1. Introduction

With the development of China’s economy and e-commerce, the timeliness and safety requirements of high-value-added goods are also constantly improving, and high-speed railways can meet the transportation needs of such goods due to their advantages. However, due to the low market share of the high-speed railway express, the fixed pricing schemes, and the lack of multi-stop transportation schemes, it is difficult for high-speed railway express companies to achieve good returns. Given the above problems, this research studies the freight market share of the high-speed railway express and the multicriteria decision-making scheme of product pricing and slot allocation, aiming to achieve the optimal income under the influence of shares.

At present, some progress has been made in the research of product pricing and slot allocation schemes in railway transportation. There are many relevant studies on high-speed railway express transportation, and it is feasible to use high-speed railway to carry out fast freight transportation to a considerable extent [

1]. In research on product pricing schemes, based on the premise that freight trains can run on the same line as passenger trains without interfering with each other [

2], the freight pricing scheme can be solved by establishing a two-layer objective function with the smallest freight cost and the largest freight profit [

3]. According to known customer needs, establishing the cargo fare class mix (CFCM) model and designing a special algorithm can solve the optimal price combination and slot allocation plan for freight trains [

4]. In research on slot allocation, establishing a two-stage model of high-speed railway express trains and using a column generation algorithm can solve the travel plan, including slot allocation [

5]. The heuristic algorithm and Lagrangian relaxation algorithm can be used to solve the mixed-integer programming model, including the train slot allocation plan, opening route and stopping plan [

6]. By referring to the theory of revenue management, the optimal allocation and optimal pricing models of different levels of cabins can be established from the perspectives of profit maximization and cost minimization [

7,

8], and they can finally be solved by the artificial bee colony algorithm [

9,

10].

While the above research focuses on the feasibility, product portfolio, and pricing of high-speed railway freight transportation, there is little research on the comprehensive optimization of product pricing and slot allocation, and there is a lack of research on the enterprise income in the competitive environment.

In view of the above research limitations, this research focuses on the comprehensive optimization of high-speed railway express product pricing and slot allocation under competitive conditions.

The main objective of this study is to make freight transportation pricing and slot allocation decisions for high-speed railway express companies. This study takes China’s Beijing–Shanghai high-speed railway as the research area. We perform calculations according to the actual freight demand between cities and finally draw up a freight transportation pricing and slot allocation plan for the high-speed railway express in the actual operation process. Therefore, a comprehensive optimization model is established in this paper, and the competitive factors among enterprises are considered.

The main contribution of the results and characteristics of this study, which makes it different from other studies, is the application of revenue management theory in the field of high-speed railway freight in order to propose a comprehensive decision-making model for freight transportation pricing and slot allocation, and to incorporate the dimension of sharing rate into the model. In addition, in terms of its actual contribution, this study provides a quantitative decision-making method for high-speed railway express companies in the process of commercial operation, which not only ensures the competitiveness of the high-speed railway express in the freight market but also improves profits.

The remainder of this article is arranged as follows:

Section 2 is the introduction of the study area and data. After this, in

Section 3, the model is established, and the algorithm is designed in. Furthermore, a case study is presented in

Section 4. Finally, in

Section 5, the conclusions and future research directions are discussed.

2. Study Area and Data

The Beijing–Shanghai high-speed railway was selected as the research object. The Beijing–Shanghai high-speed railway has a total length of 1318 km, directly connecting three municipalities under the Central Government, passing through four provinces, and undertaking busy passenger and freight transport tasks. It also has huge potential for development. The five cities of Beijing, Tianjin, Jinan, Nanjing, and Shanghai are distributed along the line. These cities have large populations and high consumption levels. E-commerce has developed rapidly in these cities, which has led to numerous demands for express freight. Therefore, the above area became a primary and representative market for high-speed railway express travel.

Different modes of transportation operate at the same time in the Beijing–Shanghai section. Due to the influence of its own characteristics, there is a high degree of overlap for the suitable cargo types among the high-speed railway express, highway transportation, and air transportation, which leads to an obvious competitive relationship among various modes of transportation, reflected in the mainline transportation process. Therefore, the mainline transportation process of the Beijing–Shanghai section was selected as the research section. The mainline transportation distance between major cities is shown in

Table 1.

Through enterprise surveys, telephone consultations, and network surveys, the characteristic values of different modes of transportation in the mainline transportation process were determined and are shown below.

In the process of mainline transportation, the transportation speed and carrying capacity of different transportation methods are different. At present, the allowable maximum speed of trucks on highways in China is 100.0 km/h [

11], and their maximum carrying capacity can reach 30.0 tons. The transportation speed of aviation can exceed 500.0 km/h, and its maximum carrying capacity can reach 12.0 tons. In December 2020, high-speed freight Electric Multiple Unit (EMU) trains were officially launched. These trains have a maximum operating speed of 350.0 km/h and a maximum carrying capacity of 87.0 tons.

Our team visited China Railway-Shun Feng (CR-SF) International Express on 15 March 2021 and communicated with the vice president and two operation experts. We obtained relevant data through interviews. Due to the confidentiality requirements of the experts, we do not mention their positions and names in this article. During the interviews, we learned that the cost of high-speed railway mainline freight transportation is USD 0.42/kg, and the price of high-speed railway mainline freight transportation is USD 0.46–0.62/kg. Therefore, the price range of high-speed railway express can be set at USD 0.42–0.62/kg. After checking information through the official website of more than ten logistics companies and consulting them on the phone, we found that the price of mainline air transportation is USD 0.77/kg and the price of mainline road transportation is USD 0.31/kg.

According to a survey on the transportation characteristic value statistics of the Civil Aviation Administration of China (CAAC), the State Post Bureau, and the China State Railway Group Corporation, the rate of air transport punctuality is 81.4% [

12]; the rate of road transport punctuality is 77.9% [

13]; and the rate of its cargo damage is 2.0%. The rate of high-speed railway express punctuality is 95.0%.

Beijing, Tianjin, Jinan, Nanjing, and Shanghai are municipalities and provincial capitals with a rapid economic development, rapid development of e-commerce, and strong demand for express freight. The past statistics of express freight between cities cannot be selected as the basic data for calculating future inter-city express travel demand. Therefore, the daily demand for express goods between cities in 2022 is predicted according to the statistics of express freight from 2005 to 2018 [

14], and the results are shown in

Table 2.

3. Modeling Study

3.1. Model Establishment

3.1.1. Sharing Rate Model Establishment

According to the previous analysis, there is competition among different modes of transportation in the mainline transportation process. Therefore, it is necessary to establish a sharing rate model to calculate the market share of freight transportation by different modes of transportation.

Suppose that there are a total of L sections of the running route, including L + 1 stops that can carry out freight operations. Let m represent the operating section, m = 1, 2, … L. Let (i, j) represent the origin/destination (OD), composed of one or more continuous sections, where i is the start station of OD, and j is the end station of OD. In a certain period of time, there are various modes of transportation that can provide freight services on (i, j). Let k be a certain mode of transportation. When k = 1, 2, 3, they refer to road transportation, air transportation, and high-speed railway express routes, respectively.

The Logit model is used to calculate the market share of freight transportation by different modes of transportation. Introducing the conversion coefficient

, and assuming that the probability that the goods in total demand for (

i,

j), the

k-th transportation mode is chosen as

, and the Logit model can be expressed as Formula (1) [

15]:

where

: the share rate of the k-th transportation mode in the section (i, j);

: the utility function of the k-th transportation mode in the section (i, j);

: the contribution rate conversion factor.

The main factors that affect the competitiveness of the fast freight of different modes of transportation are economy, punctuality, speed, and safety [

16,

17,

18]. Therefore, from the above four aspects, construct the utility function

of the

k-th transportation mode for goods on (

i,

j), as shown in Formula (2) [

15]:

where

: the transportation price of the k-th transportation mode on (i, j). Unit: USD/kg;

: the transportation punctuality rate of the k-th transportation mode. Unit: %;

: the transport time of the k-th transport mode on the mainline between (i, j). Unit: h;

: transport safety of the k-th mode of transport. Unit: %;

: mainline transportation time utility function parameters;

: punctual utility function parameters.

From the actual research and interview with CR-SF International Express, the actual transportation cost was obtained. In order to ensure the profit of the high-speed railway enterprise, the transportation price cannot be lower than the cost. From the relevant information, the freight price of other transportation methods was obtained; considering the customer’s intention and competitiveness, the price of high-speed railway cannot be too high. So, the price of transportation

needs to take into account social benefits and transportation costs at the same time and limit them to fluctuating within a certain range, as shown in Formula (3):

where

: the lower limit of freight price for the k-th transportation mode on (i, j). Unit: USD/kg;

: the upper limit of freight price for the k-th transportation mode on (i, j). Unit: USD/kg.

The trunk transportation time

T is usually calculated by the transportation distance and the transportation speed, as shown in Formula (4):

where

: the distance between (i, j). Unit: km;

: the average transportation speed of the k-th transportation mode during (i, j) mainline transportation. Unit: km/h.

The safety is reflected by the cargo damage rate, as shown in Formula (5) [

15].

where

: the cargo damage rate of the k-th mode of transport in the process of cargo transportation. Unit: %.

3.1.2. Optimal Model Establishment

Take the freight price

on (

i,

j) and the allocated quantity

of space on (

i,

j) for the

k-th mode of transportation as decision variables. The maximum tonnage of cargo that can be loaded on the section and the scope of price fluctuations as the constraints, as well as the optimal profit as the objective, function to establish a comprehensive optimization model for transportation product pricing and slot allocation, as shown in Formula (6):

where:

: the transportation price of the k-th transportation mode on (i, j). Unit: USD/kg;

: the slot allocation quantity of the k-th transportation mode on (i, j). Unit: t;

: the maximum capacity of the k-th transportation mode. Unit: t;

: the traffic volume occupied by the k-th mode of transportation on (i, j). Unit: t;

can be calculated according to Formula (7):

The optimal solution is obtained by solving the number of slot allocations under the pricing plan , and the optimal objective function value obtained is the optimal value of the various transportation modes under the condition that the pricing plan is and the space allocation plan is for freight revenue.

3.2. Model Design

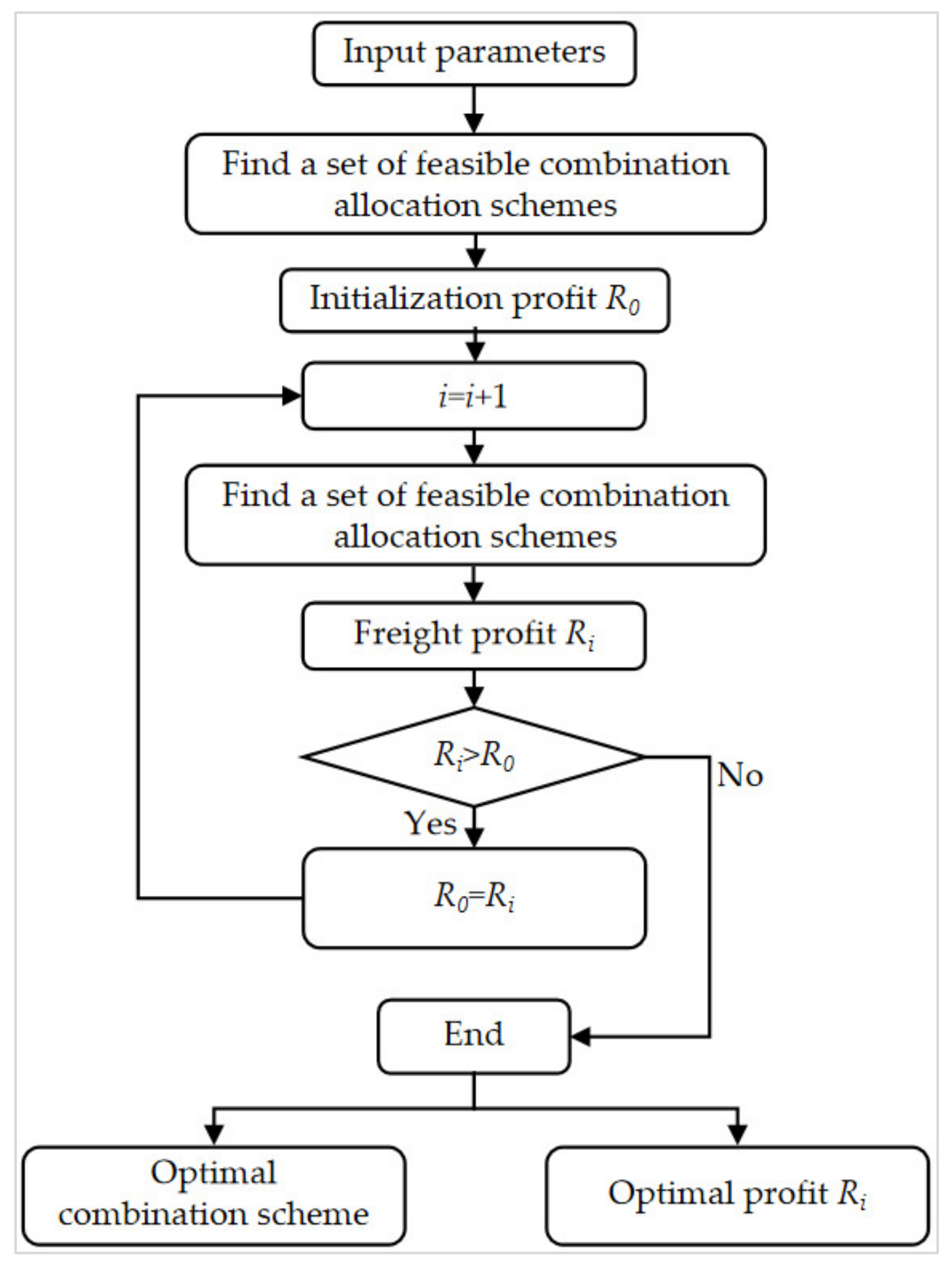

The model established above is a typical constrained, nonlinear, mixed-integer programming model. It is necessary to design related algorithms to solve the problem. The specific steps of the algorithm are as follows:

Step 1: Set the initial parameters of the algorithm: express product price, space allocation, and number of iterations (the initial number of iterations is 0).

Step 2: According to the freight utility function and the sharing rate model, calculate the sharing rate of high-speed railway express transportation and the demand for cargo transportation at different prices.

Step 3: Compare the demand for cargo transportation with the allocated space, take the minimum of the two, and calculate the freight revenue under the pricing plan and the space allocation combination plan.

Step 4: Regarding the cargo space as the outer loop and the product price as the inner loop, record the freight revenue under different product prices and space allocation combinations.

Step 5: Output the optimal freight income and the corresponding product price and space allocation combination plan.

The basic flow of the algorithm is shown in

Figure 1.

4. Case Study

Because high-speed railway freight transportation does not operate on a large scale in China and high-speed railway freight stations have not been built, this study is advanced, novel, and makes some assumptions. Therefore, we assume that the scenario of this research is that a high-speed freight Electric Multiple Unit (EMU) train can be normally operated and included in the high-speed railway train diagram. The other assumptions are as follows:

(i) The high-speed freight Electric Multiple Unit (EMU) train only serves express travel, and mixed passenger and freight transportation are not considered.

(ii) A special freight station for the high-speed railway express has been built, or the existing railway station can meet the operation requirements of the high-speed railway express, and the train can complete the cargo loading and unloading operation at the intermediate station.

(iii) This research only studies the single train operation of a high-speed rail freight EMU train from the departure station to the terminal station.

According to numerous studies and the statistical analysis of historical data, the values of the trunk transportation time utility function parameter

, the punctual utility function parameter

, and the sharing rate model conversion coefficient

are 1.65, 0.12, and 0.012, respectively [

14,

15]. Using MATLAB and Python to solve the model in

Section 3, the final result of the comprehensive optimization of the product pricing and slot allocation of the Beijing–Shanghai high-speed railway express train is shown in

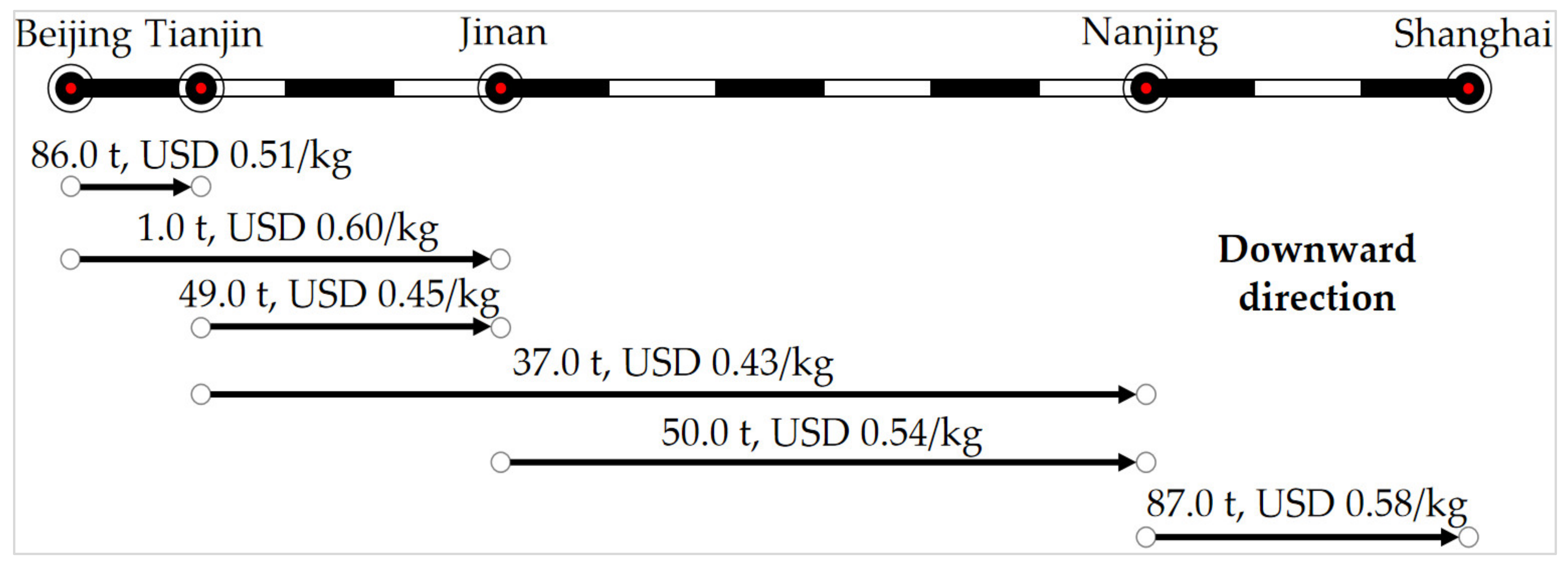

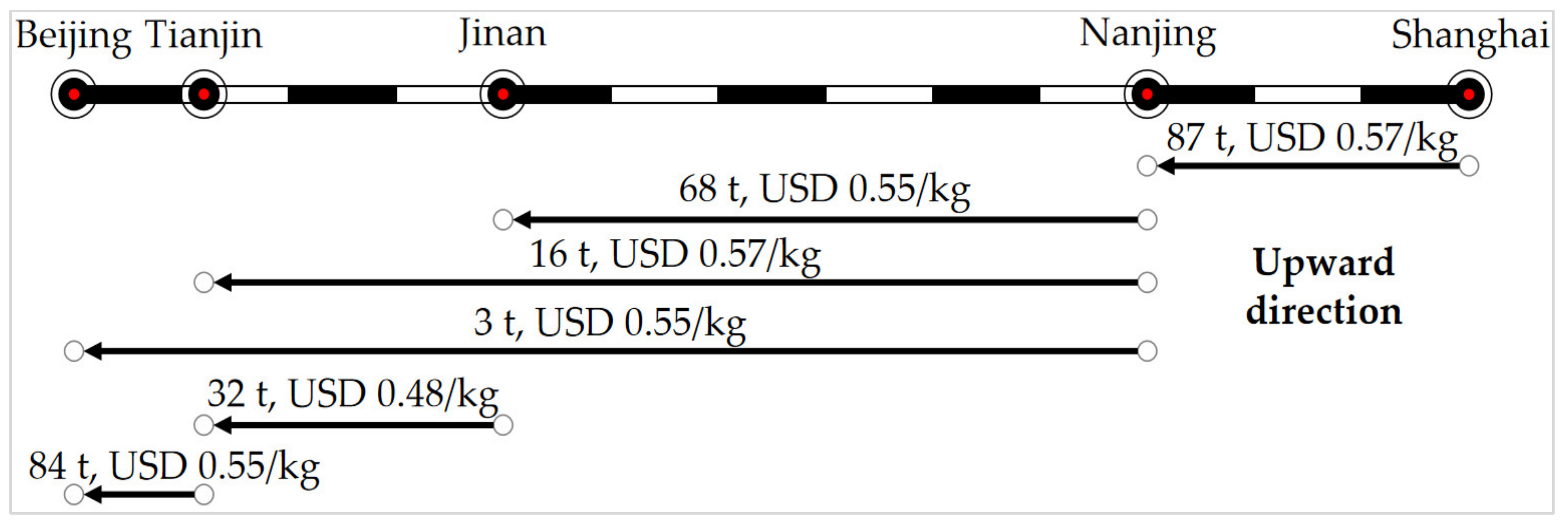

Table 3.

Taking the Tianjin–Nanjing section as an example, the results show that the product pricing and slot allocation plans for the Tianjin–Nanjing section of the high-speed railway express freight train from Beijing to Shanghai (downward) are USD 0.43/kg and 37.0 tons, respectively. The plans for Nanjing–Tianjin (upward) are USD 0.57/kg and 16.0 tons.

According to the description in

Section 2, the price range of high-speed railway mainline transportation products is generally USD 0.46–0.62/kg. Taking USD 0.46/kg and USD 0.62/kg as the existing transportation prices of high-speed railway express transportation, the profit of the high-speed railway express under the existing pricing scheme is shown in

Table 4.

According to the results shown in

Table 4,compared with the existing fixed pricing schemes, the product pricing and slot allocation combination scheme proposed in this study can achieve a freight profit higher than the original 13.6%.

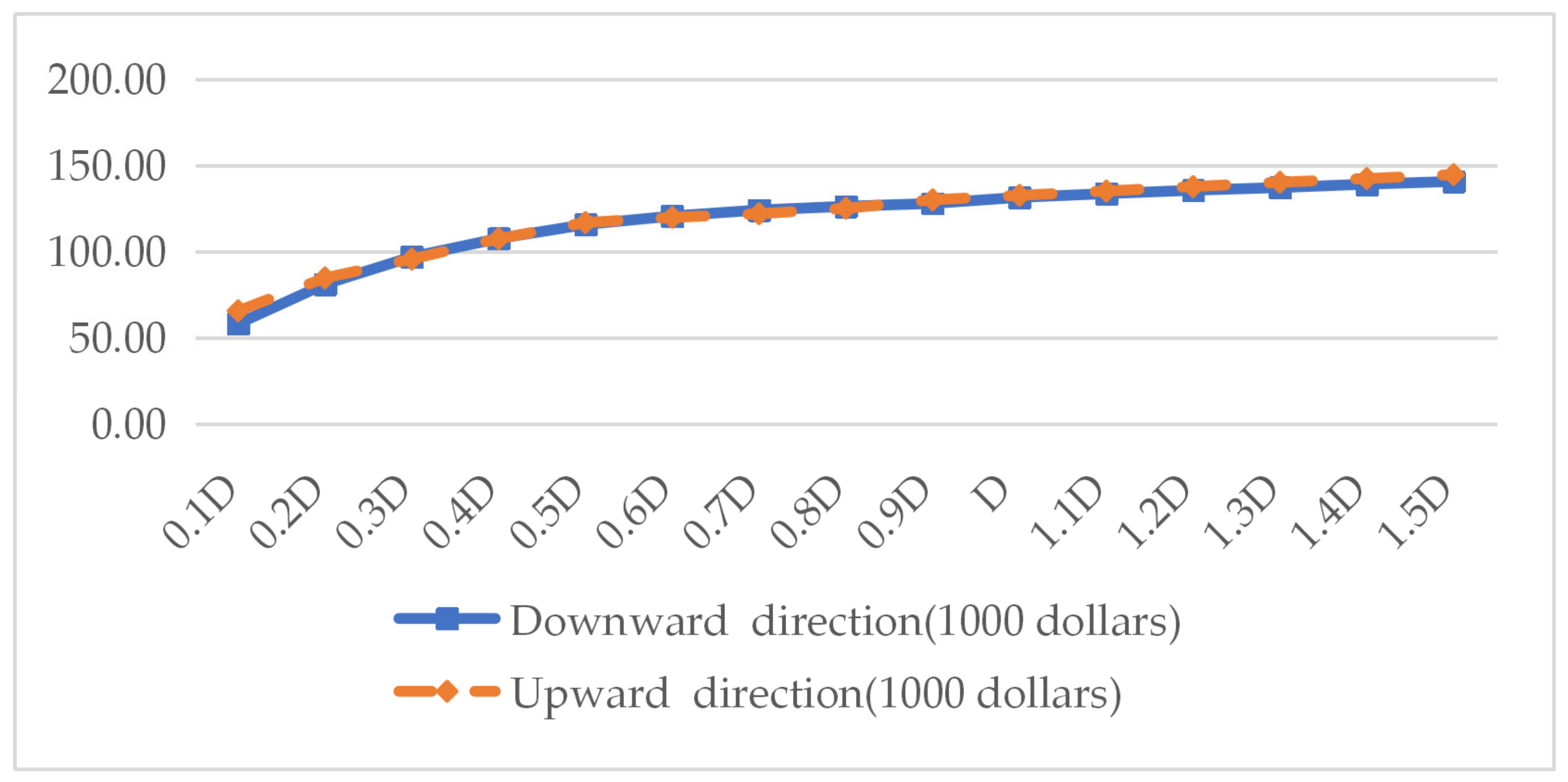

The key factor affecting the combination strategy in the competitive environment is the demand for express transportation. In order to eliminate the contingency of the combination plan caused by the shortage of supply, a sensitivity analysis of the optimal combination plan of high-speed rail express product pricing and slot allocation to the demand for express freight is also explored.

After adjusting the demand

D of express freight transportation in a certain period of time, the relationship between the optimal benefit of high-speed railway express transportation and the demand

D for express cargo transportation is calculated, as shown in

Figure 4.

When the demand for express freight transportation increases, the optimal profit of high-speed railway express also increases. However, due to the existence of market competition, we cannot consider simply increasing pricing to increase profit, so the optimal profit curve tends to be flat. We need to expand value-added services, rather than simply relying on transportation to increase profit.

The optimal combination scheme of high-speed railway express product pricing and slot allocation under different express cargo transportation needs of 0.1, 0.5, and 1.2 is shown in

Table 5.

It can be seen from

Table 5 that, when the demand is low, the average price of high-speed railway express products is USD 0.49/kg, and the slot allocation of the entire OD shows the characteristics of less slot allocation in a single section and more in opening sections. When the demand is higher, the average price of high-speed railway express products is USD 0.52/kg, and the slot allocation of the entire OD shows the characteristics of large slot allocation in a single section and a few opening sections. Therefore, in the early stage of market expansion, due to this small scale, high-speed railway companies can increase profit by serving more cities. When demand increases, companies can develop high-quality routes to increase profit and improve the timeliness of transportation.

5. Conclusions

The Beijing–Shanghai high-speed railway in its corresponding section was selected as the research line, and the provincial capitals were selected as the research cities for this study. This research provides a comprehensive optimization study on the price adjustment and slot allocation scheme of high-speed railway express trains under the environment of competition between different transportation modes. By comparing and analyzing existing high-speed railway express pricing schemes, it can be concluded that the profit from the comprehensive optimization study in this research is higher. Following a sensitivity analysis of transportation demand, it could be concluded that the profit realized by the comprehensive optimization method will rise with an increase in transportation demand, during which the product pricing will decrease with the increase in demand. Moreover, the slot allocation scheme shows that the amount of slot allocation in a single section will increase, and the length of the section will decrease.

In the current competitive environment of the freight market, the scheme proposed in this study not only ensures the competitiveness of high-speed railway expresses but also improve enterprise profits by 13.6%. All of this can enhance the viability of high-speed railway express enterprises in economic competition.

However, research on the pricing and slot allocation of high-speed railway express products is a complex and long-term problem. There are still many subsequent problems that need to be further studied. The assumption in this research is that the high-speed railway freight EMU train has been included in the high-speed railway train diagram. Determining how to achieve minimum impact on passenger service on the basis of operation, or maximum profit from passenger and freight combination, represents an important problem to be studied in the future. Furthermore, this research focuses on the competitive relationship of various transportation modes in the process of mainline transportation. It is also necessary to consider the competitive and cooperative relationship in the process of short-barge transportation in future research.