Understanding Consumers’ Preferences for Protected Geographical Indications: A Choice Experiment with Hungarian Sausage Consumers

Abstract

:1. Introduction

Willingness to Pay for GI-Labelled Foods

2. Methodology

2.1. Case Description

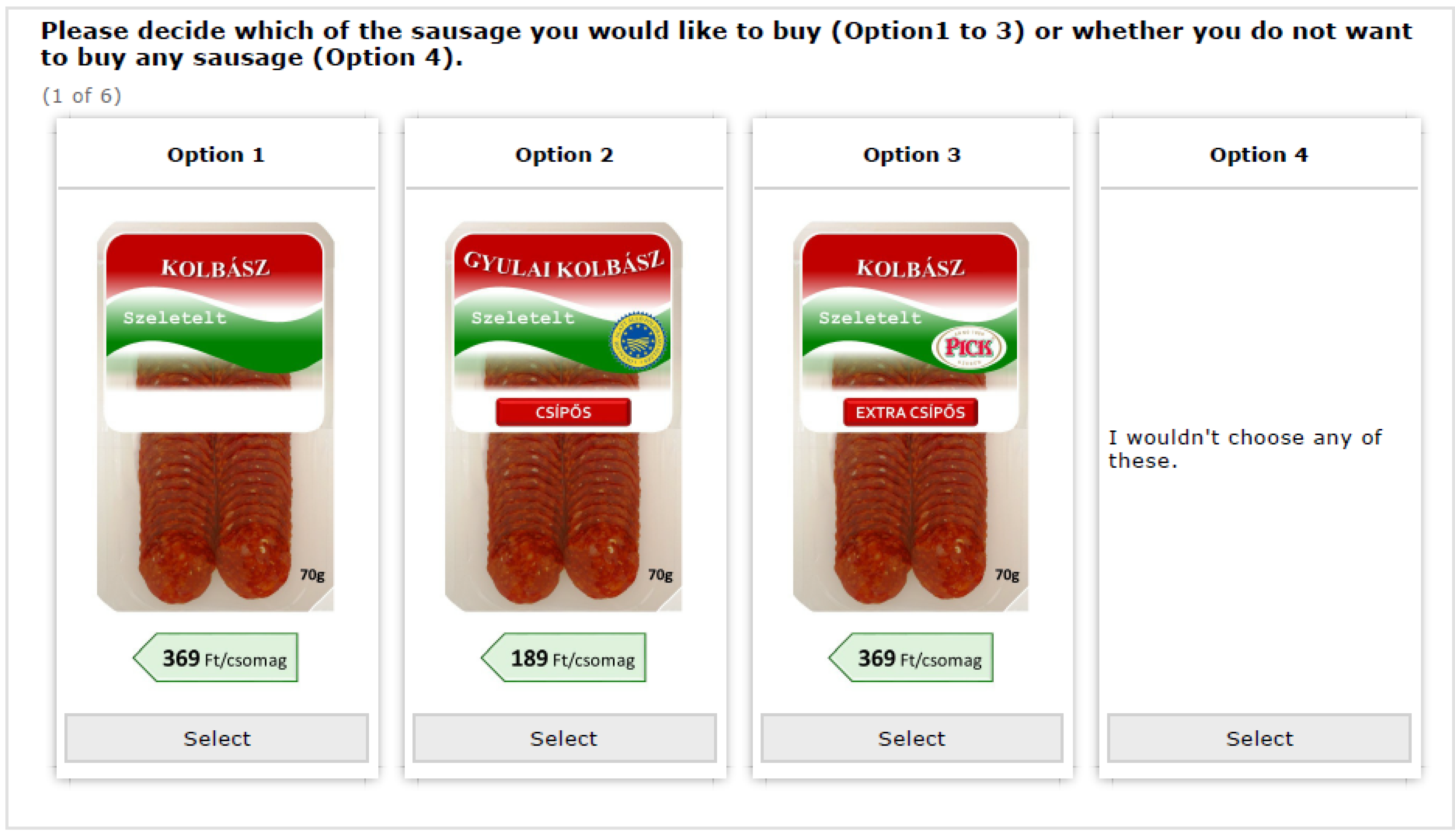

2.2. Experiment Design

2.3. Data Collection

2.4. Empirical Method and Model

3. Results

3.1. Buying and Consumption Habits

3.2. Model Estimations

3.3. Willingness to Pay (WTP) Estimates

4. Discussion

4.1. Theoretical Implications

4.2. Business Implications

4.3. Limitations and Future Research Directions

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Author (Year) | Country, Sample | Product | Attributes (in Addition to Price) | Method and Model | Findings |

|---|---|---|---|---|---|

| Paffarini, Torquati, Tempesta, Venanzi and Vecchiato [4] | Italy, n = 213 | Lentils | Located in a traditional rural landscape, Located in Natura 2000 SCI, EU quality label (PDO or PGI) | Stated Choice Experiment; Multinomial Logit (MNL), Random Parameter Logit (RPL) and Endogenous Attribute Attendance (EAA) models | The most important attribute affecting the propensityto pay a premium price to buy organic lentils is the EU quality label |

| Bonaiuto, De Dominicis, Cancellieri, Crano, Ma and Bonaiuto [27] | Italy, n = 204; China, n = 191; USA, n = 237 | Olive oil, pasta | PDO Made in Italy, Made in Italy, Italian Sounding, and Generic Foreign | Different type of scales, repeated-measures analysis of variance (ANOVA), Mediation analyses | PDO label’s positive reputation and WTP is the strongest |

| Ballco and Gracia [29] | Zaragoza, Spain, n = 216 | Olive oil | Origin (local, region, national), PDO | Real Choice Experiment, Error Corrected Random Parameter Logit (ECRPL) model | Higher WTP for local and regional compared to national origin, PDO positive effect on WTP |

| Pérez y Pérez, Gracia and Barreiro-Hurlé [39] | Aragon, Spain, n = 540 | Olive oil | Geographical origin, organic | Stated Choice Experiment; MNL, RPL and ECRPL models | Price most important attribute, PDO positive and more important than organic |

| Sanjuán-López and Resano-Ezcaray [32] | Zaragoza, Spain, n = 208 | Saffron | Origin, PDO, organic, strands/ | Stated and Real Choice Experiment, Conditional Logit (CL) and RPL models | WTP for local, PDO and, to a lesser extent, organic |

| Maza, Gracia and Saied [40] | Zaragoza, Spain, n = 170 | Lamb | Cut of meat, PGI, packaging type, label sticker | Stated Choice Experiment; MNL, RPL and ECPRL models | Positive WTP for PGI. Cut of meat (leg, chop) more important than GI. |

| Garavaglia and Mariani [41] | Parma and Monza, Italy, n = 189 | Dry cured ham | PDO, origin, ageing, taste (sweet/tasty) | Conjoint Analysis, OLS Multiple Regression | PDO more important than origin. More aged hams preferred. |

| Kokthi and Kruja [31] | Tirana, Albania, n = 300 | Cheese | Four varieties differing in terms of origin | Contingent Valuation (blind, labelled, blind and labelled conditions), Paired Sample T-Test | Strong preference for local, but lower if reputation weakened by lack of GI |

| Yangui, Costa-Font and Gil [33] | Catalonia, Spain, n = 401 | Olive oil | Product system (conventional, PDO, organic), origin, brand | Stated Choice Experiment, Hybrid Choice Model (HCM) | Organic attribute generates a disutility, PDO positive values, local preferred over other Spanish and national origin. Brand not significant |

| Pilone, et al. [88] | Southern Italy, n = 757 | Cheese | PGI, shelf life, environmental certification, cheese ageing, pack size | Stated Choice Experiment, CL model | PGI positive value and more important than shelf life and env. certification |

| Albayram, Mattas and Tsakiridou [28] | Izmir, Turkey, n = 271 | Olive oil | GI, local, | Survey scenarios, Binary Logistic Regression | WTP higher for local rather than GI |

| Panico, Del Giudice and Caracciolo [38] | Italy, n = 1054 | Olive oil | Origin, certification (organic, GI), taste (sweet, pungent, fruity) | Stated Choice Experiment, RPL model | Positive effect for Italian, organic more valuable than PDO/PGI, strong negative effect for pungent |

| Dhamotharan and Selvaraj [36] | Tamil Nadu, India, n = 263 | Bananas | Quality, production system (organic, GI etc.) | Conjoint Analysis, Part-worth | Positive WTP for certified organic/GI attribute |

| Aprile, et al. [34] | Naples, Italy, n = 200 | Olive oil | PDO, PGI, organic, extra virgin | Stated Choice Experiment, RPL model | PDO higher WTP than PGI or organic (all positive values) |

| Cicia, Cembalo and Del Giudice [35] | Germany, n = 300 | Peaches | Country of origin, PDO/PGI, organic | Stated Choice Experiment, Latent Class (LC) model | Country of origin more important than PDO/PGI and organic. WTP for organic higher than PDO/PGI |

| Menapace, Colson, Grebitus and Facendola [37] | Toronto, Canada, n = 207 | Olive oil | Appearance, certification (PDO, PGI), colour, country of origin, organic, size | Stated Choice Experiment, RPL model | Higher WTP for PDO than PGI. Organic WTP higher than GIs. Strong positive effect for Italy. |

| Fotopoulos and Krystallis [30] | Crete, Greece, n = 116 | Olive oil | Region, PDO | Conjoint Analysis, Part-worth | Region and PDO positive attributes on WTP but former more important |

References

- Barjolle, D.; Chappuis, J.M.; Dufour, M. Key success factors of competitive position for some Protected Designation of Origin (PDO) cheeses. Indic. Milk Beef Qual. 2005, 112, 245–262. [Google Scholar]

- London Economics. Evaluation of the CAP Policy on Protected Designations of Origin (PDO) and Protected Geographical Indications (PGI); London Economics: London, UK, 2008. [Google Scholar]

- AND-International; ECORYS; COGEA. Evaluation Support Study on Geographical Indications and Traditional Specialities Guaranteed Protected in the EU. 2020. Available online: https://europa.eu/eurobarometer/surveys/detail/2229 (accessed on 17 June 2021).

- Paffarini, C.; Torquati, B.; Tempesta, T.; Venanzi, S.; Vecchiato, D. Rural sustainability and food choice: The effect of territorial characteristics on the consumers’ preferences for organic lentils. Agric. Food Econ. 2021, 9, 23. [Google Scholar] [CrossRef]

- Tregear, A.; Gorton, M. The challenges of sharing: Brands as club goods. Eur. J. Mark. 2009, 43, 826–842. [Google Scholar] [CrossRef] [Green Version]

- European Commission. Europeans, Agriculture and the CAP; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- AND-International. Study on Economic Value of EU Quality Schemes, Geographical Indications (GIs) and Traditional Specialities Guaranteed (TSGs); European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Mintel. Provenance in Food and Drink-UK; Mintel Group Ltd.: London, UK, 2013. [Google Scholar]

- Salnikova, E.; Grunert, K.G. The role of consumption orientation in consumer food preferences in emerging markets. J. Bus. Res. 2020, 112, 147–159. [Google Scholar] [CrossRef]

- Hartmann, M.; Yeh, C.H.; Amilien, V.; Csillag, P.; Filipovic, J.; Giraud, G.; Kuč, V.; Menozzi, D.; Poschwatta, O.; Roos, G. Report on Quantitative Research Findings on European Consumers’ Perception and Valuation of EU Food Quality Schemes as Well as Their Confidence in Such Measures. Available online: https://www.strength2food.eu/2019/02/28/report-on-quantitative-research-findings-on-european-consumers-perception-and-valuation-of-eu-food-quality-schemes-as-well-as-their-confidence-in-such-measures/ (accessed on 31 August 2021).

- Medina-Molina, C.; Rey-Moreno, M.; Periáñez-Cristóbal, R. Analysis of the moderating effect of front-of-pack labelling on the relation between brand attitude and purchasing intention. J. Bus. Res. 2021, 122, 304–310. [Google Scholar] [CrossRef]

- Bonnet, C.; Simioni, M. Assessing consumer response to Protected Designation of Origin labelling: A mixed multinomial logit approach. Eur. Rev. Agric. Econ. 2001, 28, 433–449. [Google Scholar] [CrossRef]

- Hassan, D.; Monier-Dilhan, S.; Orozco, V. Measuring Consumers’ Attachment to Geographical Indications. J. Agric. Food Ind. Organ. 2011, 9. [Google Scholar] [CrossRef]

- Hensher, D.A.; Rose, J.M.; Greene, W.H. Applied Choice Analysis; Cambridge University Press: New York, NY, USA, 2005. [Google Scholar] [CrossRef]

- Grant, K.R.; Gallardo, R.K.; McCluskey, J.J. Consumer preferences for foods with clean labels and new food technologies. Agribusiness 2021, 37, 764–781. [Google Scholar] [CrossRef]

- Grashuis, J. A price premium for the farmer-owned label? A choice experiment with milk consumers in the Netherlands. Agribusiness 2021, 37, 749–763. [Google Scholar] [CrossRef]

- Paul, J.; Bhukya, R. Forty-five years of International Journal of Consumer Studies: A bibliometric review and directions for future research. Int. J. Consum. Stud. 2021, 45, 937–963. [Google Scholar] [CrossRef]

- Tregear, A. From Stilton to Vimto: Using food history to re-think typical products in rural development. Sociol. Rural. 2003, 43, 91–107. [Google Scholar] [CrossRef]

- Nyström, H. Product Development Strategy: An Integration of Technology and Marketing. J. Prod. Innov. Manag. 1985, 2, 25–33. [Google Scholar] [CrossRef]

- Guerrero, L.; Claret, A.; Verbeke, W.; Enderli, G.; Zakowska-Biemans, S.; Vanhonacker, F.; Issanchou, S.; Sajdakowska, M.; Granli, B.S.; Scalvedi, L.; et al. Perception of traditional food products in six European regions using free word association. Food Qual. Prefer. 2010, 21, 225–233. [Google Scholar] [CrossRef]

- Caputo, V.; Sacchi, G.; Lagoudakis, A. Traditional Food Products and Consumer Choices: A Review. In Case Studies in the Traditional Food Sector; Cavicchi, A., Santini, C., Eds.; Woodhead Publishing: Sawston, UK, 2018. [Google Scholar] [CrossRef]

- Trichopoulou, A.; Soukara, S.; Vasilopoulou, E. Traditional foods: A science and society perspective. Trends Food Sci. Technol. 2007, 18, 420–427. [Google Scholar] [CrossRef]

- Bowen, S.; De Master, K. New rural livelihoods or museums of production? Quality food initiatives in practice. J. Rural Stud. 2011, 27, 73–82. [Google Scholar] [CrossRef]

- Grunert, K.G.; Aachmann, K. Consumer reactions to the use of EU quality labels on food products: A review of the literature. Food Control 2016, 59, 178–187. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Paul, J.; Criado, A.R. The art of writing literature review: What do we know and what do we need to know? Int. Bus. Rev. 2020, 29, 101717. [Google Scholar] [CrossRef]

- Bonaiuto, F.; De Dominicis, S.; Cancellieri, U.G.; Crano, W.D.; Ma, J.H.; Bonaiuto, M. Italian Food? Sounds Good! Made in Italy and Italian Sounding Effects on Food Products’ Assessment by Consumers. Front. Psychol. 2021, 12, 30. [Google Scholar] [CrossRef]

- Albayram, Z.; Mattas, K.; Tsakiridou, E. Purchasing local and non-local products labeled with geographical indications (GIs). Oper. Res. 2014, 14, 237–251. [Google Scholar] [CrossRef]

- Ballco, P.; Gracia, A. Do market prices correspond with consumer demands? Combining market valuation and consumer utility for extra virgin olive oil quality attributes in a traditional producing country. J. Retail. Consum. Serv. 2020, 53, 101999. [Google Scholar] [CrossRef]

- Fotopoulos, C.; Krystallis, A. Are Quality Labels a Real Marketing Advantage? J. Int. Food Agribus. Mark. 2001, 12, 1–22. [Google Scholar] [CrossRef]

- Kokthi, E.; Kruja, D. Consumer Expectations for Geographical Origin: Eliciting Willingness to Pay (WTP) Using the Disconfirmation of Expectation Theory (EDT). J. Food Prod. Mark. 2017, 23, 873–889. [Google Scholar] [CrossRef]

- Sanjuán-López, A.I.; Resano-Ezcaray, H. Labels for a Local Food Speciality Product: The Case of Saffron. J. Agric. Econ. 2020, 71, 778–797. [Google Scholar] [CrossRef]

- Yangui, A.; Costa-Font, M.; Gil, J.M. The effect of personality traits on consumers’ preferences for extra virgin olive oil. Food Qual. Prefer. 2016, 51, 27–38. [Google Scholar] [CrossRef] [Green Version]

- Aprile, M.C.; Caputo, V.; Nayga, R.M. Consumers’ valuation of food quality labels: The case of the European geographic indication and organic farming labels. Int. J. Consum. Stud. 2012, 36, 158–165. [Google Scholar] [CrossRef]

- Cicia, G.; Cembalo, L.; Del Giudice, T. Country-of-origin effects on German peaches consumers. New Medit 2012, 11, 75–79. [Google Scholar]

- Dhamotharan, P.; Selvaraj, K. Determining Consumer Preference and Willingness to Pay for GI Registered Bananas. J. Intellect. Prop. Rights 2013, 18, 576–583. [Google Scholar]

- Menapace, L.; Colson, G.; Grebitus, C.; Facendola, M. Consumers’ preferences for geographical origin labels: Evidence from the Canadian olive oil market. Eur. Rev. Agric. Econ. 2011, 38, 193–212. [Google Scholar] [CrossRef]

- Panico, T.; Del Giudice, T.; Caracciolo, F. Quality dimensions and consumer preferences: A choice experiment in the Italian extra-virgin olive oil market. Agric. Econ. Rev. 2014, 15, 100–112. [Google Scholar]

- Pérez y Pérez, L.; Gracia, A.; Barreiro-Hurlé, J. Not Seeing the Forest for the Trees: The Impact of Multiple Labelling on Consumer Choices for Olive Oil. Foods 2020, 9, 186. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Maza, M.T.; Gracia, A.; Saied, M. Consumers’ valuation of two packaging aspects for fresh lamb meat: Vacuum and information labels. Packag. Technol. Sci. 2018, 31, 123–132. [Google Scholar] [CrossRef]

- Garavaglia, C.; Mariani, P. How Much Do Consumers Value Protected Designation of Origin Certifications? Estimates of willingness to Pay for PDO Dry-Cured Ham in Italy. Agribusiness 2017, 33, 403–423. [Google Scholar] [CrossRef]

- Wilson, L.; Lusk, J.L. Consumer willingness to pay for redundant food labels. Food Policy 2020, 97, 101938. [Google Scholar] [CrossRef]

- Rybak, G.; Burton, S.; Johnson, A.M.; Berry, C. Promoted claims on food product packaging: Comparing direct and indirect effects of processing and nutrient content claims. J. Bus. Res. 2021, 135, 464–479. [Google Scholar] [CrossRef]

- Tian, Y.; Yoo, J.H.; Zhou, H. To read or not to read: An extension of the theory of planned behaviour to food label use. Int. J. Consum. Stud. 2021, 1–10. [Google Scholar] [CrossRef]

- Rana, J.; Paul, J. Consumer behavior and purchase intention for organic food: A review and research agenda. J. Retail. Consum. Serv. 2017, 38, 157–165. [Google Scholar] [CrossRef]

- Moon, S.J.; Costello, J.P.; Koo, D.M. The impact of consumer confusion from eco-labels on negative WOM, distrust, and dissatisfaction. Int. J. Advert. 2017, 36, 246–271. [Google Scholar] [CrossRef]

- Boylan, S.; Welch, A.; Pikhart, H.; Malyutina, S.; Pajak, A.; Kubinova, R.; Bragina, O.; Simonova, G.; Stepaniak, U.; Gilis-Januszewska, A.; et al. Dietary habits in three Central and Eastern European countries: The HAPIEE study. BMC Public Health 2009, 9, 439. [Google Scholar] [CrossRef]

- Brosig, S.; Hockmann, H. How Effective Is the Invisible Hand? Agricultural and Food Markets in Central and Eastern Europe; Studies on the Agricultural and Food Sector in Central and Eastern Europe: Halle, Germany, 2005. [Google Scholar]

- Olewnik-Mikołajewska, A.; Guzek, D.; Głąbska, D.; Gutkowska, K. Consumer behaviors toward novel functional and convenient meat products in Poland. J. Sens. Stud. 2016, 31, 193–205. [Google Scholar] [CrossRef]

- Khajavi, M.Z.; Abhari, K.; Barzegar, F.; Hosseini, H. Functional Meat Products: The New Consumer’s Demand. Curr. Nutr. Food Sci. 2020, 16, 260–267. [Google Scholar] [CrossRef]

- Szakály, Z.; Kovács, S.; Pető, K.; Huszka, P.; Kiss, M. A modified model of the willingness to pay for functional foods. Appetite 2019, 138, 94–101. [Google Scholar] [CrossRef] [PubMed]

- Hungarian Central Statistical Office. Annual per Capita Food Consumption. Available online: http://www.ksh.hu/docs/hun/xtabla/haztfogy/tablhf08_01_05b.html (accessed on 17 June 2021).

- Ipsos Marketing. Kutatási Report Sertéshús Fogyasztói Szokásokról; Ipsos Marketing: Budapest, Hungary, 2013. [Google Scholar]

- Kesjár, S.; Balsa-Budai, N.; Soós, M. Kolbászfogyasztási szokások vizsgálata Magyarországon. Élelmiszer Táplálkozás És Mark. 2019, 13, 25–32. [Google Scholar] [CrossRef]

- Csillag, P.; Török, Á. PDO Kalocsai Paprika Powder in Hungary. In Sustainability of European Food Quality Schemes; Arfini, F., Bellasen, V., Eds.; Springer: Berlin/Heidelberg, Germany; Cham, Switzerland, 2019; pp. 151–170. [Google Scholar]

- Dedinszky, G. A Csabai Kolbász; Tevan Kiadó: Budapest, Hungary, 1998. [Google Scholar]

- Csillag, P.; Török, Á. PGI Gyulai Sausage in Hungary. In Sustainability of European Food Quality Schemes; Arfini, F., Bellasen, V., Eds.; Springer: Cham, Switzerland, 2019; pp. 337–354. [Google Scholar]

- Bosworth, R.; Taylor, L.O. Hypothetical bias in choice experiments: Is cheap talk effective at eliminating bias on the intensive and extensive margins of choice? BE J. Econ. Anal. Policy 2012, 12. [Google Scholar] [CrossRef]

- Carlsson, F.; Frykblom, P.; Lagerkvist, C.J. Using cheap talk as a test of validity in choice experiments. Econ. Lett. 2005, 89, 147–152. [Google Scholar] [CrossRef] [Green Version]

- Ngene, C. 1.2 User Manual & Reference Guide; ChoiceMetrics Pty Ltd.: Sydney, Australia, 2018. [Google Scholar]

- Bethlehem, J. Selection bias in web surveys. Int. Stat. Rev. 2010, 78, 161–188. [Google Scholar] [CrossRef]

- Hungarian Central Statistical Office. National Data-Summary Tables. Available online: http://www.ksh.hu/stadat (accessed on 17 June 2021).

- Ben-Akiva, M.E.; Lerman, S.R.; Lerman, S.R. Discrete Choice Analysis: Theory and Application to Travel Demand; MIT Press: Cambridge, MA, USA, 1985; Volume 9. [Google Scholar]

- McFadden, D. Conditional Logit Analysis of Qualitative Choice Behavior. In Frontiers in Econometrics; Zarembka, P., Ed.; Academic Press: New York, NY, USA, 1974; pp. 105–142. [Google Scholar]

- Boxall, P.C.; Adamowicz, W.L. Understanding heterogeneous preferences in random utility models: A latent class approach. Env. Resour. Econ. 2002, 23, 421–446. [Google Scholar] [CrossRef]

- Louviere, J.J.; Hensher, D.A.; Swait, J.D. Stated Choice Methods: Analysis and Applications; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar] [CrossRef]

- McFadden, D.; Train, K. Mixed MNL models for discrete response. J. Appl. Econom. 2000, 15, 447–470. [Google Scholar] [CrossRef]

- Bujosa, A.; Riera, A.; Hicks, R.L. Combining Discrete and Continuous Representations of Preference Heterogeneity: A Latent Class Approach. Env. Resour. Econ. 2010, 47, 477–493. [Google Scholar] [CrossRef]

- Greene, W.H.; Hensher, D.A. Revealing additional dimensions of preference heterogeneity in a latent class mixed multinomial logit model. Appl. Econ. 2013, 45, 1897–1902. [Google Scholar] [CrossRef] [Green Version]

- Train, K.; Weeks, M. Discrete Choice Models in Preference Space and Willingness-to-Pay Space. In Applications of Simulation Methods in Environmental and Resource Economics; Scarpa, R., Alberini, A., Eds.; Springer: Dordrecht, The Netherlands, 2005; pp. 1–16. [Google Scholar] [CrossRef] [Green Version]

- Hess, S.; Palma, D. Apollo: A flexible, powerful and customisable freeware package for choice model estimation and application. J. Choice Model. 2019, 32, 100170. [Google Scholar] [CrossRef]

- Hess, S.; Palma, D. Apollo Version 0.2.4, User Manual. Available online: www.ApolloChoiceModelling.com (accessed on 1 June 2021).

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2020. [Google Scholar]

- Hess, S.; Train, K.E.; Polak, J.W. On the use of a Modified Latin Hypercube Sampling (MLHS) method in the estimation of a Mixed Logit Model for vehicle choice. Transp. Res. B-Meth. 2006, 40, 147–163. [Google Scholar] [CrossRef] [Green Version]

- Arfini, F.; Mancini, M.C. The effect of information and co-branding strategies on consumers willingness to pay (WTP) for Protected Designation of Origin (PDO) products: The case of pre-sliced Parma Ham. Prog. Nutr. 2015, 17, 15–22. [Google Scholar]

- Donati, M.; Wilkinson, A.; Veneziani, M.; Antonioli, F.; Arfini, F.; Bodini, A.; Amilien, V.; Csillag, P.; Ferrer-Pérez, H.; Gkatsikos, A.; et al. Economic Spill-Over of Food Quality Schemes on Their Territory. J. Agric. Food Ind. Organ. 2021, 19, 95–111. [Google Scholar] [CrossRef]

- Keller, K.L.; Lehmann, D.R. Brands and branding: Research findings and future priorities. Mark. Sci. 2006, 25, 740–759. [Google Scholar] [CrossRef] [Green Version]

- Wood, L. Brands and brand equity: Definition and management. Manag. Decis. 2000, 38, 662–669. [Google Scholar] [CrossRef] [Green Version]

- De Pelsmacker, P.; Janssens, W.; Sterckx, E.; Mielants, C. Consumer preferences for the marketing of ethically labelled coffee. Int. Mark. Rev. 2005, 22, 512–530. [Google Scholar] [CrossRef]

- Swaminathan, V.; Sorescu, A.; Steenkamp, J.-B.E.M.; O’Guinn, T.C.G.; Schmitt, B. Branding in a Hyperconnected World: Refocusing Theories and Rethinking Boundaries. J. Mark. 2020, 84, 24–46. [Google Scholar] [CrossRef] [Green Version]

- Brexendorf, T.O.; Keller, K.L. Leveraging the corporate brand. Eur. J. Mark. 2017, 51, 1530–1551. [Google Scholar] [CrossRef]

- European Commission. Eurobarometer Interactive. Available online: http://ec.europa.eu/commfrontoffice/publicopinion/index.cfm/Chart/index (accessed on 20 April 2018).

- Grau, A.; Reig, A. Operating leverage and profitability of SMEs: Agri-food industry in Europe. Small Bus. Econ. 2021, 57, 221–242. [Google Scholar] [CrossRef]

- Balogh, P.; Békési, D.; Gorton, M.; Popp, J.; Lengyel, P. Consumer willingness to pay for traditional food products. Food Policy 2016, 61, 176–184. [Google Scholar] [CrossRef] [Green Version]

- Czine, P.; Török, A.; Pető, K.; Horváth, P.; Balogh, P. The Impact of the Food Labeling and Other Factors on Consumer Preferences Using Discrete Choice Modeling-The Example of Traditional Pork Sausage. Nutrients 2020, 12, 1768. [Google Scholar] [CrossRef] [PubMed]

- Szakály, Z.; Horvát, A.; Soós, M.; Pető, K.; Szente, V. A minőségre és származásra utaló jelölések szerepe a fogyasztói döntéshozatalban. Élelmiszer Táplálkozás És Mark. 2014, 10, 3–10. [Google Scholar]

- Crescenzi, R.; De Filippis, F.; Giua, M.; Vaquero-Piñeiro, C. Geographical Indications and local development: The strength of territorial embeddedness. Reg. Stud. 2021, 56, 1–13. [Google Scholar] [CrossRef]

- Pilone, V.; De Lucia, C.; Del Nobile, M.A.; Conto, F. Policy developments of consumer’s acceptance of traditional products innovation: The case of environmental sustainability and shelf life extension of a PGI Italian cheese. Trends Food Sci. Technol. 2015, 41, 83–94. [Google Scholar] [CrossRef]

| Attributes and Respective Levels |

|---|

|

| Sociodemographic Factors | Sample (N = 380) | Hungarian Population * |

|---|---|---|

| Gender (%) | ||

| Female | 49.47 | 52.15 |

| Male | 50.53 | 47.85 |

| Age (category) (%) | ||

| <30 | 23.16 | 32.81 |

| 30–39 | 21.58 | 11.75 |

| 40–49 | 24.21 | 16.25 |

| 49< | 31.05 | 39.19 |

| Highest level of education (%) | ||

| Upper secondary/lower secondary/primary education or below University or college entrance qualification Bachelor’s, master’s or doctoral degree | 31.32 | 51.83 |

| 25.52 | 29.45 | |

| 43.16 | 18.72 | |

| Monthly net income (%) | ||

| <150,000 HUF (<c.a. EUR 469) | 6.32 | 244,609 HUF (c.a. EUR 764)/month |

| 150,000–205,000 HUF (c.a. 469–EUR 641) | 11.58 | |

| 205,001–235,000 HUF (c.a. 64–EUR 734) | 11.58 | |

| 235,001–380,000 HUF (c.a. 734–EUR 1188) | 38.68 | |

| 380,001–835,000 HUF (1188–EUR 2609) | 30.00 | |

| 835,000 < HUF (c.a. EUR 2609<) | 1.84 | |

| Residence (%) | ||

| City | 46.84 | 37.91 |

| Urban (non-cities) | 36.32 | 32.58 |

| Rural | 16.84 | 29.51 |

| Household size (mean) | 2.86 | 2.86 |

| Number of children (<18 years) in a household (mean) | 0.57 | 1.06 |

| Average Price Normally Paid for a 70 g Package of Sausage (%) | |

|---|---|

| Below 150 HUF (c.a. EUR 0.47) | 1.32 |

| Between 150–220 HUF (c.a. EUR 0.47–0.69) | 13.68 |

| Between 221–290 HUF (c.a. EUR 0.69–0.91) | 17.90 |

| Between 291–360 HUF (c.a. EUR 0.91–1.13) | 26.58 |

| Between 361–430 HUF (c.a. EUR 1.13–1.34) | 15.26 |

| Between 431–500 HUF (c.a. EUR 1.34–1.56) | 8.16 |

| Above 500 HUF (c.a. EUR 1.56) | 7.63 |

| Does not know | 9.47 |

| Frequency of purchase (%) | |

| Less than once a month | 7.11 |

| Once a month | 25.53 |

| Twice a month | 27.89 |

| Three times a month | 15.26 |

| Once a week | 20.79 |

| More than once a week | 3.16 |

| Does not know | 0.26 |

| Frequency of consumption (%) | |

| Less than once a month | 8.42 |

| Twice or three times a month | 18.42 |

| Once a week | 26.32 |

| Twice a week, three times a week | 37.10 |

| Four to six times a week | 7.11 |

| Every day | 1.58 |

| Does not know | 1.05 |

| Attributes and Model Details | MNL | MLM | ||

|---|---|---|---|---|

| Coeff. | S.E. | Coeff. | S.E. | |

| ASC no choice | −2.39 *** | 0.11 | −4.41 *** | 0.22 |

| Price (scaled by 100) | −0.43 *** | 0.02 | −0.86 *** | 0.07 |

| Price (SD) | − | − | 0.77 *** | 0.11 |

| GI label | 0.58 *** | 0.06 | 0.95 *** | 0.11 |

| GI label (SD) | − | − | 0.82 *** | 0.15 |

| Private brand | 0.53 *** | 0.06 | 0.90 *** | 0.10 |

| Private brand (SD) | − | − | 0.85 *** | 0.14 |

| Spicy | −0.26 *** | 0.06 | −0.51 *** | 0.14 |

| Spicy (SD) | - | - | 2.09 *** | 0.17 |

| Extra Spicy | −0.69 *** | 0.06 | −1.35 *** | 0.17 |

| Extra Spicy (SD) | - | - | 2.39 *** | 0.19 |

| 0.15 | 0.28 | |||

| Log-likelihood (0) | −3160.75 | −3160.75 | ||

| Log-likelihood (model) | −2694.89 | −2264.75 | ||

| AIC | 5401.77 | 4551.50 | ||

| BIC | 5436.16 | 4614.55 | ||

| Attributes and Model Details | LC | RLC | ||||||

|---|---|---|---|---|---|---|---|---|

| Coeff. | S.E. | Coeff. | S.E. | |||||

| ASC no choice | −3.13 *** | 0.16 | −4.71 *** | 0.26 | ||||

| Class 1 | Class 2 | Class 1 | Class 2 | |||||

| Coeff. | S.E. | Coeff. | S.E. | Coeff. | S.E. | Coeff. | S.E. | |

| Price (scaled by 100) | −0.49 *** | 0.03 | −0.70 *** | 0.06 | −0.89 *** | 0.08 | −0.94 *** | 0.12 |

| Price (SD) | - | - | - | - | 0.84 *** | 0.16 | 0.88 *** | 0.22 |

| GI label | 0.73 *** | 0.08 | 0.39 ** | 0.19 | 0.96 *** | 0.13 | 0.73 *** | 0.27 |

| GI label (SD) | - | - | - | - | 0.91 *** | 0.17 | 0.84 ** | 0.41 |

| Private brand | 0.64 *** | 0.07 | 0.83 *** | 0.22 | 0.86 *** | 0.12 | 1.10 *** | 0.19 |

| Private brand (SD) | - | - | - | - | 0.95 *** | 0.15 | 0.06 | 0.40 |

| Spicy | 0.57 *** | 0.09 | −3.37 *** | 0.28 | 0.79 *** | 0.13 | −3.93 *** | 0.62 |

| Spicy (SD) | - | - | - | - | 0.29 | 0.34 | 3.85 *** | 0.64 |

| Extra Spicy | 0.06 | 0.09 | −4.11 *** | 0.40 | 0.24 | 0.20 | −4.35 *** | 0.43 |

| Extra Spicy (SD) | - | - | - | - | 1.30 *** | 0.18 | 0.40 | 0.82 |

| δ | 0.90 *** | 0.13 | −0.61 *** | 0.16 | ||||

| Class probability values | 0.71 | 0.29 | 0.65 | 0.35 | ||||

| 0.24 | 0.31 | |||||||

| Log-likelihood (0) | −3160.75 | −3160.75 | ||||||

| Log-likelihood (model) | −2401.92 | −2167.03 | ||||||

| AIC | 4827.85 | 4378.06 | ||||||

| BIC | 4896.63 | 4504.16 | ||||||

| Product Attributes | Willingness to Pay | |||||

|---|---|---|---|---|---|---|

| MNL | MLM | LC | RLC | |||

| Class 1 | Class 2 | Class 1 | Class 2 | |||

| GI label | 1.34 *** | 1.13 *** | 1.48 *** | 0.57 ** | 1.07 *** | 0.93 *** |

| (1.22 ***) | (1.20 ***) | (0.27) | ||||

| Private brand | 1.23 *** | 1.14 *** | 1.31 *** | 1.20 *** | 0.97 *** | 1.58 *** |

| (0.99 ***) | (1.17 ***) | (0.24) | ||||

| Spicy | −0.61 *** | −1.07 *** | 1.16 *** | −4.84 *** | 0.67 *** | −6.19 *** |

| (2.65 ***) | (0.71 ***) | (6.58 ***) | ||||

| Extra Spicy | −1.61 *** | −2.24 *** | 0.12 | −5.90 *** | 0.28 | −8.69 *** |

| (3.24 ***) | (1.53 ***) | (0.09) | ||||

| Sociodemographic Factors | Traditional Consumers 71% | Brand Conscious Consumers 29% |

|---|---|---|

| Gender (%) *** | ||

| Female | 45.86 | 58.39 |

| Male | 54.14 | 41.61 |

| Age (category) (%) | ||

| <30 | 23.85 | 21.44 |

| 30–39 | 20.37 | 24.57 |

| 40–49 | 26.26 | 19.15 |

| 49< | 29.52 | 34.84 |

| Highest level of education (%) | ||

| Upper secondary/lower secondary/primary education Below University or college entrance qualification Bachelor’s, master’s or doctoral degree | 31.48 | 30.91 |

| 23.69 | 30.07 | |

| 44.83 | 39.02 | |

| Monthly net income (%) | ||

| <150,000 HUF (<c.a. EUR 469) | 6.30 | 6.37 |

| 150,000–205,000 HUF (c.a. EUR 469–641) | 11.16 | 12.61 |

| 205,001–235,000 HUF (c.a. EUR 641–734) | 12.86 | 8.42 |

| 235,001–380,000 HUF (c.a. EUR 734–1188) | 36.87 | 43.17 |

| 380,001–835,000 HUF (EUR 1188–2609) | 30.82 | 27.96 |

| 835,000 < HUF (c.a. EUR 2609<) | 1.99 | 1.47 |

| Residence (%) | ||

| City | 45.80 | 49.43 |

| Urban (non-cities) | 36.98 | 34.68 |

| Rural | 17.22 | 15.89 |

| Household size (mean) | 2.85 | 2.87 |

| Number of children (<18 year) in a household (mean) | 0.54 | 0.63 |

| Questions | Traditional Consumers 71% | Brand Conscious Consumers 29% |

|---|---|---|

| Average price normally paid for a 70 g package of sausage (%) | ||

| Below 150 HUF (c.a. EUR 0.47) | 1.81 | 0.08 |

| Between 151–220 HUF (c.a. EUR 0.47–0.69) | 11.89 | 18.13 |

| Between 221–290 HUF (c.a. EUR 0.69–0.91) | 17.58 | 18.67 |

| Between 291–360 HUF (c.a. EUR 0.91–1.13) | 27.20 | 25.04 |

| Between 361–430 HUF (c.a. EUR 1.13–1.34) | 15.12 | 15.61 |

| Between 431–500 HUF (c.a. EUR 1.34–1.56) | 9.02 | 6.04 |

| Above 501 HUF (c.a. EUR 1.56) | 8.74 | 4.90 |

| Does not know | 8.64 | 11.53 |

| Frequency of purchase (%) | ||

| Less than once a month | 5.40 | 11.30 |

| Once a month | 23.73 | 29.96 |

| Twice a month | 28.51 | 26.37 |

| Three times a month | 15.36 | 15.04 |

| Once a week | 22.97 | 15.40 |

| More than once a week | 4.02 | 1.02 |

| Do not know | <0.01 | 0.91 |

| Frequency of consumption (%) ** | ||

| Less than once a month | 5.61 | 15.36 |

| Two-three times a month | 15.70 | 25.16 |

| Once a week | 27.57 | 23.22 |

| Two-three times a week | 41.38 | 26.54 |

| Four to six times a week | 7.44 | 6.28 |

| Every day | 1.93 | 0.70 |

| Do not know | 0.37 | 2.74 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Török, Á.; Gorton, M.; Yeh, C.-H.; Czine, P.; Balogh, P. Understanding Consumers’ Preferences for Protected Geographical Indications: A Choice Experiment with Hungarian Sausage Consumers. Foods 2022, 11, 997. https://doi.org/10.3390/foods11070997

Török Á, Gorton M, Yeh C-H, Czine P, Balogh P. Understanding Consumers’ Preferences for Protected Geographical Indications: A Choice Experiment with Hungarian Sausage Consumers. Foods. 2022; 11(7):997. https://doi.org/10.3390/foods11070997

Chicago/Turabian StyleTörök, Áron, Matthew Gorton, Ching-Hua Yeh, Péter Czine, and Péter Balogh. 2022. "Understanding Consumers’ Preferences for Protected Geographical Indications: A Choice Experiment with Hungarian Sausage Consumers" Foods 11, no. 7: 997. https://doi.org/10.3390/foods11070997

APA StyleTörök, Á., Gorton, M., Yeh, C.-H., Czine, P., & Balogh, P. (2022). Understanding Consumers’ Preferences for Protected Geographical Indications: A Choice Experiment with Hungarian Sausage Consumers. Foods, 11(7), 997. https://doi.org/10.3390/foods11070997