1. Introduction

More than 1000 licensing deals have been recorded each year within the biotech industry since 2002 and global licensing activity has seen approximately 100 licensing deals in the TMT (technology, media and telecommunications) industry each year. We can see by the number of licensing transfers in the biotech industry that it is at least 10 times more active than other industries [

1,

2]. Drug development requires a long time (i.e., over 10 years) and over GBP 500 million from the initial concept to approval by the regulatory authorities. Therefore, drug development is a process requiring significant money and time, and may also be risky [

3,

4]. For this reason, licensing is regarded as a good strategy during development [

5]; therefore more licensing transactions are generated compared to other industries [

1,

2], and valuation is used to calculate the transaction price for licensing or Merge and Acquisition (M&A) transactions [

6]. Furthermore, royalties are recognized as one of the major revenue sources in the biotech industry, and licensing is recognized as a good exit strategy to overcome the economic crisis of biopharmaceutical companies.

The valuation for a drug under development is required for various purposes, such as licensing and M&A transactions. The prediction of the future value of the asset is useful and important to determine future economic action [

7]. Two quantitative valuation approaches have been mainly used in the biotechnology sector: The discounted cash flow (DCF) method, which utilizes net present value (NPV) as the technology value before applying the technology factor; and, the real options method, which involves the concept of future opportunity cost for commercialization cost and term [

8]. However, the DCF method often results in a negative value when applied to early-stage drugs. Meanwhile, the real options methodology is relatively complicated and theoretical, and thus has a lot of poor case studies and is not preferred by the new drug experts [

3]. The real options methodology can be classified into four methods: The formula method, the finite differences method, the simulation method, and the tree method. The advantages and disadvantages of the four methods are as follows. The formula and finite differences methods are easy to use and can handle complex assumptions, but have the disadvantage of not being able to explain the estimation basis, as the calculation process is not transparent. The simulation method has the advantage of good risk measurement because it implements a number of simulations through random number generation to compensate for the uncertainty of value, but has the disadvantage that the process is time consuming and path dependent. The tree method makes it easy to understand and visualize what might happen in the marketplace, but it is difficult to estimate the cause as the link to the value driver is missing [

6].

The risk-adjusted net present value (rNPV) method has emerged to overcome the disadvantages of the DCF and real options methodologies. The rNPV method is an NPV method that uses only the attrition rate as a discount rate for considering the risk at each development stage [

9]. The attrition rates proposed by DiMasi [

10] are used most often for valuation among technology traders in biotechnology and pharmaceutical companies. The recent study of Thomas et al. derived the attrition rate at each development stage for four drug types [

11]. This study is believed to be helpful for enhancing the rNPV method as it can be applied by considering the drug type as well as the development phase. Currently, the rNPV method has been introduced to overcome the shortcomings of the DCF and the real options methods, which are mainly used as valuation methods in the biotech industry but are nonetheless limited in reflecting the characteristics of the biotech industry.

We conducted analytic hierarchy process (AHP) analysis to derive the priority of determinants affecting the license fee from the survey results of three groups and found that Group 1 and Group 2 were more concerned with the environmental factor than Group 3. In the case of Group 1, the market and financial factors of patent technology were more important than the technology factor. There was nothing related to the licensor among the determinants that make up the top five ranking in the level four ranking comparison, while the four related to the licensee.

This rest of this paper is organized as follows. In

Section 2, we present a review of the preceding research. In

Section 3, we introduce the AHP methodology, sample, and AHP Framework.

Section 4 presents the findings of the AHP analysis and

Section 5 provides our conclusions and implications. In

Section 6, we provide the scope and limitations of our research. In

Section 7, we provide topics for further research. We provide

Appendix A, including tables and figures, for a clearer understanding of the conclusions and implications.

3. Methodology

3.1. AHP Analysis Method

The AHP technique developed by Saaty can be applied not only to factors that can be quantified, but also to qualitative factors that are difficult to quantify in a rational and systematic manner in complex multi-criteria decision situations. AHP can be regarded as the most suitable analysis tool for analyzing the importance of multi-criteria decision-making factors [

54,

55]. AHP is a widely used method of making decisions based on a number of criteria that systematically scales the relative attractiveness of various alternatives in problem situations where there are multiple criteria. AHP has been adopted in many areas where it is necessary to make decisions because of its theoretical simplicity and wide applicability. This is useful for prioritizing multiple choices in situations where choosing the best option is complicated by conflicting criteria, imperfect information, or other forms of constraints in the resource approach [

55].

AHP measures the weight of each element and generates a pairwise comparison matrix. A single normalized priority vector is computed from this diagonal matrix for each level of hierarchy using the mathematical method called the eigenvalue method. When using AHP, it is necessary to execute the decision-making structure in four stages: (1) The collection of information for evaluation by pairwise comparisons; (2) estimations of relative weights; (3) aggregations; and, (4) decisions on priority levels.

To reach the highest-rated goal, the priority in each hierarchy needs to be derived by comparing each pair of elements in the hierarchy. Upon completion of this analysis, an overall ranking of the composite weight and the alternatives is created. The aggregate importance generated by this process is the rating-based score for the alternatives under test. This is important when determining the priority of different alternatives.

To make our understanding easier in terms of weighting matrices, let us consider a pairwise comparison matrix, denoted

A. The element at row

i and column

j in the pairwise comparison matrix

A,

, is calculated from

where

are the weights of

n elements,

A1,

A2, …,

An. The next problem is to assign numerical weights

to

n elements,

, that reflect the recoded decision. If

A is a consistency matrix, then the relationship between weights

and the judgments

are simply given by

(for

), as shown by Equation (1) below.

The elements of matrix

A are multiplied by the weight vector (

), yielding

; that is,

, where

= (

) and

n is an eigenvalue. Given that

denotes the subjective judgment of decision-makers concerning the comparison and evaluation with the actual value

having a certain degree of variation,

cannot be established. Therefore, Saaty [

56] defines the largest eigenvalue,

, as follows:

If

A is a consistency matrix, then eigenvector

X can be computed using the following formula:

Here, the reciprocal matrix

A is

n or more. Therefore, in consistent pairwise comparisons, it is the same as

n. In order to verify the consistency of the comparison matrix, Saaty [

57] proposed the use of the consistency index (CI) and the consistency ratio (CR). The CI and random index (RI) are defined as follows:

RI is the average consistency index generated from the inverse matrix created by the random setting of a value between one and nine. RI represents the allowable rate of consistency. To achieve the highest-rated goal, the priority in each hierarchy should be derived by comparing each pair of elements of the hierarchy. Once this analysis is complete, an overall prioritization of the compound weight calculations and alternatives should be performed. The integrated importance rates derived from this process becomes the rating-based points for the alternatives to be tested. This becomes very important in the process of completing priority ratings of different alternatives. For the statistical verification and analysis, we hereby chose an AHP decision-making program, referred to as Expert Choice 11.

3.2. Survey Sample

The AHP survey was distributed and gathered from 9 April to 16 April 2018. In selecting the experts for the surveys, we selected experts who had experience in technology valuation and technology trading of biotechnology, satisfying one of the following conditions: (1) Expert Forum member of KISTI (Korea Institute of Science and Technology Information) Technology Valuation LAB; (2) best specialist pool of KVA (Korea Valuation Association); and (3) specialist pool of KTTAA (Korea Technology Transfer Agents Association) with a technology transfer agent certificate. KISTI is a Korean government-funded research institute designed to maximize the efficiency of science and technology R&D and support high-tech R&D for researchers; KVA is the Korean branch of IACVS (International Valuers’ Association). KVA and KTTAA are nonprofit organizations under the MOTIE (Ministry of Trade, Industry and Energy) of Korea. We surveyed 32 experts who worked in one of a national research institutes, company, national agency, or university. With regards to national research institute employees, nine professionals from the KISTI (Korea Institute of Science and Technology Information), FACT (Foundation of Agri. Tech. Commercialization and Transfer), KIMST (Korea Institute of Marine Science and Technology Promotion), KITECH (Korea Institute of Industrial Technology), KRIBB (Korea Research Institute of Bioscience and Biotechnology), ETRI (Electronics and Telecommunications Research Institute), and SNUH BRI (Seoul National University Hospital Biomedical Research Institute) were selected as participants. For the firm sample, we chose eight professionals from the KVA (Korea Valuation Association), T-Value, the law firm Hanmaru, the Jidam IP Law Firm, Mirawiz, Techwith, Orum Therapeutics, and Bridge Biotherapeutics. Finally, for the national agency and university sample, we chose nine professionals from Dongguk University, Yonsei University, Myongji University, Korea University of Technology and Education, KIPA (Korea Invention Promotion Association), KIPSA (Korea Intellectual Property Strategy Agency), KIAT (Korea Institute for Advancement of Technology), STEPI (Science and Technology Policy Institute), and MSIT (Ministry of Science and ICT) as participants. In grouping the survey samples, different roles and positioning in technology transfer were considered. Companies have traditionally been clearly identified as technology consumers and we reviewed universities, national research institutes, and government agencies as technology providers. According to Ryu, in the case of technology transactions, the national research institutes focused on whether to make technology transactions, while universities focused on preventing core technology leakage [

58]. According to Park, the main barrier to the technology trading market in the case of a government research institute was the strategy for revitalizing the transaction, while the main barriers in the case of the university were found to be the difficulties in releasing key technologies [

48]. Even though government research institutes and universities were located in the same technology provider position as the above-mentioned two studies, the viewpoints that are important in technology transactions are different, and government research institutes have more advantages in licensing performance. For that reason, we classified national research institutes and universities into separate groups, although they are the same technology providers. According to Tony, technology-based technology startups in university research will attract investment from the private and public sectors, strengthen local and international networks, create jobs and diversify the local economy, attract talented people and investment, and contribute to economic development [

59]. Additionally, government agencies, except for government research institutes, are in the position to activate the start-up and focus on policies for regional economic development. For this reason, we classified government agencies and universities into the same group. Therefore, we conducted research into three groups, (1) Group 1: technology users (company), (2) Group 2: technology supplier 1 (national research institutes), and (3) Group 3: technology supplier 2 (university-government agency).

Table 1 shows the statistics of the survey distribution, response rates for each group, and the results of consistency.

We achieved a response rate of approximately 90% and verified the integrity of the data in consideration of the consistency ratio (CR). If the derived value of CR was less than 0.1, the response had reasonable consistency, and if it was less than 0.2, the response was allowed [

60]. The CR of this study was 0.01 and proved to be very consistent. A total of 25 valid survey samples was reached by deleting four inconsistent survey samples according to the CR criteria.

3.3. AHP Framework

This research derived the weight of each variable through AHP analysis and proposed the priority of factors affecting the license fee. In order to find the factors that affected the license fee of technology transfer, we reviewed 135 related studies and integrated 167 related factors from 36 papers. To analyze the significance of the determinants of the license fee, the primary common factors related to the determinants of the license fee were derived from the previous research and classified into groups to set the decision hierarchy. We classified the variables affecting the license fee of the technology contracts extracted from the literature, and then assigned the variables in a framework of a 3 × 4 matrix. The 3 × 4 matrix is the framework in which technological factors, financial factors, market factors, and environmental factors are placed on the x-axis, and patent characteristics, technology supplier characteristics, and technology user characteristics are arranged on the y-axis. The survey regarding factors determining the royalty was conducted through email and sent directly to 25 or more specialists including technical value evaluators, technology transfer experts, and technology licensing experts in biopharmaceutical industries. The survey groups consisted of Group 1, Group 2, and Group 3. Based on the survey results, we calculated the importance and priority of AHP weighting analysis on the relative importance of factors of license fee determination.

Determining factors affecting the license fee derived from the review of preceding research could be effectively expressed in the form of the 3 × 4 matrix shown in

Table 2.

Table 2 shows the structure of the AHP hierarchy and the determinants assigned in Level 4. We chose the following four factor groups as Level 2: Technical factor, financial factor, market factor, and environmental factor. Next, we chose the following three characteristics groups as Level 3: Patent characteristics, licensor characteristics, and licensee characteristics.

When we analyzed the frequency of each determinant, we found that ‘technical life cycle (12)’ was superior relative to its frequency in the literature. The frequency of determinants was in the order of ‘Stability of patent rights, Profitability (9)’, ‘Development Phase & Attrition Rate (8)’, ‘Quality of technology, Licensor R&D Costs, IP Tradability (7)’, ‘Technology Commercialization environment (5)’, and ‘Licensor patent number, Licensor patent similarity, Licensee patent similarity, Licensor sales per capital, Licensee sales per capital, Licensor licensing experience, Licensee licensing experience (4)’.

The definitions and explanations of the Hierarchy 4 factors in the tables shown in

Appendix A were included in the questionnaires to prevent misunderstanding and to provide an effective survey.

4. Results

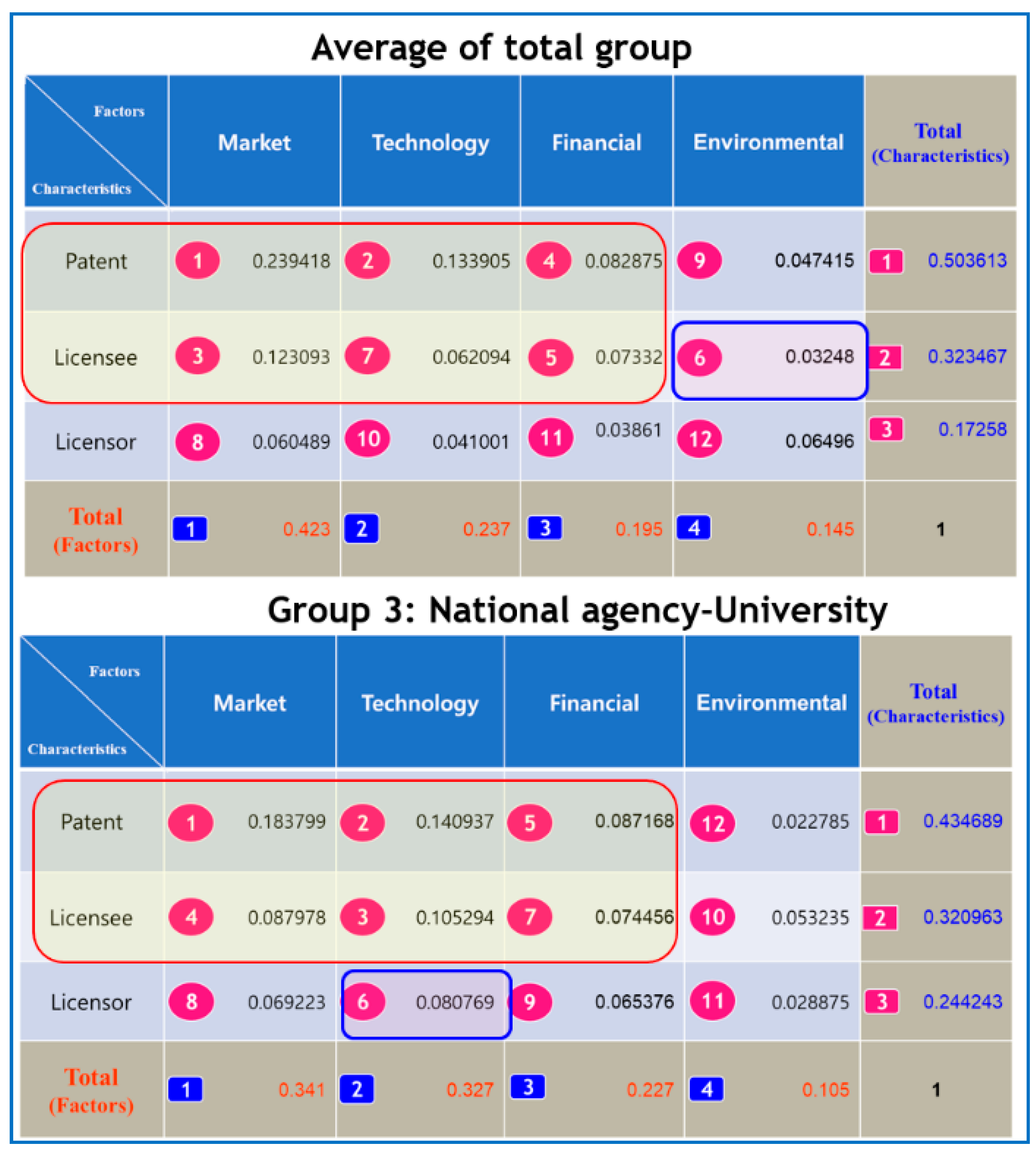

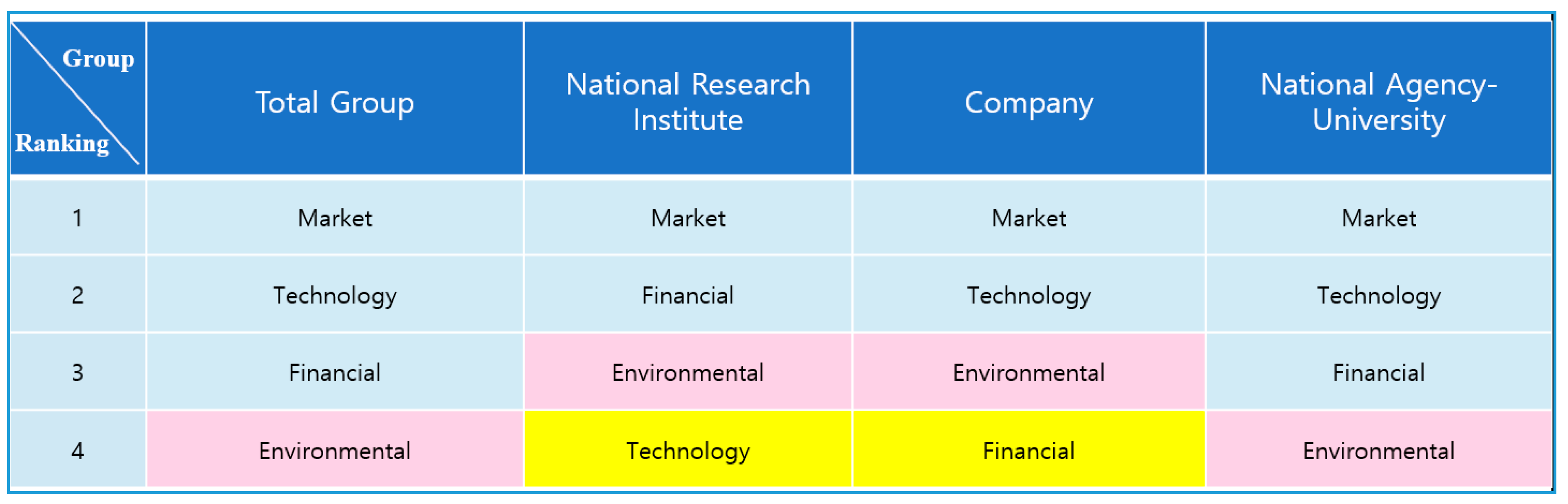

The priority analysis results of factors affecting the license fee for future possible transactions are illustrated in detail in

Table 3. From examining

Table 3 in conjunction with

Figure 2 and

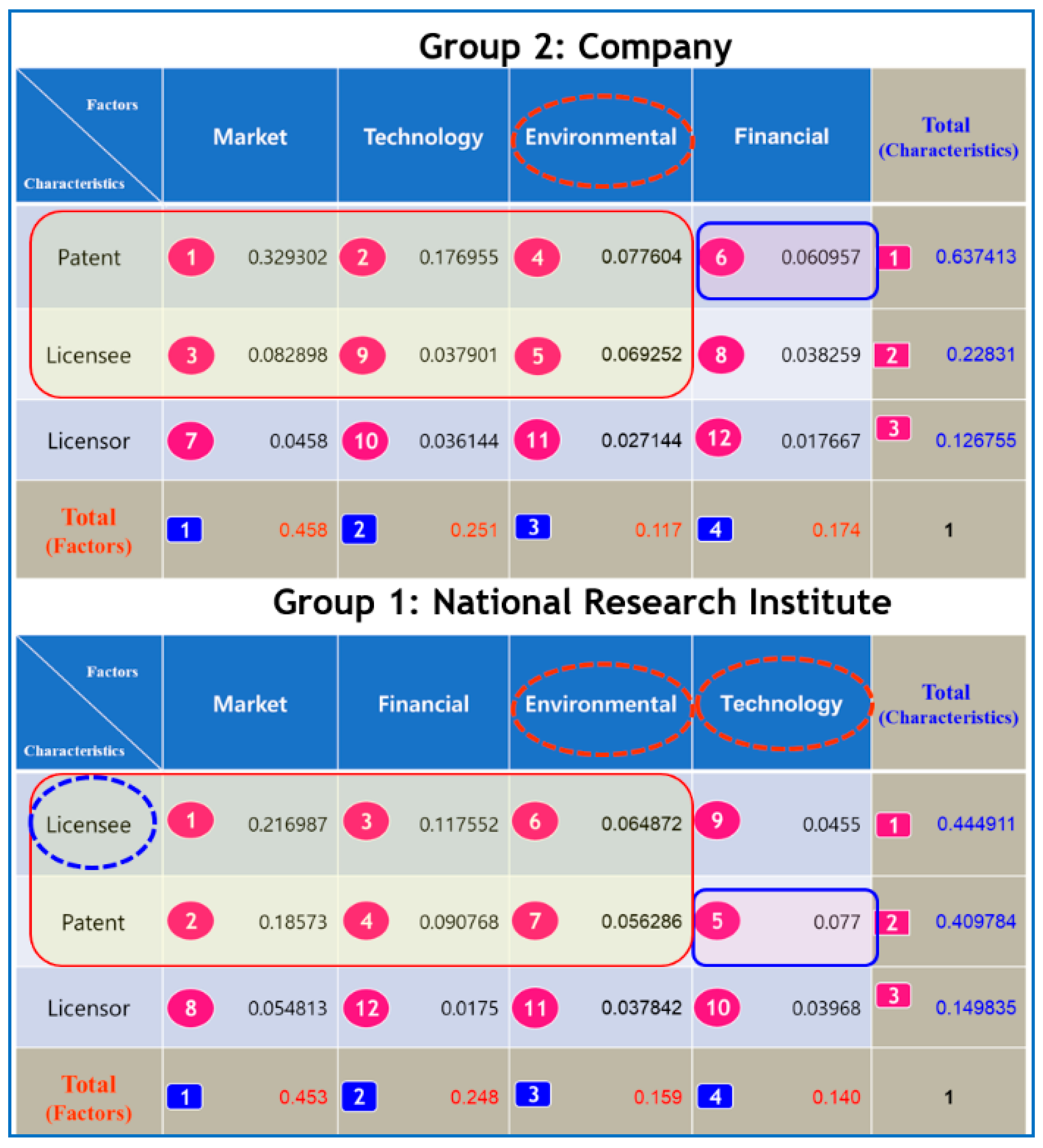

Figure 3, in the case of the total group, market factor (0.423) appeared to have the largest weight, followed by technical factor (0.237), financial factor (0.195), and environmental factor (0.145) in terms of the factor. When we analyzed Group 1 in

Figure 3, we found that market factor (0.453) was superior in terms of the factor. The weightings of financial factor (0.248), environmental factor (0.157), and technical factor (0.140) followed, in that order. In Group 2 in

Figure 3, we noted that the market factor (0.458) was the most important, followed by technical factor (0.251), environmental factor (0.174), and financial factor (0.117). For Group 3 in

Figure 2, we found that the market factor (0.341) was the most important, followed by technical factor (0.327), financial factor (0.227), and environmental factor (0.105).

For the average of the Total group in

Figure 2, the patent characteristic index (0.503613) appeared to have the largest weight, followed by licensee characteristics (0.323467), and licensor characteristics (0.17258) in terms of characteristics. In a similar way, we found that in the case of Group 1, licensee characteristics (0.444911) was superior in terms of characteristics in

Figure 3. The weightings of the patent characteristic index (0.409784), and licensor characteristics (0.149835) followed in that order. In Group 2 in

Figure 3, we noted that the patent characteristic index (0.637413) was the most important, followed by licensee characteristics (0.22831), and licensor characteristics (0.126755). For Group 3 in

Figure 2, we found that the patent characteristic index (0.434689) was the most important, followed by licensee characteristics (0.320963), and licensor characteristics (0.244243).

The average of the Total group and Group 3 showed the same tendency at a Level 3 ranking, in which the priority of determining the license fee was the ranking of ‘the market factor, the technology factor, the financial factor and the environmental factor’ in terms of factor, and ‘patent characteristics, licensee characteristics, and licensor characteristics’ in terms of characteristics. The determinants belonging to the top 50% ranking were mostly included in the ‘Factor (Market, Technology, Financial)—Characteristics (Patent, Licensee)’ surrounded by circles in

Figure 2. ‘Factors (Environmental)-Characteristics (Licensee)’ in the total group and ‘Factor (Technology)—Characteristics (Licensor)’ in the National Agency—University group were determinants belonging to the 50% rank outside the circle. In the Level 3 ranking analysis, the Total group and the National Agency–University group, we could see that the environmental factor and licensor characteristics were the least important determinants.

In the Level 3 ranking, Groups 1 and 2 showed different tendencies from the Total group. For Group 2, the priority of determining the license fee was the ranking of ‘the market factor, the technical factor, the environmental factor, and the financial factor’ in terms of factor. For Group 1, the priority in determining the license fee in terms of factor was in the order of ‘the market factor, the financial factor, the environmental factor, and the technology factor’. For Group 2, the priority was the order of ‘patent characteristics, licensee characteristics, and licensor characteristics’ in terms of characteristics. For Group 1, the priority was in the order of ‘licensee characteristics, patent characteristics, and licensor characteristics’ for characteristics. It is noteworthy that ‘licensee characteristics’ was the most important priority in Group 1 and ‘the environmental factor’ was the third most important priority in both Group 1 and Group 2. It was also beyond our usual expectation that ‘the technology factor’, with the second most important priority in the other groups, had the least important priority in Group 1.

The determinants belonging to the top 50% ranking in Group 2 mostly included the ‘Factor (Market, Technology, Environment)—Characteristics (Patent, Licensee)’ surrounded by circles in

Figure 3. The determinants belonging to the top 50% ranking in Group 1 mostly included the ‘Factor (Market, Technology, Environmental)—Characteristics (Patent, Licensee)’ surrounded by circles. ‘Factors (Financial)—Characteristics (Patent)’ in Group 2 and ‘Factor (Technology)—Characteristics (Patent)’ in Group 1 were determinants belonging to the 50% rank outside the circle. In the Level 3 ranking analysis, we could see that the financial factor and licensor characteristics were the least important determinants in Group 2, and the technology factor and licensor characteristics were the least important determinants in Group 1.

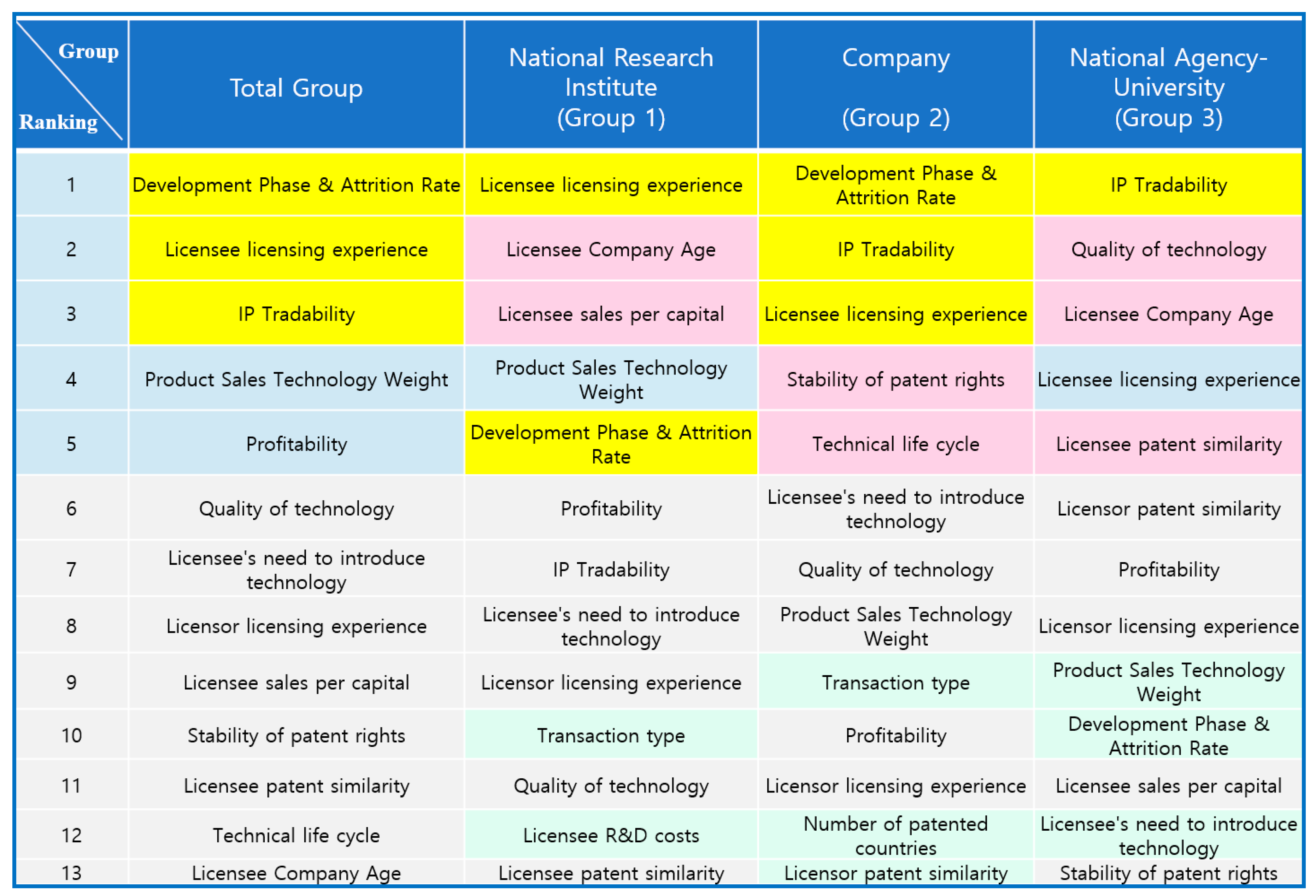

The determinants that belonged to the top five ranking in the Total group that showed in more than two groups were ‘Development Phase & Attrition Rate’, ‘Licensee licensing experience’, and ‘IP Tradability’, as shown in

Figure 4. The determinants in the top five ranking in Group 1, but not in the Total group, were ‘Licensee Company Age’ and ‘Licensee sales per capital’. The determinants in the top five ranking in Group 2, but not in the Total group, were ‘Stability of patent rights’ and ‘Technical life cycle’. The determinants in the top five ranking in Group 3, but not in the Total group, were ‘Quality of technology, ‘Licensee Company Age’, ‘and Licensee patent similarity’.

The determinants that were in the top 50% ranking in Group 1, but not shown in the Total group, were ‘Transaction type’ and ‘Licensee R&D costs’, and the determinants in the top 50% ranking in Group 2, but not in the Total group, were ‘Transaction type’, ‘Number of patented countries’, and ‘Licensor patent similarity’, and the only determinant in the top 50% ranking in the National Agency-University group, but not in the Total group, was ‘Licensor patent similarity’, as shown in

Figure 4.

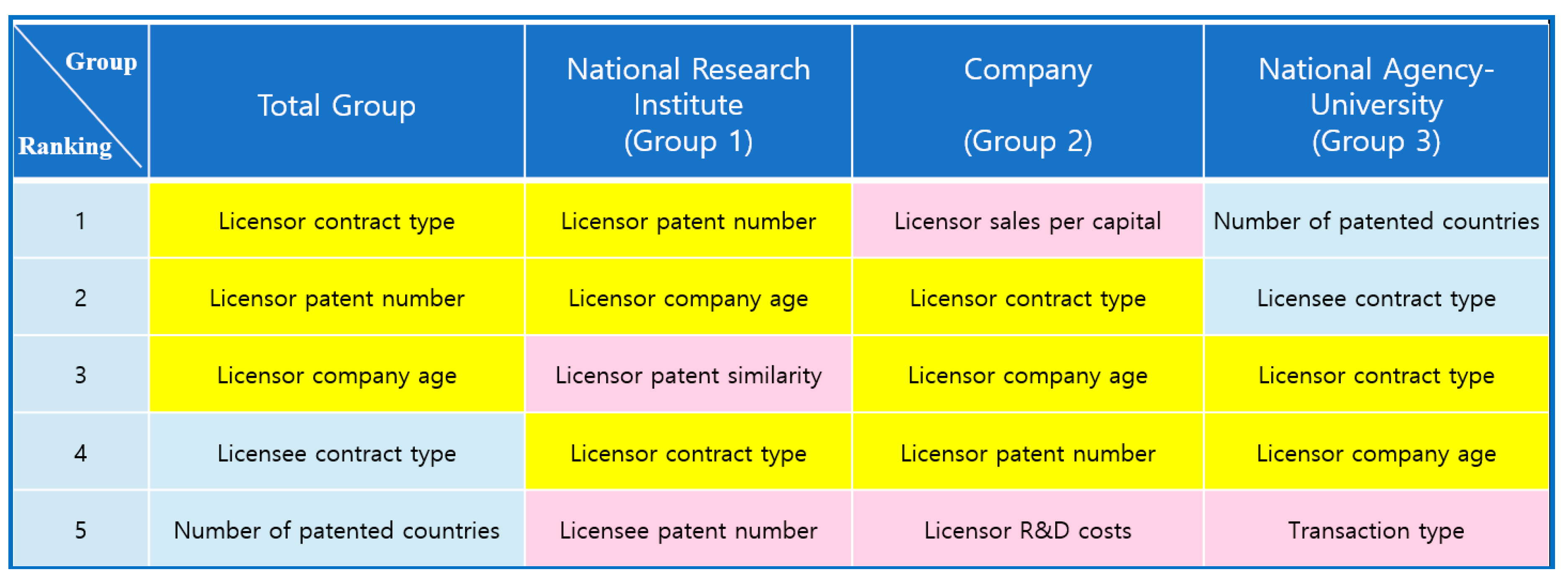

The determinants that belonged to the top five reverse ranking in all groups and showed in more than two groups were ‘Licensor contract type’, ‘Licensor patent number’, and ‘Licensor company age’, as shown in

Figure 5. The determinants in the top five reverse ranking in Group 1, but not in the Total group, were ‘Licensor patent similarity’ and ‘Licensee patent number’. The determinants in the top five reverse ranking in Group 2, but not in the Total group, were ‘Licensor sales per capital’ and ‘Licensor R&D costs’. The only determinant in the top five reverse ranking in the National Agency-University group, but not in the Total group, was ‘Transaction type’.