by the Macroeconomic and Financial Research Centre (BRIN) and analysts from the Fiscal Policy Agency, Ministry of Finance. Second, data source triangulation (

Krefting, 1991) was applied through multi-stakeholder FGDs involving data controllers, processors, users, regulators, and academics. Third, peer examination (

Krefting, 1991) involved critical review and feedback from fellow researchers to validate the findings.

4. Empirical Findings from FGDs

This section presents key empirical findings from the FGDs conducted by the research team. Organized thematically, the results reflect stakeholder insights on the implementation, benefits, and limitations of ICS in Indonesia. Where relevant, participant quotes are used to illustrate consensus or divergence across groups.

4.1. Implementation of ICS in Indonesia

The development of ICS in Indonesia began with OJK Regulation No. 13/POJK.02/2018, which introduced a regulatory sandbox to evaluate non-P2P fintech services for compliance and consumer protection. Participating firms underwent a one-year trial (extendable by six months) and had to meet core requirements, including legal partnerships and user consent. This was followed by OJK Circular Letter No. 20/2019, which established a licensing pathway for firms that passed the sandbox stage (

Wijaya, 2023).

Despite these early efforts, ICS development remained fragmented until 2023, when Law No. 4/2023 (P2SK Law) strengthened OJK’s supervisory role. The policy environment grew more complex with presidential directives requiring credit scoring for non-collateralized People’s Business Credit (KUR). In 2024, OJK expanded its authority through POJK No. 3/2024, introducing stricter compliance measures. Additional regulations, SEOJK No. 6/2024 and POJK No. 29/2024, focused on accountability and data protection. Still, tensions between innovation, regulation, and consumer protection persist, underscoring the need for a clearer, more adaptive framework.

While multiple regulations have been introduced to support ICS, progress has been limited. As of 2024, only ten ICS providers are officially operational (

OJK, 2024), far below what is needed to serve Indonesia’s growing financial ecosystem—comprising 105 commercial banks, 1356 rural banks, 250 microfinance institutions, 97 P2P lending platforms, and over 130,000 cooperatives (

Ministry of Cooperatives and SMEs of The Republic of Indonesia, 2019). This gap reflects a disconnect between regulatory ambitions and practical implementation.

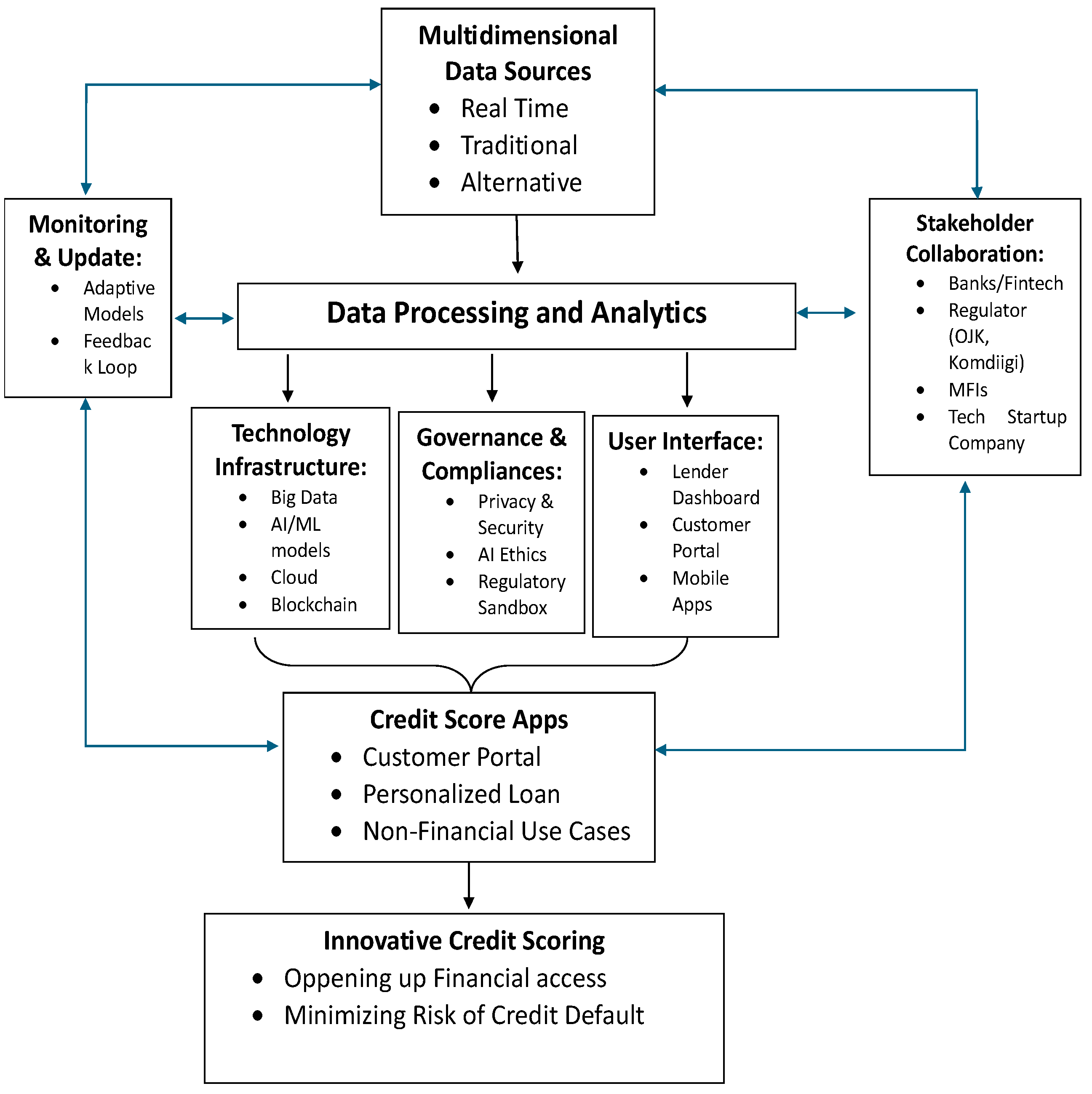

FGD participants also identified institutional fragmentation as another major bottleneck. According to FGD participants, the ICS ecosystem involves many uncoordinated actors across sectors and data domains (

Figure 1). Accordingly, the number of ICS providers remains limited, and their assessments rely heavily on a narrow range of data—primarily from e-commerce, social media, and utilities—while many valuable datasets remain inaccessible due to licensing restrictions and confidentiality constraints. International experience shows that effective implementation of ICS requires a coordinated framework that promotes strong stakeholder collaboration. This must be supported by robust governance, monitoring, and evaluation mechanisms. Without such an integrated approach, progress will remain fragmented, impeding the development of a cohesive and scalable ICS ecosystem.

Moreover, applying ICS to first-segment MSMEs presents additional challenges. These enterprises often lack digital footprints, reducing algorithmic accuracy and increasing exclusion risks. Biases in training data further disadvantage groups with limited formal financial histories. Low digital literacy, infrastructure gaps, and language barriers—especially in rural areas—compound these issues. Without targeted policies, inclusive data strategies, and locally adapted models, ICS could inadvertently reinforce the exclusion it aims to address.

4.2. Advantages

4.2.1. Enhances Financial Access

ICS represents a major improvement over the traditional 5Cs approach by broadening credit access to previously underserved groups (

Rachbini et al., 2023;

Njuguna & Sowon, 2021;

Wijaya, 2023;

World Bank, 2022). While AI-driven credit models are known for their accuracy in predicting defaults (

Lee & Yang, 2024), their broader inclusion effects remain underexplored, raising critical questions about who ultimately benefits from these technologies.

FGDs generated empirical insights showing that ICS enhances borrower assessment, resulting in higher approval rates without compromising loan quality. IS (Regulator representative, FGD-6, 18 October 2024), cited a 2024 pilot by the Ministry of Cooperatives and SMEs involving 30,666 MSMEs. The pilot showed a 5% improvement in approval rates compared to the 5Cs method, while non-performing loan levels stayed constant. ICS achieved a Gini Index of 82%, outperforming the 64% recorded by conventional credit bureau data—demonstrating stronger risk differentiation.

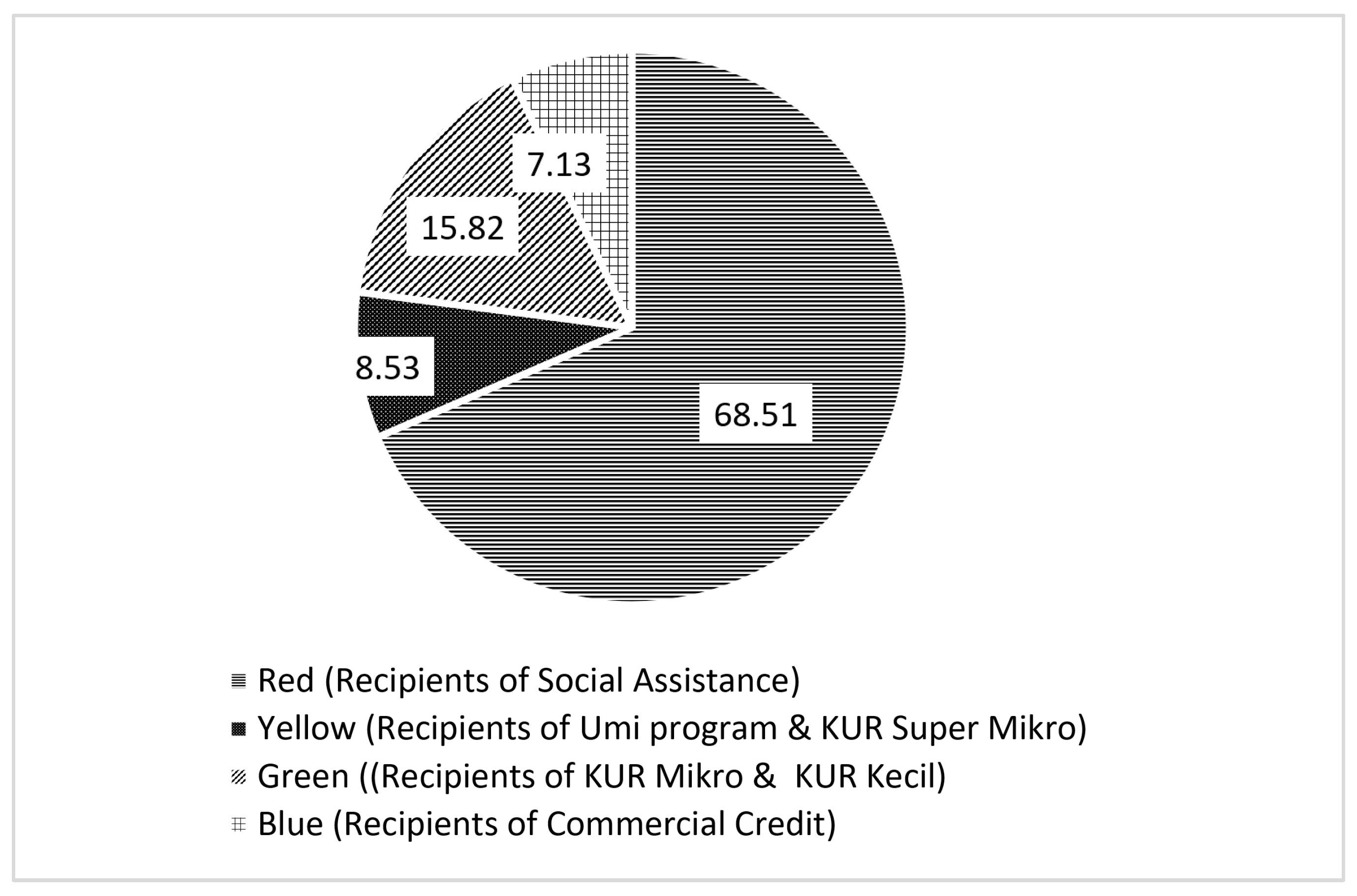

However, ICS’s impact varies across MSME segments. Indonesia’s 32.1 million MSMEs fall into four groups (

Figure 2). Its value is highest when reaching social assistance recipients with no credit history. It has a moderate benefit for UMI and Super Micro KUR borrowers, who still face access barriers. Its contribution declines when applied to Micro and Small KUR recipients already served by formal lenders, suggesting the need to target the most excluded.

4.2.2. Credit Scoring Improves Risk Assessment Accuracy

ICS improves credit risk assessment by using alternative data to build a more comprehensive view of a borrower’s financial behavior. This enables financial institutions to better manage default risk and support financial inclusion, especially for those lacking formal credit histories. FGDs with data providers, financial institutions, regulators, and academics provide insight previously unreported, highlighting broad consensus on ICS’s effectiveness. AS (an Academic, FGD-4, 11 October 2024) emphasized that ICS captures financial behavioral patterns missed by conventional tools, making assessments more accurate and equitable.

ICS can also flag risks that conventional systems like SLIK overlook. SW (Financial Institution representative, FGD-2, 2 October2024) noted that while SLIK may approve a borrower, ICS might reveal delayed utility payments, prompting reassessment. This makes ICS a valuable complementary filter for more reliable decisions.

However, adoption remains uneven. Many cooperatives and non-bank lenders still prioritize collateral and treat ICS as secondary. AAD and SW (Cooperative representatives, FGD-2, 2 October 2024) observed that lending often proceeds based on assets, even when ICS flags high risk—undermining efforts to modernize credit evaluation.

In contrast, fintechs and some banks use ICS more strategically to improve speed and accuracy. RW and TAW (Fintech and State-Owned Bank representatives, FGD-2, 2 October 2024 and FGD-8, 30 October 2024) emphasized that ICS enables faster credit assessments, quicker on-boarding, and better risk prediction. As RW explained, ICS automates checks using alternative data and supports real-time decisions, allowing lenders to serve more customers efficiently while keeping default risks low.

4.2.3. Automated Systems for Faster, Cheaper, and More Efficient Credit Assessments

Credit assessment is a core function of financial decision-making but has traditionally depended on manual processes that are slow, costly, and prone to error (

Tomczak & Ziȩba, 2015). Financial institutions are now adopting automated systems powered by big data and AI, enabling faster, more accurate, and cost-efficient assessments by minimizing human error and subjectivity (

Kamimura et al., 2023;

Mwangi, 2024). Still, automation introduces risks, including algorithmic bias and excessive reliance on data, reinforcing the need for balanced human–machine interaction.

In Indonesia, ICS has accelerated digital, paperless credit evaluations through alternative data and machine learning. According to SN (Financial Services Authority, FGD-5, 16 October 2024) and AS (Indonesian Microfinance Expert Association, FGD-4, 11 October 2024), ICS improves real-time fraud detection and broadens access for unbanked populations. SP (Indonesian Fintech Association, FGD-1, 25 September 2024) added that ICS benefits borrowers without formal credit histories, especially MSMEs.

However, contrary to the literature, ICS has not significantly reduced operational costs. Informants such as HW (Pefindo Credit Bureau, FGD-4, 11 October 2024), HBM (Coordinating Ministry, FGD-6, 18 October 2024), and FI (financial institution, FGD-8, 30 October 2024) cited high data access fees, costly system upgrades, and maintenance burdens as key constraints to wider adoption.

Cost challenges are compounded by a fragmented and noninteroperable data ecosystem. TD (Ministry of Finance, FGD-5, 16 October 2024) noted institutional reluctance to share borrower data, while SLIK-OJK access limitations restrict non-bank and fintech actors from obtaining essential credit data.

Legal and technical barriers further impede progress. Law No. 27/2022 on Personal Data Protection (PDP) has increased hesitation around data sharing due to fear of sanctions (BAP, State Electricity Company, FGD-7, 23 October 2024). Meanwhile, growing dependence on cloud services raises cybersecurity concerns (FI, FGD-8, 30 October 2024), and the absence of national data standards blocks interoperability. Without clear regulations and secure, integrated data-sharing frameworks, ICS’s potential for inclusion and efficiency will remain limited.

4.2.4. Alternative Data Allows for Dynamic, Real-Time Credit Evaluations

ICS uses alternative data to assess borrowers without formal credit histories. In Indonesia, where about 91 million adults remain excluded from traditional credit systems, financial institutions often equate credit invisibility with poor creditworthiness (

Wijaya, 2023). FGDs indicated that ICS helps address this gap. Evidence from

Cloudera (

2019) shows that ICS improves credit uptake, encourages digital microfinance innovation, and reduces fraud by 40%.

ICS enables real-time credit scoring updates based on behavioral and utility data, allowing lenders to better assess risks and adjust credit terms accordingly. PKN (Financial Institution representative, FGD-8, 30 October 2024) emphasized that high-quality data is crucial for reliable scoring, particularly in evaluating excluded individuals more fairly. This supports ICS’s role in advancing financial inclusion.

Yet challenges persist. As

Wijaya (

2023) warns, AI and ML may replicate human biases—such as proxy, sampling, and labeling errors—which distort outcomes. Despite these risks, alternative data remains essential for expanding credit access and reducing defaults among underserved groups (

Lee & Yang, 2024;

Lu et al., 2019). SH (an Academic, FGD-1, 25 September 2024) noted that ICS improves access for excluded MSMEs while reducing NPLs through more accurate pre-disbursement evaluation.

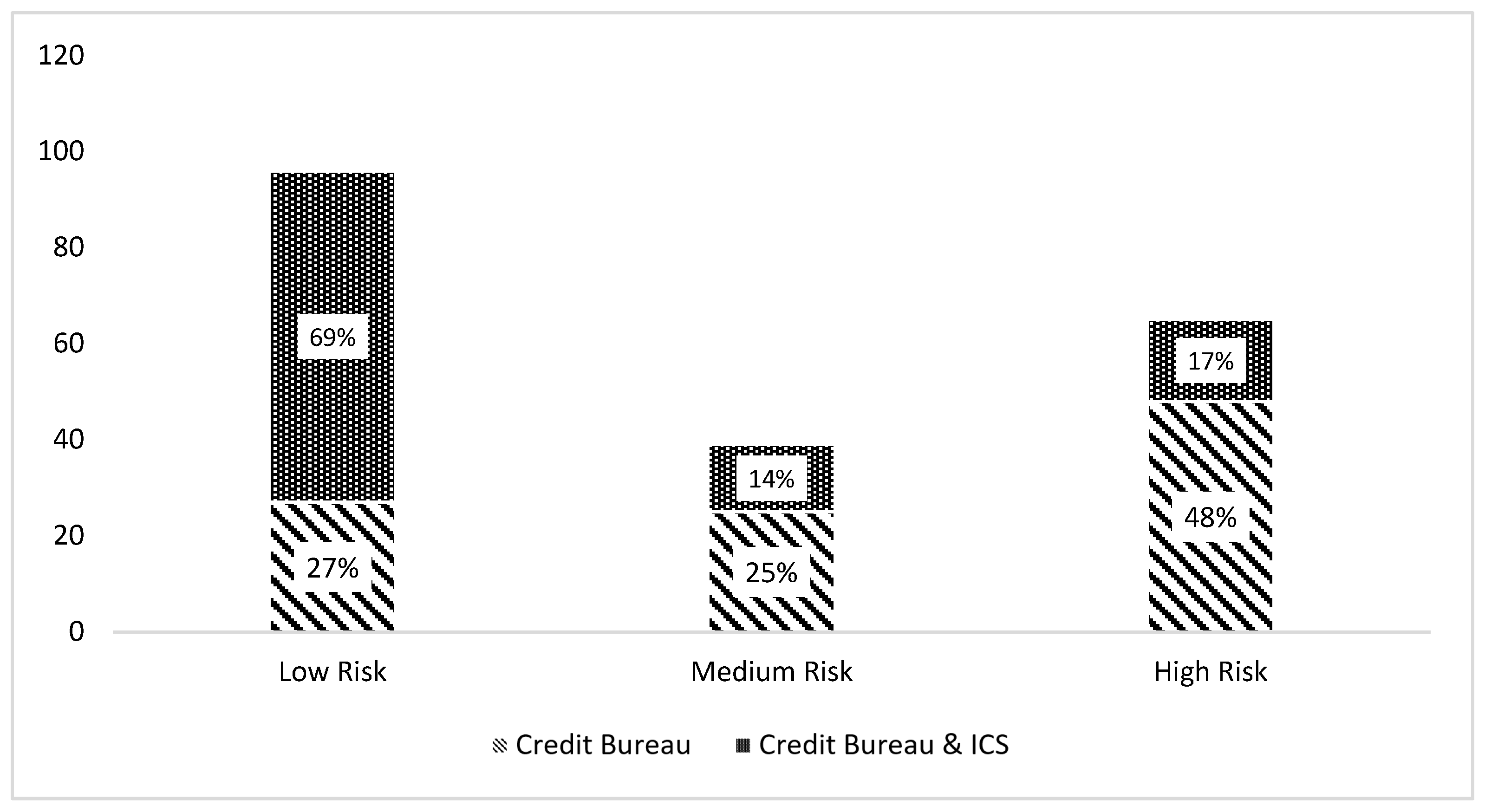

A 2024 pilot by the Ministry of Cooperatives and MSMEs demonstrated ICS’s effectiveness in enhancing risk classification and reducing non-performing loans (NPLs). Using CLIK Credit Bureau data alone, 48% of borrowers were high risk and 25% medium. When combined with Eurika Scores, medium-risk borrowers fell to 14% and low-risk rose to 69% (

Figure 3), showing improved classification.

Cloudera (

2019) also found that integrating psychometrics with AI/ML reduced NPLs by 1.15%, while

Alibhai et al. (

2020) noted gains in access and risk reduction for unsecured borrowers. ICS enables proactive risk management, helping institutions engage high-risk clients early.

4.3. Challenges

4.3.1. Data Privacy and Security

PDP Law No. 27/2022 outlines data governance rules in Indonesia, covering processing, user rights, institutional roles, and sanctions. However, implementation remains weak due to unclear authority between Data Protection Officers (DPOs) and sectoral regulators, such as AFTECH, and ambiguity over the ‘legitimate interest’ basis for ICS providers. Overlapping mandates and the absence of competency standards for DPOs further hinder enforcement. These gaps have eroded trust, reflected in unresolved breaches involving Dukcapil, PLN, MyPertamina, and others.

These regulatory uncertainties pose particular risks for ICS, which relies on decentralized and sensitive data. ICS systems aggregate alternative data from various external sources, making them especially vulnerable to fragmentation. Two key challenges arise: greater exposure to breaches that discourage data sharing, and the absence of a clear legal framework to enable flexible, cross-sector governance. The next subsections explore these issues in detail.

Data Vulnerability and Institutional Hesitation in ICS Adoption

Data security remains a major barrier to ICS adoption, as it relies on fragmented external sources—unlike conventional and centralized models including SLIK-OJK (

Aggarwal, 2021;

Rachbini et al., 2023). Regulatory uncertainty under the PDP Law intensifies institutional reluctance to share data, with FGD participants citing fears of legal violations. HBM (Government Official representative, FGD-6, 28 October 2024) described the law’s chilling effect, while TAW (Financial Institution representative, FGD-8, 30 October 2024) emphasized concerns over data breaches. These reflect ICS’s structural vulnerability.

However, others see the PDP Law as a long-term enabler. IRS (Government Official representative, FGD-6, 18 October 2024) highlighted its potential to expand credit access by 5%, and RW (Financial Institutions representative, FGD-2, 2 October 2024) noted its role in strengthening institutional data governance. Thus, while the law poses short-term barriers, it also provides a foundation for more secure and inclusive data ecosystems in the long run.

Toward a Coherent Legal Framework for ICS

Despite its foundational role, the PDP Law remains inadequate for regulating ICS. The absence of a designated central Data Protection Authority and poor coordination with sectoral bodies like AFTECH (

Widiatedja & Mishra, 2022) creates key institutional gaps. FGD participants, including EMR (a Researcher, FGD-4, 11 October 2024), stressed the urgent need for derivative regulations to ensure legal certainty and operational clarity. Institutional mistrust—rooted in liability concerns—continues to hinder collaboration. CL (Data Processor representative, FGD-4) and TAW and AKS (Financial Institutions’ representatives, FGD-8, 30 October 2024) noted that the current rigid regulatory approach clashes with the flexibility required for alternative data use.

The lack of an integrated framework for data access, interoperability, and oversight further hampers implementation. Unless the legal framework becomes more adaptive and coherent, ICS will struggle to fulfill its promise of supporting inclusive and responsible financial innovation.

4.3.2. Algorithmic Bias

Another major challenge in ICS implementation is algorithmic bias, especially when models rely on historical data that perpetuate structural inequalities. Biases, such as sampling, labeling, and proxy errors, can distort credit assessments and disproportionately penalize marginalized groups (

Wijaya, 2023;

World Bank, 2019). Underrepresentation of certain populations (sampling bias), inconsistent classification (labeling bias), and the use of indirect indicators like location or occupation (proxy bias) often misclassify low-risk individuals—such as agricultural workers—as high risk. FGD findings, consistent with

CGAP and World Bank (

2022) and

Das et al. (

2023), confirm that such biases can lead to de facto discrimination, particularly when sensitive attributes like gender, age, or religion are inferred through behavioral or geospatial data.

Garcia et al. (

2024) warn that such bias can enter at various stages—from data selection and preprocessing to model tuning. In Indonesia, these risks are heightened by weak data infrastructure. HW (Data Processor representative, FGD-4, 11 October 2024) noted limited access to diverse, validated datasets, while AKS (Financial Institution representative, FGD-8, 30 October 2024) highlighted verification issues, such as utility data not matching actual users. Fragmented databases and poor coordination among data providers further limit reliability and scalability.

Adding to the problem is algorithmic opacity. ICS models often lack explainability, making it difficult for borrowers to understand or challenge decisions (

World Bank, 2019). Without transparent models and accountable governance, ICS risks becoming a “black box” that perpetuates exclusion under the guise of innovation.

4.3.3. High Cost of ICS Deployment

In contradiction to national financial inclusion goals, many state-owned enterprises (SOEs) treat public data as a commercial commodity. As RW (Fintech representative) noted: “We pay IDR 350 per data point to PLN—this contradicts their public service mandate” (FGD-2, 2 October 2024). This commercial approach undermines ICS adoption, particularly among micro and ultra-micro finance institutions operating on tight margins. While the OJK-SLIK data is free (

AFPI, 2024), alternative data often carries high fees, limiting accessibility for smaller players. This issue is compounded by the need to evaluate diverse borrower segments, such as traders and farmers, further raising costs.

Unreported elsewhere, FGDs revealed that many data providers—both SOEs and ministries—prioritize revenue over accessibility, hindering inclusive finance. HW (Data Processor representative, FGD-4, 11 October 2024) noted that building in-house ICS systems also incurs major expenses, including technology acquisition, integration, and capacity building. Institutions must invest in cloud infrastructure, cybersecurity, and staff training while ensuring compliance with data protection regulations (

Dhaigude & Lawande, 2022;

Irfan, 2023). These upfront and ongoing costs—such as for technical support and model retraining (

Miljkovic & Wang, 2025;

Munoz-Cancino et al., 2022)—make ICS financially burdensome, particularly for resource-constrained institutions. Without affordable data access and support, the scalability of ICS remains limited.

5. Discussion

This study reveals that Indonesia’s ICS ecosystem is constrained not by technological limitations, but by governance failures overlooked in the prior literature. Three key barriers explain the implementation gap: (1) regulatory fragmentation that prioritizes compliance over inclusion; (2) data hoarding by SOEs treating public data as proprietary assets; and (3) algorithmic opacity that perpetuates bias against rural MSMEs. These findings shift the discourse from ICS’s theoretical benefits to its contested real-world viability—a critical contribution given Indonesia’s position as a testbed for Global South financial innovation.

5.1. Aligning Regulation with Market Realities

Indonesia’s ICS regulatory framework has advanced with the issuance of POJK 29/2024, which introduces a licensing regime and sets enforceable standards on governance, data protection, algorithmic transparency, and consumer safeguards. This represents a substantive departure from earlier instruments—POJK 13/2018 on regulatory sandboxing and Law No. 27/2022 on PDP—which were not designed to address the specific risks inherent in alternative credit scoring. Previously, ICS providers operated under the broader Financial Sector Technology Innovation (ITSK) regime (POJK 3/2024), which lacked clear provisions for regulating opaque algorithms, unstructured data, and asymmetric information flows (

Table 2). Consequently, oversight remained fragmented. OJK sandbox outcomes illustrate this. Only 2 of 17 ICS applicants were approved in 2023, increasing modestly to 8 of 15 in 2024—suggesting procedural improvements but persistent inefficiencies.

While POJK 29/2024 seeks to harmonize fragmented practices through transitional provisions, FGDs uncovered a critical tension between regulatory standardization and innovation. Specifically, the regulation’s punitive sanctions (

Table 3) may disincentivize experimentation and risk-taking, generating a chilling effect that is underexplored in the literature.

FGD findings also stress that effective regulation must go beyond licensing. Key priorities include the following: (1) robust data security through encryption and ISO 27001 standards (

International Organization for Standardization & International Electrotechnical Commission, 2022); (2) institutional accountability with enforceable contracts; (3) alignment with PDP Law principles, particularly consent and purpose limitation; and (4) AI tools for identity verification and fraud detection. These are vital to bridge legal design with practical implementation.

5.2. Fixing Fragmentation in Governance and Data Silos

Regulatory fragmentation remains a major impediment to Indonesia’s ICS development. Although the PDP Law assigns data governance roles to both OJK and Kominfo, the absence of a centralized Data Protection Authority has created enforcement gaps and blurred institutional accountability. As HBM (Government Official, FGD-6, 10 October 2024) noted, the absence of a single oversight body complicates coordination and weakens institutional coherence.

Trust deficits further constrain ICS adoption. Many borrowers remain unaware of how their data is collected or used, fostering misinformation and resistance. Building trust requires public education and institutional reforms that guarantee transparency, informed consent, and accessible grievance mechanisms.

Limited access to state-held administrative data also hampers ICS scalability. Ministries and SOEs, despite controlling high-value datasets, often restrict access due to commercial motives and regulatory uncertainty. While fintechs advocate open access to improve financial inclusion, SOEs frequently monetize data under the pretext of PDP Law compliance, as noted by HBM. Contrary to the prevailing literature that attributes data silos to technical limitations, FGD findings highlight institutional profiteering as a core issue. FGDs noted that SOEs routinely monetize data under the pretext of complying with the PDP Law, effectively commodifying exclusion. These practices underscore the urgent need for a national data governance framework that reconciles public interest with sustainable monetization, grounded in interoperability, data portability, and open finance principles.

Sanctions under the PDP Law—up to 2% of annual revenue or IDR 60 billion—signal strong regulatory intent. However, without technical implementation guidelines, they create legal uncertainty. Compared to other jurisdictions (

Table 3), Indonesia’s penalties appear stringent but risk being ineffective without proportionate and transparent enforcement mechanisms.

5.3. Enforcing the Law Beyond the Letter

Despite legal provisions, enforcement of data protection remains inconsistent. High-profile breaches (e.g., Dukcapil, PLN) reveal persistent gaps, while smaller ICS providers face costly compliance burdens that hinder innovation. Ambiguous terms such as “legitimate interest” create legal uncertainty. As SP (an Academic) noted: “We operate in a grey area—encouraged to innovate, but penalized for pushing boundaries” (FGD-1, 25 September 2024).

ICS systems using AI and ML enhance credit assessment but introduce algorithmic risks. Indonesia’s current laws lack binding standards on fairness, transparency, and accountability. Unlike frameworks such as the U.S. Fair Credit Reporting Act, there are no mandatory audits, model explainability requirements, or bias detection protocols. Some providers voluntarily adopt tools like CRISP-DM, but these efforts remain fragmented.

Effective ICS governance requires sector-specific regulation beyond general data protection. Audits, bias diagnostics, and human oversight must be institutionalized. Without them, opaque algorithms risk embedding structural inequality. POJK 29/2024 and the PDP Law offer baseline protections but fall short of addressing ICS’s distinct risks, particularly in contexts of low digital literacy. Algorithmic opacity is not just technical—it encodes exclusion. Explainability is essential to ensure equitable, accountable, and inclusive credit access.

5.4. Modernizing Governance for a Digital Age

Indonesia’s regulatory model remains reactive rather than proactive. Although POJK 29/2024 addresses AI-based credit scoring, it lacks essential provisions on explainability, bias mitigation, and algorithmic accountability—principles central to the EU’s GDPR. AKS (Financial Institutions representative, FGD-8, 30 October 2024) noted that this gap risks entrenching discrimination, especially against marginalized groups.

The current framework is ill-equipped for emerging technologies like blockchain and federated learning, which challenge traditional notions of data ownership and centralization. By treating all data—behavioral and transactional—as equal, it overlooks their distinct privacy risks and analytical value, as CL (an Academic) emphasized: “the law treats all data equally, ignoring important distinctions” (FGD-4, 11 October 2024). To remain effective, ICS regulation must move beyond static compliance and adopt agile policy-making, iterative regulatory tools, and continuous engagement with technical stakeholders.

5.5. Expanding Digital Infrastructure

Infrastructure remains a foundational bottleneck. Despite 97.16% 4G coverage, rural regions face significant deficits in banking access points, Internet reliability, and advanced connectivity—hindering the deployment of AI, APIs, and other ICS enablers, as stated by EMR (an Academic, FGD-4, 11 October 2024) and BH (Financial Institutions representative, FGD-2, 2 October 2024. With only 2.9% 5G penetration, bridging this digital divide requires investment in decentralized technologies such as satellite broadband and mesh networks tailored to Indonesia’s terrain (

Komdigi, 2024;

Onoja & Ajala, 2022).

Data interoperability also poses a major challenge. Fragmented ministry data hinders MSME data consolidation, weakening ICS’s analytical foundation. Establishing a unified “Satu Data UMKM” with verified name–address datasets, similar to India’s MSME DataBank, would strengthen policy-making and credit inclusion. Public–private partnerships are essential to expand digital access and affordability. However, infrastructure alone is insufficient—low digital literacy increases vulnerability to fraud and exclusion. Coordinated efforts by OJK, MoF, and industry groups to integrate digital and financial literacy into education and outreach are crucial for equitable participation in Indonesia’s digital finance ecosystem.

6. Conclusions

This study deepens the understanding of ICS as both a technological innovation and a governance challenge within emerging financial systems. While previous research has focused on its predictive advantages over traditional credit models, this paper offers new empirical and conceptual insights into the structural barriers that limit its real-world application in emerging economies. Using Indonesia as a case study, it shows that ICS’s potential is constrained less by technical shortcomings than by fragmented regulation, institutional data hoarding, and opaque algorithmic practices.

Scientifically, this study offers three key insights. First, it highlights a regulatory paradox. ICS depends on real-time, decentralized data, but existing laws—like the PDP Law and recent POJK regulations—still favor centralized, sectoral oversight. This misalignment creates a governance gap that stifles innovation and fails to protect users. Second, algorithmic bias in ICS is shown to be institutional, not just technical, rooted in unrepresentative training data, weak audit requirements, and poor explainability standards—disproportionately harming rural borrowers and women. Third, the study reveals how SOEs treat public data as commercial assets, commodifying exclusion and undermining ICS’s inclusive potential.

To address these barriers, the paper proposes a dual-track model that integrates ICS with conventional systems (SLIK, 5Cs) to balance innovation with risk management. Realizing this vision requires coordinated policy reforms. First, regulatory frameworks must better reflect digital credit realities, with POJK 29/2024 introducing key licensing and transparency standards to support responsible innovation. Second, data governance should break down silos through interoperability initiatives like “Satu Data UMKM.” Third, oversight must include mandatory algorithm audits, bias mitigation protocols, and borrower redress mechanisms. Fourth, expanding digital infrastructure—particularly rural connectivity, 5G, and data literacy—is essential to ensure equitable access.

Beyond Indonesia, these findings contribute to the global conversation on ICS governance in low- and middle-income countries. They demonstrate that financial innovation alone does not guarantee inclusion. Effective scaling depends on institutional trust, accountable data ecosystems, and the political will to balance commercial and public interests in data access.

The study is not without limitations. Its reliance on purposively selected FGD participants limits generalizability, and the absence of longitudinal or baseline data constrains causal inference. Future research should employ mixed-methods designs, representative sampling, and cross-country comparison to assess the evolving impact of ICS on financial inclusion.

Overall, this paper shifts the ICS debate from technical capability to institutional feasibility, emphasizing that data-driven innovation must confront regulatory fragmentation, power asymmetries, and opaque decision-making. Effective governance must address not only data protection, but also the political economy of credit scoring to ensure equitable and inclusive financial access.

Author Contributions

Conceptualization, L.A. (Latif Adam) and B.S.; methodology, L.A. (Latif Adam), M.S., and J.S. (Jiwa Sarana); software, J.S. (Joko Suryanto); L.A. (Lisa Angelia); validation, L.A. (Latif Adam), M.R.N.A., Y.P., and M.T.; formal analysis, E.M., M.R.N.A., T.E., and Y.S.; investigation, Y.P., S.A., and L.A. (Lisa Angelia); resources, L.A. (Latif Adam), M.T., and M.S.; data curation, J.S. (Joko Suryanto), T.E., Y.S., and S.A.; writing—original draft preparation, L.A. (Latif Adam), J.S. (Jiwa Sarana), and B.S.; writing—review and editing, L.A. (Latif Adam), J.S. (Jiwa Sarana), and B.S.; visualization, J.S. (Joko Suryanto), S.A., and M.R.N.A.; supervision, M.S., M.T., and B.S.; project administration, J.S. (Jiwa Sarana) and S.A.; funding acquisition, Y.S., E.M., and T.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Fiscal Policy Agency, Financial Sector Policy Center, Ministry of Finance of the Republic of Indonesia (Grant Number: S-1/KF.5/2025).

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Institutional Review Board of On Social Studies And Humanities Research, BRIN No: 859/KE.01/SK/10/2024, 23 October 2024.

Informed Consent Statement

Informed consent was obtained orally from all participants, as documented through invitation and verbal agreement prior to the Focus Group Discussion.

Data Availability Statement

The datasets generated or analyzed during the current study are available from the corresponding author upon reasonable request.

Acknowledgments

The authors gratefully acknowledge the Fiscal Policy Agency of the Ministry of Finance for its financial and technical support. We also thank OJK (Indonesian Financial Services Authority) and AFTECH (Indonesia Fintech Association) for providing resources, facilities, and data. Special thanks to Aries Setiadi for his valuable assistance and insightful discussions. Any remaining errors or omissions are the sole responsibility of the authors.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| AI | Artificial Intelligence |

| AFTECH | Indonesia Fintech Association |

| CRISP-DM | Cross-Industry Standard Process for Data Mining |

| Dukcapil | Population and Civil Registration Agency |

| FCRA | Fair Credit Reporting Act |

| FGD | Focus Group Discussion |

| ICS | Innovative Credit Scoring |

| ISO | The International Organization for Standardization |

| KUR | People’s Business Credit |

| ML | Machine Learning |

| MSME | Micro, Small, and Medium Enterprises |

| OJK | Indonesian Financial Services Authority |

| PDP | Personal Data Protection |

| PLN | National Electrical Company |

| SLIK | Financial Information Services System |

References

- AFPI. (2024). Paparan FGD prospek innovative credit scoring sebagai alternatif pilihan ketiadaan atau kurangnya kualitas physical collateral pada UMK dan/atau perorangan berpenghasilan rendah (PBR). AFPI. [Google Scholar]

- Aggarwal, N. (2021). The norms of algorithmic credit scoring. Cambridge Law Journal, 80(1), 42–73. [Google Scholar] [CrossRef]

- Aitken, R. (2017). “All data is credit data”: Constituting the unbanked. Competition and Change, 21(4), 274–300. [Google Scholar] [CrossRef]

- Aji, N. A., & Dhini, A. (2019, July 13–15). Credit scoring through data mining approach: A case study of mortgage loan in Indonesia. 2019 16th International Conference on Service Systems and Service Management (ICSSSM) (pp. 1–5), Shenzhen, China. [Google Scholar] [CrossRef]

- Alibhai, S., Bessir Achew, M., & Strobbe, F. (2020). Designing a credit facility for women entrepreneurs lessons from the Ethiopia women entrepreneurship development project (WEDP). World Bank. [Google Scholar]

- Badan Pusat Statistik (BPS). (2023, February). Keadaan ketenagakerjaan indonesia februari 2023. Employment Situation in Indonesia. Available online: https://www.bps.go.id/id/pressrelease/2023/05/05/2001/februari-2023--tingkat-pengangguran-terbuka--tpt--sebesar-5-45-persen-dan-rata-rata-upah-buruh-sebesar-2-94-juta-rupiah-per-bulan.html (accessed on 24 February 2025).

- Bank Indonesia. (2022). Financial stability review (FSR)—2022. Available online: https://www.bi.go.id/en/publikasi/kajian/Documents/Financial-Stability-Review_38.pdf (accessed on 27 March 2025).

- Berg, T., Burg, V., Gombovic, A., & Puri, M. (2019). On the rise of FinTechs: Credit scoring using digital footprints. The Review of Financial Studies, 33(7), 2845–2897. [Google Scholar] [CrossRef]

- Braun, V., & Clarke, V. (2006). Using thematic analysis in psychology. Qualitative Research in Psychology, 3(2), 77–101. [Google Scholar] [CrossRef]

- CGAP & World Bank. (2022). The CGAP annual report 2022. Available online: https://www.cgap.org/story/annualreport2022 (accessed on 25 April 2025).

- Cloudera. (2019). Utilizing big data, AI and ML to better understand customers: Bank Rakyat Indonesia customer success story. Cloudera. Available online: https://www.cloudera.com/ (accessed on 24 February 2025).

- Das, S., Stanton, R., & Wallace, N. (2023). Algorithmic fairness. Annual Review of Financial Economics, 38, 30. Available online: https://www.annualreviews.org/content/journals/10.1146/annurev-financial-110921-125930 (accessed on 24 February 2025).

- Demirgüç-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2022). Global Findex Database 2021: Financial inclusion, digital payments, and resilience in the age of COVID-19. World Bank. [Google Scholar] [CrossRef]

- Dhaigude, R., & Lawande, N. (2022, February 24–26). Impact of artificial intelligence on credit scores in lending process. 2022 Interdisciplinary Research in Technology and Management (IRTM) (pp. 1–5), Kolkata, India. [Google Scholar] [CrossRef]

- DLA PIPER. (2024, January 19). Enforcement in Ghana. DLA PIPER. [Google Scholar]

- Ebong, J., & Babu, G. (2020). Demand for credit in high-density markets in Kampala: Application of digital lending and implication for product innovation. Journal of International Studies, 13(4), 295–313. [Google Scholar] [CrossRef]

- Erlando, A., Riyanto, F. D., & Masakazu, S. (2020). Financial inclusion, economic growth, and poverty alleviation: Evidence from eastern Indonesia. Heliyon, 6(10), e05235. [Google Scholar] [CrossRef]

- Garcia, A. C. B., Garcia, M. G. P., & Rigobon, R. (2024). Algorithmic discrimination in the credit domain: What do we know about it? AI and Society, 39(4), 2059–2098. [Google Scholar] [CrossRef]

- Hennink, M. M., Kaiser, B. N., & Marconi, V. C. (2017). Code saturation versus meaning saturation: How many interviews are enough? Qualitative Health Research, 27(4), 591–608. [Google Scholar] [CrossRef]

- Hlongwane, R., Ramaboa, K. K. K. M., & Mongwe, W. (2024). Enhancing credit scoring accuracy with a comprehensive evaluation of alternative data. PLoS ONE, 19(5), e0303566. [Google Scholar] [CrossRef]

- International Finance Corporation (IFC). (2025). MSME finance gap. World Bank Group. Available online: https://www.smefinanceforum.org/sites/default/files/Data%20Sites%20downloads/IFC%20Report_Annex%20ONLY%20Final%203%2025.pdf?utm_source (accessed on 15 July 2025).

- International Monetary Fund (IMF). (2020). Financial access survey: How to interpret FAS data? IMF Working Paper No. 20/291. Available online: https://www.imf.org/en/Publications/WP/Issues/2020/12/18/Financial-Access-Survey-How-to-Interpret-FAS-Data-49952 (accessed on 14 April 2025).

- International Organization for Standardization & International Electrotechnical Commission. (2022). Information security, cybersecurity and privacy protection—Information security management systems—Requirements Sécurité (Vol. 2022). International Organization for Standardization; International Electrotechnical Commission. [Google Scholar]

- Irfan, M. (2023). The impact of AI innovation on financial sectors in the era of industry 5.0. IGI Global. [Google Scholar]

- Kamimura, E. S., Pinto, A. R. F., & Nagano, M. S. (2023). A recent review on optimisation methods applied to credit scoring models. Journal of Economics, Finance and Administrative Science, 28(56), 352–371. [Google Scholar] [CrossRef]

- Kemenkop UMKM Republik Indonesia. (2024). UMKM dalam angka. Kemenkop UMKM Republik Indonesia. [Google Scholar]

- Komdigi. (2024, June 21). DJPPI kominfo merilis infografis infrastruktur jaringan telekomunikasi Indonesia. Komdigi. [Google Scholar]

- Krefting, L. (1991). Rigor in qualitative research: The assessment of trustworthiness. The American Journal of Occupational Therapy, 45(3), 214–222. [Google Scholar] [CrossRef]

- Krueger, R. A., & Casey, M. A. (2014). Focus groups: A practical guide for applied research (5th ed.). SAGE Publications. [Google Scholar]

- Lainez, N., & Gardner, J. (2023). Algorithmic credit scoring in Vietnam: A legal proposal for maximizing benefits and minimizing risks. Asian Journal of Law and Society, 10(3), 401–432. [Google Scholar] [CrossRef]

- Lee, J. Y., & Yang, J. (2024). Properties of alternative data for fairer credit risk predictions. Journal of Data-centric Machine Learning Research. Available online: https://data.mlr.press/assets/pdf/v02-2.pdf (accessed on 19 February 2025).

- Leong, C., Tan, B., Xiao, X., Tan, F. T. C., & Sun, Y. (2017). Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. International Journal of Information Management, 37(2), 92–97. [Google Scholar] [CrossRef]

- Lopez, T., & Winkler, A. (2018). The challenge of rural financial inclusion–evidence from microfinance. Applied Economics, 50(14), 1555–1577. [Google Scholar] [CrossRef]

- Lu, T., Zhang, Y., & Li, B. (2019). The value of alternative data in credit risk prediction: Evidence from a large field experiment (Vol. 10). Available online: https://aisel.aisnet.org/icis2019/data_science/data_science/10 (accessed on 5 May 2025).

- Makarim & Taira S. (2025, July). OJK provides further guidelines for reporting of shares in publicly listed companies through electronic system (Issue 15). M&T Advisory. Available online: https://www.makarim.com (accessed on 24 February 2025).

- Miljkovic, T., & Wang, P. (2025). A dimension reduction assisted credit scoring method for big data with categorical features. Financial Innovation, 11(1), 29. [Google Scholar] [CrossRef]

- Ministry of Cooperatives and SMEs of The Republic of Indonesia. (2019). Perkembangan data UMKM. Ministry of Cooperatives and SMEs of The Republic of Indonesia. [Google Scholar]

- Mostafa, S., Ashraf, S. E., & Marwa, E. (2023). The impact of financial inclusion on economic development. International Journal of Economics and Financial Issues, 13(2), 93–101. [Google Scholar] [CrossRef]

- Munoz-Cancino, R., Bravo, C., Rios, S., & Grana, M. (2022). Assessment of creditworthiness models privacy-preserving training with synthetic data. In Hybrid artificial intelligent systems. HAIS 2022. Lecture Notes in Computer Science, 13469. Springer. [Google Scholar] [CrossRef]

- Mwangi, M. (2024). The role of machine learning in enhancing risk management strategies in financial institutions. International Journal of Modern Risk Management, 2(5), 44–53. [Google Scholar]

- Newman, J. (2014). Conducting social science research. SAGE Publications. [Google Scholar]

- Njuguna, R., & Sowon, K. (2021, June 28–July 2). Poster: A scoping review of alternative credit scoring literature. The 2021 4th ACM SIGCAS Conference on Computing and Sustainable Societies, COMPASS 2021 (pp. 437–444), Virtual. [Google Scholar] [CrossRef]

- OJK. (2021). National strategy on Indonesian financial literacy (SNLKI) 2021–2025. OJK. [Google Scholar]

- OJK. (2024). Survei nasional literasi dan inklusi keuangan 2024. OJK. [Google Scholar]

- Onay, C., & Öztürk, E. (2018). A review of credit scoring research in the age of big data. Journal of Financial Regulation and Compliance, 26(3), 382–405. [Google Scholar] [CrossRef]

- Onoja, J. P., & Ajala, O. A. (2022). Innovative telecommunications strategies for bridging digital inequities: A framework for empowering underserved communities. GSC Advanced Research and Reviews, 16(1), 210–217. [Google Scholar] [CrossRef]

- P&L Law. (2018, May 9). Philipinne e-legal forum. P&L Law. [Google Scholar]

- Purnagunawan, R. M., Temenggung, D., Adam, L., & Tresnatri, F. A. (2023). Financial inclusion and economic recovery programme: From limiting factor to opportunity. In Keeping Indonesia safe from the COVID-19 pandemic (pp. 455–494). ISEAS–Yusof Ishak Institute Singapore. [Google Scholar] [CrossRef]

- Rachbini, E. M., Listiyanto, E., Irhamna, A. D. P., Adha, I. A. F., Komaria, N., Maarif, B., & Firlana, A. M. (2023). Innovative credit scoring untuk inklusi keuangan. In INDEF POLICY BRIEF, No. 5/2023. Institute for Development of Economics and Finance (INDEF). [Google Scholar]

- Simatele, M., & Kabange, M. (2022). Financial inclusion and intersectionality: A case of business funding in the South African informal sector. Journal of Risk and Financial Management, 15(9), 380. [Google Scholar] [CrossRef]

- Smith, M. M., & Henderson, C. (2018). Beyond thin credit files. Social Science Quarterly, 99(1), 24–42. [Google Scholar] [CrossRef]

- SSEK Law Firm. (2024, July 29). What are the consequences of breaches of data protection law in Indonesia? SSEK Law Firm. [Google Scholar]

- Sugandi, E. A. (2021). The covid-19 pandemic and Indonesia’s fintech markets*ADBI working paper 1281. Asian Development Bank Institute. Available online: https://www.adb.org/publications/covid-19-pandemic-indonesia-fintech-markets (accessed on 24 February 2025).

- Tan, T., Zhang, Y., Suang Heng, C., & Ge, C. (2021). Empowerment of grassroots consumers: A revelatory case of a chinese FinTech innovation. Journal of the Association for Information Systems, 1(22), 179–203. [Google Scholar]

- TBI. (2023, August 11). Data protection act: Prison sentence dropped in new draft, only fine kept. TBI. [Google Scholar]

- The Times of India. (2023, August 3). Entities violating digital data protection norm to face penalty of up to Rs 250 crore. The Times of India. [Google Scholar]

- Thomas, L. C. (2000). A survey of credit and behavioural scoring: Forecasting financial risk of lending to consumers. International Journal of Forecasting, 16(2), 149–172. [Google Scholar]

- Tomczak, J. M., & Ziȩba, M. (2015). Classification restricted Boltzmann machine for comprehensible credit scoring model. Expert Systems with Applications, 42(4), 1789–1796. [Google Scholar] [CrossRef]

- Widiatedja, P., & Mishra, N. (2022). Establishing an independent data protection authority in Indonesia: A future-forward perspective. International Review of Law, Computers and Technology, 37(3), 252–273. [Google Scholar] [CrossRef]

- Wijaya, T. (2023). Berkembangnya sistem innovative credit scoring di Indonesia: Menilai risiko dantantangan kebijakan. Available online: www.cips-indonesia.org (accessed on 6 May 2025).

- World Bank. (2018). Developing and operationalizing a national financial inclusion strategy: Training materials. World Bank. [Google Scholar]

- World Bank. (2019). Credit scoring approaches guidelines. World Bank. [Google Scholar]

- World Bank. (2022). Key principles for effective regulation and supervision of credit reporting service providers. World Bank. Available online: www.worldbank.org (accessed on 3 May 2025).

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).