Abstract

The present study aimed to identify the most important packaging attributes for purchasing a product not currently on the Brazilian market: antioxidant-rich instant coffee, a blend of roasted coffee and green coffee. Five package types of the same brand of instant antioxidant-rich coffee marketed in different countries were evaluated through a focus group. The attributes’ glass shape, glass lid color and label, information and brand were selected for the quantitative study. The purchase intent for the packaging images was evaluated with conjoint analysis. In general, an increased purchase intent was verified for more modern packages and browner labels that indicated roasted coffee. The consumers preferred the image of green and roasted coffee beans next to the cup of coffee and valued information about the product’s differentiation (the origin, type, quantity and functions of antioxidants) that was presented in the form of explanatory charts on the back of the packaging.

1. Introduction

Brazil, the second largest consumer of coffee and the largest producer and exporter, is responsible for one-third of the production and one-fourth of the bean exports globally [1]. As projection presented by the CEO of Illy Coffee, world coffee consumption should increase by 70 million bags by 2030. In addition to increased supply, producers will face the challenge of delivering a better product to a new consumer profile, as coffee has been more recently seen as a product associated with pleasure as well as beneficial to health [2]. Instant coffee adds the ease of fast preparation to coffee’s sensorial attributes and health benefits, presenting potential for new products development.

Green coffee, roasted and instant coffees and the brews prepared from it are very complex mixtures which comprises both naturally occurring compounds and those induced by the roasting process. The roasting process changes the chemical composition, giving coffee its characteristic aroma and flavor but also affecting the biological activity of the product [3,4,5]. Chlorogenic acids (CGAs), key components of the phenolic fraction of green coffee beans, not only have potent antioxidant activity but also protect the liver and have hypoglycemic and antiviral activities. During processing, the CGA can be partially isomerized, hydrolyzed or degraded to compounds of low molecular weight. The roasting process also produces lactones and CGA polymers that form melanoidins as a final product [4]. In addition to the traditionally known benefits of caffeine [6], the biological and antioxidant effects of melanoidins on human health have been noteworthy [7]. In general, instant coffee brews have excellent antioxidant power due to large amounts of robusta coffee and an extraction process that enriches the coffee with antioxidant compounds such as CGA and caffeine. Vignoli et al. [5] reported that the degree of the roast has less influence on the antioxidant activity of instant coffee than the raw material employed, as CGA degradation is partly compensated for by the formation of melanoidins.

Considering that consumers are increasingly concerned about nutrition and health [8,9] and that both the green and roasted coffee have positive functional characteristics [3,4,6], an interesting alternative could result from blending these products to obtain an instant coffee rich in bioactive compounds and with sensory characteristics similar to those of the traditionally marketed product. These products are already available on the international market, but there is no functional instant coffee (enriched with natural or others bioactive compounds) available in the Brazilian market.

In Brazil, the most common roasts are medium and moderate-dark [10], which define Brazilian coffee to be extremely bitter and dark, with a “smoked” taste and a reduced aroma [11]. Therefore, marketing a blend rich in green coffee extract requires knowledge about how to introduce a product based on the interests, preferences and attitudes of Brazilian consumers (the second largest consumer market).

Before developing functional products, manufacturers should ensure that these new products and concepts meet consumer expectations and that any health information is provided in an honest and attractive manner [12]. Because technological solutions are difficult and costly, consumer research can prevent serious mistakes in investments and processes. Among consumer research focuses, determining the influence of information and packaging design and the consumers’ purchase intent is noteworthy.

Packaging is one of the most important factors driving sales, food identity and brand construction. It represents consumers’ first contact with the product and is crucial to their purchase decisions [13]. Consumer expectations and perceptions derive from their previous knowledge of the product and the information displayed on the packaging [14]. Such expectations and perceptions can be subjectively assessed with qualitative tests, including focus groups, and with quantitative tests such as conjoint analysis.

The focus group represents an exploratory method in which the goal is to examine ideas about preferences, stimuli and certain behavior barriers, while an impartial moderator allows the participants to explain, in a roundtable discussion, their motivation, attitudes, and perceptions [15]. Conjoint analysis is used to understand the conjoint effect of two or more independent variables on a variable that measures consumer opinion [16,17,18]. In food packaging studies, the conjoint analysis allows for a comparison of the effects of nutritional properties and other characteristics, including price, packaging type, label and color [13,14,19,20,21,22].

Therefore, the present study aimed to identify and quantify packaging attributes that influence Brazilian consumers purchase intent for instant coffee enriched with antioxidants naturally obtained from blending roasted and green coffee extracts.

2. Experimental Section

This study was approved by the Committee of Ethics in Research Involving Human Subjects, State University of Londrina (Certificate of Presentation for Ethical Assessment 0143.0.268. 000-10).

2.1. Survey of Relevant Purchase Attributes

The focus group technique was applied in order to survey of packaging attributes that could impact consumer acceptance of instant antioxidant-rich coffee. In this first part of the study, the main attributes (and their levels) were defined for the further quantitative study by conjoint analysis. The sessions following guidelines presented in the literature [23]. During the interview, five packages of the same brand of instant coffee, available in European and Asian markets were presented sequentially to the participants (Table 1).

The products were a blend of green coffee and roasted coffee and thus were antioxidant enriched. The packages were select to present differences in terms of shape, color, information, images and font size. Four of the products were presented in 100 g glass containers. At the end of each session, a 2 g stick package made of laminated paper was also presented to determine consumer interest in this type of individual packaging for this product.

Consumers (23 individuals aged from 18 to 69 years) were selected from questionnaires considering coffee consumption, food label reading and purchase habits. Considering that the product is not available on the Brazilian market as well as the need of subjects that understand its concept and are able to read a label in other languages, educated coffee consumers (high school to post-graduate) were selected. They were divided into four focus groups according to their considering socio-demographic characteristics and experience/knowledge with the subject of the study (coffee and functional foods), so the sessions occurred in focused manner and provide representative discussions of the target audience and product interest. The main characteristics of each group are described in the Table S1. The evaluation was completed in four 90-min sessions.

Table 1.

Description of the packages (P) of commercial antioxidant-rich instant coffees, of same brand, used in the focus group sessions.

| P | Description |

|---|---|

| A | Cylindrical glass container, wrapped with paper label with a gray and brown background color. Round gray plastic lid. Front images: coffee cup with white foam and steam held by two hands, red coffee fruit and with two half green bean and two half roasted bean. Information regarding the differential of the product (IDP): “body partner”, “3 × more antioxidants than green tea”, “100% pure instant coffee”, “naturally rich in antioxidants”, “ingredients: blend of roasted and green coffee beans”, “a mild roast to give you smooth excellent taste” and organization chart with three boxes containing information about the types of antioxidants, origin and functions. Place of purchase: Philippines |

| B | Rectangular and waisted glass container. Paper label with a green and brown background color. Hexagonal black plastic lid. Front image: oval coffee bean (half green and half roasted). IDP: In front—“new”, “naturally rich in health supporting antioxidants”, “delicious blend of green and roasted coffees”. On the back—chart containing information about the product taste, the source of antioxidants, the customer service information and nutritional facts with the total amount of antioxidants and polyphenols, and in text form, intake of antioxidants by cup, “from a blend of green and roasted coffee beans naturally rich in health supporting antioxidants”. Place of purchase: United Kingdom |

| C | Cylindrical flattened and waisted glass container. Paper label color: Idem B. Round green plastic lid. Front image: idem B. IDP: In front—“new”, “help care for you”, “with natural antioxidants of green coffee”, “blend of green and roasted coffee”. On the back—organization chart containing information about the importance of a healthy lifestyle, the presence of green coffee, the origin and functions of antioxidants, nutritional facts with the amount of polyphenols, and in text form, “instant coffee and green instant coffee”, “ingredients: 65% roasted coffee and 35% green coffee”, “a smooth and aromatic coffee”. Place: Spain |

| D | Hexagonal and waisted glass container. Paper label with a green and brown background color. Hexagonal paris green plastic lid. Front image: Idem B. IDP: In front—roasted and green coffee rich in antioxidants”, “naturally rich in antioxidants”. On the back—“to enjoy your coffee with sweet and fruity aroma”, nutritional facts (by 100 g and by cup (2 g)) containing the amount of total antioxidant and polyphenols, ingredients: idem C. Place: France |

| E | Stick foil package with a green and brown background color. Image: Oval coffee bean (half green and half roasted). Packed in a cardboard box with a 15-stick capacity, with green and brown gradation in the background. Front images: oval coffee bean (half green and half roasted) and two sticks. IDP: In front—same as for product D. Side—“The ‘brand’ captured precious specific antioxidants of the green coffee: site”; nutritional information table identical to that of product D; “30 g (15 × 2 g)”, “green and roasted instant coffee”; ingredients: idem C. On the back—“The pleasure of roasted coffee with the benefits of green coffee!” information about green coffee, the origin and type of antioxidants, and a website for information. Place: France |

The participants visited the supermarket regularly and were solely (34% of participants) or partially responsible for purchasing the food for their homes. All participants affirmed to purchase coffees for their home and almost all of the participants (84%) reported having purchased instant coffee specifically. Approximately half of the participants reported consuming one to four cups per day of pure coffee (45%), while others (47%) consumed one to three cups a day of instant coffee mixed with milk. It was also noted that 79% of the participants read the labels of the products they consume and pay special attention to the nutritional information and ingredients used (83%), the expiration date (78%), price and brand (65%).

To standardize the sessions, the moderator used a guideline presenting issues to be discussed in a no specific order according to the context and dynamics of the group (Table S2). At the end of each session, each participant placed the packages in descending order of preference and justified the ordering.

2.2. Definition and Elaboration of Stimulus Profiles

Based on the qualitative results, the attributes brand, glass shape, glass lid and label color and information about product differentiation were selected for the subsequent quantitative study. Levels of study for each attribute were also established based on the focus group discussions. The levels of the “brand” attribute were defined on the basis of a well-known brand and market leader of instant coffee in Brazil, and a retail brand associated with diverse types of food, but not specifically related to instant coffee. The glass containers included a distinctive “modern” container (a hexagonal and waisted glass with a hexagonal lid) that allowed a broad view of the instant coffee on the sides, and a “conventional” glass container (a cylindrical container with a lid that were more familiar in the domestic market), that allowed a limited view of the product. Color attribute levels were “more brown”, a brown lid and a label with prevalence of brown color in the background, and “more green”, green lid with less prevalence of brown color in the background. Regarding the “information” attribute, it was defined two levels: less information (“instant coffee naturally enriched with antioxidants”) and more information (“new, delicious blend of green and roasted coffee, enriched with natural coffee antioxidants, with the taste of your roasted coffee”).

A 24−1 fractional factorial design was used to define the stimulus profiles used in this study. Eight images (on cards) were created based on the combined levels of each attribute (Table S3). Only the front of the modified packages was created, following the pattern of the images on the international market. The marketed product images were photographed with color film and transferred to slides. Corel Photo-Paint 12 [24] and Microsoft PowerPoint [25] were used to edit the images. Figure 1 shows two examples of packaging images (stimulus profiles 3 and 6, Table S3).

Figure 1.

Examples of stimulus profiles used in the conjoint analysis.

2.3. Stimulus Profile Evaluations and Purchase Intent Measurement

This part of the study consisted of 10 sessions with 149 coffee consumers who agreed to participate in the study. Among the participants were students, teachers and employees of five different educational institutions from the cities of Medianeira, Umuarama, Paranavaí and Londrina in Parana State and São José do Rio Preto in São Paulo State. These are small-to-medium cities (40,000 to 500,000 inhabitants) in Brazilian states that are traditionally coffee producers and consumers and headquarters of the instant coffee industry. The participants were invited by electronic mail to participate in the study. Inclusion criteria were: to be a coffee consumer and to have responsibility for buying food products, in order that he/she already had been in a real situation of buying coffee. Before the analysis, the participants answered a questionnaire to characterize them according to their demographics, food purchasing attitudes, coffee consumption and knowledge about coffee and antioxidants.

The analysis procedure followed that of Costa et al. [19] and Souza et al. [22]. The participants were asked to evaluate the different images created for the packaging in conference rooms outfitted with a projection system (computer connected to a Boxlight SP-6t projector) and artificial lighting (fluorescent daylight). While seated in front of the screen, the participants first viewed all of the packages on the same slide, obtaining an overall view similar to the way one would view products at a supermarket. Next, the three-digit encoded packages were presented in sequence. The order of presentation was randomized for each session. Each image was displayed for 30 s. Between image presentations, a blank slide was shown for 10 s.

Before the evaluations began, the participants were informed that they should evaluate the packages of instant antioxidant-rich coffee and behave as if they were at a supermarket searching for an instant coffee for their homes. A seven-point scale ranging from “would definitely not buy” to “would definitely buy” was used to evaluate the purchase intent for each treatment.

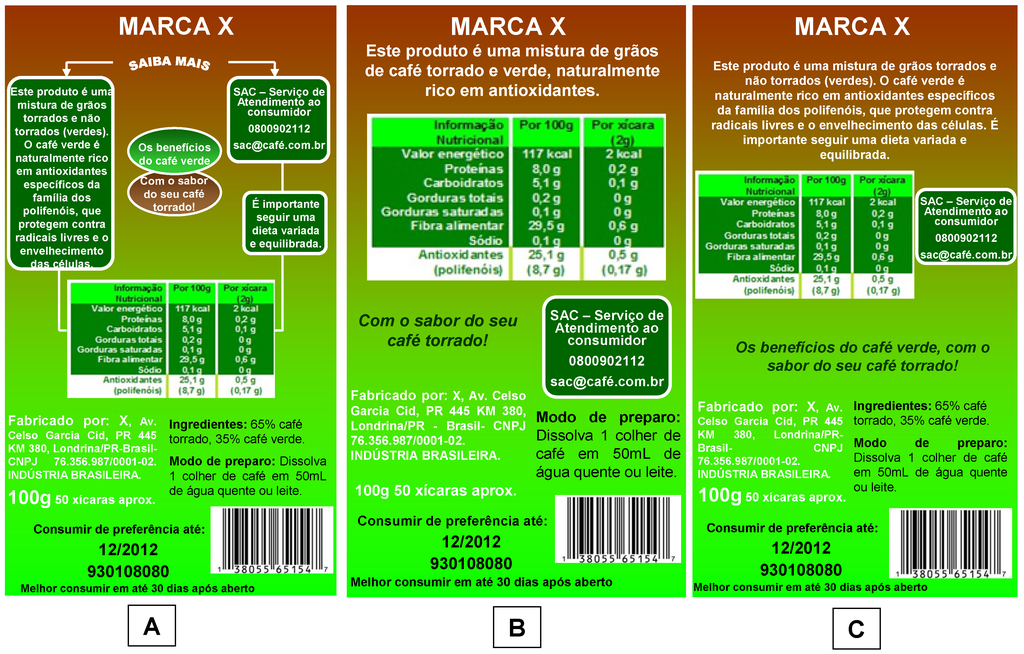

2.4. Evaluation of Back Labels

Based on the focus group discussion, three back labels were created for the instant antioxidant-rich coffee packages. They contained common information, including the ingredients, method of preparation, manufacturer, barcode, shelf life and yield, but differed in their display and the amount of information about the product. Label A contained more detailed information about coffee antioxidants and the product in an organizational chart display. Label C contained the same information displayed more conventionally as text. Label B provided summary information about the product displayed in text form and with a larger font size (Figure 2).

The images were created using Microsoft PowerPoint [25], coded with three random digits and randomly projected at the end of each session of the purchase intent analysis. The 149 participants were asked to arrange the labels in descending order of preference.

Figure 2.

Back labels used in the preference ranking test.

2.5. Data Analysis

The data obtained from the focus group were analyzed and discussed, with special attention given to the consumer vocabulary, the context of the question and response specificity, which were represented by percentages whenever possible.

For the purchase intent analysis, the results for each packaging were scored from 1 to 7 and tabulated within a double-entry frame of consumers vs. packaging. The additive model was used as a composition rule. It predicts that the overall evaluation of preference (purchase intent) is formed by the sum of the factor level contributions (packaging attributes). Equation (1) represents the general additive model for n factors, each with m levels [26].

where Y is the overall evaluation of a certain product, ʋij is the coefficient of preference combined with the j-th level of the i-th factor (i = 1, 2,..., n and j = 1, 2,..., m), and Xij is the dummy variable (Xij = 0 or Xij = 1) that indicates the presence of the j-th level of the i-th factor on the evaluated treatment.

The results were analyzed according to a cluster-segmentation model [27]. Initially, the part-worths for each consumer were estimated using multiple linear regressions with dummy variables, using the Ordinary least squares method. Next, hierarchical clustering analysis (HCA) was performed using the average distance between groups and the Euclidean distance as a measure of similarity. The consumers were then grouped by similarity into part-worths, i.e., similar purchase intent. An aggregate analysis was conducted for each consumer group. The part-worths and their relative importance were estimated per group using the estimated means from the individual models. The statistical analysis followed the transreg and cluster procedures of the SAS software [28]. The part-worths for each consumer were also used as variables for the principal components analysis (PCA) realized using Statistica software [29].

The results of the ranking test for the back labels were scored from 1 to 3 (1 for the most preferred, and 3 for the least preferred). Friedman’s method with nonparametric multiple comparisons was used to evaluate the differences at the 5% level [30] and was performed using Statistica software [29].

3. Results and Discussion

3.1. Qualitative Attributes Raised by the Focus Group Discussions

In general, the participants preferred the hexagonal and waisted shapes defined as modern; however, in all of the sessions, they emphasized the importance of being able to clearly see the product inside. This response was similar to that reported by Kobayashi and Benassi [31] when they evaluated regular instant coffees on the Brazilian market.

Regarding lid color, the participants disagreed on the most appropriate color for naturally enriched instant coffee: many participants preferred the Paris green color, which would emphasize the distinctive addition of green coffee, while other participants considered brown the most appropriate color for coffee. The grey color pleased some participants who thought it was innovative and different from other coffee packaging, but it did not positively influence purchase intent: in the preference ordering, product A was set in the fifth place (last position) by 10 of the 23 participants and in fourth place by the nine remaining participants. The preference was for less “information overload” and more colored labels, with harmony between the grades of brown and green in the background. Although Kobayashi and Benassi [31] and Della Lúcia et al. [13] reported that brown and red were the most accepted packaging colors for both instant and ground coffee, all of the participants agreed that a light green detail should be used on the packaging because of the green coffee added to the blend.

For the images, the consumers reported a preference for a small cup of steaming hot coffee with a product color similar to that of conventional instant coffee. The presence of green beans beside the cup, in a proportion representative of that added to the product, was also suggested. In general, the participants did not favor emphasizing the green coffee in the images or in the product’s name, as it could give the impression that the color and taste were less intense and characteristic. Ares et al. [32] recommend using caution when providing information about the origin of the functional ingredient because while it can distinguish the product and make it more attractive to consumers, it can also create a negative sensory expectation. Because antioxidant-rich instant coffee is a distinctive product, the consumers in all sessions emphasized the importance of displaying taste information on the front label to ensure that the taste will be similar to that of the traditional product. These considerations are relevant since the Brazilian consumer considers that a “good” coffee should have a good taste (55% of consumers), a pleasant aroma (39%) and the correct roasting degree (10%) [33]. Brazilian coffees are typically medium- to dark-roasted [10].

Regarding product information, a direct emphasis on the product’s distinguishing characteristics (i.e., the enrichment of natural coffee antioxidants) was considered important. A comparison between the amounts of antioxidants in coffee and green tea was shown on label A. The participants indicated that such comparisons would only be relevant in places where green tea is well known and widely consumed, such as Asian countries [34,35]. This claim would have a limited impact on Brazilian consumers, as tea is not frequently consumed in Brazil: 31% of consumers drink tea, while 95% drink coffee [33]. In addition to the usual information on the back label (e.g., expiration date, nutritional information, customer service information), the participants suggested adding a clear statement that green coffee contains antioxidants, the amount of antioxidants in the product and the health effects of the antioxidants. Ares et al. [36] observed that the use of scientific names for functional ingredients are not recommended in labels for Uruguayan consumers because it creates a negative impact unless it is connected to a health claim on the label to increase the association between an ingredient and its health effects. The organizational chart display used on some of the packages pleased some participants. In three of the four sessions, the importance of the method of preparation was mentioned, suggesting that information should be provided about how to prepare it with water or milk (the most common manner of consumption in Brazil) and that the amount of antioxidants per cup should be defined to better inform the consumers. In general, the type, amount and format of information were relevant to the consumers. According to Gonçalves et al. [37], packaging labels are vehicles of mass communication addressed to a wide range of people (anonymous, heterogeneous and dispersed) and reaching a large audience simultaneously. As the main link between consumers and products, packaging labels target behavior and change consumer habits. In addition, they are important tools for food education. Thus, it is important to evaluate specific products’ packaging labels and the level of information they present.

The packaging design (i.e., the shape/color of the lid and the shape of the glass) was one of the most frequently mentioned topics in the sessions. Product D, which was rated pleasant in color and shape and has a label that presented less information, was ranked as the most likely to be purchased by 74% of participants.

Because all of the products presented were the same brand, the participants were not able to discuss the impact of branding; however, they emphasized that in the case of a new product being evaluated, the involvement of a well-known and strong brand would be crucial to its acceptance.

Regarding the product’s price, the participants said that even though product was more expensive than conventional coffee (30% to 40% higher), this would not necessarily interfere with purchase intent. It is to be noted that the focus group had a heterogeneous distribution of family income: 31% earned between one and five times the minimum wages, 43% earned between six and 10 times the minimum wage and 26% earned between 11 and 20 times the minimum wage per person. Many participants mentioned that consumers are willing to pay more for a distinguished product, such as organic coffee, when they can identify its benefits. This opinion is in accordance with consumer research that reported a 73% increase in the consumption of specialty coffees (gourmet, decaffeinated, organic, of certified region and with certificate of origin) between 2003 and 2010. In 2010, price was the determinant of coffee-purchasing decisions for 16% of consumers, while brand was the determinant for 51% of the respondents. Interestingly, 3% of respondents mentioned “a coffee that benefits health” when asked about their expectation for a new coffee product [33].

For the stick package, the participants mentioned that it is important to establish the enriched product on the market first and then launch the stick as an alternative. The text box information about functionality was considered good, organized and self-explanatory and was suggested to be an ideal description of the product. The participants emphasized the interesting back slogan (“the pleasure of roasted coffee with the benefits of green coffee!”), the good choice of font size and preparation instructions and the color of the background, which they associated with the product’s benefits. The individual packaging was not favored due to its wastefulness, although it was considered practical for those who live alone or for work and travel. In 2010, a study of consumer expectations regarding new coffee-based products was conducted in which 3% of the respondents spontaneously mentioned “coffee sachet”, 1% mentioned “individual coffee packaging” and 2% required “more options of packages for consuming coffee outside the home” [33].

The summary of the most frequently occurring responses to the four glass packages raised by the four focus group sessions can be viewed in Table S4.

Therefore, the attributes: design, color (label/lid), brand and quantity of information were selected for the quantitative study. These attributes were chosen as they were among the most discussed in all the sessions and there was no consensus regarding the participants’ preferences. For the levels of study for each attribute, the definition was also established based on focus group discussions. For example, regarding the product information (that was consensually defined as important), two levels were studied: less information (“instant coffee naturally enriched with antioxidants”) and more information (“new, delicious blend of green and roasted coffee, enriched with natural coffee antioxidants, with the taste of your roasted coffee”) (Detailed information in Section 2.2).

Picture and price were also among the attributes more cited in the discussion, but they were not selected to the quantitative study. The participants of the focus group did not consider that price was important for the purchase intent of this kind of product. The image attribute was highly important to the acceptance of the package but there was clearly a consensus on the preference by the image kind (cup of coffee), so a further evaluation was not necessary.

3.2. Conjoint Analysis

The purchase intent results of the consumers group for the eight stimulus profiles were analyzed using the cluster-segmentation model [27], and the part-worths values were individually analyzed for the 149 participants. Some studies have chosen to exclude consumers who did not fit the model, considering an exclusion range from p > 0.10 to > 0.20 [14,19,21,22]. Exclusions of 13% [21] to 48% [14] of participants have been reported. In the present study, 52% of participants were associated with p values above 0.10.

Recently, the verification of data consistency using determination coefficients (R2) was suggested by Moskowitz et al. [38] in a conjoint analysis study that evaluated a combination of concepts. The higher the degree of the respondent’s consistency in the evaluation of all concepts, the higher the R2 value; R2 values above 0.66 are considered consistent, indicating that the respondents are paying attention to the test combinations. Chung et al. [39] observed that 97% of participants showed an R2 above 0.66 (n = 400, number of concepts = 21), and Moskowitz et al. [38] reported the same for 75% of their participants (n = 168, number of concepts = 60). Both groups of authors considered that high-quality data had been obtained and then included all participants in the conjoint analysis. The R2 profile for the 149 participants of the present study demonstrated that 78% (116 of 149) had values above 0.66 (number of images = 8) (Figure S1), showing satisfactory data quality. Therefore, all participants were included in the present study.

A cluster analysis was performed for the 149 participants and resulted in three groups containing 118, 22 and nine consumers. The participants were predominantly female (75%) and younger than 40 years of age (83%). This is an appropriate profile, as females remain responsible for the majority of coffee purchases and preparation in their homes [33]. The education profile was quite diversified: 53% of participants had completed basic education or high school, and approximately half were graduates and post-graduates. All participants bore at least 25% of the responsibility for making food purchases for their residence. The packaging characteristics most often observed at the time of purchase were expiration date (85%), price (79%), brand (73%), nutritional information (62%) and ingredients (52%). Package design characteristics (shape, color, and image) were considered less important at the time of purchase. All of the participants said they read the label of the products they purchase, even if only occasionally. The participants also confirmed being coffee consumers, and 93% of them consume instant coffee specifically: 30% consume the product daily, 41% occasionally, and 22% consume it one to three times a week (Table S5). These values were considered high, as the Brazilian coffee industry association survey shows instant coffee being consumed by only 17% of consumers [33].

The percentage of participants’ knowledge about health benefits of the coffee (52%) was similar to that obtained in a research conducted by the Brazilian Association of the Coffee Industry (ABIC) (50%) [33], although only 38% of our participants mentioned one of the benefits (Table 2).

Table 2.

Knowledge and attitude of participants regarding coffee products.

| Question | Option * | Frequency (%) | |||

|---|---|---|---|---|---|

| Group 1 (n = 118) | Group 2 (n = 22) | Group 3 (n = 9) | Total (n = 149) | ||

| Have you ever heard of the benefits of drinking coffee? What? | Yes | 55.1 | 40.9 | 44.4 | 52.4 |

| No | 44.9 | 59.1 | 55.6 | 47.6 | |

| YJ | 40.7 | 27.3 | 33.3 | 38.3 | |

| Have you ever heard of the benefits of drinking instant coffee? What? | Yes | 5.1 | 9.1 | 11.1 | 6.0 |

| No | 94.9 | 90.9 | 88.9 | 94.0 | |

| YJ | 5.1 | 4.6 | 11.1 | 5.4 | |

| Have you ever heard of the benefits of antioxidant intake? What? | Yes | 66.1 | 63.6 | 55.6 | 65.1 |

| No | 33.9 | 36.4 | 44.4 | 34.9 | |

| YJ | 45.7 | 31.9 | 11.1 | 41.6 | |

| Would you consume an antioxidant-rich instant coffee? | Yes | 99.1 | 100.0 | 100.0 | 99.3 |

| No | 0.9 | 0.0 | 0.0 | 0.7 | |

| And if it was worse regarding sensory characteristics? | Yes | 24.5 | 31.9 | 0.0 | 24.1 |

| No | 75.4 | 68.1 | 100.0 | 75.8 | |

| And if it was more expensive? | Yes | 71.2 | 45.4 | 77.8 | 67.8 |

| No | 28.8 | 54.6 | 22.2 | 32.2 | |

| Do you know any kind of functional instant coffee? | Yes | 4.2 | 4.6 | 0.0 | 4.0 |

| No | 95.8 | 95.4 | 100.0 | 96.0 | |

* Yes and justified: Percentage of participants who responded and cited the benefits they know.

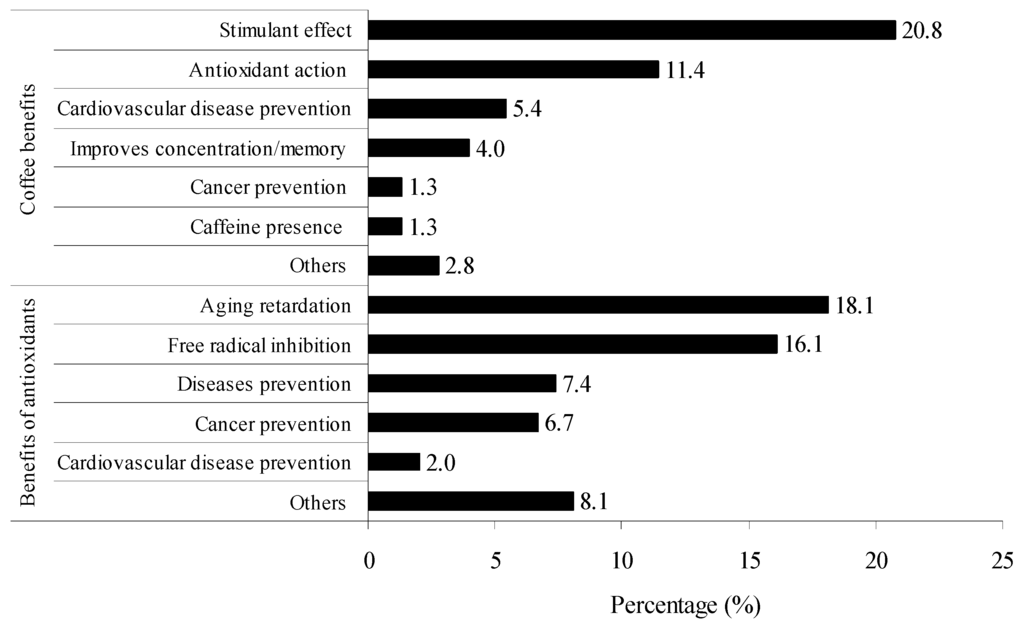

Among the most mentioned benefits were the stimulant effects (mentioned by 20.8% of participants), similar to the results of ABIC, [33] and the antioxidant action (mentioned by 11.4% of participants; Figure 3). Although instant coffee had health benefits similar to those reported to roasted and ground coffee [5], the participants exhibited less knowledge about this. Consumer knowledge about antioxidants was somewhat more solid, especially for the principal group (group 1) (Table 2). The most-mentioned benefits were anti-aging action and free radical inhibition (Figure 3). These findings indicate the need for appropriate information about the product on the package. Some authors have reported that consumers should at least know the relationship between health and the functional ingredient before selecting a functional food [40]. Effective information about health benefits should provide a better use of the characteristics and properties for marketing. According to some authors, products that are intrinsically healthy are credible carriers of functional properties and are easily accepted by consumers. Additionally, the health perceptions are higher when the functional ingredient is inherent in the original product [41,42].

Figure 3.

Consumer knowledge regarding to the benefits of the intake of antioxidants and coffee (n = 149).

The participants’ attitudes toward the studied product were quite favorable, as most participants (96%) were not aware of any coffee marketed as functional. However, a positive attitude is maintained only if the product ensures similar sensory quality (Table 2). This is a challenge not only for coffee, but for all functional foods. Several studies show that consumers are not willing to give up sensory quality when considering purchasing functional foods [43]. It seems that price does not greatly affect consumers’ purchasing attitudes. These observations support the qualitative results raised by focus groups showing that consumers are willing to pay more for products with identified benefits as long as the familiar sensory quality remains present. According to some authors the acceptance of a functional food depends, among other factors, on the product that will carry the functional ingredient [42].

Table 3 shows the values of the part-worths and the relative importance (RI) for each group. The part-worth represents the contribution of each level of each factor (attribute) to the overall preference. The factors and levels are represented by values and signs. The highest coefficient values of each attribute indicate the components corresponding to the most accepted packaging. The positive sign indicates that the level has a positive influence on a consumer group’s purchasing intent; the negative sign indicates the opposite.

Table 3.

Aggregate analysis results for each consumer group.

| Group 1 (n = 118) | Group 2 (n = 22) | Group 3 (n = 9) | |

|---|---|---|---|

| % total consumers | 79.2 | 14.8 | 6.0 |

| Attributes and levels | Part-worths * | ||

| Glass shape | |||

| 1. Conventional | −0.85 | 0.24 | −0.45 |

| 2. Modern | 0.85 | −0.24 | 0.45 |

| Relative importance (%) | 80.4 | 25.0 | 27.1 |

| Color (lid and label) | |||

| 1. More brown | 0.05 | 0.44 | 0.01 |

| 2. More green | −0.05 | −0.44 | −0.01 |

| Relative importance (%) | 4.5 | 44.8 | 0.8 |

| Information | |||

| 1. Less information | −0.06 | 0.03 | −1.20 |

| 2. More information | 0.06 | −0.03 | 1.20 |

| Relative importance (%) | 6.1 | 2.9 | 71.3 |

| Brand | |||

| 1. Less associated | −0.09 | −0.27 | −0.01 |

| 2. More associated | 0.09 | 0.27 | 0.01 |

| Relative importance (%) | 9.0 | 27.3 | 0.8 |

* Coefficients with positive sign indicates a positive impact on consumer purchase intent.

The first group, which included the majority of the consumers (79%), made their purchase decision based on the glass shape (RI = 80%), expressing a higher purchase intent for the product with a modern package. A positive contribution of the brown color, more information and brand associated with the product instant coffee were observed; however, the relative importance was small (Table 3).

Group 2, composed of 22% consumers, ascribed greater importance to the color (45%). The consumers in this group were those who most valued the product's brand (RI = 27%). And also attached a high importance to the format (25%), but they preferred the conventional packaging (Table 3). It is noteworthy that this group was formed by older consumers (32% above 40 years, Table S5) and, in general, they would be more inclined to compromise the product taste than product price (Table 2).

The purchase intent of group 3, composed of 9% of the consumers, was affected mainly by increased information (RI = 71%), followed by the attributes’ shape (RI = 27%). Greater purchase intent was observed for the product that contained more information plus modern packaging (Table 3). The participants of this group were younger and have a lower education level, and they were less aware of the benefits of antioxidants, which may explain their preference for more product information. Extensive information about the product was less important to groups 1 and 2, whose participants had higher levels of education and income (Table S5) and more knowledge about the health benefits of antioxidants and coffee. It is also highlighted that this group was the one that gave the most value to the sensory characteristics of the product (Table 2).

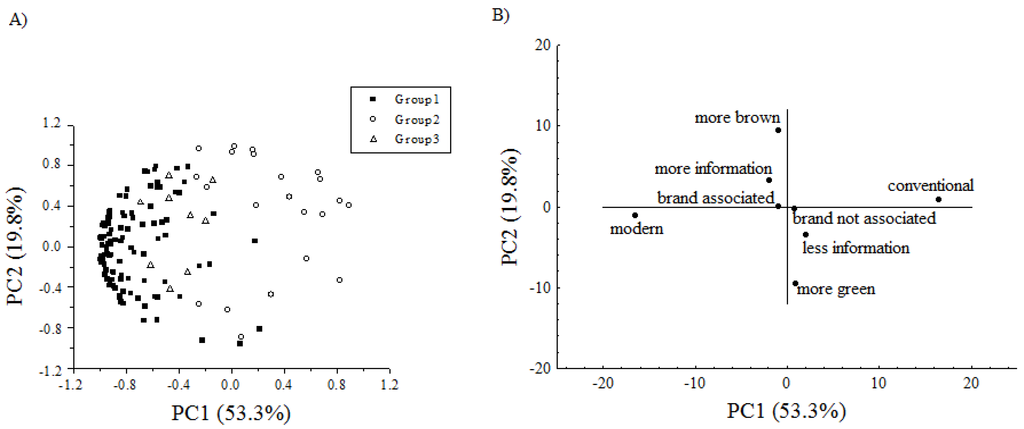

The principal component analysis (Figure 4) shows the distribution of the participants identified by the groups. PC1 accounted for 53% of variance, and was mainly associated with the package shape. PC2 explained 20% of the variance, and was mainly associated with the color and amount of information. The brand was the variable that least influenced the purchase intent. A large number of consumers were located on the left of the graph which reflects the trend toward increased purchase intent with more modern packaging, probably because of the potential for packaging reuse mentioned in the focus group. Although the product has the addition of green coffee, the consumers indicated a preference for the package with the brown lid and label (related to a roasted coffee product). A larger amount of information has a positive effect on purchase intent, as reflected by the concentration of consumers at the top of the graph.

Figure 4.

Principal component analysis considering the impact of the factors in purchase intent: (A) Scatter plot of the consumers identified by the groups; (B) Projection of the variables: shape, color, brand and amount of information.

3.3. Considerations about the Product’s Back Label

In the focus group discussions, some back label attributes, including the amount and display of the product information and the font (letter) size, were noted by the participants. Opinions diverged at times because the distinguishing attributes for consumers were not well proven and increased information requires the use of a smaller font size and is associated the risk of information overload. The results obtained in the ranking tests for all three versions of the back label are shown in Table 4. The back label that included a large amount of information displayed in an organizational chart (A) was significantly more preferred (p < 0.05) by consumers than were the labels that presented information in a conventional text box.

Among the explanations for this choice is that it is the most attractive format for displaying information (reported by 48.3% of participants). A product’s information devices are based on the elements of the visual message that, when properly planned, enable the user-product interface. Thus, the perception and interpretation of information rely both on internal factors, such as the user’s motivation and learning, and external factors, such as the types of codes used and how the information is presented. The information should be appropriate to visual perceptual capacity. In packaging, these information devices result directly from the readability of characters and symbols and some of the factors that influence visual discrimination and information overload [44].

Table 4.

Rank sums for the three back labels.

| Label * | Description | Rank Sums ** |

|---|---|---|

| A | More information in an organizational chart display | 233 a |

| B | Summary information displayed in text form and with a larger font size | 330 b |

| C | More information displayed in text form and with a smaller font size | 331 b |

* Figure 2; ** Descending order of preference; Rank sum followed by the same letter are not significantly different (p < 0.05). The critical difference for the three samples and 149 judges = 40.45 [30].

A second explanation for preference is the amount of information (reported by 40.5% of participants), and a third is the ease of understanding the text (cited by 14.6% of participants). Considering the important role of information in food labeling, consumers expect to read labels at the time of the food purchase. In most cases, the difficulty of establishing a habit of reading labels is associated with a population’s ability to understand label information. This difficulty could be attributed to the use of technical language that can be understood only by a specific audience. For a label to be effective, the information it provides must be reliable and accessible to all social segments [45]. This is especially true regarding health effects [46]; clear and accurate information on label attributes more credibility to the product [47].

Special attention should be given to the content of information about food health benefits. In addition to considering consumer perceptions and acceptance, it should meet statutory requirements. Verbeke et al. [48] observed the conviction, credibility and purchase intent of consumers faced with different claims. Health claims were perceived as the most convincing and made the product more attractive than nutritional information, but these two types of information did not differ in their impact on the product’s perceived credibility or purchase intent. Reduction of disease risk claim was related to lower credibility and product purchase intent. However, only claims related to the functional and/or health property of a nutrient or non-nutrient aspect of a food are approved for functional products marketed in Brazil, in accordance with ordinance 18/1999 of the National Health Surveillance Agency (Agência Nacional de Vigilância Sanitária [ANVISA]). No claims have been approved for the functional components of coffee (i.e., melanoidins, chlorogenic acid, caffeine); therefore, such claims must comply with the legal procedures for product registration with the appropriate agency by providing proof of the product’s safety and effectiveness. In the present study, we used previously approved claims for antioxidants components present in products sold in other countries.

The present study showed the perceptions, expectations and attitudes of Brazilian consumers toward instant coffee that has been naturally enriched with antioxidants by the addition of green coffee extract. The consumer segmentation obtained from the response patterns to combinations of packaging attributes can form the basis of marketing strategies for similar products. The marketing of the antioxidant-rich instant coffee, would meet a consumer demand for coffee-based distinguished products and with health benefits.

4. Conclusions

In conclusion, the results indicated that design has an important impact on purchase intent. The consumer prefers to associate the product with images of a small, steaming hot cup of coffee that shows that the product color is similar to that of conventional instant coffee. The presence of both green and roasted beans next to the cup is suggested in proportion to the amounts of each that the product contains to characterize its composition. A modern glass package (hexagonal and waisted) that provides a good view of the product had a positive impact on purchase intent, as did the prevalence of a browner color. The participants suggested the use of a brown lid and label, but with some green to show the inclusion of green coffee. Despite the low relative influence of brand on the purchase intent, it was emphasized that because the product is new in Brazilian market, it is important that it be associated with a strong brand already associated with instant coffee.

Regarding the information presented on the label, a larger amount of information about distinguishing attributes displayed on the front of the package had a positive effect on purchase intent. The consumers valued a greater amount of information on the back label related to product differentiation (origin, type, quantity and function of antioxidants), especially if the information is arranged interactively, as in organizational charts. This information is essential because the consumers were willing to pay more for a distinguished product if they are well informed about the benefits.

Therefore, any antioxidant-rich instant coffee made available in the Brazilian market should contain a label with clear and focused information to distinguish the product’s attributes (antioxidant rich-coffee) while ensuring the consumer a taste and aroma that is similar to that of conventional coffee. The recommendation for this product is a modern package with colors that refer more to roasted coffee, as the packaging design had a considerable impact on the consumers’ decision to purchase the product.

However, we highlight that these findings are restricted to: (a) an initial acceptance regarding to product packaging; (b) the Brazilian consumers. Despite the leadership of Brazil on the coffee market by its great potential for production, export and consumption, studies with consumers from other cultures could be interesting in order to aggregate information to propose a packaging for a wider public. Future studies evaluating the sensory acceptance of similar products and also an evaluation of the influence of socio-demographic, behavioral and cognitive determinants on the acceptance this kind of product could improve the understanding of consumer behavior.

Acknowledgments

The authors gratefully acknowledge the financial support of Conselho Nacional de Pesquisa (CNPq), Coordenação de Aperfeiçoamento de Pessoal de Nível Superior (CAPES) and Fundo de Apoio ao Ensino, à Pesquisa e à Extensão (FAEP/UEL).

Author Contributions

All authors contributed equally to this paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- International Coffee Organization—ICO. Trade Statistics. 2015. Available online: http://www.ico.org/trade_statistics.asp (accessed on 12 August 2015).

- Arruda, V.G. Consumo Mundial de Café Deve Aumentar em 70 Milhões de Sacas Até 2030. Available online: http://revistagloborural.globo.com/Noticias/Agricultura/Cafe/noticia/2015/03/consumo-mundial-de-cafe-deve-aumentar-em-70-milhoes-de-sacas-ate-2030-diz-andrea-illy.html (accessed on 12 August 2015).

- Daglia, M.; Papetti, A.; Gregotti, C.; Berte, F.; Gazzani, G. In vitro antioxidant and ex vivo protective activities of green and roasted coffee. J. Agric. Food Chem. 2000, 48, 1449–1454. [Google Scholar] [CrossRef] [PubMed]

- Farah, A.; Donangelo, C.M. Phenolic compounds in coffee. Braz. J. Plant Physiol. 2006, 18, 23–36. [Google Scholar] [CrossRef]

- Vignoli, J.A.; Bassoli, D.G.; Benassi, M.T. Antioxidant activity, polyphenols, caffeine and melanoidins in soluble coffee: The influence of processing conditions and raw material. Food Chem. 2011, 124, 863–868. [Google Scholar] [CrossRef]

- Esquivel, P.; Jiménez, V.M. Functional properties of coffee and coffee by-products. Food Res. Int. 2012, 46, 488–495. [Google Scholar] [CrossRef]

- Wang, H.Y.; Qian, H.; Yao, W.R. Melanoidins produced by the Maillard reaction: Structure and biological activity. Food Chem. 2011, 128, 573–584. [Google Scholar] [CrossRef]

- Betoret, E.; Betoret, N.; Vidal, D.; Fito, P. Functional foods development: Trends and technologies. Trends Food Sci. Technol. 2011, 22, 498–508. [Google Scholar] [CrossRef]

- Lalor, F.; Madden, C.; Mckenzie, K.; Wall, P.G. Health claims on foodstuffs: A focus group study of consumer attitudes. J. Funct. Foods 2011, 3, 56–59. [Google Scholar] [CrossRef]

- Marcucci, C.T.; Benassi, M.T.; Almeida, M.B.; Nixdorf, S.L. Teores de trigonelina, ácido 5-cafeoilquínico, cafeína e melanoidinas em cafés solúveis comerciais brasileiros. Quim. Nova 2013, 36, 544–548. [Google Scholar] [CrossRef]

- Moura, S.C.S.R.; Germer, S.P.M.; Anjos, V.D.A.; Mori, E.E.M.; Mattoso, L.H.C.; Firmino, A.; Nascimento, C.J.F. Influência dos parâmetros de torração nas características físicas, químicas e sensoriais do café arábica puro. Braz. J. Food Technol. 2007, 10, 17–25. [Google Scholar]

- Urala, N.; Lähteenmäki, L. Consumers’ changing attitudes towards functional foods. Food Qual. Prefer. 2007, 18, 1–12. [Google Scholar]

- Della Lucia, S.M.; Minim, V.P.R.; Silva, C.H.O.; Minim, L.A. Fatores da embalagem de café orgânico torrado e moído na intenção de compra do consumidor. Cienc. Tecnol. Aliment. 2007, 27, 485–491. [Google Scholar] [CrossRef]

- Dantas, M.I.S.; Deliza, R.; Minim, V.P.R.; Hedderley, D. Avaliação da intenção de compra de couve minimamente processada. Cienc. Tecnol. Aliment. 2005, 25, 762–767. [Google Scholar] [CrossRef]

- Casey, M.A.; Krueger, R.A. Focus group interviewing. In Measurement of Food Preferences; Macfie, H.J.H., Thomson, D.M.H., Eds.; Academic & Professional: Blackie Glasgow, Scotland, 1994; pp. 77–96. [Google Scholar]

- Green, P.E.; Rao, V.R. Conjoint measurement for quantifying judgmental data. J. Mark. Res. 1971, 8, 355–363. [Google Scholar] [CrossRef]

- Carneiro, J.D.S.; Silva, C.H.O.; Minim, V.P.R.; Regazzi, A.J.; Deliza, R.; Suda, I.R. Princípios básicos da conjoint analysis em estudos do consumidor. Bol. SBCTA 2003, 37, 107–114. [Google Scholar]

- Moskowitz, H.R.; Silcher, M. The applications of conjoint analysis and their possible uses in Sensometrics. Food Qual. Prefer. 2006, 17, 145–165. [Google Scholar] [CrossRef]

- Costa, M.C.; Deliza, R.; Rosenthal, A.; Hedderley, D.; Frewer, L. Non conventional technologies and impact on consumer behavior. Trends Food Sci. Technol. 2000, 11, 188–193. [Google Scholar] [CrossRef]

- Deliza, R.; Macfie, H.; Hedderley, D. Use of computer-generated images and conjoint analysis to investigate sensory expectations. J. Sens. Stud. 2003, 18, 465–486. [Google Scholar] [CrossRef]

- Carneiro, J.D.S.; Minim, V.P.R.; Deliza, R.; Silva, C.H.O.; Carneiro, J.C.S.; Leão, F.P. Labelling effects on consumer intention to purchase for soybean oil. Food Qual. Prefer. 2005, 16, 275–282. [Google Scholar] [CrossRef]

- Souza, E.A.M.; Minim, V.P.R.; Minim, L.A.; Coimbra, J.S.R.; Rocha, R.A. Modeling consumer intention to purchase fresh produce. J. Sens. Stud. 2007, 22, 115–125. [Google Scholar] [CrossRef]

- Barrios, E.X.; Costell, E. Review: Use of methods of research into consumer’s opinions and attitudes in food research. Food Sci. Technol. Int. 2004, 10, 359–371. [Google Scholar] [CrossRef]

- Corel Corporation. Corel Photo-Paint 12 Anniversary; Corel Corporation: Otawa, ON, Canada, 2004. [Google Scholar]

- Microsoft Corporation. Microsoft PowerPoint; Microsoft: San Francisco, CA, USA, 2000. [Google Scholar]

- Steenkamp, J.B.E.M. Conjoint measurement in ham quality evaluation. J. Agric. Econ. 1987, 38, 473–480. [Google Scholar]

- Moore, W.L. Levels of aggregation in conjoint analysis: An empirical comparison. J. Mark. Res. 1980, 18, 516–523. [Google Scholar] [CrossRef]

- SAS Institute Inc. SAS Users’ Guide: Statistics; Version 6.12; SAS Institute: Cary, NC, USA, 1996. [Google Scholar]

- Statsoft. Statistica for Window: Computer Program Manual; Versão 6.0; Statsoft Inc.: Tulsa, OK, USA, 2001. [Google Scholar]

- Christensen, Z.T.; Ogden, L.V.; Dunn, M.L.; Eggett, D.L. Multiple comparison procedures for analysis of ranked data. J. Food Sci. 2006, 71, S132–S143. [Google Scholar] [CrossRef]

- Kobayashi, M.L.; Benassi, M.T. Impact of packaging characteristics on consumer purchase intention: Instant coffee in refill packs and glass jars. J. Sens. Stud. 2015, 30, 160–180. [Google Scholar] [CrossRef]

- Ares, G.; Giménez, A.; Gámbaro, A. Does information about the source of functional ingredients influence consumer perception of functional milk desserts? J. Sci. Food Agric. 2008, 88, 2061–2068. [Google Scholar] [CrossRef]

- Associação Brasileira da Indústria de Café—ABIC. Tendências do Consumo de Café VII. Available online: http://www.abic.com.br/publique/media/EST_PESQTendenciasConsumo2010.pdf (accessed on 12 August 2015).

- Cheng, T.O. All teas are not created equal: The Chinese green tea and cardiovascular health. Int. J. Cardiol. 2006, 108, 301–308. [Google Scholar] [CrossRef] [PubMed]

- Nishiyama, M.F.; Costa, M.A.F.; Costa, A.M.; Souza, C.M.G.; Bôer, C.G.; Bracht, C.K.; Peralta, R.M. Brazilian green tea (Camellia sinensis var assamica): Effect of infusion time, mode of packaging and preparation on the extraction efficiency of bioactive compounds and on the stability of the beverage. Cienc. Tecnol. Aliment. 2010, 30, 191–196. [Google Scholar] [CrossRef]

- Ares, G.; Giménez, A.; Gámbaro, A. Consumer perceived healthiness and willingness to try functional milk desserts. Influence of ingredient, ingredient name and health claim. Food Qual. Prefer. 2009, 20, 50–56. [Google Scholar] [CrossRef]

- Gonçalves, A.A.; Passos, M.G.; Biedrzycki, A. Consumer’s perception of food packing: Trends. Estud. Tecnol. 2008, 4, 271–283. [Google Scholar] [CrossRef]

- Moskowitz, H.R.; Silcher, M.; Beckley, J.; Minkus-Mckenna, D.; Mascuch, T. Sensory benefits, emotions and usage patterns for olives: Using internet-based conjoint analysis and segmentation to understand patterns of response. Food Qual. Prefer. 2005, 16, 369–382. [Google Scholar] [CrossRef]

- Chung, H.S.; Hong, H.D.; Kim, K.; Cho, C.W.; Moskowitz, H.R.; Lee, S.Y. Consumer attitudes and expectations of ginseng food products assessed by focus groups and conjoint analysis. J. Sens. Stud. 2011, 26, 346–357. [Google Scholar] [CrossRef]

- Ares, G.; Giménez, A.; Gámbaro, A. Influence of nutritional knowledge on perceived healthiness and willingness to try functional foods. Appetite 2008, 51, 663–668. [Google Scholar] [CrossRef] [PubMed]

- Ares, G.; Gámbaro, A. Influence of gender, age and motives underlying food choice on perceived healthiness and willingness to try functional foods. Appetite 2007, 49, 148–158. [Google Scholar] [CrossRef] [PubMed]

- Van Kleef, E.; van Trijp, H.C.M.; Luning, P. Functional foods: Health claim-food product compatibility and the impact of health claim framing on consumer evaluation. Appetite 2005, 44, 299–308. [Google Scholar] [CrossRef] [PubMed]

- Jaeger, S.R.; Axten, L.G.; Wohlers, M.W.; Sun-Waterhouse, D. Polyphenol-rich beverages: Insights from sensory and consumer science. J. Sci. Food Agric. 2009, 89, 2356–2363. [Google Scholar] [CrossRef]

- Lautenschläger, B.I. Avaliação de Embalagem de Consumo com Base Nos Requisitos Ergonômicos Informacionais. Master’s Thesis, University Federal of Santa Catarina, Santa Catarina, Brazil, 2001. [Google Scholar]

- Marins, B.R.; Jacob, S.C.; Peres, F. Qualitative evaluation of the reading habit and understanding: Reception of the information contained in labels of food products. Cienc. Tecnol. Aliment. 2008, 28, 579–585. [Google Scholar] [CrossRef]

- Siró, I.; Kápolna, E.; Kápolna, B.; Lugasi, A. Functional food. Product development, marketing and consumer acceptance: A review. Appetite 2001, 51, 456–467. [Google Scholar] [CrossRef] [PubMed]

- Levy, A.S.; Fein, S.B. Consumer’s ability to perform tasks using nutrition labels. J. Nutr. Educ. 1998, 30, 210–217. [Google Scholar] [CrossRef]

- Verbeke, W.; Scholderer, J.; Lähteenmäki, L. Consumer appeal of nutrition and health claims in three existing product concepts. Appetite 2009, 52, 684–692. [Google Scholar] [CrossRef] [PubMed]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).