4.2.1. Propagation Mechanisms with a Single Factor

First, the input-output covariance is defined as:

where

refers to the

th row of the technical coefficient matrix and

and

refer to the

th and

th columns of the Leontief inverse matrix, respectively. The left-hand side of the equation is referred to as the input-output covariance because it can be expressed in the form

. Here,

can be viewed as a set of probabilities, given that

, while

,

. Like the general properties of covariance, the input-output covariance is both linear and symmetric. Following this, we present the following theorem:

Theorem 3 (Second-order propagation of microeconomic shocks with a single factor).

In the context of a production network, the second-order effect of productivity shocks with a single factor is given by:where denotes the elasticity of substitution in sector j, which measures the degree of substitution between two factors in response to changes in their relative prices. The first-order effect of the production network on microeconomic shocks is captured by the expectation of the Leontief inverse matrix, whereas the second-order effect is represented by the covariance of the Leontief inverse matrix. Next, the paper still applies the second-order effects to the three benchmark cases.

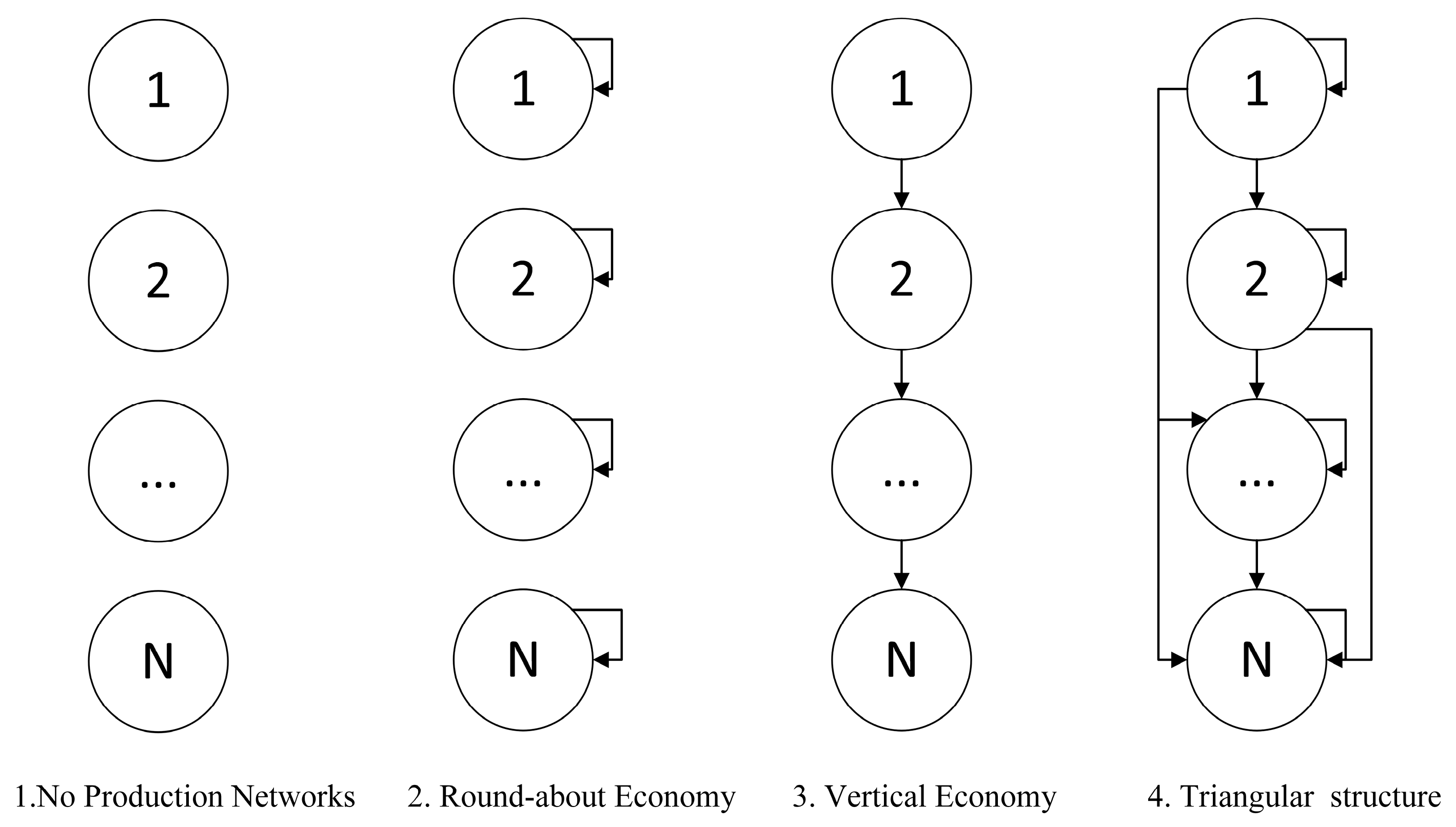

1. No Production Networks. In the case of no production network structure, the fact that A is a zero matrix leads to . Consequently, the input-output covariance is constant 0, leading to zero second-order effects. It can be concluded that the structure of the production network is a necessary condition for second-order effects under single-input factor conditions.

2. Round-about Economy. In the case where a sector utilizes intermediate goods produced by itself, the presence of the production network ensures that the second-order impact is non-zero. Substitute the technical coefficient matrix and the Leontief matrix into Equation (22) yields:

On the one hand, productivity shocks in sector have no effect on the sales share of sector since each sector operates as an independent entity. On the other hand, the productivity shock in sector influences its own sales share, and we define the network-related term as the second-order intra-sector feedback. In particular, the size of the second-order feedback effect within a sector is only times the size of the first-order effect. Consequently, the second-order effect is smaller than the first-order effect, indicating that the impact diminishes with increasing order.

3. Vertical Economy. When there is a strict upstream-downstream relationship between sectors, their first-order effects are amplified through input-output relationships, with the magnitude remaining as

. Considering the second-order effects, we substitute the technical coefficient matrix and the Leontief matrix into Equation (22) yields:

For example, for the sales share

, it is affected by shocks from both

and

, with the magnitudes of the shocks given by:

It can be concluded that, first, in the absence of a feedback structure, the response of sector ’s sales share to a shock is independent of its own sales share. Second, due to the vertical structure between sectors, where no sector acts as both an input provider and user for the same set of sectors, the sales share of sector is independent of the productivity shock in sector and further downstream sectors. For instance, the partial derivative of with respect to sector 1 shocks is equal to zero. Third, the response of to a shock does not depend on the sales share of sector and further downstream departments. For example, the partial derivatives of with respect to shocks in arbitrary sectors are independent of . In summary, the response of sales share of sector to shocks is determined by three factors: the production network structure, the elasticity of substitution, and the sales share of some downstream sectors. After excluding the intra-sectoral feedback effect, we refer to the amplification of the production network as the second-order inter-sectoral production network effect.

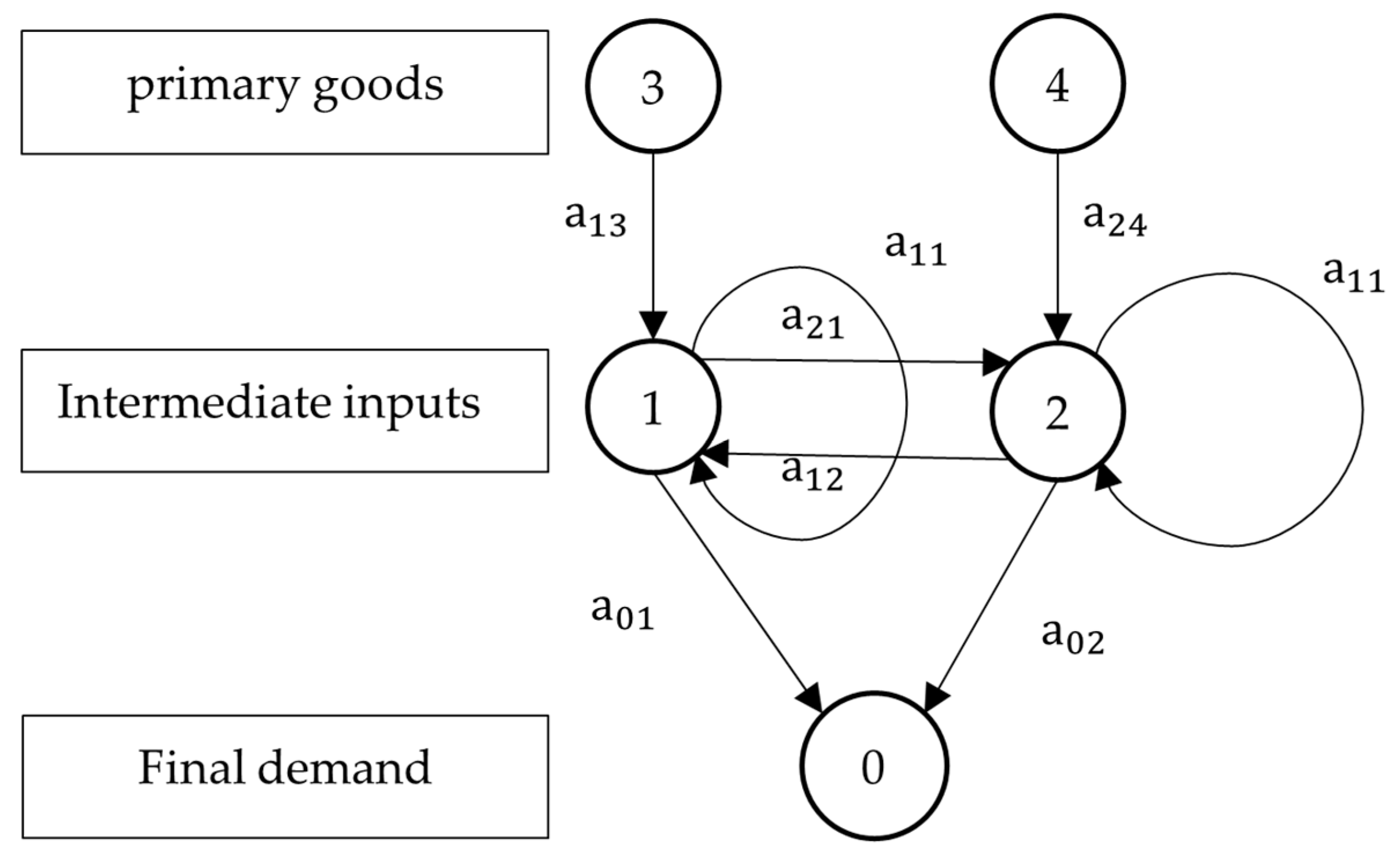

Next, we introduce the production network with a triangular structure into the second-order propagation formula for productivity shocks and analyze its propagation mechanism. The production network with a triangular structure not only contains the intra-sectoral feedback effect and inter-sectoral production network effect but also entails more complex input-output linkages between sectors. In addition, for simplification purposes, the final demand (sector 0 in

Section 3.2) was not included in the previous model. However, the influence of the final demand is explored here.

First, consider a (4 × 4) triangular production network structure comprising two production sectors, a primary factor sector, and a final demand sector, where production sector 1 is positioned downstream and production sector 2 is located upstream. The technical coefficient matrix and the Leontief inverse matrix are given by:

Thus, the second-order impact of a sectoral productivity shock is given by:

where

,

,

,

are parameters related to the structure of the production network, which can be expressed as a combination of intra-sectoral feedback effects and inter-sectoral production network effects. Unlike the previous inter-sectoral production network effect, the second-order effect of sector

on

may be amplified again by intra-sectoral feedback from sector

. Thus, the second-order effect of the inter-sectoral production network in this case is amplified due to intra-sectoral and inter-sectoral interactions. On the other hand, for the second-order effect of a productivity shock in sector

on itself, the linear component on the right-hand side of the equation, associated with its own sales share, represents the purely intra-sectoral feedback effect. Meanwhile, the linear component associated with the sales shares of other sectors is a combination of both the inter-sectoral production network effect and the intra-sectoral feedback effect.

Based on the above formula, the following important insights can be drawn: First, the second-order effects of microeconomic shocks are symmetric, due to the symmetry inherent in the covariance structure of the production network. This finding aligns with the conclusions of Baqaee and Farhi [

31]. Second, the effect of productivity shocks in sectors 1 and 2 on the sales share of sector 1 is positively proportional to

,

, the effect of productivity shocks in sector 1 on the sales share of sector 2 is proportional to

,

, and the effect of productivity shocks in sector 2 on the share of sales in sector 2 is proportional to

,

,

. As a result, the productivity shock affects the sales shares of all sectors both upstream and downstream, and the second-order effect on the macroeconomy is non-zero. In the absence of production networks, the second-order impact on the macroeconomy would remain zero. Therefore, production networks induce a second-order impact by affecting the sales shares of all sectors.

Written in a unified equation, the magnitude of the second-order impact can be expressed as:

where

is a parameter related to the structure of the production network. Changes in sectoral sales shares are related to factor substitution between sectors. Since the products of sector i are only used as intermediate inputs in the downstream sectors, only these downstream sectors can substitute for them. As a result, the change in the sales share of sector

is only related to the elasticity of substitution and sales share of its downstream sectors. Extending the above triangular production network structure to sector N, the following theorem can be obtained:

Theorem 4 (Second-order propagation of microeconomic shocks in the triangular production network structure). In the triangular production network structure, there are two important conclusions, which are as follows:

- (1)

The magnitude of the effect of a productivity shock in sectoron the sales share of sectoris always greater than 0. This magnitude depends on (i) the elasticity of substitution from sector 0 to sectorand (ii) the sales share from sector 0 to sector. The effect of a productivity shock in sectoron the sales share in sectoris simultaneously propagated upstream and downstream.

- (2)

The magnitude of the second-order impact of a productivity shock in sector depends on (i) the elasticity of substitution of sector and its downstream sectors and (ii) the sales share of sector and its downstream sectors. Additionally, the second-order impact of a productivity shock in sector propagates both upstream and downstream.

Finally, we analyze the propagation mechanism of microeconomic shocks based on the above results. We first introduce the effect of productivity shocks on product prices under a single primary input:

Thus, the second-order effects of factor productivity shocks can be rewritten as:

Thus, the first major effect of the productivity shock of sector is the price effect on each sector, which is measured by the column of the matrix. In a triangular production network, if . In this case, productivity shocks in sector only affect prices downstream. As a result, the price impact of a productivity shock is transmitted downstream. However, in the real economy, prices in the downstream sectors often exert an inverse forcing mechanism on the prices in the middle and upstream sectors. Characterizing such a forcing mechanism presents an important direction for future model development.

After the primary impact, the relative price changes induce each producer to substitute its factors, with the elasticity of substitution playing a crucial role in determining the extent of this adjustment. Assume that there are only two inputs

and

. Their sales are

and

, respectively, and the elasticity of substitution between the two inputs by the producer is

, then we have:

where the effect of elasticity of substitution on relative sales under relative price changes is summarized by

, which explains the presence of the term

in the second-order effect.

After the definition, we return to the derivation following the relative price change. Sector substitutes goods in sector l with other goods. When , a rise in the relative price of sector l implies an increase in the relative input share, leading to higher Domar weights. The magnitude of this substitutability is measured by the input-output covariance . Among this, the probability of the covariance represents the interchangeable inputs of sector , including inputs from sector ; denotes the size of price change in each sector following the productivity shock in sector k; denotes the total demand coefficient for sector in each sector. Ultimately, the effect of sector ’s productivity shock on sector ’s sales share is equal to the sum of impact from input substitution by all sectors to sector . When the input-output covariance increases, the relative relationship between sector and the prices of the sectors becomes stronger, leading to a greater input substitution of sector for sector .

Overall, the second major impact of the productivity shock in sector is a change in the share of sales in sector caused by a change in prices in each sector. The second-order impact of the productivity shock is transmitted upstream because sector substitutes for goods upstream. Combining the first and second impacts, the second-order impacts of sectoral productivity shocks are transmitted both upstream and downstream along the supply chain, so that the second-order impacts on all sectors are not zero.

In the special triangular production network case, the impact mechanism of sector ’s productivity shock on the factor income share of sector can be analyzed in detail. The first major effect influences the prices of the sector and its downstream sectors, and the second major effect arises from factor substitutions made by sector . On the one hand, sector is downstream of sector because it relies on intermediate inputs from sector , so that . On the other hand, price shocks must propagate through inputs in sector , and prices of the sector and its downstream sectors change, so sector is downstream of sector , i.e., . In all, , which is the same result as in Theorem 4. There are two conditions under which the sales share of sector contributes to the impact of the sector ’s shock on sector : (1) sector uses intermediate inputs from sector , and (2) the price of the intermediate inputs used by sector is affected by the price shock.

4.2.2. Propagation Mechanisms with Multiple Factors

In the previous section, we analyzed the second-order propagation mechanism of productivity shocks under a single primary input. However, in real-world scenarios, there are multiple factors. Next, we explore the propagation mechanism under multiple factors.

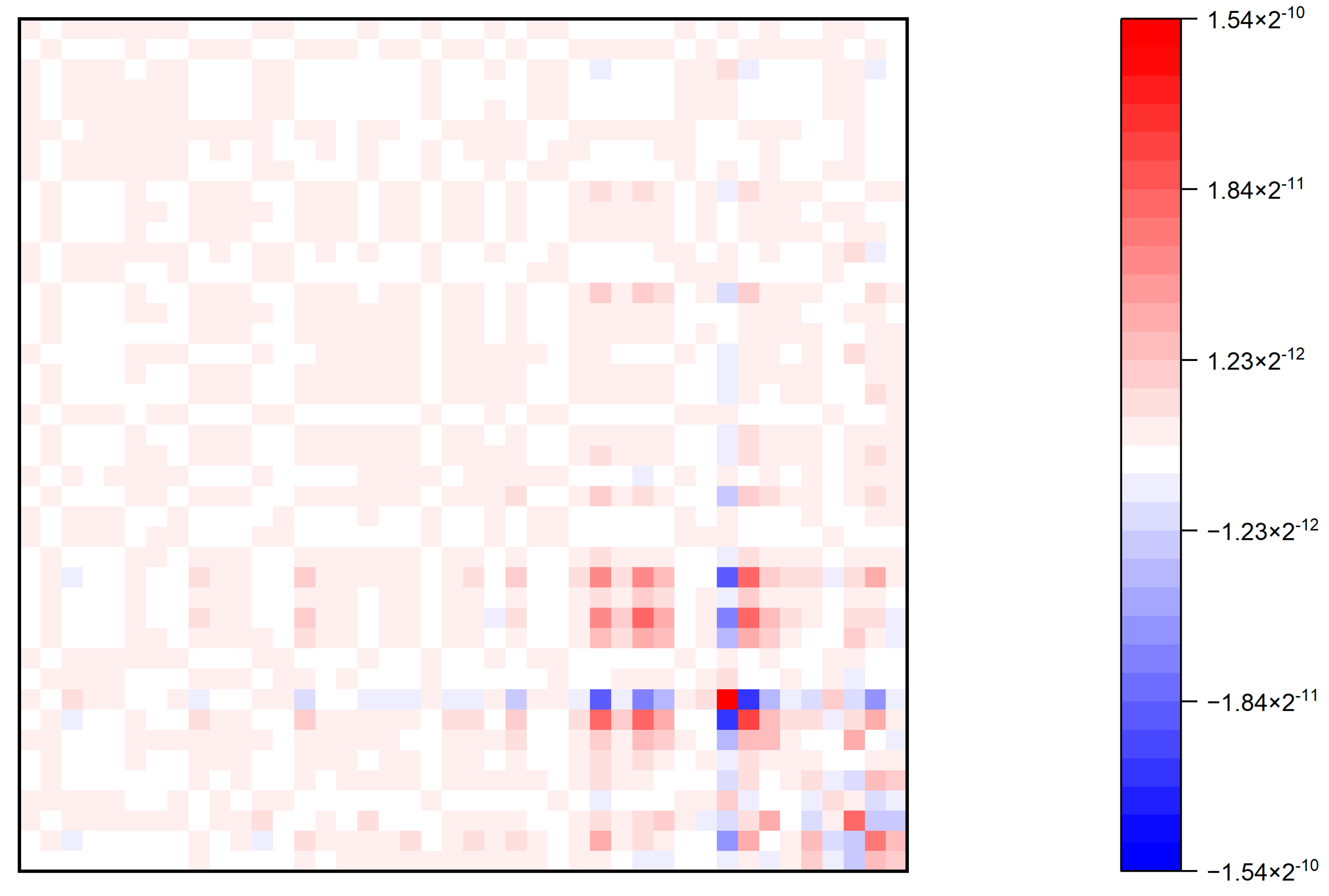

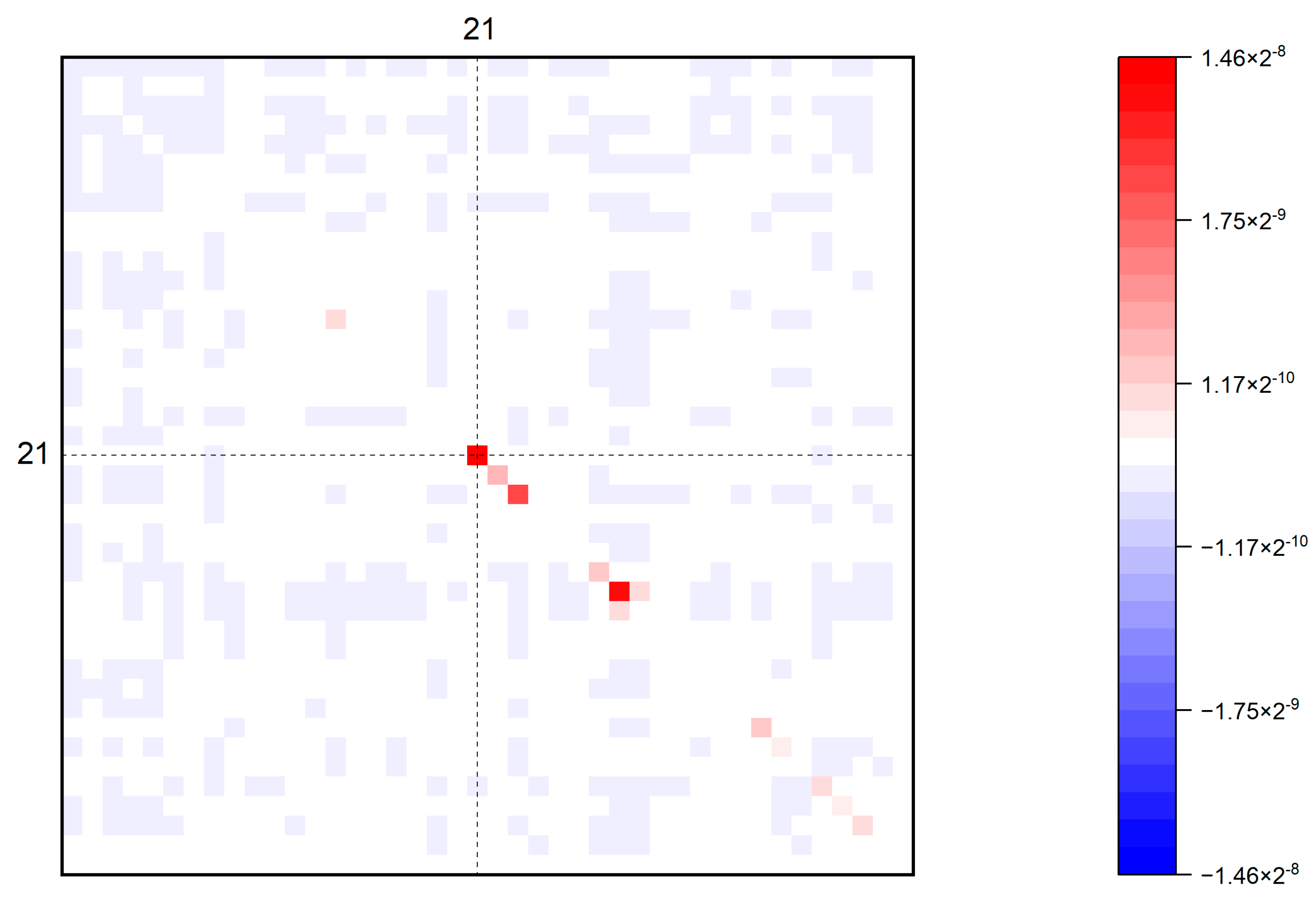

Theorem 5. The second-order impact of productivity shocks with multiple factors is:where the third equality is derived from the linear properties of the covariance operator. By replacing the sales share in the above formula with the factor income share , the impact of the productivity shock on the factor income share can be expressed as follows:which can be rewritten in matrix form as:where the elements of and are denoted by: It can be seen from the second equality of Equation (27) that the first term in the case of multiple factors is the same as that in the case of a single factor. Therefore, the propagation mechanism of this term is also transmitted both upstream and downstream, and the magnitude of the second-order influence is only related to the downstream factor income share. However, in the case of multiple primary inputs, the microeconomic productivity shock also affects the sales share through the factor reallocation effect.

Equations (28)–(31) analyze in detail the impact of productivity shocks on factor income shares. The impact comes from two sources. First, the factor income share of factor

is directly affected by the productivity shock of sector

with the magnitude determined

. When the relative price of factors is not considered, the productivity shock of sector

can be described by Equation (22). Therefore, the direct effect

without factor substitution can be obtained by just replacing the corresponding sector index

with

. The change of factor income share will cause the change of factor price. To analyze this mechanism, we introduce the relationship between factor price

and factor income proportion

as:

A change in factor prices, like a change in product prices, will further induce changes in the share of all sectors. Particularly, it will cause changes in factor income shares. Replace in Formula (22) with to represent the change in factor income shares caused by factor price changes. Changes in the factor income share in turn cause further changes in relative factor prices, and the process repeats itself. Finally, the change of factor income shares is expressed as a multidimensional fixed-point equation.

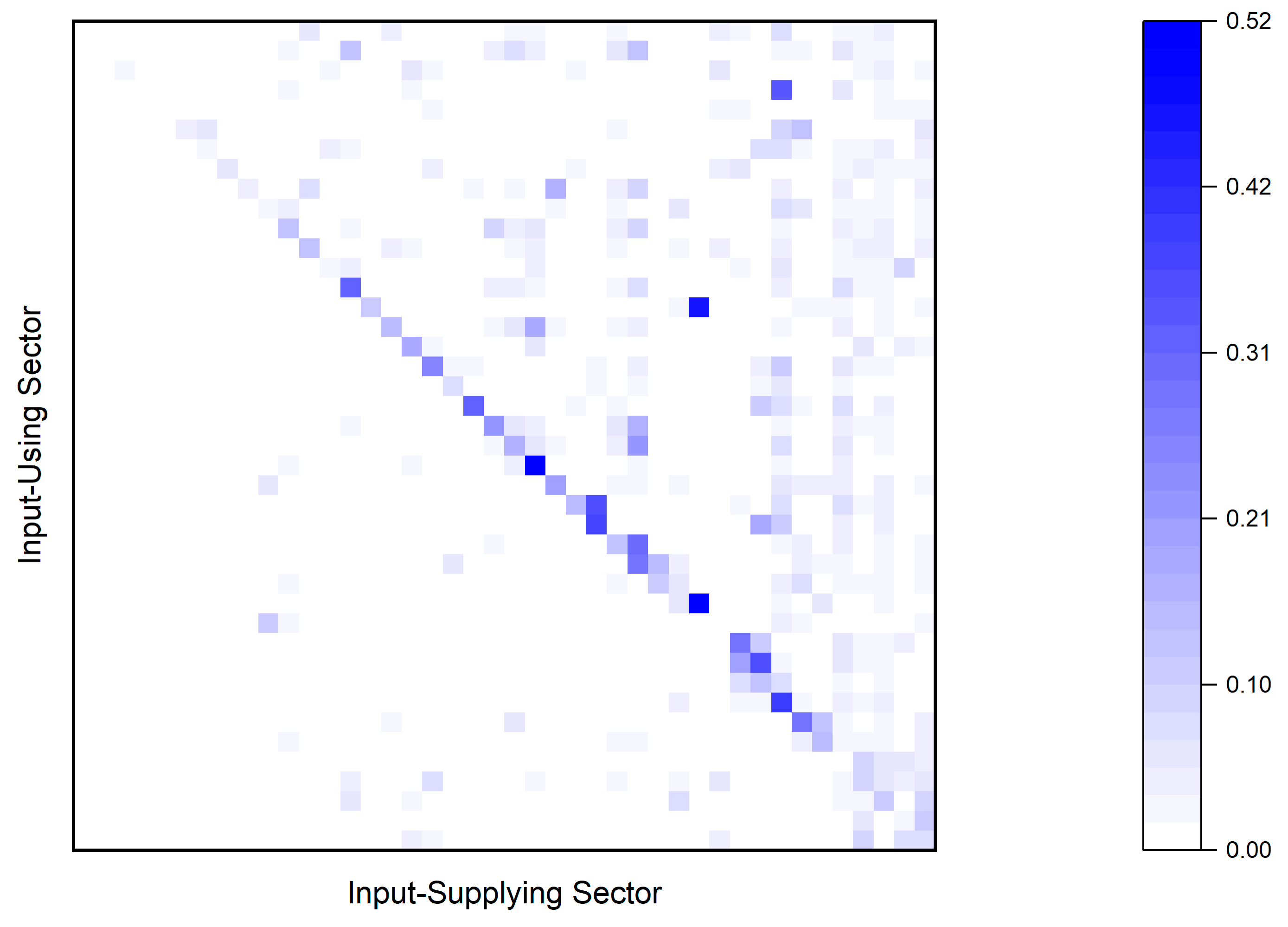

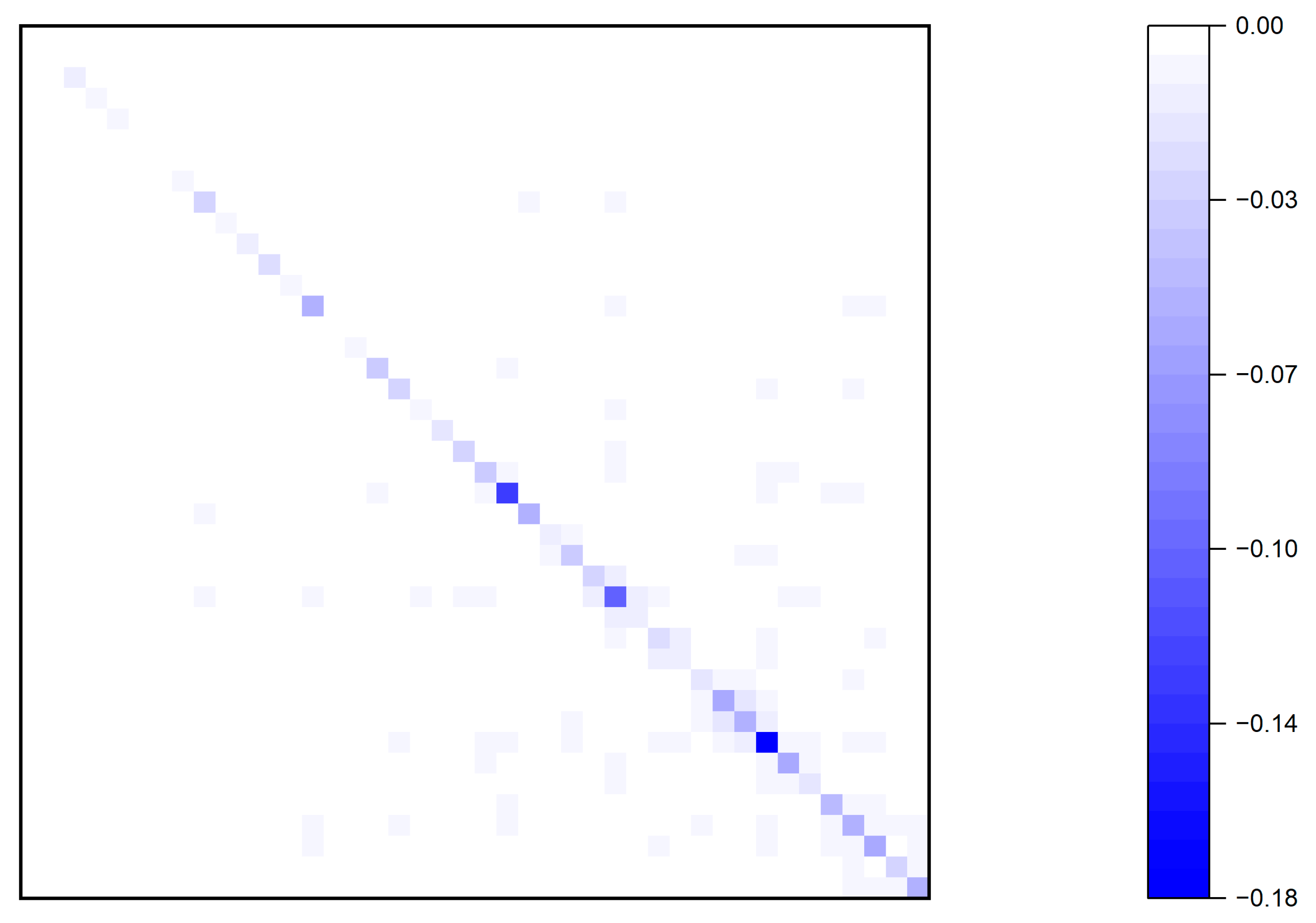

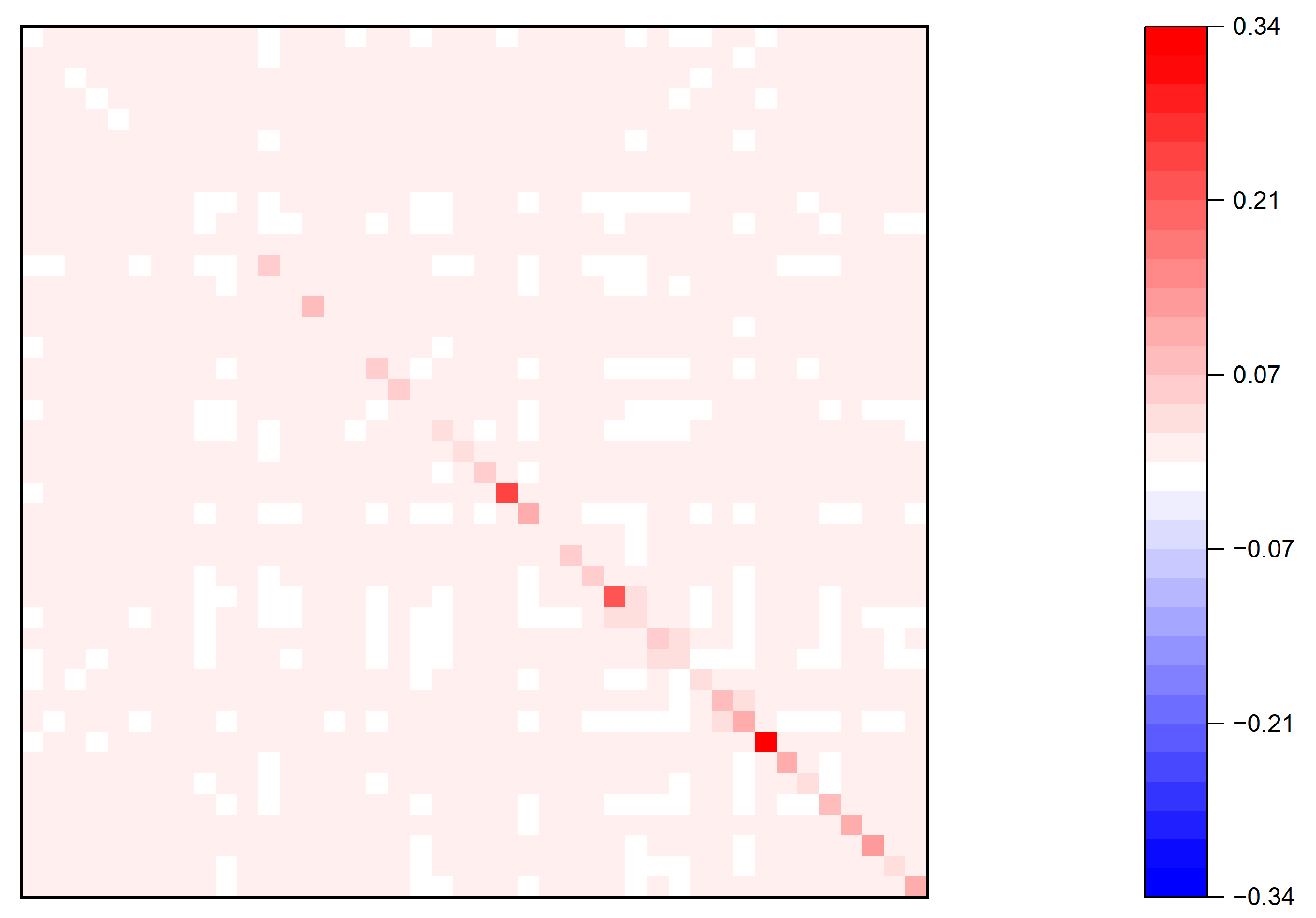

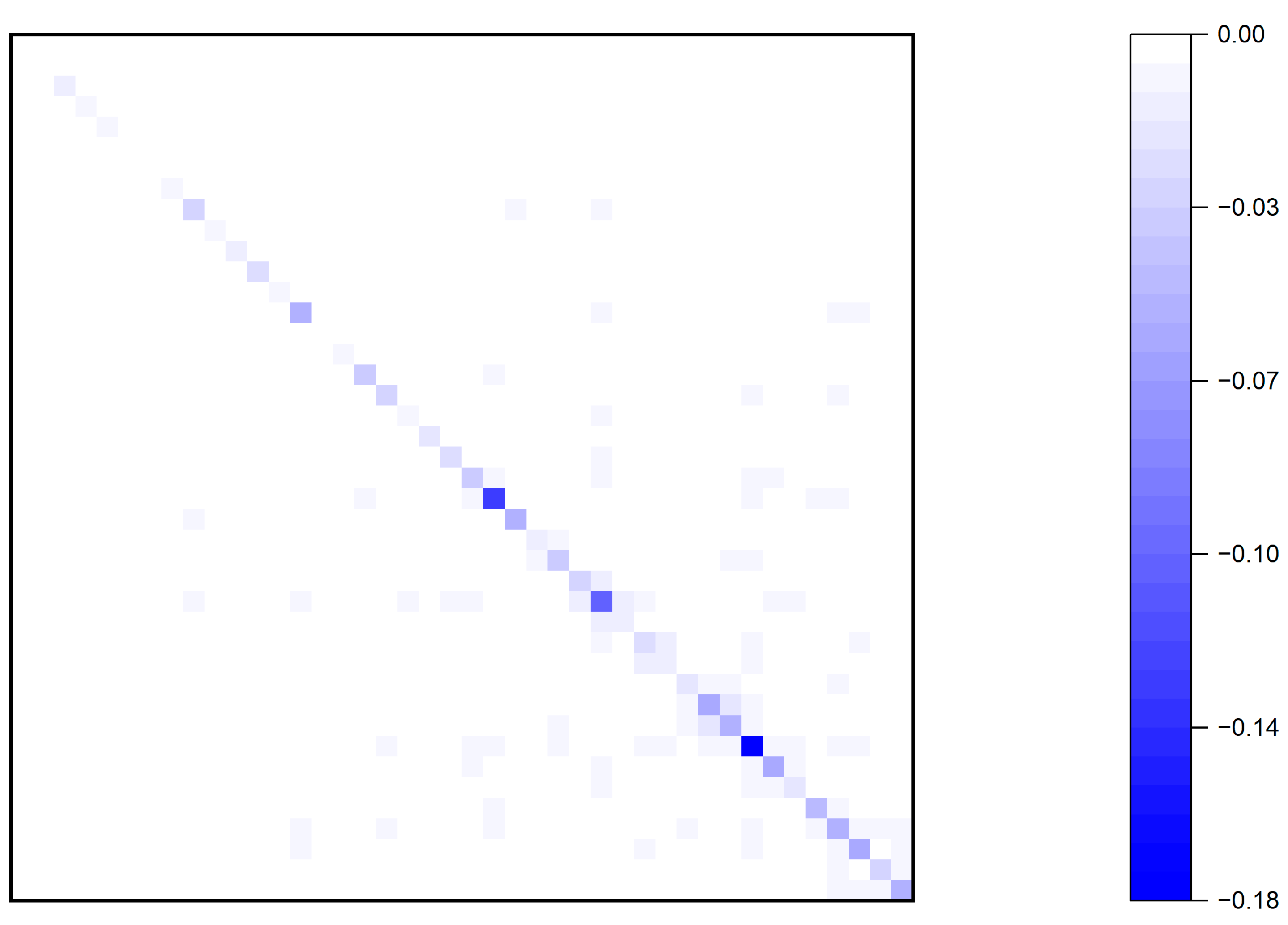

After analyzing the change in factor income shares, we now return to the change in sales shares or Domar weights in the production sectors. The change also consists of two parts (shown in

Figure 3). First, sectoral productivity shocks cause price changes in their own and in downstream sectors, inducing input substitution in more downstream sectors, which results in changes in the sales share in all sectors. Second, the productivity shock causes price changes in both the sector itself and its downstream sectors, leading to changes in factor income shares. The change in factor prices, in turn, causes changes in the prices of the product sectors that utilize the factor, which leads to input substitution in the downstream sectors, ultimately resulting in changes in the sales shares of all sectors. Changes in sectoral sales shares result from both changes in product prices and changes in factor prices. In addition, there is a feedback mechanism between changes in factor prices and changes in factor income shares. Since primary factors can be considered the most upstream sector, productivity shocks in any sector can influence factor prices.

To further analyze the pattern of shock propagation, attention should be given to the last equality of Equation (27), where the change in prices due to microeconomic shocks is:

Thus, the second-order effects of productivity shocks under multiple primary inputs can still be categorized into a twofold impact. The first impact consists of two paths: one directly through the production network, and the other by affecting factor income shares, which in turn impacts factor prices and is transmitted to the sectors that use these factors. In terms of direction, both product and factor prices are transmitted downstream, establishing a downstream propagation path. The second impact of the productivity shock mirrors that in the case of a single primary input, representing an upstream propagation path. Therefore, sectoral productivity shocks are transmitted both upstream and downstream simultaneously, ultimately leading to changes in the sales shares of all sectors.

To explore how the factor reallocation effect works, we begin with a simple case of a factor self-input structure. Assuming that there is a final demand sector, a self-input sector, and two primary factors in the economy, the corresponding direct requirements matrix and Leontief inverse Matrix are:

where

denotes the primary factor input coefficient, which refers to the value of primary inputs in the total output of each sector. Thus, the second-order effect is given by:

where ξ is the second-order effect under a single factor, which can be expressed as:

Several interesting findings can be derived from the above equations. First, when there are two factors, the impact of the shock is related to the factor income shares , and the primary factor input coefficient , for both factors. Second, when there is only one production sector, the final demand expenditure share is 1 as there is only one final good. The coefficient on the term containing , is zero because the final demand sector is no longer substituting inputs in this case. Third, multiple primary inputs reduce the magnitude of the second-order effect of productivity shocks through factor income shares, so the factor reallocation effect acts as a negative feedback process.

We extend the above results to a generalized triangular production network structure. First, in terms of relevance, the second-order effects of sectoral productivity shocks are correlated with both the factor income shares and primary factor input coefficients of each factor due to changes in factor income shares and relative factor prices. Moreover, changes in relative factor prices provide an additional mechanism for sectoral substitution, which can also be transmitted upstream. As a result, the second-order effects, in general, are correlated with the sales shares (Domar weights) of each production sector. Second, in terms of magnitude, the impact through factor income shares, and hence relative factor prices, is negative, which attenuates the second-order impact through downstream substitution alone in the case of a single factor. Third, in terms of calculation, when the number of production sectors exceeds 2, the inverse matrix becomes highly complicated, resulting in the absence of a corresponding analytical or closed-form solution. Therefore, numerical solutions must be used in practice to derive results.