Evaluating the Effectiveness of Standardized Sales Incentive Contracts Under Agent Heterogeneity

Abstract

1. Introduction

- (1)

- Does heterogeneity among the salespeople lead to a loss in incentive effectiveness under standardized incentive contracts?

- (2)

- How can firms identify and quantify the presence and degree of such heterogeneity as well as evaluate the effectiveness of standardized incentive schemes?

- (3)

- Do different types of salesperson heterogeneity, such as heterogeneity in capability versus heterogeneity in risk attitude, differ in their impact on contract effectiveness and in the methods required for their evaluation?

2. Literature Review

2.1. Research on the Design of Sales Incentive Contracts

2.2. Research on the Evaluation of Sales Incentive Contract Effectiveness

2.3. Contributions

- (1)

- Theoretical Advancement: By focusing on the effectiveness evaluation of standardized sales incentive contracts, this research addresses a critical gap in the sales compensation literature. It extends the scope of incentive contract management and responds to Ahearne and Ahearne’s [8] call for further investigation into the effectiveness of sales incentive allocations;

- (2)

- Modeling and Methodology: Leveraging a principal–agent game-theoretical framework, we examine heterogeneous salespeople’s responses to standardized incentive contracts. Our analysis yields two novel methodologies for assessing contract effectiveness, thereby establishing a robust theoretical foundation for future research in this domain;

- (3)

- Managerial Implications: The proposed evaluation frameworks demonstrate strong operational feasibility, offering actionable insights for salesperson management. These tools enable firms to systematically optimize incentive structures, enhancing both efficiency and effectiveness in salesperson management.

3. Model

3.1. Firm

3.2. Salesperson

3.3. Decision Equilibrium

3.3.1. Scenario CK

- Incentive Compatibility Constraint (IC):which ensures that the contract encourages the salesperson to exert the optimal effort level that maximizes their utility, eliminating moral hazard;

- Rational Constraint (IR):which guarantees that the utility of the salesperson exceeds a minimum threshold of , representing their opportunity cost, where is high enough so that in the optimal contract is positive.

3.3.2. Scenario PK

- Incentive Compatibility Constraint (IC1):which ensures that the sales incentive contract motivates the salesperson to truthfully disclose the market’s potential sales volume;

- Incentive Compatibility Constraint (IC2):which ensures that the contract encourages the salesperson to exert the optimal effort level that maximizes their utility, eliminating moral hazard;

- Rational Constraint (IR):which guarantees that the utility of the salesperson exceeds a minimum threshold of , representing their opportunity cost.

4. The Incentive Contract Effectiveness Evaluation with Salesperson Heterogeneity

4.1. Salesperson Heterogeneity in Scenario CK

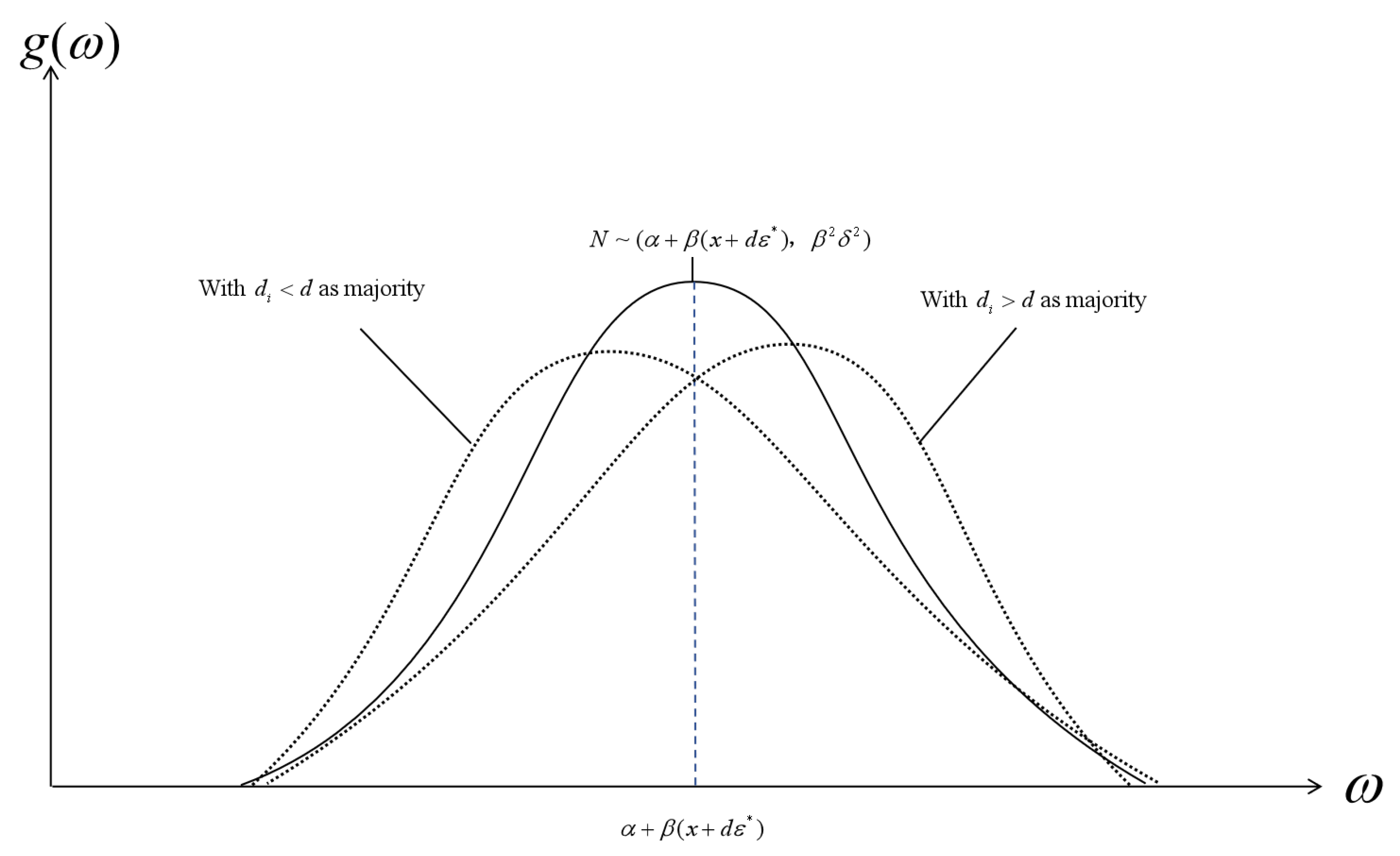

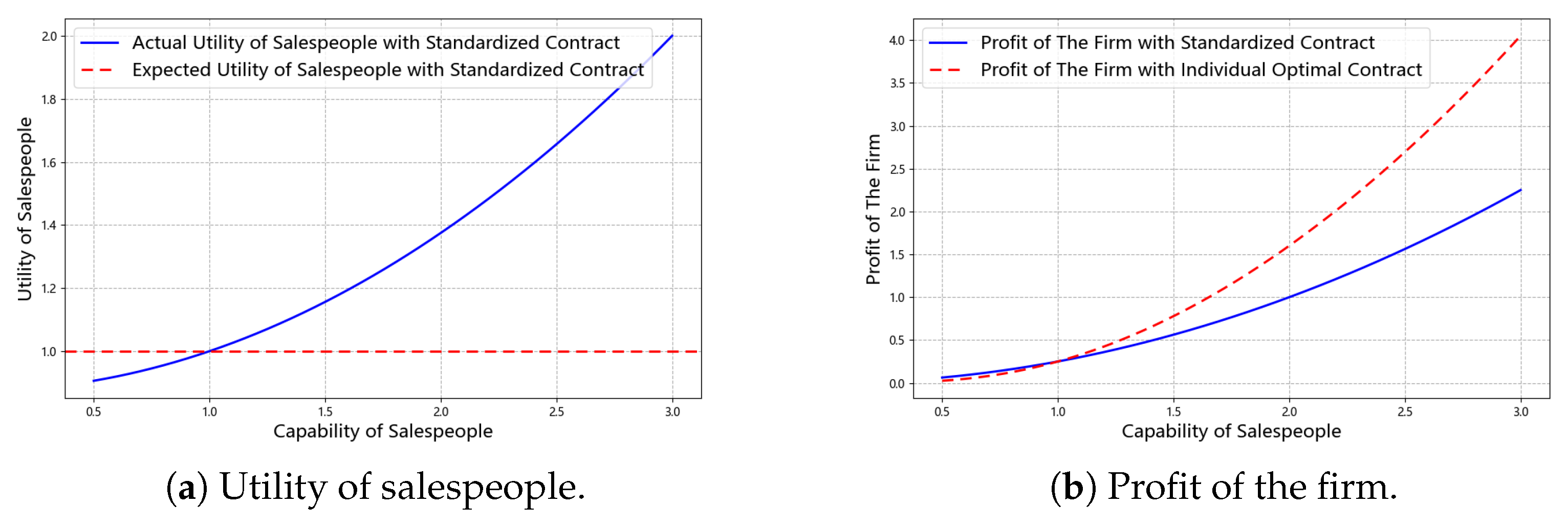

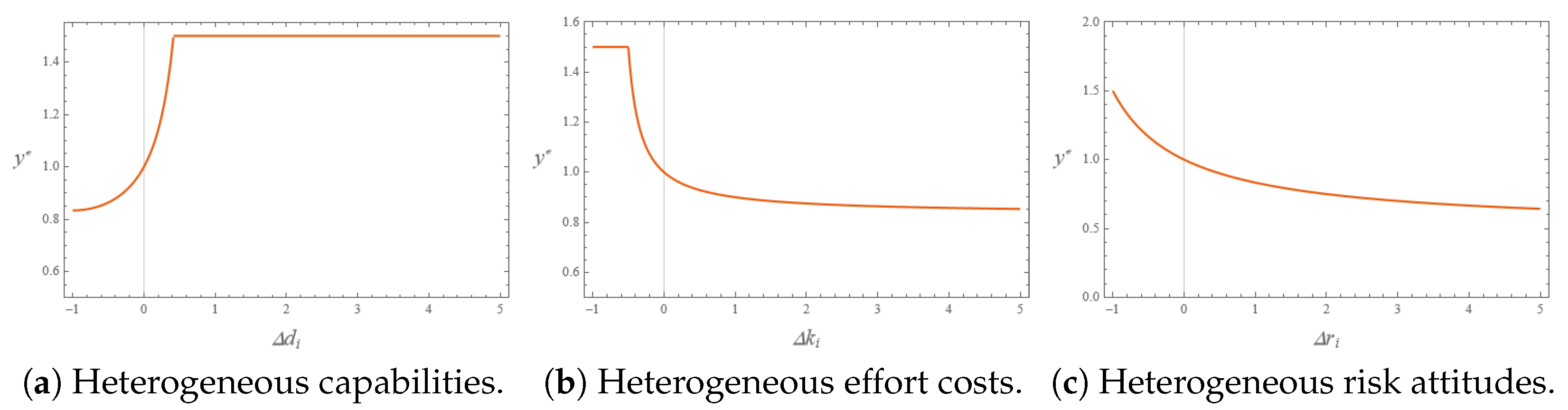

4.1.1. The Incentive Contract Effectiveness Evaluation with Heterogeneity in Salespeople’s Capabilities

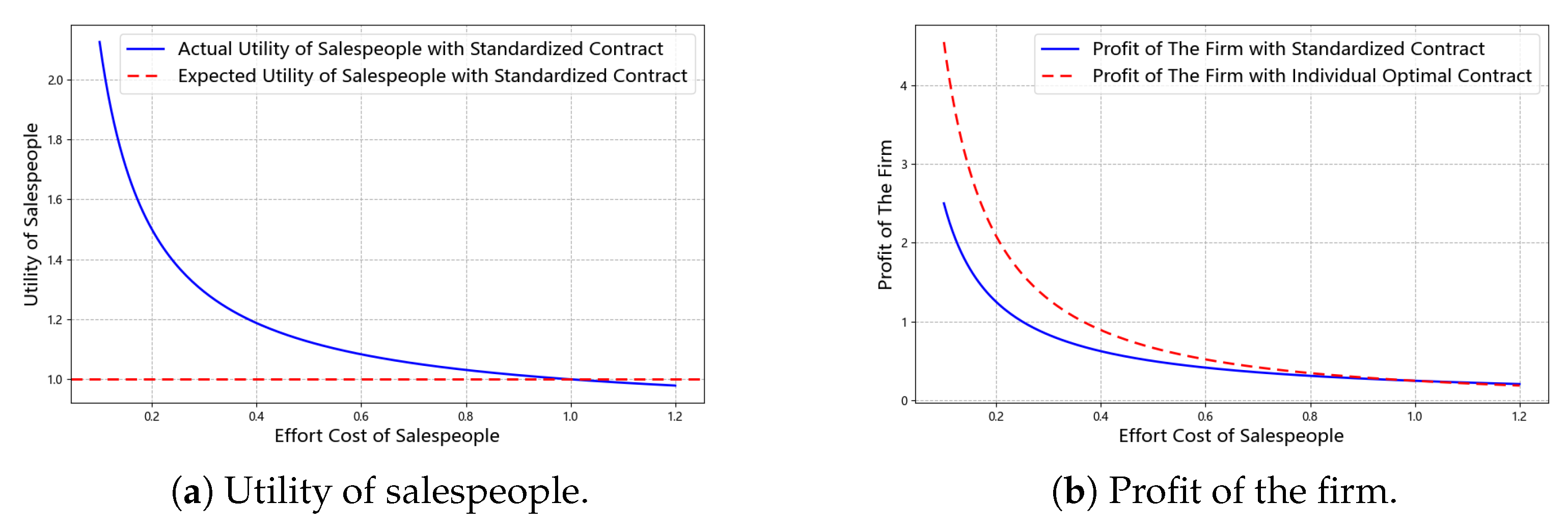

4.1.2. The Incentive Contract Effectiveness Evaluation with Heterogeneity in Salespeople’s Effort Costs

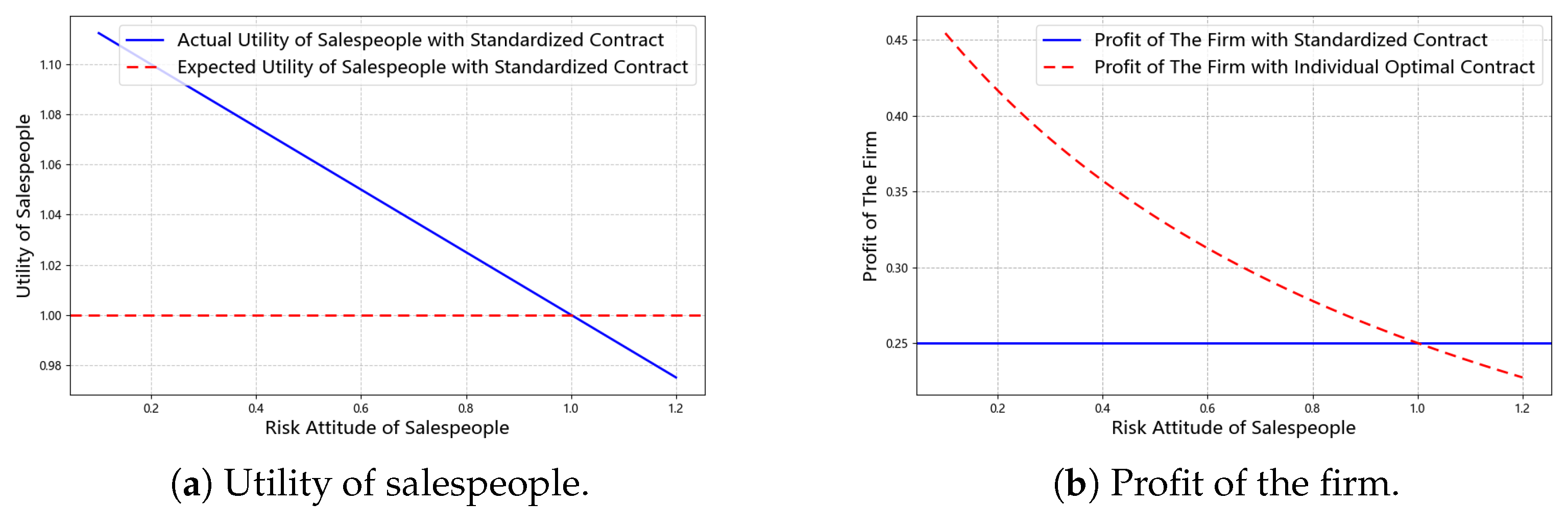

4.1.3. The Incentive Contract Effectiveness Evaluation with Heterogeneity in Salespeople’s Risk Attitudes

4.2. Salesperson Heterogeneity in Scenario PK

4.2.1. The Incentive Contract Effectiveness Evaluation with Heterogeneity in Salespeople’s Capabilities

4.2.2. The Incentive Contract Effectiveness Evaluation with Heterogeneity in Salespeople’s Effort Costs

4.2.3. The Incentive Contract Effectiveness Evaluation with Heterogeneity in Salespeople’s Risk Attitudes

4.3. Summary of Evaluation Methods

- (1)

- Evaluation based on actual income distribution relies on interim performance outcomes as evaluation signals, serving as a form of ex post (real-time) control. In contrast, evaluation based on salespeople’s reported market potential sales volumes uses their information transmission as signals and functions as a form of ex ante (preemptive) control;

- (2)

- In the game between the firm and salespeople over the sales incentive contract, when the market potential is private information held by the salespeople, the ex ante control method is effective under all three types of heterogeneity: capability, effort cost, and risk attitude. When the market potential is common knowledge, the ex post control method is effective under capability heterogeneity and effort cost heterogeneity but ineffective under risk attitude heterogeneity;

- (3)

- Even when the market potential is private information, the ex post control method remains effective under capability and effort cost heterogeneities and can serve as a complementary approach to ex ante control in practical implementation.

4.4. Further Discussion on Dynamics and Selection

5. Monte Carlo Numerical Simulation Experiments

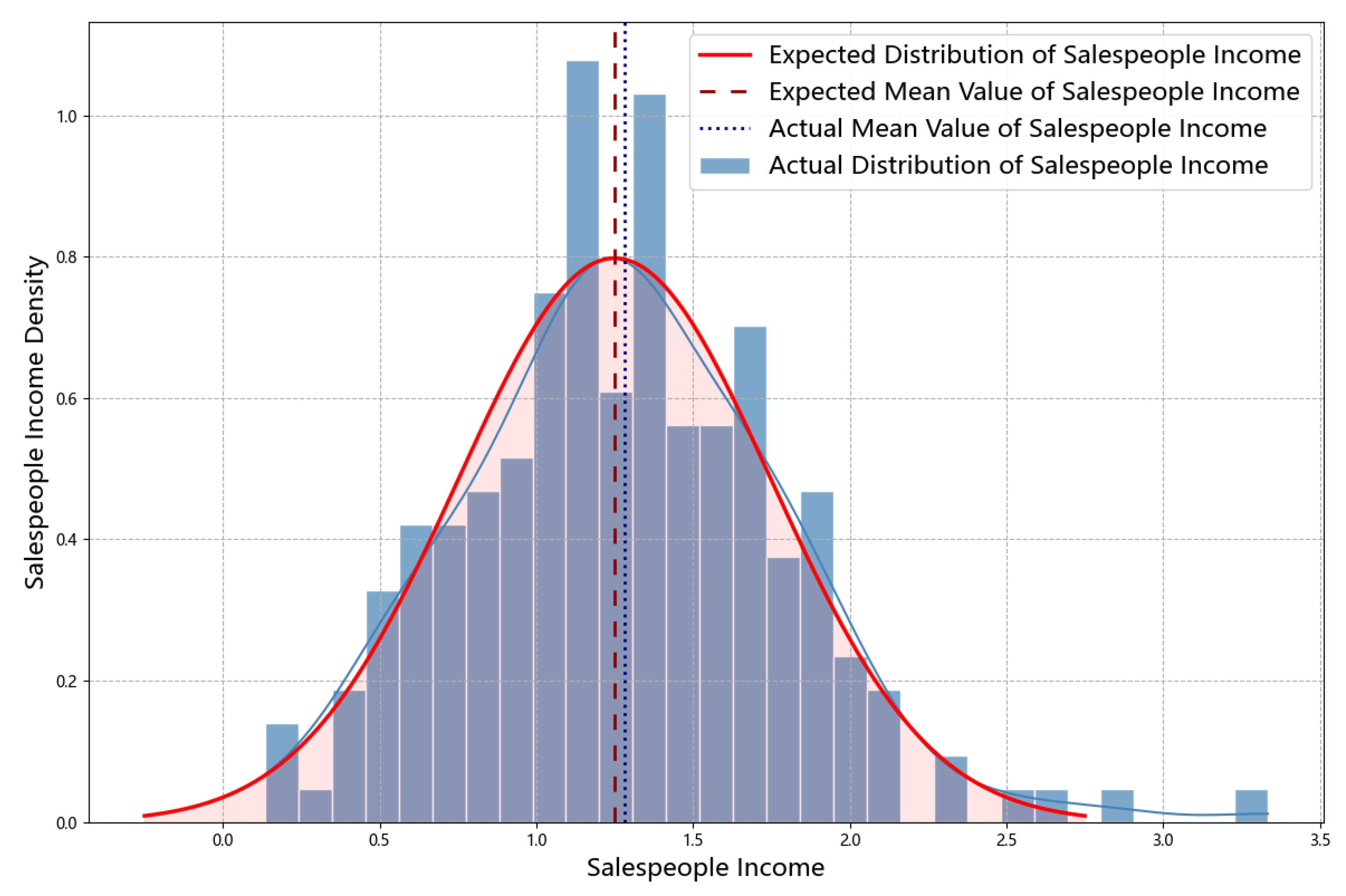

5.1. Salesperson Heterogeneity in Scenario CK

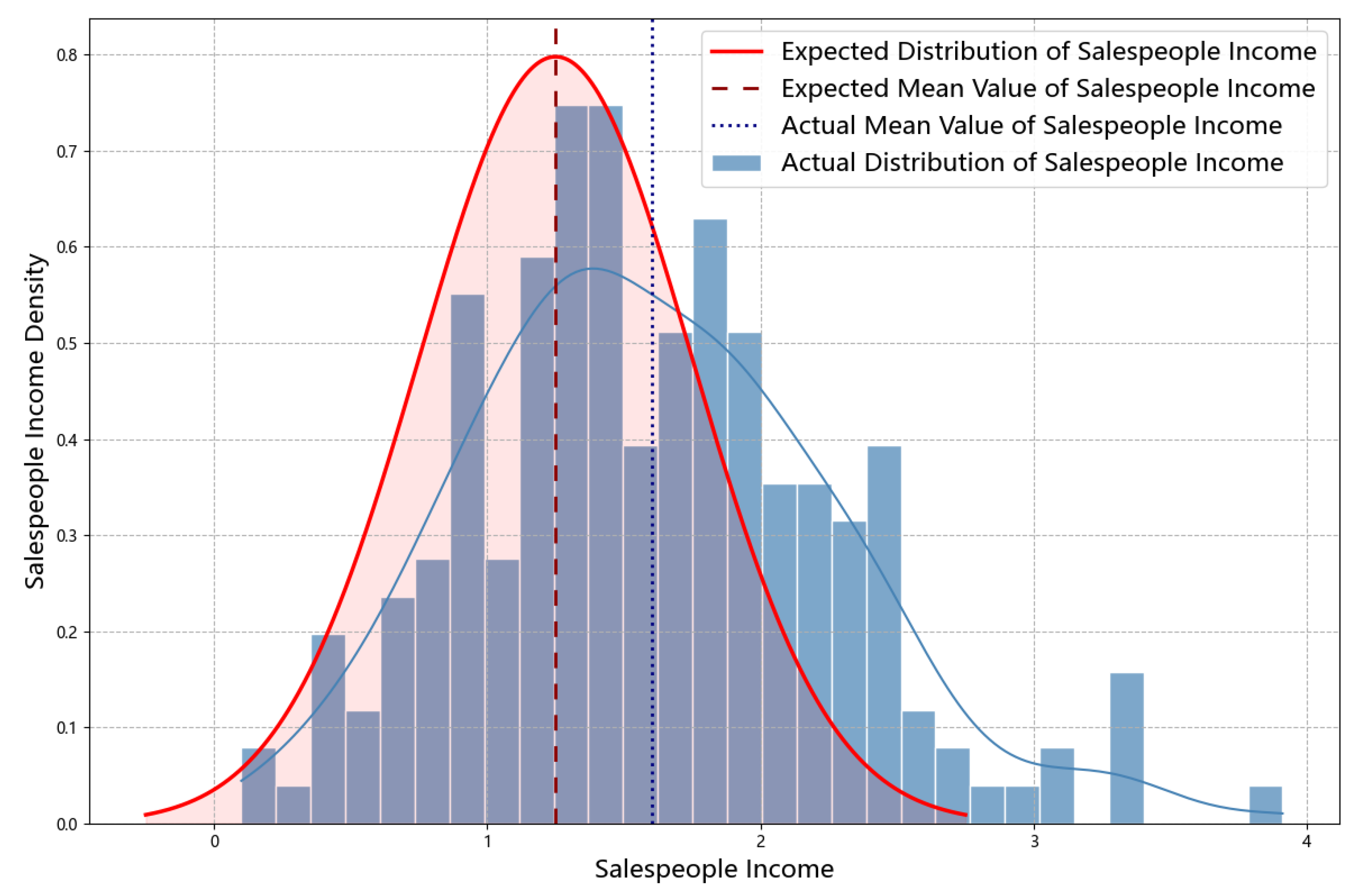

5.2. Salesperson Heterogeneity in Scenario PK

5.3. Robustness Check

6. Conclusions

6.1. Key Findings

6.2. Managerial Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Proof of Theorem 1

Appendix A.2. Proof of Theorem 2

Appendix A.3. Proof of Proposition 3

Appendix A.4. Proof of Proposition 8

Appendix A.5. Proof of Proposition 9

Appendix A.6. Proof of Proposition 10

References

- Arditto, L.; Cambra-Fierro, J.J.; Fuentes-Blasco, M.; Olavarria Jaraba, A.; Vazquez-Carrasco, R. How Does Customer Perception of Salespeople Influence the Relationship? A Study in an Emerging Economy. J. Retail. Consum. Serv. 2020, 54, 101952. [Google Scholar] [CrossRef]

- Bergen, M.; Dutta, S.; Walker, O.C. Agency Relationships in Marketing: A Review of the Implications and Applications of Agency and Related Theories. J. Mark. 1992, 56, 1–24. [Google Scholar] [CrossRef]

- Chohan, R. Agency Theory in Marketing: 27 Years On. J. Strateg. Mark. 2023, 31, 767–793. [Google Scholar] [CrossRef]

- Bowen, M.; Haas, A.; Hofmann, I. Sales Force Financial Compensation—A Review and Synthesis of the Literature. J. Pers. Sell. Sales Manag. 2023, 44, 374–397. [Google Scholar] [CrossRef]

- Steenburgh, T.; Ahearne, M. Motivating Salespeople: What Really Works. Harv. Bus. Rev. 2012, 90, 70–75. [Google Scholar]

- Chung, D.J. How to Really Motiv. Salespeople. Harv. Bus. Rev. 2015, 93, 54–61. [Google Scholar]

- Bommaraju, R.; Hohenberg, S. Self-Selected Sales Incentives: Evidence of Their Effectiveness, Persistence, Durability, and Underlying Mechanisms. J. Mark. 2018, 82, 106–124. [Google Scholar] [CrossRef]

- Ahearne, M.; Ahearne, M. Designing Sales Incentives: Opportunities for Research with Impact. AMS Rev. 2025, 15, 307–312. [Google Scholar] [CrossRef]

- Farley, J.U. An Optimal Plan for Salesmen’s Compensation. J. Mark. Res. 1964, 1, 39–43. [Google Scholar] [CrossRef]

- Basu, A.K.; Lal, R.; Srinivasan, V.; Staelin, R. Salesforce Compensation Plans: An Agency Theoretic Perspective. Mark. Sci. 1985, 4, 267–291. [Google Scholar] [CrossRef]

- Holmstrom, B.; Milgrom, P. Aggregation and Linearity in the Provision of Intertemporal Incentives. Econometrica 1987, 55, 303–328. [Google Scholar] [CrossRef]

- Lal, R.; Staelin, R. Salesforce Compensation Plans in Environments with Asymmetric Information. Mark. Sci. 1986, 5, 179–198. [Google Scholar] [CrossRef]

- Mantrala, M.K.; Sinha, P.; Zoltners, A.A. Structuring a Multiproduct Sales Quota-Bonus Plan for a Heterogeneous Sales Force: A Practical Model-Based Approach. Mark. Sci. 1994, 13, 121–144. [Google Scholar] [CrossRef]

- Bhardwaj, P. Delegating Pricing Decisions. Mark. Sci. 2001, 20, 143–169. [Google Scholar] [CrossRef]

- Joseph, K. On the Optimality of Delegating Pricing Authority to the Sales Force. J. Mark. 2001, 65, 62–70. [Google Scholar] [CrossRef]

- Mishra, B.K.; Prasad, A. Delegating Pricing Decisions in Competitive Markets with Symmetric and Asymmetric Information. Mark. Sci. 2005, 24, 490–497. [Google Scholar] [CrossRef]

- Jain, S. Self-Control and Incentives: An Analysis of Multiperiod Quota Plans. Mark. Sci. 2012, 31, 855–869. [Google Scholar] [CrossRef]

- Jerath, K.; Long, F. Multiperiod Contracting and Salesperson Effort Profiles: The Optimality of “Hockey Stick,” “Giving up,” and “Resting on Laurels”. J. Mark. Res. 2020, 57, 211–235. [Google Scholar] [CrossRef]

- Dai, T.; Jerath, K. Salesforce Compensation with Inventory Considerations. Manag. Sci. 2013, 59, 2490–2501. [Google Scholar] [CrossRef]

- Dai, T.; Jerath, K. Technical Note—Impact of Inventory on Quota-Bonus Contracts with Rent Sharing. Oper. Res. 2016, 64, 94–98. [Google Scholar] [CrossRef]

- Dai, T.; Jerath, K. Salesforce Contracting under Uncertain Demand and Supply: Double Moral Hazard and Optimality of Smooth Contracts. Mark. Sci. 2019, 38, 852–870. [Google Scholar] [CrossRef]

- Bhargava, H.K.; Rubel, O. Sales Force Compensation Design for Two-Sided Market Platforms. J. Mark. Res. 2019, 56, 666–678. [Google Scholar] [CrossRef]

- Dai, T.; Ke, R.; Ryan, C.T. Incentive Design for Operations-Marketing Multitasking. Manag. Sci. 2021, 67, 2211–2230. [Google Scholar] [CrossRef]

- Zhang, Y.; Xu, Q.; Zhang, G. Optimal Contracts with Moral Hazard and Adverse Selection in a Live Streaming Commerce Market. J. Retail. Consum. Serv. 2023, 74, 103419. [Google Scholar] [CrossRef]

- Gao, L. Optimal Incentives for Salespeople with Learning Potential. Manag. Sci. 2023, 69, 3285–3296. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Balachander, S. Group or Individual Sales Incentives? What Is Best for Brand-Managed Retail Sales Operations? J. Mark. 2024, 88, 103–120. [Google Scholar] [CrossRef]

- Homburg, C.; Hohenberg, S.; Hahn, A. Steering the Sales Force for New Product Selling: Why Is It Differ. How Can Firms Motiv. Differ. Sales Reps? J. Prod. Innov. Manag. 2019, 36, 282–304. [Google Scholar] [CrossRef]

- Wang, X.; Li, P.; Zheng, Y.; Jiang, L.A.; Yang, Z. Salespersons’ Self-Monitoring, Psychological Capital and Sales Performance. Asia Pac. J. Mark. Logist. 2021, 33, 1918–1933. [Google Scholar] [CrossRef]

- Kuo, S.Y.; Kao, Y.L.; Tang, J.W.; Tsai, P.H. Impacts of Emotional Regulation, Adaptive Selling and Customer-Oriented Behavior on Sales Performance: The Moderating Role of Job Resourcefulness. Asia Pac. J. Mark. Logist. 2023, 35, 1075–1092. [Google Scholar] [CrossRef]

- Mallin, M.L.; Pullins, E.B. The Moderating Effect of Control Systems on the Relationship between Commission and Salesperson Intrinsic Motivation in a Customer Oriented Environment. Ind. Mark. Manag. 2009, 38, 769–777. [Google Scholar] [CrossRef]

- Hohenberg, S.; Homburg, C. Motivating Sales Reps for Innovation Selling in Different Cultures. J. Mark. 2016, 80, 101–120. [Google Scholar] [CrossRef]

- Homburg, C.; Morguet, T.R.; Hohenberg, S. Incentivizing of inside Sales Units—The Interplay of Incentive Types and Unit Structures. J. Pers. Sell. Sales Manag. 2021, 41, 181–199. [Google Scholar] [CrossRef]

- Kaynar, N.; Siddiq, A. Estimating Effects of Incentive Contracts in Online Labor Platforms. Manag. Sci. 2023, 69, 2106–2126. [Google Scholar] [CrossRef]

- Opitz, S.; Sliwka, D.; Vogelsang, T.; Zimmermann, T. The Algorithmic Assignment of Incentive Schemes. Manag. Sci. 2025, 71, 1546–1563. [Google Scholar] [CrossRef]

- Lal, R.; Srinivasan, V. Compensation Plans for Single- and Multi-Product Salesforces: An Application of the Holmstrom-Milgrom Model. Manag. Sci. 1993, 39, 777–793. [Google Scholar] [CrossRef]

- Yu, Y.; Kong, X. Robust Contract Designs: Linear Contracts and Moral Hazard. Oper. Res. 2020, 68, 1457–1473. [Google Scholar] [CrossRef]

- Pratt, J.W. Risk Aversion in the Small and in the Large. Econometrica 1964, 32, 122–136. [Google Scholar] [CrossRef]

| Literature | Research Method | Research Contexts | Focus on Practical Effectiveness | ||

|---|---|---|---|---|---|

| Game-Theoretical Models | Empirical Econometric Approaches | Platform-Based Heterogeneity Estimation | |||

| Basu et al. [10] | ✓ | Basic Enterprise Sales | |||

| Lal and Staelin [12] | ✓ | Basic Enterprise Sales | |||

| Mishra and Prasad [16] | ✓ | Basic Enterprise Sales with Pricing Delegation | |||

| Dai and Jerath [20] | ✓ | Basic Enterprise Sales with Inventory | |||

| Bhargava and Rubel [22] | ✓ | Two-sided Market Sales | |||

| Dai et al. [23] | ✓ | Multitasking Sales | |||

| Homburg et al. [32] | ✓ | Effects of Unit Structures | Partially | ||

| Zhang et al. [26] | ✓ | Brand-Managed Retail Sales | |||

| Opitz et al. [34] | ✓ | Online Labor Platforms | Partially | ||

| This paper | ✓ | Basic Enterprise Sales | ✓ | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, N.; Duan, H.; Ning, L. Evaluating the Effectiveness of Standardized Sales Incentive Contracts Under Agent Heterogeneity. Mathematics 2025, 13, 2968. https://doi.org/10.3390/math13182968

Wang N, Duan H, Ning L. Evaluating the Effectiveness of Standardized Sales Incentive Contracts Under Agent Heterogeneity. Mathematics. 2025; 13(18):2968. https://doi.org/10.3390/math13182968

Chicago/Turabian StyleWang, Ning, Housheng Duan, and Lang Ning. 2025. "Evaluating the Effectiveness of Standardized Sales Incentive Contracts Under Agent Heterogeneity" Mathematics 13, no. 18: 2968. https://doi.org/10.3390/math13182968

APA StyleWang, N., Duan, H., & Ning, L. (2025). Evaluating the Effectiveness of Standardized Sales Incentive Contracts Under Agent Heterogeneity. Mathematics, 13(18), 2968. https://doi.org/10.3390/math13182968