1. Introduction

The latest empirical research studies have shown that financial asset returns are asymmetrically distributed and information regarding tail risks are missing when using conventional Gaussian type asset pricing formulas [

1,

2]. For example, investors underestimate left tail risk and under-insure against very low oil prices in crude oil derivative markets [

2]. Motivated by the leptokurtic feature of asset returns and excessive losses caused by financial crises, the literature began to link tail risk management with derivative pricing [

3,

4,

5]. In this regard, option-trading-based strategies were introduced, and novel options were designed for tail risk hedging. Meanwhile, several non-Gaussian distributions were adopted for revising conventional option pricing models.

Next, we first start to give a brief review of tail risk hedging and existing option pricing models dealing with tail risks and leptokurtic features, and then discuss the practical limitations and design insufficiency of those pricing models closely related to our proposed work in this paper.

Regarding tail risk hedging using options, the seminal works were due to Bhansali (2008, 2014) [

6,

7], providing a valuable benchmark for developing option-based tail risk hedging strategies. Based on their framework, offensive tail risk management [

8], active tail risk management [

9], behavioral insight [

10], tail risk hedging in a low-rate environment [

11], and hedging robustness during extreme events such as COVID-19 [

12] were further investigated. Furthermore, novel options were also designed for tail risk hedging purposes [

13].

For the leptokurtic features, extreme losses and fat-tail phenomena were considered by using non-Gaussian distributions to model underlying asset returns in option pricing models. The typical distributions include: (1) generalized distributions, such as GB class [

14,

15,

16], generalized extreme value (GEV) [

17], and generalized logistic (GLO) [

18]; (2) asymmetric distributions, such as skewed-

t [

19], variance gamma [

20], Weibull [

21], and distorted lognormal distribution [

22]; and (3) mixture distribution such as the mixture of Gaussian and heavy-tailed model [

23].

To detect tail risk signals via an option pricing model, a natural choice for the underlying asset’s modeling is GEV distribution. In this regard, Markose and Alentorn (2011) [

17] proposed a GEV option pricing model, from which one can obtain implied volatility and implied tail index simultaneously by using option price data. However, empirical study shows that the GEV pricing model did not perform well during many time periods (Kim and Kim, 2014 [

18]). One reason may be that using the GEV to fit losses could cause the over-fitting problem. According to Fisher–Tippett theorem [

24], it is the block maxima of returns and/or losses rather than returns and/or losses per se that follow the GEV distribution. This is the so-called “domain of attraction” principle, based on which it is to conclude that directly pre-assuming the daily losses to be a GEV distribution may not be either mathematically or practically reasonable (in the empirical result of Markose and Alentorn (2011) [

17], the implied tail indexes vary from positive to negative back and forth frequently, which may also imply the GEV setting can be questionable, thereby making their results suffering an over-fitting problem in some market circumstances).

Besides the GEV distribution, attention was also paid to the GB class distributions. In particular, the generalized beta of the second kind (GB2) and the exponential generalized beta of the second kind (EGB2) distributions show promising potential. For example, McDonald and Bookstaber (1991) [

14] proposed a GB2 option pricing model in the literature. Based on the equilibrium conditions proposed by Cox and Ross (1976) [

25], the GB2 option pricing model can obtain a closed-form solution by using GB2 cumulative distribution function (C.D.F.). However, in the explicit expression of the theoretical option prices, there exists a term

, which means that the theoretical option prices can only be determined when the underlying asset price at the maturity date

T is known; but, such an assumption is practically not implementable. The reason is, based on the payoff functions of vanilla options, if

is given, the option prices are known, which means that we do not need additional information or a pricing formula in this case. In addition, Fischer (2000) [

17] proposed an Esscher-EGB2 option pricing model, where the underlying price process is modeled by an exponential EGB2-Lévy motion. By using the Esscher transformation, pricing formulas are given. There are some problems with the formula in practice. The final expression of the pricing model involves a Fourier inversion formula. Moreover, it is composed of complex numbers, meaning one must implement numerical methods to obtain the theoretical prices. In the pricing and risk management realms, the numerical method makes the pricing formula relatively complicated and less feasible. Another GB2 pricing model was proposed by Mirfendereski and Rebonato (2001) [

16], which has a straightforward closed-form pricing formula. However, one essential assumption of “zero risk-free rate” makes the model not applicable in the non-zero rate real world.

Whereas the existing studies do provide a valuable basis for related research, we note that there are still many gaps in this field. First, many of the non-Gaussian option pricing models can be too “ad hoc” to be applicable in the real world. By merely focusing on specific market situations or strongly relying on “too-strong” pre-assumptions, one may lose the feasibility and generality of the pricing models, thereby making it of less pricing accuracy and robustness. In addition, we note that many existing non-Gaussian option pricing models do not entail the benchmark Black–Scholes (B−S) model [

26] or any Gaussian models as special cases, which also hinders the models’ universality and financial interpretability. Second, many existing models may suffer from simplicity and feasibility issues. For instance, the model based on the Lévy process may include complex numbers in its resulting formula, which means that one has to use numerical methods to obtain theoretical option prices. Meanwhile, the models that adopt time-changed motions or jump-diffusion processes are mathematically complicated, which may add lots of computational burdens and difficulties in practice. Last but not least, most of the existing research mainly paid attention to the pricing but rarely discussed the connection with risk analysis. For example, in the seminal B−S formula, one can “detect” the overall market risk level by directly looking at the option price and calculating the corresponding B−S implied volatility. However, similar discussions are relatively scarce for non-Gaussian distribution-based models.

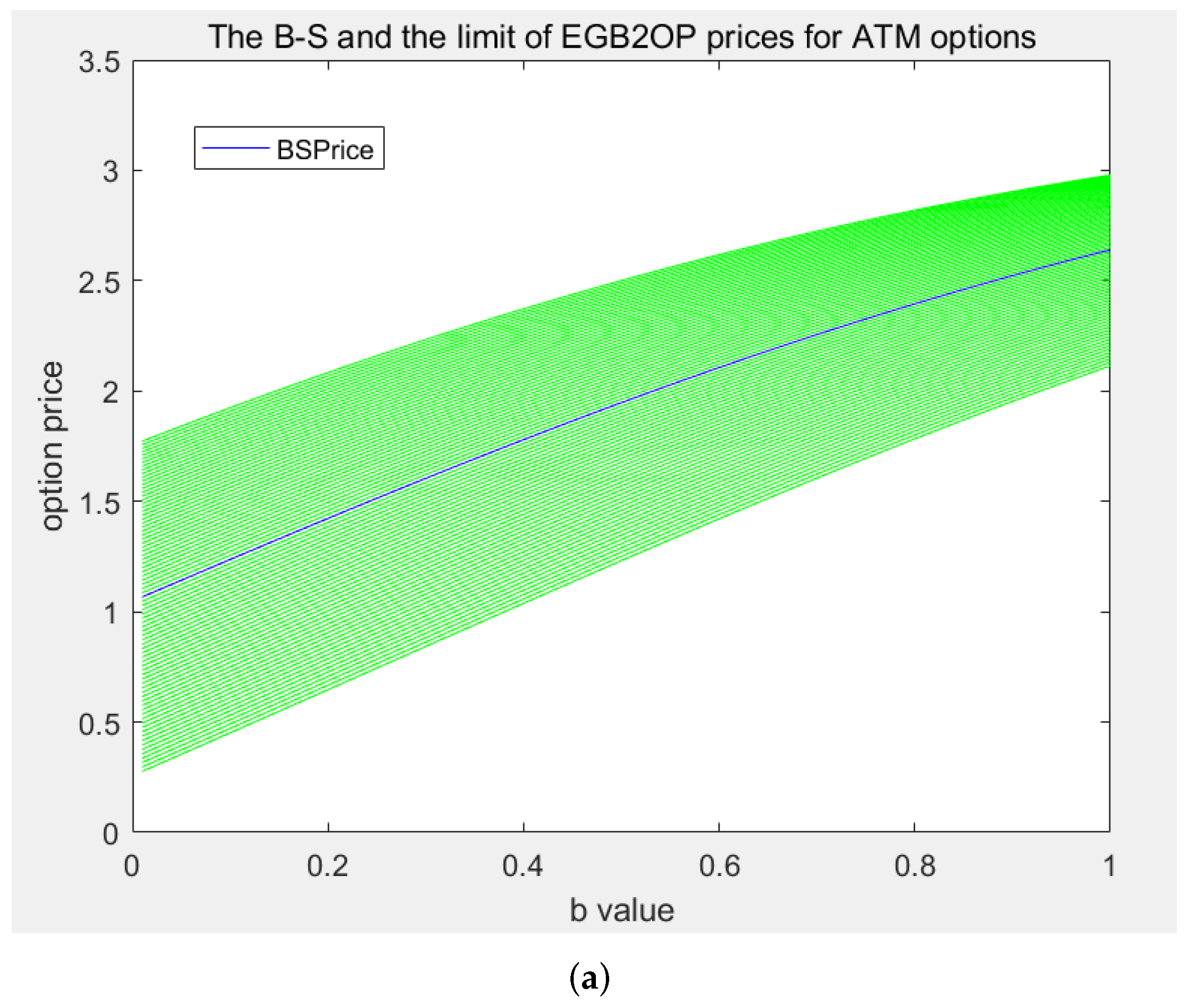

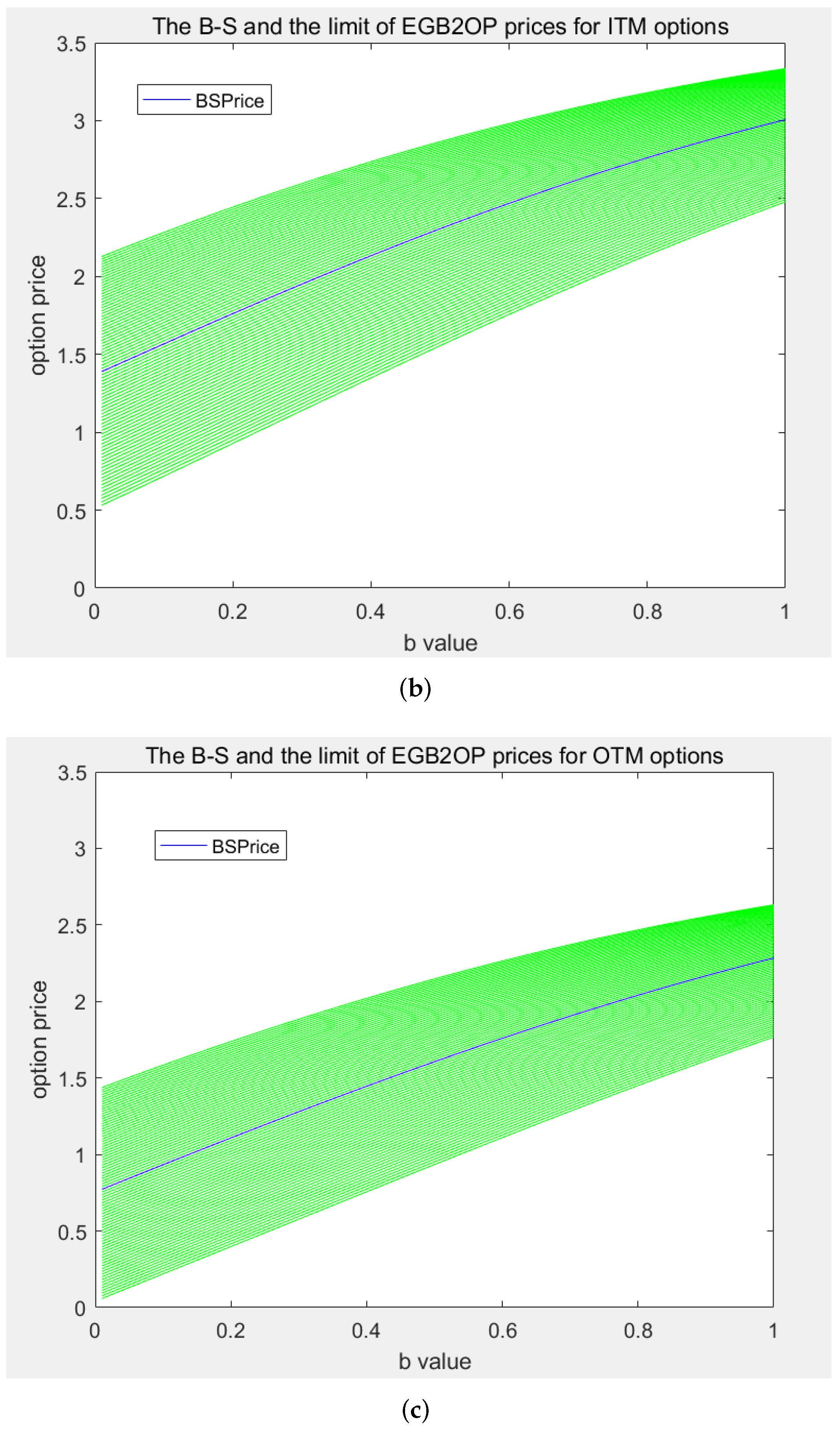

This paper proposes a novel option pricing model based on the exponential generalized beta of the second kind (EGB2) distribution, which fills the current gaps by introducing the following novelties. First, the newly proposed EGB2 option pricing (EGB2OP) model is of great generality, interpretability, and robustness. It contains the seminal B−S model as a limit case and can replicate option prices generated from the jump-diffusion model, thereby making it robust in varying market seniors. The resulting pricing formulas are analog to the form of the B−S model while providing additional financial interpretability for each parameter (See

Section 3.3). With a B−S analogous pricing formula, the newly proposed model preserves the B−S model’s interpretability characteristics and adds capacity for characterizing the tail behavior and asymmetry in price changes. Second, the proposed model is of great simplicity. It does not include complex numbers, “too-strong” pre-assumptions, or complicated mathematical processes, thereby making it computationally cheaper. This may offer an attractive competitive advantage in terms of practical utilization. Finally, based on the proposed model, tail risk signals can be directly detected or “implied” from option prices. Based on our pricing model, we propose three model-based risk measures, which may offer powerful implications for both investors and policymakers. Just like one can “detect” the overall market risk signal via the B−S formula by looking at the implied volatility, people can directly “detect” the tail risk signal via the EGB2OP model by looking at the implied tail index. To the authors’ best knowledge, to date, there is no model equivalent to the one proposed by this paper. It is worth noting that the reason why our EGB2OP model is of generality, robustness, and satisfactory pricing and risk reporting performances is not because it includes more than one parameter, but because of the interpretable structure of the model per se. As a matter of fact, as reviewed before, there are many option pricing models in the literature having many or even more parameters, and they may not be able to obtain satisfactory properties.

The rest of the paper is organized as follows.

Section 2 provides a brief review of the EGB2 distribution. The EGB2OP model is proposed in

Section 3.

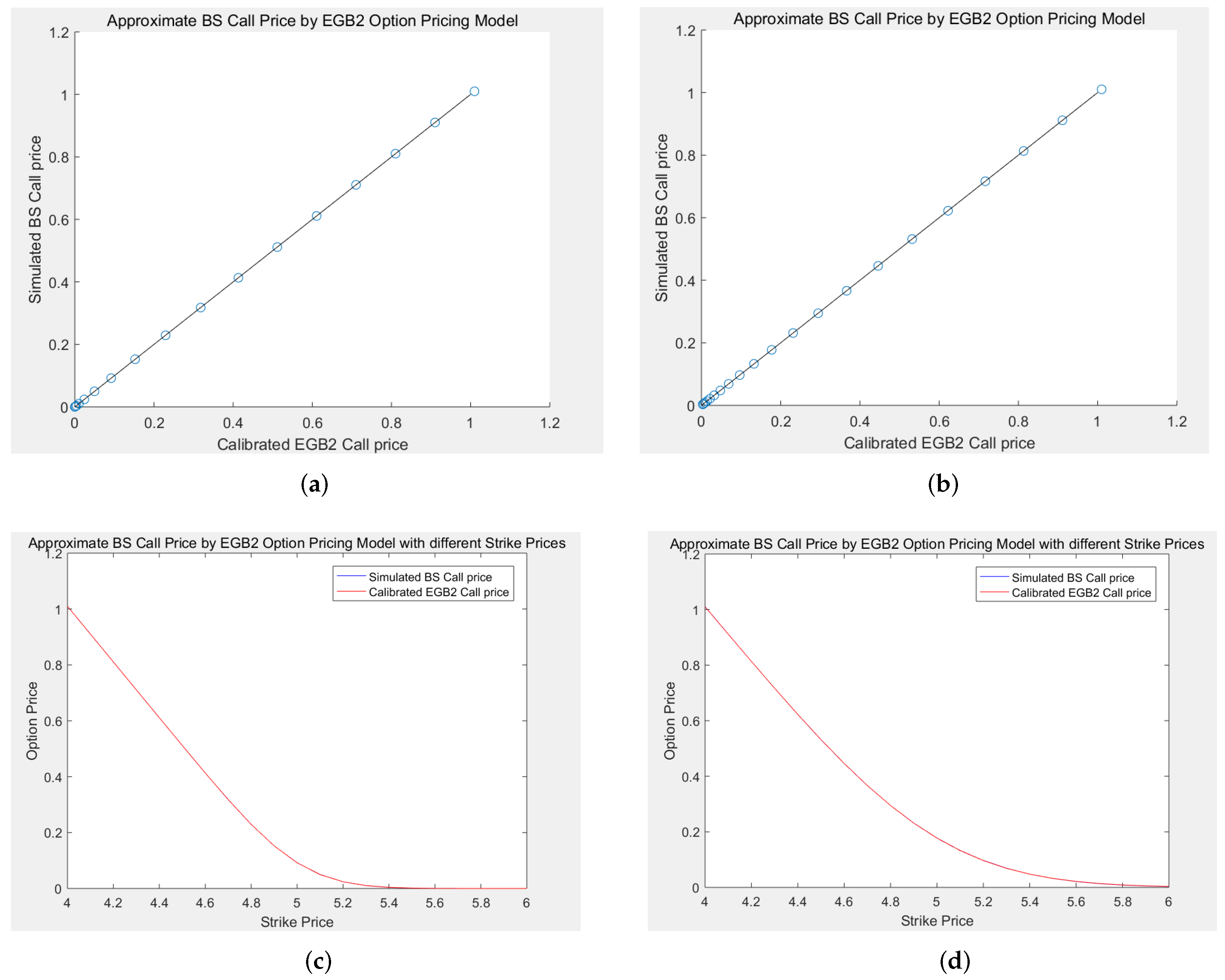

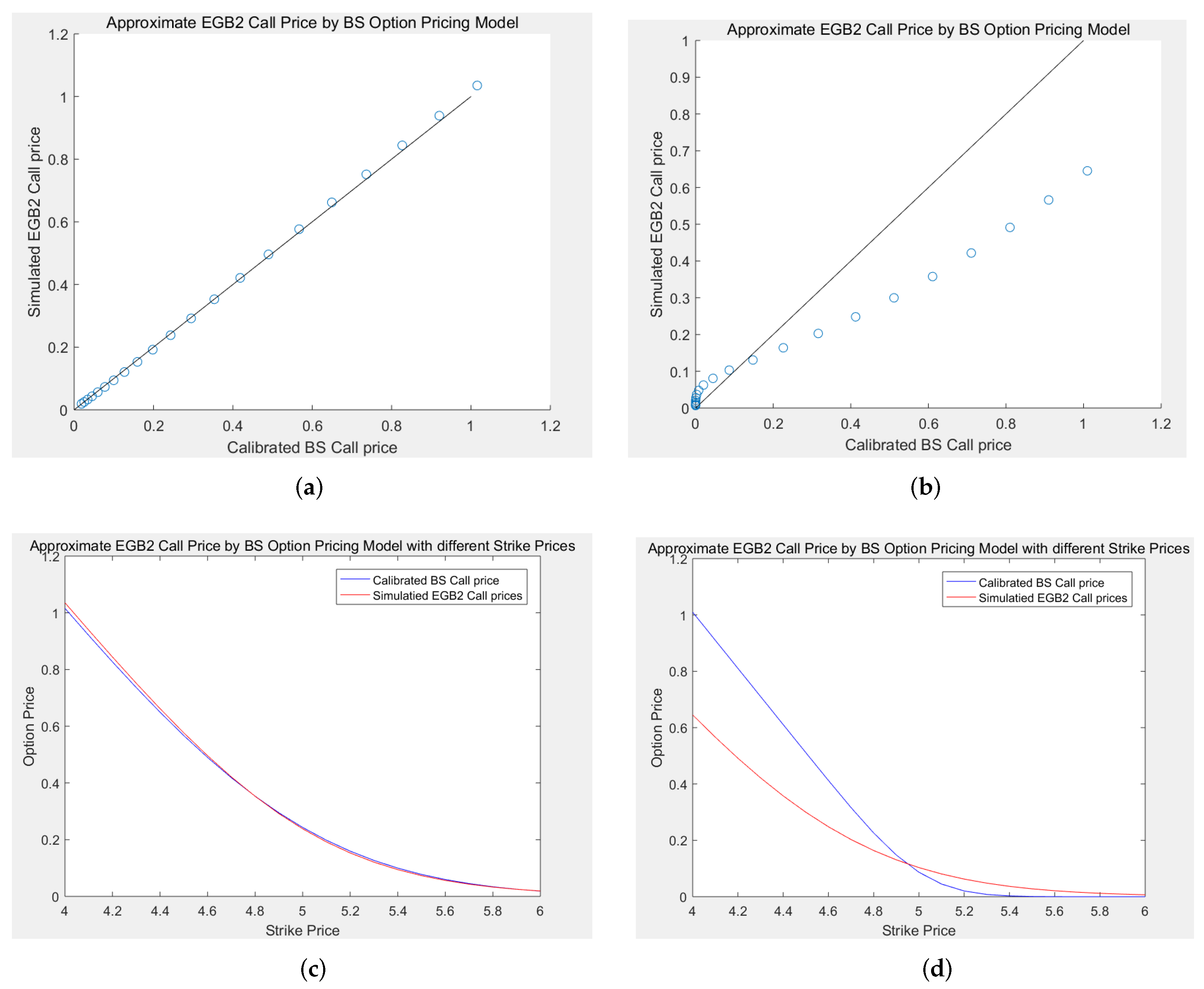

Section 4 provides the simulation experiments that compare the pricing performance and flexibility of the B−S model and EGB2OP model.

Section 5 uses simulation examples to examine the ability of the EGB2OP model to “replicate” Merton’s jump-diffusion model and compare their pricing performances under various market scenarios.

Section 6 provides the empirical results using China’s option market data. Three EGB2OP model-based measures are designed for detecting tail risk signals in

Section 7.

Section 8 concludes the paper. Additional derivations and examples are presented in the

Appendix A.

2. Review of the EGB2 Distribution

The exponential generalized beta of the second kind (EGB2) distribution is proposed by McDonald and Xu (1995) [

27], which is a generalization of both logistic distribution and beta distribution. The standardized density function (with neither location parameter nor scale parameter) of EGB2 is given by Equation (

1):

where

is an incomplete beta function, and

and

are shape parameters or tail parameters governing the left tail and right tail of the distribution, respectively. Introducing location parameter

a and scale parameter

leads to a four parameters p.d.f. as Equation (

2):

and denote its corresponding distribution function as EGB2(

) or EGB2(

) for a short notation. When

and

, it is denoted as EGB2(

).

Tail Parameters and Tail Behavior. According to McDonald (1991) [

28], the relative gap between the left tail parameter

p and the right tail parameter

q has essential meaning for capturing tails’ behavior. If

, the distribution is positively skewed. If

, the distribution is negatively skewed. If

, the distribution is symmetric. In general, the smaller the value of

q, the more the distribution is skewed to the right; the smaller the value of

p, the more the distribution is skewed to the left. In the empirical literature, it has been shown that the extreme behaviors of asset returns (losses) are highly asymmetrical, especially during extreme events [

29]. Thus, it would be of practical significance to trace tail behaviors on both tails.

Special Cases. According to McDonald and Xu (1995) [

27], EGB2 goes in limit to Weibull when

and

, to standard logistic when

, to EGG or lognormal when

, to BR2 or EBR2 when

, and to normal when

and

. To see more special cases for EGB2, refer to the partial EGB distribution tree by McDonald and Xu (1995) [

27].

The Moments. In the literature [

27,

28,

30], the characteristic function and moment-generating function of

X are given by

and

respectively, from which we can obtain the moments of the EGB2 distributions.

The first moment of EGB2 is

where

is the digamma function, given by

The second to fourth moments of EGB2 are

To further capture the tail behavior, one can define the standardized third (skewness) and fourth (kurtosis) moments as:

These quantities will be used in the subsequent computations.

The Relationship with GB2 [

27,

31]. Compared to the conventional relationship between normal and lognormal, the EGB2 distribution has a similar connection to the generalized beta of the second kind (GB2) distribution. If

, then the variable

.

In the literature, EGB2 distribution has been widely used in empirical studies, such as the modeling of income distribution [

27], stock returns [

32], future markets’ sentiment [

33], currency exchange rates [

34,

35], and carbon emission inequality [

36].

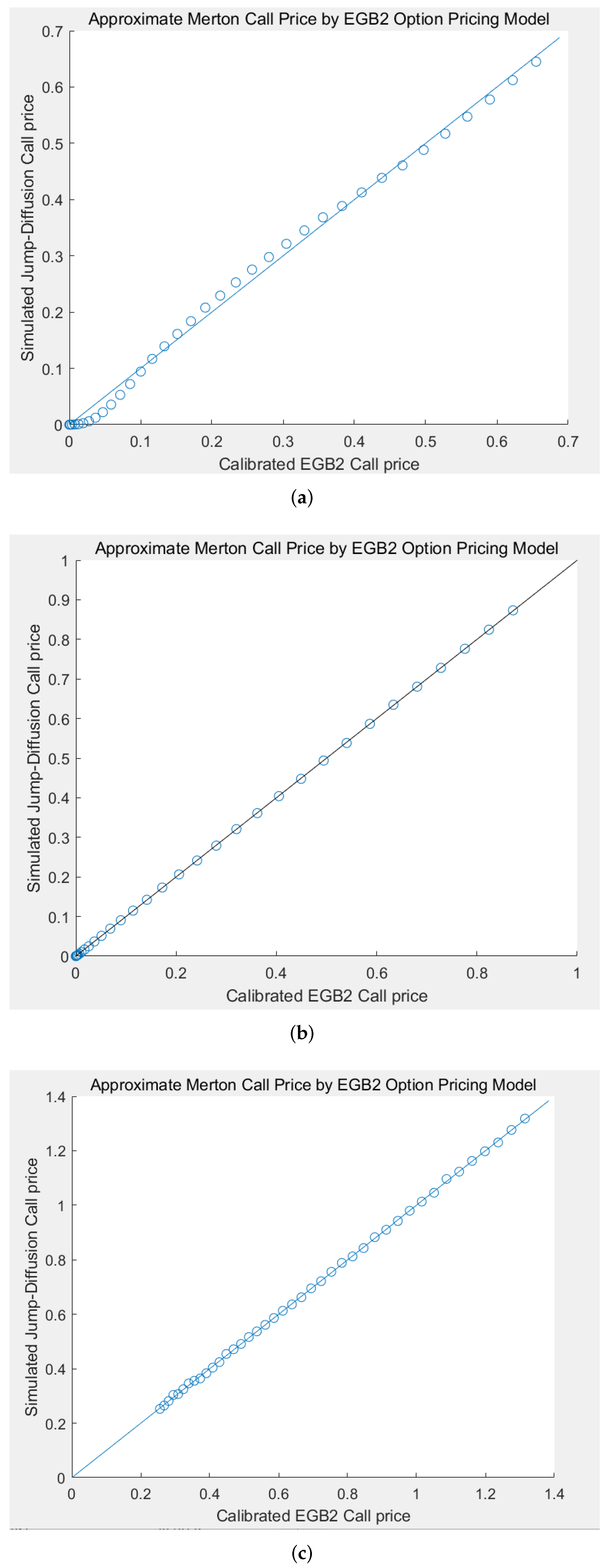

5. Simulation Study: Comparison of the EGB2OP Model and Merton’s Jump-Diffusion Model

The aim of this section is to highlight the ability of the EGB2OP model to replicate (or approximate) Merton’s jump-diffusion model prices under varying market scenarios. We firstly calibrate Merton’s jump-diffusion model using option price data during three time spans: (1) a financial crisis period (1 July 2015–31 August 2015); (2) a market rebound period (1 January 2016–29 February 2016); and (3) a normal market period (1 April 2018–31 May 2018). Each time, we simultaneously calibrate four parameters in Merton’s pricing model: the variance rate

, the frequency of jumping

, the expectation of jumping, and the variance of jumping. Based on the resulting parameters, we conduct Monte Carlo simulations to generate the Merton option prices under these three market scenarios (Without loss of generality, we only generate call option prices in this study. The situations of puts are similar due to Put-Call Parity and thus omitted). Finally, we calibrate the EGB2OP model using the simulated Merton option prices and examine the approximation performance by checking the p-p plots, RMSEs, MAEs, and economic meanings of the calibrated EGB2OP parameters. In addition, the pricing performance of Merton’s jump-diffusion model during three selected periods is also compared with those of the EGB2OP model (detailed empirical results are shown in

Section 6). All calibrations in this section are performed by minimizing SSEs between the theoretical prices and the observed (or simulated) prices, which is introduced in

Section 6.2.

Example 5. In this Monte Carlo experiment, each jump-diffusion process is set to have 100,000 paths and 100 nodes. The theoretical prices of Merton’s model are computed by taking the average of the option values over all paths. For comparative purposes, we set , , and (days, i.e., 1 year) in each scenario, and examine various moneyness options with strike prices K ranging from 9 to 11 by step size 0.05, i.e., .

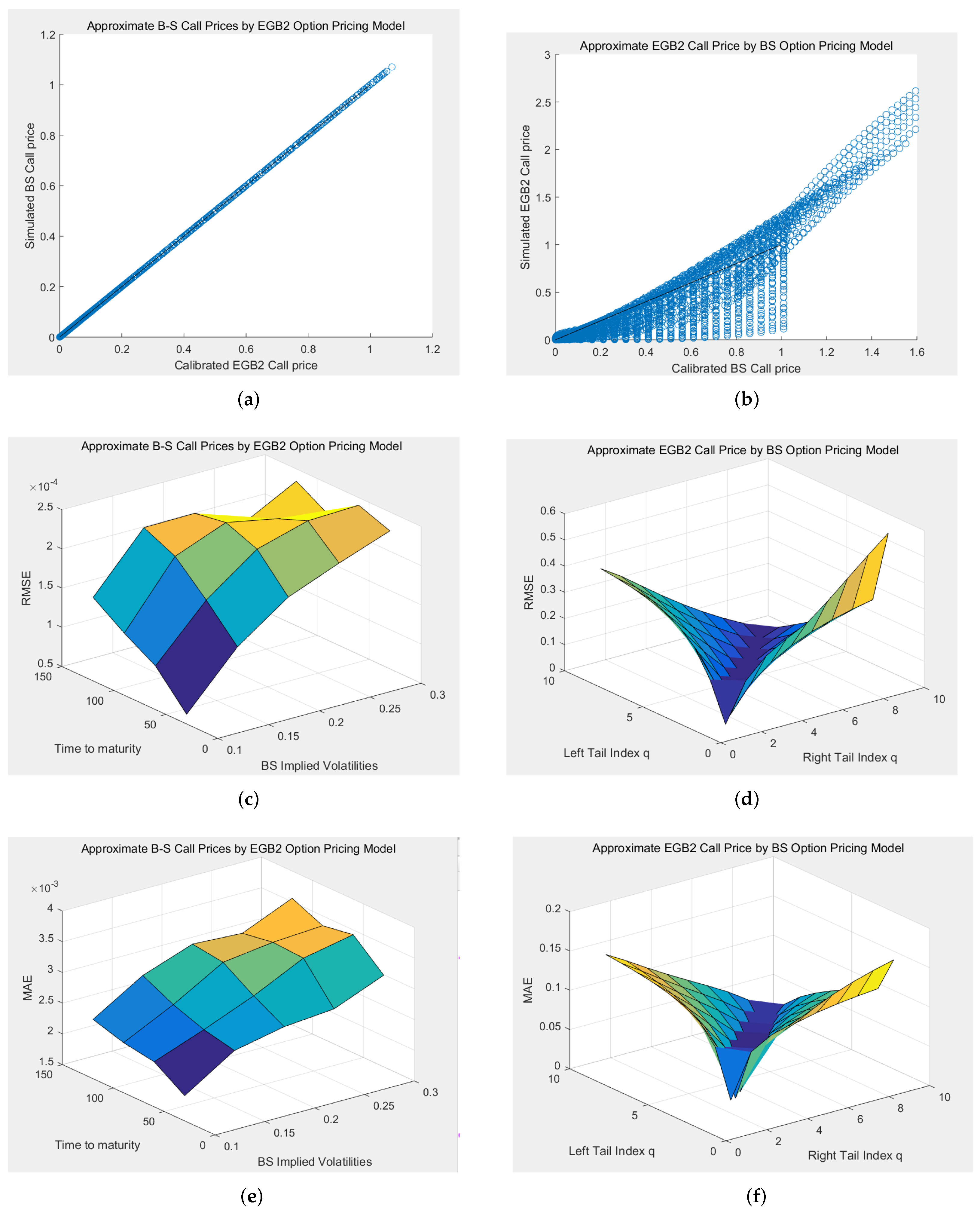

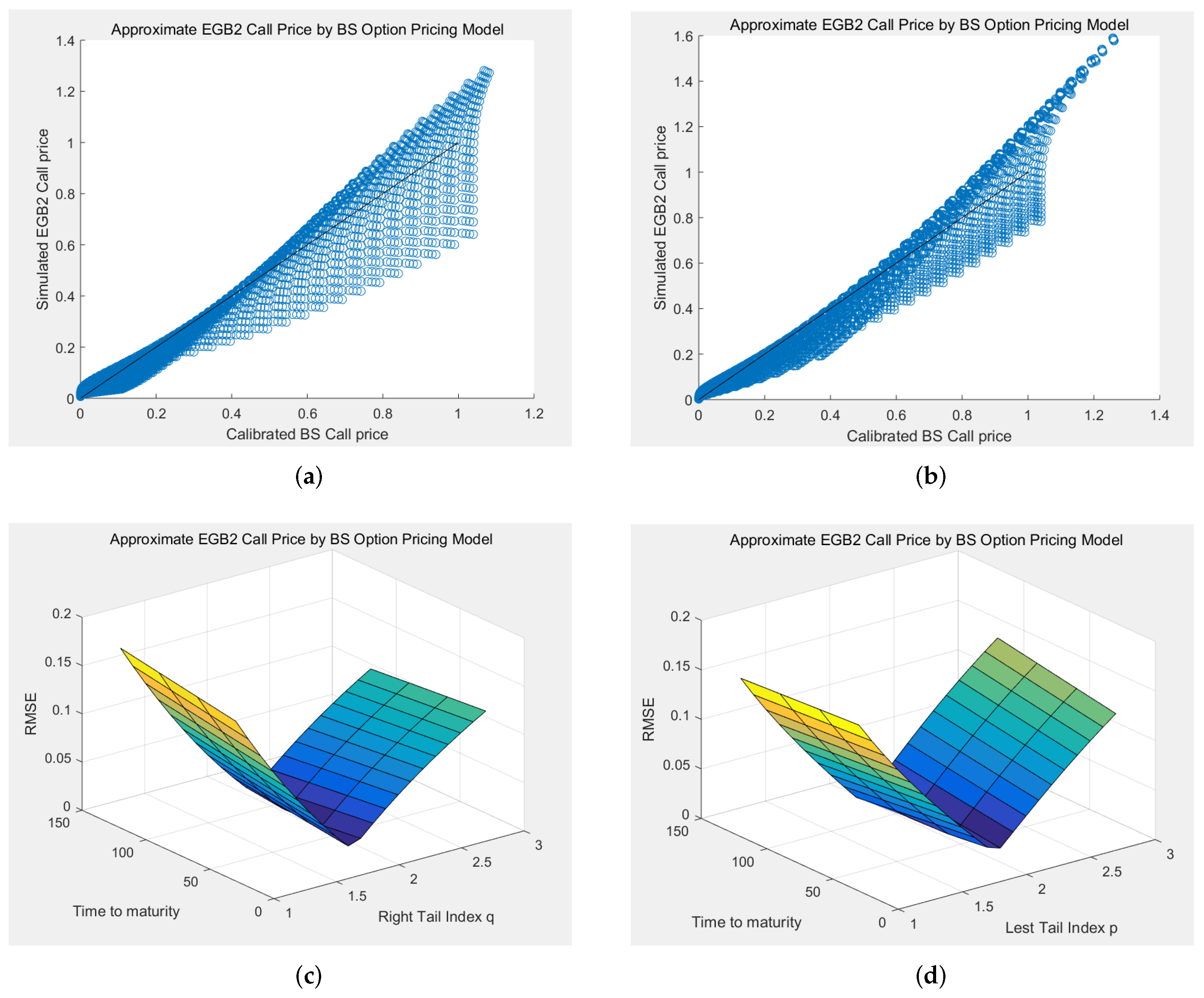

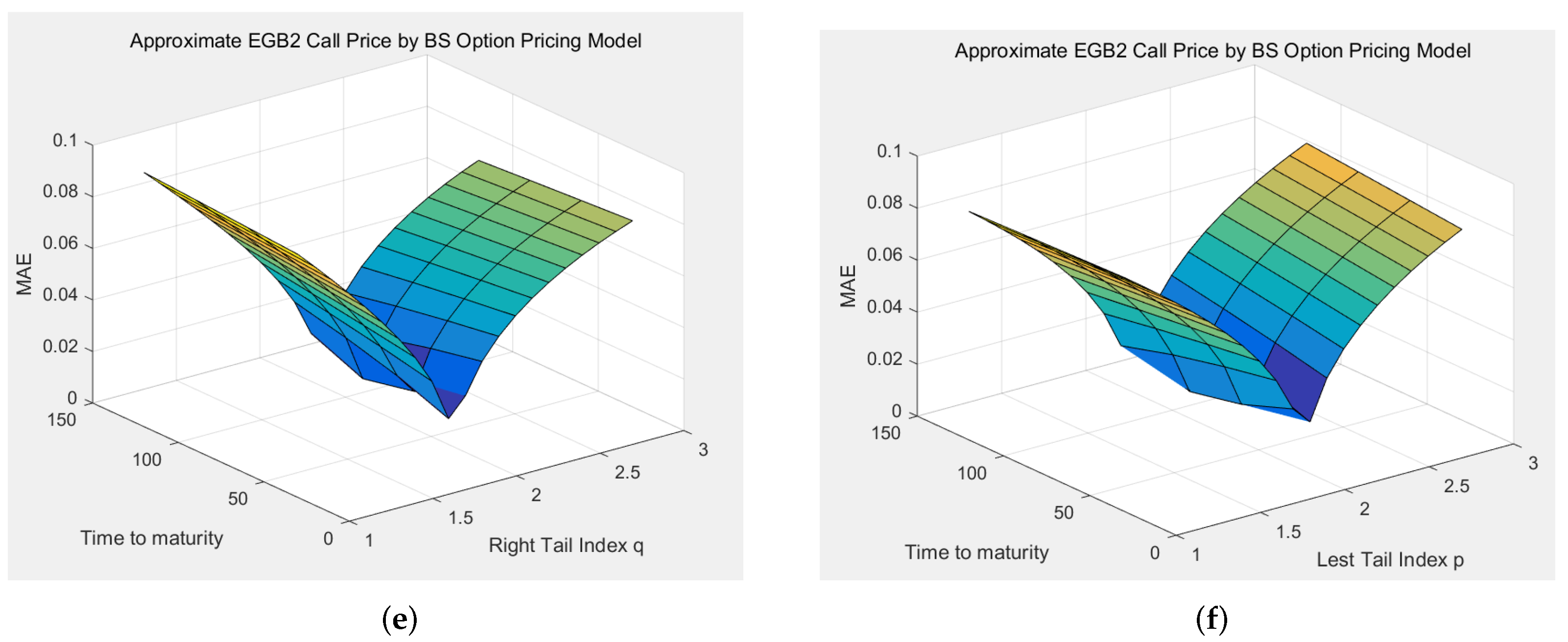

The resulting p-p plots are shown in

Figure 4. The RMSEs in three scenarios (financial crisis, market rebound, and normal market) are 0.0127, 0.0007, and 0.0040. The corresponding MAEs are 0.0249, 0.0019, and 0.0260, respectively. Generally speaking, the points in each p-p plot are close to the 45-degree line, and the resulting RMSEs and MAEs are acceptable, meaning that the EGB2OP model has excellent abilities to approximate (or to “replicate”) Merton option prices when

K is changing. Among these scenarios, the EGB2OP model provides the best approximation toward Merton’s prices during a market rebound and ideal approximations in a normal market. Admittedly, some of the points in panel (a) of

Figure 4 are slightly apart from the 45-degree line. However, this does not mean that the EGB2OP model cannot capture the price change of jump-diffusion models during market turmoils. We can notice that the p-p points in panel (a) of

Figure 4 wraps around the 45-degree line and does not contain abrupt change, which means the tiny gaps between the EGB2OP prices and Merton prices are probably computational and negligible.

The real-data pricing performances are compared in

Table 1. As shown, the EGB2OP model can provide less RMSE and MAE than Merton’s jump-diffusion model in all the scenarios. This means that the jump-diffusion model may not be as practical as the EGB2OP model. In addition, we should note that this comparative analysis is merely in terms of pricing (i.e., the in-sample performance) rather than prediction (i.e., the out-of-sample performance). If predicting ability is considered, the EGB2OP model may outperform all types of jump-diffusion models, as the jump-diffusion setting may entirely model tail risks (i.e., the jumps) stochastically and thus exclude the ability to predict the future. Conversely, the EGB2OP model may detect possible tail risk signals using real data and thus can be used to “report” financial crises. In this regard, this paper proposes three EGB2OP model-based risk reporting tools. See

Section 7 for a more detailed tail risk prediction application.

7. Model-Based Instruments for Tail Risk Signals Detection

Asset pricing and risk analysis are two sides of a coin. Serving as one of the novelties of this paper, this section proposes three model-based instruments to detect tail risk signals from option prices. The first instrument is the tail risk index, which can directly measure tail risk constructed using EGB2 parameters. The second instrument is the EGB2 implied Value at Risk (EGB2-VaR), which quantifies the extent of possible financial losses underlying the EGB2 setting. Via daily calibration of the pricing models, dynamic tail risk signals curves can be obtained using these two instruments. In

Section 7.1 and

Section 7.2, we demonstrate their powerful tail risk detection and early warning abilities by using real data. The third tool is the EGB2 implied risk-neutral density, which detects tail risk signals in a static way. In

Section 7.3, we conduct an event study using the data during the 2015 “stock disaster” in China’s market and demonstrate that the EGB2 implied R.N.D. do provide timely beforehand warnings showing asymmetry in underlying’s losses.

7.1. The EGB2 Implied Tail Risk Index

The tail risk index proposed in this subsection is analogous to the B−S volatility but reflects returns’ asymmetry and market views towards tail risks (the newly proposed measure is termed “implied tail risk index”, or for short, “tail index”). The tail index is constructed using EGB2OP model parameters. Thus, once the model is calibrated, the implied tail (risk) index can be obtained.

The EGB2OP implied tail index

(or

for call options and

for put options) defined as:

and

where

and

are the implied left tail parameter and the implied right tail parameter based on the calibration results of time

t with maturity date

T. One can obtain the EGB2OP implied tail indexes dynamics for both calls and puts by calibrating each day’s EGB2 option pricing model. Ideally, the EGB2 implied tail indexes

and

should be able to reflect the investors’ opinions about tail risks by trading options. If the tail index is positive, i.e., the implied left tail parameter

is larger than the implied right tail parameter

for losses, the underlying R.N.D. for losses in the future is skewed to the right, and the tail probability for big loss is much larger than big gain. When

is positive and extremely large, it is a warning for a bear market or financial crisis. If the tail index is negative, the implied left tail parameter

is smaller than the implied right tail parameter

, i.e., the underlying R.N.D. for losses is skewed to the left, and the tail probability for big gain is larger than a big loss. When

is negative and close to

, it is an indicator of a bull market, and investors are optimistic about the future in terms of “small probability to win a big deal”. The construction of the tail index and the interpretation of the parameters

p and

q also demonstrate the financial interpretability of the EGB2OP model.

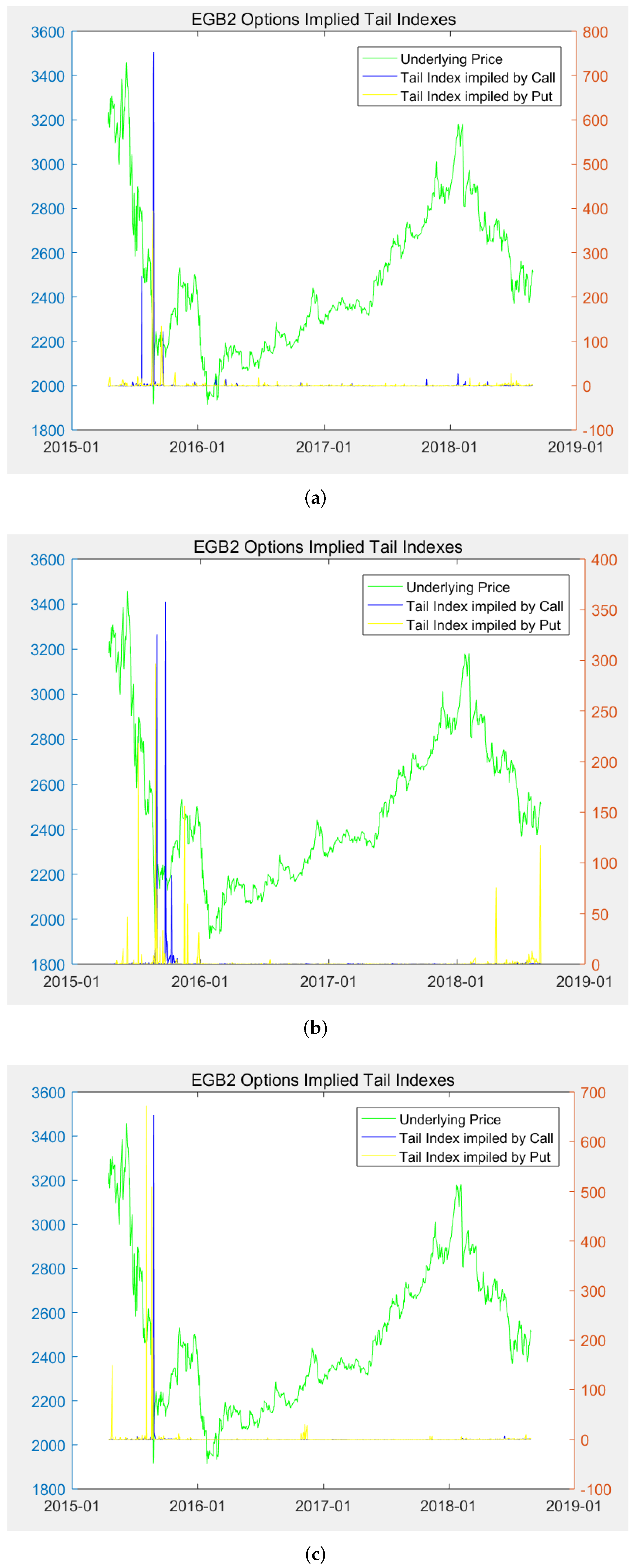

Figure 8 exhibits dynamics of the model-based EGB2 implied tail indexes for the next-month, the near-season, and the next-season. For illustrative purposes, we display the underlying price dynamic in each panel as well. As can be seen from the figures, the tail index

is not far away from 0 except for the time when the markets are at risk. For example, there is a period when implied tail indexes are very large from August 2015 to October 2015, which happens to be a “stock disaster” period in China. The tail indexes were over 3200 for both calls and puts at that time, indicating a financial crisis. Such a warning was meaningful for tail risk management at that time. For studying the use of the EGB2 implied tail indexes and the implied R.N.D. for tail risk warning, we undertake an event study in the next subsection.

7.2. The EGB2 Implied Value at Risk

The second model-based risk measuring instrument is the EGB2 implied Value at Risk (EGB2-VaR). Compared to the method for computing conventional Value at Risk (VaR), the EGB2-VaR is defined as the upper

quantile of R.N.D. of the underlying losses:

where

is the Cumulative Distribution Function (C.D.F.) of R.N.D Equation (

13) using calibrated parameters. Theoretically, a higher value of EGB2-VaR means a stronger signal for tail risk warning.

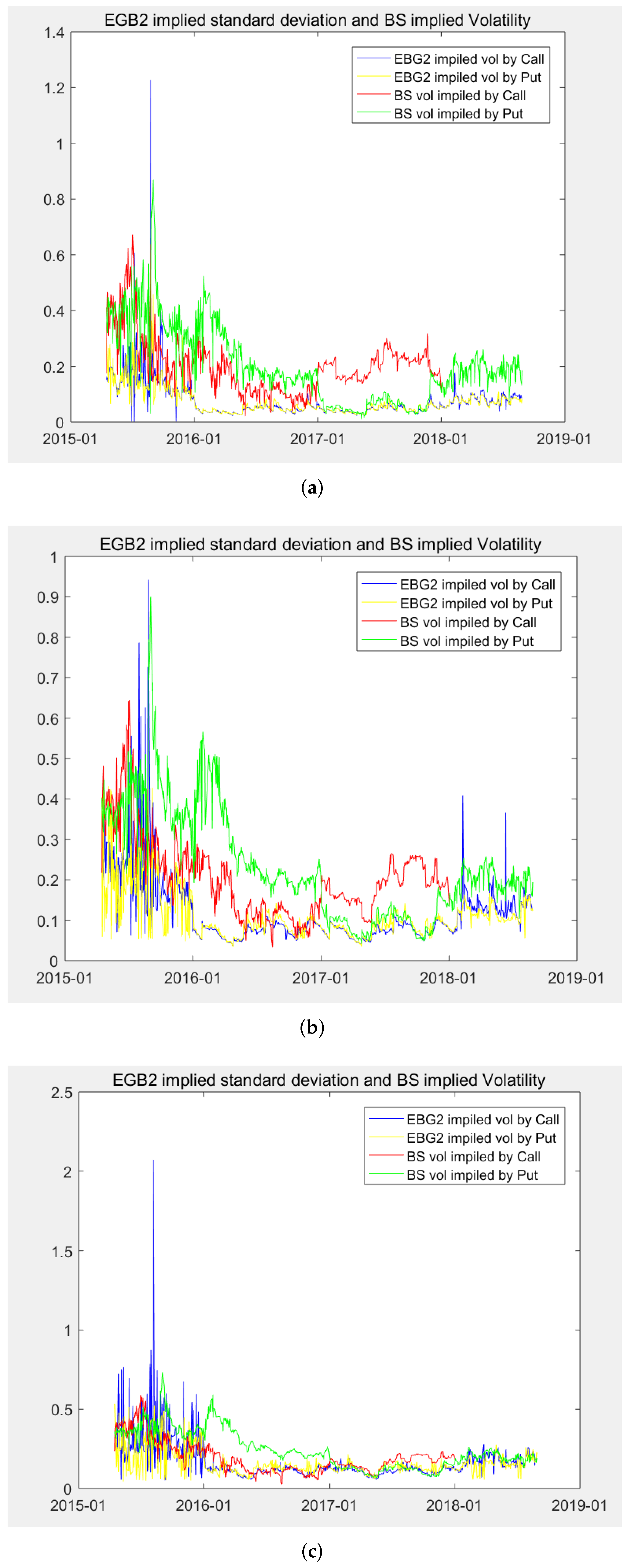

The implied EGB2-VaR dynamics when

are shown in

Figure 9. As shown, both the implied EGB2-VaR for calls and puts reach substantial values from August 2015 to October 2015, which can be seen as signals of tail risk warning. Similarly, the implied EGB2-VaR for the near-season and the next-month calls also puts signal crisis warnings in January 2018 and April 2018. Those results are evidence that EGB2-VaR can be a powerful tool for tail risk signals detection.

7.3. Event Study and the EGB2 Implied Risk-Neutral Density

In practice, the essential element for an option pricing model to reflect the market view and predict the future is the risk-neutral density (R.N.D.). If a model does provide a good mirror of the market’s view, the ex-ante predicting performance is crucial. This paper assumes that it is the negative logarithmic losses rather than the underlying prices that follow the EGB2 distribution. This assumption, in turn, yields the EGB2 model-based R.N.D. for losses, which has great flexibility for capturing tail behavior and fat tail phenomena of markets. In this subsection, we undertake an event study for a bear market time and use one-day-ex-ante R.N.D. The B−S R.N.D.s are also provided in this study as a reference and comparison.

The maximum daily losses for the underlying asset (SSE 50 ETF, trading code: 510050) over our sample period is on the date of 24 August 2015. To examine the one-day-ex-ante prediction performance, we display the EGB2OP implied R.N.D. for loss, and the B−S implied R.N.D. for profit/loss in the last trading date, 21 August 2015. For illustrative reasons, we choose the next-month as an example because it provides the best sensitivity.

The R.N.D. for losses implied by the EGB2OP calls and puts are shown in

Figure 10a and

Figure 10b, respectively. As a comparison, the R.N.D. for returns implied by the B−S model are shown in

Figure 10c,d for calls and puts. As shown in

Figure 10a,b, one day before the extreme crisis came for both calls and puts, the EGB2OP implied R.N.D. of losses were already exhibiting significantly positive skewness and fat tails on the right, which implies that large losses are possible, but high returns are almost impossible. Such results could be an effective warning of the negative sentiment in the market about the ongoing crisis. However, according to

Figure 10c,d, the B−S implied R.N.D. for returns are symmetric for both calls and puts without exhibiting any fat-tail features. Based on the B−S pricing results, one can hardly infer or obtain the market view about the upcoming crisis. Those results evidence that the EGB2 R.N.D. is an ideal static measure for detecting tail risk signals.

8. Conclusions, Implications, and Future Research Directions

8.1. Conclusions and Implications

This paper proposes a novel option pricing model based on the EGB2 distribution, which includes the B−S formula as a limit case and can perfectly “replicate” Merton’s option prices. The generality and interpretability guarantee that the proposed model can capture price behaviors in both peace market periods and financial crises. The pricing accuracy is shown by an empirical study using China’s options data.

We note that the reason why the proposed model has the above ideal properties is because of the powerful structure of the EGB2 distribution per se, rather than the utilization of many parameters. First of all, the EGB2 distribution includes normal and many other distributions as limit cases, which makes it possible for the EGB2OP model to perfectly “replicate” the B−S and Merton’s prices, demonstrating its generality. In addition, due to the flexibility provided by the two tail parameters, the pricing model can guarantee its pricing abilities in both asymmetrical (crises) and symmetrical (normal) cases, which indicates its robustness.

Based on our option pricing model, three tail risk measures (EGB2 tail risk index, EGB2-VaR, and EGB2 R.N.D.) are proposed, all of which are shown to be powerful indicators of tail risks. In practice, investors and policymakers can detect potential tail risk signals by tracing the dynamics of the EGB2-tail risk index and EGB2-VaR. Extremely large values in EGB2 tail indexes and EGB2-VaR are timely warning signals for upcoming crises.

In practice, the proposed EGB2OP model and three model-based tail risk signals detecting tools may offer important implications for policymakers, portfolio managers, and derivatives traders. From a macro level, policymakers can effectively understand the ”market view” of tail risks from the option market to take the lead in using preventive policies before the financial crisis (such as providing timely capital liquidity and market liquidity to the market) macro-level tail risk hedging. At the micro level, portfolio managers can fully use the three tail risk detection tools for portfolio optimization to avoid huge losses (liquidation risks) in a rapidly changing market situation. Meanwhile, since the proposed option pricing model results in better pricing accuracy, it would also be beneficial for asset management companies to conduct more accurate asset pricing when trading derivatives and issuing OTC derivatives.

8.2. Further Study Directions

The proposed EGB2OP model and three model-based tail risk signals detecting instruments might offer a novel benchmark for detecting tail risk signals from option prices, based on which many further studies can be conducted in the future.

First, extending the proposed EGB2OP model into a more general form would be of academic significance. The proposed model is a static model with only a single asset. To make it more general, one can modify the EGB2OP model into a dynamic version by modeling four model parameters with time-series approaches or extend the model into a multi-assets case using multivariate statistical methods.

Second, from an applied perspective, it would be of practical significance to link the EGB2OP model with risk hedging. In this regard, novel EGB2OP model-based Greeks and corresponding tail risk hedging strategies can be further investigated.

Last but not least, this study might offer more hints and implications for complicated option pricing research. In this paper, the proposed model targets the vanilla option, which is the simplest type of option. But it would be necessary to consider tail risk effects and leptokurtic features of asset returns when dealing with more complicated option pricing issues. In the future, EGB2OP model-based pricing algorithms can be further proposed for pricing exotic products such as barrier options, backdating options, and Asian options.