Regime-Switching Fractionally Integrated Asymmetric Power Neural Network Modeling of Nonlinear Contagion for Chaotic Oil and Precious Metal Volatilities

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. MS–FIAPGARCH Model

3.2. MS–ARMA–GARCH–MLP and MS–ARMA–FIAPGARCH–MLP Models

3.3. MS–ARMA–FIAPGARCH–MLP

3.4. MS–ARMA–FIAPGARCH–Copula and MS–ARMA–FIAPGARCH–MLP–Copula

4. Empirical Results

4.1. Data

- i.

- ii.

- Examining presence of chaotic behavior through Lyapunov exponents, Kolmogorov–Shannon entropy tests. Exploring whether the Eckmann–Ruelle [73] condition holds.

- iii.

- Determination of the number of regimes, calculating regime durations and regime transition probabilities [11].

- iv.

- Estimation of MS–FIAPGARCH–copula and MS–FIAPGARCH–MLP–copula models which integrate fractional integration into the MS–GARCH–MLP model of [54].

- v.

- Determination of contagion effects, as well as the persistence and dependency behavior.

- vi.

- Obtaining the forecast results and evaluating forecast performances.

4.2. Results

4.2.1. Descriptive Unit Root, ARCH Effects and Nonlinearity Tests

4.2.2. Chaotic Behavior Tests

4.2.3. Model Selection for MS–GARCH–Copula

4.2.4. MS–FIAPGARCH–Copula Estimation Results

4.2.5. MS–FIAPGARCH–MLP–Copula Estimation Results

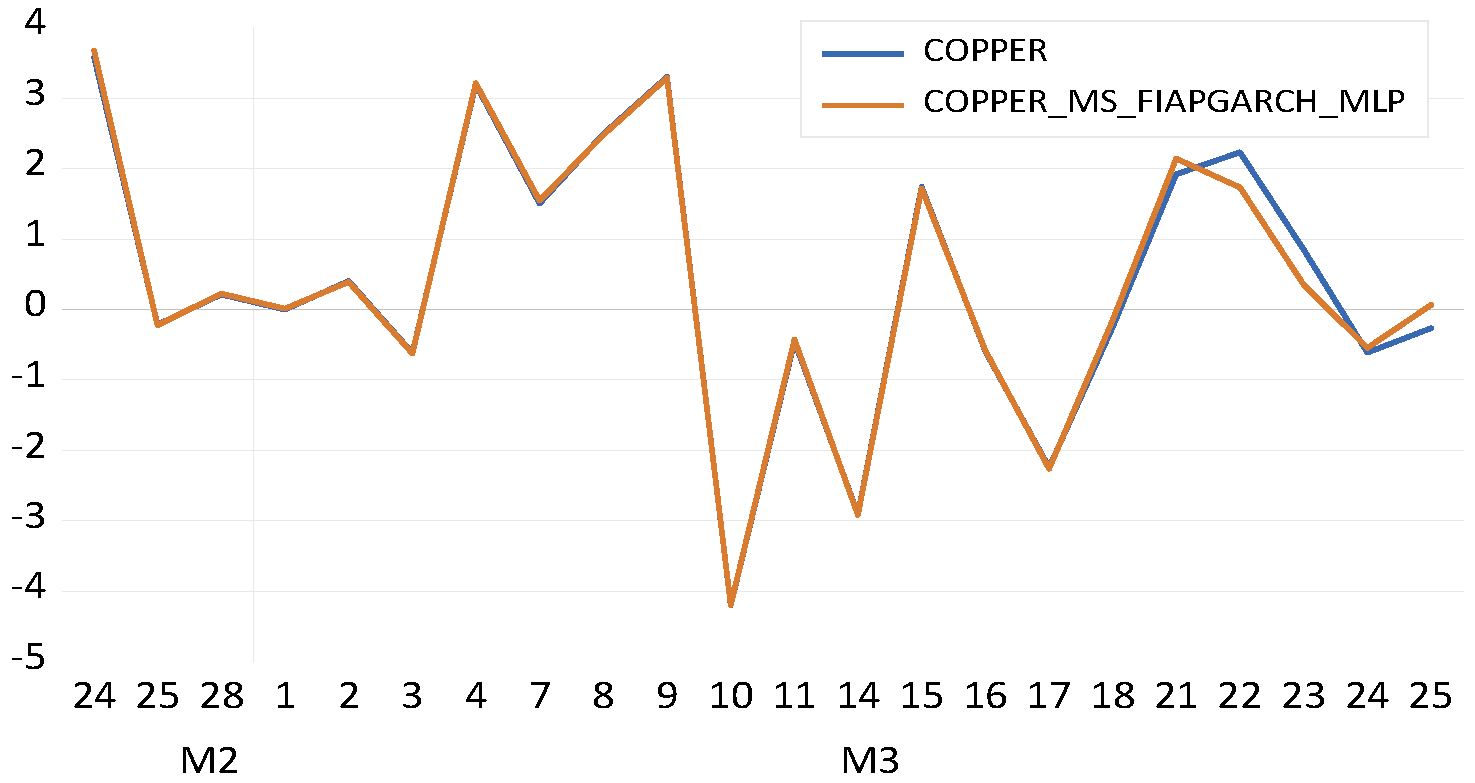

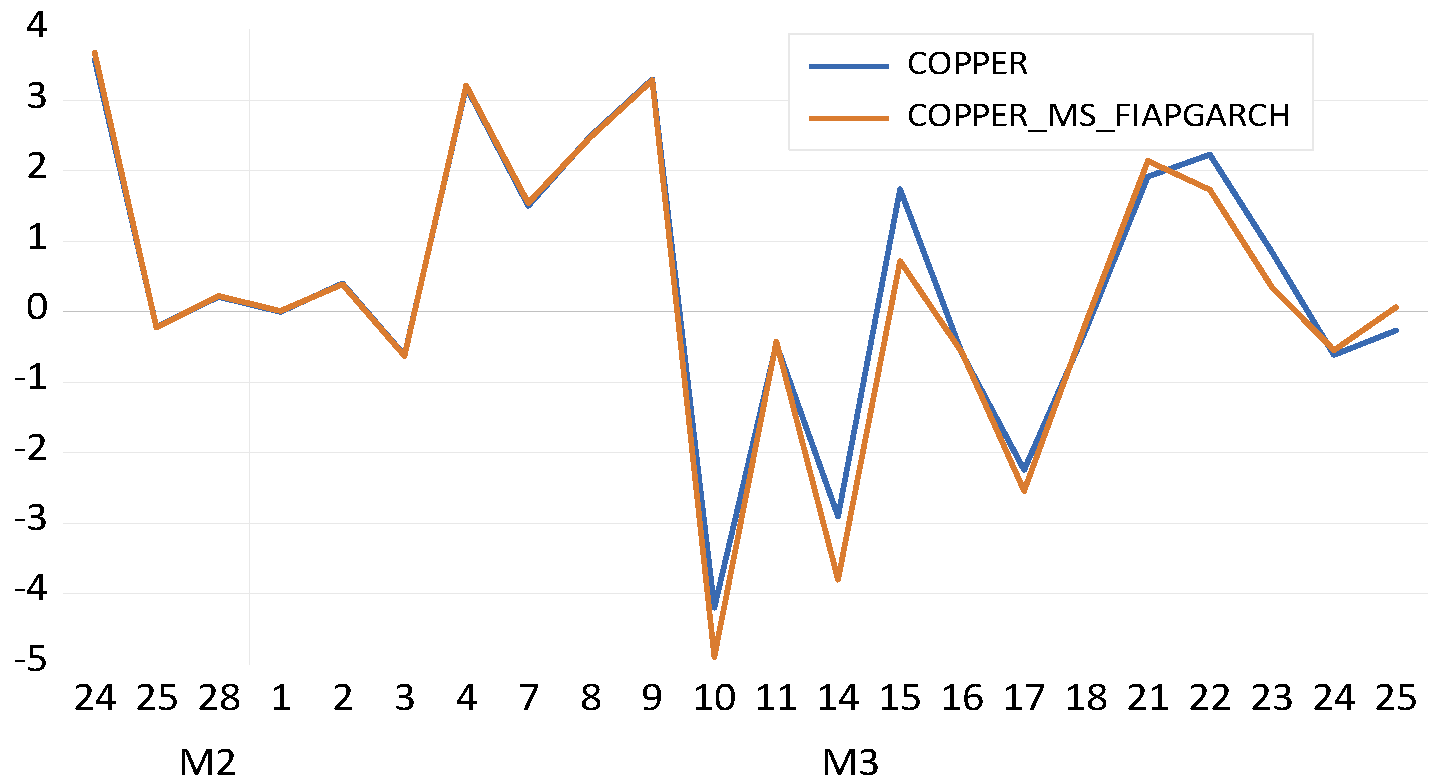

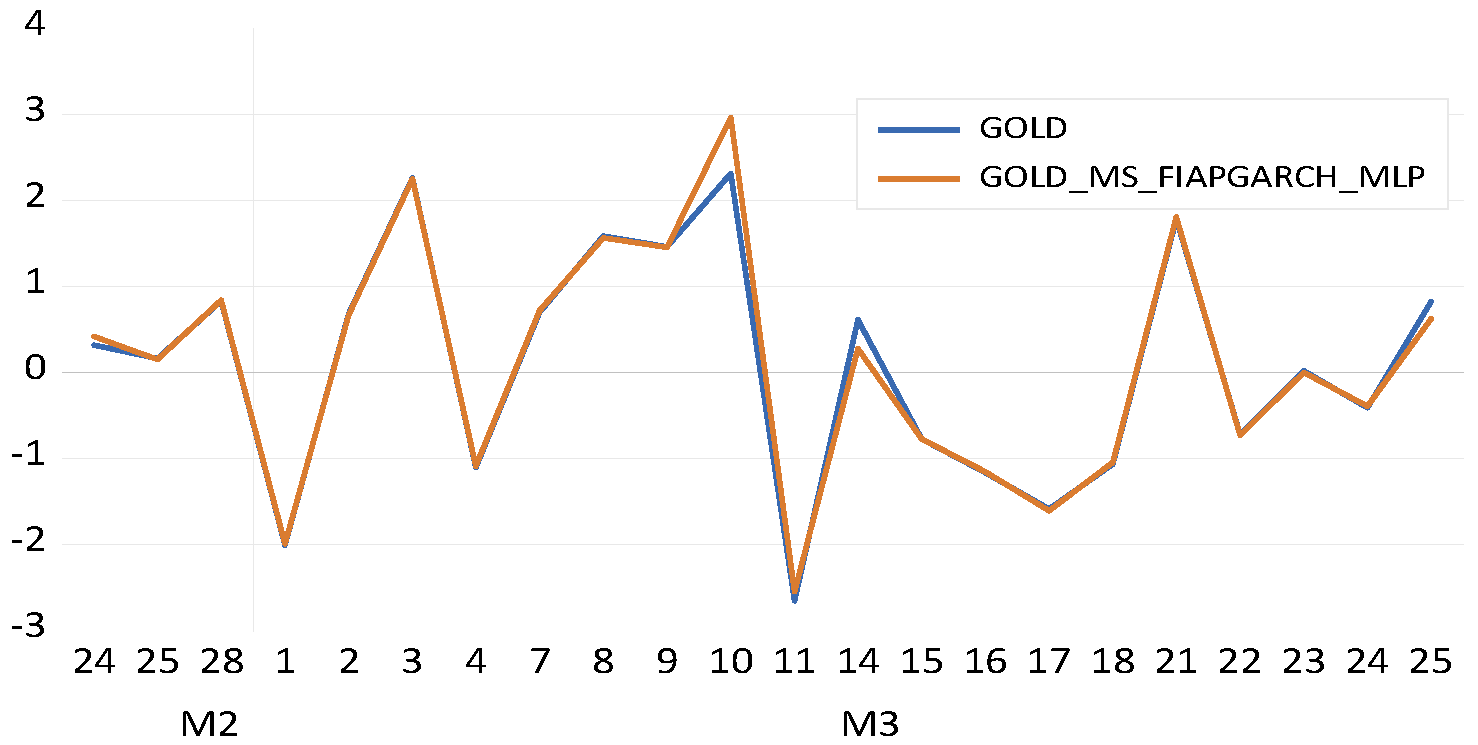

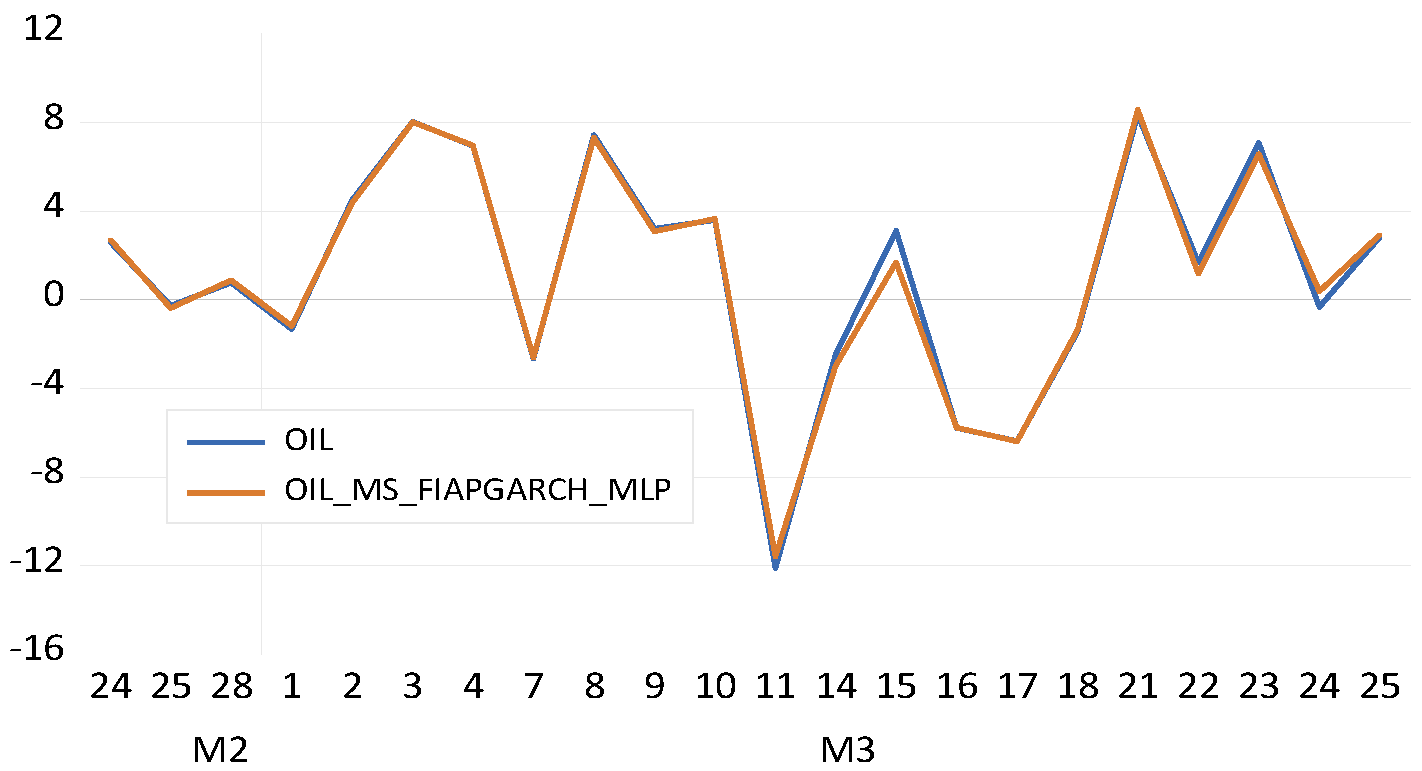

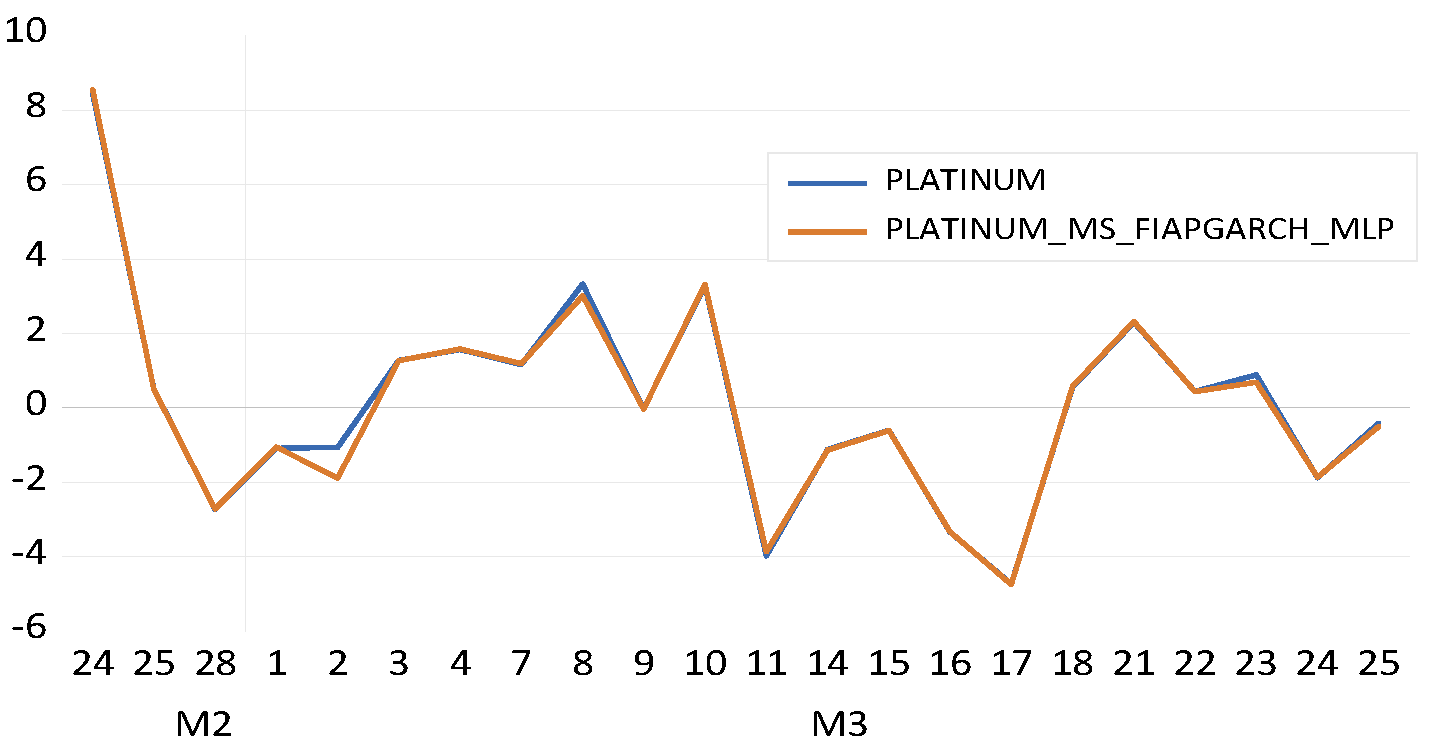

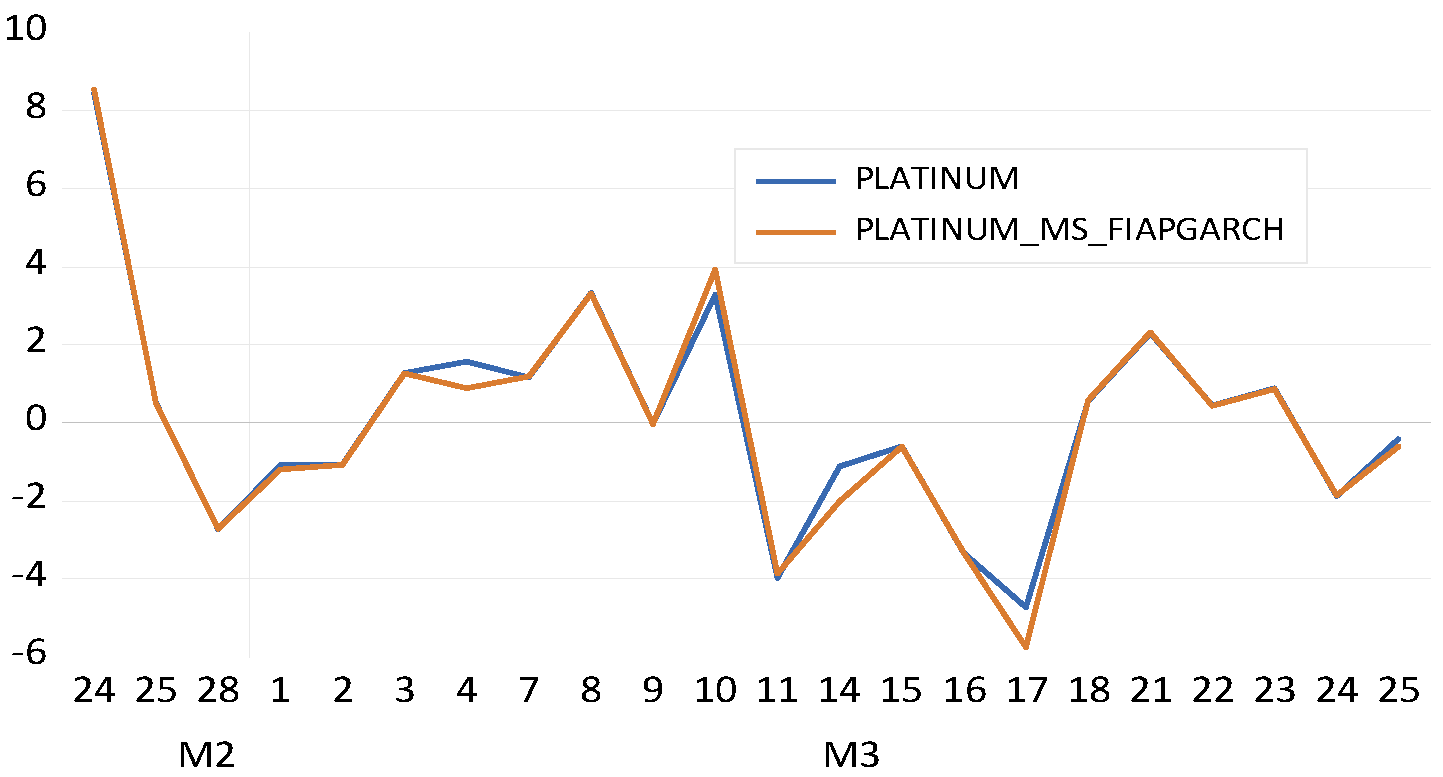

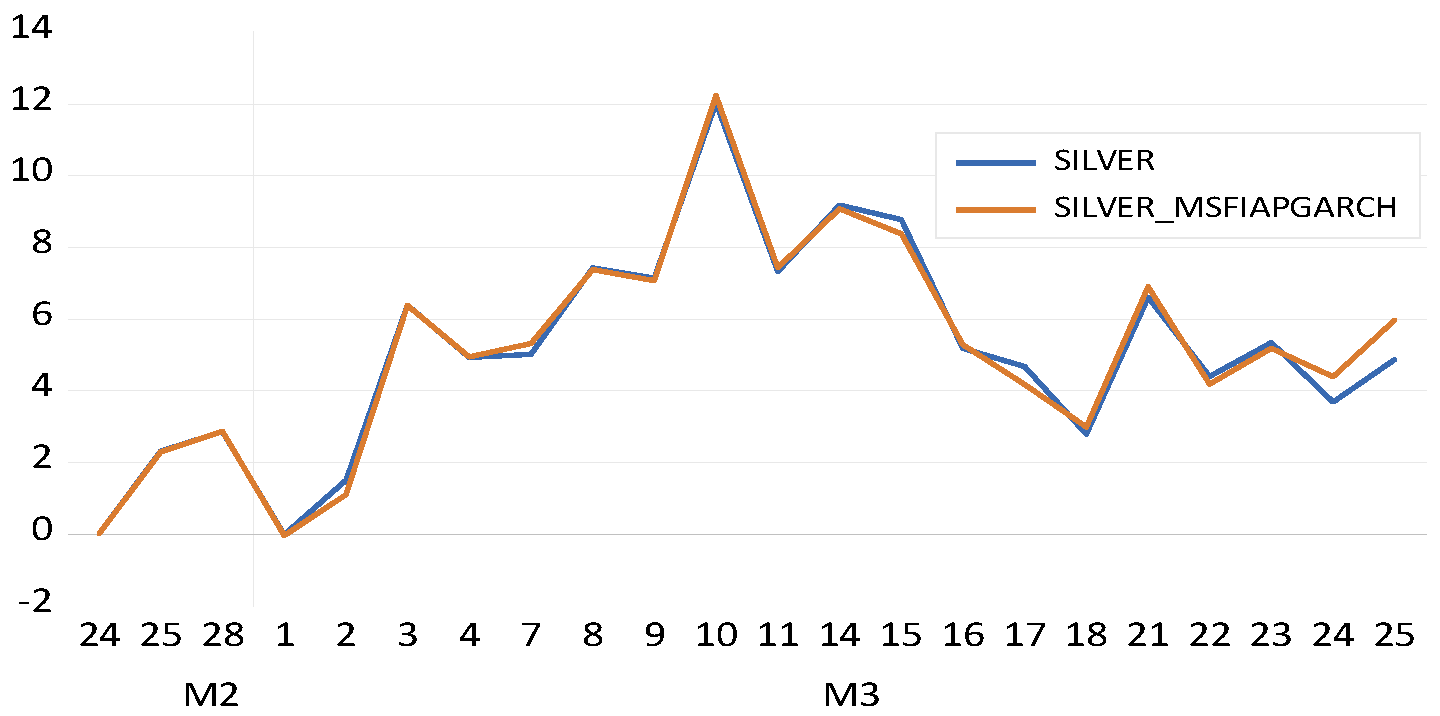

4.2.6. Forecasting Results

4.3. Discussion and Policy Recommendations

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- U.S. Geological Survey. USGS Minerals Yearbook 2014, 1st ed.; National Minerals Information Center: Reston, VA, USA. Available online: https://minerals.usgs.gov/minerals/pubs/commodity/tin/myb1-2014-tin.pdf (accessed on 18 November 2022).

- Bildirici, M.E.; Turkmen, C. Nonlinear causality between oil and precious metals. Resour. Policy 2015, 46, 202–211. [Google Scholar] [CrossRef]

- Arouri, M.; Hammoudeh, S.; Lahiani, A.; Nguyen, D. Long memory and structural breaks in modelling the return and volatility dynamics of precious metals. Q. Rev. Econ. Financ. 2012, 52, 207–218. [Google Scholar] [CrossRef]

- Bildirici, M.; Ozaksoy, F. The effects of oil and gold prices on oil-exporting countries. Energy Strategy Rev. 2018, 22, 290–302. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Tripathy, T. Modelling volatility persistence and asymmetry: A Study on selected Indian non-ferrous metals markets. Resour. Policy 2014, 41, 31–39. [Google Scholar] [CrossRef]

- Bildirici, M.; Ersin, Ö. Forecasting oil prices: Smooth transition and neural network augmented GARCH family models. J. Pet. Sci. Eng. 2013, 109, 230–240. [Google Scholar] [CrossRef]

- Bildirici, M.; Ersin, Ö. Modeling Markov switching ARMA-GARCH neural networks models and an application to forecasting stock returns. Sci. World J. 2014, 497941. [Google Scholar] [CrossRef]

- Bildirici, M.; Ersin, Ö. Forecasting volatility in oil prices with a class of nonlinear volatility models: Smooth transition RBF and MLP neural networks augmented GARCH approach. Pet. Sci. 2015, 12, 534–552. [Google Scholar] [CrossRef]

- Bildirici, M.; Ersin, Ö. Markov switching artificial neural networks for modelling and forecasting volatility: An application to gold market. Procedia Econ. Finance 2016, 38, 106–121. [Google Scholar] [CrossRef]

- Ersin, Ö.; Bildirici, M. Markov-switching vector autoregressive neural networks and sensitivity analysis of environment, economic growth and petrol prices. Environ. Sci. and Pol. Res. 2018, 25, 31630–31655. [Google Scholar]

- Hamilton, J.D. Analysis of time series subject to changes in regime. J. Econ. 1990, 45, 39–70. [Google Scholar] [CrossRef]

- Cuddington, J.; Jerrett, D. Super cycles in real metals prices? IMF Staff. Pap. 2008, 55, 541–565. [Google Scholar] [CrossRef]

- U.S. Geological Survey USGS. Mineral Commodity Summaries 2012, 1st ed.; National Minerals Information Center: Reston, VA, USA, 2012. [Google Scholar] [CrossRef]

- Wilburn, D.; Bleiwas, D.I. Platinum-Group Metals—World Supply and Demand, Open-File Report 2004, Series Number 1224. Available online: https://pubs.er.usgs.gov/publication/ofr20041224 (accessed on 18 November 2022).

- Hansen, B. Rethinking the univariate approach to unit root testing-using covariates to increase power. Econ. Theory 1995, 11, 1148–1171. [Google Scholar] [CrossRef]

- Stock, J.H. Unit roots, structural breaks and trends. In Handbook of Econometrics, 1st ed.; Engle, R.F., McFadden, D.L., Eds.; Elsevier: Amsterdam, The Netherlands, 1994; Chapter 46; pp. 2379–2841. [Google Scholar]

- Gil-Alana, L.A.; Chang, S.; Balcilar, M.; Aye, G.C.; Gupta, R. Persistence of precious metal prices: A fractional integration approach with structural breaks. Resour. Policy 2015, 44, 57–64. [Google Scholar] [CrossRef]

- Lee, J.; List, J.A.; Strazicich, M.C. Non-renewable resource prices: Deterministic or stochastic trends? J. Environ. Econ. Manag. 2006, 51, 354–370. [Google Scholar] [CrossRef]

- Carnero, M.A.; Peña, D.; Ruiz, E. Effects of outliers on the identification and estimation of GARCH models. J. Time Ser. Anal. 2007, 28, 471–497. [Google Scholar] [CrossRef]

- Carnero, M.A.; Peña, D.; Ruiz, E. Estimating GARCH volatility in the presence of outliers. Econ. Lett. 2012, 114, 86–90. [Google Scholar] [CrossRef][Green Version]

- Aggarwal, R.; Inclan, C.; Leal, R. Volatility in emerging markets. J. Financial Quant. Anal. 1999, 34, 33–55. [Google Scholar] [CrossRef]

- Charles, A. Forecasting volatility with outliers in GARCH models. J. Forecast. 2008, 27, 551–565. [Google Scholar] [CrossRef]

- Ané, T.; Loredana, U.R.; Gambet, J.B.; Bouverot, J. Robust outlier detection for Asia-Pacific stock index returns. Int. Finance Mark. Inst. Money 2008, 18, 326–343. [Google Scholar] [CrossRef]

- Charles, A.; Darné, O. Volatility persistence in crude oil markets. Energy Policy 2014, 65, 729–742. [Google Scholar] [CrossRef]

- Charles, A.; Darné, O. Large shocks in the volatility of the dow jones industrial average index: 1928–2013. J. Bank. Finance 2014, 43, 188–199. [Google Scholar] [CrossRef]

- Laurent, S.; Lecourt, C.; Palm, F.C. Testing for jumps in conditionally gaussian ARMA-GARCH models, a robust approach. Comput. Stat. Data Anal. 2016, 100, 383–400. [Google Scholar] [CrossRef]

- Chan-Lau, J.A.; Mathieson, D.J.; Yao, J.Y. Extreme contagion in equity markets. IMF Staff. Pap. 2004, 51, 386–408. [Google Scholar] [CrossRef]

- Forbes, K.J.; Rigobon, R. No contagion, only interdependence: Measuring stock market comovements. J. Finance 2002, 57, 2223–2261. [Google Scholar] [CrossRef]

- Boubaker, H.; Sghaier, N. Instability and dependence structure between oil prices and GCC stock markets. Energy Stud. Rev. 2014, 20, 50–65. [Google Scholar] [CrossRef][Green Version]

- Bildirici, M. The chaotic behavior among the oil prices, expectation of investors and stock returns: TAR-TR-GARCH copula and TAR-TR-TGARCH copula. Pet. Sci. 2019, 16, 217–228. [Google Scholar] [CrossRef]

- McKenzie, M.; Mitchell, H.; Brooks, R.; Faff, R. Power ARCH modeling of commodity futures data on the London metal exchange. Eur. J. Finance 2001, 7, 22–38. [Google Scholar] [CrossRef]

- Lin, L.; Kuang, Y.; Jiang, Y.; Su, Z. Assessing risk contagion among the Brent crude oil market, London gold market and stock markets: Evidence based on a new wavelet decomposition approach. N. Am. J. Econ. Fin. 2019, 50, 101035. [Google Scholar] [CrossRef]

- Tully, E.; Lucey, B.M. A power GARCH examination of the gold market. Res. Int. Bus. Finance 2007, 21, 316–325. [Google Scholar] [CrossRef]

- Kang, S.H.; Kang, S.M.; Yoon, S.M. Forecasting volatility of crude oil markets. Energy Econ. 2009, 31, 119–125. [Google Scholar] [CrossRef]

- Morales, L.; Andreosso-O’Callaghan, B. Comparative analysis on the effects of the Asian and global financial crises on precious metals markets. Res. Int. Bus. Finance 2011, 25, 203–227. [Google Scholar] [CrossRef]

- Cochran, S.J.; Mansur, I.; Odusami, B. Threshold Effects of the Term Premium in 25 Metal Returns and Return Volatilities: A Double Threshold-FIGARCH Approach; Working Paper; Villanova University: Villanova, PA, USA, 2011; pp. 1–30. [Google Scholar]

- Cochran, S.J.; Mansur, I.; Odusami, B. Volatility persistence in metal returns: A FIGARCH approach. J. Econ. Bus. 2012, 64, 287–305. [Google Scholar] [CrossRef]

- Ewing, B.; Malik, F. Volatility transmission between gold and oil futures under structural breaks. Int. Rev. Econ. Finance 2013, 25, 113–121. [Google Scholar] [CrossRef]

- Chkili, W.; Hammoudeh, S.; Nguyen, D.K. Volatility forecasting and risk management for commodity markets in the presence of asymmetry and long memory. Energy Econ. 2014, 4, 1–18. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Sahadudheen, I. Understanding the nexus between oil and gold. Resour. Policy 2015, 46, 85–91. [Google Scholar] [CrossRef]

- Behmiri, N.B.; Manera, M. The role of outliers and oil price shocks on volatility of metal prices. Resour. Policy 2015, 46, 139–150. [Google Scholar] [CrossRef]

- Mensi, W.; Nekhili, R.; Vo, X.V.; Kang, S.H. Oil and precious metals: Volatility transmission, hedging, and safe haven analysis from the Asian crisis to the COVID-19 crisis. Econ. Anal. Policy 2021, 71, 73–96. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Yuan, Y. Metal volatility in presence of oil and interest rate shocks. Energy Econ. 2008, 30, 606–620. [Google Scholar] [CrossRef]

- Diaz, F.J. Do scarce precious metals equate to safe harbor investments? The case of platinum and palladium. Econ. Res. Int. 2016, 2361954. [Google Scholar] [CrossRef]

- Das, D.; Bhatia, V.; Kumar, S.B.; Basu, S. Do precious metals hedge crude oil volatility jumps? Int. Rev. Finance Anal. 2022, 83, 102257. [Google Scholar] [CrossRef]

- Ahmed, R.; Chaudhry, S.; Kumpamool, C.; Benjasak, C. Tail risk, systemic risk and spillover risk of crude oil and precious metals. Energy Econ. 2022, 112, 106063. [Google Scholar] [CrossRef]

- Bentes, S.R. On the stylized facts of precious metals’ volatility: A comparative analysis of pre- and during COVID-19 crisis. Phys. A 2022, 600, 127528. [Google Scholar] [CrossRef]

- Dinh, T.; Goutte, S.; Nguyen, D.K.; Walther, T. Economic drivers of volatility and correlation in precious metal markets. J. Commod. Mark. 2022, 100242. [Google Scholar] [CrossRef]

- Mensi, W.; Ali, S.; Vo, X.; Kang, S. Multiscale dependence, spillovers, and connectedness between precious metals and currency markets: A hedge and safe-haven analysis. Resour. Policy 2022, 77, 102752. [Google Scholar] [CrossRef]

- Sephton, P.S. Revisiting the inflation-hedging properties of precious metals in Africa. Resour. Policy 2022, 77, 102735. [Google Scholar] [CrossRef]

- Kaczmarek, T.; Będowska-Sojka, B.; Grobelny, P. False safe haven assets: Evidence from the target volatility strategy based on recurrent neural network. Res. Int. Bus. Finance 2022, 60, 101610. [Google Scholar] [CrossRef]

- Jahanshahi, H.; Yousefpour, A.; Wei, Z.; Alcaraz, R.; Bekiros, S. A financial hyperchaotic system with coexisting attractors: Dynamic investigation, entropy analysis, control and synchronization. Chaos Solitons Fractals 2019, 126, 66–77. [Google Scholar] [CrossRef]

- Bildirici, M.; Sonüstün, F.O. Chaotic behavior in gold, silver, copper and bitcoin prices. Resour. Policy 2021, 74, 102386. [Google Scholar] [CrossRef]

- Bildirici, M.E. Chaos structure and contagion behavior between COVID-19, and the returns of prices of precious metals and oil: MS-GARCH-MLP copula. Nonlinear Dyn. Psychol. Life Sci. 2022, 26, 209–219. [Google Scholar]

- Syllignakis, M.N.; Kouretas, G.P. Dynamic correlation analysis of financial contagion: Evidence from the central and eastern European markets. Int. Rev. Econ. Finance 2011, 20, 717–732. [Google Scholar] [CrossRef]

- Choe, K.I.; Choi, P.; Nam, K.; Vahid, F. Testing financial contagion on heteroskedastic asset returns in time-varying conditional correlation. Pacific-Basin Finance J. 2012, 20, 271–291. [Google Scholar] [CrossRef]

- Celik, S. The more contagion effect on emerging markets: The evidence of DCC-GARCH model. Econ. Model. 2012, 29, 1946–1959. [Google Scholar] [CrossRef]

- Ahmad, W.; Sehgal, S.; Bhanumurthy, N.R. Eurozone crisis and BRIICKS stock markets: Contagion or market interdependence? Econ. Model. 2013, 33, 209–225. [Google Scholar] [CrossRef]

- Pesaran, B.; Pesaran, M.H. Conditional volatility and correlations of weekly returns and the VaR analysis of 2008 stock market crash. Econ. Model. 2010, 27, 1398–1416. [Google Scholar] [CrossRef]

- Guo, F.; Chen, C.R.; Huang, Y.S. Markets contagion during financial crisis: A regime switching approach. Int. Rev. Econ. Finance 2011, 20, 95–109. [Google Scholar] [CrossRef]

- Ramchand, L.; Susmel, R. Volatility and cross correlation across major stock markets. J. Empir. Finance 1998, 5, 397–416. [Google Scholar] [CrossRef]

- Aloui, R.; Ben-Aissa, M.S.; Nguyen, D.K. Global financial crisis, extreme interdependences and contagion effects: The role of economic structure? J. Bank. Finance 2011, 35, 130–141. [Google Scholar] [CrossRef]

- Rodriguez, J.C. Measuring financial contagion: A copula approach. J. Empir. Finance 2007, 14, 401–423. [Google Scholar] [CrossRef]

- Boubaker, H.; Sghaier, N. Contagion effect and change in the dependence between oil and ten MENA stock markets. RRJSMS 2016, 2, 1–17. [Google Scholar]

- Boubaker, H.; Sghaier, N. Markov-switching time-varying copula modeling of dependence structure between oil and GCC stock markets. Open J. Stat. 2016, 6, 565–589. [Google Scholar] [CrossRef]

- Francq, C.; Zakoian, J. Stationarity of multivariate Markov-switching ARMA models. J. Econ. 2001, 102, 339–364. [Google Scholar] [CrossRef]

- Henneke, S.; Rachev, S.; Fabozzi, F.; Nikolov, M. MCMC-based Estimation of Markov Switching ARMA-GARCH Models. Appl. Econ. 2011, 43, 259–271. [Google Scholar] [CrossRef]

- Joe, H. Multivariate Models and Dependence Concepts, 1st ed.; Chapman & Hall: London, UK, 1997; pp. 1–416. [Google Scholar]

- Bildirici, M.; Salman, M.; Ersin, Ö. Nonlinear contagion and causality nexus between oil, gold, VIX investor sentiment, exchange rate and stock market returns: The MS-GARCH copula causality method. Mathematics 2022, 10, 4035. [Google Scholar] [CrossRef]

- Reboredo, J.; Rivera-Castro, M.A. A wavelet decomposition approach to crude oil price and exchange rate dependence. Econ. Model. 2013, 32, 42–57. [Google Scholar] [CrossRef]

- Tsay, R.S. Nonlinearity tests for time series. Biometrika 1986, 73, 461–466. [Google Scholar] [CrossRef]

- Hsieh, D. Chaos and nonlinear dynamics: Application to financial markets. J. Finance 1991, 46, 1839–1877. [Google Scholar] [CrossRef]

- Eckmann, J.P.; Ruelle, D. Ergodic theory of chaos and strange attractors. Theory Chaotic Attractors 1985, 57, 617. [Google Scholar]

- Adrangi, B.; Chatrath, A.; Dhanda, K.K.; Raffiee, K. Chaos in oil prices? Evidence from futures markets Energy Econ. 2001, 23, 405–425. [Google Scholar]

- Bildirici, M.; Sonüstün, F.O. Chaotic structure of oil prices. AIP Conf. Proc. 2018, 1926, 20009. [Google Scholar]

- Zhu, H.M.; Li, R.; Li, S. Modelling dynamic dependence between crude oil prices and asia-pacific stock market returns. Int. Rev. Econ. Finance 2013, 29, 208–223. [Google Scholar] [CrossRef]

- Cashin, P.; McDermott, C.; Scott, A. Booms and slumps in world commodity prices. J. Dev. Econ. 2002, 69, 277–296. [Google Scholar] [CrossRef]

- Rossen, A. What are metal prices like? Co-movement, price cycles and long-run trends. Resour. Policy 2015, 45, 255–276. [Google Scholar] [CrossRef]

- Masa, A.; Diaz, F.J. Long-memory modelling and forecasting of the returns and volatility of exchange-traded notes (ETNs). J. Appl. Econ. Res. 2017, 11, 23–53. [Google Scholar] [CrossRef]

- Batten, J.A.; Ciner, C.; Lucey, B.M. The macroeconomic determinants of volatility in precious metals markets. Resour. Policy 2010, 35, 65–71. [Google Scholar] [CrossRef]

- Fassas, A. Exchange-traded products investing and precious metal prices. J. Deriv. Hedge Funds 2012, 18, 127–140. [Google Scholar] [CrossRef]

- Sensoy, A. Dynamic relationship between precious metals. Resour. Policy 2013, 38, 504–511. [Google Scholar] [CrossRef]

- Wen, X.; Wei, Y.; Huang, D. Measuring contagion between energy market and stock market during financial crisis: A copula approach. Energy Econ. 2012, 34, 1435–1446. [Google Scholar] [CrossRef]

- Donaldson, R.G.; Kamstra, M. An artificial neural network—GARCH model for international stock return volatility. J. Empir. Finance 1997, 4, 17–46. [Google Scholar] [CrossRef]

| Gold | Oil | Silver | Platinum | Copper | |

|---|---|---|---|---|---|

| Min | −0.121 | −0.289 | −0.199 | −0.287 | −0.141 |

| Max | 2.531 | 2.266 | 1.132 | 1.810 | 2.117 |

| Skewness | 0.377 | −0.227 | 0.319 | −0.878 | −0.776 |

| Kurtosis | 7.743 | 4.701 | 6.438 | 4.5137 | 5.303 |

| JB | 975.92 | 620.912 | 785.391 | 639.645 | 845.025 |

| Q(5) | 8.114 | 11.952 | 9.428 | 15.402 | 15.046 |

| R/S | 1.382 | 1.702 | 1.276 | 1.601 | 1.401 |

| Runs test | 6.359 | 5.764 | 6.227 | 3.304 | 5.203 |

| Lo R/S 1 | 1.919 | 1.091 | 1.355 | 1.602 | 1.402 |

| Gold | Oil | Silver | Platinum | Copper | |

|---|---|---|---|---|---|

| ADF Unit Root Test | |||||

| Tau test statistic: | −7.091 | −7.032 | −6.511 | −4.142 | −8.394 |

| Decision: | I(0) | I(0) | I(0) | I(0) | I(0) |

| ARCH–LM Tests 1 | |||||

| ARCH–LM (1) | 81.179 | 37.462 | 100.852 | 213.684 | 186.743 |

| ARCH–LM (4) | 59.810 | 26.0476 | 55.541 | 88.199 | 148.903 |

| Decision | Yes | Yes | Yes | Yes | Yes |

| (a) | |||

| Oil | 16.224 (0.000) 1 | ||

| Copper | 9.257 (0.000) | ||

| Gold | 8.549 (0.000) | ||

| Silver | 13.686 (0.000) | ||

| Platinum | 10.932 (0.000) | ||

| (b) | |||

| r(1,1) | r(2,2) | r(3,3) 2 | |

| Oil | 0.121 | 0.884 | 0.124 |

| Copper | −0.148 | −0.051 | 0.282 |

| Gold | −0.123 | −0.057 | 0.128 |

| Silver | 0.151 | −0.039 | 0.176 |

| Platinum | 0.029 | 0.132 | 0.155 |

| Copper | Gold | Silver | Platinum | Oil | |

|---|---|---|---|---|---|

| Largest LE | 0.302 | 0.183 | 0.598 | 0.169 | 0.325 |

| Shannon entropy (SE) | 0.028 | 0.046 | 0.042 | 0.046 | 0.045 |

| Kolmogorov entropy (KE) | 0.028 | 0.055 | 0.044 | 0.039 | 0.667 |

| Existence of chaotic behavior | |||||

| Decision: | Yes | Yes | Yes | Yes | Yes |

| Uncertainty | |||||

| Decision: | Yes | Yes | Yes | Yes | Yes |

| Eckmann–Ruelle condition | |||||

| Decision: | Yes | Yes | Yes | Yes | Yes |

| Acceptance | DIC | |

|---|---|---|

| Clayton | 0.49 | −2363.15 |

| Gumble | 0.52 | −2472.79 |

| Student’s t | 0.41 | −2291.06 |

| Symmetrized Joe Clayton (SJC) | 0.35 | −1995.28 |

| Oil | ||||||||||

| ARCH | GARCH | d–FIGARCH | APARCH (gamma) | APARCH (delta) | Constant | Trans. Prob’s: P(0|0) = 0.77, P(1|1) = 0.82 | Diagnostics: LL = 179012 RMSE = 0.33 ARCH = 0.05 (0.97) | |||

| R1 | 0.11 *** (0.00) | 0.71 *** (0.00) | 0.34 *** (0.00) | 0.09 *** (0.00) | 0.84 *** (0.00) | 0.92 *** (0.002) | ||||

| R2 | 0.41 *** (0.00) | 0.58 *** (0.00) | 0.42 *** (0.00) | 0.12 *** (0.00) | 1.78 *** (0.00) | 0.02 *** (0.003) | ||||

| Copper | ||||||||||

| R1 | 0.23 *** (0.00) | 0.74 ** (0.03) | 0.81 ** (0.01) | 0.15 *** (0.01) | 0.99 *** (0.002) | −0.13 ** (0.03) | P(0|0) = 0.79, P(1|1) = 0.81 | LL = 16444.7, RMSE = 0.35, ARCH = 0.12 (0.6) | ||

| R2 | 0.27 ** (0.01) | 0.71 *** (0.007) | 0.99 *** (0.009) | 0.30 *** (0.01) | 1.49 *** (0.00) | 0.65 *** (0.009) | ||||

| Gold | ||||||||||

| R1 | 0.28 *** (0.00) | 0.70 *** (0.00) | 0.28 ** (0.03) | 0.26 *** (0.01) | 0.93 *** (0.001) | 0.07 *** (0.001) | P(0|0) = 0.74, P(1|1) = 0.82 | LL = 17211.6, RMSE = 0.365, ARCH = 0.33 (0.54) | ||

| R2 | 0.32 *** (0.002) | 0.65 *** (0.01) | 0.19 ** (0.05) | 0.23 ** (0.03) | 0.84 ** (0.02) | −0.01 *** (0.00) | ||||

| Silver | ||||||||||

| R1 | 0.20 *** (0.00) | 0.72 *** (0.00) | 0.07 * (0.07) | 0.09 ** (0.003) | 0.97 *** (0.001) | −0.358 *** (0.001) | P(0|0) = 0.76, P(1|1) = 0.83 | LL = 19330.4, RMSE = 0.31, ARCH = 0.52 (0.46) | ||

| R2 | 0.29 *** (0.00) | 0.61 *** (0.00) | 0.19 *** (0.00) | 0.16 ** (0.03) | 0.96 *** (0.02) | 0.0176 *** (0.01) | ||||

| Platinum | ||||||||||

| R1 | 0.13 *** (0.00) | 0.82 *** (0.00) | 0.08 ** (0.03) | −0.34 *** (0.01) | 0.98 *** (0.001) | 0.32 ** (0.01) | P(0|0) = 0.79, P(1|1) = 0.80 | LL = 23144.7, RMSE = 0.34, ARCH = 0.19 (0.91) | ||

| R2 | 0.24 *** (0.002) | 0.72 *** (0.0001) | 0.11 *** (0.00005) | 0.14 ** (0.03) | 0.99 ** (0.02) | 0.02 ** (0.01) | ||||

| Copula Results: | ||||||||||

| Oil–Gold | Oil–Copper | Oil–Silver | Oil–Platinum | Copper– Platinum | ||||||

| L | U | L | U | L | U | L | U | L | U | |

| R1 | 0.535 | 0.525 | 0.519 | 0.503 | 0.535 | 0.508 | 0.671 | 0.631 | 0.102 | 0.048 |

| R2 | 0.425 | 0.485 | 0.521 | 0.563 | 0.587 | 0.506 | 0.456 | 0.501 | 0.131 | 0.083 |

| Gold–Copper | Gold–Silver | Silver–Platinum | Copper–Silver | Gold–Platinum | ||||||

| L | U | L | U | L | U | L | U | L | U | |

| R1 | 0.09 | 0.101 | 0.589 | 0.561 | 0.303 | 0.396 | 0.001 | 0.136 | 0.508 | 0.594 |

| R2 | 0.11 | 0.11 | 0.512 | 0.528 | 0.321 | 0.305 | 0.108 | 0.123 | 0.551 | 0.561 |

| Oil | ||||||||||

| ARCH | GARCH | d–FIGARCH | APARCH (gamma1) | APARCH (delta) | ξ | λ | Transition Probabilities | Diagnostics | ||

| R1 | 0.28 *** (0.00) | 0.70 *** (0.00) | 0.66 *** (0.00) | 0.10 *** (0.00) | 0.98 ** (0.01) | 0.07 *** (0.00) | 0.002 ** (0.02) | P(0|0) = 0.78, P(1|1) = 0.81 | LL = 1027.53, RMSE = 0.192 | |

| R2 | 0.32 *** (0.00) | 0.66 *** (0.00) | 0.45 *** (0.01) | 0.13 *** (0.00) | 0.85 ** (0.01) | 0.09 ** (0.02) | ||||

| Copper | ||||||||||

| R1 | 0.14 ** (0.01) | 0.80 *** (0.00) | 0.81 *** (0.00) | 0.156 ** (0.02) | 0.99 ** (0.01) | 0.08 *** (0.00) | 0.004 *** (0.00) | P(0|0) = 0.82, P(1|1) = 0.92 | LL = 7347.62, RMSE = 0.206 | |

| R2 | 0.21 *** (0.03) | 0.71 ** (0.02) | 0.93 *** (0.00) | 0.13 *** (0.00) | 1.29 *** (0.00) | 0.61 *** (0.009) | ||||

| Gold | ||||||||||

| R1 | 0.21 *** (0.00) | 0.71 *** (0.009) | 0.68 *** (0.00) | 0.26 ** (0.02) | 1.16 *** (0.01) | 0.08 *** (0.00) | 0.006 *** (0.00) | P(0|0) = 0.75, P(1|1) = 0.81 | LL = 3445.6, RMSE = 0.211 | |

| R2 | 0.302 (0.00) | 0.651 ** (0.01) | 0.50 ** (0.02) | 0.11 ** (0.01) | 1.18 *** (0.00) | 0.07 *** (0.00) | ||||

| Silver | ||||||||||

| R1 | 0.24 *** (0.008) | 0.74 *** (0.009) | 0.66 *** (0.00) | 0.17 ** (0.02) | 0.99 *** (0.00) | 0.08 *** (0.00) | 0.008 *** (0.009) | P(0|0) = 0.97, P(1|1) = 0.98 | LL = 6687.11, RMSE = 0.202 | |

| R2 | 0.28 *** (0.009) | 0.69 ** (0.01) | 0.59 ** (0.02) | 0.31 *** (0.007) | 1.32 *** (0.00) | 0.07 *** (0.00) | ||||

| Platinum | ||||||||||

| R1 | 0.22 ** (0.01) | 0.79 *** (0.00) | 0.63 *** (0.00) | 0.24 ** (0.02) | 0.97 *** (0.00) | 0.095 *** (0.00) | 0.005 *** (0.00) | P(0|0) = 0.93, P(1|1) = 0.91 | LL = 6446.52, RMSE = 0.129 | |

| R2 | 0.26 *** (0.008) | 0.71 ** (0.02) | 0.57 ** (0.01) | 0.13 ** (0.02) | 1.21 *** (0.00) | 0.088 *** (0.00) | ||||

| Copula Results: | ||||||||||

| Oil–Gold | Oil–Copper | Oil–Silver | Gold–Platinum | Oil–Platinum | ||||||

| L | U | L | U | L | U | L | U | L | U | |

| R1 | 0.720 | 0.733 | 0.721 | 0.731 | 0.707 | 0.701 | 0.848 | 0.973 | 0.829 | 0.801 |

| R2 | 0.873 | 0.825 | 0.886 | 0.896 | 0.812 | 0.824 | 0.668 | 0.891 | 0.856 | 0.896 |

| Gold–Copper | Gold–Silver | Copper–Silver | Silver–Platinum | Copper–Platinum | ||||||

| L | U | L | U | L | U | L | U | L | U | |

| R1 | 0.109 | 0.131 | 0.716 | 0.756 | 0.282 | 0.101 | 0.345 | 0.489 | 0.862 | 0.898 |

| R2 | 0.112 | 0.186 | 0.721 | 0.995 | 0.295 | 0.199 | 0.365 | 0.495 | 0.901 | 0.956 |

| MS–FIAPGARCH–MLP –Copula | MS–FIAPGARCH –Copula | |||

|---|---|---|---|---|

| MSE | RMSE | MSE | RMSE | |

| Copper | 0.178 | 0.241 (5th) | 0.632 | 0.399 (7th) 1 |

| Gold | 0.027 | 0.163 (2nd) | 0.656 | 0.431 (9th) |

| Oil | 0.177 | 0.411 (4th) | 0.672 | 0.451 (10th) |

| Platinum | 0.036 | 0.193 (3rd) | 0.587 | 0.345 (6th) |

| Silver | 0.015 | 0.123 (1st) | 0.639 | 0.409 (8th) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bildirici, M.; Ersin, Ö.Ö. Regime-Switching Fractionally Integrated Asymmetric Power Neural Network Modeling of Nonlinear Contagion for Chaotic Oil and Precious Metal Volatilities. Fractal Fract. 2022, 6, 703. https://doi.org/10.3390/fractalfract6120703

Bildirici M, Ersin ÖÖ. Regime-Switching Fractionally Integrated Asymmetric Power Neural Network Modeling of Nonlinear Contagion for Chaotic Oil and Precious Metal Volatilities. Fractal and Fractional. 2022; 6(12):703. https://doi.org/10.3390/fractalfract6120703

Chicago/Turabian StyleBildirici, Melike, and Özgür Ömer Ersin. 2022. "Regime-Switching Fractionally Integrated Asymmetric Power Neural Network Modeling of Nonlinear Contagion for Chaotic Oil and Precious Metal Volatilities" Fractal and Fractional 6, no. 12: 703. https://doi.org/10.3390/fractalfract6120703

APA StyleBildirici, M., & Ersin, Ö. Ö. (2022). Regime-Switching Fractionally Integrated Asymmetric Power Neural Network Modeling of Nonlinear Contagion for Chaotic Oil and Precious Metal Volatilities. Fractal and Fractional, 6(12), 703. https://doi.org/10.3390/fractalfract6120703