Forecasting FOMC Forecasts

Abstract

:1. Introduction

The Federal Open Market Committee (FOMC) announced on Wednesday that, as part of its ongoing commitment to improve the accountability and public understanding of monetary policy making, it will increase the frequency and expand the content of the economic projections that are made by Federal Reserve Board members and Reserve Bank presidents and released to the public.(FOMC Press Release 14 November 2007)

Appropriate monetary policy is defined as the future policy most likely to foster outcomes for economic activity and inflation that best satisfy the participant’s interpretation of the Federal Reserve’s dual objectives of maximum employment and price stability.(FOMC Minutes, 31 October 2007, p. 9)

Faust’s position raises several questions. Specifically, does the absence of hints imply the absence of any information? Indeed, is understanding monetary policy, as sought by the SEP, limited to discovering such hints? If not, what empirical alternatives might be available? Addressing these questions is the goal of this paper.The SEP, in my view, deserves a special place in the annals of obfuscation in the service of transparency. The SEP is purely a depiction of the policymakers’ different views on the outlook and appropriate policy, with no hints about how any differences may be resolved.

2. FOMC Forecasts

2.1. Participants

2.2. Frequency and Horizon

2.3. Content

- Immediate. Immediately after the relevant meeting, the FOMC releases information that includes participants’ forecast range and central tendency for GDP growth, inflation, and unemployment;

- Five-year delay. With an approximate five-year delay, the FOMC releases participants’ individual projections (without attribution) and the Tealbook forecasts from the staff of the Federal Reserve Board;

- Ten-year delay. With an approximate ten-year delay, the FOMC releases the participants’ individual projections with attribution, i.e., naming which participant made which forecast.

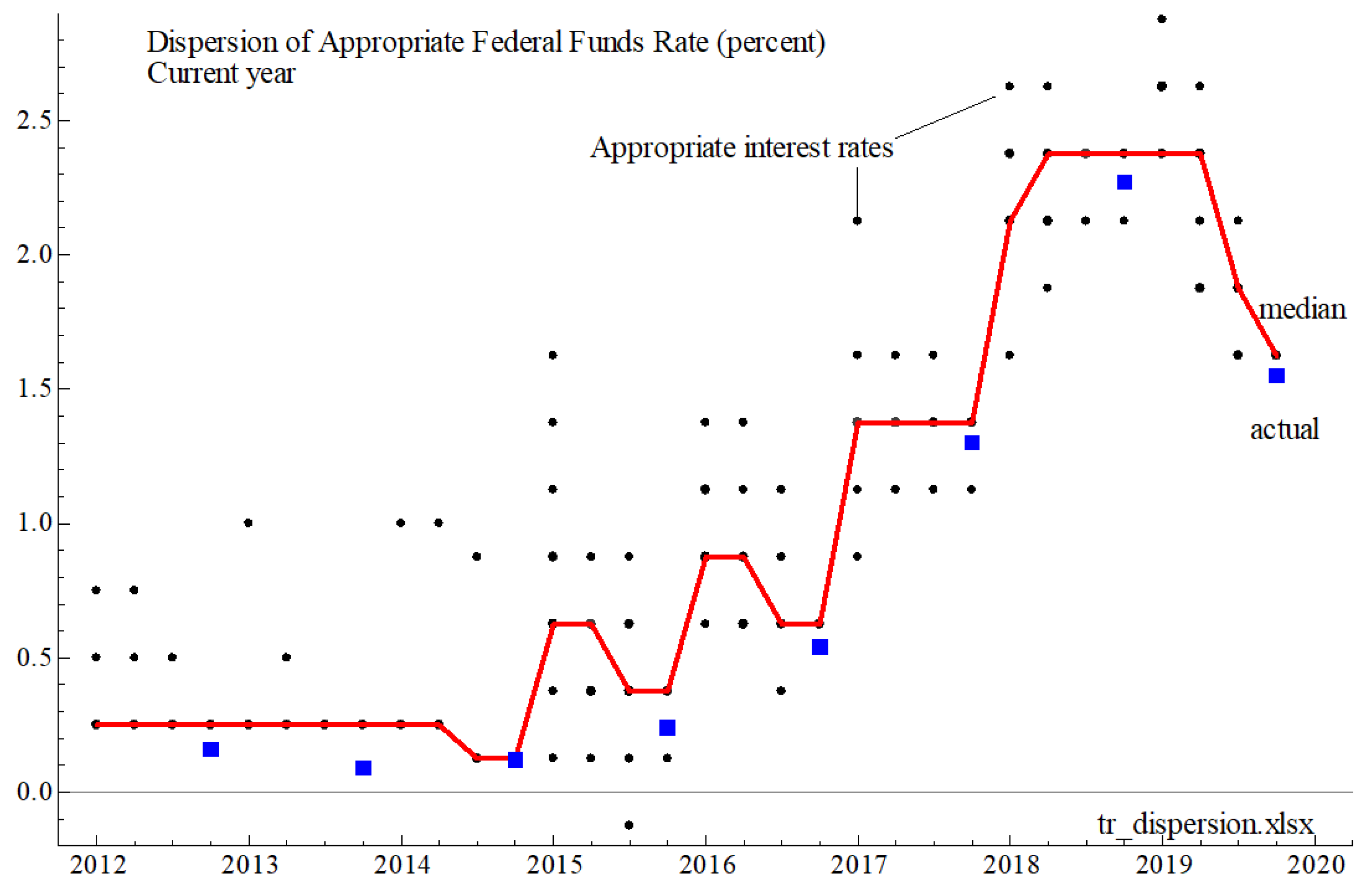

2.4. Appropriate Federal Funds Rate

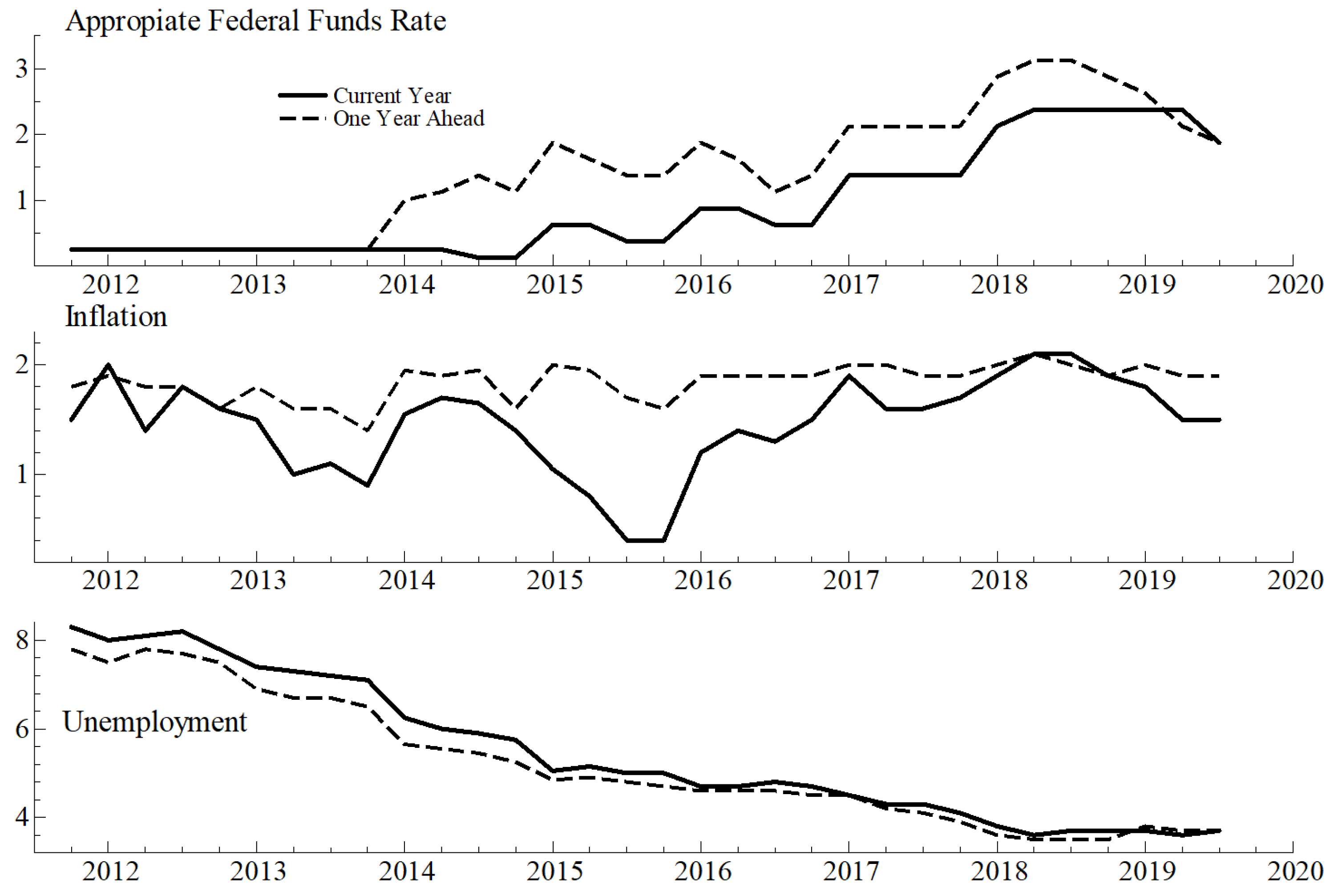

2.5. Inflation and Unemployment Forecasts

2.6. Loss of Information from Delayed Releases

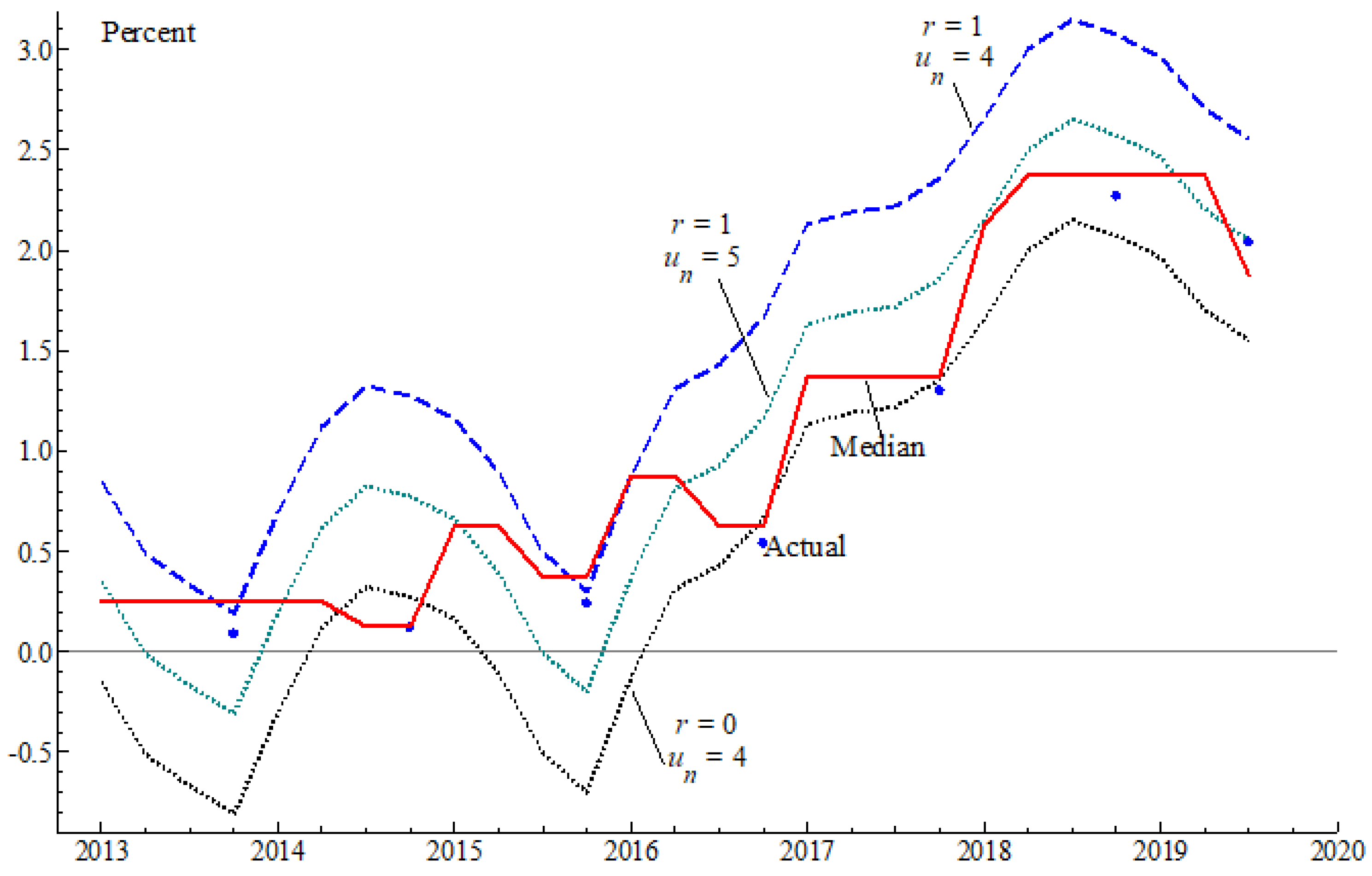

3. Models of the Projected Appropriate Interest Rate

3.1. Single-Equation Models

Wouldn’t it be easier if the FOMC just provided its reaction function, together with collective projections of key macroeconomic variables? In principle, yes; and in fact, in the course of expanding the SEP, the FOMC under my chairmanship experimented with developing a consensus committee forecast, together with alternative scenarios, that could be released to the public.

3.2. Multi-Equation Models

3.3. Data

3.4. Empirical Formulations

- is the inflation projection issued in period p for target year ;

- is the unemployment projection issued in period p for target year ;

- is the federal funds rate projection issued in period p for target year ;

- ;

- This model has 78 coefficients.

- B and rule out cross-persistence effects. Specifically, affects , but not ;

- C shows that the use of publicly available data is targeted. For example, and affect , but not

3.5. Estimation Results

- (1)

- (2)

- Table 10 reports the test statistics for the hypothesis of serial independence, homoscedasticity, and normality applied to the individual equation’s residuals and to the associated vector of residuals. The results indicate mixed support for these properties;

- (3)

- Figure 8 and Figure 9 report three sequences of recursive Chow test statistics: one-step-ahead (1up); N-periods-ahead, where N decreases as the estimation sample increases (N N-periods-ahead where N increases as the estimation sample increases (N. The focus is on and the system as a whole (“CHOWs”). The test statistics are well below the one-percent critical rejection value, except for in 2019 using the restricted model.

3.6. Model Fit

3.7. Congruency: Residuals

3.8. Congruency: Recursive Chow Tests

4. Assessing the Models’ Usefulness

4.1. Predictive Accuracy

4.2. Forecast Revisions

- Figure 11 shows that a transitory, one percentage point upward revision in ( see Equations (6) and (7)) raises by 40 basis points and by 80 basis points in the unrestricted VAR. These increases contradict existing macroeconomic theory, the Taylor rule, and the empirical results shown in the single-equation estimation results reported above. Therefore, the unrestricted VAR developed here is not consistent with the macroeconomic theory underlying the dual mandate. Applying the same forecast revision to the restricted VAR shows that decreases by 40 basis points and that decreases by nearly 50 basis points. These decreases are consistent with the macroeconomic theory that underlies the Fed’s dual mandate. Thus, only the restricted VAR satisfies and

4.3. Forecast Revisions

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. List of Variables

| Symbol | Definition |

|---|---|

| p | calendar period given by the row headings of Table 3 |

| t | target date for FOMC forecasts given by the column headings of Table 3 |

| dummy variable equal to one for Bernanke’s tenure as Chair of the FOMC, zero otherwise | |

| dummy variable equal to one for Greenspan’s tenure as Chair of the FOMC, zero otherwise | |

| dummy variable equal to one for Powell’s tenure as Chair of the FOMC, zero otherwise | |

| dummy variable equal to one for Yellen’s tenure as Chair of the FOMC, zero otherwise | |

| forecast for from the Survey of Professional Forecasters released in period p for target date t | |

| forecast for u from the Survey of Professional Forecasters released in period p for target date t | |

| forecast for from the Federal Reserve Board’s Greenbook released in period p for target date t | |

| forecast for u from the Federal Reserve Board’s Greenbook released in period p for target date t | |

| BLS recorded value for u in period p | |

| BLS recorded value for u in period p | |

| midpoint of the range of the distribution of the FOMC forecasts for released in period p for target date t | |

| midpoint of the range of the distribution of the FOMC forecasts for u released in period p for target date t | |

| median of the distribution of the FOMC forecasts for released in period p for target date t | |

| median of the distribution of the FOMC forecasts for u released in period p for target date t | |

| median of the distribution of the FOMC forecasts for R released in period p for target date t |

Appendix B. Coefficient Estimates for the Restricted Model

| Current-Year Bloc Equation (7) | ||||||||

| Variable | coeff | se | Variable | coeff | se | Variable | coeff | se |

| 0.611 | (0.172) | 0.218 | (0.088) | 0.276 | (0.100) | |||

| 0.175 | (0.183) | 0.851 | (0.128) | 0.317 | (0.103) | |||

| 0.119 | (0.156) | −0.399 | (0.104) | −0.365 | (0.078) | |||

| −0.266 | (0.336) | 0.219 | (0.126) | |||||

| −0.402 | (0.625) | −0.461 | (0.242) | |||||

| 2.126 | (2.367) | 2.137 | (0.833) | 2.462 | (0.598) | |||

| 1.824 | (1.862) | 1.520 | (0.653) | 1.938 | (0.425) | |||

| 2.139 | (2.289) | 1.707 | (0.823) | 2.468 | (0.448) | |||

| One-Year-Ahead Bloc—Equation (7) | ||||||||

| Variable | coeff | se | Variable | coeff | se | Variable | coeff | se |

| 0.162 | (0.066) | 0.896 | (0.054) | −2.158 | (1.320) | |||

| −0.064 | (0.049) | 0.154 | (0.448) | −3.870 | (4.482) | |||

| - | - | - | - | - | -0.717 | (0.626) | ||

| - | - | - | - | - | 0.522 | (0.204) | ||

| 1.935 | (0.361) | 0.025 | (1.023) | −3.870 | (7.335) | |||

| 1.964 | (0.249) | −0.005 | (0.992) | −5.761 | (7.518) | |||

| 1.912 | (0.224) | −0.043 | (1.001) | −3.749 | (7.240) | |||

| 1 | An earlier and complementary study is that of Castle et al. (2017). |

| 2 | The literature on forecasting is vast, but references relevant to this paper include (Clements and Hendry 1998a, 1998b, 2002, 2011). |

| 3 | Note that the median of R need not correspond to a participant with the median of or |

References

- Bernanke, Ben S. 2016. Federal Reserve Economic Projections: What Are They Good for? Brookings. Available online: https://www.brookings.edu/blog/ben-bernanke/2016/11/28/federal-reserve-economic-projections/ (accessed on 22 January 2021).

- Bespalova, Olga. 2018. Forecast Evaluation in Macroeconomics and International Finance. Ph.D. thesis, George Washington University, Washington, DC, USA. [Google Scholar]

- Castle, Jennifer L., David F. Hendr, and Andrew B. Martinez. 2017. Evaluating Forecasts, Narratives and Policy Using a Test of Invariance. Econometrics 5: 39. [Google Scholar] [CrossRef] [Green Version]

- Clements, Michael P., and David F. Hendry. 1998a. Forecasting Economic Processes. International Journal of Forecasting 14: 111–31, (with discussion). [Google Scholar] [CrossRef]

- Clements, Michael P., and David F. Hendry. 1998b. Forecasting Economic Time Series. Cambridge: Cambridge University Press. [Google Scholar]

- Clements, Michael P., and David F. Hendry, eds. 2002. A Companion to Economic Forecasting. Oxford: Blackwell Publishers. [Google Scholar]

- Clements, Michael P., and David F. Hendry, eds. 2011. Oxford Handbook of Economic Forecasting. Oxford: Oxford University Press. [Google Scholar]

- Doornik, Jurgen A. 2009. Autometrics. In The Methodology and Practice of Econometrics: A Festschrift in Honor of David Hendry. Edited by Jennifer Castle and Neil Shephard. Oxford: Oxford University Press. [Google Scholar]

- Doornik, Jurgen A., and David F. Hendry. 2018. Empirical Econometric Modeling. London: Timberlake Consultants Press, vol. 3. [Google Scholar]

- Ericsson, Neil R. 2016. Eliciting GDP forecasts from the FOMC’s minutes around the financial crisis. International Journal of Forecasting 32: 571–83. [Google Scholar] [CrossRef] [Green Version]

- Faust, Jon. 2016. Oh What Tangled Web we Weave: Monetary Policy Transparency in Divisive Times. Hutchison Center Working Paper #25. Available online: https://www.brookings.edu/wp-content/uploads/2016/11/wp25_faust_monetarypolicytransparency_final1.pdf (accessed on 22 January 2021).

- Hendry, David F. 1980. Econometrics—Alchemy or Science? Economica 47: 387–406. [Google Scholar] [CrossRef]

- Hendry, David F., and Jurgen A. Doornik. 1999. Empirical Econometric Modelling Using PcGive. London: Timberlake. [Google Scholar]

- Powell, Jerome H. 2018. Monetary Policy in a Changing Economy, Board of Governors of the Federal Reserve System, Remarks at the Jackson Hole Meetings, August 24. Available online: https://www.federalreserve.gov/newsevents/speech/files/powell20180824a.pdf (accessed on 22 January 2021).

- Stekler, Herman, and Hilary Symington. 2016. Evaluating qualitative forecasts: The FOMC minutes, 2006–2010. International Journal of Forecasting 32: 559–70. [Google Scholar] [CrossRef]

| Forecast Date | 1995 | 1996 | 1997 | 1998 |

|---|---|---|---|---|

| February 1995 | • | |||

| July 1995 | • | • | ||

| February 1996 | • | |||

| July 1996 | • | • | ||

| February 1997 | • | |||

| July 1997 | • | • |

| Forecast Date | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ⋯ | Long-Run |

|---|---|---|---|---|---|---|---|---|

| 2010:Q1 | • | • | • | ⋯ | • | |||

| 2010:Q2 | • | • | • | ⋯ | • | |||

| 2010:Q3 | • | • | • | • | ⋯ | • | ||

| 2010:Q4 | • | • | • | • | ⋯ | • | ||

| 2011:Q1 | • | • | • | ⋯ | • | |||

| 2011:Q2 | • | • | • | ⋯ | • | |||

| 2011:Q3 | • | • | • | • | ⋯ | • | ||

| 2011:Q4 | • | • | • | • | ⋯ | • | ||

| 2012:Q1 | • | • | • | ⋯ | • | |||

| 2012:Q2 | • | • | • | ⋯ | • | |||

| 2012:Q3 | • | • | • | • | ⋯ | • | ||

| 2012:Q4 | • | • | • | • | ⋯ | • |

| Date of Press Release | Content |

|---|---|

| 14 November 2007 | Range and Central Tendency |

| 25 January 2012 | Range and Central Tendency |

| Participants’ Appropriate Rates | |

| 17 September 2015 | Range and Central Tendency |

| Participants’ Appropriate Rates | |

| Median of Forecast Distributions | |

| 16 December 2020 | Range and Central Tendency |

| Participants’ Appropriate Rates | |

| Median of Forecast Distributions | |

| Measures of FOMC Forecast Uncertainty |

| Appropriate Rate | Inflation and Unemployment | |||||||

|---|---|---|---|---|---|---|---|---|

| Date | Source | Frequency | Release→ | Immediate | Immediate | 5-Year Delay | ||

| ↓ | ↓ | ↓ | Content→ | All Forecasts | Range | Median | Range | Median |

| 1992–2007 | MPR | Semi-annual | no | yes | no | yes | yes | |

| 2007–2012 | SEP | Quarterly | no | yes | no | yes | yes | |

| 2013–2015:Q2 | SEP | Quarterly | yes | yes | no | no | no | |

| 2015:Q3–2019:Q3 | SEP | Quarterly | yes | yes | yes | no | no | |

| 1992:1–2013:Q42 | 2015:12–2019:9 | |||||||

|---|---|---|---|---|---|---|---|---|

| Median | Midpoint | Difference | Median | Midpoint | Difference | |||

| Inflation (%) | Mean | 2.052 | 2.127 | −0.074 | 1.517 | 1.565 | −0.047 | |

| Std. Dev | 0.777 | 0.779 | 0.161 | 0.494 | 0.450 | 0.092 | ||

| Unemployment (%) | Mean | 6.568 | 6.558 | 0.010 | 4.229 | 4.250 | −0.020 | |

| Std. Dev | 1.779 | 1.752 | 0.083 | 0.522 | 0.520 | 0.031 | ||

| Mnemonic | Description |

|---|---|

| median of the distribution of FOMC inflation forecast issued in period p for target year t | |

| median of the distribution of FOMC unemployment forecast issued in period p for target year t | |

| vector of exogenous variables listed below | |

| midpoint of the range of FOMC inflation forecasts made in period for target year t | |

| midpoint of the range of FOMC unemployment forecasts made in period for target year t | |

| Greenbook forecasts for inflation issued in period for target year t | |

| Greenbook forecasts for unemployment issued in period for target year t | |

| median of SPF inflation forecast, issued in period for target year t | |

| median of SPF unemployment forecasts, issued in the quarter associated with period for target year t | |

| actual inflation in the month prior to the FOMC meeting | |

| actual unemployment in the month prior to the FOMC meeting | |

| variable equal to one for Greenspan’s tenure as Chair of the FOMC, zero otherwise | |

| variable equal to one for Bernanke’s tenure as Chair of the FOMC, zero otherwise | |

| variable equal to one for Yellen’s tenure as Chair of the FOMC, zero otherwise | |

| variable equal to one for Powell’s tenure as Chair of the FOMC, zero otherwise | |

| variable equal to one if the CPI inflation is the price measure targeted by the FOMC, zero otherwise |

| Variable/Test | Median of Inflation Forecasts | Median of Unemployment Forecast | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| General | Final | General | Final | ||||||||

| Coeff | se | Coeff | se | Coeff | se | Coeff | se | ||||

| −0.703 | (0.186) | −0.582 | (0.133) | 0.246 | (0.180) | – | – | ||||

| 0.266 | (0.137) | 0.316 | (0.073) | 0.026 | (0.132) | 0.257 | (0.076) | ||||

| −0.028 | (0.177) | – | – | −0.345 | (0.171) | – | – | ||||

| 0.376 | (0.063) | 0.378 | (0.042) | −0.181 | (0.061) | −0.128 | (0.044) | ||||

| 0.090 | (0.379) | – | – | −0.333 | (0.366) | – | – | ||||

| −0.090 | (0.301) | −0.074 | (0.036) | 0.531 | (0.291) | – | – | ||||

| 0.048 | (0.105) | – | – | −0.005 | (0.101) | – | – | ||||

| −0.062 | (0.164) | 0.426 | (0.095) | 0.297 | (0.158) | – | – | ||||

| −0.068 | (0.258) | – | – | 1.090 | (0.250) | 0.958 | (0.042) | ||||

| −0.062 | (0.151) | – | – | 0.367 | (0.146) | 0.351 | (0.129) | ||||

| −0.415 | (0.249) | – | – | 0.056 | (0.241) | – | – | ||||

| 1.517 | (0.509) | 1.145 | (0.362) | −0.198 | (0.491) | −0.256 | (0.376) | ||||

| SER | 0.405 | 0.393 | 0.391 | 0.409 | |||||||

| Sample Standard deviation | 0.758 | 0.758 | 1.736 | 1.736 | |||||||

| Sample Mean | 1.990 | 1.990 | 6.499 | 6.499 | |||||||

| Hypotheses Testing for Coefficients | |||||||||||

| Exclude and | 0.000 | - | 0.011 | - | |||||||

| Valid Model Simplification | - | 0.832 | - | 0.120 | |||||||

| Testing Properties of Residuals | |||||||||||

| Serial Independence | 0.790 | 0.863 | 0.158 | 0.498 | |||||||

| Homoscedasticity | 0.780 | 0.871 | 0.620 | 0.936 | |||||||

| Normality | 0.138 | 0.074 | 0.194 | 0.229 | |||||||

| Variable/Test | General | Final | |||

|---|---|---|---|---|---|

| Coeff | se | Coeff | se | ||

| 0.358 | (0.124) | 0.359 | (0.112) | ||

| −0.012 | (0.281) | – | – | ||

| −0.441 | (0.176) | −0.436 | (0.123) | ||

| 0.291 | (0.092) | 0.292 | (0.089) | ||

| −0.314 | (0.083) | −0.316 | (0.062) | ||

| 2.105 | (0.504) | 2.110 | (0.482) | ||

| Long-Run SER | 0.291 | 0.286 | |||

| Standard Deviation of | 0.826 | 0.826 | |||

| Mean of | 0.939 | 0.939 | |||

| 0.949 | 0.957 | ||||

| Testing Valid Model Simplification | 0.966 | ||||

| Testing Properties of Residuals | |||||

| Serial Independence | 0.625 | 0.656 | |||

| Homoscedasticity | 0.869 | 0.847 | |||

| Normality | 0.280 | 0.272 | |||

| Variable/Test | General | Final | |||

|---|---|---|---|---|---|

| Coeff | se | Coeff | se | ||

| 0.099 | (0.130) | – | – | ||

| −0.356 | (0.202) | −0.509 | (0.029) | ||

| 0.018 | (0.214) | – | – | ||

| 0.198 | (0.192) | 0.393 | (0.105) | ||

| −0.082 | (0.214) | – | – | ||

| −0.484 | (0.185) | −0.483 | (0.025) | ||

| 0.274 | (0.138) | – | – | ||

| 2.402 | (0.570) | 3.358 | (0.271) | ||

| Long-Run SER | 0.291 | 0.240 | |||

| 0.945 | 0.915 | ||||

| Testing for Valid Model Simplification | 0.242 | ||||

| Testing Properties of Residuals | |||||

| Serial Independence | 0.478 | 0.120 | |||

| Homoscedasticity | 0.728 | 0.836 | |||

| Normality | 0.034 | 0.192 | |||

| VAR (Equation (6)) | Restricted VAR (Equation (7)) | ||||||

|---|---|---|---|---|---|---|---|

| Residual of | Serial Indep. | Homoscedasticity | Normality | Serial Indep. | Homoscedasticity | Normality | |

| 0.239 | 0.368 | 0.401 | 0.025 | 0.376 | 0.922 | ||

| 0.207 | 0.247 | 0.138 | 0.002 | 0.938 | 0.723 | ||

| 0.108 | 0.087 | 0.359 | 0.277 | 0.738 | 0.010 | ||

| 0.132 | 0.074 | 0.823 | 0.0002 | 0.029 | 0.497 | ||

| 0.466 | 0.118 | 0.227 | 0.001 | 0.352 | 0.189 | ||

| 0.267 | 0.961 | 0.673 | 0.012 | 0.412 | 0.081 | ||

| 0.020 | 0.030 | 0.244 | 0.177 | 0.376 | 0.002 | ||

| SEP June 2019→ | 2.4 | 1.5 | 3.6 | 2.1 | 1.9 | 3.7 |

| Single eqs.: | ||||||

| FOMC Data Equation (4) | 2.37 (0.250) | - | - | - | - | - |

| Public Data Equation (5) | 2.41 (0.230) | - | - | - | - | - |

| Multi-eqs.: | ||||||

| VAR Equation (6) | 2.32 (0.168) | 1.76 (0.165) | 3.70 (0.089) | 2.48 (0.195) | 1.95 (0.088) | 3.81 (0.178) |

| Restricted VAR Equation (7) | 2.41 (0.164) | 1.69 (0.191) | 3.43 (0.131) | 2.69 (0.192) | 1.97 (0.133) | 3.33 (0.228) |

| SEP September 2019→ | 1.9 | 1.5 | 3.7 | 1.9 | 1.9 | 3.7 |

| Single eqs.: | ||||||

| FOMC Data Equation (4) | 2.35 (0.250) | - | - | - | - | - |

| Public Data Equation (5) | 2.41 (0.230) | - | - | - | - | - |

| Multi-eqs.: | ||||||

| VAR Equation (6) | 2.16 (0.168) | 1.75 (0.165) | 3.80 (0.089) | 1.98 (0.195) | 1.92 (0.088) | 3.93 (0.178) |

| Restricted VAR Equation (7) | 2.41 (0.164) | 1.78 (0.191) | 3.51 (0.131) | 2.39 (0.192) | 1.98 (0.133) | 3.41 (0.228) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kalfa, S.Y.; Marquez, J. Forecasting FOMC Forecasts. Econometrics 2021, 9, 34. https://doi.org/10.3390/econometrics9030034

Kalfa SY, Marquez J. Forecasting FOMC Forecasts. Econometrics. 2021; 9(3):34. https://doi.org/10.3390/econometrics9030034

Chicago/Turabian StyleKalfa, S. Yanki, and Jaime Marquez. 2021. "Forecasting FOMC Forecasts" Econometrics 9, no. 3: 34. https://doi.org/10.3390/econometrics9030034

APA StyleKalfa, S. Y., & Marquez, J. (2021). Forecasting FOMC Forecasts. Econometrics, 9(3), 34. https://doi.org/10.3390/econometrics9030034