Abstract

Hydrogen is increasingly considered as an environmentally friendly energy source as it stores a large amount of chemical energy per unit mass (142 MJ·kg−1) that can be released without the emission of combustion by-products. The presented research is based on simulation modeling of biohydrogen production projects from agricultural waste. Based on the probability theory and mathematical statistics, the models of the variable market value of biohydrogen and natural gas are substantiated. The results of the research indicate that in 2019, projects regarding the production of biohydrogen from agricultural raw materials were mostly unprofitable for the investors. However, starting in 2030, the forecasted return on investment in biohydrogen production projects from agricultural raw materials indicates that such projects will be profitable for investors, and the number and scale of such projects will significantly increase worldwide.

1. Introduction

By 2050, the “New Green Deal” document will cover all definitions of CO2 reduction in Europe for the so-called ETS sector, which is obliged to purchase CO2 emission rights, as well as the so-called non-ETS sectors, e.g., transport and agriculture. They are not part of the system but are also required by law to reduce CO2 emissions. The main aim of #EUGreenDeal [1] is decarbonization, i.e., reducing the use of coal and coal products, as well as natural gas and crude oil [2,3,4,5,6,7,8]. For this purpose, new activities, financial instruments, and legal acts are being introduced. In transport and industry, the most profitable solutions include the use of biomethane, i.e., purified biogas, and biohydrogen, i.e., hydrogen derived from biomass or other renewable energy sources [9,10,11,12,13,14].

Currently, the industry uses hydrogen derived from coal or natural gas. However, the use of biohydrogen should soon become a priority for the national goals of the EU Member States [15]. On 14 March 2020, the European Commission announced the Clean Hydrogen Alliance—a code of conduct that requires the largest companies in Europe, such as refineries or gas operators, to implement the largest projects in the field of decarbonization in the gas or industrial products market. The second area of work is the development of hydrogen technologies in transport, primarily in public transport. Currently, Sweden and Norway operate the largest number of hydrogen filling stations. In 2019, Germany has also adopted the Hydrogen Strategy to create a hydrogen refueling infrastructure for cars or technical vehicles, but above all, to use the current gas infrastructure for mixing natural gas with hydrogen. This trend is the most cost-effective due to the technical simplicity of mixing both gases (Figure 1).

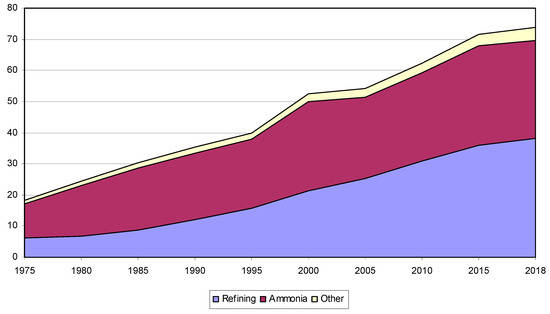

Figure 1.

Global demand for pure hydrogen, 1975–2018. Source: https://www.iea.org [3].

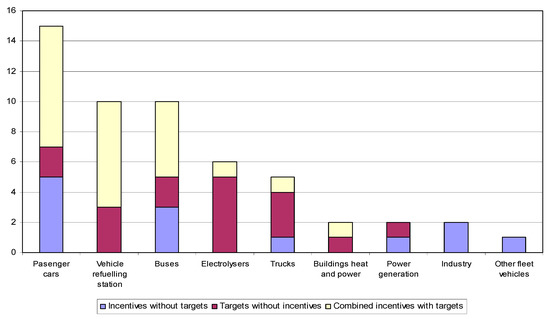

The preliminary analysis allows identifying at least four areas that demonstrate the greatest potential for the use of hydrogen, and where it can contribute to the successful decarbonization and global energy transformation in Europe: power and heat production, transport, and industry (Figure 2).

Figure 2.

Current policy support for hydrogen deployment, 2018. Source: https://www.iea.org [3].

According to Hydrogen Europe [4], the largest industry organization that unites the largest producers of biohydrogen for the industrial and transport sectors, the key document, Hydrogen in the EU Green Deal COM (2019), includes the most important postulates on hydrogen that will allow EU governments and sectors to effectively implement new policies on this key technology towards decarbonization of the economy [1,5,6,7].

2. Analysis of Literature Data and Problem Statement

Quantitative risk assessment of components of projects in various application areas is one of the important project management processes. These processes are regulated in international project management standards [16,17]. Moreover, many scientific works [18,19] are devoted to risk assessment of projects dealing with certain applied areas. At the same time, both these standards and the known scientific works offer no details of the process of production of biohydrogen from agricultural raw materials. This disqualifies these works from use in forecasting the quantitative indicators of the investor’ s profit risk in projects dedicated to the production of biohydrogen from agricultural raw materials.

The available scientific works [19,20] dedicated to the challenges of risk management in production projects and the changing project environment demonstrate the importance of calculating risk when forecasting the effectiveness and value of projects for stakeholders. Some papers that are related to risk forecasting in agricultural production projects [21,22,23,24,25,26] have also been identified. The above literature is however inadequate to fully predict the quantitative indicators of the investor’s profit risk in biohydrogen production from agricultural raw materials. On the other hand, widely recognized scientific papers do not consider the impact of changing market conditions on forecasting the investors’ profits in biohydrogen production from agricultural raw materials. However, the project environment significantly affects the quality of forecasting the quantitative indicators of profit risk in the said projects [27,28].

To eliminate disadvantages of the known models and problem-solving methods in forecasting the effectiveness of the projects dedicated to the production of biohydrogen from agricultural raw materials, and its profitability for the stakeholders in various applied fields, it is suggested to use the approach presented in the scientific work [20,21]. The authors of this work suggest using simulation modeling of the project works to determine their implementation cost, taking into account the changing project environment. This approach allows eliminating the above-described disadvantages of existing models and problem-solving methods in predicting project effectiveness and value. The market value of agricultural raw materials used for the production of biohydrogen can be predicted based on official statistical data and mathematical statistics methods, as well as probability theory. This approach will take into account the changing market value of raw materials for the production of biohydrogen [11,29,30].

3. The Aim and Objectives of the Research

The study aims to substantiate the approach to forecasting the quantitative risk indicators in projects related to biohydrogen production from agricultural raw materials.

To achieve the objective, the following tasks should be performed:

- -

- to propose an approach to forecasting the value of projects dedicated to biohydrogen production from agricultural raw materials;

- -

- to perform forecasting and establish trends in quantitative indicators of the investor’s profit risk in projects dedicated to biohydrogen production from agricultural raw materials using the proposed approach.

4. Materials and Methods

The performed studies are based on simulation modeling of projects dedicated to the production of biohydrogen from agricultural waste [18,31,32]. It provides high-quality forecasting of investments in biohydrogen production, taking into account the existing global trends in terms of cost and volume used. The stochastic market value of biohydrogen and natural gas is estimated based on statistical and forecasted data of countries where large biohydrogen production projects are implemented. Models of the variable market value of biohydrogen and natural gas are substantiated according to the known methods of probability theory and mathematical statistics [24,33].

A set of studies in this area was conducted in the educational and scientific laboratory “DAK GPS” at the Institute of Energy of State Agrarian and Engineering University in Podilya [12,13,22]. For high-quality and accelerated risk assessment of biohydrogen production profits, the software written in “Python” technology, developed at the Department of Information Systems and Technologies of Lviv National Agrarian University was used [20].

5. Results

Based on the statistical data analysis [20] and relevant calculations, the authors estimated the stochastic characteristics of the market value of biohydrogen and natural gas (Table 1). It was adopted that the biohydrogen will be produced from agricultural waste. The biomass gasification based on the hydrogen production system has the energy and exergy efficiency of 53.6% and 49.8%, respectively, at the hydrogen production rate of 106.9 g/s. [27,34]. Thus far, it is one of the most prospective methods of obtaining biohydrogen available in Ukraine [35].

Table 1.

Characteristics of the market value of biohydrogen from agricultural waste and natural gas, $·kg−1.

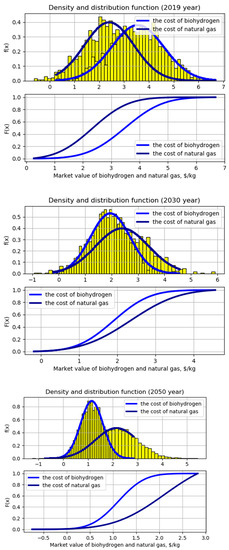

Considering the results of research [8,22] which state that the global market value of energy resources is described by the normal law distribution, we have constructed the market value distributions for biohydrogen from agricultural waste and natural gas.

In particular, based on the analysis of the obtained data (Table 1) and their visualization in the Python 3.8 (Corporation for National Research Initiatives, Reston, VA, USA) programming language using Matplotlib, Numpy, and Scipy libraries, the market value distributions of biohydrogen and natural gas for the previous year (2019), as well as forecasts for the years 2030 and 2050 are constructed (Figure 3).

Figure 3.

Density and function of market value distributions of biohydrogen from agricultural waste and natural gas.

The obtained densities and functions of the market value distributions of biohydrogen from agricultural waste and natural gas are the foundations for assessing the profit risk in biohydrogen production projects.

For high-quality and accelerated profit risk assessment in biohydrogen production projects, the application software written in Python, developed at the Department of Information Systems and Technologies of Lviv National Agrarian University, was used [18].

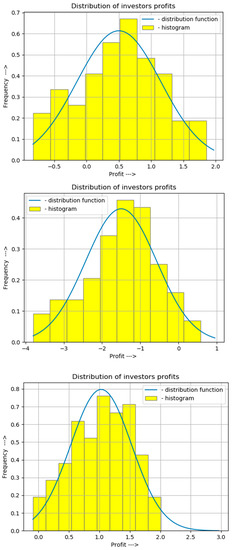

The initial data for calculation of the investors’ profit in biohydrogen production from agricultural raw materials include market value distribution of biohydrogen and natural gas. Based on the obtained data, presented in Table 1, distributions of investor profit from the individual projects for the previous year (2019) and the forecasted years 2030 and 2050 are calculated (Figure 4).

Figure 4.

Histogram and theoretical curve of investors’ profit distribution in projects dedicated to the production of biohydrogen from agricultural raw materials.

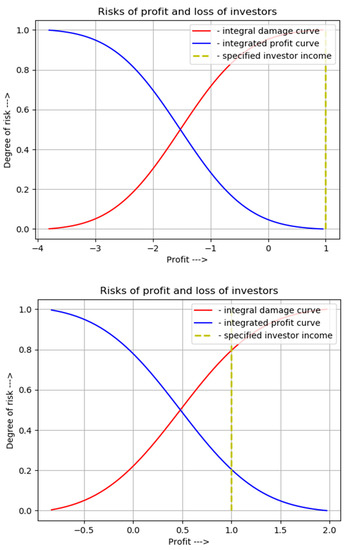

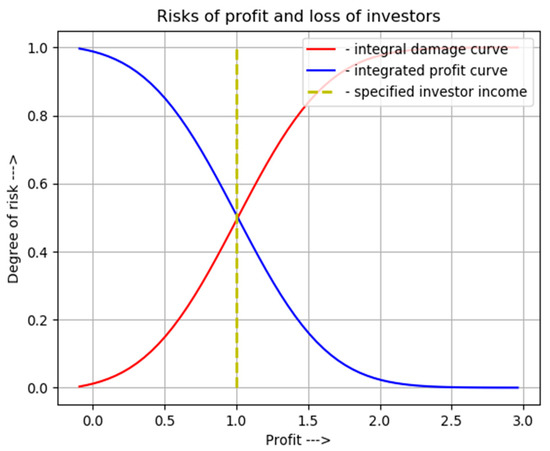

Based on the obtained distributions of profits in biohydrogen production from agricultural raw materials (Figure 3), integrated with profit (Pr) and loss curves (Pl) under the set investor requirements—the minimum profit Ps, are constructed in Figure 5.

Figure 5.

The integrated curves of profit (Pr) and loss (Pl) for investors in biohydrogen production projects from agricultural raw materials, taking into account their requirements (the minimum profit of investors—Ps = 1 $/kg).

The conducted computer experiments allowed forecasting the quantitative indicators of the profit risk in global projects dedicated to the production of biohydrogen from agricultural raw materials (Table 2).

Table 2.

The results of forecasting the quantitative profit risk indicators R(Ps) in projects dedicated to the production of biohydrogen from agricultural raw materials 1.

Based on the obtained results of forecasting the quantitative indicators of the profit risk R(Ps) in the projects dedicated to biohydrogen production from agricultural raw materials, it is established that the profit risk is critical in 2019 for all project options at the minimal profit requirement of 0.1–1.0 $/kg of obtained biohydrogen.

At the same time, the forecasted increase in the scale of biohydrogen production projects, and the level of technologies used, will reduce its production cost and increase the investor profits. It is predicted, that in 2030, at the requested minimal profit of 0.1–0.2 $/kg of obtained biohydrogen, the production risk will be admissible within 0.3–0.5 $/kg—average, within 0.6–0.8 $/kg—high, and more 0.9 $/kg—critical. At the same time, it is established that in 2050 for changes in the minimal profit within 0.1–1.0 $/kg of obtained biohydrogen, the forecasted profit risk will change from minimal to average.

The results of the research indicate that in 2019, the projects of biohydrogen production from agricultural raw materials were mostly unprofitable and had no value for their investors. At the same time, starting from 2030, the forecasted profit risk indicators in projects dedicated to the production of biohydrogen and agricultural raw materials indicate that such projects will be valuable for investors and their number will significantly increase globally.

Further research should be conducted to substantiate the planning and implementation of projects dedicated to the production of biohydrogen from agricultural raw materials, taking into account the characteristics of production conditions in individual regions and the risk change tendencies in the investment value of the individual projects.

6. Discussion of Research Results

The main scientific result of the research is a sound approach to forecasting the investor risk in biohydrogen production from agricultural raw materials. The research has identified trends in quantitative investment risk indicators in these projects, taking into account the forecasted trends in market conditions.

Based on the analysis, it was determined that the existing scientific works are important for the theory of project environment forecasting and project planning in various subject areas. Most of these works do not take into account the character of agricultural production projects, especially in the production of agricultural raw materials for biohydrogen. Since some individual works discuss agricultural production projects, which are inherent in risk, it was determined by literature analysis that they cannot be fully used to predict the risk of investors in biohydrogen production from agricultural raw materials. The shortcomings include not taking into account the peculiarities of the project design environment for the production of biohydrogen from agricultural raw materials, which makes it impossible to justify the variable indicators of the value of these projects. Moreover, the said works do not provide forecasting indicators of the changing market conditions. It is this component of the project environment that significantly influences the quality of valuation for investors of biohydrogen production projects from agricultural raw materials.

To eliminate the shortcomings of the mentioned investor risk forecasting tools in the projects dedicated to biohydrogen production from agricultural raw materials, a proprietary approach was proposed. It provides modeling simulations of project works to determine the cost of the implementation of the said biohydrogen production projects in terms of resources and design environment. Thus, the proposed approach eliminates the disadvantages of existing methods.

In the approach, the market value of agricultural raw materials for biohydrogen production is predicted based on statistical data, using probability theory and mathematical statistics. Thus, the changing nature of the market price of biofuel raw materials is taken into consideration. Taking into account the stochastic market and the conditions for the production of agricultural raw materials for biohydrogen, the approach provides a qualitative assessment of the profit risks in these projects.

To accelerate the profit risk assessment in the projects dedicated to the production of biohydrogen from agricultural raw materials, the Department of Information Systems and Technologies of Lviv National Agrarian University developed a suitable software, which was then used in the research to forecast the investment risk in the said biohydrogen production projects. The software provides calculations of quantitative indicators of risk of investors in biohydrogen production projects from agricultural raw materials, as well as trend visualizations.

It was determined that the increase of the scale of biohydrogen production from agricultural raw materials, and the relevant technology level, over ten years will reduce the cost of raw materials. At the same time, over the next ten years, biohydrogen production from agricultural raw materials will attract more investors, as the projects will become profitable, with acceptable risk levels.

Analyzing the trends in the quantitative indicators of investor risk of biohydrogen production projects from agricultural raw materials (Figure 4 and Figure 5 and Table 2), we can say that from year to year biohydrogen production projects from agricultural raw materials will be more relevant and attractive to investors.

The proposed approach and stages of the research are the foundation of the decision support system for risk planning in the biohydrogen production projects, as they will provide a qualitative and accelerated quantitative assessment of these risks. This will significantly accelerate the decision-making processes regarding the quantitative risk indicators of the projects as per given production conditions, as well as increase their accuracy.

The conducted research is useful for project managers involved in the projects dedicated to biohydrogen production from agricultural raw materials, as well as for the community leaders and agricultural enterprises that plan to launch the production of biohydrogen from agricultural raw materials.

7. Conclusions

Based on the analysis of the state of the art and practice of biohydrogen production from agricultural raw materials, the relevance and feasibility of the relevant projects have been established. However, the tasks of qualitatively forecasting the value of investors in biohydrogen production projects from agricultural raw materials remain unsolved.

The proposed approach, and the applied forecasting software, are based on simulation modeling. They take into account the stochastic market, and the production conditions of these projects, allowing for high-quality and accelerated risk assessment in biohydrogen production projects.

Based on the research, it is established that the forecasted increase in the biohydrogen production projects, and the related technologies, will reduce the total biohydrogen production costs. Starting in 2030, 80% of biohydrogen production from agricultural raw materials.

The profitability change tendencies in the projects dedicated to the production of biohydrogen from agricultural raw materials were established, taking into account the project requirements. In particular, in 2030, at the minimum return request of 0.1–0.2 $/kg, the risk of obtaining biohydrogen from agricultural materials will be “acceptable”, at 0.3–0.5 $/kg—“average”, at 0.6–0.8 $/kg—“high”, and at over 0.9 $/kg—“critical”. At the same time, in 2050, these indicators will significantly improve. Along with the changes in the minimum return on investment in biohydrogen production at 0.1–1.0 $/kg, the projected profit risk will change from “minimum” to “average”. This indicates that the biohydrogen production from agricultural raw materials will be more relevant and more attractive for investors with every year.

Author Contributions

Conceptualization, A.T. and T.H.; methodology, I.T. and S.G.; literature review, S.Y. and D.S.; database creation, D.K.; funding acquisition, S.T. All authors have read and agreed to the published version of the manuscript.

Funding

The article is published within the framework of the topic “Formation of Organizational and Economic Mechanism for Development Production of Biohydrogen From Biomass—Green Hydrogen” with the support of the International Visegrad Fund (www.visegradfund.org).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

Anonymous reviewers are gratefully acknowledged for their constructive review that significantly improved this manuscript and International Visegrad Fund (www.visegradfund.org).

Conflicts of Interest

The authors declare no conflict of interest.

References

- A European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal (accessed on 8 October 2020).

- The Future of Hydrogen. Available online: https://www.iea.org/reports/the-future-of-hydrogen (accessed on 8 October 2020).

- International Energy Agency. Available online: https://www.iea.org/data-and-statistics/charts/current-policy-support-for-hydrogen-deployment-2018 (accessed on 8 October 2020).

- Hydrogen Europe. Available online: https://hydrogeneurope.eu (accessed on 8 October 2020).

- National Energy and Climate Plans (NECPs). Available online: https://ec.europa.eu/energy/topics/energy-strategy/national-energy-climate-plans_en (accessed on 8 October 2020).

- EBA. European Biogas Association. Available online: https://www.europeanbiogas.eu/2020-gas-decarbonisation-pathways-study/ (accessed on 8 October 2020).

- Gas Decarbonisation Pathways 2020–2050-Gas for Climate. Available online: https://www.gasforclimate2050.eu (accessed on 8 October 2020).

- Szelag-Sikora, A.; Sikora, J.; Niemiec, M.; Gródek-Szostak, Z.; Kapusta-Duch, J.; Kubon, M.; Komorowska, M.; Karcz, J. Impact of Integrated and Conventional Plant Production on Selected Soil Parameters in Carrot Production. Sustainability 2019, 11, 5612. [Google Scholar] [CrossRef]

- Sikora, J.; Niemiec, M.; Szelag-Sikora, A.; Kubon, M.; Olech, E.; Marczuk, A. Biogasification of wastes from industrial processing of carps. Przem. Chem. 2017, 96, 2275–2278. [Google Scholar] [CrossRef]

- Gródek-Szostak, Z.; Malik, G.; Kajrunajtys, D.; Szeląg-Sikora, A.; Sikora, J.; Kuboń, M.; Niemiec, M.; Kapusta-Duch, J. Modeling the Dependency between Extreme Prices of Selected Agricultural Products on the Derivatives Market Using the Linkage Function. Sustainability 2019, 11, 4144. [Google Scholar] [CrossRef]

- Kargbo, H.; Harris, J.S.; Phan, A.N. “Drop-in” fuel production from biomass: Critical review on techno-economic feasibility and sustainability. Renew. Sustain. Energy Rev. 2021, 135, 110168. [Google Scholar] [CrossRef]

- Yermakov, S.; Hutsol, T.; Mudryk, K.; Dziedzic, K.; Mykhailova, L. The analysis of stochastic processes in unloading the energy willow cuttings from the hopper. Environment, Technology, Resources. In Proceedings of the 12th International Scientific and Practical Conference, Rezekne, Latvia, 20–22 June 2019; pp. 249–252. [Google Scholar] [CrossRef]

- Krzysztof, D.; Krzysztof, M.; Taras, H.; Barbara, D. Impact of Grinding Coconut Shell and Agglomeration Pressure on Quality Parameters of Briquette; Engineering for Rural Development: Jelgava, Latvia, 2018; pp. 1884–1889. [Google Scholar] [CrossRef]

- Kubon, M.; Kocira, S.; Kocira, A.; Leszczyńska, D. Use of Straw as Energy Source in View of Organic Matter Balance in Family Farms. In Renewable Energy Sources: Engineering, Technology, Innovation; Book Series; Springer Proceedings in Energy; Springer: Cham, Germany, 2018. [Google Scholar] [CrossRef]

- Hydrogen Economy Outlook Key Messages. Blooomberg NEF. 30 March 2020. Available online: https://data.bloomberglp.com/professional/sites/24/BNEF-Hydrogen-Economy-Outlook-Key-Messages-30-Mar-2020.pdf (accessed on 29 January 2021).

- Practice Standard for Project Configuration Management; Project Management Institute, Four Campus Boulevard: Newton Square, PA, USA, 2007.

- ISO 21500. Guidance on Project Management. 2012. Available online: http://www.projectprofy.ru/ (accessed on 10 January 2014).

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Ftoma, O.; Padyuka, R.; Rudynets, M. Forecasting the risk of the resource demand for dairy farms basing on machine learning. In Proceedings of the 2nd International Workshop on Modern Machine Learning Technologies and Data Science, MoMLeT+DS 2020, Shatsk, Ukraine, 10 May 2020; Volume I, pp. 327–340. Available online: http://ceur-ws.org/Vol-2631/paper25.pdf (accessed on 26 September 2020).

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Ftoma, O. Forecasting of a Lifecycle of the Projects of Production of Biofuel Raw Materials With Consideration of Risks. In Proceedings of the International Conference on Advanced Trends in Information Theory (ATIT), Kyiv, Ukraine, 18–20 December 2019; pp. 420–425. [Google Scholar] [CrossRef]

- Tryhuba, A.; Ftoma, O.; Tryhuba, I.; Boyarchuk, O. Method of quantitative evaluation of the risk of benefits for investors of fodder-producing cooperatives. In Proceedings of the 14th International Scientific and Technical Conference on Computer Sciences and Information Technologies (CSIT), Lviv, Ukraine, 17–20 September 2019; Volume 3, pp. 55–58. [Google Scholar] [CrossRef]

- Tryhuba, A.; Hutsol, T.; Tryhuba, I.; Pokotylska, N.; Kovalenko, N.; Tabor, S.; Kwasniewski, D. Risk Assessment of Investments in Projects of Production of Raw Materials for Bioethanol. Processes 2021, 9, 12. [Google Scholar] [CrossRef]

- Hutsol, T.; Yermakov, S.; Firman, J.; Duganets, V.; Bodnar, A. Analysis of technical solutions of planting machines, which can be used in planting energy willow. In Renewable Energy Sources: Engineering, Technology, Innovation; Springer: Cham, Germany, 2018; pp. 99–111. [Google Scholar] [CrossRef]

- Tryhuba, A.; Bashynsky, O.; Hutsol, T.; Rozkosz, A.; Prokopova, O. Justification of Parameters of the Energy Supply System of Agricultural Enterprises with Using Wind Power Installations. In Proceedings of the 6th International Conference–Renewable Energy Sources (ICoRES 2019), E3S WebConf, Krynica, Poland, 12–14 June 2019; Volume 154, p. 06001. [Google Scholar] [CrossRef]

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Boyarchuk, O.; Ftoma, O. Evaluation of Risk Value of Investors of Projects for the Creation of Crop Protection of Family Dairy Farms. Acta Univ. Agric. Et Silvic. Mendel. Brun. 2019, 67, 1357–1367. [Google Scholar] [CrossRef]

- Ovcharuk, O.; Hutsol, T.; Ovcharuk, O.; Rudskyi, V.; Mudryk, K.; Jewiarz, M.; Wróbel, M.; Styks, M. Prospects of Use of Nutrient Remains of Corn Plants on Biofuels and Production Technology of Pellets. Renew. Energy Sources Eng. Technol. Innov. 2020, 293–300. [Google Scholar] [CrossRef]

- Kasprzak, K.; Wojtunik-Kulesza, K.; Oniszczuk, T.; Kuboń, M.; Oniszczuk, A. Secondary Metabolites, Dietary Fiber and Conjugated Fatty Acids as Functional Food Ingredients against Overweight and Obesity. Nat. Prod. Commun. 2018, 13, 1073–1082. [Google Scholar] [CrossRef]

- Mohammad, T.A.; Aqsha, A.; Mariam, A.; Ain, S.; Hellgardt, K.; Sumaiya, Z.A.; Farooq, S. Catalytic reforming of oxygenated hydrocarbons for the hydrogen production: An outlook. Biomass Conv. Bioref. 2020, 127, 109852. [Google Scholar] [CrossRef]

- Huber, G.W.; Dumesic, J.A. An overview of aqueous-phase catalytic processes for production of hydrogen and alkanes in a biorefinery. Catal. Today 2006, 111, 119–132. [Google Scholar] [CrossRef]

- Zhou, C.; Xia, X.; Lin, C.; Tong, D.; Beltramini, J. Catalytic conversion of lignocellulosic biomass to fine chemicals and fuels. Chem. Soc. Rev. 2011, 40, 5588–5617. [Google Scholar] [CrossRef] [PubMed]

- Kayfeci, M.; Keçebaş, A.; Bayat, M. Hydrogen production. Solar Hydrog. Prod. Process. Syst. Technol. 2019, 45–83. [Google Scholar] [CrossRef]

- Nikolaidis, P.; Poullikkas, A. A comparative overview of hydrogen production processes. Renew. Sustain. Energy Rev. 2017, 67, 597–611. [Google Scholar] [CrossRef]

- Ishaq, H.; Dincer, I. Comparative assessment of renewable energy-based hydrogen production methods. Renew. Sustain. Energy Rev. 2021, 135, 110192. [Google Scholar] [CrossRef]

- Golub, G.; Skydan, O.; Kukharets, V.; Yarosh, Y.; Kukharets, S. The estimation of energetically self-sufficient agroecosystem’s model. J. Cent. Eur. Agric. 2020, 21, 168–175. [Google Scholar] [CrossRef]

- Ni, M.; Leung, D.Y.; Leung, M.K.; Sumathy, K. An overview of hydrogen production from biomass. Fuel Process. Technol. 2006, 87, 461–472. [Google Scholar] [CrossRef]

- Diachuk, O.; Chepeliev, M.; Podolets, R.; Trypolska, G.; Venger, V.; Saprykina, T.; Yukhymets, R. Transition of Ukraine to the Renewable Energy by 2050. In Heinrich Boell Foundation Regional Office in Ukraine; Publishing house “Art Book” Ltd.: Kyiv, Ukraine, 2017; Volume 88, Available online: https://ua.boell.org/sites/default/files/transition_of_ukraine_to_the_renewable_energy_by_2050_1.pdf (accessed on 1 November 2017).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).