Creating Stakeholder Value through Risk Mitigation Measures in the Context of Disaster Management

Abstract

1. Introduction

2. Objective, Materials and Methods

2.1. Objective

- How do the concepts of value creation and disaster management interrelate?

- How can the benefits of risk mitigation measures for various stakeholders be realized?

2.2. Methodology

- Include only peer reviewed scientific journal articles

- Ensure relevance by selecting articles that contain at least one keyword in their title or abstract

- Exclude articles with very narrow aspects or context (e.g., suitable only for a single case)

- Read remaining abstracts and ensure their relevance to the subject

- Further, read remaining articles in their entirety to ensure relevance of content

3. Literature Review: Comparing Value Creation and Disaster Management Processes

- Absolute profitability is achieved if the total cost of an investment (e.g., risk mitigation measure) is lower than the total cost of rejecting it.

- Relative profitability is achieved if investing (e.g., implementing a risk mitigation measure) results in a total cost that is lower than that of other options under consideration.

- people’s way of life

- culture

- community

- political systems

- the environment

- people’s health and wellbeing

- personal and property rights

- people’s fears and aspirations.

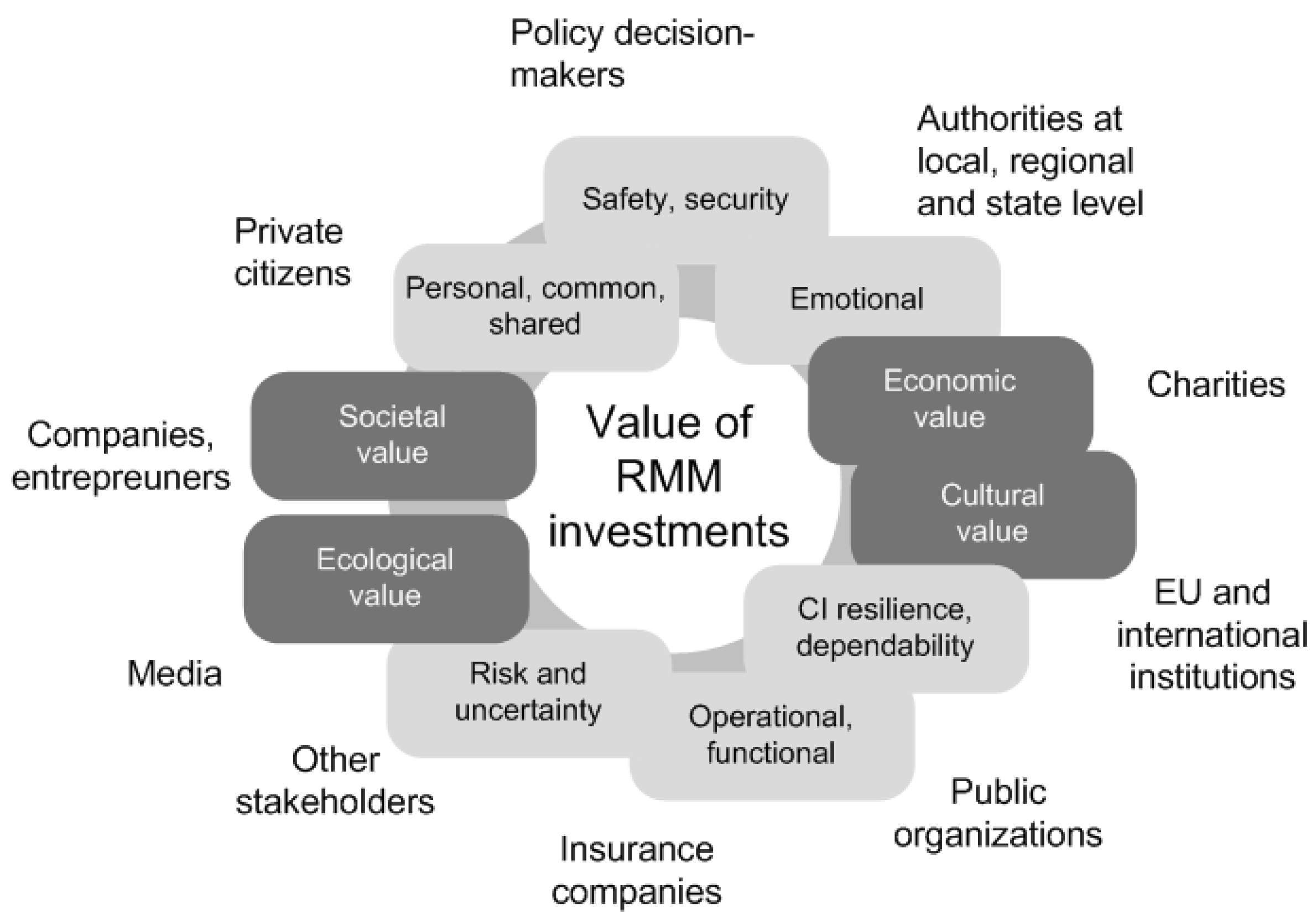

4. Creating Stakeholder Value through Risk Mitigation Measures

- Benefits of the risk mitigation measures in economic, environmental, and social termsThe environmental dimension, the natural environment: “a cleaner environment”, “environmental stewardship”, “environmental concerns in business operations”.The social dimension, the relationship between business and society: “contribute to a better society”, “integrate social concerns in their business operations”, “consider the full scope of their impact on communities”.The economic dimension, socio-economic or financial aspects: “contribute to economic development”, “preserving the profitability”, “business operations” [57].

- Impact of the risk mitigation measures on reliability, availability, and maintainability of electricity distribution networkReliability is the ability of a system to perform a required function under given conditions for a given time interval. Availability is the ability of an item to be in a state to perform a required function under given conditions at a given instant of time, or in average over a given time interval, assuming that the required external resources are provided. Maintainability is that aspect of maintenance that takes downtime of the systems into account [58].

- Life-cycle cost (investment and operating costs) of the risk mitigation measuresLife-cycle cost is the total cost incurred during the life-cycle of an RMM including both investment and operating cost [59].

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- The INTACT Project—Impact of Extreme Weather on Critical Infrastructure. Available online: http://www.intact-project.eu (accessed on 4 May 2017).

- Heikkilä, A.-M.; Molarius, R.; Rosqvist, T.; Perrels, A. Mitigating the impacts of extreme weather originated disasters by simulating the effects of different preparation and action decisions of crisis management. In Proceedings of the Programme and Abstracts of the Second Nordic International Conference on Climate Change, Adaptation Research Meets Adaptation Decision-Making, Helsinki, Finland, 29–31 August 2012; Carter, T., Perrels, A., Hildén, M., Eds.; Finnish Environment Institute: Helsinki, Finland, 2012. [Google Scholar]

- Birkmann, J.; Cutter, S.; Rothman, D.; Welle, T.; Garschagen, M.; van Ruijven, B.; O’Neill, B.; Prestion, B.L.; Kienberger, S. Scenarios for vulnerability: Opportunities and constraints in the context of climate change and disaster risk. Clim. Chang. 2015, 133, 53–68. [Google Scholar] [CrossRef]

- Stephenson, D.B. Definition, diagnosis, and origin of extreme weather and climate events. In Climate Extremes and Society; Murnane, R., Diaz, H., Eds.; Cambridge University Press: Cambridge, UK, 2008; pp. 11–23. [Google Scholar]

- Cutter, S.; Barnes, L.; Berry, M.; Burton, C.; Evans, E.; Tate, E. A place-based model for understanding community resilience to natural disasters. Glob. Environ. Chang. 2008, 18, 598–606. [Google Scholar] [CrossRef]

- Gheorghe, A.V.; Masera, M.; Weijnen, M.; de Vries, L. Critical Infrastructures at Risk; Springer: Dordrecht, The Netherlands, 2006. [Google Scholar]

- Räikkönen, M.; Mäki, K.; Murtonen, M.; Forssén, K.; Tagg, A.; Petiet, P.J.; Nieuwenhuijs, A.H.; McCord, M. A Holistic Approach for Assessing Impact of Extreme Weather on Critical Infrastructure. Int. J. Saf. Secur. Eng. 2016, 6, 171–180. [Google Scholar] [CrossRef]

- Linnenluecke, M.K.; Griffiths, A.; Winn, M.I. Organizational adaptation and resilience to extreme weather events. In Proceedings of the Annual Meeting of Academy of Management, Anaheim, CA, USA, 8–13 August 2008. [Google Scholar]

- Lindström, M.; Olsson, S. The European programme for critical infrastructure protection. In Crisis Management in the European Union; Springer: Berlin/Heidelberg, Germany, 2009; pp. 37–59. [Google Scholar]

- Simonovic, S.P. From risk management to quantitative Disaster resilience—A paradigm shift. Int. J. Saf. Secur. Eng. 2016, 6, 85–95. [Google Scholar] [CrossRef]

- Kröger, W.; Zio, E. Vulnerable Systems; Springer: London, UK, 2011. [Google Scholar]

- Mäki, K.; Forssén, K.; Vidar Vangelsten, B. Factors Contributing to CI Vulnerability and Resilience, INTACT Deliverable D3.2. Project Co-Funded by the European Commission under the 7th Framework Programme; Project Report. 2015. Available online: http://www.intact-project.eu/intact/assets/File/D3_2%20-%20Factors%20Contributing%20to%20CI%20Vulnerability%20and%20Resilience.pdf (accessed on 18 October 2017).

- Pursiainen, C.; Rød, B.C.; Baker, C.; Honfi, D.; Lange, D. Critical Infrastructure Resilience Index. In Proceedings of the European Safety and Reliability (ESREL) Conference on 2016 European Safety and Reliability, Glasgow, UK, 25–29 September 2016. [Google Scholar]

- Molarius, R.; Räikkönen, M.; Forssén, K.; Mäki, K. Achieving enhanced resilience of electricity networks by multi-stakeholder assessment of co-operation and communication risk: A case study of adverse winter weather in Finland. J. Extreme Events 2016, 3. [Google Scholar] [CrossRef]

- Wijnia, Y. The asset management process reference model for infrastructure. In Proceedings of the 10th World Congress on Engineering Asset Management, Tampere, Finland, 28–30 September 2015. [Google Scholar]

- ISO 55000. Asset Management-Overview, Principles and Terminology; International Organization for Standardization: Geneva, Switzerland, 2014. [Google Scholar]

- ISO 55001. Asset Management-Management Systems-Requirements; International Organization for Standardization: Geneva, Switzerland, 2014. [Google Scholar]

- ISO 31000. Risk Management-Principles and Guideline; International Organization for Standardization: Geneva, Switzerland, 2009. [Google Scholar]

- ISO 31010. Risk Management: Risk Assessment Techniques; International Organization for Standardization: Geneva, Switzerland, 2009. [Google Scholar]

- Bowman, C.; Ambrosini, V. Firm value creation and levels of strategy. Manag. Decis. 2007, 45, 360–371. [Google Scholar] [CrossRef]

- Saarijärvi, H.; Kannan, P.K.; Kuusela, H. Customer participation and value creation: A systematic review and research implications. Eur. Bus. Rev. 2013, 25, 6–19. [Google Scholar] [CrossRef]

- Lanne, M.; Jähi, M.; Murtonen, M. Risk-conscious value creation. In Proceedings of the XXIV Annual RESER Conference 2014, Helsinki, Finland, 11–13 September 2014; pp. 843–852. [Google Scholar]

- Lepak, D.P.; Smith, K.G.; Taylor, S.M. Value creation and value capture: A multilevel perspective. Acad. Manag. Rev. 2007, 32, 180–194. [Google Scholar] [CrossRef]

- Khalifa, A.S. Customer value: A review of recent literature and an integrative configuration. Manag. Decis. 2004, 42, 645–666. [Google Scholar] [CrossRef]

- Räikkönen, M.; Pilli-Sihvola, K.; Kunttu, S.; Yliaho, J.; Jähi, M.; Zuccaro, G.; del Cogliano, D. Assessing economic impacts of crises—A decision-support approach to long-term strategic planning. In Proceedings of the IX International Conference on Risk Analysis and Hazard Mitigation (Risk Analysis 2014), The New Forest, UK, 4–6 June 2014; pp. 229–241. [Google Scholar]

- Guha-Sapir, D.; Santos, I. The Economic Impacts of Natural Disasters; OUP: Oxford, MS, USA, 2013. [Google Scholar]

- McKenzie, E.; Prasad, B.; Kaloumaira, A. Guidelines for Estimating the Economic Impact of Natural Disasters in the Pacific, the Australia Agency for International Development; The Australia Agency for International Development: Canberra, Australia, 2005. [Google Scholar]

- Middelmann, M.H. Natural Hazards in Australia. Identifying Risk Analysis Requirements; Geoscience Australia: Canberra, Australia, 2007; Available online: https://d28rz98at9flks.cloudfront.net/65444/65444.pdf (accessed on 17 October 2017).

- Freeman, R.E. Managing for stakeholders: Trade-offs or value creation. J. Bus. Eth. 2010, 96, 7–9. [Google Scholar] [CrossRef]

- Parmar, B.L.; Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Purnell, L.; de Colle, S. Stakeholder theory: The state of the art. Acad. Manag. Ann. 2010, 4, 403–445. [Google Scholar] [CrossRef]

- Tantalo, C.; Priem, R.L. Value creation through stakeholder synergy. Strateg. Manag. J. 2016, 37, 314–329. [Google Scholar] [CrossRef]

- The INTACT Wiki. Available online: http:www.intact-wiki.eu (accessed on 4 May 2017).

- Easterby-Smith, L.; Thorpe, R.; Lowe, A. Management Research. An Introduction, 2nd ed.; SADE Publications: London, UK, 2002. [Google Scholar]

- Webster, J.; Watson, R.T. Analyzing the past to prepare for the future: Writing a literature review. MIS Q. 2002, 26, 13–23. [Google Scholar]

- Yair, L.; Ellis, T.J. A Systems Approach to Conduct an Effective Literature Review in Support of Information Systems Research. Inf. Sci. J. 2006, 9, 181–212. [Google Scholar]

- Newbert, S.L. Empirical research on the resource-based view of the firm: An assessment and suggestions for future research. Strateg. Manag. J. 2007, 28, 121–146. [Google Scholar] [CrossRef]

- ISO 31010:2009. Risk Management-Risk Assessment Techniques. Available online: http://www.iso.org/iso/catalogue_detail?csnumber=51073 (accessed on 4 May 2017).

- Saaty, T.L. The Analytic Hierarchy Process; McGraw-Hill: New York, NY, USA, 1980. [Google Scholar]

- Götze, U.; Northcott, D.; Schuster, P. Investment Appraisal: Methods and Models; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Keeney, L.; Raiffa, H. Decisions with Multiple Objectives: Preferences and Value Trade-offs; Cambridge University Press: Cambridge, UK, 1993. [Google Scholar]

- Millet, I.; Wedley, W.C. Modelling Risk and Uncertainty with the Analytic Hierarchy Process. J. Multi Criteria Decis. Anal. 2002, 11, 97–107. [Google Scholar] [CrossRef]

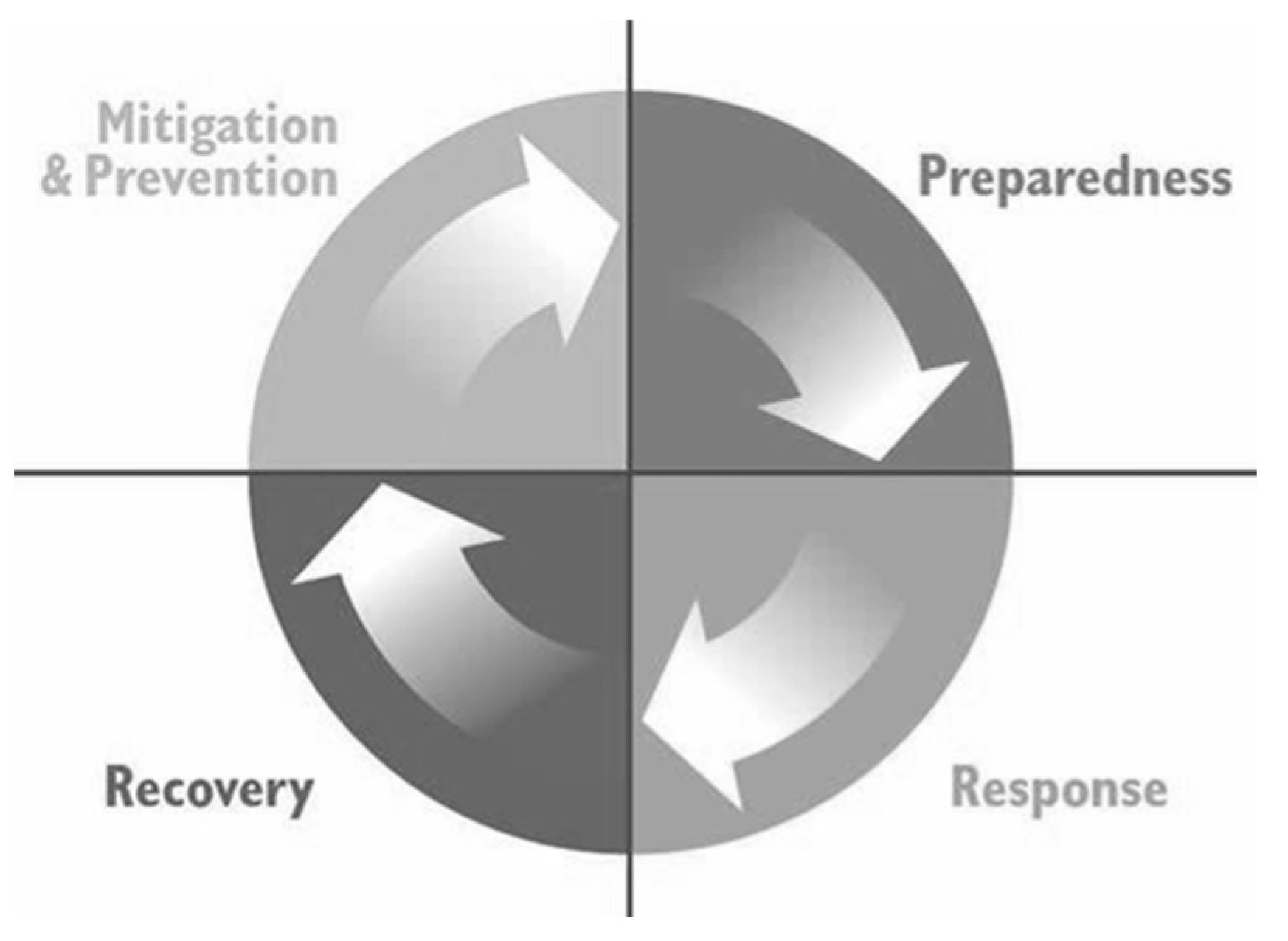

- Crisis Management Cycle. The Vitruv Consortium. Available online: http://securipedia.eu/mediawiki/index.php/Crisis_management_cycle (accessed on 3 October 2016).

- Disaster Management Cycle. Available online: https://sites.google.com/site/dimersarred/disaster-management-cycle (accessed on 25 April 2017).

- Lin Moe, T.; Pathranarakul, P. An integrated approach to natural disaster management: Public project management and its critical success factors. Disaster Prev. Manag. Int. J. 2006, 15, 396–413. [Google Scholar] [CrossRef]

- Coetzee, C.; van Niekerk, D. Tracking the evolution of the disaster management cycle: A general system theory approach. J. Disaster Risk Stud. 2012, 4, 9. [Google Scholar] [CrossRef]

- Lin Moe, T.; Gehbauer, F.; Senitz, S.; Mueller, M. Balanced Scorecard for Natural Disasters on Development in the Pacific. Disaster Prev. Manag. 2007, 16, 785–806. [Google Scholar] [CrossRef]

- Voima, P.; Heinonen, K.; Strandvik, T. Exploring Customer Value Formation—A Customer Dominant Logic Perspective. In Working Paper, 552, Workbooks of Hanken School of Economics; Laurea publications: Helsinki, Finland, 2010. [Google Scholar]

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Vanclay, F. International principles for social impact assessment. Impact Assess. Proj. Apprais. 2003, 21, 5–12. [Google Scholar] [CrossRef]

- Abreu, A.; Camarinha-Matos, L.M. On the role of value systems to promote the sustainability of collaborative networks. Int. J. Prod. Res. 2008, 46, 1207–1229. [Google Scholar] [CrossRef]

- Räikkönen, M.; Kunttu, S.; Uusitalo, T.; Takala, J.; Shakeel, S.R.; Tilabi, S.; Forss, T.; Koivunen, J. A framework for assessing the social and economic impact of sustainable investments. Manag. Prod. Eng. Rev. 2016, 7, 79–86. [Google Scholar] [CrossRef]

- Meyer, V.; Becker, N.; Markantonis, N.; Schwarze, R.; van den Bergh, J.C.; Bouwer, L.M.; Bubeck, P.; Ciavola, P.; Genovese, E.; Green, C.; et al. Review article: Assessing the costs of natural hazards-state of the art and knowledge gaps. Nat. Hazards Earth Syst. Sci. 2013, 13, 1351–1373. [Google Scholar] [CrossRef]

- Pike, R.; Neale, B. Corporate Finance and Investment: Decisions and Strategies, 4th ed.; Prentice Hall: Harlow, UK, 2003. [Google Scholar]

- Boardman, A.E.; Greenberg, D.H.; Vining, A.R.; Weimer, D.L. Cost–Benefit Analysis: Concepts and Practice, 3rd ed.; Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Rose, A. Defining and measuring economic resilience to disasters. Disaster Prev. Manag. 2004, 13, 307–314. [Google Scholar] [CrossRef]

- United Nations Office for Disaster Risk Reduction (UNIDSR). 2009 UNIDRS Terminology on Disaster Risk Reduction; United Nations Office for Disaster Risk Reduction: Geneva, Switzerland, 2009. [Google Scholar]

- Dahlsrud, A. How Corporate Social Responsibility is Defined: An Analysis of 37 Definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Tiusanen, R.; Jännes, J.; Liyanage, J.P. Evaluation of RAMS + I factors affecting different offshore wind turbine concepts. Int. J. Offshore Polar Eng. 2013, 23, 137–142. [Google Scholar]

- IEC60300-3-3. Dependability Management—Part 3–3: Application Guide—Life Cycle Costing, 3rd ed.; IEC Commission Electrotechnique Internationale: Geneva, Switzerland, 2017. [Google Scholar]

- Molarius, R.; Tuomaala, P.; Piira, K.; Räikkönen, M.; Aubrecht, C.; Polese, M.; Zuccaro, G.; Pilli-Sihvola, K.; Rannat, K. A Framework for Comprehensive Impact Assessment in the Case of an Extreme Winter Scenario, Considering Integrative Aspects of Systemic Vulnerability and Resilience. Comput. Model. Eng. Sci. 2015, 109, 131–158. [Google Scholar]

- Forssén, K. Resilience of Finnish Electricity Distribution Networks against Extreme Weather Conditions. Master’s Thesis, Aalto University, Espoo, Finland, 2016. [Google Scholar]

| Characteristics | Disaster Management | Value Creation |

|---|---|---|

| Description | The range of activities designed to maintain control over disaster and emergency situations and to provide a framework for helping those who are at risk to avoid or recover from the impact of the disaster [55,56]. | A process that provides more novel and appropriate benefits than target users currently possess, and that they are willing to pay for [23]. |

| Aim | Reducing (avoiding, if possible) the potential EWE impacts on CI, assure prompt and accurate assistance during the EWE, achieving rapid and durable recovery, business continuity, facilitating decision-making, increasing stakeholder wealth. | Focus on economic profitability, but lately also on societal and environmental value, investment decision-making (risk mitigation measures), financial situation and standing, company success. |

| Research disciplines | Risk management, reliability engineering, insurance, management, psychology. | Management accounting, finance, service research, marketing. |

| Elements | Hazards, losses, tangible and intangible impacts, resilience, vulnerability, dependability, uncertainty, probability, consequences, risk. | Cost, profit, value, benefit, sacrifices. |

| Methods and models | Hazard models, vulnerability models, loss models, methods for capacity, capability and resource management. | Investment appraisal, impact assessment, value propositions, service concept models. |

| Stakeholders | All stakeholder groups of the society. Decision-makers at all decision-making levels: local, regional and state authorities, EU institutions, public organisations, private companies and citizens. | All but focus typically on private companies ability to create value and on creating economic value to shareholders. |

| Critique | Focusing on negative impacts. | Challenges and ethical implications related to the valuation of intangible impacts, e.g., economic valuation of life. |

| Mitigation | Preparedness | Response | Recovery |

|---|---|---|---|

| Overhead line placement | Adjacent forest management | Situational awareness | Distributed generation |

| Underground cabling | Inspection of the network condition | Cooperation and lending arrangements | Micro grids |

| Coating of conductors | Contingency plans | ||

| Regular aerial inspections | Emergency power systems | ||

| Network structure modifications | Smart grids | ||

| Preparedness of households | |||

| Mutual planning and training |

| Preparedness: Mutual Planning and Training | Underground Cabling (Weather-Proof Network) | ICT Solutions (Technology, Systems) | Forming and Disseminating Situational Awareness (Method) | Up-to-Date Contingency Plans (i.e., Critical Points of Consumption Listed, Increasing of Preparedness Level etc.) | Adjacent Forest Management, Sufficient Vegetation Clearance Resources (Weather-Proof Network) | Backup Power | |

|---|---|---|---|---|---|---|---|

| Economic, environmental and social benefits of RMMs (scale 1–5) | 5 | 5 | 5 | 4 | 4 | 3 | 3 |

| Impact of the RMMs on RAMS* of electricity distribution network (scale 1–5) | 5 | 5 | 5 | 5 | 4 | 4 | 2 |

| LCC (investment and operating costs) of the RMMs (scale 1–5) | 5 | 4 | 2 | 3 | 2 | 4 | 2 |

| Total (weighted) (Benefits: 42%, RAMS: 37%, Life-cycle costs: 21%) | 15.0 | 14.4 | 13.1 | 12.5 | 11.4 | 10.7 | 10.7 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Räikkönen, M.; Molarius, R.; Mäki, K.; Forssén, K.; Petiet, P.; Nieuwenhuijs, A. Creating Stakeholder Value through Risk Mitigation Measures in the Context of Disaster Management. Infrastructures 2017, 2, 14. https://doi.org/10.3390/infrastructures2040014

Räikkönen M, Molarius R, Mäki K, Forssén K, Petiet P, Nieuwenhuijs A. Creating Stakeholder Value through Risk Mitigation Measures in the Context of Disaster Management. Infrastructures. 2017; 2(4):14. https://doi.org/10.3390/infrastructures2040014

Chicago/Turabian StyleRäikkönen, Minna, Riitta Molarius, Kari Mäki, Kim Forssén, Peter Petiet, and Albert Nieuwenhuijs. 2017. "Creating Stakeholder Value through Risk Mitigation Measures in the Context of Disaster Management" Infrastructures 2, no. 4: 14. https://doi.org/10.3390/infrastructures2040014

APA StyleRäikkönen, M., Molarius, R., Mäki, K., Forssén, K., Petiet, P., & Nieuwenhuijs, A. (2017). Creating Stakeholder Value through Risk Mitigation Measures in the Context of Disaster Management. Infrastructures, 2(4), 14. https://doi.org/10.3390/infrastructures2040014