- Article

Macroeconomic Drivers of Poultry Price Volatility in Nigeria: A Study of Inflation and Exchange Rate Dynamics

- Prosper E. Edoja,

- Rosemary N. Okoh and

- Goodness C. Aye

- + 1 author

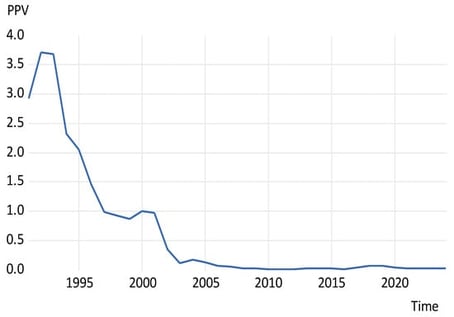

Poultry price instability remains a critical challenge for food security in Nigeria. This study examines the relationship between poultry price volatility (PPV), exchange rate (LEXR), and inflation (LCPI) from 1991 to 2024 using the Autoregressive Distributed Lag (ARDL) model. Descriptive results show that PPV had the highest variability (mean 0.65; standard deviation 1.07), while LEXR and LCPI were relatively more stable. Trend analysis indicates that poultry price volatility was high in the early 1990s but declined steadily after 2005, coinciding with persistent inflation and cycles of exchange rate depreciation and appreciation.Unit root and bounds tests confirm that the variables werecointegrated, with an F-statistic of 4.50 exceeding the upper bound at 5 percent significance. The long-run estimates reveal that inflation hada negative effect on poultry price volatility (−0.109), while the exchange rate exerteda positive effect (0.2702). The errorcorrection term (−0.336) indicates a 33.6 percent adjustment to equilibrium each period. In the short run, changes in inflation (0.942) and lagged exchange rate variations significantly influenced poultry price volatility. These findings underscore the importance of stabilizing exchange rates and controlling inflation to reduce price volatility in Nigeria’s poultry sector.

15 January 2026