1. Introduction

In the past, offshoring has been a widely adopted strategy that allowed companies to reduce production costs, enhance operational efficiencies, and improve coordination with overseas partners. By tapping into global talent pools, leveraging cost advantages, and benefiting from economies of scale, offshoring became a popular choice for businesses seeking to maintain competitive pricing and expand their global presence [

1,

2].

However, with the age of Industry 4.0, a countertrend of backshoring has emerged among scholars [

3,

4]. The integration of advanced digital technologies such as machine-to-machine (M2M) communication, AI-driven process automation, cyber-physical systems, and data-driven smart services is revolutionizing traditional logistics and value chains across the manufacturing sector [

5,

6,

7,

8]. This technological shift is reshaping manufacturing operations, making backshoring an increasingly attractive option for firms looking to capitalize on these innovations [

9]. The advantages of backshoring include increased supply chain resilience, enhanced quality control, and the mitigation of currency risks, enabling companies to respond more effectively to disruptions, ensuring high product quality through closer monitoring, protecting intellectual property, and lowering intercultural communication problems [

10]. The COVID-19 pandemic has further underscored the vulnerabilities of global supply chains, prompting many companies to prioritize control and reduce reliance on distant suppliers [

11]. This has led experts to advocate for leveraging new technologies to bring manufacturing back home, thus enhancing control over production and reducing exposure to global uncertainties.

When deciding between offshoring and backshoring strategies, companies must consider a range of factors beyond cost savings. These include quality control, speed to market, the potential for sales growth, and the impact on innovation [

12]. By carefully weighing these considerations, firms can make more informed strategic decisions that align with their long-term objectives and the evolving technological landscape.

Despite these trends, it remains unclear whether companies benefit more from either backshoring or offshoring, as the optimal choice may vary depending on specific circumstances and strategic objectives. The extent to which companies today truly benefit from offshoring and backshoring strategies is still not fully understood, highlighting the need for further research into their actual impact on business performance.

2. Theoretical Background

When companies face the decision between offshoring and backshoring certain activities, transaction costs play a critical role in influencing the success of their choices. Originally conceptualized by Coase [

13], transaction costs encompass the various expenses involved in conducting economic transactions, including searching for relevant information, negotiating contracts, monitoring performance, and resolving disputes [

14]. These costs reflect both financial and non-financial burdens arising from information asymmetries and other complexities inherent in business exchanges. The decision to offshore or backshore hinges on whether the transaction costs of performing a particular function at home outweigh the potential benefits of relocating it abroad [

15,

16]. When domestic transaction costs are higher, companies tend to offshore; conversely, they backshore when offshoring becomes less advantageous [

17,

18,

19]. Thus, transaction costs significantly shape the international manufacturing landscape.

2.1. Trade-Offs in Transaction Costs

However, offshoring in the manufacturing industry requires a nuanced evaluation of multiple factors that can negatively impact these decisions. Firstly, companies must consider how increased volatility could undermine their long-term competitiveness. The integration of advanced technologies in Industry 4.0 introduces complexities, such as enhanced product functionality, the need for integrating diverse technical disciplines, and new collaboration models with external partners and freelancers [

20]. Firms must carefully assess the compatibility of their systems with those of external service providers. This evaluation, depending on the maturity level of Industry 4.0, ensures smooth data exchange, robust cybersecurity, and consistent quality standards throughout the outsourcing process, which are crucial for maintaining efficiency and security in operations involving external partnerships [

21].

Second, the future of offshoring in manufacturing is shaped by volatile market factors, including geopolitical shifts, trade policies, and supply chain disruptions [

22]. The volatile, uncertain, complex, and ambiguous (VUCA) nature of global manufacturing markets significantly impacts decision-making [

23]. Higher market uncertainty can lead to increased transaction costs between international business partners, prompting companies to reconsider offshoring in favor of backshoring to reduce exposure to such risks [

24].

Third, advancements in automation challenge the traditional cost advantages of offshoring. As automation technologies improve, the importance of a factory’s geographic location diminishes, while the quality of infrastructure and the availability of skilled labor become more critical [

25]. Enhanced automation can optimize manufacturing processes, reduce labor costs, and increase productivity domestically, making backshoring a more attractive option [

26].

2.2. Dynamic Capabilities and Competitive Advantages

The resource-based view (RBV) framework suggests that firms can achieve competitive advantage by leveraging unique resources, such as technological capabilities and sustainable practices [

27]. Integrating these resources with offshoring and backshoring strategies allows companies to not only reduce costs and improve efficiency but also drive innovation in product development and operational processes [

28,

29]. Theories on dynamic capabilities, therefore, offer additional insights into how firms can adapt to rapid technological changes by reconfiguring their resource base, including strategically reallocating production between offshore and domestic sites [

30,

31]. These theoretical perspectives emphasize aligning offshoring and backshoring with broader innovation and sustainability goals, enhancing a firm’s competitive advantage in the context of AI-driven production. Applying RBV and dynamic capabilities to offshoring decisions can significantly improve strategic planning in sustainable manufacturing [

32], enabling firms to leverage proprietary technologies and sustainability considerations to minimize environmental impact while boosting efficiency and resilience [

33].

2.3. The Role of Advanced Technologies

Industry 4.0 solutions play a further pivotal role in modern offshoring and backshoring strategies. Kinkel et al. [

34] highlight the adoption of AI and other digital technologies for companies’ relocation of production activities. Dachs et al. [

35] argue that European manufacturing firms investing in AI and automation are more likely to backshore their production, as these technologies enhance productivity and coordination, making domestic operations more competitive.

The digitalization of production, driven by digital platform technologies and AI automation, enhances collaboration with global partners [

36,

37]. Digitalization increases transparency and reduces transaction costs related to information search, activity coordination, and managing uncertainties [

38]. These technological advancements can significantly lower transaction costs by facilitating seamless communication and collaboration between manufacturers and their international partners [

39].

Butollo and Schneidemesser [

40] underscore the importance of B2B platforms in enabling small-scale manufacturers to participate in global value chains, irrespective of their location. These platforms reduce entry barriers by alleviating resource constraints and providing easier access to networks [

41]. Such flexibility supports the integration of specialized firms into interactive networks and innovation ecosystems [

42], allowing manufacturing companies to expand their offshoring capabilities strategically [

43]. Industry 4.0 also promotes “hyperspecialization”, where specialized firms operate within decentralized global value chains, enhancing collaboration under reduced transaction costs [

44,

45]. These advancements offer companies opportunities to optimize their value chains and strengthen their competitive position [

46].

2.4. Impact of COVID-19

The COVID-19 pandemic has further disrupted global supply chains, exposing vulnerabilities in offshoring strategies and highlighting the need for resilience. Pandemic-induced lockdowns and restrictions led to delays, increased costs, and shortages of essential components. These disruptions have accelerated the trend toward backshoring as companies seek to reduce dependence on distant suppliers and enhance supply chain resilience [

47]. Firms with more localized supply chains have demonstrated greater capacity to manage pandemic-related disruptions effectively [

48,

49].

3. Research

Understanding the optimal balance between offshoring and backshoring is crucial for companies striving to enhance their competitiveness and innovation capabilities. Johansson and Olhager [

50] highlighted in their analysis of Swedish manufacturing firms that labor-intensive production tends to be offshored while more complex production is brought back onshore. This indicates that their choice is not solely driven by cost factors but is influenced by a broader range of considerations, including technological advancements, market dynamics, and their overall effect on value creation.

The discussion around backshoring has gained further momentum as firms increasingly prioritize factors beyond cost savings. These factors include improved quality control, shorter lead times, increased flexibility, access to skilled labor, and proximity to research and development (R&D) facilities [

51]. Moreover, this shift is reinforced by a growing focus on sustainability, technological sophistication, and the strategic alignment of production with innovation.

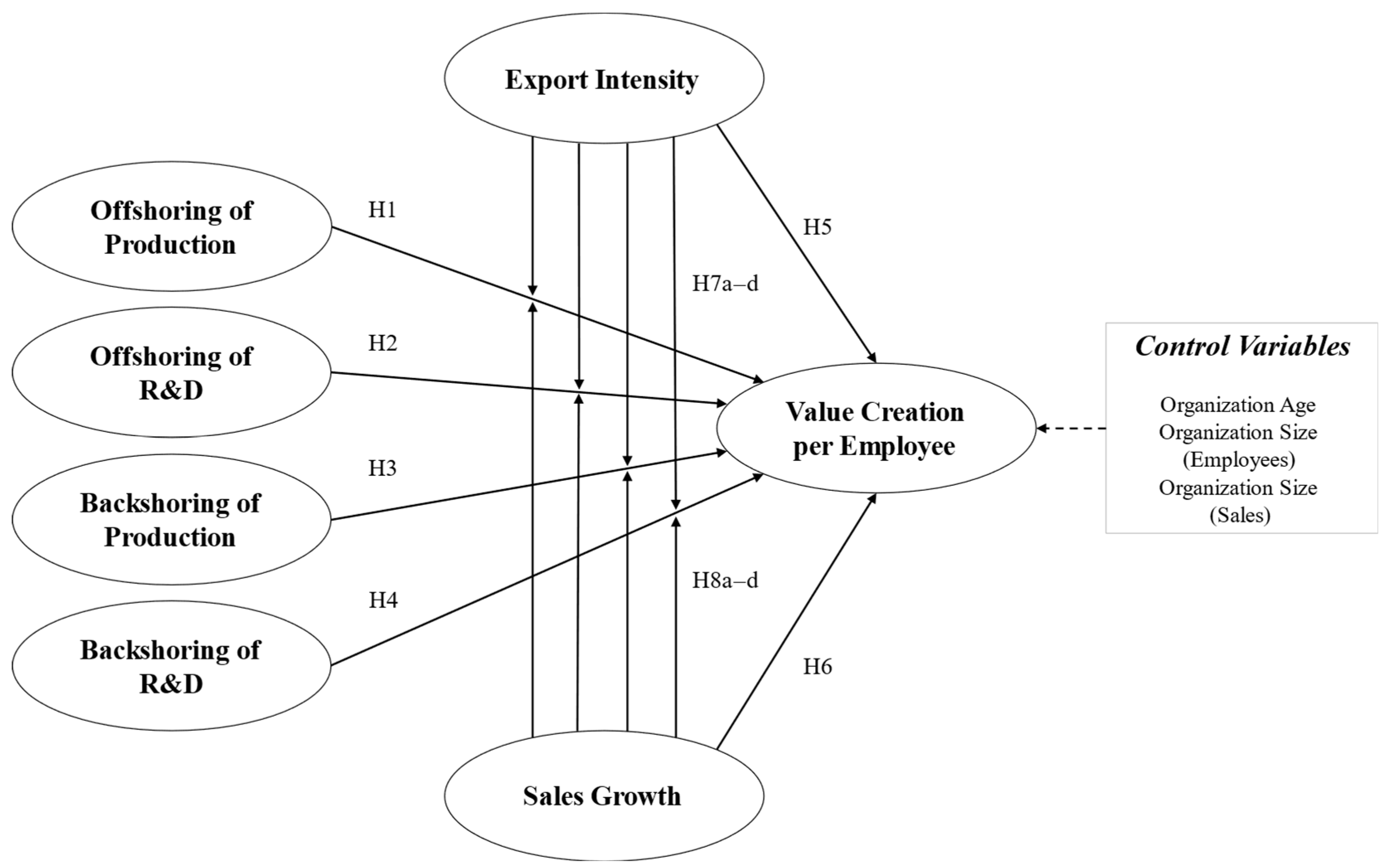

Against the backdrop of ongoing debates about the advantages of offshoring in the era of Industry 4.0, this study aims to explore how both offshoring and backshoring impact value creation per employee, considering contexts of high sales growth and export intensity. By examining these dynamics, the study seeks to provide further insights into how companies can strategically align their production and R&D decisions to optimize their productivity and competitiveness. Building on this diverse discussion, the following hypotheses are tested:

H1: Firms engaging in offshoring of production realize higher value creation per employee.

Moving production activities offshore can reduce labor costs and increase efficiency, thus enhancing value creation per employee. By relocating production to countries with lower operational costs, companies can improve productivity and profitability per employee.

H2: Firms engaging in offshoring of R&D realize lower value creation per employee.

While offshoring R&D might offer cost savings and access to a wider talent pool, it often introduces challenges such as communication barriers, time zone differences, and misalignment with strategic objectives. These factors can ultimately hinder the ability of companies to generate value per employee.

H3: Firms engaging in backshoring of production realize lower value creation per employee.

Backshoring production can negatively influence value creation per employee, especially in cost-sensitive manufacturing industries, where the primary advantage of offshoring is the reduction in labor and operational costs. When companies move production back to their home country, they often face higher labor costs, increased regulatory requirements, and potentially higher taxes, all of which can drive up overall production expenses.

H4: Firms engaging in backshoring of R&D realize higher value creation per employee.

Backshoring R&D enables improved coordination, faster innovation cycles, and better alignment with customer needs and market trends. By relocating R&D closer to the company’s home base, firms can take advantage of local expertise, advanced technology, and strategic alignment, therefore strengthening their innovation processes and creating higher value creation per employee.

H5 and H7a–d: Export intensity.

Export intensity is expected to directly enhance value creation per employee by enabling companies to access a wider range of international markets. This broad market exposure encourages firms to tailor their strategies, which improves productivity and efficiency across their workforce. Furthermore, for firms engaging in offshoring and backshoring of production and R&D, export intensity amplifies the differences in value creation per employee from those that do not engage in respective off- and backshoring activities (H7a–d). Especially in scenarios of high export intensity, the choice to backshore R&D should allow companies to tailor innovations to specific international markets more efficiently.

H6 and H8a–d: Sales growth.

Sales growth also has a direct positive influence on value creation per employee. Rapidly growing companies are often better positioned to scale their operations efficiently, improve productivity, and fully capitalize on market opportunities. Additionally, for firms engaging in off- and backshoring activities (i.e., for both R&D and production), sales growth intensifies the differences from those firms that do not engage in off- and backshoring activities (H8a–d). In particular, companies that experience high sales growth can benefit more from the decision to backshore production. The ability to closely manage domestic production and operations allows firms to respond more effectively to rising demand.

Figure 1 summarizes the effects tested in this study.

4. Data Set and Methodology

The study is based on data from the European Manufacturing Survey (EMS), specifically data collected in Switzerland. The survey aims to systematically assess the development of manufacturing industries in different European countries. The survey addresses subsidiaries (later referred to as companies) with 20+ employees from all manufacturing sectors. The questionnaire consists of questions regarding the implementation of organizational innovations, the implementation of new technologies, cooperation, off- and backshoring activities, different performance indicators, and general company information. The EMS in Switzerland was first launched in 2001, followed by data collections in 2003, 2006, 2009, 2012, 2015, 2018, and most recently in 2022 (data currently in the harmonization and quality control phase).

This study is based on data from the 2018 survey, in which 5418 companies were contacted and invited to answer the questionnaire either online or paper-based. Respondents who completed the questionnaire were predominantly either production managers (or COOs) and CEOs of respective companies. The sample used for this analysis initially included 875 organizations. As many respondents in this sample did not provide information on their offshoring and backshoring activities and/or their share of exports, the final net sample consisted of n = 413 organizations.

To test these hypotheses, multiple linear regression analysis was used, applying a hierarchical procedure. This approach allowed for the testing and comparison of different models and effects in separate steps:

Model 1 includes only the control variables (i.e., organization size measured by number of employees and sales as well as organization age).

Model 2 adds all main effects (i.e., presence of off- and backshoring of production and R&D)

Model 3 includes export intensity (i.e., share of export) as well as sales growth.

Model 4 further includes the interaction effects between the presence of offshoring and backshoring activities and export intensity, as well as sales growth.

These models are structured to incrementally build on each other, allowing for a comprehensive analysis of the main effects and interaction terms related to offshoring and backshoring strategies and their impact on value creation per employee. The measures used in this study are displayed in

Table 1.

5. Results

Table 2 summarizes the descriptive statistics and the correlations of the variables used in this study, while

Table 3 outlines the results of the hypothesis tests and

Table 4 provides an overview of the results of the regression analysis. The results of this study, based on the hierarchical linear regression analysis, provide important insights into the relationship between the presence of offshoring and backshoring activities and value creation per employee. The analysis yields an R

2 of 0.313 in Model 4, meaning that the model explains roughly 31.3% of the variance in value creation per employee. According to Cohen [

52], this indicates a moderate effect size. Each step of the regression analysis shows significant improvements in explanatory power, supporting the meaningfulness of the additions made in the different steps. Below, we discuss the results in relation to each hypothesis.

The findings highlight the complexities in the relationships between the presence of offshoring and backshoring, as well as export intensity and sales growth, and how these variables interact to affect value creation per employee. While some hypotheses were supported, others were contradicted by the data, providing new insights into how firms can strategically navigate offshoring and backshoring decisions depending on their growth and market context.

H1: Firms engaging in offshoring of production realize higher value creation per employee.

The hypothesis proposed that firms engaging in offshoring of production would realize higher value creation per employee by reducing costs and improving efficiency. However, the results indicate that the presence of offshoring of production has no significant effect on value creation (β = −0.073, p = 0.362), contradicting the original assumption. Consequently, H1 is rejected, suggesting that value creation per employee from firms engaging in offshoring of production does not differ significantly from that of firms that do not offshore production in the context of the firms studied.

H2: Firms engaging in offshoring R&D realize lower value creation per employee.

We hypothesized that firms engaging in offshoring of R&D would realize lower value creation per employee due to communication barriers and reduced innovation capabilities. The findings, however, show that there is no significant difference in value creation per employee between firms that offshore R&D and those that do not (β = −0.042, p = 0.755), indicating no measurable impact on value creation per employee. Therefore, H2 is also rejected, as the presence of offshoring R&D does not significantly influence value creation.

H3: Firms engaging in backshoring of production realize lower value creation per employee.

Contrary to the hypothesis that firms engaging in backshoring of production would have a lower value creation per employee than those that do not due to increased labor costs, no significant difference was found (β = 0.049, p = 0.613). This suggests that firms engaging in backshoring of production neither realize higher nor lower value creation per employee in this sample. As a result, H3 is rejected.

H4: Firms engaging in backshoring of R&D realize higher value creation per employee.

We hypothesized that firms engaging in backshoring of R&D would realize a higher value creation per employee by improving coordination and innovation. However, the results show a marginally significant but negative difference (β = −2.824, p = 0.057), which contradicts the original hypothesis. Firms backshoring R&D, hence, appear to realize lower value creation per employee. Thus, H4 is partially rejected, as the effect is marginally significant but in the opposite direction than expected.

H5 and H7a–d: Export intensity directly and indirectly influences value creation per employee.

Export intensity was hypothesized to have both a direct and moderating influence on value creation per employee. The results show a significant positive direct effect of export intensity (β = 0.176, p < 0.001), confirming its importance. Moreover, export intensity has an even stronger positive effect on value creation for firms engaging in backshoring of R&D, as it marginally moderates the relationship between the presence of backshoring of R&D and value creation (β = 2.911, p = 0.050), suggesting that firms with high export intensity benefit from backshoring R&D in terms of value creation. However, export intensity does not moderate the relationships involving offshoring or backshoring of production in a significant way. Therefore, H5 is supported, and H7a–d are partially supported.

H6 and H8a–d: Sales growth directly and indirectly influences value creation per employee.

While sales growth was expected to have a direct effect on value creation, the results show that it does not have a significant direct effect (β = 0.025,

p = 0.591). However, sales growth does have a positive effect on value creation per employee for firms engaging in backshoring of production, as it positively moderates the relationship between the presence of backshoring of production and value creation (β = 0.141,

p = 0.005), indicating that companies experiencing high sales growth can benefit from backshoring of production. The moderation effects on other relationships, such as offshoring of production or R&D, are not significant. Therefore, H6 is not supported, but H8a-d are partially supported, as sales growth enhances the impact of backshoring of production on value creation.

Table 3 summarizes the results of the hypotheses tests.

6. Discussion

This analysis examines factors influencing value creation per employee, focusing on both internal company characteristics and strategic decisions. The findings from the four models indicate that companies should focus on a holistic approach.

6.1. Importance of Company Size and Structure

Company size, measured by sales revenue, has a significant positive effect on value creation per employee. Larger companies benefit from economies of scale and resource advantages, allowing them to achieve higher productivity. Conversely, increasing the number of employees has a significant negative impact on value creation per employee, suggesting that workforce expansion does not necessarily enhance efficiency. This can be attributed to the complexities and increased administrative costs associated with managing larger teams, which can strain organizational structures. To mitigate inefficiencies, companies should consider adopting AI and Industry 4.0 technologies to streamline operations and boost productivity.

6.2. Export Intensity as a Key Driver of Higher Value Creation

Export intensity, defined as the proportion of a company’s revenue derived from exports, significantly boosts value creation per employee. Companies engaged in exporting can enhance efficiency by accessing larger markets, expanding their customer base, and leveraging advanced technologies. These findings underscore the critical role of internationalization in boosting operational efficiency and productivity.

6.3. Role of Offshoring

In Model 4, the effect of offshoring production on value creation per employee is not statistically significant. This suggests that, on its own, the decision to offshore production does not have a consistent and strong impact on improving or reducing productivity. Although some of the dummy variables, such as the offshoring of production, are not statistically significant (p > 0.05), this does not necessarily mean they have no practical impact. Rather, it could indicate that additional factors or contexts (e.g., specific market conditions or strategic orientations) play a larger role, which were not captured in this model. This lack of significance indicates that other factors, such as the company’s broader strategic orientation or market conditions, might play a more crucial role in determining the effectiveness of offshoring production. Similarly, offshoring R&D activities do not significantly impact value creation per employee. These results imply that relocating R&D abroad does not directly and significantly affect value creation per employee. The decision to offshore R&D might depend on specific contexts, such as the type of R&D activities or the country to which they are offshored. These nuances suggest that simply moving R&D abroad does not guarantee productivity gains and may require additional factors to be effective.

6.4. Role of Backshoring

The effect of backshoring production is also not statistically significant. This indicates that bringing production processes back to the home country does not, by itself, have a definitive impact on value creation per employee. The effectiveness of backshoring production may depend on its integration with other strategic factors, such as technology adoption, market positioning, or the specific reasons for backshoring (e.g., quality control, proximity to key markets). The main effect of backshoring R&D shows a slight negative impact on value creation per employee, though this effect is not statistically significant in Model 4. This suggests that merely bringing R&D activities back to the home country may not improve productivity and could potentially introduce inefficiencies or higher costs. This implies that backshoring R&D needs to be strategically aligned with other factors, such as innovation strategy or market needs, to be effective.

6.5. Interaction Effects Are Relevant

The results from Model 4 highlight that the effects of offshoring, backshoring, export intensity, and sales growth are interconnected and cannot be considered in isolation. Interaction effects demonstrate that the combination of these factors has a significant impact on value creation per employee. For instance, companies that engage in backshoring R&D activities while maintaining high export intensity achieve higher value creation, possibly due to better alignment with market demands and improved coordination. Similarly, companies that backshore production while experiencing high sales growth can also realize greater value creation per employee. This combination may provide a strategic advantage in scaling up production rapidly and maintaining stringent quality control to meet increasing market demand.

6.6. Complexity and Context-Dependence of Strategic Decisions

The analysis reveals that strategic decisions are complex and heavily context-dependent. One-dimensional strategies such as offshoring without considering the interplay of export intensity or sales growth may not deliver optimal results. Instead, companies achieve optimal results by tailoring their strategies to specific market conditions and organizational contexts. This necessitates a comprehensive analysis of both internal capabilities and external opportunities to identify the most effective strategy combinations. Pursuing an integrated strategic management approach that considers the interplay of offshoring, backshoring, company size, and international market engagement is crucial. Before adopting backshoring strategies, companies should ensure that their internal capabilities are aligned with external market opportunities to maximize value creation and operational efficiency.

7. Specific Recommendations for Managers in Industry 4.0 Decisions

The analysis highlights that company size and strategic decisions related to internationalization, such as export intensity and offshoring/backshoring, significantly influence value creation per employee. Although this study did not directly address Industry 4.0, the findings can be interpreted within the context of Industry 4.0 to enhance productivity and efficiency. Key recommendations include:

7.1. Maximize Productivity through Sales Growth and Digitalization

The analysis shows that larger companies with higher sales volumes generally achieve better productivity. Managers should, therefore, focus on increasing sales by entering new markets or expanding product lines. To support this growth and minimize potential inefficiencies, companies should consider adopting Industry 4.0 technologies such as automation, data analytics, and smart manufacturing systems. These technologies can streamline operations, reduce costs, and optimize the use of human resources, ensuring that productivity gains are maintained even as the company scales up. While the direct impact of these technologies was not measured in this study, their potential to enhance efficiency in large-scale operations is well-supported by industry trends.

7.2. Engage in International Markets with Smart Technologies

The study found that increasing export intensity is linked to higher value creation per employee, underscoring the importance of international market engagement. Managers should prioritize strategies that enhance their company’s presence in global markets. Industry 4.0 technologies such as the Internet of Things (IoT), advanced supply chain analytics, and AI-driven customer insights can be instrumental in improving global logistics, tailoring products to meet diverse customer needs, and responding swiftly to market changes. Although these technologies were not explicitly analyzed, their application in optimizing international operations is a logical step for companies looking to maximize the benefits of export intensity.

7.3. Leverage Interaction Effects for Greater Gains

The combination of strategic moves, such as backshoring with strong export orientation or leveraging sales growth, leads to significant productivity gains. Managers should consider using Industry 4.0 tools like digital asset management, predictive maintenance, digital twins, and advanced data analytics and AI tools to optimize these strategies. For example, backshoring efforts can be enhanced by using real-time data to coordinate R&D and production more effectively, ensuring that innovations reach the market quickly and efficiently. These tools can help managers make data-driven decisions, aligning strategic actions with real-time operational and market insights. Although the study did not directly explore these technologies, incorporating them aligns with broader trends in achieving operational excellence.

8. Limitations and Future Research

This study’s key limitation is the lack of data on the degree of Industry 4.0 adoption among surveyed firms, which restricts the applicability of findings, particularly in industries where digital transformation significantly impacts productivity. Future research should include data on automation, AI, and IoT adoption to assess their influence on value creation per employee. Understanding the extent of automation will also provide deeper insights into the relationship between Industry 4.0 technologies and offshoring/backshoring strategies. Finally, sector-specific analyses are necessary to understand the varying effects of strategic decisions across industries.

The analysis further relies on cross-sectional data, capturing a single point in time. This approach limits the ability to draw causal inferences and understand the dynamic relationships between company size, strategic decisions, and value creation over time. Using longitudinal data to track changes over time would help establish causal relationships and the long-term effects of strategic decisions like offshoring and backshoring on productivity. In this respect, future research should also incorporate more recent data to reflect the current landscape and account for the impact of COVID-19 on global supply chains. By comparing pre- and post-pandemic data, researchers can gain a comprehensive understanding of how offshoring and backshoring strategies have evolved in response to recent global disruptions.

At last, the findings may not be fully applicable across different industries, as the impact of company size, export intensity, and strategic decisions like offshoring and backshoring can vary widely. Conducting sector-specific analyses can provide more tailored insights, acknowledging that the effects of strategic decisions vary across industries due to different market dynamics and competitive pressures. By addressing these research gaps, future studies can provide a more nuanced understanding of how firms can optimize their offshoring and backshoring strategies to enhance competitiveness in the dynamic landscape of Industry 4.0.

9. Conclusions

This study demonstrates that both company size and strategic decisions related to internationalization, such as export intensity, offshoring, and backshoring, significantly influence value creation per employee. Larger companies benefit from economies of scale, while a larger workforce can introduce inefficiencies. Export intensity consistently enhances productivity, underscoring the importance of international market engagement. However, the effectiveness of offshoring and backshoring is context-dependent and influenced by various factors, including the company’s strategic orientation and market conditions.

The findings suggest that managers should consider the broader context when making strategic decisions, including potential synergies and interactions between different strategies. Incorporating Industry 4.0 technologies offers additional opportunities to optimize productivity and efficiency, although these were not directly examined in this study.

Future research should integrate digital transformation into the analysis, explore industry-specific dynamics, and use longitudinal data to better understand the long-term impacts of these strategies. By doing so, companies can develop more comprehensive, data-driven strategies to enhance value creation and maintain competitiveness in an increasingly complex and globalized business environment.