Pensions, Ageing and Social Security Research: Literature Review and Global Trends

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Search Criteria and Database

3.2. Data Extraction

3.3. Data Analysis

4. Results

4.1. Descriptive Analysis

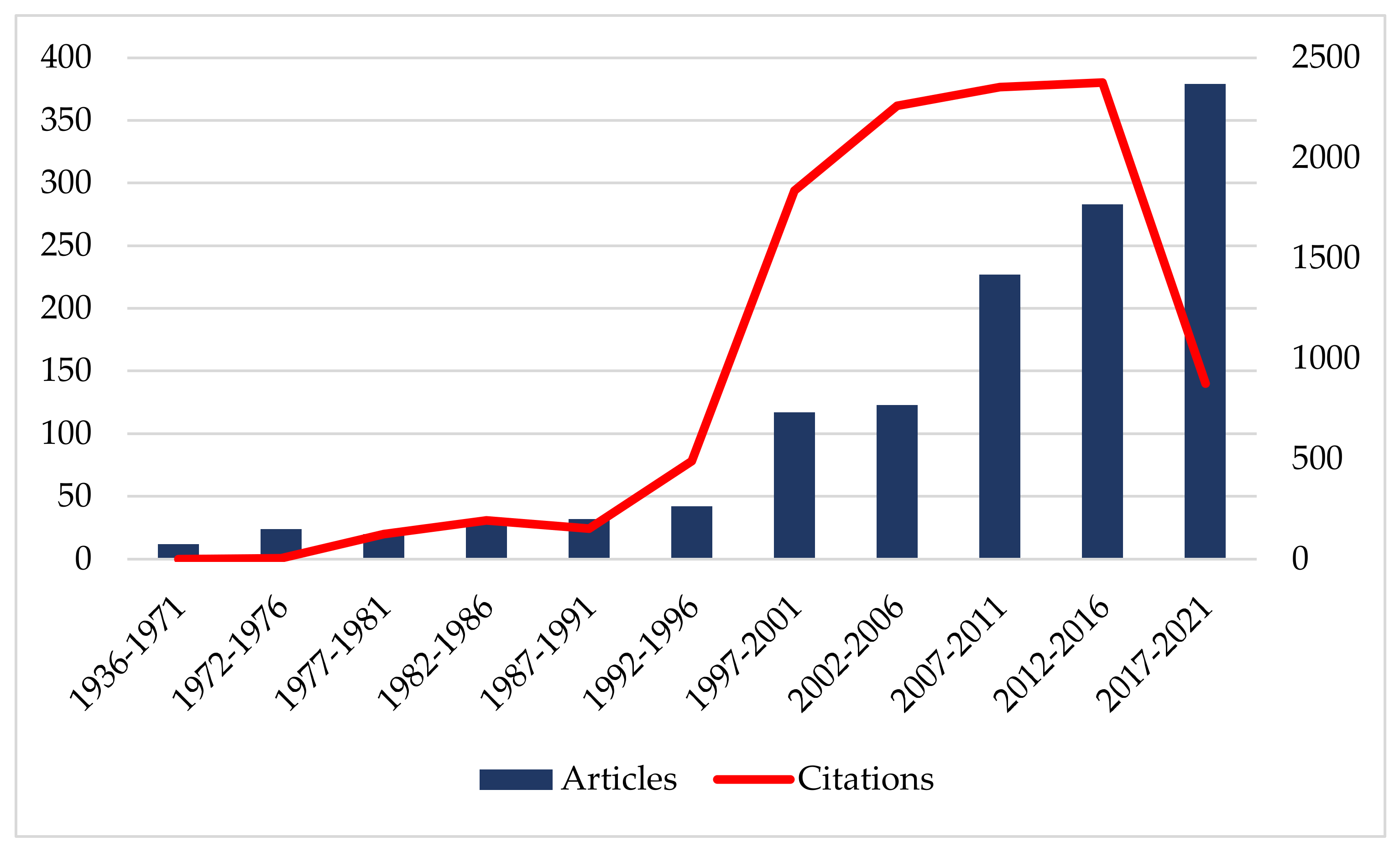

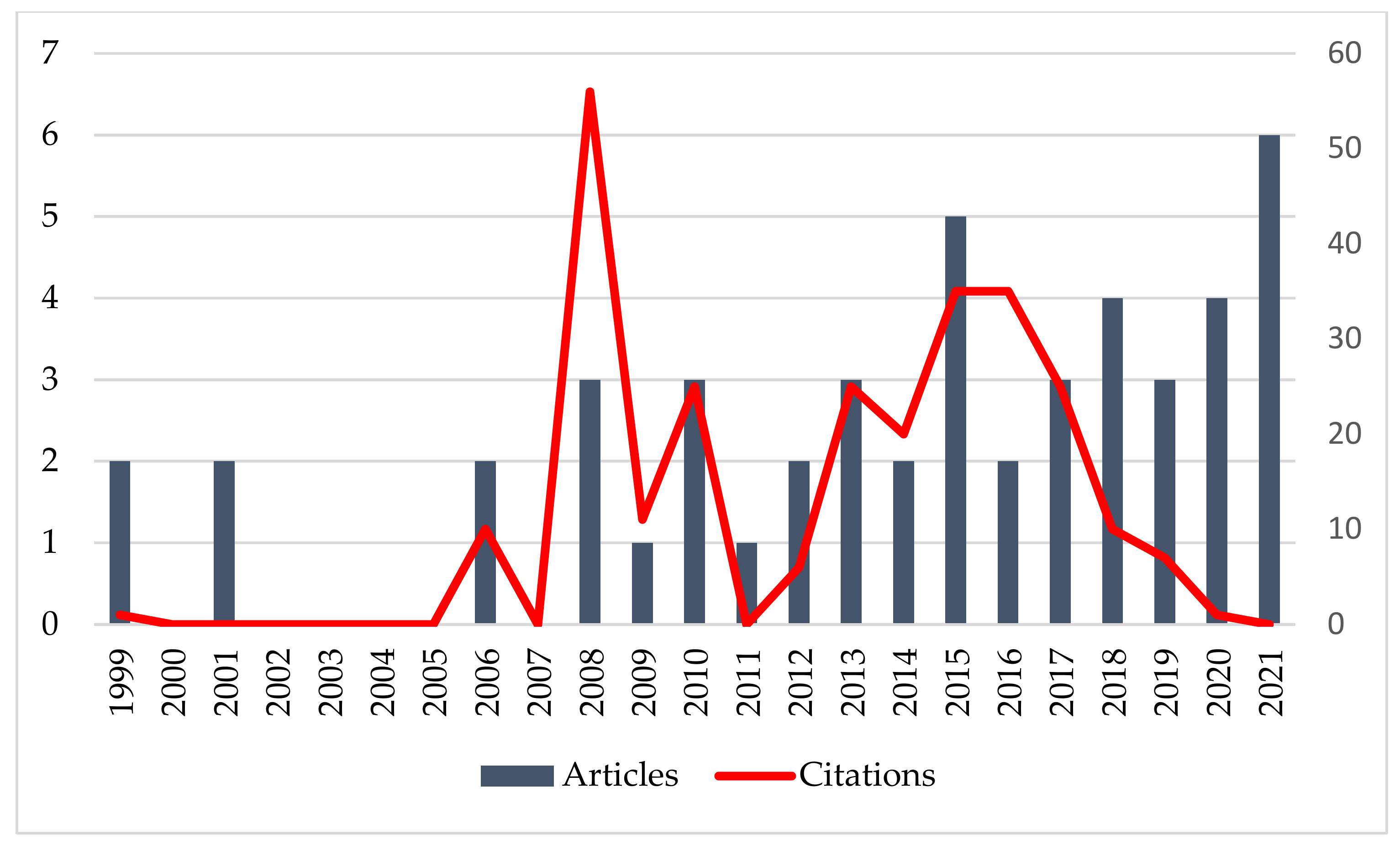

4.1.1. Evolution of Scientific Production

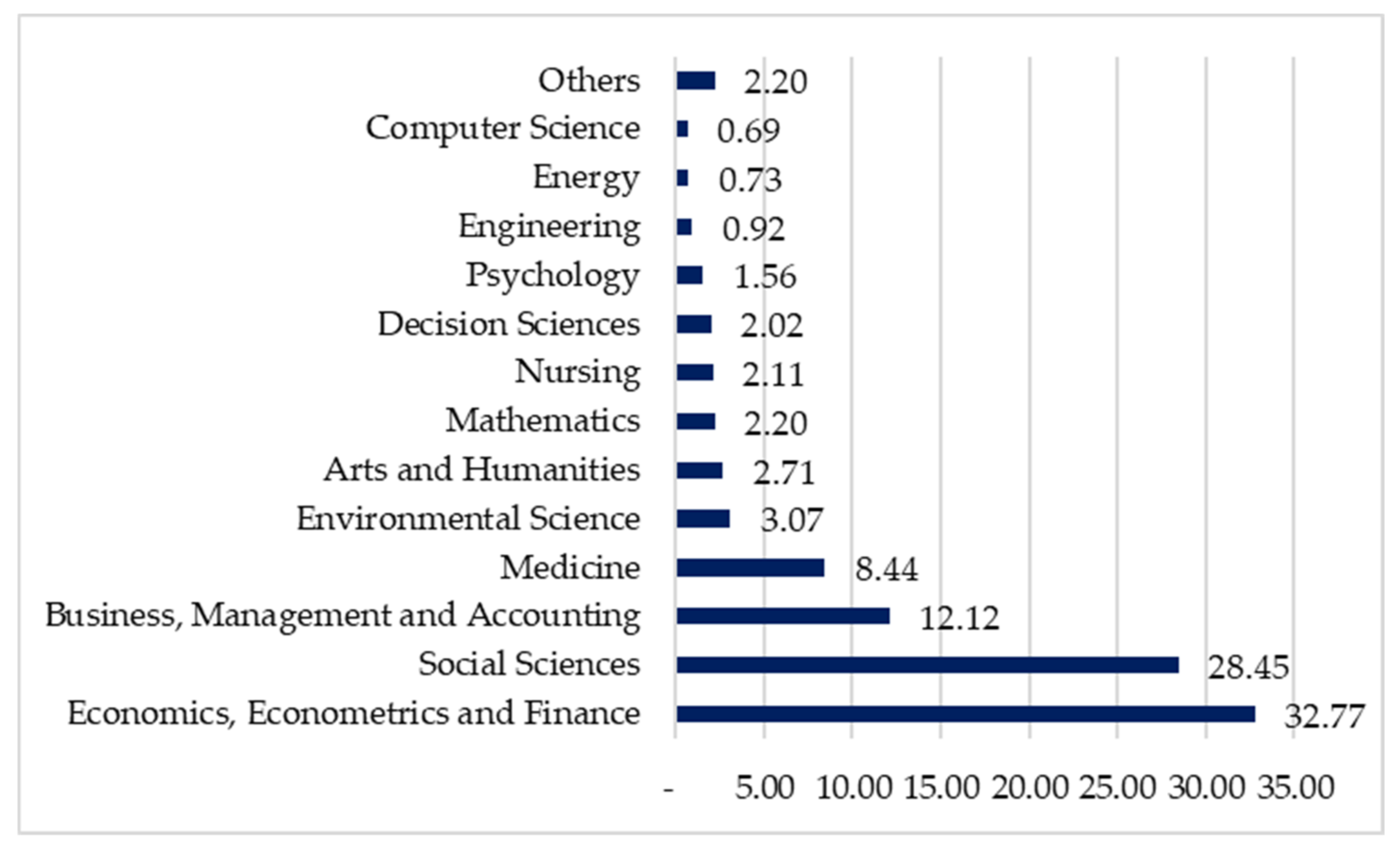

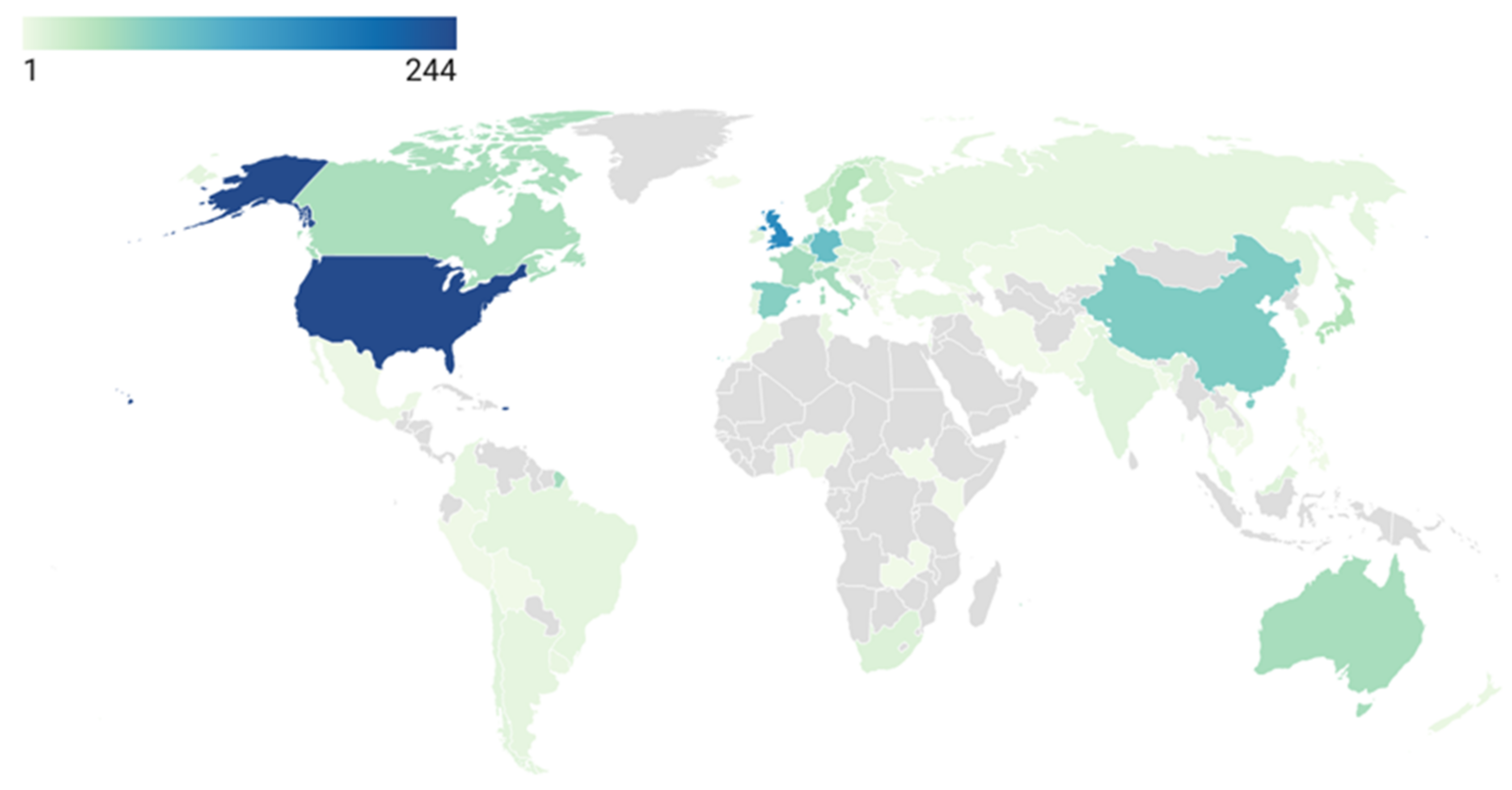

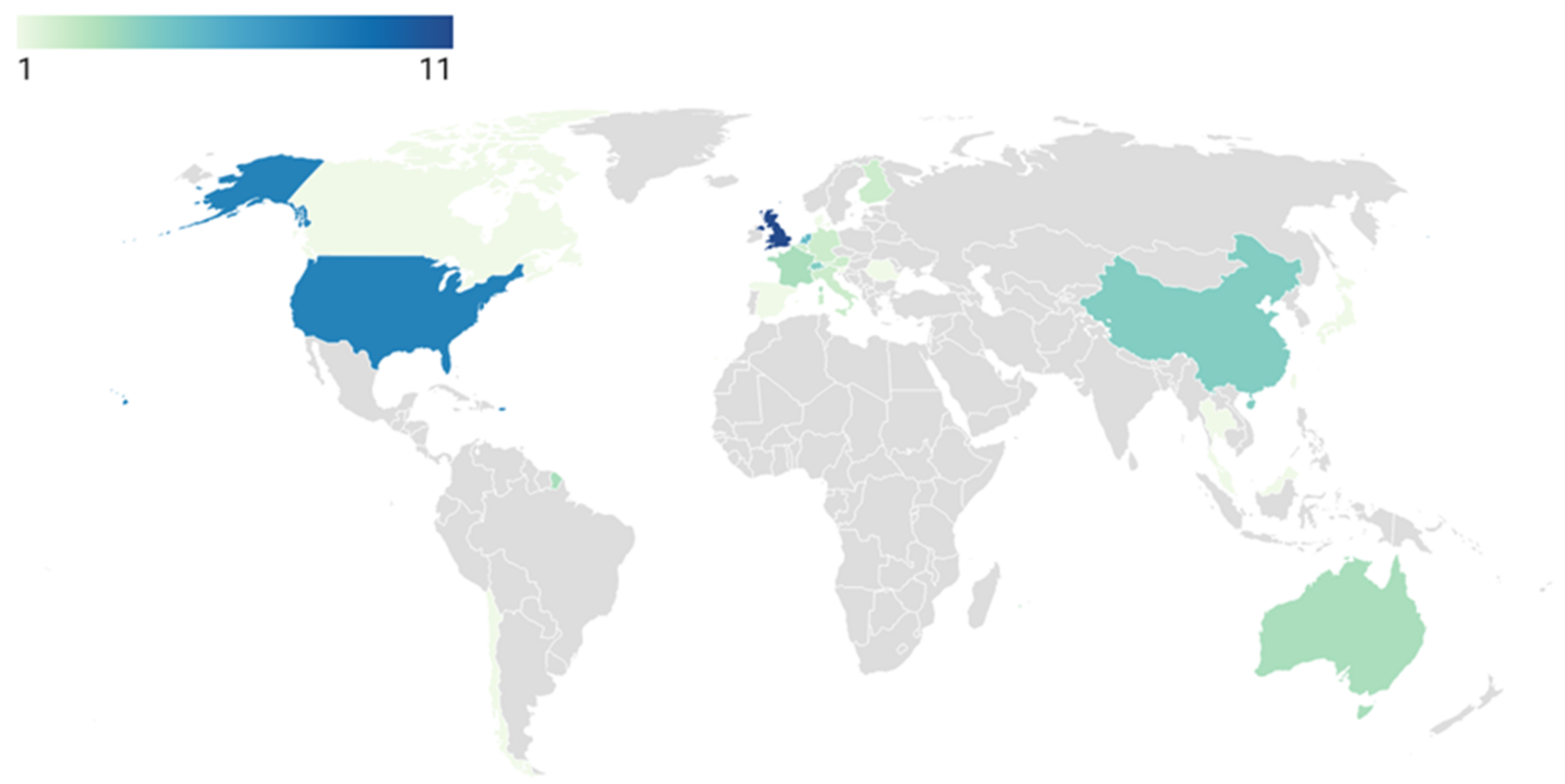

4.1.2. Distribution of Scientific Production

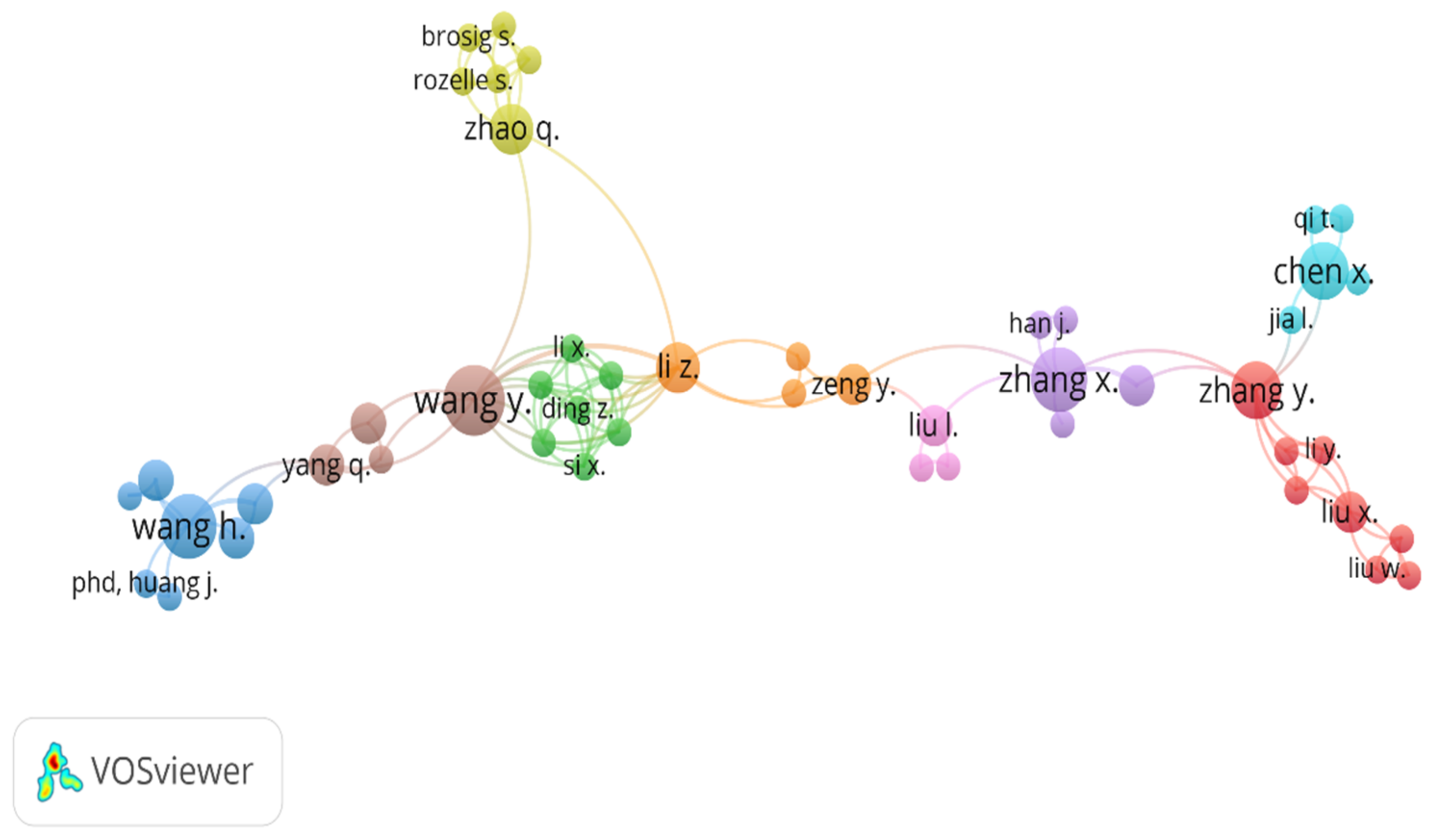

4.2. Content Analysis

4.2.1. Research Trends

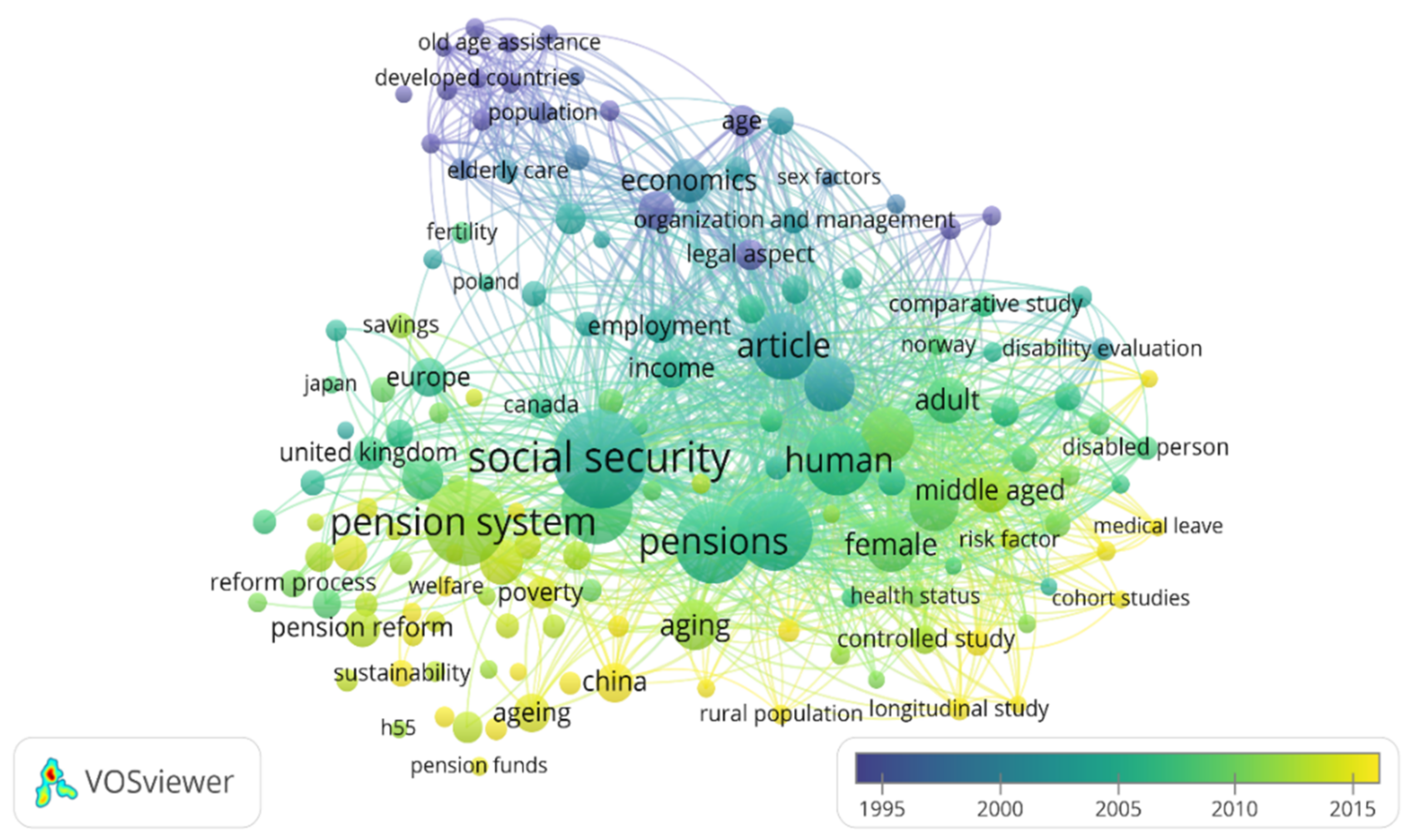

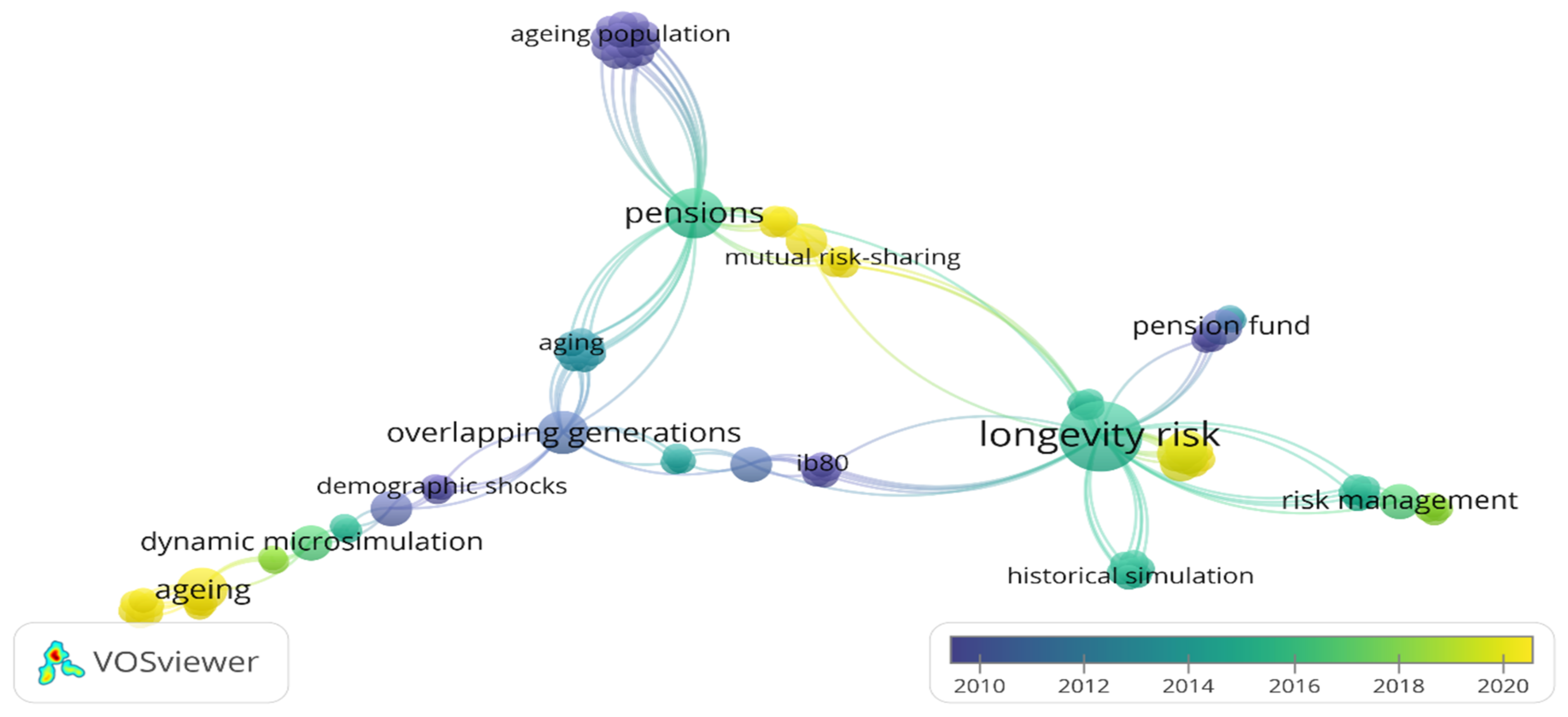

4.2.2. Keywords

4.3. Results in the Mathematics Area

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alonso-García, J.; Rosado-Cebrian, B. Financial crisis and pension reform in Spain: The effect of labour market dynamics. J. Econ. Policy Reform 2021, 24, 201–218. [Google Scholar] [CrossRef]

- Hinrichs, K. Recent pension reforms in Europe: More challenges, new directions. An overview. Soc. Policy Adm. 2021, 55, 409–422. [Google Scholar] [CrossRef]

- Pérez-Salamero González, J.M.; Regúlez-Castillo, M.; Vidal-Meliá, C. Differences in Life Expectancy Between Self-Employed Workers and Paid Employees when Retirement Pensioners: Evidence from Spanish Social Security Records. Eur. J. Popul. 2021, 37, 697–725. [Google Scholar] [CrossRef] [PubMed]

- Valls Martínez, M.d.C.; Cruz Rambaud, S.; Abad Segura, E. Savings operations over random periods. Cogent Bus. Manag. 2018, 5, 1515572. [Google Scholar] [CrossRef]

- Symeonidis, G.; Tinios, P.; Xenos, P. Enhancing Pension Adequacy While Reducing the Fiscal Budget and Creating Essential Capital for Domestic Investments and Growth: Analysing the Risks and Outcomes in the Case of Greece. Risks 2020, 9, 8. [Google Scholar] [CrossRef]

- Weaver, R.K. The politics of pensions: Lessons from abroad. In Framing the Social Security Debate; National Academy of Social Insurance: Washington, DC, USA, 1998; pp. 183–229. [Google Scholar]

- Wolf, I.; Lopez del Rio, L.C.y. The Expectation for Pension Insurance in Funded Schemes: Theoretical Model and Global Implementation. Acad. J. Interdiscip. Stud. 2021, 10, 161. [Google Scholar] [CrossRef]

- Ebbinghaus, B. The varieties of pension governance. In Pension Privatization in Europe; Oxford University Press: Oxford, UK, 2011. [Google Scholar]

- Möhring, K. Employment histories and pension incomes in Europe: A multilevel analysis of the role of institutional factors. Eur. Soc. 2015, 17, 3–26. [Google Scholar] [CrossRef]

- Hammond, R.; Baxter, S.; Bramley, R.; Kakkad, A.; Mehta, S.; Sadler, M. Considerations on State Pension Age in the United Kingdom. Br. Actuar. J. 2016, 21, 165–203. [Google Scholar] [CrossRef]

- Wang, X.; Williamson, J.B.; Cansoy, M. Developing countries and systemic pension reforms: Reflections on some emerging problems. Int. Soc. Secur. Rev. 2016, 69, 85–106. [Google Scholar] [CrossRef]

- Febrero, E.; Cadarso, M.Á. Pay-As-You-Go versus funded systems. Some critical considerations. Rev. Polit. Econ. 2006, 18, 335–357. [Google Scholar] [CrossRef]

- Fernández López, S.; Vivel Búa, M.; Otero González, L.; Rodeiro Pazos, D. El ahorro para la jubilación en la UE: Un análisis de sus determinantes. Rev. Econ. Mund. 2012, 31, 111–135. [Google Scholar]

- Hira, T.K.; Rock, W.L.; Loibl, C. Determinants of retirement planning behaviour and differences by age. Int. J. Consum. Stud. 2009, 33, 293–301. [Google Scholar] [CrossRef]

- Pan, G.; Li, S.; Geng, Z.; Zhan, K. Do Social Pension Schemes Promote the Mental Health of Rural Middle-Aged and Old Residents? Evidence From China. Front. Public Health 2021, 9, 710128. [Google Scholar] [CrossRef]

- Lee, S.-L.; Park, M.-H.; Montalto, C.P. The effect of family life cycle and financial management practices on household saving patterns. Int. J. Hum. Ecol. 2000, 1, 79–93. [Google Scholar]

- Fontes, A. Differences in the likelihood of ownership of retirement saving assets by the foreign and native-born. J. Fam. Econ. Issues 2011, 32, 612–624. [Google Scholar] [CrossRef]

- Harrysson, L.; Montesino, N.; Werner, E. Preparations for retirement in Sweden: Migrant perspectives. Crit. Soc. Policy 2016, 36, 531–550. [Google Scholar] [CrossRef]

- Díaz Casero, J.C.; Fernández Portillo, A.; Sánchez Escobedo, M.C.; Hernández Mogollón, R. Estructura intelectual del fracaso empresarial. Faedpyme Int. Rev. 2014, 3, 43–55. [Google Scholar] [CrossRef]

- Shi, Y.; Li, X. An overview of bankruptcy prediction models for corporate firms: A systematic literature review. Intang. Cap. 2019, 15, 114–127. [Google Scholar] [CrossRef]

- Li, H.; Yu, J.-L.; Yu, L.-A.; Sun, J. The clustering-based case-based reasoning for imbalanced business failure prediction: A hybrid approach through integrating unsupervised process with supervised process. Int. J. Syst. Sci. 2014, 45, 1225–1241. [Google Scholar] [CrossRef]

- Payán-Sánchez, B.; Belmonte-Ureña, L.J.; Plaza-úbeda, J.A.; Vazquez-Brust, D.; Yakovleva, N.; Pérez-Valls, M. Open innovation for sustainability or not: Literature reviews of global research trends. Sustainability 2021, 13, 1136. [Google Scholar] [CrossRef]

- Merigó, J.M.; Yang, J.-B. A bibliometric analysis of operations research and management science. Omega 2017, 73, 37–48. [Google Scholar] [CrossRef]

- Snyder, H. Literature review as a research methodology: An overview and guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Pak, T.-Y. What are the effects of expanding social pension on health? Evidence from the Basic Pension in South Korea. J. Econ. Ageing 2021, 18, 100287. [Google Scholar] [CrossRef]

- Ronne-Engström, E.; Alexanderson, K.; Friberg, E. Sickness absence, disability pension and economic situation after a spontaneous subarachnoid haemorrhage among people of working age: A Swedish longitudinal nationwide cohort study. BMJ Open 2021, 11, e040941. [Google Scholar] [CrossRef] [PubMed]

- Samsuddin, S. Are There Adequate Benefits and Contributions for SOCSO’s Invalidity Pension Scheme (I.P.S.)? ASM Sci. J. 2021, 16, 1–7. [Google Scholar] [CrossRef]

- Valls Martínez, M.d.C.; Martín Cervantes, P.A.; Soriano Román, R. Public Management Resources of the NHS. In Global Encyclopedia of Public Administration, Public Policy, and Governance; Springer: Cham, Switzerland, 2021; pp. 1–7. [Google Scholar] [CrossRef]

- Okulicz-Kozaryn, A.; Morawski, L. A similar effect of volunteering and pensions on subjective wellbeing of elderly. Econ. Sociol. 2021, 14, 11–39. [Google Scholar] [CrossRef]

- Yasuoka, M. How should a government finance pension benefits? Aust. Econ. Pap. 2021, 60, 138–152. [Google Scholar] [CrossRef]

- Owadally, I.; Ram, R.; Regis, L. An analysis of the Dutch-style pension plans proposed by UK policy-makers. J. Soc. Policy 2021, 1–21. [Google Scholar] [CrossRef]

- Fong, J.H.; Piggott, J.; Sherris, M. Longevity selection and liabilities in public sector pension funds. J. Risk Insur. 2015, 82, 33–64. [Google Scholar] [CrossRef]

- Komp, K.; Johansson, S. Population ageing in a lifecourse perspective: Developing a conceptual framework. Ageing Soc. 2016, 36, 1937–1960. [Google Scholar] [CrossRef]

- Martin, L.G. Demography and aging. In Handbook of Aging and the Social Sciences; Binstock, R.H., George, L.K., Eds.; Academy Press: London, UK, 2010; pp. 33–45. ISBN 978-0-12-380880-6. [Google Scholar]

- Okulicz-Kozaryn, A.; Morawski, L. Effect of Volunteering and Pensions on Subjective Wellbeing of Elderly—Are there Cross-Country Differences? Appl. Res. Qual. Life 2021, 16, 1943–1959. [Google Scholar] [CrossRef]

- Balsameda, M.; Melguizo, A.; Taguas, D. Las reformas necesarias en el sistema de pensiones contributivas en España. Moneda Crédito 2006, 222, 313–340. [Google Scholar]

- Ni, S.; Podgursky, M. How Teachers Respond to Pension System Incentives: New Estimates and Policy Applications. J. Labor Econ. 2016, 34, 1075–1104. [Google Scholar] [CrossRef]

- Danzer, A.M.; Dolton, P.; Bondibene, C.R. Who wins? Evaluating the impact of U.K. public sector pension scheme reforms. Natl. Inst. Econ. Rev. 2016, 237, R38–R46. [Google Scholar] [CrossRef][Green Version]

- Disney, R. Pension reform in the United Kingdom: An economic perspective. Natl. Inst. Econ. Rev. 2016, 237, R6–R12. [Google Scholar] [CrossRef]

- Clark, R.L.; Hanson, E.; Mitchell, O.S. Lessons for public pensions from Utah’s move to pension choice. J. Pension Econ. Financ. 2016, 15, 285–310. [Google Scholar] [CrossRef]

- Farrell, J.; Shoag, D. Asset management in public DB and non-DB Pension Plans. J. Pension Econ. Financ. 2016, 15, 379–406. [Google Scholar] [CrossRef]

- Lewis, G.B.; Stoycheva, R.L. Does Pension Plan Structure Affect Turnover Patterns? J. Public Adm. Res. Theory 2016, 26, 787–799. [Google Scholar] [CrossRef]

- Platanakis, E.; Sutcliffe, C. Pension Scheme Redesign and Wealth Redistribution Between the Members and Sponsor: The U.S.S. Rule Change in October 2011. Insur. Math. Econ. 2016, 69, 14–28. [Google Scholar] [CrossRef][Green Version]

- Boldrin, M.; Dolado, J.J.; Jimeno, J.F.; Peracchi, F. The future of pension systems in Europe. Econ. Policy 1999, 29, 286–323. [Google Scholar]

- Yang, Z. Population aging and public pension: The case of Beijing analysed by an OLG model. Singapore Econ. Rev. 2016, 61, 1–14. [Google Scholar] [CrossRef]

- Robertson-Rose, L. Understanding Default Behaviour in Workplace Pensions: Automatic Enrolment in the UK. J. Soc. Policy 2021, 50, 21–39. [Google Scholar] [CrossRef]

- Prattley, J.; Chandola, T. The Influence of Household Pension Wealth, Partner’s Health and Spousal Employment Status on Heterogeneous Early Retirement Transitions among Women in England. Work. Employ. Soc. 2021, 35, 57–77. [Google Scholar] [CrossRef]

- Cesaratto, S. The Economics of Pensions: A non-conventional approach. Rev. Polit. Econ. 2002, 14, 149–177. [Google Scholar] [CrossRef]

- Cesaratto, S. Transition to fully funded pension schemes: A non-orthodox criticism. Cambridge J. Econ. 2006, 30, 33–48. [Google Scholar] [CrossRef]

- Van Praag, B.M.S.; Hop, J.P. Demography and provisions for retirement: The pension composition, a behavioral approach. J. Demogr. Econ. 2021, 87, 1–31. [Google Scholar] [CrossRef]

- Harris, M.N.; Loundes, J.; Webster, E. Determinants of Household Saving in Australia. Econ. Rec. 2002, 78, 207–233. [Google Scholar] [CrossRef]

- Huberman, G.; Iyengar, S.S.; Jiang, W. Defined contribution pension plans: Determinants of participation and contributions rates. J. Financ. Serv. Res. 2007, 31, 1–32. [Google Scholar] [CrossRef]

- Miti, J.J.; Perkiö, M.; Metteri, A.; Atkins, S. Pension coverage extension as social innovation in Zambia: Informal economy workers’ perceptions and needs. Int. Soc. Secur. Rev. 2021, 74, 29–53. [Google Scholar] [CrossRef]

- Wang, H.; Huang, J. How Can China’s Recent Pension Reform Reduce Pension Inequality? J. Aging Soc. Policy 2021, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Rahman, M.; Khan, T.I.; Sabbih, M.A. An Estimation of the Implementation Costs and Financing Options for Introducing a Universal Pension Scheme in Bangladesh. South Asia Econ. J. 2021, 22, 110–131. [Google Scholar] [CrossRef]

- Wang, Q.; Timonen, V. Retirement pathways and pension inequality in China: A grounded theory study. Int. J. Sociol. Soc. Policy 2021, 41, 96–111. [Google Scholar] [CrossRef]

- Forman, J.B. Removing the legal impediments to offering lifetime annuities in pension plans. Conn. Insur. Law J. 2016, 23, 31–141. [Google Scholar]

- Winter, P.; Planchet, F. Modern tontines as a pension solution: A practical overview. Eur. Actuar. J. 2021, 1–30. [Google Scholar] [CrossRef]

- Merigo, J.M.; Blanco-Mesa, F.; Gil-Lafuente, A.M.; Yager, R.R. Thirty years of the International Journal of Intelligent Systems: A bibliometric review. Int. J. Intell. Syst. 2017, 32, 526–554. [Google Scholar] [CrossRef]

- Zambrano Farias, F.; Valls Martínez, M.d.C.; Martín-Cervantes, P.A. Explanatory Factors of Business Failure: Literature Review and Global Trends. Sustainability 2021, 13, 10154. [Google Scholar] [CrossRef]

- Li, Z.C.; Huang, H.J.; Yang, H. Fifty years of the bottleneck model: A bibliometric review and future research directions. Transp. Res. Part B Methodol. 2020, 139, 311–342. [Google Scholar] [CrossRef]

- Small, H. Visualizing science by citation mapping. J. Am. Soc. Inf. Sci. 1999, 50, 799–813. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. Science mapping software tools: Review, analysis, and cooperative study among tools. J. Am. Soc. Inf. Sci. Technol. 2011, 62, 1382–1402. [Google Scholar] [CrossRef]

- Castillo-Vergara, M.; Alvarez-Marin, A.; Placencio-Hidalgo, D. A bibliometric analysis of creativity in the field of business economics. J. Bus. Res. 2018, 85, 1–9. [Google Scholar] [CrossRef]

- Jeong, D.; Koo, Y. Analysis of Trend and Convergence for Science and Technology using the VOSviewer. Int. J. Contents 2016, 12, 54–58. [Google Scholar] [CrossRef]

- Cobo, M.J.; López Herrera, A.G.; Herrera Viedma, E.; Herrera, F. SciMAT: A new Science Mapping Analysis Software Tool. J. Am. Soc. Inf. Sci. Technol. 2012, 63, 1609–1630. [Google Scholar] [CrossRef]

- Da Silva Pereira, R.; de Resende, L.M.M.; Betim, L.M.; Bonatto, F.; von Agner, T. Systematic Bibliometric Analysis of Horizontal Network of Enterprises. IFAC-PapersOnLine 2015, 48, 1821–1826. [Google Scholar] [CrossRef]

- Sweileh, W.M. Research trends on human trafficking: A bibliometric analysis using Scopus database. Global. Health 2018, 14, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Dupleix, M.D.; Rébori, A. Strategy and turnaround in declining firms: A literature review of the past 15 years. Estud. Gerenciales 2017, 33, 141–152. [Google Scholar] [CrossRef]

- Moed, H.; De Bruin, R.; Van Leeuwen, T.H. New bibliometric tools for the assessment of national research performance: Database description, overview of indicators and first applications. Scientometrics 1995, 33, 381–422. [Google Scholar] [CrossRef]

- León-gómez, A.; Ruiz-palomo, D.; Fernández-gámez, M.A.; García-revilla, M.R. Sustainable Tourism Development and Economic Growth: Bibliometric Review and Analysis. Sustainability 2021, 13, 2270. [Google Scholar] [CrossRef]

- López Núñez, J.A.; López-Belmonte, J.; Moreno-Guerrero, A.-J.; Ramos Navas-Parejo, M.; Hinojo-Lucena, F.-J. Education and diet in the scientific literature: A study of the productive, structural, and dynamic development in web of science. Sustainability 2020, 12, 4838. [Google Scholar] [CrossRef]

- Terán-Yépez, E.; Marín-Carrillo, G.M.; del Pilar Casado-Belmonte, M.; de las Mercedes Capobianco-Uriarte, M. Sustainable entrepreneurship: Review of its evolution and new trends. J. Clean. Prod. 2020, 252, 1–21. [Google Scholar] [CrossRef]

- Shah, S.H.H.; Lei, S.; Ali, M.; Doronin, D.; Hussain, S.T. Prosumption: Bibliometric analysis using HistCite and VOSviewer. Kybernetes 2019, 49, 1020–1045. [Google Scholar] [CrossRef]

- Raghav, R.S.; Pothula, S.; Vengattaraman, T.; Ponnurangam, D. A survey of data visualisation tools for analysing large volume of data in big data platform. In Proceedings of the 2016 International Conference on Communication and Electronics Systems (ICCES), Coimbatore, India, 21–22 October 2016; pp. 1–6. [Google Scholar]

- Caldarelli, G.; Ellul, J. Trusted Academic Transcripts on the Blockchain: A Systematic Literature Review. Appl. Sci. 2021, 11, 1842. [Google Scholar] [CrossRef]

- Kraus, S.; Li, H.; Kang, Q.; Westhead, P.; Tiberius, V. The sharing economy: A bibliometric analysis of the state-of-the-art. Int. J. Entrep. Behav. Res. 2020, 26, 1769–1786. [Google Scholar] [CrossRef]

- Fogel, R.W.; Costa, D.L. A theory of technophysio evolution, with some implications for forecasting population, health care costs, and pension costs. Demography 1997, 34, 49–66. [Google Scholar] [CrossRef] [PubMed]

- Mykletun, A.; Overland, S.; Dahl, A.A.; Krokstad, S.; Bjerkeset, O.; Glozier, N.; Aarø, L.E.; Prince, M. A population-based cohort study of the effect of common mental disorders on disability pension awards. Am. J. Psychiatry 2006, 163, 1412–1418. [Google Scholar] [CrossRef] [PubMed]

- Brown, J.R. Private pensions, mortality risk, and the decision to annuitise. J. Public Econ. 2001, 82, 29–62. [Google Scholar] [CrossRef]

- Hari, N.; De Waegenaere, A.; Melenberg, B.; Nijman, T.E. Longevity risk in portfolios of pension annuities. Insur. Math. Econ. 2008, 42, 505–519. [Google Scholar] [CrossRef]

- Chen, Z.; Li, Z.; Zeng, Y.; Sun, J. Asset allocation under loss aversion and minimum performance constraint in a DC pension plan with inflation risk. Insur. Math. Econ. 2017, 75, 137–150. [Google Scholar] [CrossRef]

- De la Croix, D.; Pierrard, O.; Sneessens, H.R. Aging and pensions in general equilibrium: Labor market imperfections matter. J. Econ. Dyn. Control 2013, 37, 104–124. [Google Scholar] [CrossRef]

- Zhao, X. A scientometric review of global BIM research: Analysis and visualisation. Autom. Constr. 2017, 80, 37–47. [Google Scholar] [CrossRef]

| Data | Pension Research |

|---|---|

| Number of articles | 1287 |

| Number of journals | 536 |

| Number of authors | 2035 |

| Number of countries | 112 |

| Number of citations | 10663 |

| Average citations/article | 8.29 |

| Average citations/authors | 5.24 |

| Year | A | AU | AU/A | C | J | TC | TC/A |

|---|---|---|---|---|---|---|---|

| 1936–1971 | 12 | 12 | 1.00 | 3 | 11 | 0 | 0.00 |

| 1972–1976 | 24 | 26 | 1.08 | 7 | 10 | 4 | 0.17 |

| 1977–1981 | 20 | 16 | 0.80 | 4 | 11 | 125 | 6.25 |

| 1982–1986 | 28 | 37 | 1.32 | 8 | 22 | 192 | 6.86 |

| 1987–1991 | 32 | 41 | 1.28 | 11 | 26 | 153 | 4.78 |

| 1992–1996 | 42 | 64 | 1.52 | 19 | 26 | 489 | 11.64 |

| 1997–2001 | 117 | 160 | 1.37 | 26 | 68 | 1837 | 15.70 |

| 2002–2006 | 123 | 195 | 1.59 | 32 | 75 | 2260 | 18.37 |

| 2007–2011 | 227 | 401 | 1.77 | 59 | 118 | 2353 | 10.37 |

| 2012–2016 | 283 | 509 | 1.80 | 59 | 183 | 2376 | 8.40 |

| 2017–2021 | 379 | 847 | 2.23 | 73 | 222 | 874 | 0.23 |

| Journal | A | C | TC | TC/A | 1st A | Last A | TC/Y | SJR(Q) | h-Index |

|---|---|---|---|---|---|---|---|---|---|

| International Social Security Review | 122 | U.K. | 1092 | 8.95 | 1970 | 2021 | 21.41 | 0.349(Q2) | 17 |

| Journal of Pension Economics and Finance | 55 | U.K. | 483 | 8.78 | 2002 | 2021 | 25.42 | 0.501(Q2) | 12 |

| Social Security Bulletin | 33 | U.S.A. | 116 | 3.52 | 1974 | 2020 | 2.47 | 0.365(Q2) | 5 |

| Pensions | 24 | U.K. | 50 | 2.08 | 2009 | 2012 | 4.17 | - | 4 |

| Journal of Public Economics | 23 | The Netherlands | 892 | 38.78 | 1978 | 2021 | 20.74 | 3.826(Q1) | 16 |

| Journal of Ageing and Social Policy | 20 | U.S.A. | 186 | 9.3 | 1996 | 2021 | 7.44 | 0.450(Q2) | 6 |

| Ageing and Society | 18 | U.K. | 207 | 11.5 | 1989 | 2020 | 6.47 | 0.770(Q1) | 9 |

| Journal of the Economics of Ageing | 16 | The Netherlands | 87 | 5.44 | 2014 | 2021 | 12.43 | 0.529(Q2) | 6 |

| Geneva Papers on Risk and Insurance: Issues and Practice | 15 | U.S.A. | 125 | 8.33 | 1999 | 2016 | 5.68 | 0.535(Q2) | 6 |

| Insurance: Mathematics and Economics | 14 | The Netherlands | 155 | 11.07 | 2008 | 2021 | 11.92 | 1.139(Q1) | 7 |

| Country | A | TC | TC/A | 1st A | Last A | TC/Y | h-Index |

|---|---|---|---|---|---|---|---|

| U.S.A. | 244 | 3264 | 13.38 | 1972 | 2021 | 66.61 | 29 |

| U.K. | 160 | 1848 | 11.55 | 1976 | 2021 | 41.07 | 22 |

| Germany | 95 | 1263 | 13.29 | 1989 | 2021 | 39.47 | 21 |

| China | 76 | 361 | 4.75 | 2004 | 2021 | 21.24 | 11 |

| Spain | 72 | 495 | 6.88 | 1995 | 2021 | 19.04 | 11 |

| The Netherlands | 69 | 739 | 10.71 | 1990 | 2021 | 23.84 | 14 |

| France | 53 | 436 | 8.23 | 1993 | 2021 | 15.57 | 13 |

| Italy | 52 | 327 | 6.29 | 1995 | 2021 | 12.58 | 10 |

| Australia | 51 | 512 | 10.04 | 1979 | 2021 | 12.19 | 12 |

| Canada | 49 | 448 | 9.14 | 1975 | 2021 | 9.73 | 13 |

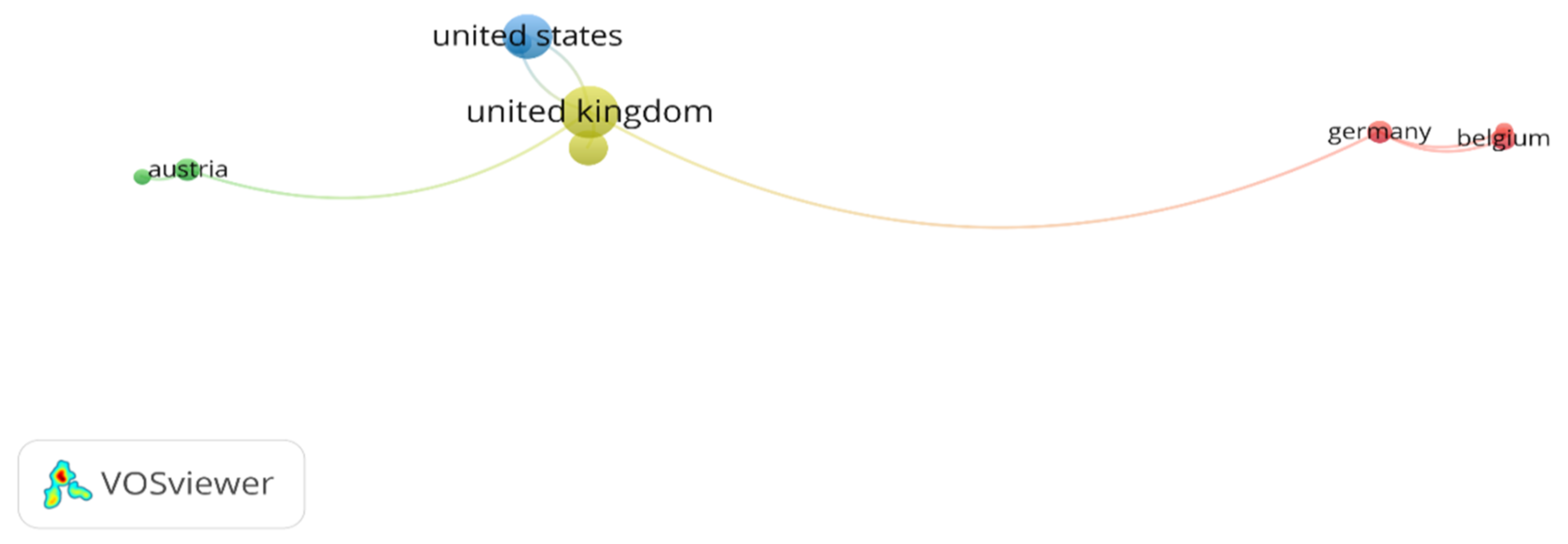

| Country | A | C | NC | Main Collaborators |

|---|---|---|---|---|

| U.S.A. | 241 | 3264 | 96 | U.K., China, Germany |

| U.K. | 160 | 1848 | 76 | U.S.A., Italy, Australia |

| Germany | 95 | 1263 | 50 | U.S.A., The Netherlands, U.K. |

| The Netherlands | 69 | 739 | 37 | Germany, Italy, U.S.A. |

| France | 53 | 436 | 36 | Belgium, U.K., Canada |

| Belgium | 26 | 254 | 31 | France, U.S.A., Germany |

| China | 76 | 361 | 30 | U.S.A., Canada, U.K. |

| Canada | 49 | 448 | 27 | U.S.A., China, France |

| Italy | 52 | 327 | 26 | U.K., The Netherlands, U.S.A. |

| Australia | 51 | 512 | 22 | U.K., U.S.A., Norway |

| Author | A | TC | TC/A | 1st A | Last A | TC/Y | h-Index | Country | Affiliation |

|---|---|---|---|---|---|---|---|---|---|

| Pestieau, P. | 12 | 169 | 14.08 | 1991 | 2012 | 5.63 | 8 | Belgium | University of Liège |

| Williamson, J.B. | 11 | 151 | 13.73 | 1993 | 2020 | 5.39 | 8 | U.S.A. | Boston College |

| Meijdam, L. | 10 | 182 | 18.20 | 1996 | 2017 | 7.28 | 6 | The Netherlands | Tilburg University |

| Vidal-Meliá, C. | 8 | 60 | 7.50 | 2012 | 2021 | 6.67 | 6 | Spain | University of Valencia |

| Casey, B.H. | 7 | 54 | 7.71 | 1998 | 2014 | 2.35 | 5 | U.K. | University of Warwick |

| Holzmann, R. | 7 | 117 | 16.71 | 1989 | 2021 | 3.66 | 5 | Austria | Austrian National Bank |

| Verbon, H.A.A. | 7 | 71 | 10.14 | 1996 | 2008 | 2.84 | 6 | The Netherlands | Tilburg University |

| Béland, D | 6 | 81 | 13.50 | 2007 | 2019 | 5.79 | 5 | Canada | University of Saskatchewan |

| Claussen, B. | 6 | 112 | 18.67 | 2007 | 2013 | 8.00 | 5 | Norway | National Institute of Public Health |

| Cremer, H. | 6 | 86 | 14.33 | 2005 | 2011 | 5.38 | 5 | France | University of Toulouse |

| Institution | Country | A | TC | TC/A | 1st A | Last A | TC/Y | h-Index |

|---|---|---|---|---|---|---|---|---|

| Tilburg University | The Netherlands | 30 | 334 | 11.13 | 1996 | 2020 | 13.36 | 9 |

| Network for Studies on Pension, Ageing, and Retirement | The Netherlands | 21 | 218 | 10.38 | 2006 | 2021 | 14.53 | 7 |

| London School of Economics and Political Science | U.K. | 18 | 388 | 21.56 | 1989 | 2021 | 12.13 | 12 |

| L’Organisation de Coopération et de Développment Economiques | France | 17 | 225 | 13.24 | 1998 | 2016 | 9.78 | 8 |

| UNSW Sydney | Australia | 16 | 134 | 8.38 | 1990 | 2021 | 4.32 | 7 |

| Université de Liège | Belgium | 15 | 143 | 9.53 | 1991 | 2020 | 4.93 | 8 |

| Boston College | U.S.A | 15 | 175 | 11.67 | 1993 | 2020 | 6.25 | 9 |

| Harvard University | U.S.A. | 14 | 336 | 24.00 | 1978 | 2019 | 7.81 | 7 |

| National Bureau of Economic Research | U.S.A. | 14 | 761 | 54.36 | 1978 | 2018 | 17.70 | 11 |

| Universidad de Valencia | Spain | 12 | 78 | 6.50 | 2004 | 2021 | 4.59 | 7 |

| Title | Author/s | Journal | T.C. | Year | T.C./Year |

|---|---|---|---|---|---|

| A theory of technophysio evolution, with some implications for forecasting population, health care costs, and pension costs | Fogel R.W., Costa D.L. | Demography | 226 | 1997 | 9.42 |

| A population-based cohort study of the effect of common mental disorders on disability pension awards | Mykletun A., Overland S., Dahl A.A., Krokstad S., Bjerkeset O., Glozier N., Aarø L.E., Prince M. | American Journal of Psychiatry | 186 | 2006 | 12.40 |

| Private pensions, mortality risk, and the decision to annuitise | Brown J.R. | Journal of Public Economics | 125 | 2001 | 6.25 |

| Population ageing and the rising cost of public pensions | Bongaarts J. | Population and Development Review | 118 | 2004 | 6.94 |

| New evidence on pensions, social security, and the timing of retirement | Samwick A.A. | Journal of Public Economics | 114 | 1998 | 4.96 |

| Ageing, pension reform, and capital flows: a multi-country simulation model | Börsch-Supan A., Ludwig A., Winter J. | Economics | 112 | 2006 | 7.47 |

| Social security and endogenous fertility: pensions and child allowances as Siamese twins | Van Groezen B., Leers T., Meijdam L. | Journal of Public Economics | 109 | 2003 | 6.06 |

| The intergenerational state education and pensions | Boldrin M., Montes A. | Review of Economic Studies | 90 | 2005 | 5.63 |

| Elephants on the move. patterns of public pension reform in OECD countries | Hinrichs K. | European Review | 87 | 2000 | 4.14 |

| Reforming pensions: principles, analytical errors, and policy directions | Barr N., Diamond P. | International Social Security Review | 84 | 2009 | 7.00 |

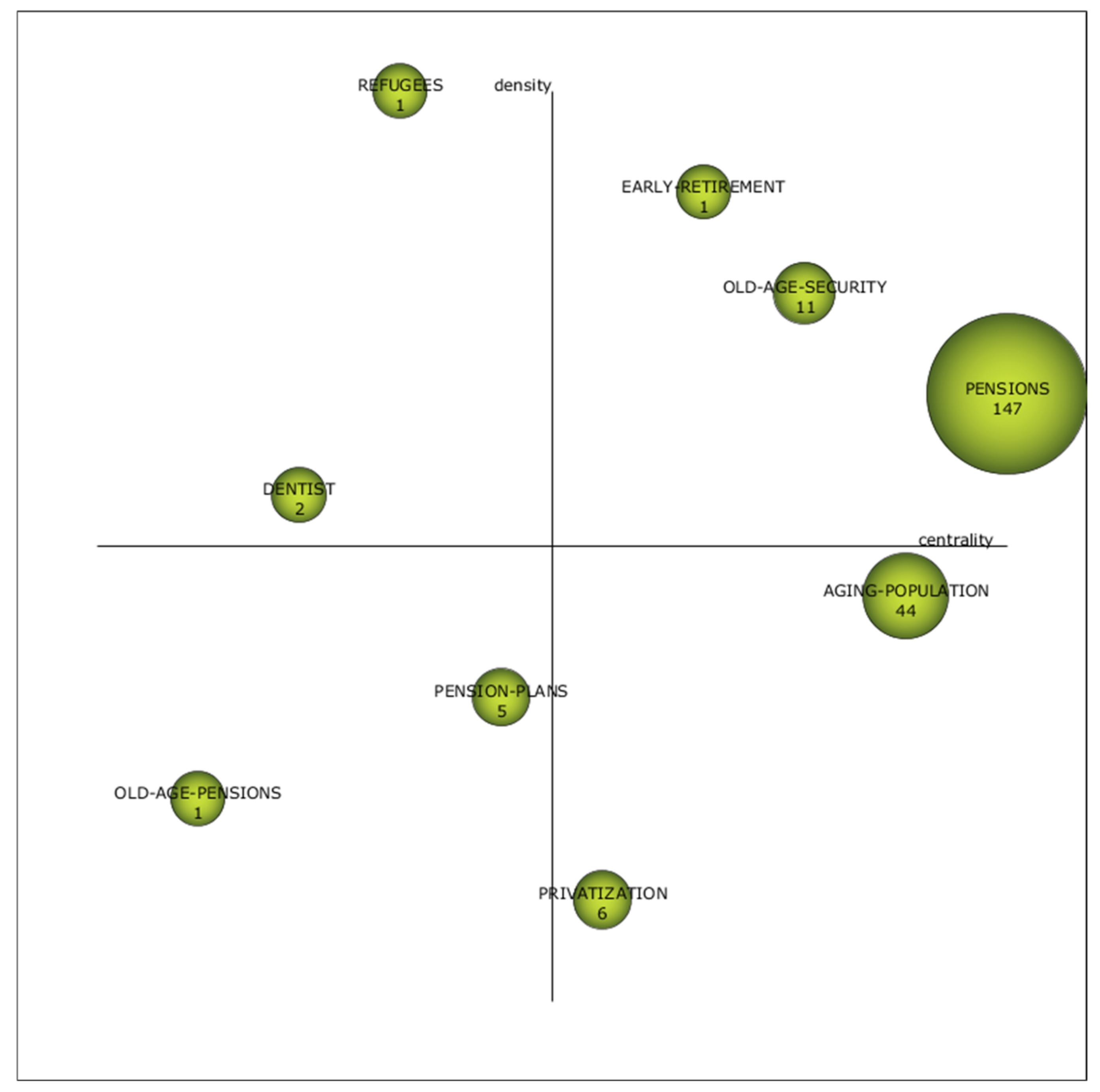

| Topics | Documents | h-Index | Citations | Centrality | Density |

|---|---|---|---|---|---|

| Pensions | 147 | 24 | 2214 | 1 | 0.67 |

| Ageing population | 44 | 13 | 528 | 0.89 | 0.44 |

| Old age security | 11 | 4 | 63 | 0.78 | 0.78 |

| Pension plans | 5 | 2 | 24 | 0.44 | 0.33 |

| Privatisation | 6 | 4 | 59 | 0.56 | 0.11 |

| Refugees | 1 | 1 | 19 | 0.33 | 1 |

| Dentist | 2 | 0 | 0 | 0.22 | 0.56 |

| Early retirement | 1 | 1 | 63 | 0.67 | 0.89 |

| Old age pensions | 1 | 1 | 1 | 0.11 | 0.22 |

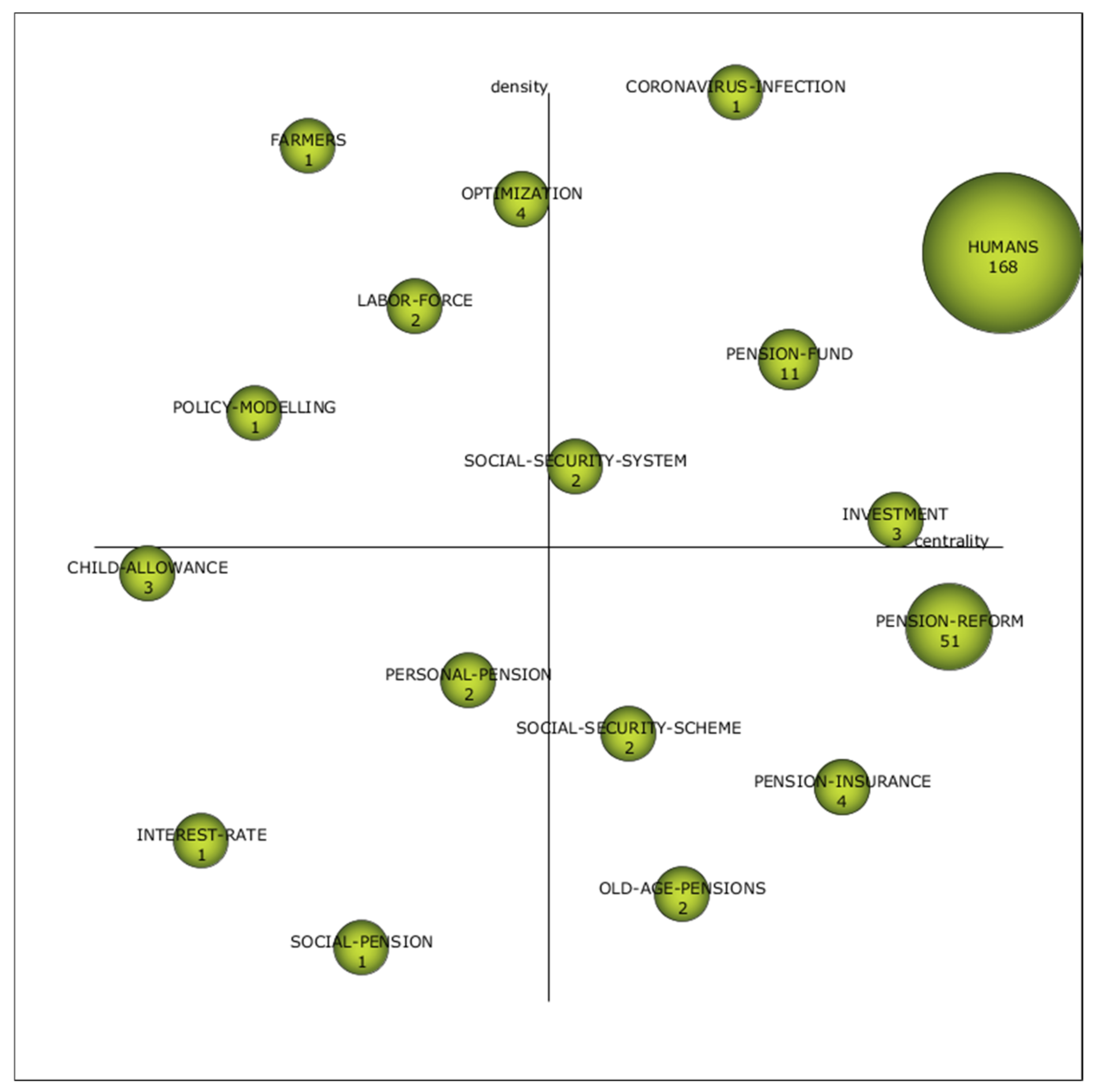

| Topics | Documents | h-Index | Citations | Centrality | Density |

|---|---|---|---|---|---|

| Humans | 168 | 16 | 1152 | 1 | 0.82 |

| Pension reform | 51 | 10 | 327 | 0.94 | 0.41 |

| Pension fund | 11 | 3 | 20 | 0.76 | 0.71 |

| Investment | 3 | 2 | 28 | 0.88 | 0.53 |

| Optimisation | 4 | 2 | 36 | 0.47 | 0.88 |

| Pension insurance | 4 | 1 | 2 | 0.82 | 0.24 |

| Labour force | 2 | 0 | 0 | 0.35 | 0.76 |

| Personal pension | 2 | 1 | 1 | 0.41 | 0.35 |

| Social security scheme | 2 | 0 | 0 | 0.59 | 0.29 |

| Child allowance | 3 | 2 | 10 | 0.06 | 0.47 |

| Social security system | 2 | 2 | 10 | 0.53 | 0.59 |

| Old age pensions | 2 | 2 | 85 | 0.65 | 0.12 |

| Farmers | 1 | 1 | 2 | 0.24 | 0.94 |

| Coronavirus infection | 1 | 0 | 0 | 0.71 | 1 |

| Policy modelling | 1 | 1 | 3 | 0.18 | 0.65 |

| Interest rate | 1 | 0 | 0 | 0.12 | 0.18 |

| Social pension | 1 | 1 | 2 | 0.29 | 0.06 |

| Data | Pension Research |

|---|---|

| Number of articles | 48 |

| Number of journals | 20 |

| Number of authors | 99 |

| Number of countries | 24 |

| Number of citations | 267 |

| Average citations/article | 5.56 |

| Average citations/authors | 2.70 |

| Journal | A | C | TC | TC/A | 1st A | Last A | TC/Y | SJR(Q) | h-Index |

|---|---|---|---|---|---|---|---|---|---|

| Insurance: Mathematics and Economics | 14 | The Netherlands | 156 | 11.14 | 2008 | 2021 | 12.00 | 1.139(Q1) | 7 |

| North American Actuarial Journal | 8 | U.K. | 18 | 2.25 | 1999 | 2021 | 0.82 | 0.936(Q2) | 2 |

| European Actuarial Journal | 4 | Switzerland | 5 | 1.25 | 2019 | 2021 | 2.5 | 0.661(Q2) | 1 |

| Journal of Economic Dynamics and Control | 3 | The Netherlands | 37 | 12.33 | 2006 | 2014 | 2.47 | 1.181(Q1) | 3 |

| Scandinavian Actuarial Journal | 3 | U.K. | 5 | 1.67 | 2006 | 2019 | 0.33 | 1.061(Q1) | 2 |

| Country | A | TC | TC/A | 1st A | Last A | TC/Y | h-Index |

|---|---|---|---|---|---|---|---|

| U.K. | 11 | 53 | 4.82 | 2010 | 2021 | 4.82 | 3 |

| U.S.A. | 8 | 26 | 3.25 | 1999 | 2021 | 1.18 | 3 |

| The Netherlands | 5 | 80 | 16.00 | 2006 | 2020 | 5.33 | 4 |

| China | 4 | 40 | 10.00 | 2012 | 2017 | 4.44 | 3 |

| Switzerland | 4 | 12 | 3.00 | 2001 | 2020 | 0.60 | 1 |

| Country | A | C | NC | Main Collaborators |

|---|---|---|---|---|

| U.K. | 11 | 52 | 5 | U.S.A., Austria, Germany |

| Germany | 2 | 25 | 3 | U.K., Belgium, Luxembourg |

| U.S.A. | 8 | 26 | 2 | U.K., Italy |

| Austria | 2 | 0 | 2 | U.K., Spain |

| Belgium | 2 | 28 | 2 | Germany, Luxembourg |

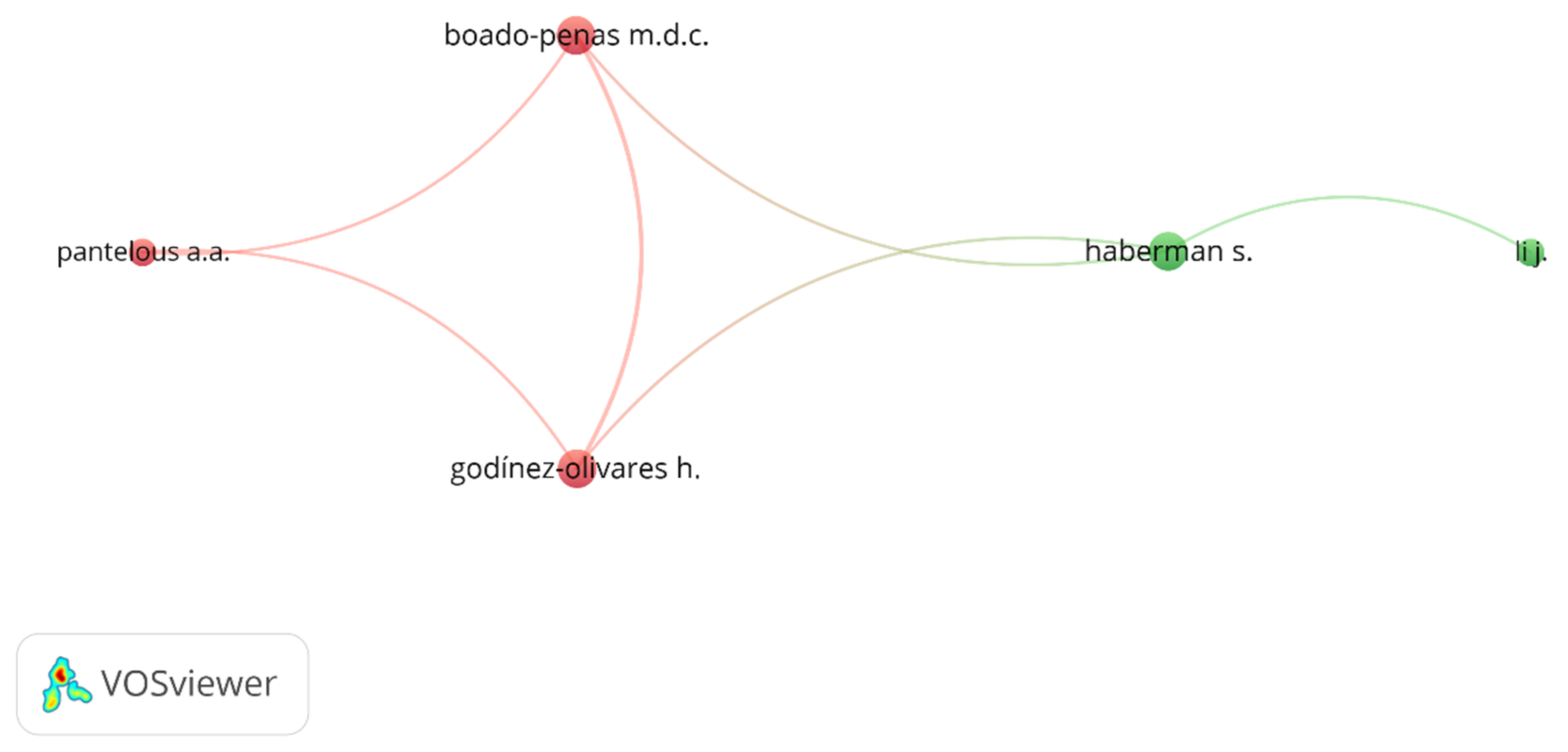

| Author | A | TC | TC/A | 1st A | Last A | TC/Y | h-Index | Country | Affiliation |

|---|---|---|---|---|---|---|---|---|---|

| De Waegenaere, A. | 2 | 68 | 34.00 | 2008 | 2010 | 5.23 | 2 | The Netherlands | Tilburg University |

| Godínez-Olivares, H. | 2 | 35 | 17.50 | 2016 | 2016 | 7.00 | 2 | U.K. | University of Liverpool |

| Haberman, S. | 2 | 30 | 15.00 | 2015 | 2016 | 5.00 | 2 | U.K. | Cass Business School |

| Kleinow, T. | 2 | 2 | 1.00 | 2019 | 2020 | 1.00 | 1 | U.K. | Heriot-Watt University |

| Melenberg, B. | 2 | 68 | 34.00 | 2008 | 2010 | 5.23 | 2 | The Netherlands | Tilburg University |

| Institution | Country | A | TC | TC/A | 1st A | Last A | TC/Y | h-Index |

|---|---|---|---|---|---|---|---|---|

| Tilburg University | The Netherlands | 3 | 75 | 25.00 | 2006 | 2010 | 5.00 | 3 |

| Heriot-Watt University | U.K. | 3 | 2 | 0.67 | 2010 | 2020 | 0.18 | 1 |

| Cass Business School | U.K. | 3 | 32 | 16.00 | 2013 | 2016 | 4.00 | 2 |

| University of Liverpool | U.K. | 3 | 36 | 13.00 | 2016 | 2020 | 7.20 | 2 |

| Network for Studies on Pension, Ageing and Retirement | The Netherlands | 3 | 75 | 25.00 | 2006 | 2010 | 5.00 | 3 |

| Title | Author/s | Journal | T.C. | Year | T.C./Year |

|---|---|---|---|---|---|

| Longevity risk in portfolios of pension annuities | Hári N., De Waegenaere A., Melenberg B., Nijman T.E. | Insurance: Mathematics and Economics | 48 | 2008 | 3.69 |

| Asset allocation under loss aversion and minimum performance constraint in a D.C. pension plan with inflation risk | Chen Z., Li Z., Zeng Y., Sun J. | Insurance: Mathematics and Economics | 25 | 2017 | 6.25 |

| Ageing and pensions in general equilibrium: labour market imperfections matter | de la Croix D., Pierrard O., Sneessens H.R. | Journal of Economic Dynamics and Control | 23 | 2013 | 2.88 |

| Longevity risk in pension annuities with exchange options: the effect of product design | Stevens R., De Waegenaere A., Melenberg B. | Insurance: Mathematics and Economics | 20 | 2010 | 1.82 |

| Optimal strategies for pay-as-you-go pension finance: a sustainability framework | Godínez-Olivares H., Boado-Penas M.D.C., Haberman S. | Insurance: Mathematics and Economics | 18 | 2016 | 3.60 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Valls Martínez, M.d.C.; Santos-Jaén, J.M.; Amin, F.-u.; Martín-Cervantes, P.A. Pensions, Ageing and Social Security Research: Literature Review and Global Trends. Mathematics 2021, 9, 3258. https://doi.org/10.3390/math9243258

Valls Martínez MdC, Santos-Jaén JM, Amin F-u, Martín-Cervantes PA. Pensions, Ageing and Social Security Research: Literature Review and Global Trends. Mathematics. 2021; 9(24):3258. https://doi.org/10.3390/math9243258

Chicago/Turabian StyleValls Martínez, María del Carmen, José Manuel Santos-Jaén, Fahim-ul Amin, and Pedro Antonio Martín-Cervantes. 2021. "Pensions, Ageing and Social Security Research: Literature Review and Global Trends" Mathematics 9, no. 24: 3258. https://doi.org/10.3390/math9243258

APA StyleValls Martínez, M. d. C., Santos-Jaén, J. M., Amin, F.-u., & Martín-Cervantes, P. A. (2021). Pensions, Ageing and Social Security Research: Literature Review and Global Trends. Mathematics, 9(24), 3258. https://doi.org/10.3390/math9243258