1. Introduction

Japan’s electricity generation is heavily dependent on fossil fuels, which made up over 75% of its energy supply in 2020 [

1]. Of this, natural gas contributed 39%, coal 31%, and crude oil 6%. The global fossil fuel market has been significantly affected by the COVID-19 pandemic since 2019 and the Russia–Ukraine conflict that began in 2022 [

2]. Geopolitical factors, oil prices, and risk premiums are closely linked, often disrupting global and regional stability [

3,

4]. As a strategically important yet unevenly distributed resource, oil plays a politically charged role in international trade [

5]. Political uncertainties, especially geopolitical risks, have emerged as key influences on the oil market, making them prominent and contentious topics in current discussions [

6,

7].

On 21 April 2020, U.S. crude oil prices turned negative for the first time, leading producers to pay buyers to take excess barrels due to a surplus of oil [

8]. This unprecedented price drop was largely the result of unsuccessful talks between Russia and the Organization of the Petroleum Exporting Countries (OPEC) about cutting daily oil production, compounded by a sharp decline in demand caused by the COVID-19 pandemic. The drop in oil demand was part of a wider decrease in energy consumption, driven by widespread office closures and a significant slowdown in industrial activity due to travel and work restrictions imposed by governments to contain the virus [

9,

10]. Furthermore, research by Buechler et al. [

11] on global electricity consumption during the COVID-19 pandemic revealed that stricter government restrictions and significant drops in mobility, especially in retail and recreation, were closely linked to decreases in electricity usage.

Japan, like many other countries, is currently struggling to stabilize its electricity prices amid ongoing crises. The Japanese electricity market is closely linked to the fossil fuel market because fossil fuels are still the main source of electricity generation in many countries, and changes in fossil fuel prices have a significant impact on electricity costs [

12]. In 2022, Japan was the fifth-largest oil consumer globally and depended on imports for 97% of its oil needs due to its limited domestic resources [

13]. Therefore, disruptions in the oil supply chain, whether from geopolitical conflicts or global events like the COVID-19 pandemic, can greatly impact both the economy and market prices [

5,

14]. This makes it more important than ever for the Japanese government to understand the connection between electricity and fossil fuel prices to develop effective energy policies that stabilize the electricity market. In Japan, electricity is supplied to consumers under three types of contracts: extra-high-, high-, and low-voltage contracts [

15].

The extra-high-voltage contract is for consumers whose maximum monthly electricity demand exceeds 2000 kilowatts (kW) and is often provided for customers such as large factories and railway companies. The high-voltage contract is made between the power company and customers such as companies and small- to medium-sized factories whose maximum monthly electricity demand is between 50 kW and 2000 kW. Finally, the low- voltage contract is for customers whose demand is less than 50 kW, such as normal households, small shops, and so on.

Since 2016, Japan’s electricity market has been fully liberalized, which has separated power generation and retail activities among multiple independent market participants [

16]. While introducing competition typically lowers prices, it also increases price volatility, causing prices to fluctuate both up and down. Because electricity cannot be stored, this volatility can lead to sharp price increases, known as spikes, as well as negative prices, both of which can destabilize the market [

17]. Given the critical role of electricity for nations, regulatory policies are often implemented to complement power markets, ensuring smooth trading on exchanges and reducing the risk of market instability. However, the subsequent changes in market dynamics and price responses to external factors such as fuel costs are not yet fully understood.

Japan’s electricity industry was historically dominated by ten regional monopolies, each responsible for all aspects of the sector, from power generation to retail [

18]. Studies on Japan’s average monthly electricity demand after events like the global financial crisis (GFC) and the Great Tohoku earthquake and tsunami, and the Fukushima disaster show that different types of electricity users respond differently to disruptions [

16]. For example, large energy users, such as industrial facilities, reduced their electricity demand following the GFC, whereas reductions in demand after the Fukushima disaster were mainly driven by domestic users. This aligns with findings by Wakiyama et al. [

19], who reported significant national reductions in electricity usage after such events. Additional research has examined changes in demand patterns, with Murakoshi et al. [

20] noting a decoupling of electricity demand from temperature following the disaster, and Daggy et al. [

21] exploring reductions in domestic energy consumption in the context of energy-saving reforms and supportive social structures.

Although there is a strand of literature exploring the linkage between electricity and fossil fuel markets [

12,

22,

23], residential behavioral changes and electricity consumption [

24], COVID-19’s impact and electricity demand and generation, not much has been investigated on whether there is a distinction among the types of electricity contracts regarding their effects from the fossil fuel market. Since extra-high-voltage electricity consumers, such as factories and train companies, are heavy users of electricity, they are less likely to adjust their energy consumption even when rising fossil fuel prices drive up electricity costs. On the other hand, consumers on low-voltage contracts—primarily regular residential households—are more likely to reduce their electricity usage. As a result, electricity prices under low-voltage contracts may be affected differently compared to those under extra-high-voltage contracts. To shed light on this issue, the current study examines the impact of the recent unstable fossil fuel market on the three types of electricity contracts (extra-high-voltage, high-voltage, and low-voltage) in Japan.

This study makes the following contributions. First, the study is one of the maiden attempts to quantitatively test how the Japanese electricity market is affected by fossil fuel prices during times of distress when fossil fuel prices are severely affected by the COVID-19 pandemic and the Russia–Ukraine war. Second, the study also statistically tests whether there are structural breaks in the Japanese electricity prices during 2019–2022 and seeks to identify the timing of events (such as the COVID-19 pandemic and the Russia–Ukraine war) relative to the electricity prices. Third, previous studies have not considered the three types of Japanese electricity contracts (extra-high-, high-, and low-voltage contracts) in their empirical models, which provides user-specific findings. Finally, the result provides valuable information for policymakers and stakeholders in the electricity market to understand what impact might occur on the electricity market from the fossil fuel market when crises are impacting the fossil fuel market at a level rarely seen in history. The study also helps us understand which fossil fuel sources contribute to electricity prices when they are surging due to a pandemic and war.

The paper is organized as follows:

Section 2 provides a literature review,

Section 3 details the data sources,

Section 4 explains the methodology,

Section 5 discusses the empirical results, and

Section 6 wraps up with policy implications.

2. Literature Review

Recent research has highlighted the growing connection between natural gas and electricity markets [

25,

26,

27,

28]. These studies investigate how changes in natural gas prices impact electricity prices and market operations. Binder and Mjelde [

29] find long-term relationships between coal inventories and the prices of coal, natural gas, and electricity. They observe these relationships in the U.S. market but point out that deregulation might cause parameter instability, indicating a need for more research on the impact of regulatory changes. Chuliá et al. [

30] examine the connections between different energy markets using a detailed dataset of prices for electricity, natural gas, coal, oil, and carbon. Additionally, recent studies have looked into how natural gas and electricity prices interact during periods of market stress. Scarcioffolo and Etienne [

31] and Uribe et al. [

32] find evidence of spillovers between natural gas and electricity returns in various market conditions, especially at moderate to high return levels. Uribe et al. [

32] also investigated how shocks in natural gas prices affect electricity prices across 21 European markets during the dramatic price increases seen in 2021 and 2022.

Moreover, in recent times, pandemics and war conflicts have significantly impacted energy supply chains and market prices due to economic stagnation across the world [

33,

34]. In some studies, the effects of the COVID-19 pandemic have been examined for the energy markets [

35,

36] and electricity markets [

37,

38]. Similar concerns have also followed the Russia–Ukraine turmoil, adding to global energy market uncertainty [

39,

40]. Since our study focuses on the relationship between the Japanese electricity and fossil fuel markets under crisis events, here we only covered studies that investigate such relationships along with the recent global crisis events. It is also important to note that most of the studies applied conditional quantile regression [

32], the Granger causality test [

12,

26], time series forecasting models [

33], multi-fractal detrended cross-correlation analysis (MF-DCCA) [

39], and so on.

There also exist studies focusing on the relationships among energy markets and external shocks. Aruga [

41] shows that Japan’s post-Fukushima reliance on fossil fuels increased electricity costs and market vulnerability. Grossman [

42] highlights how energy shocks trigger reactive policy responses, emphasizing institutional adaptability. Smith et al. [

43] and Amamou and Bargaoui [

44] demonstrate how COVID-19 disrupted global energy markets and reduced emissions. Nyga-Łukaszewska and Aruga [

45] further found that crude oil and gas prices in the U.S. and Japan displayed signs of market immunity, with varying responses to pandemic-induced shocks. Together, these studies underscore how crises reshape energy prices, policies, and system resilience.

None of the aforementioned studies examined the effects of natural gas and coal prices on the Japanese electricity market during the crisis using an ARDL model that incorporates structural breaks in the time series data. One of the contributions of the present study to the existing literature is that it examines the effects of the recent unstable fossil fuel market on the three different types of electricity contracts in Japan. Although the study conducted by Uribe et al. [

32] is conceptually similar to ours, they focused on European markets through conditional quantile regression and considered weather-related variables, including wind speed, temperature, precipitation, and irradiance. The current study is different from this study since it focuses on the relationship between electricity and fossil fuel prices and compares differences in the relationships among different types of electricity contracts.

3. Sources of Data

This study analyzes the relationship between fossil fuel prices with the Japanese electricity prices (extra-high-, high-, and low-voltage contracts) during crises using monthly data from January 2019 to November 2022. The reason for choosing this period is to include one year before and after the 2020–2021 period, which was severely affected by the COVID-19 pandemic. All the price variables are obtained from the homepage administered by the Energy Information Center (EIC), a general incorporated association located in Tokyo, Japan [

46]. The unit of measurement for electricity prices is JPY per megawatt-hour, while that for fossil fuels is United States Dollar (USD) per metric ton. According to the EIC, the original electricity prices are estimated by the Electricity and Gas Market Surveillance Commission under the Ministry of Economy, Trade, and Industry of Japan. The LNG price refers to the LNG import price (CIF: Cost, Insurance, and Freight), the coal price corresponds to the Australian coal price, and the crude oil price is based on the Dubai Fateh price as reported by the World Bank. Since the electricity price was provided in Japanese Yen (JPY) while the fossil fuel prices were in USD, the electricity prices are converted to JPY using the monthly exchange rate provided by Investing.com. Then, all the price data used in the study are transformed into a natural log form (

Table 1).

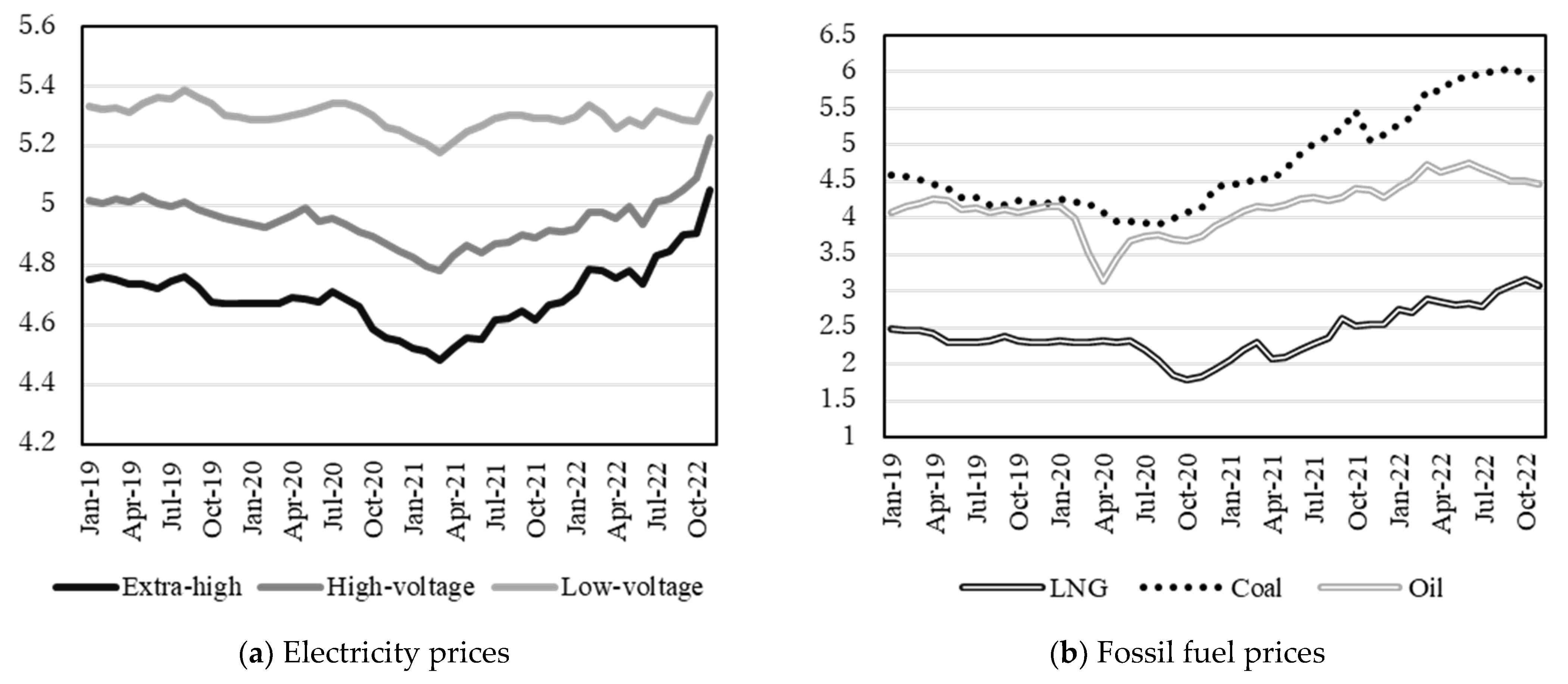

Moreover,

Figure 1 illustrates the plots of log prices investigated in the study. It is evident from the figure that both electricity and fossil fuel prices are stagnant until 2020, but they start to show an increasing trend after 2021. The drop in electricity and fossil fuel prices in 2020 is likely related to the effect of restrictions on human mobility due to the spread of COVID-19. Aruga [

38] reveals that an increase in the number of hours spent at home in 2020 had a negative impact on electricity demand during the COVID-19 pandemic in Tokyo. The increase in price after 2021 is perhaps connected to the recovery from the effects of the pandemic, since economic activities began to normalize after 2021. The figure also reveals a sharp increase in the coal price from the beginning of 2022 compared to LNG and crude oil. METI [

47] suggests that this sharp increase is attributed not only to the impact of COVID-19 but also to heightened concerns over energy security due to the destabilization of the international situation, such as Russia’s invasion of Ukraine, and the persistent high levels of energy resource prices.

4. Material and Methods

The theoretical background of the econometric model analyzed in this study is based on the electricity and fossil fuel price model developed by Mohammandi [

12]. In this study, this model has been modified to consider the seasonality effects, the COVID-19 pandemic, and the Russia–Ukraine war impacts by including the effects of breakpoints in the time series data after statistically identifying them.

First, a multiple structural break test was conducted to identify changes in the price series, using the method developed by Bai and Perron [

48]. Although other techniques, such as those by Andrews [

49] and Andrews and Ploberger [

50], can detect structural breaks in time series data when the breaks are unknown, they often struggle with nonstationary data. The Bai–Perron test is particularly useful because it effectively handles these challenges and can identify multiple unknown breaks in the series [

51]. The Bai–Perron test is performed under the following m-partitioned regression model:

where

is the electricity price for the types of electricity contracts at time

t,

is a vector of independent variables including an intercept that is regime specific,

is the corresponding vector of coefficients, m is the number of breaks, and

is the disturbance term. In this study, Equation (1) is analyzed by including the lag of the electricity price to estimate the model with a simple autoregressive model (AR (1)), and liquefied natural gas (LNG), coal, and oil prices to consider their effects on the electricity price. The maximum number of breaks is set to three in this study.

If any breaks were determined by the Bai–Perron test, a dummy variable, break, is created to capture the effect of the breaks in the price series. Using this dummy variable, the electricity and fossil fuel price relationships are tested under the following ARDL model:

where electricity is the type of electricity (extra-high-, high-, and low-voltage contracts) LNG is the cost, CIF is the price of imported LNG for Japan. Coal and oil are the Australian imported coal price and the Dubai Fateh crude oil price. These prices are one of the major indicators of imported coal and crude oil prices in Japan. All price series are monthly data. Finally, summer and winter are dummy variables capturing seasonality effects, where summer contains months from June to September and winter includes months from December to March. In Equation (2),

denotes the first order difference,

p is the order of the lag of the independent variable, and

q,

r, and

s are the lag orders of LNG, coal, and oil prices. The optimal lag for the model is estimated using the Akaike information criteria (AIC).

The period covered in this study is from January 2019 to November 2022. Since the ARDL model requires the test variables to be either integrated of order zero or one, three types of unit roots were preliminary conducted on the test variables. For this purpose, the Augmented Dickey–Fuller (ADF) and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) tests were conducted with intercept and trend. In addition, the Zivot–Andrews (ZA) with a trend break was performed to consider the effect of a structural break in the series.

Finally, to analyze the dynamic causal effects between electricity and fossil fuel prices, we employed the ARDL model to estimate the cumulative dynamic multipliers. Developed by Pesaran et al. [

52], the ARDL methodology is preferred because it has distinct advantages over other cointegration techniques. It can accommodate variables with various levels of stationarity—whether I(0), I(1), or a combination of both—making it robust regardless of the variables’ stationary properties. The ARDL model is also effective due to its “general to specific” approach, which uses an appropriate number of lags to facilitate meaningful data interpretation. By addressing both short-term adjustments and long-term equilibrium, the ARDL method enables the derivation of the error correction mechanism (ECM) through a straightforward linear transformation, preserving the long-run relationship and thus enhancing the model’s interpretative power and applicability.

Empirical evidence shows that the ARDL approach is more effective than the Johansen and Juselius method, especially with small sample sizes [

52]. It effectively addresses issues related to residual correlation and mitigates endogeneity concerns that can arise from inadequate lag selection [

40]. Additionally, the ARDL approach clearly distinguishes between dependent and independent variables, leading to a more detailed analysis of their interactions.

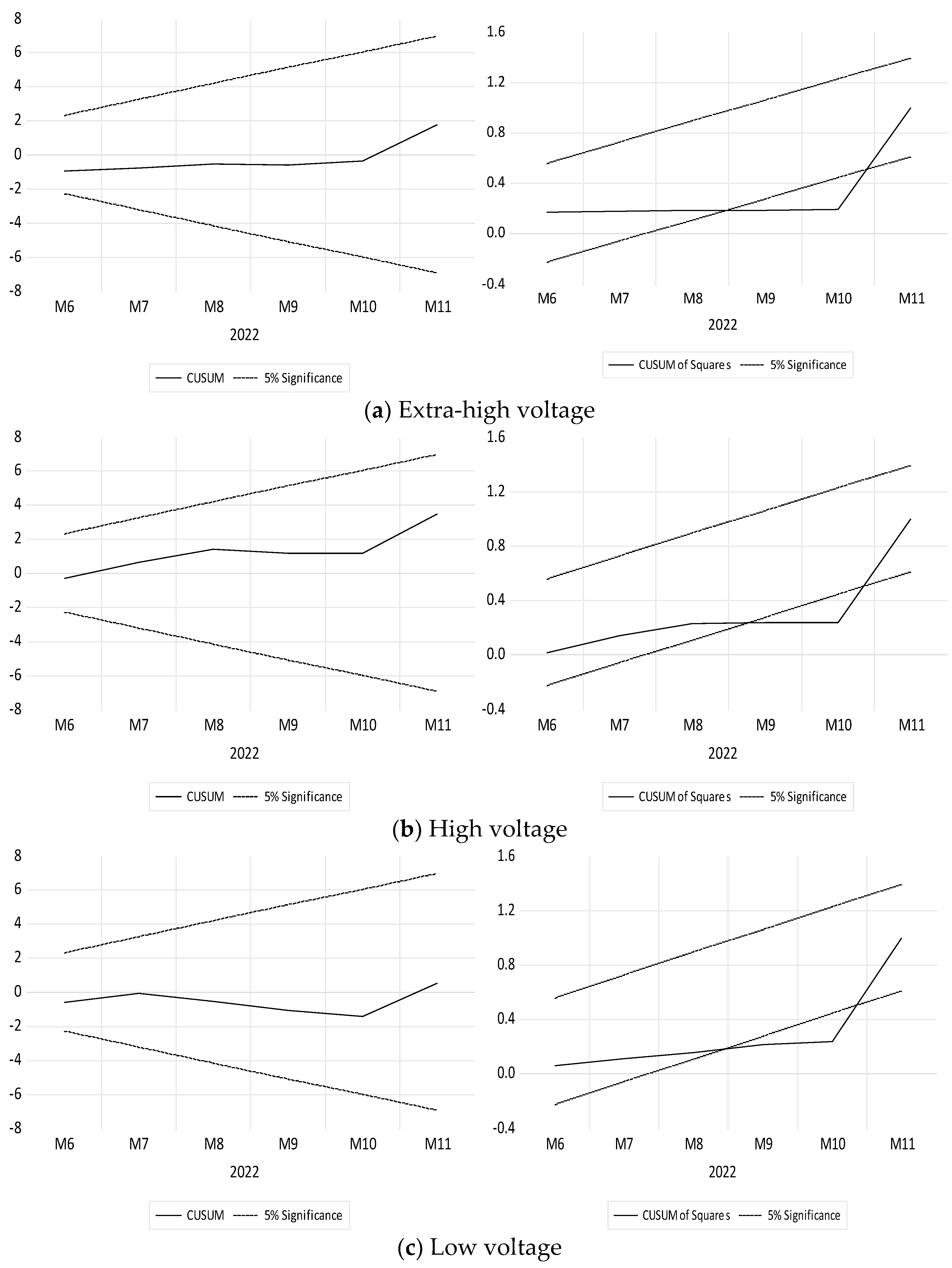

To test the robustness of the models, we conducted assessments for serial correlation, heteroskedasticity, and stability. Serial correlation was tested using the Breusch–Godfrey (BG) test, and heteroskedasticity was checked with the Breusch–Pagan–Godfrey (BPG) test (see

Table A1 in

Appendix A). The stability of the coefficients was evaluated with the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) tests (see

Figure A1 in

Appendix B). Since the low-voltage contract model showed signs of heteroskedasticity and autocorrelation, the ARDL models were estimated using the Newey–West estimator, which accounts for both heteroskedasticity and autocorrelation.

Table 2 presents a statistical summary associated with the actual values of variables from January 2019 to November 2022. Comparing the mean, median, and standard deviation among the electricity prices, it is discernible that the electricity prices of low-voltage users are higher than those of extra-high- and high-voltage users. On the other hand, among fossil fuel prices, mean coal prices are higher than LNG and crude oil.

Extra-high-voltage, high-voltage, LNG, and coal prices are positively skewed, while low-voltage and crude oil prices are negatively skewed. Moreover, kurtosis statistics show that most of the modeled variables (extra-high-, high-, and low-voltage, and crude oil) prices have a kurtosis value greater than 3, which represents relatively high kurtosis, meaning it has heavy tails and a sharper peak compared to the normal distribution, while LNG and coal prices showed that the distribution is platykurtic, meaning it is flatter and has fewer extreme values (i.e., thinner tails) compared to a normal distribution.

5. Results and Discussion

We began by applying the Bai–Perron multiple structural change test, setting the maximum number of breaks at five. The results from the unweighted and weighted double maximum tests (UDmax and WDmax) indicated that the optimal number of breaks was three. Based on this finding, we proceeded with the SupF test, limiting the maximum number of breaks to three. The SupF test results confirmed that three structural breaks were statistically optimal across all three electricity contract types (

Table 3). According to the sequential SupF test [

48], three was the statistically optimal number of breaks.

The first break was found in October 2020 for the extra-high-voltage contract, and it was in October 2019 for the high- and low-voltage contracts. In all contracts, the second break occurred in 2021, when the COVID-19 pandemic relatively calmed down in Japan. Thus, it could be postulated that the period between the first and second breaks is affected by the COVID-19 pandemic. Finally, in all contracts, the third break was identified in May 2022, which is likely related to the effects of the Russian invasion of Ukraine in February 2022. Dummy variables to capture the breaks were created using the breakpoints determined in the electricity price series. B1 denotes the first break, which is the period before October 2020 for extra-high-voltage contracts and before October 2019 for the high- and low-voltage contracts. B2 is the second break, which represents the period between October 2020 and July 2021 for the extra-high-voltage contract and between October 2019 and April 2021 for the high and low contracts. B3 signifies the third structural break, containing the period after May 2022 in all contracts.

To confirm the validity of applying the ARDL model to the test series, the Augmented Dickey–Fuller, Zivot–Andrews, and Kwiatkowski–Phillips–Schmidt–Shin tests were conducted. As seen in

Table 4, the Zivot–Andrew test nonetheless indicated that all price variables were either I(0) or I(1), supporting the use of the ARDL model for analyzing the price series (

Table 4).

Next, we performed the ARDL bound test to explore the cointegrating relationship between electricity and fossil fuel prices.

Table 5 shows the result of the long-run bound test to see if cointegration persists among electricity and fossil fuel prices. The table indicates that all cointegration relationships are sustained across all three electricity contracts.

Table 6 presents the result of the long-run relationships, which explains which fossil fuel prices contribute to the cointegration relationship. The results indicate that none of the fossil fuel prices affect the extra-high-voltage contract price in the long run.

In contrast, for both low-voltage and high-voltage contracts, natural gas prices are the primary drivers of the long-term relationship, exerting an upward influence on electricity contract prices. The positive relationship between LNG prices and electricity prices is likely closely associated with the Fuel Cost Adjustment (FCA) mechanism in electricity pricing in Japan, which adjusts electricity rates in response to fluctuations in fossil fuel prices [

53]. The FCA typically incorporates the average prices of three major fuels—crude oil, LNG, and coal—allowing utilities to pass rising fuel costs onto consumers. Consequently, a positive relationship between LNG prices and electricity prices is consistent with the FCA framework, particularly given LNG’s significant share in Japan’s electricity generation mix.

However, it can be observed from

Table 6 that coal and crude oil prices had a negative impact on electricity prices in low-voltage contracts, which is counterintuitive within the FCA structure. Several explanations may account for this result. First, higher coal and oil prices may signal broader energy cost inflation, prompting consumers to reduce electricity consumption through conservation or substitution, thereby exerting downward pressure on electricity prices. Second, since coal and oil contribute less to Japan’s electricity generation compared to LNG; their price fluctuations may exert a more limited influence on retail electricity rates through the FCA. Lastly, market dynamics such as declining wholesale prices driven by reduced demand or policy interventions aimed at stabilizing electricity costs for low-voltage consumers may offset the expected cost pass-through effects.

Table 7 illustrates the result of the ARDL short-run estimation. It is evident from the table that natural gas did not have a short-run impact in all three contract models at the 5% significance level. However, it indicates that the change in crude oil price had a negative impact on the high-voltage contract model. This negative relationship might stem from the increased costs associated with electricity generation using crude oil in high-voltage-contract scenarios. It also suggests that the coal price had a negative impact on the low-voltage model. This negative impact of the fossil fuel price on electricity prices in the short run might be reflected by the drop in electricity demand when fossil fuel prices rise, leading to a temporary decrease in electricity prices. This negative correlation could imply that when coal prices rise, there might be a short-term reduction in electricity prices for low-voltage contracts due to cost adjustments in electricity generation from coal. This finding is supported by Tingting et al. [

54], who found that as the penetration rate of renewable energy with lower marginal costs increases in the power generation structure, the overall price of the electricity market decreases, and grid operators, in response, lower the sale price of electricity. The study revealed that while regional electricity demand data in Japan generally matched expected trends for residential users, it fell short for business and industrial users, particularly those in the 50–2000 kW range. The most significant deviations from these trends occurred in May 2020, coinciding with voluntary lockdown measures. These results are in line with international studies on the impact of COVID-19 on electricity demand [

16].

The Bai–Perron test detected a major shock in October 2019, showing a drop in electricity prices from October 2019 to April 2021, during the COVID-19 pandemic in Japan. This decline is consistent with Aruga [

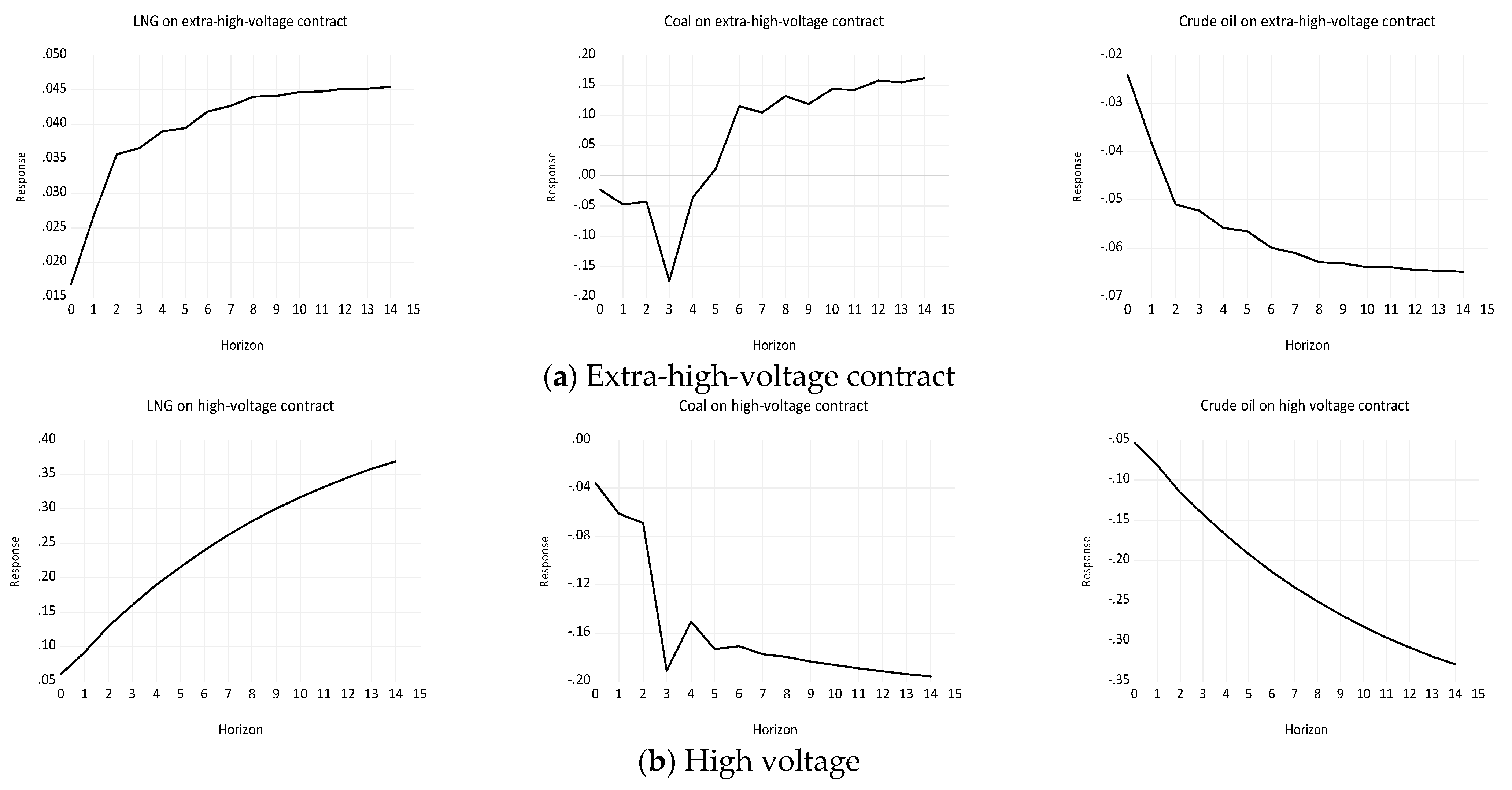

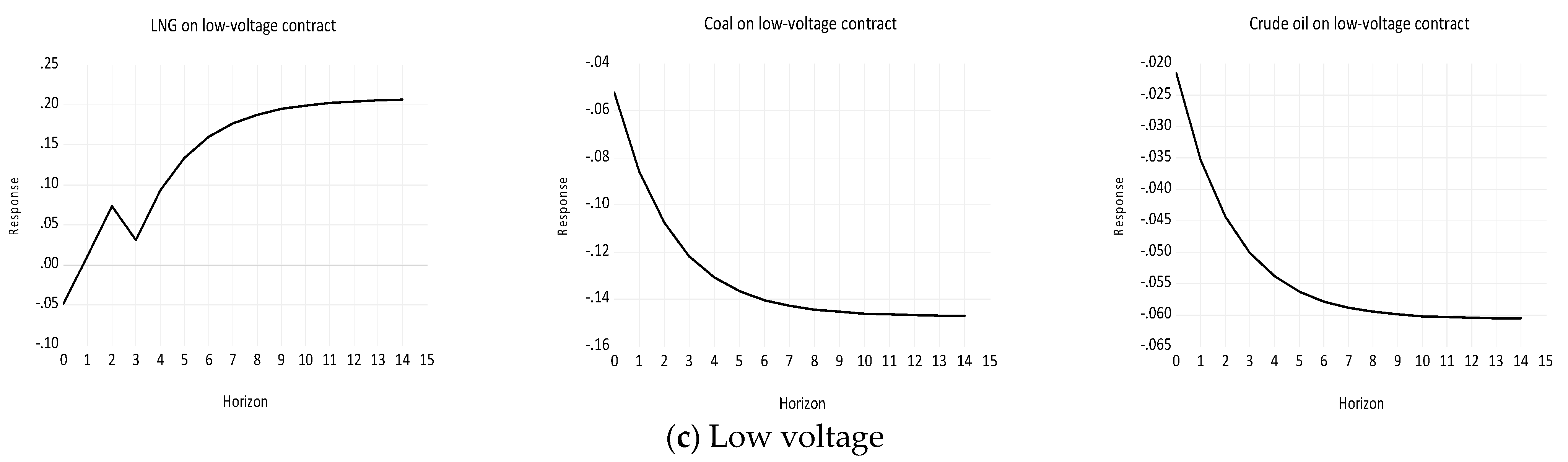

38], who also reported a decrease in Tokyo’s electricity prices due to pandemic-related restrictions. Furthermore, a structural shock observed after May 2022 indicated a rise in electricity prices, suggesting that the Russia–Ukraine war contributed to increasing electricity costs. Finally, the cumulative dynamic multipliers in

Figure 2 suggest that the shock from natural gas had an increasing effect on all three electricity contracts, while crude oil had a decreasing impact on all contracts.

Coal had a different influence among the three contracts. There was a rising shock after the third-period shock in the extra-high-voltage contract model, while high- and low-voltage contracts revealed a declining shock.

6. Conclusions and Policy Implications

The study investigated how the severe changes in fossil fuels during the COVID-19 pandemic and the 2022 Russia–Ukraine war influenced the Japanese electricity market. The estimated results suggest that the impact of each fossil fuel price change on electricity prices is very different in the short and long term. The fossil fuel price did not establish a long-term relationship with the extra-high-voltage contract. However, for both low-voltage and high-voltage contracts, the natural gas price played a pivotal role in determining the long-term relationship, exerting a negative influence on electricity contract prices. Additionally, coal and crude oil prices negatively affected electricity prices in the case of the low-voltage contract.

On the other hand, the short-run ARDL estimation results indicate that natural gas did not exert a short-term influence across all three contract models. However, there was a negative effect of crude oil price changes observed in the high-voltage contract model, implying that immediate adjustment mechanisms between natural gas and electricity pricing may not be robust or direct. This adverse relationship could stem from increased costs associated with electricity generation using crude oil in high-voltage-contract scenarios. Furthermore, the analysis suggests a negative impact of coal price on the low-voltage model. This short-term negative influence of fossil fuel prices on electricity prices may be manifested in decreased electricity demand when fossil fuel prices rise, leading to a temporary reduction in electricity prices.

This indicates the importance of providing special subsidies or support for low- and high-voltage electricity consumers when a surge in natural gas prices increases the electricity price. Furthermore, to mitigate the effect of the increase in the natural gas price on the electricity price, power companies in Japan need to continue their efforts to increase the use of renewable energy to diversify their electricity generation mix. Additionally, enhancing energy security measures is crucial to mitigate the impact of geopolitical events, such as conflicts in major fossil fuel-producing regions, on the electricity market. This could involve strategic reserves of energy resources and fostering the domestic production of alternative energy sources to reduce reliance on imports. Moreover, to support the transition to alternative energy sources and mitigate the impact of fossil fuel price volatility, policymakers could prioritize investment in energy infrastructure.

The generalizability of this study’s findings is limited by several factors. The analysis covers a period affected by significant geopolitical events (such as the Russia–Ukraine war) and a pandemic (COVID-19). The observed impacts may be specific to the atypical conditions of the study period, potentially limiting the generalizability of the results to more stable contexts. Furthermore, the findings are likely to vary if the analysis period is altered. The study focuses on how natural gas, coal, and crude oil prices affect electricity contracts, possibly missing interactions with renewable or alternative energy sources, which could provide a fuller picture of the energy market. While the ARDL model identifies relationships between variables, it does not easily establish causality. Future research could strengthen these findings by incorporating primary data for comparison. Additionally, future studies may consider applying alternative econometric approaches, such as VAR or VECM models, and utilizing different datasets to further examine the dynamic interactions among the variables.